Crypto World

Previewing policy at Consensus Hong Kong 2026: State of Crypto

CoinDesk is hosting its second annual Consensus Hong Kong conference, and as always, we’ll have a number of policy-focused sessions. Are you in town? Find me on stage or around the show floor and say hi!

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The narrative

CoinDesk’s annual Consensus Hong Kong conference will kick off this Wednesday with a speech from Hong Kong Chief Executive John KC Lee.

Why it matters

Hong Kong is playing an interesting role in the intersection of financial services between the global East and West. CoinDesk will be exploring that role at Consensus,

Breaking it down

We’ll be hearing from Financial Secretary Paul Chan and Securities and Futures Commission Chief Executive Julia Leung on day one of Consensus, and having conversations around the growth of real-world asset tokenization, stablecoins and evolving payment systems and how exchange-traded funds (ETFs).

Our speakers will include regulators and politicians from around the world, with panels looking at how both regulators and industry participants alike approach the sector — a conversation we’ve had every year at Consensus, but one that continues to evolve.

Privacy, artificial intelligence, decentralized finance and trading behaviors will also take one of the many stages throughout the conference.

It’ll be part of a busy week ahead: SEC Chair Paul Atkins will be testifying before the House Financial Services and Senate Banking Committees. Though the hearings are focused on SEC oversight generally, expect crypto and Atkins’ efforts to develop rulemakings around the sector to come up.

The White House is also convening yet another meeting between crypto and banking industry representatives. Not a lot of detail is available yet.

Tuesday

- The White House is convening a second meeting between representatives of the crypto and banking industries to discuss stablecoin yield concerns.

Wednesday

- 01:30 UTC (9:30 a.m. HKT) Day 1 of Consensus Hong Kong kicks off.

- 15:00 UTC (10:00 a.m. ET) The House Financial Services Committee is holding an oversight hearing with Securities and Exchange Commission Chair Paul Atkins.

Thursday

- 02:00 UTC (10:00 a.m. HKT) Day 2 of Consensus Hong Kong kicks off.

- 15:00 UTC (10:00 a.m. ET) The Senate Banking Committee is holding an oversight hearing with Securities and Exchange Commission Chair Paul Atkins.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

Crypto World

Quantum Computers Need Millions More Qubits to Break Bitcoin, CoinShares Reports

TLDR:

- Breaking Bitcoin encryption requires quantum computers 100,000 times more powerful than today’s technology

- Only 10,200 BTC in legacy addresses could cause market disruption if suddenly compromised by quantum attack

- Cryptographically relevant quantum computers unlikely to emerge before 2030s, according to CoinShares analysis

- Bitcoin can adopt post-quantum signatures through soft forks while maintaining defensive adaptability

Quantum computing poses no immediate threat to Bitcoin’s security infrastructure, according to digital asset manager CoinShares.

The firm’s latest analysis dismisses concerns about near-term vulnerabilities in the cryptocurrency’s cryptographic foundation.

Current quantum technology remains decades away from breaking Bitcoin’s encryption protocols. CoinShares estimates only 1.7 million BTC faces potential exposure, representing 8% of total supply.

The research suggests institutional investors should view quantum risks as manageable engineering considerations rather than existential crises.

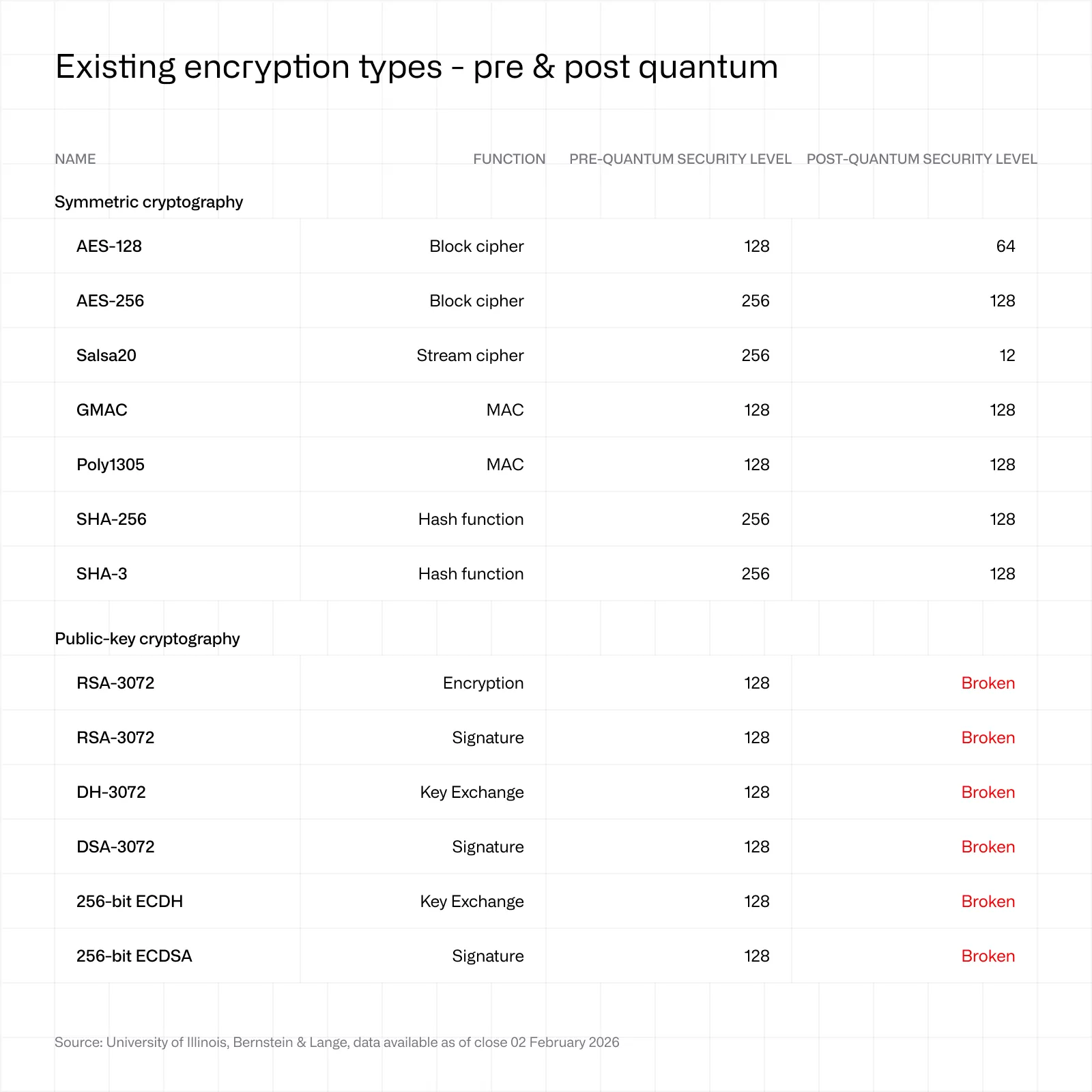

Technology Requires Decades Before Becoming Cryptographically Relevant

CoinShares’ analysis reveals breaking Bitcoin’s secp256k1 encryption demands quantum systems with millions of logical qubits.

Current quantum computers operate at approximately 105 qubits, falling dramatically short of required thresholds.

Source: CoinShares

Researchers estimate attackers would need machines 100,000 times more powerful than today’s largest quantum systems.

Reversing a public key within one day requires 13 million physical qubits and fault tolerance levels not yet achieved.

Breaking encryption within one hour would demand quantum computers 3 million times more advanced than current capabilities.

Each additional qubit makes maintaining system coherence exponentially more difficult, according to technical experts.

Cybersecurity firm Ledger’s Chief Technology Officer Charles Guillemet provided expert perspective on the technical challenges facing quantum development.

Speaking to CoinShares, Guillemet emphasized the massive scale required for cryptographic attacks. “To break current asymmetric cryptography, one would need something in the order of millions of qubits. Willow, Google’s current computer, is 105 qubits. And as soon as you add one more qubit, it becomes exponentially more difficult to maintain the coherence system,” Guillemet confirmed.

CoinShares projects cryptographically relevant quantum computers may not emerge until the 2030s or beyond. Long-term attacks on vulnerable addresses could take years to complete even after technology matures.

Short-term mempool attacks would require computations finishing in under 10 minutes, remaining infeasible for decades ahead.

Limited Vulnerability Concentrates in Legacy Address Formats

The digital asset manager’s research identifies exposure primarily in legacy Pay-to-Public-Key addresses holding roughly 1.6 million BTC.

Modern address formats including Pay-to-Public-Key-Hash and Pay-to-Script-Hash conceal public keys behind cryptographic hashes. These contemporary formats maintain security until owners actively spend their funds.

CoinShares determined only 10,200 BTC sit in outputs potentially causing market disruption if compromised suddenly.

Source: CoinShares

The remaining vulnerable coins distribute across 32,607 individual outputs of approximately 50 BTC each. Breaking into these addresses would require millennia even under optimistic quantum advancement scenarios.

Bitcoin’s security framework relies on elliptic curve algorithms for authorization and SHA-256 hashing for protection.

Quantum algorithms cannot alter Bitcoin’s fixed 21 million supply cap or bypass proof-of-work validation requirements.

Grover’s algorithm reduces SHA-256 security effectively but brute-force attacks remain computationally impractical.

Renowned cryptographer Dr. Adam Back addressed Bitcoin’s capacity for defensive evolution in response to future quantum threats.

The Blockstream CEO and Bitcoin contributor explained the network’s adaptability to CoinShares. “Bitcoin can adopt post-quantum signatures. Schnorr signatures paved the way for more upgrades, and Bitcoin can continue evolving defensively,” Back told CoinShares.

Users retain sufficient time to migrate funds voluntarily to quantum-resistant addresses. Market impact appears minimal, with vulnerable coins likely resembling routine transactions rather than systemic shocks.

Crypto World

Are Non-Financial Use Cases in Blockchain Dead?

Prominent crypto venture capitalists are clashing online about whether non-financial use cases in crypto, Web3, and blockchain have failed due to a lack of investor demand and product-market fit or if the best days for non-financial applications still lay ahead.

The debate started on Friday when Chris Dixon, a managing partner at venture capital firm a16z crypto, published an article arguing that years of “scams, extractive behavior and regulatory attacks” were the reason that non-financial use cases in crypto have not taken off.

These use cases include decentralized social media, digital identity management, decentralized media streaming platforms, digital rights platforms, Web3 video games and more.

“Non-financial use cases for crypto have failed because no one wants them,” Haseeb Quereshi, a managing partner at crypto venture firm Dragonfly, said in a response on Sunday. He added:

“Let’s just admit it. They were bad products. They failed the market test. It was not Gensler or Sam Bankman-Fried (SBF) or Terra that caused these things to fail; it was that no one wanted any of it. Pretending otherwise is coping.”

Dixon said that as a16z crypto’s funds are managed with at least a 10-year time horizon, “building new industries takes time.”

“You don’t have the luxury of ‘waiting to be right’ in VC,” Nic Carter, the founding partner of venture firm Castle Island Ventures, said in a reply to Quereshi. “You need to be right about a market during the 2-3 year fund deployment period,” he said.

The debate follows a surge of VC investment into crypto projects in 2025, which mostly flowed to tokenized real-world assets (RWAs), physical or traditional financial assets represented onchain by digital tokens.

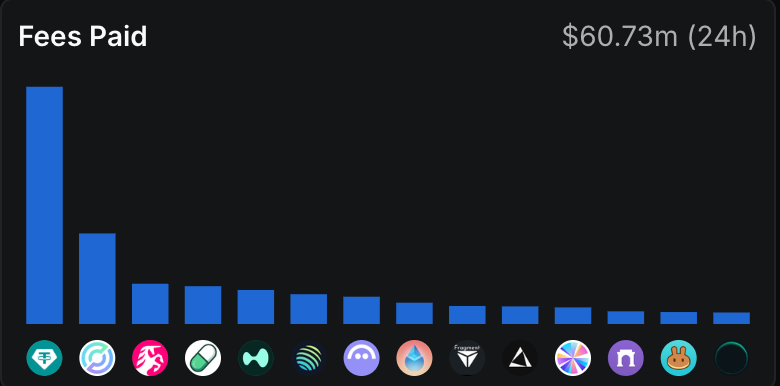

Related: Web3 revenue shifts from blockchains to wallets and DeFi apps

Different approaches to portfolio building

Dragonfly’s portfolio is built around financial use cases and blockchain infrastructure that helps move value and risk through the onchain financial system.

Some of the firm’s investments include the Agora stablecoin and payments platform, payments infrastructure provider Rain, synthetic dollar issuer Ethena, and the Monad layer-1 blockchain network.

As for a16z, the firm’s crypto portfolio includes many financial use cases like Coinbase and decentralized crypto exchange Uniswap, but also features a much wider range of Web3 sectors like community building, gaming and media streaming.

These projects include the community building club Friends With Benefits, digital identity provider World and Web3 gaming platform Yield Guild Games.

Magazine: Web3 games shuttered, Axie Infinity founder warns more will ‘die’: Web3 Gamer

Crypto World

Vitalik Buterin Says Most DeFi Is Fake

Ethereum co-founder Vitalik Buterin and crypto analyst c-node have reignited the debate over the true purpose of Decentralized Finance (DeFi).

Together, the two industry experts challenge the booming industry to rethink its priorities.

Sponsored

Experts Clash Over What Counts as “Real” DeFi

The underlying issue, according to the experts, is that much of today’s DeFi hype is superficial, serving speculative interests rather than advancing genuinely DeFi infrastructure.

“There is no reason to use DeFi unless you have longs on cryptocurrencies and want access to financial services while preserving self-custody,” c-node wrote.

They dismissed common yield-generating strategies—like depositing USDC into lending protocols—as “cargo cults,” suggesting they mimic DeFi’s success without embodying its original ethos.

The analyst further emphasized that non-Ethereum chains may struggle to replicate Ethereum’s DeFi boom, noting that early ETH participants were ideologically committed to self-custody. Meanwhile, newer ecosystems are dominated by venture capital funds using institutional custodians.

Buterin’s reply offered both a counterpoint and a broader framework for what counts as “real” DeFi. The Russo-Canadian innovator argued that algorithmic stablecoins, particularly when overcollateralized or structured to decentralize counterparty risk, qualify as genuinely decentralized.

“Even if 99% of the liquidity is backed by CDP holders who hold negative algo-dollars and separately positive dollars elsewhere, the fact that you have the ability to punt the counterparty risk to a market maker is still a big feature,” Buterin wrote.

Sponsored

DeFi’s Ideological Divide and the Push for Decentralized Risk

The Ethereum co-founder also criticized popular USDC-based strategies, noting that simply depositing centralized stablecoins into lending protocols fails to meet the criteria for DeFi.

Beyond technical definitions, he articulated a long-term vision: moving away from dollar-denominated systems toward diversified units of account backed by decentralized collateral structures.

The discussion highlights a deeper ideological divide within crypto:

Sponsored

- On one side, DeFi is seen as a tool for speculative capital efficiency—leveraging positions and generating yields without relinquishing custody.

- On the other hand, it is viewed as a foundational financial system capable of reshaping the global monetary sector through decentralization and risk distribution.

Subsequent replies in the thread reinforced this tension. Some argued that using DeFi with centralized assets still reduces intermediaries, potentially lowering systemic risk.

Others, however, sided with c-node’s purist view, predicting that market forces will favor self-custody-driven protocols over hybrid or fiat-backed systems.

This debate may shape the next phase of crypto innovation. Ethereum’s dominance in DeFi, fueled by ideological early adopters, contrasts sharply with other chains, where venture-backed investors prioritize convenience over decentralization.

Meanwhile, Buterin’s push for overcollateralized algorithmic stablecoins and diversified indices points to a possible evolution beyond current dollar-pegged structures.

Sponsored

As DeFi approaches its second decade, these discussions show that the sector is no longer just about yields and liquidity.

Instead, the conversation is turning toward the very principles that define it—custody, decentralization, and risk distribution.

This raises questions about whether DeFi can truly offer an alternative to TradFi systems or remains a sophisticated tool for crypto speculators.

Crypto World

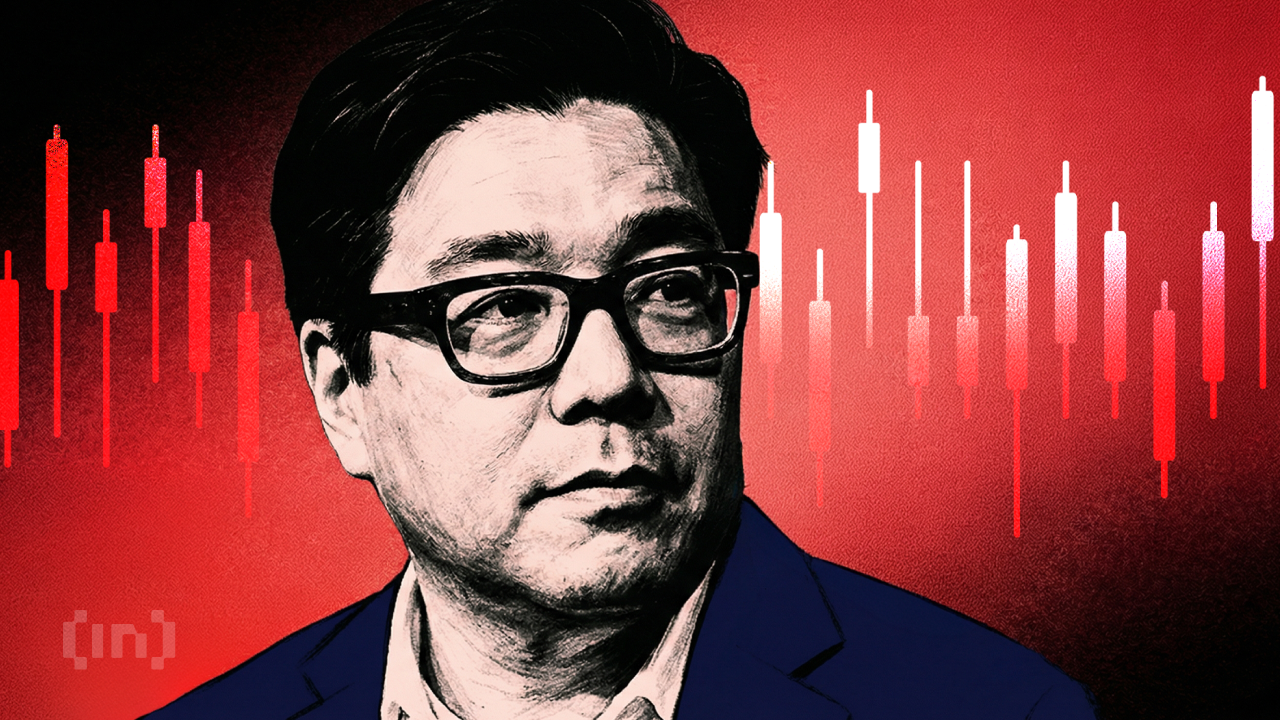

Tom Lee’s BitMine Adds $42 Million to its Ethereum Hoard

BitMine, the largest corporate holder of Ethereum, has capitalized on the digital asset’s recent price volatility to expand its treasury holdings.

On February 7, blockchain analysis platform Lookonchain reported the transaction, citing data from Arkham Intelligence. The firm acquired approximately 20,000 ETH for a total capital outlay of $41.98 million.

Sponsored

Sponsored

BitMine Chair Defends Aggressive Buying Amid Crash

Notably, this latest tranche moves the firm significantly closer to its long-term objective of controlling 5% of Ethereum’s total circulating supply. Data from Strategic ETH Reserve shows it has achieved over 70% of that goal with its 4.29 million ETH holdings.

Meanwhile, BitMine’s latest ETH purchase comes at a moment of extreme market fragility.

Ethereum prices have collapsed roughly 31% over the past 30 days, trading around $2,117 as of press time. Over the past week, the asset traded for as low as $1,824, its lowest level since May 2025.

Still, BitMine remain committed to the crypto token, with the firm’s chairman Tom Lee arguing that “Ethereum is the future of finance.”

Consequently, Lee has dismissed concerns regarding the firm’s deepening unrealized losses.

Sponsored

Sponsored

In a recent statement, Lee argued that the current volatility is “a feature, not a bug.” According to him, Ethereum has weathered drawdowns of 60% or worse on seven occasions since 2018.

So, despite the “Crypto Winter” optics exacerbated by the nomination of Kevin Warsh to the Federal Reserve and geopolitical tensions following the Greenland incident, the Ethereum network’s fundamental usage remains robust.

Moreover, BitMine has been evolving beyond a simple “buy-and-hold” treasury strategy.

To outperform the cycle and mitigate the drag of falling spot prices, the company is pivoting toward what it describes as “accretive acquisitions” and high-risk capital deployment.

This includes publicized “moonshot” allocations into smaller-cap tokens like Orbs and investments in media outlets like Mr Beast.

Additionally, BitMine continues to leverage its massive stack for yield, staking nearly 3 million ETH.

These efforts are designed to offset the heavy pressure of a macro environment that has turned sharply risk-off.

Crypto World

PBOC Bans Unapproved Yuan-Pegged Stablecoins in China

The People’s Bank of China (PBOC) and seven regulatory agencies issued a joint statement on Friday prohibiting the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs). The directive applies to both onshore and offshore issuers, underscoring Beijing’s intent to keep financial instrumentation closely aligned with state policy while continuing to push the domestic CBDC ecosystem forward. The announcement, signed by the PBOC alongside the Ministry of Industry and Information Technology and the China Securities Regulatory Commission, reiterates a posture that private crypto activities remain outside the formal financial system unless they receive explicit clearance. A translated version of the statement framed the policy as a guardrail against stablecoins that imitate fiat currency functions during circulation and use.

“Stablecoins pegged to fiat currencies perform some of the functions of fiat currencies in disguise during circulation and use. No unit or individual at home or abroad may issue RMB-linked stablecoins without the consent of relevant departments.”

Winston Ma, an adjunct professor at New York University (NYU) Law School and a former Managing Director at CIC, China’s sovereign wealth fund, weighed in on the development, indicating the ban covers both onshore and offshore RMB variants. He noted that the policy applies to CNH and CNY alike, reflecting a comprehensive approach to RMB-related markets. CNH, the offshore version of the yuan, is designed to maintain currency flexibility in international markets while preserving capital controls, Ma explained.

The overarching narrative here is clear: Beijing intends to quarantine speculative crypto activity from the formal financial system even as it accelerates the broader rollout of e-CNY, the sovereign CBDC managed by state authorities. The policy positions digital yuan usage as the preferred channel for digital financial innovation while signaling a hard boundary against RMB-pegged instruments that could replicate traditional money-like functions outside of official oversight.

The move comes on the heels of China’s broader digital currency strategy. Just ahead of the announcement, officials approved commercial banks to share interest with clients holding the digital yuan, a development designed to make the CBDC more attractive to investors and everyday users alike. This aligns with a consistente trajectory: expand the practical utility of the digital yuan while constraining parallel ecosystems that could siphon demand or create regulatory ambiguity.

Within the policy landscape, China has repeatedly signaled a preference for harnessing digital currency tools under state supervision. A more permissive stance toward yuan-backed private tokens would complicate capital controls and challenge risks management frameworks, while the digital yuan remains a controlled instrument for domestic monetary policy and financial stability. The new directive reinforces the idea that the regime will tolerate innovation only within the boundaries of regulatory approval and centralized oversight.

Chinese government briefly considered yuan-pegged stables, but focused on CBDC instead

Earlier reporting in August 2025 suggested that China’s leadership was weighing a potential pivot toward allowing private companies to issue yuan-pegged stablecoins to facilitate global currency usage. Those discussions, however, did not translate into policy change. By September that year, regulators moved to pause or halt stablecoin trials until further notice, indicating that the government remained wary of private instruments that could undermine monetary sovereignty or complicate enforcement. The sequence illustrates a careful balancing act: while China explores financial innovation, it remains disciplined about the channels through which that innovation can reach the broader market.

In a broader context, China has shown a consistent preference for the centralized digital yuan over private stablecoins. The January 2026 policy to allow interest payments on digital yuan wallets is part of a long-run strategy to elevate the CBDC’s appeal and to test new incentive structures within a tightly regulated framework. The shift mirrors ongoing debates in other major economies about how to reconcile crypto innovation with financial stability and national monetary sovereignty, but China’s approach remains notably centralized and policy-driven.

In parallel coverage, the digital yuan story has been a recurring theme in the crypto-policy discourse, with broader examinations of CBDCs and their implications for cross-border payments and domestic finance. The conversations around stablecoins, RWAs, and the CBDC ecosystem continue to be closely watched as regulators in Beijing refine the balance between innovation and oversight.

Market context

The cross-currents in China’s crypto policy reflect a broader, global tension between digital asset innovation and regulatory control. The latest ban reinforces a risk-off stance toward private tokens and tokenized assets within a framework designed to preserve financial stability while promoting the government’s CBDC agenda. Investors and project developers watching RMB-linked instruments will likely reassess their onshore and offshore strategies in light of the explicit permission regime now underscored by multiple ministries and commissions.

Why it matters

For market participants, the joint statement clarifies that the Chinese authorities intend to keep RMB-related financial engineering firmly under state supervision. This has direct implications for any entity seeking to issue stablecoins pegged to the Renminbi or to tokenize real-world assets in a way that could bypass regulatory channels. The onshore/offshore consistency implied by the ban signals a regime-wide approach—no loopholes for RMB-backed tokens operating in the gray zones of global finance.

For issuers and platforms, the development serves as a clear reminder that regulatory clearance is a prerequisite for RMB-linked products. The alignment among the PBOC, MIIT, and CSRC indicates a shared risk assessment across monetary policy, information technology, and securities oversight. As China’s CBDC ecosystem matures, providers will likely pivot toward products and services anchored in the official digital yuan rather than those that attempt to replicate fiat-like functionality through private tokens.

From a policy perspective, the episode underscores Beijing’s dual posture: promote digital currency adoption domestically, while limiting the permissibility of private tokens that could complicate capital controls or blur the lines between currency and asset. The tension between innovation and sovereignty remains a defining feature of the Chinese crypto regulatory landscape and may shape global attitudes toward RMB-linked financial instruments and tokenized assets in the near term.

What to watch next

- Whether the regulators issue further guidance on RMB-linked tokens and tokenized RWAs, including definitions of what constitutes an “unapproved” issuance and potential penalties.

- Any enforcement actions against noncompliant issuers, both domestic and foreign, that attempt to issue RMB-linked instruments without consent.

- The ongoing rollout and uptake of the digital yuan wallet, particularly any changes to interest-bearing features or user incentives.

- Reactions from financial institutions, stablecoin operators, and tokenized-RWA platforms regarding the enforceability of the ban and its implications for cross-border activity.

- Regulatory developments related to CNH cross-border use and how offshore RMB markets will adapt to the policy, given the policy’s emphasis on RMB-related markets across borders.

Sources & verification

- Official statement: People’s Bank of China and seven agencies joint release (PBOC site) – https://www.pbc.gov.cn/tiaofasi/144941/3581332/2026020619591971323/index.html

- Overview of China’s digital yuan

- What are CBDCs? A beginner’s guide to central bank digital currencies

- China digital yuan pressure on US stablecoins

- China tech giants halt Hong Kong stablecoin plans

- China digital yuan interest wallets 2026

- China considering yuan-backed stablecoins global currency usage

Introduction

The People’s Bank of China (PBOC) and seven major regulators issued a joint directive on Friday that bars the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs). The measure targets both domestic and international issuers, signaling Beijing’s intent to curb private, crypto-style instruments in favor of tightly controlled monetary tools. The statement—co-signed by the PBOC, the Ministry of Industry and Information Technology, and the China Securities Regulatory Commission—frames RMB-linked stablecoins as devices that mimic fiat currency during circulation unless they secure explicit authorization. A translated section of the release emphasizes that no unit or individual may issue RMB-linked stablecoins without the consent of relevant departments.

Why it matters – The long arc of China’s digital finance policy

The policy is not an isolated move; it fits within a multi-year effort to keep speculative crypto activity outside of the formal financial system while promoting the digital yuan’s broader adoption. In this context, China’s approach is to constrain private tokens that could bypass capital controls or undermine monetary policy, even as it experiments with CBDC-based financial tools. The announcement arrived alongside other developments, including a 2026 push to offer interest on digital yuan wallets, designed to make the CBDC more attractive to users and investors alike. The stance also reflects a broader regional and global debate about how CBDCs will interact with private stablecoins and tokenized assets in a rapidly evolving digital economy.

The commentary from Winston Ma, an adjunct professor at NYU Law, underscores the breadth of the enforcement scope. He notes that the ban spans onshore and offshore RMB variants (CNH and CNY), reinforcing a centralized policy that seeks to keep RMB-related markets within a clearly defined regulatory perimeter. The policy’s emphasis on consent and authorization echoes long-standing Chinese priorities: maintain currency sovereignty, assure financial stability, and accelerate the domestic CBDC agenda without inviting parallel private infrastructures that could complicate policy transmission or risk management.

Looking ahead, the policy invites a clearer delineation of which digital assets and tokenized products may proceed under regulatory oversight. It also suggests that the ongoing policy dialogue around the digital yuan, CBDCs, and tokenized RWAs will continue to shape the global crypto regulatory landscape, affecting how international players approach RMB-linked products and cross-border digital finance in the years to come.

In the coming months, observers will watch for explicit enforcement guidelines, any adjustments to CBDC wallet incentives, and the extent to which offshore RMB markets adapt to a more stringent regime. The balance Beijing seeks—between innovation and control—will likely influence both domestic fintech deployments and cross-border financial engineering involving RMB-denominated instruments.

Crypto World

BTC, Gold & Silver Exposed?

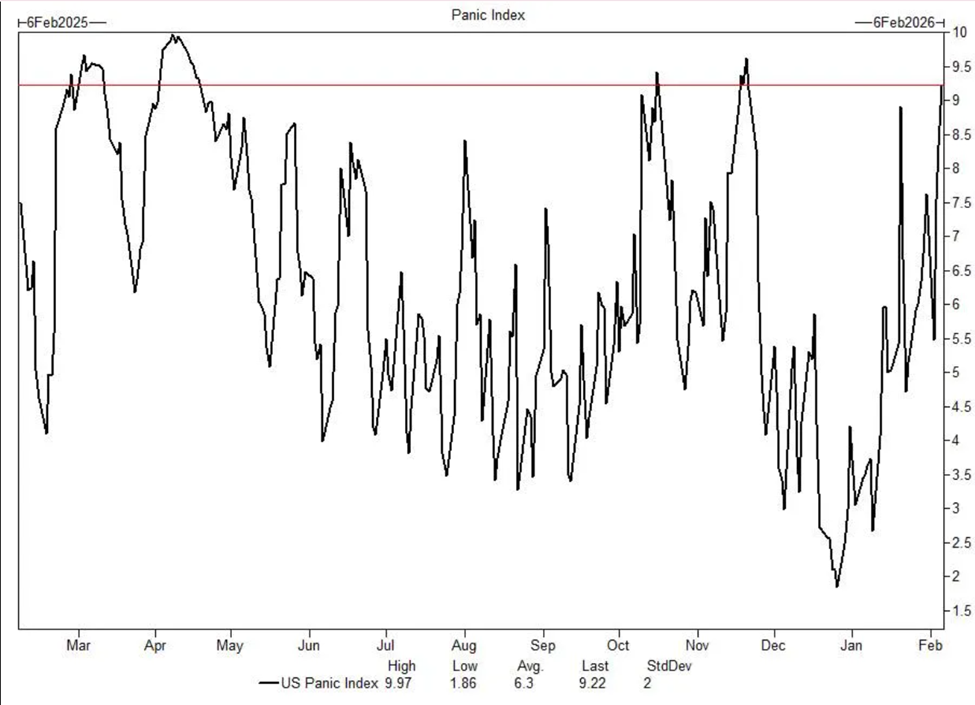

Global markets may be entering a new phase of volatility after Goldman Sachs warned that systematic funds could offload tens of billions of dollars in equities in the coming weeks.

This wave of selling could ripple into Bitcoin, gold, and silver as liquidity conditions deteriorate.

Sponsored

Goldman Warns CTA Selling Could Accelerate as Liquidity Thins

According to Goldman’s trading desk, trend-following funds known as Commodity Trading Advisers (CTAs) have already triggered sell signals in the S&P 500. What’s more, they are expected to remain net sellers in the near term, regardless of whether markets stabilize or continue falling.

The bank estimates that roughly $33 billion in equities could be sold within a week if markets weaken further.

More significantly, Goldman’s models suggest that as much as $80 billion in additional systematic selling could be triggered over the next month if the S&P 500 continues to decline or breaches key technical levels.

Market conditions are already fragile. Goldman analysts noted that liquidity has deteriorated and options positioning has shifted in ways that may amplify price swings.

When dealers are positioned “short gamma,” they are often forced to sell into falling markets and buy into rising ones, intensifying volatility and accelerating intraday moves.

Sponsored

Goldman also highlighted those other systematic strategies—including risk-parity and volatility-control funds—still have room to reduce exposure if volatility continues to rise. That means selling pressure may not be limited to CTAs alone.

Investor sentiment is also showing signs of strain. Goldman’s internal Panic Index recently approached levels associated with extreme stress.

Meanwhile, retail investors, after a year of aggressively buying dips, are beginning to show fatigue. Recent flows indicate net selling rather than buying.

Sponsored

Although Goldman’s analysis focused primarily on equities, the implications extend beyond stock markets.

Historically, large, flow-driven equity sell-offs and tightening liquidity conditions have increased volatility across macro-sensitive assets, including crypto.

Bitcoin, which has increasingly traded in line with broader risk sentiment during periods of liquidity stress, could face renewed volatility if forced selling in equities accelerates.

Crypto-linked equities and retail-favored speculative trades have already shown sensitivity to recent market swings, suggesting positioning remains fragile.

Sponsored

At the same time, turbulence in equities can trigger complex cross-asset flows. While risk-off conditions can pressure commodities, precious metals such as gold and silver can also attract safe-haven demand during periods of heightened uncertainty, leading to sharp moves in either direction depending on broader liquidity trends and the dollar’s strength.

In the meantime, the key variable remains liquidity. With systematic funds deleveraging, volatility rising, and seasonal market weakness approaching, markets may remain unstable in the weeks ahead.

If Goldman’s projections materialize, the coming month could test equities, with a spillover effect on Bitcoin and precious metals.

Crypto World

Ethereum Staking Demand Hits Record Levels as Exit Queue Remains Minimal

TLDR:

- Staking entry queue reaches 4.05M ETH, exit queue only 38K ETH, showing overwhelming demand.

- ETH price remains under $2,000 despite record network activity and staking growth.

- Large holders and ETFs increase selling pressure, adding short-term market volatility.

- Selective accumulation occurs during dips, supporting medium-term stabilization in ETH supply.

Ethereum staking demand is reaching unprecedented levels, with over 4 million ETH waiting to enter while exit orders remain minimal.

This surge reflects strong long-term conviction, structural scarcity, and growing network participation despite recent price declines below $2,000.

Staking and Network Activity

Ethereum’s staking queue shows a clear imbalance between entries and exits. The entry queue holds 4.05 million ETH, while exit requests total only 38,000 ETH.

This demonstrates overwhelming demand. Validators choose long-term yield and network alignment over liquidity.

The 70-day wait to stake confirms that protocol limits cannot match current demand. Meanwhile, exit orders clear in hours, showing no panic.

This situation reduces circulating ETH and limits immediate sell pressure. When combined with Ethereum’s burn mechanism, structural scarcity increases.

Therefore, staked ETH effectively leaves the liquid supply, supporting potential upward movement.

Ethereum network usage remains strong. Transfer counts reached 1.1 million on a 14-day average, demonstrating active token movement.

However, network activity alone cannot reverse recent price declines or short-term selling.

Retail participation is declining. Futures open interest dropped from $26.3 billion to $25.4 billion in one day.

As a result, network activity contrasts with weak capital flows, causing temporary price compression despite higher usage.

Large Holders, ETFs, and Price Dynamics

Large holders have added to short-term selling pressure. Trend Research sold 170,033 ETH, while Vitalik Buterin and Stani Kulechov sold smaller amounts.

Consequently, supply increased amid weaker market demand. BitMine Immersion Technologies holds 4.28 million ETH, of which 2.9 million is staked.

This generates an estimated $188 million annualized revenue. Therefore, staking reduces liquid supply while maintaining long-term treasury support.

Spot ETH ETFs experienced outflows totaling $80.79 million on February 5, with Fidelity’s FETH accounting for $55.78 million. Consequently, passive selling continues steadily, adding supply pressure without quick reversals.

Derivatives data show liquidation risk between $1,509 and $1,800. Leveraged positions could trigger forced selling if prices drop further.

Meanwhile, selective accumulation occurs as long-term investors buy during dips. ETH may test $1,500–$1,800 if selling persists.

Simultaneously, staking reduces liquid supply, and high network activity provides gradual stabilization. Thus, structural scarcity continues even while short-term volatility remains.

Crypto World

Is the Fed Already Too Late for Rate Cuts? Warning Signs Suggest Policy Overtightening

TLDR:

- Truflation shows US inflation near 0.68% while Federal Reserve maintains restrictive policy stance

- Credit card delinquencies and auto loan defaults rise, signaling late-cycle economic stress levels

- Labor market weakening faster than Fed acknowledges with rising layoffs and hiring slowdowns across sectors

- Monetary policy lag means economic damage may occur before Fed reacts to confirmed weakness in data

Is the Fed already too late for rate cuts? This question dominates market discussions as economic indicators increasingly diverge from official central bank messaging.

Real-time inflation data shows rapid cooling while credit stress and labor weakness accelerate across sectors. The Federal Reserve maintains rates at restrictive levels despite mounting evidence of economic deceleration.

Policy timing has become critical as analysts debate whether preventive cuts or reactive measures will shape the next cycle.

Policy Lag Creates Timing Dilemma for Rate Adjustments

Monetary policy operates with substantial delays between action and economic impact. Rate changes require months to fully influence business investment and consumer spending patterns.

By the time official statistics confirm weakness, underlying conditions may have deteriorated significantly. This lag effect raises concerns about the Fed’s current positioning.

Real-time inflation tracking suggests price pressures have cooled dramatically from previous peaks. According to Bull Theory, “Truflation is showing US inflation near 0.68%” while the Fed maintains its cautious stance on price stability.

This reading contradicts central bank statements emphasizing sticky inflation and persistent concerns. The gap between alternative metrics and policy rhetoric continues widening.

Bull Theory highlighted this disconnect in recent market commentary, noting that “the Fed keeps repeating that the job market is still strong” despite contradictory signals.

The analysis emphasized that layoffs, credit defaults, and bankruptcies are rising simultaneously. These developments typically emerge when restrictive policy begins damaging weaker economic participants.

Yet official communications continue to characterize the economy as fundamentally resilient.

Credit markets flash late-cycle warning signals across consumer and corporate segments. Credit card delinquencies have increased alongside auto loan default rates.

Corporate bankruptcy filings are accelerating as higher borrowing costs strain over-leveraged balance sheets. Small businesses face particular vulnerability when capital costs remain elevated for extended periods.

Economic Deterioration Outpaces Fed Recognition Timeline

Labor market conditions show progressive weakening despite central bank assertions of continued strength. Hiring slowdowns and increased layoff announcements paint a different picture than official statements suggest.

Wage trend data indicate a moderating demand for workers across industries. The employment situation is degrading faster than policy rhetoric acknowledges.

The risk equation has shifted from inflation concerns toward deflation threats. Bull Theory warned that “inflation slows spending, but deflation stops spending,” highlighting the danger of delayed policy response.

When consumers expect falling prices, purchasing decisions shift toward delay rather than immediate action. Businesses respond by reducing production and cutting workforce expenses.

Credit stress serves as an early indicator of policy overtightening relative to economic capacity. Rising delinquencies across credit categories demonstrate that households and corporations struggle under current rate levels.

These pressures typically spread from weaker participants to broader segments if conditions remain restrictive. The damage compounds as financial stress feeds back into reduced spending and investment.

The analyst posed a critical question: “If inflation is already cooling, if the labor market is already weakening, if credit stress is already rising, then holding rates restrictive for too long can amplify the slowdown instead of stabilizing it.”

Markets have begun pricing expectations for policy reversal driven by growth fears rather than inflation control. The next phase may hinge on whether rate cuts arrive soon enough to stabilize conditions or merely react to confirmed recession.

Crypto World

Was Kyle Samani’s Exit Coincidental?

Kyle Samani stepped down from Multicoin Capital on February 5, 2026, after nearly a decade as co-founder. Today, he is publicly criticizing Hyperliquid (HYPE) as on-chain data shows Multicoin purchased over $40 million in HYPE tokens.

The close timing has fueled speculation that internal conflicts over investment strategy prompted the departure of one of the most notable Solana advocates in the crypto industry.

Multicoin, Hyperliquid, and Kyle Samani: Coincidence or Clash?

Samani’s departure announcement on February 5 marked a significant shift for Multicoin Capital, a leading force in institutional crypto investment.

Sponsored

Sponsored

Despite his departure, Samani stated he would remain engaged in cryptocurrency, especially within the Solana ecosystem.

The announcement came only days after MLM analysts flagged wallets believed to be linked to Multicoin accumulating large amounts of Hyperliquid’s HYPE token in late January.

They highlighted purchases totalling tens of millions of dollars. Additional analysis suggests that substantial ETH flows were rotated into HYPE over several days via intermediary wallets.

Notably, no official confirmation has linked the trades directly to Multicoin’s internal strategy decisions.

Today, February 8, just three days after his formal exit, Samani is criticizing Hyperliquid on social media, making his position unmistakably clear.

“Hyperliquid is, in most respects, everything wrong with crypto. The founder literally fled his home country to build Openly, which facilitates crime and terror. Closed source Permissioned,” wrote Samani in a post.

This strong criticism stands in direct contrast to Multicoin’s high-profile investment in HYPE tokens. As a result, observers wondered if Samani’s views clashed with the firm’s recent decisions, helping drive his exit.

Sponsored

Sponsored

Solana Investment Philosophy Versus HYPE Strategy

Multicoin Capital earned its reputation as a vocal backer of Solana. In September 2025, the firm led a $1.65 billion private investment into Forward Industries, working with Jump Crypto and Galaxy Digital to create what they called “the world’s leading Solana treasury company.”

Samani was named Chairman of Forward Industries’ Board, underlining his importance to Multicoin’s Solana focus.

The Solana investment strategy centered on transparent yields through staking, DeFi protocols, and capital efficiency. Multicoin highlighted Solana’s infrastructure as offering better economics than Bitcoin treasury models, citing native yields of 8.05% as of September 2025.

The firm also released research on Solana projects like Jito, which by March 2025 powered over 94% of all Solana stake via custom block production technology.

Hyperliquid, meanwhile, represents a contrasting approach. The platform is a decentralized perpetual futures exchange with its own blockchain.

It is popular for high leverage and low fees, but faces criticism for its centralized validator system, closed-source code, and regulatory risks. These features appear to oppose the principles Samani promoted at Multicoin.

Sponsored

Sponsored

Tensions between strategies became more evident as analysts speculated about internal dynamics.

“Does this mean that they couldn’t buy HYPE as long as Kyle was running the fund, which is why his leaving coincides with Multicoin buying a lot of HYPE?” wrote one user.

Kyle Samani did not immediately respond to BeInCrypto’s request for comment.

Supporters Defend Hyperliquid as Samani’s Exit Sparks Ideological Debate

Some investors and traders pushed back strongly against Samani’s criticism. They argue that Hyperliquid represents a return to crypto’s original principles rather than a departure from them.

Hyperliquid’s decision to direct revenue toward token buybacks and community incentives reflects a model designed to more closely align users and infrastructure than many venture-backed projects.

Sponsored

Sponsored

The divide highlights a deeper ideological split emerging within crypto markets. On one side are investors who prioritize transparency, decentralization, and community ownership as defining principles.

On the other hand, there are those who champion performance, liquidity depth, and institutional-grade infrastructure, even when those systems require trade-offs in governance or architecture.

Samani’s departure itself has not been formally tied to any specific investment decision. Neither Multicoin nor Samani has publicly stated that Hyperliquid or portfolio positioning played any role in the transition.

Sometimes, leadership changes at venture firms often stem from long-term strategic shifts, personal decisions, or fund-structure considerations that may not be visible externally.

Still, the timing has proven difficult for markets to ignore. In crypto, an industry where narratives travel quickly, the combination of on-chain transparency and social media speculation often fills gaps left by limited official disclosures.

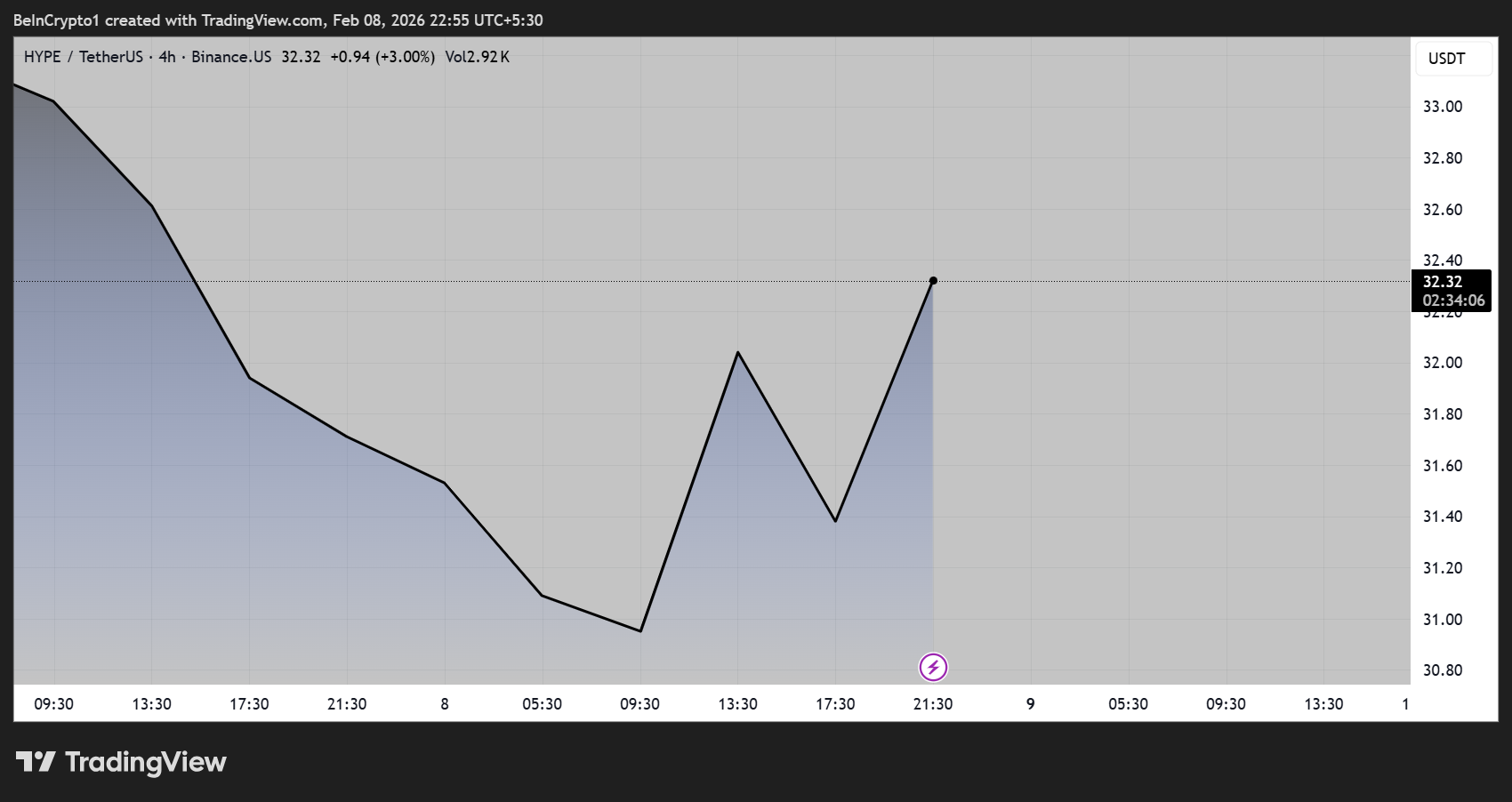

Meanwhile, the HYPE token is nurturing a recovery, with a higher low on the 4-hour timeframe, suggesting a trend reversal if buyer momentum sustains.

Crypto World

Canton Network: Wall Street’s Hidden Blockchain Settles $350 Billion in Daily Repo Trades

TLDR:

- Canton Network processes $350 billion in daily repo transactions across over 600 validator nodes globally

- DTCC tokenizing U.S. Treasuries on Canton with SEC approval, targeting MVP launch in first half of 2026

- JPMorgan’s Kinexys announced plans to issue JPM Coin deposit token natively on Canton Network in January

- Platform carries over $6 trillion in tokenized real-world assets with privacy features for regulated firms

Canton Network has emerged as a major institutional blockchain infrastructure, processing $350 billion in daily repo transactions.

The Layer 1 blockchain carries over $6 trillion in tokenized real-world assets across more than 600 validator nodes.

Major financial institutions, including JPMorgan, DTCC, Goldman Sachs, and Franklin Templeton, have deployed production systems on the network.

The platform handles over 700,000 daily transactions while maintaining privacy requirements for regulated financial institutions.

Privacy-First Architecture for Regulated Finance

Canton Network operates as a Layer 1 blockchain designed specifically for financial institutions moving real-world assets on-chain.

Digital Asset built the platform around privacy between counterparties, rapid settlement, and native compliance features.

Traditional public blockchains display every transaction to all network participants, creating legal obstacles for banks required to maintain client confidentiality.

Delphi Digital noted that “$350 billion a day settles on a blockchain many people have never heard of.” The network solves privacy challenges through DAML smart contracts that embed access and authorization rules directly into assets and transactions.

Two firms can complete trades without exposing details to outside parties. Regulators maintain necessary access while other network participants cannot view unrelated activity.

Settlement happens atomically, eliminating the multi-day clearing processes common on traditional financial rails. Both sides of trades execute simultaneously, removing windows where one party has delivered while the other has not.

According to the analysis, “there is no window where one party has delivered, and the other hasn’t,” eliminating risk categories in repo markets where hundreds of billions move daily.

The platform enables different financial applications to interact natively across the network. A tokenized treasury on one platform can serve as collateral on another platform within a single transaction.

Cross-application settlement between regulated institutions occurs without central intermediaries, a capability not previously demonstrated at this scale.

Production Deployments from Major Institutions

Daily repo volumes reached $350 billion in recent months, up from $280 billion in August 2025. Broadridge operates its entire Distributed Ledger Repo platform on the network as the first major live deployment. Banks and institutions use repo markets to borrow short-term against Treasury collateral.

DTCC is tokenizing U.S. Treasury securities on Canton Network, backed by SEC No-Action Letter approval. The project targets an MVP release in the first half of 2026 with broader rollout planned for later that year.

DTCC joined the Canton Foundation as co-chair alongside Euroclear. As observers emphasized, this is “not a test. Not a pilot.”

Franklin Templeton expanded its tokenized fund platform to the network, joining Goldman Sachs, BNP Paribas, and Deutsche Börse.

JPMorgan’s blockchain unit Kinexys announced plans to issue JPM Coin, its USD deposit token, natively on Canton Network in January.

Fireblocks subsequently integrated the platform and became a Super Validator, providing regulated custody for institutional clients.

The validator network includes HexTrust and Tharimmune, the first NASDAQ-listed company operating as a super validator. These regulated firms run production systems processing real transactions under regulatory oversight.

The network lacks public block explorers, reflecting its institutional focus. As noted, “Canton was not built for retail. It was built for the firms that move your money.”

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics4 hours ago

Politics4 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business3 hours ago

Business3 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics6 hours ago

Politics6 hours agoThe Health Dangers Of Browning Your Food

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business11 hours ago

Business11 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report