CryptoCurrency

KSA and UAE Rank in Global Top 10 for AI in Finance Competitiveness

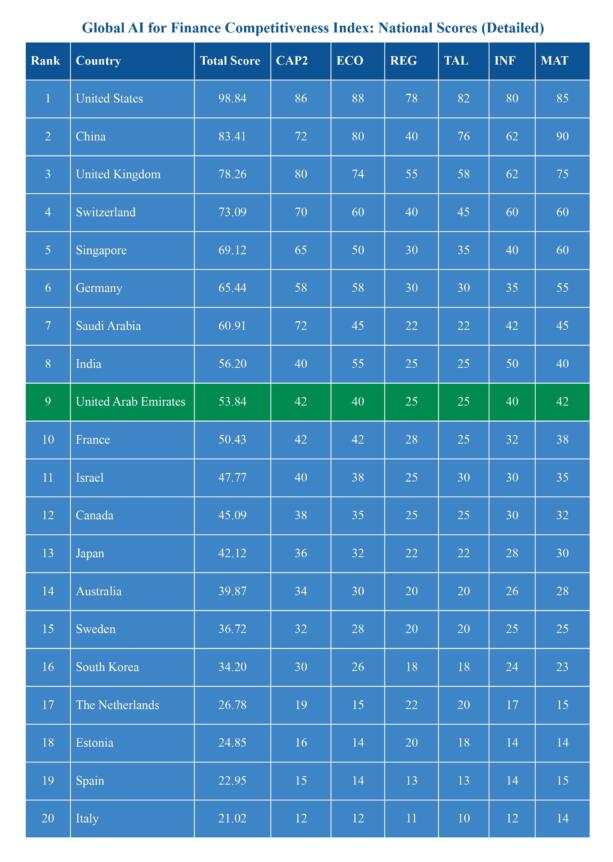

Editor’s note: A new Global AI for Finance Competitiveness Index places Saudi Arabia and the UAE among the world’s top ten markets for AI adoption in financial services, ranking 7th and 9th respectively. Released by Deep Knowledge Group with the Hong Kong Financial Services Development Council as observer, the index benchmarks 20 countries and 15 city hubs on finance-grade AI capability, maturity, and deployment readiness. The results highlight how Gulf markets are moving beyond experimentation toward operational use of AI in regulated finance, with Saudi Arabia scaling rapidly and the UAE demonstrating strong execution across institutions.

Key points

- Saudi Arabia ranks 7th globally, cited as the Gulf’s fastest-scaling market for AI-enabled finance.

- The UAE ranks 9th, recognized for turning AI capability into deployed systems in regulated markets.

- The index evaluates countries and city hubs on deployment readiness, institutional capacity, and ecosystem breadth.

- Leaders are defined by production-grade AI adoption, not research output alone.

Why this matters

The rankings underscore a shift in AI for finance from pilot projects to infrastructure-level deployment. For builders, banks, and regulators in the Gulf, this signals growing expectations around governance, auditability, and resilience. For investors and market participants, it highlights where capital, talent, and policy alignment are converging to support scalable AI use in financial services. The results also position the region as an increasingly relevant testbed for finance-grade AI under real regulatory constraints.

What to watch next

- How Saudi Arabia translates rapid scaling into sustained, production-grade deployments.

- The UAE’s continued rollout of AI systems within regulated financial institutions.

- Updates to the index methodology and future editions tracking maturity over time.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Hong Kong, 28 January 2026: Saudi Arabia and the UAE have been ranked 7th and 9th respectively in the Global AI for Finance Competitiveness Index (GAICI), which was released today by Deep Knowledge Group with the Hong Kong Financial Services Development Council (FSDC) serving as an observer.

Access the full report here.

The index provides a benchmark analysing AI competitiveness from a finance, economy and financial services perspective. It combines a global landscape overview of AI adoption in finance with an indicator-based competitiveness index that ranks 20 countries and 15 city-level finance hubs on AI-for-Finance capability and maturity.

Saudi Arabia has emerged as the Gulf’s fastest-scaling contender in AI-enabled finance, securing a remarkable 7th place globally in the index. This achievement underscores the country’s ambitious drive to integrate AI within its financial systems, fueled by state-led investments and a strategic focus on modernizing its financial infrastructure. While not yet a mature global finance hub, Saudi Arabia is quickly building the capabilities to become a key player in AI for finance. The nation’s rapid AI adoption is propelled by its institutional commitment and capital investment, positioning it as a major force in shaping the future of finance in the Gulf region.

The UAE stands out not only for its technological capability but also for its ability to turn AI potential into operational financial systems. This unique combination of state-driven AI development, a globally oriented financial ecosystem, and robust institutional execution makes the UAE a front-runner in deploying AI in regulated financial markets. As a “system builder,” the UAE competes not on the sheer volume of research output but on its speed of AI adoption, regulatory modernization, and efficient deployment pathways. Its ability to rapidly implement AI programs, set clear regulatory frameworks, and scale AI-powered financial tools has positioned it as a global testbed for finance-grade AI.

“Saudi Arabia’s rapid scaling in AI-driven finance is a testament to its strategic vision and ability to turn ambition into action,” said Dmitry Kaminskiy, General Partner of Deep Knowledge Group. “The Kingdom’s strong institutional backing and focus on infrastructure development are setting the stage for long-term success. Prioritizing AI adoption in critical financial services, Saudi Arabia is positioning itself to become an essential player in the global AI finance ecosystem.”

“The UAE’s unique position in the AI for Finance Index highlights its ability to not just innovate but to efficiently deploy AI systems that meet the rigorous demands of regulated financial markets. This makes the UAE a key player in shaping the future of finance through AI across the globe,” Kaminskiy added.

The index is led by the United States (98.84) and China (83.41), followed by the United Kingdom (78.26) and Switzerland (73.09), with Singapore (69.12) next. The leaders are not defined by a single strength, but by multi-pillar performance that supports production-grade AI in finance—including deployment readiness, institutional capacity, and ecosystem breadth. The U.S. leads with large-scale capability across AI, capital markets, and financial services adoption. China ranks second on the strength of ecosystem scale and rapid implementation dynamics in AI-enabled financial services. The U.K. and Switzerland follow as high-performing financial centres where strong institutional environments and finance-grade expectations—governance, accountability, and risk discipline—support consistent AI adoption. Singapore rounds out the top tier, reflecting strong ecosystem coordination and high deployment readiness relative to its size.

“The leaders in this index are not simply ‘AI-strong’; they are strong at converting AI capacity into deployed financial systems—where governance, resilience, and market integrity are non-negotiable,” Kaminskiy continued.

Meanwhile, city-hub ranking places New York (99) and London (81) first and second, with Hong Kong (76) third—reflecting their combined advantages in market connectivity, institutional concentration, and capital formation for AI-enabled financial activity. The next positions—San Francisco (70) and Shanghai (67)—reflect the interaction between AI capability and financial-market pull. Mid-table hubs (e.g., Toronto, Singapore, Tokyo, Chicago, Riyadh) typically show strengths in one or two dimensions but less complete end-to-end breadth. Lower-ranked hubs are often constrained by thinner ecosystem density, fewer scalable deployment pathways into regulated institutions, or weaker global market connectivity. Moving up the ranking generally requires (i) strengthening capital-formation and listing pathways, (ii) expanding production-grade adoption mechanisms across regulated institutions, and (iii) increasing ecosystem breadth so that AI capabilities translate into repeatable, auditable deployments rather than isolated pilots.

Dr King Au, Executive Director of the FSDC, remarked, “Hong Kong’s ranking among leading global finance hubs reflects the city’s excellent market connectivity and top-notch institutional quality—two conditions that matter when AI for finance must operate under finance-grade expectations.”

Dr Patrick Glauner, Professor of AI at Deggendorf Institute of Technology, a co-author of the report, noted, “In finance, competitive advantage comes from trustworthy AI—models that are explainable, auditable, and robust under real-world constraints. The index makes clear that deployment quality matters as much as innovation.”

Additional Key Findings

- AI for finance is shifting from novelty to infrastructure: competitive advantage now reflects repeatable deployment in regulated workflows.

- Top-ranked countries pair ecosystem scale with execution capacity: strong performance typically requires strength across multiple pillars, not one-off advantages.

- The hub ranking underscores concentration: AI-for-finance activity clusters in a limited set of global financial centres with strong market infrastructure.

- Model governance and assurance are central: monitoring, auditability, and operational resilience are becoming baseline expectations.

- Data exchange and interoperability remain most common bottlenecks in mid-tier markets.

- Strategic takeaway: the next phase of competition is about institutionalisation—turning tools into operating systems.

About Deep Knowledge Group

Deep Knowledge Group is a consortium of commercial and non-profit organizations active on many fronts in the realm of DeepTech and Frontier Technologies (AI, Longevity, FinTech, GovTech, InvestTech), from scientific research to investment, entrepreneurship, analytics, media, philanthropy, and more.

The FSDC was established in 2013 by the Hong Kong Special Administrative Region Government as a high-level, cross-sectoral advisory body to engage the industry in formulating proposals to promote the further development of financial services industry of Hong Kong and to map out the strategic direction for the development.

In September 2018, the FSDC was incorporated as a company limited by guarantee. This change allows it to better discharge its functions through research, market promotion, and human capital development with greater flexibility.