Crypto World

As bitcoin (BTC) price extends declines, industry figures say it’s time to buy: Crypto Daybook Americas

By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin dropped for a third straight day after failing to remain above the $70,000 hit during the weekend recovery as spot trading volumes thinned and theCrypto Fear and Greed Index held in “extreme fear” territory.

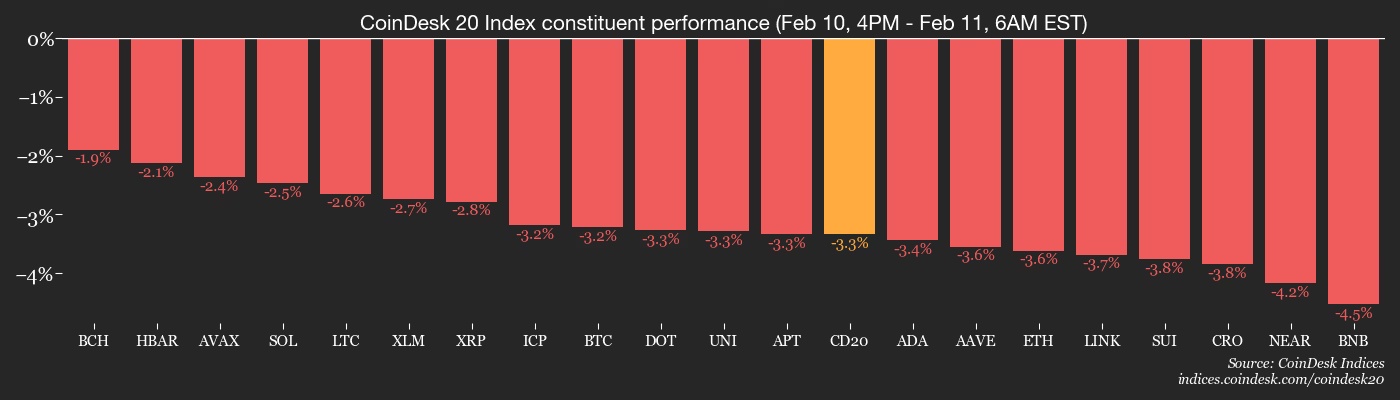

The broader crypto market capitalization has slipped to about $2.28 trillion, with the CoinDesk 20 (CD20) index losing 3.4% over the past 24 hours. Even so, onchain data aggregator Glassnode described the pullback as modest by past standards, with no signs of panic selling seen in prior cycle peaks.

Despite the lower volumes and poor sentiment, inflows to spot bitcoin ETFs have been steady over the past three days, helping absorb some selling pressure. The market is now in a price discovery phase, according to Wintermute.

“With spot volumes still relatively light, leverage is driving short term moves as was illustrated by BTC squeezing back up from the lows last friday on the back of heavily crowded perp shorts,” Wintermute desk strategist Jasper De Maere wrote in an emailed note. “It’s likely the market will continue to whip across this range as its still in price discovery.“

Major figures appear to remain bullish. Speaking at Consensus Hong Kong, Tom Lee, chief investment officer of Fundstrat and chairman of ether treasury firm BitMine Immersion (BMNR), told investors they should look for entry points rather than try to time a bottom.

On CNBC, Michael Saylor, executive chairman of bitcoin treasury firm Strategy (MSTR), reiterated his long-term bet on the cryptocurrency, saying he expects it to outperform traditional equities despite the drawdown.

Weak U.S. retail sales have moderately lifted U.S. interest rate-cut expectations and weighed on the dollar. Now, attention will switch to today’s nonfarm payrolls figures and inflation data, which could further influence risk appetite. Stay alert.

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- Feb. 11: Immutable to complete the merge of Immutable X and Immutable zkEVM.

- Macro

- Feb. 11, 8:30 a.m.: U.S. nonfarm payrolls for January Est. 70K (Prev. 50K)

- Feb. 11, 8:30 a.m.: U.S. unemployment rate for January Est. 4.4%(Prev. 4.4%)

- Feb. 11, 8:30 a.m.: U.S. average hourly earnings for January YoY Est. 3.8% (Prev. 3.6%)

- Earnings (Estimates based on FactSet data)

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- Feb. 11: Ripple to host XRP Community Day on X Spaces discussing XRP adoption, regulated finance and innovation.

- Unlocks

- Token Launches

- Feb. 11: Coinbase to list RaveDAO (RAVE), DeepBook (DEEP), and Walrus (WAL).

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 0.25% from 4 p.m. ET Tuesday at $66,868.63 (24hrs: -3.14%)

- ETH is down 2.96% at $1,947.84 (24hrs: -3.25%)

- CoinDesk 20 is down 2.75% at 1,900.89 (24hrs: -3.53%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.83%

- BTC funding rate is at -0.0023% (-2.536% annualized) on Binance

- DXY is down 0.3% at 96.50

- Gold futures are up 1.73% at $5,117.80

- Silver futures are up 6.22% at $85.39

- Nikkei 225 closed up 2.28% at 57,650.54

- Hang Seng closed up 0.31% at 27,266.38

- FTSE is up 0.50% at 10,405.94

- Euro Stoxx 50 is down 0.41% at 6,022.26

- DJIA closed on Tuesday up 0.1% at 50,188.14

- S&P 500 closed down 0.33% at 6,941.81

- Nasdaq Composite closed down 0.59% at 23,102.47

- S&P/TSX Composite closed up 0.71% at 33,256.83

- S&P 40 Latin America closed down 0.57% at 3,746.47

- U.S. 10-Year Treasury rate is down 1 bps at 4.135%

- E-mini S&P 500 futures are unchanged at 6,966.50

- E-mini Nasdaq-100 futures are unchanged at 25,218.00

- E-mini Dow Jones Industrial Average Index futures are up 0.13% at 50,338.00

Bitcoin Stats

- BTC Dominance: 59.12% (-0.29%)

- Ether-bitcoin ratio: 0.02914 (-0.81%)

- Hashrate (seven-day moving average): 1,002 EH/s

- Hashprice (spot): $33.56

- Total fees: 2.6 BTC / $179,640

- CME Futures Open Interest: 120,785 BTC

- BTC priced in gold: 13.1 oz.

- BTC vs gold market cap: 4.46%

Technical Analysis

- BTC/USD is currently hovering below the 200-week exponential moving average, a critical support level that must be reclaimed to prevent further downside.

- The market now awaits the weekly close to confirm whether this breach marks a definitive breakdown or a temporary deviation.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $162.51 (-2.83%), -3.39% at $157.00 in pre-market

- Circle Internet (CRCL): closed at $59.75 (-0.58%), -1.84% at $58.65

- Galaxy Digital (GLXY): closed at $21.19 (+0.19%), -1.75% at $20.82

- Bullish (BLSH): closed at $32.05 (+0.00%), -1.68% at $31.51

- MARA Holdings (MARA): closed at $7.66 (-4.96%), -3.13% at $7.42

- Riot Platforms (RIOT): closed at $14.83 (-0.94%), -2.29% at $14.49

- Core Scientific (CORZ): closed at $18.13 (-2.26%), -2.48% at $17.68

- CleanSpark (CLSK): closed at $10.03 (-1.57%), -2.49% at $9.78

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $42.62 (-2.76%)

- Exodus Movement (EXOD): closed at $10.86 (+1.12%)

Crypto Treasury Companies

- Strategy (MSTR): closed at $133.00 (-3.93%), -3.12% at $128.85

- Strive (ASST): closed at $9.18 (-9.51%), -3.27% at $8.88

- SharpLink Gaming (SBET): closed at $6.65 (-6.47%), -0.60% at $6.61

- Upexi (UPXI): closed at $0.98 (-7.14%), +1.96% at $0.99

- Lite Strategy (LITS): closed at $1.03 (-1.90%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $166.5 million

- Cumulative net flows: $54.98 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: $13.8 million

- Cumulative net flows: $11.91 billion

- Total ETH holdings ~5.84 million

Source: Farside Investors

While You Were Sleeping

Crypto World

Amazon (AMZN) Shares Struggle to Find Support After Weak Report

As the chart shows, Amazon (AMZN) shares have displayed pronounced bearish momentum following the release of a weak earnings report on 5 February:

→ Revenue: $213.4 bn (forecast: $211.4 bn)

→ Earnings per share (EPS): actual $1.95, forecast $1.97

According to media reports, particular concern arose after Amazon announced plans to spend $200 bn on capital expenditure in 2026, mainly on AI, data centres, and chips. This represents an increase of roughly 60% from last year and significantly exceeds analysts’ expectations of around $146 bn.

Market participants may fear that the AI arms race (against Microsoft and Google) will be extremely costly, monetisation of these technologies could take years, and success is not guaranteed. As a result, we see two wide bearish gaps under the $232 and $220 levels, formed after the earnings release.

Technical Analysis of Amazon (AMZN)

Since June last year, the thickened trendline acted as a key support, regarded by the market as an attractive level to buy AMZN shares. That line has now been decisively broken.

Using this trendline as the median and the historical peak as the upper boundary to construct a channel, we can observe that the line dividing the channel into the lower two quarters (QL) currently serves as support.

The gap areas may act as resistance, and prevailing negative sentiment is likely to continue weighing on AMZN shares. In this scenario, bears could break not only the QL line but also the psychological $200 level, heightening concerns.

Under this bearish scenario, the share price could fall towards the lower boundary of the channel, near $188.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Robinhood Enters Layer 2 Race With Public Testnet Launch of Robinhood Chain

Infrastructure providers, including Chainlink, Alchemy, and LayerZero, are already integrating with Robinhood Chain’s newly launched testnet.

Robinhood has launched the public testnet for Robinhood Chain, an Ethereum Layer 2 network built on Arbitrum. The US-based trading platform said the testnet is designed to accelerate the development of tokenized real-world and digital assets.

This move would give developers early access to the core infrastructure ahead of a planned mainnet launch later this year.

Arbitrum-Based Layer 2 Testnet

With the public testnet now live, developers can begin building and verifying applications on Robinhood Chain, using an environment that is compatible with standard Ethereum development tools and leverages Arbitrum technology. Robinhood stated that several infrastructure providers, such as Alchemy, Allium, Chainlink, LayerZero, and TRM, are already integrating with the network.

More partners are expected to be onboarded during the early stages of the testnet. As part of the launch, participants can access network entry points to the testnet, developer documentation hosted on Robinhood’s website, and early infrastructure support from ecosystem partners.

The company stated that the testnet phase is intended to support experimentation, identify potential issues, improve network stability, and lay the groundwork for developers ahead of the upcoming mainnet.

Robinhood Chain is backed by the company’s existing infrastructure and experience. It was developed with a focus on reliability, security, and compliance, the release said. Built on Arbitrum, the network supports bridging and self-custody, along with the scalability and customizability needed for financial-grade decentralized products such as tokenized asset platforms, lending platforms, and perpetual futures exchanges.

Going forward, Robinhood said developers building on the chain will gain access to testnet-only assets, including Stock Tokens for integration testing, as well as direct testing with Robinhood Wallet. The company added that the chain is designed to provide a familiar development environment within the broader Ethereum and Arbitrum ecosystem.

You may also like:

Institutional Expansion Meets Revenue Headwinds

The trading platform has continued to deepen its exposure to cryptocurrencies since rolling out crypto trading for users. Last year, Robinhood officially completed the $200 million acquisition of Bitstamp, which was touted as its formal entry into institutional crypto. However, its revenue trends have weakened in the last few months.

In the fourth quarter of 2025, Robinhood generated $221 million from cryptocurrency transactions, down 38% from a year earlier. The result contrasted with the previous quarter, when crypto revenue jumped to $268 million, amidst broader market turmoil.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

UNI Soars 30% Amid Strategic Investment from BlackRock

Uniswap and Securitize have announced a strategic partnership with BlackRock to provide DeFi liquidity for BlackRock’s tokenized fund.

Uniswap Labs and Securitize have announced a new partnership with financial giant BlackRock to enhance DeFi liquidity for institutional investors through BlackRock’s USD Institutional Digital Liquidity Fund, also known as BUIDL.

Following the announcement, the price of Uniswap’s native token, UNI, surged by 27% from around $3.30 to $4.36, before retracing to $3.81 by press time.

The collaboration will enable on-chain trading of BUIDL’s share on UniswapX, an auction-driven trading protocol, unlocking new liquidity options for BUIDL holders, Uniswap said in a blog post today.

Tokenization platform Securitize, for its turn, will facilitate trading for BUIDL investors who elect to participate through UniswapX’s framework.

“For the first time, institutions and whitelisted investors can access technology from a leader in the decentralized finance space to trade tokenized real-world assets like BUIDL with self-custody,” said Carlos Domingo, CEO of Securitize.

As part of the collaboration, BlackRock has also made a strategic investment within the Uniswap ecosystem, the blog post reads, though no details were given.

The collaboration comes shortly after investment management firm Franklin Templeton teamed up with Binance to launch tokenized collateral program. As The Defiant reported earlier, eligible clients can now use tokenized money market funds as off-exchange trading collateral.

This article was generated with the assistance of AI workflows.

Crypto World

Kaspersky Unveils Hunt Hub to Boost Transparency in Threat Detection

Editor’s note: Kaspersky has rolled out a significant update to its Threat Intelligence Portal, adding a new Hunt Hub alongside expanded MITRE ATT&CK coverage and a much larger vulnerabilities database. The update is aimed at giving security teams clearer visibility into how threats are detected, why alerts are triggered, and which risks matter most in real-world environments. As cyberattacks grow in volume and complexity, the focus shifts from raw alerts to context and prioritization. This release positions threat intelligence as a practical decision-making tool for analysts, CISOs, and organizations managing increasingly complex digital infrastructures.

Key points

- Hunt Hub centralizes Kaspersky’s threat hunting rules and detection logic, mapped to MITRE ATT&CK techniques.

- Detection logic is presented in a structured, SIGMA-like format for deeper analyst understanding.

- The MITRE ATT&CK coverage map now unifies SIEM, EDR, NDR, and Sandbox visibility in one view.

- The vulnerabilities database has expanded to nearly 300,000 CVEs, with emphasis on exploited threats.

Why this matters

For organizations facing a rising volume of sophisticated cyber threats, transparency and prioritization are critical. By exposing detection logic and linking it directly to attacker behavior and real-world vulnerabilities, the updated portal helps security teams move beyond reactive alert handling. This approach supports more efficient threat hunting, better risk assessment, and smarter allocation of defensive resources, which is especially relevant as digital infrastructure, cloud services, and enterprise networks continue to expand.

What to watch next

- Adoption of Hunt Hub by security operations teams and threat hunters.

- How organizations use the unified MITRE ATT&CK view to assess security gaps.

- Updates to hunt libraries and vulnerability intelligence over time.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Kaspersky has announced a major update to its Threat Intelligence Portal (TIP), introducing a new Hunt Hub section alongside an enhanced MITRE ATT&CK coverage map and a significantly expanded vulnerabilities database. The update strengthens organizations’ ability to investigate threats, understand adversary behavior, and proactively monitor the most relevant risks across their environments.

According to the Kaspersky Security Bulletin 2025 report, Kaspersky’s detection systems discovered an average of 500,000 malicious files per day in 2025, marking a 7% increase compared to the previous year. As cyberattacks become more sophisticated and frequent, security teams need more than alerts – they need clarity.

The newly launched Hunt Hub is designed to address growing market demand for greater transparency and deeper insight into how modern detection technologies work. Integrated into the Threat Landscape section of the Threat Intelligence Portal, Hunt Hub provides centralized access to Kaspersky’s threat hunting expertise and detection knowledge.

Hunt Hub includes Kaspersky Next EDR Expert hunts, also known as indicators of attack (IoA) or detection rules. All portal users can explore the catalogue of hunts and their descriptions, while Kaspersky Next EDR Expert customers gain extended access to detailed recommendations and detection logic presented in a convenient, SIGMA-like format. Each hunt is mapped to relevant MITRE ATT&CK tactics and techniques and linked to known threat actors, giving analysts clear context behind every detection.

By making detection logic visible and structured, Hunt Hub effectively removes the “black box” from threat detection. It allows security teams not only to respond to alerts, but also to understand why a detection was triggered and which threat it is designed to uncover – improving trust in security technologies and increasing the efficiency of threat investigation processes.

As part of the update, the MITRE ATT&CK coverage map within the Threat Landscape has been significantly enhanced. The portal now brings together product coverage across SIEM, EDR, NDR and Sandbox solutions, MITRE ATT&CK techniques with scoring, coverage percentages, and related Kaspersky Next EDR Expert hunts in a single, unified view. This enables organizations to assess how well their security stack covers relevant attack techniques and identify potential gaps in protection.

The Vulnerabilities section has also been expanded, with the CVE database now covering nearly 300,000 vulnerabilities. In addition, the portal provides more detailed information on vulnerabilities that have been exploited in real-world attacks, helping organizations prioritize remediation efforts based on actual threat activity.

“With the launch of Hunt Hub in the Kaspersky Threat Intelligence Portal, we are opening up our detection expertise and giving analysts clear visibility into how and why threats are detected. This transparency helps organizations move from reactive alert handling to informed threat hunting and proactive risk management,” comments Nikita Nazarov, Head of Threat Exploration at Kaspersky.

To learn more about Kaspersky Threat Intelligent Services, please follow the link.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure, and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com

Crypto World

How AI Predictive Analytics is Redefining Risk Management in Tokenized Asset Portfolios?

Tokenized asset portfolios are rapidly becoming a core component of modern digital finance. By converting real-world and financial assets into blockchain-based tokens, enterprises unlock greater liquidity, fractional ownership, and global market access. While these advantages are significant, they also introduce a level of complexity that traditional risk management frameworks were never designed to handle. This growing complexity has accelerated the adoption of AI-powered financial analytics to improve visibility and decision-making across digital investment ecosystems.

Unlike conventional portfolios that operate within defined market hours and centralized systems, tokenized assets function in a continuous, decentralized environment. Risk factors evolve in real time, driven by on-chain activity, secondary market behavior, protocol dependencies, and regulatory developments. In such an ecosystem, identifying risk after it has already materialized is both inefficient and costly, making advanced AI in risk management a critical requirement rather than an optional enhancement.

This reality is pushing enterprises and institutional investors toward predictive risk management. AI predictive analytics enables organizations to anticipate potential risk scenarios before they escalate, allowing for timely intervention and informed decision-making. Rather than reacting to volatility, liquidity shocks, or compliance issues, enterprises can proactively manage exposure across tokenized asset portfolios using data-driven forecasting models.

Key drivers behind the need for predictive risk management include:

- Continuous market operations: Tokenized assets trade 24/7, increasing exposure to sudden market shifts and reinforcing the need for real-time Tokenized assets risk analysis.

- Data-rich environments: Massive volumes of on-chain and off-chain data require intelligent interpretation through AI-powered financial analytics to extract meaningful risk insights.

- Dynamic portfolio exposure: Asset correlations and liquidity profiles change rapidly in tokenized ecosystems, increasing demand for AI-enhanced portfolio risk optimization.

The New Risk Landscape of Tokenized Asset Portfolios

Tokenization is changing investments and transforming how investors view risks in their portfolios. While traditional asset portfolios have mostly well-defined risks (e.g., market volatility, credit risk, macroeconomic conditions), tokenized portfolios span multiple markets and three distinct areas – financial markets, blockchain infrastructure, and digital asset performance. This convergence has elevated the role of Artificial intelligence in investment risk analysis, as manual risk models struggle to process these interconnected variables.

This convergence introduces a new and unique set of uncertainties that necessitate holistic risk assessments; therefore, risk is no longer just about asset performance, but how the technology layers, market infrastructure, and regulatory interpretations affect portfolio risk.

1. Market Risk

Risk in the tokenized marketplace is exacerbated by numerous buys and sells, speculative trading, and a speculative trading environment. Because of the short-term nature of many Tokenized Assets (TAs), their prices could be significantly misaligned with their underlying asset’s industrial value due to issues such as lack of liquidity, speculative trading behavior, and larger movements in the broader cryptocurrency market. If not monitored regularly, the volatility associated with TAs may produce large impacts to portfolio value, highlighting the importance of AI predictive analytics for forward-looking risk assessment.

2. Liquidity Risk

Liquidity for TAs is typically highly fragmented (e.g., decentralized exchanges, centralized exchanges, OTC brokerage accounts) and may appear adequate prior to periods of stress; however, when stress occurs, liquidity may be very limited. As such, it becomes essential to apply AI-enhanced portfolio risk optimization techniques to anticipate liquidity constraints when planning and executing exit strategies and allocating capital.

3. Risk with Smart Contracts

Smart contracts determine how to create, distribute and move tokenized assets from one person to another. Systemic risk can arise from improper contract logic, security holes in the contract or poor upgrade management. The risk is of a technical nature; however, financial ramifications will be direct, making automated Tokenized assets risk analysis increasingly necessary.

4. Risk due to Regulation

Tokenized assets are often used across multiple jurisdictions and have changing compliance laws and regulations. Changes to the laws surrounding compliance, reporting and asset classification will change the structure of portfolios and compiler will have participation. Predictive compliance monitoring using AI in risk management helps enterprises stay ahead of regulatory shifts.

5. Operational Risk

Reliance on oracles, custodians, blockchains and other third-party services is a potential point of failure in operations. Failure at one of these points will impact either the availability of the asset, the accuracy of its price or the completion of a transaction, reinforcing the need for AI-powered financial analytics across operational layers.

Build AI-Powered Risk Intelligence Into Your Tokenization Stack

Why Traditional Risk Models Fall Short in Tokenized Markets

Traditional risk management frameworks were developed for centralized financial systems with predictable reporting cycles and limited data sources. While effective for legacy portfolios, these models struggle to address the dynamic nature of tokenized assets, particularly when compared to modern Artificial intelligence in investment risk frameworks.

Conventional models rely heavily on historical data and assume relatively stable market behavior. Tokenized markets, however, evolve in real time and generate risk signals that require immediate analysis supported by AI predictive analytics.

Key limitations of traditional risk models include:

- Backward-looking analysis: Historical performance fails to capture emerging on-chain trends identified through Tokenized assets risk analysis.

- Static assumptions: Fixed correlations and volatility assumptions do not reflect real-time dynamics captured through AI-enhanced portfolio risk optimization.

- Delayed response cycles: Manual reviews and periodic reporting slow down decision-making in environments requiring real-time AI in risk management.

- Limited data integration: Inability to process blockchain data, smart contract activity, and decentralized liquidity metrics without AI-powered financial analytics.

As a result, risk is often identified only after losses occur, making mitigation reactive rather than preventive.

How AI Predictive Analytics Changes Risk Assessment

AI analytics is transforming the way risk is assessed and managed in a tokenized portfolio. AI predictive analytics employs machine learning, statistical modeling and real-time data to provide continuous risk assessments as conditions change, redefining AI in risk management practices.

AI models provide more than just static thresholds or historical averages for making risk assessments; they continuously evolve to reflect historical data while also incorporating live market and blockchain data. This allows for risk assessments based on future probabilities and scenarios, strengthening Artificial intelligence in investment risk strategies.

Here is how AI is changing risk assessments:

- Continuous intelligence: Real-time updates to risk metrics as new information comes in through AI-powered financial analytics.

- Pattern recognition: Machine learning recognizes correlations and patterns in data sets that a human may not be able to recognize, enabling deeper Tokenized assets risk analysis.

- Predictions based on probability: Risk is assessed based on probabilities of occurrence and impact, not historical averages, supporting AI-enhanced portfolio risk optimization.

The result is a shift for enterprises to move from traditional methods of risk reporting to anticipating future risks, thereby improving their overall resilience in managing their tokenized asset portfolios.

Key Predictive Risk Capabilities Powered by AI

AI-powered risk management platforms provide specialized capabilities that are particularly suited to tokenized asset ecosystems and enterprise-grade AI in risk management.

1. Forecasting Volatility

To determine future volatility, AI analyzes an assortment of factors including historical prices, volume of trades, depth of the order book and sentiment indicators. These insights support AI predictive analytics by allowing portfolio managers to anticipate price swings and manage exposure proactively.

2. Liquidity Stress Testing

Using simulated market stress events, predictive analytics evaluates liquidity behavior across venues. This form of Tokenized assets risk analysis is critical for large institutional exits and capital preservation.

3. Scenario Simulation & Stress Analysis

AI allows for advanced scenario modeling under regulatory changes, downturns, or macroeconomic shocks, strengthening AI-enhanced portfolio risk optimization strategies.

4. Anomaly Detection and Risk Signals

By continuously scanning transaction flows, smart contract data, and market behavior, AI systems enhance Artificial intelligence in investment risk monitoring by detecting early warning signals.

Where AI-Driven Risk Intelligence Delivers the Most Value

AI predictive analytics delivers the greatest value in tokenized portfolios that involve complex assets, long investment horizons, or regulatory oversight. Proactive AI-powered financial analytics helps preserve capital and maintain investor confidence.

High-impact application areas include:

- Tokenized real estate and infrastructure: Predictive valuation and liquidity modeling using AI in risk management

- Private credit and debt instruments: Default risk forecasting through Tokenized assets risk analysis

- Commodity-backed assets: Volatility and supply-demand forecasting enabled by AI predictive analytics

- Institutional multi-asset portfolios: Cross-asset correlation and AI-enhanced portfolio risk optimization

From Reactive Controls to Predictive Risk Management: How Antier Enables the Shift

As organizations build Tokenized asset portfolios that are larger and more complex than ever before, they require more sophisticated risk controls. Antier addresses this need by delivering enterprise-ready frameworks built on AI-powered financial analytics, AI predictive analytics, and advanced blockchain intelligence.

Antier’s AI-driven blockchain solutions enable organizations to move beyond reactive controls and embrace predictive, data-driven AI in risk management. By combining real-time on-chain data with off-chain market intelligence, Antier strengthens Artificial intelligence in investment risk capabilities across tokenized ecosystems.

By embedding predictive intelligence into tokenized asset operations, Antier enables enterprises to implement scalable AI-enhanced portfolio risk optimization, preparing portfolios for market volatility, regulatory change, and operational complexity.

Crypto World

In unfamiliar market conditions, historical data-driven AI trading bots will falter

Today’s AI trading bots are based on a limited amount of historical data which means totally unfamiliar market events like the 10/10 liquidations or even last week’s severe selloffs will leave agentic trading models short of the mark.

These historical data-driven AI models have never seen huge liquidations on a single day and would find this “very unfamiliar” said Bitget CEO Gracy Chen on a panel about agentic trading bots at Consensus Hong Kong 2026. As such human intervention is needed.

“As an exchange, we don’t plan to build our own LLM [large language model]. But trading bots are a big thing,” Chen said. “Current AI bots are a bit like an intern: faster, cheaper but needs a little supervision.”

However, further down the line this will be more like a “full employee,” and in 3-5 years AI can replace a lot of us, Chen said.

These are sentiments heard regularly in the algorithmic trading world when it comes to AI.

While complex LLM and machine learning trading technology is improving at a rapid clip, there are still plenty of people who think a human overlay is an essential part of the process – particularly in situations like the severe volatility that recently gripped crypto markets.

Joining Chen on the panel, Saad Naj, founder and CEO of agentic trading startup PiP World agreed the tech is in its infancy and that comes with risk. But he pointed out that 90% of day traders and retail players lose money.

“As humans we are too emotional. We can’t compete with AI solutions,” Naj said.

Crypto World

Decentralized AI is in a trough but real opportunities are emerging, crypto VCs say

The intersection of crypto and artificial intelligence (AI) has entered a quieter, more selective phase, according to two prominent venture capitalists.

Anand Iyer of Canonical Crypto and Kelvin Koh of Spartan Group described the current climate as a post-hype moment for decentralized AI protocols, with capital and talent shifting toward more focused, utility-driven applications during Consensus Hong Kong 2026.

“I think we’re in the trough right now,” said Iyer, whose San Francisco-based firm backs early-stage infrastructure and applications built on decentralized networks. “We went through a frothy period. Now it’s about figuring out where the real strength lies.”

Both Iyer and Koh criticized what they see as overinvestment in GPU marketplaces and attempts to build decentralized alternatives to large AI models like those from OpenAI or Anthropic. The capital required, Koh noted, is “night and day” compared to what’s available in crypto.

Instead, they see potential in purpose-built, full-stack solutions, tools that start with a specific problem and build down to the model, compute, and data layers.

Iyer pointed to startups skipping expensive SaaS tools and using AI to build custom internal systems in days. “Speculation won’t drive product anymore,” he said. “We have to think about users first.”

Both investors emphasized the importance of proprietary data, regulatory advantages, or go-to-market edges as new forms of competitive moats.

For founders looking to raise capital, Koh offered blunt advice: “Twelve months ago, it was enough to have a wrapper on ChatGPT. That’s no longer true.”

Crypto World

Apptronik Secures $520 Million Funding to Advance Humanoid Robot Production

TLDR

- Apptronik raised $520M, bringing its Series A round to $935M for Apollo robot production.

- Apollo robots are deployed in factories and warehouses with partners like Mercedes-Benz and GXO Logistics.

- Apptronik’s robots will collaborate safely with humans for tasks like lifting, sorting, and transporting.

- The company faces competition from Tesla’s Optimus and Chinese humanoid developers like Unitree and Agility.

- Apptronik plans to expand its presence and begin fulfilling robot orders in 2027, with $1B in projected demand.

Apptronik, a robotics startup based in Austin, Texas, has raised $520 million in funding, bringing its Series A round to $935 million. The new capital will help the company refine and mass-produce its Apollo humanoid robots, aiming to lead the market ahead of competitors such as Tesla and Chinese developers.

Apollo Robots in Early Deployment

Apptronik’s Apollo robots are already deployed in several factories and warehouses under strategic partnerships with companies like Mercedes-Benz, GXO Logistics, and Jabil. These robots operate within predefined areas using sensors and light curtains to ensure safe interaction with human workers.

Today, we’re excited to announce that we’ve raised more than $935M in Series A funding with a $520M Series A-X extension round, bringing our total capital raised to nearly $1B.

This milestone is a powerful vote of confidence in our mission: building AI-powered humanoid robots…

— Apptronik (@Apptronik) February 11, 2026

The robots pause when a human crosses into their operational space, with plans for more advanced collaborative capabilities. CEO Jeff Cardenas stated that the Apollo robots will eventually be able to work alongside humans safely, performing tasks such as lifting, sorting, and transporting components.

This technology aims to make the robots more adaptable to dynamic factory environments. Apptronik believes that the versatility of humanoid robots will provide immense value by enabling a single robot to perform multiple tasks.

Apptronik AI Competition and Industry Growth

Apptronik faces stiff competition from other humanoid robot developers, including Tesla’s Optimus project and Chinese companies like Unitree and Agility Robotics. While Tesla has invested heavily in its robot development, its humanoid project remains in early-stage research.

Apptronik, however, has made strides in refining its Apollo robots, with its partnerships already demonstrating the robots’ practical applications in industrial settings. The recent funding and partnership with Google DeepMind mark major milestones for Apptronik.

Google’s Gemini Robotics AI models are now enhancing the Apollo robots’ capabilities, enabling faster, more efficient operations. Apptronik’s CEO refrained from making specific predictions about the robot’s future production timelines but indicated that they will continue refining their technology in the coming months.

The company also plans to expand its presence in Austin and open a new office in California later this year. Apptronik is focused on preparing its robots and facilities for mass production, with expectations to fulfill orders starting in 2027. B Capital’s Howard Morgan is optimistic about the future, predicting that demand for the Apollo robots will reach $1 billion in orders within a few years.

Crypto World

XRP price forecast: bulls falter amid fresh bearish sentiment

- XRP price dropped to $1.35 as selling pressure resumed.

- Bears have pushed Bitcoin back under $68k and altcoins are mirroring the decline.

- Short-term, bearish sentiment could trigger a sell-off to $1 or lower.

XRP continues to face bearish pressure as the latest attempts to establish an upside momentum stall, with prices down 14% in the past week.

In early trading on Wednesday, the Ripple cryptocurrency fell to lows of $1.35, extending its pullback from recent highs following a retest of $1.53.

The waning upside momentum suggests a potential further downside for the altcoin, whose performance mirrors the renewed selling pressure currently throttling Bitcoin and Ethereum bulls.

As of writing, market metrics showed derivatives data largely bearish, with retail traders signalling their downbeat perspective through dwindling XRP futures Open Interest.

Massive liquidations, most of which have been lopsided against longs, add to the retail indecision.

XRP price technical outlook

XRP’s struggles align with a cautious crypto environment. Bitcoin’s failure to hold above $70k means widespread selling that hasn’t spared top altcoins like XRP.

Technical indicators for XRP price, such as fading RSI, highlight potential weakness. If buyers fail to reclaim $1.50 and target $2.00, XRP risks testing key support levels near $1.22 and $1.13.

Conversely, breaking $2 might flip sentiment and allow bulls to target the $2.75 resistance level. The falling wedge pattern on the 4-hour chart signals such a breakout.

XRP price: likely bullish catalysts?

US XRP ETF demand has faded in recent weeks, while technical indicators highlight bears’ control.

Despite the gloom, several catalysts could spark a reversal for XRP holders.

Regulatory developments, particularly ongoing efforts to pass the Clarity Act, could be a key driver of crypto market sentiment.

A spike in adoption amid further regulatory clarity will cascade to XRP.

Whale accumulation also continues to ramp up as large holders add to positions.

This shows conviction and has the short-term effect of stabilizing prices ahead of what analysts see as an inevitable broader market recovery.

Stablecoin growth on the XRP Ledger adds another layer of utility, drawing institutional interest and increasing network activity.

DeFiLlama data shows that while DeFi TVL has declined, stablecoin market cap has jumped from around $331 million in early February to over $418 million as of writing.

Amid usage for XRPL, Ripple USD is also gaining traction.

Ripple has entered various partnerships aimed at tokenising traditional fund structures on the XRP Ledger, one of the moves set to accelerate growth.

Meanwhile, spot exchange-traded fund inflows have cooled in recent weeks. However, cumulative net inflows have topped $1.2 billion, and could explode when sentiment flips.

Crypto World

Sam Bankman-Fried Seeks FTX Retrial Citing Fresh Testimony

FTX founder Sam Bankman-Fried is legally challenging his 25-year sentence, filing a motion for a new trial on February 10.

The thirty-three-year-old cites “fresh testimony” that allegedly proves the defunct exchange was solvent.

The filing potentially throws a spanner in the liquidation process, with the claim that the Department of Justice suppressed critical evidence during the original proceedings.

Why Is Bankman-Fried Seeking a New FTX Trial Now?

It has been years since FTX’s November 2022 collapse wiped out $8 billion in customer funds.

Since then, self-custody has become a buzzword for retail investors, who have had to live through multiple bear markets while US regulators prepare comprehensive legislation to ensure it doesn’t happen again.

However, SBF isn’t done fighting. Serving a 25-year sentence, the disgraced mogul filed a pro se motion citing Rule 33 of the Federal Rules of Criminal Procedure.

Bankman-Fried argues that his original conviction was a miscarriage of justice because key witnesses never took the stand.

While global enforcement efforts often successfully target financial malfeasance through standard audits, SBF contends the DOJ’s rapid prosecution missed the actual financial reality of FTX.US.

He maintains that the money was “always there,” a claim he intends to support with evidence that was allegedly unavailable during his initial defense.

What the New Motion Claims

The new filing specifically hinges on declarations from Daniel Chapsky, the former head of data science at FTX.US.

According to the motion, Chapsky’s data analysis contradicts the government’s narrative regarding the $8 billion shortfall.

Bankman-Fried also points to potentially favorable testimony from former co-CEO Ryan Salame, who is currently serving a seven-and-a-half-year sentence.

In the legal documents filed Feb. 10, Bankman-Fried alleges that prosecutors intimidated witnesses and that Judge Lewis Kaplan showed “manifest prejudice” by rushing the verdict. He is demanding a new judge for any retrial, framing the original proceedings as politically motivated “lawfare”.

While the industry has largely shifted toward a compliance-focused market structure to prevent another FTX-style meltdown, SBF argues the DoJ prevented him from showing the jury data that proved solvency.

Legal experts note that Rule 33 motions face an incredibly high bar, often viewed as a “Hail Mary” in federal appeals.

What This Means for Crypto Regulation

While a retrial is statistically unlikely, the motion keeps the FTX wounds fresh for active traders and victims awaiting restitution.

The persistence of the case highlights the long-term risks of offshore exchange failures.

Regulators are likely to use this continued legal drama to justify stricter oversight. We are already seeing similar crackdowns globally, such as when Venezuela’s anti-corruption investigation shut down exchanges in a massive sweep.

For the market, this serves as a stark reminder that the legal fallout from the 2022 crash is far from over, even as prices recover.

Discover:

The post Sam Bankman-Fried Seeks FTX Retrial Citing Fresh Testimony appeared first on Cryptonews.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech12 hours ago

Tech12 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World23 hours ago

Crypto World23 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

EXCLUSIVE: SBF SEEKS NEW TRIAL, CLAIMS DOJ SILENCED DEFENSE WITNESSES AND MISLED JURY ON FTX SOLVENCY

EXCLUSIVE: SBF SEEKS NEW TRIAL, CLAIMS DOJ SILENCED DEFENSE WITNESSES AND MISLED JURY ON FTX SOLVENCY