Crypto World

Zcash faces potential 66% decline, holders reduce stakes

Zcash recorded a 7% price decline over the past 24 hours, while broader cryptocurrency markets also slipped. However, large holders reduced their positions by approximately 38% over the past seven days, raising concerns about the cryptocurrency’s near-term prospects.

Summary

- Large holders reduced their stakes by 38% over the past week, and technical analysis suggests a bearish flag pattern.

- Zcash has seen a 40% drop month-over-month.

- The concentration of 70% of the supply in the top 100 addresses suggests Zcash’s current price foundation may be unstable.

The privacy-focused cryptocurrency has increased 5.8% over the past week, but decreased over 40% month-over-month, according to CoinGecko.

Bitcoin and Ethereum experienced larger declines during the same period as the broader cryptocurrency market continued its selloff.

Exchange flow data showed net outflows on Feb. 12, indicating some purchasing activity. However, on-chain data revealed that large holders decreased their Zcash holdings by roughly 38% over seven days, with additional selling occurring in the past 24 hours. Exchange inflows increased simultaneously, suggesting coins moved from private wallets to exchanges.

Technical analysts identified a bearish flag and pole pattern forming on Zcash price charts. This formation typically appears after a sharp decline, followed by a consolidation period. When prices break down from this pattern, the resulting decline often matches the distance of the initial drop, according to technical analysis methodology. For Zcash, this measured move indicates a potential 66% decline from current levels if the pattern completes.

A four-month bearish divergence signal has also formed between October and February. During this period, Zcash prices reached a higher high while the Relative Strength Index (RSI), a momentum indicator, recorded a lower high. This divergence typically indicates weakening buying pressure despite rising prices.

The RSI continues to trend downward while prices remain near recent highs, creating a widening gap between price action and momentum indicators.

On-chain data shows the top 100 addresses control approximately 70% of the total supply. Smart money indicators remained flat with no significant accumulation detected, according to blockchain analytics.

The cryptocurrency rebounded from lows reached in early February. Technical analysts stated that a breakout above resistance levels would be required to invalidate the bearish setup, while a breakdown below key support would likely accelerate declines.

Market observers noted that the relative outperformance compared to other cryptocurrencies occurred while large holders distributed their positions, creating what analysts described as a potentially unstable foundation for current price levels.

Crypto World

Perplexity AI Predicts the Price of XRP, Solana and Shiba Inu by The End of 2026

Global headlines may be dominated by reports of conflict, but crypto is holding steady. According to projections generated by Perplexity, holders of XRP, SOL, and SHIB could still see significant gains this year.

Many say that geopolitical risk may already have been priced into markets after Donald Trump’s previous warnings about possible U.S. military escalation involving Greenland and Iran earlier this year.

With uncertainty still lingering, we examine how realistic Perplexity’s projections are.

XRP ($XRP): Perplexity Projects a Potential 7x Surge by Year-End

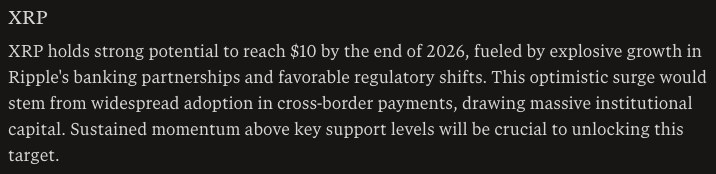

In a recent update, Ripple reaffirmed that XRP ($XRP) plays a central role in the XRP Ledger’s (XRPL) growth into a global payments infrastructure designed for enterprise use.

XRP enables near-instant settlement and extremely low transaction fees, positioning the network to capture two rapidly expanding sectors in crypto: stablecoins and tokenized real-world assets.

With XRP currently trading close to $1.36, Perplexity AI predicts the asset could potentially climb to around $10 in 2026, representing a little over sevenfold return for current HODLers.

XRP’s relative strength index (RSI) currently sits near 42, while price movement has begun stabilized around its 30-day moving average, suggesting perhaps the extended consolidation period is nearing its end.

Several catalysts could further strengthen XRP’s outlook, including rising institutional demand following the launch of U.S.-listed XRP exchange-traded funds, Ripple’s expanding network of international partnerships, and comprehensive crypto legislation (the CLARITY Act) in the United States.

Solana (SOL): Could Solana Soon Hit $700?

Solana ($SOL) currently secures around $6.7 billion in total value locked and has a market capitalization of $48 billion.

Institutional interest increased after the introduction of Solana-based exchange-traded funds by prominent asset managers such as Bitwise and Grayscale.

However, SOL crashed toward the end of 2025 and spent much of February trading below the $100 mark.

Perplexity sees Solana rising from $84 today to approximately $700 by Christmas. That would give 8x returns and price Solana more than double it’s January 2025 ATH of $293 recorded.

Moreover, major asset managers like Franklin Templeton and BlackRock have begun issuing tokenized assets on Solana.

Shiba Inu (SHIB): Perplexity Forecasts a Potential 2,000% Rally

Originally launched in 2020 as a tongue-in-cheek Dogecoin challenger, Shiba Inu ($SHIB) has since developed into a broader ecosystem with a market capitalization of $3.2 billion.

Currently around $0.000005359, Perplexity’s analysis suggests that a decisive breakout above the $0.000025–$0.00003 resistance range could trigger strong upward momentum. Under that scenario, SHIB could potentially climb toward $0.00008 before the end of the year.

Such a move would represent gains of roughly 15x, or around 1,400%, bringing it a hair’s breadth beneath its October 2021 ATH of $0.00008616.

Beyond its meme coin reputation, the project has introduced practical utility through Shibarium, its Ethereum Layer-2 scaling solution. Shibarium delivers faster transactions, lower fees, enhanced privacy features, and improved developer tools for building decentralized applications.

Maxi Doge: Emerging Meme Coin Aims for Rapid Growth

Perplexity’s projection of a potential 14x surge for Shiba Inu reflects expectations that a new meme coin cycle could accompany the next crypto bull market. However, projects at earlier stages often present even greater growth potential.

One project gaining attention is Maxi Doge ($MAXI), which has already raised $4.7 million through its ongoing presale as early investors accumulate what some believe could become the next Shiba Inu.

Maxi Doge is the loud, louche and degenerate distant cousin to Dogecoin, embracing a comic marketing approach inspired by the chaotic enthusiasm of the 2021 meme coin boom.

MAXI is an ERC-20 asset on Ethereum’s proof-of-stake network, giving it a significantly smaller environmental footprint compared with Dogecoin’s proof-of-work system.

Early participants in the presale can currently stake MAXI for yields reaching up to 67% APY. These rewards gradually decrease as more tokens enter the staking pool.

The token is currently priced at $0.0002807 during the latest presale phase, with automatic price increases scheduled at each new funding milestone. Investors can purchase the token using supported wallets such as MetaMask and Best Wallet.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Maxi Doge Website Here

The post Perplexity AI Predicts the Price of XRP, Solana and Shiba Inu by The End of 2026 appeared first on Cryptonews.

Crypto World

Kraken rolls out xChange engine to power tokenized stock markets

Kraken’s tokenized equities platform xStocks has launched xChange, an onchain trading engine designed to facilitate trading of tokenized stocks across the Ethereum and Solana networks.

According to the company, the system supports trading of more than 70 tokenized equities backed 1:1 by underlying shares held in custody, with prices intended to track the corresponding public market stocks.

The launch adds new trading infrastructure for tokenized equities, part of the broader tokenized real-world asset market that aims to bring traditional financial instruments such as stocks onto blockchain-based trading systems.

Kraken launched xStocks in June, offering tokenized versions of publicly traded companies issued by Backed Assets, though the products are not available to users in the United States, the United Kingdom or other restricted jurisdictions.

Since then, the platform has recorded $3.5 billion in onchain transaction volume and about $25 billion in total trading volume across exchanges, with about $225 million in tokenized assets held across about 80,000 blockchain wallets, according to company data.

The move from Kraken comes days after the exchange said its banking unit, Kraken Financial, had been granted a limited-purpose master account by the Federal Reserve Bank of Kansas City, giving it direct access to the Fedwire payments network used by banks and credit unions.

Related: Kraken introduces fixed-rate crypto loans for its Pro users

Traditional and crypto exchanges build rails for tokenized stocks

Kraken is not alone in exploring infrastructure for tokenized securities, as both crypto exchanges and traditional market operators experiment with ways to bring stocks onto blockchain-based trading systems.

In December, Coinbase announced that it plans to launch Coinbase Tokenize, an institutional platform designed to support the issuance and management of tokenized real-world assets, including equities.

About a month later, the owner of the New York Stock Exchange, Intercontinental Exchange, said it is developing a platform to support trading of tokenized securities, including stocks and exchange-traded funds.

The proposed system would combine the exchange’s existing matching engine with blockchain-based settlement infrastructure and could support round-the-clock trading with near-instant settlement, potentially using stablecoins instead of the current one-day settlement cycle in US equity markets.

The London Stock Exchange Group has also said it is developing blockchain-based infrastructure intended to support the trading and settlement of tokenized securities such as equities and bonds.

Nasdaq, meanwhile, has proposed integrating tokenized versions of stocks and exchange-traded products into its existing trading infrastructure, a change that could increase liquidity for tokenized securities if approved by regulators.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

as WTI rips past $90, is there a weekend opportunity?

Oil’s violent intraday squeeze is colliding with fragile crypto risk sentiment, setting up a tense weekend for Hyperliquid oil perps and broader macro-linked digital assets.

Summary

- WTI crude spiked 13% intraday, pushing toward the key $90 level per barrel.

- The move comes as rate-cut expectations firm and crypto trades lower across majors.

- Hyperliquid oil perps now sit at the crossroads of an energy shock narrative and a tired crypto risk complex.

WTI crude’s surge to around $89.21 per barrel, a 13% intraday jump is a full-blown squeeze into a psychologically loaded $90 handle, leading to what analysts say could be a $100 or even $200 barrel price as the war with Iran rages on.

Coupled with that, WTI has ripped to fresh highs with daily relative strength index (RSI) pushing above +88, a momentum extreme ZeroHedge notes hasn’t been seen since the Kuwait War, as crude rockets through resistance on Iran‑linked supply fears and panic‑level volatility. That combo – geopolitics, stretched positioning, and technicals at blow‑off levels – is exactly what’s now bleeding into Hyperliquid perps, Polymarket oil markets, and, by extension, the entire crypto macro trade.

The immediate backdrop is a macro tape increasingly conditioned on Federal Reserve cuts later this year, with multiple officials signaling openness to easing if data cooperates and market pricing in a non-trivial probability of a June cut. In that context, oil ripping higher injects an inflationary tail-risk back into the narrative right as investors were starting to price a smoother disinflation glide path.

Oil and the broader crypto market

Crypto is not trading in a vacuum here. Majors like BTC (BTC), ETH (ETH), and BNB (BNB) are flashing red, with BTC around $68,446.80, ETH near $1,981.04, and BNB at $631.50, all down between roughly 3–5% on the day. Even HYPE (HYPE), a proxy for appetite around Hyperliquid’s ecosystem, is off about 2.62% at $29.81. In a classic macro playbook, higher oil plus fading momentum in crypto raises the probability of a broader de-risking if energy stays bid into next week.

Hyperliquid oil-linked futures volume surges

Hyperliquid has already shown what an Iran weekend looks like in the perps tape. During the first wave of strikes last weekend, the exchange saw nearly 17 million dollars in oil derivatives volume and roughly 148 million dollars in gold trading in a single weekend session, pushing total 24‑hour commodity turnover close to 200 million dollars while COMEX and CME were dark. Subsequent reports put open interest in Hyperliquid’s CL USDC oil perpetuals above 50 million dollars and highlighted gold and silver perps turning into a de facto 24/7 macro hedge, with some instruments briefly trading above 5,400 dollars per ounce as traders rushed to price Iran risk before legacy benchmarks reopened.

For Hyperliquid traders running oil perps into the weekend, the setup is binary and unforgiving. On one side, if $90 breaks and holds, you are effectively long an inflation scare that could bleed into rates, equities, and high-beta crypto, with oil longs and defensive tokens outperforming.

On the other, if this move is an overextended squeeze driven by positioning and thin liquidity, mean reversion early next week could crush late longers while offering crypto a brief relief window as real-yield fears ebb. With Fed expectations fragile, upcoming data and any geopolitical headlines around supply will matter more than usual.

Oil’s spike is not just about Fed cuts and positioning; it is about Iran risk bleeding into the tape. A widening U.S.–Israel confrontation with Tehran and shipping disruptions around the Strait of Hormuz have injected a hard geopolitical premium into crude, with analysts warning that up to a third of global seaborne supply and a fifth of LNG flows sit in the crosshairs if transit is impaired. Even before WTI flirted with $90, oil had been grinding higher on fears of supply shocks and potential blockage scenarios, keeping prices elevated despite otherwise comfortable inventories. For Hyperliquid oil perps, that means you are no longer just trading a chart; you are implicitly taking a view on whether Iran risk escalates into a genuine supply event or fades back into background noise as flows normalize.

Polymarket oil market opportunities?

Polymarket’s crude oil markets are already trying to price that regime shift in real time, with contracts on where CL settles by month‑end and whether oil prints specific upside targets effectively encoding crowd probabilities on an Iran‑driven spike. As of March 26, Polymarket traders are pricing $150 barrel oil at 9%, while bettors see a $100 barrel at 71%.

Crypto World

Coinbase Prime Integrates Regulated Futures and Cross-Margin Trading for Institutional Crypto

TLDR:

- Coinbase Prime now offers 20+ CFTC-regulated futures contracts with 24/7 trading through Coinbase Financial Markets.

- Unified cross-margin allows institutions to manage spot and futures exposures within one single capital framework.

- Assets are secured under Coinbase’s NYDFS-regulated custodian, keeping all trading within a fully regulated structure.

- Coinbase’s Deribit acquisition moves the platform closer to one unified exchange for spot, futures, and options.

Coinbase Prime has taken a major step forward in institutional crypto infrastructure. The platform announced integrated regulated futures trading and unified cross-margin functionality across spot and derivatives markets.

Through Coinbase Financial Markets, its CFTC-regulated futures commission merchant, institutions now access over 20 futures contracts.

These include perpetual-style products with round-the-clock trading availability. The launch positions Coinbase Prime as a full-service, regulated prime brokerage built specifically for institutional-grade digital asset operations.

Unified Cross-Margin Reshapes Capital Management for Trading Desks

Traditionally, spot and futures trading required separate collateral pools and independent risk systems. That separation often created inefficiencies for institutional trading desks managing complex multi-market strategies. Coinbase Prime now brings both under one capital framework through unified cross-margin.

With this setup, institutions can evaluate spot and futures exposures together within a single portfolio view. Capital moves more freely across strategies, while risk is monitored holistically across the entire platform.

This is particularly useful for basis trading, where hedged positions can benefit from more efficient margin treatment.

Coinbase Institutional shared the development on X, stating that Prime is now “the most comprehensive operating system for institutional crypto.”

The post noted that institutions can now “trade, finance, and manage assets within a regulated full-service crypto prime brokerage framework.”

Prime’s deterministic risk model also allows trading desks to calculate margin requirements before execution. That transparency reduces reliance on opaque margin engines that have historically complicated pre-trade planning for institutions.

Regulated Infrastructure Brings Futures Directly Into the Prime Workflow

Futures access through Coinbase Financial Markets, a CFTC-regulated FCM, is now embedded directly into the Prime workflow.

Institutions no longer need separate platforms to access derivatives markets. Execution, custody, and risk management now operate within a single environment.

Assets remain secured within Coinbase’s NYDFS-regulated qualified custodian throughout the trading lifecycle. This structure allows institutions to operate within a fully regulated framework while accessing both spot and derivatives markets simultaneously.

Beyond futures, Coinbase Prime also covers financing, lending, and operational infrastructure at institutional scale.

The platform is designed so trading desks no longer need to coordinate across fragmented or self-assembled systems.

Coinbase’s recent acquisition of Deribit, the world’s leading crypto options exchange, further broadens this ecosystem.

The goal is a single platform where institutions can access spot, futures, perpetuals, and options together. That consolidated model reflects Coinbase Institutional’s broader objective of building what it describes as an “Everything Exchange” for professional market participants.

Crypto World

Curve Finance Warns PancakeSwap About Licensing Violation

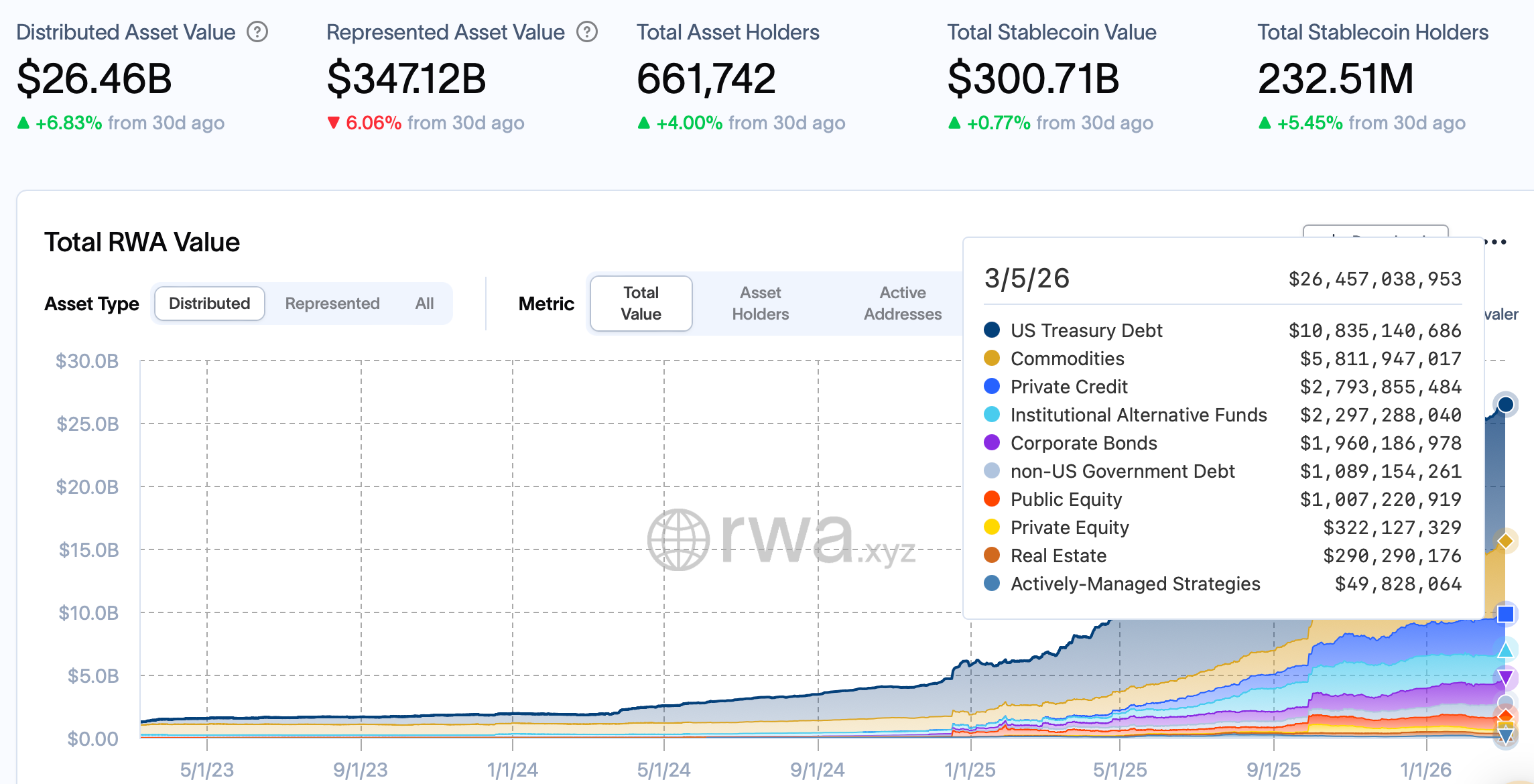

The team behind the Curve Finance decentralized finance (DeFi) platform accused the PancakeSwap decentralized exchange (DEX) of using its code without the proper licensing.

The code is tied to the “StableSwap” feature used for swapping stablecoins and “tightly-pegged” assets on PancakeSwap Infinity, the latest version of the PancakeSwap DEX.

“If you want to enjoy using stableswap without legal problems and to borrow some of our expertise to keep users SAFU, you still can contact us for licensing and collaboration,” the Curve team said on X.

In a separate post, Curve said “deep stableswap expertise” is needed to safely integrate swap features, and cited the 2022 hack of the Saddle Finance DEX and the $116 million hack of DeFi protocol Balancer in 2025 as examples of swap-based code exploits.

The PancakeSwap team said it would reach out to Curve Finance to discuss the issue. “Indeed, better to be friends and build together,” the Curve team responded.

Cointelegraph reached out to both teams but did not receive a response by the time of publication.

The incident highlights the potential cybersecurity and legal issues that arise in decentralized finance as projects and protocols continue to iterate on products and expand features.

Related: Curve founder says DeFi must ditch token emissions for real revenue

PancakeSwap Infinity launches and goes cross-chain

PancakeSwap Infinity launched on the Arbitrum network and BNB Chain in April 2025, following the integration of one-click, cross-chain swaps that allow users to move digital assets between blockchain protocols.

The updated DEX introduced “hooks,” smart contract plug-ins that customize parameters for liquidity pools, including dynamic fee structuring, tailored rebates and onchain limit orders that execute when preset conditions are met.

The upgrade also lowered pool creation fees by up to 99% and was built to accommodate different liquidity strategies, according to PancakeSwap.

In July 2025, PancakeSwap Infinity launched on Base, an Ethereum layer-2 (L2) scaling network, and touted up to 50% cheaper trading fees when Ether (ETH), the native token of the Ethereum layer-1 blockchain network, was traded against ERC-20 tokens.

ERC-20 is the token standard for most assets minted on Ethereum, including the gas and governance tokens of Ethereum L2s, memecoins, and other projects issuing tokens on Ethereum.

Magazine: MakerDAO’s plan to bring back ‘DeFi summer’ — Rune Christensen

Crypto World

Kazakhstan’s Central Bank to Invest $350 Million in Crypto Assets

Kazakhstan’s central bank has announced a strategic move to invest up to $350 million in cryptocurrency assets, marking a significant shift in its reserve management strategy.

Kazakhstan’s central bank has unveiled plans to invest up to $350 million in cryptocurrency assets. This decision represents a substantial policy shift aimed at diversifying the country’s reserves.

Kazakhstan has emerged as a significant player in the global crypto mining sector, contributing approximately 6-8% of Bitcoin’s global mining due to its low electricity costs. The government is also working on a regulatory framework to legalize and tax crypto mining and trading, further solidifying its position as a crypto-friendly nation, according to Reuters.

The central bank, which oversees Kazakhstan’s monetary policy and manages its currency reserves, is implementing this investment strategy as part of a broader approach to reserve management.

This move is likely to influence neighboring Central Asian countries, encouraging them to consider similar investments or regulatory measures. The shift could potentially transform the regional crypto landscape, making Central Asia a hub for cryptocurrency development and innovation.

The investment decision aligns with global trends where central banks are increasingly exploring crypto assets as part of their reserve diversification strategies.

This article was generated with the assistance of AI workflows.

Crypto World

Bitcoin Exchange Outflows Signal Holder Conviction Amid Hormuz Crisis

Bitcoin outflows from exchanges continued during the Hormuz crisis, signaling holders are moving coins into cold storage rather than selling.

Bitcoin (BTC) held near $70,000 on March 6 after a geopolitical shock tied to tensions around the Strait of Hormuz pushed energy prices higher and triggered risk-off behavior across global markets.

Despite the turbulence, blockchain data shows BTC continuing to leave exchanges, suggesting many holders are not preparing to sell.

Energy Shock Rattles Markets

Analyst GugaOnChain linked the latest volatility to disruptions around the Strait of Hormuz, a major energy shipping route, which remains effectively closed amid the U.S.-Israeli war on Iran.

The market watcher noted that Brent crude traded near $85 and West Texas Intermediate around $81 as the situation pushed up fuel costs, including a $0.27 increase in U.S. gasoline prices during the week.

According to the same analysis, the shock drained liquidity across global markets and led to outflows of just under $228 million from Bitcoin exchange-traded funds on March 5. However, exchange flow data showed an unusual divergence. Using a seven-day moving average, Bitcoin’s net exchange flows remained negative, meaning more coins were leaving exchanges than entering them. Daily data showed withdrawals of 500 BTC, while the weekly total reached about 6,500 BTC, leaving trading venues.

According to GugaOnChain, such movements often signal that investors are transferring holdings into cold storage, which reduces the supply immediately available for sale.

“Given the notable on-chain resilience, the directive is to adopt a tactical defensive stance, maximizing cash now and awaiting confirmation of a reversal in institutional flows before raising exposure again,” the analyst advised.

Trading Activity Intensifies on Major Exchanges

While coins are leaving exchanges overall, trading activity inside platforms has accelerated. Data shared by Arab Chain on March 6 showed Bitcoin turnover on Binance reaching about 425,000 BTC over the past 30 days, one of the highest readings since December.

You may also like:

Binance’s Bitcoin reserves currently stand near 660,000 BTC, and compared with the 30-day turnover figure, the liquidity ratio sits around 0.64, meaning about 64% of those reserves have been traded or transferred during the period.

That pattern suggests the same coins are changing hands repeatedly within a short time frame, which reflects increased speculative activity and stronger liquidity circulation within the market.

Bitcoin has fallen from a monthly peak attained earlier in the week, with price data from CoinGecko showing the asset trading just under $71,000 at the time of writing, down about 2% in the last 24 hours but still up close to 5% over seven days.

At the moment, the flagship cryptocurrency is sitting between renewed institutional demand and global macro pressure. Exchange withdrawals imply that many holders are waiting rather than rushing to exit positions, even as traders remain active inside the market.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Insights on crypto’s new marketing logic from Bitget Wallet CMO Jamie Elkaleh

As part of Outset PR’s Web3 communications talks, the agency founder Mike Ermolaev recently spoke with Jamie Elkaleh, CMO of Bitget Wallet, about how marketing changes when a crypto wallet evolves from a trading tool into a broader financial interface.

Summary

- Crypto marketing is moving towards utility-driven adoption, where product experience and real-world usability play a central role.

- Regional differences increasingly shape communication strategies, as adoption patterns, regulations, and user expectations vary between markets such as Asia and the West.

- As the industry matures, both media narratives and market movements are becoming more influenced by verifiable data, institutional capital, and macroeconomic forces.

While the full conversation explores everything from user acquisition to media strategy and the shifting dynamics of crypto markets, here are several key insights that are worth broader market attention.

Smooth onboarding drives sustainable user acquisition

One of Jamie’s key points is that sustainable wallet growth is no longer driven by incentives. Airdrops and points programs are often used to generate rapid attention. But according to him, these tactics rarely translate into long-term users. Instead, the focus should be on reducing product friction and simplifying onboarding.

“When users can transact without managing seed phrases or holding native gas tokens, adoption becomes more sustainable.”

In a utility-driven market, Jamie says, product design effectively becomes marketing.

Marketing in Asia vs. the West reflects different user expectations

Another point Jamie raised is that crypto marketing strategies vary significantly by region.

In Asia, adoption is closely tied to everyday financial use cases such as remittances, cross-border transfers, and stablecoin payments. As a result, communication tends to focus on speed, accessibility, and practical value.

“In 2025, the region recorded a 69% year-over-year increase in on-chain value. That reflects strong grassroots usage.”

In Western markets, the situation is different. Regulatory clarity and institutional trust shape user expectations much more strongly.

“With frameworks such as MiCA in Europe and new U.S. stablecoin legislation, users prioritize compliance, proof of reserves, and risk transparency.”

Despite these differences, Jamie notes that the core requirement remains the same across regions: products must work reliably in real-world financial contexts.

Data now underlies media credibility

At Bitget Wallet’s scale, Jamie insists that media coverage can’t rely on generic commentary. Journalists increasingly expect verifiable data that helps explain what is actually happening in the market.

“We publish research reports based on on-chain analytics and user behavior trends, which allows reporters to reference measurable insights.”

Per him, stories supported by real usage patterns – whether in transaction volume, adoption, or user growth – travel much further across the media ecosystem. This approach also changes how the team evaluates PR performance.

“We prioritize tier-one mentions, analyst citations, and share of voice within strategic narratives. Secondary indicators include organic brand mentions, backlink authority, inbound media inquiries, and invitations to podcasts or research collaborations.”

The real signal, Jamie adds, appears when external analysts start referencing the company’s data independently.

Crypto markets now move with macro capital

Jamie also confirms that crypto’s relationship with news has fundamentally changed. In earlier cycles, a single headline could move markets within hours. Today, price actions are increasingly shaped by macro capital flows, because

“Crypto has matured into a macro-sensitive asset class.”

As sector valuations reached multi-trillion-dollar levels, individual headlines naturally stopped carrying such influence.

With nearly $44 billion flowing into Bitcoin ETFs in 2025, institutional capital now plays a structural role in the market. In this environment, narratives matter less than fundamentals.

Utility is becoming crypto’s growth model

Reflecting on the conversation, one pattern becomes clear: the crypto industry is gradually shifting away from narrative-driven growth toward functional adoption.

Wallets are used not just for trading but for payments, transfers, and yield farming. Users expect reliability rather than explanations. And as institutional capital becomes a structural force, macro conditions are more important than short-term hype.

In that environment, the logic of marketing changes as well.

“If users don’t need to understand the infrastructure behind the product, the marketing has done its job.”

Crypto World

Vitalik Buterin Proposes Human-Verified AI Wallets for Crypto Transactions

Buterin proposed AI-assisted wallets where algorithms suggest transaction plans but users must manually confirm large transfers.

Vitalik Buterin has outlined his perspective on how artificial intelligence (AI) could redefine the next generation of Web3 wallets.

He also proposed a model where humans remain directly involved in approving high-value transactions.

AI Will Shape Newer Crypto Wallets

The Ethereum co-founder shared his views on the decentralized social media platform Farcaster, noting that it is “pretty obvious” that the next iteration of wallets will heavily involve AI.

Despite this, Buterin added that he would not trust LLMs with multi-million-dollar transactions or control over large amounts of money. Instead, he gave an approach in which AI systems assist users while leaving the final decision in human hands.

He described an optimal workflow in high-value situations that would involve an AI system proposing a plan, after which a local light client simulates the transaction. The person would then review the intended action and the required outcome before manually confirming it.

However, Buterin warned that this approach must be implemented conservatively with a strong emphasis on security. He suggested that one way to achieve this is by removing decentralized application interfaces from the transaction process. By eliminating dApp user interfaces from the flow entirely, the system could reduce several attack vectors associated with theft and privacy risks.

The 32-year-old has previously discussed how cryptocurrency and AI could evolve together. He envisions blockchains and the technology working hand-in-hand, with crypto providing the trust, privacy, and economic infrastructure that it needs to operate safely and fairly.

You may also like:

Proposed AI-Assisted Wallet Workflows

Other developers and community members responded to Buterin’s comments by describing potential implementations of the idea.

Ethereum developer Andrey Petrov suggested two additional scenarios. In the first, a user initiates a transaction as usual while AI analyzes the payload about to be signed. The technology would then attempt to guess their intended action and explain it in plain language, allowing them to confirm whether the transaction accurately reflects what they meant to do.

In the second case, the user either states their intended action directly or relies on the explanation generated in the first step. The AI then tries to reconstruct the transaction independently, without referencing the original amount, to determine whether it arrives at the same outcome. He explained that any differences between the two would show areas that require further review before the process is finalized.

Another Farcaster user, identified as fkaany, described a framework in which AI plans complex crypto strategies such as multi-hop swaps, yield optimization, and gas minimization.

This would involve a local light client simulating the outcome, which would allow individuals to review a clear summary and manually confirm the transaction, helping reduce risks from blind signing, phishing interfaces, and malicious dApp payloads.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Vitalik Buterin Backs Minimmit Over Casper FFG for Ethereum’s Consensus Layer

TLDR:

- Minimmit achieves finality in one signing round, replacing Casper FFG’s two-round justification and finalization process. (truncate to fit — 105 chars)

- The new gadget lowers fault tolerance from 33% to 17%, but raises the unilateral censorship threshold from 67% to 83%.

- Buterin argues censorship poses a greater threat than finality reversion, as it lacks immediate, verifiable on-chain evidence.

- Minimmit requires 83% of clients to share a bug before incorrect finalization occurs, giving developers a wider safety margin.

Minimmit has been put forward as a direct replacement for Casper FFG within Ethereum’s consensus layer. Ethereum co-founder Vitalik Buterin recently shared a detailed technical post comparing both finality gadgets.

Casper FFG has long served as a two-round finality mechanism on the network. The proposed system, by contrast, achieves finality in a single round of validator signatures.

The proposal is drawing attention as the Ethereum community continues to evaluate changes to its consensus architecture.

Why the New System Operates in a Single Round

Casper FFG asks each attester to sign a block on two separate occasions. The first signature “justifies” the block, and the second “finalizes” it.

Minimmit cuts this down to a single signing round. This makes the process more efficient for validators across the network.

The change comes with a direct cost to fault tolerance, though. The new system’s threshold sits at 17%, compared to 33% under Casper FFG.

A smaller portion of malicious stake can therefore disrupt finality under the new model. Still, Buterin’s post makes the case that other properties of the system more than offset this drop.

In the post shared on X, Buterin described himself as a long-standing “security assumptions hawk” in Ethereum’s consensus research. He cited his past push for 49% fault tolerance under synchrony.

He also referenced his work on DAS for dishonest-majority-resistant data availability checks. Despite this record, he stated he is “even enthusiastic” about the proposed design.

The asynchronous network case also differs between the two systems. Under ideal 3SF, finality holds as long as an attacker controls less than 33% of stake.

The proposed gadget lowers that same protection to 17%. In both cases, any reversion of finality triggers massive slashing penalties against offending validators.

Censorship Resistance and the Broader Security Picture

Buterin’s argument centers on identifying censorship as the more dangerous threat. Unlike finality reversion, censorship produces no immediate, publicly verifiable evidence against the attacker.

A reversion event, on the other hand, results in automatic, large-scale slashing. This asymmetry is a core reason behind his support for Minimmit’s design.

Both systems require an attacker to control over 50% of staked ETH to carry out censorship. The key distinction lies in what happens at higher thresholds.

In 3SF, an attacker above 67% can finalize the chain unilaterally, removing any coordination point for honest validators. The new system raises that threshold to 83%.

Software bugs present another area where the proposed gadget holds an advantage. Under 3SF, a flaw shared by 67% of client software can accidentally finalize an incorrect chain state.

Minimmit raises that bar to 83%. This wider margin gives developers more time to identify and respond before errors become permanent.

Buterin also addressed the economic argument against finality reversion attacks. With 15 million ETH staked, reverting finality under 3SF would require slashing 5 million ETH, or roughly $10 billion.

He noted that the 17% baseline still represents an enormous deterrent on its own. From there, he argues the proposed system’s other properties make it the stronger overall consensus design for Ethereum.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business8 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports7 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports1 day ago

Sports1 day ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Fashion4 hours ago

Fashion4 hours agoWeekend Open Thread: Ann Taylor

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion5 days ago

Fashion5 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed