The Federal Reserve on Wednesday opted to hold interest rates steady as officials reckon with fearful markets and concerns of an economic slowdown sparked by the trade wars launched by President Donald Trump and his efforts to overhaul and dismantle government agencies.

After a two-day meeting of its monetary policy committee in Washington, D.C., the Fed announced it would hold its rate target at a range of 4.25% to 4.50%. Investors anticipated the move. The Fed’s target rate remains a full percentage point lower than it was when the Fed pivoted to cutting rates last September.

The meeting of the Federal Open Market Committee was the first since President Donald Trump imposed tariffs after much speculation about the timing and scope of the levies. The uncertainty surrounding tariffs and cuts to federal government spending has caused markets to roil, and projections for negative economic growth have stoked fears of a slowdown or even a recession.

After about two years of interest rates being at near-zero levels during the pandemic, the Fed hiked interest rates in 2022 in response to growing inflation. It kept raising rates and held them at historically high levels until just this past September, when it began the process of gradually paring them back.

Inflation in the consumer price index has dropped from a 2022 peak of about 9% to 2.8%, according to the most recent report.

That is still too high, as the Fed’s goal is to have inflation running at 2%. The Fed opting to hold rates steady and not cut this week is an indication that central bank officials don’t think the inflation fight is quite over.

But the Fed is threading a needle, because keeping rates too high could further slow economic growth. If the Fed cuts rates too quickly, though, it could undo some of the progress on lowering inflation.

Another variable at play are Trump’s tariffs. Economists largely argue that tariffs put upward pressure on prices, as the increased costs are passed through to the consumer and borne by them akin to a tax.

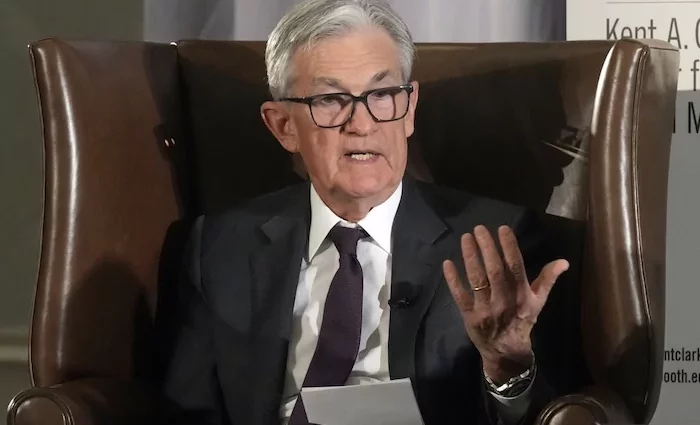

Trump, who famously prefers lower interest rates, has inherited an economy where inflation is still too hot — analysts and the markets will be watching closely to what Fed Chairman Jerome Powell says at his Wednesday press conference and how Trump reacts to the interest rate decision.

The stock market has faced some major turbulence in recent weeks.

While the Dow Jones Industrial Average have pared back some losses this past week, the index has declined more than 6% in the past month. The index is flat over the past six months. The tech-heavy Nasdaq has dropped about 12% over the past month.

Generalized anxiety on Wall Street is captured by the Chicago Board Options Exchange Volatility Index, better known as VIX but also as the “fear index.” Notably, the VIX was up about 36% over the past month.

In addition to the recent tariffs on Canada, Mexico, and China, the administration insists that it is pushing forward with reciprocal tariffs on allies and adversaries alike in early April. Trump’s team has also worked to cut government employment and reduce government spending.

A potential slowdown in gross domestic product growth, which is a broad measure of economic output, has further compounded anxiety on Wall Street. GDP growth has been positive for just under five years, aside from a slight decrease in the first quarter of 2022.

But the Atlanta Fed’s “GDPNow” tracker predicts that gross domestic product growth in the first quarter will fall by 1.8%, according to the latest estimate.

There has been a historical precedent of labeling two consecutive quarters of negative economic growth recessionary — a scenario that hasn’t played out since the peak of the pandemic in 2020.

Treasury Secretary Scott Bessent and other administration officials have acknowledged that there will be some economic upheaval as Trump’s agenda is implemented.

CARRIED INTEREST: WHAT TO KNOW ABOUT THE TAX ‘LOOPHOLE’ TRUMP AIMS TO END

Notably, the labor market has remained solid despite the years of higher interest rates.

The economy added 151,000 jobs in February, and the unemployment rate ticked up slightly to 4.1%, the Bureau of Labor Statistics reported. The coming jobs reports will be closely watched given the government layoffs and concerns about the broader economy.