Crypto World

Why AI Is Eating DeFi UX

For most of DeFi’s short, chaotic life, “user experience” has meant one thing: dashboards.

Charts. Tables. APRs stacked on APRs. Pools, tranches, gauges, emissions, and tooltips explaining why the number you clicked is now different. DeFi didn’t simplify finance — it open-sourced complexity and handed users the keys with a shrug.

That era is ending.

AI isn’t just improving DeFi UX.

It’s devouring it, replacing dashboards with outcomes and interfaces with intent.

And once you see it, you can’t unsee it.

The Dashboard Era Was a Necessary Evil

Early DeFi users were power users by default.

If you were yield farming in 2020–2023, you had to understand:

- Impermanent loss

- Pool composition

- Emission schedules

- Rebalancing

- Gas optimization

- Cross-chain risk

- Protocol governance risk

Dashboards emerged because there was no other way to expose this complexity. Protocols didn’t know what users wanted — so they showed everything.

The result?

-

Cognitive overload

-

Decision paralysis

-

Constant tab-switching between analytics tools

-

A UX designed for traders, not humans

Dashboards weren’t badly designed.

They were honest design — mirrors reflecting how messy DeFi really was.

But mirrors don’t scale.

The Core Problem: DeFi Optimizes Data, Not Outcomes

Here’s the uncomfortable truth:

Users don’t want information. They want results.

Nobody wakes up thinking:

“I’d love to compare stablecoin pool APYs across five chains today.”

They think:

-

“I want passive income.”

-

“I want my capital protected.”

-

“I want to outperform inflation.”

-

“I want this to be handled while I sleep.”

Dashboards require users to manually translate goals into actions.

AI flips that entirely.

AI Changes the UX Primitive: From Clicks to Intent

AI-native DeFi doesn’t ask:

“Which pool do you want to enter?”

It asks:

“What outcome do you want?”

This is the real shift.

Instead of:

-

Clicking pools

-

Setting ranges

-

Monitoring positions

-

Rebalancing manually

Users express intent in plain language:

-

“Earn yield with low risk.”

-

“Maximize stablecoin income.”

-

“Protect downside but keep upside exposure.”

-

“Allocate $5,000 conservatively for 6 months.”

AI agents translate intent into:

-

Strategy selection

-

Position sizing

-

Risk management

-

Execution timing

-

Continuous optimization

The interface disappears — outcomes become the UI.

Why Dashboards Lose to AI Agents

Dashboards are static.

Markets are not.

DeFi dashboards assume:

-

The user is always watching

-

The user knows when to act

-

The user understands second-order effects

AI agents don’t assume anything.

They:

-

Monitor markets continuously

-

React faster than humans

-

Optimize across protocols, chains, and timeframes

-

Enforce constraints without emotion

A dashboard shows you what happened.

An AI agent decides what should happen next.

That gap is fatal.

DeFi Is Quietly Becoming “Set and Forget”

The most successful new DeFi products aren’t prettier dashboards.

They’re:

Their UX looks deceptively simple:

-

One input box

-

A few constraints

-

A clear outcome

Under the hood?

The complexity didn’t disappear.

It got absorbed.

That’s what great UX always does.

Why This Is Existential for Legacy DeFi Apps

If your product’s value is:

You’re already late.

AI doesn’t need help deciding.

It is the decision layer.

Dashboards will still exist — but only for:

-

Power users

-

Auditors

-

Strategists

-

People who enjoy pain

Everyone else will choose outcomes over interfaces, every time.

The New DeFi UX Stack

Here’s what the emerging stack looks like:

1. Intent Layer

Natural language inputs, constraints, and preferences.

2. Intelligence Layer

AI models that understand markets, risk, and protocol mechanics.

3. Execution Layer

Non-custodial, on-chain agents executing autonomously.

4. Observability Layer

Transparency, auditability, and human override — not micromanagement.

Notice what’s missing?

Dashboards are the primary interface.

This Isn’t About AI Hype — It’s About Responsibility

There’s a deeper reason AI is eating DeFi UX:

Financial responsibility doesn’t scale cognitively.

As DeFi grows:

-

More chains

-

More protocols

-

More strategies

-

More risk surfaces

Expecting users to manually manage this is irresponsible design.

AI isn’t dumbing DeFi down.

It’s making it survivable.

The End of DeFi as a Hobby

DeFi started as a hobby for:

-

Engineers

-

Traders

-

Crypto-native masochists

It becomes infrastructure only when:

AI is the bridge.

Dashboards taught us DeFi.

AI will run it.

And once users experience outcome-driven finance, no one is going back to clicking pools ever again.

REQUEST AN ARTICLE

Crypto World

Dollar Strengthens on Middle East Tensions

The dollar strengthened as geopolitical tensions in the Middle East intensified. Heightened uncertainty traditionally boosts demand for safe-haven assets and dollar liquidity, supporting the US currency against a range of peers. An additional factor remains the resilience of US macroeconomic indicators, which limits expectations of an imminent easing of the Federal Reserve’s monetary policy.

Amid the escalation of the conflict, investors are reducing risk exposure and reallocating capital into more defensive instruments. As a result, volatility has increased and capital inflows into dollar-denominated assets have strengthened, while traditional safe-haven currencies are showing a mixed reaction.

USD/JPY

The USD/JPY pair maintains its upward structure and is approaching the year’s highs in the 158.40–159.50 range. Despite the yen’s status as a “safe-haven asset”, the dollar retains the advantage due to higher US Treasury yields and stable expectations regarding the Federal Reserve’s policy rate. Should geopolitical tensions continue to intensify, a spike in volatility and a sharp correction towards 157.00 are possible; however, momentum currently remains on the dollar’s side.

Key events for USD/JPY:

- today at 15:15 (GMT+2): US ADP non-farm employment change;

- today at 16:45 (GMT+2): US services sector business activity index;

- today at 17:00 (GMT+2): US ISM non-manufacturing PMI.

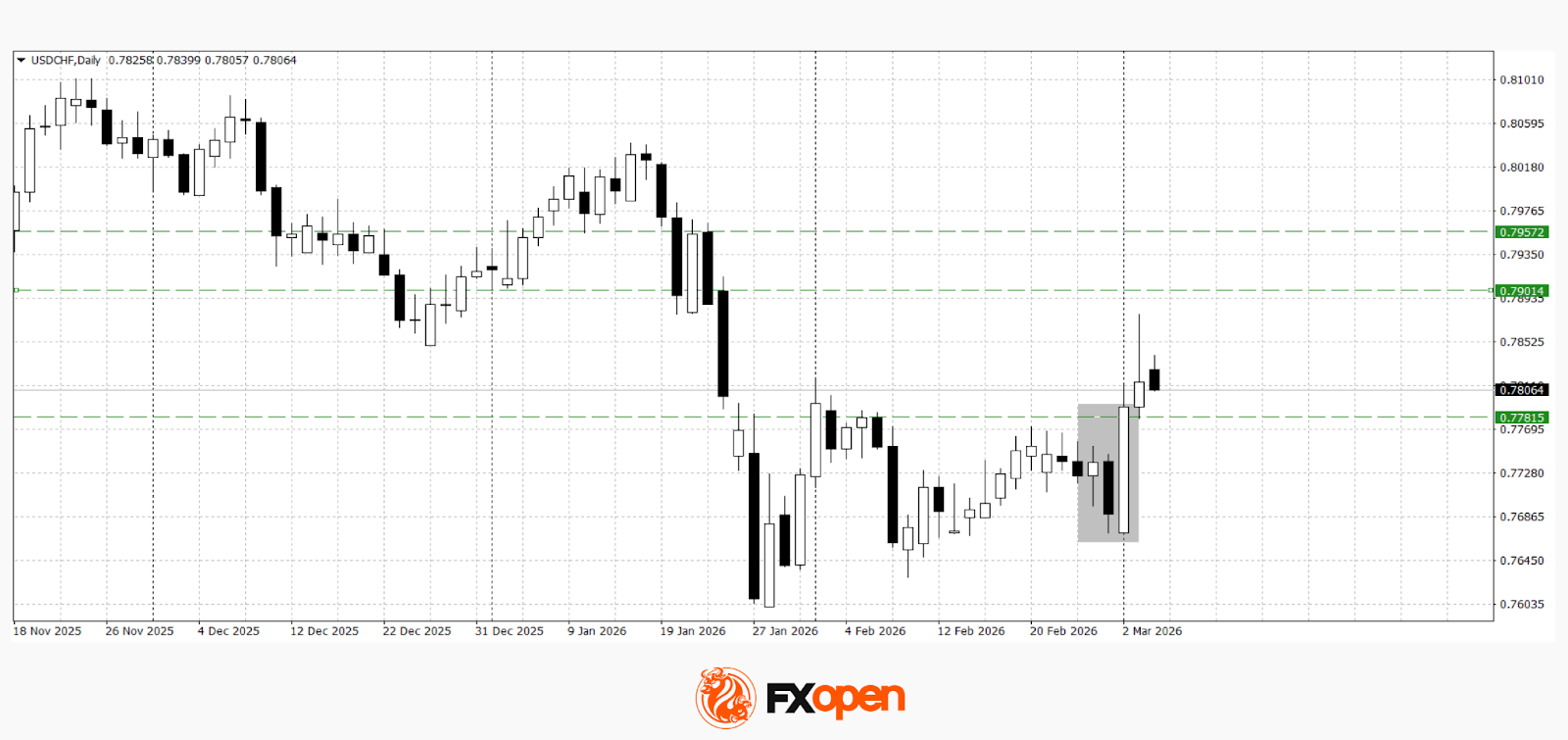

USD/CHF

The USD/CHF pair is showing moderate dollar strength, although price action remains relatively restrained due to the Swiss franc’s “safe-haven” status. Nevertheless, technical analysis of USD/CHF suggests potential upside towards 0.7900–0.7950, as a “bullish engulfing” pattern has formed and been confirmed on the daily timeframe. The bullish scenario would be invalidated by a confident move below 0.7780.

Key events for USD/CHF:

- today at 09:30 (GMT+2): Switzerland consumer price index;

- today at 11:30 (GMT+2): Swiss National Bank press conference;

- tomorrow at 10:00 (GMT+2): Switzerland unemployment rate (seasonally adjusted).

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

US Spot Bitcoin ETFs Add $225M as BlackRock IBIT Offsets Redemptions

US spot Bitcoin ETFs posted mixed trading flows on Tuesday, reflecting a nuanced backdrop for the U.S. ETF market as investors weighed short-term liquidity against broader risk-off sentiment. Data from SoSoValue showed that overall spot BTC ETFs drew a net inflow of $225.2 million, highlighting sustained appetite for direct exposure to the benchmark cryptocurrency even as the sector remains choppy. The standout contributor was iShares Bitcoin Trust (IBIT), which logged substantially larger inflows, helping offset redemptions across other products. The week’s numbers come as crypto traders monitor a delicate balance between inflows, price action, and evolving macro risk signals.

The latest weekly snapshot reveals that IBIT brought in about $322.4 million in fresh funds, while competing vehicles posted smaller outflows: Fidelity Wise Origin Bitcoin Fund (FBTC) shed roughly $89.3 million, and Grayscale Bitcoin Trust ETF (GBTC) reduced by about $28.2 million. Those figures helped shape a broader trend in the sector: inflows across the board still exist, but buyers must contend with a spectrum of product-specific dynamics and issuer strategies that influence demand on a week-to-week basis. The net effect was a positive tilt for spot BTC, even as the distribution of flows across issuers remained uneven.

aggregating data from Farside, the week’s tally lifted total ETF inflows to $683.3 million, following last week’s $787.3 million, marking the first stretch of positive flows after five consecutive weeks of outflows that had drained nearly $4 billion from the sector. In other words, while the broader ETF complex remains choppy, a subset of products continues to attract fresh capital, underscoring a segmented demand pattern rather than a unanimous bet on spot BTC exposure.

Investors have shown caution in the current environment, with market sentiment reflecting geopolitical concerns that have weighed on risk appetite. The broader crypto market has endured a period of uncertainty, and Bitcoin’s price action over the past week has been modest but persistent. CoinGecko tracks Bitcoin’s price trajectory, noting that the asset advanced about 5.4% over the last seven days, a gain that has helped stabilize some investors’ expectations even as overall sentiment remains tenuous.

Ether fund flows turn negative amid market uncertainty

Across the broader suite of crypto-linked ETFs, Ether (ETH) funds moved into negative territory, registering about $10.8 million in net outflows. The shifting fortunes of ETH-focused products reflect a risk-off tilt that tends to nudge investor capital away from second-largest asset classes when macro headlines or flow dynamics shift abruptly.

Meanwhile, other tokens found pockets of support. XRP (CRYPTO: XRP) funds recorded inflows of roughly $7.5 million, while Solana (CRYPTO: SOL) funds attracted about $1 million. These modest, yet positive, numbers hint at targeted demand for specific layer-1 and smart-contract ecosystem tokens, even as larger market participants remain selective about the broader risk profile in the current environment.

The mixed picture across ETFs comes as geopolitical frictions in the Middle East weigh on investor sentiment, a headwind that has kept risk assets sensitive to headline risk and macro shifts. The Crypto Fear & Greed Index, a gauge of market sentiment, dipped to 10 on Wednesday after a brief uptick to 14, signaling persistent concern among traders about near-term price direction and liquidity conditions.

Industry voices continue to frame the debate around Bitcoin’s medium-term potential. Notably, Ray Dalio, the American billionaire and head of Bridgewater Associates, reiterated cautions about Bitcoin on the All-In Podcast, arguing that Bitcoin’s privacy features, potential quantum risks, and relatively small market size constrain its appeal as a form of money. “I think Bitcoin has received a lot of attention, but as a form of money, it’s small compared with gold. There is only one gold,” he remarked, underscoring a skeptical view of Bitcoin’s monetary role in a diversified portfolio.

But the rebuttal from Bitcoin proponents was swift and sharp. Matt Hougan, chief investment officer at Bitwise, countered the critique with a message of long-term opportunity. In an X post, he framed the current critiques as part of Bitcoin’s evolving story, arguing that the very factors some critics point to—privacy, scalability, and market size—are precisely the issues that, in time, could unlock greater adoption and price discovery. “Some hear criticism; I hear opportunity,” Hougan wrote, later adding: (blockquote) “These are the reasons Bitcoin is 4% the size of gold. If these critiques did not exist, Bitcoin would already be around $750,000 per coin. I invest in Bitcoin in part because I am confident these things will change over time.” (blockquote)

Market context

The inflows into spot BTC ETFs come amid a broader layer of caution in crypto markets, where liquidity has sometimes tightened even as certain products attract fresh capital. The latest movements suggest a nuanced demand environment: investors are buying targeted exposure via IBIT while other ETF products experience outflows, a pattern that may reflect issuer-specific strategies, product design, and perceptions of regulatory clarity. The weekly data align with a transitional moment for crypto ETFs, as participants weigh macro signals alongside ongoing debates about market structure, custody, and the evolving regulatory landscape.

Overall, the week’s flow story mirrors a market that is neither bullishly insistent nor narrowly bearish, but rather focused on selective exposures and risk management in the face of a mixed macro backdrop. The BTC price rally, while meaningful, has not translated into a universal reallocation of risk toward crypto assets, suggesting that investors are evaluating spot exposure within a broader, multi-asset framework rather than chasing a single narrative.

Why it matters

For investors, the evolving ETF landscape matters because it shapes how accessible crypto exposure is in traditional portfolios. The outsize influence of IBIT on inflows demonstrates that the equity ETF ecosystem can steer capital toward digital assets, especially when other products experience withdrawals. The divergence between IBIT’s inflows and outflows elsewhere also highlights how issuer dynamics, fund structure, and liquidity provision can influence the speed and direction of capital flows into crypto markets.

From a market-building perspective, these flows contribute to price discovery mechanisms by providing more on-exchange visibility for spot BTC exposure. They also signal to market participants that there remains a persistent demand for regulated, transparent access to cryptocurrency markets—a factor that could shape future product development and regulatory dialogue. Yet the concurrent outflows in ETH ETFs and persistent caution about macro risk emphasize that the crypto ecosystem remains highly mosaic, with different tokens and vehicles trading on their own set of fundamentals and investor appetites.

For builders and researchers, the data underline the importance of robust analytics around ETF performance and issuer behavior. The fact that inflows are not evenly distributed across products suggests that investors are weighing product design, cost structures, and track records when deciding where to allocate. This could influence the way new spot BTC funds are pitched and the type of liquidity arrangements that underpin these products, particularly as the market contends with ongoing questions about custody and settlement in regulated environments.

What to watch next

- Upcoming weekly ETF flow reports from SoSoValue and Farside to see if IBIT’s momentum persists or if redemptions reemerge in other issuers.

- Next price action for Bitcoin following inflow spikes, with monitoring of the 7–14 day horizon to assess whether flows translate into sustained price gains.

- ETF-specific inflow changes for Ether, XRP, and Solana to understand whether ETH outflows reverse or persist and whether selective demand broadens beyond BTC.

- Updates to market sentiment gauges, including the Crypto Fear & Greed Index, to gauge whether risk appetite improves alongside price movements.

- Public commentary and regulatory developments related to spot BTC ETFs and broader crypto market structure to assess potential implications for future flows.

Sources & verification

- SoSoValue data on US spot Bitcoin ETF inflows and outflows.

- Farside data detailing ETF flows by issuer (IBIT, FBTC, GBTC).

- CoinGecko price data for Bitcoin’s seven-day performance.

- Alternative.me Crypto Fear & Greed Index readings.

- All-In Podcast interview with Ray Dalio and related commentary.

- Matt Hougan’s X post defending Bitcoin and outlining long-term opportunities.

- Jane Street-linked discussion referenced in the Magazine feature.

What the numbers say about the market’s current state

In a week characterized by mixed ETF flows and cautious sentiment, the crypto market continues to demonstrate resilience in some segments while showing fragility in others. The surge in spot BTC ETF inflows driven by IBIT indicates that demand for regulated, on-exchange exposure remains a meaningful driver of liquidity. Yet the broader pattern—outflows in Ether funds, mixed signals from major asset classes, and a Fear & Greed Index pinned in the lower echelons—suggests that confidence is not universally restored. As market participants weigh these dynamics, performance will likely hinge on the interplay between issuer strategies, macro headlines, and the ongoing discourse around crypto market infrastructure and governance. The environment remains one of careful repositioning, rather than a decisive reallocation, as investors aim to balance risk, diversification, and potential upside in a still-evolving regulatory landscape.

Key figures and next steps

With IBIT leading the charge on spot BTC inflows and last week’s overall inflow tally signaling a potential shift after a prolonged period of outflows, market observers will be watching whether this week’s numbers sustain the momentum or fade as macro headlines shift. The spread between inflows and outflows across competing BTC ETFs highlights a nuanced market where product design and issuer behavior can materially influence capital allocation. As always, traders should balance the pursuit of structured exposure with an awareness of broader risk signals, including price action and sentiment proxies like the Fear & Greed Index.

Crypto World

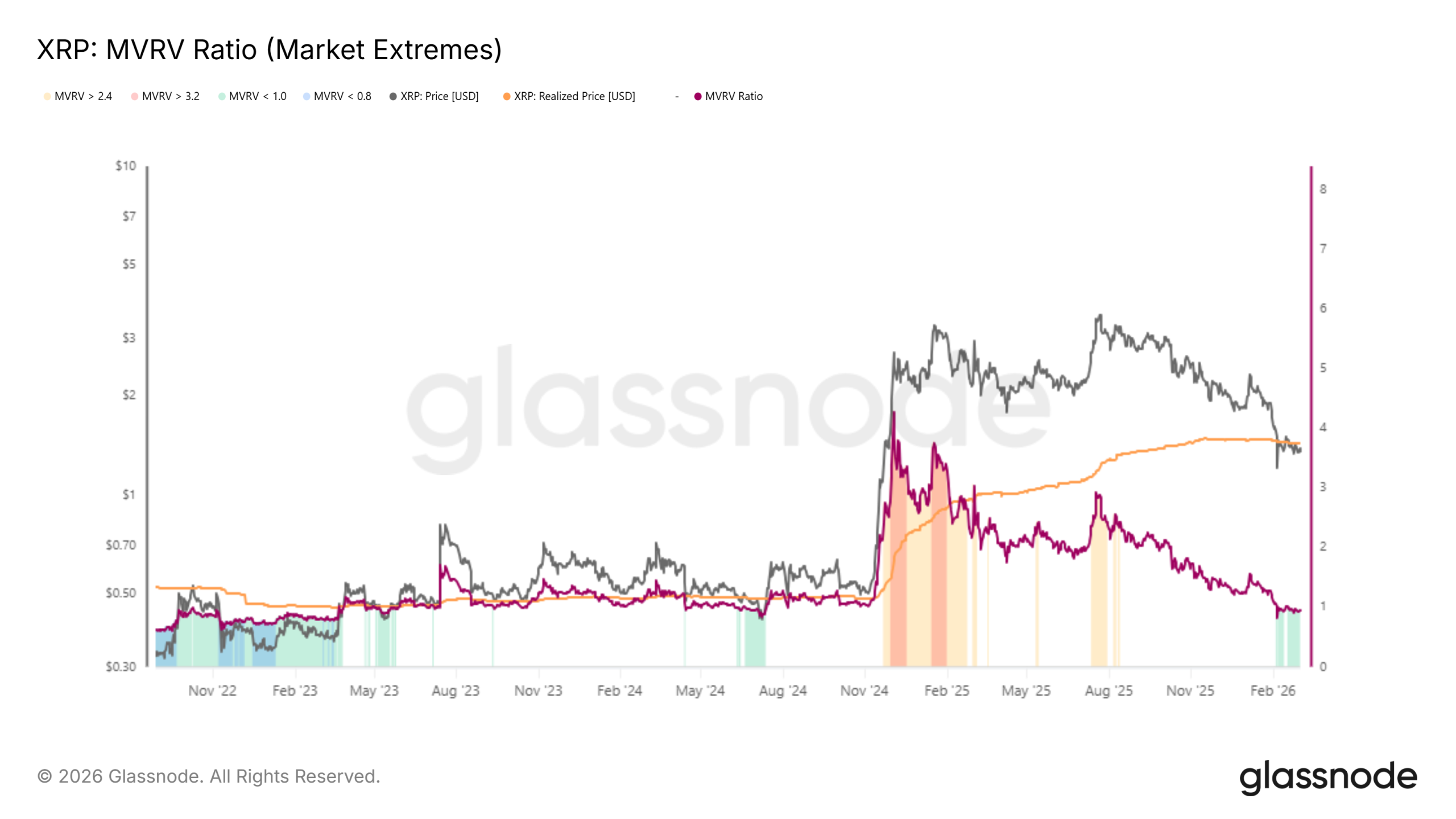

Here’s Why XRP Price’s 2026 Downtrend May Not End Soon

XRP has faced a period of sideways momentum over the past month, with its price consolidating between key levels. This range-bound movement suggests that the altcoin has been struggling to break free from the pressure that led to its current consolidation.

Given the ongoing market conditions, XRP could face further decline before any potential recovery.

XRP Faces Extreme Pressure

The MVRV Extreme Ratio, which measures the relationship between market value and realized value, indicates that XRP is undervalued and under pressure. Currently, the MVRV has been below 1.0 for approximately 15% of trading days, signaling a lack of positive momentum.

Historically, this metric has either led to short-term recoveries or worsened the situation further, potentially driving XRP to new lows. Based on current trends, XRP may face the latter scenario, with continued downward pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In this context, the low MVRV ratio suggests that investors are hesitant to drive the price upward, and the market sentiment around XRP remains weak. Unless a significant catalyst emerges, the undervaluation reflected by this metric could continue to suppress XRP’s price in the near term.

XRP is also facing a shift in macro momentum, as the overall market sentiment appears to be turning bearish. The exchange net position change highlights an increase in selling pressure, with a decline in buying momentum.

As exchanges begin to register more inflows than outflows, the shift from buying to selling could signal that a downturn is imminent for XRP. This change in dynamics could put further strain on the altcoin, as it struggles to maintain upward momentum.

As buying slows down and selling picks up, XRP could see its price slip further. This shift in the macro momentum highlights the current market instability, which could contribute to a prolonged downtrend for XRP in the coming months.

XRP Price May Struggle To Recover

At the time of writing, XRP is trading at $1.35, caught within a range between $1.34 and $1.47. The downtrend that has persisted since the beginning of the year remains intact, with the cryptocurrency struggling to break free from the range. This resistance at $1.47 has proven difficult to overcome, while support at $1.34 has been tested multiple times.

Given the current market conditions and the pressure indicated by the MVRV ratio and macro momentum, XRP faces a bearish outlook in the short term. The price could break through the $1.34 support level, potentially falling to $1.21. This would signal a deeper decline and extend the ongoing downtrend, increasing the pressure on the altcoin.

However, if XRP holders manage to find support from investors and buying momentum resumes, the altcoin could break through the $1.47 resistance level. A move above this level could propel XRP to $1.58, invalidating the bearish outlook and signaling the potential for a reversal. If XRP manages to sustain upward momentum, it could eventually target $1.70, marking a complete shift in market sentiment.

Crypto World

ServiceNow (NOW) Stock Jumps 3.7% as Dip Buyers Return

TLDR

- ServiceNow shares advanced 3.7% Tuesday, closing at $113.44 with approximately 17.5 million shares traded

- The enterprise software firm introduced AI-driven products: Autonomous Workforce and EmployeeWorks

- A strategic partnership with NTT DOCOMO and StarHub was announced for autonomous telecom roaming solutions

- Wall Street maintains a “Moderate Buy” rating with a consensus price target of $192.06

- Shares have declined 23.2% year-to-date and currently trade 45.8% beneath the 52-week peak of $208.94

Shares of ServiceNow (NOW) advanced 3.7% during Tuesday’s trading session, reaching an intraday peak of $114.92 before closing at $113.44. The stock finished Monday at $109.42.

Trading volume reached approximately 17.5 million shares for the day. This figure represented about 12% less than the stock’s typical daily volume of roughly 19.9 million shares.

The upward movement suggests bargain hunters are returning to the stock following a sustained selloff that has pressured enterprise software equities.

ServiceNow has declined 23.2% year-to-date in 2026. The current price level represents a 45.8% discount from the 52-week high of $208.94 reached in July 2025.

Tuesday’s rally reflects growing investor confidence that AI technologies may complement rather than displace enterprise software platforms. Company leadership has consistently challenged narratives suggesting AI will eliminate demand for their solutions.

Just five days earlier, the stock had already jumped 4.3% following comments from Nvidia’s CEO Jensen Huang, who dismissed concerns that AI would destroy the enterprise software industry. Those remarks triggered rallies across the sector, including gains for Zscaler (ZS) and CrowdStrike (CRWD).

Product Innovation and Strategic Partnership

ServiceNow unveiled two AI-enhanced solutions this week: Autonomous Workforce and EmployeeWorks. These offerings are designed to broaden workflow automation capabilities for enterprise clients.

The company simultaneously announced a strategic collaboration with NTT DOCOMO and StarHub. This partnership leverages ServiceNow CRM technology to enable autonomous roaming resolution for telecommunications providers — demonstrating application beyond the firm’s core IT service management offerings.

Additionally, HCLTech received ServiceNow’s 2026 Partner of the Year award, underscoring the strength of its partner ecosystem and channel strategy.

Financial Performance and Wall Street Outlook

ServiceNow delivered its latest quarterly earnings on January 28th, posting earnings per share of $0.92 — exceeding analyst expectations of $0.89 by $0.03.

Quarterly revenue totaled $3.57 billion, surpassing the Street’s estimate of $3.53 billion. This represented year-over-year growth of 20.7%. The company achieved a net profit margin of 13.16% and return on equity of 18.54%.

Analyst opinions on the stock’s trajectory vary significantly. Goldman Sachs maintains a $216 price objective. BNP Paribas recently lowered its target from $186 to $120 with a neutral stance. UBS established a $115 target.

According to MarketBeat data, the consensus recommendation stands at “Moderate Buy” with an average price target of $192.06. Among analysts tracking the stock, 32 rate it a Buy, three assign a Strong Buy, six recommend Hold, and two rate it a Sell.

The stock’s 50-day moving average currently sits at $125.70. Its 200-day moving average stands at $158.84.

Institutional ownership accounts for 87.18% of outstanding shares. Recent insider activity includes CFO Gina Mastantuono selling 2,075 shares in December at $170, while insider Kevin Thomas Mcbride sold 1,400 shares in February at $105.71.

Wall Street projects full-year earnings per share of $8.93 for the current fiscal year.

Crypto World

Alibaba (BABA) Shares Drop Approximately 10% Over the Week

Last Wednesday, the closing price of Alibaba (BABA) shares was $152.28, while the closing price yesterday was $135.59, marking a 2026 low.

The roughly 10% decline was driven by a combination of bearish factors, including:

→ Unexpected resignation of Lin Junyang (Justin Lin) – Lin led Alibaba’s AI project Qwen, a key LLM platform. According to Reuters, this is the third notable departure from Qwen in 2026, and Lin has not provided a reason.

→ Overall bearish trend in tech stocks – High capital expenditures combined with uncertainty over profitability have weighed on the sector. Alibaba previously committed at least CNY 380 billion (around $52 billion) for AI and cloud infrastructure investments over three years.

→ Pressure from US regulators – Reports indicate that Alibaba was added to a list of companies cooperating with China’s military, potentially complicating business. Although the listing was later removed from the US Federal Register, the attempt itself increases the risk of new sanctions from the administration.

→ Geopolitical tensions – With the threat of the Middle East conflict escalating into a wider war, financial markets see increased demand for safe-haven assets. Chinese tech companies are particularly exposed to these pressures.

Despite these challenges, technical analysis offers hope for the bulls.

Technical Analysis of Alibaba (BABA) Shares

Take a look at the most recent BABA candlestick – the closing price is well above the low, while trading volume has surged to the highest level since late January. This can be interpreted as a sign of demand preventing further price declines.

Looking at history confirms this observation. In late August, BABA shares broke through the descending trendline and, on extremely high volumes, began a run towards multi-month highs.

At that time, demand clearly dominated – bulls may gain confidence near the $130 mark and prevent a deeper drop in the stock.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

A Guide to Its Privacy-Focused Blockchain Ecosystem

Beldex presents a privacy-oriented blockchain ecosystem that aims to enable confidential, censorship-resistant digital interactions.

It’s common knowledge that transaction details on most public blockchains are transparent and traceable. Beldex, on the other hand, focuses on embedding privacy at the protocol level by combining confidential transactions with additional tools designed to protect browsing activity, communication, and digital identity.

At the heart of its ecosystem is the BDX token, which serves as the network’s native utility asset. It is used for a range of purposes, such as paying transaction fees, participating in masternodes, interacting with applications built within the Beldex ecosystem, and more.

While the project originated as a privacy-focused one, it has vastly expanded its scope to include decentralized networking, messaging, and identity services. This broader approach aims to position it as more than just a single-purpose privacy coin and to provide an integrated infrastructure for private digital activity.

Core Vision and Mission

The team has a clearly stated mission, which is centered on making privacy the default layer of digital interaction. Beldex is built around the idea that every user should be able to retain control over their financial data, online identities, and communications, without having to rely on centralized intermediaries.

That said, the core objectives of the project include:

- Transaction privacy

- Communication privacy

- Network privacy

- Decentralized identities

Beldex doesn’t just focus on financial transfers, but instead aims to create a layered stack of privacy-oriented capabilities. This includes decentralized networking infrastructure, user-facing applications such as browsers and messaging tools, blockchain-level confidentiality, and more.

History and Evolution

Initially launched in 2018 as a fork of Monero, in its early phases, Beldex operated under the proof-of-work (PoW) consensus algorithm, similar to how Monero functioned.

In December 2021, three years later, the team transitioned from Proof-of-Work to Proof-of-Stake (PoS), marking a significant structural shift in how the network functioned.

Under PoS, validators (known as masternodes) must lock up a minimum amount of 10000 BDX tokens to participate in governance and validate blocks.

There were a few factors that motivated this particular decision to transition:

- Improved efficiency

- Faster block times

- Lower transaction costs

- Higher throughput and scalability

- Opportunities for broader participation

In essence, this evolution from a Monero-derived privacy coin into a fully-fledged, independent PoS-based privacy infrastructure underscores its intent to expand.

Privacy and Cryptographic Foundations

As mentioned above, privacy in Beldex is embedded directly at the protocol level – it’s not an optional add-on. The network introduces additional upgrades, but also inherits several core privacy mechanisms from its origins as a fork of Monero.

On-Chain Privacy Mechanisms

Beldex leverages multiple cryptographic techniques to conceal transaction metadata.

Ring Signatures

Ring signatures are designed to allow a sender’s transaction to be mixed with several inputs – known as decoys. Observers can verify that one of the inputs is valid, but they cannot determine which one exactly initiated the transaction.

Stealth Addresses

The way transactions work on Beldex is that, instead of sending funds to a static public address, the network generates a one-time destination address for every transaction. Of course, the recipient can detect and spend the funds using their own private keys, but outside observers can hardly link multiple payments to the same recipient.

Ring Confidential Transactions (RingCT)

The goal of RingCT is to hide the amount that’s being transferred in a transaction. The network itself can verify that no coins are created or destroyed legitimately, but the transferred value itself is not visible to the public.

Bulletproof++

Through its Obscura update, Beldex integrated Bulletproof++ range proofs. These are designed to reduce the size of confidential transaction proofs. Smaller proofs, for their part, help with scalability, reduce the verification overhead, and lower transaction costs.

These mechanisms ensure that:

- Transaction amounts remain hidden

- Recipient addresses are unlinkable

- Sender identities are obfuscated

Network-Level Privacy

Even though transaction privacy protects on-chain information, metadata can still potentially be exposed at the network layer itself.

To combat this, Beldex incorporates:

- Decentralized node infrastructure

- Ongoing plans to implement routing improvements such as Dandelion++

- Integration with its own privacy network, BelNet

Consensus

As you already know, in December 2021, Beldex transitioned from a Proof-of-Work to a Proof-of-Stake governance model, and in doing so, replaced miners with stake-based validators known as masternodes.

Proof-of-Stake Model

Under PoS, validators are required to lock a minimum of 10,000 BDX to operate a masternode. In doing so, they become responsible for:

- Validating transactions

- Producing new blocks

- Securing the network

- Supporting ecosystem infrastructure components

The block times were also reduced considerably following the transition, which aimed to improve both latency and throughput.

Masternodes as Network Backbone

Undoubtedly, the core of the network are masternodes, which, beyond validation, they also support:

- Maintaining uptime, validating transactions, and securing the chain

- Protocol enforcement and consensus integrity

- Network services that are associated with privacy applications such as BChat, BelNet, and the Beldex Browser

- Infrastructure for decentralized services within the ecosystem

Operators receive staking rewards because they maintain the network’s uptime and also perform validation duties. However, as with many PoS systems, this requires a certain capital commitment.

Native Token: BDX

BDX serves as the native utility token of the network and functions as an economic layer, powering transactions, staking, validator participation, as well as interaction with the broader ecosystem.

Some of its core utilities include, but are not limited to:

- Transaction fees

- Staking and masternodes

- Ecosystem services

- BNS identity registrations

- Cross-chain usage

Keep in mind that BDX is positioned as a utility token within a broader infrastructure that also includes decentralized networking, identity services, and messaging.

Beldex: The Ecosystem

Beyond a confidential blockchain, Beldex extends into offering a set of privacy-oriented applications.

BChat

BChat is a decentralized privacy messaging app that is developed within the broader Beldex ecosystem. Its purpose is to provide a peer-to-peer, private communication without having to rely on centralized servers.

Some of the most important characteristics include:

- Decentralized infrastructure

- Decentralized message routing

- End-to-end encrypted messaging

- Optional use of the Beldex Name Service usernames instead of public keys

BelNet

BelNet is a decentralized virtual private network, as well as an onion-routing network that’s developed to anonymize internet traffic.

Instead of having to route traffic through a single centralized provider, BelNet distributes it across many nodes.

Some of its intended functions include:

- IP address masking

- Censorship resistance

- Community-run masternode relays and exit nodes

- Reduced dependency on centralized VPN operators

Beldex Browser

The Beldex Browser is focused on privacy and designed to block trackers, intrusive ads, and more.

It’s positioned as a user-friendly gateway into the broader Beldex privacy stack, combining traditional web browsing with decentralized networking tools.

Some of its features are:

- Tracker and ad blocking

- Censorship-free browsing

- Integration with BelNet for built-in anonymized browsing

Beldex Name System

Also known as BNS, the Beldex Name Service is a decentralized naming service that’s designed to map human-readable names to blockchain addresses. For example, yourname.bdx would be equivalent to your public address.

Some of its aims include:

- Enabling censorship-resistant domain ownership

- Simplifying user interaction with crypto addresses

- Providing consistent identities across Beldex apps and the ecosystem

Pros and Cons

Let’s address some of the key strengths of Beldex, as well as some of the challenges that it will inevitably have to face.

Pros/Strengths

- Ongoing technical development

- Ecosystem diversification

- Energy-efficient consensus mechanism

- Protocol-level confidentiality

- Integrated privacy architecture

Cons/Challenges

- Questionable broader regulatory environment

- Adoption competition

- Technical complexity

Conclusion

All in all, Beldex is building a privacy-focused blockchain project that has evolved from a Monero-based Proof-of-Work cryptocurrency into a broader, standalone ecosystem centered on confidential digital infrastructure.

Beyond what’s currently implemented, Beldex has also outlined additional enhancements, including VRF-based validator selection, Dandelion++ routing for network-layer obfuscation, and further research into Fully Homomorphic Encryption and Post Quantum Cryptography.

These initiatives suggest a continued focus on improving both privacy and security guarantees as well as the consensus’s overall robustness.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

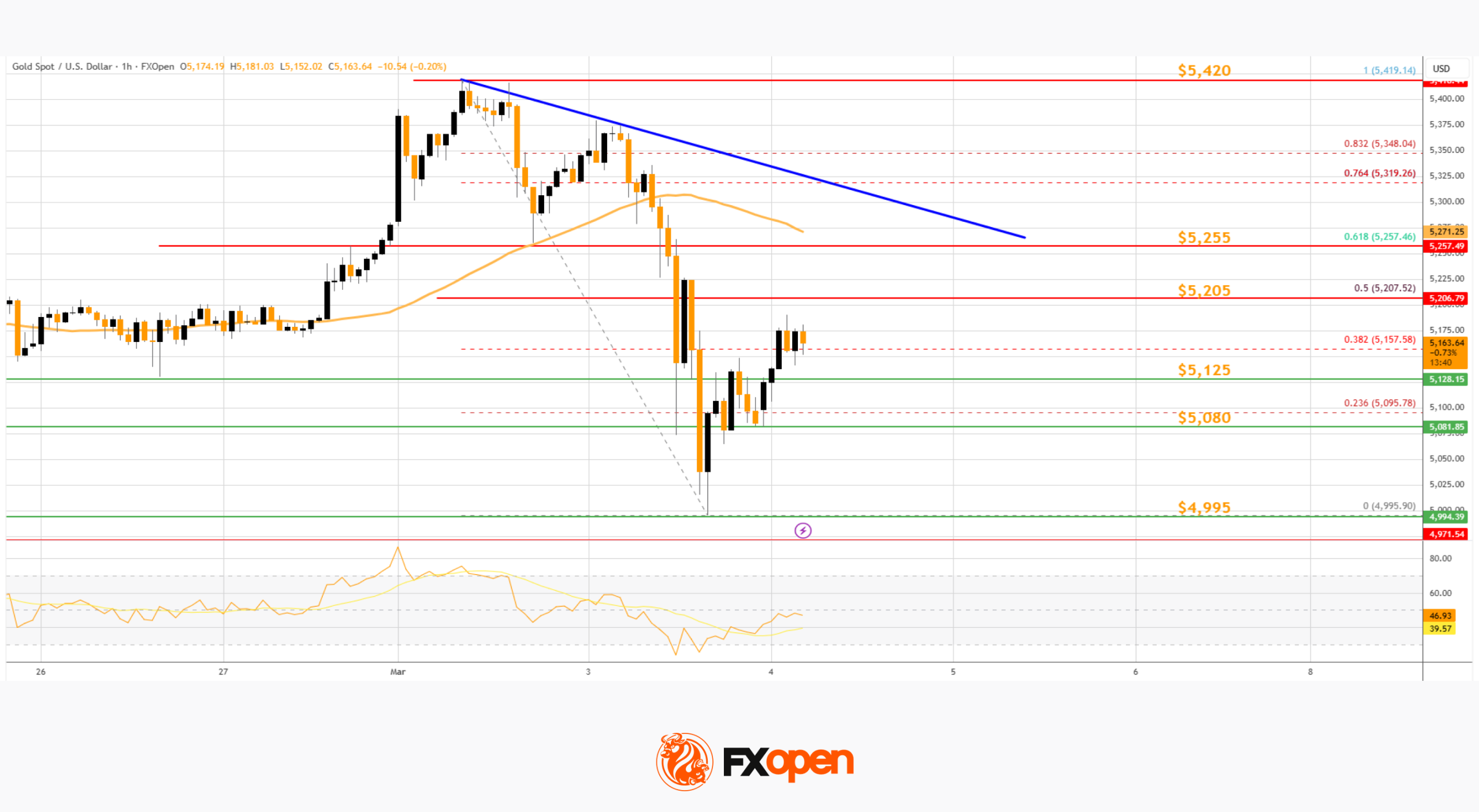

Market Analysis: Gold Under Pressure as WTI Crude Extends Rally During Iran War

Gold price extended losses below $5,100 before the bulls appeared. WTI Crude oil prices are rising and could climb further higher toward $80.00.

Important Takeaways for Gold and WTI Crude Oil Prices Analysis Today

· Gold price failed to clear $5,420 and corrected lower against the US Dollar.

· There is a key bearish trend line forming with resistance at $5,255 on the hourly chart of gold at FXOpen.

· WTI Crude oil prices are moving higher above the $72.00 resistance zone.

· There is a bullish trend line forming with support near $72.85 on the hourly chart of XTI/USD at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price was able to climb above $5,150. The price even broke $5,250 before the bears appeared. The price traded toward $5,420 before there was a fresh decline.

There was a move below $5,250 and $5,050. The price settled below the 50-hour simple moving average, and RSI dipped below 40. Finally, it tested the $5,000 handle. A low was formed at $4,995 and the price is now attempting to recover.

The price climbed above the 23.6% Fib retracement level of the downward move from the $5,419 swing high to the $4,995 low. Immediate resistance on the upside is $5,205 and the 50% Fib retracement.

The first major hurdle sits at $5,255. There is also a key bearish trend line forming with resistance at $5,255. A close above $5,255 could initiate a recovery wave to $5,420. An upside break above $5,420 could send Gold price toward $5,500. Any more gains may perhaps set the pace for an increase toward $5,650.

If there is no fresh increase, the price could continue to move down. Initial support on the downside is near the $5,125 level. The first key area of interest might be $5,080. If there is a downside break below $5,080, the price might decline further. In the stated case, the price might drop to $5,000.

WTI Crude Oil Price Technical Analysis

On the hourly chart of WTI Crude Oil at FXOpen, the price started a strong increase from $63.50 against the US Dollar. The price gained bullish momentum after it broke $68.00.

There was a sustained upward movement above $69.50 and $72.00. The bulls pushed the price above the 50-hour simple moving average, and the RSI climbed toward 80. A high was formed near $77.07 before there was a minor pullback.

The price declined below the 23.6% Fib retracement level of the upward move from the $63.56 swing low to the $77.07 high. However, the bulls are active above $72.00. There is also a key bullish trend line forming with support near $72.85.

Immediate resistance is $75.00. If the price climbs further, it could face hurdles near $77.05. The next major stop for the bulls might be $78.00. Any more gain might send the price toward $80.00.

Conversely, the price might correct gains and retest the 50-hour simple moving average or the trend line. The next area of interest on the WTI crude oil chart is near the 50% Fib retracement at $70.35. If there is a downside break, the price might decline to $66.75. Any more losses may perhaps open the doors for a move toward $63.55.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Solana risks repeating 95% crash seen in 2022 while funding in Mutuum Finance nears $21m

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As Solana shows technical signals reminiscent of its 2022 downturn, investors are increasingly watching emerging DeFi projects like Mutuum Finance.

Summary

- Despite strong network metrics and growing on-chain activity, Solana remains in a long-term descending channel with indicators such as the monthly SuperTrend flashing a sell signal similar to conditions preceding its 2022 crash.

- Mutuum Finance is developing a non-custodial lending protocol on Ethereum that supports both Peer-to-Contract and Peer-to-Peer lending models.

- The project has raised over $20.7 million from more than 19,000 holders, with smart contracts audited by Halborn Security and the token reviewed by CertiK, while its V1 protocol is live on the Sepolia testnet.

Solana (SOL) is trading at levels that have prompted comparisons to its 2022 cycle, when the token declined roughly 95%. The current price structure has shown signs of weakness, with resistance zones capping upside attempts and momentum remaining fragile. Meanwhile, Mutuum Finance (MUTM) has seen funding approach the $21 million mark. The project operates a non-custodial lending and borrowing protocol within the decentralized finance sector, and the capital inflow reflects continued investor participation during a period of uncertainty for larger-cap assets.

Solana bearish trend persists

Solana’s real-world asset ecosystem reached $1.66 billion in tokenized value, reflecting increased on-chain capital movement and institutional participation. The network ranked among the leading Layer 1 chains in dApp revenue and recorded a rise in app revenue capture ratio from 262% to 375%, supported by strong network activity and spot ETF inflows.

Despite these metrics, SOL remains in a long-term descending channel on the weekly chart. Analysts identify price imbalances up to $140 that could be filled before a potential test of the $47.9 extension level. The monthly SuperTrend indicator has flipped to a “sell” signal, a condition last seen in 2022 before a 95% decline. While network fundamentals show growth, the prevailing technical structure remains bearish. Meanwhile, Mutuum Finance sees strong growth.

Mutuum Finance lending

Built on the Ethereum network, Mutuum Finance is a new decentralized lending and borrowing protocol. It is a non-custodial platform, allowing users complete control over their funds. The project offers flexibility through its dual lending model, supporting both Peer-to-Contract (P2C) and Peer-to-Peer (P2P) lending. In the P2C system, users can deposit widely used assets like USDT or ETH into shared liquidity pools and earn interest automatically; for example, a $50,000 USDT deposit at 8% APY would grow to $54,000 over a year without additional action, while borrowers provide overcollateralized assets at dynamic rates based on pool demand.

The P2P model, on the other hand, caters to high-volatility tokens, allowing direct negotiations between borrowers and lenders; for instance, an investor holding $25,000 in a meme coin like PEPE could obtain a $13,800 USDC loan at 14% APY with 180% overcollateralization, preserving exposure to potential gains in PEPE while providing the lender $966 in interest in 6 months.

Security and community engagement

Mutuum Finance’s lending and borrowing smart contracts recently underwent a full audit by Halborn Security. The project team incorporated all recommendations highlighted by the security firm before the protocol’s testnet debut. The MUTM token itself has also been audited by CertiK, achieving a token scan score of 90/100. MUTM is priced at $0.04, with more than 19,070 holders and over $20.72 million committed to the project.

Solana is currently down 73% from its $294 ATH, following sharp downturns since Q4 2025. Frequent whale selling and profit-taking have further eroded confidence in the token. Meanwhile, Mutuum Finance shows steady development. Its V1 Protocol is live on the Sepolia testnet, allowing users to test the protocol’s core features, including staking, borrowing, and lending. Users can borrow and lend ETH, USDT, LINK, and WBTC, which are the supported test tokens. The testnet also includes an automated liquidator bot, which maintains protocol health.

As Solana risks repeating its 95% crash from 2022, with bearish technical signals and a sell signal on the monthly SuperTrend, investors are cutting their losses to seek alternative market plays. Meanwhile, strong capital inflows are being reported for Mutuum Finance (MUTM), whose funding is approaching $21 million. Built on Ethereum, MUTM offers a non‑custodial lending protocol with a dual‑market structure, live on Sepolia testnet, audited by Halborn and CertiK.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

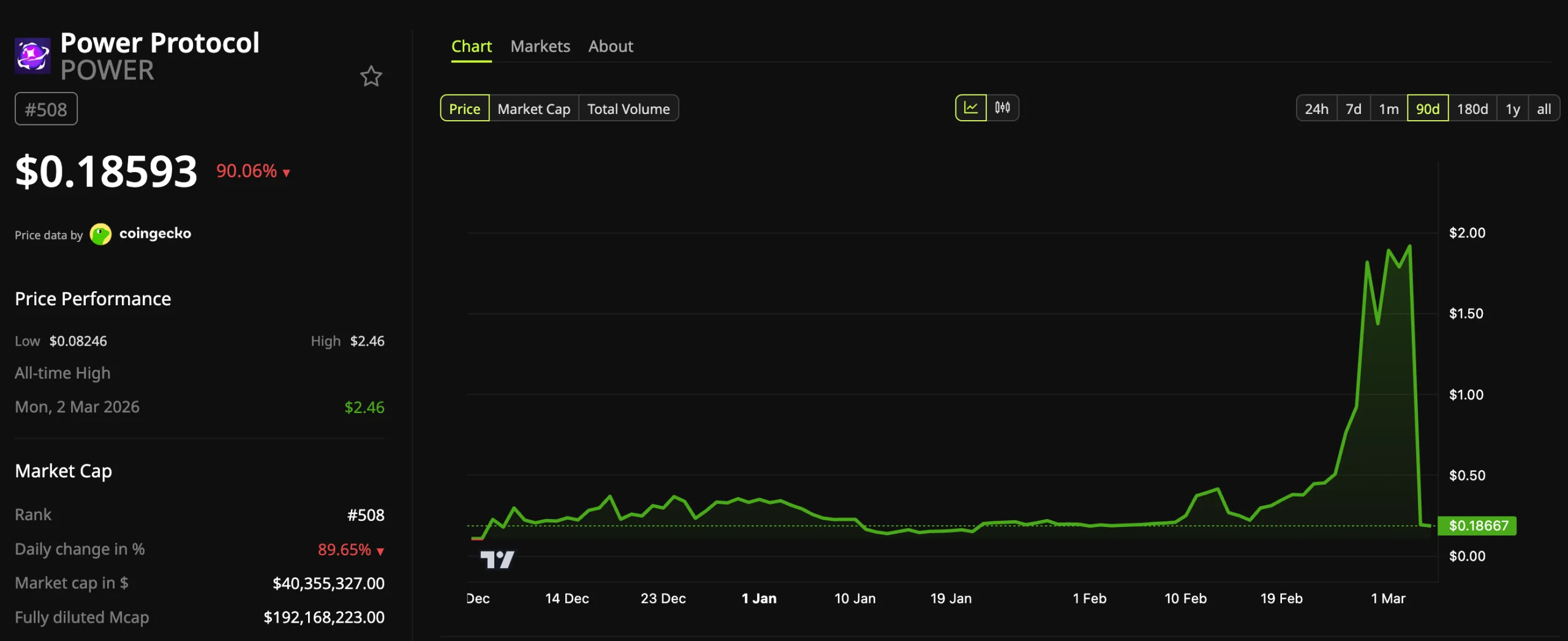

Why Did The POWER Token Drop Over 90%?

Power Protocol’s POWER token has dropped over 90% over the past 24 hours, erasing all its February 2026 gains.

The staggering loss has sparked debate about the project as a major token unlock approaches.

Power Token Surges 900% in February, Then Faces 90% Loss

For context, Power Protocol is a blockchain infrastructure platform focused on Web3 gaming and entertainment. It unifies games, consumer applications, studios, and digital IP under a shared economic layer powered by the POWER token.

The altcoin is a relatively new market entrant, having launched on December 5, 2025. Following an initial rally, the token experienced volatility.

Nonetheless, momentum picked up again in early February, even as the broader market continued to struggle. Later in the month, the platform secured $3 million in funding from BITKRAFT Ventures.

“Power Protocol raised new funding in a round led exclusively by BITKRAFTVC, bringing total funding to $15.4M. We’re building the economic engine behind the next generation of crypto entertainment, with POWER at the core,” the platform announced.

Over the course of February, POWER climbed more than 900%. The rally culminated in the altcoin hitting an all-time high of $2.46 on March 2.

However, what followed was a massive drop. BeInCrypto Markets data showed the token declined 90% over the past day, hitting an intraday low of $0.15, its lowest level since late January. At press time, POWER traded at $0.18.

Follow us on X to get the latest news as it happens

The sharp decline has also propelled POWER to the top of CoinGecko’s daily losers list. Additionally, community sentiment remains largely negative, with 64% of users bearish about the token.

CoinGecko attributed the decline to two triggers. First, the Ronin Bridge reportedly saw a temporary pause. This created a significant price gap between on-chain markets and centralized exchanges (CEXs).

Second, an upcoming token unlock scheduled for March 5 intensified fears of additional selling pressure. According to DropsTab data, the unlock represents 1.2% of the total supply.

Meanwhile, the severity of the drop also triggered community speculation. Some users on X made rug-pull allegations, while others labeled it a “crime dump.”

“Crime coins can also do what $POWER is doing now….go -75% in a day. What goes up…,” Altcoin Sherpa wrote.

While these remain allegations, it is clear that the drop has affected investor sentiment. As the March 5 unlock date approaches, market participants may be growing cautious. Further declines could follow if sentiment continues to worsen and newly unlocked tokens are sold off swiftly.

Crypto World

BTC jumps above $71,000, building on resilience to Middle East conflict

Bitcoin surged Wednesday, underscoring it’s growing resilience to turmoil in the Middle East, while gold, a traditional safe haven, lagged.

The leading cryptocurrency by market value rose to $71,023 during the European hours, up over 6% on a 24-hour basis, according to CoinDesk data. Other majors such as ether (ETH), XRP (XRP) and solana (SOL) followed bitcoin’s lead, rising 4% to 6%, respectively.

The CoinDesk 20 Index, a broader market gauge, rose over 5% to 2,025 points.

“Bitcoin may now exhibit some defensive characteristics during crisis periods, but gold’s retreat highlights that even classic safe-havens are not immune to market dynamics, positioning Bitcoin as a more flexible yet still high-beta alternative,” Tagus Capital said in its daily newsletter.

BTC’s latest move to multi‑week highs follows even as the crisis has intensified, with Iran blocking oil supplies through the Strait of Hormuz and raising the spectre of energy‑price inflation around the world. Since the conflict between Israel, the U.S., and Iran erupted on Saturday, bitcoin has proved surprisingly resilient, with the downside capped around $65,000.

Meanwhile, gold, a traditional safe haven, peaked above $5,400 per ounce on Monday and has since declined to $5,160. Asian equity indices, led by South Korea’s Kospi index, have bled heavily as oil imports cost rise.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics1 day ago

Politics1 day agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat4 days ago

NewsBeat4 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat4 days ago

NewsBeat4 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Entertainment2 days ago

Entertainment2 days agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech5 days ago

Tech5 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat3 days ago

NewsBeat3 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Crypto World5 days ago

Crypto World5 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat2 days ago

NewsBeat2 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech3 days ago

Tech3 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI