Crypto World

What Triggered the Latest Bitcoin and Altcoin Crash?

Analysts explain what took place in the crypto markets in the past 24 hours or so, and whether the worst is behind us.

It’s safe to say that this is no longer a bull phase. After all, BTC dumped by more than 50% since its October all-time high and plummeted to around $60,000 late on Thursday.

But in this article, we will focus more on the events that took place yesterday than on the overall decline over the past several months. In the span of just 24 hours, the cryptocurrency plummeted from $77,000 to $60,000 in one of its worst single-day trading performances since its inception.

Multiple altcoins registered even more profound losses of up to 20%, as was the case with XRP. The total value of wrecked positions in just one day shot up to $2.6 billion, according to Coinglass data. Nearly 600,000 traders were liquidated.

Despite bouncing off local lows, BTC and the altcoins erased months and years of gains, returning to levels last seen before the US presidential elections at the end of 2024. During and after similar calamities, the most obvious question is why. Here’s a breakdown through the eyes of the Kobeissi Letter.

What Happened?

First things first, the analyst reassured that although bitcoin has plummeted by over $30,000 in the past couple of months, the “fundamental picture for crypto” has remained “vastly unchanged.” They added that the answer to why the asset class is tanking lies in the October 10 crash, when over $19 billion in leveraged positions were wiped out. They believe “something structural” changed on that day.

The answer to this question requires going back to October 10th.

The most recent TOP in crypto came on October 6th, just 4 days before the -$19.5 billion record liquidation.

Something structural appears to have shifted on October 10th.

And, markets never truly recovered. pic.twitter.com/l07mKRBAbQ

— The Kobeissi Letter (@KobeissiLetter) February 5, 2026

Although BTC remained entirely rangebound for two months between November 15 and January 15, the analysts said there were brief periods of liquidation with “gaps” in both directions, which were another sign of the market’s structural collapse. They noted that sentiment is “all that matters” during crypto cycles, and it was broken after the October crash.

You may also like:

“The result is a massive virtuous cycle, shifting from liquidations to sentiment deterioration, and back. Since January 24th, we have seen $10 billion worth of levered positions liquidated. That’s ~55% of the record amount seen on October 10th. It’s a structural decline.”

The analysts offered more evidence showing the nature of the structural collapse, including the spread of selling pressure into other asset classes, and that BTC’s market depth, the capital available to absorb large orders, is still more than 30% below its October peak. The latest time it hit such numbers was after the FTX crash in 2022.

Lastly, the Kobeissi Letter indicated that a large player, perhaps an institution, sold or was liquidated during the violent trading session, given BTC’s rapid and massive correction.

Today’s decline was particularly noteworthy as Bitcoin fell over -$9,000 and selling pressure was constant.

At times, Bitcoin would fall $2,000+ in a matter of minutes.

It seems that a large player, perhaps an institutional investor, sold/liquidated during today’s session. pic.twitter.com/EWnLxUT1Vl

— The Kobeissi Letter (@KobeissiLetter) February 5, 2026

When Bottom?

The second popular question after a crypto market collapse is whether we have bottomed out or if there is more pain ahead. The analysts answered that bitcoin would bottom once “structural liquidity is restored.”

“This will be a combination of both capitulation in price and leverage, as well as maximum bearish sentiment.”

The good news is that they added, “we seem to be somewhat near that point.”

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BNB Price Forecast: Which Is The Best Crypto To Invest In As BNB Sell-off Intensifies

As BNB’s sell-off intensifies, breaking below $750 under a bearish technical pattern, investors are questioning which crypto assets can deliver reliable growth. The declining retail interest and falling momentum in major exchange tokens shift focus toward new projects with tangible utility and strong early-stage momentum. In this climate, Mutuum Finance (MUTM) emerges as a strong answer for what crypto to buy, combining a low-entry presale with a feature-rich protocol ready for adoption.

BNB Faces Strong Bearish Pressure

BNB is experiencing significant downward momentum, trading 46% below its all-time high. A critical “Death Cross” pattern has formed on its chart, where short-term moving averages fall below long-term ones, signaling entrenched bearish sentiment. While developers are proposing new token standards for AI assets, these long-term initiatives do not address the current weak price structure and low retail trading volume. For investors seeking growth, this environment makes BNB a risky hold, pushing the search toward newer, more dynamic projects.

Mutuum Finance’s Presale Phase Offers High-Growth Entry

For investors deciding what crypto to buy for substantial returns, Mutuum Finance presents a clear opportunity. The project is in Phase 7 of its presale, with tokens priced at $0.04. Having already raised over $20.4 million from 18,970 holders, the presale is moving swiftly toward its next phase, where the price will rise to $0.045.

The launch price is set at $0.06, but analysis points to a rapid surge toward $0.30-$0.40 post-listing, a 7.5x to 10x gain from the current price. This projection is based on the token’s fixed supply of 4 billion coins and the high demand expected from top-tier exchange listings. A $1,000 investment now could see a potential rise to $7,500 in a short period, defining MUTM as a top crypto to buy for accelerated growth.

Testnet Demonstration Proves Real Functionality

Building confidence in its roadmap, Mutuum Finance has successfully launched its V1 protocol on the Sepolia testnet. This public demonstration allows users to interact with the core lending system, including depositing test assets, taking out loans, and observing the automated liquidation processes that maintain stability. The testnet confirms the protocol’s readiness and operational security, providing a transparent look at the platform’s mechanics before any real-world funds are involved. This step is crucial for a new project, transitioning it from concept to a verifiable product.

Fixed Supply and Strategic Allocation Create Scarcity

A key feature supporting MUTM’s value is its definitive tokenomics. The total supply is capped at 4 billion tokens, with 45% allocated to the presale. No new tokens will be minted, meaning all future circulating supply is already defined. This fixed scarcity contrasts with inflationary tokens and directly supports price appreciation as user adoption grows. For a potential buyer, this means early acquisition positions them before demand from a growing user base meets a limited available supply, a fundamental driver for value increase.

Community Incentives Drive Engagement and Reward

Beyond the protocol, Mutuum Finance actively rewards its community, fueling participation. A standout incentive is the $100,000 giveaway, where ten winners will each receive $10,000 in MUTM tokens.

Additionally, a dynamic 24-hour leaderboard awards a daily $500 MUTM bonus to the top contributor. These initiatives, combined with the planned use of protocol fees to buy back and distribute tokens, create multiple avenues for holders to gain additional value simply by participating in the ecosystem.

Positioning as the Strategic Investment Choice

While BNB struggles with market-wide sell-offs and complex development initiatives, Mutuum Finance offers a straightforward growth narrative. Its presale stage, proven testnet technology, scarce token supply, and direct reward mechanisms provide a cohesive case for rapid appreciation. For investors determining the best crypto to invest in during market uncertainty, MUTM represents a structured opportunity with the potential for significant short-term gains and sustainable long-term utility.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Microsoft (MSFT) Stock: Should You Buy After 22% Plunge?

TLDR

- Microsoft stock plunged 22% from all-time highs after January 28 earnings report revealed AI growth challenges

- Copilot adoption reached only 15 million licenses out of 400 million available Microsoft 365 seats

- Azure cloud revenue growth slowed to 39% from 40% previous quarter despite beating analyst expectations

- OpenAI represents $281 billion or 45% of Microsoft’s $625 billion order backlog creating concentration risk

- Stock trades at P/E ratio of 26.5, cheapest valuation in three years compared to Nasdaq-100’s 32.8 multiple

Microsoft stock has tumbled 22% from record highs following its fiscal Q2 2026 earnings release. Shares fell over 10% on January 28 alone as investors questioned the company’s AI momentum.

The stock closed at $393.58 on February 5, marking a sharp retreat from its $555 peak. Despite posting 16.7% revenue growth over the trailing twelve months, concerns about AI execution have spooked Wall Street.

Microsoft’s Copilot virtual assistant has struggled to penetrate enterprise markets. The company sold just 15 million Copilot licenses for Microsoft 365 out of 400 million total business licenses available.

That 3.7% adoption rate doubled from a year earlier but disappointed investors. Copilot integrates AI capabilities into Word, Excel, Outlook and other productivity applications.

The company found more success with developers. Paid Copilot subscriptions for software developers surged 77% from the prior quarter.

Healthcare showed promise too. Dragon Copilot now assists over 100,000 medical professionals and processed 21 million patient encounters in Q2, tripling year-over-year.

Azure Growth Rate Decelerates

Azure cloud platform revenue increased 39% year-over-year in the second quarter. The result beat Wall Street’s 37.1% forecast but slowed from 40% growth three months earlier.

Investors interpreted the deceleration as a warning sign. Azure provides critical infrastructure and AI development tools for businesses building applications.

Microsoft pointed to data center capacity shortages as a limiting factor. The company’s order backlog from customers waiting for infrastructure ballooned 110% year-over-year to $625 billion.

OpenAI Concentration Creates Vulnerability

A closer look at the backlog revealed troubling details. OpenAI alone accounts for $281 billion or 45% of total future commitments.

The AI startup lacks sufficient cash reserves to fund those orders immediately. OpenAI must depend on investor capital and revenue expansion to meet obligations.

Microsoft’s CFO disclosed this concentration during the earnings call. Shareholder lawsuits emerged in February 2026 alleging the company misled investors about OpenAI dependence.

Capital spending reached $37.5 billion in Q2 2026 as Microsoft invests heavily in AI infrastructure. Company-wide gross margins contracted despite revenue gains, pressuring profitability.

The More Personal Computing division declined 3% year-over-year. Gaming revenue fell 9% with Xbox content and services dropping 5%.

Microsoft currently trades at a price-to-earnings ratio of 26.5 based on trailing earnings of $15.98 per share. That represents the lowest valuation in three years.

The Nasdaq-100 trades at a 32.8 P/E multiple, making Microsoft cheaper than most tech peers. Analysts project fiscal 2027 earnings of $19.06 per share, implying a forward P/E of 22.4.

The company maintains robust cash generation with a 25.3% free cash flow margin and 46.7% operating margin. Microsoft’s market capitalization stands at $2.9 trillion as of February 5, 2026.

Crypto World

What’s Been Behind the Bitcoin Crash as BTC Falls to $60K

Key Insights

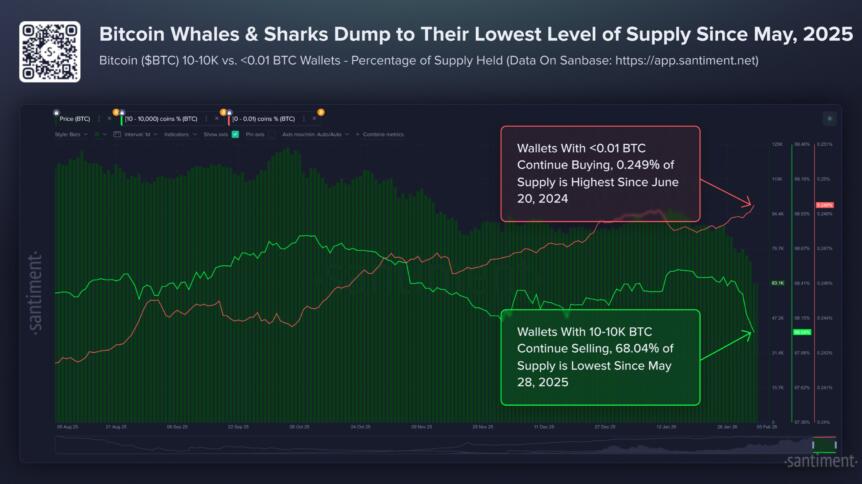

- Bitcoin whales sold over 81,000 BTC in eight days, adding strong supply pressure to the market.

- Large wallets now hold their lowest share of Bitcoin supply recorded in the past nine months.

- Retail wallets increased accumulation, reaching their highest Bitcoin supply share in 20 months.

Bitcoin continued its downward move as the broader cryptocurrency market faced renewed selling pressure. Total market capitalization declined by about 7.9% to $2.23 trillion, reflecting reduced risk appetite across digital assets. Bitcoin traded near $65,100 after briefly falling to $60,074, its lowest price level since October 2024.

Ethereum followed the same trend, falling close to 9% to around $1,913. The leading altcoins such as BNB, XRP, Solana, and Dogecoin also recorded losses of between 9 per cent to 14 per cent. The market evidence indicates internal supply forces but not one macroeconomic precipitator triggered the decline.

Large Holders Reduce Bitcoin Exposure

On-chain data from Santiment shows sustained selling by large Bitcoin holders. Wallets holding between 10 and 10,000 BTC reduced their holdings over recent weeks. These wallets now control about 68.04% of total Bitcoin supply, marking a nine-month low.

Over the last eight days, big holders sold about 81,000 BTC. This selling increased available supply during weaker demand sessions. As supply pressure grew, Bitcoin prices moved lower, testing levels not experienced in several months.

Large holders often adjust exposure during periods of uncertainty. Their actions tend to influence short-term price movements due to the volume involved.

Small Investors Increase Accumulation Despite Price Decline

Large wallets decreased holdings, but smaller investors kept on accumulating Bitcoin. The proportion of wallets that contained less than 0.01 BTC expanded their total supply to approximately 0.249.This value represents the highest level recorded in roughly 20 months.

The retail wallets dominate such a small part of the total supply, but their constant accumulation indicates that they are still involved at lower levels of prices. This trend shows that smaller investors were able to absorb some of the selling pressure that was generated by larger holders.

Supply Shifts Drive Market Volatility

The contrasting behavior between large and small holders continues to shape Bitcoin’s market structure. Similar patterns have appeared during extended corrective phases in past market cycles. Big sellers allocate supply and retail players slowly escalate exposure.

Until selling activity from large wallets declines and demand improves, Bitcoin may remain volatile. The trend in prices is expected to portray a continuing shift in supply allocation and not news flash.

Crypto World

New Standard for Crypto Community

Bitget, the world’s largest Universal Exchange (UEX), today announced the launch of the Bitget Fan Club, a new community initiative designed to bring users closer into the platform’s growth journey through structured participation, product collaboration, and content-driven engagement.

The Bitget Fan Club invites users from around the world to become officially recognized contributors to the Bitget ecosystem. Members, who will be known as Bitget Fans, will play an active role in shaping product experiences, sharing feedback, amplifying community initiatives, and supporting ecosystem development across markets.

Unlike traditional loyalty or referral programs, the Bitget Fan Club is built around a tiered participation model that rewards meaningful contributions over time. Members progress through levels by engaging with Bitget’s products, contributing ideas and content, participating in community discussions, and supporting broader ecosystem initiatives. As members advance, they unlock increased recognition, exclusive access, and opportunities to collaborate more closely with Bitget teams.

“The Bitget Fan Club reflects how we value community. Not as passive users, but as co-builders in our UEX vision,” said Gracy Chen, CEO of Bitget.

“As our platform expands across assets and regions, it’s important that we create pathways for our most engaged users to contribute, be recognized, and grow alongside us.”

Members of the Bitget Fan Club gain access to a range of evolving benefits, including official identity badges, token airdrops, product feedback channels, content and community support, early access opportunities, and invitations to online and offline Bitget events. Higher-tier members may also participate in community decision-making initiatives, product direction discussions, and official content collaborations.

The initiative is designed around transparency and fairness, with clearly defined progression criteria and regular reviews to ensure active participation and accountability. Full details on membership tiers, progression paths, and perks are available on the official Bitget Fan Club page.

By launching the Bitget Fan Club, Bitget continues to strengthen its community-first approach, building an ecosystem where users are empowered to influence products, culture, and the long-term evolution of the platform.

To find out more and apply to join the Bitget Fan Club, visit here. Users can also join the Telegram group here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Crypto World

BeInCrypto Wins ‘Best Crypto Publisher’ at Crypto Awards 2025

BeInCrypto has been named Best Crypto Publisher at The Crypto Awards 2025, Russia’s leading awards for cryptocurrency and blockchain technologies. The event recognized top projects across 24 categories with a festive ceremony, celebrating those making an impact on the Russian crypto market.

A special shoutout goes to Evgeniya Likhodey, Managing Editor at BeInCrypto Russia, whose leadership helped the editorial team deliver in-depth analyses and news coverage that resonate with professionals and everyday readers alike.

Sponsored

Sponsored

Evgeniya shared her perspective on the award:

“I think this award has become a symbol of our commitment to covering crypto in Russia honestly and without embellishment. We’re not afraid to talk about challenges, because real progress only comes from addressing them directly. At the same time, we make a point of highlighting positive developments that move the industry forward. This recognition belongs to the entire editorial team, whose daily work and dedication make this possible, and to our readers, whose trust we truly value.”

Since 2018, BeInCrypto has grown into a world-leading crypto news platform, reaching over 7 million monthly readers in their own language. As a proud member of the Trust Project, BeInCrypto remains committed to reliable, trustworthy journalism, supporting readers with accurate and timely crypto news.

This award highlights our ongoing commitment to accurate, timely, and credible coverage, helping readers stay informed in a fast-moving crypto landscape.

See the full list of winners here: https://cryptoawards.ru/

Crypto World

Michael Saylor’s Strategy sheds $6 billion in a day — again

On March 20, 2000, Strategy (formerly MicroStrategy) co-founder and then-CEO Michael Saylor lost $6 billion in one day — more money than any public company executive had ever previously lost in a single day.

He — and Strategy shareholders — lost even more yesterday.

Strategy opened for trading yesterday at a 52-week low after missing out on a $33 billion profit. Somehow, things got even worse by dinnertime.

By 5pm, Saylor’s company admitted to losing $42.93 per share of MSTR in diluted earnings within the final three months of 2025. The stock also declined another 20% to below $102 — incinerating another $7 billion in market capitalization within 24 hours.

With a share price of just $102, the company posted a $15.23 per share loss for the 2025 calendar year.

$6 billion in more missed profit

The bad news continued. The foregone $33 billion profit that it had missed out on by Wednesday night had turned into a $39 billion missed profit just 24 hours later.

Strategy’s ex-general counsel Shao Wei-Ming sold another 3,000 shares of MSTR. The company posted an operating loss of $17.4 billion for Q4 2025 — 16.4x higher than Q4 of the prior year.

Its net loss per common share on a diluted basis was $42.93, as mentioned above, which calculates to a year-over-year increase of 1,316% in the wrong direction.

Dilution of MSTR continues

Its capital-raising abilities showed continued reliance on common stock dilution — despite months of attempts by management to switch the mix toward preferred shares.

From October 1, 2025 through February 1, 2026, the company’s at-the-market share sales relied on MSTR dilution for 79%: $7.8 billion compared to just $1.6 billion from preferreds.

Worse, revenues from product licenses from the company’s actual operating business, enterprise software sales, plummeted 48% from $15.2 million in Q4 2024 to less than $7.8 million in Q4 2025.

Revenue lines labeled Product Support and Other Services also declined, with only Subscription Services posting a year-over-year increase. General and Administrative costs also ticked higher.

Read more: Michael Saylor doesn’t believe BTC is digital money

Dividend payments to preferred shareholders — which did not exist in 2024 — dragged another $381.3 million out of the company in 2025.

The company’s flagship series of preferred, Stretch, which is the top focus of the company’s “laser-eyed” devotion, closed trading yesterday 6.3% below its intended $100 price, despite paying an 11.25% dividend and running X ads to motivate demand.

The company’s bitcoin (BTC) yield, a measure of management’s ability to accrete BTC per share by operating a good business and avoiding MSTR dilution, has slowed to a crawl in 2026.

As of February 1, BTC yield for common shareholders is just 0.3% year-to-date, which compares with formerly impressive figures of 7.3% in 2022, 74.3% in 2023, and 22.8% in 2024.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Ripple lays out institutional DeFi blueprint for XRPL with XRP at center

Ripple and XRPL contributors have outlined a growing set of “institutional DeFi” building blocks on the XRP Ledger that aim to make the network viable for regulated financial activity, per a Thursday blog.

XRP’s utility as a settlement and bridge asset is being highlighted as central to that infrastructure, with usecases ranging from from forex and stablecoin rails to tokenized collateral and native lending markets.

The latest roadmap emphasizes features already live — such as multi-purpose token standards (MPT), permissioned domains with compliance tooling, credential-backed access and batch transactions — alongside upcoming releases that extend XRPL into credit markets and privacy-preserving workflows.

Unlike many smart contract chains that bolt on compliance after the fact, XRPL’s approach has been to embed identity and control primitives at the protocol layer.

Permissioned domains and credentials allow markets to gate participation by verified entities, a requirement institutions often cite as a barrier to onchain integration.

On the payments and FX side, XRP’s role as an auto-bridge between assets continues to be cited as a demand driver, with stablecoin corridors and remittance flows adding to onchain volume and fee activity. Token escrows and object reserves denominated in XRP further tie network usage back to the native asset.

Looking ahead, the introduction of XLS-65/66 — the XRPL lending protocol — is slated to offer pooled and underwritten credit on ledger without entirely offloading risk logic onchain.

Single asset vaults, fixed-term lending and optional permissioning tools are designed to feel familiar to institutional risk managers while operating in an onchain settlement context.

Privacy features like confidential transfers for MPTs, arriving in the first quarter, aim to satisfy enterprise and regulatory expectations around transaction-level anonymity and controlled disclosure.

Critics have long pointed to XRPL’s lack of EVM-style programmability as a hindrance. The new EVM sidechain — bridged via the Axelar network — is meant to address this by letting Solidity developers tap into XRPL liquidity and identity features while accessing familiar tooling.

XRP prices are down 22% over the past seven days, in line with a broader market drop.

Crypto World

NFT Market Cap Returns to Pre-Hype Levels Near $1.5B

The global non-fungible token (NFT) sector fell below $1.5 billion in total market capitalization, returning to levels last seen before the sector’s rapid expansion in 2021.

The retracement unfolded alongside a broader crypto market downturn over the past two weeks, CoinGecko data shows. On Jan. 23, total crypto market capitalization stood at about $3.1 trillion, before falling to $2.2 trillion on Friday.

Major assets like Bitcoin (BTC) slid from around $89,000 to about $65,000, while Ether (ETH) fell from $3,000 to near $1,800 throughout the same time frame. Bitcoin and Ethereum are the top two networks for NFTs in terms of 30-day trading volume, according NFT data aggregator CryptoSlam.

The NFT market cap drop follows several high-profile closures and exits, highlighting the sector’s continued contraction.

Rising supply collides with falling demand

The market reset has been compounded by a growing imbalance between NFT supply and buyer demand.

As reported by Cointelegraph on Dec. 31, total NFT supply continued to expand even as sales and prices declined, pushing the sector into a high-volume, low-price structure.

CryptoSlam data showed that the number of NFTs in circulation rose to nearly 1.3 billion in 2025, up by 25% compared to 2024. Total NFT sales fell 37% year-over-year to $5.6 billion, while average sale prices slipped below $100.

The divergence suggests that while minting became cheaper and barriers to issuance fell, buyer participation and spending failed to keep up.

Related: US prosecutors drop OpenSea NFT fraud case after appeals court reversal

Corporate exits and platform closures add pressure

The drop follows a series of high-profile retreats that mirror the market’s pullback. On Jan. 7, footwear giant Nike quietly offloaded RTFKT, the digital collectibles studio it acquired at the height of the NFT boom.

The reported sale followed the company’s decision to shut down operations amid an investor lawsuit.

In addition, marketplace shutdowns have accelerated. Nifty Gateway, one of the earliest NFT platforms, said it will close on Feb. 23 and has entered withdrawal-only mode. The Gemini-owned platform cited a prolonged market downturn as it winds down.

On Jan. 28, social NFT platform Rodeo announced it would cease operations after failing to scale sustainably. Rodeo said it would transition to read-only mode before shutting down entirely in March.

Magazine: Digital art will ‘age like fine wine’: Inside Flamingo DAO’s 9-figure NFT collection

Crypto World

Gemini shutters operations across Europe and Australia to focus on the U.S. and prediction markets

Gemini Space Station Inc. (GEMI) is shutting down operations in the U.K., the European Union (EU) and Australia.

The crypto exchange is also reducing its staff by 25%, according to a blog post on Thursday that suggests it is focusing resources into prediction markets.

“Effective 6 April 2026, Gemini will be ceasing operations in the United Kingdom,” the crypto trading platform said in an email sent to customers seen by CoinDesk which does not mention Australia or Europe. “Starting 5 March 2026, all customer accounts in these regions will be placed in withdrawal mode.”

New York-based Gemini stated that it had partnered with brokerage platform eToro to assist customers with their offboarding process. It instructed customers to sign up with eToro so they could “assist in transferring your assets.” Full closures of all accounts will follow in April, the New York-based company said. New account creation and incentive programs will also be disabled.

Crypto equities have lagged broader markets as risk sentiment shifted in early 2026. While major stock indices have posted gains, leading digital-asset–linked equities have slid, reflecting waning investor appetite and tightening liquidity. This underperformance underscores a retrenchment of speculative capital from crypto-linked stocks.

Tyler and Cameron Winklevoss, CEO and President of Gemini, cited difficulties gaining traction in the U.K., Europe and Australian markets as their reason for exiting them, while saying the U.S. has been great to them.

“The reality is that America has the world’s greatest capital markets and America has always been where it’s at for Gemini,” they said. “So it’s time for Gemini to focus and double down on America.”

Tyler and Cameron also shared their view that prediction markets would outgrow capital markets, saying they have plans to venture into this sector.

“Our thesis is that prediction markets will be as big or bigger than today’s capital markets,” they said. “Our investment in securing a license to launch our own prediction marketplace positions us as an early mover on this new and exciting frontier.”

They added that more than 10,000 users have traded over $24 million since the debut of Gemini Predictions in mid-December.

Gemini, which went public in September, has seen its shares fall about 23% since the start of 2025 amid a broader downturn in crypto prices. The stock was down 2.8% on Thursday.

Read more: SEC dismisses lawsuit against billionaire Winklevoss twins-backed Gemini over Earn product

Crypto World

IREN and AMZ down on earnings miss, as BTC equities bounce back

IREN (IREN) earnings showed weaker than expected headline results, with the company missing consensus on both revenue and earnings per share (EPS) as it accelerates its transition from bitcoin mining to AI Cloud.

Financially, Q2 revenue declined to $184.7 million, missing expectations and down from $240.3 million in Q1, while the company reported a net loss of $155.4 million, also below consensus.

IREN secured $3.6 billion of GPU financing for its Microsoft contract which together with a $1.9 billion customer prepayment is expected to cover around 95% of GPU related capex.

Tech giant Amazon (AMZ) also missed expectations on EPS but beat on revenue, according to investing.com. Investor focus shifted to management’s plan to spend around $200 billion on capex in 2026, primarily AI related. Amazon shares are down 10%.

Pre-market update

Bitcoin rebounded from around $60,000 to $66,000, driving a broad rally across crypto exposed equities. Strategy (MSTR), the largest publicly traded holder of bitcoin, rose 7% in pre-market trading, mirroring a 7% gain for Galaxy (GLXY) and MARA Holdings (MARA) while Coinbase (COIN) increased by 6%.

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business20 hours ago

Business20 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World20 hours ago

Crypto World20 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World19 hours ago

Crypto World19 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation