Crypto World

XRP gains momentum as Arizona moves to add it to state crypto reserve

- XRP has held strong near $1.40 despite mixed market signals.

- Key resistance levels to watch are $1.50, $1.54, and $1.91.

- Arizona has proposed to include XRP in a state-managed crypto reserve fund.

XRP cryptocurrency has held steady above $1.40, showing resilience despite a broadly cautious market.

Recent developments in US policy have added a fresh layer of optimism for XRP enthusiasts.

Arizona advances bill to include XRP in state reserve

Arizona lawmakers are moving forward with legislation that could formally include XRP in a state-managed digital assets fund.

The proposal seeks to create a strategic reserve for digital currencies obtained through seizures or confiscations.

XRP, alongside Bitcoin (BTC), is explicitly listed as an eligible asset.

🚨BREAKING: ARIZONA ADVANCES BILL TO ADD XRP TO OFFICIAL STATE DIGITAL ASSET RESERVE 🇺🇸🔥

Arizona’s Digital Assets Strategic Reserve Fund bill (SB1649) just CLEARED the Senate Finance Committee in a 4–2 vote — and it explicitly includes $XRP in the RESERVE. 👀

The bill now… pic.twitter.com/2x8uVH6LXD

— Diana (@InvestWithD) February 17, 2026

The bill recently passed a key Senate committee in a 4-2 vote, marking a significant step forward.

If enacted, the fund would be managed by the state treasurer with strict custodial oversight.

This move would make Arizona one of the first US states to formally reference XRP in a government financial framework.

For XRP holders, this development is largely symbolic.

The state would not be directly purchasing XRP with taxpayer money, but inclusion in the reserve adds credibility.

It reinforces XRP’s reputation as a functional and settlement-oriented digital asset rather than just a speculative token.

Market activity signals caution

XRP’s short-term price action has been mixed.

The coin is supported around $1.40 to $1.44, creating a key floor that traders are watching closely.

Exchange outflows suggest accumulation by larger holders, while smaller whales have added to their balances, hinting at potential upward pressure.

Technical indicators show both bullish and bearish signals.

Momentum oscillators suggest limited buying activity in the short term, but longer-term smart money metrics point to possible gains.

Patterns on the charts indicate that a break below $1.42 could trigger a short-term pullback toward $1.12.

At the same time, if support holds, traders could see upside targets near $1.91 and $2.13.

XRP has been rangebound for the past month, but the combination of policy developments and structural market accumulation could push it higher.

XRP price prediction

Policy developments in Arizona, combined with accumulation patterns and technical support, may give XRP the momentum it needs to challenge its next resistance levels.

Traders should watch the $1.40–$1.44 support zone closely.

A strong hold here could set the stage for a breakout.

The resistance levels to monitor are $1.50 and $1.54 in the near term.

Beyond that, the next targets are $1.67 and $1.91.

These levels align with smart money accumulation and historical trading ranges.

A sustained move above $2.00 could signal a return of broader bullish sentiment.

Overall, XRP’s price is poised in a delicate balance.

Short-term caution is warranted, but medium-term prospects look promising.

Crypto World

Kresus secures $13M investment from Hanwha to scale wallet and RWA tokenization tech

Wallet infrastructure firm Kresus Labs has raised approximately 18 billion won ($13 million) in investment from Hanwha Investment & Securities, one of South Korea’s largest financial institutions.

The investment follows a memorandum of understanding signed in December at Abu Dhabi Finance Week and is aimed at expanding Kresus’ enterprise digital wallet infrastructure, real-world asset (RWA) tokenization platforms and onchain financial workflows.

The wallet and blockchain infrastructure firm develops digital asset tools for both consumers and institutions, including “seedless” wallet recovery technology and multi-party computation (MPC)-based security systems.

Seedless recovery refers to the means of restoring access to a digital asset stored in a wallet without having to use the traditional stream of 12-24 random words, which could prove a barrier to entry for some.

Kresus also operates wallet infrastructure and tokenization platforms designed to meet institutional compliance and operational requirements.

Hanwha plans to use Kresus’ technology to enhance its client-facing digital asset services and to develop tokenized versions of traditional financial products. For established financial firms, wallet security and compliant tokenization frameworks remain key barriers to deeper engagement with blockchain-based markets.

The raise underscores how capital continues to flow into infrastructure providers even when broader crypto markets are volatile. Rather than backing speculative tokens, institutions are increasingly targeting custody, security and tokenization layers that can plug into existing financial systems.

Crypto World

Unknown Trader Up $7M While Others Lose Millions

A relatively unknown crypto trader gained $7 million from shorting ETH while major investors suffered huge losses.

An anonymous trader known only as 0x58bro has accumulated $7 million in unrealized profits by shorting Ethereum (ETH) and a handful of other cryptocurrencies, according to data from on-chain intelligence platform Arkham.

What’s noteworthy about their success is that it has come at a time when several high-profile crypto personalities have suffered eight-figure losses betting on price increases.

The Quiet Whale Swimming Against the Current

Despite holding a portfolio valued at just under $13 million, 0x58bro maintains a minimal social media presence with just 1,300 followers on X. Arkham’s analysis shows the trader has generated the bulk of his profits from two positions: a $3.7 million gain shorting ETH and $1.45 million from shorting ENA, the governance token of Ethena Labs.

The trader’s wallet composition also revealed a strategic approach to the current market volatility. They hold over $7.5 million in Aave’s interest-bearing ETH token (aETHWETH) and $5 million in Aave’s USDC deposit token (aETHUSDC), suggesting they have positioned capital to earn yield while maintaining the flexibility to deploy it against further downside.

A smaller position of 10 million HANA tokens, currently worth close to $353,000, represents their only significant long exposure.

The timing of these short positions has proven critical, with Ethereum struggling to maintain momentum in recent weeks and prices hovering around the $2,000 psychological support level.

Market Backdrop Shows Leverage Risks and Speculation Cycles

While 0x58bro is profiting from market declines, other traders have faced catastrophic losses attempting to catch a falling knife. On-chain data shows that Machi Big Brother, a well-known crypto personality once worth nearly nine figures, has seen his Hyperliquid account value fall below $1 million. To meet margin calls on his long positions, he was forced to tap into PleasrDAO treasury funds deposited five years ago, with his total losses now standing at $28 million.

You may also like:

The contrast extends to institutional players as well. For instance, Trend Research, the trading firm led by Liquid Capital founder Jack Yi, fully exited its Ethereum positions last week after accumulating about $1.34 billion in ETH at an average entry of $3,180. The exit locked in losses of approximately $869 million, according to Arkham data, coming just days after Yi publicly predicted ETH would reach $10,000.

While Trend Research was forced to unwind what was once Asia’s largest ETH long position, on-chain data from CryptoQuant shows that wallets with no history of outflows holding at least 100 ETH, known as “accumulation addresses,” are still buying through the downturn. These addresses now hold around 23% of Ethereum’s circulating supply and have maintained their accumulation even when prices were trading below their average cost basis.

Whether 0x58bro will maintain his short positions or join the accumulating addresses betting on a rebound remains unknown. But for now, the trader with 1,300 followers has outperformed an industry of influencers with millions watching their every move.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Shielded Labs Introduces Advisory Services to Support Teams Building on Zcash Network

TLDR:

- Shielded Labs launched Partner Support Services to diversify funding beyond its existing donation-based revenue model.

- The NEAR Foundation became the first partner, covering past work and ongoing technical and strategic Zcash support.

- NEAR Intents has made it easier for users to acquire ZEC directly without depending on centralized crypto exchanges.

- Shielded Labs is already in talks with additional teams exploring similar advisory and ecosystem coordination agreements.

Shielded Labs has introduced a new Partner Support and Advisory Services initiative to diversify its funding. The organization, which backs long-term Zcash development, previously relied solely on donations.

Under the new program, external teams building on or integrating with Zcash can engage Shielded Labs directly. Services include technical support, advisory work, and ecosystem coordination. The NEAR Foundation is the first confirmed partner under this arrangement.

Shielded Labs Expands Revenue Model Through Ecosystem Partnerships

Shielded Labs has structured the new initiative to serve teams working through integrations, network upgrades, and related development efforts.

The program also offers advisory input based on direct experience with the Zcash protocol, community, and governance process. This creates a clearer path for external teams to engage with Zcash more efficiently.

The initiative also aims to reduce friction for builders entering the Zcash ecosystem. Teams that previously had no formal channel to engage Shielded Labs now have a direct route.

This approach helps ensure that new integrations align naturally with the broader ecosystem’s direction and standards.

Partner Services does not replace Shielded Labs’ core technical mission. Rather, it runs alongside it as a supplementary revenue stream.

The organization stated that its primary focus remains building and supporting technology that strengthens Zcash over the long term.

Shielded Labs confirmed it is already in discussions with additional teams considering similar engagements. Organizations interested in exploring collaboration are encouraged to contact the team directly, according to the announcement.

NEAR Foundation Becomes First Partner Under the New Program

Shielded Labs and the NEAR Foundation have formalized an agreement that covers both past contributions and future work.

Early collaboration involved communications and awareness strategy around Zcash’s initial integration into NEAR Intents.

Shielded Labs also helped organize the NEAR Intents hackathon and provided similar coordination support for integrations with Rhea Finance and Templar Protocol.

NEAR Intents has been noted as a meaningful development for Zcash, making it easier for users to acquire ZEC without relying on centralized exchanges.

Wallet teams, including Zashi, have since brought NEAR Intents integrations into mobile applications independently. These developments expanded access to ZEC for a broader user base.

As part of the ongoing agreement, Shielded Labs will continue providing technical, strategic, and ecosystem support to the NEAR Foundation.

This also covers teams building use cases around NEAR Intents. Stakeholder engagement, education, and coordination remain central components of the continued work.

On the technical side, Shielded Labs is exploring ways to simplify implementation for partners through targeted guidance and coordination.

Advisory input on security and privacy improvements is also part of the scope as new use cases around NEAR Intents continue to develop.

Crypto World

Is This the End of the Machi Big Brother Dump? Giant Whale Clings to Last $1M After Disaster

Arkham Intelligence estimates cumulative trading losses at $28 million.

Machi Big Brother is known for taking massive, highly leveraged long positions in several tokens on the decentralized exchange Hyperliquid, which has led to significant, high-profile liquidations.

Recent volatile months have massively drained his remaining capital.

Fortune Shrinks

Blockchain data shared by Arkham Intelligence revealed that Machi Big Brother’s Hyperliquid HL account value has fallen below $1 million. The data indicates the Taiwanese-American entrepreneur and former musician, whose real name is Jeffrey Huang, added margin to recent Hyperliquid long positions by drawing from the PleasrDAO treasury, funds that were deposited roughly five years ago.

Arkham Intelligence reports that around five months ago, Machi Big Brother’s net worth was close to nine figures. Since then, his holdings have witnessed a steep fall.

The on-chain tracking firm estimates his cumulative trading performance at a loss of $28 million. The movements were identified through wallet activity linked to Machi Big Brother and the PleasrDAO treasury.

Controversies

Machi Big Brother has been one of the controversial figures in crypto who is known for massive gains, heavy losses, and constant reinvention. He entered the space around 2017, launching Mithril (MITH), a “social mining” project that rewarded users with tokens. The project raised about $13 million, but the token collapsed roughly 80% within months.

He later joined Formosa Financial, which helped raise around 44,000 ETH, then worth about $37 million. About 22,000 ETH later disappeared from the treasury and were never recovered. In 2020, he moved aggressively into DeFi, forking Compound to create Cream Finance. The protocol suffered multiple exploits, and total losses surpassed $192 million.

You may also like:

He continued launching fast-moving forks such as Mith Cash, Wifey Finance, and Typhoon Cash, many of which failed within weeks. From 2021 to 2023, he became a dominant NFT player and amassed more than 200 Bored Ape Yacht Club NFTs worth over $9 million at the peak.

He later sold more than 1,000 NFTs in a short period, which crashed floor prices in what became known as the “Machi Dump.” In 2022, on-chain investigator ZachXBT accused him of embezzling 22,000 ETH and leaving multiple failed projects behind. Machi responded with a defamation lawsuit in Texas, which ended quietly without a ruling.

In 2024, he launched the Boba Oppa meme coin on Solana. He raised over $40 million before the token dropped sharply.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

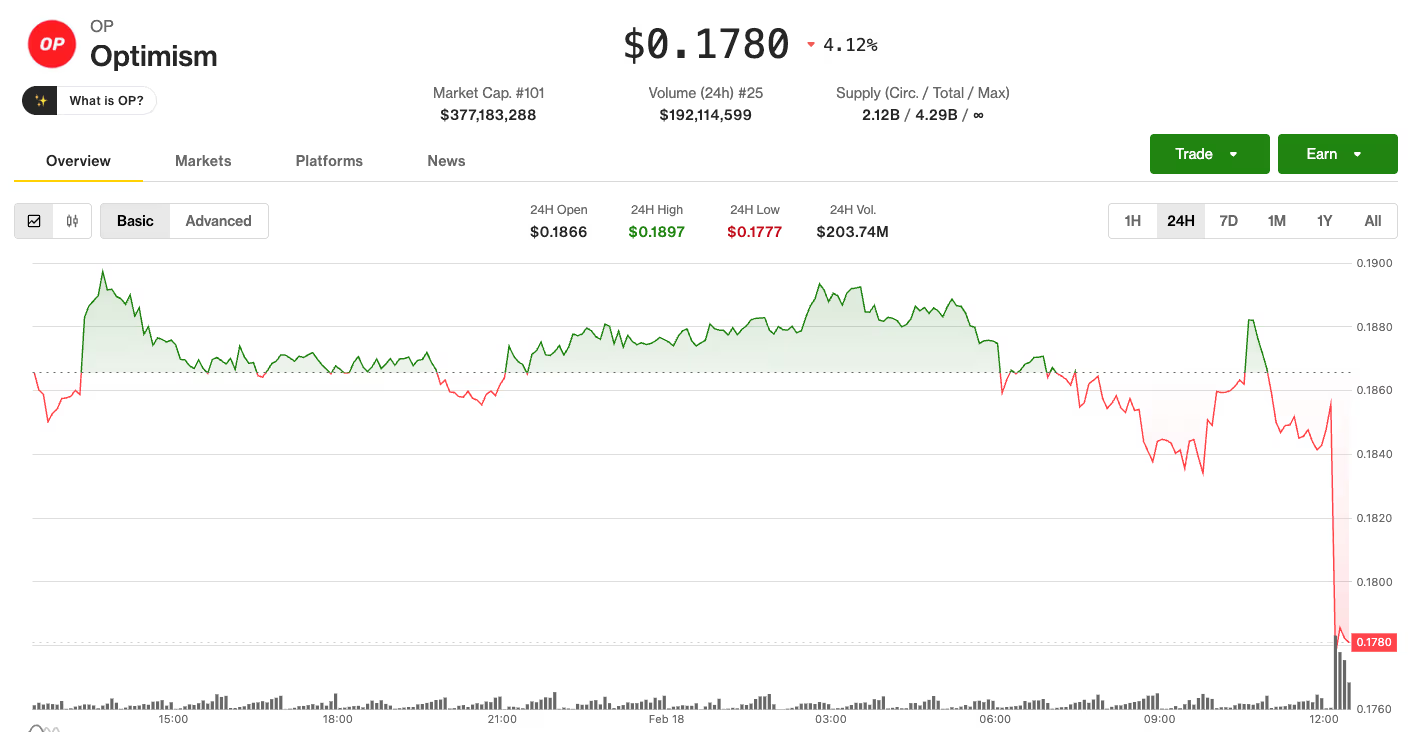

Optimism’s OP token falls after Base moves away from the network’s ‘OP stack’ in major tech shift

Coinbase’s Ethereum layer-2 network, Base, is changing the technology that powers it, stepping back from relying on Optimism’s OP Stack, the toolkit it originally launched on.

In a blog post titled “The Next Chapter for Base,” the team said it plans to take more control over its own code and infrastructure. Instead of depending on multiple outside teams for key upgrades and changes, Base will consolidate everything into a Base-managed codebase.

In simple terms, Base was built using Optimism’s technology, but now it wants to steer more of its own ship. Optimism is a layer-2 blockchain on top of Ethereum that aims to reduce settlement times and transaction costs.

Base launched in 2023 and quickly became one of the most widely used Ethereum layer-2 networks, with $3.85 billion locked in the protocol today. When the network went live, the Optimism and Base teams shared that Base could earn up to approximately 118 million OP tokens over six years. It is unclear as to what that means for that agreement.

The OP token is down 4% over the past 24 hours following the announcement.

The team said that the change doesn’t mean Base is cutting ties with Optimism entirely. The company said it will still work with Optimism for support and will remain compatible with OP Stack standards during the transition. For everyday users and developers, nothing should immediately change.

The team said the shift is happening because, if it controls its own stack, Base can ship upgrades faster and simplify how the network operates behind the scenes, aiming to double its pace of major upgrades to about six per year.

For now, the transition is mostly technical.

“This unification does not mean Base will be built in isolation. The protocol remains public and specified in the open, and alternative implementations are welcome and encouraged,” the team wrote in their blog post.

“We’re grateful for our three-year partnership with Base, and proud to have helped it become one of the most successful Layer 2 deployments in history,” an OP Labs spokesperson told CoinDesk.

“Our focus remains on delivering enterprise-grade blockchain infrastructure to our ecosystem, and we will continue to serve Base as an OP Enterprise customer while they build out their independent infrastructure.”

UPDATE (Feb. 18, 2026, 18:06 UTC): Adds OP Labs statement + background info on 118M OP token agreement.

Read more: Coinbase Officially Launches Base Blockchain in Milestone for a Public Company

Crypto World

OpenAI Unveils AI Benchmark Tool to Enhance Blockchain Security

Developed in collaboration with Paradigm, EVMbench evaluates AI agents’ ability to detect, patch, and exploit smart contract vulnerabilities.

EVMbench, a benchmarking tool, is set to enhance blockchain security by measuring the capabilities of AI agents in detecting, patching, and exploiting vulnerabilities in smart contracts. This new tool underscores the growing role of artificial intelligence in enhancing the security of decentralized finance (DeFi) ecosystems.

EVMbench employs historical vulnerabilities and a Rust-based harness to evaluate AI performance. At the forefront is GPT-5.3-Codex, an AI model developed by OpenAI, which achieved a score of 72.2% in exploit-mode evaluations.

EVMbench’s evaluation is comprehensive, utilizing 120 curated vulnerabilities from over 40 audits. These include scenarios provided by Tempo L1, which focuses on payment-oriented evaluations.

The tool also benefits from Paradigm’s expertise, which provides domain knowledge and quality control. This collaboration ensures the accuracy and reliability of EVMbench’s evaluations.

This article was generated with the assistance of AI workflows.

Crypto World

Hyperliquid Launches Policy Center to Shape DeFi Regulations in D.C.

Hyperliquid has launched the Hyperliquid Policy Center in Washington, D.C., to advocate for clearer regulations for decentralized finance (DeFi). The new nonprofit aims to focus on DeFi regulation and perpetual derivatives while engaging lawmakers and regulators. With prominent crypto lawyer Jake Chervinsky at the helm as CEO, the center plans to provide advocacy and research around policy issues impacting the decentralized financial space.

The initiative, funded by a $28 million contribution from the Hyper Foundation, aims to represent Hyperliquid’s ecosystem in policy discussions. The launch comes at a critical time when U.S. lawmakers are considering the future of blockchain technology and decentralized markets. With the financial markets shifting toward blockchain infrastructure, the new policy center seeks to address the gaps in U.S. regulations regarding decentralized systems.

Jake Chervinsky Leads the Hyperliquid Policy Center’s Efforts

Jake Chervinsky, a well-known advocate for DeFi policy, will lead the Hyperliquid Policy Center. He emphasized that the center is an independent organization focused on research and advocacy. The policy center’s mission is to ensure that DeFi can continue to thrive within the U.S. financial system. Chervinsky pointed out that while financial markets are increasingly moving to public blockchains, regulators have yet to create rules to accommodate decentralized systems like Hyperliquid.

1/ I am proud to announce the launch of Hyperliquid Policy Center, where I will serve as CEO.

HPC is an independent research and advocacy organization dedicated to ensuring that DeFi can flourish in the United States.

The future of finance will be decentralized. https://t.co/ObDFGsjlwj

— Jake Chervinsky (@jchervinsky) February 18, 2026

He also noted that DeFi platforms like Hyperliquid face regulatory challenges that were not foreseen in traditional financial laws. Hyperliquid itself operates on a public, permissionless blockchain and has grown to rival centralized exchanges in terms of liquidity. According to Chervinsky, current U.S. regulations do not fully align with decentralized technologies, which creates regulatory uncertainties.

Chervinsky explained that the Hyperliquid Policy Center will work directly with U.S. lawmakers and regulators to establish clearer rules for blockchain-based financial infrastructure. The goal is to ensure that U.S.-based companies can innovate and operate in the decentralized finance space without facing regulatory hurdles that could stifle growth.

Funding and Support from the Hyper Foundation

To support its efforts, the Hyper Foundation has contributed 1 million HYPE tokens, valued at $28 million. These tokens will be unstaked immediately and will help fund the creation of the Hyperliquid Policy Center. The foundation emphasized that this contribution demonstrates its commitment to the long-term success of the DeFi ecosystem in Washington, D.C.

The Hyper Foundation’s contribution not only helps launch the policy center but also ensures that the community has a voice in regulatory discussions. The foundation aims to help bridge the gap between the DeFi sector and policymakers. Through its contribution, the foundation hopes to elevate the discussion about decentralized finance at the federal level.

As part of its mission, the policy center will produce technical research, publish commentaries on proposed regulations, and answer questions related to decentralized markets. The center will also serve as a resource for lawmakers and regulators to better understand the technical aspects of DeFi.

The Policy Center’s Team and Focus Areas

The Hyperliquid Policy Center has also introduced its founding team, which includes Brad Bourque and Salah Ghazzal. Bourque, the new Policy Counsel, has previously worked with Sullivan & Cromwell LLP, bringing legal expertise to the center’s efforts. Ghazzal, the Policy Director, has experience working as a policy lead at Variant, further strengthening the team’s understanding of regulatory affairs.

The team will focus on several key areas, particularly decentralized finance and perpetual derivatives. They plan to contribute to ongoing policy debates and engage in discussions on how existing regulations apply to decentralized technologies. In addition to advocacy, the center will provide technical insights to help inform policymakers about how DeFi platforms operate and the risks involved.

The center also plans to dive deep into complex issues tied to decentralized markets. This includes providing feedback on proposed rules and offering recommendations for how regulations can be adapted to the evolving DeFi landscape.

The Hyperliquid Policy Center and the CLARITY Act

The launch of the Hyperliquid Policy Center coincides with ongoing discussions around the CLARITY Act, which is currently stalled in the Senate Banking Committee. The bill aims to divide oversight of digital assets, classifying them either as digital commodities under the CFTC or as investment contract assets under SEC rules. While the bill has faced delays, including the cancellation of markup sessions scheduled for January, it remains a key piece of legislation for the future of blockchain regulation in the U.S.

Jake Chervinsky has been vocal in his support for the CLARITY Act, calling for stronger protections for DeFi platforms during the legislative process. He has warned that the DeFi community needs clear protections in place for the industry to continue developing and evolving. Chervinsky has also emphasized the importance of safeguarding developers from legal liabilities while ensuring that DeFi platforms comply with applicable regulations.

As the Hyperliquid Policy Center begins its advocacy efforts, it will likely play a key role in pushing for stronger safeguards and clearer rules for the DeFi sector as the CLARITY Act moves forward.

The Future of DeFi Regulation and Advocacy

The Hyperliquid Policy Center’s launch highlights the growing need for clear regulatory frameworks around decentralized finance in the United States. As more financial services move to blockchain-based platforms, lawmakers will face increasing pressure to address the legal and regulatory challenges that these technologies present.

By focusing on education and advocacy, the Hyperliquid Policy Center aims to fill a critical gap in the current regulatory landscape. Its work will not only support the interests of the Hyperliquid ecosystem but also help shape the future of DeFi regulation in the U.S. Through its leadership and research, the center hopes to ensure that DeFi continues to thrive while operating within a clear and fair regulatory framework.

Crypto World

Pump.fun overhauls creator fees, launches trader ‘cashback coins’

Solana-based token launch platform Pump.fun is changing how creator fees work, giving users the ability to decide whether token deployers or traders should receive fee rewards.

Summary

- Pump.fun has introduced “Cashback Coins,” allowing token creators to redirect 100% of creator fees to traders instead of themselves.

- Creators must choose between Creator Fees or Trader Cashback before launch, and the decision is permanently locked once the token goes live.

- The move aims to address concerns that some deployers collect fees without contributing ongoing value, letting the market decide who gets rewarded.

Pump.fun lets traders take the fees with new cashback model

In a post on X, Pump.fun said “not every token deserves Creator Fees,” announcing the launch of a new feature called Cashback Coins. The update allows token creators to choose, before launch, whether fees generated by the token will go to the creator or be redirected entirely to traders.

In a follow-up post, Pump.fun’s CEO said the update was aimed at “rewarding traders and REAL projects.”

Creator fees have traditionally been positioned as a way to help founders, teams, and project leads fund development and grow their communities. However, Pump.fun acknowledged that many tokens gain traction without an active team or long-term project roadmap.

In such cases, the platform said, creator fees can disproportionately reward deployers who may not contribute ongoing value.

Under the new system, coin creators must select one of two options at launch: Creator Fees or Trader Cashback. If Trader Cashback is selected, 100% of the creator fees are redirected to traders instead of the deployer. Once the token is launched, that choice is permanently locked and cannot be changed.

Pump.fun also clarified that “CTOs,” or community takeovers, cannot be carried out on Cashback Coins. Tokens launched under the cashback model will permanently reward traders and holders rather than any original deployer. Creator Fee coins are similarly locked into their chosen structure.

The feature is now available within the Pump.fun mobile app and website during the token creation process. Users who participate in Cashback Coins can claim rewards directly through the app by navigating to their profile and accessing the rewards section.

The move reflects growing debate within the memecoin ecosystem over incentive alignment and fairness.

By shifting fee distribution decisions to token creators, and ultimately letting traders choose which model to support, Pump.fun is positioning the market itself as the mechanism that determines who gets rewarded.

Crypto World

David Bailey’s Nakamoto Buys His Own Bitcoin Empire at a Discounted Public Price

The deal brings Bailey’s private ventures under a public umbrella, without a new shareholder vote.

A Bitcoin‑focused public company just bought two businesses that its own CEO originally founded, leaving many in the crypto circles scratching their heads over who’s really running the show.

The buyer, recently launched Bitcoin treasury company Nakamoto Inc., said in a Feb. 17 press release that it will merge with BTC Inc., the media and events group behind Bitcoin Magazine and The Bitcoin Conference, and UTXO Management, a Bitcoin-focused investment adviser.

David Bailey, Nakamoto’s chairman and CEO, co-founded BTC Inc. and UTXO Management, meaning he is effectively the buyer, seller, and CEO approving the deal.

“The Transaction is intended to further establish Nakamoto as a diversified Bitcoin operating company with a global brand, established distribution networks, and institutional capabilities across media, asset management, and advisory services,” the press release states.

The deal is expected to close in Q1 2026 and is valued at about $107.2 million. Shares of Nakamoto, which trade on Nasdaq under the ticker NAKA, are down over 90% on the year.

NAKA shares are down 2.5% today and trading 10% lower since yesterday evening, following the news.

As Bitcoin advocate Justin Bechler pointed out in an X article on Feb. 17, in November 2025 Bailey handed the CEO title of BTC Inc. to Brandon Greene, who previously served as managing director, chief of staff, and head of events at BTC Inc., driving the growth of Bitcoin Magazine.

Bailey’s background spans over a decade in crypto leadership, including leading Bitcoin Magazine and organizing industry events. During the 2024 U.S. election cycle he was a visible Bitcoin advocate who advised Donald Trump’s campaign on crypto and played a role in securing Trump’s keynote appearance at the 2024 Bitcoin Conference.

‘Exit Liquidity’

As multiple commentators on X pointed out, the mechanics of the deal appear messy, given the ownership of the involved parties. The transaction will be financed entirely with newly issued common stock priced at $1.12 per share under pre‑existing call‑option terms, giving the sellers shares worth more than four times NAKA’s current market price, trading near $0.27 at press time.

That means Bailey’s private companies are being absorbed into the public shell at a price set long before most current shareholders bought in.

“Forget the pricing fiction on the contract. What matters is that 363.6 million new shares just entered the float. Existing shareholders are being diluted by that number regardless of whether the paperwork says $1.12 or $0.29. The $1.12 label is a courtesy to the seller. The dilution is real,” Bechler writes.

Because the call rights were previously disclosed and approved as part of earlier merger documentation, Nakamoto said “No additional Nakamoto shareholder approval is required to complete the Transaction.”

Some onlookers argue it was expected that Nakamoto would pull this move. Brian Brookshire, advisor at Bitcoin credit‑backed stablecoin protocol Saturn, noted in an X post yesterday evening that “no one should be surprised by this deal,” adding that “it was crystal clear from the outset that Nakamoto was a vehicle for bringing BTC Inc. public.”

For outside investors, the deal shows how linked operating businesses can be folded into a public shell while using shareholders as “exit liquidity.” Some explicitly pointed out the redundant ownership structure, saying the transaction was nothing more than “David pays David for David’s company with shareholders money…and the scam goes on.”

Crypto World

Bitcoin Bottom Signal That Preceded a 1,900% Rally Flashes Again

Bitcoin’s on-chain signals have shifted in a way that several researchers say signals capitulation could be underway, potentially setting the stage for a cycle bottom. The most studied metric — the short-term holder stress — has sunk to levels not seen since the late-2018 bear market trough, according to data from Checkonchain. The indicator measures the gap between the spot price and the average cost basis of wallets holding coins for under 155 days, applying Bollinger Bands to identify oversold conditions. Traders and researchers see the print as aligning with prior macro bottoms, though consensus on timing remains mixed. The conversation also points to macro liquidity catalysts: Wells Fargo cites tax refunds in 2026 as a possible tailwind that could pour liquidity into Bitcoin and equities by March, potentially absorbing remaining selling pressure. The path forward will hinge on whether market participants sustain buying interest as on-chain stress remains subdued across multiple cohorts, including short-term holder wallets.

Key takeaways

- Bitcoin’s Short-Term Holder (STH) MVRV Bollinger Band indicator has moved into its deepest oversold territory since the 2018 bear market bottom, signaling potential capitulation pressure.

- Historical precedents show similar oversold prints preceding substantial rallies, including a roughly 150% gain within a year and a 1,900% surge over three years after the 2018 bottom.

- The November 2022 trough, which preceded a multi-year rally to a record high near $126,270, is cited as another data point supporting cycle-bottom expectations.

- Realized losses among short-term holder whales have remained muted since Bitcoin’s October 2025 peak near $126,000, suggesting larger buyers have not yet fully capitulated.

- Macro liquidity signals, such as Wells Fargo’s note on sizable 2026 tax refunds potentially fueling a “YOLO” trade into Bitcoin and equities, could provide near-term upside pressure if flows materialize by end-March.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. While on-chain stress hints at a potential bottom, there is noConfirmed breakout scenario described and macro factors remain a key variable.

Market context: The combination of on-chain stress relief and a potential liquidity impulse from tax flows frames a window where risk appetite could improve in the near term. observers are watching whether the inflows materialize into persistent demand, or whether price action remains range-bound as macro conditions evolve.

Why it matters

On-chain metrics have long been a yardstick for evaluating Bitcoin’s market cycle phases, distinct from price action alone. The Short-Term Holder MVRV Bollinger Band approach temporarily puts a spotlight on coins held by newer entrants, treating them as a proxy for imminent selling or hold-to-maturity behavior. When the oscillator breaks below its lower Bollinger Band, it suggests that the average cost basis of short-term holders is being undercut by the current price — a condition historically associated with capitulation in the broader market. The 2018 experience, where oversold prints preceded a multi-year uptrend, is frequently cited by analysts as a potential template for this cycle.

The depth of the current oversold reading is meaningful because it aligns with a broader narrative: that selling pressure could be waning as investors capitulate, potentially creating room for a sustainable bottom. Yet, the analysis cautions that such signals are not guarantees. Bitcoin’s price has previously rebounded from similar conditions only to face renewed headwinds from macro shocks or shifts in risk appetite. The discussion around realized losses among short-term holder whales adds nuance: even as prices have fallen, large holders have not uniformly capitulated, suggesting that demand may still exist at higher levels than recent prices imply. This balance matters because it influences the probability of a durable bottom versus a quick bounce that fails to gain traction.

The macro dimension adds another layer. Wells Fargo’s strategists highlighted the potential for tax refunds to unlock liquidity that could support risk-on assets, including Bitcoin, by injecting capital into the market through March. If the $150 billion figure referenced by analysts proves accurate, such inflows could mitigate selling pressure and help price discover a more meaningful bottom. The convergence of on-chain signals with real-world liquidity flows is the kind of alignment that market watchers view as a constructive sign for risk assets, even as they remain cautious about the pace and durability of any rebound.

Analysts also point to historical cycles where bottoms were followed by notable recoveries. The late-2018 experience showed that oversold conditions, when paired with improving macro sentiment and increasing demand from new buyers, could catalyze a multi-year upside. The November 2022 bottom, followed by a surge to near-record highs, reinforces the idea that bottoms often coincide with periods of intense buyer interest returning to the market, even if the path there is bumpy. In this environment, the emphasis is on how fast new money and existing holders re-enter the market and how quickly sellers exhaust their supply, factors that are inherently linked to broader liquidity and sentiment dynamics.

Within the broader ecosystem, some traders and researchers also reference a smell-test of market psychology: the extent to which realized losses have cooled among the most active short-term participants suggests that the willingness to re-enter at higher levels remains present, albeit tentative. This is why the current data is interpreted as a potential setup for a cycle low rather than a guaranteed bottom. The shared takeaway is that while the signals are promising, the next few weeks — especially through the end of March — will be telling as tax-driven liquidity and on-chain dynamics continue to unfold.

The discussion around these dynamics is not isolated to Bitcoin. While the primary focus is on the flagship asset, the pattern of on-chain stress, macro liquidity, and historical analogs feeds into broader debates about the resilience of the crypto market amid evolving market structure and regulation. As always, readers are advised to view these signals as parts of a larger puzzle, not a definitive forecast. The intersection of on-chain data, fund flows, and macro risk sentiment remains the most informative lens for assessing where Bitcoin might head next.

What to watch next

- Monitor whether Bitcoin price stabilizes or rallies in the coming weeks, particularly if the STH Bollinger Band reading remains in oversold territory or begins to recover.

- Track tax-related liquidity flows into markets through March, as discussions around the $150 billion potential influx gain visibility.

- Observe changes in realized losses among short-term holder wallets and any signs of capitulation shifting toward distribution or accumulation phases.

- Watch updates from on-chain analytics providers like Checkonchain for new readings on short-term cost bases and holder behavior.

Sources & verification

- Checkonchain on the Short-Term Holder (STH) Bollinger Band metric and its historical precedents.

- Past Bitcoin bottoms in 2018 and 2022 that preceded major rallies, including a move to about $126,270 in 2022.

- Bitcoin price context around the October 2025 peak near $126,000 and the persistence of muted realized losses among short-term holder whales.

- Wells Fargo analysis cited by CNBC, noting potential liquidity inflows from tax refunds in 2026 and their possible impact on Bitcoin and equities.

- Matrixport’s bottom outlook as part of the broader analyst consensus around on-chain signals and macro risk sentiment.

Bitcoin on-chain stress signals edge toward potential cycle bottom

Bitcoin (CRYPTO: BTC) on-chain metrics have shifted in a way that several researchers say signals capitulation could be underway, potentially setting the stage for a cycle bottom. Foremost among them is the Short-Term Holder (STH) MVRV Bollinger Band indicator, which dipped into levels not seen since the 2018 bear trough, according to data from Checkonchain. By applying Bollinger Bands to the gap between the spot price and the average cost basis for wallets that have held BTC for less than 155 days, the oscillator flags oversold conditions when the price trades beyond the lower band.

The pattern mirrors a historical playbook: when the STH oscillator crosses the lower Bollinger band, Bitcoin has tended to trade well below the average purchase price of recent buyers, signaling capitulation pressure that often precedes a multi-month or multi-year rebound. In late 2018, such an oversold print foreshadowed a substantial rally, with BTC staging roughly a 150% ascent within a year and a cumulative rise of about 1,900% over three years. Similarly, the November 2022 trough marked a turning point before a dramatic upleg toward a record high near $126,270. These episodes illustrate how on-chain stress and market cycles can align in the aftermath of stress events.

Beyond price gaps, the market’s on-chain composition offers a nuanced view: realized losses among short-term holder whales have remained muted since Bitcoin’s October 2025 peak around $126,000, implying that larger buyers may still be sitting on loss-adjusted positions rather than capitulating. This balance between buying pressure and seller fatigue is often critical for confirming a bottom rather than a simple bounce. The data point is echoed in other analyses showing that demand from new entrants and opportunistic buyers has not yet faltered, though the overall macro environment remains uncertain.

Macro traders are also watching liquidity catalysts that could influence near-term direction. Wells Fargo’s Ohsung Kwon, cited by CNBC, highlighted that unusually large tax refunds anticipated in 2026 could revitalize what some call a “YOLO” trade — a rapid, all-in bet across equities and digital assets. Estimates floated in the note suggest as much as $150 billion could flow into stocks and Bitcoin by the end of March, a wave that may help absorb remaining selling pressure and support a stabilization narrative through the first quarter. More details

Such liquidity inflows would not, by themselves, guarantee a sustained rally, but they could dampen downside volatility and create a backdrop for a gradual rebound if on-chain metrics continue to show exhaustion of sellers. The discussion around short-term holder metrics is complemented by institutional commentary and analyst forecasts that point to a potential cycle low rather than a simple bounce. Some market observers, including researchers tracking long-run cycles, emphasize that the bottom’s timing is intrinsically linked to how quickly buyers re-emerge and how macro risk sentiment evolves in the coming weeks.

https://platform.twitter.com/widgets.js

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment11 hours ago

Entertainment11 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech15 hours ago

Tech15 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Entertainment2 hours ago

Entertainment2 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Business17 hours ago

Business17 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World5 hours ago

Crypto World5 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone