Crypto World

Put crypto to work with KT DeFi and earn up to $5,000 per day with cloud mining

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

KT DeFi launches regulated cloud mining, offering low-entry, transparent access to BTC, XRP, ETH, SOL, and DOGE.

Summary

- Global crypto mining shifts to renewable energy as KT DeFi offers sustainable, low-cost cloud mining access.

- KT DeFi supports BTC, XRP, DOGE, SOL, and ETH, enabling steady mining returns without active trading.

- As miners adopt solar and wind power, KT DeFi positions cloud mining as a stable, eco-friendly income option.

In today’s rapidly evolving crypto landscape, a quiet but powerful transformation is taking place — one driven by energy efficiency and sustainability.

Across the globe, large-scale mining operations are moving away from traditional high-energy mining models and adopting renewable energy sources such as solar and wind power. This shift not only significantly reduces operating costs, but also improves long-term stability while aligning mining profitability with environmental responsibility.

For investors, this represents more than an environmental upgrade; it marks a smarter and more sustainable way to participate in crypto mining.

Why cloud mining is gaining momentum

As market volatility increases and mining technology becomes more complex, many investors are reconsidering how they participate in crypto mining.

Instead of purchasing hardware, managing electricity costs, and handling technical maintenance, more users are turning to cloud mining — a simpler and more efficient alternative.

With cloud mining:

- Hardware deployment and maintenance are handled by professional teams

- Energy management and system optimization are centralized

- Users simply select a mining contract

- Mining rewards are calculated and distributed daily

- No technical knowledge or active trading is required

This makes cloud mining an ideal entry point for beginners and a time-efficient solution for long-term investors.

KT DeFi: A beginner-friendly and transparent cloud mining platform

KT DeFi is a regulated cloud mining platform designed to make crypto mining accessible, transparent, and sustainable.

The platform supports multiple major cryptocurrencies, including BTC, XRP, DOGE, SOL, ETH, and more. With a clear interface and straightforward contract structure, users can participate in mining with a low entry threshold and predictable returns.

For investors who prefer steady income over short-term speculation, KT DeFi offers a clear alternative:

No market timing, no frequent trading — just consistent, automated mining rewards.

Why choose KT DeFi

- Beginner-friendly design – Simple setup, intuitive interface, no technical background required

- Global mining infrastructure – Hundreds of mining facilities and over one million devices worldwide

- 100% renewable energy mining – Powered by solar and wind energy for long-term sustainability

- Stable passive income model – Mining runs automatically once a contract is activated

- Strong security standards – Multi-layer protection and transparent platform operations

This model has attracted over 9 million users globally, reflecting strong trust and long-term adoption.

Key platform benefits

- $17 instant signup bonus for new users

- No hidden service or management fees

- Multi-currency settlement: XRP, SOL, DOGE, BTC, LTC, ETH, USDC, USDT, BCH

- Affiliate program with referral rewards of up to $50,000

- Protected by McAfee® Security and Cloudflare®

- 100% uptime guarantee

- 24/7 live customer and technical support

How to start mining with KT DeFi

Step 1: Create an account

Register using an email address and gain immediate access to cloud mining services. New users can start mining Bitcoin and other cryptocurrencies right away.

Step 2: Choose a mining contract

| Contract Name | Asset Type | Investment (USD) | Duration | Expected Return (Principal + Profit) |

| BTC Welcome Plan | BTC | $100 | 2 Days | $108 |

| Goldshell Mini DOGE Pro | DOGE / LTC | $500 | 6 Days | $539.6 |

| Bitmain Antminer L7 | DOGE / LTC | $5,000 | 20 Days | $6,500 |

| Antminer S19k Pro | BTC | $10,000 | 30 Days | $14,830 |

| ANTSPACE HK3 | BTC / BCH | $50,000 | 35 Days | $80,625 |

Mining rewards begin the day after contract activation

Once total earnings reach $100, users may withdraw or reinvest

About KT DeFi

Founded in 2019, KT DeFi is a UK-registered and licensed cloud mining platform dedicated to making cryptocurrency mining more accessible, efficient, and sustainable.

By leveraging advanced mining hardware, intelligent hash rate allocation, and renewable energy infrastructure, KT DeFi lowers the barriers to entry for crypto mining, allowing users of all experience levels to participate with confidence.

KT DeFi believes that long-term value comes from stability, transparency, and sustainable returns, not short-term speculation. Through continuous system optimization and strict security standards, the platform aims to help users achieve steady asset growth in a reliable environment.

For investors seeking consistent passive income in the crypto space, KT DeFi is built to be a trusted long-term partner.

For more information, visit the official website, or download the mobile app.

Email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

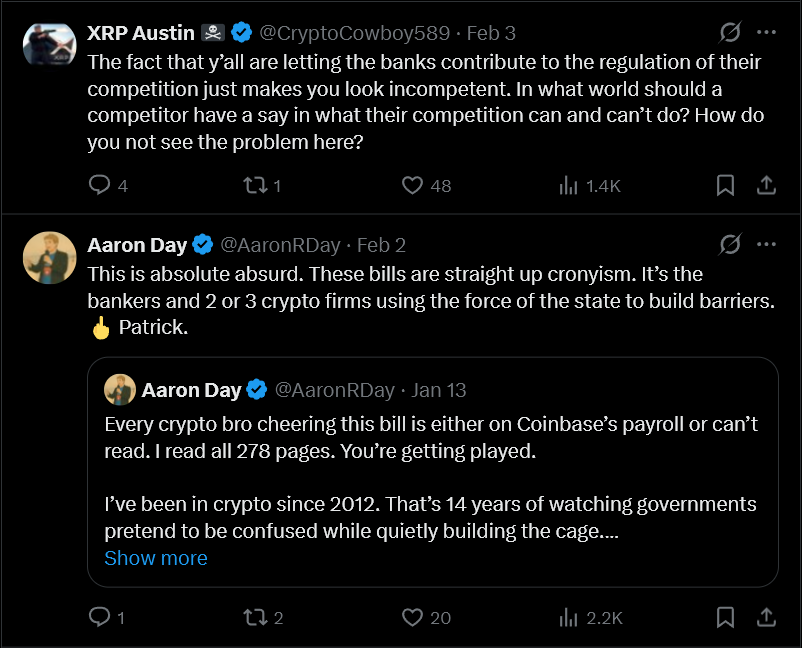

White House Tweet Exposes CLARITY Act’s Banking Trap

The CLARITY Act debate has largely revolved around the tug-of-war between banks and crypto firms over stablecoin yield. While that conflict dominates coverage of what is framed as a market-structure bill, it obscures a quieter and potentially more consequential issue.

Once enacted, the CLARITY Act would formally legitimize regulated crypto roles and implicitly subject them to Bank Secrecy Act compliance. Even without explicit mandates, this risks entrenching a surveillance-first model that pressures intermediaries to delist privacy assets and abandon privacy-by-design before Congress has openly debated the trade-offs.

Sponsored

Sponsored

Banks Join Talks on Stablecoin Yield

On Monday, industry insiders met with advisors to US President Donald Trump to explore potential compromises in a still-contentious market structure bill.

The discussions were led by Patrick Witt, executive director of the President’s Council of Advisors on Digital Assets. The roundtable included senior figures from both the crypto sector and traditional banking.

The meeting reignited tensions between the crypto sector and traditional finance.

Critics questioned why policymakers invited Wall Street to help shape legislation governing products that directly compete with its core business. Chief among these are yield-bearing stablecoins, which many view as a direct threat to traditional bank deposits.

However, the meeting also allowed a far subtler, yet equally significant issue to slip largely unnoticed: privacy.

Sponsored

Sponsored

How CLARITY Pulls Crypto Under the Bank Secrecy Act

The CLARITY Act presents itself as a market structure framework that promises regulatory certainty for the US crypto industry. It aims to clearly assign activities to regulators and deliver long-sought legal clarity to market participants.

Yet, the bill does more than draw jurisdictional boundaries.

By formally defining regulated crypto roles, particularly for centralized exchanges and stablecoin issuers, it embeds these actors within the existing financial system.

Once those roles are legally recognized, compliance with the Bank Secrecy Act (BSA) becomes effectively unavoidable, even though the legislation does not specify how BSA requirements should apply to on-chain activity.

That lack of specificity hands key decisions to intermediaries, who would set the rules instead of Congress.

Sponsored

Sponsored

In response, exchanges and custodians default to expansive identity checks, sweeping transaction monitoring, and heightened data collection. In doing so, they establish de facto standards without a clear legislative mandate.

Within this framework, privacy-focused projects stand to bear the greatest cost.

Privacy Assets in the Line of Fire

The BSA requires financial institutions to verify customer identities and monitor for suspicious activity. In practice, this means knowing who customers are and reporting specific red flags to authorities.

Sponsored

Sponsored

What the law does not require is constant, system-wide transparency or the ability to trace every transaction back to an identity at all times.

Nonetheless, major crypto firms such as Binance, Coinbase, and Circle already operate as if it does. They equate BSA compliance with maximum on-chain visibility in order to minimize regulatory risk amid legal uncertainty.

This approach translates into strict traceability requirements and the avoidance of protocols that limit transaction visibility. Centralized exchanges typically refuse to list privacy-focused cryptocurrencies like Monero or Zcash, not because the BSA explicitly demands it, but as a precautionary measure.

As it stands, the CLARITY Act does not account for how the BSA should apply to blockchain systems where privacy and pseudonymity operate differently from traditional finance. That silence matters.

By leaving key obligations undefined, the CLARITY Act risks entrenching the most conservative, surveillance-heavy interpretation of the BSA as the default.

As a result, participants aligned with crypto’s cypherpunk roots are likely to be most affected, as privacy-oriented tools and services face the greatest restrictions.

Crypto World

UBS Reports Strong Profit Yet Stock Falls Over Cautious Crypto Plans

TLDR

- UBS Group AG reported a sharp rise in net profit driven by strong client activity and cost efficiency.

- The bank maintained capital ratios well above regulatory requirements and reiterated confidence in its 2026 financial targets.

- UBS confirmed continued progress in integrating acquired Swiss accounts and winding down non-core assets.

- Despite the earnings beat, UBS shares declined nearly 5 percent after the results were announced.

- The decline followed cautious comments from UBS management regarding its timeline for crypto and tokenized asset offerings.

- CEO Sergio Ermotti stated that UBS will follow a fast follower approach instead of leading in digital asset innovation.

UBS Group AG delivered strong quarterly earnings, reporting higher net profit and capital returns, yet its shares dropped nearly 5% following the results, as investors recalibrated expectations for growth in digital assets. Despite positive performance metrics, the bank’s cautious approach to crypto and tokenized assets drew focus, overshadowing its earnings beat. Management confirmed a slow rollout of blockchain initiatives, which may have cooled sentiment among forward-looking investors.

UBS Group AG Reports Higher Profit and Strong Capital Ratios

UBS Group AG posted a surge in net profit, supported by firm client activity and solid capital positions. The bank reported higher returns on CET1 capital, reinforcing its message of stable and resilient balance sheet management. Profitability gains reflected progress in cost control and integration of acquired assets, especially in Swiss-booked businesses.

Trading activity remained robust, and client asset inflows continued across major segments during the quarter. UBS maintained capital ratios well above regulatory requirements, reinforcing its conservative financial approach. Management reiterated that 2026 targets remain on track, including plans for higher returns and improved efficiency.

The bank emphasized continued execution on its strategic roadmap, supported by disciplined risk management and sustained client engagement. UBS also confirmed further wind-down of non-core assets and steady progress on system integration. These operational improvements contributed to stronger fundamentals across the board.

Crypto Strategy Comments Drive Market Reaction

During the earnings call, CEO Sergio Ermotti addressed growing interest in crypto and tokenized asset offerings. He stated, “We are building core infrastructure but will not lead the market on this front.” The bank confirmed it would pursue a fast follower approach rather than immediate deployment of blockchain-based products.

UBS aims to offer crypto access to individual clients and tokenized deposit options to corporate customers. However, it set expectations that these developments will unfold over three to five years. Investors responded by reassessing near-term growth potential from digital assets.

The measured tone contrasted with some market hopes for faster adoption and monetization of crypto services. UBS positioned digital initiatives as long-term complements to its traditional offerings, not near-term revenue drivers. This divergence may have triggered a repricing of expectations around technology-led growth.

Strong Execution Overshadowed by Delayed Crypto Monetization

Despite delivering on financial targets, the stock declined after the report, reflecting market’s focus on future-facing initiatives. UBS delivered what it promised in capital returns, profits, and cost cuts, but offered no immediate digital catalyst. The gap between execution and investor enthusiasm over crypto timing became the central theme.

The selloff suggests the market sought faster signals on UBS’s role in tokenized finance. Although fundamentals remain firm, expectations around digital expansion weighed on investor sentiment. UBS’s conservative stance may align with its culture, but not with all shareholders’ timelines.

UBS emphasized long-term goals, targeting improved capital efficiency by 2028. Shareholder returns remain a core focus, with dividends and buybacks continuing. However, no accelerated plans were revealed for blockchain offerings.

Crypto World

CME Group Mulls Proprietary Token for Collateral and Margin

Chicago-based derivatives exchange CME Group is examining how tokenized assets could reshape collateral and margin across financial markets, CEO Terry Duffy said during a recent earnings call. The conversations revolve around tokenized cash and a CME-issued token that could run on a decentralized network, potentially used by other market participants as margin. Duffy argued that the quality of collateral matters, suggesting that instruments issued by a systemically important financial institution would provide more confidence than tokens from smaller banks attempting to issue margin tokens. The comments signal a broader industry push to experiment with tokenized collateral as traditional markets increasingly explore blockchain-based settlement and liquidity tools.

Key takeaways

- CME Group is evaluating tokenized cash alongside a possible CME-issued token designed to operate on a decentralized network for margin purposes.

- Registry-style collateral could be favored if issued by systemically important financial institutions, rather than tokens from smaller banks.

- The discussion ties into a March collaboration with Google Cloud around tokenization and a universal ledger, indicating a concrete technical path for pilots.

- CME plans 24/7 trading for cryptocurrency futures and options in early 2026, subject to regulatory approval, reflecting a broader push toward continuous pricing and settlement.

- In parallel, CME has outlined growth in regulated crypto offerings, including futures tied to Cardano, Chainlink and Stellar, and a joint effort with Nasdaq to unify crypto index products.

Tickers mentioned: $ADA, $LINK, $XLM

Market context: The CME move comes as traditional banks and asset managers accelerate experiments with tokenized assets and stablecoins, while policymakers in the United States weigh regulatory frameworks for digital currencies and centralized versus decentralized settlement rails. The sector-wide trend includes both institutional pilots and ongoing regulatory scrutiny surrounding stablecoins and token-based payments.

Why it matters

The potential introduction of a CME-issued token or the broader use of tokenized collateral could redefine how institutions post margin and manage risk during periods of market stress. If a CME token were to gain traction among major market participants, it could provide a recognizable, regulated anchor for on-chain settlement workflows, potentially reducing settlement latency and settlement risk across a spectrum of asset classes. The emphasis on collateral quality—favoring instruments from systemically important institutions—helps address credibility concerns that have accompanied attempts by other entities to issue margin-related tokens in the past.

The development sits within a wider institutional push into tokenization and digital assets. Banks have been advancing their own experiments with tokenized cash and stablecoins to streamline cross-border payments and interbank settlements. For example, large banks have publicly discussed stablecoin exploration and related payment technologies, underscoring a broader demand for faster, more efficient settlement rails. Yet this momentum coexists with a regulatory push to address potential risks, coverage, and disclosure standards around tokenized instruments and stablecoins, including debates over yield-bearing stablecoins and the evolving legal framework in the CLARITY Act era.

Beyond the tokenization plans, CME’s broader crypto strategy—ranging from planned futures on leading tokens to a unified Nasdaq-CME Crypto Index—signals an intent to align traditional derivatives infrastructure with blockchain-enabled assets. The push toward 24/7 crypto derivatives trading marks a notable shift in market structure, as exchanges and market participants increasingly expect around-the-clock access to price discovery and settlement. The timing aligns with a confluence of industry experiments and policy discussions, creating a testing ground for tokenized collateral to become a practical, regulated element of mainstream finance.

What to watch next

- Regulatory clearances for 24/7 crypto derivatives trading expected in early 2026; approval status will shape CME’s execution timeline.

- Details on the CME-issued token’s design, governance, and interoperability with decentralized networks remain to be seen—watch for formal disclosures or filings.

- Progress of the Google Cloud-based Universal Ledger pilot for wholesale payments and asset tokenization; any case studies or results will inform practical feasibility.

- Updates on CME’s planned futures tied to Cardano (ADA), Chainlink (LINK) and Stellar (XLM) and how liquidity and risk controls will be implemented under the Nasdaq-CME alignment.

Sources & verification

- CME Group CEO Terry Duffy’s remarks on tokenized cash and potential CME-issued token during a Q4-2025 earnings call (Seeking Alpha transcript referenced in coverage).

- March press release announcing CME Group and Google Cloud’s tokenization initiative using Google Cloud’s Universal Ledger to enhance capital-market efficiency.

- Cointelegraph reporting on the CME-Google Cloud tokenization pilot and related technology discussions.

- CME’s January disclosures about expanding regulated crypto offerings with futures on Cardano (ADA), Chainlink (LINK) and Stellar (XLM) and the Nasdaq-CME Crypto Index integration.

- Regulatory context and policy discussions surrounding stablecoins and tokenization, including debates around the GENIUS Act and related rulemaking.

Key figures and next steps

Market participants will be watching for concrete technical details behind any CME-issued token, including how it would be stored, audited, and reconciled with existing collateral frameworks. The form and governance of a token designed for margin would influence whether such an asset could be widely adopted by clearing members and other systemically important institutions. As CME progresses its discussions with regulators and industry stakeholders, the potential for tokenized collateral to function as an accepted, high-credibility instrument will hinge on demonstrating robust risk controls, liquidity, and interoperability with existing settlement ecosystems.

Key figures and next steps

In the near term, observers should monitor updates on 24/7 crypto derivatives trading plans, potential regulatory approvals, and any incremental disclosures on how tokenized cash and a CME-issued token would be integrated into margin requirements. The collaboration with Nasdaq to unify crypto index offerings also merits close attention, as it could influence how institutional investors gauge exposure to digital assets in a standardized framework.

Why it matters (expanded)

For users and investors, the emergence of tokenized collateral could offer new pathways to manage liquidity and collateral agility, potentially reducing funding costs for participants who post margin across exchanges. For builders and platform teams, this trend underscores a need to design secure, auditable on-chain representations of traditional assets and to ensure that risk models and governance processes are aligned with regulated markets. For the market at large, CME’s exploration highlights how the line between on-chain assets and regulated, traditional finance is becoming more permeable, creating opportunities and challenges in equal measure.

What to watch next

- Regulatory approvals for 24/7 crypto derivatives trading anticipated in early 2026.

- Detailed disclosures on the CME-issued token’s architecture and governance in forthcoming filings or announcements.

- Milestones from the Google Cloud universal ledger pilot, including any pilot results or expansion plans.

Crypto World

CZ Flags AI-Generated Fake Account Behind Binance FUD

CZ exposed a long-running fake account using AI-generated images to pose as a Binance supporter before spreading BNB-related FUD.

Changpeng “CZ” Zhao, the founder of Binance, has publicly identified and dismantled a coordinated misinformation campaign against him and the exchange.

CZ exposed a long-running fake account that apparently used AI-generated images to pose as a loyal supporter before posting critical “feedback.”

The Unraveling of a Fake Supporter

The incident began when CZ noticed a post from an account named “Wei 威 BNB” claiming to close a Binance account due to alleged manipulation. The account had 863,000 followers and used imagery from a BNB Chain event, making it appear legitimate.

However, the former Binance CEO said that concerns about the account’s veracity emerged after some close inspection. For starters, the account, which had blocked him, had posted several images purportedly featuring Zhao posing with the user, all of which appeared altered.

One photo showed Zhao wearing a shirt in a color he said he does not own, while another mixed low-resolution images of him and Binance executive Yi He with a sharper image of the account holder. CZ claimed the original photo featured Aster CEO Leonard.

He also claimed the account history suggested it either changed hands or was compromised years ago. The account’s history shows it originally belonged to a woman and posted exclusively female photos until July 2015, when it abruptly switched to crypto-only content without removing earlier material.

“Either a hacked takeover or bought,” CZ wrote.

He criticized the campaign as “lazy” and suggested it was likely orchestrated by a “self-perceived” competitor more focused on Binance than its own business.

You may also like:

Influencer ShirleyXBT also noted the account’s profile picture was an artificial copy of her own photo.

Community Backing and a Pattern of Scrutiny

The exposure drew some support from the crypto community, with World of Dypians CEO Teki thanking CZ for the clarification and admitting the initial post had briefly seemed believable.

Commentator Vegas offered a broader analysis, suggesting attackers fall into three categories: opportunists farming engagement, genuinely frustrated traders, and organized FUD campaigns. They also claimed to have been offered payment to spread negative sentiment about Binance, implying possible coordination by large market players or direct competitors.

This latest revelation has come amid sustained scrutiny of CZ and Binance. On January 28, the crypto entrepreneur faced backlash for allegedly promoting harmful market behavior after he advocated a buy-and-hold investment strategy, forcing him to clarify that his advice was personal and did not apply to every token.

Furthermore, on January 30, Binance announced it would convert the $1 billion in its SAFU insurance fund from stablecoins back into Bitcoin, a move some commentators viewed as a bullish signal but which also kept focus on the exchange’s financial strategies.

Despite the criticism, Binance’s market position is still quite strong, with data shared by CryptoQuant at the beginning of the year showing the exchange captured 41% of spot trading volume and 42% of Bitcoin perpetual futures volume among top-tier platforms in 2025.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Spanish lender BBVA joins stablecoin venture of EU banks to challenge digital dollars

BBVA, Spain’s second-largest bank by assets, said it joined Qivalis, a group of lenders aiming to introduce a regulated euro stablecoin and challenge the dominance of digital dollars.

Adding BBVA, which has $800 billion of assets, the group now includes a dozen major European Union banks, including BNP Paribas, ING and UniCredit.

The project’s goal is to create a token backed by a network of established banks, offering an alternative to crypto-native stablecoins, many of which are tied to the dollar and operated by companies based outside of the bloc.

Of the $300 billion stablecoin market, only $860 million are tied to the single currency. Tether, based in El Salvador, dominates with its $185 billion USDT, followed by New York-based Circle Internet’s (CRCL) $70 billion USDC.

A euro-pegged coin could allow EU businesses and consumers to make blockchain-based payments and settlements using euros, without relying on traditional financial rails or third-party providers outside the bloc.

“Collaboration between banks is key to create common standards that support the evolution of the future banking model,” Alicia Pertusa, head of partnerships and innovation at BBVA CIB, said in a statement.

BBVA’s involvement “reflects the increasing dedication of European banking institutions to jointly develop a European on-chain payment ecosystem based on the trust that banks provide,” said Jan-Oliver Sell, CEO of Qivalis and a former executive of Coinbase Germany. “This step consolidates Qivalis’ standing as Europe’s foremost bank-supported stablecoin initiative.”

Qivalis is currently pursuing authorization from the Dutch central bank to operate as an electronic money institution, a step required to issue stablecoins under the EU’s digital asset regulatory framework dubbed MiCA.

The project plans to debut the token in the second half of 2026.

Read more: BNP Paribas Joins EU Bank Stablecoin Venture Helmed by Ex-Coinbase Germany Exec

Crypto World

Ethereum Price Rise, Vitalik Buterin Calls for Protocol Simplification

Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price has surged 2% in the last 24 hours to trade at $3,350 after co-founder Vitalik Buterin called for a major simplification of the protocol.

Buterin warned that Ethereum’s increasing complexity, driven by the continuous addition of new features without removing outdated ones, poses a threat to trustlessness, self-sovereignty, and long-term sustainability. According to him, even a highly decentralized system with strong security measures can fail if its codebase becomes too complicated for users to understand or rebuild independently.

Buterin highlighted three main risks caused by protocol bloat. First, users are forced to rely on experts, or “high priests,” to explain how the system works, weakening trust. Second, Ethereum fails the “walkaway test,” as rebuilding high-quality clients would be nearly impossible if development teams disappear. Third, self-sovereignty is compromised because even technically skilled users cannot fully inspect or reason about the system.

An important, and perenially underrated, aspect of “trustlessness”, “passing the walkaway test” and “self-sovereignty” is protocol simplicity.

Even if a protocol is super decentralized with hundreds of thousands of nodes, and it has 49% byzantine fault tolerance, and nodes fully… pic.twitter.com/kvzkg11M3c

— vitalik.eth (@VitalikButerin) January 18, 2026

Buterin Calls for Ethereum “Garbage Collection”

To address these challenges, Buterin urged Ethereum developers to introduce “garbage collection,” a process aimed at simplifying the protocol. This involves removing rarely used features, reducing lines of code, limiting reliance on complex cryptographic primitives, and introducing fixed rules, or invariants, to make client behavior more predictable. He pointed to previous upgrades, such as Ethereum’s shift from proof-of-work to proof-of-stake and recent gas cost reforms, as examples of effective simplification.

Future changes could move less essential features into smart contracts, easing the burden on client developers while maintaining network security. In contrast, Solana Labs CEO Anatoly Yakovenko argued that blockchains must keep evolving to meet user and developer needs. He emphasized that constant iteration is vital for Solana’s survival, even if no single team drives the changes. Buterin, however, maintained that Ethereum should eventually reach a state where it can operate securely and predictably for decades without ongoing developer intervention.

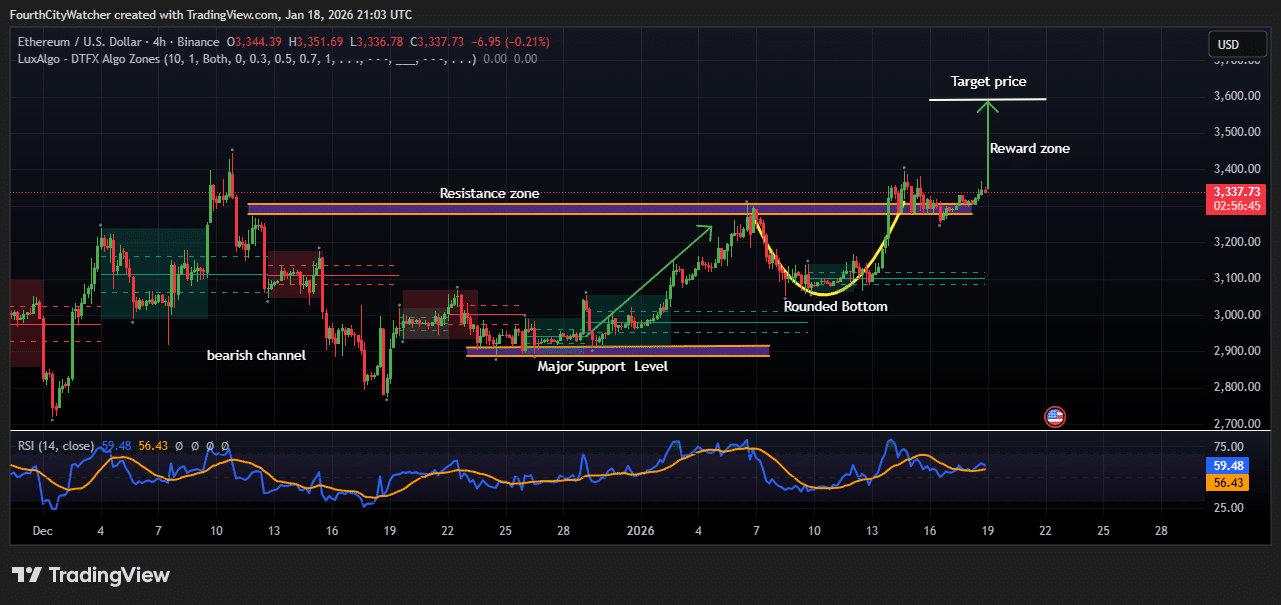

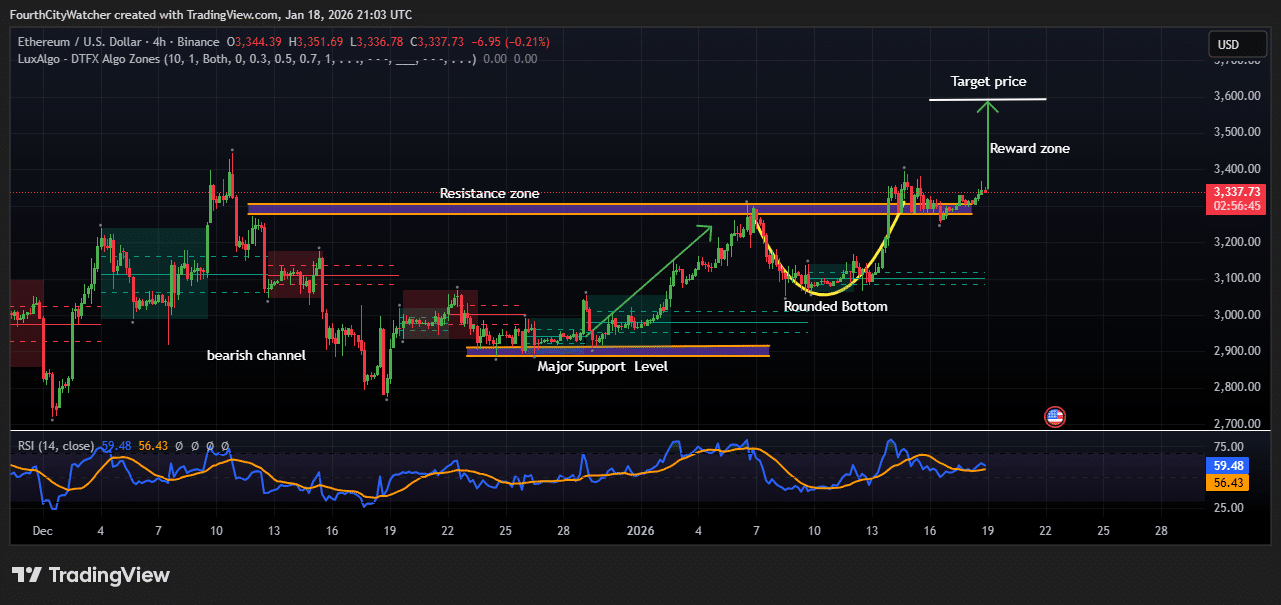

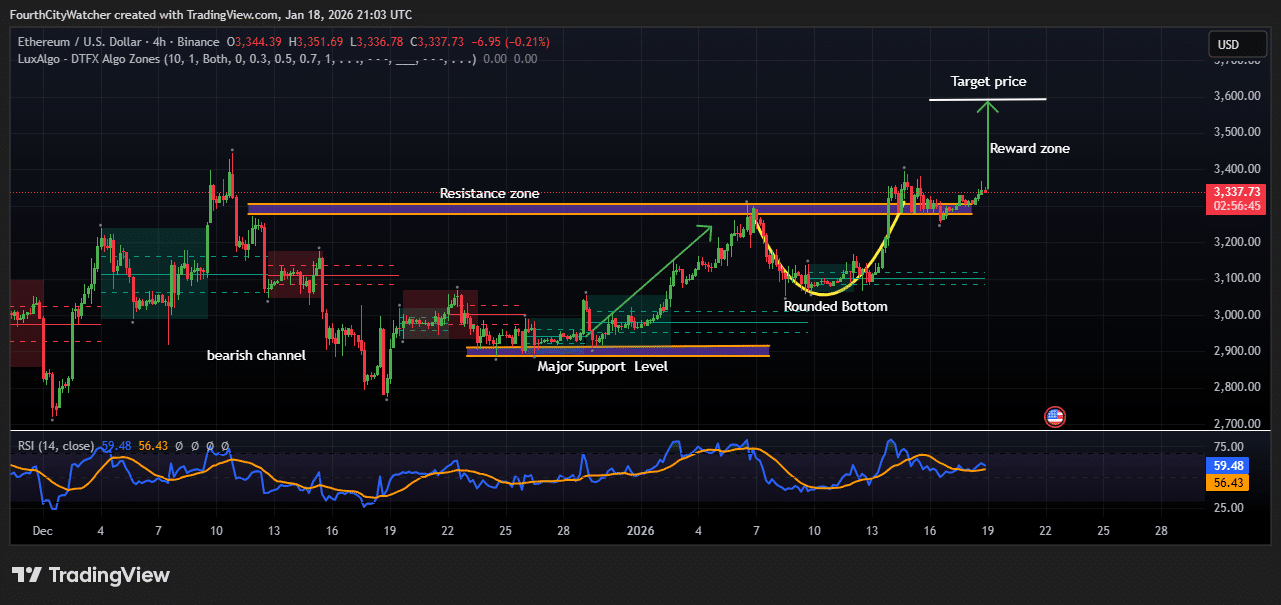

Ethereum Price Eyes Upside After Key Support Bounce

The 4-hour Ethereum chart shows clear signs of bullish momentum. Price recently bounced off a strong support level around $2,950–$3,000, which has held multiple times over the past month. This support has acted as a solid foundation, allowing Ethereum to recover from previous declines.

Before this bounce, Ethereum was moving in a bearish channel, making lower lows and lower highs. The recent breakout above this channel marked a key trend reversal, signaling that buyers are regaining control. Between January 10 and January 16, a rounded bottom pattern developed, which often signals a shift from bearish to bullish sentiment.

This pattern reflects a period of accumulation, where sellers gradually lost influence and buyers began gaining momentum. The rounded bottom now supports price consolidation above $3,300, showing that the market has stabilized and is preparing for potential further gains.

ETHUSDT Analysis Source: Tradingview

On the upside, there is a clear resistance zone between $3,350 and $3,400. Ethereum has tested this area multiple times but has struggled to break above it decisively. Currently, the price is consolidating just below this zone, forming a potential springboard for the next upward move.

A confirmed breakout above $3,400 could open the door to a reward zone near $3,550–$3,600, representing the next likely target for bullish traders. RSI analysis further supports this positive outlook. The Relative Strength Index sits around 59, below overbought levels, suggesting there is still room for Ethereum to move higher before encountering selling pressure. The RSI has steadily strengthened after recovering from previous dips, highlighting growing buying momentum in the market.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Payments Protocol by Coinbase, Shopify Processes Just $1.2M USDC Since June: growthepie

The partnership between Shopify, Coinbase and Stripe allows Shopify merchants to accept USDC payments settled on Base.

Crypto World

U.S. regulator declares do-over on prediction markets, throwing out Biden era ‘frolic’

The U.S. government is formally reversing its previous stance on banning certain activities at prediction market firms such as Kalshi and Polymarket, with U.S. Commodity Futures Trading Commission Chairman Mike Selig moving Wednesday to withdraw a proposed event-contracts rule from 2024 and scrapping an earlier advisory he said confused the industry.

In 2024, the derivatives regulator proposed a rule that would have banned contracts based on the outcome of political events, legally equating them with illicit contracts on war, terrorism and assassination and calling them “contrary to the public interest.” That rule never advanced to a final stage before President Donald Trump returned to the White House and appointed new CFTC leadership. The CFTC had allowed prediction markets based on political events to launch after losing a court fight over Kalshi’s intended offering that same year.

The recently confirmed chairman of the agency, Selig, has now cleared the decks of that and a minor advisory issued in September on certain contract markets.

“The 2024 event contracts proposal reflected the prior administration’s frolic into merit regulation with an outright prohibition on political contracts ahead of the 2024 presidential election,” Selig said in a statement. “The Commission is withdrawing that proposal and will advance a new rulemaking grounded in a rational and coherent interpretation of the Commodity Exchange Act that promotes responsible innovation in our derivatives markets in line with Congressional intent.”

Selig’s action is unsurprising, following closely on the heels of his remarks last week that signaled it was coming. He said he’d “directed CFTC staff to move forward with drafting an event contracts rulemaking.”

The Trump administration’s embrace of the prediction markets has paved the way for increased interest from companies seeking to throw their hat into the sector, such as Coinbase, or the tangential pursuit of similar products from Cboe.

The September advisory Selig pulled back had been meant to caution platforms about litigation concerns, he said, but it had “inadvertently created confusion and uncertainty for our market participants.”

The CFTC is expected to become a central voice in digital assets oversight, in which the prediction markets have had an overlapping interest. Selig is working on a number of new initiatives, and the Congress is negotiating its crypto market structure bill that — among many other points — is meant to establish the CFTC as the rightful watchdog of crypto spot markets that don’t involve securities.

Read More: U.S. SEC, CFTC chiefs push united front on paving the way for crypto

Crypto World

Kyle Samani steps away from Multicoin Capital

Kyle Samani, co-founder of crypto investment firm Multicoin Capital, is stepping down from his role as managing director, he announced Wednesday in a post on X.

“It’s a bittersweet moment for me because my time at Multicoin has been some of the most meaningful and rewarding of my life,” Samani wrote. “After nearly a decade in crypto, I’m more confident than ever that crypto is going to fundamentally rewire the circuitry of finance.”

Samani said he’s taking time off and “exploring other areas of technology,” but made clear he’s not walking away from crypto entirely. “While I’ll be stepping away professionally from the industry, I will continue to make personal investments in the space,” he wrote.

He also pointed to the potential impact of U.S. crypto legislation in development, particularly the Clarity Act, a bill designed to provide legal definitions for crypto assets. “I believe the Clarity Act will unlock a tidal wave of new entrants and spur adoption unlike anything we’ve seen,” he wrote.

Samani did not say what his next role would be or when he might return to the industry. As of now, Multicoin has not named a replacement. Co-managing partners Tushar Jain and Brian Smith are currently running the firm’s day-to-day operations.

Founded in 2017, Multicoin quickly gained visibility for backing projects like Solana and before they became widely known. It operates across both venture capital and liquid token markets, setting it apart from traditional VC firms.

Samani says he will remain as chairman at Solana treasury company Forward Industries (FWDI) and is requesting in-kind redemption in FWDI shares and warrants from the Multicoin Master Fund, rather than cash.

Crypto World

Bitwise Leader Makes Shocking Claim on Crypto Winter and Bear Market

Matt Hougan, Chief Investment Officer (CIO) at Bitwise Asset Management, said the market is experiencing a crypto winter.

According to his analysis, the crypto winter began in January 2025, but heavy institutional inflows “papered over that truth,” masking the depth of the downturn. The key question now is, how long will the winter last?

Sponsored

Sponsored

Market Weakness Signals an Ongoing Crypto Winter

In a recent market commentary, Hougan rejected the idea that recent price weakness represents a temporary pullback. Instead, he described the current environment as a “full-blown crypto winter,” pointing to steep drawdowns across major assets.

He highlighted that Bitcoin (BTC) is now trading about 39% from its October 2025 all-time high. Meanwhile, Ethereum (ETH) has fallen roughly 53%. Many altcoins have declined far more.

“This is not a ‘bull market correction’ or ‘a dip.’ It is a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter—set into motion by factors ranging from excess leverage to widespread profit-taking by OGs,” Hougan noted.

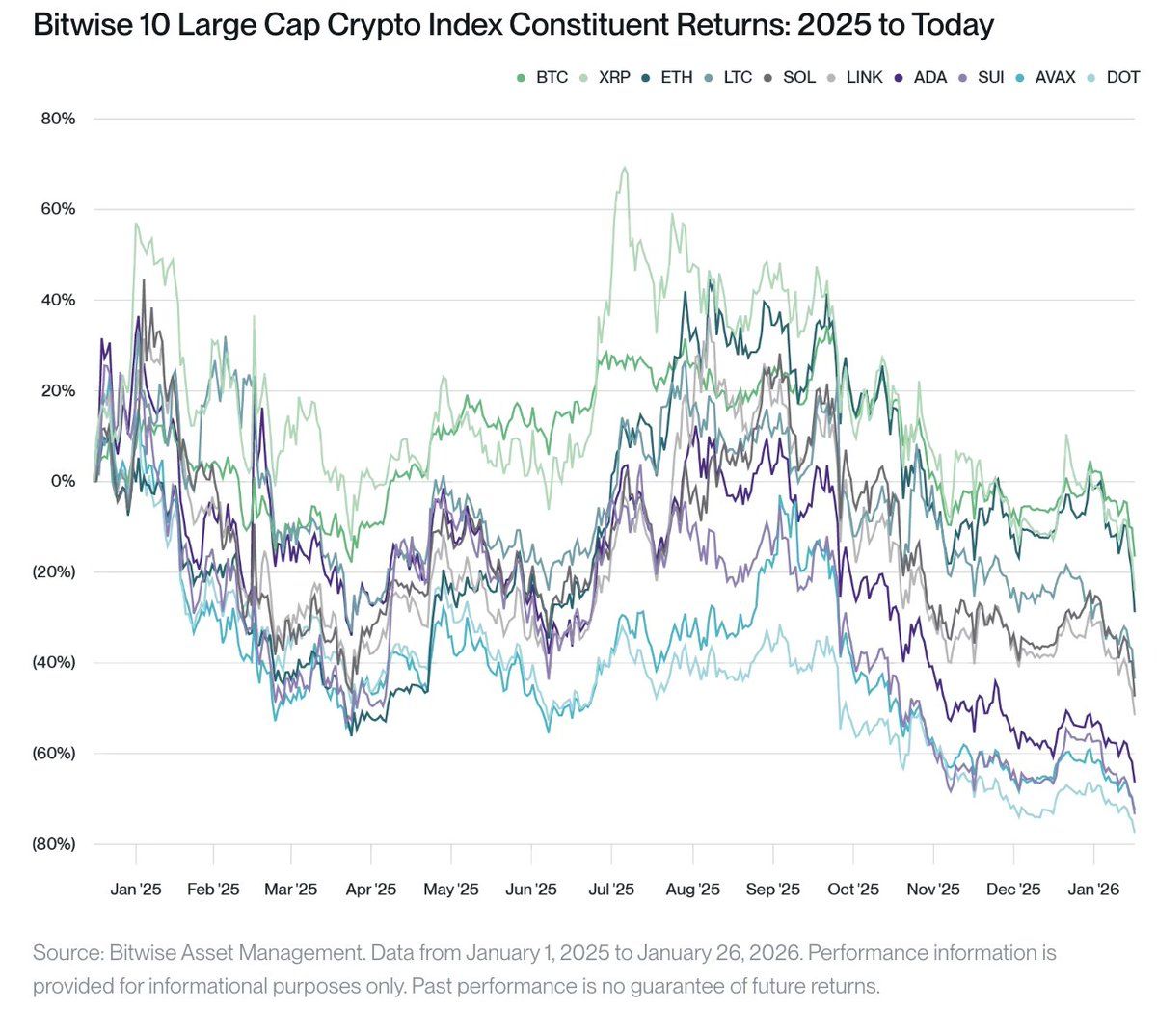

Institutional demand, he said, played a key role in masking the downturn. Using data from the Bitwise 10 Large Cap Crypto Index, Hougan highlighted a clear divide.

Assets with strong institutional support, such as Bitcoin, Ethereum, and XRP (XRP), have posted relatively modest declines since January 2025. Tokens that gained ETF access in 2025, like Solana (SOL), Chainlink (LINK), and Litecoin (LTC), suffered deeper losses.

Nonetheless, assets without any institutional exposure fell between roughly 60% and 75%. According to him,

“The thing that separates the three groups is basically whether or not institutions had the ability to invest in them.”

Sponsored

Sponsored

During this period, exchange-traded funds (ETFs) and Digital Asset Treasuries (DAT) accumulated more than 744,000 Bitcoin, worth an estimated $75 billion. Hougan argued that without this level of institutional support, Bitcoin’s losses would likely have been far greater.

“Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while,” the executive remarked.

Hougan also addressed a question many market participants have raised: why do crypto prices continue to fall despite positive developments such as increased institutional adoption, regulatory progress, and broader acceptance by Wall Street?

His answer was straightforward. In the depths of a crypto winter, good news typically has little immediate impact on prices.

“Those of you who followed crypto during past winters—either 2018 or 2022—will remember that good news doesn’t matter in the depths of winter. Crypto winters don’t end in excitement; they end in exhaustion,” he added.

However, he suggested that while positive developments are often ignored during bear markets, they do not disappear. Instead, they accumulate as what he described as “potential energy,” which can fuel a recovery once sentiment improves.

Sponsored

Sponsored

Hougan pointed to several factors that could help lift market sentiment, including stronger economic growth that triggers a risk-on rally, a positive surprise related to the Clarity Act, signs of sovereign adoption of Bitcoin, or simply the passage of time.

Looking at historical cycles, Hougan said crypto winters typically last around 13 months. If the current winter indeed began in January 2025, then it’s possible that the end may be near.

He stressed that the prevailing mood of despair and malaise often characterizes the final phase of a crypto winter and stressed that nothing fundamental about crypto has changed during the current pullback.

“I think we’re going to come roaring back sooner rather than later. Heck, it’s been winter since January 2025. Spring is surely coming soon,” Hougan claimed.

Sponsored

Sponsored

When Did Crypto Bear Market Start: Debating the Timeline

Though Hougan traces the bear market’s start to January 2025, not all analysts concur. Julio Moreno, Head of Research at CryptoQuant, acknowledged differences in asset performance due to institutional exposure but disputed the timeline.

“I disagree with the winter starting in January 2025. Bitcoin prices remained in a long-term upward trend throughout 2025, and reached a new ATH in October. The fact that we did not have a blow-off top or closed the year positive doesn’t mean we were in a bear market in 2025. The Bitcoin bear market started on November 2025, as suggested by on-chain and market data,” he posted.

The start date matters. Historically, crypto winters last about 13 months. If the downturn began in January 2025, a spring recovery could be near. If Moreno is right and the market peaked in November 2025, the bear phase would continue.

“The timing has implications for when it will end. My current expectation is Q3 2026,” Moreno wrote.

Whether recovery comes early in 2026, as Hougan predicts, or is pushed to Q3 under Moreno’s timeline, remains to be seen. What is clear, however, is that the market is deep in a downturn.

History suggests these phases do not end with a single catalyst but rather over time. If past cycles are any guide, the groundwork for the next recovery may be forming beneath the surface.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech16 hours ago

Tech16 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards