Crypto World

Story delays $IP token unlock by 6 months as supply overhang fears mount and usage remains thin

Layer 1 blockchain Story Protocol has delayed the scheduled unfreezing of its $IP token by six months, opting to keep a larger share of supply locked for longer as debate intensifies over how crypto projects manage token releases.

In a statement, Story said the decision is part of a broader set of long-term measures aimed at strengthening alignment with its community and reinforcing the network’s economic foundations, describing the delay as a way to introduce new liquidity more gradually alongside lower emissions and wider participation.

“When we launched Story, our mission was to build foundational infrastructure for programmable intellectual property,” Story said in a statement. “While that mission remains unchanged, our understanding of where the strongest traction is forming, and what long-term success requires has continued to evolve.”

The $IP token is trading around $1.45 to $1.50 right now. That’s down about 32% over the past 30 days, worse than the CoinDesk 20 Index’s 22% drop, highlighting the tough market conditions Story mentioned.

Under the revised schedule, the first major release of previously locked team, investor, and early contributor tokens will shift from February 2026 to August 2026.

Story says the change doesn’t touch the total 1 billion token supply, individual allocations or legal ownership, and only alters the timing at which locked tokens may enter circulation. The foundation added that an automated smart-contract mechanism has been introduced to enforce the updated lockup terms, while emphasizing that it does not gain custody of wallets or the ability to move tokens.

Token unlocks are closely watched events in crypto markets because sudden increases in circulating supply can weigh on prices, and recent research has suggested that large releases often lead to delayed selling pressure rather than immediate rebounds.

Analysts frequently point to so-called low-float, high-fully-diluted-valuation launches, where a small portion of tokens trade freely while most remain locked, as a source of volatility and investor distrust when vesting periods expire.

On-chain metrics compiled by DeFiLlama show Story has had nearly non-existent activity so far, with less than $100 in daily on-chain revenue, underscoring how much of the token’s $500 million valuation remains tied to future expectations rather than present cash flow.

Late last year, Story’s co-founder Jason Zhao announced he was stepping back from day-to-day operations to join a new AI venture.

Crypto World

Crypto Markets Bleed Amid Tech Stock Selloff

Bitcoin is down 18% in seven days as tech stocks continue to disappoint.

Crypto World

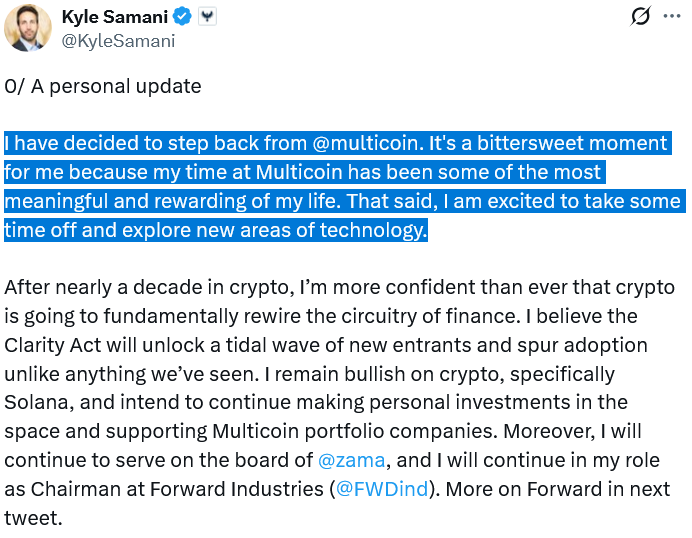

Kyle Samani leaves Multicoin in ‘bittersweet moment’ to explore new tech

Multicoin Capital’s co-founder, Kyle Samani, said he is stepping down as managing partner of the crypto investment firm after 10 years in the industry.

Samani called it a “bittersweet moment” in a post on Wednesday, adding, “I am excited to take some time off and explore new areas of technology,” which he later revealed would include AI and robotics.

He added that he is “more confident than ever that crypto is going to fundamentally rewire the circuitry of finance.”

“The Clarity Act will unlock a tidal wave of new entrants and spur adoption unlike anything we’ve seen,” Samani said, adding that he is particularly bullish on Solana and intends to continue making personal investments in the space and supporting Multicoin portfolio companies.

However, the post appears to conflict with a reportedly deleted earlier X post, in which he stated: “I once believed in the web3 vision. dapps. I don’t anymore…Crypto is just fundamentally not as interesting as many crypto enthusiasts wanted. Myself included.”

Samani has previously criticized the Bitcoin and Ethereum ecosystems.

Last month, Samani said discovering Ethereum was his “entry into crypto” in 2016, after becoming convinced by permissionless finance and smart contracts.

However, he later lost faith in Ethereum, saying he was dissatisfied with how Ethereum developers addressed scaling.

Samani helped turn Multicoin into a $5.9 billion company

He came across the Solana shortly after founding Multicoin in May 2017, which went on to lead some of Solana’s earliest investment rounds in 2018.

It turned out to be one of the best bets for Multicoin, which reported managing $5.9 billion worth of assets in May 2025, making it one of the most prominent investment firms in the crypto industry.

Related: Telegram’s Durov slams Spain’s online age verification proposal

In a letter co-written by Samani and Multicoin’s other co-founder, Tushar Jain, they said Samani would spend his next chapter exploring other technologies, including AI, longevity and robotics.

Multicoin said its conviction on crypto is still strong, stating:

“In our view, crypto is at a critical inflection point — on the eve of regulatory clarity, infrastructure maturity, and mainstream adoption — where it can meaningfully disrupt global financial and capital markets.

Magazine: ‘If you want to be great, make enemies’: Solana economist Max Resnick

Crypto World

U.S. Stocks Fall as Tech Declines and Investors Await Alphabet Results

TLDR

- U.S. stocks showed mixed performance as investors awaited Alphabet’s earnings results.

- The Nasdaq Composite dropped over one percent while the Dow Jones gained slightly.

- Private payrolls in the U.S. rose by only twenty-two thousand in January.

- Tech stocks, including Alphabet, Meta, and Tesla, traded lower during the session.

- AMD shares plunged despite reporting strong fourth-quarter results and guidance.

U.S. stocks traded mixed on Wednesday, as technology shares declined sharply, job data disappointed, and investors braced for Alphabet’s earnings. The Nasdaq Composite fell by over 1%, while the S&P 500 edged lower and the Dow gained. Markets responded to underwhelming private job figures and shifts in investor sentiment toward big tech.

Alphabet Earnings Loom as Tech Stocks Drop

Alphabet shares declined along with other large-cap tech names such as Tesla, Meta, and Nvidia during midday trading. Investors reduced exposure ahead of the company’s upcoming earnings release, which remains highly anticipated. Despite no major earnings warning, selling pressure increased across the tech-heavy Nasdaq index.

“Speculators have entered the market. The problem is that the construction of data centers includes very few people,” said Diane Swonk. Her comment underscored concerns that AI infrastructure growth isn’t contributing meaningfully to job creation. Alphabet’s performance will likely influence market direction into the end of the week.

While optimism remains around 2026–2027 profit expectations, immediate investor focus shifted to Q4 performance. Concerns about slower growth and earnings multiples pressured valuations across the Magnificent Seven. Meta, Nvidia, and Tesla were all trading lower in line with Alphabet’s downward movement.

U.S. stocks mixed after weak job gains

The S&P 500 dropped by 0.3%, the Nasdaq Composite fell 1.2%, and the Dow Jones Industrial Average rose 0.7%. U.S. stocks reacted quickly to January’s private payrolls data, which showed only 22,000 jobs were added, well below forecasts. ADP revised December’s numbers down as well, weakening optimism in labor market strength.

Ryan Detrick from Carson Group said, “Analysts keep raising their earnings calls for 2026 and 2027,” which he noted is boosting the S&P 500. However, the weaker labor data has cast doubts on near-term momentum. The healthcare sector led hiring, while manufacturing and other sectors shed jobs.

S&P Global’s U.S. Composite PMI rose to 53.0 in January, slightly above December’s 52.7. The PMI reading exceeded expectations, suggesting some economic resilience despite job weakness. Yet investors showed more concern about employment trends than services activity growth.

AMD, Boston Scientific, and AbbVie Lead Decliners

AMD shares fell by 16%, even though the company posted earnings and guidance that surpassed Wall Street expectations. Investors appeared to focus on valuation and future growth rates rather than immediate performance. Selling intensified during the session despite the strong Q4 results.

Boston Scientific shares declined by 15.4% after it issued a 2026 outlook that did not match investor hopes. Though Q4 earnings beat estimates, future growth projections fell short. This triggered a broad reaction in the medical technology segment.

AbbVie’s stock dropped 6.9% following its better-than-expected Q4 earnings release. The market responded negatively to guidance concerns. The pharmaceutical sector reflected broader investor caution across earnings-heavy sectors.

Crypto World

AMD stock falls over 16 percent despite beating Q4 earnings estimates

TLDR

- AMD stock declined more than 16 percent after the company released its Q4 earnings report.

- The company reported earnings per share of $1.53 on revenue of $10.3 billion which beat analyst expectations.

- Despite strong results in data center and PC segments investors expected higher performance and guidance.

- AMD projected Q1 revenue between $9.5 billion and $10.1 billion which exceeded Street estimates but fell short of hopes.

- The gaming segment missed expectations with revenue of $843 million against a forecast of $855 million.

Advanced Micro Devices (AMD) saw its stock drop more than 16% on Wednesday, even after it surpassed Q4 expectations, raised guidance, and reported growth in its key businesses, as investors reacted to what some considered modest projections compared to high anticipation.

Q4 Results Top Forecasts But Disappoint Market Hopes

AMD posted Q4 earnings per share of $1.53 on $10.3 billion revenue, exceeding estimates of $1.32 and $9.6 billion, respectively. The company’s revenue rose from $7.7 billion in the same period last year, showing strong year-over-year growth. However, investors appeared to want even higher beats given the stock’s sharp rally over the past year.

The stock had climbed over 112% in the last 12 months, outpacing Nvidia’s 54% growth during that same period. Expectations were high as many expected AMD to capture more market share from Nvidia in AI and data center segments. While AMD delivered strong numbers, market response indicated it fell short of loftier hopes.

In the data center segment, AMD reported $5.4 billion in revenue, above expectations of $4.97 billion. The PC client unit generated $3.1 billion versus projections of $2.9 billion, also beating estimates. Its gaming division reported $843 million, just under the $855 million analysts expected.

AMD Stock Drops as Guidance Fails to Satisfy Lofty Expectations

Despite raising its Q1 forecast, AMD stock declined sharply following the earnings release. The company said Q1 revenue would range between $9.5 billion and $10.1 billion. While this guidance beat the consensus estimate of $9.4 billion, investors had hoped for numbers exceeding $10 billion.

Advanced Micro Devices, Inc., AMD

Some forecasts predicted results above the top end of AMD’s own range, intensifying pressure on the stock. “We believe we are well-positioned for growth in 2026,” said CEO Lisa Su. Even with a strong outlook, the bar appeared too high for Wall Street enthusiasm to hold.

The drop in AMD stock followed sharp market reactions to other tech earnings, including Microsoft and Meta. Traders responded differently to those reports, cheering Meta but raising concerns over Microsoft’s increased spending. The contrast in reactions highlights how sensitive markets are to future investment narratives.

AMD Unveils New AI Chips and Server Products

At CES 2026, AMD introduced the Helios rack-scale server system, targeting large-scale AI workloads. The Helios system contains 72 GPUs and aims to rival Nvidia’s NVL72 rack, which features similar specs. AMD called it the “world’s best AI rack,” directly challenging Nvidia’s position in the AI infrastructure market.

AMD also showcased its MI500 GPU series, claiming up to 1,000x performance over its previous MI300X chips. This suggests aggressive efforts to capture AI market share from competitors, particularly Nvidia. Su projected the AI data center market to be worth $1 trillion by 2030.

At the event, AMD also announced its new AI PC chips and discussed future plans for the humanoid robotics space. These product announcements align with AMD’s broader strategy to diversify its portfolio. However, growing competition from Amazon, Google, and Microsoft’s custom chips could present challenges.

Crypto World

What This Means for Traders

XRP’s derivatives market has dropped to multi-month lows in open interest, clearing leverage, and setting up cleaner conditions for a possible trend reversal.

Ripple’s (XRP) price has been on a consistent decline over the past month amid broader crypto weakness, as it shed over 26% during the period. A fresh decline of almost 3% on Wednesday revived concerns that liquidation pressure from last weekend’s sharp sell-off may not be fully exhausted.

But new data suggests that the market reset following the liquidations could allow spot demand to drive the price naturally, without over-leveraged positions causing swings.

Market Reset Underway

XRP’s open interest (OI) on Binance has fallen sharply to $406 million, which happens to be its lowest level since November 2024. This decline is indicative of a major reduction in leveraged positions, likely caused by long liquidations or traders closing positions amid the recent price drop, CryptoQuant said in its latest analysis.

When OI reaches such lows, the market becomes less vulnerable to volatility from long or short squeezes, as much of the speculative leverage has been cleared. CryptoQuant revealed that this “reset” in the derivatives market often sets the stage for a more stable trend.

With forced liquidation pressure reduced, future price movements are less likely to be exaggerated by over-leveraged positions. If spot demand increases, supported by high on-chain activity, XRP’s price could recover more naturally. The analysis demonstrates that this “clean slate” may create conditions for a meaningful trend reversal, and the derivatives market is now positioned to respond more calmly to new buying or selling pressure.

Full Reset Phase

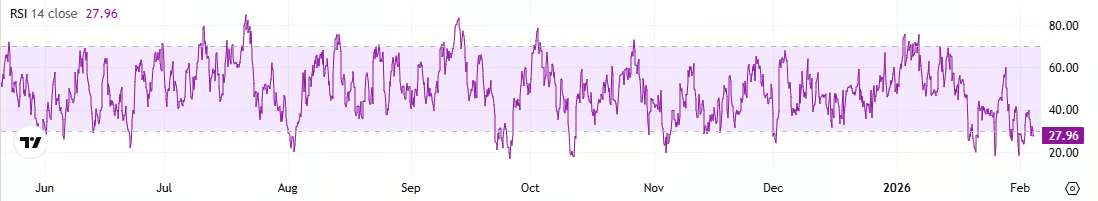

Similar signals are emerging from technical momentum indicators. Crypto analyst Egrag Crypto said XRP’s macro relative strength index (RSI) has fallen into the 45-50 zone faster than he expected, a level that has historically preceded sharp price bounces.

The analyst noted that while downside momentum appears aggressive, the selling pressure does not look retail-driven but instead reflects distribution by large holders during liquidity sweeps. Egrag Crypto stressed that this RSI behavior is not bearish, while describing it as a “full reset phase” following a prior RSI peak near 80.

You may also like:

He added that the 45-50 range has acted as macro support in every previous XRP cycle and has never been broken. According to the analyst, this compression typically flushes out weaker hands, resets momentum, and is followed by expansion. He said the structure would only turn bearish if RSI falls below roughly 43.

In terms of institutional appetite, US-listed spot XRP ETFs attracted $19.46 million in inflows on February 3rd, according to SoSoValue. XRPZ Franklin XRP ETF topped the chart with $12.13 million in inflows, followed by Bitwise’s fund with $4.8 million and Grayscale XRP Trust ETF with $2.51 million. By comparison, Bitcoin ETFs recorded $272 million in net outflows, while Ethereum ETFs attracted about $14 million, leaving XRP funds as relative outperformers.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Further 50% Collapse on the Way?

Is SOL headed toward $50?

The cryptocurrency market seems to can’t catch a break lately, and numerous digital assets continue to chart painful losses.

Solana (SOL) is among the poorest performers, with its price plunging by 25% in the past week alone. According to some market observers, the bears might be just stepping in.

Major Collapse on the Horizon?

Just hours ago, SOL tumbled to approximately $95, its lowest level since February 2024. As of this writing, it trades at around $96, which is a staggering decline from the all-time high of almost $300 registered nearly a year ago.

Many industry participants are now concerned that the asset may experience a further decrease in the short term. Ali Martinez, for instance, predicted that SOL could nosedive to $74.11 and even $50.18.

The analyst, going on X as curb.sol, outlined $100 as an “extremely important level” for the token. In their view, holding that zone could result in a new bull run to a fresh all-time high, whereas the opposite scenario might lead to a crash to roughly $50 sometime this year.

For their part, Alex RT₿ assumed the price may retreat to $70-$80 if SOL breaks below the $90 support level.

Any Chance for the Bulls’ Return?

It is important to note that some analysts believe the current rates could present great buying opportunities. The one using the X handle, Lucky, told their almost two million followers that “if the market behaves well, this could be a smart entry.”

You may also like:

“Opportunities like this don’t show up often,” they added.

Mookie also recently chipped in, vowing to go all-in should SOL drop below $100.

if $SOL drops below $100 i’m going all in

Solana at $100 is def free pic.twitter.com/ORftQMa2dv

— Mookie (@MookieNFT) January 31, 2026

Meanwhile, some key indicators suggest it might be time for a rebound. SOL’s Relative Strength Index (RSI) fell well below 30, meaning the price has declined too much in a short period of time. Ratios under that level signal that SOL is oversold and due for a potential rally, whereas anything above 70 is seen as bearish territory.

Furthermore, exchange outflows have significantly surpassed inflows in the past several weeks. This suggests that investors have shifted from centralized platforms to self-custody, thereby reducing immediate selling pressure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Massive Malware Dataset Exposes 420,000 Accounts

A leaked dataset of 149M stolen credentials reportedly includes login details for around 420,000 Binance accounts.

A trove of 149 million stolen credentials, including login details for 420,000 Binance accounts, was discovered circulating among cybercriminals this week.

The findings highlight a shift in crypto theft toward long-term malware infections that steal data directly from users’ devices, often long before any funds are moved.

The Scale of the Threat

According to an alert posted on February 4 by security firm Web3 Antivirus, the dataset was compiled from information-stealing malware installed on victim devices. Beyond exchange logins, the stolen data included passwords, private keys, API keys, and browser session tokens for email, social, and financial platforms.

The firm noted that these “infostealers” capture data that can later be used for account takeovers and fund theft, emphasizing that prevention requires early detection at the device level since by the time suspicious activity appears on-chain, it is often too late.

Furthermore, in a separate series of posts, Web3 Antivirus detailed how malicious AI skills on platforms like ClawHub are being used to steal crypto data. Per the security firm, these fraudulent skills, posing as wallet tools or trading bots, install information-stealing malware that can remain dormant until a victim’s crypto balance grows or specific actions are taken. This vulnerability represents a supply-chain risk that moves upstream “from wallets to the tools people trust to manage them.”

A Persistent Challenge for Users and Platforms

The gravity of losses resulting from crypto theft cannot be understated. A recent report from PeckShield noted that scams and hacks drained over $4.04 billion in 2025, with scams alone jumping 64% year-over-year. The firm observed a move toward targeting centralized exchanges and large organizations, which accounted for 75% of stolen funds in 2025.

Meanwhile, Web3 Antivirus put the volume of 2025’s illicit crypto activity at approximately $158 billion, up from $64 billion in 2024. While the on-chain security provider partly attributed the increase to better tracking and more state-linked activity, the figures show that even small success rates for thieves can result in large losses at scale.

You may also like:

The recent data thefts highlighted a gap between user and platform protection, with the company stating,

“Scams don’t succeed because users ignore advice; they succeed because risk is only surfaced after execution is already possible.”

The firm argued that platforms, which can see transaction approvals and behavioral patterns before users do, sit at “the last real control point” for preventing theft.

One of the more common attack vectors is wallet drainers, which Web3 Antivirus stated had gotten worse, with 15,530 suspicious approvals across 11,908 wallets leading to $4.25 million in losses in January. These drainers usually enter through malicious transaction approvals, making pre-signature detection extremely important.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

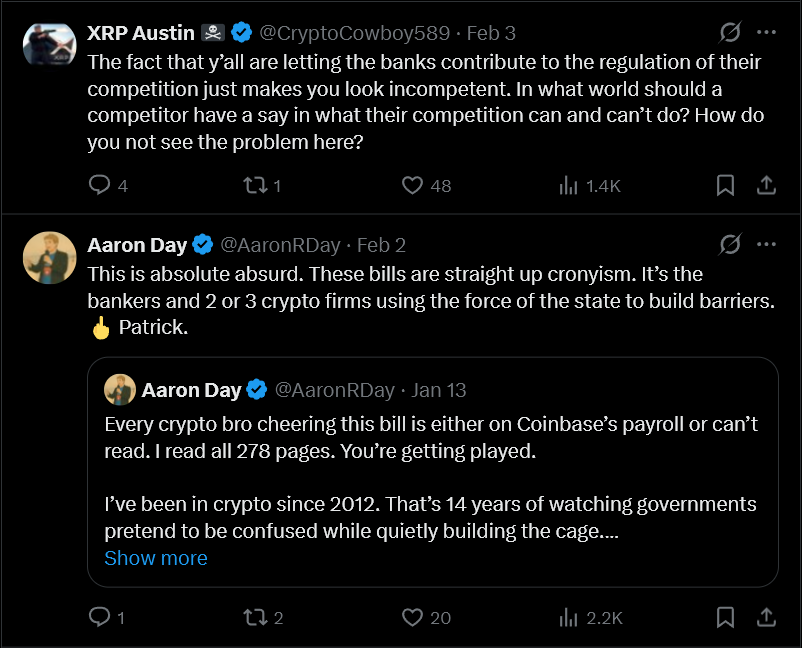

White House Tweet Exposes CLARITY Act’s Banking Trap

The CLARITY Act debate has largely revolved around the tug-of-war between banks and crypto firms over stablecoin yield. While that conflict dominates coverage of what is framed as a market-structure bill, it obscures a quieter and potentially more consequential issue.

Once enacted, the CLARITY Act would formally legitimize regulated crypto roles and implicitly subject them to Bank Secrecy Act compliance. Even without explicit mandates, this risks entrenching a surveillance-first model that pressures intermediaries to delist privacy assets and abandon privacy-by-design before Congress has openly debated the trade-offs.

Sponsored

Sponsored

Banks Join Talks on Stablecoin Yield

On Monday, industry insiders met with advisors to US President Donald Trump to explore potential compromises in a still-contentious market structure bill.

The discussions were led by Patrick Witt, executive director of the President’s Council of Advisors on Digital Assets. The roundtable included senior figures from both the crypto sector and traditional banking.

The meeting reignited tensions between the crypto sector and traditional finance.

Critics questioned why policymakers invited Wall Street to help shape legislation governing products that directly compete with its core business. Chief among these are yield-bearing stablecoins, which many view as a direct threat to traditional bank deposits.

However, the meeting also allowed a far subtler, yet equally significant issue to slip largely unnoticed: privacy.

Sponsored

Sponsored

How CLARITY Pulls Crypto Under the Bank Secrecy Act

The CLARITY Act presents itself as a market structure framework that promises regulatory certainty for the US crypto industry. It aims to clearly assign activities to regulators and deliver long-sought legal clarity to market participants.

Yet, the bill does more than draw jurisdictional boundaries.

By formally defining regulated crypto roles, particularly for centralized exchanges and stablecoin issuers, it embeds these actors within the existing financial system.

Once those roles are legally recognized, compliance with the Bank Secrecy Act (BSA) becomes effectively unavoidable, even though the legislation does not specify how BSA requirements should apply to on-chain activity.

That lack of specificity hands key decisions to intermediaries, who would set the rules instead of Congress.

Sponsored

Sponsored

In response, exchanges and custodians default to expansive identity checks, sweeping transaction monitoring, and heightened data collection. In doing so, they establish de facto standards without a clear legislative mandate.

Within this framework, privacy-focused projects stand to bear the greatest cost.

Privacy Assets in the Line of Fire

The BSA requires financial institutions to verify customer identities and monitor for suspicious activity. In practice, this means knowing who customers are and reporting specific red flags to authorities.

Sponsored

Sponsored

What the law does not require is constant, system-wide transparency or the ability to trace every transaction back to an identity at all times.

Nonetheless, major crypto firms such as Binance, Coinbase, and Circle already operate as if it does. They equate BSA compliance with maximum on-chain visibility in order to minimize regulatory risk amid legal uncertainty.

This approach translates into strict traceability requirements and the avoidance of protocols that limit transaction visibility. Centralized exchanges typically refuse to list privacy-focused cryptocurrencies like Monero or Zcash, not because the BSA explicitly demands it, but as a precautionary measure.

As it stands, the CLARITY Act does not account for how the BSA should apply to blockchain systems where privacy and pseudonymity operate differently from traditional finance. That silence matters.

By leaving key obligations undefined, the CLARITY Act risks entrenching the most conservative, surveillance-heavy interpretation of the BSA as the default.

As a result, participants aligned with crypto’s cypherpunk roots are likely to be most affected, as privacy-oriented tools and services face the greatest restrictions.

Crypto World

UBS Reports Strong Profit Yet Stock Falls Over Cautious Crypto Plans

TLDR

- UBS Group AG reported a sharp rise in net profit driven by strong client activity and cost efficiency.

- The bank maintained capital ratios well above regulatory requirements and reiterated confidence in its 2026 financial targets.

- UBS confirmed continued progress in integrating acquired Swiss accounts and winding down non-core assets.

- Despite the earnings beat, UBS shares declined nearly 5 percent after the results were announced.

- The decline followed cautious comments from UBS management regarding its timeline for crypto and tokenized asset offerings.

- CEO Sergio Ermotti stated that UBS will follow a fast follower approach instead of leading in digital asset innovation.

UBS Group AG delivered strong quarterly earnings, reporting higher net profit and capital returns, yet its shares dropped nearly 5% following the results, as investors recalibrated expectations for growth in digital assets. Despite positive performance metrics, the bank’s cautious approach to crypto and tokenized assets drew focus, overshadowing its earnings beat. Management confirmed a slow rollout of blockchain initiatives, which may have cooled sentiment among forward-looking investors.

UBS Group AG Reports Higher Profit and Strong Capital Ratios

UBS Group AG posted a surge in net profit, supported by firm client activity and solid capital positions. The bank reported higher returns on CET1 capital, reinforcing its message of stable and resilient balance sheet management. Profitability gains reflected progress in cost control and integration of acquired assets, especially in Swiss-booked businesses.

Trading activity remained robust, and client asset inflows continued across major segments during the quarter. UBS maintained capital ratios well above regulatory requirements, reinforcing its conservative financial approach. Management reiterated that 2026 targets remain on track, including plans for higher returns and improved efficiency.

The bank emphasized continued execution on its strategic roadmap, supported by disciplined risk management and sustained client engagement. UBS also confirmed further wind-down of non-core assets and steady progress on system integration. These operational improvements contributed to stronger fundamentals across the board.

Crypto Strategy Comments Drive Market Reaction

During the earnings call, CEO Sergio Ermotti addressed growing interest in crypto and tokenized asset offerings. He stated, “We are building core infrastructure but will not lead the market on this front.” The bank confirmed it would pursue a fast follower approach rather than immediate deployment of blockchain-based products.

UBS aims to offer crypto access to individual clients and tokenized deposit options to corporate customers. However, it set expectations that these developments will unfold over three to five years. Investors responded by reassessing near-term growth potential from digital assets.

The measured tone contrasted with some market hopes for faster adoption and monetization of crypto services. UBS positioned digital initiatives as long-term complements to its traditional offerings, not near-term revenue drivers. This divergence may have triggered a repricing of expectations around technology-led growth.

Strong Execution Overshadowed by Delayed Crypto Monetization

Despite delivering on financial targets, the stock declined after the report, reflecting market’s focus on future-facing initiatives. UBS delivered what it promised in capital returns, profits, and cost cuts, but offered no immediate digital catalyst. The gap between execution and investor enthusiasm over crypto timing became the central theme.

The selloff suggests the market sought faster signals on UBS’s role in tokenized finance. Although fundamentals remain firm, expectations around digital expansion weighed on investor sentiment. UBS’s conservative stance may align with its culture, but not with all shareholders’ timelines.

UBS emphasized long-term goals, targeting improved capital efficiency by 2028. Shareholder returns remain a core focus, with dividends and buybacks continuing. However, no accelerated plans were revealed for blockchain offerings.

Crypto World

CME Group Mulls Proprietary Token for Collateral and Margin

Chicago-based derivatives exchange CME Group is examining how tokenized assets could reshape collateral and margin across financial markets, CEO Terry Duffy said during a recent earnings call. The conversations revolve around tokenized cash and a CME-issued token that could run on a decentralized network, potentially used by other market participants as margin. Duffy argued that the quality of collateral matters, suggesting that instruments issued by a systemically important financial institution would provide more confidence than tokens from smaller banks attempting to issue margin tokens. The comments signal a broader industry push to experiment with tokenized collateral as traditional markets increasingly explore blockchain-based settlement and liquidity tools.

Key takeaways

- CME Group is evaluating tokenized cash alongside a possible CME-issued token designed to operate on a decentralized network for margin purposes.

- Registry-style collateral could be favored if issued by systemically important financial institutions, rather than tokens from smaller banks.

- The discussion ties into a March collaboration with Google Cloud around tokenization and a universal ledger, indicating a concrete technical path for pilots.

- CME plans 24/7 trading for cryptocurrency futures and options in early 2026, subject to regulatory approval, reflecting a broader push toward continuous pricing and settlement.

- In parallel, CME has outlined growth in regulated crypto offerings, including futures tied to Cardano, Chainlink and Stellar, and a joint effort with Nasdaq to unify crypto index products.

Tickers mentioned: $ADA, $LINK, $XLM

Market context: The CME move comes as traditional banks and asset managers accelerate experiments with tokenized assets and stablecoins, while policymakers in the United States weigh regulatory frameworks for digital currencies and centralized versus decentralized settlement rails. The sector-wide trend includes both institutional pilots and ongoing regulatory scrutiny surrounding stablecoins and token-based payments.

Why it matters

The potential introduction of a CME-issued token or the broader use of tokenized collateral could redefine how institutions post margin and manage risk during periods of market stress. If a CME token were to gain traction among major market participants, it could provide a recognizable, regulated anchor for on-chain settlement workflows, potentially reducing settlement latency and settlement risk across a spectrum of asset classes. The emphasis on collateral quality—favoring instruments from systemically important institutions—helps address credibility concerns that have accompanied attempts by other entities to issue margin-related tokens in the past.

The development sits within a wider institutional push into tokenization and digital assets. Banks have been advancing their own experiments with tokenized cash and stablecoins to streamline cross-border payments and interbank settlements. For example, large banks have publicly discussed stablecoin exploration and related payment technologies, underscoring a broader demand for faster, more efficient settlement rails. Yet this momentum coexists with a regulatory push to address potential risks, coverage, and disclosure standards around tokenized instruments and stablecoins, including debates over yield-bearing stablecoins and the evolving legal framework in the CLARITY Act era.

Beyond the tokenization plans, CME’s broader crypto strategy—ranging from planned futures on leading tokens to a unified Nasdaq-CME Crypto Index—signals an intent to align traditional derivatives infrastructure with blockchain-enabled assets. The push toward 24/7 crypto derivatives trading marks a notable shift in market structure, as exchanges and market participants increasingly expect around-the-clock access to price discovery and settlement. The timing aligns with a confluence of industry experiments and policy discussions, creating a testing ground for tokenized collateral to become a practical, regulated element of mainstream finance.

What to watch next

- Regulatory clearances for 24/7 crypto derivatives trading expected in early 2026; approval status will shape CME’s execution timeline.

- Details on the CME-issued token’s design, governance, and interoperability with decentralized networks remain to be seen—watch for formal disclosures or filings.

- Progress of the Google Cloud-based Universal Ledger pilot for wholesale payments and asset tokenization; any case studies or results will inform practical feasibility.

- Updates on CME’s planned futures tied to Cardano (ADA), Chainlink (LINK) and Stellar (XLM) and how liquidity and risk controls will be implemented under the Nasdaq-CME alignment.

Sources & verification

- CME Group CEO Terry Duffy’s remarks on tokenized cash and potential CME-issued token during a Q4-2025 earnings call (Seeking Alpha transcript referenced in coverage).

- March press release announcing CME Group and Google Cloud’s tokenization initiative using Google Cloud’s Universal Ledger to enhance capital-market efficiency.

- Cointelegraph reporting on the CME-Google Cloud tokenization pilot and related technology discussions.

- CME’s January disclosures about expanding regulated crypto offerings with futures on Cardano (ADA), Chainlink (LINK) and Stellar (XLM) and the Nasdaq-CME Crypto Index integration.

- Regulatory context and policy discussions surrounding stablecoins and tokenization, including debates around the GENIUS Act and related rulemaking.

Key figures and next steps

Market participants will be watching for concrete technical details behind any CME-issued token, including how it would be stored, audited, and reconciled with existing collateral frameworks. The form and governance of a token designed for margin would influence whether such an asset could be widely adopted by clearing members and other systemically important institutions. As CME progresses its discussions with regulators and industry stakeholders, the potential for tokenized collateral to function as an accepted, high-credibility instrument will hinge on demonstrating robust risk controls, liquidity, and interoperability with existing settlement ecosystems.

Key figures and next steps

In the near term, observers should monitor updates on 24/7 crypto derivatives trading plans, potential regulatory approvals, and any incremental disclosures on how tokenized cash and a CME-issued token would be integrated into margin requirements. The collaboration with Nasdaq to unify crypto index offerings also merits close attention, as it could influence how institutional investors gauge exposure to digital assets in a standardized framework.

Why it matters (expanded)

For users and investors, the emergence of tokenized collateral could offer new pathways to manage liquidity and collateral agility, potentially reducing funding costs for participants who post margin across exchanges. For builders and platform teams, this trend underscores a need to design secure, auditable on-chain representations of traditional assets and to ensure that risk models and governance processes are aligned with regulated markets. For the market at large, CME’s exploration highlights how the line between on-chain assets and regulated, traditional finance is becoming more permeable, creating opportunities and challenges in equal measure.

What to watch next

- Regulatory approvals for 24/7 crypto derivatives trading anticipated in early 2026.

- Detailed disclosures on the CME-issued token’s architecture and governance in forthcoming filings or announcements.

- Milestones from the Google Cloud universal ledger pilot, including any pilot results or expansion plans.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech17 hours ago

Tech17 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards