Business

‘You Have My Word on That’

Apple CEO Tim Cook has pledged that he will lobby Washington on immigration amidst widespread deportation fears in the United States.

This comes after he was criticised over a memo released following his attendance at the “Melania” premiere held at the White House. The premiere was held just hours after the killing of Alex Pretti in Minneapolis.

Tim Cook Makes Promise to Lobby Washington on Immigration

According to Bloomberg’s Mark Gurman, Cook acknowledged that Apple has “team members across the US on some form of Visa.”

“I’ve heard from some of you that don’t feel comfortable leaving your homes,” he said during the meeting. “No one should feel this way. No one.”

Cook went on to assure employees that they have his word when it comes to lobbying Washington on immigration.

“For as long as I can remember, we have been a smarter, wiser, more innovative company because we’ve attracted the best and brightest from all corners of the world,” Cook told employees. “I am going to continue to lobby lawmakers on this issue. You have my word on that.”

Tim Cook’s Memo on Killing of Alex Pretti

As 9to5Mac’s report notes, the meeting comes after Cook was widely criticised for a memo he released following the shooting of Alex Pretti in Minneapolis.

“This is a time for deescalation,” he said in the memo. “I believe America is strongest when we live up to our highest ideals, when we treat everyone with dignity and respect no matter who they are or where they’re from, and when we embrace our shared humanity.”

Many have blasted Cook for the memo, which many say stopped short of criticising the US government for its immigration crackdown.

Given this, the report points out that Cook’s comments at the meeting can be taken as damage control.

Only time will tell if he really is true to his word.

Business

Google’s AI investments pay off as Alphabet closes gap with OpenAI

‘The Big Money Show’ discusses the dump in software and data stocks after new AI tools spark disruption fears, destroying $300 billion in market value.

Alphabet executives struck a confident tone on Wednesday’s post-earnings call, signaling that Google’s heavy investments in artificial intelligence are now translating into real revenue growth across the business.

The call was the first since Google released its Gemini 3 model, which has boosted user engagement and helped the company regain momentum in the intensifying AI race.

While executives did not name OpenAI directly, the message to investors was clear: Google’s AI push is no longer just about experimentation – it is delivering returns across search, cloud and enterprise products.

That confidence is underpinning Alphabet’s willingness to dramatically increase spending. Executives said the company is considering capital expenditures of between $175 billion and $185 billion in 2026 to expand AI computing capacity, a forecast that initially rattled investors.

APPLE SEES BIGGEST SALES JUMP IN 4 YEARS, POWERED BY ‘STAGGERING’ IPHONE DEMAND

Sundar Pichai, the CEO of Google’s parent company, Alphabet. (Brandon Wade/Reuters / Reuters)

“Overall, we’re seeing our AI investments and infrastructure drive revenue and growth across the board,” CEO Sundar Pichai said.

The scale of that growth is now visible across the company. Alphabet reported more than $400 billion in annual revenue for the first time, underscoring the strength of its core businesses even as it pours money into AI infrastructure.

SPOTIFY NOW REPRESENTS ONE-THIRD OF THE MUSIC INDUSTRY’S TOTAL RECORDED REVENUE IN 2025

Google’s Gemini app surpassed 750 million monthly active users by the end of the October through December quarter, up from 650 million in the prior period. While it still trails OpenAI’s ChatGPT – which its CEO said has more than 800 million weekly users – Pichai said engagement has risen sharply since the Gemini 3 launch.

Gemini 3 is now embedded into Google’s search experience and powers its enterprise AI offerings, which have reached 8 million paying licenses, according to the company.

AI assistant apps on a smartphone – OpenAI ChatGPT, Google Gemini, and Anthropic Claude. (Getty Images)

Investor nerves over the capex surge eased as results came in. Google Cloud revenue jumped 48% in the quarter, reinforcing Wall Street’s view that Alphabet’s AI investments are driving tangible growth rather than speculative spending.

The stock initially fell as much as 6% in after-hours trading before stabilizing, reflecting a broader message from investors: massive AI spending will be tolerated only if it produces clear financial returns.

Alphabet’s financial strength gives it an edge in that environment. With a deep cash position and multiple profit engines – from search and YouTube to cloud services – the company is better positioned than many rivals to sustain the enormous costs of the AI arms race.

OpenAI CEO Sam Altman speaks during the Microsoft Build conference at the Seattle Convention Center Summit Building in Seattle, Washington. (Jason Redmond/Getty Images)

Since early last year, Alphabet has gone from perceived laggard to leader among the “Magnificent Seven” tech giants, now rivaled only by Nvidia and Apple in market value. By contrast, growing investor unease around OpenAI’s costly expansion has highlighted the appeal of Alphabet’s scale, profitability and balance-sheet firepower.

CLICK HERE TO GET FOX BUSINESS ON THE GO

“If you are software and you are connected to OpenAI, you’re doubly not intriguing to people,” said Eric Clark, portfolio manager of the LOGO ETF. “Right now, Google has the hot hand.”

Business

(VIDEO) 49ers Legend Roger Craig Elected to Pro Football Hall of Fame Class of 2026

Roger Craig, the San Francisco 49ers’ versatile running back who became the first player in NFL history to rush and receive for 1,000 yards in a single season, has been elected to the Pro Football Hall of Fame’s Class of 2026.

The former 49ers star, a three-time Super Bowl champion and four-time Pro Bowler, earned induction through the seniors committee after years of advocacy from fans and former teammates. Craig’s selection caps a remarkable career that redefined the running back position and helped launch San Francisco’s dynasty of the 1980s.

Craig’s historic 1,000-1,000 season changed the game

Craig made history in 1985, the first year of Bill Walsh’s West Coast offense, when he rushed for 1,050 yards and added 1,016 receiving yards — a feat unmatched until Marshall Faulk in 1999 and Christian McCaffrey more recently. That dual-threat production, totaling 2,066 yards from scrimmage, showcased Craig’s unique skill set as both a power runner and reliable receiving option out of the backfield.

Over eight seasons in San Francisco (1983-1990), Craig amassed 6,535 rushing yards and 46 rushing touchdowns, plus 4,106 receiving yards and 15 receiving scores. His 1988 campaign — 1,502 rushing yards and 534 receiving yards — earned first-team All-Pro honors and cemented his status as one of the era’s elite backs.

Craig finished his 11-year career with the Los Angeles Raiders and Minnesota Vikings, retiring with 8,189 rushing yards, 4,911 receiving yards, 73 total touchdowns and membership on the NFL’s All-Decade Team of the 1980s.

Three Super Bowl rings anchor championship pedigree

Craig’s postseason résumé sparkles brightest. He played in 18 playoff games across 11 seasons, rushing for 841 yards and seven touchdowns while catching 51 passes for 606 yards and two scores. As a rookie in 1983, he scored the first touchdown of Super Bowl XVI in a 26-21 win over Miami. He added scoring runs in Super Bowls XIX and XXIII, victories over Miami and Cincinnati that completed San Francisco’s three titles in six seasons.

“From fullback to feature back, Roger did it all,” said former 49ers teammate Joe Montana. “He blocked for us, ran between the tackles, caught passes out of the backfield. Nobody impacted winning like Roger Craig.”

Drafted 49th overall in 1983 — making him the first No. 49 pick enshrined — Craig thrived under Walsh’s innovative scheme that demanded multifaceted backs ahead of their time.

Long road to Canton highlights Hall’s seniors process

Craig’s induction required navigating the Hall of Fame’s seniors committee, designed to recognize overlooked contributors from the pre-2000 era. He reached finalist status alongside Ken Anderson, L.C. Greenwood, Bill Belichick and Robert Kraft, but only Craig secured the necessary 80% threshold from the 50-member selection committee.

Each voter could select up to three finalists, creating intense competition. Reports indicated Belichick fell just short at 39 votes, leaving room for Craig’s election as the lone seniors inductee. “This was one of the most debated classes in years,” said committee chair Rick Berman. “Roger’s unique impact separated him.”

49ers fans had long championed Craig’s candidacy, frustrated by annual snubs despite his statistical dominance and championship pedigree. His 2026 election joins modern-era inductees Drew Brees, Larry Fitzgerald, Adam Vinatieri and Luke Kuechly in a star-studded class announced ahead of Super Bowl LX.

Redefining the running back position

Craig pioneered the modern “third-down back” archetype, excelling as runner, receiver and pass protector. His 566 career receptions ranked among the most for running backs when he retired, and his versatility influenced coaches like Walsh, Mike Holmgren and Andy Reid.

Only Hall of Famers like Faulk have matched his 1,000-1,000 season while winning Super Bowls. Craig’s blocking in San Francisco’s power sweep — often overlooked statistically — sprung Montana, Jerry Rice and John Taylor for big gains. “Roger was our engine,” Walsh once said. “Without him, none of it happens.”

Post-career, Craig transitioned to broadcasting and community work in the Bay Area, mentoring youth and supporting 49ers legends events. At 64, he becomes the 49ers’ 16th Hall of Famer, joining Montana, Walsh, Rice, Ronnie Lott and others from that dynasty.

49ers dynasty cornerstone finally gets gold jacket

San Francisco’s 1980s run — three Super Bowls, four NFC titles — rested on Craig’s consistency. He started as fullback behind Wendell Tyler, transitioned to feature back and finished as a trusted veteran. His 214-yard playoff outburst against the Giants in 1985 remains a franchise postseason record.

Class of 2026 ceremonies arrive August 2026 in Canton, where Craig joins an elite fraternity. “This is for every 49er fan who believed,” Craig posted on social media. “From the Bay to Canton — Faithful forever.”

Craig’s statistical legacy by the numbers

| Category | Regular Season | Playoffs | Career Total |

|---|---|---|---|

| Rushing Yards | 8,189 | 841 | 9,030 |

| Rushing TDs | 56 | 7 | 63 |

| Receiving Yards | 4,911 | 606 | 5,517 |

| Receiving TDs | 17 | 2 | 19 |

| Total Yds from Scrimmage | 13,100 | 1,447 | 14,547 |

Craig’s per-season averages — 746 rushing yards, 446 receiving — sustained across 148 games underscore his durability. No other back matched his receiving volume while maintaining 4.1 yards per carry.

Modern backs cite Craig as influence

Christian McCaffrey echoed Craig’s dual-threat blueprint, while Alvin Kamara and Austin Ekeler credit his receiving innovations. “Roger invented what we do,” McCaffrey said post-2025 1,000-1,000 season. “Hall of Fame overdue.”

49ers owner Jed York called Craig “the heart of our dynasty. His election validates everything Faithful fans knew.” Current coach Kyle Shanahan, whose father George contributed to Walsh’s staff, praised Craig’s “revolutionary impact.”

Hall process drama adds intrigue

Craig’s path highlighted tensions in the Hall’s evolving seniors system. Voters faced tough choices pitting Belichick’s dynasty against Craig’s innovations, Anderson’s MVP case and Greenwood’s Steel Curtain role. Belichick’s near-miss — reportedly 39 votes — freed the final spot, underscoring Craig’s broad appeal.

The maximum-three-seniors cap forced compromises, but Craig’s unanimous support among 49ers alumni proved decisive. “Finally,” tweeted Hall of Famer Steve Young. “Roger Craig belongs in Canton.”

Craig’s gold jacket cements his legacy as pioneer, champion and 49ers icon — a fitting tribute to the back who ran, caught and blocked his way into immortality.

Business

Left Leg Injury Leaves LA Reeling

Luka Dončić, the NBA’s leading scorer, limped off the court late in the first half of the Los Angeles Lakers’ matchup against the Philadelphia 76ers on Thursday night and was ruled out for the remainder of the game with left leg soreness.

The superstar guard played just 16 minutes, scoring 10 points on 3-for-10 shooting to go with four rebounds, two assists and a frustrating five turnovers before clutching the back of his left leg and heading to the locker room with 3:03 left in the second quarter. Dončić did not return after halftime, with Rui Hachimura stepping into the starting lineup alongside LeBron James as the Lakers trailed by double digits.

Dončić’s troubling limp sparks hamstring fears

Witnesses described Dončić visibly grimacing and kicking the scorer’s table in frustration as he exited, later appearing distraught in the tunnel on Spectrum SportsNet’s broadcast. The Lakers initially listed the issue as “left leg soreness,” but a source told ESPN that Dončić is scheduled for an MRI on his left hamstring Friday to assess the severity.

This marks the latest blow to a Lakers season plagued by injuries to their star trio. Dončić has already missed eight games with various leg ailments, while LeBron James sat out the first 14 contests with sciatica and Austin Reaves just returned Tuesday from a 19-game absence due to a left calf strain. Thursday marked only the 10th game this season with James, Dončić and Reaves all available together.

The timing could not be worse for Los Angeles, sitting at 30-19 and clinging to sixth place in a brutal Western Conference where every game impacts playoff seeding. With four games remaining before next weekend’s All-Star break—including a marquee home date against the Golden State Warriors on Saturday—the Lakers face a critical stretch without their 33.4 points-per-game leader.

Lakers’ nightmare first half without their engine

Dončić’s early exit compounded a dismal opening for Los Angeles, which fell behind by as many as 11 points in the first quarter against a 76ers team missing Joel Embiid but surging behind Tyrese Maxey and Quentin Grimes. Through 16 minutes, Dončić struggled with five turnovers—a season high in a half—highlighting uncharacteristic sloppiness before the injury sidelined him.

In his absence, James shouldered primary playmaking duties, while Reaves—fresh off his calf recovery—joined Hachimura and Jake LaRavia in elevated roles. Marcus Smart remained sidelined with a lumbar strain, further thinning the Lakers’ bench depth. Coach JJ Redick turned to secondary creators like LaRavia and Smart’s replacement to stabilize the offense, but Philadelphia’s perimeter defense exploited the Lakers’ shorthanded attack.

Dončić’s seamless transition powers Lakers’ rise

Since arriving in a blockbuster trade last summer, Dončić has transformed the Lakers into legitimate contenders, leading the league in scoring (33.4 ppg), assists (8.7 apg) and rebounds (7.9 rpg) for a franchise chasing its first title since 2020. His chemistry with James—forged through mutual respect and on-court synergy—has been a revelation, with James recently praising Dončić’s basketball IQ and competitive fire.

The duo’s partnership peaked during a January surge that vaulted Los Angeles into playoff position, bolstered by Redick’s acquisition of sharpshooter Luke Kennard at the trade deadline. Dončić’s absence exposes the Lakers’ heavy reliance on his 40-plus minutes of usage, a dynamic that propelled them past Oklahoma City and Denver but leaves them vulnerable to targeted defenses like Philadelphia’s.

Injury-plagued season tests Lakers’ depth

Los Angeles entered Thursday healthier than at any point this year, with Reaves’ Tuesday return marking the first full-strength lineup in months. James’ sciatica recovery and Dončić’s prior durability had fueled optimism for a pre-All-Star push, but the hamstring scare reignites concerns about load management and playoff readiness.

Team medical staff will prioritize caution ahead of the All-Star break, potentially sitting Dončić out of Phoenix if imaging reveals even minor damage. “We’ve been banged up all year,” James said postgame. “Luka carries us every night. We’ll rally around him like he does for us.” Redick echoed that sentiment, emphasizing Hachimura’s versatility and Reaves’ emergence as key factors in any extended absence.

76ers seize momentum in injury-riddled Eastern clash

Philadelphia capitalized immediately, extending the lead to 15 by halftime behind Maxey’s 22 first-half points and Grimes’ opportunistic defense. Without Embiid, the Sixers leaned on VJ Edgecombe’s bench spark and Kelly Oubre Jr.’s two-way play, exposing Lakers’ interior weaknesses absent Dončić’s gravity.

The matchup pitted two injury-decimated contenders, with Philadelphia holding seventh in the East at 13-9 despite Embiid’s inconsistent availability. Maxey’s recent explosion—coupled with Edgecombe’s rookie flashes—has kept the Sixers afloat, making Thursday’s win a statement in their own seeding battle.

What an MRI means for Dončić’s outlook

Hamstring strains represent a nightmare for high-usage guards like Dončić, whose herky-jerky style and 35-plus minutes per game accelerate recovery timelines. Mild strains typically sideline players 1-2 weeks; moderate tears require 4-6 weeks. Given Dončić’s history—eight prior leg absences—the Lakers will err conservative, especially with the All-Star break offering forced rest.

Friday’s MRI will clarify severity, but sources indicate optimism for a short-term absence barring structural damage. Dončić’s track record of rapid returns bodes well, though Redick faces tough rotations against Golden State, where Stephen Curry awaits.

Lakers’ contingency plans lean on James-Reaves core

Without Dončić, expect James (averaging 28.4 ppg) to eclipse 40 minutes, with Reaves handling point-of-attack creation post-calf scare. Hachimura’s midrange game and LaRavia’s hustle provide balance, while Kennard’s deadline addition offers spacing absent Dončić’s pick-and-roll mastery.

Redick’s adjustments will test the coaching staff’s adaptability, a strength during James’ early absences. “We’ve prepared for every scenario,” Redick said pregame. “Luka’s our heartbeat, but this group’s deeper than people think.” Saturday’s Warriors tilt—potentially without Dončić—looms as the ultimate referendum on those contingency plans.

Fan frenzy and national ripple effects

Social media erupted post-exit, with #PrayForLuka trending amid Lakers fans’ injury fatigue. National pundits framed the scare as a Western Conference pivot, with Denver and Oklahoma City lurking should Los Angeles stumble. Dončić’s visible anguish—pounding the table, tunnel meltdown—underscored his passion, endearing him further to a fanbase starved for sustained health.

As imaging looms Friday, the Lakers hold collective breath. Dončić’s seamless integration has redefined their ceiling; his potential absence recalibrates expectations heading into the marathon’s final turn. For now, James carries the load, Reaves steps up and Purple & Gold faithful brace for answers.

Business

LIC shares climb 4% after Q3 results. Should you buy, sell, or hold?

The insurer reported a 17% year-on-year (YoY) rise in consolidated net profit at Rs 12,930 crore for the December quarter, compared with Rs 11,008 crore in the year-ago period.

Net premium income stood at Rs 1.26 lakh crore in Q3FY26, up 17% from Rs 1.07 lakh crore in the corresponding period last year. On a sequential basis, profit after tax rose 28% from Rs 10,098 crore reported in Q2FY26, even as net premium income declined marginally by 0.7% quarter-on-quarter.

During the nine months ended December 31, 2025, LIC sold 1,16,63,856 policies in the individual segment, slightly lower than 1,17,10,505 policies sold in the same period last fiscal year, reflecting a decline of 0.40%.

On an Annualised Premium Equivalent (APE) basis, total premium for 9MFY26 stood at Rs 44,007 crore. Of this, Individual Business contributed 62.61% or Rs 27,552 crore, while Group Business accounted for 37.39% or Rs 16,455 crore.

Within Individual Business, Par products made up 63.54% of APE at Rs 17,507 crore, while Non-Par products accounted for 36.46% or Rs 10,045 crore. Individual Non-Par APE increased to Rs 10,045 crore for the nine months ended December 31, 2025, compared with Rs 6,813 crore in the year-ago period, registering a growth of 47.44%.

The Value of New Business (VNB) for the nine-month period rose to Rs 8,288 crore from Rs 6,477 crore a year earlier, marking a growth of 27.96%. Net VNB margin expanded by 170 basis points to 18.8%, compared with 17.1% in the year-ago period.LIC’s solvency ratio improved to 2.19 as on December 31, 2025, from 2.02 a year earlier. Assets under management (AUM) increased to Rs 59,16,680 crore as of December 31, 2025, compared with Rs 54,77,651 crore on December 31, 2024, reflecting a rise of 8.01% YoY.

The overall expense ratio for the nine months ended December 31, 2025 declined by 132 basis points to 11.65%, compared with 12.97% in the corresponding period last year.

Brokerage view

Bernstein maintained a neutral stance on LIC, assigning a Market-Perform rating with a target price of Rs 940.

The brokerage said LIC delivered a strong topline performance in Q3FY26 despite ongoing GST-related pressures, while margins improved on the back of a healthier business mix and favourable yield curve movements.

It noted that new business margins rose to around 21%, aided by a better product mix and yield gains, with the GST impact largely offset through tight cost discipline.

On the strategic front, management indicated that the process for the government’s stake sale is likely to commence soon. Bernstein also expects greater clarity on LIC’s dividend policy following the transition to IFRS accounting standards, a key monitorable for investors.

(Disclaimer: The recommendations, suggestions, views, and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Toyota CEO Sato to step down, to be replaced by CFO Kon

Toyota CEO Sato to step down, to be replaced by CFO Kon

Business

StepStone Group Inc. (STEP) Q3 2026 Earnings Call Transcript

Operator

Good day, and thank you for standing by. Welcome to the Q3 2026 StepStone Group Inc. Earnings Conference Call. [Operator Instructions] Please be advised that today’s conference is being recorded.

I would now like to hand the conference over to your first speaker today, Seth Weiss, Head of Investor Relations. Please go ahead.

Seth Weiss

Managing Director of Corporate Investor Relations

Thank you. Joining me on today’s call are Scott Hart, Chief Executive Officer; Jason Ment, President and Co-Chief Operating Officer; Mike McCabe, Head of Strategy; and David Park, Chief Financial Officer.

During our prepared remarks, we will be referring to a presentation, which is available on our Investor Relations website at shareholders.stepstonegroup.com.

Before we begin, I’d like to remind everyone that this conference call as well as the presentation contains certain forward-looking statements regarding the company’s expected operating and financial performance for future periods.

Forward-looking statements reflect management’s current plans, estimates and expectations and are inherently uncertain and are subject to various risks, uncertainties and assumptions. Actual results for future periods may differ materially from those expressed or implied by these forward-looking statements due to changes in circumstances or a number of risks or other factors that are described in the Risk Factors

Business

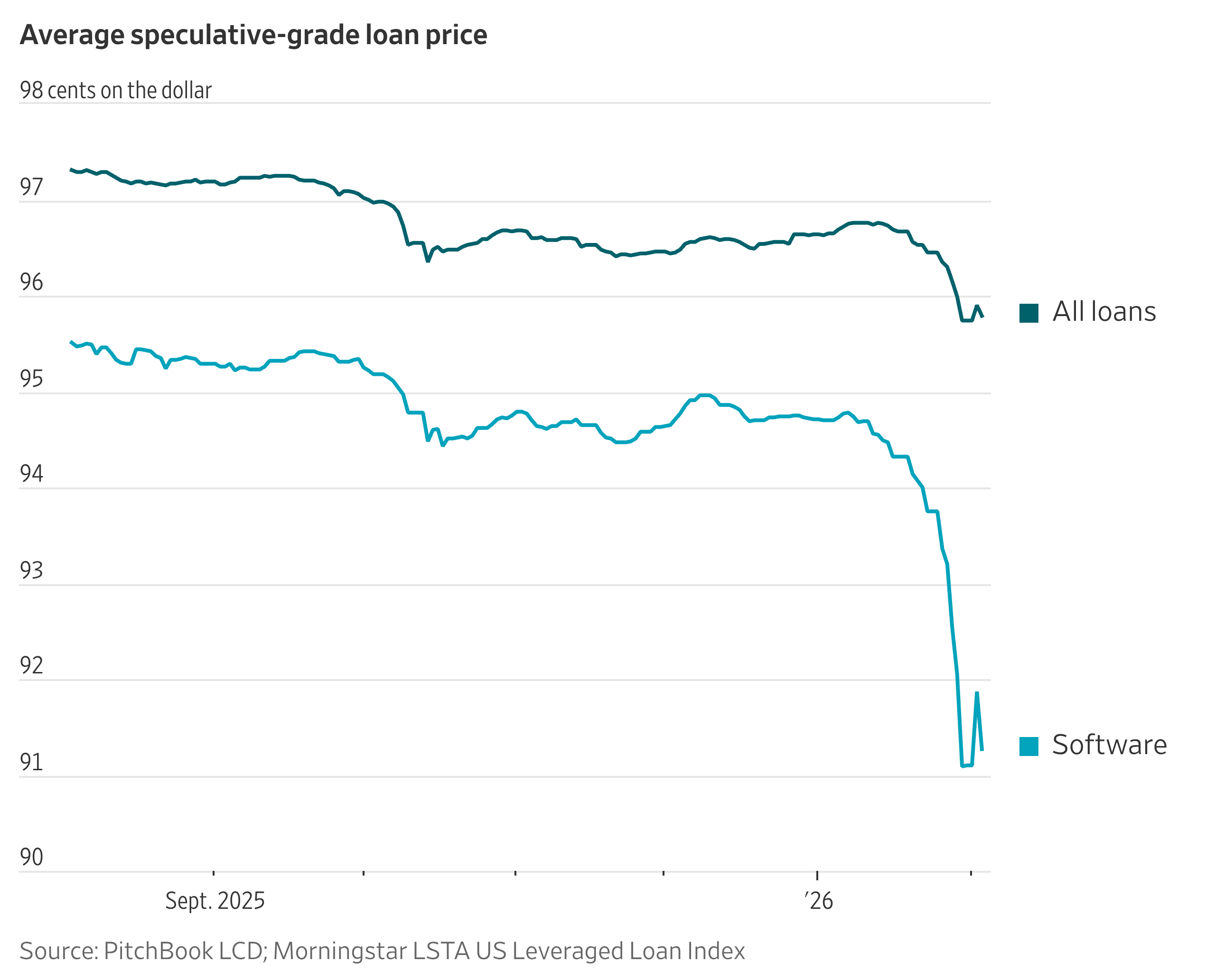

Software Selloff Extends to Loan Market

As of Tuesday, the average price of software company loans was 91.27 cents on the dollar, down from 94.71 cents at the end of last year.

At the end of January, the extra yield, or spread, that investors demand to hold software loans over a benchmark short-term interest rate had jumped to 5.95 percentage points from 4.78 percentage points at the end of December.

Some $25 billion of software loans were trading at distressed levels–below 80 cents on the dollar–at the end of January, up from $11 billion a month earlier. That accounted for nearly a third of all distressed loans.

Business

SiTime Corporation 2025 Q4 – Results – Earnings Call Presentation (NASDAQ:SITM) 2026-02-05

Q4: 2026-02-04 Earnings Summary

EPS of $1.53 beats by $0.32

| Revenue of $113.28M (66.32% Y/Y) beats by $11.38M

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Five Key Challenges for China’s Green Economy in 2026

China’s five-year plan targets carbon peaking by 2030 and neutrality by 2060, but coal dominates energy. Challenges include inefficient renewable energy distribution and costly grid upgrades amid ongoing economic difficulties.

Key Points

- China’s upcoming five-year plan (2026-2030) strives for carbon peaking by 2030 and carbon neutrality by 2060, despite coal constituting over 51% of its energy supply.

- The nation faces significant challenges in renewable energy distribution and costly upgrades to its inefficient grid, which often leads to curtailing excess energy production.

- Investment in energy transport and storage is crucial, as the State Grid Corporation plans to allocate 650 billion yuan to modernize the power network.

China’s ambitious new five-year plan, which spans from 2026 to 2030, aims for significant climate targets: carbon peaking by 2030 and achieving carbon neutrality by 2060. Despite these goals, coal continues to play a dominant role in China’s energy landscape, supplying around 51% of the nation’s electricity as of mid-2025. This reliance on coal presents a persistent challenge for China as it attempts to transition toward a greener economy.

One considerable obstacle in this green transition lies in the inefficiencies of renewable energy distribution. For instance, in regions like Tibet, Xinjiang, and Qinghai, an abundance of solar and wind energy is generated on optimal days. However, the country’s power grid struggles to manage this load effectively. When renewable energy generation surges and threatens to overload the system, grid operators are forced to curtail output, leading to significant amounts of clean energy being wasted. This produced energy often fails to reach key economic centers in eastern China, where demand is significantly higher.

Addressing these distribution challenges requires substantial investments in infrastructure for energy transport and storage. The State Grid Corporation of China plans to allocate approximately 650 billion yuan (about £69 billion) by 2025 to upgrade the nation’s power network, with prospects for future investments thereafter. However, sustaining such capital-intensive projects poses a dilemma, especially as China’s broader economy grapples with the enduring repercussions of the 2021 property crisis.

As China solidifies its commitment to greening its economy, it faces a complex interplay of technological, economic, and infrastructural challenges. Successfully navigating these hurdles will be crucial for the fulfillment of its climate promises and for achieving a sustainable energy paradigm. The dual focus on short-term energy needs and long-term environmental goals exemplifies the difficulty of balancing economic resilience with climate responsibility.

Read the original article : China’s five green economy challenges in 2026

Other People are Reading

Business

India central bank holds policy rate, as expected

India central bank holds policy rate, as expected

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business12 hours ago

Business12 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat18 hours ago

NewsBeat18 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World12 hours ago

Crypto World12 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”