Crypto World

Wintermute CEO Dismisses Crypto Blowup Rumors As Market Seeks Clarity

TLDR:

- Wintermute CEO says no credible sources confirm circulating crypto liquidation rumors

- Modern perpetual futures markets offer transparency unlike previous cycle’s lending platforms

- Digital asset desks buying Bitcoin above $100K face mounting pressure from current prices

- Legal penalties in major jurisdictions deter false bankruptcy claims from struggling firms

Wintermute CEO Evgeny Gaevoy publicly challenged spreading rumors about major crypto firm liquidations following recent market volatility.

He expressed skepticism about immediate spillover effects despite speculation linking an Asian trading firm to Bitcoin ETF sales. The executive noted that credible industry insiders have not confirmed any blowup stories circulating on social media.

Current rumors originate from unverified accounts rather than trusted sources with direct knowledge.

Market Structure Changes Reduce Contagion Risk

Gaevoy outlined how crypto leverage shifted fundamentally since the previous cycle’s catastrophic failures.

Uncollateralized lending platforms like Genesis and Celsius facilitated opaque borrowing arrangements that collapsed spectacularly. Those entities operated without transparency and created systemic risks across the industry.

Modern leverage concentrates in perpetual futures markets with visible risk management and automated liquidation systems.

The Wintermute executive contrasted current speculation with past blowup events that followed clear patterns. Three Arrows Capital’s collapse spread through private messages within two to three days after Terra’s implosion.

FTX troubles became obvious when Binance bailout discussions leaked to the public. Major solvency crises don’t remain hidden long when real contagion exists.

Exchange risk controls improved dramatically after expensive lessons from Three Arrows Capital.

Deribit was the only exchange that lost money on that default due to special credit lines. No major platforms show appetite for similar unsecured arrangements anymore.

Auto-deleveraging mechanisms now prevent customer liquidations from damaging exchange balance sheets.

Gaevoy dismissed concerns about exchanges themselves failing through FTX-style misuse of customer funds. The practice of investing user deposits into illiquid assets appears abandoned industry-wide.

Exchanges also became better at detecting hacks even when firms attempt concealment. Legal consequences for false bankruptcy denials create real deterrents in major jurisdictions like Europe, the US, UK and Singapore.

Overleveraged Peak Buyers Still Face Reckoning

Despite short-term skepticism, Gaevoy acknowledged that market consequences from peak mania buying remain inevitable.

Digital asset trading desks purchased heavily at levels now deeply underwater. Some firms acquired Solana above $225, Ethereum above $4000 and Bitcoin above $100000. Those positions face severe pressure given current prices.

The October 10th crash damaged the altcoin market in ways still not fully understood. Smaller trading desks focused on speculative tokens likely carry even worse exposure.

Historical patterns show that reckless behavior during bull markets creates delayed problems. The executive warned that affected entities may not surface for months as positions unwind gradually.

Social media speculation linked recent volatility to an Asian firm liquidating Bitcoin through IBIT ETFs after precious metals margin calls.

Gaevoy’s comments suggest such rumors lack substance currently. However, his acknowledgment that overleveraged players will eventually face consequences indicates patience may reveal the damage

.

Crypto World

Jack Dorsey’s Block May Slash Up To 10% of Staff: Report

Jack Dorsey’s payments company Block Inc. has begun informing hundreds of employees that their roles could be eliminated during annual performance reviews, as the firm undertakes a wider restructuring effort.

As much as 10% of Block’s workforce may be affected, Bloomberg reported on Sunday, citing people familiar with the matter. The company employed just under 11,000 people as of late November, an executive reportedly said at the time.

The potential layoffs come as Block reshapes its operations following a reorganization launched in 2024 aimed at improving efficiency and aligning its product lines. The company is working to more closely link its peer-to-peer payments platform Cash App with its merchant services arm Square.

At the same time, Block is expanding newer initiatives, including its Bitcoin (BTC) mining division Proto and an artificial intelligence project known as Goose.

Related: Cash App plans to unlock stablecoin transactions ’soon’

Block expected to post $403 million Q4 profit

Block is scheduled to release quarterly earnings on Feb. 26, according to Bloomberg. Analysts expect adjusted profit of about $403 million, or 68 cents per share, on revenue of roughly $6.25 billion for the fourth quarter, per the report.

The company last reported third-quarter net income of $461.5 million on $6.11 billion in revenue. Gross profit rose 18% year over year, driven by 24% growth in Cash App and 9% growth in Square, though the stock fell after the release as some performance metrics missed Wall Street expectations.

For the third quarter, Bitcoin generated about $1.97 billion in revenue, down from $2.4 billion a year earlier but still the company’s second-largest revenue stream. Block held 8,780 BTC worth over $1 billion by the end of September, recording a $59 million quarterly valuation loss.

Related: Jack Dorsey urges tax-free status for ‘everyday’ Bitcoin payments

Square launches Bitcoin payments for merchants

In November last year, Square, the payments platform owned by Block, rolled out a Bitcoin payment option, allowing merchants to accept BTC directly at checkout through its point-of-sale terminals. Sellers can process transactions in multiple ways, including Bitcoin-to-Bitcoin and automatic conversion between Bitcoin and fiat currency.

The launch added on earlier tools that let merchants convert a portion of daily card sales into Bitcoin as part of Square’s broader payment and wallet ecosystem. More than four million sellers across eight countries use Square.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Bitso Deploys Ripple Payments and RLUSD to Speed Up Latin American Transfers

TLDR:

- Bitso reduces cross-border transfer times from multiple days to near-instant using blockchain technology

- RLUSD provides regulated dollar-denominated stability for volatile Latin American payment corridors

- Platform positions as U.S.-LATAM payout partner as demand for compliant stablecoin solutions expands

- Ripple Payments eliminates multi-hop banking processes, reducing costs and increasing transparency

Bitso accelerates cross-border payments through its deployment of Ripple Payments, XRP and RLUSD across Latin American markets.

The digital asset platform reduces international transfer times from days to near-instant settlement for business clients.

Traditional banking systems previously required multiple intermediaries and extended processing periods. Bitso now delivers faster money movement by leveraging blockchain rails and regulated stablecoin infrastructure for regional payment corridors.

Speed Improvements Replace Multi-Day Settlement Processes

Bitso has transformed its platform to prioritize transaction velocity for cross-border transfers. The company shifted from crypto exchange operations to B2B payment infrastructure.

Legacy payment systems in Latin America typically process international transfers through several correspondent banks. Each intermediary adds processing time and reduces transparency throughout the settlement chain.

Ripple Payments enables Bitso to bypass traditional multi-hop routing entirely. Blockchain technology settles transactions in minutes rather than the standard two-to-five business days.

XRP serves as a bridge currency to accelerate conversions between different fiat denominations. RLUSD provides dollar-denominated stability without requiring traditional banking infrastructure.

The acceleration benefits both remittance flows and commercial payment operations. Businesses previously waited days to receive international payments from partners or customers.

Bitso now completes these same transfers within minutes using distributed ledger technology. Recipients access funds almost immediately after transaction initiation.

Gabriele Zuliani, Head of Growth at Bitso, spoke about the transformation this technology brings. “RLUSD and Ripple Payments let us reinvent how money moves globally: faster, at lower cost, and with far greater transparency,” Zuliani said.

He added that as demand grows in the U.S., Bitso stands ready to serve that demand. The platform aims to become the rail and payout partner for LATAM.

Rapid Blockchain Settlement Powers Regional Payment Distribution

The acceleration strategy addresses specific pain points within Latin American financial markets. Local currency volatility creates urgency around fast, stable settlement options.

Businesses cannot afford to wait days while exchange rates fluctuate during transfer processing. RLUSD enables rapid conversion to dollar-denominated value.

Bitso positions itself as a payout partner capable of distributing funds throughout the region quickly. The platform maintains local market presence across multiple Latin American countries.

This regional footprint combines with blockchain speed to deliver comprehensive payment solutions. Companies can now send payments that reach recipients the same day.

Regulated stablecoin infrastructure supports the acceleration without sacrificing compliance requirements. RLUSD operates within established financial oversight frameworks while maintaining transaction speed.

Traditional compliance processes often slow down international transfers through extended verification periods. Bitso balances regulatory adherence with operational efficiency.

Growing demand from U.S. businesses requires scalable, rapid payment infrastructure for Latin American operations.

Bitso’s blockchain-based approach handles increasing transaction volumes without proportional slowdowns. As cross-border payment needs expand, the platform scales its acceleration capabilities accordingly.

The combination of Ripple Payments, XRP and RLUSD creates infrastructure for next-generation regional money movement.

Crypto World

Bitcoin Mining’s Biggest Shock Since the 2021 China’s Ban

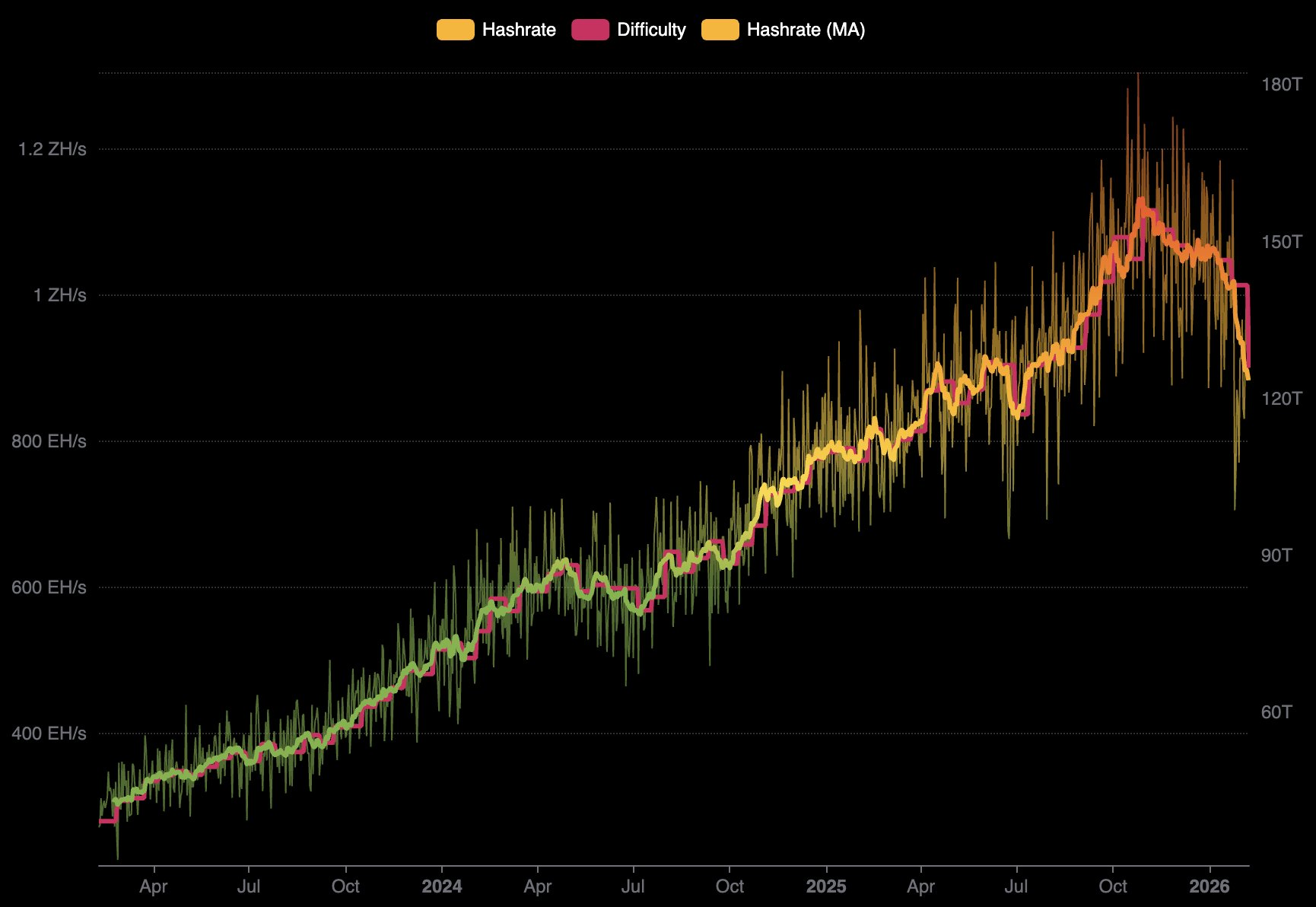

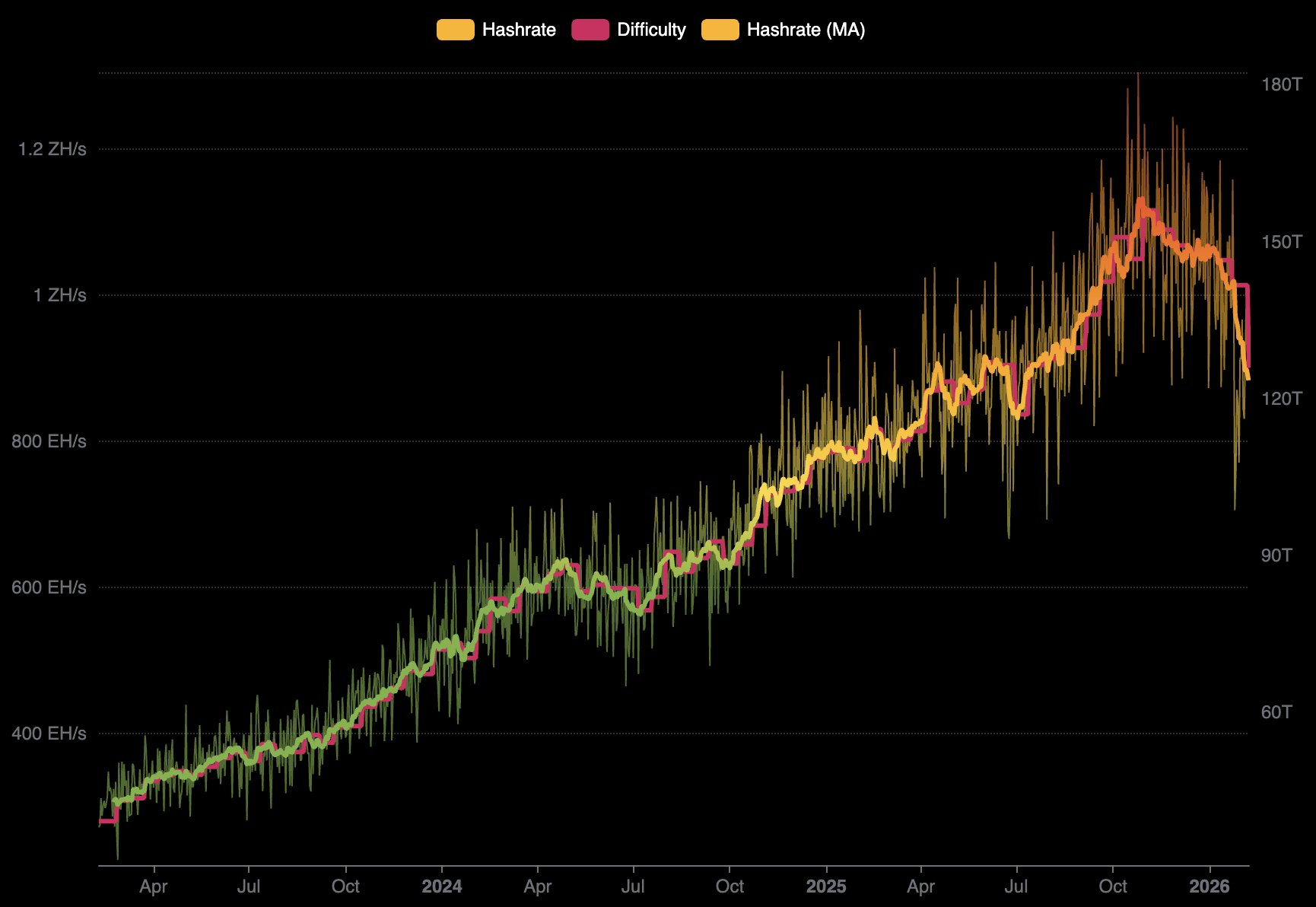

Bitcoin’s mining difficulty has registered its steepest decline in nearly five years.

The historic drop signals a dual crisis of extreme weather constraints and deepening economic pressure on network operators.

Sponsored

Sponsored

Bitcoin Mining Economics Crack Amid Falling Prices

According to Mempool developer Mononaut, the network’s difficulty adjusted downward by 11.16% to 125.86 trillion (T) this week.

Notably, this adjustment marks the largest capitulation in mining power since July 2021. At the time, a state-mandated ban in China forced a massive exodus of hashing power.

The difficulty adjustment mechanism is designed to keep Bitcoin block production at steady 10-minute intervals.

When miners go offline, block times slow, prompting the protocol to lower the difficulty to make mining easier for the remaining participants.

Unlike the geopolitical shocks of 2021, the current decline is driven by a collision of meteorological instability and thinning profit margins.

Sponsored

Sponsored

The sharp contraction follows severe winter storms across North America in late January, which disrupted energy grids serving major mining clusters.

In jurisdictions such as Texas, miners participate in “demand response” programs. These operators voluntarily reduce their power consumption during peak load periods to help stabilize the grid in exchange for energy credits.

However, the magnitude of this 11% drop suggests more than just temporary curtailment. It points to economic capitulation.

The severe weather stressed the electrical infrastructure, spiking spot power prices.

For operators running older, less efficient hardware, the surge in operating expenses likely pushed profitability into negative territory. This financial strain led to a permanent or semi-permanent shutdown of rigs.

Notably, available data suggest that major industry players were already operating with exceptionally thin margins before the storms hit.

Ki Young Ju, CEO of the analytics firm CryptoQuant, estimated that Bitcoin miner Marathon Digital spent approximately $67,704 to mine a single BTC in the third quarter of 2025.

With BTC trading below $70,000, several miners are operating at a loss before accounting for other general expenses.

Crypto World

Ethereum Faces 200-Day EMA Rejection Amid $7B Liquidation Cascade

TLDR:

- ETH failed three times at the 200-day EMA, confirming weakening momentum and sustained selling pressure.

- Over $1.3B in long liquidations shows derivatives activity dominated price action, not spot demand.

- The $2.7K level flipped from support to resistance, redefining near-term market structure.

- Focus now shifts to $2.3K and $1.8K as the next zones of potential buyer interest.

ETH 200-day EMA rejection shows repeated failures near resistance aligned with a wave of forced liquidations. Price action now reflects leverage-driven volatility instead of organic trend recovery.

Distribution Behavior Emerges at Key Technical Resistance

ETH price moved higher, yet the advance lacked sustained demand. Instead, it appeared driven by short covering into a known supply zone.

Momentum weakened with every approach to the moving average. Candle bodies narrowed, and upper wicks became more frequent. At the same time, volume failed to expand.

Furthermore, the repeated rejection pattern reinforced technical exhaustion. Three attempts at the same resistance level produced lower follow-through each time. This suggested that sellers maintained control despite temporary upside pressure.

On social media, several analysts shared charts showing price stalling exactly at the 200-day EMA. Therefore, upside strength functioned mainly as liquidity for larger participants.

Soon after, ETH slipped back below $2.7K. That level had served as short-term support during the rebound phase. Once breached, it transitioned into resistance, and market bias tilted downward.

This pivot divided two narratives. Above $2.7K, traders could argue for base formation. Below it, the structure favored continued probing lower. As a result, each rally into that zone now attracts selling interest.

Moreover, price behavior showed hesitation rather than conviction. Buyers failed to defend higher levels with sustained closes. Sellers, in contrast, reacted quickly at technical boundaries.

Thus, the pattern reflected strategic positioning rather than emotional panic. Distribution unfolded gradually, supported by visible rejection zones and fading momentum. The chart no longer communicated recovery. Instead, it communicated controlled exits into strength.

Liquidation Cascades Replace Organic Market Flow

ETH 200-day EMA rejection coincided with violent intraday swings driven by derivatives activity. Price repeatedly moved from $80 to $100 within minutes. Such behavior is not typical of spot-led markets.

Approximately $1.3 billion in long liquidations occurred during the session. These events represented forced closures of leveraged positions, not discretionary selling. Therefore, the tape reflected margin mechanics rather than investor sentiment.

As the price crossed clustered liquidation levels, automated orders accelerated the decline. Each wave triggered the next. Consequently, volatility expanded in both directions.

Total liquidations surpassed $7 billion across the broader market. This scale revealed how one-sided positioning had become before the breakdown. When exposure concentrates, even small price shifts can ignite chain reactions.

Meanwhile, ETH failed to stabilize above reclaimed levels. The $2.7K zone remained overhead resistance. This reinforced the idea that rebounds were corrective, not impulsive.

Attention has now shifted to the $2.3K region. That area previously hosted strong demand. If the price reaches it, buyers may attempt to stabilize conditions. However, failure there would expose the $1.8K support band.

Traders continue to frame current rallies as liquidity events. Strength is treated cautiously, while resistance zones receive priority.

Crypto World

ARK Invest Sells $22M Coinbase Shares, Buys Bullish Across ETFs

error code: 524

This article was originally published as ARK Invest Sells $22M Coinbase Shares, Buys Bullish Across ETFs on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Crypto World

Gemini and ChatGPT Predict Shocking Lows for Cardano’s ADA

Has ADA finally bottomed after dumping below $0.23 or is there more pain ahead?

Cardano’s native token is once again under heavy pressure, alongside most of the market. However, while BTC and most other alts crashed to their lowest levels since the US presidential elections in late 2024, ADA went even further, dropping to $0.222 (on Bitstamp and other exchanges) for the first time since June 2023.

Despite recovering slightly to $0.27, the token is still 34% down monthly. Moreover, it has plunged by 80% since its cycle top at $1.33 marked in late 2024. Consequently, we asked ChatGPT and Gemini whether the worst is behind ADA or if there is more pain around the corner.

ChatGPT Says…

ChatGPT began with some harsh words for Cardano investors, suggesting that the decline to the $0.22 area is “not just another routine dip.” Instead, it believes it represents a “structural breakdown of long-term support, confirming that sellers remain firmly in control.” This was proven after the asset plunged below key support levels at $0.40, $0.30, and even $0.25 (which was later reclaimed, though).

What could spell further trouble for ADA looking ahead is that these consecutive price drops suggest that “the buy-the-dip demand has steadily weakened” lately. As such, all eyes have now turned to the $0.20 support, which has become the “line in the sand.”

If ADA is to fall below that psychological level, the most realistic target during the ongoing bear phase would be a dip to $0.15-$0.16. However, ChatGPT outlined a more extreme capitulation scenario, in which the token plummets to $0.10-$0.12.

“While this may sound shocking, large-cap altcoins have historically lost 80-90% from cycle highs during severe downturns. ADA is not immune to that pattern,” it concluded.

Gemini’s Take

Dumping below $0.30 meant that ADA’s daily chart has turned into a “falling knife,” said Gemini. This breakdown below the multi-year support was the “final nail in the coffin for many long-term holders.” On its way down, the asset dumped below its 200-day MA (at around $0.45), and it obliterated millions in leveraged longs. Gemini’s “nightmare” scenario envisions a drop to even below $0.10 if certain factors align in an adverse manner:

“If Bitcoin capitulates to $55K in the coming weeks, ADA risks losing its status as a “major” altcoin. A breakdown below $0.15 opens a liquidity vacuum all the way down to $0.09. While this sounds impossible, remember that “impossible” things happen regularly in crypto winters,” it warned.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Two High Schoolers Charged in Arizona Home Invasion Targeting $66M in Crypto

Two teenagers from California are facing serious felony charges after authorities say they traveled hundreds of miles to carry out a violent home invasion in Scottsdale, Arizona, in a bid to obtain cryptocurrency believed to be worth $66 million.

Key Takeaways:

- Two California teens allegedly traveled over 600 miles to carry out a violent home invasion targeting $66 million in cryptocurrency.

- Police arrested the suspects shortly after they fled the scene and recovered restraints and a 3D-printed firearm.

- Investigators say unknown contacts on an encrypted messaging app directed the plot and funded supplies.

According to court records cited by local media, the 16- and 17-year-old suspects drove more than 600 miles from San Luis Obispo County and arrived at a residence in the Sweetwater Ranch neighborhood on the morning of Jan. 31 wearing delivery-style uniforms resembling those used by shipping carriers.

Investigators say they forced entry into the home, restrained two adults with duct tape and demanded access to digital assets.

One victim denied holding cryptocurrency, after which the confrontation escalated into physical assault.

Police Stop Suspects After Violent Home Invasion Attempt

Police were alerted when an adult son elsewhere in the house called emergency services. Officers arriving at the property found a struggle underway and one victim screaming.

The suspects fled in a blue Subaru but were stopped at a dead end shortly afterward.

Authorities recovered zip ties, duct tape, stolen license plates and a 3D-printed firearm without ammunition. It remains unclear whether the weapon was functional.

Both teens were initially placed in juvenile detention but prosecutors intend to try them as adults. Each faces eight counts including kidnapping, aggravated assault and burglary, while the older suspect also faces an unlawful flight charge.

They were later released on $50,000 bail and fitted with electronic monitoring devices.

Investigators say the younger suspect told police the pair had recently met and were directed by unknown individuals communicating through the encrypted messaging platform Signal.

The contacts, identified only as “Red” and “8,” allegedly supplied the address and sent $1,000 for disguises and equipment purchased at retail stores.

The suspect also claimed he had been pressured into participating after being invited on a trip to “tie people up” for access to cryptocurrency.

Wrench Attacks on Crypto Holders Rise Sharply in 2025

The case reflects a broader rise in so-called wrench attacks, physical assaults aimed at forcing crypto holders to hand over private keys.

Security researcher Jameson Lopp’s public database lists roughly 70 such incidents in 2025, a sharp increase from the previous year.

The Scottsdale attack is the first recorded US case of 2026, though many incidents are believed to go unreported.

Security analysts say criminals are increasingly using leaked personal data to identify targets and recruiting young perpetrators online to reduce traceability.

A recent industry breach involving customer identity information has been cited by investigators as a factor increasing exposure risks.

Authorities have not linked the incident to separate cryptocurrency ransom demands reported the same day in Tucson, about two hours away.

The post Two High Schoolers Charged in Arizona Home Invasion Targeting $66M in Crypto appeared first on Cryptonews.

Crypto World

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Milwaukee Bucks forward Giannis Antetokounmpo has taken a stake in prediction market platform Kalshi, marking the first time an active NBA player has directly invested in the federally regulated event-contracts exchange.

Key Takeaways:

- Giannis Antetokounmpo became the first active NBA player to invest directly in prediction market platform Kalshi.

- Kalshi offers federally regulated “yes-or-no” event contracts across sports, politics and entertainment.

- The deal follows growing scrutiny over the blurred line between trading markets and sports betting.

The two-time NBA MVP announced the partnership Friday, saying he will join Kalshi as a shareholder and collaborate with the company on live events and marketing campaigns.

Kalshi confirmed the agreement in a statement, adding that Antetokounmpo will not be allowed to trade on any NBA-related markets due to internal rules prohibiting insider trading and manipulation.

Inside Kalshi’s ‘Yes-or-No’ Prediction Trading Markets

Kalshi operates a marketplace where users trade “yes or no” contracts tied to real-world outcomes.

The platform lists markets spanning politics, entertainment and sports, allowing traders to take positions on events such as award winners or championship results.

Earlier this week, the service even hosted a market on whether Antetokounmpo himself would be traded before the NBA deadline.

Although money changes hands, the platform is treated as a financial exchange rather than a sportsbook.

As a result, Kalshi is permitted to operate across the United States under federal oversight, avoiding the patchwork of state gambling regulations that apply to traditional betting operators.

The NBA’s collective bargaining agreement allows players to promote betting companies under certain conditions, provided they do not advertise wagers on NBA, WNBA or G League games.

Players may also hold passive equity stakes of up to 1% in such businesses. Antetokounmpo’s investment falls within those limits.

“I like to win. It’s clear to me Kalshi is going to be a winner and I’m excited to be getting involved,” Antetokounmpo said.

He is not the first basketball figure linked to the company. Phoenix Suns star Kevin Durant is reportedly an indirect investor through the 35V venture fund he co-founded with agent Rich Kleiman.

The move comes amid heightened scrutiny of sports wagering. US authorities recently filed gambling-related charges involving several basketball figures, and regulators have been examining the expanding overlap between trading platforms and betting markets.

The NCAA previously asked Kalshi to modify wording on its site that suggested an official relationship with the organization.

Kalshi Expands Sports Push With NHL Deal and Athlete Endorsement

Despite the attention, Kalshi has been expanding its sports presence.

The company announced a partnership with the NHL in October and, in January, signed professional golfer Bryson DeChambeau as its first athlete endorser, including appearances and promotional campaigns tied to events in which he competes.

Kalshi has also secured a major media breakthrough after signing a partnership with CNN, making the company the network’s official prediction markets partner while closing a $1 billion funding round at an $11 billion valuation.

Web3 prediction markets have crossed $13 billion in cumulative trading volume, marking a record high even as broader crypto markets cool.

The surge has drawn in major players across tech and finance, including Fanatics, Coinbase, and MetaMask, all of which have recently launched or expanded event-trading platforms.

The post NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi appeared first on Cryptonews.

Crypto World

BTC Price Retests $70K as BNB Overtakes XRP: Weekend Watch

The battle for the fourth position in terms of market cap continues, but this time, BNB has come on top.

The rather calm behavior during the weekend has worked in favor of bitcoin, at least for now, as the asset has steadily climbed above $70,000 after the rejection on Saturday morning.

Most larger-cap altcoins are also in the green, with ETH trading above $2,100 and SOL close to $90. HYPE is among the few alts deep in the red today.

BTC Taps $70K

The previous weekend brought unexpected volatility to the cryptocurrency markets. The largest of the bunch dumped from $84,000 to under $76,000 on Saturday night and tried to recover to $79,000 on Sunday. However, it was stopped there, and the bears resumed control during almost the entire business week.

After initiating several smaller and less painful leg downs, they stepped up on the gas pedal on Thursday, causing another market calamity. In just over 24 hours, they brought BTC to its knees, pushing it from $77,000 to $60,000 on Friday morning, its lowest price in well over a year.

The cryptocurrency rebounded sharply after this massive decline, and bounced to $72,000 on Friday evening and Saturday morning. It couldn’t proceed further and was pushed down to $68,000 yesterday. Now, though, it has jumped to just over $70,000 after a 2.3% daily increase.

Its market cap has reclaimed the $1.4 trillion mark, while its dominance over the alts is just shy of 57% on CG.

BNB Flips XRP (Again)

ETH was among the poorest performers during the crash, dumping from $2,400 to $1,730 in a few days. However, it has recovered almost $400 since then and now sits above $2,100. BNB and XRP continue to fight for the fourth spot in terms of market cap, but Binance Coin has emerged as the winner during the weekend.

Solana’s SOL is up to almost $90, while LTC, LINK, ZEC, and XLM have posted gains of up to 4%. In contrast, HYPE has dropped by almost 5% to under $32.

The total crypto market cap has added another $80 billion since yesterday and is close to $2.5 billion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

ARK Sells $22M in Coinbase Shares, Buys Bullish Across ETFs

Cathie Wood’s ARK Invest continued reducing its exposure to crypto exchange Coinbase on Friday, unloading $22 million worth of shares across multiple exchange-traded funds (ETFs) while adding to its position in digital asset platform Bullish.

According to ARK’s trade disclosures, the firm sold 92,737 Coinbase Global shares from the ARK Innovation ETF (ARKK), 32,790 shares from the Next Generation Internet ETF (ARKW) and 8,945 shares from the Fintech Innovation ETF (ARKF). The combined transactions totaled 134,472 shares, worth around $22.1 million.

The sale came as ARK Invest, led by Cathie Wood, has reversed course on Coinbase, selling 119,236 COIN worth about $17.4 million on Thursday after a brief purchase earlier in the week. The Thursday sale was the firm’s first Coinbase sale of 2026 and its first since August 2025.

Meanwhile, Coinbase stock climbed during the Friday session, closing at about $165 after gaining roughly 13% on the day. However, the exchange’s shares are still down by 26% year-to-date (YTD), according to data from Google Finance.

Related: Cathie Wood’s ARK boosts crypto shares amid stock pullback

ARK boosts Bullish stake

At the same time, ARK accumulated shares of Bullish across multiple funds. The investment manager purchased 278,619 shares in ARKK, 70,655 shares in ARKW and 43,783 shares in ARKF, accumulating a total of 393,057 shares worth $10.7 million.

Bullish shares ended the trading day near $27, up about 10%. However, the stock is down by 27% YTD as the company reported a net loss of $563.6 million, or $3.73 per diluted share, in the fourth quarter of 2025, reversing a profit of $158.5 million recorded a year earlier.

Alongside the crypto moves, ARK added Alphabet, Recursion Pharmaceuticals and Tempus AI, while reducing exposure to several high-growth technology companies including Roku, The Trade Desk and PagerDuty.

Related: Cathie Wood’s ARK adds Coinbase, Circle, Bullish as crypto slides

Crypto slump weighs on ARK ETFs

As Cointelegraph reported, a fourth-quarter pullback in digital asset markets hurt several of Cathie Wood’s ARK ETFs. In its latest quarterly report, ARK said weakness in companies tied to digital assets, particularly Coinbase, was a major drag on flagship funds including ARKK, ARKW and ARKF.

Coinbase shares fell more sharply than major cryptocurrencies during the period as centralized exchange trading volumes dropped 9% quarter-on-quarter after October’s liquidation event. The stock declined nearly 35% from October to year-end, underperforming both Bitcoin (BTC) and Ether (ETH).

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

-

Video5 days ago

Video5 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports1 day ago

Sports1 day agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports22 hours ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat1 day ago

NewsBeat1 day agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat5 days ago

NewsBeat5 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World3 days ago

Crypto World3 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World3 days ago

Crypto World3 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

Fashion2 days ago

Fashion2 days agoKelly Rowland and Method Man Bring the Fashion for Relationship Goals Press Tour: Courtside in a Fringed TTSWTRS Jacket, Black and White Rowen Rose, Stella McCartney, and More!