Business

SpaceX acquires xAI as Elon Musk moves to unite rockets, satellites and artificial intelligence

SpaceX has acquired xAI, Elon Musk’s fast-growing artificial intelligence venture, in a move designed to bring the billionaire entrepreneur’s AI, space and communications ambitions under a single corporate structure.

The deal unites the world’s most valuable private aerospace company with the developer of the Grok chatbot, marking one of the most striking corporate combinations to emerge from Silicon Valley in recent years. It also comes ahead of a widely reported blockbuster stock market listing later this year.

In a memo to staff, also published on X, Musk said the acquisition would create “the most ambitious, vertically integrated innovation engine on (and off) Earth”.

“By combining AI, rockets, space-based internet, direct-to-mobile communications and the world’s foremost real-time information platform, we can accelerate innovation across every domain,” he wrote.

The transaction deepens Musk’s strategy of fusing advanced AI with his space and satellite-internet empire, allowing SpaceX to tap into xAI’s computing power, data infrastructure and engineering talent. Industry observers say the integration could support long-term ambitions such as AI-driven satellite networks and even space-based data centres.

Last year, Musk used xAI to acquire X, formerly Twitter, folding the social media platform into his broader AI strategy. The New York Times reported that the combined xAI-X entity was valued at around $113bn at the time.

The latest move brings SpaceX, xAI, X and the Grok chatbot closer together ahead of a mooted initial public offering that would place much of Musk’s private empire under one listed umbrella. According to Bloomberg, the combined group could be valued at around $1.25 trillion, with shares potentially priced at about $527 each.

SpaceX, which designs and launches reusable rockets and operates the Starlink satellite broadband network, is estimated to have generated revenues of about $15.5bn last year. Separately, the company is reported to be exploring a capital raise of up to $50bn at a valuation of roughly $1.5 trillion — a figure that would eclipse Saudi Aramco’s record-breaking 2019 flotation.

Several global investment banks, including Bank of America, Goldman Sachs, JPMorgan Chase and Morgan Stanley, are said to be lining up for leading roles in the IPO, underlining investor appetite for Musk’s increasingly integrated vision of AI, space and communications.

While the scale and ambition of the deal are unprecedented, analysts note that the combination also brings together two capital-intensive businesses, both heavily reliant on advanced chips, data centres and energy. How effectively the merged group balances those costs — and convinces public market investors of its long-term profitability — will be closely watched in the months ahead.

Business

Form 144 TFS FINANCIAL CORPORATION For: 4 February

Form 144 TFS FINANCIAL CORPORATION For: 4 February

Business

Perdaman progresses 50MW solar farm near Karratha

A Perdaman-backed solar farm looks set to become the foundation tenant of a traditional owner-backed green energy park near Karratha.

Business

Vacant Perth lot earmarked for office, dwellings in $10m plan

A vacant strip of land in Northbridge has been earmarked for an eight-storey office and apartment building.

Skypacts Property Resources has submitted a $10 million plan to build a mixed-use development on 441 William Street.

The 508-square metre lot, currently an unoccupied infill site, sits next to the Perth Mosque and is bound by William Street and Brisbane Place.

According to Skypacts’ application filed with the City of Vincent, the proposed development comprises offices and associated parking from the first to the fourth floor, and nine apartments across the upper levels.

Lateral Planning, on behalf of Skypacts, said the project would be a high-quality development on an underutilised infill site.

“Overall, the proposed development will not detract from the amenity of the area rather, it will significantly enhance it,” the application said.

“It represents a positive, forward-looking contribution to the locality, by supporting strategic planning goals, and promoting sustainable urban growth.”

RP data shows Skypacts bought the site for about $2.5 million in 2022.

Skypacts Property Resources is owned by Kian Kiong Lee and has a registered address in Nedlands, according to an Australian Securities and Investments Commission document.

About 600 metres away, another vacant Northbridge lot was flagged for development.

A 480-square metre site at 195 Beaufort Street, next to the Ellington Jazz Club, has been vacant for about 20 years.

In May 2024, a development assessment panel approved a $2.4 million proposal to build a four-storey apartment and retail project on the site.

However, the site, with the attached development application approval, was recently listed on the market.

Business

Ford and Geely in talks for manufacturing, technology partnership, sources say

Ford and Geely in talks for manufacturing, technology partnership, sources say

Business

Analysis: Fiscal realities rein in US’s aggressive Nordic ambitions

ANALYSIS: The negative response of financial markets dissuaded the US president from pursuing his designs on Greenland.

Business

Pinterest sacks engineers for tracking layoffs

The social media platform announced last week that it was laying off around 15% of its workforce.

Business

Brokerages May Start Charging ETF Issuers Distribution Fees, Says J.P. Morgan

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

Business

Analysis-Ultra-low bond spread unity still out of reach for euro area

Analysis-Ultra-low bond spread unity still out of reach for euro area

Business

Opinion: Net downside in fishing bans

OPINION: The state government may have hooked itself with what looked like an easy political decision.

Business

Airbnb: Hotel Expansion Is Promising, But The Valuation Leaves Little Room For Error

Airbnb: Hotel Expansion Is Promising, But The Valuation Leaves Little Room For Error

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat23 hours ago

NewsBeat23 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World8 hours ago

Crypto World8 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

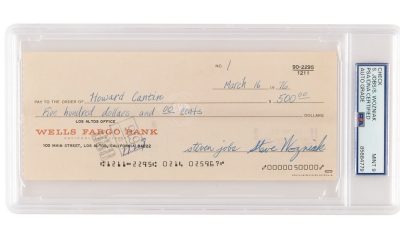

Tech4 days ago

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined