Crypto World

Sui Blockchain Secures Institutional Backing as Grayscale Files ETF with Coinbase Custody

TLDR:

- Grayscale’s S-1 amendment for Sui ETF with Coinbase custody brings institutional capital access channels.

- zkLogin technology eliminates seed phrases by enabling Google, Face ID, and phone authentication methods.

- Object-centric architecture processes transactions simultaneously, maintaining sub-cent fees during peak usage.

- Move programming language prevents asset duplication and deletion, eliminating common smart contract exploits.

The Sui blockchain has entered a new phase of development in February 2026 as institutional finance shows increased interest in the platform.

Grayscale recently amended its S-1 filing for a Sui exchange-traded fund, naming Coinbase as custodian. This development marks a shift from retail-driven speculation toward institutional infrastructure adoption.

The move signals growing recognition of Sui’s technical capabilities and regulatory compliance standards within traditional finance circles.

Institutional Capital Opens New Access Channels

The Grayscale ETF filing represents more than a routine regulatory submission. Exchange-traded funds transform digital tokens into recognized financial instruments accessible to pension funds and retirement accounts.

These institutional investors can now gain exposure without managing wallets or private keys directly. Coinbase’s role as custodian addresses security and compliance requirements that traditional finance demands.

Bitcoin ETFs previously demonstrated how institutional access drives capital inflows at scale. However, Bitcoin had already matured before ETF approval.

Sui remains in earlier development stages, meaning institutional capital entering now carries greater relative impact. Fixed supply dynamics combined with increasing demand create favorable conditions for long-term growth.

The institutional validation extends beyond price speculation. Regulatory recognition attracts enterprise developers and commercial applications.

Projects building on blockchains with clear compliance pathways face fewer legal uncertainties. This regulatory clarity reduces friction for businesses considering blockchain integration.

Capital markets now view Sui as legitimate infrastructure rather than experimental technology. The shift reflects broader industry maturation as crypto moves from speculative trading toward functional utility.

Traditional finance involvement brings stability and resources that support long-term ecosystem development.

Technical Architecture Removes Adoption Barriers

Sui addresses two critical obstacles that have prevented mainstream adoption. The platform eliminates seed phrase requirements through zkLogin technology developed by partners, including Human.tech’s Wallet-as-a-Protocol and Ika.

Users authenticate with Google accounts, Face ID, or phone numbers while maintaining full asset control. Zero-knowledge authentication verifies identity without exposing private keys to third parties.

This onboarding simplification removes the most intimidating aspect of cryptocurrency usage. Traditional wallet setup requires writing down twelve-word phrases and understanding address systems.

Sui reduces this process to familiar login methods users already trust. The technology breakthrough makes blockchain accessible without requiring technical education.

The underlying architecture also delivers performance improvements. Sui employs an object-centric model where assets exist as independent objects rather than account balances.

Tokens, NFTs, and smart contracts process simultaneously instead of sequentially. This parallel execution prevents network congestion even during high-demand periods.

Transaction fees remain under one cent with finality achieved in approximately 400 milliseconds. The Mysticeti consensus upgrade further reduced latency.

Move programming language adds security advantages by treating assets as resources that cannot be copied or accidentally deleted.

This design eliminates common exploit categories, including reentrancy attacks. The combination of usability and technical performance positions Sui for practical application deployment across finance and gaming sectors.

Crypto World

Kazakhstan’s Central Bank to Invest $350 Million in Crypto Assets

Kazakhstan’s central bank has announced a strategic move to invest up to $350 million in cryptocurrency assets, marking a significant shift in its reserve management strategy.

Kazakhstan’s central bank has unveiled plans to invest up to $350 million in cryptocurrency assets. This decision represents a substantial policy shift aimed at diversifying the country’s reserves.

Kazakhstan has emerged as a significant player in the global crypto mining sector, contributing approximately 6-8% of Bitcoin’s global mining due to its low electricity costs. The government is also working on a regulatory framework to legalize and tax crypto mining and trading, further solidifying its position as a crypto-friendly nation, according to Reuters.

The central bank, which oversees Kazakhstan’s monetary policy and manages its currency reserves, is implementing this investment strategy as part of a broader approach to reserve management.

This move is likely to influence neighboring Central Asian countries, encouraging them to consider similar investments or regulatory measures. The shift could potentially transform the regional crypto landscape, making Central Asia a hub for cryptocurrency development and innovation.

The investment decision aligns with global trends where central banks are increasingly exploring crypto assets as part of their reserve diversification strategies.

This article was generated with the assistance of AI workflows.

Crypto World

Bitcoin Exchange Outflows Signal Holder Conviction Amid Hormuz Crisis

Bitcoin outflows from exchanges continued during the Hormuz crisis, signaling holders are moving coins into cold storage rather than selling.

Bitcoin (BTC) held near $70,000 on March 6 after a geopolitical shock tied to tensions around the Strait of Hormuz pushed energy prices higher and triggered risk-off behavior across global markets.

Despite the turbulence, blockchain data shows BTC continuing to leave exchanges, suggesting many holders are not preparing to sell.

Energy Shock Rattles Markets

Analyst GugaOnChain linked the latest volatility to disruptions around the Strait of Hormuz, a major energy shipping route, which remains effectively closed amid the U.S.-Israeli war on Iran.

The market watcher noted that Brent crude traded near $85 and West Texas Intermediate around $81 as the situation pushed up fuel costs, including a $0.27 increase in U.S. gasoline prices during the week.

According to the same analysis, the shock drained liquidity across global markets and led to outflows of just under $228 million from Bitcoin exchange-traded funds on March 5. However, exchange flow data showed an unusual divergence. Using a seven-day moving average, Bitcoin’s net exchange flows remained negative, meaning more coins were leaving exchanges than entering them. Daily data showed withdrawals of 500 BTC, while the weekly total reached about 6,500 BTC, leaving trading venues.

According to GugaOnChain, such movements often signal that investors are transferring holdings into cold storage, which reduces the supply immediately available for sale.

“Given the notable on-chain resilience, the directive is to adopt a tactical defensive stance, maximizing cash now and awaiting confirmation of a reversal in institutional flows before raising exposure again,” the analyst advised.

Trading Activity Intensifies on Major Exchanges

While coins are leaving exchanges overall, trading activity inside platforms has accelerated. Data shared by Arab Chain on March 6 showed Bitcoin turnover on Binance reaching about 425,000 BTC over the past 30 days, one of the highest readings since December.

You may also like:

Binance’s Bitcoin reserves currently stand near 660,000 BTC, and compared with the 30-day turnover figure, the liquidity ratio sits around 0.64, meaning about 64% of those reserves have been traded or transferred during the period.

That pattern suggests the same coins are changing hands repeatedly within a short time frame, which reflects increased speculative activity and stronger liquidity circulation within the market.

Bitcoin has fallen from a monthly peak attained earlier in the week, with price data from CoinGecko showing the asset trading just under $71,000 at the time of writing, down about 2% in the last 24 hours but still up close to 5% over seven days.

At the moment, the flagship cryptocurrency is sitting between renewed institutional demand and global macro pressure. Exchange withdrawals imply that many holders are waiting rather than rushing to exit positions, even as traders remain active inside the market.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Insights on crypto’s new marketing logic from Bitget Wallet CMO Jamie Elkaleh

As part of Outset PR’s Web3 communications talks, the agency founder Mike Ermolaev recently spoke with Jamie Elkaleh, CMO of Bitget Wallet, about how marketing changes when a crypto wallet evolves from a trading tool into a broader financial interface.

Summary

- Crypto marketing is moving towards utility-driven adoption, where product experience and real-world usability play a central role.

- Regional differences increasingly shape communication strategies, as adoption patterns, regulations, and user expectations vary between markets such as Asia and the West.

- As the industry matures, both media narratives and market movements are becoming more influenced by verifiable data, institutional capital, and macroeconomic forces.

While the full conversation explores everything from user acquisition to media strategy and the shifting dynamics of crypto markets, here are several key insights that are worth broader market attention.

Smooth onboarding drives sustainable user acquisition

One of Jamie’s key points is that sustainable wallet growth is no longer driven by incentives. Airdrops and points programs are often used to generate rapid attention. But according to him, these tactics rarely translate into long-term users. Instead, the focus should be on reducing product friction and simplifying onboarding.

“When users can transact without managing seed phrases or holding native gas tokens, adoption becomes more sustainable.”

In a utility-driven market, Jamie says, product design effectively becomes marketing.

Marketing in Asia vs. the West reflects different user expectations

Another point Jamie raised is that crypto marketing strategies vary significantly by region.

In Asia, adoption is closely tied to everyday financial use cases such as remittances, cross-border transfers, and stablecoin payments. As a result, communication tends to focus on speed, accessibility, and practical value.

“In 2025, the region recorded a 69% year-over-year increase in on-chain value. That reflects strong grassroots usage.”

In Western markets, the situation is different. Regulatory clarity and institutional trust shape user expectations much more strongly.

“With frameworks such as MiCA in Europe and new U.S. stablecoin legislation, users prioritize compliance, proof of reserves, and risk transparency.”

Despite these differences, Jamie notes that the core requirement remains the same across regions: products must work reliably in real-world financial contexts.

Data now underlies media credibility

At Bitget Wallet’s scale, Jamie insists that media coverage can’t rely on generic commentary. Journalists increasingly expect verifiable data that helps explain what is actually happening in the market.

“We publish research reports based on on-chain analytics and user behavior trends, which allows reporters to reference measurable insights.”

Per him, stories supported by real usage patterns – whether in transaction volume, adoption, or user growth – travel much further across the media ecosystem. This approach also changes how the team evaluates PR performance.

“We prioritize tier-one mentions, analyst citations, and share of voice within strategic narratives. Secondary indicators include organic brand mentions, backlink authority, inbound media inquiries, and invitations to podcasts or research collaborations.”

The real signal, Jamie adds, appears when external analysts start referencing the company’s data independently.

Crypto markets now move with macro capital

Jamie also confirms that crypto’s relationship with news has fundamentally changed. In earlier cycles, a single headline could move markets within hours. Today, price actions are increasingly shaped by macro capital flows, because

“Crypto has matured into a macro-sensitive asset class.”

As sector valuations reached multi-trillion-dollar levels, individual headlines naturally stopped carrying such influence.

With nearly $44 billion flowing into Bitcoin ETFs in 2025, institutional capital now plays a structural role in the market. In this environment, narratives matter less than fundamentals.

Utility is becoming crypto’s growth model

Reflecting on the conversation, one pattern becomes clear: the crypto industry is gradually shifting away from narrative-driven growth toward functional adoption.

Wallets are used not just for trading but for payments, transfers, and yield farming. Users expect reliability rather than explanations. And as institutional capital becomes a structural force, macro conditions are more important than short-term hype.

In that environment, the logic of marketing changes as well.

“If users don’t need to understand the infrastructure behind the product, the marketing has done its job.”

Crypto World

Vitalik Buterin Proposes Human-Verified AI Wallets for Crypto Transactions

Buterin proposed AI-assisted wallets where algorithms suggest transaction plans but users must manually confirm large transfers.

Vitalik Buterin has outlined his perspective on how artificial intelligence (AI) could redefine the next generation of Web3 wallets.

He also proposed a model where humans remain directly involved in approving high-value transactions.

AI Will Shape Newer Crypto Wallets

The Ethereum co-founder shared his views on the decentralized social media platform Farcaster, noting that it is “pretty obvious” that the next iteration of wallets will heavily involve AI.

Despite this, Buterin added that he would not trust LLMs with multi-million-dollar transactions or control over large amounts of money. Instead, he gave an approach in which AI systems assist users while leaving the final decision in human hands.

He described an optimal workflow in high-value situations that would involve an AI system proposing a plan, after which a local light client simulates the transaction. The person would then review the intended action and the required outcome before manually confirming it.

However, Buterin warned that this approach must be implemented conservatively with a strong emphasis on security. He suggested that one way to achieve this is by removing decentralized application interfaces from the transaction process. By eliminating dApp user interfaces from the flow entirely, the system could reduce several attack vectors associated with theft and privacy risks.

The 32-year-old has previously discussed how cryptocurrency and AI could evolve together. He envisions blockchains and the technology working hand-in-hand, with crypto providing the trust, privacy, and economic infrastructure that it needs to operate safely and fairly.

You may also like:

Proposed AI-Assisted Wallet Workflows

Other developers and community members responded to Buterin’s comments by describing potential implementations of the idea.

Ethereum developer Andrey Petrov suggested two additional scenarios. In the first, a user initiates a transaction as usual while AI analyzes the payload about to be signed. The technology would then attempt to guess their intended action and explain it in plain language, allowing them to confirm whether the transaction accurately reflects what they meant to do.

In the second case, the user either states their intended action directly or relies on the explanation generated in the first step. The AI then tries to reconstruct the transaction independently, without referencing the original amount, to determine whether it arrives at the same outcome. He explained that any differences between the two would show areas that require further review before the process is finalized.

Another Farcaster user, identified as fkaany, described a framework in which AI plans complex crypto strategies such as multi-hop swaps, yield optimization, and gas minimization.

This would involve a local light client simulating the outcome, which would allow individuals to review a clear summary and manually confirm the transaction, helping reduce risks from blind signing, phishing interfaces, and malicious dApp payloads.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Vitalik Buterin Backs Minimmit Over Casper FFG for Ethereum’s Consensus Layer

TLDR:

- Minimmit achieves finality in one signing round, replacing Casper FFG’s two-round justification and finalization process. (truncate to fit — 105 chars)

- The new gadget lowers fault tolerance from 33% to 17%, but raises the unilateral censorship threshold from 67% to 83%.

- Buterin argues censorship poses a greater threat than finality reversion, as it lacks immediate, verifiable on-chain evidence.

- Minimmit requires 83% of clients to share a bug before incorrect finalization occurs, giving developers a wider safety margin.

Minimmit has been put forward as a direct replacement for Casper FFG within Ethereum’s consensus layer. Ethereum co-founder Vitalik Buterin recently shared a detailed technical post comparing both finality gadgets.

Casper FFG has long served as a two-round finality mechanism on the network. The proposed system, by contrast, achieves finality in a single round of validator signatures.

The proposal is drawing attention as the Ethereum community continues to evaluate changes to its consensus architecture.

Why the New System Operates in a Single Round

Casper FFG asks each attester to sign a block on two separate occasions. The first signature “justifies” the block, and the second “finalizes” it.

Minimmit cuts this down to a single signing round. This makes the process more efficient for validators across the network.

The change comes with a direct cost to fault tolerance, though. The new system’s threshold sits at 17%, compared to 33% under Casper FFG.

A smaller portion of malicious stake can therefore disrupt finality under the new model. Still, Buterin’s post makes the case that other properties of the system more than offset this drop.

In the post shared on X, Buterin described himself as a long-standing “security assumptions hawk” in Ethereum’s consensus research. He cited his past push for 49% fault tolerance under synchrony.

He also referenced his work on DAS for dishonest-majority-resistant data availability checks. Despite this record, he stated he is “even enthusiastic” about the proposed design.

The asynchronous network case also differs between the two systems. Under ideal 3SF, finality holds as long as an attacker controls less than 33% of stake.

The proposed gadget lowers that same protection to 17%. In both cases, any reversion of finality triggers massive slashing penalties against offending validators.

Censorship Resistance and the Broader Security Picture

Buterin’s argument centers on identifying censorship as the more dangerous threat. Unlike finality reversion, censorship produces no immediate, publicly verifiable evidence against the attacker.

A reversion event, on the other hand, results in automatic, large-scale slashing. This asymmetry is a core reason behind his support for Minimmit’s design.

Both systems require an attacker to control over 50% of staked ETH to carry out censorship. The key distinction lies in what happens at higher thresholds.

In 3SF, an attacker above 67% can finalize the chain unilaterally, removing any coordination point for honest validators. The new system raises that threshold to 83%.

Software bugs present another area where the proposed gadget holds an advantage. Under 3SF, a flaw shared by 67% of client software can accidentally finalize an incorrect chain state.

Minimmit raises that bar to 83%. This wider margin gives developers more time to identify and respond before errors become permanent.

Buterin also addressed the economic argument against finality reversion attacks. With 15 million ETH staked, reverting finality under 3SF would require slashing 5 million ETH, or roughly $10 billion.

He noted that the 17% baseline still represents an enormous deterrent on its own. From there, he argues the proposed system’s other properties make it the stronger overall consensus design for Ethereum.

Crypto World

Ex-CFO Sentenced to Two Years after Diverting $35M to Crypto Venture

Nevin Shetty was convicted of wire fraud related to secretly moving $35 million in funds from a Seattle startup to his own crypto platform in 2022 to use for DeFi investments.

A Seattle judge has sentenced the former chief financial officer of a local startup to two years in prison following his conviction for wire fraud related to a cryptocurrency business.

In a Thursday notice, the US Justice Department said Nevin Shetty would serve two years in prison after he “secretly moved approximately $35 million in company funds to a cryptocurrency platform he controlled as a side business.” He moved the funds to the HighTower Treasury platform in 2022 before a crypto market downturn, resulting in the disclosure of the transfer.

According to the DOJ, Shetty was able to transfer the funds without any executives or board members at the Seattle startup knowing about it, then using the money to invest in “high-yield DeFi lending protocols that promised to generate returns of 20% or more.” He initially earned $133,000 in the first month before the collapse of the Terra ecosystem contributed to a significant market downturn.

“[T]he cryptocurrency investments that Shetty made with the stolen funds soon began declining and by May 13, 2022, the value of the investments was nearly zero,” said the DOJ. “After the $35 million was essentially gone, Shetty told two of his fellow executives what he had done. He was immediately fired.”

Shetty was indicted on charges of wire fraud in May 2023 and found guilty on four counts in November 2025 after a nine-day jury trial. He has been ordered to pay back the stolen funds and be on supervised release for three years after serving his two-year sentence.

Related: Analysts reject Jane Street ‘10 a.m. dump’ claims, say Bitcoin isn’t easily manipulated

Former FTX CEO is still waiting on an appeal

Shetty’s 2022 case happened months before the collapse of cryptocurrency exchange FTX, which later resulted in the arrest and conviction of its former CEO, Sam “SBF” Bankman-Fried. SBF was sentenced to 25 years in prison in 2024 but has filed to appeal the ruling. As of Friday, the US Court of Appeals for the Second Circuit had not announced any decision since it heard arguments in November.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Kazakhstan’s Central Bank quietly joins the Crypto reserve club

Astana’s $350M pivot from gold and FX to digital assets lands just as Bitcoin grinds against the $70K ceiling, adding fresh “real money” bid to an already tight market.

Summary

- Kazakhstan will reallocate up to $350M from its gold and FX reserves into crypto-linked assets starting April–May.

- The move trims exposure to sanction‑prone reserve assets and adds indirect Bitcoin and Ethereum exposure via funds and infrastructure stocks.

- It lands as Bitcoin trades in the high‑$60Ks to low‑$70Ks with resistance near $73K–$76K, tightening the macro link between sovereign flows and crypto pricing.

According to Reuters, Kazakhstan’s central bank has confirmed plans to carve out up to $350M from its roughly $69B stockpile of gold and foreign exchange reserves to build a crypto‑focused portfolio, a structural shift few emerging market monetary authorities have dared to make.

Rather than loading Bitcoin directly onto the balance sheet, the National Bank will channel capital into funds, index products, and equities tied to digital asset infrastructure, including Bitcoin (BTC) and Ethereum (ETH) exposure via intermediated vehicles. The allocation, slated to begin around April–May, will be funded by rotating out of existing gold and FX holdings, effectively swapping a slice of traditional reserves for higher‑beta digital risk.

Commentators have been blunt that diverting reserves into crypto‑linked assets is a hedge against the kind of reserve freezes Russia faced in 2022, when “safe” FX and gold suddenly proved politicized. By allocating to liquid, globally traded crypto instruments and the companies that support them, Kazakhstan is testing whether digital rails can complement the legacy reserve system without openly confronting it. With only a small fraction of total reserves at stake, the central bank preserves plausible deniability while signaling to miners, exchanges, and infrastructure providers that Astana wants to be a regional hub.

The timing intersects directly with a taut crypto market. Bitcoin is trading in a consolidation band roughly between the high‑$60Ks and mid‑$70Ks, repeatedly probing resistance around $73K–$76K amid rising volumes and a market cap north of $1.4T. Short‑term forecasts cluster around a $72K–$76K range, with technicians watching for a breakout that could extend toward $78K–$80K if fresh capital keeps arriving. Against that backdrop, Kazakhstan’s $350M is not huge in nominal terms, but it is “sticky,” multi‑year reserve capital—precisely the kind of flow that strengthens the narrative of Bitcoin as an emerging reserve adjunct rather than just a speculative trade. If more mid‑tier sovereigns follow, price action at $70K stops being just a chart level and starts to look like a policy decision made in central bank boardrooms.

Crypto World

Ethereum Ecosystem Hits $15B in Tokenized RWAs and $1T in Aave Loans in a Single Month

TLDR:

- Tokenized real-world assets on Ethereum mainnet surpassed $15 billion in total market capitalization this month.

- Aave crossed $1 trillion in all-time cumulative loans, marking a major milestone for decentralized lending on Ethereum.

- BNP Paribas and BlackRock deepened their presence on Ethereum through new tokenized fund launches and integrations.

- Ethereum’s Layer 2 networks advanced significantly, with Linea peaking at 218 mGas/s and Optimism shipping Upgrade 18.

Ethereum builders delivered a remarkable month of progress across the ecosystem, with milestones that captured attention across both crypto and traditional finance.

Tokenized real-world assets on Ethereum mainnet crossed $15 billion in market cap. Aave surpassed $1 trillion in all-time loans, marking a major threshold for decentralized lending.

These achievements arrived alongside 25 distinct ecosystem deliverables spanning privacy, scaling, institutional adoption, and developer tooling.

Tokenized Real-World Assets and Institutional Products Hit Record Levels

Ethereum builders pushed tokenized real-world assets past $15 billion in total market cap on mainnet. The figure reflects sustained growth in onchain financial products built on Ethereum infrastructure. Several institutions contributed directly to that growth through new product launches this month.

BNPParibas launched a euro-denominated money market fund directly on Ethereum’s public blockchain. The move brought one of Europe’s largest banks into Ethereum’s financial infrastructure in a meaningful way. It also added to the growing list of regulated financial products now operating onchain.

OndoFinance brought tokenized stocks, SPYon and QQQon, live as DeFi collateral on @Morpho. @eulerfinance also accepted tokenized equities as collateral through a collaboration with Ondo Finance, Sentora, and Chainlink. Traditional financial exposure is now usable inside Ethereum-native lending markets without leaving the chain.

Uniswap integrated with Securitize to make BlackRock’s BUIDL fund tradeable through UniswapX. @StartaleGroup introduced JPYSC, the first trust bank-backed Japanese yen stablecoin on Ethereum. Together, these launches show institutions treating Ethereum as core financial infrastructure rather than experimental technology.

Aave Crosses $1 Trillion as DeFi Activity Compounds Across the Ecosystem

Aave crossing $1 trillion in cumulative all-time loans stands as one of the month’s most watched milestones. The figure represents years of consistent lending activity built on Ethereum’s open financial layer. It also reflects growing trust in decentralized protocols to handle serious financial volume over time.

MetaLeX_Labs added to DeFi’s expanding use cases by launching cyberSign this month. The product allows users to sign legally binding agreements using Ethereum or Base as the signing infrastructure. It bridges legal execution with blockchain-native identity in a practical and accessible way.

RobinhoodApp launched the public testnet for Robinhood Chain, an Ethereum L2 powered by Arbitrum. The platform targets institutional settlement and aims to bridge traditional brokerage activity with public rollup infrastructure. It joins a growing set of financial platforms building directly on Ethereum’s Layer 2 ecosystem.

@base also announced that Y Combinator startups can now receive funding in USDC on Base. The development connects early-stage startup capital with Ethereum’s stablecoin and payment rails. It opens a practical path for new companies to operate natively within the Ethereum ecosystem from day one.

Builders Advance Privacy Tools, Scaling Capacity, and Staking Infrastructure

Ethereum builders made parallel progress in privacy, performance, and staking throughout the month. @payy_link announced Payy Network, a privacy-first EVM Layer 2 with default private token transfers.

@hinkal_protocol enabled private ETH and stablecoin payments on Arbitrum, extending privacy further across L2s.

Starknet integrated Nightfall for confidential institutional DeFi and released Starkzap, an open-source SDK for consumer apps. @blockscout launched a Tor-native onion service, giving users a private way to view Ethereum state.

The @ethereumfndn also released the One Trillion Dollar Security Dashboard, offering a full view of ecosystem security.

LineaBuild sustained over 100 mGas per second throughout the month, peaking at 218 mGas per second. @Optimism shipped Upgrade 18, targeting a more performant and customizable OP Stack for builders. These results confirm that Ethereum’s rollup layer is actively delivering on its throughput promises.

Rocket_Pool activated Saturn One, introducing 4 ETH megapool validators to strengthen decentralized staking. @ether_fi released its Android app, lowering the barrier for mobile users entering staking and DeFi.

The @ethereumfndn also published its 2026 priorities — Scale, Improve UX, and Harden the L1 — keeping long-term development coordinated and public.

Crypto World

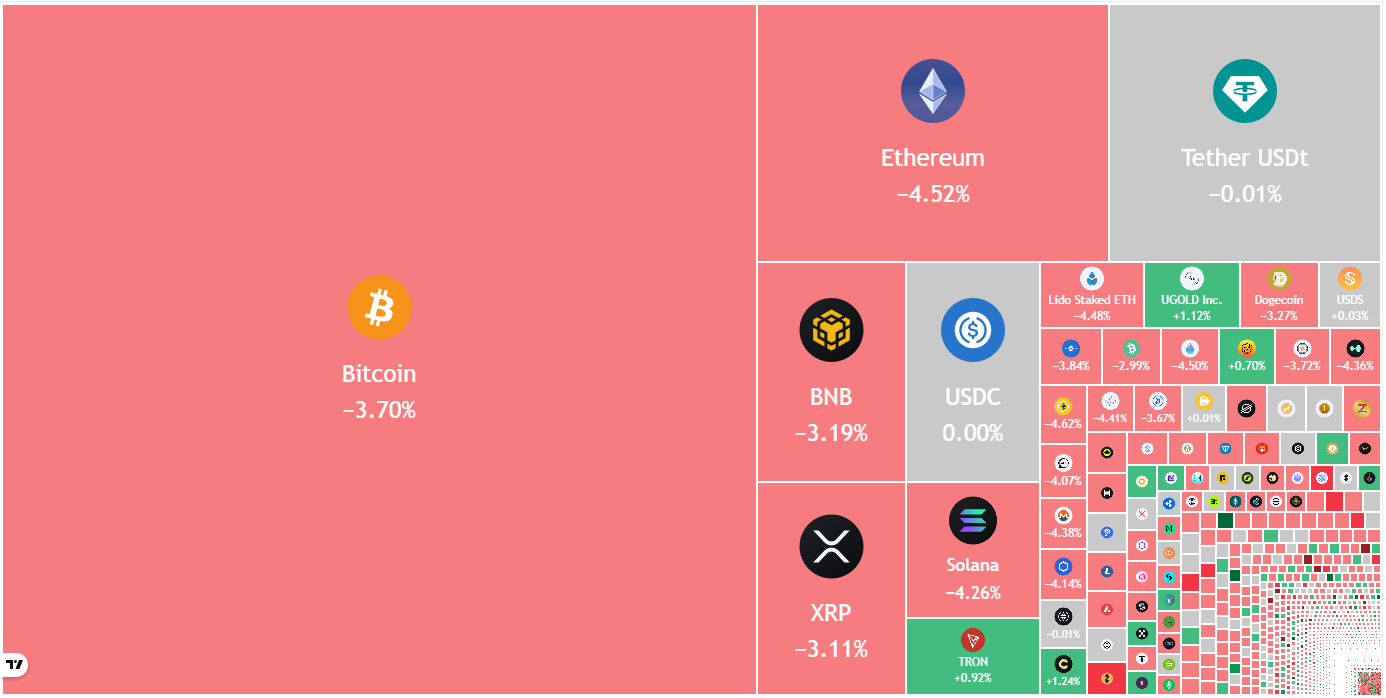

Will BTC See $60K Again?

Key points:

-

Analysts believe that Bitcoin will have to stay above the $68,000 level to continue its recovery.

-

Several major altcoins have turned down from their overhead resistance levels, indicating that bears remain in control.

Bitcoin’s (BTC) relief rally was rejected at the $74,000 level, and the bears have pulled the price below $68,500. Select analysts believe that BTC will have to hold the $68,000 to $70,000 zone to continue its short-lived bull trend.

The big question on traders’ minds is whether BTC has bottomed out or if it could fall further. Coinbureau CEO Nic said in a post on X that BTC’s price relative to gold has historically “taken about 14 months to go from peak to bottom.” The bottom of the ratio has been followed by a sharp rally of more than 300% in BTC on every occasion. The current 13-month decline from the previous ratio peak suggests that BTC may be close to bottoming out.

Not everyone believes that BTC’s bear market may be ending. On-chain analytics company CryptoQuant said in a post on X that BTC is in a bear market as per their Bull Score Index, which remains deep in bearish territory. The platform said data shows the current rally is “likely just a relief rally, not the start of a new bull phase.”

Could BTC and select major altcoins hold on to their support levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price prediction

BTC turned down from the breakdown level of $74,508 on Thursday, indicating that the bears are defending the level with all their might.

The 20-day exponential moving average ($69,003) is the critical support to watch out for on the downside. If the Bitcoin price turns up from the 20-day EMA, the bulls will again attempt to clear the obstacle at $74,508. If they can pull it off, the BTC/USDT pair may soar to $84,000. Such a move suggests that the pair may have bottomed out at $60,000.

On the contrary, a close below the 20-day EMA may pull the price to the support line. This is a vital level to keep an eye on as a break below the support line tilts the advantage in favor of the bears. The pair may then collapse to $60,000.

Ether price prediction

Ether (ETH) cleared the $2,111 resistance on Wednesday, but the bears pulled the price back below the level on Thursday.

The Ether price continued lower and broke below the 20-day EMA ($2,032), suggesting that the market rejected the break above the $2,111 level. The ETH/USDT pair is likely to oscillate between $1,750 and $2,200 for some time.

Conversely, if the price turns up from the current level and breaks above the 50-day SMA ($2,328), it suggests that the selling pressure has weakened. The pair may then start an up move to $2,600.

BNB price prediction

BNB (BNB) turned down from the $670 level on Thursday, indicating that the bears are vigorously defending the level.

The bears have pulled the price below the 20-day EMA ($637), indicating that the bulls have given up. That suggests the BNB/USDT pair may remain inside the $570 to $670 range for a while longer.

The bulls will be back in the driver’s seat on a close above the $670 level. That opens the doors for a rally to the 50-day SMA ($718) and later to $790. Sellers will have to yank the BNB price below the $570 level to start the next leg of the down move to $500.

XRP price prediction

XRP (XRP) closed above the 20-day EMA ($1.41) on Wednesday, but the bulls could not sustain the higher levels.

The bears are attempting to pull the XRP/USDT pair below the $1.27 support. If they manage to do that, the XRP price may slump to the support line of the descending channel pattern.

On the contrary, if the pair turns up and breaks above the 20-day EMA, it suggests that the bulls are attempting a comeback. The pair may then rally to $1.61, which could again act as stiff resistance.

Solana price prediction

Solana (SOL) turned down from the $95 level on Thursday and has slipped below the 20-day EMA ($86).

The flattish 20-day EMA and the RSI just below the midpoint indicate a balance between supply and demand. The Solana price may oscillate between $76 and $95 for a few more days.

Buyers will have to secure a close above the $95 level to suggest that the bears are losing their grip. The SOL/USDT pair may then surge to the $117 level. Sellers will be back in the game on a close below $76.

Dogecoin price prediction

Dogecoin (DOGE) rose above the 20-day EMA ($0.10) on Wednesday, but the bulls could not pierce the 50-day SMA ($0.11).

The Dogecoin price turned down and reached the critical $0.09 support. If the bears pull the price below the $0.09 level, the DOGE/USDT pair may retest the Feb. 6 low of $0.08. Buyers are expected to fiercely defend the $0.08 level, as a close below it may sink the pair to $0.06.

The bulls will have to thrust the price above the 50-day SMA to signal strength. The pair may then rally to the breakdown level of $0.12, where the bears are expected to step in.

Cardano price prediction

Buyers attempted to push Cardano (ADA) above the 20-day EMA ($0.27) on Thursday, but the bears held their ground.

However, a minor advantage in favor of the bulls is that they have not allowed the Cardano price to dip below the $0.25 level. If the price turns up from the current level or the $0.25 support, the bulls will again attempt to push the ADA/USDT pair to the downtrend line of the descending channel pattern.

On the other hand, a close below the $0.25 level opens the doors for a retest of the support line. A close below the support line may sink the pair to the $0.15 level.

Related: Was $74K a bull trap? Bitcoin traders diverge on 2022 crash repeating

Bitcoin Cash price prediction

The bounce off the $443 level in Bitcoin Cash (BCH) fizzled out at $476 on Wednesday, indicating a negative sentiment.

The bears will attempt to strengthen their position by pulling the Bitcoin Cash price below the $443 support. If they manage to do that, the BCH/USDT pair will complete a bearish head-and-shoulders pattern. The pair may then plummet to $375.

Buyers will have to propel the price above the 20-day EMA ($488) to signal strength. The pair may then reach the 50-day SMA ($533), which is likely to attract sellers. A close above the 50-day SMA indicates the start of a sustained recovery toward $600.

Hyperliquid price prediction

Hyperliquid (HYPE) has pulled back to the moving averages, which are a crucial support to watch out for.

If the Hyperliquid price rebounds off the moving averages with force, the bulls will again attempt to drive the HYPE/USDT pair to the $36.77 overhead resistance. A close above the $36.77 level signals the start of a new up move.

Contrary to this assumption, if the price continues lower and breaks below the moving averages, it suggests that the pair may remain inside the $20.82 to $36.77 range for a few more days.

Monero price prediction

Buyers are attempting to push Monero (XMR) above the $360 level, but are facing stiff resistance from the bears.

The 20-day EMA ($347) is the crucial support to watch out for on the downside. If the Monero price bounces off the 20-day EMA, the possibility of a break above the 50-day SMA ($396) increases. The XMR/USDT pair may then rally to the 61.8% Fibonacci retracement level of $414.

Instead, if the price turns down and breaks below the 20-day EMA, it signals that the bears are active at higher levels. That may keep the pair range-bound between $384 and $302 for some time.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Exclusive Ukrainian National Football Team Card Skin and Match Tickets Giveaway

[PRESS RELEASE – Vilnius, Lithuania, March 6th, 2026]

WhiteBIT, the largest European cryptocurrency exchange by traffic and the official title crypto partner of the Ukrainian National Football Team, has introduced a new fan-focused initiative that blends digital innovation with real-world experiences.

As part of the initiative, WhiteBIT is launching an exclusive Ukrainian National Football Team skin for its WhiteBIT Nova VISA card and giving fans the chance to win tickets to upcoming national team qualification matches.

This campaign reflects WhiteBIT’s broader mission to make crypto accessible and meaningful to everyday users by connecting digital assets with real-life passions. For football fans, crypto becomes a gateway to exclusive experiences, community engagement, and moments that extend far beyond the screen.

New Ukrainian National Team Skin Unlocks Matchday Perks

From March 3, WhiteBIT Nova VISA card holders gain access to a limited-edition skin designed in collaboration with the Ukrainian National Football Team. It celebrates national pride while turning a daily payment tool into a symbol of support for the team.

WhiteBIT also introduces functional perks for fans attending the Ukraine–Sweden games in Valencia on March 26 and March 31. The WhiteBIT Nova VISA cardholders will receive 50% cashback on purchases made with the card at the stadium bars on the match day. Further prize giveaways are also planned at the stadium, extending the campaign beyond the digital environment into the live event experience.

Ticket Giveaway: Chance to See Ukraine Live

In parallel, WhiteBIT is rolling out a ticket giveaway campaign for fans eager to see the Ukrainian National Football Team live. The image of the Ukrainian National Football Team skin is hidden on the WhiteBIT website and must be found to participate in the giveaway. Five randomly selected participants will each receive two tickets to the Ukraine–Sweden game at Estadi Ciutat de València on March 26, creating an unforgettable matchday experience for supporters.

To participate in the ticket draw, users should:

- Open a WhiteBIT Nova card in the WhiteBIT app

- Find the image of the Ukrainian National Football Team skin on the official WhiteBIT website — a hint: the skin image can be found “where everything begins”.

- Click on the skin and complete the required action

- Five random users who successfully find the skin will receive two tickets to a Ukrainian national team match in Valencia.

With this initiative, WhiteBIT once again reinforces its position as a brand that brings crypto closer to real life — where passion meets opportunity, and every fan can unlock more than just a payment experience.

About WhiteBIT

WhiteBIT is the largest European cryptocurrency exchange by traffic, offering over 900 trading pairs, 350+ assets, and supporting 8 fiat currencies. Founded in 2018, the platform is a part of W Group which serves more than 35 million customers globally. WhiteBIT collaborates with Visa, FACEIT, FC Juventus and the Ukrainian national football team. The company is dedicated to driving the widespread adoption of blockchain technology worldwide.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business7 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports1 day ago

Sports1 day ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion5 days ago

Fashion5 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker