Tech

Nvidia’s new technique cuts LLM reasoning costs by 8x without losing accuracy

Researchers at Nvidia have developed a technique that can reduce the memory costs of large language model reasoning by up to eight times. Their technique, called dynamic memory sparsification (DMS), compresses the key value (KV) cache, the temporary memory LLMs generate and store as they process prompts and reason through problems and documents.

While researchers have proposed various methods to compress this cache before, most struggle to do so without degrading the model’s intelligence. Nvidia’s approach manages to discard much of the cache while maintaining (and in some cases improving) the model’s reasoning capabilities.

Experiments show that DMS enables LLMs to “think” longer and explore more solutions without the usual penalty in speed or memory costs.

The bottleneck of reasoning

LLMs improve their performance on complex tasks by generating “chain-of-thought” tokens, essentially writing out their reasoning steps before arriving at a final answer. Inference-time scaling techniques leverage this by giving the model a larger budget to generate these thinking tokens or to explore multiple potential reasoning paths in parallel.

However, this improved reasoning comes with a significant computational cost. As the model generates more tokens, it builds up a KV cache.

For real-world applications, the KV cache is a major bottleneck. As the reasoning chain grows, the cache grows linearly, consuming vast amounts of memory on GPUs. This forces the hardware to spend more time reading data from memory than actually computing, which slows down generation and increases latency. It also caps the number of users a system can serve simultaneously, as running out of VRAM causes the system to crash or slow to a crawl.

Nvidia researchers frame this not just as a technical hurdle, but as a fundamental economic one for the enterprise.

“The question isn’t just about hardware quantity; it’s about whether your infrastructure is processing 100 reasoning threads or 800 threads for the same cost,” Piotr Nawrot, Senior Deep Learning Engineer at Nvidia, told VentureBeat.

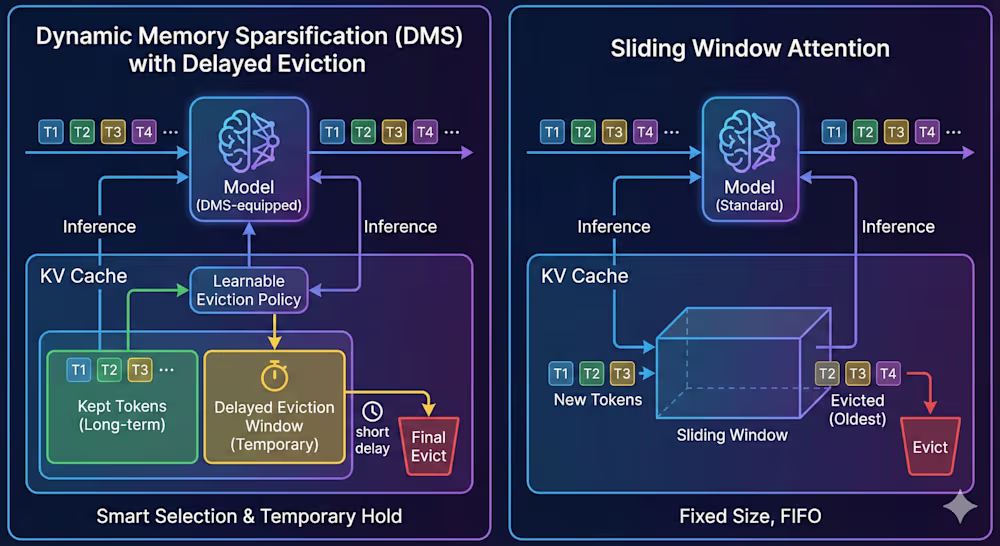

Previous attempts to solve this focused on heuristics-based approaches. These methods use rigid rules, such as a “sliding window” that only caches the most recent tokens and deletes the rest. While this reduces memory usage, it often forces the model to discard critical information required for solving the problem, degrading the accuracy of the output.

“Standard eviction methods attempt to select old and unused tokens for eviction using heuristics,” the researchers said. “They simplify the problem, hoping that if they approximate the model’s internal mechanics, the answer will remain correct.”

Other solutions use paging to offload the unused parts of the KV cache to slower memory, but the constant swapping of data introduces latency overhead that makes real-time applications sluggish.

Dynamic memory sparsification

DMS takes a different approach by “retrofitting” existing LLMs to intelligently manage their own memory. Rather than applying a fixed rule for what to delete, DMS trains the model to identify which tokens are essential for future reasoning and which are disposable.

“It doesn’t just guess importance; it learns a policy that explicitly preserves the model’s final output distribution,” Nawrot said.

The process transforms a standard, pre-trained LLM such as Llama 3 or Qwen 3 into a self-compressing model. Crucially, this does not require training the model from scratch, which would be prohibitively expensive. Instead, DMS repurposes existing neurons within the model’s attention layers to output a “keep” or “evict” signal for each token.

For teams worried about the complexity of retrofitting, the researchers noted that the process is designed to be lightweight. “To improve the efficiency of this process, the model’s weights can be frozen, which makes the process similar to Low-Rank Adaptation (LoRA),” Nawrot said. This means a standard enterprise model like Qwen3-8B “can be retrofitted with DMS within hours on a single DGX H100.”

One of the important parts of DMS is a mechanism called “delayed eviction.” In standard sparsification, if a token is deemed unimportant, it is deleted immediately. This is risky because the model might need a split second to integrate that token’s context into its current state.

DMS mitigates this by flagging a token for eviction but keeping it accessible for a short window of time (e.g., a few hundred steps). This delay allows the model to “extract” any remaining necessary information from the token and merge it into the current context before the token is wiped from the KV cache.

“The ‘delayed eviction’ mechanism is crucial because not all tokens are simply ‘important’ (keep forever) or ‘useless’ (delete immediately). Many fall in between — they carry some information, but not enough to justify occupying an entire slot in memory,” Nawrot said. “This is where the redundancy lies. By keeping these tokens in a local window for a short time before eviction, we allow the model to attend to them and redistribute their information into future tokens.”

The researchers found that this retrofitting process is highly efficient. They could equip a pre-trained LLM with DMS in just 1,000 training steps, a tiny fraction of the compute required for the original training. The resulting models use standard kernels and can drop directly into existing high-performance inference stacks without custom hardware or complex software rewriting.

DMS in action

To validate the technique, the researchers applied DMS to several reasoning models, including the Qwen-R1 series (distilled from DeepSeek R1) and Llama 3.2, and tested them on difficult benchmarks like AIME 24 (math), GPQA Diamond (science), and LiveCodeBench (coding).

The results show that DMS effectively moves the Pareto frontier, the optimal trade-off between cost and performance. On the AIME 24 math benchmark, a Qwen-R1 32B model equipped with DMS achieved a score 12.0 points higher than a standard model when constrained to the same memory bandwidth budget. By compressing the cache, the model could afford to “think” much deeper and wider than the standard model could for the same memory and compute budget.

Perhaps most surprisingly, DMS defied the common wisdom that compression hurts long-context understanding. In “needle-in-a-haystack” tests, which measure a model’s ability to find a specific piece of information buried in a large document, DMS variants actually outperformed the standard models. By actively managing its memory rather than passively accumulating noise, the model maintained a cleaner, more useful context.

For enterprise infrastructure, the efficiency gains translate directly to throughput and hardware savings. Because the memory cache is significantly smaller, the GPU spends less time fetching data, reducing the wait time for users. In tests with the Qwen3-8B model, DMS matched the accuracy of the vanilla model while delivering up to 5x higher throughput. This means a single server can handle five times as many customer queries per second without a drop in quality.

The future of memory

Nvidia has released DMS as part of its KVPress library. Regarding how enterprises can get started with DMS, Nawrot emphasized that the barrier to entry is low. “The ‘minimum viable infrastructure’ is standard Hugging Face pipelines — no custom CUDA kernels are required,” Nawrot said, noting that the code is fully compatible with standard FlashAttention.

Looking ahead, the team views DMS as part of a larger shift where memory management becomes a distinct, intelligent layer of the AI stack. Nawrot also confirmed that DMS is “fully compatible” with newer architectures like the Multi-Head Latent Attention (MLA) used in DeepSeek’s models, suggesting that combining these approaches could yield even greater efficiency gains.

As enterprises move from simple chatbots to complex agentic systems that require extended reasoning, the cost of inference is becoming a primary concern. Techniques like DMS provide a path to scale these capabilities sustainably.

“We’ve barely scratched the surface of what is possible,” Nawrot said, “and we expect inference-time scaling to further evolve.”

Tech

HP wants you to rent, not own, your next laptop

HP has launched a subscription service for its OMEN gaming laptops.

Instead of buying hardware outright, users can rent devices with fixed monthly fees. The highest tier includes RTX 5080 GPUs for $129.99 per month, but subscribers will never own the laptop.

The service begins with a 30‑day trial, but after that, users are locked in for at least 12 months. Cancellation fees apply if you leave early, with the highest tier charging $1,429.89 in the second month. That fee decreases gradually over time.

HP offers multiple tiers, each with different specifications, with accessories and monitors also available for monthly rental. Prices range from $3.99 for a USB‑C hub to $9.99 for higher‑tier monitors. A headset costs $7.99, while a microphone is $7.99. However, the service currently appears limited to the US.

The upside is that subscribers can upgrade their laptops every year. This ensures access to relatively current hardware without waiting for traditional upgrade cycles, with HP also including 24/7 customer support.

However, it is important to reiterate that ownership is never part of the deal. If you fail to return equipment, HP can charge up to $3,299 for its highest‑tier laptop, roughly equal to retail pricing.

This financial trade‑off raises questions. At $129.99 per month, the RTX 5080 tier costs about the same as buying outright after 16 to 18 months. Yet subscribers end up with no hardware to keep. For some, the appeal lies in avoiding high upfront costs. For others, subscription fatigue makes the model less attractive.

HP’s move comes amid rising hardware demand. AI workloads have driven shortages in RAM and storage, pushing prices higher. Renting hardware may appeal to gamers who want flexibility without waiting for components to stabilise.

Still, the model highlights a broader trend. Companies increasingly push subscription services, from software to entertainment to hardware. Critics argue this erodes ownership, leaving users perpetually paying for access. Supporters see it as a way to stay current without major investments.

Ultimately, HP’s OMEN Gaming Subscription offers convenience but raises long‑term value concerns. Renting ensures upgrades and support in the short-term, but ownership remains off the table.

This service represents a new experiment on how we access hardware.

Tech

Understanding the valuation of intangible assets in tech deals

In a technology M&A deal, whether you are acquiring or selling a tech or software business, valuation rarely hinges on a single dimension. Financial performance, growth efficiency, and cash flow durability remain the backbone of any transaction. In practical terms, this means metrics such as revenue and ARR, retention as a proxy for revenue quality, margin structure, and capital intensity continue to anchor how buyers price risk. However, alongside these tangible indicators sits another layer of value, one that does not always surface cleanly in financial statements and may even remain invisible if it is not properly understood or articulated:…

This story continues at The Next Web

Tech

Baba Yaga Loads Up as Saber Interactive’s John Wick Game Set to Hit PS5, Xbox and PC

Keanu Reeves returns as the man in black, taking on the goons in a brand new John Wick action game from Saber Interactive revealed during the Playstation State of Play event. He’s preparing for a new assault on the streets in a game Saber believes was the ideal project to work on, collaborating directly with Lionsgate, director Chad Stahelski, and the man himself, Keanu Reeves.

The trailer begins with some really nice CGI action, reminding everyone what it takes to be the greatest assassin for hire, which includes a few tricks of the trade like characteristic club shootouts, and the occasional kitchen frenzy. It all leads up to the good stuff, which is actual gameplay footage of Reeves’ likeness slamming people around. The environments are all lighted up like neon nightclubs and rainy streets straight out of a John Wick film, and the camera work is flawless, weaving tight through the turmoil exactly like in the movies.

The true brilliance of the game is in the gun-fu, where shooting and hand-to-hand combat coexist in perfect harmony. You get to sneak into crowded places, popping heads and avoiding knives and chokes. Driving parts will feature several high-speed chases, with Wick evading or hitting pursuers in a huge automobile crash. Saber designed all of these features to fit the pulse of the film’s action scenes, transforming those cinematic moments into actual playable gameplay. The cityscapes on display are reminiscent of a John Wick flick, with crowded nightspots and darkly lit alleys calling for a brutal takedown.

Iglesias emphasizes the goal: deliver action that feels pulled straight from the screen. “The style of fighting will feel like an authentic John Wick action scene taken straight from the films,” he writes. “Everything is designed to faithfully mimic the movie experience in a meaningful, fully playable way.” Collaboration ensures the game’s chapter fits seamlessly into Wick’s legend, years before the first film’s events.

Within the game, everyone working on it wants to make sure it fits in smoothly with the John Wick tale, which takes place years before the first film was released. This game will be accessible on PS5, Xbox Series X|S, and PC via Steam, meaning that it will be a full-fledged AAA release with no corners cut. Of course, Saber, the team behind World War Z Aftermath and the upcoming Space Marine 2, is no stranger to crafting popular games.

There is no release date yet, but you can already start wishlisting it on the PlayStation Store to be among the first to know when it becomes available. The trailer ends with Wick reloading, surrounded by various bodies, before the logo appears on the screen, with Saber promising more information about the title, release date, and where the plot goes from here, all of which will be revealed shortly.

Tech

The US Gas Station Chains You Might Not Know Are Owned By British Companies

American consumers are likely considering many different factors when choosing where to go for gas. The cost per gallon is at the top of course, as gas stations often have different prices. Fuel type can be a close second, and even the brand name on the pumps can play a part as well. But the companies behind those brands may not be top of mind, as some US gas station chains are actually owned by British companies. Perhaps the best-known example is BP, which stands for British Petroleum, a company that dates back to the 1920s.

BP, in turn, owns Amoco, a gas station chain that was previously known as Standard Oil, once the largest oil company in the world. Amoco merged with BP in 1998, and while the brand isn’t as prominent as it once was, BP keeps it going in select locations. Another British-owned company, Shell, began as a small antiques shop in 1880s London and grew into a worldwide corporation with thousands of fuel stations across the US.

Another company that operates gas station chains in the US, EG America, is also owned by the Brits. However, you may not be familiar with this subsidiary of EG Group, as they operate under 10 different travel-stop brands throughout America. Those brands include Kwik Shop, Turkey Hill, Cumberland Farms, Tom Thumb, and the Loaf and Jug.

Other foreign-owned gas station chains in the US

In addition to British-owned chains, several US gas station companies are owned by entities based outside America. 7-Eleven began as an American company but is now owned by a Japanese corporation called Seven & I Holdings. This same parent company also owns the Speedway chain of fuel stations. Couche-Tard, a Canadian company, owns Circle K and Lukoil gas stations are owned by a Russian company.

Fomento Económico Mexicano (FEMSA), a Mexican conglomerate, took over a chain of gas stations in the southwest, when it acquired Delek US Retail. FEMSA was already an established player in the industry throughout Europe and Latin America thanks to its OXXO brand of convenience stores. Up until late 2025, Citgo was owned by Petróleos de Venezuela, a Venezuelan company. However, as of this writing, Citgo is in the process of being acquired by an affiliate-backed group of US investors.

Some of these companies have made big moves to grow their US footprint in recent years. Couche-Tard unsuccessfully attempted to buy Seven 7 & I Holdings for $38 billion in 2024, but the offer was deemed to be too low. But that didn’t stop Couche-Tard’s American expansion, as the Canadian corporation acquired a chain of stores from another company in the same year. 7-11 continued to grow as well, thanks to its own convenience store chain purchase, as well as the purchase of a restaurant chain.

Tech

Third Optis jury trial results in a victory for Apple in the US

The patent troll Optis has been told by a US jury that Apple has not infringed on any of its LTE patents, ending the elongated dispute in the US until yet another appeal is made.

Optis hoped to collect money for every iPhone sold

The latest jury trial occurred after the US Court of Appeals threw out a verdict that would have had Apple paying Optis $300 million in damages. The case was then sent to a trial by jury where the jury members would be asked a single question about the five patents.

According to a report from Reuters, the jury voted unanimously. The question was: “Did Optis prove by a preponderance of the evidence that Apple infringed at least one claim from each of the following patents?”

Continue Reading on AppleInsider | Discuss on our Forums

Tech

Highspot merging with rival Seismic in major sales software deal

Seattle-based company Highspot plans to merge with Seismic in a deal that will combine two of the biggest players in sales and revenue enablement software.

The companies announced Thursday that they’ve signed a definitive agreement to merge. Once the transaction closes, the combined company will operate under the Seismic name and be led by Seismic CEO Rob Tarkoff, who was hired in October. Highspot founder and CEO Robert Wahbe will join the board of directors of the combined company.

Permira, the private equity firm that has backed San Diego-based Seismic since 2020, will remain the controlling shareholder. The companies will operate independently until the deal closes. The platforms “will continue to be supported thereafter,” according to a press release.

The deal effectively places Highspot under Seismic’s leadership and brand. Additional terms were not disclosed. We’ve followed up with the companies to learn more about any potential workforce impact and where the combined company will be headquartered. Update: Highspot declined to provide further details.

The merger brings together two longtime competitors in the revenue enablement market. Their software is designed to help sales, marketing, and customer success teams manage content, training, analytics, and performance.

“There is a growing demand for technologies that better connect sales strategy to execution and help organizations drive consistent revenue performance at scale, especially in today’s go-to-market environment,” Tarkoff wrote on LinkedIn.

In the press release, Wahbe said the deal will let the combined company “move the revenue enablement space forward” by giving customers “more innovation” and “more insights leading to actions.”

Highspot is one of Seattle’s most prominent enterprise software companies and has raised $650 million since launching in 2011. It’s held the No. 1 spot on the GeekWire 200, our list of privately held technology companies in Seattle and the Pacific Northwest, and employs more than 1,000 people, according to LinkedIn data.

The company’s most recent publicly disclosed valuation was $3.5 billion in 2022, when it raised $248 million.

Highspot went through layoffs twice in 2023 amid a larger tech slowdown.

Highspot’s valuation in 2022 came at the peak of the software boom. Since then, venture funding has tightened and valuations across the tech sector have reset. PitchBook noted that many once high-flying “unicorns” have seen valuations fall below the $1 billion mark as capital becomes more concentrated. Established enterprise software companies are also under scrutiny amid the AI boom.

B Capital Group and D1 Capital Partners led Highspot’s Series F round in 2022. Other backers include ICONIQ Growth, Madrona Venture Group, Salesforce Ventures, Sapphire Ventures, and Tiger Global Management.

Wahbe is a former longtime employee at Microsoft, where he spent 16 years equipping sales teams with necessary information to craft customer pitches. He founded the company in 2011 with former colleagues Oliver Sharp and David Wortendyke.

“We believe this is a great next milestone and an exciting new chapter for one of Seattle’s longstanding, successful startups,” Wahbe said in a statement to GeekWire.

Seismic, founded in 2010, is best known for its Seismic Enablement Cloud. It reached a $3 billion valuation in 2021 and serves around 2,000 customers worldwide.

Highspot’s customers include Compass, Nasdaq and Stripe. The company said in November that it had more than 40 customers with 5,000 sales representatives each. Its largest deployment exceeded more than 50,000 end users.

Tech

Opinion: Here’s what’s missing from the tax debate in Washington state

Editor’s note: GeekWire publishes guest opinions to foster informed discussion and highlight a diversity of perspectives on issues shaping the tech and startup community. If you’re interested in submitting a guest column, email us at tips@geekwire.com. Submissions are reviewed by our editorial team for relevance and editorial standards.

Washington state is once again fighting about taxes. Business-and-occupation rates are up. Payroll taxes have expanded. Property taxes keep climbing. The Climate Commitment Act has raised everyday costs. Now comes the familiar call for an income tax. Each debate follows the same pattern: Is the tax fair? Is it legal? Is it progressive enough?

That framing is the problem.

Washington argues about taxes one at a time, as if each levy exists in isolation. They do not. What matters to families, workers, and employers is the total burden, how it is structured, and whether the system reflects a coherent plan. By that standard, Washington is failing.

Supporters of an income tax argue the state’s system is too regressive. They have a point. The state relies heavily on consumption taxes and business taxes that are ultimately passed through in higher prices and lower wages. Lower- and middle-income households end up paying a larger share of their income than higher earners. Adding progressivity, the argument goes, would make the system fairer.

Opponents respond that politicians cannot be trusted to stop at “just one tax.” They warn of a ratchet effect: new taxes layered on top of old ones, steadily pushing Washington through the ranks of the highest-tax states. They’re not wrong either. The Paid Family and Medical Leave payroll tax has nearly tripled since 2019. The capital gains tax rate jumped from 7% to 9.9% last year. The gas tax rose again in 2025, putting Washington among the most expensive states to fuel a car.

Both sides have valid concerns. Yet the debate remains a series of narrow, partisan skirmishes rather than a serious discussion of tax policy as a system.

What’s missing is strategy. State leaders are offering revenue ideas, not a tax vision. A strategy begins with an end state. Washington has never articulated one.

What is the state’s target tax burden as a percentage of income? How should it compare to states Washington actually competes with — California, Texas, Colorado, Oregon, Arizona? Should Washington aim to be a low-tax state, a middle-of-the-pack state, or a high-tax state that promises high-end public services? Voters are never told.

Nor is there clarity about the proper mix of revenue. How much should come from consumption? From business activity? From income, if at all? Which taxes should grow with the economy, and which should remain stable? These questions matter. They shape investment decisions, talent retention, and long-term growth.

For small businesses and startups, the consequences of this lack of clarity are immediate. Young companies don’t encounter taxes one at a time; they absorb the full stack at once. Business-and-occupation taxes apply before profitability. Payroll taxes rise the moment hiring begins. Energy and transportation costs flow directly into margins.

Unlike large corporations, startups and small firms cannot shift operations across states, absorb sudden cost increases, or negotiate their way out of regulatory complexity.

The goal is not to avoid paying taxes, but to operate within a system that is intentional and predictable. Sudden changes — such as reclassifying businesses from services to retail for B&O purposes — can render an otherwise viable business model unworkable overnight within Washington.

In practice, uncertainty and compliance churn often matter as much as the rate itself. A tax system without a defined end state makes long-term planning nearly impossible for the very firms the state says it wants to grow.

Instead, Washington’s approach has been incremental and reactive. When spending rises, a new tax appears. When equity concerns emerge, yet another tax is layered on. There is no framework tying these decisions together, only a running justification for why the next increase is unavoidable.

Consider the most recent addition to the tax base: the Climate Commitment Act. Some analysts argue that it functions as a regressive revenue mechanism because compliance costs can be passed through into energy, transportation, and consumer goods prices. If lawmakers are serious about addressing regressivity in the tax system, they should explain how the CCA’s cost impacts fit into the broader tax and mitigation framework and whether adjustments or offsets are warranted.

A more serious administration would approach this differently. It would publish a comprehensive tax strategy. It would define the desired total burden. It would benchmark Washington honestly against peer states. It would identify which taxes should expand, which should contract, and which should be eliminated. And it would explain the tradeoffs plainly, without pretending that revenue comes without cost.

Such a plan would not please everyone. But it would signal competence and demonstrate leadership. It would give voters and businesses something they currently lack: predictability.

There is also a political opportunity being squandered. Comprehensive tax reform is one of the few areas where bipartisan agreement is possible. Democrats concerned about equity and Republicans concerned about growth could meet on common ground — if the goal were a coherent system rather than the next revenue “win.”

Instead, the current approach reinforces public cynicism. Each new proposal confirms the suspicion that taxes rise without limit, that reforms are never finished, and that promises of restraint are temporary.

If Washington wants to be seen as a model of effective governance, the answer isn’t another narrow tax fight. It’s a pause. A reset. A commitment to step back from piecemeal changes and present a full plan worthy of public trust.

The country is tired of partisan trench warfare. One way to lower the temperature is to govern like adults: set goals, measure outcomes, and explain decisions. Washington has the resources and talent to do that.

What it lacks, at least for now, is a strategy.

Tech

WP Engine Says Automattic Planned To Shake Down 10 Hosting Companies For WordPress Royalties

WP Engine’s third amended complaint against Automattic and WordPress co-founder Matt Mullenweg alleges that Mullenweg had plans to impose royalty fees on 10 hosting companies beyond WP Engine for their use of the WordPress trademark.

The amended filing, based on previously sealed information uncovered during discovery, also claims Mullenweg emailed a Stripe executive to pressure the payment processor into canceling WP Engine’s contract after WP Engine sued Automattic in October 2024. Newfold, the parent company of Bluehost and HostGator, is already paying Automattic for trademark use, according to the complaint, and Automattic is in conversations with other hosts.

The filing challenges the 8% royalty rate as arbitrary, citing Mullenweg’s comments at TechCrunch Disrupt 2024 where he said the figure was based on what WP Engine “could afford to pay.” Internal Automattic correspondence cited in the complaint includes Mullenweg describing his approach to WP Engine as “nuclear war” and warning that if the hosting company didn’t comply, he would start stealing its customers.

Tech

Walmart Saturday Showdown games coming to Apple TV on February 21

Major League Soccer fans will be able to enjoy even more game highlights as part of the Walmart Saturday Showdown, debuting on Apple TV in February 2026.

Walmart Saturday Showdown is coming to Apple TV on February 21.

Apple’s push for sports-related programming continues, as the iPhone maker has now promised additional Major League Soccer content. Throughout 2026, Apple TV subscribers in the United States will be able to watch MLS games for free, with select games highlighted as part of Sunday Night Soccer.

Starting February 21, MLS fans will get to enjoy even more soccer content over the weekend, with Walmart Saturday Showdown games coming to Apple’s streaming service.

Continue Reading on AppleInsider | Discuss on our Forums

Tech

Siri & Apple Intelligence upgrades still coming in 2026 in spite of rumors

A story suggesting Apple was having internal struggles and may delay anticipated new Siri features has been mildly countered with a statement from Apple — “on track to launch in 2026.”

Apple is still aiming for a 2026 release of its revamped AI

A story based on anonymous tipsters claiming internal testing of the refreshed Siri wasn’t going well surfaced Wednesday, sparking dramatic reactions from analysts and the stock market. It didn’t help that at the same moment, Apple was being targeted by the FTC Chair over alleged Apple News bias.

However, after CNBC reached out to Apple for comment, they got back a very simple “still on track to launch in 2026” statement. As AppleInsider mentioned in its coverage on that rumored delay, there were a lot of oddities in the reporting surrounding it.

Continue Reading on AppleInsider | Discuss on our Forums

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video23 hours ago

Video23 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month