Business

Dealmakers navigate tighter terrain

Business

EU ‘open-minded’ on UK customs union talks, commissioner says

Brussels would be willing to discuss closer trade ties with the UK, including the possibility of cooperation on a customs union, a senior European commissioner has said, signalling the clearest openness yet from the EU to re-engage with Britain.Speaking to the BBC

after high-level talks in London, Valdis Dombrovskis, the European Commissioner for Economy, said the EU was “ready to engage with an open mind” if the UK wanted to explore deeper economic alignment.

His comments come amid growing pressure on Labour to reconsider its stance on a customs union with the EU, as businesses and some MPs argue closer ties could help offset global trade uncertainty.

Dombrovskis also said the EU and UK could remove “most” food checks between Britain and the bloc if agreement is reached on aligning sanitary and phytosanitary rules, potentially easing one of the biggest sources of friction for exporters since Brexit.

The commissioner was speaking following meetings with senior UK ministers, including Chancellor Rachel Reeves, European trade commissioner Maroš Šefčovič, and cabinet ministers Peter Kyle and Nick Thomas-Symonds.

The group, informally dubbed the “Quint” by diplomats, is intended to meet regularly to coordinate responses to a rapidly shifting global trade and security environment. While it is not formally tasked with renegotiating Brexit arrangements, its creation signals a renewed willingness on both sides to cooperate.

At a public event alongside Dombrovskis, Reeves said stronger UK-EU ties were becoming increasingly important as “we are sliding towards a world where the rules are less clear”, pointing to heightened geopolitical and trade tensions.

A customs union would eliminate tariffs on goods traded between the UK and the EU and significantly reduce border bureaucracy. However, critics argue it would restrict the UK’s ability to strike independent trade deals, as Britain would be required to align with the EU’s common external tariff and trade policy.

Labour’s election manifesto ruled out rejoining the EU customs union or the single market, and also rejected freedom of movement. However, senior figures have increasingly acknowledged the economic case for closer alignment, with Foreign Secretary David Lammy previously suggesting a customs union could support growth.

Asked directly whether the EU would welcome talks on a customs union, Dombrovskis stopped short of a commitment but said: “We are ready to engage with an open mind and seek those areas of cooperation.”

He added that the EU was also open to discussing alignment in specific single-market areas, while stressing that full single-market membership would require acceptance of the four freedoms, including freedom of movement.

On defence, Dombrovskis said the EU remained open to further discussions on UK participation in the bloc’s €150bn Security Action for Europe (SAFE) defence loans programme, after talks stalled last year over limits on British firms’ involvement.

“We know the prime minister has expressed interest in returning to this issue, and there is certainly openness from the EU side,” he said.

Progress has been stronger in other areas. Dombrovskis confirmed talks on a youth mobility scheme were “very advanced”, and said a forthcoming food standards agreement could eliminate most border checks, provided the UK aligns with EU rules.

The Liberal Democrats, who have long backed a customs union, welcomed the comments as a turning point. Treasury spokesperson Daisy Cooper said the EU’s stance was “a significant moment the government simply cannot afford to ignore”.

The developments come against the backdrop of escalating global tensions, including US tariff threats and renewed uncertainty over international trade rules, which both London and Brussels see as strengthening the case for closer cooperation.

Business

Citizens upgrades Airbnb stock rating to Market Outperform on hotel expansion

Citizens upgrades Airbnb stock rating to Market Outperform on hotel expansion

Business

Dowlais shares delisted following combination with Dauch

Dowlais shares delisted following combination with Dauch

Business

‘SaaSpocalypse’: What is Anthropic’s newest AI tool and what are the consequences for global tech companies?

So, first, what exactly is this new tool?

Anthropic has expanded its enterprise AI platform, Claude Cowork, by launching 11 new plugins aimed at automating a wide range of professional tasks. Claude Cowork is an agentic, no-code AI assistant built for corporate users, allowing companies to automate workflows without writing software. The new plugins are designed to handle tasks across legal, sales, marketing and data analysis functions. The most recent addition is Anthropic’s Claude Legal agent, which can perform routine legal work such as document and contract review, and compliance checks.

Anthropic has said that the tool does not provide legal advice and that all AI-generated outputs must be reviewed by licensed attorneys. Even so, the breadth of automation signals a step change in how much white-collar work AI systems can now perform.

Also read: Rs 1.9 lakh crore SaaSpocalypse for IT stocks explained: What it means for investors

Why is it worrying for tech companies?

At the heart of the market reaction is a growing concern that AI could fundamentally reshape the competitive landscape for software and IT services companies, eroding both profitability and market position.

“The fear with AI is that there’s more competition, more pricing pressure, and that their competitive moats have gotten shallower, meaning they could be easier to replace with AI,” said Thomas Shipp, head of equity research at LPL Financial, which has $2.4 trillion in brokerage and advisory assets. “The range of outcomes for their growth has gotten wider, which means it’s harder to assign fair valuations or see what looks cheap.”

Industries once considered relatively safe from AI disruption, including legal services, data analytics and customer suppor are now firmly in the crosshairs. If AI can automate these functions, the massive IT services industry built around delivering them could face existential challenges.Jefferies was among the first to label the market reaction a “SaaSpocalypse”, noting a rapid shift in sentiment from ‘AI helps these companies’ to ‘AI replaces these companies.’ Jeffrey Favuzza from Jefferies’ equity trading desk described the mood as outright panic. “Trading is very much ‘get me out’ style selling,” he said, according to Bloomberg.

What were the repercussions?

The consequences were swift and broad-based. A Goldman Sachs basket of US software stocks plunged 6%, its biggest single-day fall since April’s tariff-led selloff, according to Bloomberg. Financial services stocks were hit even harder, with an index tumbling nearly 7%.

In India, IT stocks suffered their worst single-day selloff in recent memory on Wednesday, with the sector losing Rs 1.75 lakh crore in market value as investors fled amid fears that artificial intelligence could make traditional software and IT services obsolete. Persistent Systems shares crashed over 6%, while heavyweight IT stocks, including Infosys, LTIMindtree, Coforge, TCS, Mphasis and HCL Tech tumbled 4–6% each. Wipro and Tech Mahindra fell around 4%. The combined market value of Nifty IT index stocks plunged from Rs 31.75 lakh crore to Rs 30 lakh crore.

The selloff was not confined to India. Wall Street’s tech-heavy Nasdaq fell 1.4% on Tuesday, with software stocks shedding approximately $300 billion in market value. Global giants were also hit hard: London Stock Exchange Group Plc fell 13%, Thomson Reuters Corp. plunged 16%, CS Disco Inc. sank 12%, and Legalzoom.com Inc. plummeted 20%.

JPMorgan said the ongoing generalist money outflows are triggering knee-jerk selling, amplified by index-arbitrage basket trades, programmatic de-grossing, cross-correlation factor contagion and a vacuum in passive liquidity. The bank noted that it had flagged the risks of extreme bullish positioning in AI well ahead of time. As far back as late 2022, JPMorgan had warned that AI technology would “evolve at the speed of light” and could surprise investors with the pace and scale of its capabilities.

Concerns around AI-led disruption have been building for months. Anthropic’s initial release of the Claude Cowork tool in January had already heightened investor anxiety around software sector risks. Other technology launches have added to the unease. Video game stocks were caught in a selloff last week after Alphabet began rolling out Project Genie, which can create immersive worlds using text or image prompts.

Also read: Infosys, Wipro, TCS and other IT stocks tumble up to 7%. Here’s why

As fears of AI-driven disruption spread, analysts say the coming months will be critical in determining how software and IT companies navigate this complexity. But for now, the “SaaSpocalypse” has delivered a shock to the markets.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Canadian miners flock to ASX

Canadian resources companies are increasingly eyeing the Australian stock market’s investor base and capital pools after eight new North American outfits debuted in 2025.

Business

Super Micro Computer: Blowout Earnings Confirm Bullish Case

Super Micro Computer: Blowout Earnings Confirm Bullish Case

Business

Perth Festival slumps to $850k loss

The loss was the first since Perth Festival started disclosing its annual results and came despite a 20 per cent jump in government grants to $17.6 million.

Business

China to ban electronic door handles on cars starting 2027 for safety

Check out what’s clicking on FoxBusiness.com.

China has moved to ban one of the most iconic Tesla vehicle features in order to get a handle on vehicle safety.

New safety regulations published by China’s Ministry of Industry and Information Technology state that cars sold in China will be required to have mechanical releases on their door handles, according to TechCrunch. The outlet added that the rules, which go into effect on Jan. 1, 2027, will ban hidden, electronically activated door handles.

Under the new rules, each vehicle door, except for the tailgate, will need to be equipped with a manually-released external door handle and vehicles will be required to have a mechanical release on the interior, TechCrunch reported.

TESLA ENDS PRODUCTION OF MODEL S AND MODEL X VEHICLES, WILL FOCUS ON ROBOTS IN 2026

A Tesla model Y is shown charging at a Tesla dealership in Buena Park, Calif., Jan. 28, 2026. (Mike Blake/File Photo/Reuters / Reuters)

China is the first country to implement such a ban. While the feature was made popular with Teslas, Chinese competitors, including Xiaomi, have adopted the design, according to Reuters.

The ruling followed high-profile incidents in which power failures were suspected to have prevented the doors from opening, leaving people trapped and unable to escape or be rescued, Bloomberg reported. The outlet said that two of the incidents included fiery crashes involving Xiaomi Corp. EVs.

“China is shifting from being just the largest EV market to being a rule-setter for how new vehicle technologies are regulated,” Bill Russo, founder of Shanghai-based consultancy Automobility, told Bloomberg. “By moving first, Beijing can use its huge domestic market to lock in safety standards that both Chinese and foreign automakers must follow at home — and that may ultimately travel with Chinese EV exports and influence global norms.”

A woman opens the door for a Tesla Model YL electric vehicle at a showroom in Beijing on Feb. 3, 2026. China will ban hidden door handles on cars sold in the country from next year, phasing out the minimalist design popularized by Tesla over safety c (Pedro Pardo / AFP via Getty Images / Getty Images)

ELON MUSK TAKES DIG AT WAYMO AFTER SAN FRANCISCO BLACKOUT

In December, the Office of Defects Investigation (ODI), which is under the National Highway Traffic Safety Administration (NHTSA), opened a defect probe into the Tesla Model 3 sedan’s emergency door release controls, Reuters reported. The investigation reportedly included approximately 179,071 model year 2022 vehicles.

Visitors look at a Xiaomi SU7 electric vehicle displayed at the Beijing International Automotive Exhibition, or Auto China 2024, in Beijing, China, April 25, 2024. (Tingshu Wang/Reuters)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Federal Motor Vehicle Safety Standard No. 206 lays out requirements for vehicle door locks and door retention components to help prevent occupants from being ejected during a crash.

A representative for NHTSA pointed out to FOX Business that while FMVSS No. 206 does not have specific requirements mandating a manual door release if power is lost, failing to provide a reasonable way for occupants to enter or exit a vehicle could be considered a safety defect and lead to a recall. However, the opening of a defect petition does not automatically mean that a recall will be issued.

FOX Business reached out to Tesla and Xiaomi for comment.

Business

Barclay brothers given six weeks to avoid bankruptcy after HSBC action

Howard and Aidan Barclay have been given six weeks to reach an agreement with creditors after HSBC launched bankruptcy proceedings over debts linked to the collapse of the family’s logistics empire.

At a High Court hearing on Tuesday, Mr Justice Michael Briggs granted the brothers until 17 March to circulate proposals for individual voluntary arrangements (IVAs), a formal insolvency process allowing debtors to agree repayment terms with creditors and avoid bankruptcy.

The brothers are the eldest sons of the late Sir David Barclay, who, alongside his twin brother Sir Frederick Barclay, built a sprawling business empire through highly leveraged acquisitions. Much of that empire has since unravelled.

HSBC initiated bankruptcy action in December over debts stemming from the collapse of Logistics Group, the parent company of delivery firms Yodel and ArrowXL. The group fell into administration in March 2024 after HSBC called in its loans.

Administrators recovered just £1.1 million of HSBC’s £143.5 million secured lending, representing less than 1p in the pound, according to filings by Teneo at Companies House.

IVAs allow individuals to retain greater control over their assets than bankruptcy, but require the support of creditors representing at least 75 per cent of outstanding debt. It remains unclear whether HSBC will support any proposal from the Barclay brothers or continue to pursue bankruptcy. The bank declined to comment.

The next court hearing is scheduled for 31 March.

The logistics collapse was one of several blows to the Barclay family’s holdings. In recent years, the family has lost control of the Telegraph Media Group and The Very Group.

In 2023, US private equity firm RedBird Capital Partners and Abu Dhabi-backed International Media Investments acquired around £1.2 billion of debt previously held by Lloyds Banking Group that sat behind the family’s businesses.

IMI has since appointed insolvency practitioners at Interpath Advisory to dispose of assets held by Trenport Property Holdings, one of the family’s property vehicles. Filings last year listed Aidan Barclay’s main residence as Monaco.

As part of the Logistics Group administration, ArrowXL was sold in June to Jacky Perrenot Group for an initial £2.2 million, far below a £57.5 million valuation previously put forward by the directors. Yodel was sold in February 2024, shortly before administrators were appointed.

The Barclay family relinquished control of Very in November after US private equity firm Carlyle Group took control, with IMI remaining as a lender.

Meanwhile, the long-running saga over the Telegraph titles continues. A proposed £500 million sale to RedBird collapsed in November after regulatory intervention, prolonging uncertainty since Lloyds seized the papers in 2023. The owner of the Daily Mail is now poised to acquire the Telegraph, a deal expected to face scrutiny from competition regulators.

The Barclay brothers were approached for comment.

Business

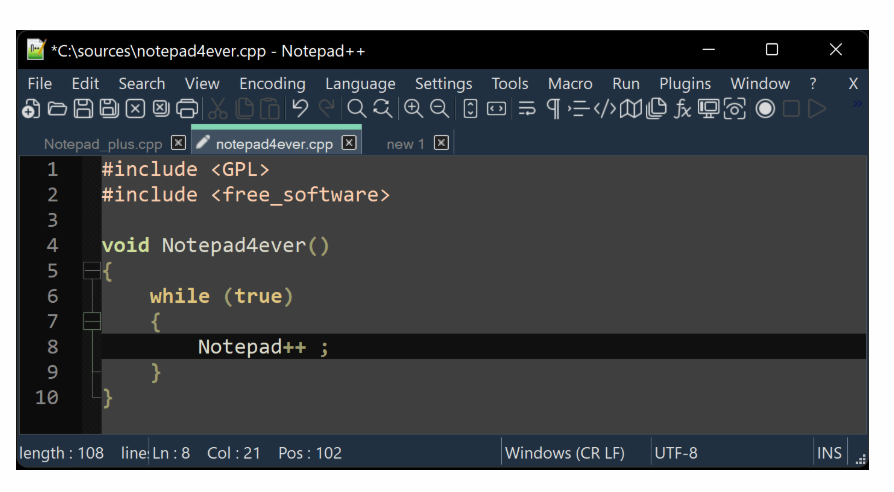

Notepad++ Hack Reveals Six-Month Backdoor Breach Targeting Millions of Users

Notepad++, one of Windows’ most widely used text editors, has confirmed a major security breach after its update infrastructure was compromised for nearly six months.

Developers say suspected China state–linked actors hijacked update traffic, delivering backdoored versions of the app to carefully selected targets.

How the Breach Happened

The compromise began in June 2025 at the infrastructure level. Attackers intercepted and redirected update requests intended for official Notepad++ servers, routing some users to rogue servers.

Full control over the compromised systems was only restored in December 2025, allowing malicious activity to go unnoticed for months.

Sophisticated Espionage Tool in the Form of Chrysalis Backdoor

Security researchers uncovered a previously unknown payload named Chrysalis, described by Rapid7 as a feature-rich, custom backdoor.

Its capabilities suggest a tool designed for long-term espionage, not simple malware. In several cases, attackers gained “hands-on keyboard” access, enabling real-time control of infected systems.

Updater Exploited Through Weak Verification

According to Ars Technica, the attackers exploited older versions of Notepad++’s updater, GUP/WinGUP, which relied on less robust verification methods.

By intercepting traffic, they altered download URLs and served malicious files. Without any question, it exposed the risks of under-secured update mechanisms at the ISP level.

Immediate Steps for Users and Organizations

Developers and security experts urge users to manually install Notepad++ version 8.9.1 or later from the official website.

For organizations, it’s recommended to restrict updater internet access and monitor installed extensions carefully.

Originally published on Tech Times

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World9 hours ago

Crypto World9 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined