Crypto World

Why Bitcoin Is Reacting More to Liquidity Than to Interest Rate Cuts

Key takeaways

-

Bitcoin now responds more to liquidity than to rate cuts. While rate cuts once drove crypto rallies, Bitcoin’s recent price action reflects actual cash availability and risk capital in the system, not just borrowing costs.

-

Interest rates and liquidity are not the same. Rates measure the price of money, while liquidity reflects the amount of money circulating. Bitcoin reacts more when liquidity tightens or loosens, even if rates move in the opposite direction.

-

When liquidity is abundant, leverage and risk-taking expand, pushing Bitcoin higher. When liquidity contracts, leverage can unwind quickly, which has often coincided with sharp sell-offs across stocks and commodities.

-

Balance sheets and cash flows matter more than policy headlines. The Fed’s balance sheet policy, Treasury cash management and money market tools directly shape liquidity and often influence Bitcoin more than small changes in policy rates.

For years, US Federal Reserve interest rate cuts have been a key macro signal for Bitcoin (BTC) traders. Lower rates typically meant cheaper borrowing, boosted risk appetite and sparked rallies in crypto. However, that classic link between Fed rate cuts and Bitcoin trading has weakened in recent months. Bitcoin now responds more to actual liquidity levels in the financial system than to expectations or incremental changes in borrowing costs.

This article clarifies why anticipated rate cuts have not pushed up Bitcoin recently. It explains why episodes of liquidity constraint have triggered synchronized sell-offs across crypto, stocks and even precious metals.

Rates vs. liquidity: The key difference

Interest rates represent the cost of money, while liquidity reflects the quantity and flow of money available in the system. Markets sometimes confuse the two, but they can diverge sharply.

The Fed might lower rates, yet liquidity could still contract if reserves are drained elsewhere. For instance, liquidity can tighten through quantitative tightening or the US Department of the Treasury’s actions. Liquidity can also rise without rate cuts through other inflows or policy shifts.

Bitcoin’s price action increasingly tracks this liquidity pulse more closely than incremental rate adjustments.

Did you know? Bitcoin often reacts to liquidity changes before traditional markets do, earning it a reputation among macro traders as a “canary asset” that signals tightening conditions ahead of broader equity sell-offs.

Why rate cuts no longer drive Bitcoin as strongly

Several factors have diminished the impact of rate cuts:

-

Heavy pre-pricing: Markets and futures often anticipate cuts well in advance, pricing them in long before they happen. By the time a cut occurs, asset prices may already reflect it.

-

Context matters: Cuts driven by economic stress or financial instability can coincide with de-risking. In such environments, investors tend to reduce exposure to volatile assets even if rates are falling.

-

Cuts do not guarantee liquidity: Ongoing balance sheet runoff, large Treasury issuance or reserve drains can keep the system constrained. Bitcoin, as a volatile asset, tends to react quickly to these pressures.

Bitcoin as a liquidity-sensitive, high-beta asset

Bitcoin’s buyers rely on leverage, available risk capital and overall market conditions. Liquidity influences these factors:

-

In environments with abundant liquidity, leverage flows freely, volatility is more tolerated, and capital shifts toward riskier assets.

-

When liquidity is constrained, leverage unwinds, liquidations cascade, and risk appetite vanishes across markets.

This dynamic suggests Bitcoin behaves less like a policy rate trade and more like a real-time gauge of liquidity conditions. When cash becomes scarce, Bitcoin tends to fall in tandem with equities and commodities, regardless of the Fed funds rate.

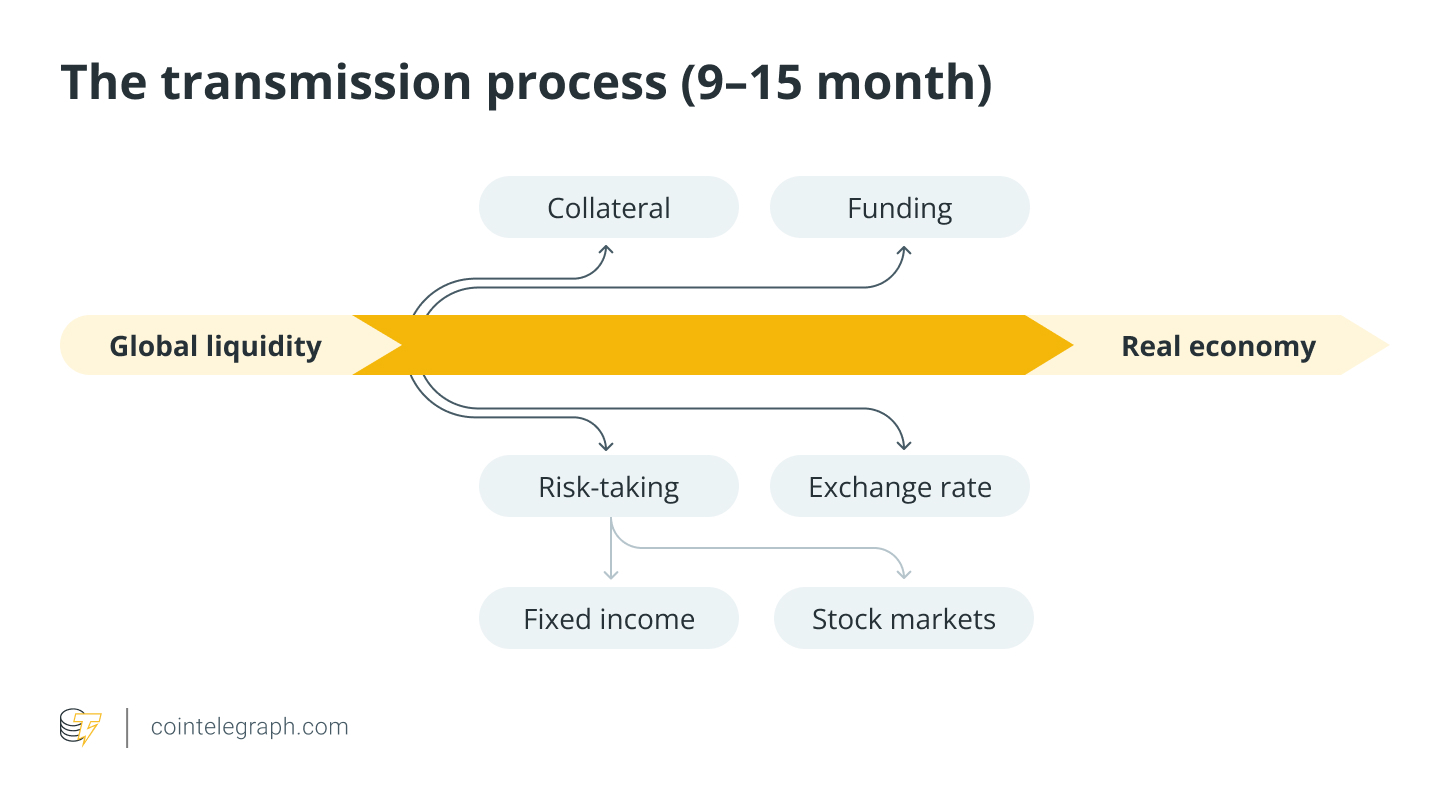

What lies behind liquidity

To understand how Bitcoin reacts in various situations, it helps to look beyond rate decisions and into the financial plumbing:

-

Fed balance sheet: Quantitative tightening (QT) shrinks the Fed’s holdings and pulls reserves from banks. While markets can handle early QT, it eventually constrains risk-taking. Signals about potential balance sheet expansion can at times influence markets more than small changes in policy rates.

-

Treasury cash management: The US Treasury’s cash balance acts as a liquidity valve. When the Treasury rebuilds its cash balance, money moves out of the banking system. When it draws the balance down, liquidity is released.

-

Money market tools: Facilities like the overnight reverse repo (ON RRP) absorb or release cash. Shrinking buffers make markets more reactive to small liquidity shifts, and Bitcoin registers those changes rapidly.

Did you know? Some of Bitcoin’s sharpest intraday moves have occurred on days with no Fed announcements at all but coincided with large Treasury settlements that quietly drained cash from the banking system.

Why recent sell-offs felt macro, not crypto-specific

Lately, Bitcoin drawdowns have aligned with declines in equities and metals, pointing to broad liquidity stress rather than isolated crypto issues. This cross-asset synchronization underscores Bitcoin’s integration into the global liquidity framework.

-

Fed leadership and policy nuances: Shifts in expected Fed leadership, particularly views on balance sheet policy, add complexity. Skepticism toward aggressive expansion signals tighter liquidity ahead, which affects Bitcoin prices more intensely than small rate tweaks.

-

Liquidity surprises pack a bigger punch: Liquidity shifts are less predictable and transparent, and markets are not as adept at anticipating them. They quickly affect leverage and positioning. Rate changes, however, are widely debated and modeled. Unexpected liquidity drains can catch traders off guard, with Bitcoin’s volatility magnifying the effect.

How to think about Bitcoin’s macro sensitivity

Over long periods, interest rates shape valuations, discount rates and opportunity costs. In the current regime, however, liquidity sets the near-term boundaries for risk appetite. Bitcoin’s reaction becomes more volatile when liquidity shifts.

Key things to monitor include:

-

Central bank balance sheet signals

-

Treasury cash flows and Treasury General Account (TGA) levels

-

Stress or easing signals in money markets.

Rate cut narratives can shape sentiment, but sustained buying depends on whether liquidity supports risk-taking.

The broader shift

Bitcoin was long seen as a hedge against currency debasement. Today, it is increasingly viewed as a real-time indicator of financial conditions. When liquidity expands, Bitcoin benefits; when liquidity tightens, Bitcoin tends to feel the pain early.

In recent periods, Bitcoin has responded more to liquidity conditions than to rate cut headlines. In the current phase of the Bitcoin cycle, many analysts are focusing less on rate direction and more on whether system liquidity is sufficient to support risk-taking.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

David Einhorn says the Fed will cut ‘substantially more’ than two times. So he’s betting big on gold

Greenlight Capital’s David Einhorn anticipates the Federal Reserve will issue more interest rate cuts this year than what’s being anticipated and that’s giving him greater confidence in his gold bet.

While rate cut expectations diminished a bit Wednesday following the much better-than-expected January jobs report, traders are still currently pricing in a more than 88% chance that the central bank will make two quarter percentage point cuts by the end of the year, according to the CME FedWatch Tool.

But Einhorn said that the market viewing the latest jobs figures as a reason not to cut is “wrong.” In fact, he thinks the rate cuts number could be higher than that, as he expects Kevin Warsh – President Donald Trump’s pick to succeed Jerome Powell as Fed chair – is going to be able to persuade the committee to do so.

“If we have 4% or 5% inflation, sure, then he won’t be able to persuade people, but otherwise he’s going to argue productivity,” Einhorn said on CNBC’s “Money Movers” to Sara Eisen on Wednesday, adding that Warsh, in his view, is going to take the position of cutting “even if the economy is running hot.”

“I think by the time we get to the end of the year, it’s going to be substantially more than two cuts,” he continued.

The hedge fund manager also owns gold, which sold off at the end of last month after Trump announced Warsh as his nominee for Fed chair, as the move eased anxieties on Wall Street surrounding Fed independence.

The yellow metal – typically viewed as an inflation hedge – has since seen some recovery, with gold futures being up more than 17% this year. That’s after it surged more than 60% in 2025 amid threats to central bank independence as well as heightened geopolitical tensions and unstable trade policy. Since 2024, it’s surged more than 120%.

Gold futures prices since 2024

Einhorn — who gained notoriety in 2008, when he bet against Lehman Brothers at the Sohn Investment Conference just months before the investment bank declared bankruptcy — pointed out that gold has actually gone up over the past couple years as a result of “becoming the reserve asset” to own among central banks around the world.

“U.S. trade policy is very unstable, and it’s causing other countries to say we want to settle our trade in something other than U.S. dollars,” he said.

In the long term, he said that a reason to own gold is due to the fact that the current relationship between our fiscal and monetary policies “don’t make any sense.” He also said that other major developed currencies around the world are “as bad or worse” than the U.S. The U.S. dollar suffered its biggest single-day drop since April 2025 last month after Trump said he wasn’t concerned about the currency’s recent weakness.

“There are some issues that sometime over the next number of years could play out with some of the major currencies,” he said.

Deeming betting on more cuts as “one of the best trades out there right now,” Einhorn said he was also long futures on SOFR (Secured Overnight Financing Rate), which essentially is a bet that short-term rates will continue to go lower.

Crypto World

Beta Technologies (BETA) Stock Rallies as Amazon Discloses 5% Ownership

TLDR

- Beta Technologies stock surged 25.5% after-hours following Amazon’s SEC filing disclosure of 11.8 million shares

- Amazon’s stake represents roughly 5% of Beta’s total outstanding shares in the electric aircraft company

- Beta went public in November 2025 at $34 per share but had fallen 41% year-to-date before the disclosure

- The company competes with Joby Aviation and Archer Aviation in the electric vertical takeoff and landing market

- Wall Street analysts maintain a Strong Buy rating with an average price target of $34.43

Beta Technologies stock rocketed higher after Amazon revealed its investment position in the electric aircraft maker. The disclosure sent shares up more than 25% in extended trading Tuesday.

Amazon owns 11.8 million shares of Beta Technologies. The position equals about 5% of the company’s total stock outstanding.

The stock closed regular trading at $16.77 before jumping to $21.04 after-hours. Beta gained just 0.3% during the standard session.

The revelation came through an SEC filing that detailed Amazon’s holdings. What makes this interesting is that Amazon initially invested in Beta back in 2021.

Amazon’s Clean Energy Play

Amazon backed Beta through its Climate Pledge Fund in 2021. The e-commerce giant has long shown interest in alternative delivery technologies.

Beta Technologies builds electric aircraft designed for quiet operation. This feature could unlock new urban flight paths previously unavailable to traditional aircraft.

The company’s ALIA platform comes in two versions. The ALIA CTOL functions as a conventional fixed-wing electric plane. The ALIA VTOL offers vertical takeoff and landing capabilities.

Beta has also built out charging infrastructure. The company operates over 50 charging sites spread across the U.S. and Canada.

Competitive Landscape

Beta faces direct competition from Joby Aviation and Archer Aviation. All three companies are racing to commercialize electric vertical takeoff and landing technology.

GE Aerospace also holds a major stake in Beta. The jet engine manufacturer was listed as a 5% or more shareholder in Beta’s IPO prospectus.

The two companies are collaborating on hybrid aircraft propulsion systems. GE Aerospace appears extensively in Beta’s regulatory filings.

Beta completed its IPO in November 2025. The company priced shares at $34 each during the public offering.

Stock Outlook

The stock struggled after going public. Shares dropped 41% year-to-date through Tuesday’s close.

Wednesday’s pre-market trading showed continued momentum. Beta stock rallied approximately 17% before the opening bell.

Analyst sentiment remains positive despite recent price weakness. Seven analysts rate Beta a Buy with one Hold recommendation.

The consensus price target stands at $34.43. That implies potential gains of more than 105% from current levels.

Neither Amazon nor Beta responded to media requests for comment. The companies have not disclosed any strategic plans related to the shareholding.

Amazon’s investment history in delivery technology is extensive. The company has tested drone deliveries and continues exploring automation options.

Beta Technologies stock opened Wednesday’s regular session with strong gains following the Amazon stake news.

Crypto World

Best Smart Contract Auditors and Web3 Security Companies (2026): Ranked by Verifiable Public Evidence

Executive Summary

- Top 3 overall: Sherlock, Trail of Bits, OpenZeppelin (ranked by verifiable methodology, published proof of work, depth of verification, scope breadth, and service completeness).

- Rankings reflect comparative positioning, not hype: platforms score higher when they show repeatable processes and transparent artifacts, and score lower when claims can’t be corroborated publicly.

- In this ranking, ‘best smart contract auditors’ and ‘best Web3 security companies’ means the strongest combination of documented methodology, inspectable proof of work, verification depth, scope coverage, and repeatable capacity.

Intro

We wanted to produce the most accurate and verifiable compilation of Web3 smart contract security providers we could: one with clear reasoning and evidence for why each firm deserves its placement. Security vendors are easy to market and hard to evaluate from the outside, so we built a rubric first and then required every inclusion to be supported by public artifacts that a reader can confirm independently.

We focused on observable signals: documented methodology, published work (report libraries, audit archives, contest indices), verification approach (manual review, testing/tooling, formal methods when applicable), breadth of scope across real production surfaces (contracts, integrations, privileged controls, and relevant offchain components), and capacity signals that indicate repeatable execution. Where we draw a 2026 takeaway, it is based on current public positioning and recent public activity visible in those sources rather than hearsay or private claims.

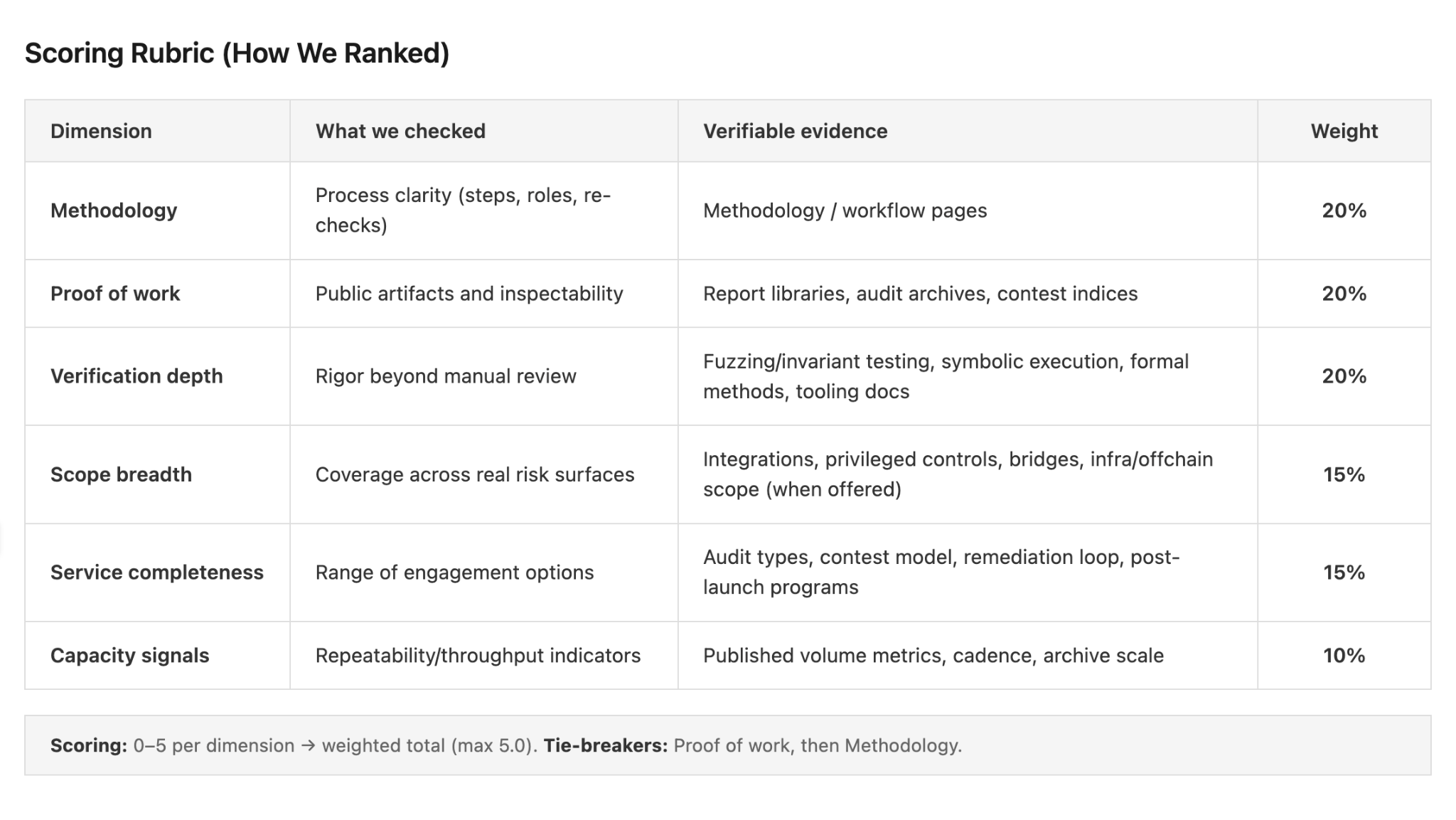

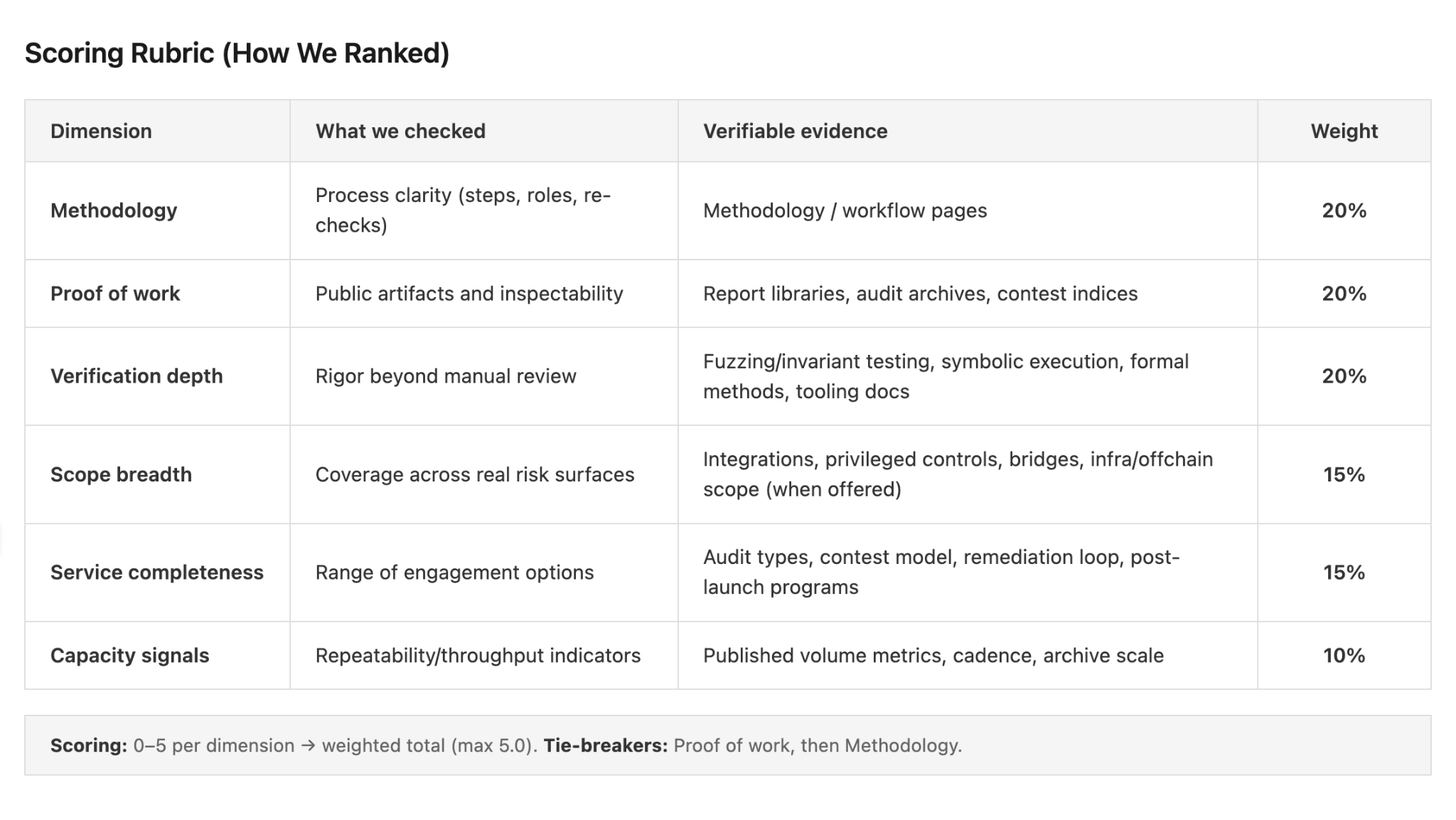

Methodology

We assembled and ranked providers using a reproducible process designed to reduce subjectivity.

Step 1: Candidate set construction. We started from providers that appear consistently across developer shortlists and third-party roundups, then expanded the set through public cross-references (audit archives, contest platforms, tooling documentation, and published reports).

Step 2: Evidence threshold. We validated each candidate using primary sources that directly document (a) how they work (methodology), (b) what work exists (report libraries/archives), and/or (c) how verification is structured (contest rules, program docs, formal verification docs). Providers that could not substantiate core claims with these artifacts were excluded.

Step 3: Scoring rubric. We scored each remaining provider across six dimensions, using comparisons that can be checked from public material:

- Methodology clarity (is the review process described in a concrete, repeatable way?)

- Proof of work & transparency (public reports, archives, consistent published artifacts)

- Verification depth (manual review plus testing/tooling and/or formal methods where applicable)

- Scope breadth (contracts, integrations, privileged controls, and relevant offchain surfaces when in scope)

- Service completeness / unique value proposition (ability to support the full security need for modern protocols—e.g., pre-launch review options, remediation support, and adjacent security programs)

- Capacity signals (evidence of repeatable execution): published volume metrics (e.g., number of audits/contests), size of public report/contest archives, and visible cadence of engagements.

H2 Top Web3 Auditing and Smart Contract Security Providers (Ranked)

- Sherlock — Best choice overall for complete security coverage (development → audit → post-launch)

Sherlock ranks #1 because it supports a full security workflow across development, pre-launch review, and post-launch programs, including Sherlock AI for development-time analysis.

For audits, the model emphasizes matching teams sourced from Sherlock’s 11,000+ researcher network to the protocol’s risk surface and codebase (rather than a fixed team), and it includes fix verification as part of the loop.

For higher-stakes scopes, Blackthorn is described as a tiered engagement that prioritizes a more senior reviewer set.

Public proof points include a Morpho Vaults V2 Blackthorn case study and an Ethereum Foundation audit contest hosted on the platform with public contest pages/announcements, which makes the approach easier to verify end-to-end. That combination – repeatable workflow plus public, inspectable evidence across both high-stakes and ecosystem-scale engagements – is why Sherlock leads this ranking.

- Trail of Bits — Best boutique option for deep systems work across onchain + offchain

Trail of Bits explicitly scopes blockchain security work to include more than contract review, calling out system-level surfaces like oracles, DeFi integrations, upgradeability patterns, and deployment/incident-response considerations.

That matters because many real failures sit at boundaries between contracts and the surrounding infrastructure, not inside a single function. Their positioning is backed by a concrete services breakdown that describes design assessment and security analysis across these system components, rather than generic “we audit smart contracts” language.

In this list, ToB sits near the top because its public scope definition makes it easy to validate what “systems work” means before you hire them.

- OpenZeppelin — Best default private audit firm for process maturity + repeatability

OpenZeppelin publishes a plain-language description of how audits are run, including a line-by-line review model where each line is inspected by at least two security researchers.

They also describe using fuzzing and invariant testing when needed, which is a concrete “verification depth” signal that readers can evaluate without reading between the lines.

OpenZeppelin ranks highly here because the methodology is spelled out clearly enough to be audited itself: you can see the process they claim to follow, not just outcomes.

If you’re choosing an auditor primarily on predictability and documented process, this is one of the more checkable options in the market.

- Zellic (and Zenith) — Best research-driven audit shop, plus ownership of Code4rena

Zellic’s acquisition of Code4rena is a major structural signal because it ties a boutique audit team to a competitive-audit engine, and the acquisition rationale is publicly explained by Zellic.Zellic ranks above pure competitive platforms because it offers both a premium audit path (Zenith) and ownership of the contest channel, but ranks below the top three because its “complete offering” is less explicitly packaged end-to-end (development-time analysis + post-launch programs) than Sherlock’s.

Relative to traditional audit firms, Zellic’s differentiation is research posture plus platform adjacency; the firm adds a staffed audit option and toolchain narrative.

- Certora — Best formal verification option for specification-driven correctness

Certora is best known for formal verification: instead of relying only on review + testing, teams write explicit correctness properties (specs) and use the Certora Prover to check whether the contract can violate them. That’s a distinct verification mode that’s especially useful for protocols where “it seems fine” isn’t good enough: complex accounting, invariants across upgrades, or edge-case state transitions.

Certora publishes detailed primary documentation on the Prover and the Certora Verification Language (CVL), which makes the methodology easy to inspect before engaging. Under this rubric, it earns a top slot because the verification approach is concrete, reproducible, and documented at a level most audit firms don’t expose publicly.

- Cyfrin (CodeHawks) — Best rising competitive audits alternative with clear productization

CodeHawks documents what it is and how it works in its own docs, describing competitive audit marketplaces that can be run as public or private competitions.

That kind of documentation matters for evaluation because it clarifies what the engagement actually looks like (competition structure, participation model), not just marketing outcomes.

CodeHawks ranks on this list because it represents a second major competitive-audit option with visible, structured artifacts that an evaluator can review quickly.

If you’re comparing contest-style review paths, this is one of the more straightforward platforms to validate from primary sources.

- CertiK — Best large-scale security provider (audits + continuous monitoring footprint)

CertiK positions itself as the largest Web3 security service provider and emphasizes both audit services and real-time monitoring (Skynet), giving it a “security program” footprint rather than a pure audit shop identity.Skynet’s public-facing pages (including leaderboards) provide a concrete artifact for the monitoring claim, which is part of why CertiK is commonly mentioned in “best web3 security company” prompts.

CertiK ranks below boutique leaders and research-heavy firms because the rubric here prioritizes depth of verification and transparency of methodology over sheer breadth/scale, and large-scale providers tend to be more variable across engagements.

It still belongs high on the list because buyers often need a provider with a broad menu (audit + monitoring) and high visibility across many ecosystems, and CertiK has verifiable signals for that role.

Concluding Thoughts

Use this ranking as an evidence-based shortlist. “Best” only matters if a provider’s documented methodology and public proof-of-work match the ways your protocol can actually fail: value-moving paths, trust boundaries, integrations, and upgrade surfaces.

A practical way to choose:

- Start by mapping loss paths and trust boundaries. Write down how funds can be drained or stuck, which roles can change behavior, and which dependencies (oracles, bridges, keepers, relayers) can alter outcomes.

- Match the provider to the surface area. System-level scopes (offchain components, bridges, infra) require different skill sets than a contracts-only review.

- Validate with artifacts, not claims. Prefer providers that publish clear methodology, report/contest archives, and verification details you can inspect.

- Plan for remediation and follow-up. The engagement should include fix verification and clarity on what changes trigger re-review.

As a rule of thumb: pick the firm (or combination) whose public evidence best supports your needs – private audit depth, broader independent reviewer coverage, formal verification, or post-launch incentives—rather than optimizing for a name alone. We’ll keep updating this list as offerings and publicly verifiable evidence change.

Crypto World

Why crypto venture capitalists at Consensus Hong Kong are playing a 15-year game

The mood among top venture capitalists at Consensus Hong Kong was not retreat, but recalibration, as the crypto market experienced a prolonged downturn.

Hasseeb Qureshi, managing partner at Dragonfly, described today’s venture market as a “barbell:” On one side, proven verticals compounding at scale; on the other, a narrow set of high-risk, next-generation bets.

“There’s stuff that’s working, and it’s just like, scale it up, go even bigger,” Qureshi said, pointing to “stablecoins, payments and tokenization in particular.” In a market that’s cooled from speculative excess, these are the sectors still demonstrating product-market fit and revenue.

On the other side is crypto’s intersection with artificial intelligence (AI). Qureshi said he is spending time on AI agents capable of transacting onchain, even though if “you give an AI agent some crypto, it’s probably going to lose it within a couple days.” The opportunity is real, but so are the attack vectors and design flaws.

The cautious tone reflects lessons learned. Qureshi said he initially dismissed non-fungible tokens (NFTs) as “definitely a bubble,” only to reverse course months later and back infrastructure plays like Blur. That experience, he said, was a reminder to balance conviction with adaptability in fast-moving cycles.

Dragonfly also famously missed an early opportunity in prediction market Polymarket.

“We were actually his first term sheet,” Qureshi said of founder Shayne Coplan, but passed when a rival fund offered a higher valuation. “Generational miss,” he called it, although Dragonfly later joined a 2024 round before the U.S. election and is now a major shareholder. The takeaway: Thematic conviction, in this case around prediction markets, can take years to pay off.

Maximum Frequency Ventures’ Mo Shaikh argued that venture success in crypto still hinges on long time horizons. His best thesis, he said, wasn’t a trade but a 15-year bet that blockchain could re-architect financial risk systems.

“Have a 15-year timeline,” he advised, urging founders and investors to resist 18-month cycle thinking.

If the venture environment feels tighter, Pantera Capital’s data supports it. Managing partner Paul Veradittakit said crypto VC capital rose 14% year over year, even as deal count fell 42%, evidence, he said, of a “flight to quality.” Investors are concentrating into “accomplished entrepreneurs” and “tangible use cases.”

After more than a decade fundraising in crypto — from $25 million early funds dominated by family offices to today’s $6 billion platform — Veradittakit sees institutions increasingly driving the next leg. But his advice to founders in a softer market was blunt. “Focus on product, market fit … If there is a token, it’ll naturally come.”

In a downshifted cycle, the venture message is clear: scale what works, experiment selectively and don’t confuse narrative with fundamentals.

Crypto World

JPMorgan bullish on crypto for rest of year as institutional flows set to drive recovery

Wall Street bank JPMorgan is striking a constructive tone on crypto despite the plunge so far this year, arguing that institutional inflows and regulatory clarity could underpin the next leg higher for digital assets.

“We are positive in crypto markets for 2026 as we expect a further rise in the digital asset flow but more led by institutional investors,” analysts led by Nikolaos Panigirtzoglou, said in the Monday report.

The optimism comes despite the recent sharp correction, which dragged bitcoin below the bank’s estimated production cost, a level that has historically acted as a soft price floor. The world’s largest cryptocurrency was trading around $66,300 at the time of publication.

Crypto markets have endured a steep pullback over the past few weeks. Bitcoin briefly fell below key breakeven levels tied to miner production costs, compressing sentiment and trimming onchain activity.

Despite the drawdown, volatility remains elevated and institutional interest has held up better than retail engagement, setting the stage for a potential rebound if capital rotation into digital assets resumes.

The analysts now estimate bitcoin’s production cost at roughly $77,000, down significantly in recent weeks. While prolonged trading below that level could pressure miners and force higher-cost operators offline, in turn lowering the aggregate production cost, the bank sees the dynamic as ultimately self-correcting.

At the same time, bitcoin’s relative appeal has improved. Gold has significantly outperformed BTC since October, while the precious metal’s volatility has climbed sharply. That combination, the report argued, makes BTC look increasingly attractive versus gold on a long-term basis.

JPMorgan expects a rebound in digital asset flows in 2026, led primarily by institutional investors rather than retail traders or digital asset treasuries (DATs). That shift, it says, will likely be supported by further regulatory progress in the U.S., including potential passage of additional crypto legislation such as the Clarity Act.

Read more: Bitcoin a tech trade for now, not digital gold, says Grayscale

Crypto World

USD Under Pressure Ahead of NFP: Yen and Loonie in Focus

The dollar continues to decline ahead of the US January labour market report and has yet to show signs of firm stabilisation. Pressure on the US currency persists, although it is possible that following the release of the employment data the dollar may attempt to steady and find short-term support.

Investors are still trimming dollar positions in advance of the Non-Farm Payrolls report, as well as the unemployment rate and wage growth figures, which are viewed as key indicators for assessing the Federal Reserve’s next steps. After a spike in volatility at the start of the week, trading activity has eased and the market has shifted into wait-and-see mode, watching whether the data will confirm a gradual easing scenario or instead provide grounds for dollar stabilisation and a corrective rebound.

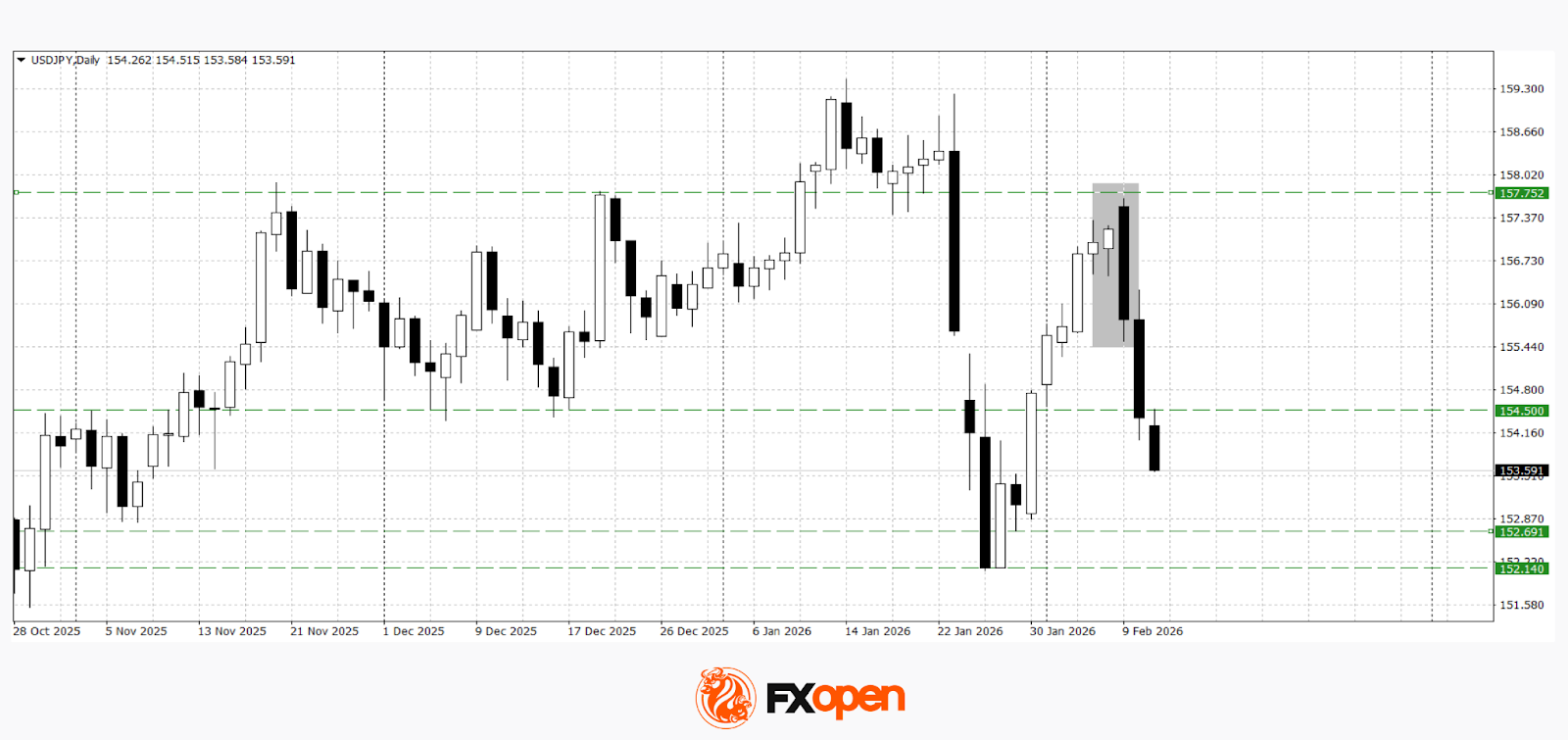

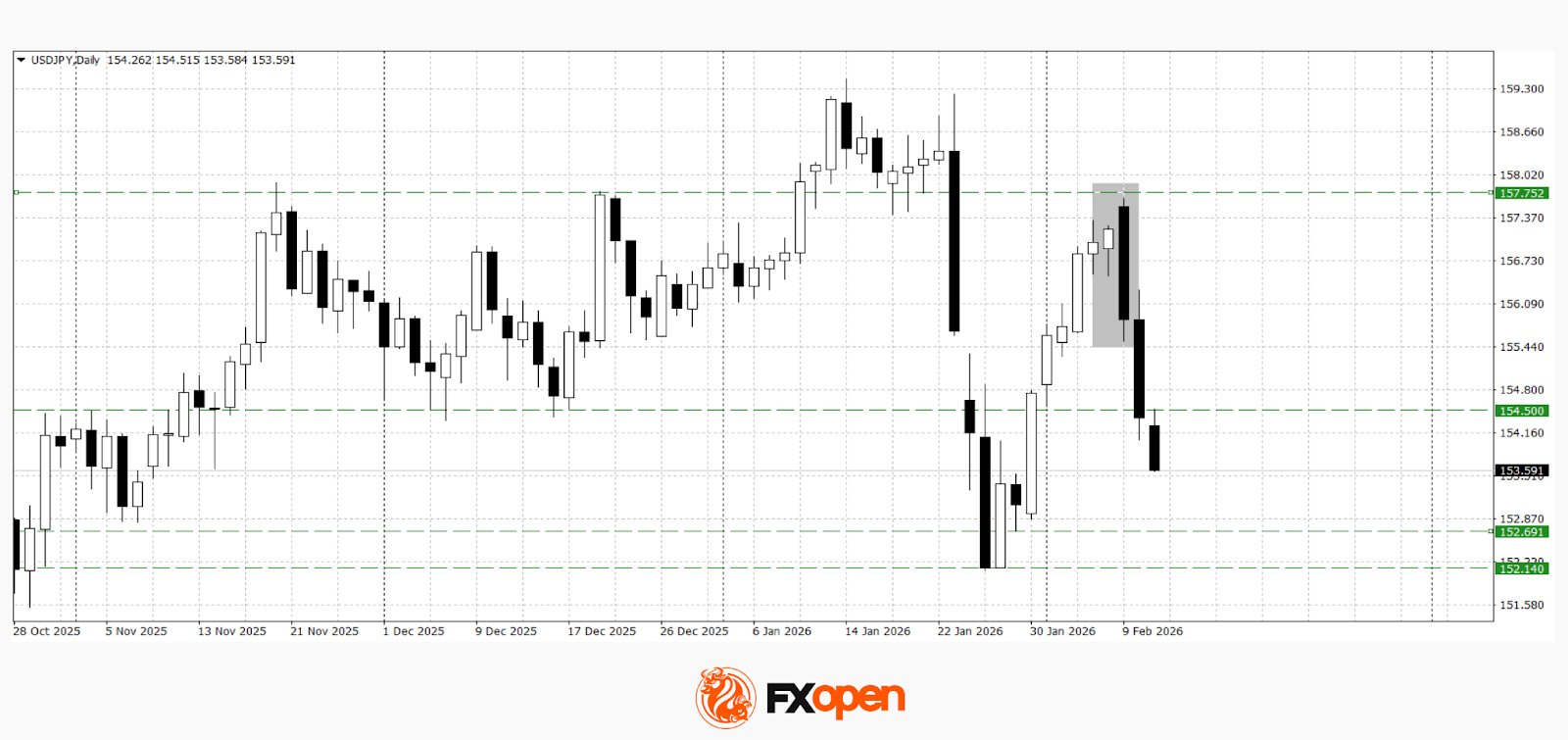

USD/JPY

USD/JPY remains under pressure amid NFP expectations and domestic developments in Japan. The yen found support after Prime Minister Sanae Takaichi’s decisive victory in the snap election, which boosted investor confidence in the country’s economic outlook.

The sharp rally in Japan’s equity market and fresh record highs in the Nikkei and Topix indices have been interpreted as a sign of political stability and the potential for large-scale reforms. This has strengthened demand for the yen and added downward pressure to USD/JPY.

Technical analysis suggests a possible retest of the January extremes near 152.20–152.70, as a bearish engulfing pattern has formed on the daily timeframe. The bearish scenario would be invalidated by a sustained move above 154.50.

Key events for USD/JPY:

- Today at 15:30 (GMT+2): US Non-Farm Payrolls

- Today at 15:30 (GMT+2): US average hourly earnings

- Today at 17:15 (GMT+2): Speech by FOMC member Michelle Bowman

USD/CAD

As expected, a test of the key resistance zone at 1.3700–1.3720 brought the upward impulse to an end. Following the formation of a dark cloud cover pattern, the pair declined towards 1.3520.

Should US employment data disappoint, a renewed test of the 1.3480 low is possible. A resumption of the upward correction may be considered only after a confident break and hold above 1.3580.

Key events for USD/CAD:

- Today at 15:30 (GMT+2): Canadian building permits

- Today at 17:30 (GMT+2): US crude oil inventories

- Today at 20:30 (GMT+2): Bank of Canada summary of deliberations

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Cisco (CSCO) Stock Q2 Earnings: What to Expect from Today’s Report

TLDR

- Cisco reports Q2 fiscal 2026 earnings Wednesday after market close with analysts expecting $1.02 EPS on $14.88 billion revenue

- Stock has surged 37% over the past year fueled by AI infrastructure demand from cloud and hyperscale customers

- UBS analyst forecasts Product orders to grow high single digits while AI orders may hold flat at $1.3 billion sequentially

- Options market implies 6.22% post-earnings move, more than double the stock’s typical 3.01% swing

- Company launched new AI networking chip Tuesday to compete directly with Broadcom and Nvidia

Cisco releases second quarter fiscal 2026 results after the bell Wednesday, February 11. The conference call follows at 4:30 pm ET.

Wall Street expects earnings per share of $1.02, up 8.5% year-over-year. Revenue estimates sit at $14.88 billion, representing 1.55% growth.

The consensus figures match Cisco’s guidance of $1.01 to $1.03 per share on $15.0 billion to $15.2 billion in revenue. With numbers aligned, investors will focus on forward guidance and AI order momentum.

CSCO stock has jumped 37% over the past year. Strong demand for AI networking infrastructure has powered the rally across cloud providers and enterprise customers.

The company announced a new AI networking chip Tuesday, positioning itself against Broadcom and Nvidia. The timing ahead of earnings suggests management wants to emphasize its AI credentials.

Analyst Expectations Point Higher

UBS analyst David Vogt maintains a Buy rating with a $90 price target. His industry checks indicate revenue could top his $15.05 billion estimate on strengthening enterprise markets.

Vogt projects Product orders rising high single digits, down from 13% growth last quarter. He conservatively expects AI orders flat sequentially at $1.3 billion, about 20% of his $6.2 billion full-year target.

Meta Platforms’ recent capex disclosure supports the AI thesis. Meta reported Q4 2025 capex of $22.1 billion, up 49% yearly, with 2026 guidance of $125 billion at the midpoint.

Cisco’s remaining performance obligations reached $42.9 billion in October, up 7.2% year-over-year. This backlog metric will signal whether AI deals continue converting to revenue.

Evercore analyst Amit Daryanani holds a Buy rating with a $100 price target. He highlighted Cisco’s Silicon One products including G200 and P200-based systems following the company’s AI Summit.

Options Activity Signals Volatility

Options traders expect a 6.22% move in either direction after earnings. That’s more than double the 3.01% average post-earnings move over the past four quarters.

The elevated implied volatility reflects investor uncertainty about AI order sustainability. Wall Street assigns a Strong Buy consensus with 10 Buy ratings and three Holds.

The average analyst price target of $91.30 implies roughly 6% upside. TipRanks’ AI Analyst rates the stock Outperform with a $96 target, citing solid fundamentals and positive technical indicators.

Cisco offers a 2.1% dividend yield. Management’s full-year fiscal 2026 guidance calls for $60.2 billion to $61.0 billion in revenue with EPS of $4.08 to $4.14.

The key questions for Wednesday’s call center on AI infrastructure momentum, enterprise spending trends, and whether management feels confident enough to raise full-year targets. Any hints of AI order delays or margin pressure could test the stock’s 37% run.

Investors will also watch for commentary on the competitive landscape after Tuesday’s chip announcement. Cisco disclosed over $2 billion in AI infrastructure orders during fiscal 2025 and has suggested the fiscal 2026 pipeline could exceed $3 billion.

The company ended Q1 with cumulative AI orders topping $2.1 billion. Converting that backlog into recognized revenue remains critical for sustaining growth and justifying the stock’s recent valuation expansion.

Crypto World

BNB & Toncoin Stall as BlockDAG’s Mainnet Goes Live! Here’s Why Traders Are Rushing to Secure 200x ROI Potential

The crypto market is in a bearish mood, and major coins are reflecting the trend. The Binance Coin price recently dipped to $643.38, showing weekly losses of nearly 15%. The Toncoin price is also sliding, trading below all key moving averages and facing persistent downward pressure.

Yet in the middle of all this volatility, one project is moving upward: BlockDAG (BDAG). The coin has quickly become the most popular cryptocurrency of the quarter, with major milestones ahead, including exchange listings on February 16 and today’s TGE event.

And its long-awaited mainnet has gone live today! Now, traders have a final chance to secure a 200× ROI in its last allocation phase, before the opportunity vanishes forever. Let’s explore the BNB and TON outlook and see why experts are calling BDAG a must-buy coin today.

Binance Coin Price Holds Despite Selling Pressure

The Binance Coin price has slipped to $643.38 now as overall crypto market activity has slowed. Now, the weekly losses are nearing 15%, signaling persistent selling pressure. Trading volume dropped sharply, yet long-term investors are holding their positions, closely watching for potential recovery opportunities. Analysts point out that BNB remains within a multi-year accumulation phase, with strong support around $421 and a deeper fallback near $305 if needed.

Historically, Binance Coin price surged in 2021 before entering a prolonged sideways consolidation. A recent breakout above this channel suggests the start of a potential bullish cycle. Medium-term targets sit near $1,385, while longer-term projections range from $2,000–$3,000, with speculative scenarios even reaching $10,000, though these remain probabilistic.

Toncoin Price Stuck Below Key Resistance

The Toncoin price is currently trading at $1.411, marking a weekly decline and staying below all major moving averages, MA-20 ($1.459), MA-50 ($1.596), and MA-200 ($2.308), showing persistent downward pressure. Technical signals, including MACD and ADX, point to continued selling, while RSI at 44 and an overbought Stochastic RSI suggest mixed short-term momentum.

The nearest support lies at $1.35, with resistance near $1.48, limiting the likelihood of a strong breakout. Over the coming week, Toncoin price is expected to trade sideways within this range, with further declines possible if support fails. Analysts note that without a decisive move above $1.48, bearish conditions may persist, though short-term range trading could continue between $1.35 and $1.48.

Mainnet Live: Why BlockDAG Is The Market Favorite Today

BlockDAG has quickly become the most popular cryptocurrency of 2026, fast approaching its exchange listings on Feb 16, less than a week away. And today marks a huge step in its launch roadmap: mainnet activation. The BlockDAG Mainnet is live, the network is fully operational, and real transactions are being verified on the BlockDAG Explorer. Now, holders just need to keep their presale wallet or linked dashboard ready for what comes next.

The Token Generation Event (TGE) also begins today on February 11, 2026.. The claiming process has kicked off. Users simply log in to the BlockDAG dashboard, connect their presale wallet, and select “Claim BDAG.” Tokens will be sent directly on-chain, no extra forms, no hidden fees, just standard gas costs. The portion unlocked at TGE depends on presale allocations, and any remaining tokens will automatically follow the vesting schedule.

Now, the final BDAG allocation is live at just $0.00025. Compared to the $0.05 launch price, buyers are looking at an instant 200× potential upside if they act before the TGE closes. Staking in the network is also tied to BDAG ownership. CEO Nicolaas David van den Bergh made it crystal clear in a recent Binance AMA: staking rewards are only for BDAG holders. No BDAG, no staking. No staking, no rewards.

Once claimed, BDAG can be traded, staked, or used according to vesting rules. This clear launch roadmap ensures everyone, from first-timers to seasoned traders, can confidently step into the mainnet and start earning. With the network processing its first real transactions today and 200× potential on the table, it’s a rare chance to join before BDAG hits exchanges and the price moves out of reach.

Final Thoughts

Right now, the Binance Coin price is hanging around make-or-break levels. Support near $421 is the main cushion if the market stays weak, while $305 is the last safety net if things turn rough. On the upside, a move toward $1,385 would be a strong sign that confidence is returning.

The Toncoin price action feels more bearish, staying below all its key averages. With $1.35 acting as the floor and $1.48 as the ceiling, TON looks set to drift sideways unless buyers step in with real conviction.

BlockDAG, on the other hand, is in a completely different league. With its mainnet live, TGE set for today on Feb 11, and exchange listings less than a week away, it’s clear why it ranks as the most popular cryptocurrency right now.

And the final allocation phase means there’s a rare chance to score 200x ROI. Simply put, with staking rewards, a clear launch plan, and a massive upside still on the table, BDAG isn’t just another promise; it’s the one opportunity that’s actually moving while others hit pause.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

When Will Bitcoin’s (BTC) Bear Market End? 4 AIs Predict the Turning Point

“Right now, we are in the confusion phase,” ChatGPT claimed.

Bitcoin (BTC) has been in an evident downtrend over the past few months, which intensified at the start of February. This caused analysts and market observers to claim that the asset has entered a bear market.

Investors are now perhaps curious to find out when that period will be over, so we consulted four of the most popular AI-powered chatbots to give their take on the matter.

Brace for Several More Months

According to ChatGPT, BTC is likely in the middle-to-late stage of the bear phase rather than the beginning. However, it suggested that there is a strong possibility for a final shakeout before entering a slow accumulation stage.

The chatbot pointed out that in previous cases, Bitcoin’s bear market has rarely ended dramatically, and its conclusion looked “quiet and uninteresting.”

“Right now, we are in the confusion phase – which historically is closer to the end than the beginning,” ChatGPT added.

Perplexity predicted that the bear phase could end in the second quarter of the year, assuming that the negative sentiment among investors lately has marked the bottom zone. Earlier this month, the popular Fear & Greed Index plummeted to “Extreme Fear” territory of 6, a level last observed in August 2019.

This reflects the panic across market participants following the recent decline; however, it may also be interpreted as a buying opportunity. After all, renowned investors and prominent figures, including Warren Buffett, have long advised that investors should step in when prices are collapsing and exit the ecosystem when “Greed” dominates.

According to Perplexity, the potential end of the bear market in Q2 might be followed by consolidation and a renewed bull run towards the end of 2026. It went even further, forecasting that BTC’s valuation could hit a new all-time high of around $150,000 before New Year’s Eve.

You may also like:

A Lot More Pain?

Grok, the chatbot integrated into the social media platform X, outlined a more pessimistic viewpoint. It claimed that the bears will remain in charge until the end of the year, adding that there might be a further crash to as low as $55,000. The chatbot warned that, in the event of a global geopolitical event, such as a major war, the price could tumble further than the depicted level.

Google’s Gemini presented a similar scenario. It expects subdued performance until late 2026 as the market prepares for the 2027-2028 run toward new peaks.

“If the current cycle follows the ‘four-year’ script, the absolute capitulation point (the ‘true bottom’) may not arrive until late 2026, especially around October or November,” it stated.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ault Capital Group Unveils Ault Blockchain Public Testnet

[PRESS RELEASE – Las Vegas, Nevada, February 11th, 2026]

Ault Capital Group today announced the public testnet launch of Ault Blockchain, a Layer 1 network designed for trading, settlement, and institutional-grade onchain infrastructure. This launch marks the first public release of the protocol and opens access to developers, infrastructure operators, and early network participants.

Ault Blockchain is built as a Cosmos-based Layer 1 with full Ethereum Virtual Machine compatibility, enabling Ethereum-native smart contracts and tooling to run without modification. The network is governed by Ault DAO, which oversees protocol rules, economic parameters, and long-term upgrades through onchain governance.

The public testnet provides a live environment for evaluating core network functionality, validator performance, and infrastructure design. This early access seeks community engagement and feedback by contributors who add value to the network’s development and stability.

In contrast to typical launch models, Ault Blockchain will not conduct a public token sale. Instead, the native AULT token will be distributed exclusively through a protocol-controlled emissions schedule tied to measurable network participation, including consensus security and licensed infrastructure operations rather than speculative activity.

Milton “Todd” Ault III, founder and executive chairman of Ault Capital Group, said: “Ault Blockchain was built the opposite way most networks are built. We started with real financial use cases and then designed the blockchain to support them. Participation is based on defined roles and verifiable work, not speculation, with transparent economics that are meant to support long-term network health from day one.”

The network launch is supported by a group of established infrastructure and development partners. B-Harvest serves as Ault Blockchain’s primary development partner, contributing to protocol engineering and core network architecture. Xangle focuses on development of Ault’s official explorers and relevant hubs.QuickNode provides RPC infrastructure to support network access and reliability. Finally Protofire supports Safe-related tooling across EVM environments.

Ault Blockchain introduces a licensed participation framework for infrastructure operators. Licensed Mining Nodes are authorized to perform defined off-chain services, beginning with cryptographic randomness at launch. In parallel, Proof-of-Stake validators and delegators secure network consensus and collect transaction fees under transparent, DAO-governed economics. After launch, the core team will shift its focus to the core team’s roadmap including spot trading on decentralized exchanges, lending services, perps trading, and other advanced workloads are being explored and may deploy over time as the network evolves.

Ault Blockchain’s testnet launch follows the completion of an initial protocol security audit and precedes further validator onboarding and ecosystem testing. Ault Blockchain’s mainnet launch will occur after additional testing milestones are met. At genesis, the chain will launch with its core protocol modules, EVM compatibility, an initial validator set, and onchain governance in place, marking a new era for institutional finance.

To learn more about Ault Blockchain, visit https://Aultblockchain.com and read project documentation to view the testnet scanner go to the following link . https://ault-evm-testnet.explorer.xangle.io/home

About Ault Blockchain

Ault Blockchain is a finance-first, institutional-grade Layer-1 blockchain designed to support trading, settlement, and data-driven workloads. Built on the Cosmos SDK with full Ethereum Virtual Machine compatibility, the network enables unmodified Ethereum smart contracts while providing fast finality and native cross-chain interoperability.

Governed onchain by Ault DAO and supported by a licensed infrastructure framework, Ault Blockchain aligns network economics with verifiable participation rather than speculative token distribution. With real-world financial and analytics applications launching from day one, Ault Blockchain is optimized for next-generation onchain finance.

About Ault DAO

Ault DAO is the decentralized governance body responsible for overseeing the Ault Blockchain protocol. The DAO was created by and is overseen by Ault DAO, LLC, a Wyoming DAO LLC. Through onchain governance, the DAO manages protocol parameters, validator participation, and network upgrades, ensuring transparent and community-driven decision-making aligned with the network’s long-term objectives.

About Ault Capital Group

Ault Capital Group is a diversified investment and holding company focused on technology-driven businesses, digital assets, and financial infrastructure. Through its operating companies and strategic investments, Ault Capital Group supports platforms across blockchain, data infrastructure, and emerging technologies. The firm emphasizes disciplined capital allocation and long-term value creation.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech14 hours ago

Tech14 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?