Crypto World

XLM Falls Below $0.2, Yet TVL Hits an ATH. Why?

Stellar (XLM) has fallen below $0.20. This move has erased all of the recovery it achieved last year. However, several positive signals suggest that many investors are still staying within the ecosystem.

In addition, real-world assets (RWA) and stablecoins could become key drivers of further XLM accumulation.

Sponsored

Positive Signs for Stellar (XLM) Despite the Sharp Price Drop

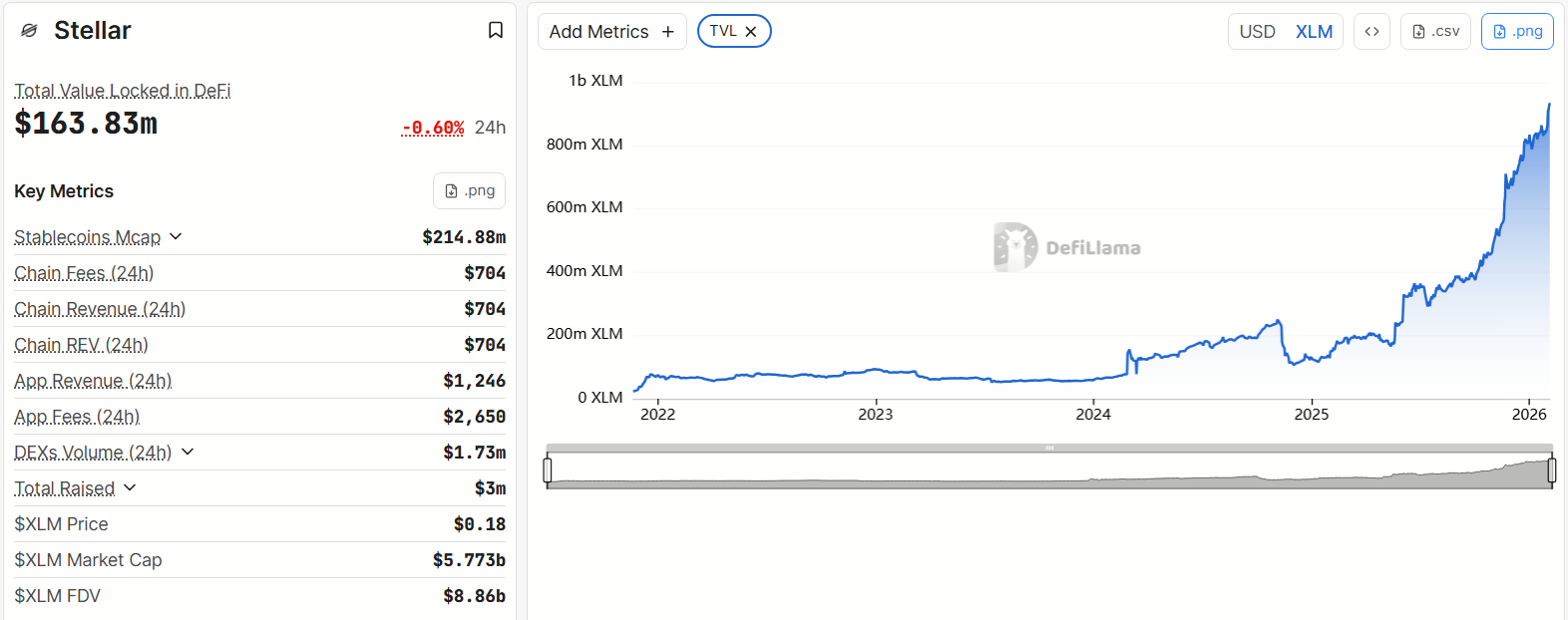

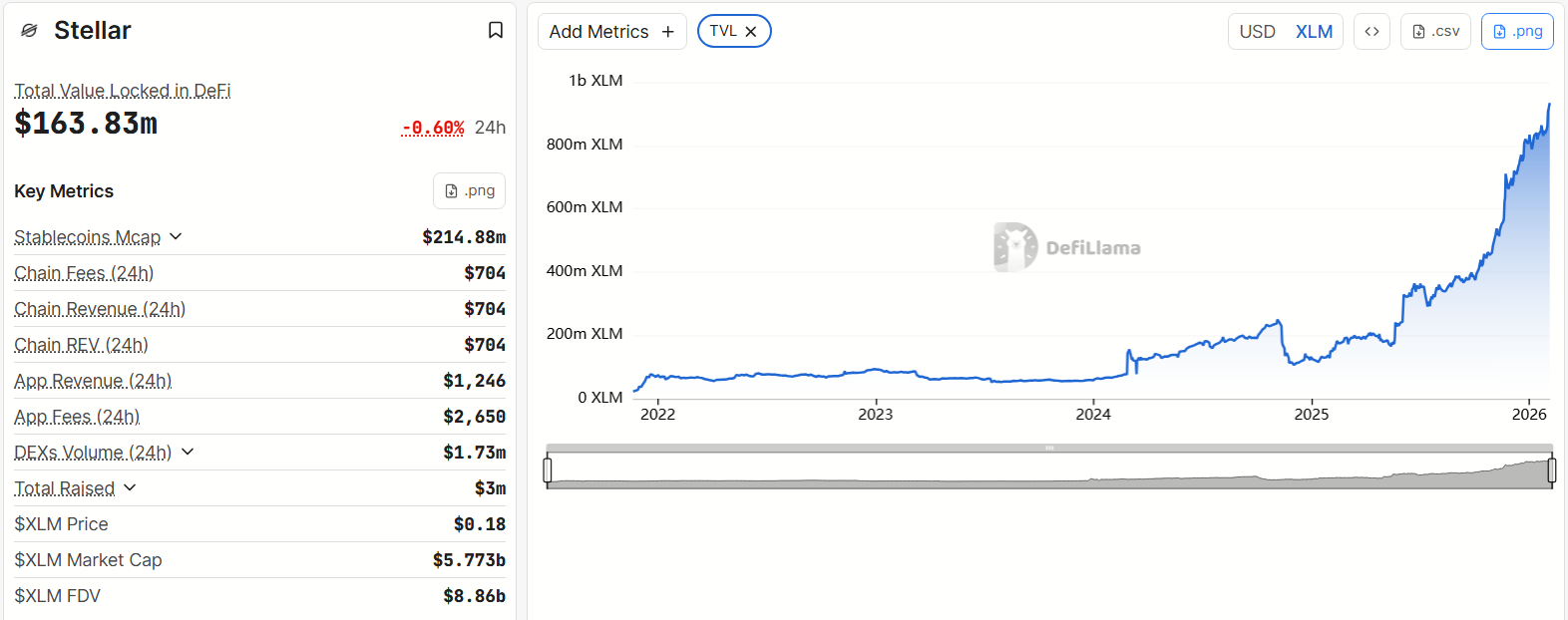

Data from DefiLlama shows that the amount of XLM locked in DeFi protocols on the Stellar network reached a new all-time high in early February 2026. It surpassed 900 million XLM.

This milestone reflects the growth of Stellar’s DeFi ecosystem. It comes even as XLM continues to fall below the year’s key support level at $0.20.

Although Stellar’s TVL, measured in USD, currently sits around $163 million, the sharp rise in locked XLM underscores strong confidence from the community and long-term investors in the network’s adoption potential.

The main protocols driving this capital inflow include Blend, a liquidity protocol that allows anyone to create flexible lending markets on Stellar, and Aquarius Stellar, an AMM protocol and liquidity management layer for the network. Together, these two protocols account for nearly 70% of total TVL.

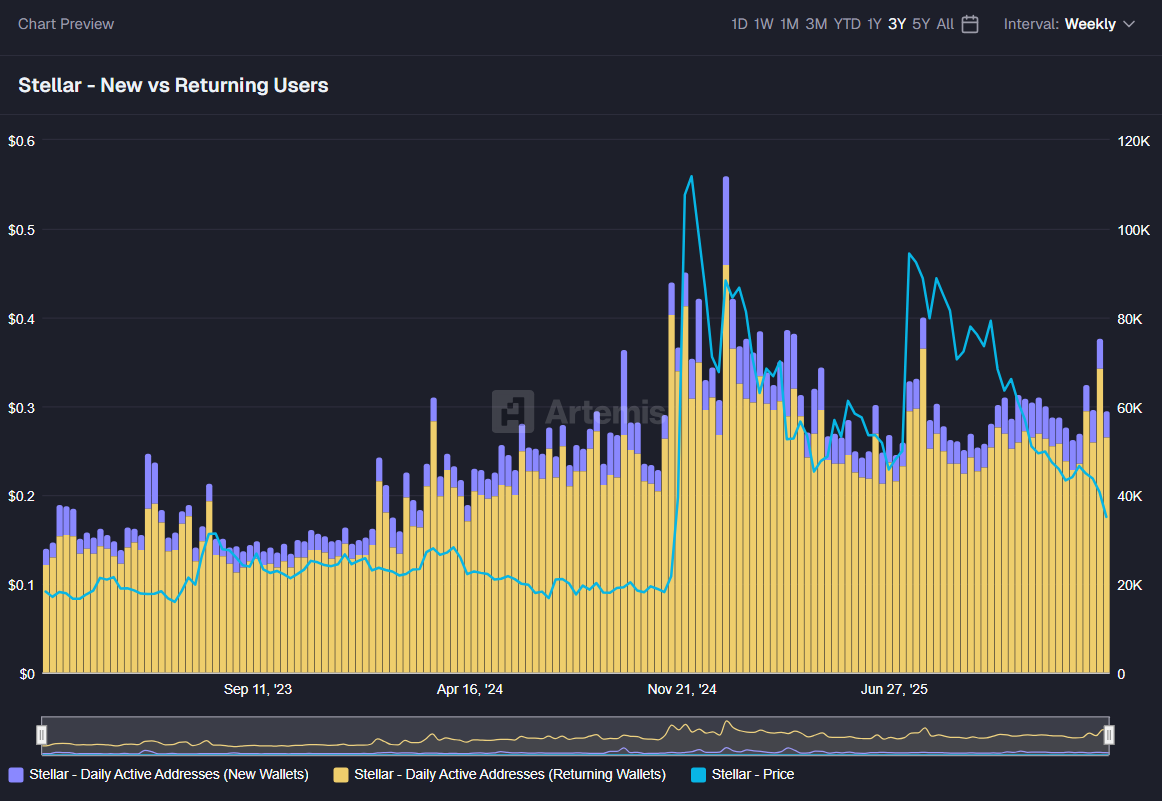

Artemis data also reveals another notable signal. Weekly active users across the Stellar ecosystem have remained steady at around 60,000 over the past few weeks. No significant decline has appeared despite the deep XLM price dump.

Sponsored

The chart indicates that in late 2024, when XLM fell below $0.10 before rising to $0.60, user activity remained stable and even trended upwards.

This suggests that Stellar users are not abandoning the network, even as capital continues to exit the broader crypto market. However, the current lack of new users may explain why XLM has not yet recovered.

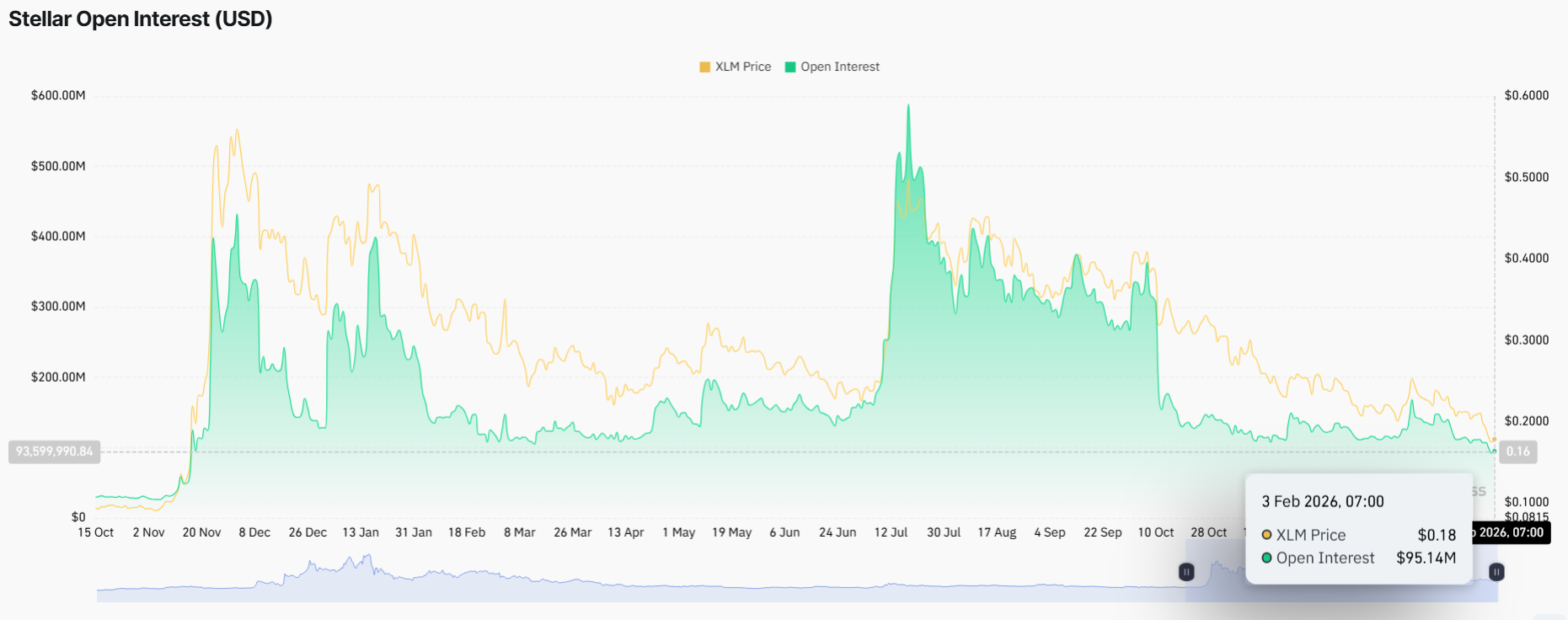

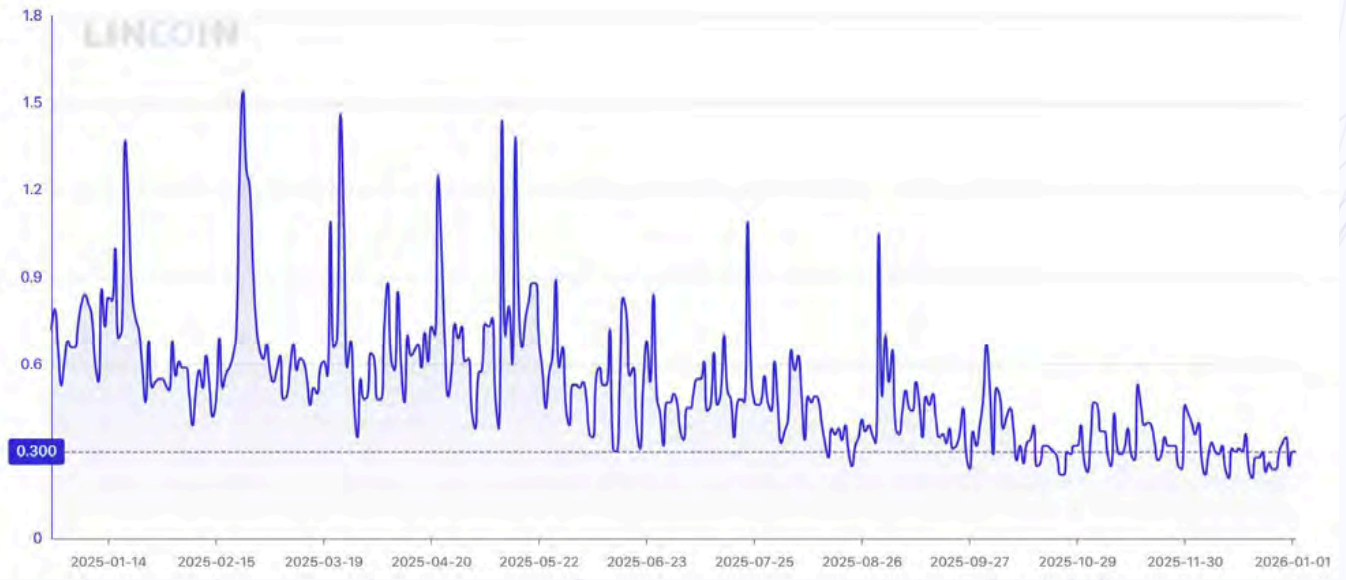

Derivatives metrics also indicate that XLM could be entering a new consolidation zone. Open Interest volume has dropped to its lowest level since November 2024. This decline reflects a sharp reduction in leveraged exposure among traders.

Sponsored

As a result, strong volatility may be fading. XLM could now be moving into a sideways phase, with less leveraged buying and selling pressure. This environment often allows a new accumulation zone to form.

However, identifying the exact market bottom and timing a recovery remains challenging under current market conditions.

Real-World Assets and Stablecoins Could Be Stellar’s Main Drivers in 2026

A report published last month stated that the total value of tokenized real-world assets on Stellar, excluding stablecoins, reached $1 billion at the start of this year.

Sponsored

Santiment, a crypto market analytics platform, also reported that Stellar ranks among the top four RWA projects by GitHub development activity since the beginning of the year.

“XLM isn’t a speculative add-on. It’s required for transactions, account operations, and network activity. As RWA volumes grow, usage of $XLM scales with it — not cyclically, but fundamentally,” said Scopuly, a Stellar wallet provider.

Stellar’s stablecoin market cap remains relatively modest at around $200 million. However, MoneyGram, one of the world’s leading companies in international remittance services and P2P payments, recently reaffirmed the stability of its USD-backed stablecoin instrument. The firm continues testing it on Stellar.

Therefore, demand for RWAs and stablecoins could become the primary drivers of XLM accumulation, especially as the token faces strong selling pressure near current lows.

Crypto World

Spanish lender BBVA joins stablecoin venture of EU banks to challenge digital dollars

BBVA, Spain’s second-largest bank by assets, said it joined Qivalis, a group of lenders aiming to introduce a regulated euro stablecoin and challenge the dominance of digital dollars.

Adding BBVA, which has $800 billion of assets, the group now includes a dozen major European Union banks, including BNP Paribas, ING and UniCredit.

The project’s goal is to create a token backed by a network of established banks, offering an alternative to crypto-native stablecoins, many of which are tied to the dollar and operated by companies based outside of the bloc.

Of the $300 billion stablecoin market, only $860 million are tied to the single currency. Tether, based in El Salvador, dominates with its $185 billion USDT, followed by New York-based Circle Internet’s (CRCL) $70 billion USDC.

A euro-pegged coin could allow EU businesses and consumers to make blockchain-based payments and settlements using euros, without relying on traditional financial rails or third-party providers outside the bloc.

“Collaboration between banks is key to create common standards that support the evolution of the future banking model,” Alicia Pertusa, head of partnerships and innovation at BBVA CIB, said in a statement.

BBVA’s involvement “reflects the increasing dedication of European banking institutions to jointly develop a European on-chain payment ecosystem based on the trust that banks provide,” said Jan-Oliver Sell, CEO of Qivalis and a former executive of Coinbase Germany. “This step consolidates Qivalis’ standing as Europe’s foremost bank-supported stablecoin initiative.”

Qivalis is currently pursuing authorization from the Dutch central bank to operate as an electronic money institution, a step required to issue stablecoins under the EU’s digital asset regulatory framework dubbed MiCA.

The project plans to debut the token in the second half of 2026.

Read more: BNP Paribas Joins EU Bank Stablecoin Venture Helmed by Ex-Coinbase Germany Exec

Crypto World

Ethereum Price Rise, Vitalik Buterin Calls for Protocol Simplification

Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price has surged 2% in the last 24 hours to trade at $3,350 after co-founder Vitalik Buterin called for a major simplification of the protocol.

Buterin warned that Ethereum’s increasing complexity, driven by the continuous addition of new features without removing outdated ones, poses a threat to trustlessness, self-sovereignty, and long-term sustainability. According to him, even a highly decentralized system with strong security measures can fail if its codebase becomes too complicated for users to understand or rebuild independently.

Buterin highlighted three main risks caused by protocol bloat. First, users are forced to rely on experts, or “high priests,” to explain how the system works, weakening trust. Second, Ethereum fails the “walkaway test,” as rebuilding high-quality clients would be nearly impossible if development teams disappear. Third, self-sovereignty is compromised because even technically skilled users cannot fully inspect or reason about the system.

An important, and perenially underrated, aspect of “trustlessness”, “passing the walkaway test” and “self-sovereignty” is protocol simplicity.

Even if a protocol is super decentralized with hundreds of thousands of nodes, and it has 49% byzantine fault tolerance, and nodes fully… pic.twitter.com/kvzkg11M3c

— vitalik.eth (@VitalikButerin) January 18, 2026

Buterin Calls for Ethereum “Garbage Collection”

To address these challenges, Buterin urged Ethereum developers to introduce “garbage collection,” a process aimed at simplifying the protocol. This involves removing rarely used features, reducing lines of code, limiting reliance on complex cryptographic primitives, and introducing fixed rules, or invariants, to make client behavior more predictable. He pointed to previous upgrades, such as Ethereum’s shift from proof-of-work to proof-of-stake and recent gas cost reforms, as examples of effective simplification.

Future changes could move less essential features into smart contracts, easing the burden on client developers while maintaining network security. In contrast, Solana Labs CEO Anatoly Yakovenko argued that blockchains must keep evolving to meet user and developer needs. He emphasized that constant iteration is vital for Solana’s survival, even if no single team drives the changes. Buterin, however, maintained that Ethereum should eventually reach a state where it can operate securely and predictably for decades without ongoing developer intervention.

Ethereum Price Eyes Upside After Key Support Bounce

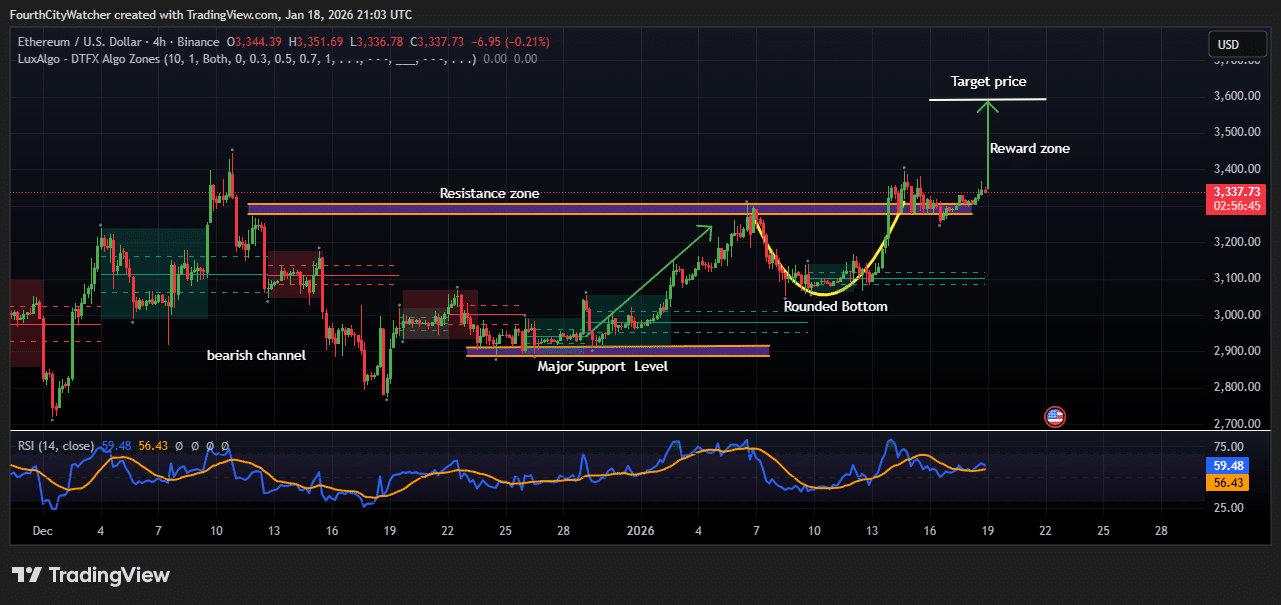

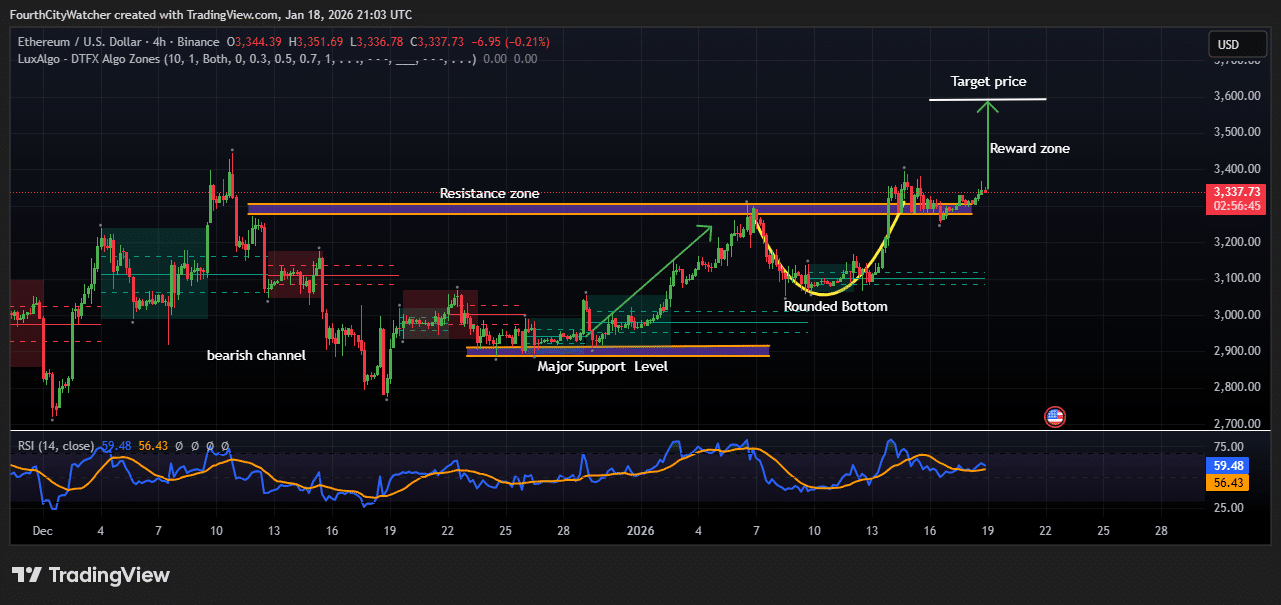

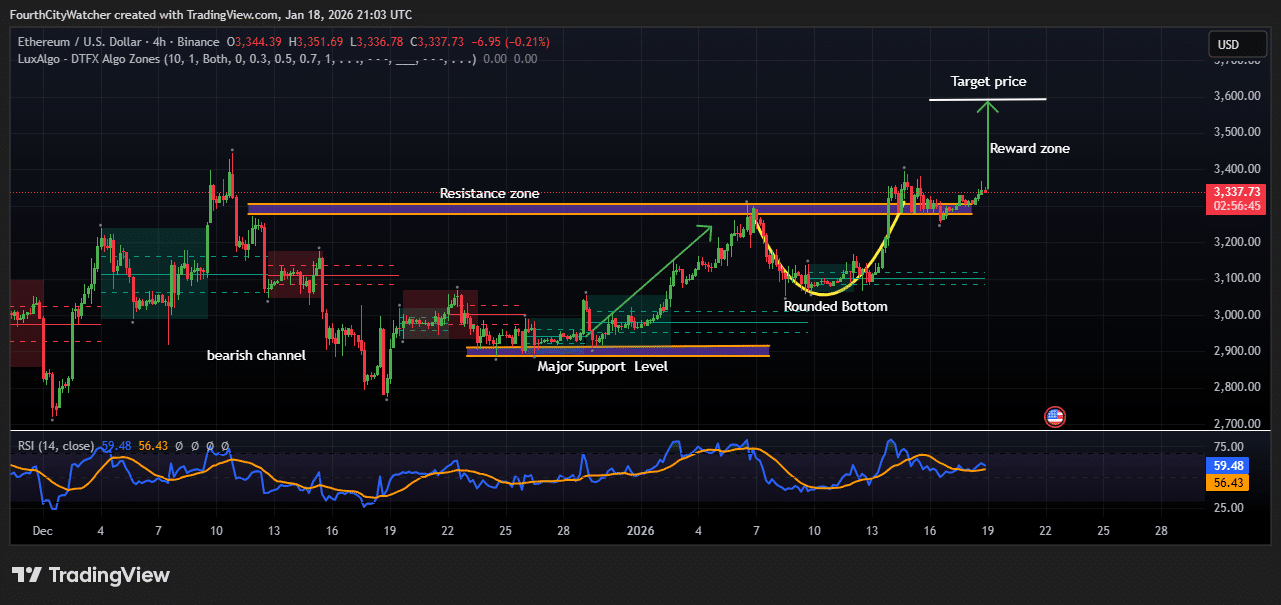

The 4-hour Ethereum chart shows clear signs of bullish momentum. Price recently bounced off a strong support level around $2,950–$3,000, which has held multiple times over the past month. This support has acted as a solid foundation, allowing Ethereum to recover from previous declines.

Before this bounce, Ethereum was moving in a bearish channel, making lower lows and lower highs. The recent breakout above this channel marked a key trend reversal, signaling that buyers are regaining control. Between January 10 and January 16, a rounded bottom pattern developed, which often signals a shift from bearish to bullish sentiment.

This pattern reflects a period of accumulation, where sellers gradually lost influence and buyers began gaining momentum. The rounded bottom now supports price consolidation above $3,300, showing that the market has stabilized and is preparing for potential further gains.

ETHUSDT Analysis Source: Tradingview

On the upside, there is a clear resistance zone between $3,350 and $3,400. Ethereum has tested this area multiple times but has struggled to break above it decisively. Currently, the price is consolidating just below this zone, forming a potential springboard for the next upward move.

A confirmed breakout above $3,400 could open the door to a reward zone near $3,550–$3,600, representing the next likely target for bullish traders. RSI analysis further supports this positive outlook. The Relative Strength Index sits around 59, below overbought levels, suggesting there is still room for Ethereum to move higher before encountering selling pressure. The RSI has steadily strengthened after recovering from previous dips, highlighting growing buying momentum in the market.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Payments Protocol by Coinbase, Shopify Processes Just $1.2M USDC Since June: growthepie

The partnership between Shopify, Coinbase and Stripe allows Shopify merchants to accept USDC payments settled on Base.

Crypto World

U.S. regulator declares do-over on prediction markets, throwing out Biden era ‘frolic’

The U.S. government is formally reversing its previous stance on banning certain activities at prediction market firms such as Kalshi and Polymarket, with U.S. Commodity Futures Trading Commission Chairman Mike Selig moving Wednesday to withdraw a proposed event-contracts rule from 2024 and scrapping an earlier advisory he said confused the industry.

In 2024, the derivatives regulator proposed a rule that would have banned contracts based on the outcome of political events, legally equating them with illicit contracts on war, terrorism and assassination and calling them “contrary to the public interest.” That rule never advanced to a final stage before President Donald Trump returned to the White House and appointed new CFTC leadership. The CFTC had allowed prediction markets based on political events to launch after losing a court fight over Kalshi’s intended offering that same year.

The recently confirmed chairman of the agency, Selig, has now cleared the decks of that and a minor advisory issued in September on certain contract markets.

“The 2024 event contracts proposal reflected the prior administration’s frolic into merit regulation with an outright prohibition on political contracts ahead of the 2024 presidential election,” Selig said in a statement. “The Commission is withdrawing that proposal and will advance a new rulemaking grounded in a rational and coherent interpretation of the Commodity Exchange Act that promotes responsible innovation in our derivatives markets in line with Congressional intent.”

Selig’s action is unsurprising, following closely on the heels of his remarks last week that signaled it was coming. He said he’d “directed CFTC staff to move forward with drafting an event contracts rulemaking.”

The Trump administration’s embrace of the prediction markets has paved the way for increased interest from companies seeking to throw their hat into the sector, such as Coinbase, or the tangential pursuit of similar products from Cboe.

The September advisory Selig pulled back had been meant to caution platforms about litigation concerns, he said, but it had “inadvertently created confusion and uncertainty for our market participants.”

The CFTC is expected to become a central voice in digital assets oversight, in which the prediction markets have had an overlapping interest. Selig is working on a number of new initiatives, and the Congress is negotiating its crypto market structure bill that — among many other points — is meant to establish the CFTC as the rightful watchdog of crypto spot markets that don’t involve securities.

Read More: U.S. SEC, CFTC chiefs push united front on paving the way for crypto

Crypto World

Kyle Samani steps away from Multicoin Capital

Kyle Samani, co-founder of crypto investment firm Multicoin Capital, is stepping down from his role as managing director, he announced Wednesday in a post on X.

“It’s a bittersweet moment for me because my time at Multicoin has been some of the most meaningful and rewarding of my life,” Samani wrote. “After nearly a decade in crypto, I’m more confident than ever that crypto is going to fundamentally rewire the circuitry of finance.”

Samani said he’s taking time off and “exploring other areas of technology,” but made clear he’s not walking away from crypto entirely. “While I’ll be stepping away professionally from the industry, I will continue to make personal investments in the space,” he wrote.

He also pointed to the potential impact of U.S. crypto legislation in development, particularly the Clarity Act, a bill designed to provide legal definitions for crypto assets. “I believe the Clarity Act will unlock a tidal wave of new entrants and spur adoption unlike anything we’ve seen,” he wrote.

Samani did not say what his next role would be or when he might return to the industry. As of now, Multicoin has not named a replacement. Co-managing partners Tushar Jain and Brian Smith are currently running the firm’s day-to-day operations.

Founded in 2017, Multicoin quickly gained visibility for backing projects like Solana and before they became widely known. It operates across both venture capital and liquid token markets, setting it apart from traditional VC firms.

Samani says he will remain as chairman at Solana treasury company Forward Industries (FWDI) and is requesting in-kind redemption in FWDI shares and warrants from the Multicoin Master Fund, rather than cash.

Crypto World

Bitwise Leader Makes Shocking Claim on Crypto Winter and Bear Market

Matt Hougan, Chief Investment Officer (CIO) at Bitwise Asset Management, said the market is experiencing a crypto winter.

According to his analysis, the crypto winter began in January 2025, but heavy institutional inflows “papered over that truth,” masking the depth of the downturn. The key question now is, how long will the winter last?

Sponsored

Sponsored

Market Weakness Signals an Ongoing Crypto Winter

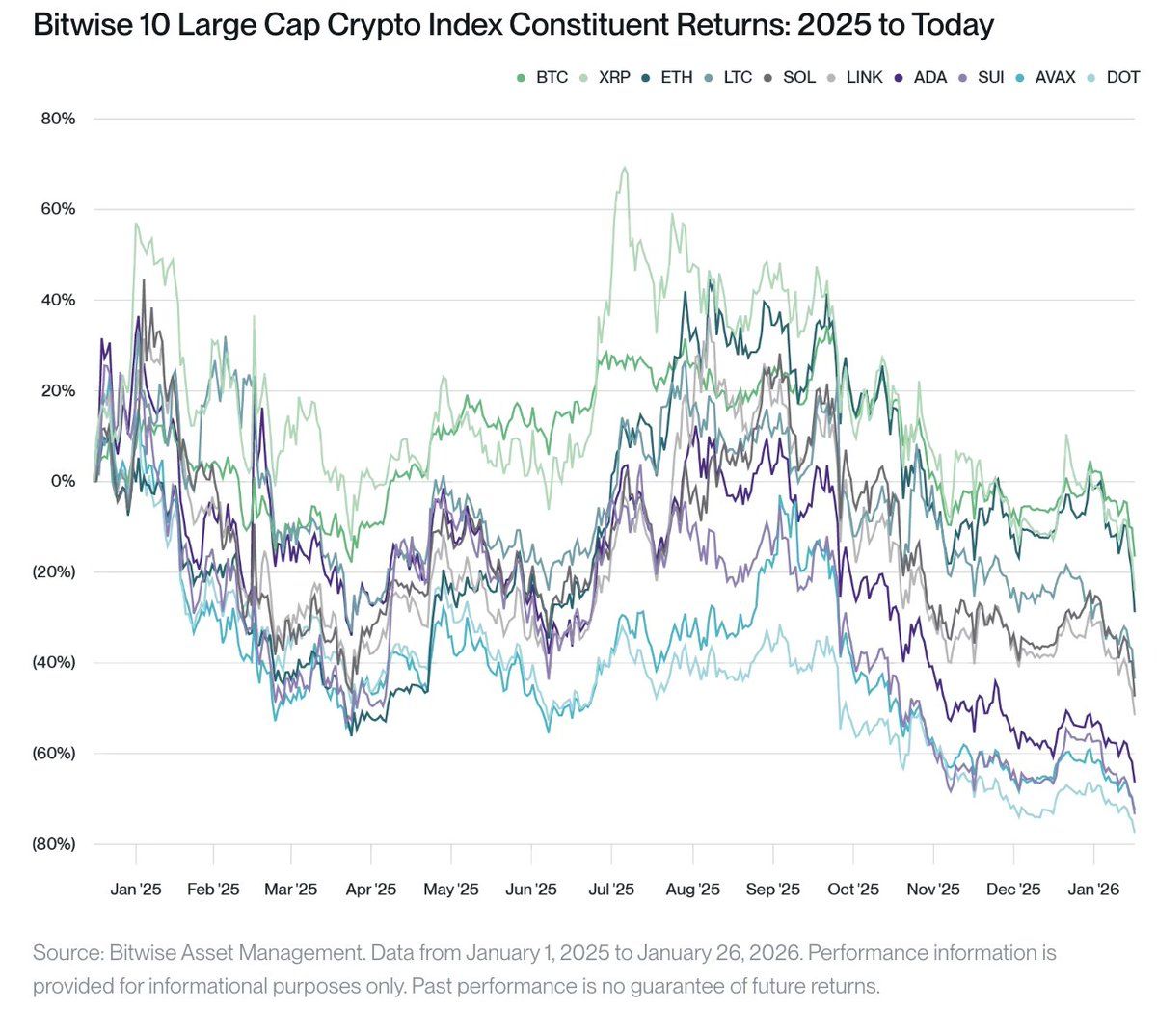

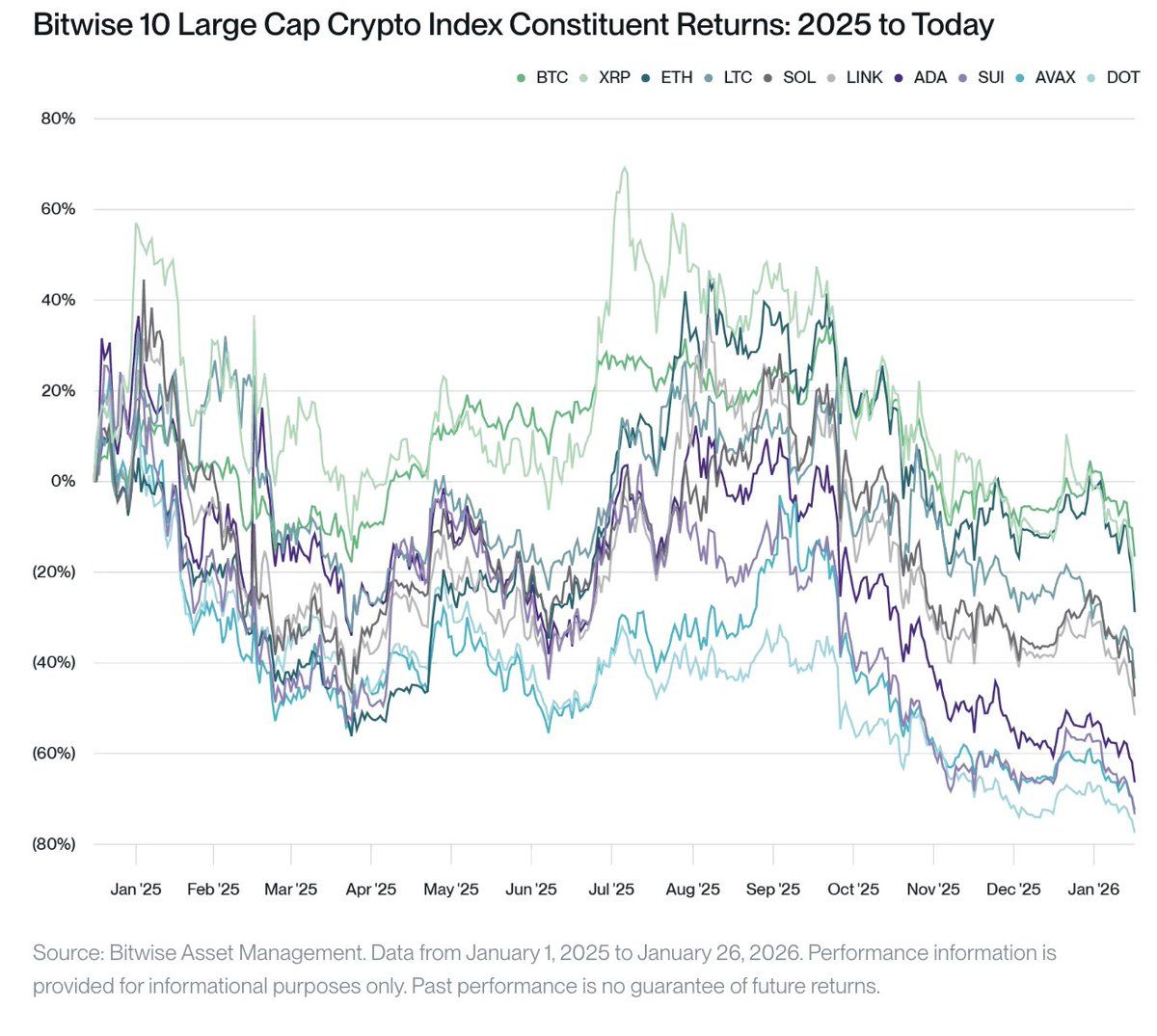

In a recent market commentary, Hougan rejected the idea that recent price weakness represents a temporary pullback. Instead, he described the current environment as a “full-blown crypto winter,” pointing to steep drawdowns across major assets.

He highlighted that Bitcoin (BTC) is now trading about 39% from its October 2025 all-time high. Meanwhile, Ethereum (ETH) has fallen roughly 53%. Many altcoins have declined far more.

“This is not a ‘bull market correction’ or ‘a dip.’ It is a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter—set into motion by factors ranging from excess leverage to widespread profit-taking by OGs,” Hougan noted.

Institutional demand, he said, played a key role in masking the downturn. Using data from the Bitwise 10 Large Cap Crypto Index, Hougan highlighted a clear divide.

Assets with strong institutional support, such as Bitcoin, Ethereum, and XRP (XRP), have posted relatively modest declines since January 2025. Tokens that gained ETF access in 2025, like Solana (SOL), Chainlink (LINK), and Litecoin (LTC), suffered deeper losses.

Nonetheless, assets without any institutional exposure fell between roughly 60% and 75%. According to him,

“The thing that separates the three groups is basically whether or not institutions had the ability to invest in them.”

Sponsored

Sponsored

During this period, exchange-traded funds (ETFs) and Digital Asset Treasuries (DAT) accumulated more than 744,000 Bitcoin, worth an estimated $75 billion. Hougan argued that without this level of institutional support, Bitcoin’s losses would likely have been far greater.

“Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while,” the executive remarked.

Hougan also addressed a question many market participants have raised: why do crypto prices continue to fall despite positive developments such as increased institutional adoption, regulatory progress, and broader acceptance by Wall Street?

His answer was straightforward. In the depths of a crypto winter, good news typically has little immediate impact on prices.

“Those of you who followed crypto during past winters—either 2018 or 2022—will remember that good news doesn’t matter in the depths of winter. Crypto winters don’t end in excitement; they end in exhaustion,” he added.

However, he suggested that while positive developments are often ignored during bear markets, they do not disappear. Instead, they accumulate as what he described as “potential energy,” which can fuel a recovery once sentiment improves.

Sponsored

Sponsored

Hougan pointed to several factors that could help lift market sentiment, including stronger economic growth that triggers a risk-on rally, a positive surprise related to the Clarity Act, signs of sovereign adoption of Bitcoin, or simply the passage of time.

Looking at historical cycles, Hougan said crypto winters typically last around 13 months. If the current winter indeed began in January 2025, then it’s possible that the end may be near.

He stressed that the prevailing mood of despair and malaise often characterizes the final phase of a crypto winter and stressed that nothing fundamental about crypto has changed during the current pullback.

“I think we’re going to come roaring back sooner rather than later. Heck, it’s been winter since January 2025. Spring is surely coming soon,” Hougan claimed.

Sponsored

Sponsored

When Did Crypto Bear Market Start: Debating the Timeline

Though Hougan traces the bear market’s start to January 2025, not all analysts concur. Julio Moreno, Head of Research at CryptoQuant, acknowledged differences in asset performance due to institutional exposure but disputed the timeline.

“I disagree with the winter starting in January 2025. Bitcoin prices remained in a long-term upward trend throughout 2025, and reached a new ATH in October. The fact that we did not have a blow-off top or closed the year positive doesn’t mean we were in a bear market in 2025. The Bitcoin bear market started on November 2025, as suggested by on-chain and market data,” he posted.

The start date matters. Historically, crypto winters last about 13 months. If the downturn began in January 2025, a spring recovery could be near. If Moreno is right and the market peaked in November 2025, the bear phase would continue.

“The timing has implications for when it will end. My current expectation is Q3 2026,” Moreno wrote.

Whether recovery comes early in 2026, as Hougan predicts, or is pushed to Q3 under Moreno’s timeline, remains to be seen. What is clear, however, is that the market is deep in a downturn.

History suggests these phases do not end with a single catalyst but rather over time. If past cycles are any guide, the groundwork for the next recovery may be forming beneath the surface.

Crypto World

Bitcoin Miners are Facing a Profit Crisis as Economics Tighten

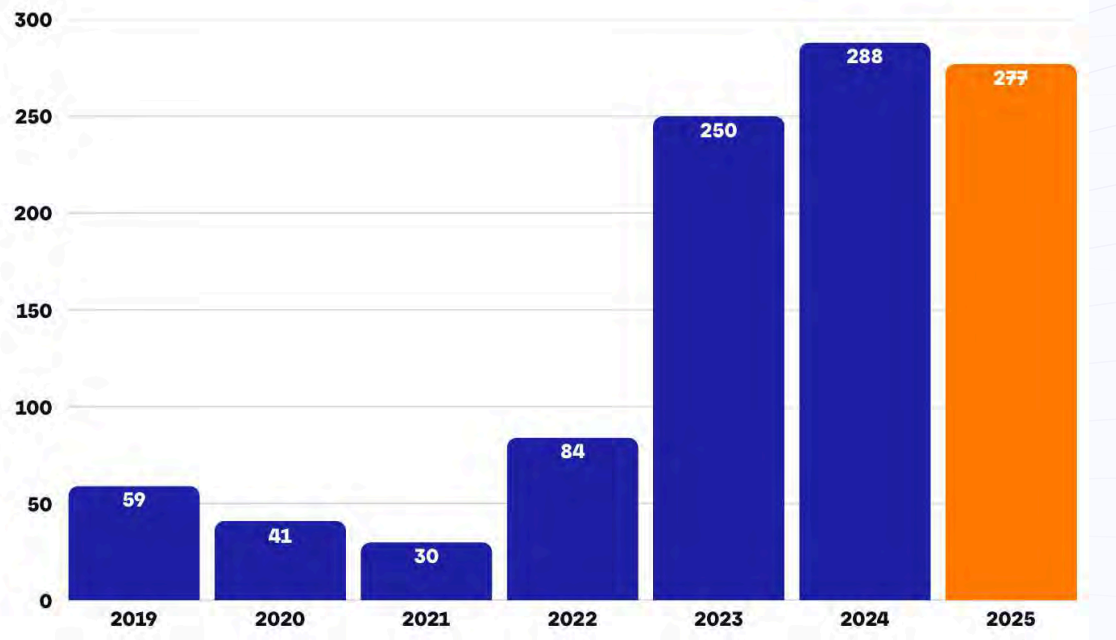

Bitcoin mining crossed a historic threshold in late 2025. According to a recent report from GoMining, the network entered the zetahash era, surpassing 1 zetahash per second of computing power.

But while hashrate surged to record levels, miner profitability moved in the opposite direction. The result is a mining industry that is larger, more industrialized — and more exposed to price risk than at any point this cycle.

Sponsored

Sponsored

Hashrate Reaches Record Highs as Mining Scales Up

The report shows Bitcoin’s network sustained over 1 ZH/s on a seven-day average, marking a structural shift rather than a temporary spike.

This growth reflects aggressive hardware upgrades, new data centers, and expanding industrial operations. Mining is no longer dominated by marginal players. It now resembles energy infrastructure.

As a result, competition for block rewards has intensified sharply.

Revenue Per Miner Falls Despite Network Growth

While hashrate expanded, revenue per unit of compute fell into one of its tightest ranges on record.

The report highlights that miner earnings increasingly depend on Bitcoin’s price and difficulty alone. Other buffers have faded, including transaction fee spikes and the higher block subsidies that once softened margin pressure

This compression means miners now operate with thinner margins, even as they deploy more capital and power.

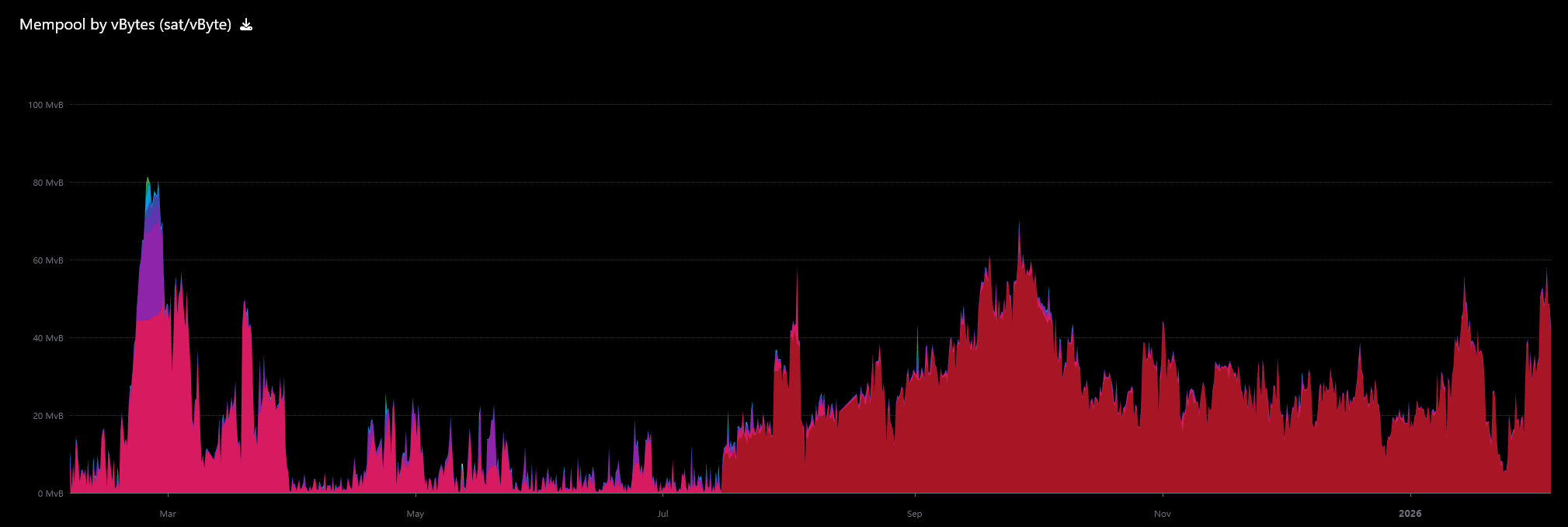

According to GoMining, the impact was visible in the mempool. For the first time since April 2023, the Bitcoin mempool fully cleared multiple times in 2025.

Sponsored

Sponsored

It means the Bitcoin network was so quiet that transactions cleared immediately, even at the lowest possible fees.

As a result, miners earned almost nothing from fees and had to rely almost entirely on Bitcoin’s price and block subsidy for revenue.

Transaction Fees Offer Little Relief After the Halving

Post-halving dynamics worsened the pressure.

With the block subsidy reduced to 3.125 BTC, transaction fees failed to offset lost revenue. The report notes that fees made up less than 1% of total block rewards for most of 2025.

As a result, miner economics became directly exposed to Bitcoin price swings, with fewer internal stabilizers.

Sponsored

Sponsored

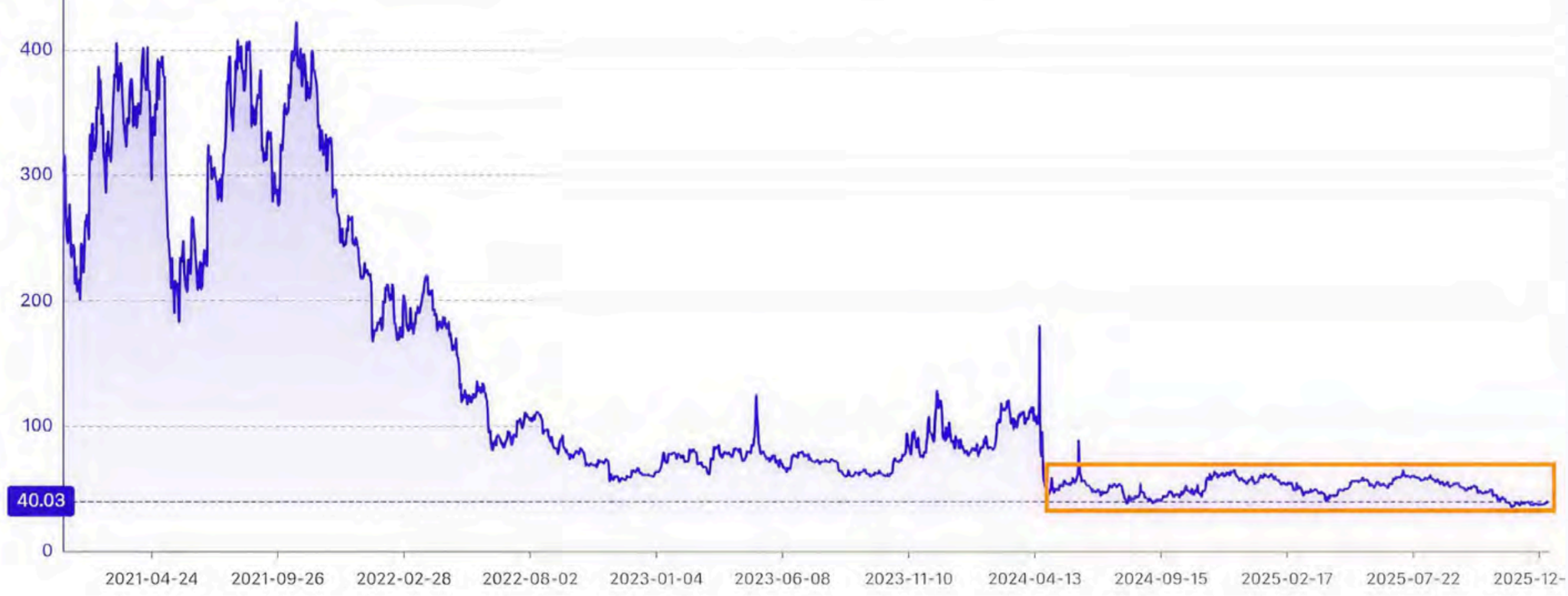

Hashprice Hits Lows as Margins Stay Under Pressure

The squeeze showed up clearly in hashprice — the daily revenue earned per unit of hashrate.

According to the report, hashprice fell to an all-time low near $35 per PH per day in November and remained weak into year-end. It finished the quarter near $38, well below historical averages.

This left little room for operational error.

Shutdown Prices Turn Price Levels Into Economic Triggers

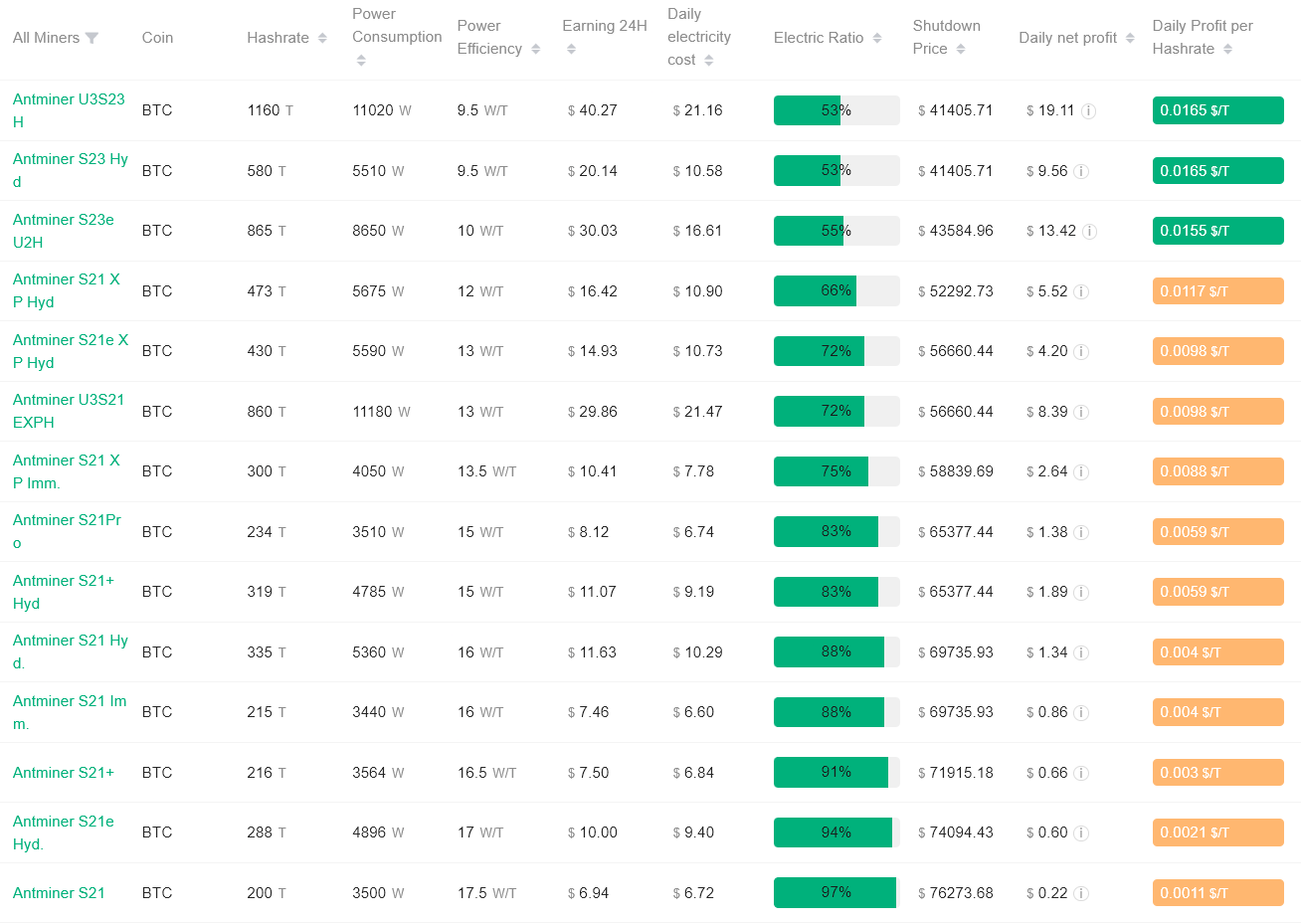

These findings align closely with recent data on miner shutdown prices.

Sponsored

Sponsored

At current difficulty and electricity costs near $0.08 per kWh, widely used S21-series miners approach breakeven between $69,000 and $74,000 per BTC. Below that range, many operations stop generating operational profit.

More efficient, high-end machines remain viable at much lower prices. But mid-tier miners face immediate pressure.

Why This Matters for Bitcoin Price Now

This does not create a price floor. Markets can trade below mining breakeven.

However, it creates a behavioral threshold. If Bitcoin stays below key shutdown levels, weaker miners may sell reserves, shut down equipment, or reduce exposure.

In a market already strained by tight liquidity, those actions can amplify volatility.

Bitcoin mining is stronger and more industrial than ever. But that scale comes with sensitivity. As hashrate grows and fees fade, price matters more, not less, for miner stability.

That makes levels like $70,000 economically meaningful — not because charts say so, but because the network’s cost structure does.

Crypto World

NFT Marketplace Collapse: Nifty Gateway, Foundation Lead Wave of Major Platform Shutdowns

TLDR:

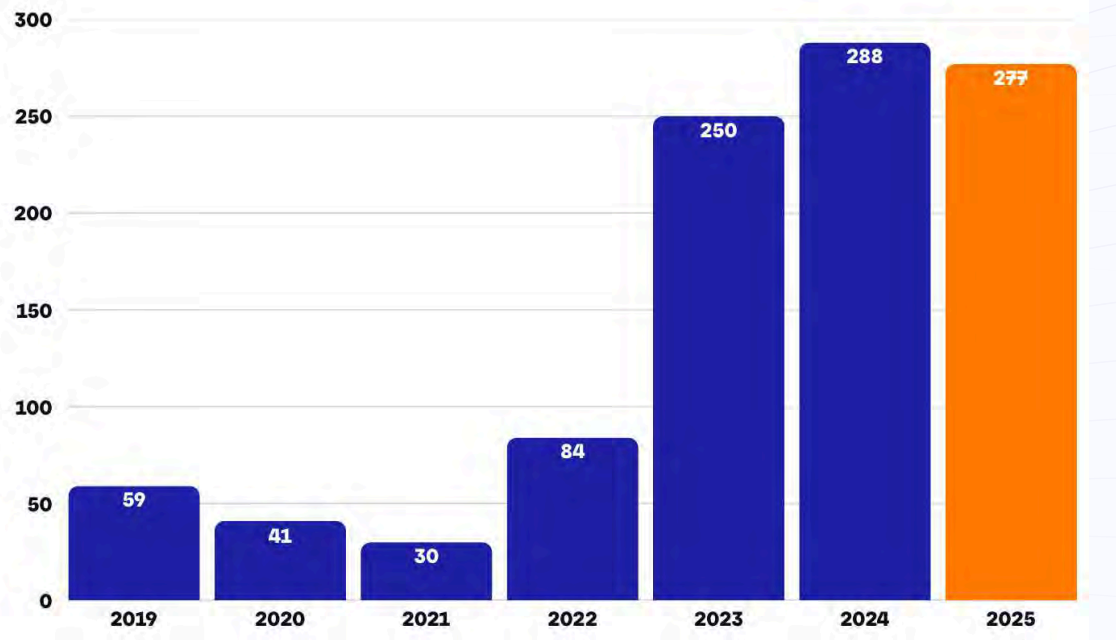

- NFT trading volumes collapsed from $2.9 billion in 2021 to just $23.8 million by early 2025 quarterly data.

- Major platforms including Nifty Gateway, Foundation, and MakersPlace announced closures within days in January 2026.

- Centralized storage systems left 27% of top NFT collections vulnerable to permanent loss after server shutdowns.

- OpenSea recaptured 67% of Ethereum NFT volume by expanding into fungible tokens as competitors exited the market.

The digital art marketplace landscape has undergone a dramatic transformation as prominent NFT platforms cease operations.

Trading volumes collapsed from $2.9 billion in 2021 to $23.8 million by early 2025, representing a 93 percent decline.

Gemini’s Nifty Gateway, Foundation, and multiple other platforms announced closures or ownership transfers within days of each other in January 2026, marking the effective end of the venture-backed NFT marketplace ecosystem.

Wave of Platform Closures Reshapes Digital Art Infrastructure

Nifty Gateway announced its shutdown on January 24, 2026, with approximately 650,000 NFTs requiring withdrawal before the April 23 deadline.

Community outcry initially extended the original February 23 closure date. Three days later, Foundation’s creator transferred ownership to BlackDove, a digital art streaming company. The platform had generated $230 million in primary sales during its operational period.

MakersPlace shut down in January 2025 after facilitating the landmark $69.3 million Beeple sale through Christie’s in 2021.

Content manager Brady Evan Walker announced that “ongoing market challenges and funding difficulties have made it impossible to sustain operations while fulfilling our mission.”

KnownOrigin, acquired by eBay in 2022, wound down operations in July 2024. Async Art closed in October 2023 despite raising $2 million in seed funding.

Active traders declined from 529,101 in 2022 to 19,575 by 2025, according to DappRadar. Average art NFT prices fell from $2,044 in 2021 to $475 in 2023.

CEO Conlan Rios reflected that when Async Art launched, “the NFT world was smaller and simpler” with “a genuine sense of altruism all around.”

Christie’s eliminated its digital art department in September 2025 after none of its 11 auctions exceeded $400,000 in sales.

Technical Infrastructure Exposes Centralization Vulnerabilities

A 2024 Pinata analysis revealed that 27 percent of top NFT collections stored metadata on centralized servers. The report noted that some NFTs “simply no longer exist” as their “smart contracts point to metadata that is no longer accessible from the original centralized servers.”

Sam Spratt commented on Twitter that Nifty Gateway’s closure represented “a pure loss” and expressed “gratitude for what was given” before the platform’s ending.

XCOPY’s early work demonstrates the fragility of NFT storage systems. The London-based artist described how Ascribe “fell into the cryptoart platform graveyard” after the service closed.

“Death Wannabe,” released on July 17, 2018, had ten editions but only three remain accessible. Seven editions are locked in the original RareArt Labs contract while “Disaster Suit” survives in four editions but lost its metadata entirely.

Nifty Gateway responded to criticism by announcing metadata migration to Arweave for newer NFTs. Artist Bryan Brinkman acknowledged that “many of us knew the risks of minting on there” but noted the platform “still clung to too many centralized choices” despite contract improvements.

Collector G4SP4RD warned that collections from artists like Beeple and Spratt could become “broken with no possibility of recovery” if servers shut down.

OpenSea recaptured 67 percent of Ethereum NFT volume by late 2025 after expanding into fungible tokens. CEO Devin Finzer tweeted that the platform crossed $2.6 billion in trading volume with “over 90 percent from token trading.”

SuperRare announced on Twitter it was “not going anywhere” and continued operating. Art Basel Miami Beach launched Zero 10 in December, selling 65 percent of digital art works by mid-afternoon on opening day.

Crypto World

Michael Saylor Hints at Strategy’s Next Bitcoin Purchase

Join Our Telegram channel to stay up to date on breaking news coverage

Michael Saylor has hinted that Strategy will soon make another Bitcoin purchase, pushing its holdings beyond 3% of Bitcoin’s total supply.

Saylor posted “Bigger Orange” on X, a phrase he has used in the past before announcing new Bitcoin buys. Strategy currently holds about 687,410 Bitcoin, which equals roughly 3% of Bitcoin’s maximum supply of 21 million coins. The company has made more than 94 Bitcoin purchases since 2020, with an average buying price of around $75,000 per Bitcoin.

Last week alone, Strategy bought 13,627 BTC for about $1.25 billion, using a mix of debt, equity, and cash. With Bitcoin trading close to $95,000, Strategy’s unrealized gains have grown significantly. This large exposure has made the company one of the biggest corporate Bitcoin holders in the world, strengthening its image as a long-term Bitcoin-focused firm.

₿igger Orange. pic.twitter.com/HI47hMCnui

— Michael Saylor (@saylor) January 18, 2026

Strategy’s Bitcoin Bet Strengthens as MSTR Lags Holdings

However, Strategy’s stock price has not fully reflected its growing Bitcoin holdings yet. According to TradingView data, MSTR shares rose about 4% in the past week and are up over 12% year-to-date. The stock was trading near $174 at the time of reporting. Over the last five years, MSTR has gained more than 180%, showing strong long-term performance.

Investor confidence also improved after MSCI decided not to change its index rules, removing uncertainty around Strategy’s market position. Many investors now see MSTR as a leveraged proxy for Bitcoin, meaning the stock often moves more sharply when Bitcoin rises or when Strategy announces new purchases.

Meanwhile, short-term Bitcoin market sentiment remains cautious. Analyst Ted Pillows noted tightening liquidity and heavy trading interest between $96,000 and $98,000. These price levels often attract strong activity and can slow price movement or trigger volatility.

Despite caution among retail traders, institutional Bitcoin futures activity is increasing, suggesting larger players are still positioning for future moves. Overall, corporate accumulation remains strong, but short-term Bitcoin price action may stay volatile.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Tether Pulls Back on $20B Fundraising Plans After Investor Pushback (Report)

Tether has scaled back fundraising talks to about $5B after investors pushed back on a proposed $500B valuation.

Tether has reportedly scaled back its planned multibillion-dollar fundraising target after facing resistance from investors.

According to a report from the Financial Times on February 4, advisers for the stablecoin issuer are now examining the possibility of raising at least $5 billion, down from the $15 billion to $20 billion figure circulated during early talks in 2025.

Lower Target Follows Valuation Concerns

The original range, first reported by Bloomberg in September 2025, was linked to a valuation of roughly $500 billion, placing Tether among the world’s most valuable private companies. However, the number has reportedly proven difficult to justify for several prospective investors.

In comments cited by the FT, Paolo Ardoino, Tether’s chief executive, said the higher figure was never a firm target. According to the executive, the amount discussed was only the maximum the company would consider selling. “If we were selling zero, we would be very happy as well,” Ardoino said, noting that the firm is profitable and does not urgently need external capital.

Tether is the issuer of USDT, the world’s largest dollar-pegged stablecoin, with about $185 billion in circulation. The company has generated strong earnings from returns on reserves backing USDT, mainly U.S. Treasuries. Ardoino said Tether made around $10 billion in profit last year, a figure that has featured prominently in valuation discussions.

Despite that profitability, some investors have taken a cautious stance, with the FT reporting that concerns centered on how the $500 billion valuation was calculated and whether it reflects realistic growth expectations in the current market environment.

Nonetheless, fundraising talks are still in the early stages, and no decision has been made on the size or timing of any raise.

You may also like:

Profitability, Reserves, and Lingering Skepticism

Tether’s capital plans have come against a backdrop of mixed sentiment around the stablecoin issuer. The firm has expanded beyond cash-like reserves in recent years, building large positions in Bitcoin and gold. Earlier in the year, Ardoino confirmed that the company bought about $779 million worth of Bitcoin in the fourth quarter of 2025, lifting its holdings to more than 96,000 BTC.

At the same time, scrutiny around transparency has not faded, especially considering that S&P Global Ratings assigned USDT its lowest score on the agency’s stablecoin stability scale in November 2025, citing gaps in disclosure and a higher share of assets such as Bitcoin, gold, and secured loans. Ardoino publicly criticized the rating, arguing that traditional frameworks fail to capture Tether’s business model.

The reduced fundraising target suggests Tether is adjusting to market feedback rather than pressing ahead with an aggressive valuation. Whether the company proceeds with a smaller raise or pauses altogether will likely depend on investor appetite and broader conditions in crypto markets over the coming months.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech15 hours ago

Tech15 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards