Crypto World

The New AI-Driven Era of Software Development

In early 2025, the term vibe coding began to circulate widely across the technology community. Coined by AI researcher Andrej Karpathy, it refers to a radically different way of building software. Instead of writing code line by line, the developer simply describes what they want to achieve in natural language, and an artificial intelligence system translates that description into executable code.

This article explores what vibe coding is, how it works, its main advantages and risks, and how it fits within the broader movement of AI-driven software development. It also examines the social and ethical dimensions of this emerging paradigm and what the future might look like if the “vibe” becomes mainstream.

What is Vibe Coding?

Vibe coding is a form of AI-assisted programming in which a developer describes a problem or a desired feature using natural language. A large language model (LLM), such as GPT or Claude, then generates the corresponding source code that implements it. Rather than acting as a mere autocomplete tool, the AI effectively becomes a creative collaborator capable of producing entire systems or applications from conceptual prompts.

The term was first introduced by Andrej Karpathy, former AI director at Tesla and a leading figure in the OpenAI ecosystem. In one of his social media posts, he summarised the concept with the now-famous phrase: “fully give in to the vibes, embrace exponentials, and forget that the code even exists.” He associated vibe coding with a freer, more experimental and iterative form of development. By mid-2025, Merriam-Webster had even listed “vibe coding” as an emerging slang term within technology.

It is important to distinguish vibe coding from traditional AI-assisted programming. Using an AI tool to generate snippets or suggest completions is not quite the same thing. What defines vibe coding is a change in mindset. Instead of controlling every detail of the code, the developer focuses on intention, results, and iterative feedback. Simon Willison, a well-known software engineer, has noted that if you still read and understand every line the AI produces, you are not truly vibe coding — you are simply using a language model as an assistant.

How Vibe Coding Works

Although the idea sounds straightforward, the practice of vibe coding involves a dynamic interplay between human creativity and machine intelligence. It typically begins with a prompt: the developer describes what they want, for example, “create an interactive dashboard using data from environmental sensors.” The AI produces the initial code, and the developer then refines it through follow-up instructions such as “make the colours change with temperature” or “add a live refresh feature.” This loop of experimentation and adjustment lies at the heart of vibe coding.

Developers primarily evaluate code through execution rather than inspection. They run the programme, see whether it behaves as expected, and request corrections when errors arise. Manual debugging still plays a role, but the relationship with code becomes more conversational than mechanical. Over time, trust in the AI fluctuates. Developers learn which tasks can be safely delegated and when to intervene directly. Researchers have described this as a process of “calibrating trust,” in which the human defines how much to rely on the system at each stage of development.

The Benefits of Vibe Coding

One of the greatest strengths of vibe coding is its speed. Ideas can be transformed into functional prototypes in a fraction of the time it would take traditional coding. This speed makes it particularly useful for startups, research teams and creative professionals who need to explore multiple directions quickly.

Another significant benefit is accessibility. People with limited technical training can now create simple applications or automate workflows without learning programming languages in depth. This democratisation of software creation could empower a new generation of makers and entrepreneurs.

By delegating repetitive or boilerplate tasks to the AI, developers can focus on strategic design and high-level logic. The workflow also encourages a sense of creative flow: instead of getting lost in syntax, the human partner can concentrate on goals, functionality and user experience. Many practitioners describe vibe coding as liberating, turning software creation into an expressive process similar to design or storytelling.

Risks and Limitations

Despite its promise, vibe coding carries significant risks. The most obvious one is the loss of understanding. Accepting generated code without reviewing it can lead to serious issues when something goes wrong. Bugs, security vulnerabilities or unexpected behaviours may remain unnoticed until they cause damage. As Andrew Ng has pointed out, vibe coding can sound effortless, but in reality, it remains cognitively demanding and far from trivial.

Quality and maintainability are also major concerns. Code produced by AI models may be inefficient, inconsistent or difficult to update, especially in large-scale projects. Furthermore, compliance and data protection become complex when generated code integrates external libraries or APIs without explicit human oversight. In 2025, a case involving the platform Base44 revealed security flaws in applications created through automated AI workflows, highlighting the importance of robust verification processes.

Culturally, some developers fear that vibe coding could erode traditional craftsmanship in software engineering. The discipline and rigour associated with manual coding is being replaced by superficial experimentation. Others have coined the term “vibe coding hell” to describe an over-reliance on AI, where developers use it for everything, including trivial tasks, eventually losing confidence in their own technical skills.

Vibe Coding and Artificial Intelligence

Vibe coding represents a natural evolution of generative AI. It is not just a new technique but a redefinition of the relationship between humans and machines. Instead of translating ideas into syntax, developers now express intentions through prompts, while the AI interprets and executes them. Researchers have called this shift a “mediation of intent,” where the act of programming becomes probabilistic and collaborative.

In this new model, cognitive work is redistributed. The human becomes a designer of prompts, a tester and a strategist, while the AI handles most of the implementation. Some scholars describe the process as “material disengagement” — the developer orchestrates code indirectly, maintaining creative control without manual manipulation.

Empirical studies show that vibe coders often experience high levels of creative flow and satisfaction when working with AI systems, even though they also face challenges such as latency, debugging uncertainty and fluctuating trust. Early adoption in technology firms like Notion and several AI startups suggests that vibe coding may soon become a standard practice for internal prototyping and innovation.

Responsible Use and Best Practices

To benefit from vibe coding without falling into its traps, developers should adopt specific best practices. Automated testing, static analysis and version control are essential to ensure reliability, even when the code is not fully read. Prompts should be written with transparency and clear objectives to avoid ambiguous or insecure results.

Human oversight must remain a core principle. Developers need to decide when to trust the AI and when to intervene manually, particularly in systems that handle sensitive data or critical operations. Maintaining detailed records of prompts and outputs can improve reproducibility and accountability.

Security audits and compliance checks are equally vital. AI-generated software must respect privacy standards and industry regulations. A hybrid approach, using vibe coding for rapid experimentation and conventional programming for critical components, seems to offer the best balance. Above all, developers should continue strengthening their ability to understand and review code, since comprehension remains the ultimate safeguard against failure.

The Future of Vibe Coding

Vibe coding marks a genuine paradigm shift in how software is created. It is not just about faster coding but about redefining the human role in development, from coder to orchestrator, from writer to conductor of intelligent systems. Academic research increasingly treats it as a socio-technical phenomenon that blends trust, creativity and delegation between humans and machines.

Yet, vibe coding is not a magical solution. Without testing, documentation and ethical oversight, projects built on “vibes” can easily become unreliable or even dangerous. The next few years will likely bring more sophisticated tools, conversational interfaces, and automated audits tailored to AI-generated code. We may also see the emergence of new professional standards focused on safety, transparency and accountability in AI-assisted development.

If used responsibly, vibe coding could democratise software creation, accelerate innovation and make technology more accessible than ever before. But like all powerful tools, it demands critical thinking, human supervision and a commitment to quality. The true promise of vibe coding lies not in abandoning code, but in transforming the act of coding into a more intuitive, creative and collaborative process.

Crypto World

AI Model Finds 22 Firefox Vulnerabilities in Two Weeks

TLDR:

- Claude Opus 4.6 found 22 Firefox bugs in 2 weeks, 14 flagged high-severity by Mozilla researchers.

- The 14 high-severity finds equal nearly a fifth of all such Firefox bugs Mozilla fixed in 2025.

- Claude succeeded in building working exploits in only 2 of several hundred automated attempts.

- Anthropic spent roughly $4,000 in API credits testing Claude’s exploit development capabilities.

Anthropic’s Claude Opus 4.6 identified 22 security vulnerabilities inside Firefox in just two weeks. Fourteen of those bugs were classified as high-severity by Mozilla. That figure represents nearly a fifth of all high-severity Firefox flaws remediated throughout 2025.

The findings emerged from a structured research partnership between Anthropic and Mozilla.

Claude AI Uncovers High-Severity Firefox Bugs at Record Speed

The collaboration began as an internal model evaluation.

Anthropic wanted a harder benchmark after Claude Opus 4.5 nearly solved CyberGym, a known security reproduction test. Engineers built a dataset of prior Firefox CVEs and tested whether the model could reproduce them.

Claude Opus 4.6 replicated a high percentage of those historical vulnerabilities. That raised a concern: some CVEs may already have existed in Claude’s training data.

Anthropic then redirected the effort toward finding entirely new bugs in the current Firefox release.

Within twenty minutes of beginning exploration, Claude flagged a Use After Free vulnerability inside Firefox’s JavaScript engine. Three separate Anthropic researchers validated the bug independently.

A bug report, alongside a Claude-authored patch, was filed in Mozilla’s Bugzilla tracker.

By the time that first report was submitted, Claude had already produced fifty additional crashing inputs. Anthropic ultimately scanned nearly 6,000 C++ files and submitted 112 unique reports to Mozilla. Most fixes shipped to users in Firefox 148.0.

Firefox 148 Ships Fixes as AI Exploit Research Raises New Alarms

Mozilla triaged the bulk submissions and encouraged Anthropic to send all findings without manual validation. That approach accelerated the pipeline significantly. Mozilla researchers have since begun testing Claude internally for their own security workflows.

Anthropic also tested whether Claude could move beyond discovery into active exploitation.

Researchers gave Claude access to the reported vulnerabilities and asked it to build working exploits. The goal was to demonstrate a real attack by reading and writing a local file on a target system.

Across several hundred attempts, spending roughly $4,000 in API credits, Claude succeeded in only two cases.

According to Anthropic’s published findings, the model is substantially better at finding bugs than exploiting them. The cost gap between discovery and exploitation runs at least an order of magnitude.

The exploits that did work required a test environment stripped of standard browser security features. Firefox’s sandbox protections were not present.

Anthropic noted that sandbox-escaping vulnerabilities do exist and that Claude’s output represents one component of a broader exploit chain.

Anthropic urged software developers to accelerate secure coding practices. The company also outlined a “task verifier” method, where AI agents check their own fixes against both vulnerability recurrence and regression tests.

Mozilla’s transparent triage process helped shape that approach throughout the research.

Crypto World

Flow Network Incident Resolved as HTX Restores Full FLOW Services

TLDR:

- HTX confirms all FLOW assets remained intact during the Flow network incident and verification process

- Flow developers patched the vulnerability responsible for abnormal transactions on December 27

- HTX restored FLOW trading, deposits, and withdrawals after verifying network stability

- Exchange removed its January notice following Flow’s detailed post-incident security report

Flow blockchain’s December security incident has reached a full resolution after coordination between the network and major exchange HTX.

The update confirms the vulnerability responsible for abnormal transactions has been patched and network operations restored. HTX also verified that all user-held FLOW tokens on its platform remain intact.

Trading, deposits, and withdrawals for the token have resumed normal operations.

Flow Network Incident Resolved as HTX Confirms Normal Operations

The Flow ecosystem shared an update confirming that the issue reported on December 27 has been fully resolved. The incident involved abnormal transactions triggered by a technical vulnerability on the network.

HTX activated internal emergency procedures once it detected the event. The exchange maintained communication with Flow ecosystem partners while monitoring the situation.

The latest update indicates that developers patched the vulnerability and restored normal network activity. The Flow team also identified and addressed abnormal minted assets during the review process.

Flow stated that ecosystem services have stabilized after the corrective actions. Network operations now function normally across supported platforms.

HTX verified user asset balances during the investigation period. The exchange reported that all FLOW tokens held by customers remain fully validated.

HTX Restores FLOW Trading, Deposits, and Withdrawals

HTX confirmed that FLOW trading resumed after reviewing the network’s recovery. Deposits and withdrawals for the token now operate without restrictions.

The exchange initially issued a notice about the incident on January 13. That notice questioned the security status of the Flow network at the time.

HTX later removed the notice after reviewing the Flow Foundation’s post-incident report. According to HTX, the report provided detailed explanations addressing earlier concerns.

The exchange stated that the new information clarified how developers handled the vulnerability. It also confirmed that the response restored stability across the network.

Flow Foundation acknowledged the collaboration between both organizations during the investigation period. The foundation stated it expects continued cooperation with HTX moving forward.

HTX reiterated that user asset security remains its top priority. The exchange said it will continue monitoring supported networks and working with ecosystem partners.

The update confirms the incident no longer affects current operations. FLOW trading infrastructure across HTX now runs under normal conditions.

Crypto World

BTC slips below $68,000 as dollar posts steepest weekly gain

Bitcoin fell to $67,960 by Saturday morning, down 3.4% over the past 24 hours and retreating sharply from the past week’s high. The move fits what has become a recurring script in recent months, with late-week selling dragging prices toward the lower end of the range heading into Saturday.

Majors took the harder hit again. Ether dropped 4.4% to $1,974, solana fell 4% to $84.31, dogecoin lost 2.9% to $0.09, and BNB slid 2.6% to $627. XRP fell 2.2% to $1.37.

The weekly picture tells a more nuanced story though. Bitcoin is still up 3.6% over seven days. Ether has gained 2.6%. BNB added 2.1%. The mid-week surge absorbed the war shock and then some, even if Friday’s pullback took the shine off.

Meanwhile, the dollar posted its steepest weekly gain in a year, strengthening as markets priced in higher energy costs, stickier inflation, and a Fed that has even less room to cut rates. That’s a direct headwind for bitcoin and every other asset denominated against the dollar.

“As tensions escalated in the Middle East last week, investors moved quickly to the safety of the U.S. dollar, which strengthened as markets began pricing in higher energy prices and reignited inflation fears, potentially delaying Federal Reserve rate cuts,” said Björn Schmidtke, CEO of Aurelion, in an email to CoinDesk.

The on-chain data paints a fragile picture beneath the surface. Glassnode data shows 43% of bitcoin’s total market supply is now sitting at a loss. That’s a significant overhang.

As bitcoin recovers, those underwater holders have an incentive to sell into any rally to break even, creating persistent resistance on the way up. It’s one reason the push to $74,000 on Thursday couldn’t hold. Every bounce toward higher prices runs into supply from people who’ve been waiting months to get out.

One bright spot came from stablecoin flows. Messari recorded a 415% jump in net stablecoin inflows to $1.7 billion over the week, with daily transfers up nearly 10%. That’s potentially dry powder waiting to be deployed, and it suggests retail isn’t entirely absent despite the fear-heavy sentiment. Whether that capital rotates into bitcoin or waits for lower prices is the question.

The war continues to set the tempo. The U.S.-Iran conflict showed no signs of resolution this week. Oil remains elevated. The Strait of Hormuz is still disrupted. And the macro backdrop of strong dollar, sticky inflation, and delayed rate cuts is the worst combination for risk assets.

Bitcoin’s week looked impressive in headlines, touching $74,000 mid-week, but the round trip from $68,000 to $74,000 and back to $68,000 is just another lap of the range.

Crypto World

Bitcoin Dip May Not Be Over As Retail Ramps Up Buying: Santiment

Retail investors have been scooping up Bitcoin after it slipped below $70,000, but whale activity suggests the price could still head lower if past patterns repeat, according to crypto sentiment platform Santiment.

“The moment Bitcoin hit $74k, these key stakeholders began taking profit,” Santiment said in a report on Friday.

Santiment explained that whales — those holding between 10 and 10,000 Bitcoin (BTC) — “accumulated heavily” between Feb. 23 and Mar. 3, when Bitcoin was trading between $62,900 and $69,600.

Since Wednesday, when Bitcoin climbed past $70,000 and touched $74,000, the cohort has offloaded around 66% of their recent purchases, Santiment said. Meanwhile, retail investors — those holding below 0.01 Bitcoin — have been increasing their positions.

Correction may not be over yet, says Santiment

“When retail buys while whales sell, it typically signals that the correction is not yet over,” Santiment said. Bitcoin is trading at $67,984 at the time of publication, according to CoinMarketCap.

Bitcoin’s price decline led the Crypto Fear & Greed Index to fall 6 points, pushing it further into “Extreme Fear” territory with a score of 12 on Saturday.

MN Trading Capital founder Michael van de Poppe shared a similar outlook, saying a further decline is possible. “If Bitcoin doesn’t find support in this $67-68K region, then we’re likely going to retest the lows for liquidity before bouncing back upwards,” van de Poppe said in an X post on Friday.

Spot Bitcoin ETFs post largest outflow day in three weeks

The decline coincided with US-based spot Bitcoin ETFs posting their largest outflow day since Feb. 12, with a total of $348.9 million in net outflows across the 11 ETF products, according to Farside data.

Related: Trump’s National Cyber Strategy pledges to support crypto and blockchain

Bitcoin’s price fell as low as $60,000 on Feb. 6 during its downtrend from the October all-time high of $126,000 before showing a modest recovery. Economist Timothy Peterson suggests this level could be the floor for the time being.

“This valuation level has always marked a bottom for Bitcoin. About 99.5% chance it stays above $60k,” Peterson said in an X post, referring to the Bitcoin Price to Metcalfe Value chart.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Trump’s National Cyber Strategy Backs Crypto and Blockchain

The US administration released its National Cyber Strategy on Friday, signaling that crypto and blockchain technologies are now explicitly targeted for protection and secure integration within the nation’s digital infrastructure. Industry executives say the emphasis could shape policy levers ranging from funding for security research to potential enforcement actions. The six-page document frames the crypto ecosystem not only as a financial frontier but as a critical layer in national security, calling for secure supply chains and privacy protections from design to deployment. As crypto firms digest the implications, questions linger about how the administration will balance innovation with controls on privacy tools, mixers, and unregulated off-ramps.

Among the bold lines, the strategy states a commitment to “build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies.” That clause, highlighted by industry observers as a first for a US cybersecurity framework, signals a potential opening for closer public-private collaboration on security standards. Yet, the policy also contains tougher language about criminal infrastructure and the denial of financial exits for illicit actors, a section that some analysts say could justify crackdowns on privacy-focused tools and crypto mixers in the longer run.

“We will build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies.”

For Galaxy Digital’s head of firmwide research, the wording is a telling shift. Alex Thorn argued that explicitly naming crypto and blockchain as technologies to be protected marks a milestone in how Washington views the sector’s role in national security. The broader document, the industry veteran noted in a post, maps a future where cybersecurity risk management dovetails with crypto governance, potentially guiding federal engagement with crypto firms and infrastructure projects.

Another thread running through the document concerns resilience against emerging threats, notably quantum computing. Castle Island Ventures founder Nic Carter has been vocal about quantum risk to Bitcoin and the broader crypto ecosystem. In a take that aligns with the strategy’s emphasis on modernizing federal information systems, Carter pointed to the section calling for “post-quantum cryptography, zero-trust architecture, and cloud transition” as proof that policymakers are taking quantum threats seriously. “Sure seems like they’re taking quantum seriously. Nothing to worry about, I’m sure,” he said on X.

Bitcoin’s quantum risk lens tightens policy dialogue

The strategy’s posture toward quantum resilience comes at a time when the industry has debated how close practical quantum computing is to undermining current cryptographic underpinnings. Carter’s views reflect a broader tension inside the crypto community: balancing the need for robust, future-proof security with the practicalities of ongoing network upgrades and governance. The document’s emphasis on post-quantum cryptography is not merely an academic exercise; it foreshadows potential standards for federal and industry-grade security that could ripple through crypto custody, exchanges, and other critical components of the ecosystem.

In the same breath, the strategy reframes AI as a frontier technology that warrants careful risk management and innovation safeguards. The document states, “We will secure the AI technology stack—including our data centers—and promote innovation in AI security.” For crypto developers and asset managers, that phrasing suggests a growing overlap between AI-enabled security tooling, data integrity, and the safeguarding of sensitive financial information within crypto networks.

Beyond technology, the strategy highlights the importance of recruiting the next generation of cyber professionals to design and deploy advanced cyber technologies. This workforce emphasis mirrors a broader policy objective of aligning national security priorities with a vibrant tech economy, including the crypto sector, which relies on sophisticated cryptography, secure software supply chains, and resilient cloud infrastructure.

Market context

Market participants are watching how this policy direction translates into practical steps. The strategy’s emphasis on secure technologies and anti-criminal enforcement may influence risk sentiment, regulator expectations, and capital flows within crypto markets. While the document stops short of prescribing specific new rules, its signaling—particularly around post-quantum security, zero-trust architectures, and secure supply chains—could shape future standards, audits, and compliance requirements for crypto firms and their service providers.

Why it matters

For crypto users and investors, the strategy’s framework could translate into clearer security expectations and potentially more formal coordination between government agencies and the private sector on safeguarding digital assets. Acknowledging crypto and blockchain as technologies warranting protection might open avenues for collaboration on security research, testing, and standard-setting, helping to reduce systemic risk in the space.

For builders and operators, the document signals that security-by-design will be a central theme in any future regulatory guidance. Post-quantum readiness, zero-trust adoption, and robust cloud migration plans could become de facto prerequisites for governmental contracts, subsidies, or public-private partnerships, shaping how wallets, exchanges, and custody solutions structure their software, audits, and incident-response playbooks.

From a policy perspective, the juxtaposition of safeguarding innovation with criminal offense enforcement creates a dynamic tension. The “uproar against criminal infrastructure” language may push policymakers to balance privacy rights with anti-money-laundering goals, a debate that will likely surface in regulatory conversations and legislative proposals in the months ahead. Market participants will need to watch not only for new rules but for how agencies interpret and implement the strategy’s guardrails across different fiscal cycles and political winds.

What to watch next

- Implementation details on the post-quantum cryptography rollout and zero-trust adoption across federal information systems.

- Guidance or proposed regulations related to privacy-focused tools, mixers, and off-ramps for digital assets.

- Standards development and collaboration efforts between government agencies and crypto industry participants on secure supply chains.

- Budget allocations or policy actions that fund cybersecurity research relevant to crypto infrastructure.

Sources & verification

- President Trump’s Cyber Strategy for America (White House PDF): https://www.whitehouse.gov/wp-content/uploads/2026/03/President-Trumps-Cyber-Strategy-for-America.pdf

- Galaxy Digital’s Alex Thorn on crypto security in the strategy: https://x.com/intangiblecoins/status/2030078133303455922?s=20

- Nic Carter on quantum readiness and policy emphasis: https://x.com/nic_carter/status/2030091238742053115?s=20

- Bitcoin quantum risk discussion and institutional concerns: https://cointelegraph.com/news/bitcoin-quantum-computing-risk-institutions-developers

- Bitcoin price context referenced in coverage: https://cointelegraph.com/bitcoin-price

National Cyber Strategy reframes crypto under security and quantum guardrails

The six-page document makes it clear that the administration views cryptography, digital assets, and blockchain as components of critical national infrastructure rather than peripheral technologies. While the exact regulatory path remains to be seen, the emphasis on post-quantum readiness and secure, privacy-conscious design sets a baseline for how federal agencies intend to engage with the crypto ecosystem. Industry voices have already started parsing the strategy’s language for practical implications—ranging from research funding opportunities to potential investigations into privacy-preserving architectures and on-ramps.

The strategy’s commitment to privacy-by-design, coupled with its tough stance on combatting illicit financial activity, positions the policy as a pivot point for the sector. Whether this translates into collaboration on cryptographic standards or a tightening of enforcement around privacy tools remains to be seen. What is clear is that the policy framework now recognizes crypto and blockchain as central to national security considerations, not just speculative technologies with speculative risk profiles.

Crypto World

$35M Corporate Crypto Bet Crashes, CFO Gets Prison Sentence

TLDR:

- Former CFO diverted $35M into DeFi lending platforms despite company policy requiring conservative investments.

- Crypto investments promising 20% yields collapsed within weeks, wiping out nearly all of the company funds.

- The software firm laid off 60 employees after the financial losses triggered a major restructuring.

- A federal court sentenced the executive to two years and ordered repayment of the full $35,000,100.

A former chief financial officer has received a two-year prison sentence after diverting $35 million in company funds into risky cryptocurrency investments.

U.S. federal prosecutors said the executive secretly transferred the money to a DeFi platform he controlled. The funds quickly collapsed in value after being placed in high-yield crypto lending protocols.

The case exposes how unauthorized crypto bets can devastate corporate finances.

CFO Moves $35M Into DeFi Lending Platforms

Nevin Shetty served as chief financial officer at a private software company beginning in March 2021. The firm raised capital to support growth and product development.

Company leadership adopted an investment policy designed to protect those funds. The policy restricted investments to conservative instruments such as money market accounts.

According to the U.S. Attorney’s Office for the Western District of Washington, Shetty helped draft that policy. However, he later transferred company funds into a cryptocurrency venture he secretly controlled.

Court records show Shetty launched a side company called HighTower Treasury in early 2022. The business had no outside customers.

Between April 1 and April 12, 2022, Shetty ordered wire transfers totaling $35,000,100 from a Chase branch near his home. The funds moved into HighTower Treasury accounts.

Prosecutors said Shetty then deployed the money across decentralized finance lending protocols. These platforms advertised yields exceeding 20 percent.

HighTower planned to return a smaller fixed payment to the software company. Shetty and his partner would keep the remaining profits.

Federal prosecutors stated the arrangement allowed Shetty to personally benefit from returns generated with company funds.

Crypto Investments Collapse Within Weeks

Initial results appeared profitable. According to court filings, the strategy generated roughly $133,000 in profits during the first month.

However, the DeFi investments soon deteriorated. Crypto market losses rapidly erased the value of the positions.

By May 13, 2022, the investment portfolio had nearly reached zero value. Almost the entire $35 million disappeared.

After the collapse, Shetty informed two fellow executives about the transfers. The company dismissed him immediately.

The financial damage forced the firm to restructure operations. Court documents state the company laid off around 60 employees after the loss.

The U.S. Attorney’s Office described the scheme as a calculated fraud carried out over several months. Prosecutors argued Shetty misled colleagues and financial institutions during the transfers.

Following a nine-day trial, a jury convicted Shetty in November 2025 on four counts of wire fraud. Federal investigators from the FBI’s Seattle field office supported the case.

A federal judge sentenced Shetty to two years in prison and ordered repayment of $35,000,100. He will serve three years of supervised release after prison.

The court also barred him from serving as a corporate officer without approval from a probation officer.

Crypto World

BTC in deep bear market, could crash by another 30%, investment firm says

Bitcoin is firmly in the deepest phase of the bear market and the pain may worsen, according to CK Zheng, founder of crypto investment firm ZX Squared Capital.

“Bitcoin’s price is convincingly in deep bear market territory now. We expect a further 30% price drop during 2026 as the Iran war started,” Zheng told CoinDesk in an email, citing the “four-year cycle” as one of the key catalysts.

The world’s largest cryptocurrency has already nearly halved since hitting a record high of over $126,000 in October last year, according to CoinDesk data. As of writing, it changed hands at around $68,000.

The four-year bitcoin cycle

Crypto investors often talk about the “four-year cycle” – a pattern in which prices surge, crash, and then recover, centred on the quadrennial mining reward halving.

The halving, most recently implemented in April 2024, is a programmed event that halves bitcoin’s supply expansion rate every 4 years. As of today, 3.125 BTC are emitted as rewards for each block mined on the Bitcoin network, down from the original 50 BTC at launch after four halving events to date.

Historically, bitcoin’s price has tended to peak about 16–18 months after a halving, followed by a bear market that typically lasts about a year.

BTC topping out in October last year, roughly 18 months after the April 2024 halving, means the cycle is playing out again. So, the bear market could deepen in the near term.

Zheng said that the cycle is proving very difficult to break. According to him, the reason is simple: human psychology.

“The “Four-year crypto cycle” momentum is gaining strength and is extremely difficult to break due to individual investors’ psychological behaviors,” Zheng said.

Individual investors tend to behave in predictable ways — buying during hype and selling during panic. That behavior reinforces the boom-and-bust four-year pattern that has defined crypto markets for more than a decade.

Because of this, Zheng said bitcoin still trades more like a speculative asset than a safe haven like gold.

He added that the institutional adoption of bitcoin remains very slow and limited in scope at this stage and warned that some firms that have purchased bitcoin as a treasury asset may be forced to sell, leading to a deeper price sell-off.

“The total size of crypto ETFs and Digital Asset Treasury companies is only around 10% of the whole crypto market. Some Digital Asset Treasury firms may be forced to sell cryptos to meet certain debt servicing requirements during this bear market, which may create a vicious cycle,” Zheng said.

For now, Zheng’s outlook is clear: crypto’s bear market may have further to run before the next cycle begins.

Crypto World

Is XRP at Risk of Falling Below $1?

“Our long-term target is $0.9000,” one analyst stated.

Ripple’s XRP has registered a minor uptick over the past week, coinciding with the broader cryptocurrency market’s revival.

However, some analysts believe its price may decline sharply in the near future and even fall below the psychological $1 level.

New Pullback Ahead?

Earlier this week, XRP tried to reclaim the $1.50 mark but failed and now trades at around $1.39 (per CoinGecko’s data). The asset’s market capitalization stands at approximately $85 billion, making it the fourth-biggest cryptocurrency, trailing behind BTC, ETH, and USDT.

One person who has been closely monitoring its performance is the X user TradingShot. In their view, XRP has been moving within a downward channel throughout its entire bear cycle, which, according to the chart, began in July 2025 – shortly after the price reached its all-time high of over $3.65.

TradingShot noted that the severe decline in February this year hit the previous target on the 1W MA200, suggesting the asset’s next potential pullback may lead to a further drop to the 1M MA100 support, set at under $0.90.

“This level is critical as it formed the June 2022 bottom of the previous Bear Cycle. Our long-term Target is $0.9000,” the X user concluded.

X user WealthManager also presented a bearish forecast. They believe XRP looks “very dangerous” right now, warning that a “huge drop could be imminent.”

Meanwhile, the prominent Bitcoin educator and advocate Adam Livingston spoke sharply against Ripple’s native cryptocurrency. He said he would rather have $100,000 in FTX customer refund claims than $100,000 in XRP.

You may also like:

“At least SBF might send a heartfelt apology from prison before he dies of old age,” Livingston added.

The Bullish Scenario

Despite the pessimistic views some express toward XRP, many indicators suggest its price may head north soon. Numerous market observers pointed out that large investors have purchased almost 4.2 billion tokens (worth a whopping $5.7 billion at current rates) since the October 10 crash.

This development reduces the amount of XRP tokens available on the open market, and economic principles dictate that the valuation should rise if demand doesn’t diminish. Moreover, this shows that whales are confident in the asset and view lower prices as an opportunity, a signal that could encourage smaller players to follow suit.

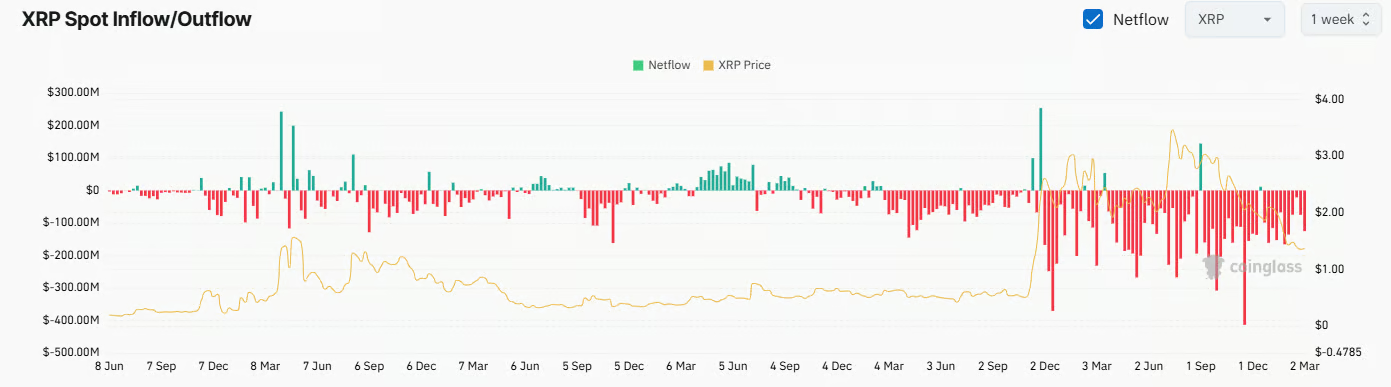

XRP’s exchange netflow is next on the list. Over the past several weeks, outflows have consistently exceeded inflows, indicating that investors are moving their holdings off centralized platforms and into self-custody. This shift reduces the amount of coins immediately available for sale, easing short-term selling pressure.

The asset’s Relative Strength Index (RSI) is also worth mentioning. It has fallen to around 30 on a weekly scale, marking oversold territory that can sometimes be a precursor to a rally. On the other hand, ratios above 70 are considered bearish.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

US National Cyber Strategy Pledges Support For Crypto And Blockchain

Crypto industry executives are combing through US President Donald Trump’s National Cyber Strategy after it was released on Friday, searching for hints about what it could signal for government support of the crypto industry.

“Crypto and blockchain are explicitly named as technologies to be ‘protected and secured.’ This is a first for any US cybersecurity strategy,” Galaxy Digital’s head of firmwide research Alex Thorn said in an X post on Friday.

Crypto and blockchain were mentioned once in the six-page report:

“We will build secure technologies and supply chains that protect user privacy from design to deployment, including supporting the security of cryptocurrencies and blockchain technologies.”

However, industry executives have also been interpreting other parts of the document to see how they relate to crypto.

Thorn pointed to a section pledging to “uproot criminal infrastructure and deny financial exit and safe haven.” “This language could easily justify crackdowns on mixers, privacy coins, and unregulated off-ramps,” he said.

Bitcoin VC points out that quantum has been taken “seriously”

Castle Island Ventures founder Nic Carter, who has been vocal about the threat of quantum computing to Bitcoin (BTC) in recent times, pointed to the section saying the government “will accelerate the modernization, defensibility, and resilience of federal information systems by implementing cybersecurity best practices, post-quantum cryptography, zero-trust architecture, and cloud transition.”

“Sure seems like they’re taking quantum seriously. Nothing to worry about, I’m sure,” Carter said in an X post.

It comes as the crypto industry continues to debate about how close quantum computing is to being a serious threat to Bitcoin. On Feb. 15, Carter said that major Bitcoin-holding institutions may eventually lose patience with Bitcoin developers for not addressing quantum computing concerns quickly enough.

Trump points to the next generation as a priority

Trump said that the National Cyber Security outlines his priorities for “ensuring that America remains unrivaled in cyberspace.” Artificial intelligence was a key focus of the report.

“We will secure the AI technology stack—including our data centers—and promote innovation in AI security,” it said.

Related: Community banks and crypto industry ‘are allies’ in CLARITY Act debate: Exec

Trump also emphasized the importance of recruiting the next generation of workers in the cyber workforce to “design and deploy exquisite cyber technologies and solutions.”

The US typically releases a national cybersecurity strategy every administration, outlining the government’s priorities for emerging technologies.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

Crypto’s Mark Zuckerfart breaks silence

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The man behind the pseudonym Mark Zuckerfart has resurfaced after months of speculation. In an exclusive interview, the marketer explains why he left the Solfart project and why he now believes Patos Meme Coin has the team, strategy, and momentum to dominate the next wave of Solana meme tokens.

crypto.news presents an exclusive look at the man behind the pseudonym: Mark Zuckerfart. With a track record of scaling meme coins into the hundreds of millions, Zuckerfart has long been a silent engine in the marketing and creative space.

But his latest chapter came with a cost. After a dispute over Solfart’s financial transparency and the team’s treatment, MZ walked away from his previous brand last November, leaving behind one final, cryptic Reddit post. Now, with the ducks flying high, it’s clear what the image meant. He has found a new home as the Marketing and Creative Head for Patos Meme Coin and a project leader.

For the first time, he’s addressing the rumors regarding Solfart and explaining why the move was necessary —and how Patos Meme Coin is a band of unrivaled Crypto Rock Stars.

MZ, let’s start with the basics. Why did you leave Solfar (SOLF) Token?

I was a co-creator of solfart but I wasn’t the owner. I never handled wallets and payments, etc, I just made sure the internet was littered with content and provided connections to all the major news outlets. I left because we had a $15k sale, and the money was mishandled. Neither the team under me nor I were compensated, while the owner squandered money. The writing on the wall was clear; he was not ‘cutting the cheese’.

But hey, I made that slogan and concept for him. Makes sense. If he doesn’t believe in the idea/concept, he has no reason to. He didn’t make the creative concepts nor share the belief

What do you think will happen to the Solfart token now, and what did you learn from the experience?

Hopefully, Fart McSatoshi learns and keeps moving forward. I wish no negatives on anyone and believe he can steer his own vision as he chooses.

I do see he’s still shilling the work I did back in November of 2025, however. I think investors should demand more. That’s it. He’s a brilliant developer. Every time I see people asking “what happened to Mark Zuckfart” or wanting my work back, I feel more inspired to continue creating with Patos.

What made you move on to Patos Meme Coin?

More control allows me to exercise greater budgetary restraint and have a firm handle on the project’s direction. To make sure there’s a fair opportunity for everyone.

My belief in building something that will spread wealth to those who invest will be honored by this project. I also believe in the developer & marketing team’s ideas. We have a crew of people from 4 countries who are absolute Rock Stars at their craft. The Beatles of the Crypto space!

Everyone shares one belief, structured around math fundamentals. Everyone works just as hard as I do, and results are showing already.

Ducks eat bread together. Ducks fly high together. “PATOS” is all that, but also a potential catalyst to Pump All Tokens on Solana by creating a FOMO for the SPL ecosystem.

Do you believe Patos Meme Coin is better than Solfart?

Undoubtedly. Our team has far more reach in the actual crypto industry. Look at what we’ve achieved in 2 months compared to Solfart.

Patos Meme Coin has more crypto exchange listings, we’re on Google News on a new site every few days, and our first round of presale is nearly sold out.And recently, we released the first dAPP with more to come. Patos.games is a play-to-earn GameFi hub launched to help anyone earn $PATOS while boosting trading volumes and, in turn, brand visibility. Speaking of after the presale, of course. If you go point for point, the facts are clear.

What makes you confident in Patos Meme Coin’s execution?

Experience. Connections. Power. Consistency. Scaling ability.

The 111 Crypto exchange idea wasn’t just to compete with my old ideas at Solfart. It’s because I, myself, and a teammate conducted an analysis of crypto exchanges’ effects on the market cap of previously listed tokens, on average; tokens on a similar scale to what Patos Meme Coin is destined to be, if not less.

That 111 Cex theory puts those averages together, and along with support from our rising “Patos Flock” following, should create an excess of momentum in the opening week, and our team, keyword ‘teamwork,’ can handle all aspects of what needs to be done to convert that momentum into a parabolic market cap increase. And 111 is a bit ‘over the top’ of where the actual math suggested, but we want to aim for Mars, not the Moon.

Parabolic increases in market cap turn into parabolic token price explosions. We even have connections with Pop Culture celebrities and influencers that will aid our growth at the right time. Our collective reach really separates us from any other presale currently live.

On PatosMemeCoin.com, it shows that the token presale’s first round is almost closed, with 9 remaining; 10 total. This means PATOS should have around 11 crypto exchange listings confirmed per round. Is this accurate?

Something like that. For instance, we expect to add 4, possibly 6, more crypto exchange listing confirmations to our resume before round 1 closes. That will boost our total CEX confirmations to 12 or 14. Our team likes to be ahead of the ball, ahead by as far as possible.

The doors are open to many people as they trust the team involved and me. The faster funding comes in, the faster listings will grow, and in compounding fashion, vs. speed.

But of course, the price of tokens goes up with each round, with the 10th-round price 47% higher than the first. The fastest duck gets the most bread.

You mentioned earlier that you have the GameFi dAP “Patos Games.” What other applications can investors expect?

We like to keep most things very much hush. As you can see from the Patos Games references, there was no mention of the actual project before it launched. There are too many energy & idea thieves in this industry, and I want to keep as many surprises for investors as possible.

Just know, we’re looking to make an impact in a way that will make Patos Meme Coin a meme coin with utility that’s used for years to come. That’s the goal.

Our team would much rather ‘show’ than talk. But at this point, we have more CEX support, a GameFi pixel game launched, and so much visibility. Changpeng Zhao, aka CZ, responded to us indirectly on X.

With just what we have now, a 50x increase in value from today’s token price is possible. comes, the faster listings will grow, and in compounding fashion vs speed increase.

Thank you for your time, Mark Zuckerfart. Wishes of great fortune and materialization of your vision for Patos Meme Coin.

Wishes aren’t needed. Just hard work If you’re ready to win, come join the Flock.The first round has 18% left, and we’re still in the 2nd month of this token presale. Check others’ ages to notice how fast we are moving by comparison.

We’re going to go even faster soon. Get your first bag holdings during the genesis round at PatosMemeCoin.com. And to all of those invested right now: Patos Fock, let’s fly Mother Quackin’ high.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business16 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion12 hours ago

Fashion12 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat7 days ago

NewsBeat7 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed