Cryptocurrency

STX leads top altcoins with 20% rally, can the momentum hold?

STX formed a God candle today, rallying as high as 19.5% after it broke out of a bullish pattern as the broader market recovered.

Stacks (STX) rose to an intraday high of $0.717 on April 21, Asian time, before settling at $0.714 as of press time. Its market cap was set at nearly $1.1 billion while its daily trading volume was up over 200% at $153 million, indicating a surge in trading activity.

Being a Bitcoin-based protocol, STX’s gains today can be largely attributed to it mirroring the uptrend in Bitcoin (BTC), which has risen nearly 3.4% over the past day to $87,573, its highest level since Trump announced his “Liberation Day” tariffs. The broader crypto market is also up 1.1% at nearly $2.85 trillion.

The rally was accompanied by a surge in demand among derivative traders who have been betting on STX’s prices. Per CoinGlass data, open interest for STX has jumped 31% to over $51 million.

STX technical analysis

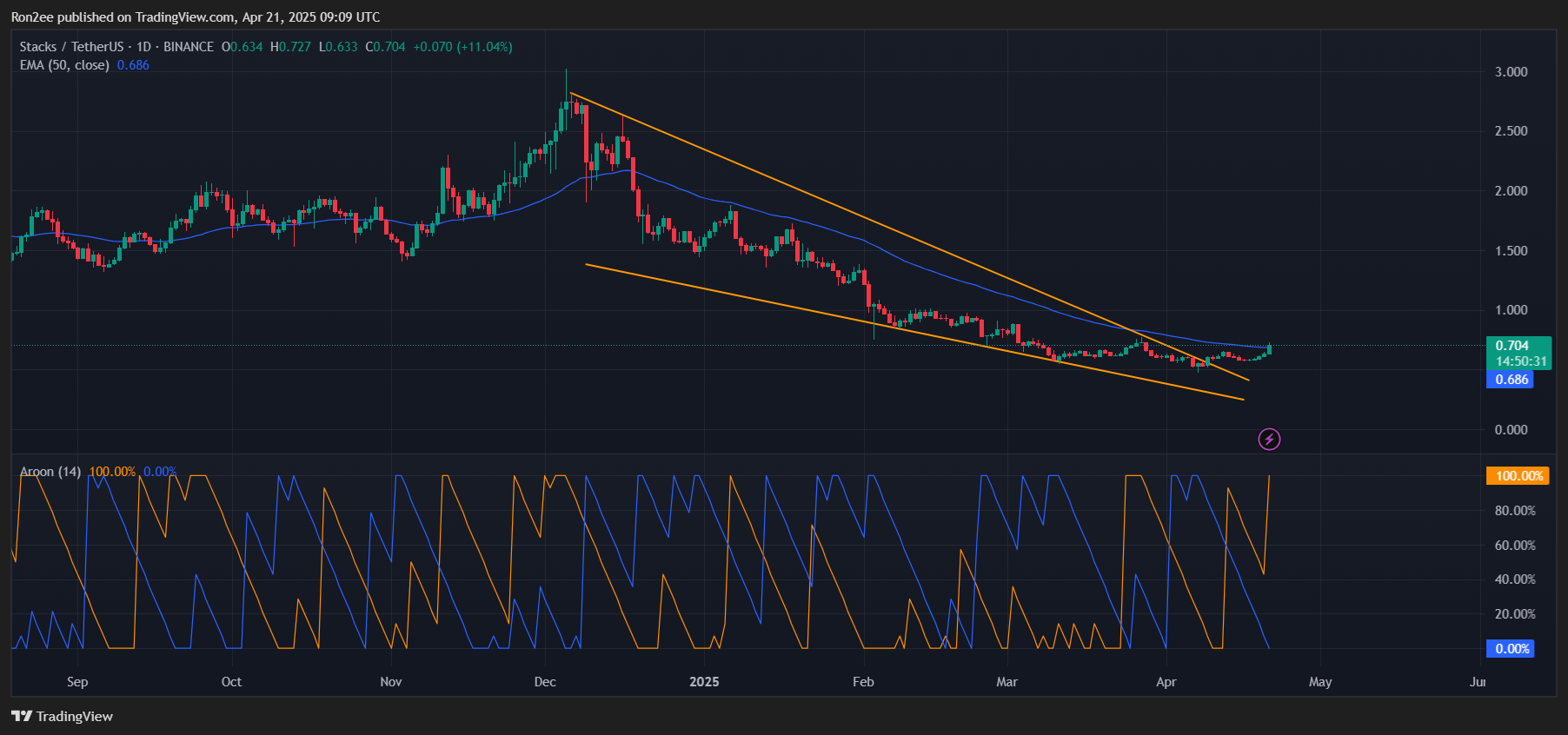

Meanwhile, on the 1-day USDT price chart, STX has broken above a falling wedge pattern, defined by two descending and converging trendlines.

In technical analysis, an upside breakout from this pattern is often seen as a bullish reversal signal, indicating the potential for a rebound in price.

According to analyst Captain Faibik, the breakout could trigger nearly 100% upside, with a near-term target of $1.40.

Adding to the bullish outlook, STX has moved above its 50-day exponential moving average, typically a sign of improving momentum that may encourage further buying activity.

Further, the Aroon Up is at 100% while the Aroon Down is at 0%, showing that buying pressure is clearly dominating over any selling right now.

Additionally, the Chaikin Money Flow is in positive territory, signalling that capital inflows are strengthening and buyers are in control.

Provided Bitcoin can sustain its positive momentum, the most likely target for STX appears to be the psychological resistance at $1. A break above this level could push it to target $1.3-1.4, a key resistance zone that aligns with previous swing highs and the projected move from the falling wedge breakout.

For the uninitiated, Stacks is a Bitcoin layer-2 network that allows developers to build smart contracts, DeFi applications, and NFTs while staying anchored to Bitcoin’s security. It uses a unique consensus mechanism called Proof of Transfer to connect its blockchain to Bitcoin, enabling advanced use cases without altering Bitcoin’s core protocol.

STX is the native token of the Stacks network. It is used to process transactions, power smart contracts, and earn Bitcoin rewards through token locking.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The Truth is that All Jobs are in Danger; we are just sugar coating here. | by YAROCELIS.eth - Tech Trends | Coinmonks | May, 2025

The Truth is that All Jobs are in Danger; we are just sugar coating here. | by YAROCELIS.eth - Tech Trends | Coinmonks | May, 2025