Crypto World

Coinbase’s Armstrong, Ripple’s Garlinghouse among familiar crypto execs in U.S. CFTC advisory group

The U.S. Commodity Futures Trading Commission, which is set to be a leading regulator of the crypto markets, has named some of the crypto sector’s most prominent executives as members of its newly established Innovation Advisory Committee, including the CEOs of Coinbase, Ripple, Robinhood and Uniswap Labs.

The 35-member committee will steer the U.S. derivatives regulator on the needs of firms at the center of financial innovation, and to fill some of its number, the agency had repurposed a previous CEO council established at the end of last year before the arrival of CFTC Chairman Mike Selig.

“By bringing together participants from every corner of the marketplace, the IAC will be a major asset for the Commission as we work to modernize our rules and regulations for the innovations of today and tomorrow,” Selig said in a statement.

While the earlier group already included members such as Gemini CEO Tyler Winklevoss, Kraken Co-CEO Arjun Sethi and Polymarket CEO Shayne Coplan, the much larger committee adds several more crypto CEOs and the top executives of FanDuel and DraftKings. Additionally, the advisers will include the leaders of many of the more traditional companies and organizations, such as the chief executives of Nasdaq, CME Group, Cboe Global Markets, Futures Industry Association (FIA) and International Swaps and Derivatives Association (ISDA).

Other new names among the 35 are Chris Dixon of a16z Crypto, Anatoly Yakovenko of Solana Labs, Peter Mintzberg of Grayscale, Sergey Nazarov of Chainlink Labs and Alana Palmedo of Paradigm. Tom Farley, the CEO of Bullish, CoinDesk’s parent company, is also a member.

Selig recently announced a crypto agenda his agency is pursuing alongside the Securities and Exchange Commission, having formally joined with the SEC’s Project Crypto.

The CFTC’s advisory committee is listed below (* denotes earlier council membership):

- Hayden Adams, CEO, Uniswap Labs

- Brian Armstrong, CEO, Coinbase

- Andrej Bolkovic, CEO, Options Clearing Corporation

- Thomas Chippas, CEO, Rothera Markets

- Shayne Coplan, CEO, Polymarket *

- Professor Harry Crane, Representative

- Chris Dixon, General Partner, a16z Crypto

- Craig Donohue, CEO, Cboe Global Markets *

- Terry Duffy, Chair & CEO, CME Group *

- Tom Farley, CEO, Bullish *

- Adena Friedman, Chair & CEO, Nasdaq *

- Brad Garlinghouse, CEO, Ripple

- Christian Genetski, President, FanDuel

- Luke Hoersten, CEO, Bitnomial *

- Frank LaSalla, President & CEO, Depository Trust and Clearing Corporation

- Walt Lukken, CEO, FIA

- Tarek Mansour, CEO, Kalshi *

- Kris Marszalek, CEO, Crypto.com *

- Nathan McCauley, CEO, Anchorage Digital

- Peter Mintzberg, CEO, Grayscale

- Sergey Nazarov, CEO, Chainlink Labs

- Scott D. O’Malia, CEO, ISDA

- Alana Palmedo, Managing Partner, Paradigm

- Vivek Raman, CEO, Etherealize

- Professor Carla Reyes, Representative

- Jason Robins, CEO, DraftKings

- David Schwimmer, CEO, LSEG *

- Arjun Sethi, Co-CEO, Kraken *

- Peter Smith, CEO, Blockchain.com

- Vance Spencer, Co-founder, Framework Ventures

- Jeff Sprecher, CEO, Intercontinental Exchange *

- Vlad Tenev, CEO, Robinhood

- Don Wilson, CEO, DRW

- Tyler Winklevoss, CEO, Gemini *

- Anatoly Yakovenko, CEO, Solana Labs

Read More: CFTC to tap Tyler Winklevoss, other crypto CEOs as first members of innovation panel

Crypto World

ETHZilla Launches Aviation Token Backed By Jet Engines

The new token offers investors exposure to lease payments generated by two jet engines.

ETHZilla Corporation (Nasdaq: ETHZ) on Thursday, Feb. 12 launched Eurus Aero Token I, a tokenized asset backed by two commercial jet engines currently in use by a U.S. air carrier.

The tokens — which are issued on Ethereum Layer 2 networks and distributed through the Liquidityio platform — give investors exposure to lease payments generated by the engines. ETHZilla said it acquired the engines for about $12.2 million. Meanwhile, tokens are priced at $100 each, with a minimum purchase of 10 tokens.

The company said in a press release viewed by The Defiant that the investment targets annual returns of about 11% over the life of the leases, which run through 2027 and 2028.

The launch comes as interest in tokenized real-world assets (RWAs) continues to grow across both crypto and traditional finance. Data from RWAxyz shows that distributed asset value rose to $23.87 billion, up nearly 11% over the past 30 days.

The value of underlying RWAs represented on-chain also increased more than 8% during the same period to $21.41 billion. Meanwhile, the number of asset holders jumped to 835,179, a 34% month-over-month increase.

ETHZilla CEO McAndrew Rudisill told The Defiant that the company’s mission is to “democratize access to institutional-grade investments” by giving investors direct exposure to RWAs that have historically been out of reach.

Rudisill explained that jet engine leasing has traditionally been accessible only to large institutions and private investment funds. However, by using tokenization technology, the asset can be accessed by smaller players – though the offering is limited to accredited investors.

“ETHZilla was able to design a financial instrument that is structured around defined lease terms, creating a uniquely transparent, income-oriented alternative to traditional private aerospace leasing structures,” he said.

Lease payments are collected each month and paid out to token holders, the release explained. The engines are not financed with debt, and ETHZilla said it does not plan to use borrowing to boost returns for this product.

While ETHZilla is contractually restricted from naming the specific air carrier, a person familiar with the matter confirmed to The Defiant that it is “one of the largest and most profitable airlines.”

Looking Ahead

Looking ahead, Rudisill said ETHZilla recently acquired a portfolio of manufactured and modular home loans, which it plans to tokenize next.

“Manufactured home loans represent an approximately $14 billion market, and are a high-yield, high-quality asset class historically accessible only to a handful of private lenders,” he said. “Not only will tokenizing these assets open this market up to a broader range of investors, we also believe that facilitating financing breadth for manufactured homes could contribute to adding housing supply and alleviate an ongoing national shortage.”

Further down the line, ETHZilla is exploring auto loans, commercial real estate, and other asset classes as potential tokenized income products, Rudisill added.

ETHZilla Corporation, formerly 180 Life Sciences, rebranded in August 2025 to focus on building an Ethereum-based treasury and developing decentralized finance (DeFi) strategies. The company currently holds 69,802 ETH, valued at about $148.4 million, according to CoinGecko.

ETHZ is currently trading at $3.40, up about 5% today following the news.

Crypto World

Bitcoin in Capitulation Zone as Traders Debate When BTC Will Bottom

Bitcoin faced renewed selling pressure on Thursday as the price retraced from an intraday high near 68,300 dollars. On-chain observations point to ongoing capitulation, with long‑term holders trimming exposure and a broad mix of leverage liquidations fueling the weakness. Several analysts argue that the current cycle could see BTC bottoming in late 2026, after a protracted downward phase that has pulled the asset from its 2025 peak in a manner not seen since prior bear markets.

Key takeaways

- On-chain indicators point to deep capitulation, with downside risks persisting as long-term holders adjust positions.

- Long-term holder net-position change shows extreme distribution, echoing patterns seen before previous bottoms in the cycle.

- Multiple analyses point toward a potential BTC bottom in Q4 2026, aligning with a history of multi-quarter bear cycles.

- Mass liquidations and shifting open interest underscore caution amid persistent stress in the derivatives market.

- Developments in on-chain metrics continue to diverge from recent price rallies, implying limited near-term upside without renewed buying interest.

Tickers mentioned: $BTC, $ETH

Sentiment: Bearish

Price impact: Negative. The ongoing capitulation signals and persistent selling pressure raise the odds of BTC trading lower in the near term.

Trading idea (Not Financial Advice): Hold. While downside risk remains, indicators suggest the market could form a bottom later in 2026, warranting cautious positioning and risk management.

Market context: The current phase sits within a broader risk-off backdrop for crypto markets, where on-chain signals and leveraged liquidations have amplified volatility while traders await clearer macro and regulatory cues.

Why it matters

The tenor of on-chain data underscores a fundamental shift in investor behavior. Long-term holders have historically acted as a counterweight to price declines, yet in this cycle their net exposure has declined sharply, suggesting widespread capitulation among a cohort that typically anchors market recoveries. The observed distribution patterns bear similarities to prior corrections that preceded further downside before a subsequent bottom, pointing to a potential multi-month horizon before a durable floor emerges.

Analysts emphasize that such capitulation does not guarantee a bottom right away; instead, it denotes a phase where weak hands have exited and confidence remains fragile. Fundamental demand appears tempered by macro uncertainty, while BTC faces the dual test of reclaiming critical price levels and reframing risk appetite among specialized participants who dominate futures and options markets. In other words, the path to a meaningful reversal is likely to hinge on whether buying interest can reassert itself after the current wave of liquidations peters out.

The data also highlight a tension between price action and longer-term metrics. While the price has flirted with notable support levels, corresponding on-chain signals have not yet shown a decisive pivot toward sustainable accumulation. Some observers argue that the most consequential developments—such as a sustained improvement in realized losses versus profits or an uptick in long-position liquidations—could precede a bottom, as past cycles have often featured distinctive phases where capitulation preceded a period of consolidation.

From a broader market perspective, the cycle’s depth has tested risk controls and liquidity across exchanges. The magnitude of long liquidations, particularly in the BTC‑USD pair, has drawn attention to the fragility of highly leveraged positions. In tandem, OI (open interest) has remained elevated relative to short-term price moves, signaling caution among participants who depend on leverage to express directional bets. These dynamics feed a narrative in which a bottom, if it materializes, may occur only after a protracted period of price discovery and tighter funding conditions rather than a quick rebound.

What to watch next

- Bitcoin price reclaim of key zones around 105,000–107,000 dollars could signal a shift in momentum and align with some bear-case bottoms.

- Continued analysis of long-term holder net-position changes to assess whether distribution slows or accelerates as markets approach mid‑2026.

- Monitoring MVRV Adaptive Z‑Score trends and other momentum indicators for signs of accumulation or renewed capitulation.

- Open interest and funding-rate dynamics on major futures platforms to gauge whether downside pressure is fading or intensifying.

- Macro and regulatory developments that could influence liquidity and risk appetite in crypto markets, potentially shaping the timing of a bottom.

Sources & verification

- Glassnode analyses on long-term holder net-position change and its relationship to bear-market bottoms.

- CryptoQuant Quicktake data showing Bitcoin’s MVRV Adaptive Z-Score at deeply negative levels.

- CoinGlass data detailing liquidation clusters and changes in futures open interest across exchanges.

- Public posts from market analysts on X discussing potential timing of a bottom, including references to historical cycles.

- On-Chain College charts illustrating net realized losses and their historical context.

Bitcoin capitulation deepens as on-chain metrics point to possible late-2026 bottom

Bitcoin has moved decisively off its intraday peak, with the price retreating from the near region of 68,300 dollars as sellers reasserted control this Thursday. The retreat comes after a sizable drawdown from the all-time high set in the previous cycle, a drop of roughly 46 percent from a peak above 126,000 dollars in October 2025. The move has intensified a narrative of capitulation that on-chain trackers have been flagging for weeks, as a substantial portion of the market remains underwater and exposure patterns shift among different investor cohorts.

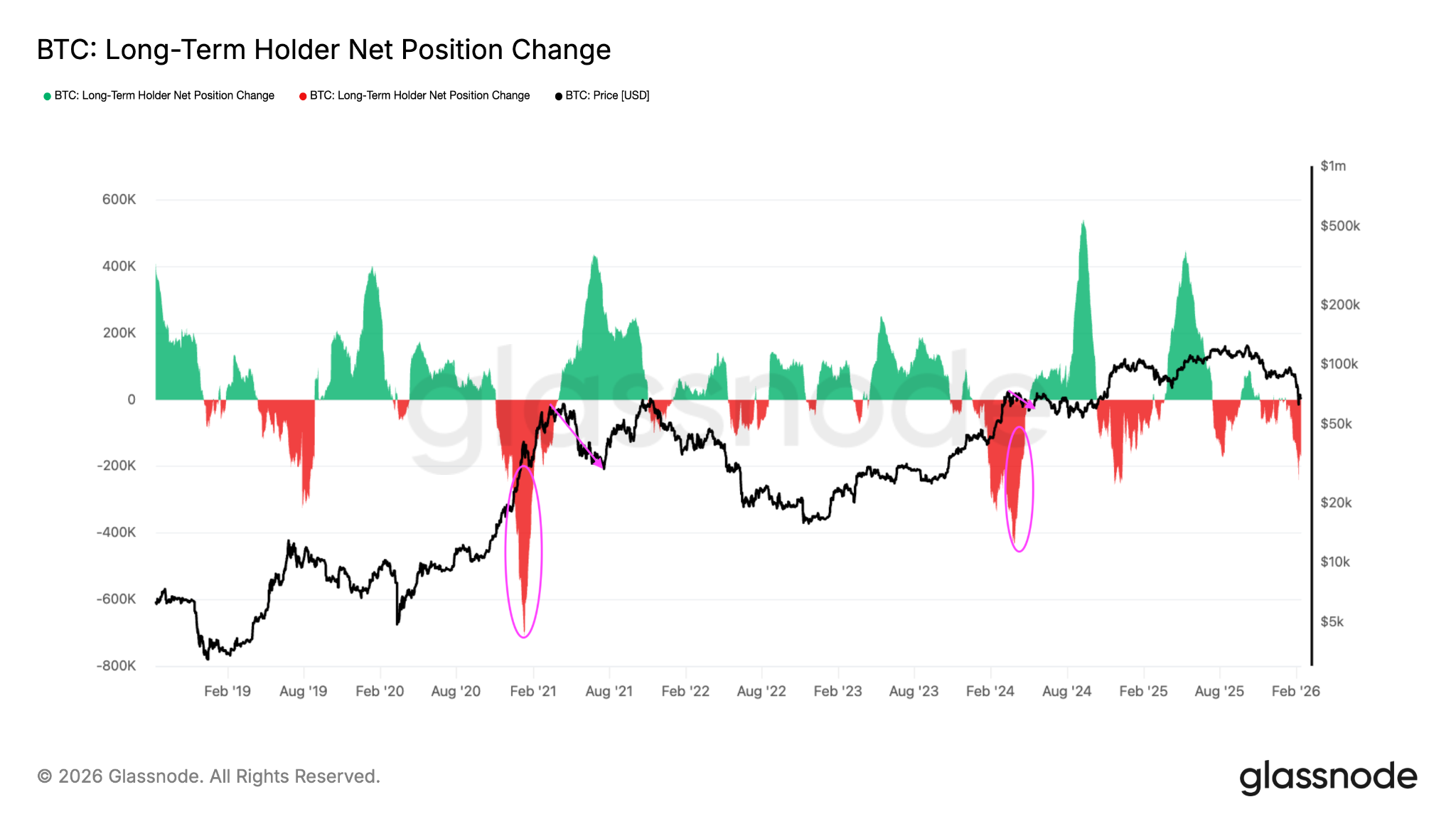

Glassnode’s data on long-term holders reveals a cycle-relative extreme in daily distribution. The net-position change shows that BTC held by long-term investors fell by about 245,000 coins on February 6, and the trend has persisted, with this group trimming exposure by an average of roughly 170,000 BTC per day since then. This behavior mirrors episodes in previous corrections when long-dated holders capitulated before the market carved out a bottom, suggesting that the present phase shares some historical characteristics with past bear cycles. The observation is not a forecast in itself, but it does provide a framework for interpreting a price action that has defied quick reversals despite briefer rallies.

“The current Z-Score reading of -2.66 proves that Bitcoin remains persistently in the capitulation zone,” CryptoQuant contributor GugaOnChain explained, noting that the metric has historically signaled an accumulation phase on the horizon.

Another lens comes from the Realized Profit/Loss Ratio, which Glassnode notes is nearing a decisive threshold. When realized losses outrun profits, markets have tended to experience broader capitulation rather than immediate recoveries, a pattern investors watch closely as they assess whether the current cycle is entering a new accumulation phase or simply grinding lower before a deeper pullback.

Meanwhile, market observers have cited the most dramatic liquidations in recent sessions, with BTC and Ether (CRYPTO: ETH) accounting for outsized losses across liquidators, and a broad 1.33 billion dollars in combined short and long liquidations reported in one window. The juxtaposition of persistent price softness with still-significant open interest highlights the fragility of the current price regime, where leverage remains at risk of triggering renewed bouts of selling if markets retest critical levels. The largest single liquidation reportedly occurred on a major platform, underscoring the scope of risk in a crowded derivatives market.

On the forecasting front, several voices argue that BTC could bottom in the fourth quarter of 2026, albeit with a wide range of potential price bands. One analyst characterized the trajectory as potentially forming a floor in the 40,000 to 50,000 dollar region, while other analysts see a more complex path shaped by liquidity cycles and macro factors. The all-time high printed in October 2025 casts a long shadow, with traders noting that the drive to find a bottom may hinge on a combination of on-chain discipline and renewed buying interest from institutions and retail participants alike.

Data of note from On-Chain College shows a spike in net realized losses up to around 13.6 billion dollars in early February, levels not seen since the 2022 bear market. If history rhymes, this peak could precede a broader bottom as market participants digest losses and reassess risk, potentially leading to a calibration of positions that could stabilize prices later in the year or into 2027. The narrative around a late-2026 bottom is not a guarantee, but a synthesis of historical patterns, current on-chain dynamics, and the persistence of downward price pressure despite intermittent rallies.

Looking ahead, the research community remains divided, with some analysts arguing that the capitulation wave could ease as positions liquidate and fear subsides, allowing a stable base to form. Others caution that until key price levels are reclaimed and investor confidence returns, BTC could stay range-bound or drift to sub-100,000 dollar territory before buyers re-emerge. This uncertainty underscores the importance of monitoring both price action and the evolving on-chain environment as a rough timetable for turning points remains ambiguous.

Crypto World

Jobs Report Complicates Trump’s Push for Lower Rates

The Fed looks set to keep interest rates on hold when policymakers meet in March, as both January’s jobs report and recent commentary from voting officials reinforce a pause-for-longer stance.

President Donald Trump has consistently called for the Fed to cut rates, even though inflation has remained stubbornly above the central bank’s 2% target level. Kevin Warsh, Trump’s nominee to replace Jerome Powell as Fed Chair in May, has also called for lower interest rates.

But January’s jobs data do little to build the case for another rate cut after three precautionary reductions late last year. Payrolls rose 130,000 and wage growth firmed last month, both coming in stronger than expected.

Crypto World

Crypto bulls ignore 'extreme fear' to push bitcoin higher

Your day-ahead look for Feb. 12, 2026

Crypto World

Transform Ventures CEO Michael Terpin says bitcoin could see ‘one more point of pain’

The current state of the crypto market is unfolding almost exactly as historical patterns would suggest, according to Michael Terpin, CEO of Transform Ventures

That’s why he was skeptical of recent overly optimistic bottom calls. “When people thought the bottom was going to be at $80,000 and that it would only be a six-week bear market, that seems ridiculous to me,” Terpin said at Consensus Hong Kong 2026 on Thursday.

Predictions that bitcoin would bottom at $60,000 and immediately resume its climb struck him as premature. “That also seems a little too soon.”

While he stopped short of forecasting another year-long drawdown, Terpin believes the market likely faces “one more point of pain” in what he describes as a fragile environment. He suggests bitcoin could revisit levels in the $50,000s or even the $40,000s before a durable bottom is formed.

The halving is central to bitcoin’s design because it cuts the reward miners receive for validating transactions in half roughly every four years, reducing the rate at which new coins are created.

This built-in supply shock reinforces bitcoin’s scarcity, a core part of its value proposition, and has historically preceded major bull markets as reduced new supply meets steady or rising demand.

The halving mechanism slows bitcoin’s inflation rate over time, ultimately capping total supply at 21 million coins and reinforcing its positioning as digital gold.

“We are exactly where we should be,” Terpin argued, pointing to the well-established four-year cycle anchored around Bitcoin’s halving events.

One of the most reliable elements of prior cycles has been the rough timing of the bubble peak and subsequent unwind, he argued.

“The bull market popped in the fourth quarter after the halving,” he notes, adding that the speculative blow-off phase typically lasts between nine and 11 months. “This time it was 11 months.”

Terpin draws a close parallel to the last cycle. “The highs, the bubble popping, were on Nov. 10, 2021,” he says. “The lows were right after FTX declared bankruptcy on Nov. 10, 2022. Exactly a year to the day.”

Read more: Crypto asset manager Bitwise says bitcoin will break its four-year cycle in 2026

Crypto World

Healthcare Still Leads as Job Engine

Job growth varied dramatically by sector last month, though healthcare and social assistance remained stalwart employment engines.

The healthcare sector started off the year strong with the addition of 82,000 jobs in January, after a softer month in December. That’s much higher than the average monthly gains of 33,000 seen in 2025.

The social assistance sector added 42,000 jobs last month. Healthcare and social assistance have been the only consistent industries for job growth for more than a year. Without their gains, the economy would have lost jobs last year. December did show some softening in those areas’ hiring, but that trend dissipated last month.

Crypto World

Here’s Why Bitcoin Analysts Say BTC Market Will Bottom in Q4 2026.

Bitcoin (BTC) sellers resumed their activity on Thursday as the Bitcoin price turned away from its intraday high of $68,300. Analysts said that Bitcoin remained in capitulation, which could push the price lower, potentially reaching a bottom during the last quarter of 2026.

Key takeaways:

-

Multiple onchain indicators suggest Bitcoin is in deep capitulation as downside risks remain.

-

Long-term holder net-position change shows extreme distribution, mirroring past corrections that preceded further downside before bottoms.

-

Analysts forecast BTC price to hit a bottom in Q4/2026 based on various technical and onchain metrics.

Bitcoin’s capitulation persists

Bitcoin’s 46% drawdown from its all-time high of $126,000 has left a significant portion of holders underwater, and data shows they are now reducing their exposure.

Glassnode’s long-term holder (LTH) net-position change shows that Bitcoin held by these investors over 30 days decreased by 245,000 BTC on Feb. 6, marking a cycle-relative extreme in daily distribution. Since then, this investor cohort has been reducing its exposure by an average of 170,000 BTC, as shown in the chart below.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto sentiment hits record low

Similar spikes in LTH net position change appeared during the corrective phases in 2019 and mid-2021, leading to BTC price consolidating before extended downtrends.

CryptoQuant data shows that Bitcoin’s MVRV Adaptive Z-Score (365-Day Window) has fallen to -2.66, reinforcing the intensity of the sell-side pressure.

“The current Z-Score reading of -2.66 proves that Bitcoin remains persistently in the capitulation zone,” CryptoQuant contributor GugaOnChain said in a Thursday Quicktake post, adding:

“The indicator suggests that we are approaching the historical accumulation phase.”

Bitcoin’s Realized Profit/Loss Ratio is about to break below 1, levels that have historically aligned with “broad-based capitulation, where realized losses outpace profit-taking across the market,” Glassnode said.

Analysts say Bitcoin will bottom out toward the end of 2026

According to multiple analyses, Bitcoin could extend its downtrend, possibly reaching as low as $40,000 to $50,000 during the last quarter of the year.

The “final capitulation on $BTC is still ahead,” Crypto analyst Tony Research said in a recent post on X, adding:

“My take is, $BTC will bottom at $40K–50K, most likely forming between mid-September and late November 2026.”

Fellow analyst Titan of Crypto said that previous bear cycles in 2018 and 2022 printed their lows 12 months after the bull market top.

Bitcoin’s current all-time high of over $126,000 was reached on Oct. 2, 2025.

“If this cycle follows the same rhythm, that puts the low around October,” the analyst added.

On-Chain College shared a chart showing that Bitcoin’s Net Realized Loss levels hit extreme levels at $13.6 billion on Feb. 7, levels last seen during the 2022 bear market.

“The 2022 loss peak occurred 5 months before the actual bear market bottom was printed,” the analyst said, suggesting that BTC could form a bottom in July 2026.

As Cointelegraph reported, many analysts expect 2026 to be a bear market year, and various forecasts predict the BTC price dropping to as low as $40,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Apple Stock Tumbles as Censorship Claims, AI Spending Fuel Investor Concerns

TLDR

- Apple stock dropped more than 5% following political controversy and regulatory scrutiny.

- The Federal Trade Commission raised concerns about political bias on Apple News.

- Several institutional investors reduced their exposure to Apple stock amid growing risks.

- Apple’s increasing investments in artificial intelligence are raising concerns about rising costs.

- Despite strong quarterly earnings, investor confidence in Apple has weakened due to regulatory and political challenges.

Apple’s stock suffered a sharp decline after facing new political controversies, investor caution, and concerns about escalating AI investments. Despite a strong performance last week, Apple’s shares dropped more than 5% on Thursday. Regulatory issues and increasing scrutiny over its content platform added to the uncertainty.

Rally Reverses as Political Controversy Erupts

The reversal of Apple’s stock came after the Federal Trade Commission (FTC) raised concerns about political bias on the Apple News platform. FTC Chair Andrew Ferguson urged CEO Tim Cook to investigate claims of censorship, specifically regarding conservative outlets. The allegations suggest that Apple News may be promoting left-wing content while suppressing conservative views.

The FTC’s letter highlighted reports that claimed Apple News was skewed toward liberal sources. Apple, however, has yet to publicly respond to these allegations. This political controversy comes at a time when technology companies are already under close regulatory scrutiny.

Apple Stock Sees Institutional Investor Withdrawals

As political risks grew, institutional investors began reducing their exposure to Apple stock. Reports revealed that NBT Bank reduced its position by 5.3%, while Campbell & Co cut its holdings by over 70%. Other firms, such as Gamco, also lowered their stakes, signaling a shift in sentiment toward Apple’s stock.

These moves reflect a broader rotation out of large tech stocks as investors seek safer investments in the current market climate. The growing regulatory scrutiny, along with political controversies, has made Apple a less attractive option for some institutional investors. This caution comes after a long period of strong performance, during which Apple’s stock price reached new highs.

AI Spending Raises Fresh Concerns

Apple’s growing investment in artificial intelligence (AI) has raised additional concerns for investors. CEO Tim Cook has called AI a “profound opportunity,” but the rising costs associated with AI development are becoming a concern. Apple’s recent acquisition of Israeli startup Q.ai, which focuses on advanced human-computer interaction, highlights the company’s deepening commitment to AI.

Investors are increasingly questioning the high costs involved in AI research and infrastructure. The capital required to compete in the AI sector, especially for specialized chips and data centers, could put pressure on Apple’s profit margins. There are concerns that the commercial viability of certain AI technologies may not justify the hefty investment required in the short term.

Despite these challenges, Apple’s financial performance remains strong. The company’s recent quarterly results showed a 16% increase in revenue, reaching $143.8 billion. The iPhone continues to be a key driver, with record sales of $85.3 billion. However, investors are now focusing on how effectively Apple can manage its increasing AI costs and whether these investments will translate into long-term growth.

In the meantime, Apple continues to benefit from favorable policy changes in India, which support its supply chain strategy. However, these long-term advantages do little to ease investor concerns in the near term, as political scrutiny and AI-related costs dominate the narrative around the company’s future prospects.

Crypto World

March Rate-Cut Odds Fade

The hot January jobs report had traders rethinking bets on multiple interest-rate cuts before July.

Odds of a quarter-point cut at the Federal Reserve’s March policy meeting fell to 6% from 20.1% prior to the report.

Through the June meeting, odds of no cuts surged to 40.4% from 24.8%. Odds of a single quarter-point cut were at 49.4% from 49%, while odds of a half point in cuts or more fell to 10.2% from 26.2%.

Crypto World

Stock Futures Pop After Stronger-Than-Expected January Jobs Report

Stock Futures Pop After Stronger-Than-Expected January Jobs Report

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video23 hours ago

Video23 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month