Crypto World

What Is a Change of Character (CHoCH) in Trading? Definition, Signals, and Examples

In Smart Money Concept (SMC) trading, recognising when market momentum shifts can mean the difference between catching a trend reversal and holding a losing position. The Change of Character (CHoCH) is a price action pattern that can signal these pivotal moments when the balance between buyers and sellers tips. Unlike continuation patterns that confirm ongoing momentum, a CHoCH alerts traders to prepare for directional changes.

This article explores how to identify CHoCH patterns on a chart, explains how they differ from similar concepts like Break of Structure and Market Structure Shift, and demonstrates their practical application through real trading examples.

Takeaways

- CHoCH is a concept that signals potential trend reversals in Smart Money Concept trading. This pattern has two forms: bullish CHoCH and bearish CHoCH. A bullish CHoCH occurs when price breaks above a recent lower high in a downtrend, while a bearish CHoCH happens when price falls below a recent higher low in an uptrend, indicating possible momentum shifts.

- A CHoCH is usually compared to a Break of Structure (BOS). However, these concepts are opposite. BOS confirms trend continuation by breaking in the direction of the existing trend, whereas CHoCH signals a potential reversal by breaking against the prevailing trend.

- Another common pattern the CHoCH is compared to is a Market Structure Shift (MSS). However, MSS is a higher-confluence CHoCH that includes additional confirmation signals like a lower high (bearish) or higher low (bullish) before the break, plus strong displacement.

- Change of Character patterns can be found across all timeframes, from intraday to weekly charts, with higher-timeframe signals generally carrying more significance.

Understanding Breaks of Structure

Before delving into concepts like Change of Character (CHoCH) traders should understand the Breaks of Structure (BOS) pattern. A BOS in trading signifies a continuation within the current trend and is marked by a clear deviation from established swing points that indicate previous highs and lows.

In the context of an uptrend, a BOS is identified when the price exceeds a previous high without moving below the most recent higher low. This action confirms that the upward momentum is still strong and likely to continue as buyers push the market to new heights.

Similarly, in a downtrend, a BOS occurs when prices drop below a previous low without breaking the prior lower high, suggesting that sellers remain in control and the downward trend is set to persist.

By recognising these points where the market extends beyond its former bounds, traders can confirm that the current trend is robust and act accordingly. This foundational concept of BOS may not only help in assessing trend strength but also sets the stage for understanding more complex patterns like CHoCH, where the focus shifts from trend continuation to potential trend reversals.

CHoCH Trading Meaning

In trading, a Change of Character (CHoCH) is a concept that reflects a potential shift in market dynamics, often indicating a reversal from the prevailing trend. It may help traders discern when the momentum is shifting, offering a strategic point to consider adjusting their positions.

A CHoCH occurs when there’s a noticeable deviation in the market’s price trend. For example, in a bullish trend characterised by a series of higher highs and higher lows, a CHoCH is indicated by the price failing to set a new high and subsequently falling below a recent higher low. This suggests that buyers are losing control, and a bearish trend could be emerging.

Similarly, during a bearish trend marked by lower highs and lower lows, a bullish CHoCH would occur if the price unexpectedly breaks above a recent lower high. This break indicates that sellers are losing their grip, and a bullish trend may be starting.

The Significance of CHoCHs Across Timeframes

The fractal nature of financial markets means that patterns and behaviours recur across various timeframes, each providing unique insights and implications for trading. Understanding CHoCHs in different timeframes may help traders align their strategies with both short- and long-term trend shifts. This is known as multi-timeframe analysis.

In intraday trading, where decisions are made on lower timeframes (like minutes or hours), a CHoCH can signal a possible short-term trend reversal. For example, if a currency pair in a downtrend on a 15-minute chart suddenly posts a higher high, this could indicate a weakening of the bearish momentum, suggesting a potential bullish reversal.

Traders might use this information to close short positions or to consider a long position, capitalising on the emerging upward trend. These short-term CHoCHs allow traders to respond quickly to market changes, potentially securing returns before larger market shifts occur.

Conversely, CHoCHs observed on higher timeframes, such as daily or weekly charts, are particularly significant because they can indicate a shift in the broader market trend that might last days, weeks, or even months. Such changes can then be used by both long and short-term traders to adjust their positioning and directional bias.

How Is Change of Character Identified?

The initial step to identify a CHoCH in trading involves clearly defining the existing trend on a specific timeframe. This is done by marking the significant swing highs and lows that delineate the trend’s progress. These points should represent somewhat meaningful retracements in the price, providing clear markers of trend continuity or potential reversal points.

According to the Smart Money Concept (SMC) theory, the integrity of an uptrend is maintained as long as the price does not trade through the most recent significant higher low. Conversely, a downtrend is considered intact if the price does not surpass the most recent significant lower high. Therefore, traders focus their attention on these critical points.

To identify a CHoCH, traders watch for a break in these crucial high or low points. For instance, in an uptrend, a bearish CHoCH is indicated when the price achieves a higher high but then reverses to descend below the previous significant higher low.

Similarly, in a downtrend, a bullish CHoCH occurs when the price drops to a lower low before reversing to break above the previous significant lower high, setting a new high. Both types of breaks signal a potential reversal in the trend direction.

To try and spot your own CHoCHs, you can head over to FXOpen’s TickTrader platform to access real-time charts and numerous market analysis tools.

Application of CHoCH

CHoCHs should be integrated with other aspects of the SMC framework. This includes the use of order blocks and imbalances, which are important components in identifying potential reversals.

Order Blocks and Imbalances

An order block is essentially a substantial consolidation area where significant buying or selling has occurred, and prices often revisit these zones before reversing. These blocks can be seen as levels where institutional orders were previously concentrated.

An imbalance, also known as a fair value gap, occurs when the price moves sharply up or down, leaving a zone that has not been traded extensively. Price often returns to these gaps to ‘fill’ them, establishing equilibrium before a potential reversal happens.

In practice, traders can look for a sequence where the price first approaches an order block and begins to fill any existing imbalances. This setup increases confidence in a potential reversal. As the price meets these criteria and a CHoCH occurs, this indicates that the influence of the order block is likely to initiate a price reversal.

Practical Example on GBP/USD

Consider the 4-hour chart of the GBP/USD pair above. We see the pair encounter an order block on the left, one that’s visible on the daily chart. As the price interacts with this block, it begins to retrace, attempting to fill the imbalance but moves away. Eventually, the price completes the fill of the imbalance and meets the previously established order block.

Switching to a 1-hour timeframe, this scenario unfolds similarly. After reaching the order block on the 4-hour chart, another CHoCH occurs, signalling the start of a new uptrend. This lower timeframe CHoCH, following the meeting of the order block, corroborates the potential for a reversal initiated by the higher timeframe dynamics.

This example illustrates how CHoCHs can be utilised across different timeframes, tying back to the fractal nature of markets discussed earlier. By recognising these patterns and understanding their interaction with order blocks and imbalances, traders can strategically position themselves to capitalise on potential market reversals, aligning their trades with deeper market forces at play.

Change of Character vs Market Structure Shift

A Market Structure Shift (MSS) is a specific type of Change of Character that includes additional signals suggesting a potential trend reversal. Unlike a straightforward CHoCH that typically indicates a trend is shifting but may also be a false break, an MSS can be seen as a higher confluence CHoCH. An MSS occurs after the market first makes a key movement contrary to the established trend—forming a lower high in an uptrend or a higher low in a downtrend—without plotting a higher high or lower low.

Following these preliminary signals, an MSS is confirmed when there is a decisive break through a significant swing point accompanied by a strong displacement (i.e. impulse) move, creating a CHoCH in the process. This sequence not only reflects that the prevailing trend has paused but also that a new trend in the opposite direction is establishing itself.

Due to these additional confirmations, an MSS can offer added confirmation for traders, indicating a stronger likelihood that a new, sustainable trend has begun. This makes the MSS particularly valuable for traders looking for more substantiated signals in their trading strategy.

The Bottom Line

The Change of Character (CHoCH) is one of the popular Smart Money concepts, offering traders valuable insight into potential market reversals. By learning to identify CHoCH patterns, traders can align their strategies with institutional order flow. However, as with any trading tool, CHoCH isn’t used in isolation but combined with other market analysis techniques.

To test different trading approaches, you can consider opening an FXOpen account and access a wide range of financial assets, low commissions*, and tight spreads* (*additional fees may apply).

FAQ

What Is CHoCH in Trading?

In trading, CHoCH is a technical observation that signifies a change in the trend’s character, where the price movement breaks from its established pattern of highs and lows, suggesting a potential reversal or substantial shift in the market’s direction.

What Is CHoCH in SMC Trading?

In Smart Money Concept (SMC) trading, a Change of Character (CHoCH) refers to a clear shift in market behaviour that indicates a potential reversal of the prevailing trend. This concept is used by traders to detect early signs of a momentum shift that might lead to significant changes in price direction, enabling strategic adjustments to their trading positions.

What Is a CHoCH in the Market Structure?

A CHoCH in market structure is identified when there is an observable deviation from established price patterns — specifically when new highs or lows contradict the current trend. It signifies that the previous market sentiment is weakening, and a new opposite trend may be starting, prompting traders to reassess their strategies.

How Is CHoCH Identified on a Price Chart?

Identifying a CHoCH involves monitoring significant swing highs and lows for breaks that are contrary to the existing trend. For instance, in an uptrend, a CHoCH would be indicated by a failure to reach a new high followed by a drop below the recent higher low, suggesting a shift to a bearish outlook.

What Is ChoCH vs BOS in Trading?

While both CHoCH and Break of Structure (BOS) are critical in assessing market dynamics, they serve different purposes. CHoCH indicates a potential trend reversal by highlighting a significant change in the price pattern. In contrast, a BOS indicates a continuation of the current trend by showing the price surpassing previous significant highs or lows, reinforcing the ongoing direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Polymarket Parent Blockratize Inc. Seeks Trademark for ‘POLY’ Token

TLDR

- Blockratize Inc., the parent company of Polymarket, has filed trademark applications for the terms “POLY” and “$POLY.”

- The trademark filings cover various services, including digital token and cryptocurrency trading, as well as platform-as-a-service offerings.

- Both trademark applications were filed on February 4 and are currently listed as “live” and “pending” by the U.S. Patent and Trademark Office.

- The filings were submitted on an “intent to use” basis, meaning the marks are not yet in active commercial use.

- Polymarket executives have previously confirmed plans to launch a native POLY token alongside an airdrop, but no official launch timeline has been provided.

Blockratize Inc., the parent company of the crypto-powered prediction platform Polymarket, has filed trademark applications in the U.S. for “POLY”. These filings, made on February 4, signal the company’s ongoing plans to launch a native token. The applications are currently listed as “live” and “pending,” suggesting the project is moving forward.

The trademark filings span multiple classes, covering digital token services, cryptocurrency trading, and platform-as-a-service offerings. This move aligns with previous statements from Polymarket executives about the potential launch of a native token, adding a formal legal step to their plans. While the filings don’t specify a timeline, they confirm ongoing preparations for the launch of the POLY token.

Trademark Filings Confirm Polymarket’s Token Plans

Polymarket’s trademark applications cover a range of services, including downloadable software for cryptocurrency trading and financial services. These filings have been submitted on an “intent to use” basis, meaning they are not yet in active commercial use. The company has also applied for digital token and cryptocurrency services as part of its broader market strategy.

While the trademark filings do not mention specific dates or mechanics, they do reinforce earlier statements from Polymarket executives. In October, Polymarket’s Chief Marketing Officer, Matthew Modabber, confirmed the company’s plans for the POLY token launch. Founder Shayne Coplan also teased the token’s release, with both executives noting that the U.S. app’s relaunch would take precedence over the token rollout.

Polymarket’s Expansion and Token Speculation

Polymarket has become one of the largest global venues for prediction markets, with $7.7 billion in trading volume last month. This growth has spurred anticipation for the POLY token, particularly as speculation around the launch continues to build. With the increasing popularity of prediction markets in politics, sports, and macro events, the token launch has captured the attention of the broader cryptocurrency community.

The company has secured significant investments, including a $2 billion deal with the Intercontinental Exchange, parent of the New York Stock Exchange. Polymarket has also formed strategic partnerships with major names like Google Finance, Yahoo Finance, DraftKings, and the National Hockey League.

Crypto World

XRP Jumps Nearly 20% as Ripple Teases Major XRPL Upgrades

The token is outperforming the broader crypto market amid a string of Ripple announcements.

XRP outperformed the broader cryptocurrency market on Friday, Feb. 6, rising nearly 20% over the past 24 hours.

The token was trading around $1.50, after briefly touching a high near $1.53, per The Defiant’s price page. XRP’s market capitalization now stands at about $91.3 billion. XRP also strengthened against Bitcoin (BTC), gaining more than 13% on the BTC pair, according to CoinGecko. Meanwhile, 24-hour trading volume climbed to roughly $16.5 billion.

The rally came as investor sentiment improved following a series of Ripple announcements this week, with the latest being the company teasing major upgrades to the XRP Ledger (XRPL) on Feb. 5.

In a blog post, Ripple outlined how new and upcoming features on the XRP Ledger would expand XRP’s real-world utility beyond payments. The company also said that XRP is increasingly being used across stablecoin settlement, FX, tokenized assets, and lending.

“With each use case, XRP’s role becomes more intertwined in institutional finance, either as the asset being moved, the bridge facilitating exchange, or the reserve currency backing network security,” the post reads.

Earlier this week, the team also announced that Ripple Prime added support for Hyperliquid – the largest decentralized perpetual futures platform by trading volume and open interest (OI), according to DeFiLlama. The move aims to provide institutional clients with on-chain derivatives liquidity through Ripple’s prime brokerage platform.

“At Ripple Prime, we are excited to continue leading the way in merging decentralized finance with traditional prime brokerage services, offering direct support to trading, yield generation and a wider range of digital assets,” said Michael Higgins, International CEO, Ripple Prime. “This strategic extension of our prime brokerage platform into DeFi will enhance our clients’ access to liquidity, providing the greater efficiency and innovation that our institutional clients demand.”

XRP’s rebound comes amid a broader market downturn that has stretched for weeks. Bitcoin (BTC) is currently trading under $70,000 – a price point not seen since Nov. 2024. Meanwhile, Ethereum (ETH) is currently changing hands at $2,000, down 25% on the week.

Crypto World

Gold Below $5,000 as Firmer Dollar Weighs

Gold prices edged lower in early trading, holding below the $5,000 mark in the absence of fresh catalysts and amid a stronger dollar.

Futures in New York fell 0.1% to $4,944 a troy ounce, while the U.S. dollar index—which measures the greenback against a basket of major currencies—is up 0.1% at 97.71.

“A stronger USD weighed on investor appetite,” ANZ analysts said. “This offset any gains coming from rising haven buying as geopolitical tensions rise in the Middle East.”

Crypto World

Bitcoin Dips to $60k, TRM Labs Reaches Crypto Unicorn Status

Cryptocurrency markets experienced a brutal sell-off this week as investor concerns grew over stagnating US liquidity following US President Donald Trump’s nomination of Kevin Warsh to lead the Federal Reserve.

Bitcoin exchange-traded funds (ETFs) recorded three consecutive days of outflows, with $431 million exiting on Thursday, according to data from Farside Investors. Bitcoin’s (BTC) price briefly dipped to $60,074 on Friday before recovering above $64,930 as of 7:49 a.m. UTC.

Warsh — who previously served as a Fed governor from 2006 to 2011 — is expected to continue the interest rate cut trajectory. His nomination may also signal that broader market liquidity is expected to “stabilize rather than meaningfully expand,” Thomas Perfumo, economist at crypto exchange Kraken, told Cointelegraph.

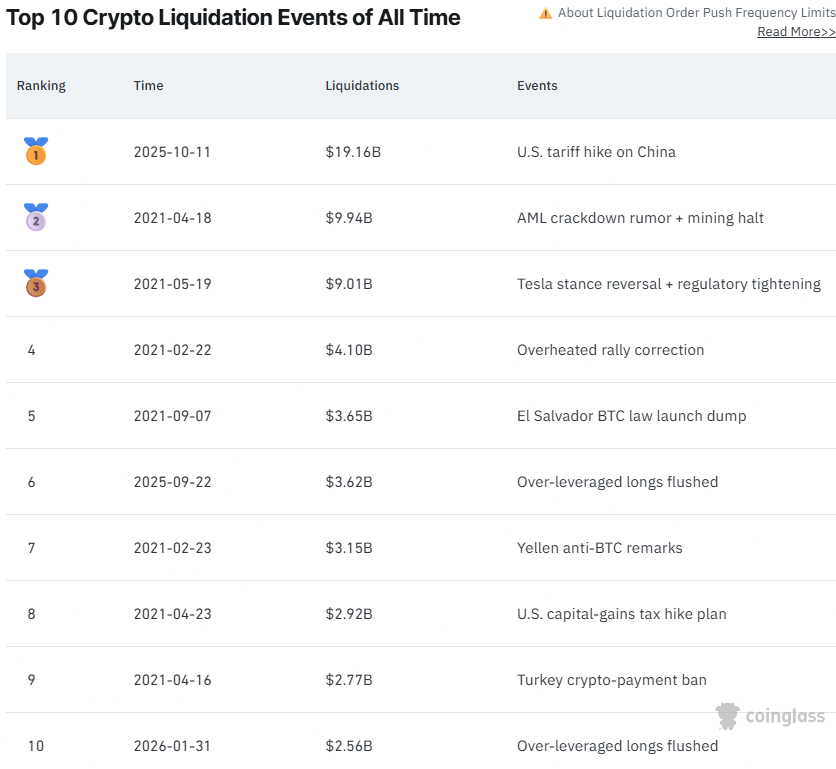

The industry recorded its 10th-largest liquidation event on Jan. 31, as more than $2.56 billion in leveraged positions were wiped out, according to derivatives data platform CoinGlass.

TRM Labs completes $70M investment round at $1B, becomes crypto unicorn

Blockchain intelligence platform TRM Labs completed a $70 million Series C funding round, valuing it at $1 billion, becoming the latest crypto company to reach unicorn status.

The investment round was led by seed investor Blockchain Capital, with participation from Goldman Sachs, Bessemer Venture Partners, Brevan Howard Digital, Thoma Bravo, Citi Ventures and Galaxy Ventures, according to a Wednesday news release.

TRM Labs seeks to equip public and private institutions with AI solutions that combat cybercrime. The company defends against illicit activities that increasingly rely on automation.

“At TRM, we’re building AI for problems that have real consequences for public safety, financial integrity, and national security,” wrote Esteban Castaño, co-founder and CEO of TRM Labs.

“This funding allows our world-class team — and the people who will join us next — to innovate alongside institutions on the front lines of the most consequential threats, and expand the potential of AI to meaningfully improve how our critical systems are protected.”

The $70 million round shows that capital is flowing into blockchain analytics platforms seeking to stop the spread of AI-fueled scams and cyberattacks, including from large traditional institutions.

Avalanche tokenization hits Q4 high as BlackRock’s BUIDL expands onchain

Blockchain network Avalanche saw increasing institutional adoption across tokenized money market funds, loans and indexes in the fourth quarter, driving the value of real-world assets (RWAs) on the layer 1 to a new high.

The total value locked of tokenized RWAs on Avalanche rose 68.6% over the fourth quarter of 2025 and nearly 950% over the year to more than $1.3 billion, boosted by the $500 million BlackRock USD Institutional Digital Liquidity Fund (BUIDL) that launched in November, Messari research analyst Youssef Haidar said in a Jan. 29 report.

Fortune 500 fintech FIS partnered with Avalanche-based marketplace Intain to launch tokenized loans in November, further boosting Avalanche’s TVL, Haidar said. Intain enables 2,000 US banks to securitize over $6 billion worth of loans on Avalanche.

The S&P Dow Jones also partnered with Dinari, an Avalanche-powered blockchain, to launch the S&P Digital Markets 50 Index, which tracks 35 crypto-linked stocks and 15 crypto tokens on Avalanche.

Traditional finance firms are increasingly confident about experimenting with tokenization, as the Securities and Exchange Commission has become more open to crypto products over the past year.

ParaFi Capital makes $35M investment in Solana-based Jupiter

Jupiter said it has secured a $35 million strategic investment from ParaFi Capital, marking the first time the Solana-based onchain trading and liquidity aggregation protocol has taken outside capital after years of bootstrapped growth.

The transaction involved token purchases at market prices with no discount and an extended lockup period and was settled entirely in Jupiter’s JupUSD stablecoin, the companies said. Financial terms beyond the $35 million investment were not disclosed.

The investment comes as Jupiter has processed more than $1 trillion in trading volume over the past year and expanded beyond swap routing into perpetuals, lending and stablecoins, according to the company.

The deal also included warrants allowing ParaFi Capital to acquire additional tokens at higher prices, a structure the companies said was intended to reflect long-term alignment.

The investment follows a recent expansion of Jupiter’s product offerings. In October, Jupiter rolled out a beta version of its onchain prediction market developed with Kalshi, followed in January by the launch of JupUSD, a Solana-native, dollar-pegged stablecoin built in partnership with Ethena Labs.

Jupiter’s native token (JUP) was up around 9% over the past 24 hours, according to CoinGecko data.

Aave winds down Avara, phases out Family wallet in DeFi refocus

Aave Labs said it is sunsetting its “umbrella brand” Avara in the company’s latest move to refocus on decentralized finance and simplify its branding.

Aave founder and CEO Stani Kulechov posted Tuesday on X that Avara, a company encompassing projects including the Family crypto wallet and previously the social media platform Lens, “is no longer required as we go all in on bringing Aave to the masses.”

Kulechov said the Apple iOS-based Family crypto wallet was also being wound down as the team has “learned that onboarding millions of users requires purpose-built experiences, such as savings, rather than generic, open-ended wallet experiences.”

The move marks Aave’s latest effort to refocus on products such as its flagship lending protocol as the project handed stewardship of Lens to the Mask Network last month, with Kulechov saying Aave’s participation in the protocol would be reduced to an advisory role so it can focus on DeFi.

Kulechov said in his latest post that Aave was “now united as one team of world-class designers, engineers, and smart contract experts, aligned around a single mission: bringing DeFi to everyone.”

Step Finance treasury wallets breached, $27M in SOL drained as STEP crashes 90%

Step Finance, a decentralized finance portfolio tracker on Solana, disclosed a security breach that led to the compromise of several treasury wallets, triggering a sharp sell-off in its native token.

“Earlier today, several of our treasury wallets were compromised by a sophisticated actor during APAC hours. This was an attack facilitated through a well-known attack vector,” the platform wrote in a post on X, adding that they have taken “remediation” steps.

Onchain data reviewed by blockchain security firm CertiK shows that roughly 261,854 Solana (SOL) (worth around $27.2 million) was unstaked and transferred from Step Finance-controlled wallets.

Step Finance has not yet confirmed the total scale of the losses. The team also did not disclose how the attacker gained access, nor whether the incident stemmed from a smart contract flaw, compromised keys or an internal access issue. It also remains unclear whether any user funds were affected, beyond protocol-owned assets.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the red.

The privacy-preserving Zcash (ZEC) token fell 35% to record the week’s biggest decline in the top 100, followed by the Story (IP) token, down 34% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Crypto World

Ethereum price hits key support as funding rate falls

Ethereum price continued its strong downward trend this week, reaching its lowest level since May last year.

Summary

- Ethereum price dropped to a crucial support level as the crypto market crash accelerated.

- Its liquidations jumped to the highest level in months.

- Ethereum’s weighted funding rate dropped to its October lows.

Ethereum (ETH) token dropped to a low of $1,768, down by 60% from its all-time high. This retreat coincided with the broader crypto market crash as retail and some institutional investors dumped the coin.

Data compiled by SoSoValue shows that American investors have sold Ethereum ETFs worth $149 million this year. January is the fourth consecutive month that these funds have shed assets.

Additional data show that Ethereum bulls were heavily liquidated as the crash continued. Ethereum positions worth nearly $2 billion were liquidated since January 31, the highest figure since Oct. 10 when positions worth over $3.8 billion were wiped out.

Most importantly, the weighted funding rate turned negative and fell to its lowest level since Oct. 10. A negative funding rate indicates that investors anticipate the coin will decline. It happens when shorts are paying long positions in the perpetual futures market.

On the positive side, Ethereum’s network is doing well, with Nansen data showing a surge in transactions, fees, and active addresses. Ethereum handled 70 million transactions in the last 30 days, while the number of active addresses rose by 42% to over 15 million.

It also holds a leading market share across sectors in the crypto industry, including stablecoins, decentralized finance, and real-world asset tokenization. These fundamentals may help fuel its long-term recovery.

Ethereum price technical analysis

The weekly chart shows that ETH price has pulled back in the past few months. It has dropped from a record high of $4,950 to a low of $1,7686 today. Its lowest point was notable because it coincided with the ascending trendline connecting the lowest levels in June 2022 and April last year.

The price was also important because it was near the left shoulder of the inverted head-and-shoulders pattern. This pattern is one of the most common bullish reversal signs in technical analysis.

Therefore, a weekly close above $2,130 will point to a reversal, potentially to $3,000. On the other hand, a close below the support at $1,768 will invalidate the bullish outlook.

Crypto World

HBAR surges 15% and XLM gains 10% as Bitcoin reclaims $70K

- Hedera and Stellar prices are up by 15% and 10% respectively as altcoin surge.

- HBAR and XLM eye key levels, helped by Bitcoin’s swift rebound to $70,000.

- Analysts warn that prices may yet dip after the latest relief rally.

HBAR and XLM are up double digits as cryptocurrencies look for a swift rebound following Thursday’s steep crash that saw over $2.6 billion in leveraged positions wiped out.

The altcoins are up as Bitcoin, which crashed to $60,000 amid the bloodbath, leads the recovery with a rebound to above $70,000.

Gains for Hedera and Stellar mirror the sharp upticks for XRP, Flare, VeChain, and Kaspa. Ethereum, which dipped to near $1,700 on Thursday, was testing the resistance at $2,000.

HBAR and XLM price gains

Hedera’s token dropped to lows of $0.073 as top coins crashed late Thursday, but currently hovers above $0.093 as buyers eye the $0.10 mark given up this week.

An uptick of over 15% in the past 24 hours amid a 65% surge in trading volume (to over $420 million) signals the strong buying that follows the latest dip.

Bulls will eye year-to-date highs of $0.13, likely if market sentiment improves further.

Stellar, which has tracked gains by XRP in the past, also jumped on Friday.

The altcoin was up 10% at the time of writing, slightly off the mark seen with a 13% uptick during early US trading hours.

XRP’s 18% spike as prices touched $1.52 following a dump to $1.13 pulled the closely related XLM higher.

CoinMarketCap data showed Stellar traded around $0.17, sharply up from the lows of $0.13 reached earlier in the day.

XLM was inching higher on increased volume, which details indicate stood at a 24-hour high of $426 million. Stellar bulls had helped push the daily volume up by more than 56% over this period.

While sentiment remains well within the extreme fear territory, analysts say a break to $0.20 could allow for fresh bullish momentum.

Bitcoin tops $70,000 as cryptocurrencies rebound

Bitcoin (BTC) is spearheading the crypto sector’s latest quest for a swift turnaround following a sharp crash.

The huge leverage unwinding saw BTC fall to $60,000, with a $10,000 drop in 24 hours marking the biggest one-day rout since bears annihilated bulls during the FTX crash in 2022.

Gains have come as open interest expands, with shorts covering positions and fueling the climb to the critical $70,000 support level. Daily RSI also shows a bullish divergence.

CoinShares says record ETP volumes, pause in whale selling, and BTC price moving below miners’ production costs are factors that have historically marked fresh accumulation “rather than the start of a new leg lower.”

However, crypto analyst Rekt Capital says bulls may yet have to take on bears.

The analyst shared his BTC price forecast as the cryptocurrency market bounced from Thursday’s crash.

According to Rekt Capital, a potential bearish acceleration is likely after another relief rally, with this based on Bitcoin’s historical chart patterns.

“History suggests there’s more downside to come,” he shared on X.

Bitcoin traded around $71,190 at the time of writing.

Crypto World

Solana price risks a dead cat bounce as recent rally lacks volume

Solana’s price has rebounded from key support, but weak volume and heavy overhead resistance raise the risk that the current rally is only a temporary dead cat bounce.

Summary

- $70 high-timeframe support triggered the bounce, but structure remains bearish

- Price is entering major resistance near $87, with VWAP and Fibonacci confluence

- Low volume weakens the rally, raising rejection and downside rotation risk

Solana (SOL) price action has staged a short-term recovery after respecting a major high-timeframe support zone near $70. While the bounce has provided brief relief following sustained selling pressure, the broader technical picture suggests caution is warranted.

The recent advance has occurred on below-average volume and is now approaching a dense cluster of resistance, increasing the probability that this move may be corrective rather than the start of a sustained trend reversal.

As Solana trades higher into key technical barriers, market participants are closely watching whether buyers can generate enough momentum to shift structure, or whether sellers will reassert control and rotate price back toward recent lows.

Solana price key technical points

- $70 high-timeframe support has held, triggering a short-term bounce

- Current price is entering major resistance confluence, including VWAP and Fibonacci

- Low volume undermines the rally, increasing dead cat bounce risk

From a higher-timeframe perspective, the $70 level has proven to be a significant area of demand for Solana. This zone has acted as a structural support level, and the recent defense of this region allowed price to stabilize and push higher on the intraday timeframe. Following the bounce, Solana reclaimed its local point of control, signaling short-term acceptance and encouraging a brief bullish reaction.

However, while the bounce itself is technically valid, it must be viewed within the context of the broader trend. Solana remains in a bearish market structure, and isolated rallies from support do not automatically imply a trend reversal, particularly when other confirming signals are absent.

Resistance confluence caps the upside

As the price moved higher, Solana is now trading into a well-defined resistance zone around the $87 region. This area represents a significant confluence of technical factors, including the value area high, VWAP-based resistance, and the 0.618 Fibonacci retracement of the prior decline. Together, these levels form a supply zone where sellers are likely to become active.

Historically, when price rallies into such confluence zones without strong volume confirmation, the probability of rejection increases. This is especially true in bearish market environments, where rallies often serve as opportunities for distribution rather than accumulation.

Weak volume signals fragile rally

One of the most important concerns surrounding the current Solana rally is the lack of bullish volume. Despite the price moving higher, participation has remained below average, suggesting that large buyers have not meaningfully stepped in. In healthy trend reversals, a rising price is typically accompanied by expanding volume, reflecting growing demand and conviction.

In this case, the lack of strong volume suggests the move higher may be driven by short-covering or opportunistic buying rather than sustained accumulation. This dynamic aligns closely with the characteristics of a dead cat bounce — a temporary recovery within a broader downtrend that ultimately fails.

Bearish structure remains intact below resistance

As long as Solana remains below the current resistance cluster, the broader bearish market structure remains unchanged. Failure to reclaim and hold above this zone would keep downside rotation as the higher-probability scenario. A rejection from resistance would likely send the price back toward the $70 support, setting up a potential retest of that level.

Repeated tests of support often weaken demand, increasing the risk of a breakdown if buyers fail to defend the zone convincingly. As a result, how price reacts to any return to $70 will be critical in determining whether Solana can stabilize or if further downside is likely.

What to expect in the coming price action

From a technical, price action, and market structure perspective, Solana’s current rally appears vulnerable. The combination of low volume and heavy resistance overhead suggests that downside risk remains elevated. A rejection near current levels would favor a rotation back toward $70, keeping the bearish structure intact.

For the outlook to improve meaningfully, Solana would need to break above resistance with strong volume confirmation and sustain acceptance at higher value. Until that occurs, traders should treat the current move cautiously and remain focused on price behavior as Solana navigates this critical resistance zone.

Crypto World

Price predictions 2/6: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

Bitcoin and altcoins saw strong double-digit price rebounds after this week’s brutal sell-off, but do technical charts forecast a longer-term recovery, or is today’s rally just a dead cat bounce?

Crypto World

2000 Bitcoin Airdrop? Bithumb Addresses Incident

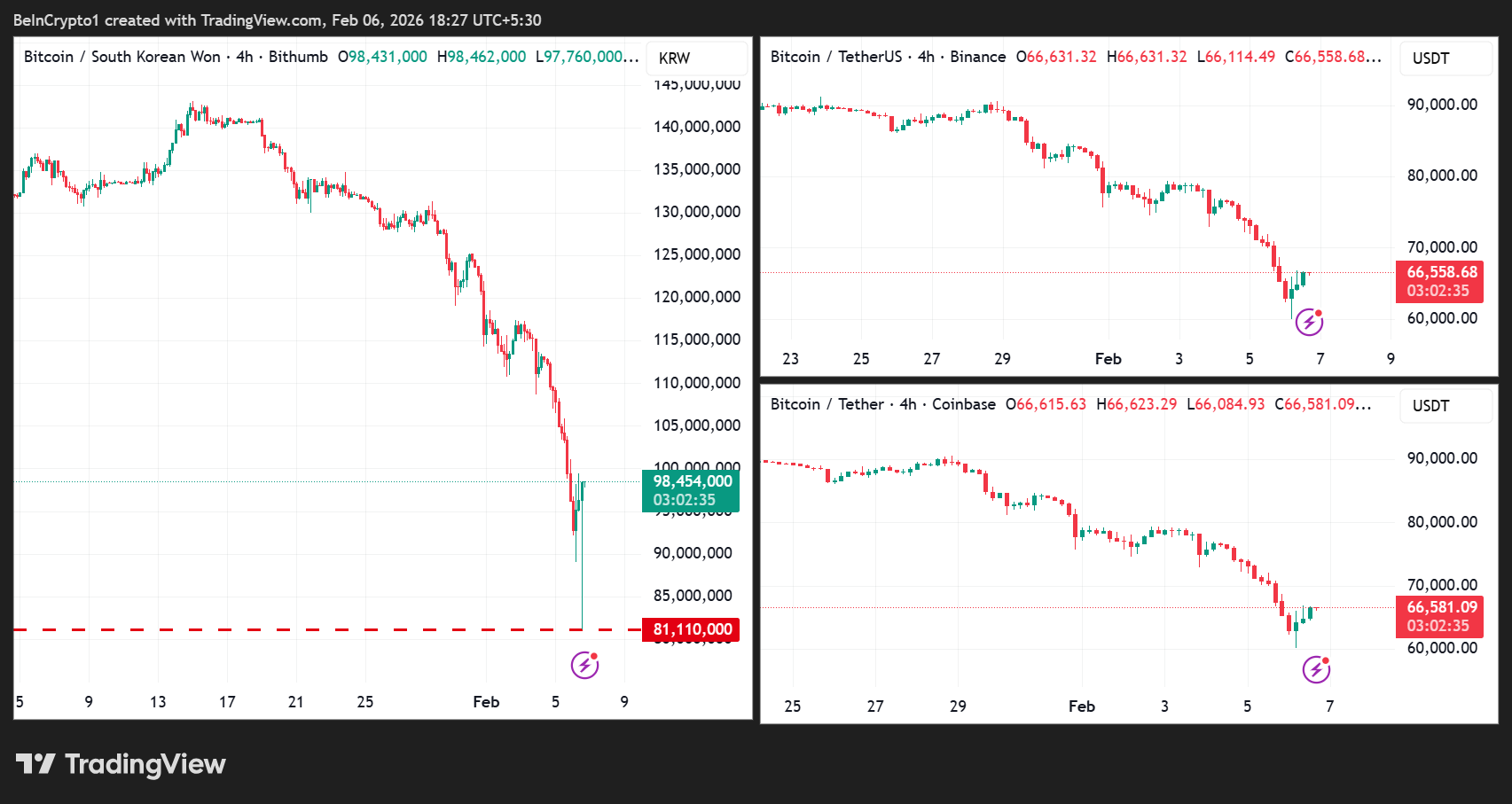

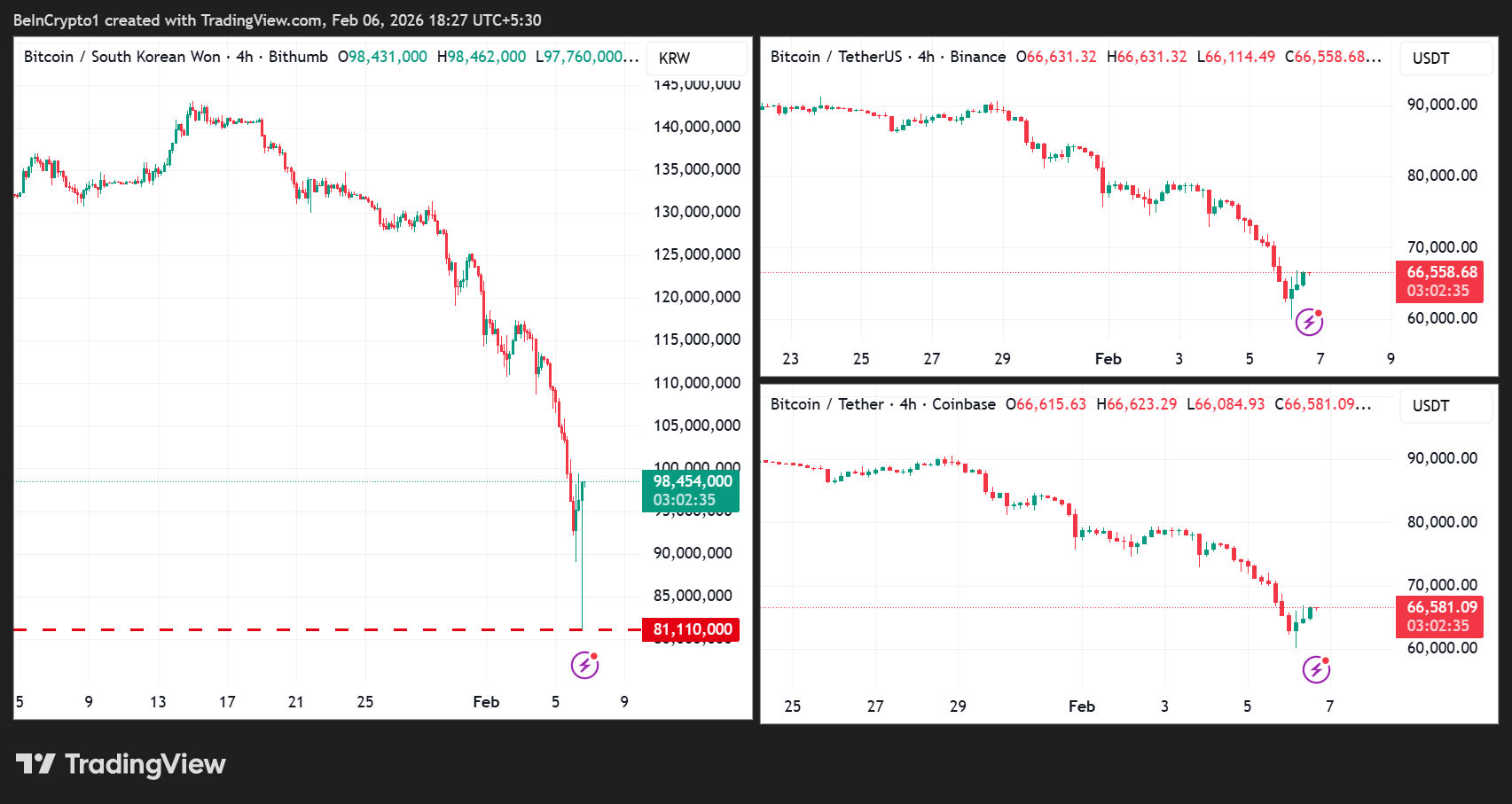

South Korean cryptocurrency exchange Bithumb has officially confirmed that an operational error led to an abnormal Bitcoin payout during a promotional event.

The incident triggered a brief but sharp price dislocation on the platform before markets stabilized within minutes.

Sponsored

Sponsored

Bithumb Confirms Accidental Bitcoin Payout

In a statement, Bithumb apologized to users, acknowledging that “an abnormal amount of Bitcoin was paid to some customers” during the event, which caused temporary volatility as recipients sold the assets.

“The Bitcoin price temporarily fluctuated sharply as some accounts that received the Bitcoin sold it,” the exchange said.

According to Bithumb, its internal monitoring systems quickly detected the abnormal transactions. The platform responded by restricting trading activity on the affected accounts, which helped contain the disruption.

“As a result, the market price returned to normal levels within 5 minutes, and the domino liquidation prevention system functioned normally, preventing chain liquidations due to the abnormal Bitcoin price,” the company stated.

The clarification comes after Bitcoin briefly traded significantly below global market rates on Bithumb, fueling speculation about the cause of the sudden price drop.

Bithumb emphasized that the incident was not the result of a cyberattack or security breach.

Sponsored

Sponsored

“We want to make it clear that this incident is unrelated to any external hacking or security breach, and does not pose any issues with system security or customer asset management,” the exchange said.

Impact on Bithumb Customer Funds

The company also reassured users that customer funds remain safe and that core services are operating normally.

“Customer assets are being safely managed as before, and transactions and deposits/withdrawals are currently operating normally,” the statement added.

Importantly, Bithumb indicated that no customers suffered losses as a result of the incident, noting that it is continuing to review the situation and will disclose further details as necessary.

“It is understood that this incident did not result in any loss or damage to customer assets. We will share all follow-up actions transparently and take full responsibility to ensure that not a single customer is harmed,” the exchange said.

The episode highlights how operational errors, even when quickly resolved, can trigger sharp short-term price distortions in crypto markets, particularly on individual exchanges where liquidity conditions differ from global averages.

Bithumb concluded its statement with another apology, saying it would strengthen safeguards and continue working to provide a stable trading environment.

“Once again, we deeply apologize for any inconvenience caused. We will continue to do our best to provide a stable and trustworthy trading environment.”

Crypto World

Bitcoin’s brutal crash just became a nightmare for the plan to put crypto in Americans’ retirement

Bitcoin’s 50% plunge from its October peak has done more than just erase $2 trillion in market value — it has reignited a fierce debate over the fiduciary math of the American retirement system.

As investors scramble to parse the drivers of the latest crash, industry observers are asking if volatile digital assets have any business being in a $12.5 trillion 401(k) market designed for stability.

“If investors want to speculate on crypto, they are welcome to do so on their own. 401ks exist to help people save for a secure retirement, not gamble on speculative assets with no intrinsic value,” said Lee Reiners, a lecturing fellow at the Duke Financial Economics Center and a co-host of the Coffee & Crypto podcast.

U.S. President Donald Trump issued an executive order in August that allowed 401(k) and other defined-contribution retirement plans access to alternative assets, including digital assets. Even Securities and Exchange Commission (SEC) chair Paul Atkins said last week, just on the eve of the latest brutal crypto selloff, that “the time is right” to open up the retirement market to crypto.

But the recent rout in crypto might just turn retirement fund managers away from plans to add crypto to 401(k)s.

Reiners said that several large crypto companies, such as Coinbase (COIN), are already included in major equity indices, which means many 401(k) plans already have indirect exposure to crypto, and that should be enough.

“Unless Congress changes the law, plan sponsors are unlikely to include crypto, or ETFs, as plan options because they don’t want to be sued by their employees. For any employers that were considering it, I’m sure recent events have them reconsidering,” Reiners said.

The problem with putting people’s life savings into crypto is that the industry is relatively young and extremely volatile, and pension funds are for stable growth.

Buying and holding can work for assets like the S&P 500, which sees large volatility mostly during Black Swan events, such as the 2008 financial crisis or COVID-19 uncertainties. However, given the size of traditional markets, the government often steps in to stop the bleeding, and numerous regulatory frameworks exist to protect people’s investments.

But for crypto, much of its activity is just speculation, and that means prices can see extreme swings over a weekend or a week, which can quickly decimate billions in value with no regulatory oversight over market moves. This makes it even more nerve-wracking for investors to put their life savings into it.

Didn’t ‘get out quickly’

To put the uncertainty in perspective, many firms were likely blindsided by the sudden crash in bitcoin and crypto over the last few days.

In fact, the recent brutal selloff was so violent and sudden that BlockTrust IRA, an AI-powered retirement platform that has added $70 million in IRA funds in the past 12 months, was caught in the bloodbath.

“Sometimes we look at things that we say, ‘you know what, we should get out,’ and sometimes we don’t. And last week, we did not get out as quickly because a lot of the underlying fundamental data we’re looking at is still very strong,” Chief Technical Officer Maximilian Pace said in an interview with CoinDesk.

However, concerning the sudden selloff, Pace pointed to the firm’s “broad sense of analytics,” which operates effectively over longer timelines than short-term trading. That strategy helped it outperform in 2025, and the firm added that it is “not necessarily wavered by volatility.” The AI trading firm’s Animus Fund outperformed bitcoin throughout 2025 and was up 27% from January to December 2025, while the bitcoin buy-and-hold strategy was down 6% to 13% over the same period, the firm said in a press release.

In Pace’s view, zooming out and considering crypto investments over a five- to 10-year time horizon is the right way to think about 401(k) plans.

“You would be better thinking like a venture capitalist rather than like a day trader,” Pace said. “There are ways of de-risking the investment, either from a time perspective or from a strategy perspective, that make it more attractive or more acceptable for things like 401(k) programs. But like anything, there’s risk.”

The future of pensions

Perhaps there’s a need to zoom out further and think about the actual blockchain technology for retirement investment management than just putting money into tokens.

Robert Crossley, Franklin Templeton’s global head of industry and digital advisory services, is thinking exactly that. The retirement industry, which he says is siloed, slow-moving and over-regulated, could be revolutionized by onchain wallets that hold tokenized assets.

And by doing so, an individual’s digital wealth will be much more aligned with the rest of their lives, Crossley said.

“Whether you are a saver, an investor, a spender, you have all of these different financial activities which are currently serviced very differently by different providers in your life,” Crossley said in an interview.

If regulations come into play that don’t prohibit innovations, it is very likely that blockchain technology can eliminate such fragmentation of intermediaries. It’s possible that industry could see a supply of wallets that “unlock the possibility of programmable assets and securities and the ability to see all of your assets in one place and control them directly, rather than being intermediated,” he said.

“When something becomes tokenized, it becomes software. That software can be an asset, but it also could be a benefit, it also could be a liability. It could be a whole 401(k). It could be your whole DC [defined contribution] plan,” Crossley said.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports9 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat5 hours ago

NewsBeat5 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

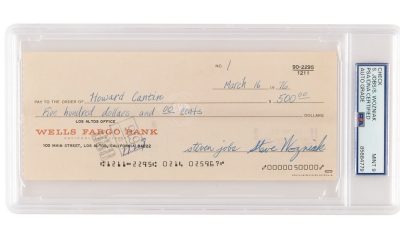

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined

-

Crypto World1 day ago

Crypto World1 day agoHeads Up! Bitcoin Enters Capitulation Mode, Trades In a ‘Phase That Rewards Discipline Over Prediction’