Crypto World

Is Crypto Becoming a Tool for Human Trafficking Networks?

Cryptocurrency flows to services linked with suspected human trafficking surged 85% year over year in 2025.

The findings come from a new report by blockchain analytics firm Chainalysis, which highlighted that the intersection of cryptocurrency and suspected human trafficking expanded markedly last year.

Sponsored

Sponsored

Which Crypto Assets Are Most Used in Suspected Human Trafficking Networks?

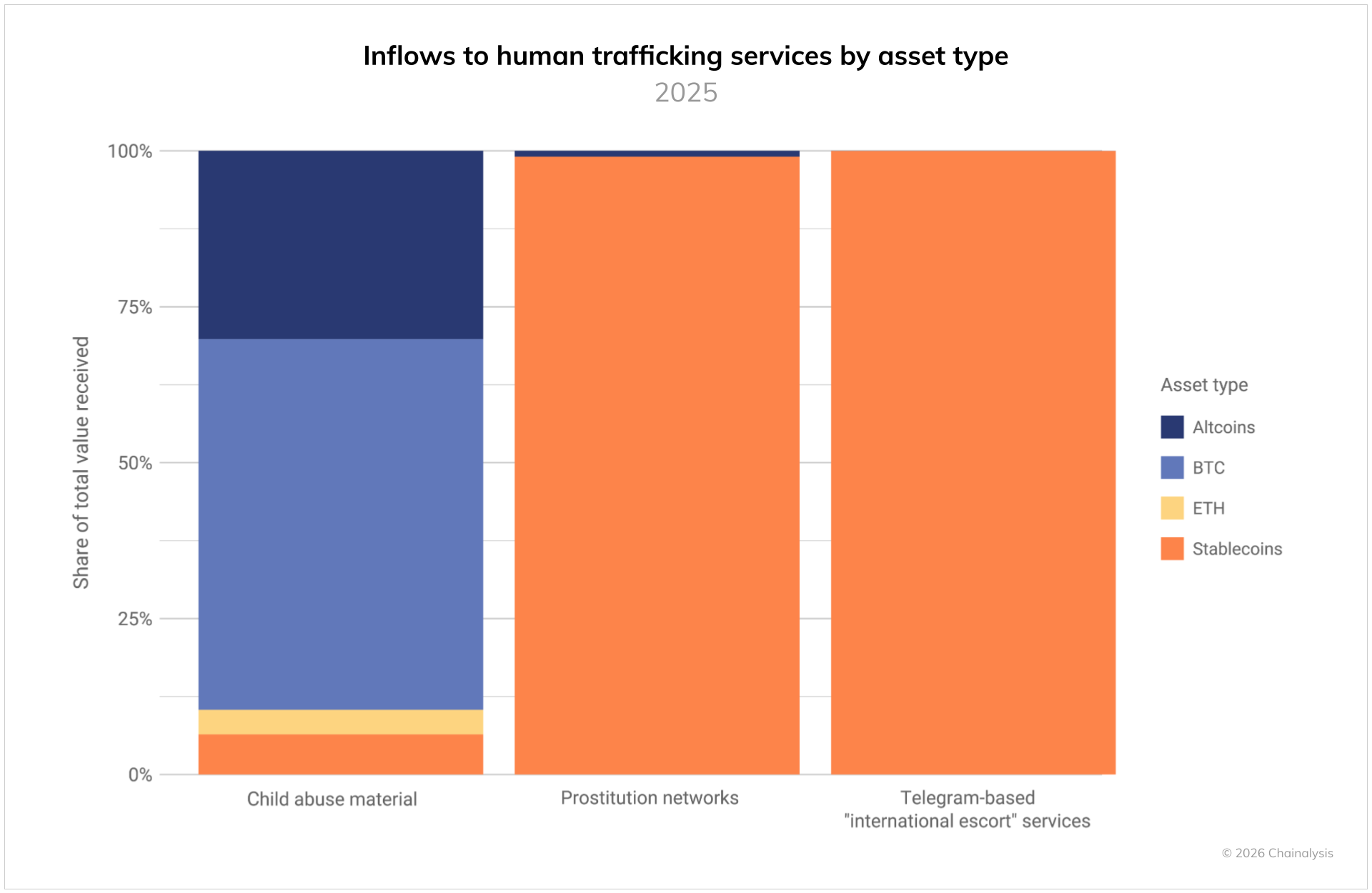

The report outlined four primary categories of suspected crypto-facilitated human trafficking. This includes Telegram-based “international escort” services, forced labor recruitment linked to scam compounds, prostitution networks, and child sexual abuse material vendors (CSAM).

“The intersection of cryptocurrency and suspected human trafficking intensified in 2025, with total transaction volume reaching hundreds of millions of dollars across identified services, an 85% year-over-year (YoY) increase. The dollar amounts significantly understate the human toll of these crimes, where the true cost is measured in lives impacted rather than money transferred,” Chainalysis wrote.

According to the report, payment methods varied across categories. International escort services and prostitution networks used stablecoins.

“The ‘international escort services are tightly integrated with Chinese-language money laundering networks. These networks rapidly facilitate the conversion of USD stablecoins into local currencies, potentially blunting concerns that assets held in stablecoins might be frozen,” Chainalysis noted.

CSAM vendors have historically relied more heavily on Bitcoin (BTC). However, Bitcoin’s dominance has declined with the rise of alternative Layer 1 networks.

Sponsored

Sponsored

In 2025, while these networks continue to accept mainstream cryptocurrencies for payments, they increasingly turn to Monero (XMR) to launder proceeds. According to Chainalysis,

“Instant exchangers, which provide rapid and anonymous cryptocurrency swapping without KYC requirements, play a crucial role in this process.”

The Dual Role of Crypto in Human Trafficking-Linked Transactions

Chainalysis noted that the surge in cryptocurrency flows to services linked with suspected human trafficking is not occurring in isolation. Instead, it mirrors the rapid expansion of Southeast Asia–based scam compounds, online casinos and gambling platforms, and Chinese-language money laundering (CMLN) and guarantee networks operating primarily through Telegram.

Together, these entities form a fast-growing regional illicit ecosystem with global reach. According to the report, Chinese-language services operating across mainland China, Hong Kong, Taiwan, and multiple Southeast Asian countries exhibit advanced payment processing capabilities and extensive cross-border networks.

Furthermore, geographic analysis reveals that while many trafficking-linked services are based in Southeast Asia, cryptocurrency inflows originate globally. Significant transaction flows were traced to countries including the United States, Brazil, the United Kingdom, Spain, and Australia.

“While traditional trafficking routes and patterns persist, these Southeast Asian services exemplify how cryptocurrency technology enables trafficking operations to facilitate payments and obscure money flows across borders more efficiently than ever before. The diversity of destination countries suggests these networks have developed sophisticated infrastructure for global operations,” the report read.

At the same time, Chainalysis stressed that blockchain transparency offers investigators deeper visibility into trafficking-related financial activity.

Unlike cash transactions, which leave little to no audit trail, blockchain-based transfers generate permanent, traceable records. This creates new opportunities for detection and disruption that are not possible with traditional payment systems.

Crypto World

Boerse Stuttgart Digital, Tradias Merge to Build European Crypto Hub

Boerse Stuttgart Group, operator of one of Europe’s largest stock exchanges, is pursuing a strategic consolidation of its regulated digital asset activities with Tradias, a Frankfurt-based crypto trading firm. The move aims to accelerate the group’s push into institutional crypto markets by combining Boerse Stuttgart Digital’s custody, brokerage and trading capabilities with Tradias’ execution and BaFin-licensed securities trading operations. The combined entity, still subject to regulatory approvals, would bring together roughly 300 employees under a unified management team. While formal financial terms were not disclosed in the initial announcement, Bloomberg reported that Tradias could be valued at about €200 million, with the merged group potentially exceeding €500 million in enterprise value. The deal underscores a broader shift toward regulated, institution-facing crypto infrastructure in Europe, aided by MiCA, the EU framework for crypto-assets.

The merger is framed as a natural evolution for Boerse Stuttgart’s regulated crypto unit, which has built out a comprehensive platform for trading, custody and tokenized assets in compliance with the Markets in Crypto-Assets Regulation (MiCA). The integration with Tradias is intended to extend the reach of this regulated backbone across Europe, enabling banks, brokers and other financial institutions to access a fully regulated crypto infrastructure under one umbrella. The announcement notes that the combined team will oversee services spanning brokerage, trading, custody, staking and tokenized assets, a suite designed to cover the entire value chain for institutional clients. In 2025, Boerse Stuttgart highlighted a surge in crypto trading volumes, signaling growing demand from institutions and an increasing contribution of digital assets to the group’s revenue. The leadership behind the merger expresses a bullish outlook on the sector’s trajectory and on the strategic advantages of scale in regulated markets.

The background of the deal includes Tradias’ status as a BaFin-licensed securities trading bank, a feature that aligns with Boerse Stuttgart Digital’s regulatory approach and its emphasis on a compliant crypto ecosystem. Tradias operates as the digital assets arm of Bankhaus Scheich, and its regulatory standing complements Boerse Stuttgart’s push to formalize a pan-European digital-asset platform capable of serving large-scale financial players. The two firms’ complementary strengths—Boerse Stuttgart Digital’s product suite and Tradias’ execution and licensing framework—are positioned to offer a more seamless, integrated experience for institutions seeking to deploy crypto strategies within established risk controls. As part of the strategic framing, Boerse Stuttgart Group chief executive Matthias Voelkel emphasized that the merger would drive consolidation and leadership across Europe’s crypto markets, noting that the combined entity would be better positioned to compete with other regulated platforms as institutional demand grows.

Within the discourse on regulated crypto markets, the deal sits at the intersection of technology, regulation and market structure. Boerse Stuttgart’s digital arm has been a steady contractor to the EU’s MiCA regime, providing trading, brokerage and custody services in line with the regulation’s requirements. The integration with Tradias is expected to accelerate the deployment of compliant crypto infrastructure at scale, potentially reducing the operational frictions that have long constrained institutional participation. The parties have kept financial terms private, but public signals about the valuation and scale of the combined group reinforce the sense that European players are wagering on a future where regulated, cross-border crypto services become a core element of traditional financial ecosystems.

“With the planned merger of Boerse Stuttgart Digital and Tradias, Boerse Stuttgart Group is driving the development and consolidation of the European crypto market,”

Voelkel’s remarks reflect a broader industry narrative in which established financial institutions seek to create end-to-end platforms that combine trading, custody and risk management for digital assets. The leadership of Tradias, led by founder Christopher Beck, has framed the merger as a step toward building a European champion with broader reach and deeper strategic capabilities. Beck stressed that the alliance would allow the two entities to cover the entire value chain for digital assets and to harness the strengths of both firms to accelerate market consolidation.

Beyond the immediate strategic benefits, the merger has implications for the European crypto ecosystem’s maturity. The combination of a regulated exchange operator and a BaFin-licensed securities trading bank is emblematic of a trend toward more integrated and regulated solutions, which could lower barriers to participation for banks and asset managers seeking regulated exposure to crypto markets. The regulatory backdrop—especially MiCA—will continue to shape how such entities structure their offerings, the kinds of products they can offer, and how they manage custody, staking and tokenized assets. In the context of 2025 regulatory developments, several commentators have highlighted how MiCA licensing frameworks may influence the design and distribution of crypto products, including the potential for more standardized governance and risk controls across borders. The ongoing shift toward regulated, institution-friendly models is consistent with the broader push to normalize crypto markets within mainstream financial systems.

Related: Denmark’s Danske Bank allows clients to buy Bitcoin and Ether ETPs

Tradias’ leadership has signaled that the merger would enable the two firms to expand their European footprint, leveraging their respective strengths to offer a more robust platform for institutional clients. Beck’s comments emphasize the goal of creating “a new European champion” with greater reach and operational depth that could accelerate consolidation in the sector. The strategic logic rests on combining Boerse Stuttgart Digital’s regulated product suite and custody capabilities with Tradias’ licensed market access and execution capabilities, potentially creating a more competitive, scalable and compliant ecosystem for digital-asset trading and custody across Europe.

The broader market context reinforces the strategic prudence of this move. The European crypto market has been evolving toward greater professionalization, with a growing emphasis on licensing, risk management and interoperability across borders. The MiCA framework is widely viewed as a driver of this shift, encouraging standardized practices and more predictable regulatory outcomes for participants. The proposed merger aligns with these dynamics, signaling a willingness among incumbents to invest in regulated infrastructures that can support institutional flows, wholesale trading and the custody of digital assets on a pan-European scale. The coming months will be crucial for the timeline and final terms, as regulatory approvals and integration milestones will determine how quickly the combined operation can begin delivering on its stated objectives.

Why it matters

The strategic union between Boerse Stuttgart Digital and Tradias could reshape how European institutions access crypto markets. By marrying regulated trading, custody and brokerage with a licensed execution platform, the merged entity could reduce the friction and compliance overhead that have historically limited institutional participation. This consolidation may also set a precedent for other European incumbents seeking to build comparable ecosystems, potentially accelerating the pace at which traditional financial services firms adopt and integrate digital-asset capabilities. The emphasis on tokenized assets and staking suggests a broader ambition to extend digital assets beyond simple trading to a more comprehensive asset-management framework that integrates with existing bank-grade risk controls.

From a user perspective, the deal promises continuity and scale. Banks and brokers seeking regulated access to crypto services could benefit from a more cohesive offering, including custody and settlement under a single governance framework. For digital-asset providers and fintechs, the merger highlights the value of partnerships with regulated institutions that can bridge retail and wholesale markets while maintaining high standards of compliance. The European landscape, long characterized by divergent national approaches, could gradually converge as more players align under MiCA-compliant models, reducing cross-border complexity and enabling more efficient capital deployment.

What to watch next

- Regulatory approvals and the closing date of the merger, including any conditions placed by BaFin or other European authorities.

- Integration milestones for Boerse Stuttgart Digital and Tradias, including the consolidation of tech platforms and onboarding of additional banks or brokers.

- Rollout of expanded services, such as custody, staking and tokenized-assets offerings, to new European markets.

- Any updates on the valuation, potential debt financing or equity arrangements tied to the transaction.

Sources & verification

- Boerse Stuttgart Digital-Tradias merger press release (PDF): https://www.bsdigital.com/media/fucbehz4/20260213_en_boerse-stuttgart_digital_tradias.pdf

- Bloomberg reporting on valuation: https://www.bloomberg.com/news/articles/2026-02-13/boerse-stuttgart-to-merge-crypto-arm-with-trading-firm-tradias

- Tradias BaFin-licensed status: https://cointelegraph.com/news/tradias-bafin-license-expansion-2025

- Markets in Crypto-Assets Regulation (MiCA) overview referenced in coverage: https://cointelegraph.com/learn/articles/markets-in-crypto-assets-regulation-mica

- Boerse Stuttgart growth and revenue context: https://cointelegraph.com/news/bourse-stock-exchange-25-percent-revenue-rise-crypto

European consolidation of regulated crypto services: what the merger means

Crypto World

Crypto CEO Sentenced to 20 Years in $200M Bitcoin Ponzi Scheme

A Virginia federal court handed a 20-year prison sentence to Ramil Ventura Palafox, the chief executive of Praetorian Group International (PGI), for leading a crypto investment scheme that prosecutors say defrauded tens of thousands of investors out of roughly $200 million. Court records describe a carefully orchestrated Ponzi scheme that promised daily returns of up to 3 percent from Bitcoin trading, only to funnel new money to earlier participants while fabricating apparent gains through an online portal.

Key takeaways

- The judge sentenced PGI’s founder, 61-year-old Ramil Ventura Palafox, to 20 years in prison after convictions on wire fraud and money laundering charges tied to a $200 million crypto investment scam.

- The scheme allegedly attracted more than $201 million from December 2019 to October 2021, including at least 8,198 Bitcoin (BTC) valued at about $171.5 million at the time; victims suffered losses of at least $62.7 million.

- Regulators say PGI claimed to trade Bitcoin at scale and to generate steady daily profits, but prosecutors contended the trading activity could not support the promised returns.

- Palafox allegedly used a multi-level marketing structure and paid referrals, while misrepresenting trading performance to lure new participants.

- The case combines criminal action from the Department of Justice with civil action from the Securities and Exchange Commission, underscoring cross-border enforcement and ongoing scrutiny of crypto-related fraud.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The sentencing arrives amid sustained regulatory focus on crypto investment platforms and crypto-enabled fraud. Authorities have signaled that the combination of alleged misrepresentation, aggressive fundraising, and the promise of consistent, high daily returns increases investor risk and elevates enforcement priorities. The case also reflects ongoing efforts to align crypto-related schemes with traditional securities and consumer-protection regimes, highlighting the challenges of policing cross-border online operations as crypto markets remain volatile and subject to rapid shifts in investor sentiment.

Why it matters

The PGI case illustrates how fraudsters continue to exploit the aura of professional crypto trading to attract money from retail investors. By presenting a façade of sophisticated AI-driven or large-scale Bitcoin trading, the scheme preyed on hopes of reliable, outsized returns and leveraged a multi-level referral structure to accelerate capital inflows. The financial footprint—tens of thousands of investors and hundreds of millions of dollars—shows the scale at which these operations can operate before regulators intervene.

From a regulatory perspective, the outcome reinforces the co-operation between criminal and civil agencies in tackling crypto-enabled fraud. The Department of Justice’s criminal case, paired with the SEC’s civil action filed later, demonstrates a multi-front approach to address both deception and improper fundraising in digital asset markets. The interplay between criminal penalties and potential restitution signals that victims may pursue recovery through court-administered processes, while enforcement actions may deter future misconduct by raising the stakes for misrepresentation and misappropriation of investor funds.

For investors and builders in the crypto space, the PGI case underscores a persistent risk layer: schemes can mimic legitimate trading operations, including claims of AI-powered platforms and guaranteed returns, even as real trading volumes and profits fail to materialize. Trust remains a critical asset in this industry, and cases like this one press the importance of due diligence, transparent performance reporting, and robust compliance programs for operators who manage other people’s money.

What to watch next

- Restitution processes: Regulators have indicated that victims may be eligible for restitution; follow communications from the U.S. Attorney’s Office regarding claims submissions and timelines.

- Civil case developments: The SEC’s civil complaint may yield further settlements or enforcement actions related to misrepresented trading activities and the claimed AI-driven platform.

- Cross-border enforcement updates: The case’s international elements—such as activity in the United Kingdom and other jurisdictions—could prompt additional regulatory coordination and potential asset tracing outcomes.

- Regulatory signaling: The convergence of criminal and civil actions in crypto fraud cases is likely to influence future policy discussions on crypto investment schemes, disclosure requirements, and investor protections.

Sources & verification

- Department of Justice press release on the sentencing of Ramil Ventura Palafox for a $200 million crypto Ponzi scheme.

- SEC civil complaint filed in April 2025 alleging misrepresentation of PGI’s trading activity and the use of new investor funds to pay earlier participants.

- DOJ actions detailing charges in the Eastern District of Virginia and the cross-border enforcement that accompanied the case.

- Information on the 2021 seizure of PGI’s website and related enforcement steps, indicating the global reach of the investigation.

Rewritten Article Body: Conviction underscores regulatory watch on crypto investment platforms

In a case that underscores the intensifying scrutiny of crypto-enabled investment fraud, a federal judge in Virginia handed down a 20-year prison sentence to Ramil Ventura Palafox, the founder and chief executive of Praetorian Group International (PGI). Prosecutors described the matter as a deliberate Ponzi scheme that lured tens of thousands of investors with promises of consistent daily gains from Bitcoin trading, a narrative that unfolds against a backdrop of growing regulatory focus on digital assets and investor protection.

According to the Department of Justice, the scheme operated between December 2019 and October 2021, drawing in more than $201 million from participants who believed they were backing a sophisticated trading enterprise. The government highlighted that the apparently robust performance—daily returns of up to 3 percent—was presented in a manner designed to reassure investors and sustain the inflow of new funds. Yet, prosecutors argued that the trading activity did not come close to supporting the promised returns, and that the apparent gains were often illusory, backed by funds from newer entrants rather than genuine profits.

The financial footprint of PGI’s operation was substantial. Investors poured in more than $201 million during the two-year window, and the case notes that at least 8,198 Bitcoin (CRYPTO: BTC) were involved in the scheme, with the digital asset valued at roughly $171.5 million at the time. Victims’ losses were estimated at no less than $62.7 million, a figure that illustrates the real-world harm that can accompany fraud in crypto markets. The court and prosecutors described a pattern in which new investor money was shuffled to pay earlier participants, a hallmark of Ponzi dynamics that undermines trust in similarly structured ventures.

Court filings depict a troubling panorama of misrepresentation and perceived legitimacy. Palafox allegedly oversaw an online portal that displayed steady gains, creating the illusion that accounts were compounding reliably. The operation reportedly relied on a multi-level marketing framework, with referral incentives designed to broaden the pool of participants. In parallel, the government contended that these promotional claims masked the absence of actual trading capacity to generate the claimed profits, allowing the scheme to sustain itself for a period before regulators began to unravel the web of financial red flags.

From a personal-finance perspective, the case paints a stark picture of resource misallocation. Authorities allege that Palafox diverted investor funds to support a lavish lifestyle, including millions spent on luxury vehicles and high-end real estate, as well as substantial expenditures on penthouse suites and other discretionary purchases. In a demonstration of cross-border reach, prosecutors noted transfers that included at least $800,000 and 100 Bitcoin moved to a family member, highlighting the opportunistic use of assets beyond the U.S. jurisdiction for personal enrichment.

The legal strategy behind the case extended beyond criminal charges. In a parallel civil action, the Securities and Exchange Commission filed a complaint in April 2025 accusing Palafox of misrepresenting PGI’s Bitcoin trading activity and using new investor money to compensate earlier participants. The SEC alleged that PGI promoted an AI-powered trading platform and guaranteed daily returns despite lacking a foundation in real trading operations capable of producing such profits. The dual track of enforcement—criminal and civil—emphasizes a broader regulatory intolerance for schemes that blur the lines between technology-driven finance and fraudulent conduct.

The trajectory of the case also reflects the cross-border enforcement environment facing crypto fraud. Regulators seized PGI’s website in 2021, signaling early steps toward dismantling the operation and tracing its financial flows beyond U.S. borders. Authorities later extended their scrutiny into the United Kingdom, where related operations were shuttered, illustrating the global dimension of crypto fraud investigations and the need for international cooperation in asset tracing and restitution efforts.

Victims remain at the center of the proceedings, with restitution potentially available through the U.S. Attorney’s Office process. While the criminal sentence serves as a punitive measure, the civil action and related enforcement signals are aimed at recovering assets and deterring similar misconduct in the crypto space. The case stands as a cautionary tale for investors and a reminder to operators that regulatory and judicial systems are increasingly attentive to the nuances of crypto-based investment promises and the risks of opaque performance reporting.

Crypto World

How Will Bitcoin’s Price React?

The cryptocurrency has suffered badly in the past few weeks, will it finally rebound?

The highly anticipated Consumer Price Index for the first month of 2025 just came out, showing that inflation has cooled year over year to 2.4%, which is slightly lower than the estimated 2.5%.

The Core CPI, which excludes more volatile sectors like food and energy, matched the expectations at 2.5%. Nevertheless, analysts indicated that the monthly increase in the regular CPI of just 0.2% is the lowest since last May.

Heather Long, Navy Federal Credit Union’s chief economist, noted that the prices for gas, used cars, and medical care all decreased in January, which helped bring down inflation even as utilities and transportation rose.

She determined that this is good news on the inflation front, even though there might be “one more bump from tariffs.”

Just In: US inflation cooled to 2.4% (y/y) in January —> The lowest inflation rate since May. The monthly increase was just 0.2%.

Gas prices, used cars and medical care all declined in January, helping to bring down inflation even as utilities and transportation rose.

Core CPI… pic.twitter.com/2z18M9va68

— Heather Long (@byHeatherLong) February 13, 2026

Bitcoin’s price has usually been volatile when the US CPI data comes out. The first minutes have been rather positive, as the asset rose slightly to $67,600 before it corrected to $67,200 as of press time.

A more significant impact is expected once the US Federal Reserve weighs in on this data for its next move in terms of interest rate reduction.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Binance Confirms Targeted Employee; Three Arrested in France Break-In

Three suspects were apprehended in France after a reported home-invasion targeted at a senior Binance France executive, with the parent company confirming that one employee was the victim. The incident unfolded in the Val-de-Marne area around 7:00 am CET, when armed intruders allegedly forced entry into an apartment and sought information leading to the head of Binance France. Police later recovered two mobile devices as the suspects fled. A separate attempt to break into a second residence in Hauts-de-Seine occurred roughly two hours later, culminating in arrests and the recovery of a vehicle linked to the case. Binance said it is cooperating with authorities and has intensified security measures to protect staff and families during an ongoing investigation.

Key takeaways

- In Val-de-Marne, three masked assailants forced entry into a resident’s home around 7:00 am CET, then sought directions to the Binance France head’s address and fled with two mobile phones.

- Two hours after the first incident, authorities arrested the suspects during a second home-invasion attempt in Hauts-de-Seine; investigators recovered the stolen phones and a vehicle.

- Binance confirmed the event to Cointelegraph, stating the employee and their family are safe and that the company is working closely with local law enforcement while enhancing security measures.

- The episode arrives amid broader security concerns in the crypto space, where wrench-attacks—physical assaults linked to crypto-related schemes—have surged in 2025, particularly in Europe and France.

- Binance’s co-founder Yi He publicly thanked French police for their swift response, underscoring the collaboration between crypto firms and law enforcement in addressing real-world risks.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The incident sits within a year of rising wrench-attacks against crypto investors and executives. CertiK documented a 75% increase in wrench attacks during 2025, with 72 verified cases globally. France recorded the highest number of incidents in 2025 (19), while Europe accounted for about 40% of global cases, highlighting a regional risk pattern as crypto activity expands across the continent.

Market context: The broader security environment for crypto companies is increasingly shaped by physical risk and targeted offenses, reinforcing the need for dedicated on-site security protocols and law-enforcement collaboration as firms expand in Europe.

Why it matters

The Binance France incident illustrates how crypto operations, even behind seemingly large organizations, face vulnerabilities beyond cyber threats. Physical security failures can expose executives and families to immediate danger, underscoring the importance of robust, end-to-end security planning for firms with regional leadership and critical operations. Binance’s response—expressing concern for staff welfare, cooperating with authorities, and enhancing security measures—signals a commitment to risk management that extends beyond digital assets and into real-world protection for personnel.

From a market and adoption perspective, incidents like this highlight that the crypto sector remains subject to traditional crime vectors even as the technology and markets mature. While there is no direct implication for asset prices from a single home invasion, the event reinforces the ongoing demand for secure governance, physical security protocols, and proactive collaboration with law enforcement across jurisdictions as regulatory and consumer scrutiny intensifies.

The public acknowledgment from Binance’s leadership—specifically a message from Yi He expressing gratitude for police efforts—reflects how the ecosystem increasingly relies on coordinated responses to safety incidents. That coordination can influence how crypto firms profile risk and allocate resources, potentially shaping future security investments and crisis-management protocols across regional teams.

What to watch next

- Official police updates on the investigation progress and any additional arrests or charges related to the two incidents.

- Binance’s security posture announcements or new measures implemented for employees in France and other regions.

- Any regulatory or policy developments in France or Europe addressing physical security for crypto firms and executives.

- Follow-up reporting on related wrench-attack cases in Europe to assess whether the incidents represent a broader pattern or are isolated events.

- Public statements from Binance France regarding ongoing risk assessments and collaboration with local authorities after the incident.

Sources & verification

- Binance’s formal confirmation to Cointelegraph regarding the home-invasion incident and the ongoing police investigation.

- RTL’s reporting on the initial attack in Val-de-Marne, including details about the home entry and subsequent arrest in Hauts-de-Seine.

- CertiK’s analysis noting a 75% rise in wrench-attacks in 2025 and the distribution of incidents across Europe and France.

- Cointelegraph coverage of related crypto-crime developments in France, including arrests tied to crypto-related ransom cases.

- Yi He’s X post acknowledging the incident and praising the French police unit Brigade de Répression du Banditisme.

What the announcement changes

Binance’s incident report underscores the evolving risk landscape for crypto executives operating in Europe. While the incident does not appear to affect market liquidity or exchange operations directly, it reinforces the need for rigorous physical-security protocols, crisis communication plans, and ongoing collaboration with law enforcement. For investors and users, the episode is a reminder that the sector’s growth is accompanied by real-world threats that require comprehensive risk management practices by firms and stronger protective measures for personnel in high-visibility roles.

Key figures and next steps

Authorities’ ongoing work will determine whether the two Val-de-Marne and Hauts-de-Seine cases are linked beyond the vehicle recovery and stolen devices. Binance’s leadership has stated that staff safety remains a top priority, and the company is pursuing enhanced security measures. The collaboration between Binance and French law enforcement, including high-profile units, will likely shape how the firm communicates future incidents and implements security improvements across its European footprint.

What to watch next

- Updates on the investigation from French police authorities (cases tied to the initial home-invasion and the second attempted entry).

- Details on the security enhancements Binance plans to deploy for its France team and regional offices.

- Regulatory responses in France and the broader European Union concerning physical-security standards for crypto firms.

https://cdn.ampproject.org/v0.js

Crypto World

A Complete Guide for DeFi Founders (2026)

If you are reading this, you are not looking for another surface-level article on stablecoins. You are here because you are making an important business and technical decision. You want to know whether your ETH-backed stablecoin can survive volatility, attract institutional capital, meet compliance standards, and scale without failure.

This guide is written for founders who want clarity before committing capital, resources, and reputation. You want to know whether your:

- The collateral model can handle market shocks

- The peg mechanism will remain stable

- Architecture meets institutional standards

- The revenue model is sustainable

- The system can pass audits and compliance reviews

This guide provides a practical, decision-ready framework for building an ETH-backed algorithmic stablecoin, backed by proven stablecoin development services and real-world implementation insights.

Why ETH-Backed Algorithmic Stablecoins Are Gaining Institutional Attention

Institutional capital does not follow hype. It follows liquidity, transparency, risk management, and infrastructure maturity. ETH-backed algorithmic stablecoins align with all four, making them increasingly attractive to serious DeFi founders and financial institutions.

Ethereum-backed models are preferred because they combine deep market liquidity, real-time on-chain collateral visibility, mature smart contract standards, and seamless integration with institutional systems supported by leading stablecoin development solutions providers.

- Strong Liquidity and Market Confidence

Ethereum remains one of the most liquid digital assets globally. In 2026, ETH continued to record high spot and derivatives volumes across major exchanges, ensuring efficient collateral liquidation during market stress. Institutional-grade custody solutions and regulated trading platforms support ETH natively, reducing onboarding friction for enterprises working with a professional stablecoin development company. High liquidity enables stablecoin systems to absorb volatility without extreme slippage, protecting peg stability.

- Real-Time On-Chain Collateral Transparency

ETH-backed stablecoins allow institutions to verify solvency directly on-chain. Leading protocols maintain:

- Collateral ratios between 130% and 180%

- Automated liquidation triggers

- Public reserve dashboards

This transparency minimizes counterparty risk and strengthens institutional trust.

- Mature Smart Contract and Oracle Infrastructure

Ethereum has one of the most battle-tested smart contract ecosystems in the industry. Billions in DeFi value have passed through audited protocols using advanced security practices. Redundant oracle networks and formal verification standards reduce systemic risk, making Ethereum-based systems more reliable than experimental networks. Institutional risk teams consistently favor platforms built with mature stablecoin development frameworks.

- Seamless Institutional Integration

Most major custodians, compliance platforms, and analytics providers already support Ethereum-based assets. This includes custody, AML monitoring, transaction reporting, and regulatory tooling. As a result, ETH-backed stablecoins can be integrated into enterprise workflows faster, lowering operational and compliance costs.

- Consistent Growth in TVL and Capital Efficiency

Recent DeFi analytics show that ETH-collateralized stablecoin protocols continue to grow in total value locked and user participation.

Key trends include:

- Higher resilience than unbacked algorithmic models

- Stronger capital retention during volatility

- Rising institutional wallet activity

Overcollateralized hybrid designs have demonstrated superior peg stability and liquidity durability, reinforcing long-term confidence among investors and enterprises.

Stress-Test Your ETH-Backed Stablecoin Strategy With Experts

What Founders Are Actually Searching For?

When a DeFi founder searches for ETH-backed algorithmic stablecoin development, they are usually trying to answer one of these critical questions:

- How do I design peg stability under volatility?

- How do I prevent liquidation cascades?

- How do I build something investors trust?

- How do I avoid becoming the next failed case study?

- Should we build internally or partner with a specialized stablecoin development team?

These queries reflect high-stakes decision-making, not casual research. Founders at this stage are evaluating long-term architecture, risk exposure, capital efficiency, regulatory readiness, and governance sustainability, often in consultation with a professional stablecoin development company. They are also assessing timelines, development costs, audit requirements, and post-launch operational responsibilities. This search intent is both technical and strategic, signaling readiness to invest in serious infrastructure rather than experimental prototypes.

The Core Architecture of an ETH-Backed Algorithmic Stablecoin

A resilient stablecoin protocol is built on six foundational layers.

1. Collateral Management Layer

- Dynamic collateral ratios

- Multi-source price feeds

- Automated margin monitoring

2. Stability Engine

- Peg maintenance algorithms

- Rebalancing mechanisms

- Market intervention logic

3. Oracle Infrastructure

- Redundant data providers

- Failover systems

- Manipulation-resistant feeds

4. Liquidity Framework

- AMM integration

- Cross-chain bridges

- Institutional liquidity channels

5. Governance System

- Risk parameter voting

- Emergency controls

- Protocol upgrade management

6. Security & Compliance Layer

- Continuous auditing

- Incident response systems

- Regulatory reporting modules

A professional stablecoin development company designs these layers as modular components to support scalability, seamless upgrades, and long-term protocol stability.

Why Most Algorithmic Stablecoins Fail

Historical analysis shows recurring failure patterns.

- Over-optimistic collateral assumptions

- Weak oracle resilience

- Incentives designed for growth but not sustainability

- Insufficient liquidity depth

- Lack of structured cryptocurrency development lifecycle management

When market volatility spikes, these weaknesses compound. Liquidation cascades begin. Confidence drops. The peg weakens. Capital exists. Founders who understand these systemic risks design countermeasures from day one.

Get Your Stablecoin Model Reviewed by Experts

Business Case: Turning Stability into Sustainable Revenue

Unlike speculative tokens that rely on short-term hype, stablecoin protocols generate value through continuous network usage, capital circulation, and enterprise integration. When supported by professional stablecoin development services, these systems evolve into core settlement and liquidity layers within the digital economy. Primary revenue drivers include:

- Stability Fees from Borrowers: Collected from users who mint or leverage the stablecoin, these fees represent a consistent income stream tied directly to protocol demand.

- Protocol Transaction Fees: Every on-chain transaction, swap, or settlement generates micro-fees that compound as network activity grows.

- Liquidity Pool Participation: By allocating treasury assets to decentralized liquidity pools, protocols earn trading fees while strengthening market depth.

- Institutional Settlement Services: Enterprise clients pay for high-volume settlement, reporting access, and customized infrastructure, creating premium revenue channels.

- Treasury Yield Optimization: Surplus collateral can be deployed into low-risk DeFi strategies, generating passive returns without exposing the peg to instability.

This ensures that revenue mechanisms remain sustainable across market cycles and do not introduce hidden risks that could weaken collateral backing or destabilize the peg.

In practice, the most successful stablecoin platforms treat monetization as a risk-managed engineering function rather than a marketing strategy. This disciplined approach is what transforms stablecoins into durable, institution-ready financial infrastructure.

Final Conclusion: Build Stability That Lasts

ETH-backed algorithmic stablecoins have evolved into core financial infrastructure in 2026. Success in this space now depends on strong collateral design, transparent risk management, secure smart contract architecture, regulatory readiness, and sustainable revenue models. Founders who approach stablecoin development with a long-term, institution-focused mindset are the ones building platforms that attract capital, retain users, and survive market cycles.

This is where Antier stands out as a trusted stablecoin development company. We help founders design secure, scalable, and future-ready stablecoin ecosystems. From architecture to compliance and post-launch support, we work as a strategic partner, not just a development vendor. Ready to Build with Confidence? Partner with Antier to launch an institutional-grade stablecoin built for performance, stability, and growth.

Frequently Asked Questions

01. What are the key factors to consider when developing an ETH-backed stablecoin?

Key factors include the collateral model’s ability to handle market shocks, the stability of the peg mechanism, compliance with institutional standards, sustainability of the revenue model, and the system’s capacity to pass audits and compliance reviews.

02. Why are ETH-backed algorithmic stablecoins gaining attention from institutional investors?

They attract institutional capital due to their strong liquidity, transparency, effective risk management, and mature infrastructure, which align with the needs of serious DeFi founders and financial institutions.

03. How does real-time on-chain collateral transparency benefit ETH-backed stablecoins?

It allows institutions to verify solvency directly on-chain, reducing counterparty risk and enhancing trust through maintained collateral ratios, automated liquidation triggers, and public reserve dashboards.

Crypto World

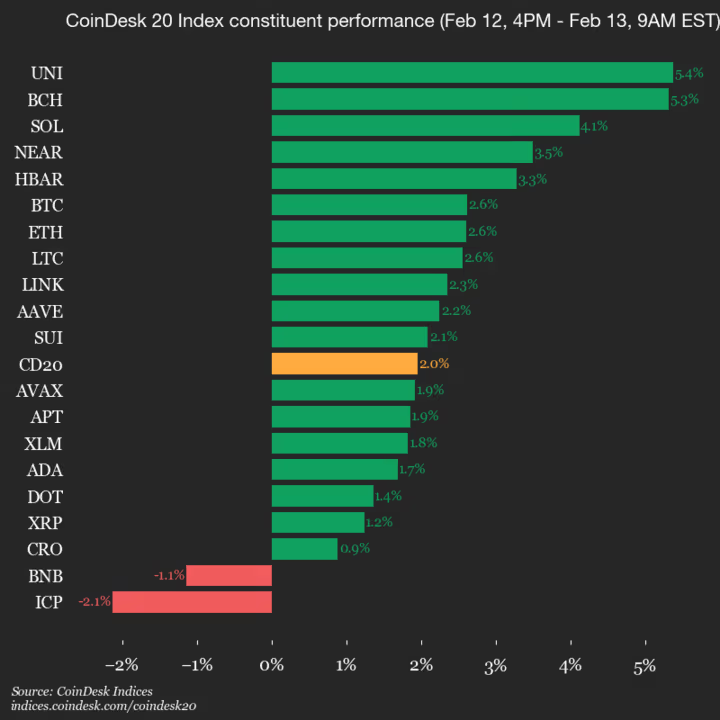

Uniswap (UNI) jumps 5.4%, leading index higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1920.47, up 2.0% (+36.77) since 4 p.m. ET on Thursday.

Eighteen of the 20 assets are trading higher.

Leaders: UNI (+5.4%) and BCH (+5.3%).

Laggards: ICP (-2.1%) and BNB (-1.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Binance Buys $1B in Bitcoin, US Inflation Lower-Than-Expected, but BTC Price Still Suffers: Weekly Crypto Recap

Bitcoin traded mostly sideways in the past week, but every breakout attempt was halted in its tracks.

Although bitcoin and most altcoins have recovered from the massive losses charted at the end of the previous business week, the past seven days weren’t exactly positive for the asset class, as it remains miles from the Q4 2025 peaks.

Before we examine the developments that took place in the past week, let’s quickly recap the latest crash that culminated on February 6 when BTC plunged to $60,000 for the first time in well over a year. Many altcoins collapsed by 20-30% daily, reaching new local lows.

Nevertheless, BTC bounced off on that day by $12,000 and tapped $72,000 in what became one of its most impressive single-day recovery attempts. However, the predominant bearish trend resumed rapidly, and BTC was stopped and driven down to $68,000 during the weekend.

It spent the next several days trading sideways between that lower boundary and $72,000. After the latest rejection at the upper boundary, the bears initiated another leg down, pushing the cryptocurrency south to $66,000 on Wednesday and $65,000 on Thursday.

The past few hours were slightly more positive for bitcoin, especially since the US CPI numbers for January came out and showed that inflation has actually cooled off. BTC jumped to $67,600 but was stopped there and now trades inches above $66,000. This means that BTC now sits at approximately the same spot as last week, but many alts have produced more substantial volatility.

On the one hand, XRP, BNB, HYPE, and SOL are deep in the red, but on the other, BCH, XMR, and HBAR have surged by up to 9.5%.

Market Data

Market Cap: $2.37T | 24H Vol: $110B | BTC Dominance: 56.7%

You may also like:

BTC: $67,200 (-0.06%) | ETH: $1,970 (+1%) | XRP: $1.38 (-3.7%)

This Week’s Crypto Headlines You Can’t Miss

Binance Completes $1B SAFU Fund Shift to Bitcoin. The most significant news in terms of BTC acquisition this week came from Binance as the exchange completed the conversion of its entire $1 billion SAFU fund to bitcoin. The company bought a total of 15,000 BTC in the span of just a few weeks.

BlackRock’s BUIDL Fund Hits Uniswap as UNI Jumped 40%. The largest decentralized exchange partnered with Securitize to make BlackRock’s USD Institutional Digital Liquidity Fund available for trading via UniswapX. The news sent shockwaves through the UNI community, with the token surging by up to 40% within minutes.

Banks Take Hard Line on Stablecoin Yields as White House Talks Stall. Although the March 1 deadline is approaching fast, the crypto industry and banks clashed again over stablecoin rewards without a clear agreement. No compromise was reached, said sources, but the session was described as “productive.”

Robinhood Enters Layer 2 Race With Public Testnet Launch of Robinhood Chain. The US-based trading platform noted earlier this week that it has launched the public testnet for Robinhood Chain, an Ethereum Layer 2 network built on Arbitrum, designed to accelerate the development of tokenized real-world and digital assets.

Miner Offloads $305M Bitcoin as Network Difficulty Sees Sharp Decline. The past few weeks have been tough on miners as well, especially in some regions due to severe weather. One of the larger entities in the field, Cango, disclosed that it had sold over $300 million worth of BTC amid rising pressure and falling profitability metrics.

Robert Kiyosaki Says Bitcoin Is a Better Investment Than Gold – Here’s Why. The best-selling author, who recently came under fire by the crypto community because of some controversial statements, believes bitcoin is a better investment than gold. Although he would rather hold both, if having to choose, he would opt for BTC due to its proven limited supply.

Charts

This week, we have a chart analysis of Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid – click here for the complete price analysis.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Stocks and crypto markets on edge as US inflation cools, Trump eyes steel tariff cuts

The stock and crypto markets remained on edge today, February 13, as participants reacted to the latest US consumer inflation report, which continued moving downwards in January.

Summary

- The stock and crypto markets retreated after the US published the latest US consumer inflation report.

- Data by the Bureau of Labor Statistics showed that the headline Consumer Price Index fell to 2.4%.

- Core inflation, which excludes the volatile food and energy prices, fell to 2.5%.

US stock indices retreated, with the futures tied to the Dow Jones. Nasdaq 100, and S&P 500 falling by over 35 basis points, continuing a trend that has continued on Thursday.

Similarly, crypto prices like Bitcoin (BTC) dropped to $66,000, while top altcoins like LayerZero (ZRO), Canton, Internet Computer, Uniswap, and Kaspa dropped by over 5% in the last 24 hours. The market capitalization of all tokens dropped to $2.29 trillion.

US consumer inflation retreated in January

A report released by the Bureau of Labor Statistics showed that the headline Consumer Price Index retreated from 2.7% in December to 2.4% in January, the lowest level in months. It retreated from 0.3% in December to 0.2% on a MoM basis.

The report showed that the core inflation, which excludes the volatile food and energy prices, dropped to 2.5% from the previous 2.6%. These numbers mean that US inflation has not surged as during President Donald Trump’s tariffs as most economists were expecting.

The report came a few hours after the Financial Times reported that Trump’s administration was considering tweaking his massive steel and aluminum tariffs, a move that will lead to lower prices in the long term

The data came two days after the BLS released strong non-farm payrolls data, which showed that the economy created 130k jobs in January, while the unemployment rate slipped to 4.3%.

Still, it is unclear whether the Federal Reserve will cut interest rates more times this year, even as inflation retreats. A Polymarket poll has the odds of no cuts in March at 93%. Another poll estimates that there will be just two cuts this year.

Stocks and crypto markets do well in periods of low interest rate

In theory, the stock and crypto markets do well when the Fed is cutting interest rates. A good example of this happened during the COVID-19 pandemic when these assets jumped as the Fed slashed rates to zero.

The assets then plunged in 2022, with Bitcoin moving below $16,000, as the Fed hiked interest rates to combat the elevated inflation.

However, the current Federal Reserve cycle has happened amid a divergence in the two assets. The stock market has soared to a record high, while Bitcoin and most altcoins are stuck in a bear market.

One reason for this is that the market has had some major moving parts in the past few months. The stock market has been driven be the ongoing AI boom, while the crypto market crash has happened because of the elevated risks, including on Iran.

Crypto World

How would Michael Saylor refinance Strategy’s $8.2B debt?

On a recent CNBC interview, Michael Saylor casually mentioned that if bitcoin (BTC) fell 90%, he would easily refinance his company’s debts. His company, Strategy (formerly MicroStrategy), owes creditors $8.2 billion.

Skeptics, however, were unconvinced that Saylor would be able to accomplish that feat so easily.

Although the company owns 714,644 BTC worth $47.4 billion at current prices, if it crashed 90%, Strategy holdings might only be worth $4.7 billion — far lower than its debt.

CNBC anchor Becky Quick, for example, was immediately unconvinced by Saylor’s flippant answer to her question about his plan for an extended bear market.

Crypto values have halved in four months, losing over $2 trillion since October 6. Maybe the worst is yet to come.

As Saylor was visibly laughing about how obvious it should be that Strategy would be able to refinance its debt after a 90% decline in the price of BTC, Quick asked a simple question.

“Refinance where, Michael?”

Saylor responded that he would “just roll it forward” to extend maturity dates on his principal repayments.

Unconvinced, Quick repeated her simple question. “You think banks would lend to you at that point?”

‘Just roll it forward’

Indeed, Saylor’s company isn’t particularly creditworthy by conventional metrics even today. S&P Global rates it at B-, which means that its bonds are speculative-grade, or colloquially, “junk bonds.”

If BTC were to decline 90%, the company would have far more debt than assets, and the company has a track record of losing money.

Indeed, its operating loss in its most recent quarter was $17.4 billion — a 16.4x increase year-over-year. Its “product support” and “other services” revenues also declined in Q4 2025 versus the prior year, as another sign of weakness.

Saylor’s confidence in his ability to roll-over his bonds is justifiable given the company’s current asset levels and his $2.2 billion in cash today, but if the price of BTC continues to collapse, those figures will deteriorate rapidly.

Read more: Michael Saylor’s Strategy sheds $6 billion in a day — again

Michael Saylor’s debt problem

With very little operating income to speak of relative to over $8 billion in bonds, hundreds of millions of dollars in annual dividend obligations, interest payments due to bondholders, salaries, and other operating expenses, Saylor might have a tough time convincing any lender to extend his credit during the depths of a bear market.

“I don’t think it’s going to $8,000,” Saylor retorted about BTC, without further explanation, at the end of that CNBC segment. “But the credit risk is de minimis at this point.”

While true, those beliefs do not answer the anchor’s question. How, exactly, does Michael Saylor plan to refinance $8 billion in debt if BTC crashes?

Again, and as many critics on social media have realized, he will not need to renegotiate the debt at all if BTC rallies. Only if BTC crashes will he need to renegotiate. At that point, it might have become impossible.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Top Trends Followed by Crypto-Friendly Neobanks in 2026

Why does sending money internationally still feel like mailing a letter in the age of instant messaging? A wire transfer takes three days, costs $45 in fees, and loses another chunk to unfavorable exchange rates.

Freelancers struggle to access basic banking services because traditional institutions can’t process cryptocurrency income. Small businesses watch profits evaporate in currency conversion fees while waiting for payments to clear.

These are not minor obstacles; they’re symptoms of a financial system built around outdated infrastructure. Banking currently moves more slowly than the digital world requires, while cryptocurrency systems are far too unpredictable for living, day-to-day lives. This disconnect can be filled by a crypto Neo bank development company having deep expertise in blockchain technology.

Now, let’s have a look at the statistics.

| According to Mordor Intelligence, the global Neobanking market is set for strong growth, rising from USD 7.38 trillion in 2025 to USD 8.18 trillion in 2026, and further accelerating to USD 13.67 trillion by 2031, at a CAGR of 10.82%. |

Crypto-friendly Neobanks do not symbolize incremental improvement; they symbolize the rebuilding of finance from scratch. Blockchain technology and bank stability are no longer topics of the future; they are happening right now, and the year 2026 will be the year of essential digital banking trends and not experimentation.

How Decentralized Banking is Reshaping Finance

Decentralized banking is the act of removing the old gatekeepers who managed our monetary systems for centuries. The simple question being asked is, why should anyone need permission to access their own money?

- Self-Custody Meets User-Friendly Design

Modern crypto banking solutions combine blockchain’s security with interfaces that feel familiar. Users maintain ownership of assets through private keys while navigating apps that look and function like traditional banking platforms. This removes the technical barriers that held mainstream acceptance at bay during the early days of crypto.

- Smart Contracts Enable Programmable Finance

Money becomes dynamic through smart contracts. Savings accounts can automatically invest surplus funds when balances exceed thresholds. Bills pay themselves on schedule. Emergency reserves are released only under predefined conditions. White label crypto Neo bank platform development is bringing these capabilities to regional providers who lack the resources to build proprietary systems.

- Geographic Borders Become Irrelevant

A user in Lagos accesses the same crypto-friendly Neobanks available in London or Los Angeles. This matters tremendously for the 1.4 billion unbanked adults worldwide. They are the people for whom traditional finance has systematically failed. The decentralized infrastructure is location-neutral and therefore allows financial services to become global for the first time.

6 Game-Changing Trends Defining Crypto Neo Banking in 2026

The landscape of crypto banking solutions is transforming rapidly. These six emerging trends are reshaping how a crypto Neo bank development company builds platforms and how users experience digital finance.

Trend #1: Agentic Banking & AI Financial Copilots

The role of artificial intelligence in crypto banking solutions is no longer limited to mere automation. Today, intelligent agents carry out complex financial maneuvers without any assistance. For instance, they analyze every spending situation and optimize every transaction.

- Transaction Routing Optimization

AI copilots evaluate gas fees, exchange rates, and settlement times in real-time. When paying an invoice in euros, the system automatically converts cryptocurrency at the optimal moment through the most cost-effective channel. No manual intervention required.

- Proactive Financial Management

A top crypto Neo bank development company uses Artificial Intelligence to forecast cash flow problems before they happen. The tools can help track forgotten subscriptions, make suggestions on how to revise the budget based on impending expenses, and flag questionable transactions, which may be evidence of fraud.

Trend #2: Embedded Finance Ecosystems

Banking is becoming integrated into systems that are frequented by the people daily. The shift represents a fundamental change in how crypto banking solutions reach users.

- Social Platform Integration

Restaurant bills get split in group chats with automatic currency conversion. Payments are routed via these kinds of messaging apps along with social networks without any detour to banking interfaces. This makes these apps popular among many people who fear accessing banking apps.

E-commerce sites integrate the crypto-friendly Neobanks directly into their payment systems. Consumers get instant stablecoin financing, rewards on pending orders, and payment options via multiple digital currencies without the need to leave the site. Those indulged in White label crypto Neo bank platform development enable this integration without merchants becoming licensed financial institutions.

Trend #3: Cross-Border Banking & Multi-Currency Wallets

International payments are finally catching up to the internet’s borderless nature. Modern crypto banking solutions treat geography as irrelevant.

Cross-border transactions are processed within minutes, not in days. A freelancer in Vietnam invoices a Canadian client and receives payment in the preferred currency before lunch ends. The three-day wire transfer is becoming as outdated as the fax machine.

- Intelligent Currency Management

In advanced wallets, assets are held in multiple denominations at any given time, allowing them to optimize based on spending patterns as well as market conditions. This means that they avoid any need for manual rebalancing while benefiting from optimal currency exchange rates.

Trend #4: Crypto-Fiat Hybrid Accounts

The distinction between cryptocurrency and traditional money is no longer absolute. Users want unified financial management, and a seasoned crypto Neo bank development company promises to deliver it without fail.

- Consolidated Financial Views

Modern platforms show traditional, crypto, and asset tokens in a singular screen or dashboard. Money is money, and the distinction between “crypto” and “fiat” matters less than how each serves specific financial needs.

Users can specify how they want their money allocated, for example, with 70% stablecoins, 20% bitcoin, 10% traditional currency, and accounts will regularly update as values shift. Similarly, portfolio management, which is only accessible to certain high-net-worth individuals, can now be found in new crypto-friendly Neobanks.

Trend #5: Mainstream Stablecoin & Tokenized Asset Integration

Stablecoins have shifted from experimental technology to financial infrastructure in 2026.

- Yield-Generating Transaction Accounts

Checking account balances earn competitive yields through stablecoin protocols. Money waiting to pay bills generates returns instead of sitting idle at zero percent interest. This represents a fundamental shift in digital banking trends, and transactional accounts are becoming productive assets.

- Fractional Asset Ownership

Tokenization enables ownership of real estate fractions, startup shares, or artwork portions, and everything is accessible through standard banking apps. White label crypto Neo bank platform development democratizes access to asset classes that once required significant wealth to enter.

Trend #6: Quantum-Safe Security & Invisible Biometrics

Security infrastructure in crypto banking solutions is evolving faster than threats emerge.

A forward-thinking crypto Neo Bank development company can employ quantum-proof algorithms, a process that is advantageous as upgrades will be done before a quantum threat actually occurs.

- Behavioral Authentication

Continuous verification is carried out through typing rhythms, device interactions, and walking gaits. Security works transparently in the background. Passphrase tension is done away with, and illegal activity is out of the question.

Develop A Compliant Neo Bank Platform Designed For Global Financial Markets

Why Regulation Will Make or Break Crypto Banking This Year

It is expected that the level of clarity that will be achieved by regulators in 2026 will be used to separate those who are viewed as legitimate crypto-friendly Neobanks from those who do business in gray areas. The framework emerging across jurisdictions will determine which platforms thrive and which disappear.

- Compliance Becomes Competitive Advantage

Clear regulations enable partnerships between crypto banking solutions and traditional financial institutions. Banks that previously avoided cryptocurrency due to uncertainty now actively pursue white label crypto Neo bank platform development partnerships to enter markets safely.

- Navigating Fragmented Requirements

The EU’s MiCA regulation, evolving US frameworks, and diverse Asian approaches create complex compliance landscapes. Successful crypto Neo bank development companies build flexible systems that adapt to multiple regulatory regimes simultaneously, turning fragmentation from an obstacle into a moat.

- License Acquisition Drives Consolidation

Multiple banking licenses and operational permissions enable broader market access. This advantage accelerates industry consolidation as smaller players either scale rapidly or face acquisition by larger licensed operators. Regulatory compliance infrastructure becomes as valuable as technical capabilities in determining which digital banking trends gain traction.

How to Create the Ultimate Digital Bank

The development of a successful crypto-friendly Neobank in 2026 demands this balance:

Different stakeholders, like cross-border workers, cryptocurrency traders who require fiat currency access, and businesses with multiple currency systems, require separate features. Serving all of these stakeholders makes the features less effective.

- Strategic Build-vs-Buy Decisions

Building proprietary systems offers maximum customization but demands enormous resources. White label crypto Neo bank platform development provides proven infrastructure and faster market entry. A successful crypto Neo bank development company adopts hybrid approaches, customizing white label platforms for specific market segments.

Architectural decisions are to be made about multi-signature wallets, hardware security modules, verification of smart contracts, and audit trails. It is a fact that security bolted onto existing systems creates vulnerabilities that sophisticated attacks will exploit. Every element of crypto banking solutions should consider security implications from the initial design.

Infrastructure should handle 100x the initial user base without architectural changes. Digital banking trends demonstrate that successful platforms grow exponentially. The appropriate selection of blockchain networks, putting in place effective scaling solutions, and designing flexible databases determines whether platforms can leverage growth opportunities or collapse under success.

Concluding Thoughts

The financial services market is split into two segments: those who adjust to change and those who formulate new paradigms of their own. Crypto-friendly Neobanks represent the convergence of blockchain’s potential with banking’s practical necessity.

AI financial copilots, quantum-safe security, embedded finance ecosystems, and tokenized assets aren’t isolated developments. They’re interconnected components of fundamental transformation in how people interact with money. Geographic Borders, banking hours, and even gatekeepers are becoming less relevant, whereas speed, transparency, and self-serve are becoming a minimum expectation.

The development of such infrastructure requires specialized expertise in blockchain technology, regulation, security configuration, and user experience. Not many teams have such a pool of expertise within their own organization, and partnerships with experts become important for success.

Ready to Launch a Neo Bank?

Antier holds expertise in white-label crypto neo-bank platform development, enabling faster market entry without compromising security and usability. As a quality crypto neo bank development company, we have successfully implemented crypto bank solutions across multiple continents.

Recognizing the rapid pace of digital banking trends and innovations, our team helps take that pace one step forward by implementing extensive crypto banking solutions that include smart contract development and highly scalable, compliant solutions.

Let’s partner together and make banking relevant for the way we live and work today.

Frequently Asked Questions

01. Why do international wire transfers take so long and cost so much?

International wire transfers can take up to three days and incur fees of around $45, along with losses from unfavorable exchange rates, due to outdated banking infrastructure that struggles to keep pace with modern digital demands.

02. What challenges do freelancers face with traditional banking systems?

Freelancers often struggle to access basic banking services because traditional institutions typically cannot process cryptocurrency income, limiting their financial options.

03. How are crypto-friendly Neobanks changing the financial landscape?

Crypto-friendly Neobanks are revolutionizing finance by combining blockchain technology with user-friendly interfaces, allowing users to maintain ownership of their assets while benefiting from features like smart contracts for automated financial management.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video3 hours ago

Video3 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle