Crypto World

SEC Clarifies Rules for Tokenized Securities

Join Our Telegram channel to stay up to date on breaking news coverage

In a recent press release, the US Securities and Exchange Commission published formal guidance on how federal securities laws apply to tokenized securities, providing a classification framework for assets recorded on distributed ledgers.

In the joint statement by the SEC’s Divisions of Corporation Finance, Investment Management, and Trading and Markets, a tokenized security is a traditional security that is formatted as a crypto asset, with ownership recorded on a blockchain.

According to the agency, tokenized securities remain securities under US law, despite how crypto-ledgers may view them.

Therefore, the guidance by the US SEC makes it clear that the technological format, whether records are kept onchain or off-chain, does not alter the legal status or registration requirements of the underlying instrument.

🚨NEW: @SECGov staff just put out guidance on tokenized securities, laying out how federal securities laws apply and distinguishing between issuer-led and third-party tokenization models. pic.twitter.com/KWZTtwgmoe

— Eleanor Terrett (@EleanorTerrett) January 28, 2026

The updated guidance comes as the agency moves to clarify rules governing county assets.

The SEC outlined two primary pathways for tokenization: “issuer-sponsored tokenized securities” and “third-party sponsored securities.”

In issuer-sponsored tokenization, the issuer issues or adopts the tokenized format natively, whereas third-party sponsorship involves an external entity creating the tokenized representation.

Regulatory Evolution and Market Context

The SEC’s guidance follows years of regulatory development and market evolution. Initially, the Commission issued its 2017 DAO Report, which was the first to apply securities laws to digital assets. Subsequently, multiple enforcement actions established precedents for token classification.

However, market participants consistently requested formal guidance rather than regulation through enforcement. The 2025 framework directly addresses these longstanding requests for clarity.

Regulation in the digital space is also approaching clarity as policymakers near the final stage. In the US, traders are awaiting the verdict of today’s Senate Agriculture Committee markup of the crypto market bill.

Moreover, the US SEC and the Commodity Futures Trading Commission (CFTC) are set to hold a meeting today to implement the US President’s policies on digital assets.

UPDATE 🚨

The SEC and CFTC chairs are holding a joint event today at 2PM ET to talk about harmonisation in the crypto industry! pic.twitter.com/N2ghFp7X3C

— That Martini Guy ₿ (@MartiniGuyYT) January 29, 2026

For the new guidance, the SEC has established a phased implementation timeline. Initial compliance requirements take effect in Q3 2025, with full implementation expected by Q2 2026. This timeline provides market participants with adequate preparation periods.

The guidance arrives as tokenized real-world assets have reached approximately $36 billion in market value, with institutional interest accelerating.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Michael Burry Warns Bitcoin Treasury Firms Face Existential Risk as BTC Slide Deepens

Burry says Bitcoin is behaving like a speculative trade, and not a hedge, which raises risks for companies holding massive BTC reserves.

Bitcoin’s (BTC) slide below $80,000 has intensified worries that a wider downturn in the broader crypto sector could be imminent.

Market experts believe that the recent slide in BTC’s price may not be an isolated correction, but a development that could seriously destabilize corporate balance sheets and magnify systemic risk if it continues to fall.

Major Market Casualty

Michael Burry has issued a stark warning that Bitcoin’s continued decline could erase significant value across the market, and the greatest risk is concentrated among companies that have built large corporate treasuries around the asset, which have mushroomed over the years.

In the latest Substack post following the latest crypto sell-off, “The Big Short” investor, Burry, said BTC’s drop below important technical levels opens the door to cascading stress not only within crypto markets but also across adjacent financial sectors.

He said that the world’s largest crypto asset is failing to meet a critical expectation often placed on it, that is, acting as a hedge against currency debasement. Instead, Burry said its recent behavior more closely resembles that of a speculative risk asset, particularly given its correlation with the S&P 500. He said gold and silver rallied on geopolitical uncertainty and dollar weakness, but Bitcoin did not follow those macro signals.

Burry also predicted that further downside could have severe consequences for Bitcoin treasury companies that accumulated BTC aggressively during higher price ranges. He highlighted the possibility that another 10% decline could leave major holders such as Michael Saylor’s Strategy billions of dollars underwater, and potentially cut them off from capital markets, thereby increasing bankruptcy risk.

Such outcomes, according to the investor, could amplify losses beyond individual firms and contribute to broader market fallout. Burry additionally noted that Bitcoin’s weakness has coincided with recent pressure in precious metals.

You may also like:

Galaxy Digital’s Zac Prince also questioned the long-term viability of Bitcoin treasury companies, which raise capital to hold BTC on their balance sheets while promising yield. Speaking on TheStreet Roundtable, Prince said these models rely on risky financial engineering rather than BTC’s native value. He compared them to past schemes that created tokens to generate Bitcoin and said that paying a premium for such structures does not make them sustainable.

He even explained that while some firms might pivot to revenue-generating activities, many will still struggle to justify their valuations, and added that businesses should focus on real operations first and treat BTC as a treasury strategy, not the primary driver.

Optimism Wanes

Bitcoin has been under tremendous pressure, and many analysts believe that there could be more pain ahead instead of a much-anticipated recovery.

Former Binance CEO Changpeng “CZ” Zhao also said that while he had been positive about a BTC super cycle just weeks ago, current market sentiment has made him less confident. Speaking on Binance’s social platform, he highlighted the rise of fear, uncertainty, and doubt (FUD) in the community and admitted that the emotional intensity has left him uncertain about BTC’s near-term prospects.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

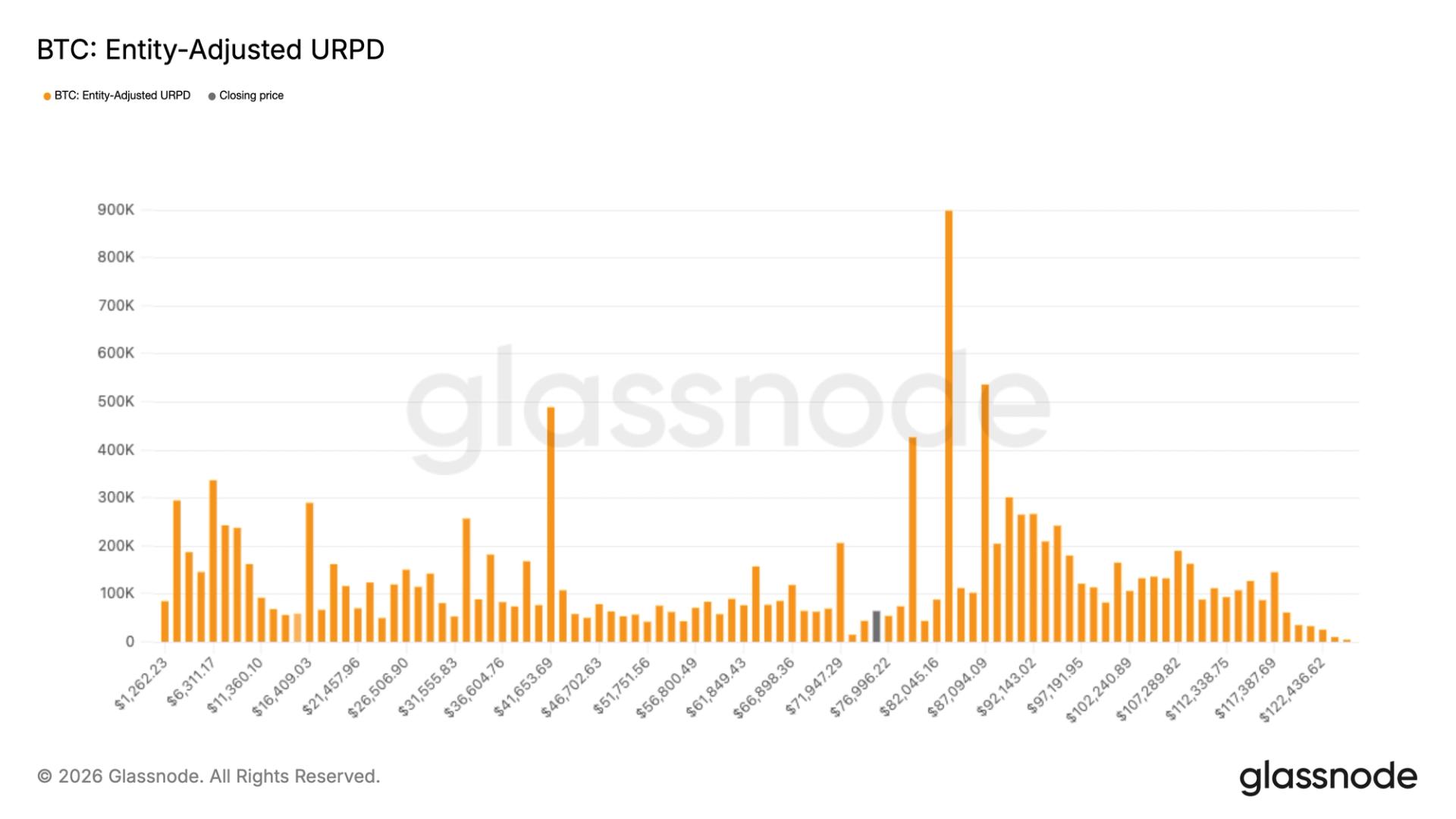

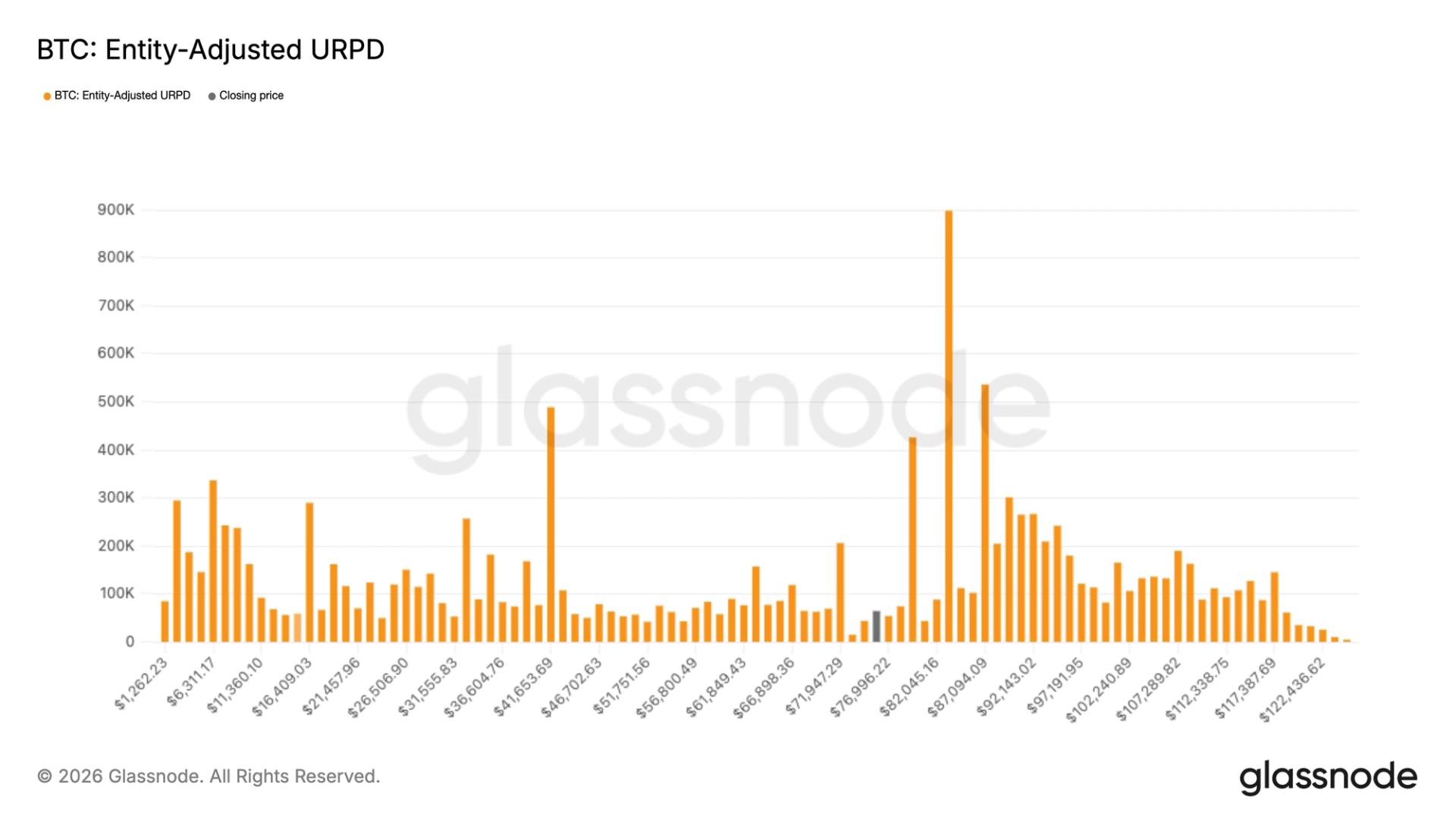

BTC’s thinnest price zone between $70,000 and $80,000

Since the weekend’s slump, the bitcoin price has been constrained between $70,000 and $79,999 for five straight days. That’s a remarkably long time for a range in which the largest cryptocurrency has spent a relatively short span of time.

In fact, bitcoin has spent about 35 days within that $10,000 bucket. Compared with other increments, it’s one of the least developed, underscoring how quickly the price has tended to move through rather than build sustained support or resistance.

The longer the price spends in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support. What this means is the price is more likely to consolidate in this range or, potentially, make another move toward the lower end near before establishing a more durable base.

During the tariff driven volatility last April, bitcoin held below $80,000 for just a few weeks before rebounding. Similarly, when it reached a then all-time high near $73,000 in March 2024, it spent only a short period at those levels before declining.

Perhaps the clearest example of how quickly bitcoin has moved through this range occurred in November 2024 following Donald Trump’s presidential election victory. The price accelerated from roughly $68,000 to $100,000 in a matter of weeks, leaving little opportunity for consolidation between $70,000 and $80,000.

It’s notable that Strategy (MSTR), the largest corporate holder of bitcoin, has only once bought bitcoin within this range. On Nov. 11, 2024, the company purchased 27,200 BTC for approximately $2 billion at an average price of $74,463.

Consider a chart that shows the prices at which bitcoin last moved within a specific price bucket. Each column represents the amount of bitcoin transferred at that price.

The data clearly shows a lack of supply between $70,000 and $80,000, suggesting that this zone remains structurally thin.

Crypto World

Major Bank Expects Solana to Outperform Bitcoin: When and How?

Standard Chartered is urging investors to look through near-term volatility in digital assets and focus on what it calls “quality” blockchain projects.

The remark comes as the recent selloff reshapes relative value across the crypto market.

Sponsored

Sponsored

Standard Chartered Backs Ethereum and Solana for Long-Term Outperformance Despite Near-Term Volatility

Geoff Kendrick, the bank’s Head of FX and Digital Assets Research, said he is actively accumulating during the downturn. According to the analyst, the pullback is a defining moment for long-term positioning.

“I am a buyer of this dip in digital assets,” Kendrick told BeInCrypto in an email. “What’s more, I think this is the start of greater differentiation in digital asset performance, whereby quality projects win.”

Within that framework, Standard Chartered continues to favor Ethereum and Solana as its top layer-1 exposures. Kendrick reiterated that view explicitly, adding:

“I have previously highlighted my view that Ethereum is one such quality project. And here I do the same for Solana. Buy quality.”

Recently, Standard Chartered said it saw Ethereum outperforming Bitcoin, citing DeFi dominance, scalability upgrades, and regulatory clarity.

The bank, however, has tempered its near-term expectations for Solana. Standard Chartered lowered its end-2026 price forecast for SOL to $250 from $310. On this, they cite the time required for the network’s next major use case to mature.

“We lower our end-2026 price forecast to USD 250, as Solana’s next dominant use case may take time,” Kendrick said.

Sponsored

Sponsored

Despite that cut, the bank raised its longer-dated projections, arguing that Solana’s structural advantages remain intact.

Solana’s Shift from Meme Coins to Micropayments Could Drive Long-Term Outperformance

According to Standard Chartered, Solana’s ultra-low-cost, high-throughput architecture positions it to eventually dominate micropayments. This, Kendrick says, is particularly true as AI-driven applications and stablecoin-based transactions gain traction.

“We raise our forecasts thereafter, as we see Solana eventually dominating the micropayments space,” Kendrick noted.

Sponsored

Sponsored

If that thesis plays out, the bank expects SOL to outperform Bitcoin between 2027 and 2030, while only gradually catching up to Ethereum as the ecosystem scales.

The report highlights a subtle but important shift underway on Solana’s decentralized exchanges. While the network has long been associated with meme coin activity, flows are increasingly rotating toward SOL-stablecoin trading pairs.

These stablecoins, Standard Chartered notes, are turning over two to three times faster than their Ethereum counterparts.

That evolution could help Solana shed its “meme coin discount,” which previously weighed on valuation and deterred TradFi participants.

Sponsored

Sponsored

Analysts Back Standard Chartered’s Quality Wins Narrative

Market commentators broadly echoed the bank’s “quality wins” narrative. Investor Mike Alfred described the drawdown as a textbook risk-off move.

“…this is a run-of-the-mill risk-off move where the lowest quality goes down the hardest, and then everything bounces… This is when real money is made,” wrote Alfred, referencing the recent market drop.

Developer and investor Mike Ippolito struck a similar tone, arguing that sentiment has swung too far in the negative direction.

“I think people are far too bearish ETH and SOL today,” he said, calling layer-1 blockchains “the Amazon or Google of our time” due to their global markets, high barriers to entry, and fee-generating potential.

Standard Chartered expects Solana to underperform Ethereum through 2026 and into 2027. But beyond that window, the bank sees a catch-up phase driven by scale, utility, and cost advantages.

In Kendrick’s view, the current volatility is less a warning sign than a sorting mechanism, one that may ultimately reward investors willing to buy quality while the market is still unsettled.

Crypto World

TRM Labs hits unicorn status in $70 million raise as crypto crime-fighting needs grow

TRM Labs, a blockchain analytics startup used by global law enforcement and financial firms, has raised $70 million in a new funding round that pushed its valuation to $1 billion.

The Series C round, Fortune reports, was led by Blockchain Capital with participation from Goldman Sachs, Citi Ventures, Bessemer, Thoma Bravo and Brevan Howard. The firm, according to data from TheTie, had raised nearly $150 million to date, having seen another $70 million fundraise back in 2023, along with other smaller fundraising rounds. That brings the total raised to $220 million.

The firm’s software helps trace cryptocurrency transactions across multiple blockchains, a service increasingly in demand as crypto crime grows more complex.

TRM counts several major government agencies, including the IRS and FBI, among its clients, as well as major banks. It was an early mover in tracking not just bitcoin but various other cryptocurrencies, a decision that set it apart from competitors. That edge has become more valuable as criminal networks diversify their use of tokens and platforms.

TRM’s global investigations team includes former federal agents, including veterans of cases that include the takedown of dark web marketplaces.

The company foresees growth in the future, given the rising sophistication of threats in the cryptocurrency space. Per Ari Redbord, TRM’s global head of policy, the company saw a 500% increase in “AI-enabled use in scams and fraud.”

TRM has also partnered with leading blockchain projects like Tron and Tether to expand its intelligence. That partnership created the T3 Financial Crime Unit task force, and has frozen more than $300 million in tainted assets.

Crypto World

An NFT Investor Allegedly Lost Punks NFTs Worth +$1M In A Hack

Join Our Telegram channel to stay up to date on breaking news coverage

Hackers and scammers are incredibly persistent, constantly evolving tactics to exploit human trust and crypto system vulnerabilities for financial gain, using sophisticated methods like phishing, AI, and automated attacks. In the latest attack, hackers have allegedly hacked the accounts of non-fungible token investor “yfimax.eth” and walked away with his eight CryptoPunks NFTs.

Yfimax.eth Reportedly Lost $1M In A Hack

Data compiled by Cryptopunks.app shows that eight cryptopunks non-fungible token series have sold for 27.5 ETH each. CryptoPunks.app is an online tool or platform that monitors the market for the iconic CryptoPunks NFT collection, providing real-time data on floor prices, sales volume, rarity, and individual Punk details, with popular trackers found on sites like Forbes, CoinGecko, and CryptoSlam, helping users track ownership and market trends for these pioneering digital collectibles.

Bit of a tragedy just happened in the @cryptopunks world. Looks like someone just got hacked and lost all 8 of their punks.. if they were all sold at floor price of 29 ETH, that’s a total of 232 ETH (USD $742,200) loss… but quite a few of them weren’t floors so it’s more like a… pic.twitter.com/P5TwmqQAaJ

— Xeer (@Xeer) January 19, 2026

The recent sale of the eight CryptoPunks NFT collections has sparked massive speculation among traders and collectors. Some of the traders on X (formerly Twitter) have described the sale as a hack, since all Punk NFTs were sold for 27.5 ETH, which fell below the current floor price of 29 ETH. If they were all sold at the floor price of 29 ETH, that’s a total of 232 ETH (USD $742,200) loss. Nonetheless, others have opined that Yfimax.eth may have grown tired of the NFT market and decided to sell them.

Launched in 2017, CryptoPunks is a globally acknowledged non-fungible token series previously from the digital asset firm ‘Larva Labs’ but now managed by the non-profit organization, Infinite Node Foundation. The iconic NFT collection, Punks, has a fixed supply of 10,000 pixilated NFTs hosted on the Ethereum blockchain. CryptoPunks is one of the leading NFT series in the global NFT market.

Thorough Investigation Ongoing Right Now

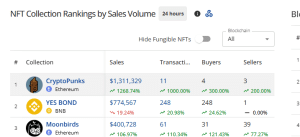

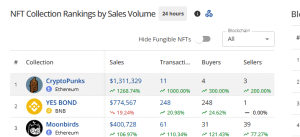

At the time of publishing, a thorough investigation into the eight CryptoPunks NFTs sold earlier today is ongoing. In response to the recent suspicious sales, the CryptoPunks NFT collection has climbed to the top, with trading volume of +$1.3 million in the past 24 hours. The global NFT market has jumped by 28% today to $8 million, while Ethereum NFT sales have risen by 66% to $4.4 million.

Source: CryptoSlam.io

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

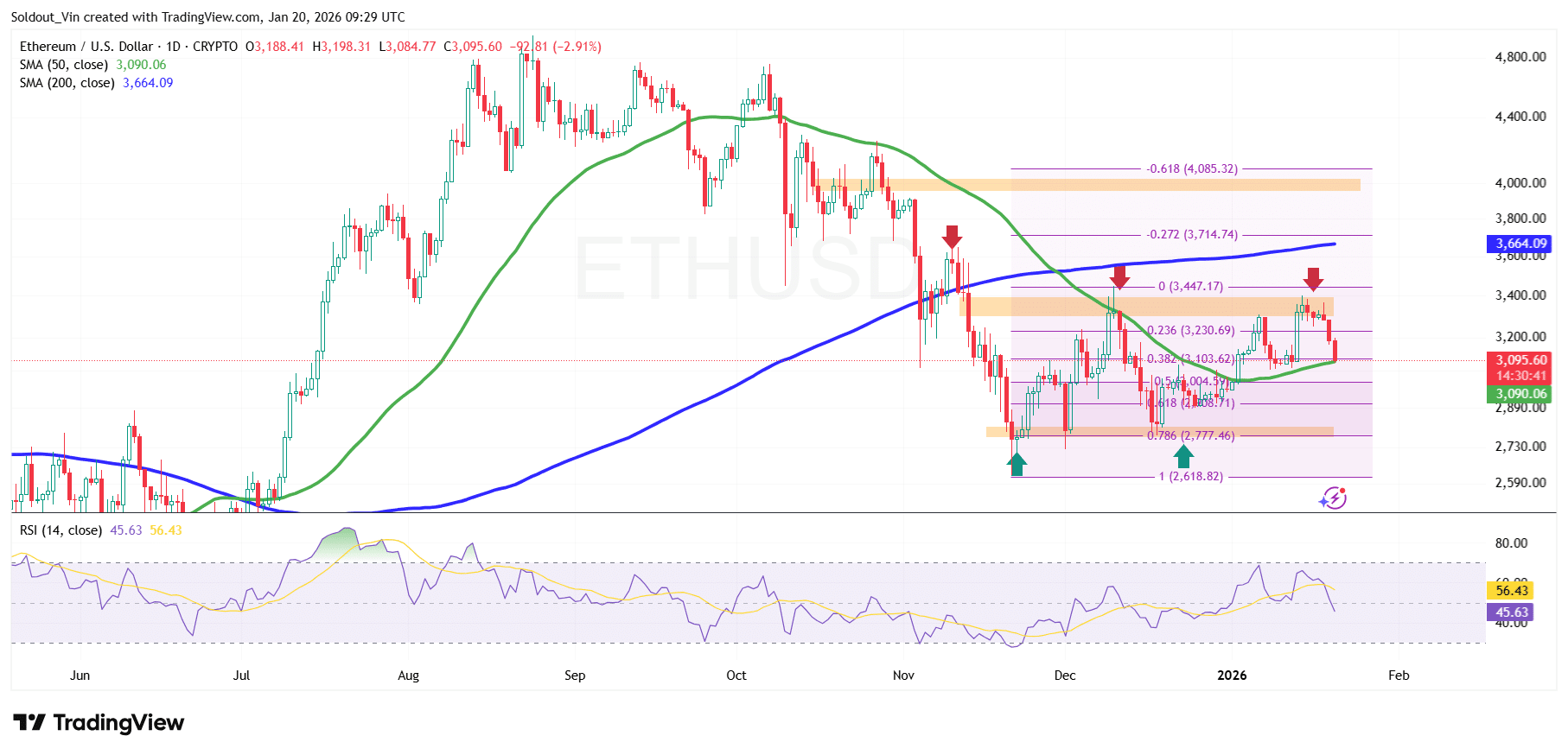

Gold, Silver Rally to ATH But Ethereum Slips Below $3,100

Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum and the broader cryptocurrency market declined over the past 24 hours as escalating geopolitical tensions between the US and European Union fueled risk aversion among investors.

Meanwhile, traditional safe-haven assets rallied sharply, with gold surging to fresh record highs and silver also touching new peaks amid flight-to-quality flows triggered by President Trump’s renewed tariff threats against several European nations over the Greenland dispute.

Spot gold climbed 1.1% to around $4,725 per ounce as of early trading on January 20, approaching its all-time high near $4,795 set late last year, according to market data.

The metal has extended its relentless bull run into 2026, bolstered by safe-haven demand as investors brace for potential transatlantic trade disruptions.

The silver price also advanced by nearly 1% to hit a new record high of $95.3/oz.

ETH price was trading at $3,095 as of 4:29 a.m. EST after a 3.6% drop in the last day, as the crypto market also dropped over 2% to a $3.15 trillion market capitalization, according to Coingecko data.

Crypto Market Rattled As Trump Tariffs Dent Risk

During the weekend, Trump threatened that he would impose import tariffs of up to 25% on several major European nations, including Denmark, France, and the US, until they reached a deal to hand over Greenland to Washington.

The US president’s demands were widely rejected by European leaders, with France seen preparing retaliatory economic measures against the United States.

The exchange between the two regions has sparked deep losses across global risk-driven markets, on concerns over a potential dissolution of NATO, as Trump plans direct steps to get Greenland.

To add to the tensions, Trump has said that he will impose a 200% tariff on French wines and champagnes, as he wants French President Emmanuel Macron to join his Board of Peace Initiative aimed at resolving global conflicts.

“I’ll put a 200% tariff on his wines and champagnes, and he’ll join, but he doesn’t have to join,” Trump said.

JUST IN – Reporter: Can you respond to Macron saying he will not join the board of peace?

Trump: Nobody wants him… I’ll put a 200% tariff on his wines and he’ll join pic.twitter.com/S5pTcTbTvn

— Insider Paper (@TheInsiderPaper) January 20, 2026

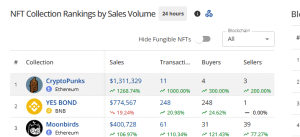

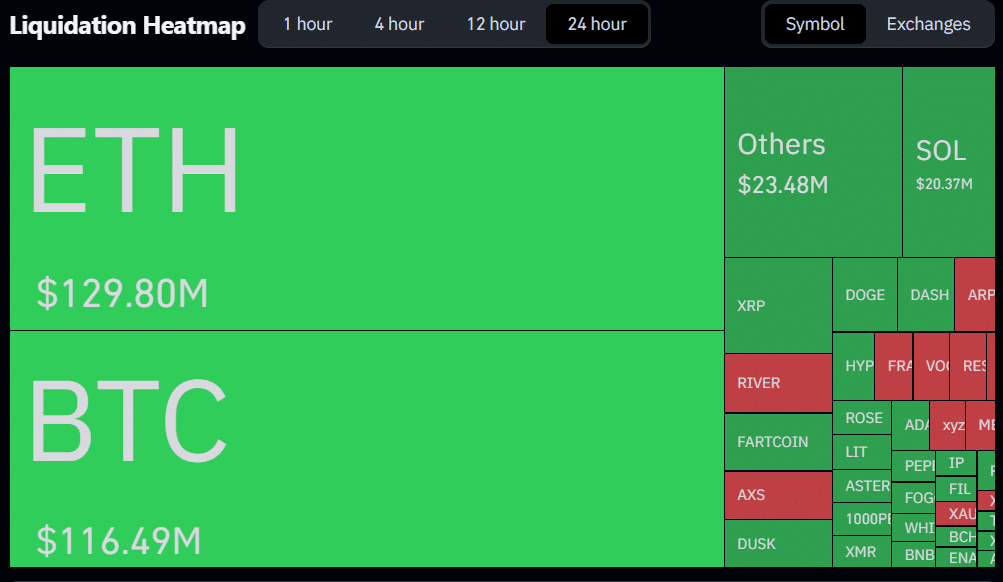

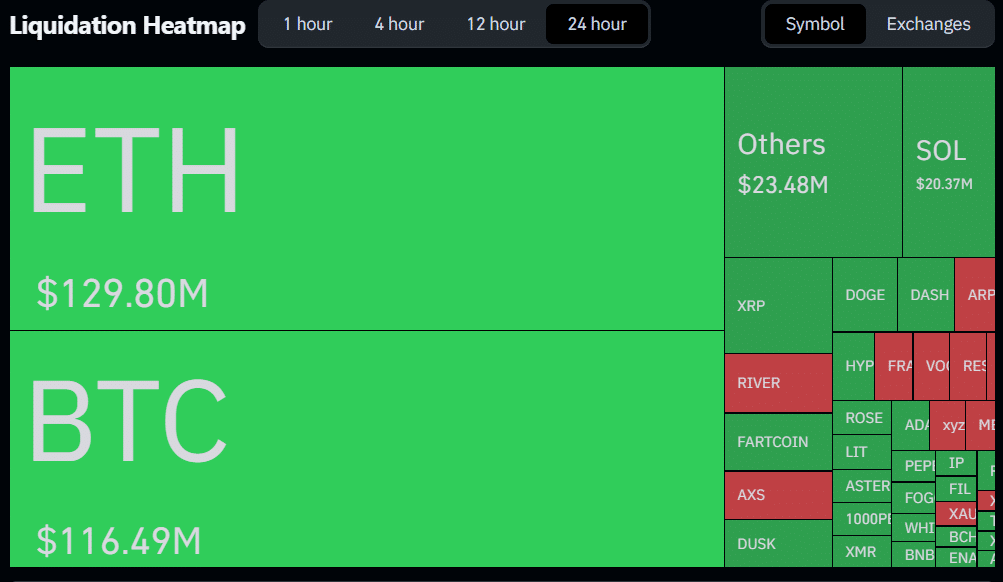

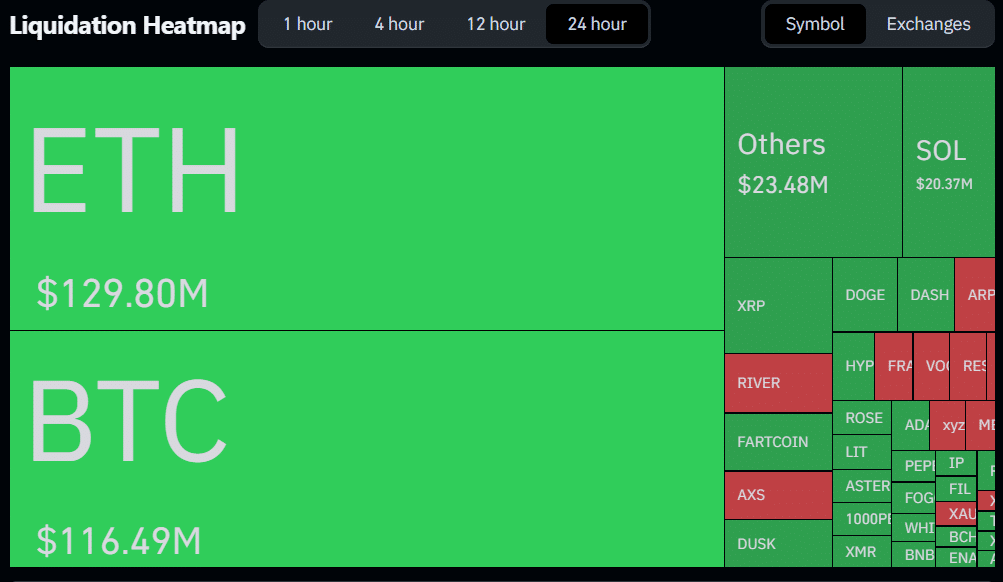

This sent jitters in the crypto space, with total liquidations coming in at $361 million, $124 million being from Ethereum longs alone.

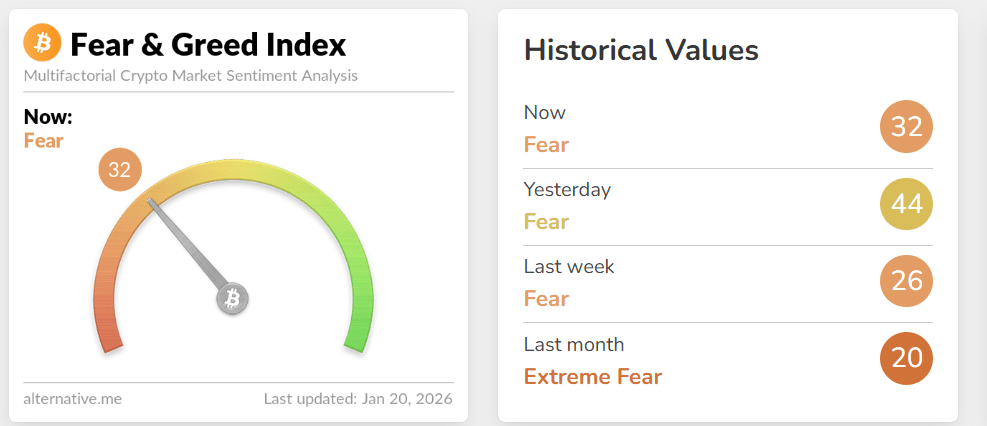

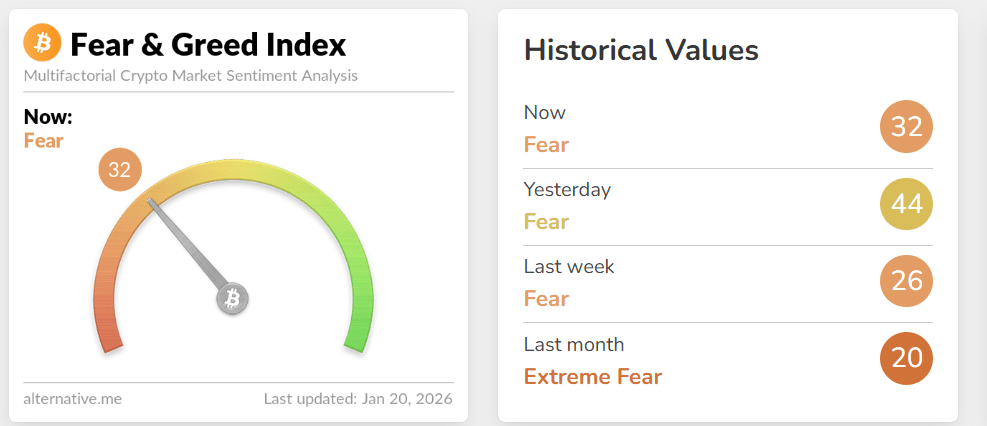

Moreover, the crypto Fear & Greed Index remains in the fear zone after several weeks of extreme fear, which shows that investor sentiment has softened but is still cautious, and the market may be undervalued.

Ethereum Price Analysis: The Drop Is A Warning Sign

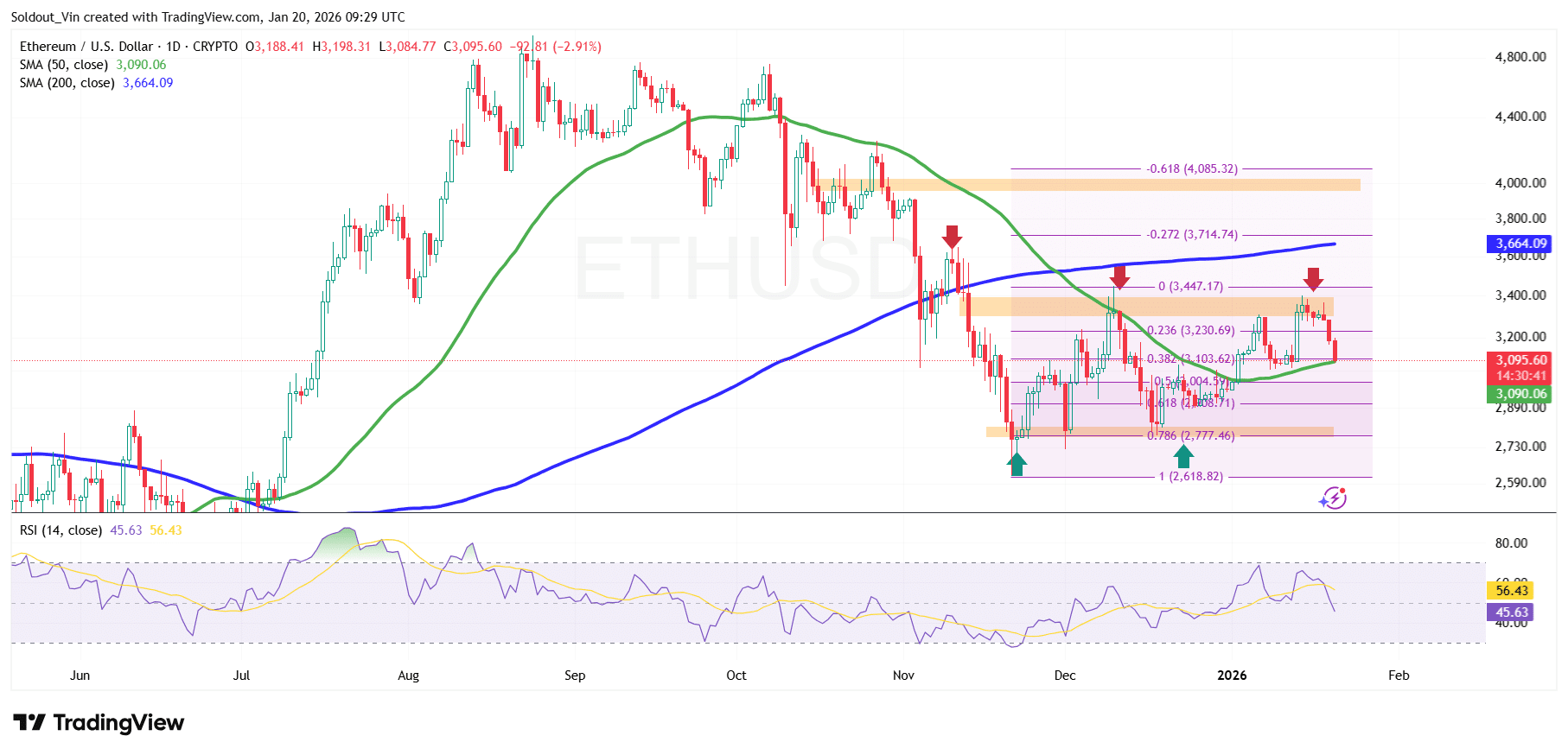

Ethereum’s price is currently trading around the $3,050–$3,150 range, attempting to stabilize after a sharp decline. While buyers are defending the $3,000 psychological support, the overall price action suggests caution rather than strength.

The recent move lower followed a strong rejection from the $3,600–$3,700 region, where Ethereum failed to hold above the 50-day Simple Moving Average (SMA).

This barrier triggered sustained pressure from the bears, sending the price down toward the $2,750–$2,800 demand zone, a historically important support area aligned with the 0.786 Fibonacci retracement.

Ethereum is currently trading near the 50-day SMA ($3,090), which is acting as short-term support. However, the price remains decisively below the 200-day SMA near $3,660, which continues to act as a major overhead resistance.

Momentum indicators also reflect this caution. The Relative Strength Index (RSI) is hovering around 45, below the neutral 50 level. This suggests that bearish momentum has eased, but bullish momentum has not yet returned.

ETH Price Prediction: $2,600 Level In Sight

Failure to hold $3,000 would increase the risk of another pullback toward $2,800–$2,750 near the 0.786 Fibonacci level. A breakdown below this demand zone would expose the $2,620 cycle low, which still acts as a critical level for the bulls to defend.

Conversely, it may attempt another push toward the $3,350 resistance zone, an area that has repeatedly capped and barred any upside moves.

A breakout above this range could open the door for a retest of $3,660 on the 200-day SMA level.

For Ethereum to realistically re-enter a bullish structure and target the $4,000 region, it would need a sustained trend reversal, starting with a decisive close above the 200-day SMA.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

ETH Dumps 25% in a Week, but Analysts Say the Bottom Isn’t In Yet

ETH struggles below $2,300, but analysts believe there’s more pain ahead.

The largest altcoin was hit hard over the past few weeks, dropping from over $3,000 to a multi-month low of $2,100.

Despite this substantial double-digit crash in the span of mere days, though, a few popular analysts recently indicated that the bottom has not been reached yet.

One of them, going by the X handle CW, indicated that ETH plummeted to a major buying wall at $2,100. If it’s to reverse anytime soon, the first significant sell wall is at $2,560.

Ali Martinez based his bottom prediction on the Market Value to Realized Value (MVRV) band, a metric that helps identify potential trend reversals.

He said that Ethereum has historically bottomed out when it dropped below the 0.80 MVRV band. If history repeats itself now, it would result in a price drop to just under $2,000.

Ethereum $ETH bottoms have historically formed below the 0.80 MVRV band.

Today, that level is near $1,959. pic.twitter.com/cgcuy2OgvI

— Ali Charts (@alicharts) February 4, 2026

Crypto Tony shared a similar opinion. The analyst with over 560,000 followers on X noted that ETH could go down to the major support and psychological level of $2,000 before it rebounds decisively.

You may also like:

His chart is quite optimistic as it shows a quick surge to $3,600 before another calamity to yearly lows at $1,500 by the summer of 2026. However, the 1-week macro chart is highly bullish as it predicts a massive run to new all-time highs above $6,000.

Personally i am looking for a bottoming to come in at $2000 level. Major support zone and a psychological level. pic.twitter.com/8VGHOQOx9t

— Crypto Tony (@CryptoTony__) February 4, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

A Hoodie Punks NFT, Bought For $82K In 2021, Sells For $382K

Join Our Telegram channel to stay up to date on breaking news coverage

Even though a significant portion of the non-fungible token market has experienced a severe downturn, with reports reportedly suggesting that over 70% of collections are now considered “dead” or worthless, specific segments of the NFT market remain profitable. Earlier today, an investor who bought his CryptoPunk for 42 ETH in August 2021 finally sold it for 120 ETH, making nearly $300,000 in solid profit.

In other news, there was a 120 ETH ($382k USD) Hoodie CryptoPunk sale three hours ago.

The seller bought it 5 years ago, August 2021, for 42 ETH ($83k USD).

Nice flip pic.twitter.com/ODUzapWF3g

— wale.moca 🐳 (@waleswoosh) January 20, 2026

Iconic Hoodie Punk NFT Sells For $382K

Data compiled by CryptoSlam.io, an on-chain crypto market aggregator and non-fungible token explorer tracking NFT collections from more than 20 blockchain networks, confirmed that iconic Hoodie Punk #9901 has found a new holder. This NFT collection, previously bought for 42 ETH, equivalent to 87,299 five years ago, was sold for 120 ETH, equivalent to $382,026. This humble and patient investor has pocketed nearly $300,00 in profit.

In response to the recent mega sale, the CryptoPunks NFT collection has surged by 60% to +$1.3 million in the past 24 hours. During this period, the global NFT market has surged by 108% to $14 million, while Ethereum NFT trading volume has increased by 274% to $9.9 million. Other NFT collections that have skyrocketed today include the Pudgy Penguins, which have risen by +50% and the Moonbirds, which have surged by 82%.

Launched in 2017, CryptoPunks is a globally acknowledged non-fungible token series previously from the digital asset firm ‘Larva Labs’ but now managed by the non-profit organization, Infinite Node Foundation. The iconic NFT collection, Punks, has a fixed supply of 10,000 pixilated NFTs hosted on the Ethereum blockchain. The CryptoPunks is one of the leading NFT series in the global NFT market.

What’s The Future Of Punks NFTs

The iconic Punk NFT collection came into the limelight in 2021 during the historic NFT bull run. At the time, rare punks sold for millions of dollars. Nonetheless, the future of Punks NFTs is shifting from speculative arts towards long-term preservation as “blue-chip” digital art. As pioneers in the NFT space, Punks are cemented as historical artifacts, with their value increasingly tied to their cultural significance and status as proof of digital ownership.

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

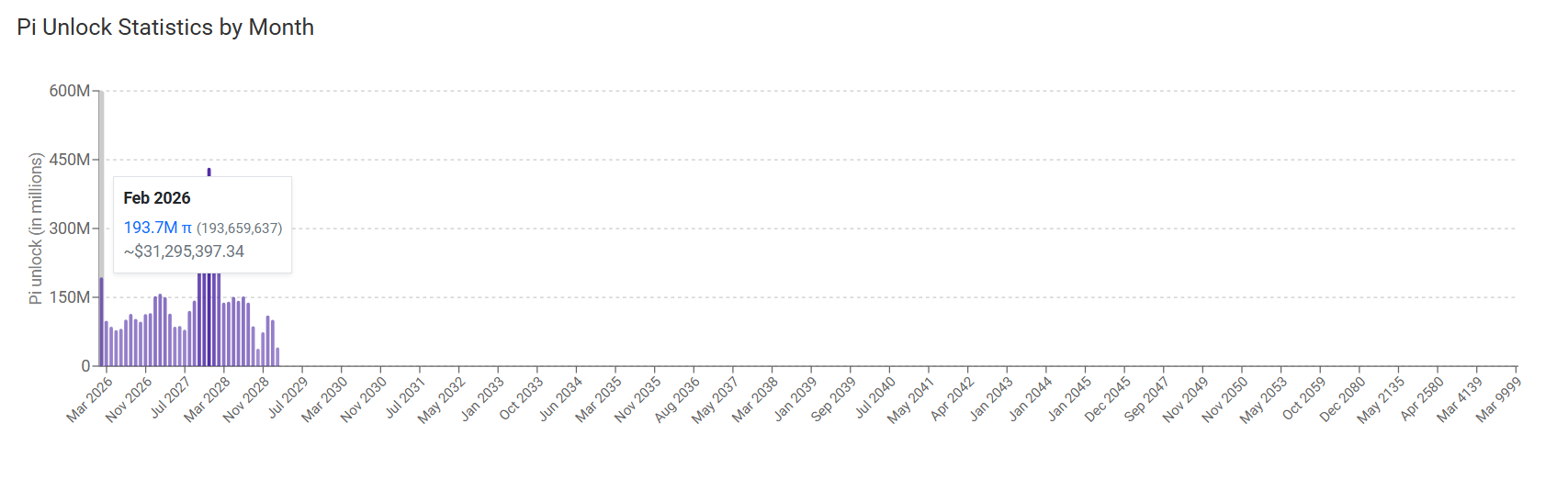

Pi Core Team Moves 500 Million Pi: What’s the Purpose?

Nearly a full year has passed since Pi opened its network and was listed on exchanges. However, Pi’s price performance has disappointed many Pioneers, as the token has dropped around 94% from its all-time high. Recent activity suggests the Pi Core Team may be rolling out new plans to strengthen the ecosystem.

At the same time, heavy unlock pressure is raising concerns that the downtrend could worsen.

Sponsored

Pi Core Team Moves Over 500 Million Pi in Early February

Wallet addresses labeled by Piscan — a Pi Network data tracking platform — as belonging to the Pi Core Team recorded several large transactions in the first days of February. This activity came as Pi’s price fell about 25% year to date, trading near $0.16.

One major transaction involved the PI Foundation 1 wallet moving 500 million Pi, worth more than $80 million. The wallet did not transfer Pi to exchanges. Instead, the funds were sent to another internal wallet also labeled as PI Foundation 1.

The move followed an announcement from the Pi Core Team stating that more than 16 million Pioneers have completed Mainnet migration. Around 2.5 million Pioneers who were previously blocked due to security checks have now been unblocked and can migrate.

The team also announced that over the next few weeks, more than 700,000 Pioneers will gain access to apply for KYC. In addition, a reward distribution system for KYC validators is currently being tested. Deployment is expected by the end of March 2026.

Sponsored

Many Pioneers believe the team’s on-chain transfers are preparations for upcoming plans.

“These updates reflect ongoing efforts to expand access to KYC and Mainnet migration, enabling broader participation in Pi’s ecosystem,” Pi Network stated.

On the positive side, more Pioneers completing Mainnet migration could make the Pi ecosystem more active and boost demand. However, it may also test long-term investor confidence, pushing holders to decide whether to sell or continue holding.

Sponsored

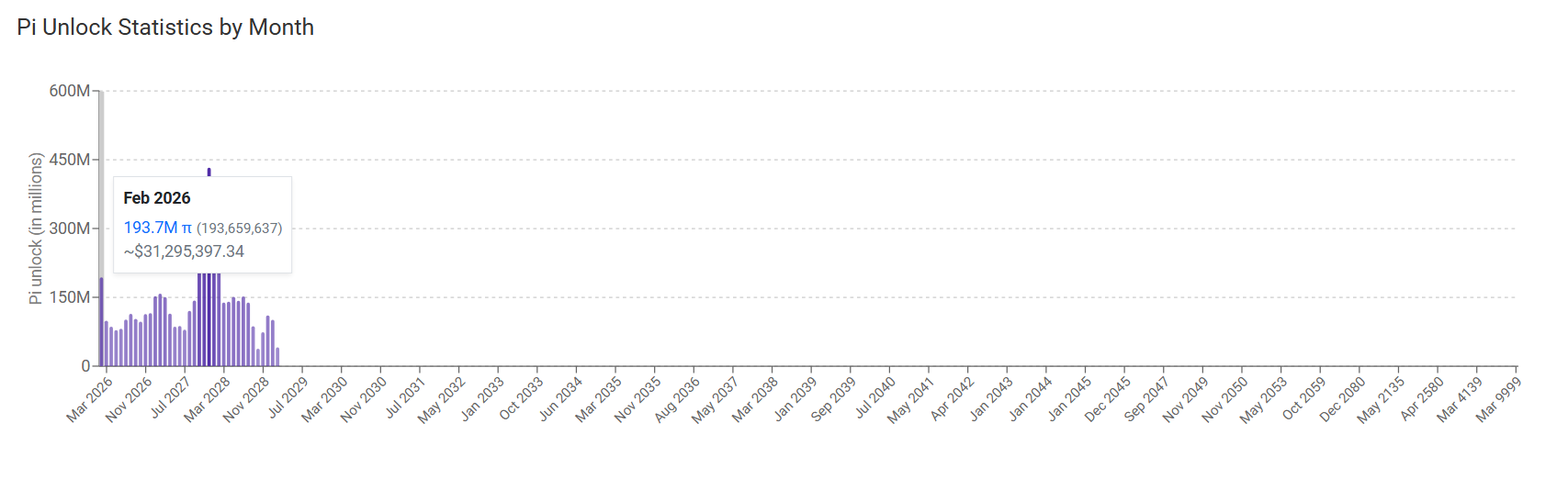

More Than 193 Million Pi to Unlock in February

Piscan data shows that more than 193 million Pi will unlock in February, worth over $31 million. This is the largest unlock amount scheduled for the period from now to October 2027.

On average, the next 30 days will see more than 7 million Pi unlocked per day, equivalent to around $1.1 million.

A recent BeInCrypto report noted that Pi’s trading volume on exchanges has dropped sharply. Daily volume remains weak, showing no improvement and staying below $20 million. Low volume combined with heavy unlock pressure creates a negative mix that continues to weigh on price.

Sponsored

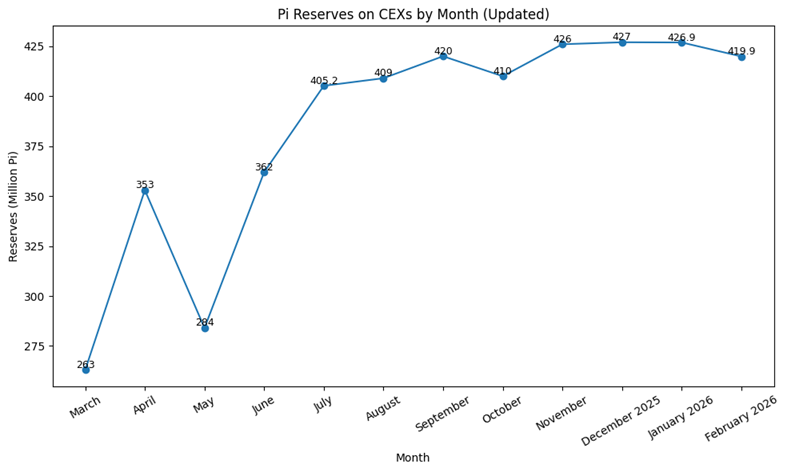

However, early February has shown some signs of demand returning. Exchange balance data compiled by Piscan indicates that Pi reserves on exchanges have started to decline after months of staying elevated.

Pi exchange balances currently stand at around 419.9 million Pi, down from 427 million Pi last month. While the decline is still modest, it suggests that early accumulation may be underway as prices remain low.

BeInCrypto’s latest analysis suggests positive sentiment could return. February is seen as the anniversary month of Pi Network’s exchange debut. Investors are also looking ahead to Pi Day in March.

Crypto World

Ethereum L2 Builders Debate Scaling Role After Vitalik’s Rollup Rethink

Several layer-2 builders responded after Ethereum co-founder Vitalik Buterin said the original vision of L2s as the primary scaling engine “no longer makes sense,” calling for a shift toward specialization.

In a Wednesday post, Buterin argued that many L2s have failed to fully inherit Ethereum’s security due to continued reliance on multisig bridges, while the base layer is increasingly capable of handling more throughput via gas-limit increases and future native rollups.

The comments prompted responses from Ethereum layer 2s, who broadly agreed that rollups must evolve beyond being cheaper versions of Ethereum but diverged on whether scaling should remain central to their role.

The Ethereum ecosystem is grappling with a shifting roadmap that aims to make the base layer more capable, while L2s reposition themselves as specialized environments serving distinct technical needs.

Ethereum L2 builders accept shift, differ on scaling’s role

Karl Floersch, a co-founder of the Optimism Foundation, said in an X post that he welcomed the challenge of building a modular L2 stack that supports “the full spectrum of decentralization.”

He also acknowledged that major hurdles exist. These include long withdrawal windows, the lack of production-ready Stage 2 proofs and insufficient tooling for cross-chain apps.

“Stage 2 isn’t production-ready,” Floersch wrote, adding that existing proofs are not yet secure enough to support major bridges. He also supported native Ethereum precompile for rollups, a concept that Buterin recently emphasized as a way to make trustless verification more accessible.

Steven Goldfeder, the co-founder of Arbitrum developer Offchain Labs, took a more forceful stance in a lengthy X thread. He argued that while the rollup model has evolved, scaling remains a core value of L2s.

Goldfeder said Arbitrum was not built as a “service to Ethereum,” but because Ethereum provides a high-security, low-cost settlement layer that makes large-scale rollups viable.

He also pushed back on the idea that a scaled Ethereum mainnet could replace the throughput currently handled by L2 networks. Goldfeder cited periods of high activity when Arbitrum and Base processed over 1,000 transactions per second, while Ethereum handled fewer.

He warned that if Ethereum was perceived to be hostile to rollups, institutions might launch independent layer-1 chains rather than deploy on Ethereum.

Related: Stablecoin ‘dust’ txs on Ethereum triple post-Fusaka: Coin Metrics

Base frames differentiation, Starknet hints alignment

Jesse Pollak, head of Base, said in an X post that Ethereum’s L1 scaling was “a win for the entire ecosystem.” He agreed that L2s cannot just be “Ethereum but cheaper.”

Pollak said Base has focused on onboarding users and developers while working toward Stage 2 decentralization, adding that differentiation through applications, account abstraction and privacy features align with the direction Buterin outlined.

StarkWare CEO Eli Ben-Sasson, whose company develops the non-EVM Starknet rollup, offered a brief but pointed reaction on X, writing: “Say Starknet without saying Starknet.”

Ben-Sasson’s comment hinted that some ZK-native L2s see themselves as already fitting the specialized role Buterin described.

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 hours ago

Tech5 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World14 hours ago

Crypto World14 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards