Crypto World

MSTR Stock Target Cut to $185 as Analyst Adjusts to Crypto Market Fall

TLDR

- Joseph Vafi from Canaccord has reduced his MSTR stock price target by 61%.

- The new MSTR stock price target is now set at $185, down from $474.

- Vafi still maintains a buy rating despite the steep cut in his price estimate.

- Strategy’s stock has dropped 15% in 2026 and 62% over the past year.

- The company’s value is now closely tied to the performance of Bitcoin.

As the ongoing crypto winter continues, investors are looking for signs that the bearish trend has reached its peak. A notable update comes from Canaccord’s Joseph Vafi, who dramatically slashed his price target on Michael Saylor’s Strategy (MSTR) stock. Vafi reduced his target by 61%, setting it at $185 from the previous $474, reflecting the significant impact of the current market conditions.

Strategy (MSTR) Faces Setback Amid Market Volatility

Joseph Vafi’s revised price target fo MSTR stock marks a stark change in outlook. After maintaining a bullish stance on the stock just a few months ago, Vafi is now adjusting his expectations to reflect the ongoing struggles within the crypto space. The analyst still holds a buy rating on the stock, despite the massive cut in his price target.

At $185, the new target implies about 40% upside from the most recent closing price of $133. However, this outlook comes after Strategy has suffered significant losses, down 15% year-to-date, 62% year-over-year, and 72% from its record high in November 2024. The bearish trend is in line with the broader decline in the cryptocurrency market, which has faced immense pressure over the past year.

Bitcoin’s Ongoing Struggles Impact MSTR Stock

In his analysis, Vafi pointed to Bitcoin’s “identity crisis” as a key factor in the struggles of MSTR. While Bitcoin is still seen as a long-term store of value, its recent price movements resemble that of a risk asset, making it more susceptible to volatility. “Bitcoin is increasingly trading like a risk asset rather than a safe-haven asset,” Vafi remarked, highlighting how the cryptocurrency failed to track with precious metals like gold.

The Bitcoin-led company Strategy has been hit hard by these developments. Despite holding more than $44 billion in Bitcoin, the company has seen its market cap drop to levels close to its Bitcoin holdings. This correlation between Bitcoin’s price and the stock’s performance has made Strategy’s financial health more reliant on the digital asset’s price fluctuations than anticipated.

MSTR’s Near-Complete Dependence on Bitcoin

With Bitcoin’s price fluctuations dominating its financial outlook, quarterly results for MSTR have become less relevant. Investors are increasingly focused on the value of the company’s Bitcoin holdings rather than its operational performance. The upcoming quarterly results are expected to show a sizable unrealized loss due to Bitcoin’s fourth-quarter selloff.

Vafi’s revised price target assumes a 20% rebound in Bitcoin prices, which would help stabilize Strategy’s mNAV. However, the stock’s future remains closely tied to Bitcoin’s performance in the coming months. Despite this, Vafi remains optimistic, stating that Strategy is still built to weather volatility, given its strong Bitcoin position.

Crypto World

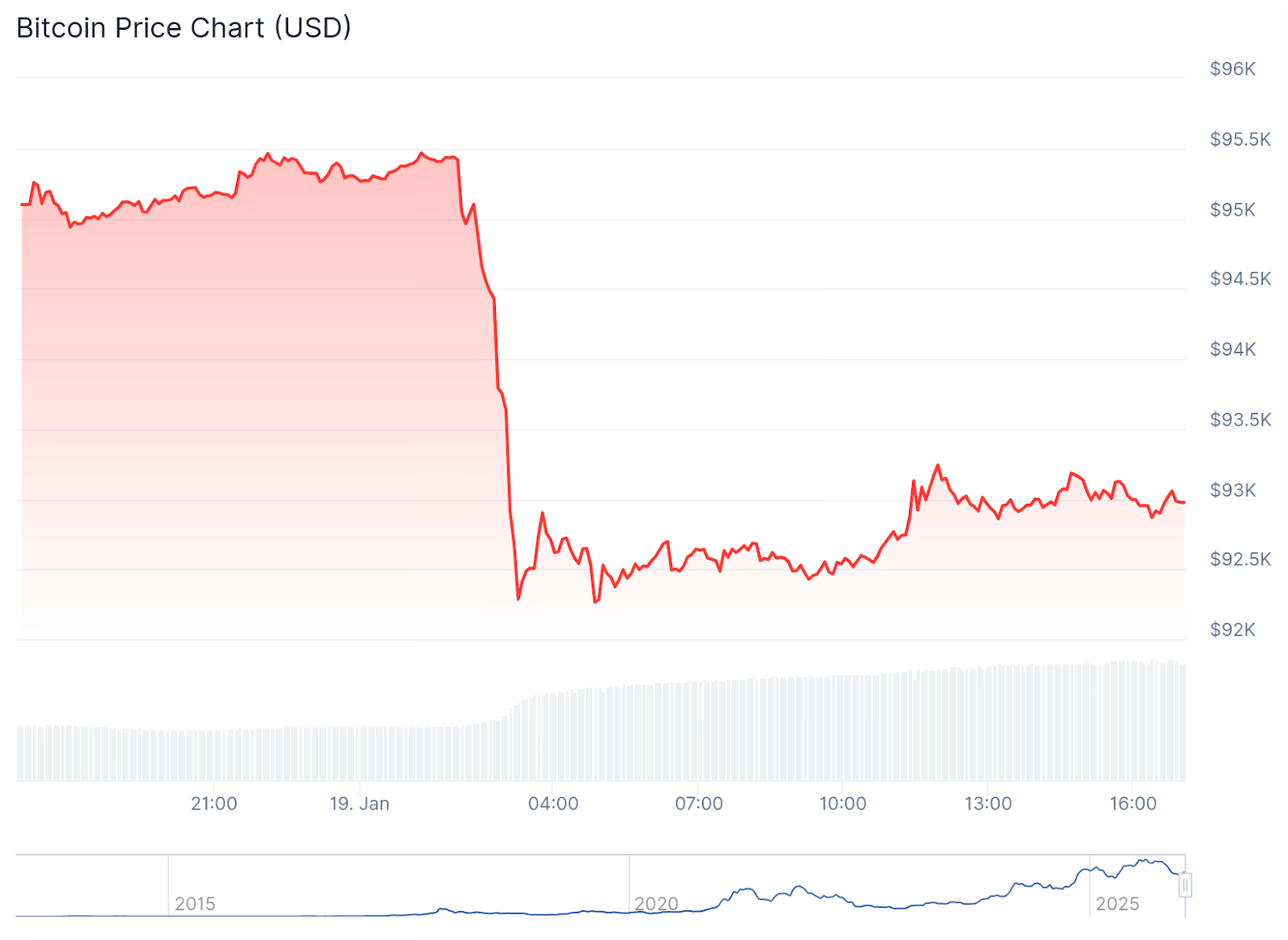

Bitcoin Drops Sharply Below $93K After Stable Weekend

All the top-10 crypto assets by market capitalization are in the red today as markets digest President Trump’s EU tariff threats over Greenland.

Crypto markets are experiencing a correction today after pushing higher last week. The Bitcoin (BTC) price dropped around $4,000 in a few minutes last night and is trading just below $93,000 at press time, down roughly 2.2% over the past 24 hours. The leading cryptocurrency is up over 2% over the past seven days, however, and was trading around $95,000 over the weekend.

All of the top-10 cryptocurrencies by market capitalization 2%-3% in the red today. Ethereum (ETH) fell about 3.2% to $3,215, after trading above $3,300 this weekend. ETH is still up nearly 4% on the weekly timeframe.

Solana (SOL) and Dogecoin (DOGE) showed the biggest losses today among the top-10 assets, both down about 6% on the day.

Total crypto market capitalization slipped to approximately $3.23 trillion, down 2.6% today, reflecting weakness across the board.

Range-Driven Market

Analysts at Matrixport noted in a Monday update on X that despite renewed tariff threats from United States President Donald Trump, this time over Greenland, “implied volatility in both Bitcoin and Ethereum has only marginally edged higher.”

The analysts noted that volatility has fallen sharply since mid-November last year, with a repricing of roughly 18-25 volume points over the past two months, which they described as a “significant compression.” They added:

“This decline signals that traders are neither chasing upside through options nor aggressively hedging downside risk.”

The cryptocurrency market’s Fear & Greed Index has slipped back into the “Fear” zone after briefly touching “Neutral” last week for the first time in several weeks, suggesting that sentiment among investors remains fragile.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, privacy coin Monero (XMR) is today’s strongest performer, rising 8% on the day, followed by Sky (SKY), which posted mild gains of roughly 2.5%.

On the downside, on-chain perpetual futures exchange Aster’s ASTER was the biggest loser today, falling around 13.5% to reach an all-time low. Sui (SUI) lost 12.4% today, making it the second-weakest performer among the top-100 large-caps.

Crypto liquidations built up over the course of last week as volatility picked up, rather than being driven by Sunday’s usually quiet trading. Total crypto liquidations spiked at around $875 million over the past 24 hours, according to Coinglass, with longs making up the majority of liquidated positions at roughly $788 million, versus about $88 million in shorts.

Bitcoin accounted for the largest share at about $234 million, followed by Ethereum with roughly $156 million, while altcoins made up another $133 million.

ETFs and Macro Conditions

Despite net outflows on Friday, crypto exchange-traded flows remained positive on the weekly timeframe. Spot Bitcoin ETFs recorded net inflows of approximately $1.42 billion last week, lifting cumulative inflows to about $57.8 billion, according to data from SoSoValue.

Spot Ethereum ETFs also saw big demand over the past week, seeing a net inflow streak every day last week, closing the week with more modest inflows on Friday. ETH ETFs posted total weekly net inflows of roughly $479 million, while cumulative inflows reached about $12.9 billion.

On the macro side, investors are leaning toward safe havens again as geopolitical tensions return, after President Trump renewed threats to raise tariffs on several European allies, tied to his push to take control of Greenland.

As Reuters reported, Trump unveiled an additional 10% tariff on goods from countries including Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and the UK, that would take effect on Feb. 1, rising to 25% on June 1 unless progress is made toward a Greenland agreement. European officials are expected to respond later today.

Crypto World

CoolWallet Integrates TRON Energy Rental to Reduce TRX Transaction Costs

CoolWallet, a self-custody hardware wallet provider, has announced the integration of TRON energy rental services, allowing users to reduce transaction costs while securely managing TRX and other TRC-20 assets.

In a press release shared with CryptoNews, the firm said the new feature allows CoolWallet users to access TRON’s blockchain infrastructure while maintaining full control over their private keys and funds through CoolWallet’s hardware wallet paired with its mobile application.

TRON remains one of the most actively used networks among CoolWallet customers, particularly due to its role in stablecoin transfers and low-fee payments.

The update is designed to expand TRON’s accessibility for retail users looking for cost-efficient transactions without sacrificing self-custody protections.

Lower Fees Through Energy Rental

The firm explains that under TRON’s resource model, transactions consume Energy, often requiring users to burn TRX for network fees. CoolWallet’s update introduces an energy rental mechanism that reduces the amount of TRX burned per transaction, helping users retain more of their holdings while maintaining full transaction functionality.

The integration also introduces flexible payment options, allowing users to pay for Energy using either USDT on TRON or TRX, providing greater cost control for frequent transfers and DeFi activity.

By lowering transaction costs, the feature is expected to make token movements and decentralized finance participation more economical for users operating within the TRON ecosystem.

Expanding Secure Self-Custody Access

CoolWallet emphasized that the integration maintains the company’s core focus on security and user sovereignty. Transactions are executed with full self-custody, meaning users retain ownership of their assets at all times without relying on third-party intermediaries.

“TRON plays a critical role in the global stablecoin ecosystem, particularly for users who prioritize cost efficiency and transaction speed,” said Michael Ou, CEO of CoolBitX. “This integration reflects our commitment to supporting the blockchain networks our users depend on most, while ensuring they retain full security and control over their assets.”

Sam Elfarra, Community Spokesperson for the TRON DAO, said the collaboration strengthens access to TRON’s infrastructure through one of the most portable hardware wallet solutions available.

“CoolWallet’s integration represents an important step in making TRON’s infrastructure more accessible to users who prioritize security and self-custody,” Elfarra said. “By bringing TRON support to one of the most portable and user-friendly hardware wallets available, we are expanding access to TRON’s blockchain infrastructure and DeFi applications.”

Strengthening TRON’s Retail and DeFi Ecosystem

The companies said the partnership reflects a shared commitment to reducing barriers to blockchain adoption while maintaining the highest standards of security and user control.

By combining TRON’s scalable infrastructure with CoolWallet’s hardware wallet design, the integration delivers secure, cost-efficient access to blockchain services for everyday users.

The post CoolWallet Integrates TRON Energy Rental to Reduce TRX Transaction Costs appeared first on Cryptonews.

Crypto World

Silver’s 17% plunge amid bitcoin drop echoes Michael Burry’s “death spiral” call

Silver sank as much as 17% in the past 24 hours, wiping out a two-day rebound as the metal struggled to find a floor after last week’s historic rout.

The move dragged gold and copper lower as well, extending an unwind that traders say has been magnified by thin liquidity and heavy speculative positioning.

The renewed drop is also showing up on crypto rails. On Hyperliquid, one of the larger liquidation prints tied to tokenized silver was a forced close of roughly $17.75 million in XYZ:SILVER, with about $16.82 million of that coming from long positions, according to trade data shared by market participants.

The lopsided unwind fits the pattern of late, with traders leaning into rebound bets only to get flushed when volatility spikes again.

That spillover is exactly what hedge fund manager Michael Burry flagged earlier this week.

Burry described a “collateral death spiral” dynamic, where leverage builds as metals rise, then falling crypto collateral forces traders to sell tokenized metals to meet margin. He singled out bitcoin losses could force institutions to liquidate profitable metals positions.

In that kind of tape, the liquidation leaderboard can look inverted, with metals products briefly doing more damage than bitcoin itself.

Macro headlines are not helping. Markets are still digesting the policy implications of Kevin Warsh’s nomination as Federal Reserve chair, while President Donald Trump has pushed back on the idea that the Fed could turn more hawkish.

Rate expectations matter for precious metals, but the bigger driver right now is positioning and forced selling, not the clean macro bid that powered last month’s surge.

Crypto World

Trump Threatens To Sue JPMorgan For Debanking Him

Join Our Telegram channel to stay up to date on breaking news coverage

President Donald Trump has threatened to sue JPMorgan Chase over allegedly debanking him following the January 6, 2021 riot at the US Capitol.

“I’ll be suing JPMorgan Chase over the next two weeks for incorrectly and inappropriately DEBANKING me after the January 6th Protest, a protest that turned out to be correct for those doing the protesting,” Trump said in a social media post.

( @realDonaldTrump – Truth Social Post )

( Donald J. Trump – Jan 17 2026, 11:13 AM ET )A front page Article in The Fake News Wall Street Journal states, without any verification, that I offered Jamie Dimon, of JPMorgan Chase, the job of Fed Chairman. T… pic.twitter.com/gQc41kUVcF

— Donald J Trump Posts TruthSocial (@TruthTrumpPost) January 17, 2026

In August, Trump signed an executive order requiring banks to ensure they are not refusing financial services to clients based on religious or political beliefs, a practice known as debanking.

Trump claimed he was personally discriminated against by banks, with JPMorgan Chase and Bank of America refusing to accept his deposits after his first term in office. At the time, JPMorgan said it does not close accounts for political reasons.

Trump and Family Turn To Crypto

After claiming that some of America’s biggest banks cut them off from services, Trump and his sons have pushed further into the world of crypto.

“We got into crypto because we were debanked,” Donald Trump Jr. said in a Fox News interview last year. “We had to come up with solutions,” he continued, adding that crypto was the most efficient way to go and “absolutely the future of banking.”

The Trump family is moving to take over TradFi services using crypto.

The $WLFI token backed by the Trump family, rolled out a lending platform for it’s stablecoin 👑

This is great strategic move as they aim to establish the company as the crypto giant. I don’t think this is a surprise to anyone who has been following their journey so far.… pic.twitter.com/ue3ZYhm3JD

— Alaoui Capital (@Alaouicapital) January 13, 2026

Trump-backed World Liberty Financial, a borrowing and lending platform that runs on Ethereum, has its own stablecoin, USD1, and wants institutions and everyday people to be use the digital token for payments.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Telegram’s Durov Warns About Spain’s Online Age-Verification Law

Pavel Durov, the co-founder of Telegram, has sharpened his critique of Spain’s proposed online age-verification regime, warning that a policy aimed at shielding minors could usher in broader censorship and government-led surveillance. The plan — which seeks to require platforms to verify users’ ages and potentially restrict access for those under 16 — follows similar moves in other European jurisdictions and was publicly unveiled as Spain’s government positioned itself at the forefront of a continent-wide push toward digital identity controls. Durov, documenting his stance on Telegram, stressed that the measures risk de-anonymizing users and empowering authorities to police online speech. The discourse arrives amid a broader debate about privacy, safety, and how to balance child protection with civil liberties.

“Pedro Sánchez’s government is pushing dangerous new regulations that threaten your internet freedoms. Announced just yesterday, these measures could turn Spain into a surveillance state under the guise of ‘protection.’”

Spain’s prime minister, Pedro Sánchez, announced on Tuesday that the country will enact online age-verification policies similar to those deployed in other parts of Europe, including the United Kingdom. Speaking at the World Governments Summit in Dubai, Sánchez framed the move as a necessary step to “protect our children,” asserting that social networks have become a “failed state” in need of stronger oversight. The remarks signaled a broader push within Spain to merge child-protection initiatives with stricter digital-identity requirements, potentially affecting how minors access social platforms.

Yet the policy has sparked a wave of pushback from privacy advocates and cyber-activists who argue that the approach sacrifices fundamental freedoms in the name of protection. Critics contend that age verification, as currently imagined, could chill speech and widen government control over what people can see, say, and share online. The debate touches on broader issues of digital identity, privacy, and the role of state power in policing online spaces — questions that increasingly draw the attention of crypto-focused communities and privacy-centered technologists alike.

In the wake of Sánchez’s announcement, privacy advocates and technologists have argued that current-age-verification techniques are imperfect and prone to circumvention. Some have pointed to the growing use of virtual private networks (VPNs) as a practical workaround, raising concerns about the efficacy and fairness of blanket age restrictions. A more constructive line of critique has emerged from industry voices who say that cryptographic identity systems could offer a path forward — proving that a person is adult or that they meet certain criteria without exposing their private data to platforms or third parties.

“You want to control people who expose the corruption in your government,” a user named Campari quipped in a social post reacting to the proposal. The discourse has drawn remarks from prominent tech figures, including billionaire Elon Musk, who criticized the approach, and journalists who urged vigilance against policies that may curtail online expression. The conversation underscores a broader concern: that well-intentioned child-safety measures could be repurposed to justify more aggressive surveillance regimes and content moderation powered by state actors.

Critics also highlight that age-verification efforts should be designed with privacy-by-default principles. As one blockchain executive noted, the current methods can be counterproductive because they push users toward opaque and less secure means of identity verification, which could expose them to data leaks or misuse. The same voices emphasize that cryptographic identity tools — if implemented properly — could allow individuals to demonstrate age or eligibility without revealing sensitive details such as birthdates or real names, thereby preserving user anonymity where appropriate while maintaining safety guarantees.

The debate in Spain mirrors related conversations across Europe and beyond about how to reconcile child-protection goals with the right to privacy on open networks. In the United Kingdom, for instance, officials have discussed similar restrictions aimed at younger users and the sharing of age-related data online. The evolving policy landscape is prompting technologists to explore privacy-preserving identity mechanisms, including self-sovereign identity concepts and blockchain-enabled proofs of age — approaches that could potentially harmonize safety with civil liberties if implemented with robust governance and privacy protections.

As policymakers weigh the practicalities of such systems, industry leaders caution that the success or failure of Spain’s program will hinge on whether verification methods can be both secure and privacy-preserving, while not creating barriers to legitimate online participation. The conversation extends to the crypto ecosystem, where debates over identity, data minimization, and user autonomy have gained renewed attention in recent years. In this context, the call for cryptographic identity management is less about creating new cryptographic gimmicks and more about aligning digital rights with real-world protections in an increasingly digital society.

In the immediate term, observers are watching for concrete legislative steps, timelines, and the scope of application — including whether the policies would apply to all social platforms or be tailored to certain categories of services. The policy’s implementation could set a precedent for other jurisdictions grappling with similar questions, potentially influencing how digital identity is constructed and regulated across borders.

Why it matters

The Spain debate sits at a critical crossroads for the digital age: the tension between safeguarding minors online and protecting civil liberties. How a government implements age verification can shape public discourse, influence platform behavior, and redefine the boundaries of privacy in an era where data is a core asset. For users and investors across cyber and crypto spaces, the policy highlights the need for privacy-preserving technologies that can simultaneously enable safety, transparency, and trust online. If Spain moves ahead with robust safeguards that respect user anonymity while preventing exploitation, it could accelerate adoption of privacy-centric identity solutions elsewhere. If, on the other hand, the design proves heavy-handed or opaque, it could catalyze calls for greater decentralization of identity management and more resilient tools for users who value privacy.

For builders in the crypto and Web3 space, the episode underscores the potential role of decentralized identity and cryptographic proofs as viable alternatives to centralized verification schemes. It also raises questions about regulatory divergency within Europe, the integration of identity standards across platforms, and the incentives governments may create for developers to design privacy-first solutions. In short, the Spain policy could become a touchstone for how digital identity is conceived, implemented, and governed in a privacy-conscious era.

What to watch next

- Timeline and wording of the proposed legislation in Spain, including which platforms and services would be affected and what verification methods would be allowed.

- Responses from privacy authorities, civil-society groups, and technology companies, including potential legal challenges or amendments.

- Developments in privacy-preserving identity technologies, including any pilot programs or collaborations with crypto-native projects.

- The UK and other European jurisdictions’ actions on under-16 access and online identification, and how those policies interact with Spain’s proposal.

- Any formal documentation outlining data-handling, opt-out provisions, and data-minimization requirements for verification data.

Sources & verification

- Pavel Durov’s post on Telegram detailing concerns about Spain’s age-verification push and potential privacy implications.

- Pedro Sánchez’s remarks at the World Governments Summit in Dubai announcing Spain’s plan to enact online age verification policies.

- Cointelegraph coverage (Spain ban social media minors security) referencing the policy’s public rollout and government stance.

- Articles and resources on digital identity management and privacy-preserving verification methods, including discussions on cryptographic proofs of age.

- Related discussions about under-16 social-media restrictions in the UK and ongoing identity debates in Europe.

Spain’s online-age debate and the crypto community’s take

The debate over online age verification in Spain has put digital privacy and child protection at the center of a broader conversation about how to manage identity in a networked world. The policy proposal channels pent-up concerns about how data may be collected, stored, and leveraged by both public and private actors. Crypto-focused voices have urged policymakers to consider solutions that minimize exposure of personal data through cryptographic techniques that allow age verification without disclosing who a person is or where they live. They argue that such approaches could reduce the risk of mass surveillance and data breaches while still meeting safety objectives.

As these conversations unfold, the industry is watching how Spain balances the competing priorities of child protection, free expression, and privacy. The outcome could influence how other jurisdictions structure their own digital-identity frameworks and what kinds of technology are promoted or discouraged in the process. The current discourse reflects a broader shift in which the crypto and privacy communities advocate for standards that empower individuals to prove specific attributes (like age) without revealing more than necessary. A decision in Spain could thus ripple across regulatory and technology choices worldwide, shaping how identity and access are managed online for years to come.

https://platform.twitter.com/widgets.js

Crypto World

XRP Sentiment Surpasses Bitcoin and Ethereum, Santiment

Despite a broad crypto market pause that has pulled Bitcoin toward the $70,000 level, XRP has carved out a comparatively resilient narrative on social media. Investor sentiment surrounding XRP remains more constructive than the mood around leaders like Bitcoin and Ethereum, even as prices slip. Santiment highlighted that XRP is enjoying a more optimistic outlook among traders on social channels, even as BTC and ETH have slid from recent highs after a pronounced downturn. The contrast underscores how on-chain chatter and price action can diverge for select assets during drawdowns.

Key takeaways

- XRP’s social sentiment metric indicates a stronger positive-to-negative mention ratio (2.19) than Bitcoin (0.80) and Ethereum (1.08), suggesting a comparatively bullish narrative for XRP despite a broader market slump.

- Over the past week, BTC declined 4.97% and ETH declined 4.92%, while XRP fell more sharply at 6.82%, signaling that XRP has not been immune to the downturn even as sentiment remains more upbeat.

- Swyftx analyst Pav Hundal argues that XRP holders “wear volatility differently” and maintain faith in the asset’s fundamentals, potentially dampening near-term selloffs.

- Analysts warn that the near term could be choppy, with XRP still down about 35.5% over the last 30 days, though some believe a relief rally could materialize if overall trader sentiment remains cautious toward the broader market.

- Macro sentiment gauges show pockets of fear: Alternative.me’s Crypto Fear & Greed Index sits at an extreme fear level (12), while the Altcoin Season Index continues to tilt toward Bitcoin dominance rather than broader altcoin strength.

Tickers mentioned: $BTC, $ETH, $XRP

Sentiment: Bullish

Price impact: Negative. XRP slipped 6.82% over the past seven days as BTC and ETH also retraced (BTC −4.97%, ETH −4.92%).

Trading idea (Not Financial Advice): Hold

Market context: In a risk-off backdrop, major coins joined a broader drawdown—BTC and ETH posted weekly declines while XRP’s social narrative remained comparatively resilient. The Crypto Fear & Greed Index registered extreme fear (12), signaling cautious positioning across the market, and the Altcoin Season Index shows a tilt toward Bitcoin-dominated sentiment as investors chase perceived safety at the top of the curve.

Why it matters

The divergence between social sentiment and price performance matters for participants who weigh narrative momentum alongside technicals. XRP’s relatively stronger sentiment signal could attract fresh buying interest if traders interpret it as a decoupling from the broader risk-off mood. The contrast also highlights how different crypto assets can react to macro pressures in heterogeneous ways—where BTC and ETH are bearing the brunt of the pullback, XRP’s community outlook remains more resilient on social channels.

From a fundamentals perspective, XRP holders have historically demonstrated a readiness to weather volatility, a stance that Swyftx lead analyst Pav Hundal described as an “unwavering faith” in the asset’s long-term value. Such a stance can translate into a slower pace of downside recognition during downturns, potentially supporting a later rebound if macro momentum shifts. Yet the same analyst cautions that the near term could remain unsettled as the market digests the path of interest rates, liquidity, and regulatory signals that influence sentiment far beyond a single token’s utility case.

Market-wide indicators reinforce a cautious posture. The Fear & Greed Index’s extreme fear reading suggests risk-off behavior among a broad swath of participants, while the Altcoin Season Index indicates a preference for Bitcoin over riskier altcoins. This backdrop implies that even if XRP’s social chatter stays comparatively buoyant, a material upside may require a confluence of positive catalysts—from improved macro liquidity to clearer regulatory signals or a shift in trader appetite toward altcoins. The tension between narrative optimism around XRP and the reality of ongoing drawdowns across the market continues to define the near-term outlook.

Meanwhile, the market continues to monitor potential near-term catalysts. Some traders posit that a relief rally could emerge if the broader market does not extend its drawdown and if the crowded sentiment around crypto remains hesitant enough to fuel a quick snap-back. In such a scenario, XRP could get a tilt from a combination of stabilizing price action and a relatively robust social narrative, even as BTC and ETH take time to reclaim upside momentum. The dynamics at play illustrate how sentiment signals and price action can diverge in the same market cycle, offering a nuanced view for traders seeking to balance narrative cues with risk management.

The broader takeaway is that the crypto winter narrative—once declared by notable voices in the space—remains a moving target. As some market participants debate whether a bottom is in, others point to a potential shift in mood that could unfold gradually rather than all at once. XRP’s case underscores the complexity: social sentiment can brighten while prices continue to drift lower, creating a leading indicator for a possible re-rating should conditions improve. For investors and builders, the lesson is clear—watch both on-chain signals and the mood of the market as they often tell complementary stories about where the cycle might head next.

What to watch next

- Track XRP price action over the next 1–2 weeks for early signs of a relief rally, especially if BTC and ETH stabilize or rebound.

- Monitor Santiment’s sentiment readings for XRP to see whether positive chatter sustains or fades as price action unfolds.

- Observe BTC/ETH momentum and liquidity conditions to gauge whether the broader market grip loosens enough to support a broader rebound.

- Keep an eye on the Crypto Fear & Greed Index for shifts away from Extreme Fear, which could accompany a broader improvement in risk appetite.

- Watch the Altcoin Season Index for any movement toward a more favorable altcoin rotation that includes XRP among potential beneficiaries.

Sources & verification

- Santiment’s X post citing XRP’s relatively optimistic social outlook and the comparison of sentiment scores (2.19 for XRP vs. 1.08 for ETH and 0.80 for BTC).

- Price performance data from CoinMarketCap showing seven-day changes: BTC −4.97%, ETH −4.92%, XRP −6.82%.

- Comments from Pav Hundal, lead analyst at Swyftx, on how XRP holders approach volatility and fundamentals.

- Alternative.me Crypto Fear & Greed Index indicating Extreme Fear (12) in the current market climate.

- CoinMarketCap Altcoin Season Index showing Bitcoin Season dynamics (32/100) and the relative preference for BTC.

Relief prospects for XRP amid broader crypto caution

Amid a risk-off environment that has pressured the major coins, XRP has emerged as a case study in how sentiment can diverge from price momentum. The narrative around XRP is colored not only by its price trajectory but also by a social-media signal that traders may interpret as resilience. Bitcoin (CRYPTO: BTC) has tested multi-month highs before retreating toward the $70,000 area, while Ethereum (CRYPTO: ETH) has mirrored the broader softness seen across the market. In that context, XRP’s social sentiment has stood out, supported by a higher positive-to-negative mention ratio than both BTC and ETH, a signal that traders are discussing XRP with a more constructive lens even as prices move lower.

The reading from Santiment—that XRP’s social sentiment is more favorable—helps explain why some market participants expect a near-term bounce even as the weekly price data are less forgiving. The seven-day window shows BTC down 4.97% and ETH down 4.92%, with XRP faring worse on the week at a 6.82% decline. These numbers illustrate the heterogeneity of the current drawdown and hint at a potential decoupling where sentiment could precede a reversal in price. The attached sentiment metrics—XRP at 2.19 vs. ETH at 1.08 and BTC at 0.80—offer a numerical snapshot of this dynamic, albeit one that must be read alongside macro liquidity and risk sentiment that continue to weigh on action across the market.

Within this framework, Pav Hundal of Swyftx emphasized a nuanced view of XRP holders’ approach to volatility. He described XRP investors as a group that tends to “wear volatility differently,” maintaining faith in the asset’s fundamentals and displaying a degree of skepticism that is less pronounced when faced with drawdowns. That perspective aligns with the observed sentiment gap and underscores a potential pathway for XRP to stabilize if macro momentum shifts. Yet, even with a seemingly steadier narrative, the near-term road remains fraught, as XRP has logged a 35.5% decline over the past 30 days, a statistic that keeps any optimistic thesis tethered to a cautionary baseline.

The market’s fear gauge—Alternative.me’s Crypto Fear & Greed Index—adds to the cautious mood. A current score of 12, marking Extreme Fear, reinforces how risk-off sentiment continues to dominate, even as some voices point to a possible relief rally in XRP should the crowd remain doubtful about crypto as a whole. The Altcoin Season Index further reinforces the pattern of risk-on behavior favoring Bitcoin (the “Bitcoin Season” standing) over a broad swath of altcoins, suggesting that a broader altcoin resurgence might require a broader shift in sentiment and liquidity conditions beyond XRP alone. In short, the path to a sustained upmove for XRP hinges on both sentiment improvement and a clearer macro backdrop that encourages demand for riskier assets.

As the quarter unfolds, market participants will be watching for a confluence of signals: a stabilization or bounce in BTC/ETH, a steady or improving social sentiment for XRP, and a broader shift in risk appetite sufficient to propel altcoins higher. The interactions between narrative momentum, price action, and macro liquidity will shape whether this period signals a bottoming process or a temporary lull before the next leg of the cycle. Investors may find that XRP’s case adds a layer of nuance to the conversation about where the market goes next, illustrating how sentiment dynamics can diverge from price charts while still offering useful information about potential catalysts and risk management considerations. The coming weeks will test whether the optimism seen in social chatter translates into tangible, tradable upside for XRP or whether it remains a narrative anchor in a still-choppy market environment.

Crypto World

Bitcoin Loses Long-Term Support, Tanking to $73K as Short-Term Holders Capitulate

Bitcoin prices hit a fresh low following a bout of panic selling by short-term holders, deepening the bear market downturn.

Bitcoin prices tanked to around $73,000 in late trading on Tuesday, its lowest level since November 2024. The fall is significant because it dropped below April 2025 support levels, which were around $74,500, confirming bear market territory.

“Negative momentum is currently extreme as the bear market persists following the October 10 flash crash,” reported Swissblock.

The asset has now crashed 25% in less than three weeks and is down 40% from its all-time high.

“Bitcoin has now crashed over $53,000 in the last 120 days,” observed analyst ‘Bull Theory’ who added:

“Either this is an insane level of manipulation or something huge has broken behind the scenes in crypto.”

The move came as geopolitical tensions escalated again, with Iran seeking a new format for nuclear dialogue with the United States.

STH Capitulation Adds to Selling Pressure

“Short-term holders have been capitulating over the past few days,” said CryptoQuant analyst ‘Darkfost’. More than 40,000 BTC have been sent to exchanges at a loss over the past day or so, they added.

“This potential selling pressure appears to have impacted the market today. When large amounts of BTC are sent to exchanges, it is mainly for selling purposes.”

🔴 Short-Term Holders have been capitulating over the past few days.

In the last 24 hours, more than 40,000 BTC have been sent to exchanges at a loss.

⁰💥 Yesterday, that figure even reached 54,000 BTC.

At current prices, this represents roughly $4B.This potential selling… pic.twitter.com/yX0HcOwSs3

— Darkfost (@Darkfost_Coc) February 3, 2026

Santiment went into further detail, reporting that wallets with 10 to 10,000 BTC, which hold just over two-thirds of all Bitcoin, have dumped 50,181 units in the past two weeks alone.

You may also like:

However, the world’s largest exchange, Binance, “shows no signs of stress,” reported CryptoQuant.

“Reserves hold near 659,000 BTC, netflows remain normal, and reserve movement sits at just 0.6%, nowhere close to the -12% panic withdrawals seen post-FTX,” it added.

Analyst ‘Sykodelic’ also remained positive, stating that “this section below the $74K lows will provide the springboard for the next macro leg higher.”

“Taking the lows, losing $74K temporarily, pushing everyone over the edge, even the most staunch of bulls… baiting a massive bear trap.”

Total Market Cap at 9 Month Low

Bitcoin had returned to trade at $76,500 at the time of writing in early trading in Asia on Wednesday, so the dip below long-term support was short-lived. However, the rest of the crypto market is in meltdown, with total capitalization tanking to a nine-month low of $2.64 trillion.

Ether fell to $2,120 before a minor recovery, and most of the altcoins had crashed to crypto winter lows with very little recovery.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP crashes to its lowest since Trump’s election win. What next

Payments-focused cryptocurrency XRP is tanking fast as bitcoin’s price slide leads to broad-based risk aversion in the crypto market.

XRP has slipped to $1.44, the lowest since November 2024 – the same month President Donald Trump won the U.S. election. Trump campaigned on pro-crypto policies to foster a favorable regulatory environment for digital assets. XRP is used by fintech firm Ripple to facilitate cross-border transactions.

While the initial reaction to Trump’s election win was bullish, the uptrend quickly slowed above $3.50 and eventually peaked at $3.65 in July last year. Since then, XRP has been in a downtrend that has gathered pace in recent weeks.

Support break

The concerning part for bulls is that it now trades firmly below $1.60, a level where buyers stepped in during the April sell-off, arresting the slide at the time. This so-called support was the prominent demand zone, and the break below the same indicates that sellers are now in control.

Now, a clear air pocket looms right down to $1.00, as charts reveal scant historical support or trading volume between the current price of $1.44 and the psychological floor.

Bearish bets

And traders look to be prepping for a deeper sell-off. Block flows on leading crypto options exchange Deribit featured demand for put spreads, a bearish strategy, and strangles, a bet on volatility boom, in the past 24 hours.

Options are derivative contracts that give the purchaser the right, but not the obligation, to purchase or sell the underlying asset at a predetermined price at a later date. A put option gives the right to sell and represents a bearish bet on the market, while a call option represents a bullish bet.

Crypto World

Ripple Prime adds Hyperliquid for institutional DeFi trading

Ripple has made a new addition to its institutional trading platform as it adjusts its approach to decentralized markets.

Summary

- Ripple Prime now supports trading on Hyperliquid’s decentralized derivatives network.

- Institutional clients can cross-margin DeFi positions with traditional assets.

- The move marks Ripple’s first direct entry into on-chain trading venues.

Ripple’s institutional brokerage arm has added access to decentralized derivatives markets by integrating Hyperliquid into its Prime brokerage platform.

The company announced the integration in a statement released on Feb. 4, framing it as a step to bridge traditional finance with decentralized trading.

First institutional bridge to DeFi derivatives

Ripple said Ripple Prime now supports trading and margining on Hyperliquid (HYPE), a decentralized perpetual futures venue built on its own layer-1 network.

Through the integration, institutional clients can access perpetual futures and other derivatives while managing exposure alongside FX, fixed income, OTC swaps, and cleared products. Positions are handled under a single counterparty framework, with centralized risk controls and consolidated margin.

For many institutions, the structure removes a key operational barrier. Trading on decentralized venues no longer requires direct wallet management or smart contract interaction, allowing firms to treat on-chain derivatives more like traditional exchange products.

“At Ripple Prime, we are excited to continue leading the way in merging decentralized finance with traditional prime brokerage services, offering direct support to trading, yield generation and a wider range of digital assets,” said Michael Higgins, International CEO of Ripple Prime.

Ripple described the move as its first direct link to a decentralized trading protocol, marking a shift from infrastructure and payments-focused services toward market access and execution.

XRP, HYPE and market positioning

Hyperliquid has emerged as one of the largest on-chain perpetuals platforms, supporting high-volume trading, and now, institutional-style market infrastructure.

Analysts have noted that the integration strengthens HYPE’s role in institutional trading workflows but does not create a direct use case for XRP (XRP) or the XRP Ledger. Following the announcement, HYPE has gained 5% despite the ongoing crypto market downturn.

Ripple has not announced additional DeFi integrations after the release, though industry sources expect further platform expansions in 2026 as prime brokers compete for institutional crypto flows.

Crypto World

NYSE Eyes Private Blockchains to Launch 24/7 Tokenized Stock Trading

The Intercontinental Exchange said the new platform is part of its broader digital strategy, as tokenized stocks soar in popularity.

The New York Stock Exchange (NYSE) is working on a new digital platform that would let people trade tokenized stocks and exchange-traded funds around the clock, seven days a week, the company revealed in a press release today, Jan. 19.

The largest stock exchange globally said in the release that the launch is only “one component” of its parent company Intercontinental Exchange’s “broader digital strategy.” Intercontinental Exchange is also working with major banks, including BNY Mellon and Citi, to support tokenized deposits across its global clearinghouses, according to the announcement.

Michael Blaugrund, vice president at Intercontinental Exchange, told Bloomberg in an interview today that the move reflects an “evolution of NYSE’s trading capabilities.” He added that NYSE could give retail investors more opportunities, allowing them to trade 24/7 and use funds immediately.

“It allows for new types of investor accessibility, and will create new opportunities for retail to participate in the stablecoin-funded markets that have attracted their attention,” Blaugrund said.

According to Bloomberg’s report, the NYSE intends to combine its existing trading system with private blockchain networks, though the team didn’t reveal further details.

The Defiant reached out to Intercontinental Exchange for details and comments on the move, but hasn’t heard back by press time.

Blaugrund also added that the company is in the process of working with the U.S. Securities and Exchange Commission (SEC) to gain approval, and Bloomberg reports that NYSE is aiming to roll out the new platform later this year.

In mid-December, Nasdaq filed with the SEC for approval to offer 24-hour trading on weekdays to meet rising global demand for U.S. stock trading. The firm says, pending regulatory approval, it plans to launch the new trading hours in the second half of this year.

Tokenized stocks have seen a huge jump in popularity in the past year. In January of last year, the total market cap of tokenized equity stood at just over $5 million, while this month it’s just over $397 million — a 7,840% increase year-over-year.

As The Defiant reported last month, centralized crypto exchanges like Coinbase and Kraken are competing for their share of the sector, while decentralized platforms such as TradeXYZ and Ostium are pushing on-chain, crypto-native adoption.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech21 hours ago

Tech21 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards