Crypto World

Crypto bros feel the burn

The honeymoon is over—for President Donald Trump and for crypto enthusiasts alike.

A new Morning Consult poll shows Trump’s approval slipping to 45%, with disapproval climbing to 52%, down slightly from two weeks ago and far below the 52% approval he enjoyed at the start of his second term.

Summary

- The Dow Jones surged past 50,000 earlier this month, but voters aren’t cheering.

- Republicans (86%) still approve of Trump, according to a new survey; while Democrats (11%) and Independents (33%) remain skeptical of his policies and actions.

- Critics view conflicts of interest from Trump and his family’s crypto ventures as problematic.

By party lines, he still commands near-universal support from Republicans (86%), while Democrats (11%) and Independents (33%) remain skeptical.

Even as the Dow Jones surged past 50,000 earlier this month, voters aren’t cheering. Only about half believe Trump has effectively tackled health care costs and grocery prices, with approval ratings of 42% and 44% for health care and the economy, respectively.

Disapproval is highest on these fronts, underscoring that record-breaking stock indexes aren’t translating into everyday relief.

Last year, crypto investors largely approved of Trump’s crypto policies and associated them with positive market impacts. Today, it’s a more mixed picture — some crypto holders are skeptical or critical of his approach or disappointed by outcomes.

The disappointment extends to cryptocurrency markets, where the post-election “Trump trade” rally is fizzling fast. Bitcoin, which soared above $125,000 in October 2025 on election euphoria, is down over 28% year-to-date. Enthusiasm for projects tied to the Trump administration, including memecoin $TRUMP, has evaporated, with some losing as much as 95% of their value.

Industry insiders cite a mix of factors: policy outcomes have underwhelmed, proposed legislation like the CLARITY Act may centralize control rather than enhance decentralization, and the market’s risk-off sentiment has replaced the previous speculative fervor.

Even supporters like Cardano founder Charles Hoskinson have labeled the administration’s crypto impact “somewhat useless,” while Nobel laureate Paul Krugman called the Bitcoin crash “the unraveling of the Trump trade.”

A survey from The Information shows that roughly 71% of respondents oppose the Trump administration’s cryptocurrency policies, with 59% strongly against them. Only about 20% expressed support.

Interestingly, even among crypto owners—around 40% of respondents—opposition outweighed support, bucking trends from other polls where crypto holders leaned pro-Trump.

Critics cited several concerns: potential conflicts of interest from Trump and his family’s crypto ventures, the risk that a strategic Bitcoin reserve could weaken the U.S. dollar, and broader worries over fraud, crime, and market volatility in digital assets.

Crypto World

Analyst Maps Out 2 Paths for Ripple’s Price

Where will XRP find a bottom and how high it would go in a subsequent bull market?

The popular cross-border token plunged hard recently, going from a January 6 peak of $2.40 to just over $1.10 during last Friday’s market-wide massacre. After crashing by over 50% within a relatively short period, it bounced off but remains sluggish below $1.40, still showing a 25% decline on a year-to-date scale.

The consensus in the cryptocurrency community is that the bear market has already begun, given the fact that not only XRP but BTC and many other larger-cap alts have plunged by 50% or more from their heights in 2025. As such, analysts have started to speculate where each asset’s bottom might be and how much pain investors would have to endure before they see a trend reversal.

$0.60 to $11?

ERGAG CRYPTO, who is among the most well-known and bullish members of the XRP army, mapped out two potential scenarios for Ripple’s cross-border token. In the first chart, the bottom is presented at $0.60, which would essentially erase all gains charted after Trump’s presidential election victory in late 2024 and push the asset back to its starting point at the time.

This chart comes with a deeper drawdown, continuous fear and disbelief, and weak hands getting flushed. On the upside, XRP could go on a sublime run once the market reverses and the bulls take over, with the analyst predicting a surge to a $11 top.

#XRP – Chart 1 or Chart 2?

💡This isn’t opinion. It’s math, structure, and market behavior.

💡Markets don’t reward comfort. They reward conviction under pressure.

💡Choose your pain or pain will choose you.

📉 Chart 1:

▫️Bottom: $0.60

▫️Top: $11

▫️ Deeper drawdown

▫️ Fear… pic.twitter.com/7KxtTwcd2A— EGRAG CRYPTO (@egragcrypto) February 13, 2026

More Modest Prediction

The alternative in ERGAG CRYPTO’s mapping was a second chart showing lower volatility ahead in both directions. The bottom would be around $0.90, while the top could be $8.5.

This scenario would provide investors with more comfort and less pain, but its upside potential would also be lower, the analyst added.

You may also like:

At the time of writing, both bottoms seem more likely to be reached, while the tops appear quite far-fetched. After all, XRP would have to skyrocket by 3x (or more) from its 2025 all-time high of $3.65 before it can challenge the double-digit price levels. In contrast, going to $0.90 or even $0.60 in the current market environment seems rather reasonable.

Nevertheless, market trends can change extremely quickly, and XRP has proven in the past that it’s capable of remarkable runs. After the US elections, it went from $0.60 to $3.40 in just a few months, which is a 466% surge.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

What It Means for Ether Price

Ether traded back above the $2,000 level on Friday, extending gains after the US consumer price index print came in cooler than expected. The relief rally adds to a nascent recovery narrative that could open the door to a test of higher targets if momentum sustains. Market participants are parsing a mix of on-chain signals, leverage data, and institutional demand as they gauge whether this move can translate into a durable bottom or simply a short-lived bounce. With weekly closes in focus, traders are watching for follow-through in the days ahead, while crypto derivatives data continues to feed the debate over whether risk appetite is finally pivoting in Ethereum’s favor.

Key takeaways

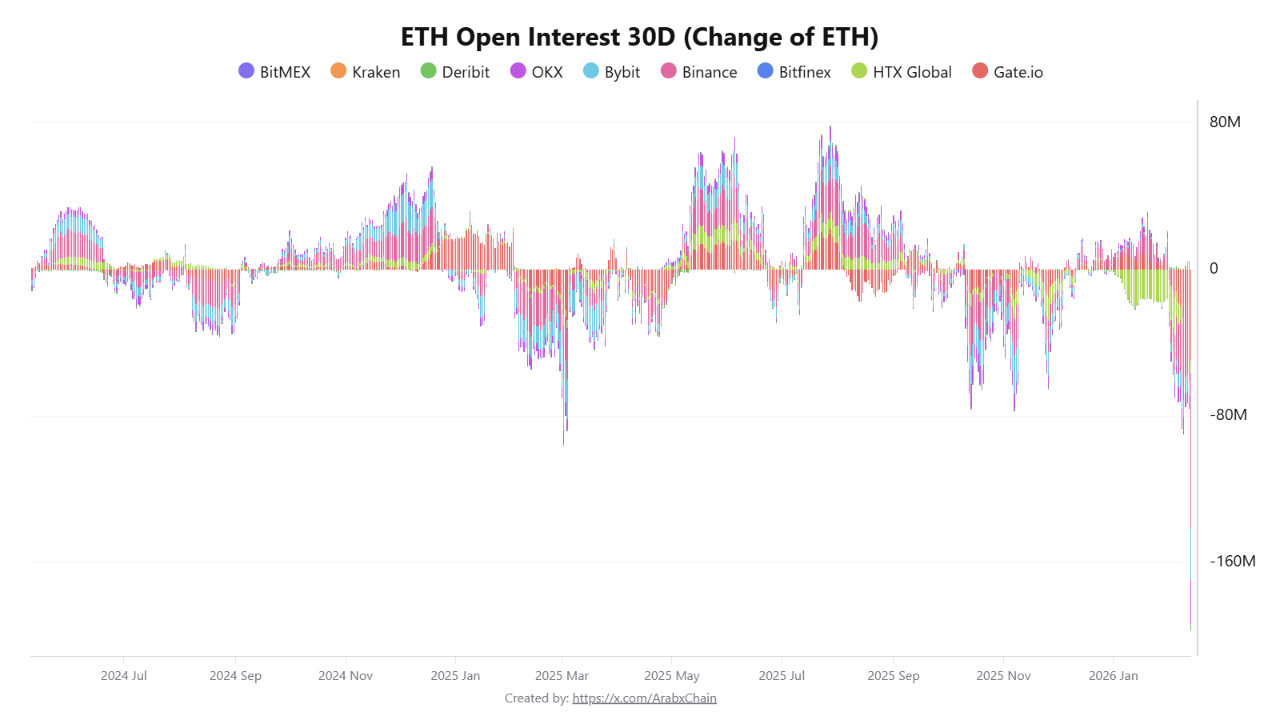

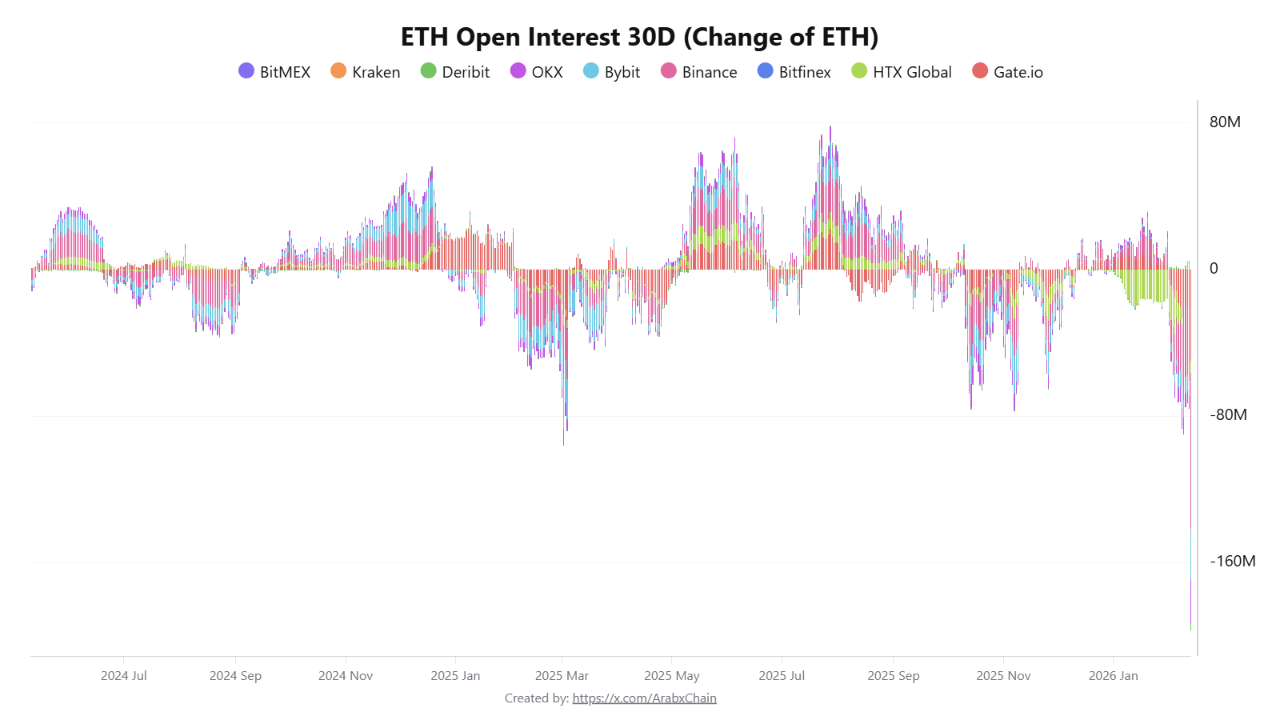

- Ether futures’ open interest across major exchanges has fallen by about 80 million ETH in the past 30 days, signaling a broad reduction in leveraged exposure rather than new long bets.

- Binance, the largest venue by volume, led the decline with roughly 40 million ETH pulled from futures positions (about half of the total drop), underscoring a widespread de-risking trend across top platforms.

- Across Gate, Bybit and OKX, combined declines pushed the total among the four major platforms toward a cumulative drop of roughly 75 million ETH, suggesting the trend is not isolated to a single exchange.

- Funding rates on Binance slipped into deep negative territory (around -0.006), the lowest seen in about three years, implying extreme bearish positioning that could set the stage for a short squeeze if buyers re-emerge.

- Technically, Ether has carved out a bullish setup, breaking from a falling wedge and hovering near $2,050; a measured move could target around $2,150, with potential tests of the 100-period SMA near $2,260 and a path toward $2,500 if demand accelerates.

- On-chain activity and rising institutional demand have persisted as tailwinds, with cost-basis accumulation identified around the $1,880–$1,900 zone helping form a potential price base for further upside.

Tickers mentioned: $ETH

Sentiment: Bullish

Price impact: Positive. The cooler CPI print contributed to a rebound from the $2,000 area and increased odds of an extended bounce toward higher targets.

Trading idea (Not Financial Advice): Hold. The setup points to potential upside on continued demand signals, but traders should remain mindful of macro surprises and the possibility of renewed volatility if liquidity conditions shift.

Market context: The latest inflation data appears to have nudged investors back toward risk assets, helping to ease some of the near-term macro headwinds that had weighed on crypto markets. Although liquidity remains uneven across venues, the combination of weaker-than-expected inflation readings and supportive on-chain dynamics has contributed to a more constructive backdrop for Ethereum in the near term.

Why it matters

From a market perspective, Ethereum’s price action this week matters not only for holders but for the broader crypto ecosystem. The confluence of falling open interest and negative funding rates suggests many participants were trimming risk rather than chasing new bets, which can reduce the likelihood of rapid, force-driven liquidations in a downside scenario. In such environments, a cleaner backdrop often arises where a new rally can take hold more easily if buyers step in decisively, creating a more stable price base. The sustained improvement in network activity and inflows from institutional actors adds another layer of fundamental support that could help underpin a more durable recovery beyond short-term speculative moves.

On the on-chain front, the observed accumulation at sub-$2,000 levels signals a cadre of investors is building a longer-term stance, a factor that matters because the health of Ether’s network—usage, validator activity, and transaction throughput—has historically fed into price resilience. This dynamic aligns with discussions in the space about Ether’s role not just as a trading instrument but as a network with ongoing growth potential, particularly if demand from institutions and developers continues to accrete.

For market participants, the critical question is whether the $2,000 threshold can function as a genuine floor in the current cycle. If price can hold that level and push higher, momentum could attract fresh buyers and sequentially lift Ether toward the $2,150–$2,260 range in the near term, with a longer arc toward the $2,500 zone if fundamental and technical signals align. Conversely, a break below that level could accelerate downside risk, especially if systemic liquidity tightens or macro headlines shift sentiment once again. In either case, the latest data suggest that the market is closer to a base-building phase than a continuation of the prior downtrend.

What to watch next

- Monitor whether ETH holds the $2,000 support on continued trading sessions and whether buyers emerge at the next test of resistance around $2,150.

- Track open interest and funding rates across major exchanges for signs of capitulation ending or renewed leverage entering the market.

- Watch for a potential challenge to the 100-period simple moving average near $2,260 and any subsequent move toward $2,500 if momentum remains constructive.

- Observe on-chain signals, including ongoing accumulation patterns and institutional flow indicators, for signs of sustained demand beyond short-term price action.

Sources & verification

- CryptoQuant Quicktake: Ethereum open interest across major exchanges declines by over 80 million ETH in 30 days.

- CryptoQuant analysis on funding rates hitting -0.006, the lowest level since December 2022, signaling extreme bearish positioning.

- Glassnode heatmap data showing a cost-basis distribution with substantial support between $1,880 and $1,900 and roughly 1.3 million ETH accumulated there.

- On-chain signals and institutional inflows discussed in related coverage, including notes on network activity tailwinds for Ether.

Ether price action and outlook

Ether broke out of a descending wedge on the four-hour chart and traded around $2,050 at the time of observation. The measured move from the breakout points toward $2,150 highlights a near-term upside trajectory, with the potential to test higher resistance if the rally gains traction. The same chart framework points to possible retests of the 100-period simple moving average near $2,260, followed by a pathway toward the $2,500 horizon should momentum accelerate beyond the immediate levels.

On the downside, a firm hold above the psychological $2,000 level remains a critical anchor, reinforced by the 50-period moving average that has acted as interim support in recent sessions. The cost-basis distribution heatmap from Glassnode emphasizes a populated zone beneath the current price, where long-term holders have previously shown willingness to accumulate, which could provide a stabilizing force if price action turns choppy in the near term.

Historically, periods of negative funding rates at strong price floors have preceded short squeezes that sparked sharper moves to the upside. If the current dynamic persists—declining open interest, controlled leverage, and improving macro sentiment—ETH could establish a more durable base rather than form a brief rally followed by renewed volatility. As market attention shifts toward macro cues and ETF developments, investors will be watching how ETH behaves around key support levels and whether on-chain demand sustains the current trajectory.

Crypto World

Bitcoin Gains 4% As Soft US CPI Boosts March Rate-Cut Odds

Bitcoin (BTC) gained at Friday’s Wall Street open as a fresh US inflation surprise boosted the mood.

Key points:

-

Bitcoin price action heads toward key resistance after US CPI inflation data cools beyond expectations.

-

Crypto becomes a standout on the day as macro assets see a cool reaction to slowing inflation.

-

Traders stay wary on overall BTC price strength.

Bitcoin spikes on soft January CPI data

Data from TradingView showed up to 4% daily BTC price gains at the time of writing, with BTC/USD reaching $69,190 on Bitstamp.

The renewed upside came after the January print of the US Consumer Price Index (CPI) fell short of expectations.

As confirmed by the Bureau of Labor Statistics (BLS), core CPI matched estimates of 2.5%, while the broader reading was 2.4% — 0.1% lower than anticipated.

Reacting, trading resource The Kobeissi Letter noted that CPI inflation was now at multiyear lows.

“Core CPI inflation is now at its lowest level since March 2021,” it wrote in a post on X.

“Odds of further interest rate cuts are back on the rise.”

Kobeissi referred to the prospects of the Federal Reserve cutting interest rates at its next meeting in March. As Cointelegraph reported, market expectations of such an outcome were previously at rock bottom, not helped by strong labor-market performance.

After the CPI release, odds of a minimal 0.25% cut remained at less than 10%, per data from CME Group’s FedWatch Tool.

Continuing, Andre Dragosch, European head of research at crypto asset manager Bitwise, argued that when viewed through the lens of Truflation, an alternative inflation meter, the CPI drop was “not really a surprise.”

📌RE: CPI Release

Not really a surprise there if you have been following the @truflation CPI number which has plummeted sub-1% already…

IYKYK pic.twitter.com/GPEUqaSNZI

— André Dragosch, PhD⚡ (@Andre_Dragosch) February 13, 2026

Elsewhere on macro, gold attempted to reclaim the $5,000 per ounce mark, while the US dollar index (DXY) sought a recovery after an initial CPI drop to 96.8.

US stocks, on the other hand, failed to copy Bitcoin’s enthusiasm, trading modestly down on the day at the time of writing.

Analyst eyes current range for BTC price higher low

Considering the outlook for BTC price action, market participants had little reason to alter their cautious positions.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto sentiment hits record low

“$BTC Still consolidating in this falling wedge,” trader Daan Crypto Trades wrote in his latest X update.

“Attempted a break out yesterday but got slammed back down at the $68K level. That’s the area to watch if this wants to see another leg up at some point.”

Earlier, Cointelegraph reported on the significance of the $68,000-$69,000 zone, which plays host to both the old 2021 all-time high and Bitcoin’s 200-week exponential moving average (EMA).

“Whether you like it or not: Bitcoin remains to be in an area where I think that we’ll see a higher low come in,” crypto trader, analyst and entrepreneur Michaël van de Poppe predicted in his own forecast.

“It’s fragile, for sure, but it doesn’t mean that we’re not going to be seeing some momentum coming in from the markets.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Binance’s Mastercard crypto card launches across CIS countries

Binance rolls out its prepaid Mastercard crypto card to select CIS markets, offering instant crypto-to-fiat payments, cashback rewards, and a Valentine promo amid scam warnings.

Summary

- Binance’s prepaid Mastercard crypto card now serves verified users in selected CIS countries, including Armenia, converting Bitcoin, Ethereum, stablecoins and 100+ tokens to local fiat at checkout.

- The card supports in-store and online Mastercard payments, offers up to 2% cashback, and runs a Valentine-themed reward campaign with pink-icon tokens like AMP, UNI and DOT for referrals, top-ups, and trading.

- U.S. prosecutors separately warn that Valentine’s Day is peak season for romance-linked crypto scams, urging users to distrust online-only partners and avoid sending funds to unverified platforms.

Binance has launched its prepaid Mastercard crypto card in several Commonwealth of Independent States countries, marketing lead Anka Tsintsadze confirmed on Friday.

The cryptocurrency exchange, the world’s largest by trading volume, made the Binance Mastercard available to verified users in select CIS jurisdictions including Armenia. The card allows users to convert bitcoin, ethereum, stablecoins and more than 100 supported tokens instantly into local fiat currency at checkout.

“Pay in crypto. Merchants get fiat or crypto. Best way to push crypto payments and adoption,” Binance co-founder Changpeng Zhao wrote on X, commenting on the service’s regional expansion.

According to Binance, the card supports both in-store and online transactions at outlets that accept Mastercard. Prepaid crypto card holders are eligible to receive up to 2% cashback on qualifying purchases, capped per month.

Users in the CIS can fund accounts using US dollars via credit or debit cards, Apple Pay, and Google Pay. In Uzbekistan, customers may deposit Uzbek som through the Humo card network, while those in Kazakhstan can top up balances in tenge through local banks and Mastercard channels.

The card enables customers to retain crypto holdings until the moment of purchase. When making payments, Binance executes the exchange at checkout, eliminating the need for cardholders to pre-convert their crypto into fiat.

The crypto-linked payment card will only be available to applicants who already hold an account with a provider that issues such cards, including a crypto exchange or a digital currency-supporting bank. Binance requires users to complete identity verification and anti-money laundering checks before ordering the card, including standard know-your-customer procedures.

Once approved, users can access card services without Binance administrative, processing, or annual fees, although third-party charges still apply in some cases, according to the company.

Prior to Friday’s announcement, the exchange had launched its card services in the UK, Austria, Belgium, Bulgaria, Croatia, the Republic of Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden. The CIS rollout extends Binance’s card footprint beyond the European Economic Area.

Binance also announced a Valentine-themed promotional campaign with a reward pool. The campaign runs for approximately one month, or until the rewards are fully distributed. The promotion features pink-themed crypto rewards and invites users to complete tasks within the Binance ecosystem.

Users can participate by referring friends, topping up wallets, or trading on Spot and Futures markets. The “Bring a Plus One” initiative rewards users for inviting new participants to the platform. “Love at First Top-Up” encourages participants to deposit via Binance P2P, fiat channels, card payments, or the Buy Crypto feature. Rewards can reach up to a set limit in tokens identified by a pink icon, including AMP, UNI, and DOT, according to Binance.

Separately, US prosecutors issued a warning Thursday that Valentine’s Day is a peak season for romance cryptocurrency scams. The US Attorney’s Office for the Northern District of Ohio advised citizens to be cautious of online relationships.

Attorney David Toepfer stated that fraudsters may have been building trust over weeks or months before February 14, luring victims into making crypto payments to fraudulent investment platforms. He listed several warning signs, including requests to move conversations from dating apps to WhatsApp or Telegram, early professions of love, refusal to meet in person, and demands for payment via crypto, gift cards, or wire transfers.

“Romance scammers are after your money, not your heart. They prey on trust and emotion, often targeting elderly Americans and vulnerable individuals. We encourage everyone to slow down, verify identities, and never send money to someone you have not met in person,” US Attorney Toepfer stated in the alert.

Crypto World

Shytoshi Kusama’s Big Reveal: New Project to Shake Shiba Inu’s Path

TLDR

- Shytoshi Kusama will reveal details about an independent AI project on February 14.

- The project focuses on solving issues related to digital identity and legacy management.

- The initiative is not related to the Shiba Inu blockchain and aims to create an encrypted archive.

- Over six months of development and 100,000 lines of custom code have gone into the project.

- Shiba Inu’s price rebounded after a five-day drop and is now targeting resistance at $0.000007 and $0.0000076.

Shiba Inu’s Shytoshi Kusama is set to reveal details about a new independent project on Valentine’s Day. Kusama, the lead ambassador of the Shiba Inu ecosystem, had previously teased a significant update. This project, separate from the official Shiba Inu roadmap, focuses on addressing modern issues related to digital identity and legacy.

Kusama’s Focus on Digital Legacy and AI

Last week, Shytoshi Kusama shared more insights about his upcoming venture. The project is not related to blockchain but is centered around a standalone AI platform. This platform aims to tackle the growing problem of digital footprints, which are often messy and unorganized. Kusama explained that it would function as an encrypted archive, designed to preserve human legacy in a secure way.

Lucie, a Shiba Inu team member, clarified that this initiative is a separate endeavor and has no direct link to the Shiba Inu blockchain. Over six months of hard work and 100,000 lines of code have gone into developing this platform. Kusama’s independent project represents a fresh direction in the digital space, emphasizing the importance of managing personal digital footprints for future generations.

Shiba Inu’s Price Movements Amid Market Trends

While the Shiba Inu community eagerly anticipates Kusama’s February 14 update, the token’s price has seen some fluctuations. On February 12, SHIB reversed a five-day losing streak and began to show signs of recovery. At the time of writing, SHIB was priced at $0.000006290, marking a 3.03% decline over the last 24 hours. Despite this, the broader cryptocurrency market had experienced an uptick in response to January’s consumer inflation data, which came in lower than expected.

The Shiba Inu token has recently witnessed a 24% rise from a low of $0.000005 on February 6. The rebound comes after a period of sideways trading in early February. The next resistance levels for SHIB are set at $0.000007 and $0.0000076, which traders will closely monitor.

Shytoshi Kusama’s New Venture Outside Shiba Inu

At the end of January, Kusama broke his silence and revealed more about his new venture. A corporate partner prompted this initiative and operates outside the Shiba Inu ecosystem. Despite its separation from SHIB, Kusama’s update has generated much interest from the community. The upcoming broadcast is expected to reveal more details about this ambitious AI project.

As the Shiba Inu community waits for the next steps in the SHIB ecosystem, attention is focused on what Kusama has to share. His independent project may have far-reaching implications, especially given its focus on AI and digital legacy management.

Crypto World

Bitcoin Price Nears Undervalued Zone as MVRV Ratio Drops Below 1

TLDR

- Bitcoin’s MVRV ratio has dropped to 1.13, signaling that its price is approaching undervalued levels.

- The MVRV ratio reaching its lowest point since March 2023 suggests that Bitcoin is nearing an undervalued zone.

- CryptoQuant’s analysis shows that Bitcoin’s price has been in a downtrend for four months after its all-time high in October 2025.

- The Z-score of Bitcoin’s MVRV ratio is at historic lows, lower than during previous market bottoms in 2015, 2018, 2020, and 2022.

- Bitcoin’s current price decline differs from past cycles, as it has not experienced a sharp rise into overvalued zones.

Bitcoin (BTC) is nearing undervalued territory for the first time in three years as its market value to realized value (MVRV) ratio approaches a critical inflection point. The MVRV ratio compares Bitcoin’s market cap to the price at which its supply last moved, often seen as a key indicator of Bitcoin’s market cycle. According to CryptoQuant’s recent research, the MVRV ratio has fallen to 1.13, signaling that the current Bitcoin price is near levels that might be considered undervalued.

Bitcoin MVRV Ratio Reaches Lowest Level Since March 2023

As Bitcoin’s price dipped below $60,000 last week, the MVRV ratio dropped to 1.13, marking its lowest point since March 2023. The ratio below 1 suggests that Bitcoin’s supply is undervalued at current price levels. CryptoQuant contributor Crypto Dan noted that Bitcoin has been on a downtrend for about four months following its all-time high in October 2025, and is now entering what could be considered an undervaluation zone.

“When the MVRV ratio falls below 1, Bitcoin is regarded as undervalued,” Crypto Dan commented, adding that the current reading of around 1.1 suggests a near-undervalued state.

The MVRV ratio last registered below 1 in early 2023. At that time, Bitcoin was trading at about $20,000. The ratio surged to a peak of 2.28 during Bitcoin’s all-time high in October 2025, showing a sharp contrast to the present situation. This change highlights a difference in the current cycle compared to past ones.

The current decline in Bitcoin price has raised questions about its potential bottom. CryptoQuant’s analysis shows that Bitcoin’s market cap has dropped significantly, with the MVRV ratio falling into the undervalued zone. This suggests that the market is entering a critical phase, with the possibility of a trend reversal.

Research also highlights that Bitcoin’s price behavior during this cycle deviates from typical MVRV patterns. Historically, Bitcoin has experienced sharp rises into overvalued zones during bull markets, but this time the price has not reached such highs.

“Bitcoin did not experience a sharp rise into a clearly overvalued zone during the recent bull cycle,” the CryptoQuant report states.

Z-Score and MVRV Indicate Bitcoin Price Bottom Is Approaching

According to crypto trader and analyst Michaël van de Poppe, the Z-score of the MVRV ratio has recently reached historic lows. The Z-score measures the standard deviation of Bitcoin’s market cap in relation to the MVRV ratio. Van de Poppe pointed out that Bitcoin’s Z-score is now lower than during previous market bottoms, including those in 2015, 2018, the COVID crash in 2020, and 2022.

Furthermore, CryptoQuant contributor GugaOnChain described Bitcoin as being in a “capitulation zone” and suggested that the market is nearing an accumulation phase.

“The statistical deviation of the Z-Score screams opportunity, signaling that the bottom of this downtrend is being forged right now,” GugaOnChain wrote.

Crypto World

China extends crypto ban to stablecoins, tokenized real-world assets

Mainland China widens its crypto ban to cover RMB-pegged stablecoins and tokenized real-world assets, even as Hong Kong pushes ahead with a licensed stablecoin regime.

Summary

- A new joint notice from the PBoC, CSRC and other agencies extends China’s virtual currency ban to tokenized real-world assets, treating many RWA platforms as illegal finance if unlicensed.

- The rules bar any domestic or controlled entity from issuing RMB-pegged stablecoins abroad without approval, tighten mining enforcement, and target “shadow” data centers that secretly run rigs.

- Hong Kong moves in the opposite direction, with the HKMA preparing its first stablecoin licenses as firms like Ant Group and JD.com apply, even as Beijing flags crime and dollar-stablecoin risks.

China’s central bank and top regulatory authorities have extended the country’s cryptocurrency ban to include tokenization of real-world assets and stablecoins, according to a new regulatory notice.

China issues new stablecoin guidance

The People’s Bank of China and the China Securities Regulatory Commission, along with other agencies, released the notice to prevent and resolve risks associated with virtual currencies. Virtual currencies and mining remain completely prohibited in China under the expanded framework.

The notice requires prior authorization for the issuance of stablecoins tied to the renminbi outside the country. Domestic businesses and foreign entities under their control cannot issue virtual currencies worldwide unless they have obtained necessary permits from relevant authorities in accordance with applicable laws and regulations, the notice stated.

The regulatory framework emphasizes that monetary sovereignty is affected by stablecoins related to legal tender since they perform certain functions in circulation and usage. No entity or individual, domestic or foreign, can issue any RMB-pegged stablecoin outside the country without appropriate authorizations, according to the notice.

The notice reiterates the prohibition of virtual currency-related companies and the need to continue regulating virtual currency mining. The National Development and Reform Commission and relevant agencies will continue implementing stringent regulations on mining operations, the document stated.

Regulatory concerns include organizations appearing to be data centers but actually engaged in mining, managers moving equipment between areas to avoid local oversight, and correlation between some mining operations and speculation and trading in virtual currencies, according to the notice.

The notice establishes ground rules for tokenization of real-world assets, including compliance criteria. Regulators defined tokenization as using encryption and distributed ledger technology for the issuance and trading of rights to ownership, income, and other interests in assets.

Providing intermediary or technology services for RWA tokenization activities in China, as well as engaging in such activities, may be considered unlawful financial operations, the notice stated. The framework forbids the illegal sale of tokenized securities, the sale of securities to the public without proper authority, the trading of criminal securities or futures, and the solicitation of funds without a proper license.

The notice indicates possible exclusions for commercial operations carried out using specified financial infrastructure and with approval of relevant authorities under current laws and regulations. The entity with actual control over underlying assets is required to file a report with the CSRC before participating in related operations, according to regulatory guidelines.

Overseas issuance paperwork must describe the domestic filing company, underlying assets, token issuance strategy, and related details in depth, along with other relevant documentation, the notice stated.

Despite mainland opposition to cryptocurrency activity, the Hong Kong Monetary Authority is planning to grant an initial set of stablecoin licenses in March. Eddie Yue, chief executive of the HKMA, said in a Legislative Council meeting that a decision was hoped for by March.

The government is evaluating dozens of applications submitted by stablecoin issuers. The HKMA began accepting applications after Hong Kong passed a Stablecoins Ordinance requiring permits for entities that issue stablecoins in the territory or link them to the Hong Kong dollar.

Stablecoins are digital currencies designed to maintain steady values by being linked to assets such as traditional currencies or gold. The HKMA has discussed regional uses including tokenized deposit systems for foreign banks and cross-border payments, according to reports.

Ant Group and JD.com have expressed interest in Hong Kong’s licensing framework, according to the Financial Times. Preparations in Hong Kong were halted after Chinese authorities, notably the People’s Bank of China, raised reservations, the Financial Times reported.

China’s regulatory framework on cryptocurrency tightened from 2013 onward, and concerns about volatility and illegal activity led to a total ban on cryptocurrency transactions in 2021.

Recent research indicates that stablecoins were used by organized crime to move illicit funds, with daily transfers facilitated by complex networks, according to reports. Beijing’s concerns include the growing role of the US dollar in the digital asset market, especially dollar-tied stablecoins.

At a recent Senate Banking Committee hearing, the US Treasury Secretary said he “would not be surprised” if Hong Kong’s digital asset program were seen as an attempt to establish an alternative to American financial leadership.

Crypto World

Ethereum Struggles Below $2K as Derivatives Markets Shed 80M ETH in Open Interest

TLDR:

- Ethereum rejected at $2.1K resistance after breaking support, confirming bearish structure remains intact

- Open interest declined 80M+ ETH across exchanges in 30 days, with Binance leading at 40M reduction

- Technical framework requires sustained reclaim of $2.1K-$2.15K range to shift bias back to bullish

- Derivatives market cleanup reduces leverage risk and may establish foundation for price stability

Ethereum continues to trade below critical support levels while derivatives markets show widespread deleveraging.

The asset sits at $1,958.53 as of this writing after failing to hold the $2.1k threshold. Meanwhile, open interest across major exchanges has contracted by more than 80 million ETH over the past month.

This dual pressure from spot price weakness and futures market retreat signals a period of market recalibration.

Technical Breakdown Points to Further Downside Risk

Ethereum’s price structure has followed a textbook pattern of support failure and failed reclaim attempts. The rising trendline near $2.8k marked the initial breakpoint in this sequence. Once that level gave way, the asset moved swiftly toward $2.1k support.

Market participants initially viewed the $2.1k zone as a potential floor for consolidation. However, that expectation proved premature as the level failed to contain selling pressure.

The subsequent drop carried ETH down to $1.7k before any meaningful bounce materialized.

Analyst Dami-Defi noted on X that the asset “bounced just enough to suck in hope” before retesting the broken $2.1k support.

That retest resulted in a clear rejection, confirming the zone had flipped from support to resistance. This behavior typically indicates continued weakness rather than bullish recovery.

The current technical framework suggests limited upside potential while ETH trades below $2.1k. A sustained reclaim of the $2.1k-$2.15k range would be required to shift the bias.

Until such a development occurs, counter-trend rallies represent selling opportunities rather than the start of new uptrends.

Futures Market Contraction Reflects Cautious Positioning

Cryptoquant analyst Arab Chain reported that derivatives markets have undergone substantial position reduction across multiple platforms.

Binance recorded the largest decline with approximately 40 million ETH in open interest exiting over 30 days. Gate.io followed with more than 20 million ETH in reduced exposure.

Additional platforms showed similar trends with OKX declining by 6.8 million ETH and Bybit by 8.5 million ETH. These four venues alone account for roughly 75 million ETH in reduced open interest.

Source: Cryptoquant

When smaller exchanges are included, the total contraction exceeds 80 million ETH across the ecosystem.

This pattern indicates traders are closing positions rather than establishing new leveraged bets. The move reflects either profit-taking after extended positioning or risk reduction in response to volatile conditions.

High-leverage participants appear particularly active in unwinding exposure during this phase.

The derivatives market reset may ultimately create healthier conditions for future price discovery. Reduced leverage decreases the risk of cascading liquidations that amplify volatility.

This cleanup process often precedes periods of greater stability and can establish a firmer foundation for subsequent moves.

Crypto World

BlackRock Raises BitMine Immersion Technologies Stake to Over 9 Million Shares

TLDR:

- BlackRock increased BitMine holdings to 9,049,912 shares, up 165.6% from last quarter

- The total position is valued at roughly $246 million according to the latest 13F filing

- BitMine controls about 4.3 million ETH, or nearly 3.5% of Ethereum’s circulating supply

- Institutional investors continue adding exposure through crypto-linked public equities

BlackRock increased its ownership in BitMine Immersion Technologies during the latest reporting period. A new regulatory filing shows the asset manager raised its stake to 9,049,912 shares, marking a 165.6% quarterly jump and valuing the position at roughly $246 million.

Institutional Allocation Grows

The updated position appeared in BlackRock’s most recent 13F disclosure filed with U.S. regulators. These filings list equity holdings managed across the firm’s broad investment portfolios.

The document shows a sharp rise from the prior quarter’s reported share count.The latest total now exceeds nine million shares of BitMine common stock.

The company trades publicly under the ticker BMNR. It operates immersion-based mining facilities and manages digital assets on its balance sheet.

Shortly after the filing surfaced, crypto-focused accounts shared the figures on social media. One widely circulated post noted that BlackRock had loaded up on BitMine shares.

The message cited the same increase and valuation metrics from the official filing. It framed the purchase as another move by institutions toward crypto-related equities.

BlackRock oversees trillions of dollars across global markets and sectors. Movements of this scale often draw attention from traders and analysts.

Ethereum Treasury Strategy

BitMine’s business model combines mining infrastructure with long-term cryptocurrency holdings. Its treasury includes approximately 4.3 million ETH accumulated through operations and reserves.

That amount represents around 3.5% of Ethereum’s circulating supply. The figure places the company among the larger known corporate holders of the asset.

Holding such reserves ties company performance closely to digital asset prices. Changes in Ethereum’s value can influence both revenue expectations and balance sheet strength.

BlackRock’s expanded position increases institutional exposure to that structure. It links traditional capital management with companies directly tied to blockchain assets.

Quarterly disclosures offer measurable data for tracking these allocations. They provide concrete numbers rather than market rumors or short-term speculation.

The latest filing presents a clear snapshot of BlackRock’s current commitment. With over nine million shares, BitMine becomes a larger piece of its public equity holdings.

The increase arrives as crypto-focused strategies continue attracting institutional capital. Public filings now serve as a key source for monitoring that steady accumulation.

Crypto World

BlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

BlackRock made its first formal move into decentralized finance this week, listing its tokenized Treasury fund on Uniswap, with Bitcoin and Ether staging only modest rebounds amid heavy ETF outflows.

Bitcoin (BTC) and Ether (ETH) each rose about 2.5% during the past week but were unable to cross key psychological levels due to mixed exchange-traded fund (ETF) flows and crypto investor sentiment sinking to record lows.

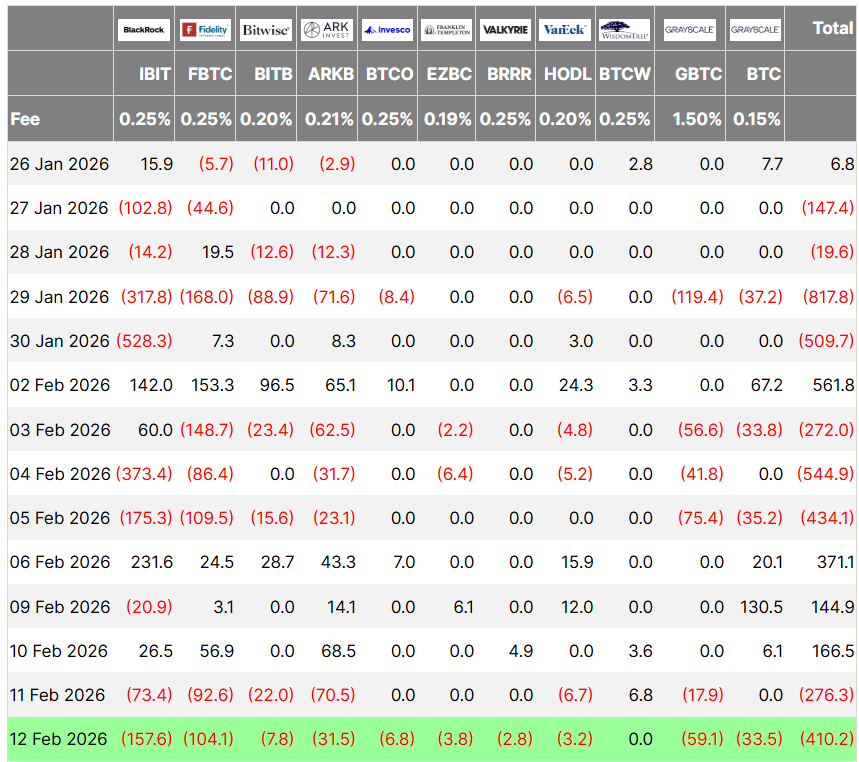

Bitcoin ETFs started the week with two consecutive days of inflows, but they quickly reversed with $276 million in outflows on Wednesday and $410 million on Thursday.

Ether ETFs saw similar flows, with two modest days of inflows, followed by $129 million in outflows on Wednesday and $113 million on Thursday, according to Farside Investors data.

In a silver lining to the correction, Bitcoin’s sharp drawdown to $59,930 may have marked a critical “halfway point” in the current bear market, as markets are now sitting at a critical inflection point that will determine the relevance of the four-year cycle theory, according to Kaiko Research.

Despite sliding crypto valuations, large institutions continue exploring cryptocurrency adoption, including the world’s largest asset manager, BlackRock, which announced its first foray into decentralized finance (DeFi) on Wednesday.

BlackRock enters DeFi, taps Uniswap for institutional token trading

Asset management giant BlackRock is making its first formal move into decentralized finance by bringing its tokenized US Treasury fund to Uniswap, marking a milestone moment for institutional adoption of DeFi.

According to a Wednesday announcement, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) will be listed on the Uniswap decentralized exchange, allowing institutional investors to buy and sell the tokenized security.

As part of the arrangement, BlackRock is also purchasing an undisclosed amount of Uniswap’s native governance token, UNI, the announcement said.

The collaboration is being facilitated by tokenization company Securitize, which partnered with the world’s biggest asset manager on the launch of BUIDL.

According to Fortune, trading will initially be limited to a select group of eligible institutional investors and market makers before expanding more broadly.

“For the first time, institutions and whitelisted investors can access technology from a leader in the decentralized finance space to trade tokenized real-world assets like BUIDL with self-custody,” said Securitize CEO Carlos Domingo.

BUIDL is the biggest tokenized money market fund, with more than $2.18 billion in total assets, according to data compiled by RWA.xyz. The fund is issued across multiple blockchains, including Ethereum, Solana, BNB Chain, Aptos and Avalanche.

In December, BUIDL reached a key milestone, surpassing $100 million in cumulative distributions from its Treasury holdings.

Trump family’s WLFI plans FX and remittance platform: Report

World Liberty Financial (WLFI), a decentralized finance (DeFi) platform backed by the family of US President Donald Trump, announced on Thursday that it will launch foreign currency exchange (FX) and remittance services for its users.

The planned foreign exchange and remittance platform, called World Swap, seeks to challenge traditional remittance and FX service providers with lower fees and a simplified user interface, according to Reuters.

Daily global FX trading volume surpassed $9.6 trillion in April 2025, according to a report from the Bank for International Settlements (BIS), and the personal remittances market topped $892 billion in annual volume in 2024, according to data from the World Bank.

No exact timeline was given for the rollout. Cointelegraph reached out to World Liberty Financial but did not receive a response by the time of publication.

The expansion into FX and remittances follows WLFI’s application for a national trust bank charter in January and the launch of World Liberty Markets, a lending platform, as WLFI continues to grow while attracting scrutiny from Democratic lawmakers in the US.

Uniswap scores early win as US judge dismisses Bancor patent suit

A New York federal judge dismissed a patent infringement lawsuit brought by Bancor-affiliated entities against Uniswap, ruling that the asserted patents claim abstract ideas and are not eligible for protection under US patent law.

In a memorandum opinion and order on Tuesday, Judge John G. Koeltl of the US District Court for the Southern District of New York granted the defendant’s motion to dismiss the complaint filed by Bprotocol Foundation and LocalCoin Ltd. against Universal Navigation Inc. and the Uniswap Foundation.

The court found that the patents are directed to the abstract idea of calculating crypto exchange rates and therefore fail the two-step test for patent eligibility established by the US Supreme Court.

The ruling marks a procedural win for Uniswap, but it is not final. The case was dismissed without prejudice, giving the plaintiffs 21 days to file an amended complaint. If no amended complaint is filed, the dismissal will convert to one with prejudice.

Shortly after the ruling, Uniswap founder Hayden Adams wrote on X, “A lawyer just told me we won.”

“Uniswap Labs has always been proud to build in public — it’s a core value of DeFi,” a Uniswap Labs spokesperson told Cointelegraph. “We’re pleased that the court recognized that this lawsuit was meritless.”

Cointelegraph reached out to representatives of Bprotocol Foundation for comment but had not received a response by publication.

Binance completes $1 billion Bitcoin conversion for SAFU emergency fund

Binance completed the $1 billion Bitcoin conversion for its emergency fund, committing to holding Bitcoin as its core reserve asset.

Binance purchased another $304 million worth of Bitcoin (BTC) on Thursday, completing the conversion of $1 billion in Bitcoin for its Secure Asset Fund for Users (SAFU) wallet, according to Arkham data.

The fund now holds 15,000 Bitcoin, worth over $1 billion, acquired at an average aggregate cost basis of $67,000 per coin, Binance said in a Thursday X post.

“With SAFU Fund now fully in Bitcoin, we reinforce our belief in BTC as the premier long-term reserve asset.”

The last tranche of BTC came three days after Binance’s previous $300 million acquisition on Monday.

The exchange first announced it would convert its $1 billion user protection fund into Bitcoin on Jan. 30, initially pledging a 30-day window for the acquisitions, which were completed in less than two weeks.

The exchange said it would rebalance the fund if volatility pushes its value below $800 million.

Vitalik draws line between “real DeFi” and centralized yield stablecoins

Ethereum co-founder Vitalik Buterin drew a clear boundary around what he considers “real” decentralized finance (DeFi), pushing back against yield-driven stablecoin strategies that he says fail to meaningfully transform risk.

In a discussion on X, Buterin said that DeFi derives its value from changing how risk is allocated and managed, not simply from generating yield on centralized assets.

Buterin’s comments come amid renewed scrutiny over DeFi’s dominant use cases, particularly in lending markets built around fiat-backed stablecoins like USDC (USDC).

While he did not name specific protocols, Buterin took aim at what he described as “USDC yield” products, saying they depend heavily on centralized issuers while offering little reduction in issuer or counterparty risk.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The Pippin (PIPPIN) token rose 195% as the week’s biggest gainer in the top 100, followed by the Humanity Protocol (H) token, up 57% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video15 hours ago

Video15 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports7 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?