Crypto World

“Compromise Is in the Air”: New Details from White House Stablecoin Talks

TLDR:

- Banks accepted limited exemption language on stablecoin rewards after previously rejecting all transaction-based incentives.

- Crypto firms want broad definitions of permissible activities, while banks seek tighter limits to protect deposit structures.

- The White House urged both sides to reach a stablecoin deal before March 1 to sustain legislative momentum.

- A smaller meeting size allowed more detailed policy language discussions than earlier White House sessions.

A smaller White House meeting brought banks and crypto firms closer on stablecoin policy but stopped short of agreement.

Participants described the discussion as more detailed and more focused than earlier sessions. Officials pressed both sides to resolve disputes over rewards and account activity rules. A March 1 deadline now shapes the next phase of negotiations.

White House Stablecoin Talks Focus on Rewards and Exemptions

The meeting centered on whether crypto companies can offer rewards tied to stablecoin transactions. Banks arrived with written principles outlining limits they would accept.

One key shift emerged around conditional exemptions. Banking groups signaled openness to limited carve-outs after earlier resistance to any transaction-based rewards.

Crypto firms pushed for broad definitions of what counts as permissible account activity. Banks argued that narrower language would better protect traditional deposit models.

According to reporting by Eleanor Terrett, both sides called the session productive despite failing to reach a final compromise. Deal terms received deeper technical discussion than in prior meetings.

Ripple’s chief legal officer Stuart Alderoty said the atmosphere suggested growing willingness to bridge gaps. He also pointed to continued bipartisan momentum for crypto market structure legislation.

The White House urged participants to settle core disagreements before March 1. Officials framed the deadline as necessary to keep legislative progress on track.

Banks and Crypto Narrow Differences on Stablecoin Policy Scope

This gathering included fewer participants than the first White House session. It was led by the executive director of the President’s Crypto Council, Patrick Witt.

Crypto attendees included representatives from Coinbase, Ripple, Paxos, Andreessen Horowitz, the Blockchain Association, and the Crypto Council for Innovation.

Major banks present were Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC Bank, and U.S. Bank. Trade groups such as the ABA and ICBA also joined.

Senate Banking Committee staff attended, signaling legislative interest in the outcome of the talks. Their presence added pressure for measurable progress.

Discussion focused on defining “permissible activities” for accounts offering stablecoin rewards. Crypto firms sought flexibility to innovate, while banks stressed financial stability concerns.

Sources in the room said the tone was more constructive than earlier meetings. Participants exchanged draft language rather than general objections.

No final resolution emerged by the end of the session. However, further discussions are expected in the coming days among the same parties.

The White House continues to position itself as a mediator between financial institutions and crypto companies. Officials want an agreement that can inform broader stablecoin and market structure rules.

Crypto World

Arkham Intelligence said to be shutting trading platform as crypto bear market bites

Arkham Exchange, the cryptocurrency trading platform built by data analytics company Arkham Intelligence, is closing down, according to a person familiar with the matter.

Arkham, whose backers include OpenAI CEO Sam Altman, did not respond to requests for comment.

The company, which was founded in 2020 and now boasts over 3 million registered users, floated the idea of adding a crypto derivatives exchange back in October 2024. The plan was to compete with giants such as Binance for retail investors.

By early 2025, Arkham Exchange had added spot crypto trading in a number of U.S. states. But volumes appear to have been a challenge, despite the firm adding a mobile trading app in December.

Binance, the largest crypto exchange by volume, had almost $9 billion of daily trading, according to CoinGecko data. Coinbase (COIN), the No. 2, had $2 billion. Akrham recorded just under $620,000 in the past 24 hours.

In addition to Altman, Arkham’s backers include Draper Associates, Binance Labs and Bedrock.

Arkham hosts its own native crypto token, ARKM, which was trading at close to $0.12 at the time of writing.

Crypto World

Why Everyone’s Talking About Robinhood Q4 2025 Earnings

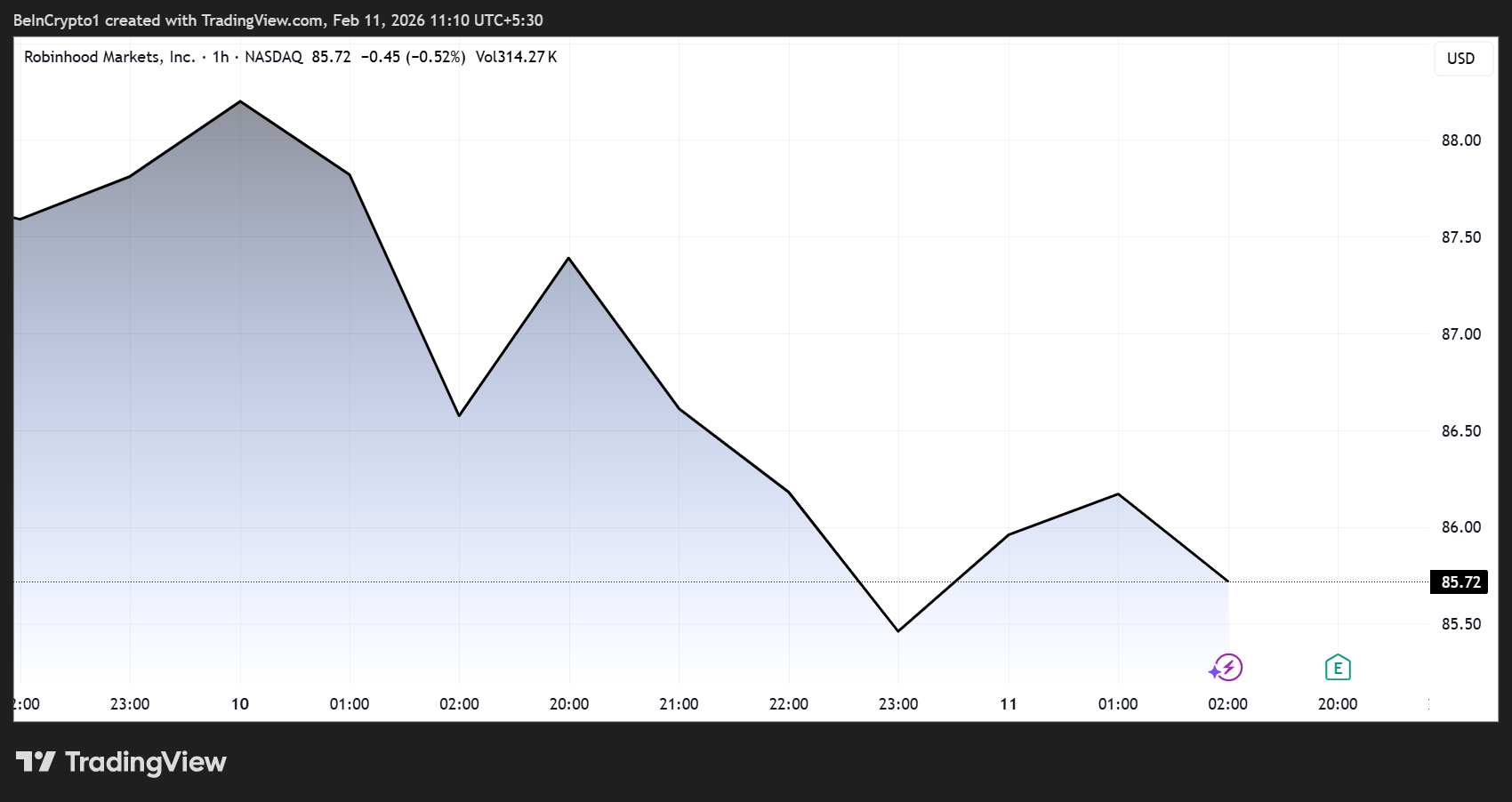

Robinhood’s Q4 2025 earnings report triggered a sharp market reaction, with the company’s stock falling roughly 8% after revenue came in below expectations.

Yet the most striking takeaway from the call was not the drop in crypto trading revenue, but the growing prominence of prediction markets and automation as pillars of the platform’s future strategy.

Robinhood Earnings Show Prediction Markets Overtaking Crypto as Key Growth Driver

Nearly one-third of analyst questions during the earnings call focused on prediction markets, reflecting how quickly the sector is moving from experimental feature to potential core business line.

Sponsored

Sponsored

“30% of $HOOD Q&A (6 of 20 questions) concerned prediction markets, by far the #1 topic,” stated Matthew Sigel, Head of Digital Assets Research at VanEck.

According to Sigel, the attention reflects fast-paced growth across the industry, with volumes now above $10 billion per month (approximately $300–400 million per day), roughly comparable to the average daily US sports betting handle.

Revenue Miss and Crypto Slowdown

Robinhood reported Q4 net revenue of $1.28 billion, below expectations of about $1.35 billion. Transaction-based revenue and crypto trading also missed forecasts, with crypto revenue coming in at approximately $221 million versus expectations closer to $248 million.

Analysts see the market reaction as largely tied to high expectations and slowing growth in key metrics rather than structural weakness in the business.

Christian Bolu, senior analyst at Autonomous Research, described the results as disappointing on the surface but constructive in outlook.

“I would say look at an expensive stock, and you know a topline miss is not helpful at all,” Bolu said, noting that some key metrics, including deposit growth, also slowed.

However, he emphasized that the longer-term outlook remains positive:

“The commentary from the management team is pretty constructive in terms of the pipeline for 2026 in terms of new business growth, and actually, transaction volumes have been very strong in January as well. So, the outlook here is actually pretty decent.”

Sponsored

Sponsored

Prediction Markets Move to Center Stage

While crypto remains an important segment, analysts increasingly see prediction markets and event contracts becoming a larger share of the business over time.

“Over time, we think things like event contracts and prediction markets will be a bigger part of the business than crypto,” Bolu added in the interview with Yahoo Finance.

The opportunity is substantial. Despite rising competition from platforms like Kalshi and Polymarket, Robinhood’s distribution advantage could prove decisive.

“The good thing about Robinhood is their value prop from a business perspective is the distribution,” Bolu said. “There aren’t many folks that can distribute or have the distribution that they do.”

Regulation Remains the Key Constraint

Even as interest grows, regulatory uncertainty remains the biggest barrier to expansion. Sigel highlighted that the issue was directly addressed during the earnings call.

“Binary yes/no contracts … can fit under CFTC event contract authority… But contracts with continuous or formula-based payouts tied to a single issuer’s financial performance could be treated as SEC ‘security-based swaps’ under Dodd-Frank.”

Sponsored

Sponsored

However, the Van Eck executive acknowledged that the lack of clarity is slowing progress:

“There’s no formal framework clarifying that boundary yet, which is why management referenced needing ‘regulatory relief.’”

AI Automation Quietly Reshaping the Business

Beyond new trading products, Robinhood is also transforming its internal operations through automation and artificial intelligence. Against this backdrop, Sigel shared one of the most striking disclosures from the call:

“AI support is really cranking. Now over 75% of our cases are solved by AI, including the complex cases that previously required licensed brokerage professionals,” he shared.

The company is also automating its engineering workflow, optimizing the entire engineering pipeline from code writing through code review to deployment and testing.

Reportedly, this is already turning into real savings and efficiency gains, estimated at over $100 million in 2025 alone.

These cost reductions could help offset cyclical revenue swings in areas like crypto and options trading.

Sponsored

Sponsored

A More Diversified Robinhood

Analysts say Robinhood today looks very different from the trading app that rose to prominence during earlier crypto and meme-stock cycles.

Bolu described the company as “a much more mature company a much more diversified company,” pointing to:

- Growing net interest income

- Retirement accounts

- Banking products, and

- Credit cards as additional revenue streams.

This diversification is one reason many analysts remain bullish despite short-term volatility. More than 80% of analysts still rate the stock a buy, according to market commentary following the results.

Robinhood’s latest earnings reinforced a key shift: crypto may no longer be the dominant narrative driving the platform.

Instead, the next phase of growth appears to be forming around prediction markets, options trading, subscriptions, and AI-driven efficiency. These segments could reduce reliance on highly cyclical crypto trading volumes.

If those trends continue, the earnings call may ultimately be remembered less for a revenue miss and more for revealing where the platform is heading next.

Crypto World

Tom Lee sees bitcoin rebound, ether bottoming below $1,800

HONG KONG — Thomas Lee, chief investment officer of Fundstrat and chairman of ether treasury firm BitMine Immersion (BMNR), said that investors should focus less on timing the exact low and start looking for entries in a keynote speech at Consensus Hong Kong 2026 on Wednesday.

“You should be thinking about opportunities here instead of selling,” Lee said.

BTC has suffered a 50% drawdown from its October record highs, its worst correction since 2022.

On Wednesday, bitcoin fell back below $67,000, giving up some of the bounce from last week’s crash lows. After managing a rapid reversal above $72,000 from $60,000 over the weekend, BTC was down 2.8% over the past 24 hours. Ethereum’s ether , meanwhile, slipped to $1,950, also around 3% lower.

‘Perfected bottom’

Lee attributed the recent weakness in crypto prices to the volatility in metals, which rippled across asset classes. Late January, gold’s market capitalization fluctuated by trillions of dollars in a single day, triggering margin calls and weighing on risk assets.

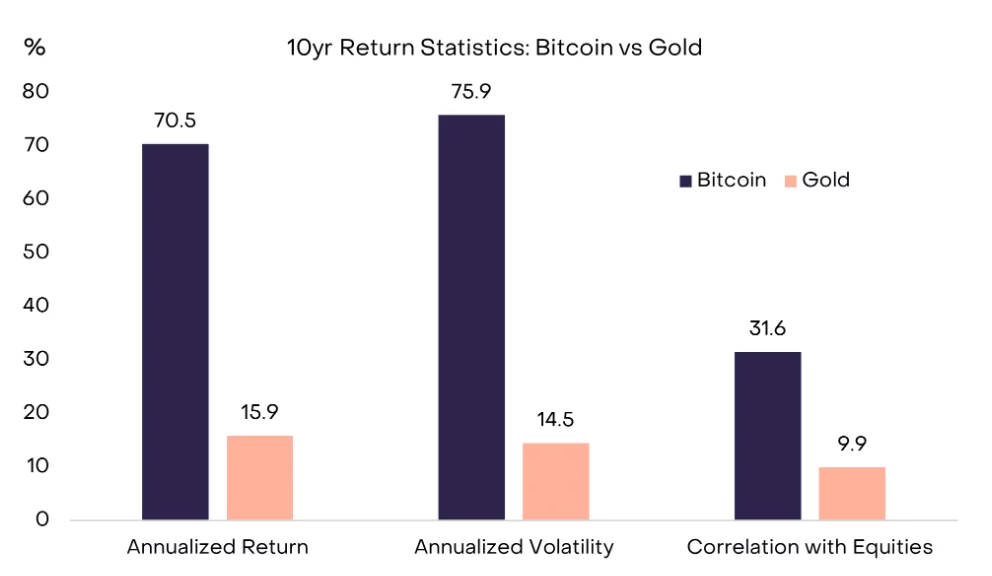

After bitcoin severely underperformed gold in 2025, he argued that the yellow metal likely has topped for this year and bitcoin is poised to outperform through 2026.

On ether , Lee said repeated 50% drawdowns since 2018 have often been followed by sharp rebounds.

Citing market technician Tom DeMark, he said ETH may need to briefly dip below $1,800 to form a “perfected bottom” before a more sustained recovery.

Read more: SkyBridge’s Scaramucci is buying the bitcoin dip, calls Trump a crypto President

Crypto World

Bitcoin trades like growth assets today, Gold tomorrow

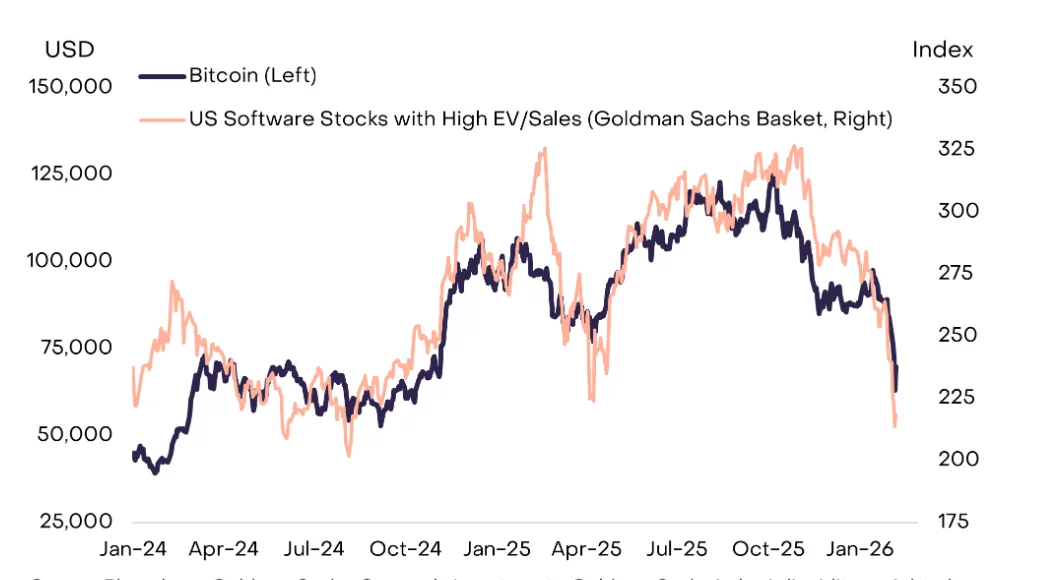

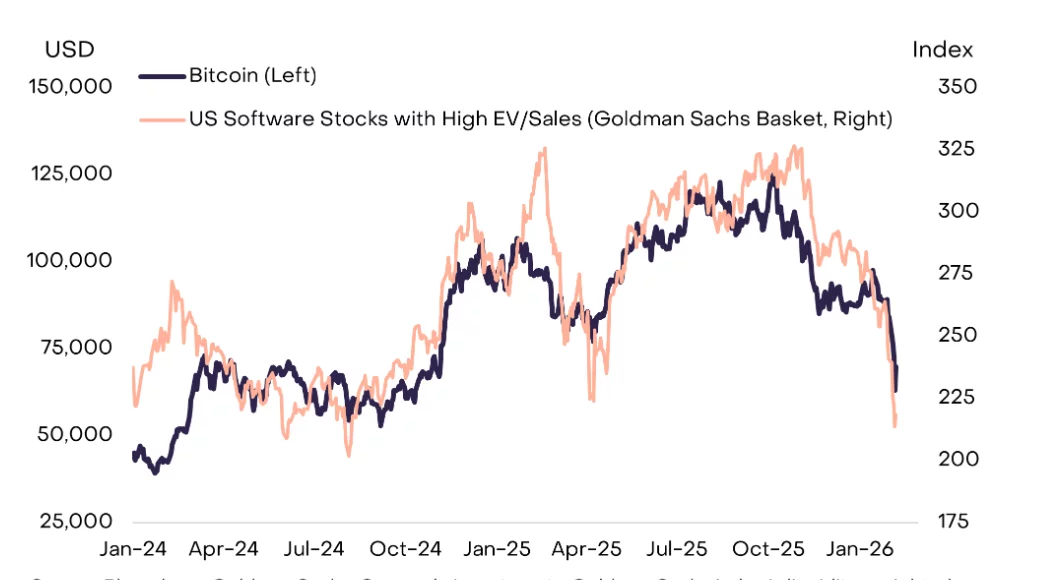

In its latest Market Byte research note, Grayscale Investments highlights a meaningful shift in Bitcoin’s price behavior. Recent BTC trading patterns resemble growth assets more closely than safe-haven commodities like gold, challenging the long-standing “digital gold” narrative.

Summary

- Bitcoin is trading more like a growth asset than gold, with recent price action closely tracking high-growth software stocks and broader risk assets, according to Grayscale.

- Near-term BTC moves are being driven by risk sentiment, not store-of-value demand, limiting its effectiveness as a hedge during equity market drawdowns.

- Grayscale maintains a long-term bullish thesis, arguing Bitcoin could eventually evolve into a gold-like monetary asset with lower volatility and weaker equity correlations if adoption continues.

According to the report’s key takeaways, Bitcoin’s (BTC) sharp move lower in early February — where the price dipped to around $60,000 on February 5 before a modest bounce — was driven by correlation with broader risk assets rather than traditional store-of-value flows.

Grayscale’s research shows Bitcoin’s price movements have tracked high-growth software stocks closely, especially since early 2024, with both falling in sync during recent sell-offs.

This behavior ushows Bitcoin’s sensitivity to market sentiment and cyclical risk appetite, similar to technology or growth equity performance during sell-offs.

What this means for Bitcoin traders

For traders, this means treating BTC more like a beta-driven risk asset in the near term. Rather than acting as a hedge during turbulent markets, Bitcoin has recently declined alongside broader speculative assets and failed to demonstrate the safe-haven characteristics typically associated with gold.

This shift has practical implications for portfolio construction and risk management. Traditional strategies that lean on Bitcoin as a hedge against macro uncertainty or inflation may be less effective when BTC behaves in sync with growth asset risk cycles.

Grayscale stresses that Bitcoin has not yet achieved gold-like status as a monetary asset, and that gap is central to the investment thesis.

However, in a future economy shaped by AI agents, humanoid robots, and tokenized capital markets, the firm argues a digital, blockchain-based commodity like Bitcoin is better suited to become the dominant store of value than physical assets such as gold or silver.

Grayscale adds that if Bitcoin succeeds in this role over the long term, its return profile could eventually shift. Price behavior may begin to resemble gold rather than growth stocks, marked by lower volatility, weaker equity correlations, and more stable — though lower — expected returns.

Crypto World

XRP price prediction as Goldman Sachs invests $153M in XRP ETFs

Goldman Sachs has renewed institutional focus on XRP after disclosing a $153 million investment in XRP ETFs, alongside major allocations to Bitcoin, Ethereum, and Solana.

Summary

- Goldman Sachs disclosed a $153 million investment in XRP ETFs, placing the token alongside its major holdings in Bitcoin and Ethereum and reinforcing XRP’s institutional relevance.

- XRP is trading near $1.37, with technical indicators showing fragile momentum as price remains capped below key moving averages and broader market sentiment stays cautious.

- Bitcoin’s ongoing consolidation is limiting altcoin upside, making BTC’s next directional move a critical factor for XRP’s near-term breakout or breakdown.

Goldman Sachs’ XRP exposure draws attention

The disclosure, highlighted by journalist Eleanor Terrett, places the Ripple token (XRP) among a select group of digital assets held at scale by one of Wall Street’s most influential banks.

The timing of the revelation is notable. Goldman has representation at a White House meeting centered on stablecoin yield policy, underscoring its role in shaping regulatory discussions.

CEO David Solomon is also scheduled to speak at the World Liberty Financial forum next week, reinforcing the firm’s growing public engagement with digital asset markets.

While ETF exposure does not directly translate into spot demand, the move adds credibility to XRP’s institutional narrative at a time when regulatory clarity remains a key market catalyst.

XRP price analysis and near-term outlook

XRP is currently trading near $1.37, reflecting continued consolidation after a sharp sell-off earlier this month.

TradingView data shows the token struggling to reclaim key short-term moving averages, indicating that bullish momentum remains fragile. The Relative Strength Index is still positioned below the neutral 50 level, signaling muted buying pressure and cautious trader sentiment.

Price action suggests that the $1.30–$1.32 region is acting as a critical support zone. A breakdown below this area could open the door to a deeper retracement toward $1.20, where buyers may attempt to re-enter.

On the upside, XRP would need a sustained move above $1.45–$1.50 to confirm a shift in market structure and pave the way for a recovery toward the $1.60–$1.65 range.

Until a clear breakout or breakdown occurs, XRP is likely to remain range-bound, with volatility driven by external catalysts.

Meanwhile, Bitcoin (BTC) seems to be consolidating following a volatile start to the year. The lack of a decisive move in Bitcoin has capped upside momentum across altcoins, keeping XRP’s recovery attempts limited.

Crypto World

The Next Phase of Crypto Hacks May Start With a Video Call

A North Korea–nexus threat actor is enhancing its social engineering playbook. The group is integrating AI-enabled lures into crypto-focused hacks, according to a new report from Google’s Mandiant team.

The operation reflects a continued evolution in state-linked cyber activity targeting the digital asset sector, which saw a notable increase in 2025.

Sponsored

Sponsored

Fake Zoom Call Triggers Malware Attack on Crypto Firm

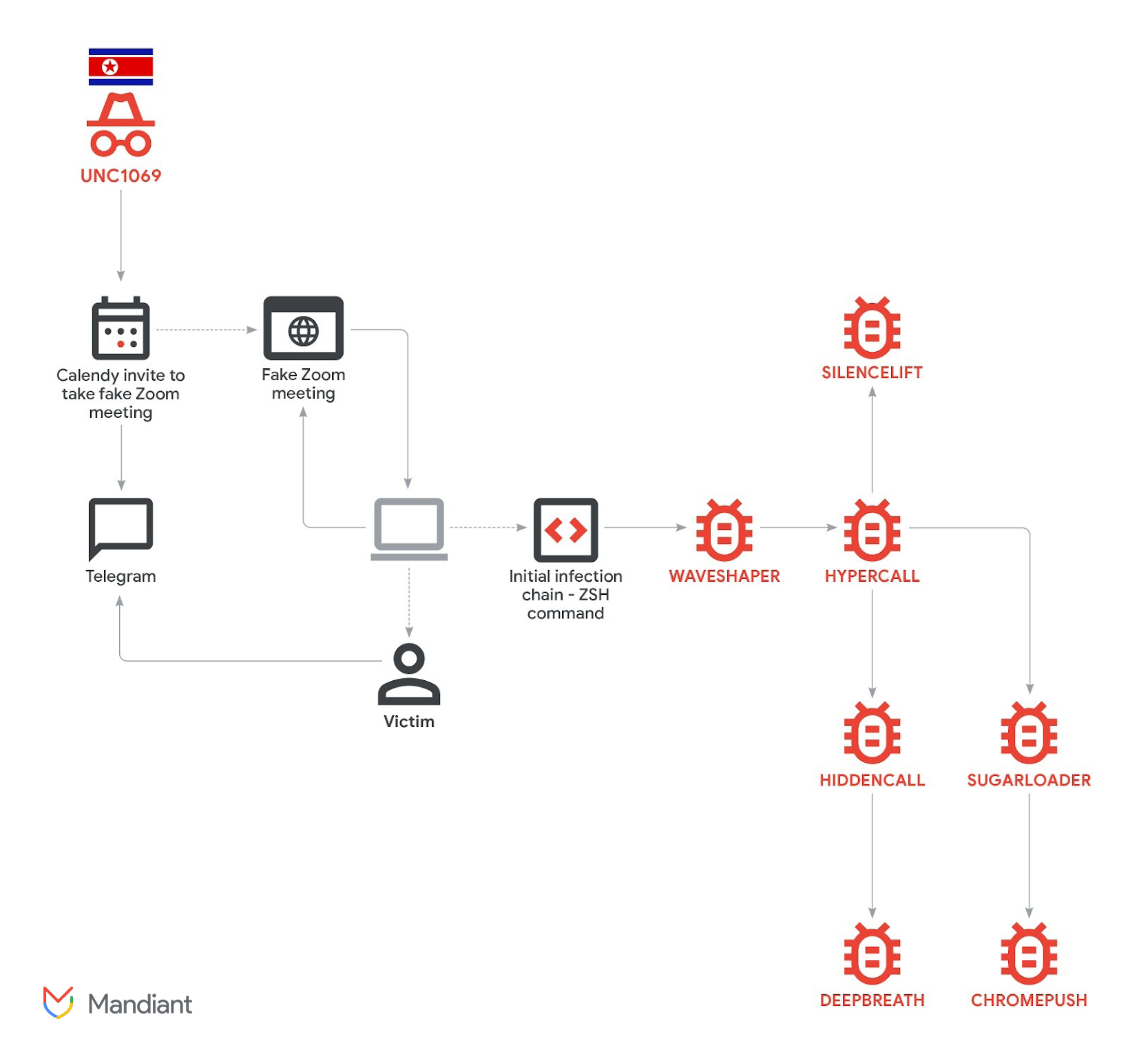

In its latest report, Mandiant detailed its investigation into an intrusion targeting a FinTech company in the cryptocurrency sector. The attack was attributed to UNC1069. It is a financially motivated threat group active since at least 2018, with links to North Korea.

“Mandiant has observed this threat actor evolve its tactics, techniques, and procedures (TTPs), tooling, and targeting. Since at least 2023, the group has shifted from spear-phishing techniques and traditional finance (TradFi) targeting towards the Web3 industry, such as centralized exchanges (CEX), software developers at financial institutions, high-technology companies, and individuals at venture capital funds,” the report read.

According to investigators, the intrusion began with a compromised Telegram account belonging to a crypto industry executive. The attackers used the hijacked profile to contact the victim. They gradually built trust before sending a Calendly invitation for a video meeting.

The meeting link directed the target to a fake Zoom domain hosted on infrastructure controlled by the threat actors. During the call, the victim reported seeing what appeared to be a deepfake video of a CEO from another cryptocurrency company.

“While Mandiant was unable to recover forensic evidence to independently verify the use of AI models in this specific instance, the reported ruse is similar to a previously publicly reported incident with similar characteristics, where deepfakes were also allegedly used,” the report added.

The attackers created the impression of audio problems in the meeting to justify the next step. They instructed the victim to run troubleshooting commands on their device.

Sponsored

Sponsored

Those commands, tailored for both macOS and Windows systems, secretly initiated the infection chain. This led to the deployment of multiple malware components.

Mandiant identified seven distinct malware families deployed during the intrusion. The tools were designed to steal Keychain credentials, extract browser cookies and login data, access Telegram session information, and collect other sensitive files.

Investigators assessed that the objective was twofold: to enable potential cryptocurrency theft and harvest data that could support future social engineering attacks.

The investigation revealed an unusually large volume of tooling dropped onto a single host. This suggested a highly targeted effort to harvest as much data as possible from the compromised individual.

The incident is part of a broader pattern rather than a standalone case. In December 2025, BeInCrypto reported that North Korean-linked actors siphoned more than $300 million by posing as trusted industry figures during fraudulent Zoom and Microsoft Teams meetings.

The scale of activity throughout the year was even more striking. In total, North Korean threat groups were responsible for $2.02 billion in stolen digital assets in 2025, a 51% increase from the previous year.

Chainalysis also revealed that scam clusters tied on-chain to AI service providers show significantly higher operational efficiency than those without such links. According to the firm, this trend suggests a future in which AI becomes a standard component of most scam operations.

With AI tools growing more accessible and advanced, creating convincing deepfakes is easier than ever. The coming time will test whether the crypto sector can adapt its security fast enough to confront these advanced threats.

Crypto World

These Altcoins Bleed Out Again as Bitcoin Dips Below $67K: Market Watch

ZRO has entered the top 100 alts after a massive surge, while most other altcoins have plunged hard yet again.

After several consecutive days of trading sideways between $68,000 and $72,000, bitcoin’s floor gave in hours ago and the asset dipped below $67,000 for the first time since Friday.

Most altcoins have joined the ride south, with ETH dumping beneath $2,000, XRP trading below $1.40, and BNB struggling to remain above $600.

BTC Slips Below $67K

It’s safe to say that the past couple of weeks have been highly unfavorable for the crypto bulls. On January 28, exactly two weeks ago, bitcoin stood tall at $90,000. However, it charted a notable price correction since then that lasted days and culminated, at least for now, last Friday.

At the time, the cryptocurrency plunged by approximately $17,000 in just over 24 hours and dumped to $60,000 on Friday morning. This became its lowest price point since before the US presidential elections in November 2024. The bulls were quick to intervene at this point and helped BTC rebound to $72,000 on that same day.

The weekend was calmer, with bitcoin trading sideways between $68,000 and $72,000. It tried to take down the upper boundary but failed on Monday and Tuesday and the subsequent rejection drove it south to under $67,000 where it currently struggles as well.

Its market capitalization has declined to $1.340 trillion on CG, while its dominance over the alts has dropped below 57%.

Alts Back in Red

Most alts have suffered even more over the past day. Ethereum has lost the $2,000 support after a 3.2% decline. A 4.1% drop from XRP has driven it to well below $1.40, while BNB is down to $600 after a 5% decrease.

SOL, ADA, HYPE, DOGE, LINK, LTC, and many other larger-cap alts are also in the red, while XMR has defied the trend today with a 3% increase to over $340.

Pi Network’s native token has charted another all-time low, while MYX is down by over 12%. BGB is next in terms of daily losses with a 9% drop. In contrast, ZRO has entered the top 100 alts after skyrocketing by 20%.

The total crypto market cap has shed over $50 billion daily and is down to $2.350 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

BTC and XRP Crash Over? Analyst Pinpoints Exact Rebound Timeline

The timeframe might be shorter than you expect.

The cryptocurrency market is bleeding out once again, led by bitcoin’s decline to under $67,000 for the first time since last Friday’s calamity.

However, one analyst believes there’s finally good news for BTC and XRP, and he even provided a more precise timing for the potential rebound.

The primary cryptocurrency has been in a free-fall state for weeks. It stood over $90,000 on January 28, but dumped by $30,000 since then to bottom out, at least for now, at $60,000 last Friday.

It tried to recover some ground since then and tapped $72,000 on a couple of occasions, but was stopped yesterday again and driven to under $67,000 as of press time.

Approximately at the time when the latest correction took place, popular analyst Ali Martinez said on X that the early TD Sequential buy signal had flashed for BTC. Moreover, he was precise with the timing of the potential rebound, claiming that it could be in the next 3-9 days.

Early TD Sequential buy signal on Bitcoin $BTC, suggesting a potential rebound could take shape over the next 3–9 days. pic.twitter.com/E1poXoOcNI

— Ali Charts (@alicharts) February 10, 2026

The metric, developed by Tom DeMark, identifies potential market reversal points, usually after a strong move in either direction. Martinez has frequently posted about the TD Sequential for several cryptocurrencies, and the indicator’s success rate has been rather impressive, especially for Ripple’s XRP.

You may also like:

Before the latest drop, the cross-border token also flashed a buy signal. Although it has since retraced by 3-4%, Martinez reminded that the TD Sequential has “perfectly timed” the local top for XRP in the past, and could signal a rapid rebound now.

The TD Sequential perfectly timed the local top on $XRP, and now it’s flashing a buy signal. pic.twitter.com/5FI3Pepsnz

— Ali Charts (@alicharts) February 10, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

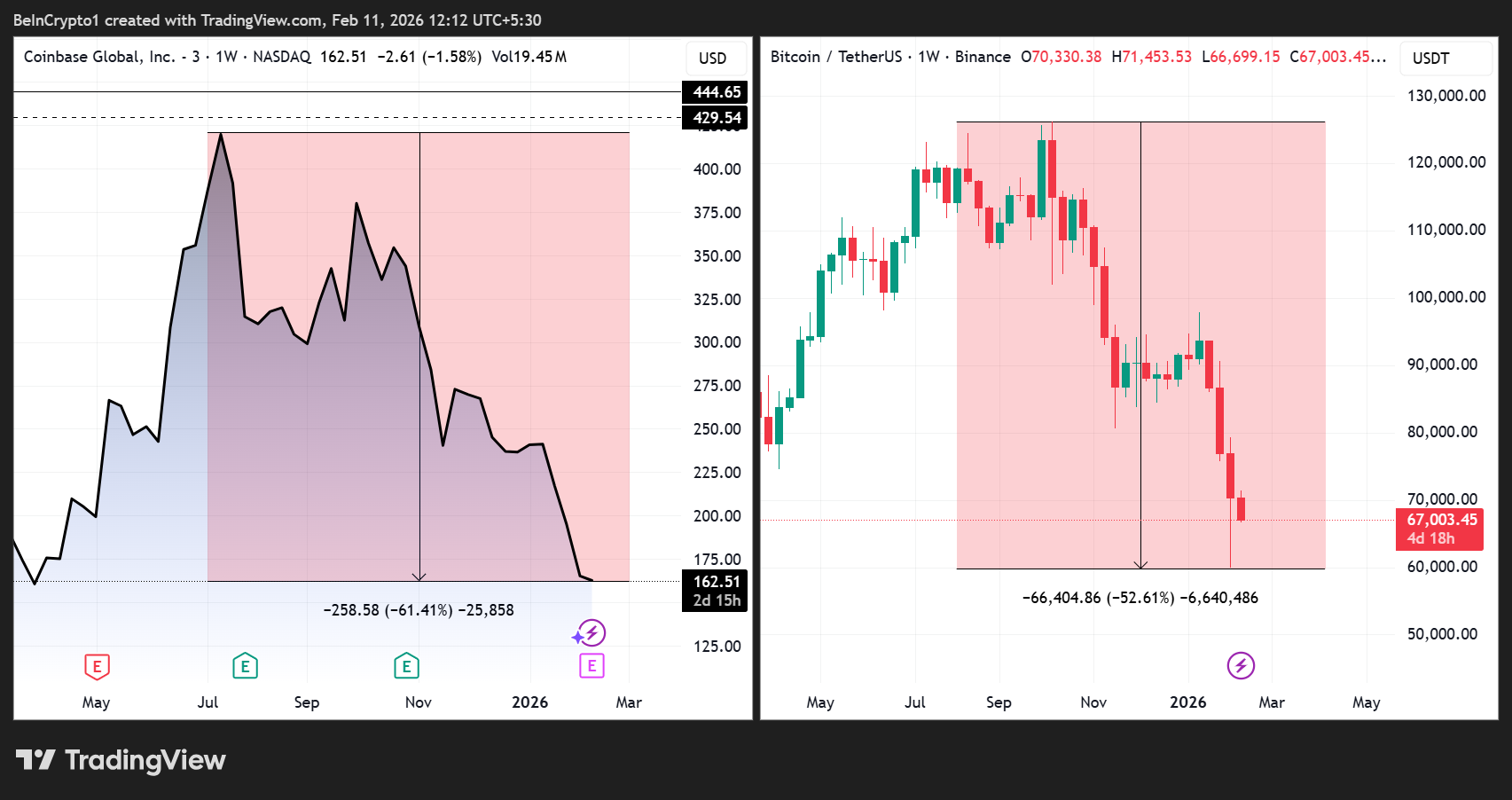

Bitcoin Drop Wipes $10 Billion From Brian Armstrong’s Net Worth

Brian Armstrong, co-founder and CEO of Coinbase, has dropped out of Bloomberg’s list of the world’s 500 richest people.

Armstrong’s net worth has fallen by more than $10 billion since July 2025. According to the Bloomberg Billionaires Index, it is down from a peak of $17.7 billion to around $7.5 billion.

Brian Armstrong’s Wealth Plummets as Coinbase Shares and Bitcoin Price Slide

The latest slide comes after JPMorgan Chase & Co. cut its price target for Coinbase stock by 27% on February 10, citing “softness in crypto prices,” declining trading volumes, and slower stablecoin adoption.

Sponsored

Sponsored

Coinbase shares have mirrored Bitcoin’s volatility, falling 60% from a July 18 high, while Bitcoin itself has dropped nearly 50% from its early October 2025 all-time high of around $126,000 to below $63,000 as of early February 2026.

Armstrong’s wealth is closely tied to his 14% stake in Coinbase, the New York-based crypto trading platform he co-founded with Fred Ehrsam in 2012.

He also holds investments in NewLimit, a biotech startup focused on longevity, and has historically sold portions of his Coinbase holdings over time.

Despite the sharp paper losses, Armstrong remains a billionaire, with his net worth estimated at approximately $7.5 billion.

The impact of the crypto slump extends beyond Armstrong. Cameron and Tyler Winklevoss, co-founders of Gemini, have seen their net worths fall to $1.9 billion each from $8.2 billion in October 2025.

Sponsored

Sponsored

Gemini recently announced plans to cut roughly 25% of its workforce and scale back some international operations.

Michael Novogratz, CEO of Galaxy Digital, saw his fortune shrink from $10.3 billion to $6.2 billion following a greater-than-expected $500 million loss in Q4 2025.

Strategy Inc. co-founder Michael Saylor also lost about two-thirds of his wealth, bringing his net worth to $3.4 billion.

Coinbase Navigates Market Headwinds While Armstrong Stays Bullish

Coinbase itself has faced operational headwinds amid the market downturn. Trading volumes have dropped sharply, and Q4 2025 transaction revenue is projected to decline 33.5% year over year.

Meanwhile, Polymarket betters see a 29% chance that Coinbase Global’s GAAP EPS for the relevant quarter will beat $0.61.

Sponsored

Sponsored

During the sell-off, the “Coinbase premium”—the price gap between BTC on Coinbase versus other exchanges—turned negative. This indicates weaker US institutional demand and potential outflows.

The exchange is further challenged by regulatory scrutiny and competition from other crypto platforms like Hyperliquid.

Despite the turbulent environment, Armstrong has maintained a bullish long-term outlook. He has publicly described crypto as “eating financial services at an incredible rate” and views market slumps as opportunities to build new products.

Sponsored

Sponsored

Armstrong has also predicted that Bitcoin could reach $1 million by 2030, framing the digital asset as a tool for wealth equalization and financial innovation.

However, while Armstrong’s net worth has been heavily impacted, his position as a founder and major shareholder could strengthen over time.

Historically, downturns have consolidated power among surviving platforms, and Coinbase may emerge leaner and more dominant if retail and institutional adoption rebounds.

Nevertheless, prolonged market weakness or a full “crypto winter” could pressure growth and test leadership strategies.

The recent wave of losses reflects the high volatility of crypto markets. While Armstrong’s exit from Bloomberg’s top 500 reflects a sharp contraction in paper wealth, long-term crypto pioneers like him have weathered multiple market cycles since 2012.

Crypto World

New Bitcoin Transfers Reported in Nancy Guthrie Ransom Account

New activity has been reported in a Bitcoin wallet tied to an alleged ransom demand in the high-profile disappearance of 84-year-old Nancy Guthrie, the mother of NBC Today co-anchor Savannah Guthrie.

Summary

- New Bitcoin activity has been detected in a wallet linked to an alleged ransom demand in the disappearance of 84-year-old Nancy Guthrie.

- The transaction marks the first reported movement in the crypto account since ransom notes demanding millions in Bitcoin were sent to media outlets earlier this month.

- Authorities have not confirmed who initiated the transfer, as the FBI continues to investigate Guthrie’s disappearance as a likely abduction.

TMZ confirmed Tuesday that for the first time since the ransom note was received, there has been “activity” in the cryptocurrency account referenced in the initial ransom demand sent to multiple media outlets, including TMZ itself.

The details of the transaction, including the amount transferred and the sender, have not been disclosed publicly. Still, the development marks a significant update in an investigation that had seen no confirmed contact from the kidnappers since earlier deadlines for ransom payments passed.

Here’s what we know about the Nancy Guthrie abduction

Nancy Guthrie was last seen at her home in Catalina Foothills, Arizona in late January and was reported missing on February 1. Law enforcement has treated her disappearance as a likely abduction after finding evidence of a struggle and DNA-matched blood at the scene.

Shortly after her disappearance, at least one ransom note demanding payment in Bitcoin (BTC) was sent to two Tucson television stations and TMZ. The note reportedly set two deadlines and demanded millions in Bitcoin for Guthrie’s safe return.

According to TMZ founder Harvey Levin, the ransom wallet tied to the first letter showed activity late Tuesday, hours after the FBI released surveillance images of a person of interest. Levin said he observed the activity “about 12 minutes” after it happened, though he declined to elaborate on the nature of the transaction.

Surveillance footage and photos of a masked person seen near Guthrie’s home early the morning she vanished, and a person of interest was detained for questioning south of Tucson earlier this week.

At present, officials have not confirmed whether the Bitcoin transaction is connected to the alleged kidnappers, the Guthrie family, law enforcement, or another party, and investigations are ongoing.

The reported Bitcoin wallet activity in the Guthrie case comes amid a wider global surge in cryptocurrency-linked kidnappings. French authorities recently arrested six suspects in a case where a magistrate and her mother were held for a crypto ransom before being rescued.

In a separate cross-border operation last year, Spanish and Danish police dismantled a gang accused of abducting and killing a crypto holder in a violent attempt to seize access to digital wallets, underscoring the growing physical security risks faced by holders of digital assets.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech6 hours ago

Tech6 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World17 hours ago

Crypto World17 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition