Politics

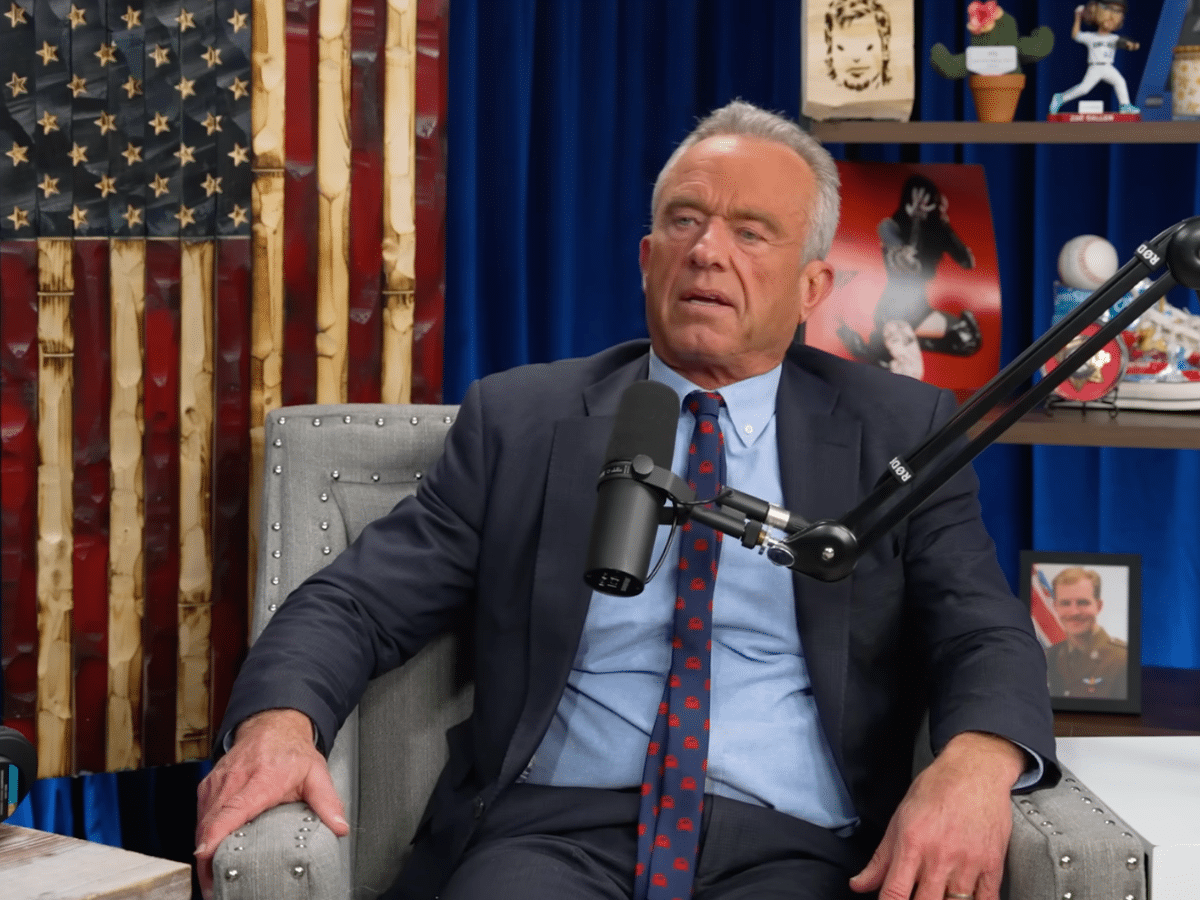

RFK admits to snorting cocaine off toilets as a pastime

Robert F Kennedy Jr just told equally off-the-wall podcast mullet Theo Von he used to snort cocaine off toilet seats. Which is, uh, fine. But the conspiracist buffoon RFK, who thinks tap water turns kids gay — or something like that, I’ve lost track — was actually using this example to tell us something TRULY WEIRD.

RFK, as he is known, was actually justifying his inane anti-intellectualism by saying he does not fear germs BECAUSE he used to snort cocaine of a toilet seats.

Reminder: this guy is in charge of what passes for healthcare in America.

Dear Lord…

Not scared

Kennedy was talking about addiction. Both he and Theo Von openly talk about addiction. And addiction is not a joke. Yet somehow they managed to make a mockery of the topic:

I’m not scared of a germ… I used to snort cocaine off of toilet seats.

Adding:

I know this disease will kill me.

They were complaining that Covid-19 meant they couldn’t attend their addiction meetings. Kennedy told Von:

Like, if I don’t, if I don’t treat it, which means for me going to meetings every day. It’s just bad for my life.

And in some level they have a point. Covid hit all kinds of people very hard: people with addiction issues, kids, older people, mentally ill people, women locked into abusive relationships and so on.

But the messenger matters.

Wild claims

RFK is known for making wild claims about medicine — something he appears to known (somehow) less than nothing about. Forbes did a useful list of some of his most colourful fantasies. These include that old classic that vaccines cause autism. He said the US government:

knowingly allowed the pharmaceutical industry to poison an entire generation of American children.

Okay, toilet boy.

RFK once said Bill Gates exaggerated Covid to push vaccines as part of what he called:

a historic coup d’état against Western democracy.

Hmm…

He also claimed Covid targeted people ethnically:

COVID-19 is targeted to attack Caucasians and Black people.

And that:

the people who are most immune are Ashkenazi Jews and Chinese.

Nice eugenics there, big man.

Kennedy also suggested AIDS does not cause HIV. That 5G gives you cancer. And that raw milk — knew it was in here somewhere — is fine. Also that fluoride:

is an industrial waste associated with arthritis, bone fractures, bone cancer, IQ loss, neurodevelopmental disorders, and thyroid disease.

IQ loss, hey. Are you sure it was just cocaine on the toilet seat, mate? He also thinks that mass shooting are caused by anti-depressants.

Looking at the state of Trump’s cabinet picks, we probably shouldn’t be surprised this lad made the cut. Yet somehow even with all we know about US politics generally — and especially US politics under Trump — RFK still manages to come out with something so completely off-piste than you have to just stop and take it in.

Featured image via YouTube/the Canary

Politics

Reform council by-election win is a warning for Gorton and Denton

Throughout social media, people are warning that a Reform victory in a council by-election is a lesson for the parliamentary by-election in Gorton and Denton.

The results? Reform win.

Reform won in Fletton and Woodston with 29.4% of the vote. The Greens narrowly came second on 27.6%. Meanwhile, Labour were fourth on 16.8%.

Many social media users are pointing out that Labour has split the vote here. If just a few of the voters for the governing party had opted for the Greens, then the Zack Polanski-led party would’ve won the seat and not Reform.

One user said voting Green Party is a double win:

vote labour, get reform. vote green not just to keep out reform, but for policies you can actually believe in! that actually want to help normal people! what a revelation!

Commentator Owen Jones, meanwhile, called the council result a “warning”:

A warning here. The Greens nearly won – but Labour split the vote, handing Reform the seat.

Former MP Lloyd Russell-Moyle, who defected to the Greens, added:

Labour splitting the vote and letting Reform in. Up and down the county the only way to stop reform is to vote Green.

Polanski: ‘Labour is not a left-wing vote’

The Electoral Calculus has the Greens winning the seat, not Reform. But in the world of the corporate media, opting for the Greens splits the ‘left’ vote, not Labour. ITV’s Robert Peston recently challenged Green leader Zack Polanski on that:

Wouldn’t you regret Reform UK coming through in Gorton and Denton if The Greens split the left vote?

Polanski responded:

We cannot say that Keir Starmer’s Labour would be a left wing vote. This is the party that wanted to slash disability benefits, then had to be shamed not to do it. It’s the same party that eventually lifted the two child benefit cap, but it took over 18 months of children living in poverty. And it’s the same party that is arming an ongoing genocide in Gaza. So I don’t think on any metric you can say Keir Starmer’s Labour party represents the left in the country. That’s why I’m confident and not complacent that we can win in Gorton and Denton.

It’s arguable that Keir Starmer’s Labour is closer to Reform than the Greens. And as Polanski has previously said, it would take a change of leadership and direction for the Greens to work with Labour against Reform.

Featured image via the Canary

Politics

Matt Goodwin claims young men are flocking to Reform

Reform’s candidate for the parliamentary seat of Gorton and Denton, Matt Goodwin, claimed on social media:

One of the untold stories in British politics right now is Reform’s very strong support among young men.

But people swiftly pointed out that the favoured party among young men is actually the Greens, according to YouGov.

The facts vs Matt Goodwin

For young men, Green support is at 30%, and Labour support is at 21%. When it comes to the Lib Dems, it’s 17% for young men, while the Conservatives and Reform both trail on 12%.

Matt Goodwin’s narrative is actually the opposite of the truth. Young men appear to understand that their material conditions will improve through cuts in the cost of living rather than through cuts to public services. And that a shift from landlords to affordable housing would benefit them. Free tuition for university may also play a part. The Greens harbour these policies.

There are other factors that play into how young men might vote. 42% of men aged 20-34 say they feel lonely “often or very often,” and, concerningly, there is a very high suicide rate for men under 50.

But the YouGov polling suggests that young men are turning towards hope and a more integrated society that recognises the individual but also the importance of community.

Gorton and Denton

Matt Goodwin’s rival in the Green Party at the Gorton and Denton by-election has exemplified why many are turning to her party. Speaking to Channel 4, Hannah Spencer said:

We care about lots of different things. We care about what’s happening here locally, as well as things across the world… Living standards are lower here, people’s incomes aren’t changing, and we have fuel poverty, which is not even a phrase we should be using in 2026. We need people in parliament where the decisions are being made, that have got the background and the relevant lived experience, to be able to feed into decisions that are being made

As a plumber, Green candidate Spencer says she understands hard graft and will therefore represent the working class parliament.

Featured image via the Canary

Politics

Quakers bring reparations conversation into parliament amid growing debate

As debates about Britain’s history, race, and responsibility continue to surface, Quakers in Britain have co-hosted a discussion in Parliament exploring what reparations might mean in practice.

The event took the title ‘Approaches to Reparations: Faith-Based, Community, and Grassroots Perspectives’. The All-Party Parliamentary Group (APPG) on African Reparations co-hosted and Bell Ribeiro-Addy MP chaired.

It brought together faith leaders, community organisers, and racial justice advocates. They took part in an open conversation about accountability, repair, and justice in a UK context.

Reparations are a process

Interest in reparations for African chattel enslavement has grown in recent years. And particularly since the Black Lives Matter protests of 2020. Yet the UK continues to struggle with how, or whether, to respond.

In 2024, the Canary published a stinging letter from academic Gus John to then foreign secretary David Lammy. He described reparations as “a process, not a single act”. And he accused the government of “insisting that this is all in the past”.

Recent pushback against the new Archbishop of Canterbury for defending the Church of England’s programme for repairing the harms of African chattel enslavement underlined how contested these conversations remain.

Panellist Richard Reddie, director of justice and inclusion at Churches Together in Britain and Ireland, said:

There is a great deal of literature in the Bible that makes the case for reparations.

Kojo Kyerewaa, national organiser for Black Lives Matter UK, said:

We need to relate reparations to the daily lives of people, and make the links between that which they already know about what is unjust and reparations as a liberatory pathway.

That way we can begin to reshape the world towards justice, and we deserve nothing less.

Quakers in Britain agreed in 2022 to consider making practical reparations for the transatlantic trade in enslaved people, colonialism, and economic exploitation.

Marghuerita Remi-Judah, co-clerk of the Quakers in Britain Trustees’ Reparations Working Group, said:

We need to name our part in the history.

The Quaker testimony is one of peace…enslavement was violence, antithetical to peace.

The decision followed years of research, listening, and discernment. And it reflects a wider commitment to anti-racism, truth-telling, and action rooted in faith.

The panel, which also included Reverend Wale Hudson-Roberts, head of racial justice for the Baptist Union, explored how reparations work has developed from grassroots and local initiatives.

Panellists discussed the role of education and community leadership, and how institutions respond to difficult questions and resistance.

Featured image via Michael Preston for Quakers in Britain

Politics

Former Labour MP will run as an independent

Beth Winter has announced that she is standing as an independent MP for the Welsh Valleys in the upcoming Senedd election. The former Labour MP launched her campaign to be MP for Pontypridd, Cynon and Merthyr on social media.

Former Labour MP Winter running as ‘independent voice’

Winter announced on the 13 Februay that she wanted to be:

A Community Independent Voice for our Valleys

In a statement posted on social media, she said she was standing because this is her home. Winter says that the valleys’ “proud working class traditions” are:

proof that when organised we can take control and keep wealth in our communities.

She doesn’t shy away from the fact that people are struggling and are disillusioned with Westminster politics, which doesn’t serve working-class communities. This is, of course, like many communities, leaving the door open for Reform:

Today, people across the South Wales Valleys face rising bills, insecure work, poverty, and the growing threat of climate collapse. Too many families are forced to choose between heating and eating, while extreme wealth continues to grow. These injustices and inequalities aren’t inevitable. They are the result of political choices, and must be challenged.

People are disillusioned and have lost trust in politicians. The vacuum that has emerged is being exploited by the far right. We cannot allow this to take root in our communities.

An MP actually from the community for the community

Instead of falling for the far-right, Winter is asking people to look at how much grassroots politics is needed in her community

It’s clear there’s a desire to break from establishment politics that is failing our communities. We need grassroots, community-based politics rooted in social justice, equality, peace and environmental responsibility – with real power and resources in the hands of people in Wales.

Winter makes it clear in her statement that she wants to work with and for the people she serves. In a bold move, with the community in mind, she pledges not to take a huge MP salary if elected.

This is why if elected to the Senedd I would only take a salary equal to my previous trade union employment, with the remainder made available to initiatives focused on community organising, education and training: local campaigns and community wealth building initiatives

She says that if she were elected, she would “not be beholden to any party”. Which is possibly not just a dig at Labour, but also at Your Party too.

Smear campaign against Sultana and MOU Operations

Most recently, Winter got caught up in a smear campaign to discredit Zarah Sultana within Your Party. Winter was one of three directors of MOU Operations, which handled the data and finances of YP, along with Jamie Driscoll and Andrew Feinstein.

They ended up at the centre of an absolute shit storm around who controlled membership data after Sultana announced the membership portal was open, then Jeremy Corbyn, confusingly, promptly disowned the portal.

MOU Operations were painted as the ones stopping the funds and membership data being handed over. However, through leaked emails and WhatsApp messages, The Canary revealed that it was actually Your Party blocking MOU Operations.

The leak also showed that MOU Operations had no involvement in the new portal being announced and that Your Party knew this, despite this, several YP members still smearing MOU Operations.

Winter, Driscoll, and Feinstein announced their resignations from MOU Operations on 30 October, saying in a statement

We have been extraordinarily patient, and tried to resolve this quietly behind the scenes. Your Party have claimed in emails and social media statements that we delayed the data transfer. We repeatedly asked them to stop making factually incorrect claims of this nature. They gave hostile briefings to journalists. We behaved with integrity.

Driscoll has since joined the Green Party. With Winter now running as an independent, this show just how little faith the grassroots left has in Your Party.

A real community-minded MP for South Wales

Winter’s would-be constituents are already celebrating the move, with comments on Facebook saying she’s made the “choice of who to vote for easy”. Others celebrated that someone from their own community would be representing them, instead of a “parachuted in” candidate.

Winter is someone who represents working-class socialist politics, we need more like her in this fight against fascism. not just from Reform but from the Labour government too. You can donate to Winter’s campaign here.

Featured image via the Canary

Politics

Nigel Farage’s claim he ‘can’t be bought’ is ridiculed

Nigel Farage has taken to X to declare that he can’t be ‘bullied’ or ‘bought’, insisting that he has:

stood for the same principles for many decades.

However, others have pointed out the super-rich tax evader ‘doth protest too much’. After all, it isn’t hard to disprove Farage’s statement when you scratch beneath the surface of his political project, Reform UK:

“Cannot be bought”

92% of Reform funding has come from climate changer deniers, the fossil fuel industry and larger polluters. pic.twitter.com/ngGNiVNhX6

— Chris Smith (@renewablesmiffy) February 12, 2026

Nigel Farage: protesting too much

Is Nigel Farage simply trying to say he’s so ‘bought’ that no one else could change his perspective?

His funding from Iranian billionaire certainly raises questions over who he is willing to be bought by. As this X account pointed out:

“I can’t be bought” says the man whose trip to Davos was financed by an obscure Iranian billionaire https://t.co/mvyrParvN3

— David (@Zero_4) February 12, 2026

He just simply tries to hide who has bought him, whilst actively working against the interests of the majority.

The Canary’s own Rachel Swindon noted that Farage may win people over with charm, but the substance of his case quickly falls apart. She wrote recently:

Farage’s personal brand — built on charisma and grievance — would crack, exposing a leader whose Trump playbook works for disruption but crumbles under responsibility and the scrutiny that comes with it.

A lack of scrutiny which Alan Lester highlights below:

It looks for all the world like “anti-global elite” Nigel Farage is obtaining huge donations by routing them from a “high risk” Kazakhstani / Iranian billionaire via a proxy company, flouting restrictions on foreign donations. pic.twitter.com/17H9CJfo0Y

— Alan Lester (@aljhlester) February 1, 2026

Oh, but the billionaire isn’t that picky, and his price tag doesn’t have to be ‘huge’.

He’s been known to sell videos for cash on Cameo, with no moral limit to the sorts of people he’s prepared to endorse:

Must be a different Nigel Farage who someone recently tricked into videoing a glowing tribute for dead paedophile Iain Watkins – precisely because he *can* be bought for £98 on Cameo. pic.twitter.com/uD9EceV7Il

— Daniel Sugarman (@Daniel_Sugarman) February 12, 2026

Oh, the price tag gets even cheaper as Mukhtar reveals on X:

Nigel Farage: “I can’t be bought.”

Also, Nigel Farage on Cameo for £69.66👇🏾 pic.twitter.com/450cgGltZZ

— Mukhtar (@I_amMukhtar) February 12, 2026

The grifter wants to be bought

When people like Nigel Farage come into politics, it’s not because they’re offended by politicians being bought; they simply want to be the ones getting the payday.

Working class people have had enough of the richest getting richer, whilst the rest of us stay stuck in the mud in ever-worsening conditions.

Featured image via the Canary

Politics

Voting rights under threat from Republicans

The US House of Representatives has passed a bill requiring proof of US citizenship for anyone voting in the midterm elections.

The House – controlled by the Republicans, took the vote on 11 February 2026 ahead of the midterms in November.

The bill passed 218-213 to approve the SAVE America Act. Only one Democrat switched sides and backed the Republican bill.

The legislation will now move forward to the also Republican-led Senate. According to Reuters:

it is expected to receive a vote but unlikely to garner the 60-vote, filibuster-proof majority needed for passage.

Democrats said the bill will impose unnecessary burdens on American voters. Additionally, it will give Donald Trump even more electoral power.

Bullshit erosion of voting rights

The legislation first emerged during the 2024 presidential election campaign. It was driven by Trump’s false claims that large numbers of people who were in the country ‘illegally’ had been voting in federal elections.

But let’s not forget, you can’t be illegal on stolen land.

A similar version of the bill passed the House twice – last April and in 2024. However, it died both times once it reached the Senate.

This vote came only a week after Trump called for Republicans to “nationalize” elections.

Along with requiring proof of citizenship to vote, it would also criminalise election officials who register anyone without the proper documentation.

Republicans also added a photo ID requirement for both in-person and mail-in voting.

However, it is already illegal for non US citizens to vote in federal elections. Additionally, the Center for Election Innovation and Research found that illegal voting is extremely rare.

It found:

CEIR continues to find that sweeping allegations about noncitizen registrations or voting appear to arise from misunderstandings, mischaracterizations, or outright fabrications about complex voter data. In every examined case, when claims about large numbers of noncitizens on voting rolls are subject to scrutiny and properly investigated, the number of alleged instances falls drastically. When investigations do turn up rare instances of improper registration or voting, officials take swift action to ensure that American elections remain secure.

So basically, it’s just another right-wing nonsense talking point that Republican friends-of-nonces are using to both demonise migrants and shut down what little democracy the US has left.

Erosion of democracy

Democratic Party leaders told Reuters that the bill is an attempt to suppress the vote. It would also undermine their electoral chances at a time when they are favoured to take control of the House.

Recently, the Democrats won a seat in the Texas state Senate, which the Republicans are seeing as a wake-up call as well as a picture of what is to come if Trump’s violent regime continues.

But the new legislation is nothing short of an attempt to erode democracy. Republicans know they are on borrowed time – and there is only so long their murderous, fascist police state can continue.

Republicans are running scared – millions of Americans have woken up since ICE agents murdered both Renee Good and Alex Pretti in cold blood. Now, the Epstein files and the associated cover-up at the highest levels of government mean that Trump and his cronies will go to any length to hold onto power.

Because let’s face it, once they lose that power, they’re all ending up in jail.

Feature image via Reuters/YouTube

Politics

DWP admit another gigantic failing

The Department for Work and Pensions (DWP) has been forced to admit that a large number of privately contracted benefit assessors have not received safeguarding training.

This puts vulnerable disabled claimants at risk of harm whilst navigating the cruel benefits system, which has already claimed so many lives.

DWP were called up on their duty to safeguard in May last year

In May 2025, a report from the Work and Pensions Committee on safeguarding vulnerable adults called for a new independent organisation to be set up. The body would bring to light the number of claimants who had been put at risk by the DWP.

At the time, chair of the committee Debbie Abrahams said

Deep-rooted cultural change of the DWP is desperately needed to rebuild trust and put safeguarding at the heart of policy development.

Then in December 2025, in a written statement, DWP chief Pat McFadden gave an update to the House of Commons. He said he wished to “reaffirm” his department’s commitment to safeguarding and their responsibility to protect claimants.

In his statement McFadden said:

Our immediate priority is to make safeguarding everyone’s business, with clear steps to recognise, respond to, and report concerns.

Mcfadden pledged that all clinical roles will have mandatory Level 3 safeguarding training. He said:

Safeguarding must be a system-wide endeavour. It requires transparency, accountability, and collaboration across Government and with partners.

Surprise, Labour blames the Tories

However, as the WPC heard this week, that is not the case. Employment Minister, Diana Johnson, was giving evidence on the state of employment support for disabled people when she shared an update on safeguarding vulnerable claimants.

As is typical with this Labour government she started by blaming the Tories, as if Labour haven’t been in power for a year and a half. In which time they’ve either done fuck all or made disabled people’s lives worse with their policies.

Johnson said she was shocked that the last lot:

Didn’t think that safeguarding was an issue that they needed to be concerned about

Which is all well and good but your lot haven’t done much better Diana, despite you claiming that “things have moved on considerably”

Labour proved just as bad as Tories once again

As proof of this she shared that while all of the DWP’s own clinical staff get mandatory Level 3 training, only 1 in 5 of contracted staff get the same level.

This means staff employed by Maximus, Capita, Serco, and Ingeus who inflict cruel benefit assessments on disabled people aren’t trained in recognising harms or risks to life. These companies carry out hundreds of thousands of PIP and WCA assessments every year.

She blamed this huge oversight on the fact that there’s such a high turnover rate of staff, meaning there’s not enough time for training.

She said:

In terms of our contractors that we use in the DWP, we hover around 80 per cent in terms of the training at level three because of the churn and the turnover of those individuals

DWP staff don’t stick around, wonder why

In January, the DWP published a report from 2022 which showed that 52% of new benefits assessors didn’t make it through their first year. Assessors reported feeling “despised” and like “cogs in machines”. So it’s no wonder there’s such a high staff turn over.

One of the respondents from the survey reported “working herself to death”, as she had no choice but to work from 5am to 10pm. This will only be ramped up by the DWP’s desperate attempts to massage the numbers of the PIP reassessment backlog.

As the Canary previously reported, the department diverted staff from dealing with new claims to get the backlog down. While the DWP got to brag that it carried out 96% more reviews in quarter 3 of 2024, 40,000 new claimants were kept waiting. As a recent report found, delays to PIP are endangering people’s lives and costing the DWP too.

Labour are worse for disabled people than the Tories – it’s time they admitted that

It’s absolutely unacceptable that the people who are supposed to determine whether disabled people get the support they need are not trained to protect vulnerable people. In a department that is responsible for so many deaths, this seems like a deliberate, violent act. But it’s just another in a long line for the DWP.

It’s also getting beyond fucking old that the now Labour led DWP are still blaming the Tories. Not only have they been in power for a year and a half, but in that short time they’ve planned cuts and policies which are even more dangerous to disabled people.

You don’t get to act like our saviours whilst you’re building the gallows yourself.

Featured image via the Canary

Politics

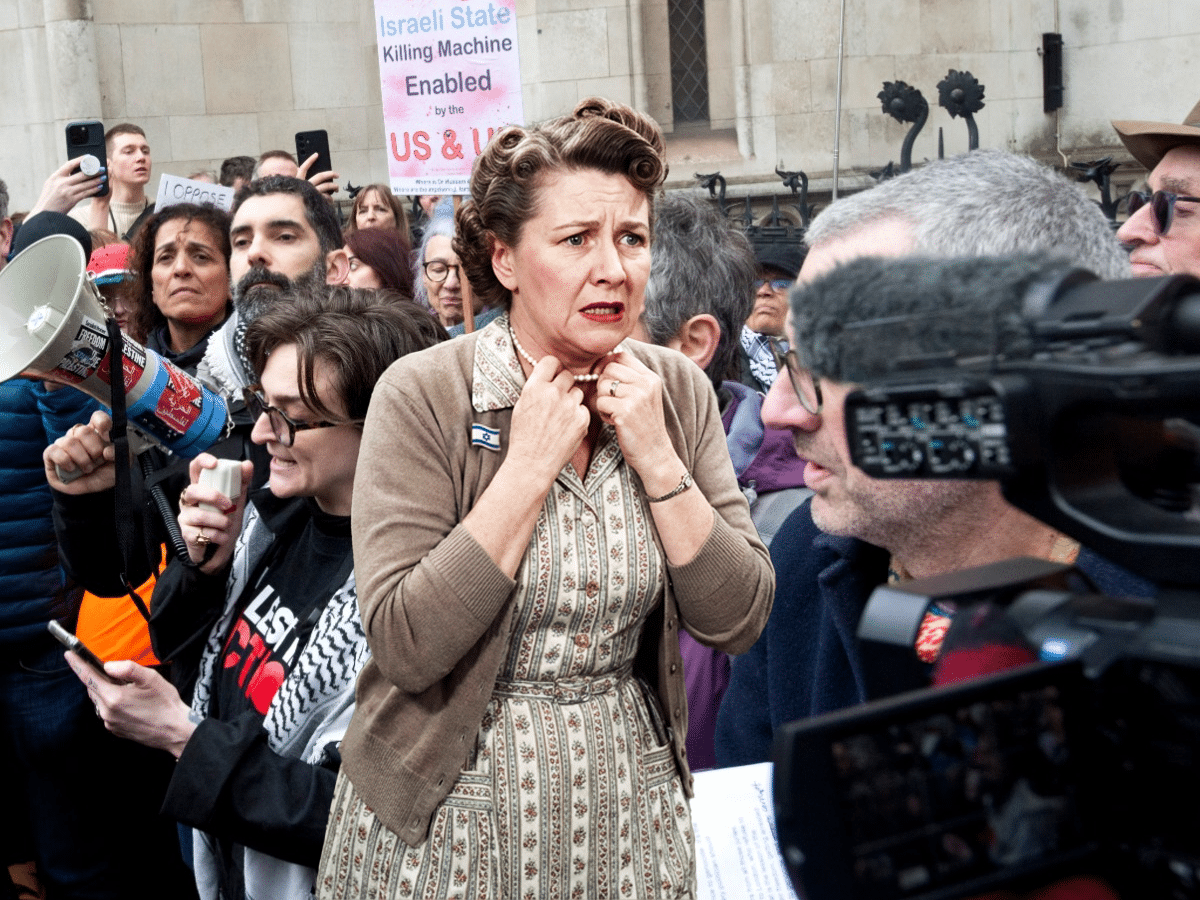

Palestine Action court decision horrifies Zionist lobby groups

Two Israel lobby groups have reacted with horror to the High Court’s decision today, Friday 13 February, to unban Palestine Action, a group that specialises in sabotaging Israeli weapons factories.

What a shock.

Zionists need their fainting couches over Palestine Action

A panel of High Court judges have today declared the Starmer regime’s ‘terrorist’ ban on Palestine Action to be unlawful and a breach of UK human rights. The so-called ‘Jewish Leadership Council’ (JLC) and the ‘Board of Deputies’ (BOD) have expressed their dismay.

Unsurprisingly, it was expressed in the most weaselly way possible. T

he groups start by claiming to respect the need for judicial oversight, lie that Palestine Action attacked “Jewish communal life” and turn the whole thing into – you’ve guessed it – an attack on the decision of the judicial oversight:

We recognise the vital importance of judicial oversight in matters of national security and civil liberties. However, the practical impact of Palestine Action’s activities on Jewish communal life has been significant and deeply unsettling.

On top of everything else, this antisemitic statement doesn’t explain how a group that only targets weapons factories and other support for Israel’s genocide and war crimes is supposedly impacting “Jewish communal life”.

And if this wording sounds a bit familiar, it’s probably because it basically recycles the BOD’s statement and logical gymnastics of just over a week ago – 4 February 2026 – when a jury acquitted six Palestine Action activists who were viciously attacked by security guards as they tried to disable an Israeli murder-drone factory in Bristol.

“While it is important to respect the integrity of the judicial process”, the BOD said, it clearly didn’t think it important enough to actually apply to the jury’s decision:

We are concerned by the troubling verdicts acquitting members of Palestine Action, an organisation that has been proscribed as a terrorist group, and whose activities have included targeting businesses linked to the Jewish community in London and Manchester.

Hmmm. And while both the BOD and JLC present themselves as “Jewish” and “communal”, the situation is not as clean as they paint it. The BOD has managed to remain a charity (though also a limited company), even though its core purpose is explicitly political – and explicitly to promote the interests of a particular foreign power.

Shilling for Israel

The BOD’s constitution states that it exists to do everything it can to advance Israel’s “standing”:

Take such appropriate action as lies within its power to advance Israel’s security, welfare and standing.

The ‘mission statement‘ of the JLC, another limited company rather than actually a ‘council’, says that its job is to make the UK ‘Jewish community’ is engaged with Israel”. JLC played a role in a 2025 smear campaign against then-new education union leader Matt Wrack, a vocal critic of Israel. It was also heavily involved in the efforts of Morgan McSweeney’s so-called ‘Labour Together’ to destroy the Canary.

Both are prominent players in the UK Israel lobby that has boasted of its role in banning Palestine Action. As has been demonstrated, they were already trying to undo the decision of a British jury to suit Israel’s interests. Not quite such a shock, then, that they are now clutching pearls over yet another court setback.

Featured image via the Canary

Politics

Use of Nimbus disability cards may breach Equality Act

Several UK companies may be breaking the law over their exclusive use of the Nimbus Disability Access Card.

Had it confirmed by someone who knows the Equality Act that venues who only accept the Nimbus card are breaching the act.

A blue badge, PIP/DLA letter, letter from a GP/Consultant or any other form of proof should not be refused under the act.

— Disability Rebellion (@DRDisabilityReb) February 11, 2026

Under the Equality Act [2010, s.20], organisations must make reasonable adjustments for disabled people to ensure they are not at a “substantial disadvantage”.

The law requires organisations to do this, regardless of whether a disabled person has paid for an access card or other third-party subscription.

However, some UK organisations are now only accepting Nimbus Access Cards as proof of disability, including Legoland Windsor, Alton Towers, and Thorpe Park.

Basically, everything that Merlin Entertainment UK owns is now only accessible to disabled people who pay for an Access Card. There’s no surprise that the same company that mistreats penguins is also mistreating disabled people.

Also on the list are Wembley Stadium, Download Festival, York Barbican, York Maze, and MCM Comic Con. And they’re just the ones we’ve found in an hour.

Of course, this is already causing problems for both disabled people and their carers.

After 20 years as a carer to a severely disabled young person, I’m now facing barriers I’ve never faced before. Everywhere I go, the answer is “Nimbus.”

No card? No carer entry. No PIP. No Blue Badge. No Carer’s Allowance accepted.

That’s gatekeeping & it’s deeply worrying.

🧵

— Rae (@Chuffin_ell) February 11, 2026

On their disability access web page, York Maze cites:

All visitors requiring these access provisions can apply via Nimbus to have their individual access requirements validated so we can not only provide reasonable adjustments, but protect them from potential misuse.

This is buying into the same bullshit that the government uses when justifying cuts to Personal Independence Payment. Of course, the system must be being abused.

Just Nimbus, the biggest accessibility ID provider in the UK, claiming disabled people “abuse” carer and companion schemes https://t.co/3WJxXNEAir

— Rachel Charlton-Dailey (@RachelCDailey_) February 8, 2026

Corporate wretches

The Nimbus website states:

Currently, we operate free-to-register access schemes on behalf of providers from Ticketing companies, West End Theatre and Theme Parks, to Leicester Square’s famous Hippodrome Casino.

Companies can use the scheme for free, yet disabled people have to pay for the card, PLUS any medical evidence they need to get it in the first place.

It’s worth noting that Nimbus offers ‘Free Access Registration’ at some venues. However, that means supplying the same data and personal information to each venue. How does that help disabled people?

There should be no requirement to share anyone’s personal data with an external company like yours! You claim to be enabling accessibility, but you’re actually putting barriers in the way of people who need support, kinda like a shield for discriminating companies to hide behind!

— Kev (@Kev1n1986) February 8, 2026

I clicked to apply for the Digital Access pass for Legoland Windsor. What struck me was that, on the first application page, it is not clear to whom you are providing your personal data.

The Merlin Entertainment logo sits at the top of the page. However, when you click the ‘our online guide’ button, it takes you to the Nimbus Access card webpage.

So is my personal data, including my photo ID, going to Merlin or Nimbus?

Spoiler alert – disabled people don’t need to provide sensitive personal data to service providers or partners to be entitled to accessibility.

Demanding sensitive data be shared w unregulated private company for accessibility could well be harassment related to disability.

— Becca Jiggens LLM Chartered FCIPD ♿️ 🇵🇸🕊️ (@beccajiggens) February 8, 2026

Nimbus claims to be run by disabled people, for disabled people. But all I can see here is an organisation profiting from disabled people trying to live their lives.

Online protests over the Nimbus card

All week, disability activists have been protesting on social media. With one X user pointing out that:

You say @nimbusdis decisions are down to venues & your service is optional. Yet your card is being treated as the only “proof” of disability. When PIP, Blue Badges & statutory evidence are refused, that creates barriers. Rights under the Equality Act aren’t card-based.

— Rae (@Chuffin_ell) February 11, 2026

When PIP or blue badges are not enough to gain disabled access, there is something really wrong with the system. It’s hard enough to get any of those three things. Yet now, some corporation wants to add another hoop for disabled people to jump through.

I truly believe that Nimbus disability are partially responsible for the role back in the rights of disabled people to have reasonable adjustments. https://t.co/wPFW9CHKpM

— Monique Botha is actually they/them 🤷🏻♀️ (@DrMBotha) February 11, 2026

It’s worth remembering that the Equality Act is not about ease or convenience for huge corporations like Merlin, or even for smaller businesses. It’s about access for disabled people.

This keeps being framed as admin and efficiency, but efficiency for systems isn’t the same as equality of access for people

Blue Badges manage scarce resources like parking. Everyday access and booking aren’t the same — and the Equality Act is about access, not admin convenience

— Rae (@Chuffin_ell) February 7, 2026

Nimbus agreed to meet with Disability Rebellion to discuss Merlin Entertainment’s access policy. However, Nimbus cancelled at short notice.

What sort of world are we living in when private corporations force disabled people to carry a card proving they’re disabled enough to be sat in a wheelchair.

It feels like a return to Nazi Germany.

Feature image via Accesscard.online

Politics

Valentine’s themed protest targets Rosebank oil field

Climate campaign group Fossil Free London has held a Valentine’s Day themed protest in St. Dunstan’s in the East churchyard. The stunt comes ahead of the UK government’s decision on whether to approve or reject the Rosebank oil field.

Campaigners stood in couples – wearing suits and pastel frilly dresses – holding up oversized love heart sweet placards that read: ‘Save Me’, ‘Hot Earth’ and ‘Stop Rosebank’.

Rishi Sunak’s Conservative government originally approved the oil field in 2023. But the Scottish courts overturned this decision in January 2025. The ruling demanded that Rosebank’s primary owner, Norwegian state oil giant Equinor, provide a more detailed assessment of the project’s full climate impacts.

Burning Rosebank’s total estimated oil and gas reserves would emit more carbon dioxide than the world’s 28 lowest-income countries combined release annually.

Rosebank: UK pays, Norway profits

Equinor would sell the vast majority of Rosebank’s oil on the international market for export. It would neither lower energy bills nor increase energy security in the UK. Meanwhile, UK public money would pick up the bill for most of its development costs.

Ahead of Equinor’s profits announcement at the start of February, Fossil Free London staged a protest over its role in Rosebank.

Most of Rosebank’s profits would flow into Norway’s substantial sovereign wealth fund. This potential megapolluter could also send profits of over £200m to the Delek Group. Delek is an Israeli fuel conglomerate that the UN has flagged for human rights violations in Palestine.

Robin Wells, Director of Fossil Free London, said:

This Valentine’s Day the U.K. government will be deciding whether Rosebank is hot…or not. But we know that Rosebank will be too hot to handle…Labour, save us from all new oil projects, because Rosebank will kill millions!

Featured image via Fossil Free London

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video10 hours ago

Video10 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?