Crypto World

Ethereum price hits key support as funding rate falls

Ethereum price continued its strong downward trend this week, reaching its lowest level since May last year.

Summary

- Ethereum price dropped to a crucial support level as the crypto market crash accelerated.

- Its liquidations jumped to the highest level in months.

- Ethereum’s weighted funding rate dropped to its October lows.

Ethereum (ETH) token dropped to a low of $1,768, down by 60% from its all-time high. This retreat coincided with the broader crypto market crash as retail and some institutional investors dumped the coin.

Data compiled by SoSoValue shows that American investors have sold Ethereum ETFs worth $149 million this year. January is the fourth consecutive month that these funds have shed assets.

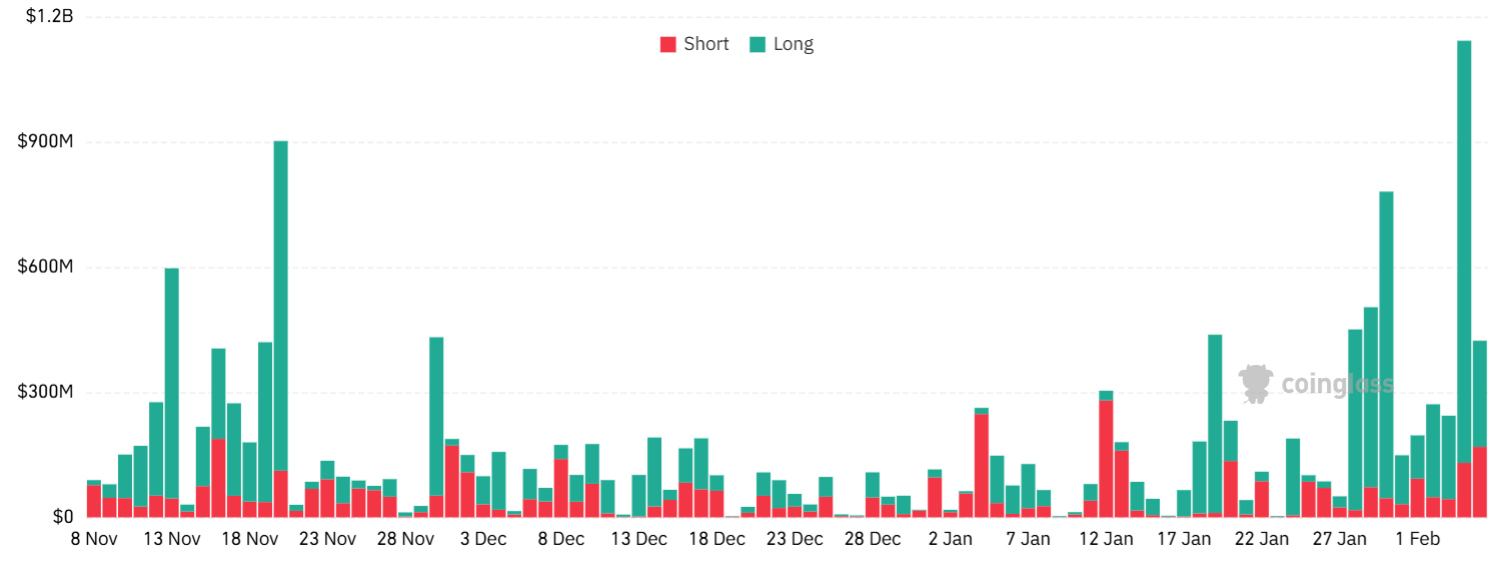

Additional data show that Ethereum bulls were heavily liquidated as the crash continued. Ethereum positions worth nearly $2 billion were liquidated since January 31, the highest figure since Oct. 10 when positions worth over $3.8 billion were wiped out.

Most importantly, the weighted funding rate turned negative and fell to its lowest level since Oct. 10. A negative funding rate indicates that investors anticipate the coin will decline. It happens when shorts are paying long positions in the perpetual futures market.

On the positive side, Ethereum’s network is doing well, with Nansen data showing a surge in transactions, fees, and active addresses. Ethereum handled 70 million transactions in the last 30 days, while the number of active addresses rose by 42% to over 15 million.

It also holds a leading market share across sectors in the crypto industry, including stablecoins, decentralized finance, and real-world asset tokenization. These fundamentals may help fuel its long-term recovery.

Ethereum price technical analysis

The weekly chart shows that ETH price has pulled back in the past few months. It has dropped from a record high of $4,950 to a low of $1,7686 today. Its lowest point was notable because it coincided with the ascending trendline connecting the lowest levels in June 2022 and April last year.

The price was also important because it was near the left shoulder of the inverted head-and-shoulders pattern. This pattern is one of the most common bullish reversal signs in technical analysis.

Therefore, a weekly close above $2,130 will point to a reversal, potentially to $3,000. On the other hand, a close below the support at $1,768 will invalidate the bullish outlook.

Crypto World

New ChatGPT Predicts the Price of XRP, Ethereum and Pi Coin By the End of 2026

ChatGPT draws on large-scale datasets and market patterns to generate forward-looking crypto analysis, and when prompted with a well-defined framework, the AI predicts head-turning 2026 price outlooks for XRP, Ethereum, and Pi Network.

According to ChatGPT’s assessment, a prolonged crypto bull market paired with more transparent and supportive regulation in the United States could accelerate price discovery for major digital assets, pushing them to new record highs sooner than many investors expect.

Below is ChatGPT’s projected trajectory for the three leading altcoins over the next eleven months.

XRP ($XRP): ChatGPT Predicts a Potential Move Toward $8 by 2027

Ripple’s XRP ($XRP) currently changing hands near $1.36, but ChatGPT forecasts that broader XRP adoption and supportive legislation could drive XRP to $8 by the end of 2026, implying gains of nearly 500% from current prices.

Last July, it notched its first new all-time high (ATH) in seven years, surging to $3.65 after Ripple achieved a decisive courtroom victory against the U.S. Securities and Exchange Commission.

That ruling lifted a major regulatory overhang and helped ease broader market fears that the SEC planned to treat altcoins as unregistered securities.

From a technical perspective, XRP’s Relative Strength Index (RSI) is hovering near 27, placing it firmly in oversold territory. The fact that it’s uptrending again suggests that selling pressure may be losing steam, setting the stage for investors to buy back in over the weekend at a relative discount.

As XRP’s price gradually realigns with its 30-day moving average, positive industry or macro developments could spark a sudden surge in the weeks or months ahead.

When combined with anticipated ETF inflows from the newly launched US spot XRP ETFs and anticipation for the U.S. CLARITY bill, a proposed comprehensive crypto regulatory framework, ChatGPT’s ambitious price target appears increasingly plausible.

Ethereum ($ETH): ChatGPT Anticipates a 5x Opportunity for Current Holders

Ethereum ($ETH), the dominant blockchain for smart contracts, decentralized applications, and decentralized finance, remains the backbone of much of the Web3 ecosystem.

With a market capitalization of roughly $233 billion and more than $59 billion in total value locked (TVL) across DeFi protocols, Ethereum continues to serve as the main hub of on-chain commercial activity.

Its long-standing security track record, reliable settlement layer, and early leadership in stablecoins and real-world asset tokenization position Ethereum well for expanding institutional participation.

Momentum could intensify if U.S. lawmakers pass the CLARITY bill, offering the regulatory clarity institutions need to deploy capital through Ethereum-based infrastructure, either through stablecoins, crypto, or real world asset tokenization.

ETH is currently trading just below $2,000, with significant resistance expected near the $5,000 mark after peaking at an all-time high of $4,946.05 last August.

If ChatGPT’s bullish outlook plays out, a decisive breakout above $5,000 could open the door to multiple new highs in 2026, with upside potential going as high as $10,000 during a full-scale 2026 bull run.

Pi Network (PI): ChatGPT Sees a 2,700% Rally This Year

Pi Network ($PI) is best known for its mobile mining model that rewards daily user participation. Simply open the app and tap when prompted to earn crypto.

According to ChatGPT’s analysis, a strong bullish phase could lift Pi Network from its current price of $0.1445 to as high as $5, representing potential gains of more than 2,668%.

The token recently outperformed several large-cap cryptocurrencies following Pi Network’s announcement of a partnership with AI firm OpenMind. The collaboration highlights how Pi node operators can provide decentralized computing resources to external organizations, reinforcing a tangible real-world use case.

Additional momentum stems from recent testnet upgrades, including decentralized exchange functionality, automated market makers, enhanced liquidity systems, and a revamped KYC framework, all of which significantly broaden the platform’s scope.

Maxi Doge (MAXI): A New Meme Coin Challenger Enters the Spotlight

Although not part of ChatGPT’s primary forecasts, Maxi Doge ($MAXI) has rapidly become one of the most talked-about meme coin presales of 2026, raising approximately $4.6 million ahead of its public launch.

The project revolves around Maxi Doge, a high-octane gym bro parody (and distant cousin) of Dogecoin/ According to its tongue-in-cheek lore, Maxi Doge spent the last decade watching Dogecoin from the sidelines, while pumping weights and shitcoins, now he’s stepping into the limelight to take control of the meme coin scene.

Bold, chaotic, and deliberately over-the-top, Maxi Doge relishes in the degen energy that originally catapulted meme coins into a global phenomenon.

MAXI is an ERC-20 token operating on Ethereum’s proof-of-stake network, giving it a substantially smaller environmental footprint compared with Dogecoin’s proof-of-work design.

During the presale, participants can stake MAXI tokens for yields of up to 68% APY, with rewards gradually declining as the staking pool grows.

The token is currently priced at $0.0002802 in the latest presale phase, with automatic price increases triggered at each funding milestone. Purchases are available via MetaMask and Best Wallet.

Dogecoin may be the progenitor, but Maxi Doge is the new alpha in Memesville!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post New ChatGPT Predicts the Price of XRP, Ethereum and Pi Coin By the End of 2026 appeared first on Cryptonews.

Crypto World

Ai.Com, Founded by Kris Marszalek, Announces Upcoming AI Agents

Proponents of AI agents say the new technology will simplify crypto trading and other financial activities for the average user.

AI platform ai.com, founded by Crypto.com co-founder and CEO Kris Marszalek, announced on Friday that it will be launching an autonomous AI agent for retail consumers.

The agentic AI will be able to execute functions including trading stocks, workflow automation and simple tasks like calendar updates and managing changes to online social profiles, according to an announcement from the company.

The agents will feature segregated user data, secured by encryption keys unique to each user, and run according to user-set restrictions on what the agent is allowed to do, the announcement said.

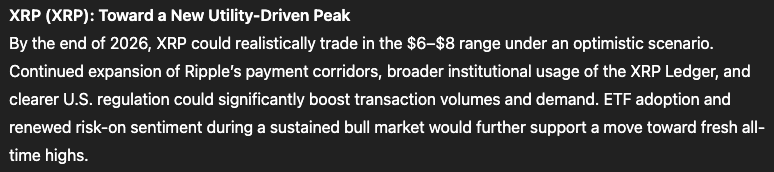

AI agents have garnered significant attention from users over the last year. About one quarter (23%) of respondents surveyed by investment research firm McKinsey indicated that their organizations were expanding the use of AI agents, according to a November report from the company.

The growth of autonomous AI agents can automate crypto trading strategies and wallet management, removing the technical barrier-to-entry for new users unfamiliar with blockchain systems and onchain transaction execution, proponents of the technology say.

Related: Crypto dev launches website for agentic AI to ‘rent a human’

How agentic AI can remove the barrier to entry for cryptocurrencies and Web3

These technical barriers include choosing the correct blockchain network and token protocols to send funds to, and complex user interfaces that are harder to navigate for new users, according to Jonathan Farnell, CEO of crypto exchange Freedx.

Agentic AI can abstract away the technical complexity of cryptocurrencies by selecting the cheapest and fastest execution pathways and simplifying stablecoin usage, according to Tether co-founder Reeve Collins.

This can include optimization for arbitrage or yield-bearing opportunities, Collins told Cointelegraph.

“When AI is integrated, all of the complexity in this space will be gone,” Collins said, adding that autonomous AI agents will allow users to hold and navigate larger portfolios of increasingly diverse token standards.

Magazine: Why AI sucks at freelance work and real-life tasks: AI Eye

Crypto World

Michael Saylor’s Strategy’s (MSTR) big Q4 loss looks dramatic, but bitcoin would have to fall below $8K to trigger trouble

Wall Street analysts covering Strategy (MSTR) broadly agree on one point after the company’s fourth-quarter earnings on Thursday: the headline losses look dramatic, but they do not signal a liquidity crisis or forced bitcoin selling.

Strategy reported a $17.4 billion operating loss and a $12.6 billion net loss for the quarter, figures driven largely by non-cash mark-to-market accounting tied to bitcoin’s price decline. Both TD Cowen and Benchmark said the market reaction missed that context, sending shares down about 17% on a day when bitcoin and other risk assets were already under pressure.

Shares are higher by 21% on Friday as bitcoin climbs from yesterday’s low of $60,000 to back above $70,000.

The two analysts agree the core debate centers on solvency, not profitability. Strategy holds 713,502 bitcoin, worth nearly $50 billion at current prices, against about $8.2 billion in convertible debt. Benchmark analyst Mark Palmer said the company would only face true balance-sheet stress if bitcoin fell below $8,000 and stayed there for years. Management emphasized on the earnings call that none of its debt carries covenants or triggers tied to bitcoin’s price or its average purchase cost.

TD Cowen’s Lance Vitanza also focused on the durability of the capital structure. He argued that Strategy was built to amplify bitcoin’s volatility by design, with common equity trading at roughly 1.5 times bitcoin’s swings. That leverage cuts both ways. Vitanza said the company’s $2.25 billion cash reserve and staggered debt maturities mean there is no reasonable scenario where Strategy would be forced to sell bitcoin in the near term, even if prices remain depressed.

Where analysts differ is less about risk and more about framing. TD Cowen leaned into Strategy’s role as a “digital credit engine,” highlighting its growing preferred equity business and the liquidity of its STRC preferred stock, which pays an 11.25% annualized dividend. Benchmark placed more weight on bitcoin’s long-term price path and the optionality embedded in Strategy’s equity if bitcoin rallies.

Both firms remain constructive on the stock. Benchmark reiterated a Buy rating with a $705 price target, based on a sum-of-the-parts model that assumes bitcoin reaches $225,000 by the end of 2026. TD Cowen also maintained a Buy rating, arguing that Strategy remains one of the most efficient ways for investors to gain leveraged bitcoin exposure outside of ETFs, though it did not disclose a specific price target in its note.

Crypto World

Why normalization of digital asset treasuries is the next big business trend

For a brief moment, the digital asset treasury (DAT) was Wall Street’s bright, shiny object.

But in 2026, the novelty has worn off.

The star of the “passive accumulator” has dimmed, and rightly so. Investors have realized that simply announcing a bitcoin purchase is no longer a magic trick that guarantees stock appreciation. The easy money trade is over.

But this cooling-off period is not a death knell; it is a reckoning. It is stripping away the hype to reveal a stark reality: Dozens of public operating companies are attempting to transform themselves into unregulated hedge funds—often without the risk architecture of a fund or the governance standards of a public company.

The playbook was alarmingly simple: raise capital, accumulate cryptocurrency, and pray for appreciation.

But as a securities attorney and CEO who has overseen more than $5 billion in capital raises, including as the General Counsel to MARA Holdings during its run to a $6 billion valuation, I know that accumulation is not a sound business strategy. It’s a crapshoot. And as we approach annual reporting deadlines, the bill for those bets is coming due.

If the DAT sector is to mature from a speculative frenzy and gain credibility as a respected fintech strategy, we must stop treating governance as an afterthought. It must be the foundation.

The risk of the “blind buy”

The prevailing DAT model has been defined by a singular mandate: raise cash, buy assets, hold. While this works in a bull market, it exposes shareholders to catastrophic downside in a bear market or during times of volatility, as we’ve all seen recently.

Without a clear, articulated strategy for why a specific asset is being chosen or how liquidity will be managed, these companies are essentially gambling with shareholder value. Both retail and institutional investors are beginning to ask harder questions. They are no longer satisfied with“we believe in crypto.” They want to know: How are you balancing capital allocation? What are the specific risks of the protocol you are invested in, and what are you doing in terms of risk mitigation? If the current strategy stalls, do you have a plan B?

A fair number of periodic reports filed by DATs today appear to offer generic boilerplate risk factors. They tend to reiterate warnings about volatility and hacking, but fail to address the idiosyncratic risks of their specific treasury assets. This is where the new generation of DATs will need to distinguish themselves to survive and be competitive.

Using the annual report as a storytelling tool

As reporting deadlines loom, management and counsel at DATs need to revamp their filings. For instance, the Risk Factor section of a 10-K should not be a regurgitation of every risk factor that has appeared on EDGAR, the SEC’s primary digital database; it should be a thoughtful assessment of realistic short- and long-term risks, specifically addressing the issuer’s business at hand.

A mature DAT must move beyond the basics and explain the trade-offs transparently. Investors deserve to know why a dollar is going into AVAX (or BTC) versus R&D or marketing, and exactly how the company generates solid revenue streams outside of asset appreciation to keep the lights on during a crypto winter. Furthermore, companies must disclose the specific protection mechanisms and controls they have in place to prevent the treasury from becoming a single point of failure.

The “governance alpha”

The next wave of successful DATs will be defined by their governance architectures. This isn’t just about regulatory compliance; it is about shareholder trust and the fulfillment of fiduciary duty.

We recently navigated this at AVAX One. We recognized the insufficiency of simply announcing a pivot to a DAT model, which meant going to our shareholders—the true owners of the capital—and asking for explicit approval for our digital asset strategy.

The result was telling. Over 96% of voting shareholders approved the move. This was not just a vote for another crypto treasury. It was a vote mandating a governance strategy for crypto.

It gave us a license to operate that “blind buy” DATs simply do not have, and we intend to use that mandate to support fintech through utilizing the Avalanche ecosystem.

The regulatory shield

Finally, we cannot ignore the SEC and the broader regulatory landscape. While many in the industry view regulation as a hindrance, for a public DAT, it is a necessary and welcome shield.

SEC disclosure obligations force a level of transparency that protects shareholders from the worst excesses of the crypto market. It is a strong tool that enables public DATs to distinguish themselves from opaque private entities.

By embracing these obligations rather than doing the bare minimum to scrape by, we build a moat of credibility and provide verifiable behavior and safety assurance.

We are entering a new phase. The “wild west” days of treasury management are ending. The market will soon punish those who are merely collecting coins and reward those who are building durable, governed financial fortresses.

Your annual report is your final term paper, and market reaction is your report card. Make sure you’ve done your homework.

Crypto World

Crypto in crisis, DeFi doomerism

002

Welcome back to Inside DeFi

It’s been an especially painful week for crypto markets and DeFi. So bad, in fact, that even the FT was reduced to posting wojaks with the rest of us.

With bitcoin dipping below the previous cycle’s peak, and ether (ETH) sub-$2,000, it may feel like there’s not much further to fall. But remember, even when down 99%, there’s still another 99% to go.

The bloodbath has also seen DeFi’s TVL drop to under $100 billion for the first time since May last year. Reactions ranged from sober doomerism to gallows humor.

Charts aside, InsideDeFi 003 returns to catch up with the week’s goings on.

Security scares

The week was, despite the ugly backdrop, thankfully light on DeFi hacks, with just two significant incidents. A failed attempt at a third was spotted and publicly mocked on-chain.

On Friday, an “arbitrary call vulnerability” in one of Gyroscope’s cross-chain contracts allowed a hacker to grant themself “full allowance to the escrow’s GYD holdings.”

Around $700,000 was lost, a third of which Gyroscope later decided to offer to the exploiter as a bounty.

A larger attack then hit CrossCurve’s bridge on Sunday. BlockSec put the losses, estimated at $2.7 million, down to an “authorization bypass,” while a post-mortem report from MixBytes claimed $1.4 million.

Puzzle Network’s founder has claimed that $700,000 of his own funds were amongst the losses in an on-chain message.

In a series of subsequent messages, he continued to request the return of his funds, even offering to buy the exploiter a beer in exchange.

According to Spearbit researcher “sujith,” the same attack vector had been previously identified but the report was dismissed as “invalid.”

While not a smart contract hack, a significantly larger loss affected the so-called frontpage of Solana, Step Finance, on Friday.

Read more: 2025’s biggest crypto hacks: From exchange breaches to DeFi exploits

A later update confirmed that approximately $40 million worth of assets were drained from the project’s treasury after executives’ devices were compromised.

Almost $5 million was subsequently recovered.

MetaMask’s Taylor Monahan implied that the theft was tied to a spate of incidents linked to hijacked Telegram accounts which, she estimates, is responsible for a total of over $300 million of losses, so far.

In better news, The DAO’s Griff Green followed up last week’s announcement of a 75,000 ETH security fund with a whitehat operation on a decade-old The DAO contract, rescuing a further 50 ETH to be added to the pot.

Read more: The DAO hacked again, but this time it’s the good guys

L2s left behind?

Ethereum co-founder Vitalik Buterin made a lengthy post on Tuesday, arguing that “the original vision of L2s and their role in Ethereum no longer makes sense, and we need a new path.”

He pointed to drastic improvements in mainnet scaling (which are set to continue, 1,000-fold), along with the slow progress on L2 decentralization, as evidence that L2s must offer a specific “value add” to remain relevant.

He followed up, underlining that pursuing more “copypasta” EVM L2s and chains is a “dead end” and suggesting that networks offering something specific, such as “privacy, app-specific efficiency [or] ultra-low latency” should be the goal.

For all his confidence in Ethereum’s future, reportedly dumping $13 million on-chain definitely didn’t do ETH sentiment any favors.

Perhaps waiting to sell until after using a mixer would be preferable in future.

Elsewhere in L2 land, a few days before Vitalik’s comments, Base suffered its latest bout of disruption, with “intermittent transaction inclusion delays.”

An incident report clarifies that, over a period of two hours and 26 minutes, approximately 80% of transactions (2.1 million) were dropped.

The network’s status page registers an outage of 11 minutes on January 31.

Transaction inclusion delays were again showing on February 5, leading to a mempool upgrade. Delays are currently ongoing, with improvements including a “transaction propagation redesign” expected to take “four to six weeks.”

Read more: Coinbase Base network halts for 44 minutes due to ‘unsafe head delay’

AAVE whale in danger

Also on Thursday, all eyes turned to a highly leveraged whale, borrowing $28 million USDC against AAVE tokens.

As prices dropped, the position entered dicey territory, which would lead to further pain for AAVE holders if liquidated.

Against the backdrop of an ongoing debate over future control of the Aave brand, the assumption the position belonged to Aave founder Stani Kulechov was apparently too tempting for some to resist.

Parallels to the DeFi founder playbook of aggressively borrowing stables against their own project’s governance tokens, especially given this week’s news of Kulechov’s purchase of a £22 million London mansion, were hard to miss.

However, Kulechov roundly denied the position was him, insisting he stakes his AAVE rather than borrowing against it.

Read more: AAVE whale crashes token 10% amid ‘disgraceful’ governance vote

Most notably, Curve Finance’s Michael Egorov used this approach long term, whilst buying up a pair of luxury properties in Melbourne.

After striking a gentleman’s agreement in the wake of 2023’s Curve hack, Egorov managed to dodge disaster before ultimately being stung in a $20 million liquidation cascade in June 2024.

Rune Christensen of Sky (formerly Maker) also uses the same approach, which occasionally leads to its own governance dramas.

Kulechov though, with no need to worry about getting liquidated, instead celebrated the protocol’s resiliency at scale, after over $450 million was liquidated this week.

Cambodia scam compound crackdown ongoing

News out of Cambodia continues to outline the sheer scale of the nationwide crackdown on online “pig butchering” scam syndicates.

The widespread disruption has led to over 100,000 foreigners leaving the country since the beginning of the year, according to local media reports, citing the country’s Secretariat of Commission for Combating Technology Crimes.

Authorities claim to have shut down 190 locations, including 44 casinos, across the country and made over 2,500 arrests.

Additionally, almost 500 people, mostly Chinese and Philippine nationals, have reportedly been deported, though it’s unclear how many of these cases were related to the scamming industry.

As well as raids on compounds, the organizations involved have been hit with high profile arrests and executions of leaders in China.

The operations are now rumored to be on the move, with Sri Lanka being the next destination.

Crypto World

HYPE Price Hits $33.98 with $1.25B Volume Amid Strong Bullish Momentum

TLDR:

- HYPE price rises to $33.98 with a 5.69% gain in the last 24 hours, showing strong market activity.

- Weekly gains reach 13.52%, signaling increasing investor confidence and positive market momentum.

- $1.25B trading volume indicates high liquidity and sustained active participation from traders.

- Accumulation zones and chart structure support potential continued upward price movement.

The price of Hyperliquid (HYPE) is $33.98 today with a 24‑hour trading volume of $1,256,990,922. This represents a 5.69% increase in the last 24 hours and a 13.52% gain over the past week.

HYPE’s current trading dynamics underscore heightened trading activity and renewed interest in the asset’s trend trajectory.

Shorting Strength and Accumulation Setup

HYPE reached $50 after moving along the upper boundary of a rising channel. Momentum indicators clearly showed weakening strength, and repeated attempts to push higher were met with selling pressure.

This structure allowed traders to identify a short opportunity at $50. The short strategy targeted the $20 demand zone while ignoring intraday noise and social sentiment.

Price respected this zone precisely, resulting in a 60% decline. Spot trading without leverage ensured risk remained controlled, demonstrating disciplined execution instead of emotional reaction.

After the price drop, HYPE entered the $20–$15 accumulation zone. This region coincided with previous high-volume support levels and long-term structural lows.

Retail sentiment had incorrectly anticipated further declines to much lower levels, but the chart indicated selling pressure was nearly exhausted.

Price began consolidating and absorbing supply, confirming this as an optimal accumulation point. Buyers could establish positions without chasing price, allowing a stress-free entry.

This accumulation phase reinforced the importance of timing trades according to structure rather than market noise.

Shorting into strength and identifying the accumulation zone together formed a high-probability setup. Traders following trend channels and structural support avoided emotional trading and ensured disciplined entry points, laying the foundation for the next phase of the cycle.

Long Flip and Controlled Bullish Expansion

Once short profits were secured, the bias flipped long at $20. Traders maintained spot positions without leverage, reducing risk and avoiding unnecessary stress.

Price steadily advanced to $35–$38, achieving an 86% gain from the accumulation entry. February derivatives data showed OI-weighted funding rates largely positive, signaling sustained bullish participation.

Occasional red dips coincided with minor pullbacks, which were quickly absorbed as the price reclaimed higher levels. This pattern reflected a balanced and controlled market expansion.

Funding spikes near the $35–$38 zone remained contained. This indicated market participants were positioning for continuation rather than overleveraging.

Price respected structure while forming higher lows and reclaiming mid-channel ranges, creating a predictable environment for trend-following traders.

This phase highlights disciplined execution. Controlled entries based on accumulation, trend channels, and monitoring derivatives data ensure stress-free, sustainable gains.

Traders following this structured approach benefited from predictable price action while minimizing risk.

Crypto World

A $5,000 investment in Remittix could turn into $25,000 this month

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix gains attention with live utility and 300% bonus, attracting selective investors amid market turbulence.

Summary

- Remittix leads the crypto rotation with live PayFi utility, a 300% bonus, and $28.9m raised in private funding.

- Built on Ethereum, Remittix targets $19 trillion cross-border payments, enabling real-time crypto-to-fiat transfers globally.

- Investor confidence rises as Remittix completes CertiK audit, ranks top on Skynet, and secures BitMart and LBank listings.

This week in Crypto has been characterized by heavy selling on centralized exchanges as Bitcoin dropped to new lows in 2026 following the violation of key support levels. Risk appetite has calmed down a lot, and fund managers of top institutions are also rebalancing their portfolios as macroeconomic challenges continue to hit many digital assets.

The majority of altcoins have followed the same free-fall Bitcoin has shown, and with correction taking place, capital flows now paint a more stratified image. An increasing number of investors are choosing to place selective investments in projects that show real progress, solid schedules, and strong asymmetric potential.

One name now dominating that rotation is Remittix, a PayFi-focused Ethereum protocol that is rapidly gaining attention thanks to a rare combination of live utility and a time-limited 300% bonus window that analysts say materially changes the short-term risk-reward profile.

Remittix’s PayFi model is built for real adoption, not market cycles

Remittix is positioning itself squarely at the intersection of crypto and real-world finance. Built on Ethereum, the protocol is here to bridge the inefficiencies that businesses and individuals encounter when trying to send money internationally.

The top Defi project is on course to become one of the biggest players in the $19 trillion global cross-border payments market, enabling direct crypto-to-fiat transfers with real-time settlement to bank accounts in 30+ countries, providing real-time utility to businesses, merchants, and individual clients. This execution-only strategy is among the reasons why investor interest has been so strong despite the broader markets retreating.

Strong backing has also helped boost confidence. According to recent reports, Remittix has already raised over $28.9 million in private capital, which reflects continued involvement of institutional and high-net-worth investors.

On the exchange front, listings on BitMart and LBank are already confirmed, with additional centralized exchange discussions reportedly ongoing. From a security standpoint, the project has completed a full CertiK audit and currently holds a leading pre-launch ranking on CertiK Skynet, adding an independent layer of credibility at a time when trust matters.

Remittix latest bonus incentive fuels aggressive capital influx

While infrastructure and adoption underpin the long-term thesis, near-term momentum around Remittix is being driven by its active deposit incentive tied to the native RTX token. According to official project updates, participants can receive up to a 300% bonus on qualifying deposits, one of the most aggressive incentive structures currently available in the market.

This dynamic is why some analysts suggest scenarios where relatively modest capital allocations can be meaningfully amplified during the campaign window. With the bonus applied, a $5,000 deposit can translate into substantially higher effective token exposure, creating a setup that many market commentators have described as unusually favorable under current conditions.

Additional factors reinforcing momentum include:

- Confirmed listings on BitMart and LBank

- Live crypto-to-fiat settlement across 30+ countries

- A growing and active global holder community

- A functional Remittix wallet is already live

- A clear roadmap centered on measurable PayFi adoption

February 9, 2026 PayFi launch anchors the long-term thesis

Beyond the bonus-driven surge, Remittix has confirmed that its full PayFi platform will officially go live on February 9, 2026. That milestone provides a concrete timeline, something increasingly valued as markets mature and speculative narratives lose favor.

As volatility reshapes capital allocation strategies, investors are becoming more selective. Projects with audited security, working products, exchange access, and real-world relevance are increasingly separated from the noise. With its PayFi infrastructure already live and a limited-time bonus amplifying early exposure, Remittix is being framed less as a short-term trade and more as a calculated positioning play ahead of broader adoption.

For more information, visit the official website, and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

XRP price risks drop to 50 cents, single-print candle theory holds

XRP price remains vulnerable to further downside as unresolved single-print imbalances continue to exert technical pressure toward the $0.50 support zone.

Summary

- Value area low has been lost, confirming bearish continuation

- Single-print imbalance remains unfilled, acting as a downside magnet

- $0.50 is critical support, where a potential macro pivot may form

XRP (XRP) price action has turned decisively bearish following an impulsive move to the downside, with structural weakness continuing to dominate the chart. After losing key value levels, the market has failed to regain bullish control, despite short-lived buying reactions.

From a long-term perspective, XRP appears to be trading within a broader corrective phase, with unfinished price structures remaining exposed below current levels.

One of the most notable technical features influencing the current outlook is the presence of a single-print candle imbalance. This structure, which often acts as a magnet for price, suggests that XRP may need to trade lower to complete unfinished auction activity before any meaningful macro pivot can occur.

XRP price key technical points

- Value area low has been lost, confirming bearish continuation

- Single-print imbalance remains partially unfilled, creating downside magnet

- $0.50 marks the base of the single-print structure, a critical high-timeframe level

XRP’s decline accelerated after the price failed to hold above the value area low, a key indication that buyers were unable to maintain acceptance at higher prices. Once this level was lost, the price fell aggressively, producing a bearish impulse that established a new swing low around $1.11.

Although price has since printed a buying tail, suggesting short-term demand, this reaction has not altered the broader market structure. Lower highs and weak follow-through continue to define price behavior, indicating that any upside moves remain corrective rather than trend-changing. As long as XRP remains below reclaimed value, downside risk stays elevated.

Understanding the single-print candle imbalance

Single-print candles occur when price moves rapidly through a zone without sufficient two-way trade, leaving behind an area of inefficiency. From a market profile and auction theory perspective, these zones are often revisited as price seeks to rebalance and complete unfinished business.

In XRP’s case, a high-timeframe single-print structure has been exposed, with only part of the imbalance filled during the recent decline. The upper portion of the single prints has already been retraced, but the base of the structure remains open. This unfinished area is located near the $0.50 level, creating a strong technical incentive for price to rotate lower.

Historically, markets show a high probability of revisiting these imbalances, particularly when broader structure aligns with bearish momentum, as is currently the case with XRP.

$0.50 emerges as a critical support zone

The $0.50 region is not only the base of the single-print candle but also aligns with a high-timeframe support zone. This convergence increases the importance of this level and makes it a key decision point for the market.

A move toward $0.50 would likely represent a continuation of the current corrective phase rather than a breakdown into uncharted territory. Such moves are often necessary to flush remaining weak hands and reset positioning before a potential macro pivot can form.

However, reaching support does not automatically imply a reversal. The reaction quality at $0.50, including volume expansion, rejection wicks, and structural behavior, will ultimately determine whether XRP can form a durable bottom or continue consolidating at lower levels.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, XRP remains biased toward further downside until the exposed single-print imbalance is fully resolved. The $0.50 level stands out as the most likely target for this rebalancing process and a zone where the market may attempt to establish a macro pivot.

If price reaches this level and shows strong acceptance and demand, it could mark the beginning of a broader base-building phase. Conversely, a weak reaction or continued acceptance below support would suggest prolonged consolidation before any sustained recovery.

For now, XRP remains structurally weak despite a short-term balance, with incomplete auction dynamics favoring a continuation of the lower trend. Traders should closely monitor how price behaves as it approaches the $0.50 region, as this area is likely to define the next major phase of XRP’s market cycle.

Crypto World

Bitcoin Reclaims $71K, But How Long Will It Hold?

Key takeaways:

-

Bitcoin’s derivatives signal caution, with the options skew hitting 20% as traders fear another wave of fund liquidations.

-

Bitcoin price recovered some of its Thursday losses, but it still struggles to match the gains of gold or tech stocks amid low leverage demand.

Bitcoin (BTC) has gained 17% since the $60,150 low on Friday, but derivatives metrics suggest caution as demand for upside price exposure near $70,000 remains constrained. Traders fear that the liquidations of $1.8 billion of leveraged bullish futures contracts in five days indicate that major hedge funds or market makers may have blown up.

Unlike the Oct. 10, 2025, market collapse that culminated with a record $4.65 billion liquidation of Bitcoin futures, the recent price weakness has been marked by three consecutive weeks of downside pressure. Bulls have been adding positions between $70,000 and $90,000, as aggregate futures open interest increased despite forceful contract liquidations due to insufficient margins.

The aggregated Bitcoin futures open interest on major exchanges totaled 527,850 BTC on Friday, virtually flat from the prior week. Although the notional value of those contracts dropped to $35.8 billion from $44.3 billion, the 20% change perfectly reflects the 21% Bitcoin price decline in the seven-day period. Data indicates that bulls have been adding positions despite the steady price decline.

To better understand if whales and market makers have turned bullish, one should assess the BTC futures basis rate, which measures the price difference relative to regular spot contracts. Under neutral circumstances, the premium should range between 5% and 10% annualized to compensate for the longer settlement period.

The BTC futures basis rate dropped to 2% on Friday, the lowest level in more than a year. The lack of demand for bullish leverage is somewhat expected, but bulls will take longer than users to regain confidence even as Bitcoin price breaks above $70,000, especially considering that BTC is still 44% below its all-time high.

Bitcoin derivatives metrics signal extreme fear

Traders’ lack of conviction in Bitcoin is also evident in the BTC options markets. Excessive demand for put (sell) options is a strong indicator of bearishness, pushing the skew metric above 6%. Conversely, when fear of missing out kicks in, traders will pay a premium for call (buy) options, causing the skew metric to flip negative.

The BTC options skew metric reached 20% on Friday, a level that rarely persists and typically represents market panic. For comparison, the skew indicator stood at 11% on Nov. 21, 2025, following a 28% price correction to $80,620 from the $111,177 peak reached twenty days earlier. Since there is no specific catalyst for the current downturn, fear and uncertainty have naturally intensified.

Related: What’s really weighing on Bitcoin? Samson Mow breaks it down

Traders are likely to continue speculating that a major market maker, exchange, or hedge fund may have gone bankrupt, and this sentiment erodes conviction and implies a high probability of further price downside. Consequently, the odds of sustained bullish momentum remain low while BTC derivatives metrics continue to signal extreme fear.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Sell-Off Hits Treasuries, ETFs and Mining Infrastructure

Crypto’s latest sell-off isn’t just a price story. It’s showing up on balance sheets, inside spot exchange-traded funds (ETFs) and even in how infrastructure gets used when markets turn.

This week, Ether’s (ETH) slide is leaving treasury-heavy companies nursing massive paper losses, while Bitcoin (BTC) ETFs are giving a new wave of investors their first real taste of downside volatility.

At the same time, extreme weather is reminding miners that hash rate still depends on power grids, and a former crypto miner-turned-AI darling shows how yesterday’s mining infrastructure has quietly become today’s AI backbone.

This week’s Crypto Biz newsletter breaks down BitMine Immersion Technologies’ widening paper losses, BlackRock Bitcoin ETF investors slipping underwater and the impact of a US winter storm on public miner production.

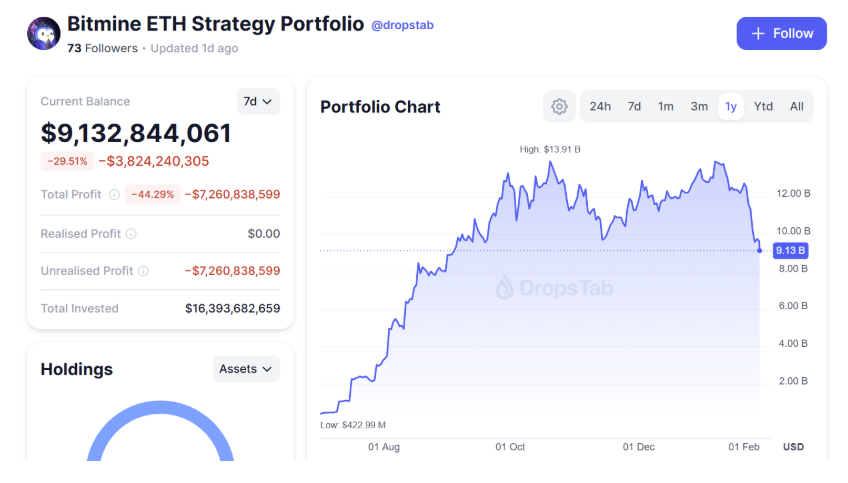

BitMine’s ETH paper losses widen

BitMine Immersion Technologies, chaired by Tom Lee, is facing mounting paper losses on its Ether-heavy treasury as ETH slid below $2,200 during the latest crypto sell-off.

The decline has pushed the company’s unrealized losses past $7 billion, underscoring the risks tied to balance sheets built around volatile digital assets.

BitMine currently holds about $9.1 billion worth of Ether, including a recent purchase of 40,302 ETH, leaving the company highly exposed to further price swings.

While the losses remain unrealized unless assets are sold, they highlight the fragility of crypto treasury strategies when markets turn lower. Lee has pushed back on the criticism, arguing that unrealized losses are inherent to ETH-holding companies. “BitMine is designed to track the price of ETH,” he said, adding that in a downturn, ETH weakness is to be expected.

BlackRock Bitcoin ETF holders slip underwater

As Bitcoin crashed below $80,000, aggregate returns for investors in BlackRock’s iShares Bitcoin Trust (IBIT) turned negative, highlighting the depth of the recent selloff and its impact on investor portfolios.

According to Unlimited Funds chief investment officer Bob Elliott, the average dollar invested in IBIT is now underwater. Bitcoin has since extended its decline below $75,000, adding further pressure to returns.

IBIT was one of BlackRock’s most successful ETF launches, becoming the asset manager’s fastest fund to reach $70 billion in assets. Those investors are now getting a firsthand lesson in Bitcoin’s volatility, especially when price action moves decisively to the downside.

US winter storm slams Bitcoin production

A powerful winter storm sweeping across the US in late January forced Bitcoin miners to sharply curtail production, underscoring how sensitive mining remains to energy grid stress during extreme weather.

New data from CryptoQuant shows daily output from public miners averaged about 70 to 90 BTC before the storm, then plunged to just 30 to 40 BTC at the height of the disruption. The drop was abrupt, reflecting widespread shutdowns as miners reduced load or went offline to avoid strain on local power grids.

The slowdown proved temporary. As weather conditions improved, production began to recover, highlighting the flexibility miners retain but also the volatility introduced by grid-dependent operations.

The CryptoQuant data tracks publicly listed miners, including CleanSpark, MARA Holdings, Bitfarms and Iris Energy, offering a snapshot of how large-scale US mining operations respond when power becomes scarce.

CoreWeave shows how crypto infrastructure became AI’s data center backbone

CoreWeave’s evolution from crypto miner to AI infrastructure provider offers a clear example of how mining-era hardware is being repurposed for the AI boom, highlighting how computing resources migrate across technology cycles.

According to The Miner Mag, Ethereum’s shift from proof-of-work to proof-of-stake sharply reduced demand for GPU-based mining, pushing CoreWeave and similar operators to pivot toward AI and high-performance computing.

While CoreWeave no longer operates as a crypto company, its transition has become a blueprint for other miners exploring diversification, including HIVE Digital, Hut 8 and MARA Holdings.

CoreWeave’s pivot gained new prominence after Nvidia agreed to a $2 billion equity investment in the company, reinforcing the idea that infrastructure built for crypto mining is now forming a critical layer of AI’s data center backbone.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech2 hours ago

Tech2 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports12 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat8 hours ago

NewsBeat8 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined