Crypto World

Why is crypto down? 6 key factors from Bitwise’s Matt Hougan

Bitcoin has taken a significant hit recently, falling 14% in a single day and 25% over the past week. And this bear market could extend for several months before it fully bottoms, according to Bitwise’s Matt Hougan.

Summary

- Bitcoin’s recent drop is driven by factors like investors preemptively adjusting to the four-year cycle, competition from AI and metals, and a major leveraged liquidation event.

- While the market has fallen 54% from its peak, previous downturns have been more severe, Hougan says.

- Regulatory progress and innovation will drive future growth, Hougan says. Fortune favors patient investors.

Although Bitcoin has shown a brief recovery, trading nearly 50% below its all-time high, investors are left grappling with questions: Why is the market down? Could it fall further? And when will it bottom?

6 key factors

According to Hougan, Bitwise’s chief investment officer, there are several complex reasons behind the current crypto market downturn, but six primary factors stand out.

- The Four-Year Cycle: A major reason for the pullback is that long-term investors have been selling to preemptively adjust for the four-year market cycle, where crypto sees strong bull years followed by inevitable pullbacks. Investors, wary of a repeat of previous cycles, have sold significant portions of their holdings—estimated to be over $100 billion in Bitcoin last year alone.

- Competition from Other Markets: Crypto has enjoyed significant retail interest, but now AI stocks and precious metals are pulling some attention away. “Attention investors,” who flocked to crypto in recent years, are now diverting their capital elsewhere.

- The October 10 Leverage Liquidation: The crypto market also faced the largest leveraged liquidation event in history following an unexpected announcement by former President Donald Trump. This event triggered panic selling in the absence of traditional market liquidity, further depressing prices.

- Concerns Over Federal Reserve Leadership: President Trump’s nomination of Kevin Warsh for Federal Reserve Chair raised concerns, particularly among investors who feared Warsh’s hawkish stance on interest rates, creating unease in broader markets, including crypto.

- Rising Fears of Quantum Computing: There’s a growing anxiety within the crypto community about the potential threat of quantum computing, which could undermine the security of Bitcoin. While many believe it’s a long-term issue, the lack of visible action has led some investors to retreat from the market.

- Macro Risk-Off Sentiment: A broader shift in global markets towards risk-off sentiment has affected Bitcoin. Alongside Bitcoin’s struggles, other assets like gold, silver, and tech stocks have also seen steep declines.

Could crypto fall further?

While the market’s current drawdown of 54% from its peak seems severe, Hougan cautions that it could go lower.

Previous downturns have been much larger—Bitcoin fell 86% in 2014, 84% in 2018, and 77% in 2022.

Historical trends suggest that bear markets typically last 12-13 months, so this current slump might not be over yet. However, given crypto’s maturing nature, a 77% drop seems unlikely, though it remains a possibility.

What could help it recover?

For many seasoned investors, this moment feels similar to past bear markets in 2018 and 2022, which were followed by massive rallies. Investors who bought the dip in those years saw substantial returns—around 2,000% from 2018 and 300% from 2022.

The fundamentals supporting crypto are still in place: a growing demand for digital currencies, increasing regulatory clarity, and innovations like tokenization and stablecoins continue to drive the sector forward.

The timing of the market bottom remains uncertain, but recovery often comes through time and exhaustion. Specific catalysts could accelerate recovery, such as regulatory developments like the Clarity Act, the continued rise of AI-linked crypto projects, or a return to risk-on market sentiment.

For now, Hougan advises patience. While it’s impossible to predict the exact moment the market will turn, the long-term outlook for crypto remains promising for those with the fortitude to weather the storm.

Crypto markets are volatile, and the current downturn could continue in the short term, Hougan adds. However, for investors with a long-term perspective, history suggests that bear markets often precede significant growth.

With key factors like regulatory advancements and growing adoption still in play, he argues that crypto’s future still holds substantial upside, making the current moment a potential buying opportunity for those prepared to wait.

Crypto World

China formalizes sweeping ban on crypto trading and RWA tokenization

China has moved to lock down virtually all crypto and real‑world asset (RWA) tokenization activity, issuing a new notice that declares such operations illegal financial activity and extends liability across the entire service stack.

Summary

- A joint PBoC notice declares Bitcoin, Ether, Tether and similar tokens lack legal tender status and brands all virtual‑currency business activity as illegal finance to be “resolutely banned”.

- RWA tokenization is swept into the same risk bucket, with onshore issuance and trading prohibited absent explicit approval and offshore entities barred from serving mainland users.

Core of the new notice

The joint circular from the People’s Bank of China (PBoC) and seven other ministries states bluntly that “virtual currency does not have the same legal status as legal tender” and that tokens such as “Bitcoin, Ether, Tether…do not have legal compensation and shall not and cannot be used as currency in the market.” All “virtual currency‑related business activities” — including fiat–crypto exchange, crypto–crypto trading, market‑making, information intermediation, token issuance and crypto‑linked financial products — “are illegal financial activities” and are to be “strictly prohibited” and “resolutely banned.”

Real‑world asset tokenization is folded into the same risk bucket. Authorities define RWA tokenization as converting ownership or income rights into tokens for issuance and trading, and warn that such activities in China “shall be prohibited” unless explicitly approved on designated financial infrastructure. Offshore entities are also barred from “illegally providing…RWA tokenization‑related services” to onshore users.

Enforcement, mining and offshore routes

The notice hardens the multi‑agency framework first laid out in 2021’s Yinfa No. 237, which labeled key crypto activities as illegal and banned offshore exchanges from serving mainland clients. Financial institutions and payment firms are now forbidden from opening accounts, transferring funds, settling, custoding, or insuring any virtual‑asset‑linked product. Internet platforms may not provide “online business venues, commercial displays, marketing, traffic‑buying or paid promotion” for crypto or RWA services and must help shut down relevant websites, apps and public accounts.

Beijing also renews its campaign against mining, ordering provinces to “comprehensively identify and shut down existing virtual currency ‘mining’ projects” and “strictly prohibit” any new capacity. On offshore structuring, regulators apply a “same business, same risk, same rules” principle: domestic entities and the overseas vehicles they control may not issue virtual currencies or conduct RWA‑style securitizations based on onshore assets without prior approval, filing or registration.

Market context and price action

The clampdown lands in a market where global traders continue to treat digital assets as high‑beta macro risk. Bitcoin (BTC) trades near $66,005, down roughly 7.9% over the last 24 hours. Ethereum (ETH) changes hands around $1,890, lower by about 11.6% on the day. Solana (SOL) sits near $77.8, off approximately 15.4% in 24‑hour terms.

The notice takes immediate effect and simultaneously repeals the landmark 2021 circular on virtual‑currency speculation, signaling that China’s stance has shifted from episodic crackdowns to a durable, high‑pressure regime designed to “maintain economic and financial order and social stability” and leave no grey zone for crypto or RWA experimentation.

Crypto World

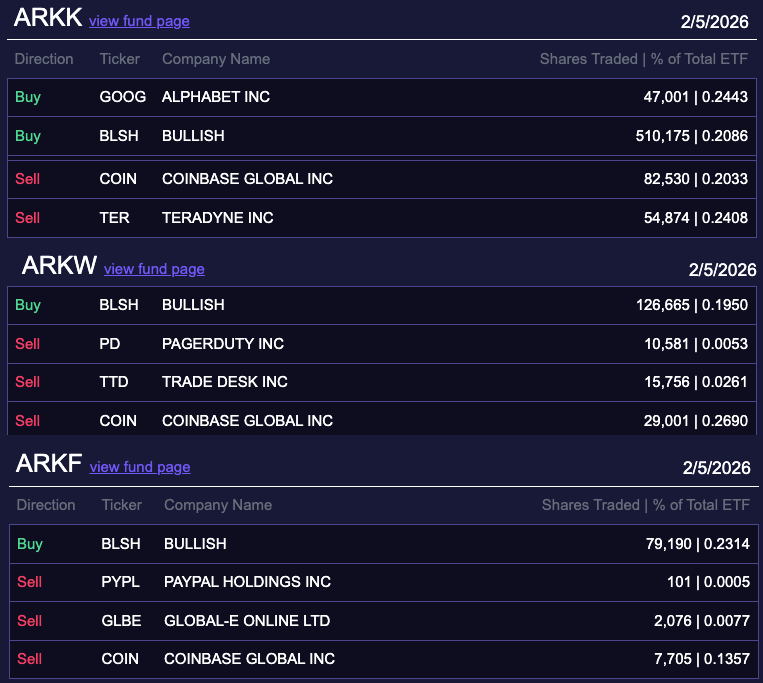

ARK Invest Sells Coinbase And Buys Bullish Shares

ARK Invest, the asset manager led by prominent Bitcoin bull Cathie Wood, has shifted from buying to selling Coinbase stock, as the shares dipped 13% and hit multi-month lows.

On Thursday, ARK offloaded 119,236 Coinbase (COIN) shares, valued at roughly $17.4 million, according to a trade filing seen by Cointelegraph.

The sale comes just a day after a modest 3,510-share ($630,000) purchase on Tuesday, following a series of buys at higher prices earlier in 2026.

This marks ARK’s first Coinbase sale of 2026 and its first since August 2025, signaling a shift in trading strategy. The cryptocurrency exchange’s stock is down around 37% year-to-date, according to Nasdaq data.

ARK sold Coinbase and bought Bullish

ARK spent almost the same amount it dumped in Coinbase shares to acquire 716,030 shares ($17.8 million) in Bullish (BLSH), an institution-focused digital asset platform that listed on the New York Stock Exchange in August 2025.

Since the trading launch, Bullish shares had slumped more than 60% to $24.9 on Thursday’s close, according to NYSE data.

Related: BlackRock’s IBIT hits daily volume record of $10B amid Bitcoin crash

ARK was one of the largest buyers of Bullish’s IPO, alongside investment giant BlackRock.

ARK holds $312 million in Coinbase stock

ARK’s latest Coinbase sale comes amid a sharp crypto market pullback, with Bitcoin (BTC) dipping below $70,000 on Thursday to briefly touch $60,000 on Friday.

For ARK, a major backer of Coinbase during tough market conditions, the move marks a notable reversal.

To date, ARK still holds $312 million in Coinbase shares across its three funds — the ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF), with COIN representing 3.7%, 3.4%, and 4.95% of each fund, respectively.

Since its April 2021 trading debut, Coinbase stock has fallen about 60%, from an opening price of $381, according to Nasdaq data.

Magazine: Bitcoin’s ‘miner exodus,’ UK bans some Coinbase crypto ads: Hodler’s Digest, Jan. 25 – 31

Crypto World

Bitcoin Traders Say $58K is Key as Dip-Buyers Help BTC Rebound 11%

Bitcoin (BTC) rebounded above $65,000 on Friday, up 11% from 15-month lows below $60,000, as focus shifted to institutional dip buyers.

Key takeaways:

-

Bitcoin finally sees investors who are willing to “buy the dip” as prices dropped to sub-$60,000 levels.

-

Traders have shifted their focus to $58,000 as the last line of defense for Bitcoin.

Bitcoin wipes out $1.1 billion longs on drop to $59,000

Bitcoin price fell as low as $60,000 on Thursday, erasing 15 months of bullish gains as investors accumulated more at lower levels.

This extended the drop from its all-time high of $126,000 reached on Oct. 6, 2025, to 50% and was accompanied by massive liquidations across the derivatives market.

Related: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Data from monitoring resource CoinGlass showed crypto liquidations over 24 hours nearing $2.6 billion, with longs accounting for $2.15 billion. Bitcoin accounted for $1.1 billion in long liquidations.

Bitcoin dip-buyers finally emerge

Binance’s Secure Asset Fund for Users (SAFU), an insurance fund established by Binance in July 2018 to protect users’ assets, bought another 3,600 BTC worth $250 million at about $65,000 per BTC.

Last week, Binance announced its intention to convert $1 billion SAFU reserves into Bitcoin over the next 30 days.

The first batch of 1,315 BTC, worth about $100 million was bought earlier this week, leaving $565 million more to be converted.

Crypto hedge funds have also been buying the dip, data from Bitwise shows.

The aggregate market beta across all global crypto hedge funds hit its “highest level in 2 years” as Bitcoin weakened, European head of research at Bitwise André Dragosch said in a Friday post on X, adding:

“This signals increasing $BTC market exposure by global crypto hedge funds.”

Dragosch also said that record ETF volumes amid moderate net outflows on Thursday suggested that there “were lots of dip buying” by US-based spot Bitcoin ETFs as well.

200-week MA: Bitcoin’s last line of defense?

BTC touched lows below $60,000, leaving traders to question where Bitcoin was likely to find a bottom.

“$BTC is testing the previous cycle highs, and bouncing slightly so far,” said trader Jelle in a Friday post on X.

According to Jelle, Bitcoin was required to hold a key area of interest between $58,000 and $62,000 to avoid a deeper correction.

“Time to see if we start basing here, or if we just roll over again.”

The $58,000 level coincides with the 200-day SMA, a key support level for BTC price, according to MN Capital founder Michael van de Poppe.

Given that Thursday’s $10,000 drop was the largest volume candle on record, the “assumption can be made that we hit the low there, for now,” van de Poppe said, adding:

“If prices can rally up slightly, we’re going to see a large wick. Like we always see with capitulation events.”

As Cointelegraph reported, Bitcoin’s demand zone now sits above $58,000, supported by historic transaction volume and the 200-week moving average.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

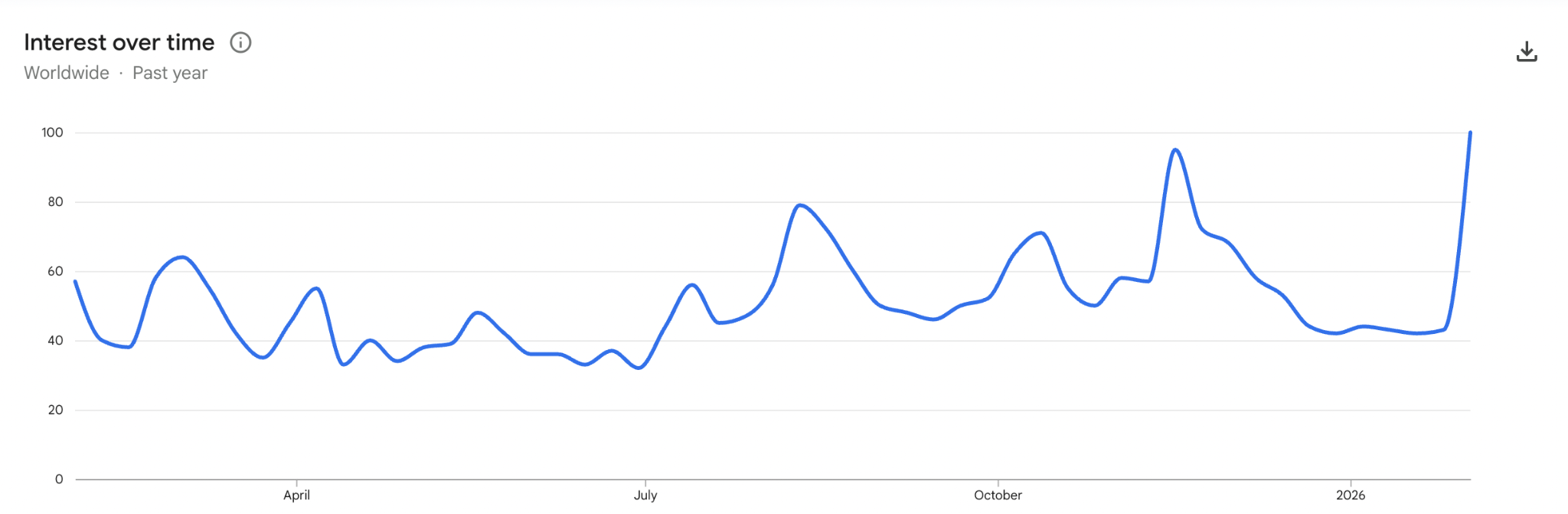

Google Search Volume For ‘Bitcoin’ Surges Amid $60K Plunge

Google search volume for the term “Bitcoin” surged over the past week as the asset’s price briefly fell to the $60,000 level for the first time since October 2024.

Google Trends provisional data shows worldwide searches for “Bitcoin” reached a score of 100 for the week starting Feb. 1, the highest level in the past 12 months.

The previous peak was a score of 95 in the week of Nov. 16–23, when Bitcoin (BTC) slipped below the psychological $100,000 level for the first time in nearly six months.

Google search interest is one of several commonly used indicators among crypto analysts to gauge retail interest in Bitcoin and the broader crypto market, which typically spikes during significant price moves, particularly major rallies to new all-time highs or sudden sell-offs.

The increase comes as Bitcoin dropped from about $81,500 on Feb. 1 to roughly $60,000 within five days, before rebounding to $70,740 at the time of publication, according to CoinMarketCap.

Some market observers suggest the current price range may be drawing renewed attention from a broader retail audience. Bitwise head of Europe, André Dragosch, said in an X post on Saturday, “Retail is coming back.”

Meanwhile, CryptoQuant’s head of research, Julio Moreno, said in an X post on Saturday that US investors are buying Bitcoin after it reached $60,000. “The Coinbase premium is now positive for the first time since mid-January,” Moreno said.

Other indicators suggest that investors are still cautious about the crypto market. The Alternative.me Crypto Fear & Greed Index fell further down once again on Saturday to an “Extreme Fear” score of 6, nearing levels that haven’t been seen since June 2022.

Related: Crypto’s stress test hits balance sheets as Bitcoin, Ether collapse

The sentiment indicator’s decline to such low levels has led some market participants to suggest it could signal a buying opportunity.

Crypto analyst Ran Neuner said in an X post on Friday that, “every single metric is telling you that Bitcoin has never been more undervalued on a relative basis.”

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Perp DEX traders face Hyperliquid, Aster, edgeX, Lighter volume surge

Perpetual DEXs processed over $70B on Feb. 5, their second‑biggest day ever, as Hyperliquid, Aster, edgeX and Lighter absorbed a sharp BTC, ETH, SOL‑led deleveraging.

Summary

- Per DeFiLlama, perp DEXs cleared $70B+ on Feb. 5, second only to the Oct. 10, 2025 “1011” crash that saw $19B in liquidations and sent BTC from $117,000 to $101,800.

- Hyperliquid handled $24.699B (about 31% share) in 24 hours, Aster $11.553B (~14.6%), edgeX $8.675B (~11%), and Lighter $7.537B (~9.5%), with edgeX alone credited with $600B+ in cumulative volume and over $1B in OI.

- As BTC hovered near $64,000, ETH in the high $1,800s, SOL around $79–80, and XRP near $1.37, perp DEXs proved to be a primary venue where leveraged crypto risk is warehoused and unwound.

Perpetual DEXs just printed their second-biggest day on record, turning a brutal sell-off into a stress test that DeFi largely passed.

Volume shock and “1011” shadow

According to DeFiLlama data, perp DEXs processed more than $70 billion in volume on Feb. 5, the second-highest daily tally in history and only behind the Oct. 10, 2025 “1011” flash crash. That earlier event saw over $19 billion in liquidations in a single day and sent Bitcoin from roughly $117,000 to $101,800, cementing “1011” as a structural stress event for crypto leverage.

On Feb. 5, the pain was smaller but the pipes were busier. Hyperliquid led with roughly $24.7 billion in 24-hour volume, Aster followed at about $10–11.6 billion, edgeX cleared around $8.7 billion, and Lighter handled roughly $7.5–7.5+ billion, according to DeFiLlama’s perp dashboard. Together, those four accounted for well over half of all perpetual DEX turnover.

Hyperliquid, Aster, edgeX, Lighter

Per DeFiLlama’s breakdown, Hyperliquid captured about 31% of total perp DEX volume over the last 24 hours, with a 24-hour print of $24.699 billion and roughly $248.1 billion traded over 30 days. Aster posted about $11.553 billion in daily volume, up 112% on the day and representing roughly 14.6% of total perp flows. edgeX processed $8.675 billion (+66.3% daily) for nearly 11% share, while Lighter’s $7.537 billion (+86.9% daily) translated into about 9.5% of the market.

These venues are increasingly driven by incentives and points programs, with edgeX for instance already credited with more than $600 billion in cumulative user trading volume and over $1 billion in open interest in recent campaigns. Volumes of this scale suggest a core mix of BTC, ETH and SOL perps, plus high-beta altcoin pairs that traders use to express directional and basis views; during sharp drawdowns, BTC-USD, ETH-USD and SOL-USD contracts typically dominate notional flow and liquidations, while long-tail pairs add convexity but less absolute size.

Market backdrop and major coins

Spot and perp flows met in a classic deleveraging move. Bitcoin traded near $64,000 on Feb. 6, down around 11–12% over 24 hours in some market snapshots. Ethereum hovered in the high $1,800s, after a multi-week slide from above $3,000 and with technicians now eyeing the $1,600–2,000 band as a key trading range. Solana changed hands around $79–80, off roughly 14% on the day, with a 24-hour range between about $70.6 and $92.8. XRP traded near $1.37, with a 24-hour low of $1.14 and high around $1.38.

What this day signals

The Feb. 5 spike shows perp DEXs are no longer a niche hedge; they are where a large chunk of leveraged crypto risk is now warehoused and unwound. Compared with “1011,” the latest sell-off generated less outright liquidation carnage but pushed structurally higher volumes through Hyperliquid, Aster, edgeX and Lighter, underscoring how much directional positioning has migrated on-chain in under 18 months.

Crypto World

Is $1 the next stop?

Crypto volatility has hit XRP hard, with macro worries and geopolitical tension putting traders on edge. The most recent drop has pushed the token near a major support level.

Next up, we’ll examine the market and provide our latest XRP price prediction.

Summary

- XRP has recently dropped over 20%, briefly touching $1.13 before recovering to around $1.40.

- The token remains under pressure from macroeconomic uncertainty, geopolitical tensions, and weak spot XRP ETF demand.

- Traders are watching key U.S. economic data, including the February 11 jobs report and February 13 CPI figures, for market guidance.

- In the short term, XRP is expected to trade sideways between $1.13 and $1.50.

- If selling resumes, XRP could test the psychologically important $1.00 level, keeping the overall outlook cautious.

Current market scenario

When investors shun risk, Ripple (XRP) usually takes a bigger hit than Bitcoin, highlighting how sensitive it is during sell-offs. Its lower levels of institutional participation make it more exposed when the market turns cautious. Right now, the XRP price is hovering around $1.40 as traders watch for early signs of renewed buying, but spot demand has remained fairly muted so far.

Over the past month, XRP has been on a steady downtrend, losing nearly 40% alongside the broader crypto market. Another sharp 20% drop this past week suggests that liquidation pressure from recent sell-offs might not yet be fully digested, keeping volatility elevated.

The market is still feeling the impact of macro and geopolitical tensions. Heightened fears of a strike on Iran have triggered risk-off moves, weighing on Bitcoin and altcoins such as XRP. At the same time, spot XRP ETFs are seeing less demand as investors hold back.

Traders are now eyeing key U.S. economic data that could influence the next major market shift. The January jobs report comes out on February 11, with CPI data following on February 13. Both releases were pushed back due to a brief government shutdown, and either could impact crypto prices.

XRP price prediction: Key levels to watch

It’s been a rough few days for XRP, which lost more than 20% and briefly dipped to $1.13 on Friday — a level not seen since early November 2024. XRP has recovered a bit, yet renewed selling could push it closer to the psychologically significant $1.00 mark.

After the big sell-off, the market appears ready to catch its breath rather than rally straight away. Traders seem hesitant to put fresh money to work until macro data offers more clarity. In this scenario, the XRP forecast points to a period of sideways, range-bound movement.

During a sideways trading period, XRP is likely to remain between $1.13 and $1.50 for the time being. A drop below this range would raise the risk of additional downside, while a move above $1.50 could hint at a potential rebound. All in all, the XRP outlook stays cautious as macro uncertainty continues to dominate the market.

Crypto World

NFT Sales Fall to $58M as Crypto Market Weakness Continues

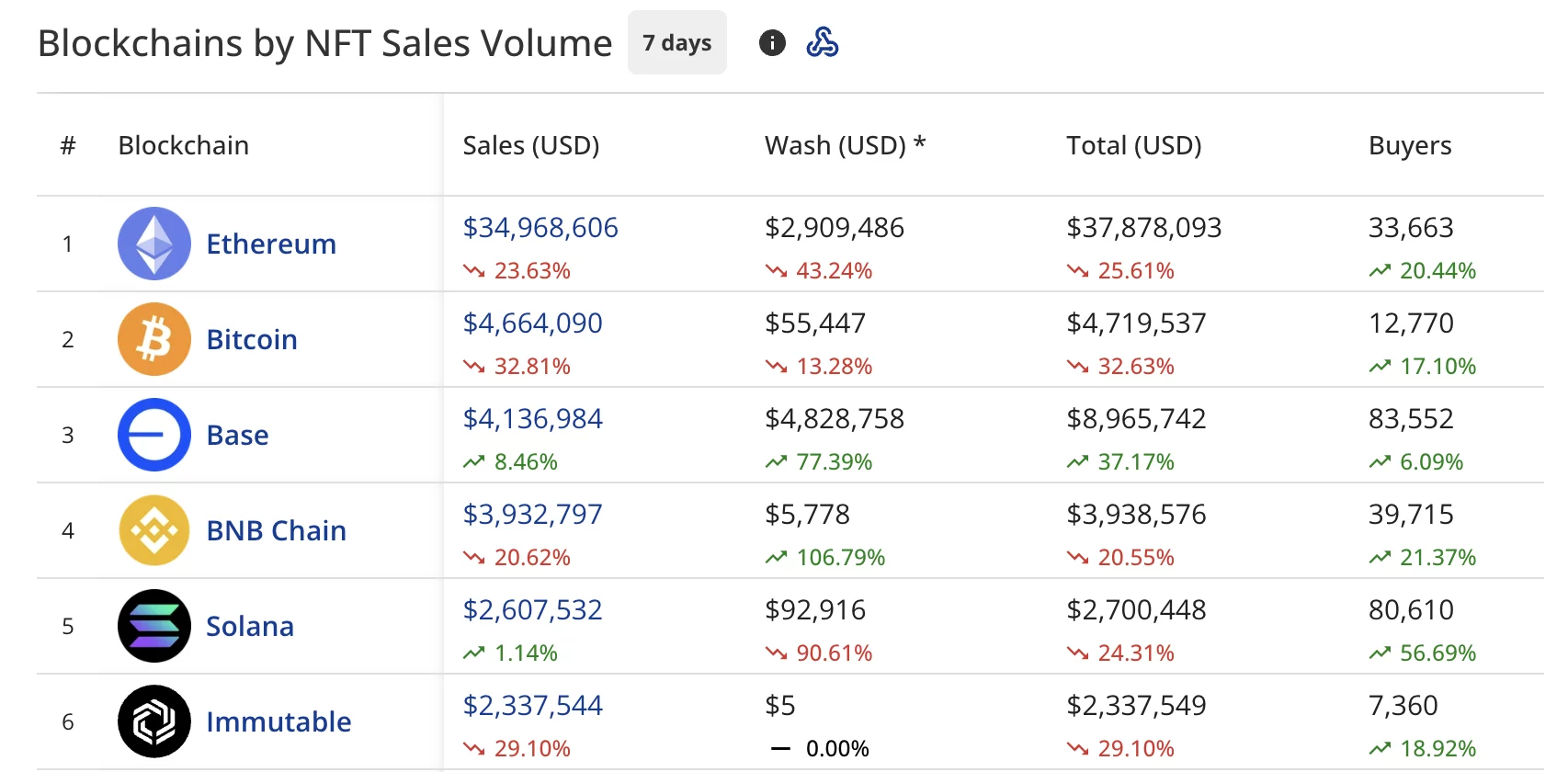

The NFT market recorded $58.34 million in sales volume over the past week, falling 20.34% from the previous period.

Summary

- NFT sales hit $58.34M, down 20%, despite buyers and sellers both rising over 20%.

- Ethereum led with $34.9M in sales, while Bitcoin NFT volume fell 33% week-over-week.

- CryptoPunks rebounded sharply, surging 147% and dominating high-value NFT sales.

NFT buyers climbed 21.97% to 296,018, while sellers jumped 24.63% to 270,495. Transaction volume decreased 4.33% to 660,674.

The overall crypto market has taken a notable hit as Bitcoin (BTC) has dropped to the $70,000 level, while Ethereum (ETH) hovers around $2,000.

The global crypto market cap now stands at $2.41 trillion, down from last week’s $2.83 trillion. This market downturn continues to pressure the NFT sector, with weekly sales volume falling for the second consecutive week.

Ethereum leads with $34.9 million despite decline

Ethereum continued to dominate all blockchains with $34.97 million in NFT sales, dropping 23.63% over the seven-day period.

The network drew 33,663 buyers, up 20.44% from the prior week. Wash trading on Ethereum totaled $2.91 million during this timeframe.

Bitcoin secured second place among blockchains with $4.66 million in sales, falling 32.81% week-over-week. The network attracted 12,770 buyers, up 17.10% despite the sales decline.

Base claimed third position at $4.14 million in sales, climbing 8.46% and drawing 83,552 buyers who rose 6.09%.

BNB Chain (BNB) ranked fourth with $3.93 million in sales, declining 20.62% while seeing 39,715 buyers who increased by 21.37%.

Solana (SOL) rounded out the top five with $2.61 million in sales, posting a modest 1.14% gain and drawing 80,610 buyers who surged 56.69% from last week.

Immutable (IMX) dropped to sixth position at $2.34 million, down 29.10%.

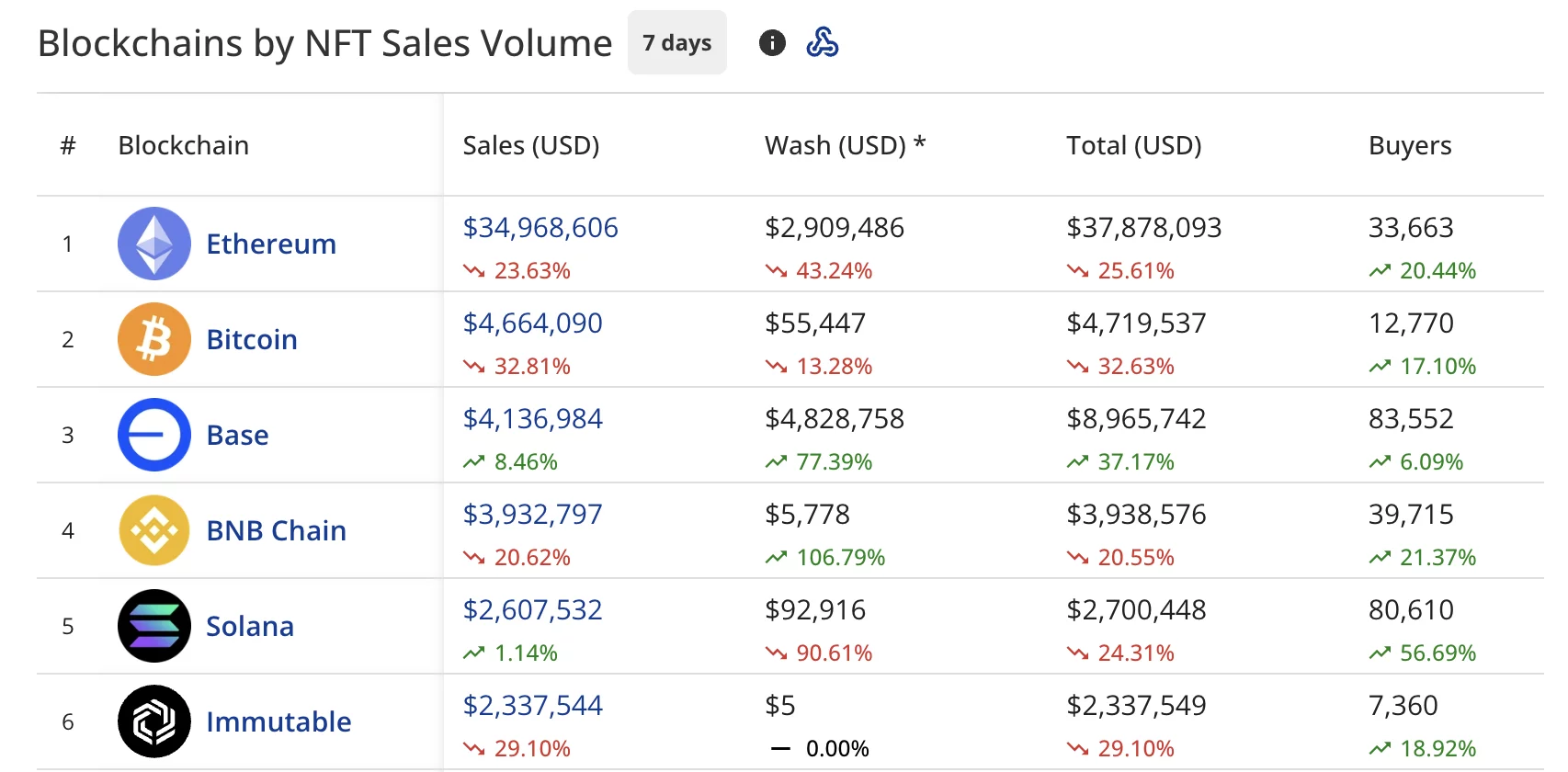

Flying Tulip PUT retains lead, CryptoPunks surge

Flying Tulip PUT on Ethereum maintained its dominance in the collection rankings with $11.41 million in sales, plummeting 49.06% from last week’s performance. The collection processed 530 transactions from 259 buyers.

CryptoPunks on Ethereum claimed second place with $4.71 million in sales, surging 146.56% over the week after last week’s 52.35% decline.

The blue-chip collection completed 69 transactions from 44 buyers, with both metrics more than doubling week-over-week.

A Base collection took third position with $2.11 million in sales, climbing 15.82%. Pudgy Penguins posted $2.09 million in sales, down 6.96%, while Bored Ape Yacht Club recorded $1.90 million with a 59.79% surge.

TokenVestingPlans on Ethereum landed in sixth with $1.65 million, climbing 67.85%, while Guild of Guardians Heroes rounded out the top seven with $1.50 million, down 22.82%.

CryptoPunks dominate high-value NFT sales

CryptoPunks dominated the week’s highest-value sales, claiming three of the top five spots.

- CryptoPunks #5402 led with $265,585 (113.5 ETH) four days ago.

- CryptoPunks #9170 at $139,761 (72 ETH) just 14 hours ago.

- Wrapped Ether Rock #98 sold for $109,128 (109,127.7422 USDC) seven days ago.

- Autoglyphs #256 fetched $105,512 (50 ETH) two days ago.

- CryptoPunks #1112 rounded out the top five at $92,850 (48.48 ETH) one day ago.

Crypto World

Accommodative Macro Policies May Not Be Bitcoin’s Next Big Catalyst

Bitcoin’s next major catalyst may come from a sharp rethinking of how rate policy interacts with the crypto market. In a recent discussion, ProCap Financial chief investment officer Jeff Park challenged the conventional view that Bitcoin’s bull case is tied primarily to falling interest rates. Park argued that more accommodative monetary conditions might not automatically propel a sustained rally, and that investors should prepare for a world where macro policy shifts could still support risk assets even as rates move higher. The remarks come ahead of a broader dialogue about how liquidity, yields, and central-bank signaling shape Bitcoin’s price trajectory in a regime of evolving financial dynamics. Park spoke with Anthony Pompliano on The Pomp Podcast, highlighting a nuanced take on the macro setup and the potential implications for crypto markets.

Key takeaways

- The traditional link between easing policy and Bitcoin bulls may not hold in all macro regimes; accommodative cycles might not be the sole engine for a long-term upside.

- Jeff Park envisions a scenario where Bitcoin could rise even as the Federal Reserve tightens, describing it as a potential “positive row Bitcoin” that defies the standard QE-driven narrative.

- Park cautions that a shift away from the conventional risk-free-rate framework could upend how yields are priced and how the dollar’s global role influences markets.

- Traders are already encoding rate-cut expectations into probabilities, with 2026 Fed cuts suggesting a non-negligible chance of policy easing later in the decade, even as rate paths remain uncertain.

- Bitcoin’s current price action shows a pullback over the past month, underscoring the ongoing tension between macro expectations and crypto liquidity.

- The discussion positions Bitcoin within a broader critique of the monetary system and the relationships between the Fed, the Treasury, and yield curves.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. Bitcoin’s recent price action shows a notable 30-day decline, signaling short-term pressure even as a broader narrative contemplates alternative catalysts.

Trading idea (Not Financial Advice): Hold. The argument rests on a contested macro thesis that requires confirmation through further data and policy signals.

Market context: The debate sits at the intersection of liquidity dynamics, interest-rate expectations, and the evolving interpretation of the dollar’s global role, which together influence risk assets beyond traditional equities and bonds.

Why it matters

The discussion around accommodative policy as a potential non-linear catalyst for Bitcoin shifts the lens through which investors view crypto cycles. If Bitcoin can navigate higher rates without losing momentum, it suggests that its price sensitivity to macro signals may be more nuanced than a straightforward risk-on/risk-off dichotomy. Park’s thesis hinges on a broader reevaluation of the appeal of crypto assets in a world where central banks recalibrate the cost of capital, inflation expectations, and liquidity provisioning. In practical terms, this could widen the set of scenarios in which Bitcoin remains attractive, notably during periods when traditional assets such as bonds offer diminishing returns while crypto markets exhibit resilience or selective risk-taking.

The remark also touches on the structure of the monetary system itself. Park argues that the existing framework—where the Fed and the Treasury influence yields and debt dynamics—may be strained, potentially altering how investors price risk and the carry associated with various assets. In such a context, Bitcoin could serve as a hedging instrument or a speculative vehicle that benefits from a re-balancing effort among macro players. The core idea is not a guaranteed rally on rate rises, but a possibility that a different set of incentives could emerge, enabling Bitcoin to find new footing in a shifting monetary landscape.

From a trading perspective, the argument emphasizes that the “risk-free rate” concept might be less stable than traditionally assumed. If the dollar’s dominance wanes or if yield curves re-price in unexpected ways, Bitcoin’s narrative may detach from conventional rate-driven logic and align more with liquidity preferences, cross-asset flows, or macro resilience. The conversation about a hypothetical “endgame” for Bitcoin—where price appreciation accompanies higher rates—rests on a broader willingness among investors to entertain non-traditional drivers of value in a complex, evolving financial system.

Amid the discourse, markets are still processing concrete data points. On Polymarket, a predicting market for Fed policy, traders assign a tangible probability to three rate cuts in 2026, pegging it at 27%. While not a forecast, such market-implied expectations illustrate how investors are betting on the policy path even as the near-term trajectory remains uncertain. In the meantime, Bitcoin trades around $70,503, reflecting a roughly 22% slide over the last 30 days, according to CoinMarketCap. The pullback underscores the tension between a theoretical macro thesis and the practical realities of price action driven by liquidity, risk sentiment, and short-term demand-supply dynamics.

Within the broader crypto discourse, the idea that Bitcoin’s price could rise in a rising-rate environment appears as a provocative counter-narrative to widely cited relationships. The conversation echoes previous market observations that Bitcoin’s behavior can be as much about macro structural shifts as about policy tempo. For readers tracking the latest developments, a related analysis by Cointelegraph looked at how Bitcoin price moves relate to demand dynamics during dips, offering a backdrop to understanding who is buying during pullbacks and how institutions view the risk-reward calculus in a volatile sector.

As the debate evolves, observers will watch how signals from policymakers, changes in fiscal-miscal policy interactions, and shifts in global liquidity influence the asset class. The tension between a traditional inflation-targeting toolkit and an expanded crypto market narrative could produce a more multi-faceted set of catalysts for Bitcoin beyond the simple rate-cut/hold dichotomy. The coming months will be telling as investors reconcile the theoretical constructs with the data that materialize in price, on-chain metrics, and macro indicators.

What to watch next

- Monitor Fed communications and policy guidance for 2026 to assess whether rate-cut expectations become more entrenched in markets.

- Track Bitcoin price action around macro data releases and liquidity shifts to gauge whether the asset displays resilience in higher-rate environments.

- Follow commentary from policy analysts and market participants on the viability of the “positive row Bitcoin” thesis and how it aligns with yield-curve dynamics.

- Observe any changes in dollar strength or cross-border capital flows that could influence crypto liquidity and risk appetite.

- Review studies or forecasts that contextualize Bitcoin within a broader monetary-system critique, particularly regarding the Fed-Treasury relationship and the pricing of risk.

Sources & verification

- The interview with Jeff Park on The Pomp Podcast via YouTube: https://www.youtube.com/watch?v=bZfsLFGz4hE

- Bitcoin price data and 30-day performance referenced by CoinMarketCap: https://coinmarketcap.com/currencies/bitcoin/

- Polymarket predictions for Fed rate paths (2026): https://polymarket.com/event/how-many-fed-rate-cuts-in-2026

- Related coverage on Bitcoin price action and market activity: https://cointelegraph.com/news/bitcoin-price-rebounds-65k-who-is-buying-the-dip

Market reaction and the evolving Bitcoin rate thesis

Bitcoin (CRYPTO: BTC) sits at the center of a debate about how macro policy interacts with digital-asset pricing. Jeff Park, the CIO of ProCap Financial, argues that the old playbook—rates falling to boost liquidity and lift risk assets—may be insufficient to describe the next phase of Bitcoin’s journey. In the discussion with The Pomp Podcast, Park suggested that ultra-loose policy is not a guaranteed passport to a sustained bullish cycle. Instead, he sees a scenario where Bitcoin can appreciate alongside a rising rate environment if macro conditions, liquidity regimes, and investor risk appetites evolve in unanticipated directions.

At the heart of Park’s argument is a contrarian view of the so-called “endgame” for Bitcoin. He describes a possible state, which he terms a “positive row Bitcoin,” where the asset climbs even as the Federal Reserve tightens, challenging the conventional wisdom of QE-driven crypto appreciation. Such a world would require a recalibration of the way markets price risk and a rethink of the role that the risk-free rate plays in the crypto narrative. The notion rests on a broader revaluation of the monetary order, especially the dynamics between the dollar’s global dominance and the pricing of long-dated yields in a system that may no longer follow textbook relationships.

Park underscores that the monetary system is not operating as it once did. He argues that the interplay between the Fed and the U.S. Treasury has moved beyond the familiar playbook, complicating how investors price the yield curve and assess the relative attractiveness of different asset classes. In this framework, Bitcoin’s appeal could be anchored not only in optimism about adoption or censorship resistance but also in a nuanced reassessment of risk, liquidity, and the sequence of policy actions. If central-bank signaling, fiscal policy, and market expectations diverge from historical patterns, then Bitcoin’s performance could diverge from the conventional correlation with rate movements.

Market participants are already weighing these possibilities against current price realities. Bitcoin’s price of around $70,503 and its 30-day decline of roughly 22.5% reflect a market navigating uncertainty about policy direction, liquidity, and macro risk sentiment. The presence of a forward-looking probability for rate cuts in 2026—27% on a Polymarket track—signals that traders are trying to parse a possible shift in the policy landscape even as the near-term trajectory remains unresolved. In this context, the coin remains a focal point for discussions about how crypto assets respond to evolving macro conditions, rather than simply reacting to immediate rate moves.

While the thesis invites cautious optimism about Bitcoin’s resilience in a higher-rate environment, it also invites scrutiny about the assumptions underpinning the narrative. The timing, magnitude, and persistence of any rate adjustments, as well as the broader spectrum of liquidity and market participation, will be critical. The discussion continues to unfold in the public sphere, with analysts and investors closely watching policy signals, macro data, and on-chain indicators to determine whether the “positive row” scenario could materialize or remain a theoretical construct. In the meantime, observers should acknowledge that the path for Bitcoin remains contingent on a confluence of factors, including central-bank decisions, fiscal policy evolution, macro resilience, and the evolving psychology of risk in a shifting financial system.

Crypto World

How Low Can Pi Network’s PI Go? Shocking Bear-Market AI Scenarios After the Latest ATLs

After several consecutive all-time lows, where is PI’s bottom and how deep can it plunge?

It has been just under a year since the controversial project’s native token began trading on several exchanges. The journey so far has been quite underwhelming for investors, who saw the PI token rocket to an all-time high of $2.99 in late February 2025 and then experienced what can only be described as a massive cataclysmic nosedive.

PI dumped by more than 95% in less than a year. The past few weeks have been particularly painful as the token crashed to consecutive all-time lows, with the latest being at $0.1338 (on CoinGecko) after a 40% decline in a month. Although it has recovered slightly to nearly $0.145, overall sentiment has taken its toll, and the question is whether PI will drop even further.

New ATLs Ahead?

To gain a different perspective on the matter, we asked ChatGPT and Gemini. OpenAI’s alternative explained that PI’s inability to respond positively to recent network updates, which we have repeatedly highlighted, is a clear sign that its market structure and supply dynamics are dominating overall sentiment.

The steady decline to new lows suggests that the selling pressure remains persistent, the speculative demand is weak, and there’s insignificant external capital entering the market.

“Unlike more established altcoins, PI lacks deep liquidity buffers. When selling accelerates, price discovery to the downside can happen fast – as the recent crash demonstrated,” ChatGPT added.

It outlined a few scenarios ahead for PI, with the extreme bear-case predicting a massive plunge to $0.06-$0.08. This “true capitulation phase” would be possible if the token unlock pressure continues, liquidity remains thin, and the broader market sentiment deteriorates even further.

However, ChatGPT reiterated that this is an extreme scenario. Instead, it envisions a more likely decline to $0.10 before the token can bottom out and find more solid support.

Or Even Worse…

Gemini said the daily chart for PI paints a clear “stairway to hell” picture ever since it broke down beneath $0.20. Interestingly, it was even more bearish on PI’s future price performance since the token is now in “no man’s land” below $0.15.

You may also like:

If the asset fails to reclaim $0.16 by the end of the week, the next major technical liquidity pool sits at $0.05-$0.06, which would be another 65% crash from current levels. There’s another, even worse path ahead, which Gemini called “the zombie chain scenario.”

In it, PI would dump below $0.05 and will effectively become a “zombie coin” – high holder count, zero trading volume, and interest. However, the current odds for such a mindblowing crash are below 20%, Gemini explained, as it would require full investor capitulation, sell-offs by the Core Team, and overall market collapse.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

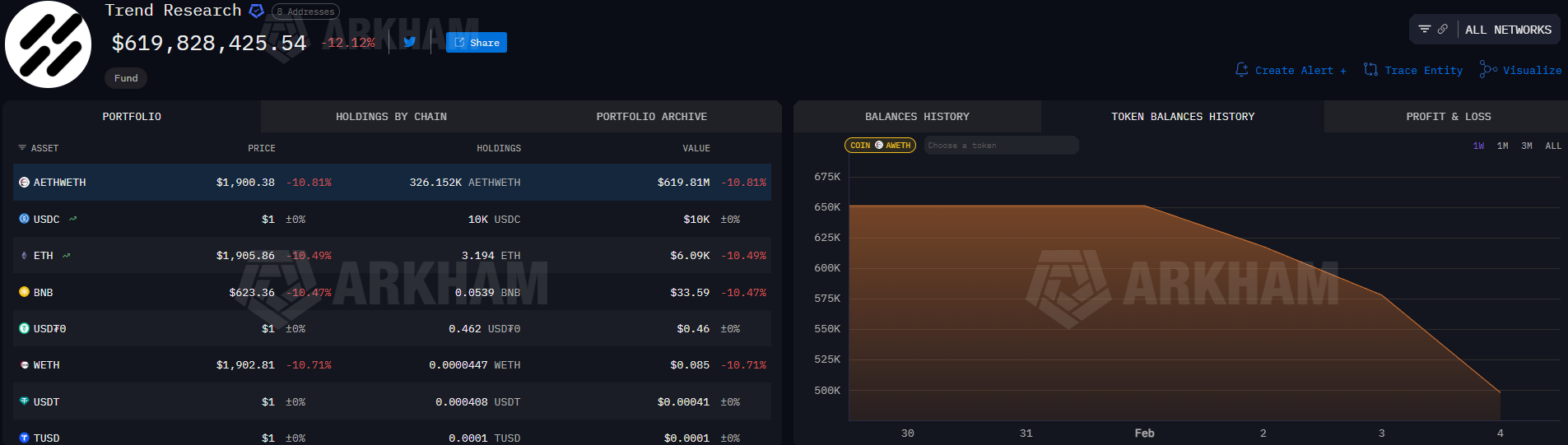

Trend Research Dumps Over 400K as Liquidation Risk Rises

Ethereum investment vehicle Trend Research continued to reduce its Ether exposure, as the latest market crash pushed the treasury company to sell off its assets to pay back loans.

It held about 651,170 Ether (ETH) in the form of Aave Ethereum wrapped Ether (AETHWETH) on Sunday. That amount dropped by 404,090, to about 247,080 on Friday, at the time of writing.

Trend Research transferred 411,075 ETH to cryptocurrency exchange Binance since the beginning of the month, according to blockchain data platform Arkham.

The transfers occurred as ETH price dropped almost 30% in the past week, to as low as $1,748 on Friday, according to CoinMarketCap. It traded at $1,967 at the time of writing.

Related: Sharplink pockets $33M from Ether staking, deploys another $170M ETH

Trend Research continues risk management as ETH liquidation level approaches

Trend Research has been tied to Jack Yi, founder of Hong Kong-based crypto venture firm Liquid Capital. Yi accumulated his Ethereum investment company’s holdings by purchasing ETH at an exchange, using that as collateral on Aave to borrow stablecoins, then using those funds to acquire more ETH.

Trend Research faces multiple ETH liquidation levels between $1,698 and $1,562, wrote blockchain data platform Lookonchain in a Friday X post.

Yi, said in a Thursday X post that he remains bullish despite admitting that he called for a bottom in crypto valuation too early and will continue to wait for a market recovery while “managing risk.”

Related: BitMine buys $105M Ether to kick off 2026, still holds $915M in cash

Trend Research came into the spotlight days after the $19 billion liquidation event of October 2025, when the investment firm began its aggressive Ether accumulation.

Trend Research would have ranked as the third-largest Ether holder in December, but as an unlisted company, it doesn’t appear on most tracking websites.

Bitmine, the largest public corporate Ether holder, was sitting on about $8 billion in unrealized profit on Friday.

Magazine: DAT panic dumps 73,000 ETH, India’s crypto tax stays: Asia Express

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech10 hours ago

Tech10 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 hours ago

Sports2 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports20 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat16 hours ago

NewsBeat16 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 hours ago

NewsBeat3 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”