Crypto World

Tether Scales Operations Globally as CFO McWilliams Strengthens Governance

TLDR:

- Tether now manages 140 investments, actively moving beyond stablecoin operations worldwide.

- The company hires 150 staff, boosting engineering, finance, and regulatory teams globally.

- CFO Simon McWilliams centralizes London operations to strengthen governance and reporting.

- Tether scales down $20B fundraising plan to $5B, focusing on investors and profitability.

Tether, issuer of the dominant stablecoin USDT with about $187 billion in circulation, is diversifying beyond crypto payments.

It is moving into a global investment group as investors pushback trim a planned $15–$20 billion capital raise to around $5 billion.

CEO Paolo Ardoino says the firm remains profitable and strategically aligned, while expanding hires, investments, and governance under new CFO Simon McWilliams.

Tether Expands Beyond Stablecoins into a Global Investment Group

Tether, the issuer of the widely used stablecoin USDT, is accelerating its transformation from a crypto infrastructure provider into a diversified global investment group.

According to the Financial Times, the company now manages around 140 investments spanning artificial intelligence, commodities, sports equity, and other sectors.

This strategic shift aims to reduce reliance on stablecoin operations while broadening revenue streams and market influence

To support this growth, Tether’s workforce is scaling. The company currently employs roughly 300 staff and plans to hire 150 more.

These new roles focus on engineering, regulatory compliance, finance, and venture investments. Offices in London, the UAE, Brazil, and Ghana indicate a deliberate push toward global reach and regulatory alignment.

Leadership changes are central to the expansion. New CFO Simon McWilliams is centralizing finance and operations in London.

Sources say he is enhancing governance, streamlining reporting, and improving operational discipline. Centralizing key functions in a major financial hub positions Tether closer to traditional markets, signaling its intent to bridge crypto and conventional finance.

Despite growth, regulatory scrutiny remains. Market participants and regulators continue to request independent audits of Tether’s reserves, even though the company issues quarterly attestations.

Executives argue that strong profitability and transparent reserve management provide flexibility to pursue long-term growth while maintaining market confidence.

Capital Strategy, Investor Response, and Market Position

Tether is simultaneously managing its capital strategy amid investor scrutiny. FT and Reuters report that the company considered a $15–20 billion fundraising scenario, potentially valuing it near $500 billion.

Following investor feedback, the company is considering a smaller raise, possibly around $5 billion, emphasizing strategic alignment rather than headline figures. CEO Paolo Ardoino clarified that the higher amounts were hypothetical, used for planning, and not formal targets.

Profitability underpins this approach. Tether projects continued earnings growth in 2026, reducing reliance on external capital.

Internal reinvestment allows the company to fund expansion into diversified sectors while maintaining operational control.

Investor sentiment is mixed. Some remain cautious due to valuation and transparency concerns.

Nevertheless, Tether’s market dominance is a stabilizing factor. With USDT circulation exceeding $185 billion, the company maintains a strong revenue base and liquidity position.

This allows it to pursue investments across multiple sectors while mitigating crypto-specific risks. In conclusion, Tether is evolving from a stablecoin issuer into a diversified investment and technology platform.

Through strategic hiring, governance enhancements, portfolio expansion, and disciplined capital management, the company balances ambition with prudence, positioning itself for sustainable long-term growth across digital and traditional financial markets.

Crypto World

Bitmine Buys 20,000 ETH During Market Panic, Defies Bearish Sentiment

TLDR:

- Bitmine added 42,000 ETH in one week, reflecting sustained accumulation during heightened market volatility

- The latest 20,000 ETH purchase occurred near market lows, signaling strategic timing rather than reactive buying

- Staking remains central to Bitmine’s model, with projected annual rewards tied to validator expansion plans

- Bitmine equity trades below NAV despite rising ETH holdings and improving Ethereum network activity.

Bitmine Ethereum accumulation has gained attention as the firm increased exposure during a broader crypto market downturn.

The move reflects a disciplined strategy centered on long-term fundamentals, staking income, and balance sheet growth rather than short-term price action.

Bitmine Ethereum Accumulation Confirms Sustained Buying and Strategic Timing

Bitmine Ethereum accumulation accelerated during a period of sharp selling across digital asset markets. On-chain data showed the firm acquired 20,000 ETH from a Kraken hot wallet during heightened volatility.

The purchase, valued at approximately $41.98 million, occurred without public statements or coordinated messaging. Market participants identified the transfer after wallet activity was shared on X.

According to Lookonchain data cited in those posts, the transaction took place within hours of the broader market downturn. The timing suggested planned accumulation rather than reactive buying.

Over the same week, Bitmine added roughly 42,000 ETH in total. Holdings now approach 4.17 million ETH, reflecting consistent balance sheet expansion.

Charts shared across social platforms showed steady increases in ETH balances. There were no visible distribution patterns or abrupt reductions in holdings.

Liquidity during the period remained thin, with forced sellers present across major venues. Such conditions often allow long-term participants to accumulate supplies efficiently.

Bitmine’s approach aligned with historical institutional behavior during prior market drawdowns. Accumulation occurred quietly while sentiment remained cautious.

The absence of hedging activity reinforced the view that ETH was treated as a strategic reserve asset. Price volatility appeared secondary to position sizing.

Staking Strategy and Valuation Context Shape Bitmine Positioning

Bitmine Ethereum accumulation is closely linked to its staking-focused operating model. The firm emphasizes yield generation to reduce idle asset risk during price weakness.

Chairman Tom Lee stated that stakeholder income could reach $374 million annually. This projection depends on full deployment of the Made in America Validator Network in 2026.

Staked ETH provides recurring revenue regardless of short-term price movement. Validator participation also supports Ethereum network security and decentralization.

Ethereum network metrics continue to show resilience. Daily transactions recently reached 2.5 million, while active addresses climbed to one million.

Lee referred to the recent pullback as an attractive entry point during remarks shared on X. He cited growing validator participation and steady network usage.

Bitmine’s equity valuation presents an additional layer. Shares recently traded near $20.44, below the reported NAV per share of $21.25.

This places the stock at approximately 0.96 times MNAV. The discount suggests the market values Bitmine’s ETH holdings below spot value.

ETH rebounded to around $2,123, gaining nearly three percent intraday. However, Bitmine’s equity closed slightly lower, reflecting ongoing caution.

As volatility stabilizes, balance sheet growth, stakeholder income, and network fundamentals remain central to Bitmine’s positioning.

Crypto World

Previewing policy at Consensus Hong Kong 2026: State of Crypto

CoinDesk is hosting its second annual Consensus Hong Kong conference, and as always, we’ll have a number of policy-focused sessions. Are you in town? Find me on stage or around the show floor and say hi!

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The narrative

CoinDesk’s annual Consensus Hong Kong conference will kick off this Wednesday with a speech from Hong Kong Chief Executive John KC Lee.

Why it matters

Hong Kong is playing an interesting role in the intersection of financial services between the global East and West. CoinDesk will be exploring that role at Consensus,

Breaking it down

We’ll be hearing from Financial Secretary Paul Chan and Securities and Futures Commission Chief Executive Julia Leung on day one of Consensus, and having conversations around the growth of real-world asset tokenization, stablecoins and evolving payment systems and how exchange-traded funds (ETFs).

Our speakers will include regulators and politicians from around the world, with panels looking at how both regulators and industry participants alike approach the sector — a conversation we’ve had every year at Consensus, but one that continues to evolve.

Privacy, artificial intelligence, decentralized finance and trading behaviors will also take one of the many stages throughout the conference.

It’ll be part of a busy week ahead: SEC Chair Paul Atkins will be testifying before the House Financial Services and Senate Banking Committees. Though the hearings are focused on SEC oversight generally, expect crypto and Atkins’ efforts to develop rulemakings around the sector to come up.

The White House is also convening yet another meeting between crypto and banking industry representatives. Not a lot of detail is available yet.

Tuesday

- The White House is convening a second meeting between representatives of the crypto and banking industries to discuss stablecoin yield concerns.

Wednesday

- 01:30 UTC (9:30 a.m. HKT) Day 1 of Consensus Hong Kong kicks off.

- 15:00 UTC (10:00 a.m. ET) The House Financial Services Committee is holding an oversight hearing with Securities and Exchange Commission Chair Paul Atkins.

Thursday

- 02:00 UTC (10:00 a.m. HKT) Day 2 of Consensus Hong Kong kicks off.

- 15:00 UTC (10:00 a.m. ET) The Senate Banking Committee is holding an oversight hearing with Securities and Exchange Commission Chair Paul Atkins.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Crypto World

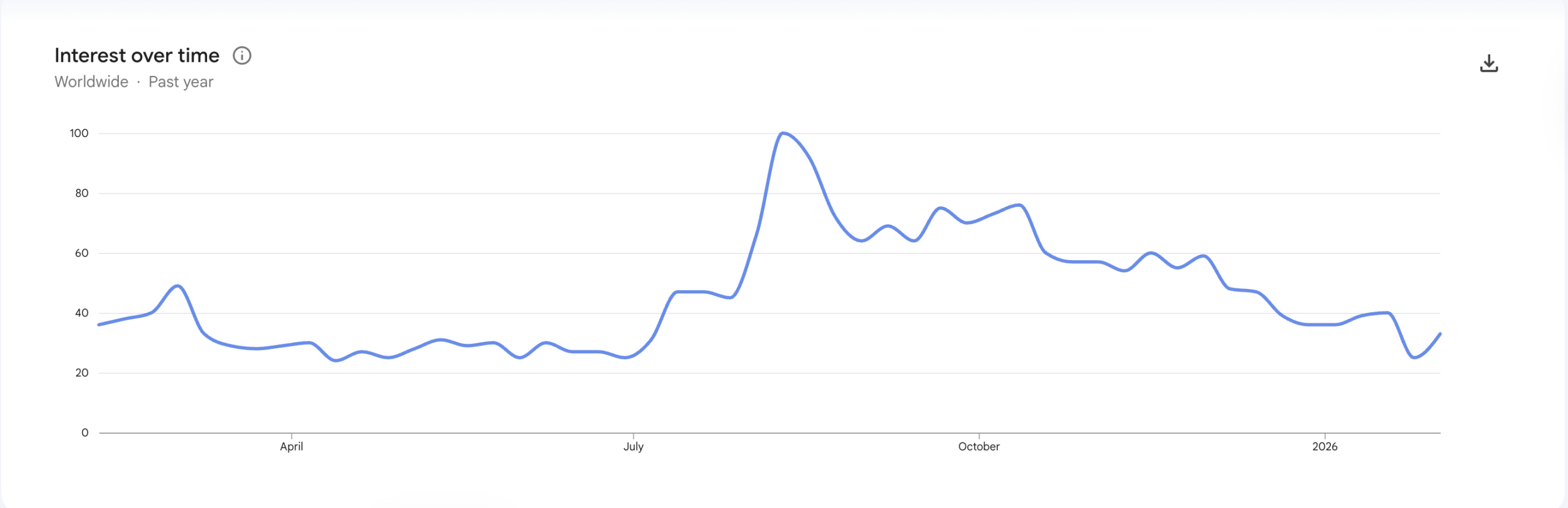

Google Search Interest in ‘Crypto’ Near 1-Year Lows Amid Market Crash

Google worldwide search volume for “crypto” is hovering near one-year lows, reflecting weak investor sentiment amid a broad market downturn that reduced the total market capitalization of crypto from an all-time high of more than $4.2 trillion to about $2.4 trillion.

Worldwide search volume for “crypto” is 30 out of 100 at the time of this writing, with a reading of 100 indicating the highest level of search interest, which was last reached in August 2025 in parallel with the market capitalization high. The 12-month low is 24, according to Google Trends data.

Search volume in the US featured a similar pattern, with volume peaking at 100 in July and dropping to below 37 in January. However, US search figures diverged from worldwide volume data by surging back up to 56 in the first week of February.

The yearly low for the US is 32, which was recorded during the April 2025 market crash fueled by US President Donald Trump’s tariff policies.

Crypto market volume is down sharply, with total market volume dropping from a high of more than $153 billion on Jan. 14 to about $87.5 billion on Sunday, according to CoinMarketCap.

Google search volume data is often used as a gauge of investor sentiment and corroborates other sentiment indicators like the Crypto Fear & Greed Index, a market indicator used to measure crowd sentiment.

Related: Google search volume for ‘Bitcoin’ skyrockets amid BTC price swings

Investor sentiment craters as Fear & Greed Index hits record lows

The Crypto Fear & Greed Index hit a record low of 5 on Thursday, but inched up to 8 by Sunday, according to CoinMarketCap. Still, both levels signal “extreme fear” in the markets.

Crypto investor sentiment is now at the same levels it was following the collapse of the Terra ecosystem and its dollar-pegged stablecoin in 2022.

The collapse of Terra sent shockwaves through the crypto world, triggering a wave of cascading liquidations that accelerated the 2022 bear market.

Investors are currently searching for social signals that the crypto market has bottomed to time their entries, according to market sentiment analysis platform Santiment.

“Crowd sentiment is fiercely bearish. The ratio of positive to negative commentary has collapsed, with negative comments hitting their highest point since December 1st,” Santiment said in a report published Friday.

Magazine: If the crypto bull run is ending… It’s time to buy a Ferrari: Crypto Kid

Crypto World

BTC Tests $70K Resistance: Could Bulls Rally to $75K or Drop Toward $65K?

TLDR:

- Bitcoin struggles at $70K, revealing weak buyer power amid high trading activity.

- BTC trades at $71,098 with $44.95B in 24-hour volume, showing strong market participation.

- Reclaiming $70K could trigger 8–10% rally toward $75K–$77K resistance zones.

- Failing $70K increases risk of testing mid-$60K support in the short term.

The price of Bitcoin (BTC) is $71,098.81 today, gaining 2.65% over the past 24 hours. However, BTC has fallen 9.04% in the last seven days, reflecting short-term volatility and resistance near the $70K level.

Trading activity remains high, with a 24-hour volume of $44.95 billion, signaling strong market engagement. Bitcoin is balancing upward momentum against broader weekly losses while determining the next potential market direction.

$70K: Key Resistance and Market Response

Bitcoin recently attempted to reclaim $70K, but the price faced rejection and could not sustain above this critical level. This shows that buyers were insufficient to absorb the supply concentrated in this zone.

Historically, decisive upward moves require serious, aggressive attempts. Weak responses often lead to temporary consolidation or minor pullbacks in the short term.

Below $70K, Bitcoin is trading in a low-liquidity area, where support remains limited until mid-$60K levels. Markets often retest recently broken levels after sharp impulse moves downward.

The failure to reclaim $70K increases the likelihood of revisiting this zone before any sustained upward attempt. Traders and analysts monitor these zones closely for structural signals rather than relying on emotional reactions.

If Bitcoin reclaims $70K with real acceptance, meaning sustained closes above the level, momentum continuation becomes clearer. Technical projections suggest an 8–10% move, targeting $75K–$77K.

This potential upward path would likely involve short covering and new buyers entering positions. Observing acceptance above $70K, rather than temporary wicks, is crucial for short-term direction.

Monthly Chart Structure and Conditional Paths

Monthly charts show Bitcoin losing key support after a parabolic advance. Historical cycles indicate hesitation below critical levels before accelerated downward moves.

Such pauses trap long-term investors and erode confidence gradually among market participants.

From 2021 to 2022, Bitcoin followed a similar pattern: strong uptrend, loss of key support, brief consolidation, then accelerated decline into demand zones.

Current action mirrors this structure, with low-$80K support broken and a potential downside expansion zone forming near historical demand areas.

Bitcoin’s short-term path depends on interaction with $70K. A decisive reclaim could trigger bullish continuation, while sustained rejection increases the likelihood of testing mid-$60K support.

Minor retracements allow accumulation for the next leg higher. Traders are advised to respect high-timeframe levels and focus on market structure rather than reacting to short-term volatility.

Crypto World

Crypto Phishing Attacks Hit New Record in January 2026

Crypto investors faced a sharp increase in sophisticated “signature phishing” attacks in January, with losses jumping more than 200%.

According to data from blockchain security firm Scam Sniffer, signature phishing drained approximately $6.3 million from user wallets in the first month of the year. While the raw count of victims fell by 11%, the total value stolen surged 207% from December levels.

Signature Phishing and Address Poisoning Wreak Havoc in January

This divergence highlights a tactical shift among cybercriminals toward “whale hunting.” The strategy involves targeting a smaller number of high-net-worth individuals rather than casting a wide net for smaller retail accounts.

Sponsored

Sponsored

Scam Sniffer reported that just two victims accounted for nearly 65% of all signature phishing losses in January. In the largest single incident, a user lost $3.02 million after signing a malicious “permit” or “increaseAllowance” function.

These mechanisms grant a third party indefinite access to move tokens from a wallet. This allows attackers to drain funds without requiring the user to approve a specific transaction.

While signature scams rely on confusing permissions, a separate and equally damaging threat known as “address poisoning” is also plaguing the sector.

In a stark example of this technique, a single investor lost $12.25 million in January after sending funds to a fraudulent address.

Address poisoning exploits user habits by generating “vanity” or “lookalike” addresses. These fraudulent strings mimic the first and last few characters of a legitimate wallet found in a user’s transaction history

The attacker hopes the user will copy and paste the compromised address from their history rather than verifying the full string.

The rise in these incidents prompted Safe Labs, the developer behind the popular multisig wallet formerly known as Gnosis Safe, to issue a security warning. The firm identified a coordinated social engineering campaign targeting its user base, using approximately 5,000 malicious addresses.

“We’ve identified a coordinated effort by malicious actor(s) to create thousands of lookalike Safe addresses designed to trick users into sending funds to the wrong destination. This is social engineering combined with address poisoning,” the firm stated.

Consequently, the firm warned users to always verify the full alphanumeric string of any recipient address before executing high-value transfers.

Crypto World

BTC surely closer to bottom than top as bears celebrate

With crypto’s multi-month downturn accelerating into a freefall last week, bulls were frantically grasping for technical signals, or maybe yarns about the blowup of some leveraged hedge fund, that might signal a final bottom for this bear market.

Perhaps the ultimate sign of a bottom, though, might be the cheers arising from those who have been faithfully bearish on bitcoin as its price rose from $0 to more than $100,000 over its 16-year lifespan.

Over the years, the Financial Times has surely stood above all traditional publications in its steadfast opposition to bitcoin and crypto. The London paper’s team of truly talented writers has seemingly never wavered from a firm no-coiner stance, and this week was their moment.

“Bitcoin is still about $69,000 too high,” was the headline of a Sunday essay by the FT’s Jemima Kelly that wonderfully summed up Kelly’s and the FT’s general stance over the last decade-plus. [The FT subsequently changed the headline to “$70,000 too high” after bitcoin rose overnight].

“Ever since its creation, bitcoin has been on a journey that will end, splattered on the ground,” Kelly wrote. “This week has shown us that the supply of ‘greater fools’ that bitcoin relies on is drying up,” she continued. “The fairy tales that have been keeping crypto afloat are turning out to be just that. People are beginning to wake up to the fact that there is no floor in the value of something based on nothing more than thin air.”

Earlier in the week, with the price of bitcoin declining below the $76,000 average cost basis of BTC treasury giant Strategy (MSTR), the FT’s Craig Coben published, “Strategy’s long road to nowhere.”

With the stock already down about 80% from its record high of late 2024, Coben in February 2026 declared, “Management has no safe choices — only different paths to destroying shareholder value … it is hard to see the case for buying into a vehicle that has merely broken even on its investments over five years.”

“Like a gigantic mastodon stuck in La Brea tar pits,” Coben concluded. “Strategy is flailing for a way out.”

Peter Schiff joins in

With gold — despite a good deal of recent volatility — continuing in a major bull cycle, longtime goldbug and bitcoin critic Peter Schiff was feeling his oats as well.

“According to Michael Saylor, bitcoin is the best-performing asset in the world,” he wrote on Tuesday. “Yet Strategy invested over $54 billion in bitcoin over the past five years, and as of now the company is down about 3% on that investment. I’m sure the losses over the next five years will be much greater!”

“Bitcoin below $76,000, it’s now worth 15 ounces of gold, down 59% from its Nov. 2021 high,” Schiff continued. “Bitcoin is in a long-term bear market priced in gold.”

Other signs

“I refuse to pick bottoms,” once said former hedge fund manager Hugh Hendry. “Monkeys spend all their time picking bottoms.”

As Hendry noted, it’s probably a good idea not to get too cute timing one’s buys to headlines like those seen in the FT this week. It’s probably fairly safe to say, though, that some sort of bottoming process is underway.

In other news this week that would never appear near tops, it appears that investor interest in Tether is evaporating. With the crypto market still perky late last year, it was reported that the stablecoin issuing giant was in talks to raise $15-$20 billion at as much as a $500 billion valuation.

According to a report in the FT on Tuesday, however, investors appear to be pushing back against that valuation, and capital-raising efforts may only be on the order of about $5 billion.

For its part, Tether CEO Paolo Ardoino told the FT that the original reports of a $15-$20 billion capital raise were a “misconception,” and that Tether had received plenty of interest at that $500 billion valuation.

Nevertheless, according to the report, investors have privately raised concerns about that lofty valuation. Things are fluid, the report continued, and a crypto rally could quickly change sentiment.

Crypto World

Bithumb Recovers Overpaid BTC, Fills 1,788 BTC Shortfall

South Korean cryptocurrency exchange Bithumb announced that it has resolved a weekend incident in which a promotional payout error briefly overcredited certain user accounts with Bitcoin. In a Sunday statement, the firm said it recovered 99.7% of the excess BTC on the same day the issue occurred. The remaining 1,788 BTC that had already been sold was reimbursed using company funds to ensure customer balances remained fully matched. Bithumb asserted that its holdings of all virtual assets were 100% equivalent to or exceeding user deposits, reinforcing the premise that customer liabilities were adequately backed. The exchange noted that most of the excess was retrieved directly from individual accounts, while the portion already liquidated in the market was funded by corporate reserves to restore balance sheets and maintain trust. The incident was not the result of a hack, and deposits and withdrawals continued normally during the disruption.

Key takeaways

- 99.7% of the overpaid BTC was recovered on the same day the incident happened, with 1,788 BTC already sold and reimbursed from corporate funds.

- Bithumb stated its total asset holdings were sufficient to cover all user deposits, underscoring balance-sheet integrity even in a disruption.

- Compensation includes 20,000 won per user for those who were connected during the incident, plus full reimbursement plus 10% for traders who sold at unfavorable prices during the event.

- A seven-day, platform-wide trading-fee waiver was announced to cushion the disruption’s impact on active traders.

- The incident originated from a promotional payout error rather than a security breach, and normal trading activity quickly stabilized after account restrictions were put in place.

- Industry context highlights ongoing operational challenges for centralized exchanges, with broader coverage of interoperability and risk controls as regulators scrutinize platform reliability.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. While there was intraday volatility during the incident, the exchange disclosed no lasting price impact beyond a temporary spike caused by liquidations and subsequent remediation measures.

Market context: The episode arrives amid a period of heightened attention on how centralized exchanges manage incidents, with observers watching how firms reconcile user balances, communicate clearly, and maintain liquidity during promotional events or high-volume trading days. The broader crypto market has seen sporadic operational hiccups across multiple platforms, reinforcing the importance of robust controls and transparent remediation steps in sustaining market confidence.

Why it matters

For users on Bithumb, the episode tested confidence in the exchange’s risk management and accounting practices. By recovering the majority of overpaid BTC on the same day and funding reimbursements from reserves for the rest, Bithumb signaled a commitment to preserving customer asset integrity even when promos and systems interact in unintended ways. The adherence to the principle that customer deposits should equal or exceed liabilities is a critical touchstone for users who rely on centralized venues for liquidity, staking, and spot trading.

The compensation scheme further matters because it attempts to reduce the financial friction faced by traders during a disruption. The per-user credit, full reimbursement of affected sale values, and an additional 10% payout for traders who sold at unfavorable prices collectively aim to restore trading activity while dampening reputational damage. The seven-day trading-fee waiver is a tangible incentive to keep volume steady and discourage a mass exodus from the platform during remediation.

From a market-structure perspective, the incident underscores a recurring theme in centralized exchanges: even without a cybersecurity breach, operational mishaps tied to promotions can trigger a cascade of effects, including price volatility and liquidity concerns. Observers will be watching how Bithumb and other platforms strengthen validation and post-event reconciliation processes to minimize recurrence. The episode also feeds into a broader discourse about the resilience of crypto ecosystems, especially as regulators demand greater clarity around risk controls, customer protections, and the speed at which firms can restore normal service after anomalous events.

What to watch next

- Clarification on the total amount of BTC credited in error and a detailed post-incident accounting breakdown by Bithumb.

- Any follow-up audits or third-party reviews assessing the effectiveness of the compensation program and the firm’s reserve adequacy.

- Regulatory or legislative responses in South Korea related to incident reporting, consumer protections, and exchange risk management.

- Announcements outlining changes to promotional payout workflows to prevent recurrence and improve real-time error detection.

Sources & verification

- Bithumb official notice: https://feed.bithumb.com/notice/1651928

- Cointelegraph: Bithumb confirms reward payout error after abnormal Bitcoin trades — https://cointelegraph.com/news/bithumb-confirms-reward-payout-error-after-abnormal-bitcoin-trades

- Cointelegraph: Bithumb flags $200M in dormant crypto assets across 2.6M inactive accounts — https://cointelegraph.com/news/bithumb-dormant-crypto-assets-200m-inactive-accounts

- Cointelegraph: Coinbase cuts unnecessary account restrictions — https://cointelegraph.com/news/coinbase-cuts-unnecessary-account-restrictions

- Cointelegraph: Binance 400m program traders hit Friday downturn — https://cointelegraph.com/news/binance-400m-program-traders-hit-friday-downturn

Resolution and compensation measures after an over-credit incident

The weekend episode centered on Bitcoin (CRYPTO: BTC), the most liquid asset in crypto markets, and tested Bithumb’s operational safeguards. After a Friday system fault during a promotional payout briefly overcredited some users, the exchange acted quickly to contain the fallout. In its Sunday update, Bithumb said it recovered 99.7% of the overpaid BTC on the same day and covered the remaining 1,788 BTC that had already left the market using corporate reserves to ensure customer balances remained fully matched. The firm added that its overall holdings of virtual assets were 100% equivalent to or exceeding user deposits, reinforcing a basic but critical premise for users: asset reserves should cover outstanding liabilities, even in disruptive events.

Most of the recovery came directly from the affected accounts as managers worked to claw back the erroneous transfers. Where balances had already been liquidated, reimbursements would come from reserve funds rather than customer funds, underscoring a commitment to limit customer losses. Importantly, Bithumb stressed that the incident was not the result of a security breach and that normal deposit and withdrawal operations continued uninterrupted during the episode. While there was widespread chatter about the total amount involved, the exchange did not disclose a final figure, though some users asserted that up to around 2,000 BTC were credited in error. The company’s messaging sought to reassure customers that the issue did not compromise the integrity of institutional or retail accounts.

As part of its response, Bithumb outlined a compensation plan aimed at restoring trust among users who were on the platform when the error occurred. Those who were connected to the service during the incident received 20,000 won (about $15) per user, a modest gesture intended to acknowledge the disruption. Traders who executed sales during the anomaly and sold at unfavorable prices will be fully reimbursed for the sale value, plus an additional 10% payout as a further remedy. Additionally, Bithumb announced a seven-day period in which trading fees would be waived across all markets, a move designed to reduce the cost of the disruption for active traders and to encourage continued participation on the platform. The plan reflects a broader approach to incident response that blends restitution with policy incentives to sustain activity during periods of system turbulence.

The Friday-late-week event was triggered by a routine promotional payout that unexpectedly inflated user balances, prompting a surge of selling activity once recipients began liquidating. The exchange moved to restrict affected accounts within minutes and stabilized trading quickly, limiting potential digit-asset liquidations for other participants. In its update, Bithumb noted that there was no connection to hacking or external exploitation and that the incident did not derail deposits or withdrawals. The absence of a security breach is a critical distinction that helps maintain confidence in the platform, even as customers digest the temporary disruption and the compensatory measures that follow.

Beyond the immediate incident, the episode feeds into a broader conversation about the reliability of centralized exchanges—the kind of institutions that handle the largest pools of liquidity in many markets. The ripple effects have already surfaced in parallel industry coverage, where other platforms have faced operational problems during crowded trading conditions, underscoring the importance of resilient infrastructure, robust reconciliation processes, and clear customer compensation policies. As users scrutinize exchange responses to promotional errors and other anomalies, regulators in several jurisdictions are paying closer attention to how firms manage risk, communicate incidents, and safeguard user assets.

Crypto World

TradFi Deleveraging Triggered Feb 5 Crypto Crash

Bitwise advisor Jeff Park attributed the February 5 crypto selloff to multi-asset portfolio deleveraging rather than crypto-specific factors.

Summary

- February 5 selling was driven by multi-asset fund deleveraging, not crypto-native fear.

- CME basis trades unwound violently as pod shops de-grossed across portfolios.

- Short gamma and structured product hedging amplified downside despite ETF inflows.

IBIT recorded 10 billion in trading volume, doubling its previous high, while options activity hit historic levels led by put contracts rather than calls.

The crash saw Bitcoin (BTC) fall 13.2% yet IBIT posted $230 million in net creations with 6 million new shares, bringing total ETF inflows above $300 million.

Goldman Sachs’ prime brokerage desk reported February 4 was one of the worst daily performances for multi-strategy funds with a z-score of 3.5. This was a 0.05% probability event 10 times rarer than a three-sigma occurrence.

Park wrote that risk managers at pod shops forced indiscriminate de-grossing, explaining why February 5 turned into a bloodbath.

CME basis trade unwinding drove violent deleveraging

Park identified the CME basis trade as a primary driver of selling pressure. The near-dated basis jumped from 3.3% on February 5 to 9% on February 6, one of the largest moves observed since ETF launch.

Multi-strategy funds like Millennium and Citadel hold large positions in the Bitcoin ETF complex and were forced to unwind basis trades by selling spot while buying futures.

IBIT showed tight correlation with software equities rather than gold over recent weeks. Gold is not typically held by multi-strategy funds as part of funding trades, confirming that drama centered on these funds rather than retail investment advisors.

The catalyst originated from software equity selloffs rather than crypto-native selling.

Structured products created crypto bloodbath

Structured products with knock-in barrier features contributed to selling acceleration. A JPMorgan note priced in November carried a barrier at $43,600.

Notes priced in December when Bitcoin dropped 10% would have barriers in the $38,000-$39,000 range.

Put buying behavior in crypto-native markets over preceding weeks meant crypto dealers held naturally short gamma positions.

Options were sold too cheaply relative to outsized moves that eventually materialized, worsening the downside. Dealers held short gamma on puts from the $64,000-$71,000 range.

February 6 recovery saw CME open interest expand faster than Binance. The basis trade partially recovered, offsetting outflow effects while Binance open interest collapsed.

Park concluded that tradfi derisking was the catalyst that pushed Bitcoin to levels where short gamma hedging ramped up declines through non-directional activity requiring additional inventory.

Crypto World

SOL Ecosystem Growth Fuels Spike In Cross-Chain Perp Trading On HFDX

Traders are now starting to look beyond single-chain markets, using more flexible on-chain derivatives products. With increasing speed in the Solana ecosystem, there is a growing need for perpetual futures products that can efficiently track price movements without compromising on non-custodial, transparent, and on-chain qualities.

These developments are taking place alongside other shifts in DeFi trading dynamics, where traders are now looking for leverage but are also requiring capital efficiency, reliability, and risk parameters.

Platforms such as HFDX are benefiting from this evolution by offering on-chain perpetual futures and structured liquidity strategies designed for cross-chain participation rather than siloed liquidity.

SOL Ecosystem Growth Fuels Spike In Cross-Chain Perp Trading On HFDX

Solana is currently trading at $92.25, down 4.82% in the last 24 hours, but trading volumes are still high. With a market cap of $52.32 billion and daily trading volumes of $8.13 billion, up over 32%, it is clear that engagement is increasing, not decreasing.

For traders, the current state of the market is conducive to derivatives trading as opposed to spot trading.

Cross-chain perps enable traders to engage, hedge, and short without leaving their ecosystems. As Solana liquidity within its ecosystem continues to increase, traders are increasingly turning to cross-chain perps for risk management and efficient leverage utilization.

This is a reality of the market that traders must understand. Liquidity does not remain on one chain, nor does demand for derivatives.

How Cross-Chain Demand Is Reshaping Perp Markets

Traders are showing a clear preference for platforms that can aggregate liquidity across ecosystems. Cross-chain perp trading allows participants to express views on assets like SOL while accessing deeper, more stable liquidity pools.

This matters during volatile conditions. When activity spikes on one chain, isolated markets can experience slippage and funding instability. Cross-chain models help smooth these effects by distributing risk and liquidity more efficiently.

For advanced traders, this also unlocks new strategies. Basis trading, hedging correlated assets, and managing multi-chain portfolios all benefit from unified, on-chain perpetual infrastructure.

HFDX Positioned For Cross-Chain Perp Growth

HFDX is designed with this exact purpose in mind. It’s a non-custodial perpetual futures protocol that allows users to trade major digital assets with leverage while keeping their funds fully on-chain. Trades occur through shared liquidity pools instead of traditional order books.

Execution is an important aspect. HFDX has executed over 500,000 trades with execution speeds of less than 2 milliseconds. For traders looking to participate in cross-chain perps, execution speed is critical during periods of volatility.

Additionally, HFDX has integrated advanced charting with TradingView. Users can view real-time price information, technical indicators, macroeconomic information, and broader market information. This combination supports informed decision-making across chains.

Alongside trading, HFDX offers Liquidity Loan Note (LLN) strategies. These allow capital to be allocated to protocol liquidity for fixed terms, with returns generated from actual trading and borrowing fees.

Why HFDX Stands Out In Cross-Chain Perp Trading

- Non-custodial, on-chain perpetual futures architecture

- Cross-chain-friendly liquidity model designed for scale

- Ultra-fast execution for volatile market conditions

- Transparent oracle-based pricing and automated risk controls

- Structured liquidity strategies backed by real protocol revenue

- Professional-grade analytics and trading tools

These features support consistent performance as cross-chain leverage demand grows.

Cross-Chain Perps And HFDX’s Early Positioning

As DeFi matures, traders are seeking leverage, but they also want flexibility, transparency, and infrastructure that works across ecosystems.

HFDX sits at the center of this shift. By combining on-chain perpetual futures, structured liquidity models, and execution built for scale, the protocol is positioning itself as a long-term derivatives infrastructure rather than speculative tooling. While all participation involves risk, HFDX offers a framework designed for disciplined trading in a multi-chain world.

For traders and liquidity participants looking to engage early with cross-chain perpetual markets, HFDX represents an opportunity to explore as on-chain derivatives adoption continues to accelerate.

Make Your Money Work Smarter And Unlock A Wealth Of Opportunities With HFDX Today!

Website: https://hfdx.xyz/

Telegram: https://t.me/HFDXTrading

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

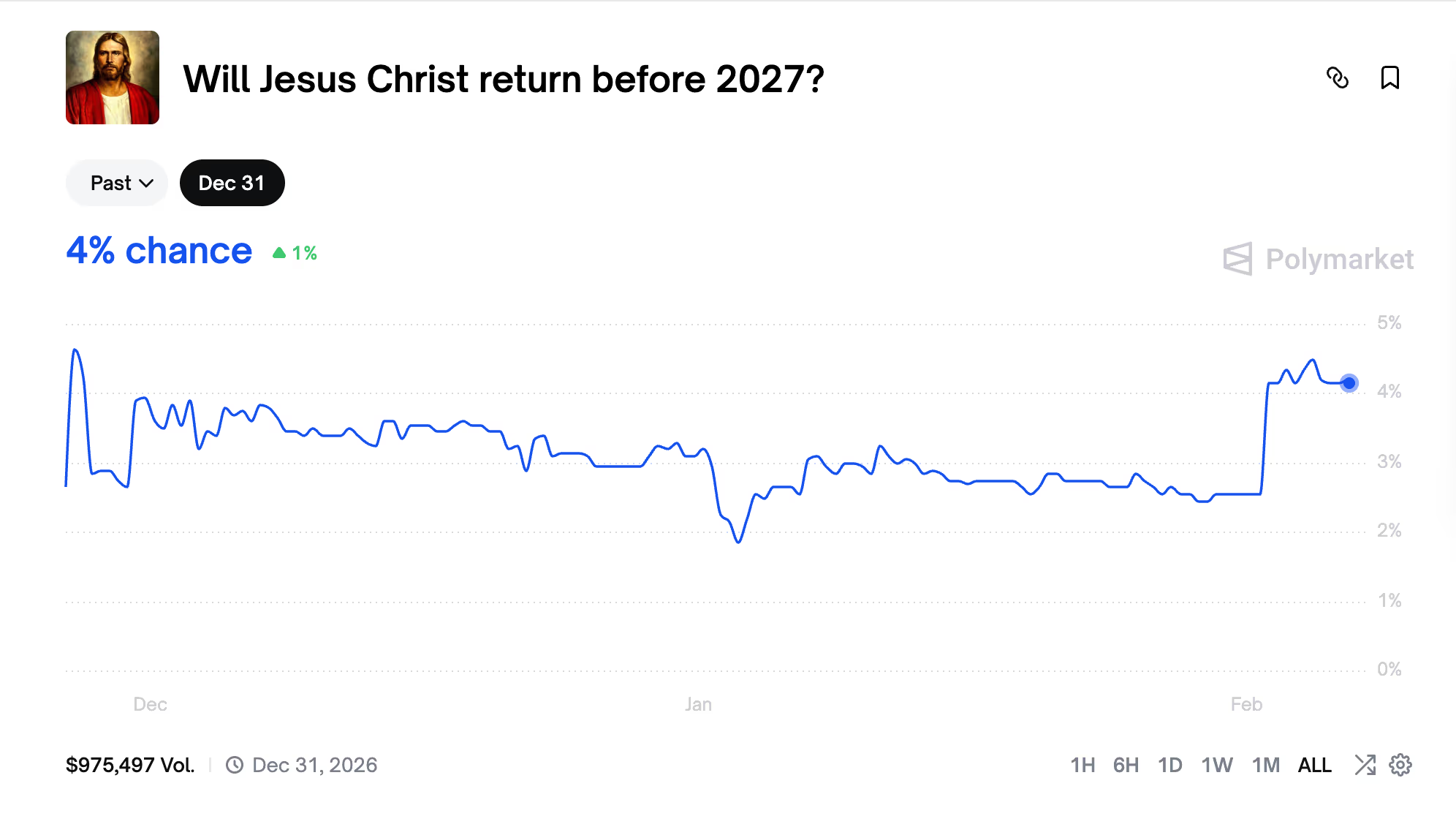

Bitcoin has performed worse than a bet tracking the chance of Jesus Christ returning this year

Traders on prediction market Polymarket have doubled the implied odds of the Second Coming of Jesus Christ occurring by year-end, turning one of the platform’s stranger contracts into a better performer than bitcoin.

The market, titled “Will Jesus return in 2026,” traded around 4 cents on Friday, implying a roughly 4% chance. That’s up from a low of about 1.8% on Jan. 3, meaning the “Yes” side has gained more than 120% in just over a month.

Bitcoin, in contrast, has been moving in the opposite direction. The largest cryptocurrency has lost 18% this year for reasons ranging from concerns that quantum computing could break its encryption to speculation about a hedge fund blow-up and broader risk-off pressure across global markets.

Such price action has left even meme-like prediction contracts looking resilient by comparison.

Polymarket markets work like binary options. A “Yes” share pays out $1 if the event happens and $0 if it doesn’t, with the trading price reflecting the crowd’s implied probability.

A trader who buys “Yes” at 4 cents is effectively paying that amount for a shot at $1. Someone buying “No” at 96 cents is betting the event will not happen and stands to earn 4 cents if the contract resolves “No.”

If “No” trades in the mid-to-high 90s for long stretches, it creates the appearance of a slow, steady gain for anyone willing to park money there, even though the trade is ultimately binary and can still swing sharply.

The contract resolves to “Yes” if the Second Coming occurs by Dec. 31, 2026 at 11:59 p.m. ET, and to “No” otherwise. Polymarket says the resolution will be based on a consensus of credible sources, a clause that highlights why traders treat the market more as a novelty than a serious forecast.

The price action offers a snapshot of how prediction markets can behave like microcap tokens. With relatively limited liquidity, even small bursts of buying can push probabilities sharply higher, creating headline-grabbing percentage gains.

The rally also reflects Polymarket’s growing role as a real-time barometer for internet attention, where everything from elections to celebrity gossip to religious prophecies can be traded in the same interface.

As such, the “Jesus trade” remains a tiny sideshow. But in a year where bitcoin has struggled to find a stable footing, it’s also a reminder that the weirdest corners of crypto are sometimes the only ones going up.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Politics3 hours ago

Politics3 hours agoThe Health Dangers Of Browning Your Food

-

Politics1 hour ago

Politics1 hour agoWhy Israel is blocking foreign journalists from entering

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business8 hours ago

Business8 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know