Crypto World

Will Bitcoin Price Drop to $50,000 by March 2026?

Bitcoin is trading around $68,700, down nearly 22% year to date and on pace for its weakest first quarter since 2018. After starting the year near $87,700, BTC has shed almost $20,000 in just a few weeks, putting pressure on the broader crypto market.

While early-year weakness is not unusual for Bitcoin, the scale of the decline has raised concerns that the current correction may not be over yet.

Sponsored

Sponsored

Worst First Quarter in 8 Years?

Historically, Bitcoin has posted a negative first quarter in 7 of the past 13 years.

However, a 22% drawdown would mark its worst Q1 performance since the 2018 bear market, when BTC plunged nearly 50% in the opening months of the year.

January and February both closed in the red, increasing the likelihood of a rare back-to-back negative start.

To meaningfully shift the narrative, Bitcoin would need to reclaim the $80,000 region, which currently appears distant given prevailing momentum.

That said, history shows that weak first quarters do not necessarily define the full year. In eight of the past thirteen years, Q2 delivered the opposite performance of Q1.

This keeps the medium-term outlook more nuanced than the headlines suggest.

9% Bounce May Have Increased Downside Risk

Between February 12 and February 15, Bitcoin staged a sharp 9% rebound. On the surface, the move appeared constructive. Underneath, leverage data tells a different story.

Sponsored

Sponsored

Open interest in BTC futures jumped from roughly $19.6 billion to $21.47 billion during the rebound, an increase of nearly $1.9 billion.

Funding rates also turned strongly positive, signaling that traders were aggressively positioning for further upside.

However, the broader chart structure still resembles a bear flag. The recent rally unfolded within a downward continuation pattern, and price is now drifting back toward the lower boundary of that structure.

Momentum indicators add to the caution. A hidden bearish divergence formed on the 12-hour chart, with price making a lower high while RSI printed a higher high. This pattern often appears when sellers are quietly regaining control.

At the same time, Bitcoin’s Net Unrealized Profit/Loss surged by roughly 90% over several days, indicating that many holders quickly returned to paper profits.

Similar profit spikes in early February preceded a 14% drop. If traders rush to lock in gains again, selling pressure could accelerate.

Sponsored

Sponsored

Key Levels: $66K Support, $58K Downside Target

Technically, the $66,270 area is a critical near-term support. A confirmed breakdown below this zone would activate the bear flag continuation pattern.

If that happens, the next major downside target sits near $58,800, aligning with the 0.618 Fibonacci retracement and representing roughly a 14% decline from current levels.

A deeper extension could bring the $55,600 region into play.

On the upside, BTC needs to reclaim $70,840 to stabilize short term. A stronger breakout above $79,290 would invalidate the bearish structure and signal that buyers have regained control.

Sponsored

Sponsored

Bitcoin Dominance and Treasury Companies Offer Mixed Signals

Beyond price action, broader market metrics paint a complex picture. Bitcoin dominance remains elevated near 58.5%, suggesting capital continues to favor BTC over altcoins during this correction. That relative strength often appears in defensive market phases.

Meanwhile, public Bitcoin treasuries continue to hold substantial Bitcoin reserves. Data from BitcoinTreasuries shows over 1.13 million BTC collectively held by public firms, led by large corporate holders.

The largest of these holders is Strategy, which holds 3.27% of the total Bitcoin supply. While this structural demand does not prevent short-term volatility, it reinforces Bitcoin’s long-term institutional footprint.

Bitcoin is caught between historical resilience and near-term technical weakness.

The 22% year-to-date drop puts Q1 on track for an unenviable record.

Meanwhile, leverage, divergence signals, and on-chain profit metrics suggest that downside risk toward $58,000 cannot be ruled out.

At the same time, elevated dominance and continued corporate accumulation highlight that the broader structure is under pressure, but not yet broken.

The coming weeks will likely determine whether this is simply another rotational phase within a larger cycle or the start of a deeper corrective leg.

Crypto World

Fake Trezor, Ledger Letters Target Crypto Wallet Users

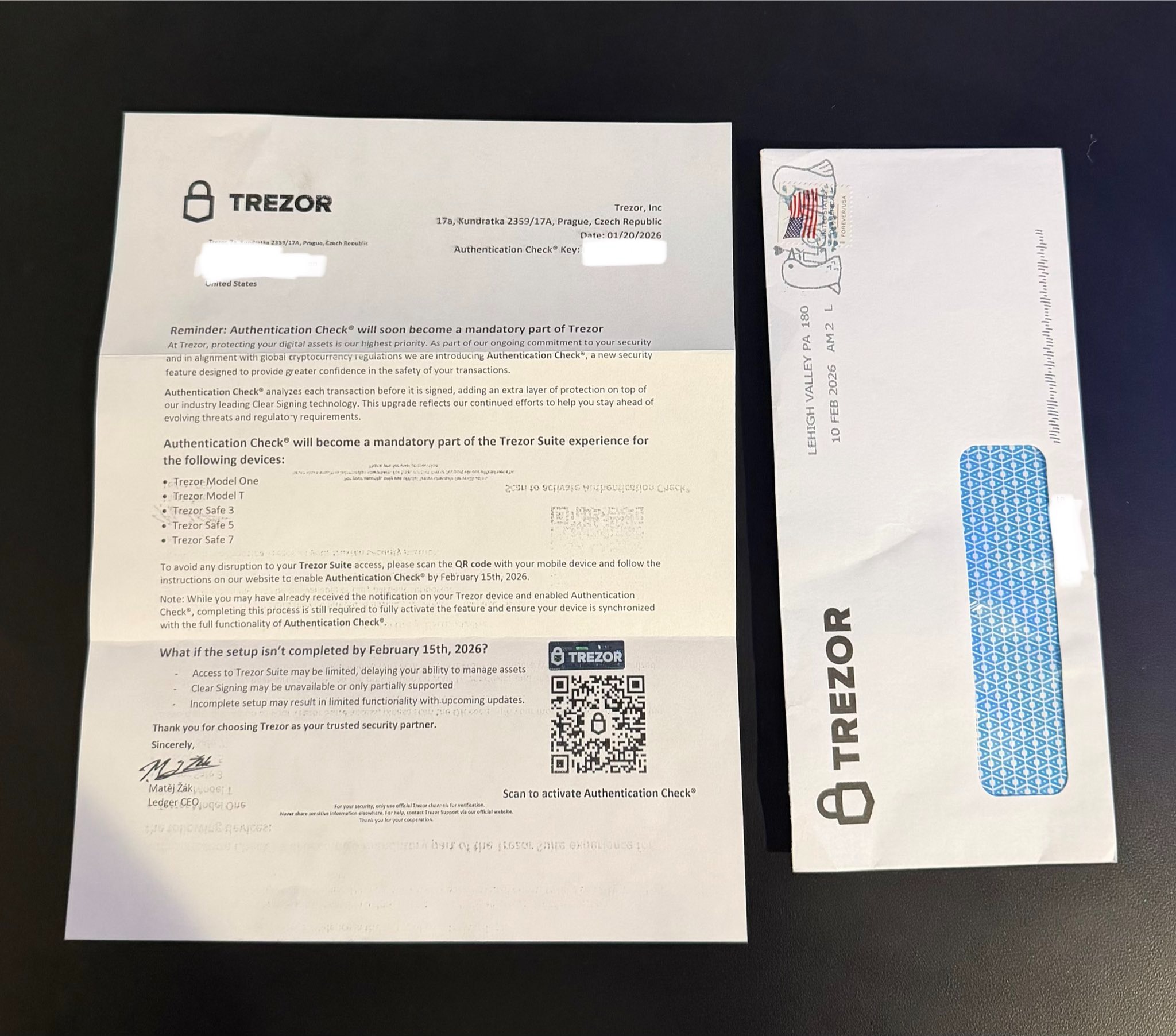

Users of crypto hardware wallets Ledger and Trezor are again reporting receiving physical letters aimed at stealing their seed recovery phrases — the latest attack on users exposed across numerous data leaks over the past six years.

Cybersecurity expert Dmitry Smilyanets was one of the first to report receiving a spurious letter from Trezor on Feb. 13, which demands users perform an “Authentication Check” by Feb. 15 or risk having their device restricted.

Smilyanets said the scam includes a hologram along with a QR code that takes users to a scam website. The letter is made to appear signed by Matěj Žák, who is described as the “Ledger CEO” (the real Matěj Žák is the CEO of Trezor).

A Ledger user reported receiving a similar letter last year in October, with the letter claiming recipients must complete mandatory “Transaction Check” procedures.

Scanning a malicious QR code for “mandatory” checks

The QR code reportedly takes the victim to a malicious website made to look like Ledger and Trezor setup pages, tricking users into entering their wallet recovery phrases.

Once entered, the recovery phrase is transmitted to the threat actor through a backend API, enabling them to import the victim’s wallet onto their own device and steal funds from it.

Related: Phishing scammers spoof Ledger’s email to send bogus data breach notice

Legitimate hardware wallet companies never ask users to share their recovery phrases through any method, including website, email, or snail mail.

Not the first time letters have been sent

Ledger and its third-party partners have suffered multiple large-scale data breaches over the past few years, resulting in leaks of customer data, including physical addresses used for postal purposes, and physical threats.

Meanwhile, Trezor flagged a security breach that exposed the contact information of nearly 66,000 customers in January 2024.

In 2021, scammers mailed counterfeit Ledger Nano hardware wallets to victims of the 2020 Ledger data breach.

Physical letters prompting victims to scan QR codes were sent in April 2025, while in May, hackers used fake Ledger Live apps to steal seed phrases and drain crypto from victims.

Ledger alerted users to the physical mail phishing scam on its website in October.

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest

Crypto World

XRP Price Prediction as token surges after Ripple CEO joins CFTC Advisory Committee

XRP price jumped after Ripple CEO Brad Garlinghouse joined the U.S. Commodity Futures Trading Commission’s (CFTC) Global Markets Advisory Committee, a move seen as strengthening Ripple’s regulatory standing in Washington.

Summary

- XRP surged after Ripple CEO Brad Garlinghouse joined the CFTC’s Innovation Advisory Committee, signaling stronger regulatory engagement.

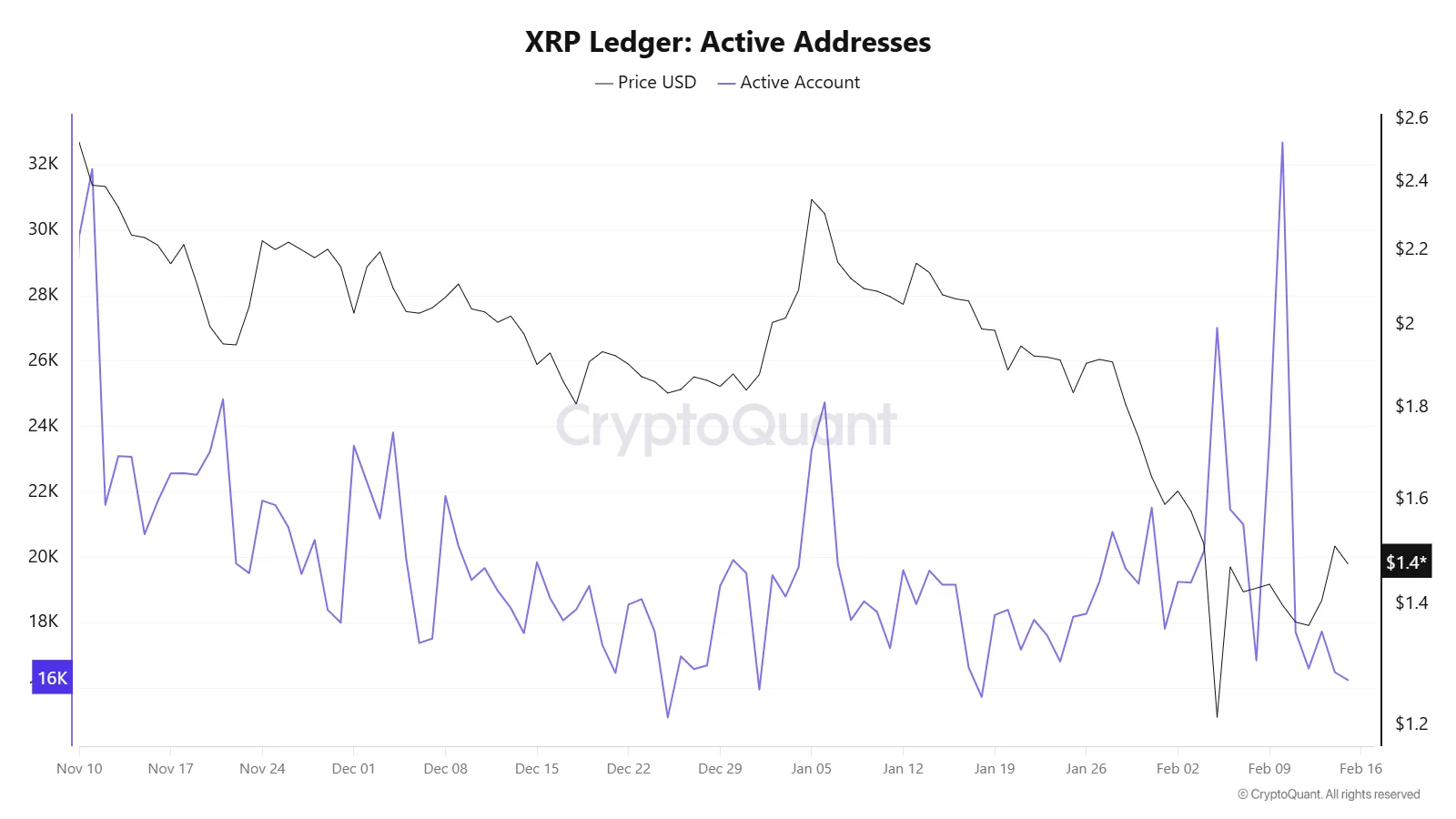

- On-chain data shows a recent spike in XRP Ledger active addresses above 30,000, pointing to renewed network activity and speculative interest.

- Technically, XRP trades near $1.46, with resistance at $1.60 and $1.74, while support stands at $1.35 and $1.20.

However, the token has since pulled back and is trading lower at press time.

Ripple CEO’s CFTC role sparks market reaction

Executives from Coinbase, Ripple and Solana were named to the CFTC’s Innovation Advisory Committee, a group focused on digital asset policy, market structure and emerging financial technologies.

The development signals deeper engagement between major crypto firms and U.S. regulators at a time when the industry is pushing for clearer oversight frameworks.

For XRP (XRP) investors, Garlinghouse’s appointment is being interpreted as a constructive step toward regulatory normalization following years of legal scrutiny.

On-chain data supports the renewed interest. The XRP Ledger active addresses chart shows notable spikes in network activity in recent weeks, including a sharp surge above 30,000 active accounts in early February.

While activity has since cooled toward the 16,000–18,000 range, the earlier spike coincided with heightened price volatility, suggesting speculative participation and renewed user engagement.

What XRP price analysis suggests

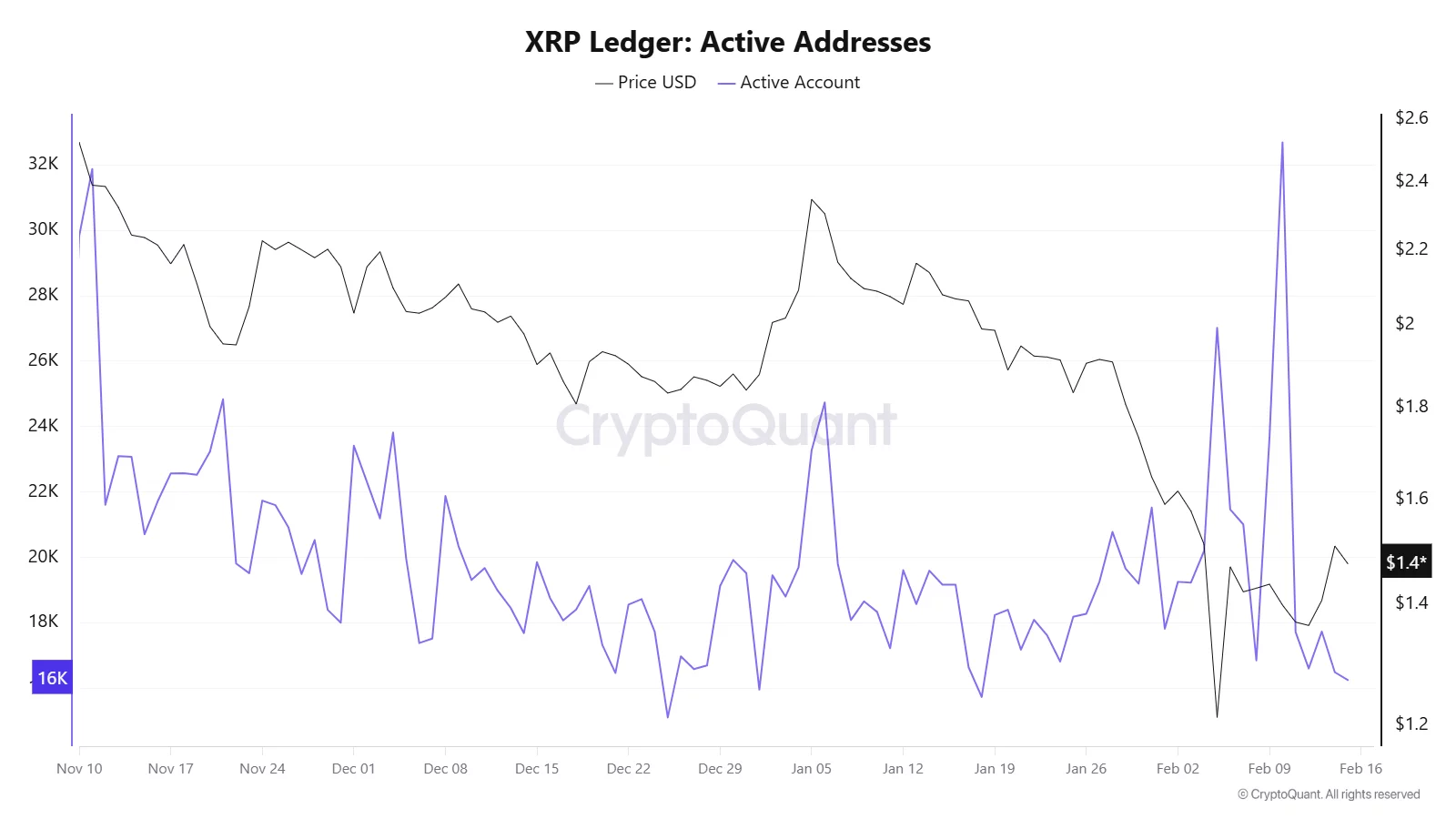

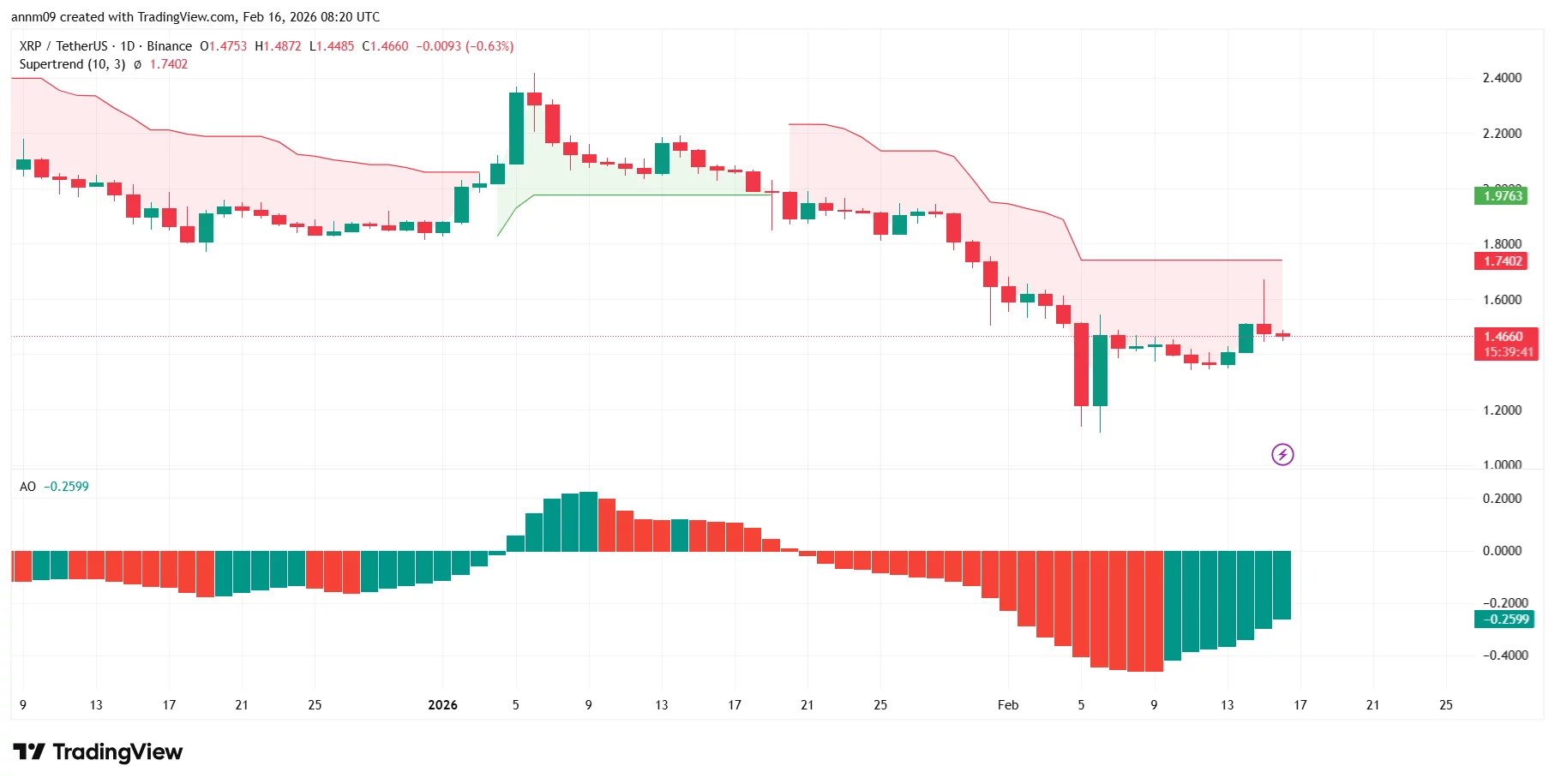

At press time, XRP is trading near $1.46 on the daily chart. The token recently rebounded from a sharp drop toward the $1.20 region but remains under technical pressure.

The Supertrend indicator (10,3) remains in bearish territory, with the trend line positioned around $1.74, signaling that the broader trend has not yet flipped bullish.

Meanwhile, the Awesome Oscillator, although still below the zero line, is printing rising green bars. This indicates bearish momentum is fading and a potential shift could be forming if buyers maintain pressure.

Immediate resistance sits near $1.60, followed by the stronger Supertrend barrier around $1.74. A daily close above that level could open the door toward the $1.90–$2.00 region.

On the downside, support lies near $1.35, with the recent swing low around $1.20 acting as critical structural support. A breakdown below $1.35 could expose XRP to another retest of that lower zone.

For now, XRP appears to be stabilizing, but a confirmed trend reversal will require a break above key resistance levels.

Crypto World

Russian crypto trading tops $640M a day, finance ministry reveals

Russia’s cryptocurrency market is experiencing a surge in transactional activity, with daily trading volumes reaching an estimated 50 billion rubles, roughly $640 million, according to Deputy Finance Minister Ivan Chebeskov.

Summary

- Russia’s Finance Ministry says crypto trading volumes have reached 50 billion rubles ($640 million) per day, or roughly $129 billion annually, much of it outside formal oversight.

- Lawmakers are preparing a sweeping regulatory framework that would introduce mandatory exchange licensing by 2027 and stricter supervision of crypto platforms.

- Proposed rules include potential retail investment caps, asset approval controls by the central bank, and penalties for unlicensed operators, while keeping the ban on crypto payments in place.

Booming crypto trade meets regulatory push

Speaking at the Alfa Talk forum on digital assets, Chebeskov said this “turnover of more than 10 trillion rubles annually” highlights the depth of crypto involvement among Russians, much of it occurring outside formal regulatory oversight.

“We’ve always said that millions of citizens are involved in this activity, representing trillions of rubles in terms of use and savings. One example is the daily cryptocurrency turnover in our country—around 50 billion rubles. That’s a turnover of more than 10 trillion rubles per year, which is currently occurring outside the regulated zone, outside our control,” the deputy minister explained.

Officials note that millions of citizens are participating in crypto trading, investing and savings, but most of these transactions currently take place through unregulated channels, leaving them beyond the attention of authorities.

Against this backdrop, Russian regulators are pushing to bring much of the crypto market under formal scrutiny. Lawmakers plan to present a comprehensive crypto regulation bill to the State Duma by June 2026, with the aim of adopting a legal framework that would take effect by July 1, 2027.

Under the draft legislation, all cryptocurrency exchanges would need licenses, and operating without approval could be penalized similarly to illegal banking. Retail investors would face annual limits on crypto purchases — proposed at about 300,000 rubles (≈ $4,000) — and qualification tests before they can trade.

Privacy-oriented cryptocurrencies could be restricted, and the central bank would have discretion over which assets are approved for legal trading beginning in mid-2027.

Major Russian exchanges, including the Moscow and St. Petersburg exchanges, have been preparing to launch regulated crypto trading platforms once the legal foundation is finalized. These efforts reflect broader policy shifts aimed at moving users away from “gray market” activity toward licensed, transparent venues.

The proposed rules also keep the long-standing ban on using crypto for domestic payments but open regulated trading as an investment vehicle. The combined push from the Ministry of Finance, the Bank of Russia, and the State Duma signals a strategic effort to balance market growth, investor protection and financial stability while reining in unregulated activity.

Crypto World

Coinbase retail traders buy Bitcoin and Ethereum dips, internal data shows

Coinbase CEO Brian Armstrong says retail users kept buying Bitcoin and Ethereum on price dips, with most Coinbase client balances in February at or above December levels.

Summary

- Coinbase internal data shows retail users increased BTC and ETH purchases during recent dips.

- Most Coinbase client crypto balances in February stayed equal to or higher than December levels.

- Analysts say resilient retail demand contrasts with softer institutional flows and may impact near-term market structure.

Coinbase CEO Brian Armstrong reported that retail investors increased cryptocurrency purchases during recent market declines, according to internal company data.

Armstrong stated in a post on social media platform X that individual investors on Coinbase demonstrated buying activity during price drops for Bitcoin and Ethereum. The executive cited internal trading data showing increased retail trading volume correlating with price declines.

“According to our data, individual users on Coinbase have been quite resilient in these market conditions: they took advantage of the dips to buy,” Armstrong stated. “We saw increases for retail users across Bitcoin and Ethereum.”

The Coinbase chief executive noted that retail investors exhibited holding behavior during short-term price volatility. Armstrong reported that most client cryptocurrency balances in February remained at or above December levels.

Bitcoin (BTC) and altcoin markets experienced sharp declines in recent weeks, with recovery attempts ongoing, according to market data.

Market analysts noted the contrast between retail buying activity and slower institutional fund inflows during the period. The divergence represents a significant factor in short-term supply and demand dynamics, according to industry observers.

Analysts stated that additional market catalysts would be needed for increased retail demand to shift broader market trends, given current macroeconomic conditions and derivatives market structure.

Coinbase operates as a cryptocurrency exchange platform serving retail and institutional clients.

Crypto World

Key macro data puts crypto markets on watch as CPI, PCE and Fed speak

Crypto and stock markets face a packed macro week, with CPI, PCE, Fed minutes and spending data set to test rate‑cut bets after mixed inflation and rising tensions.

Summary

- January CPI eased to its lowest core reading since 2021, briefly lifting crypto before gains faded.

- Markets now focus on retail sales, durable goods, PCE and Fed minutes to gauge rate‑cut timing.

- Bitcoin and Ethereum stay volatile as geopolitical risks and macro uncertainty cap risk appetite.

Financial markets are preparing for several key economic data releases this week that could influence cryptocurrency and stock prices, following mixed signals from last week’s inflation data.

January’s Consumer Price Index came in slightly below expectations, with headline inflation at 2.38% year-on-year and core CPI at 2.5%, marking the lowest level since early 2021, according to government data. The figures initially boosted stock and cryptocurrency markets on Friday, though cryptocurrency gains retreated over the weekend.

Traditional U.S. markets will be closed Monday for the President’s Day holiday. The ADP employment update is scheduled for Tuesday, followed by the January Retail Sales report. Wednesday will bring consumer spending data with the delayed December Durable Goods Orders numbers, along with Federal Reserve meeting minutes and 10 central bank speaker events.

The December Personal Consumption Expenditures (PCE) inflation report, considered a key indicator by the Federal Reserve, is expected to be released later this week. Goldman Sachs raised its PCE outlook following the January CPI data, estimating that the core PCE price index rose 0.40% in January, according to reports. The economists attributed the projection to rising consumer electronics and IT prices, which carry heavier weighting in PCE calculations than in CPI. A global shortage of RAM and storage components, driven by AI data center demand, has contributed to increased computer and component prices.

The CME Fed Watch Tool shows a 90% probability that interest rates will remain unchanged at the Federal Reserve‘s March meeting, according to current market pricing.

Cryptocurrency markets have declined in the past 24 hours, with total market capitalization falling. Bitcoin retreated from recent highs during early Asian trading on Monday and has remained rangebound for the past ten days. Ethereum prices have fallen sharply, while alternative cryptocurrencies have continued to decline.

The Kobeissi Letter noted that geopolitical tensions and macroeconomic uncertainty remain elevated, cautioning that volatility could continue this week.

Crypto World

The RWA War: Stablecoins, Speed, and Control

Consensus Hong Kong 2026 was, by many accounts, an RWA conference that happened to be about crypto. Across main stages, side events, and sponsored panels, real-world asset tokenization dominated the conversation — but not in the way it did a year ago.

The pitch decks have given way to genuine disagreements about architecture, regulation, and what tokenization actually solves. Here’s what’s actually being argued.

Stablecoins Are RWA — and Everyone Now Agrees

One of the clearest points of consensus was that the most successful RWA already exists. “The most successful RWA is USDT,” said CJ Fong, Managing Director and Head of APAC and EMEA Sales at GSR, during a panel at the main conference.

At the Gate’s side event, Chunda McCain, co-founder of Paxos Labs, described surging demand for PAXG, the firm’s gold-backed token, as evidence that stablecoins are expanding beyond dollar pegs into commodities and treasuries. Paxos secured its OCC conditional license in December and holds regulatory approvals in Singapore, Finland, and Abu Dhabi — a multi-jurisdictional strategy built around the assumption that stablecoins and tokenized assets are converging.

Brian Mehler, CEO of payment blockchain Stable, reinforced the point from the infrastructure side. His company’s USDT Zero system eliminates gas fees entirely — send 100 USDT, and 99.999 USDT arrives. At the Stablecoin Odyssey side event, Mehler compared the goal to Swift: the user shouldn’t know they’re on a blockchain.

The implication is that the stablecoin-RWA boundary is increasingly artificial. As stablecoins back themselves with T-bills, gold, and structured products, and as RWA platforms settle in USDC, the two categories are merging into a single tokenized finance layer.

The Architecture War: Permissioned vs Permissionless

The sharpest disagreement at the conference came from two companies that nominally do the same thing.

At the Consensus mainstage session “Tokenizing the Planet,” Graham Ferguson, Head of Ecosystem at Securitize, and Min Lin, Managing Director of Global Expansion at Ondo, laid out fundamentally different visions.

Securitize advocates for native token issuance under a permissioned framework. Ferguson argued that wrapper models — where an existing off-chain asset is wrapped into an on-chain token — create distance between the underlying asset and the investor, weakening protection. With BlackRock’s BUIDL fund surpassing $1 billion in AUM, he pointed to the track record of issuing securities directly on-chain with compliance built in.

Ondo takes the opposite path: permissionless wrappers that prioritize DeFi composability and global distribution. Min Lin argued that the model integrates more quickly with existing DeFi protocols and removes gatekeepers, an advantage particularly relevant for reaching investors across Asia. The company is actively expanding into Hong Kong, Singapore, and Japan.

In a follow-up interview with BeInCrypto, Ferguson questioned whether wrapper models can provide adequate investor protection. He also detailed Securitize’s plans to expand DeFi partnerships while maintaining its permissioned architecture.

The binary may already be outdated, though. At Stablecoin Odyssey’s RWA panel, Conflux CSO Forgiven described a live hybrid case: renewable energy assets packaged by a financial company and wrapped into a DeFi protocol. It’s a permissionless distribution of a regulated, real-world asset — a structure that doesn’t fit neatly into either camp.

Settlement Speed: The Argument That Keeps Winning

If one claim was repeated most across venues, it was that tokenization’s killer feature isn’t access or transparency — it’s speed.

Conflux’s Forgiven offered the most concrete benchmark: deposit USDC, receive immediate confirmation; request redemption, get USDC back within one hour. “Faster than T+0,” he noted, against traditional settlement cycles that can stretch to days.

The composability argument extends this further. Multiple panelists across sessions noted a limitation in traditional finance. Buying an asset and using it as collateral immediately is structurally impossible. On-chain, it’s native functionality.

Stable’s Mehler highlighted a practical pain point that bridges theory and reality: during the recent market selloff, ETH gas price volatility doubled transaction costs for businesses moving stablecoins. His fixed-cost USDT transfer model eliminates that variable, which matters when enterprises are processing thousands of transactions daily.

Physical Assets: Where the Narrative Meets Friction

The precious metals session at HashKey Cloud’s event provided a reality check. Ronald Tan, Director of Silver Times Limited, walked through the logistics of the silver market: warehouse costs, transportation challenges, and US-China export restrictions that don’t vanish when a token is minted.

This is the gap between financial RWA and physical RWA. Treasuries and fund shares can settle instantly because the underlying asset is already recorded in the ledger. Metals, energy, and real estate require verification that the physical asset exists and is properly custodied.

Paxos’s PAXG experience — gold tokens backed by allocated bars in London vaults — shows it can work at scale, but McCain acknowledged the company is committing additional resources to meet surging demand. The infrastructure for physical-asset tokenization is real, but far from trivial.

Asia as the Center of Gravity

Across all sessions, Asia — and Hong Kong specifically — emerged as the gravitational center of the RWA narrative.

Ondo is targeting Hong Kong, Singapore, and Japan for expansion. Securitize’s Ferguson told BeInCrypto that the company would prioritize jurisdictions with regulatory clarity, naming the same cities. Paxos already holds a Singapore MAS license. HashKey, as both an event host and a market participant, anchored multiple panels on Hong Kong’s positioning.

Forgiven of Conflux described its company as a rare Chinese blockchain project using real names. Its renewable energy RWA product was designed specifically for the Hong Kong market.

The subtext is clear: while US regulatory battles over stablecoin legislation and the Clarity Act continue — a point Anthony Scaramucci made forcefully in his own Consensus appearance — Asia is building the infrastructure and establishing the precedents.

What’s Actually at Stake

The RWA conversation at Consensus Hong Kong revealed an industry that has moved past the question of whether tokenization will happen. The arguments now center on how—permissioned or permissionless, financial or physical, institutional or retail-first—and the answers are diverging by asset class, jurisdiction, and business model.

The stablecoin-RWA convergence may prove to be the most consequential shift. If the most successful tokenized assets are stablecoins, and stablecoins are increasingly backed by real-world assets, the entire framing of RWA as a separate sector may not survive 2026.

The post The RWA War: Stablecoins, Speed, and Control appeared first on BeInCrypto.

Crypto World

Crypto funds bleed for fourth straight week as US investors pull back

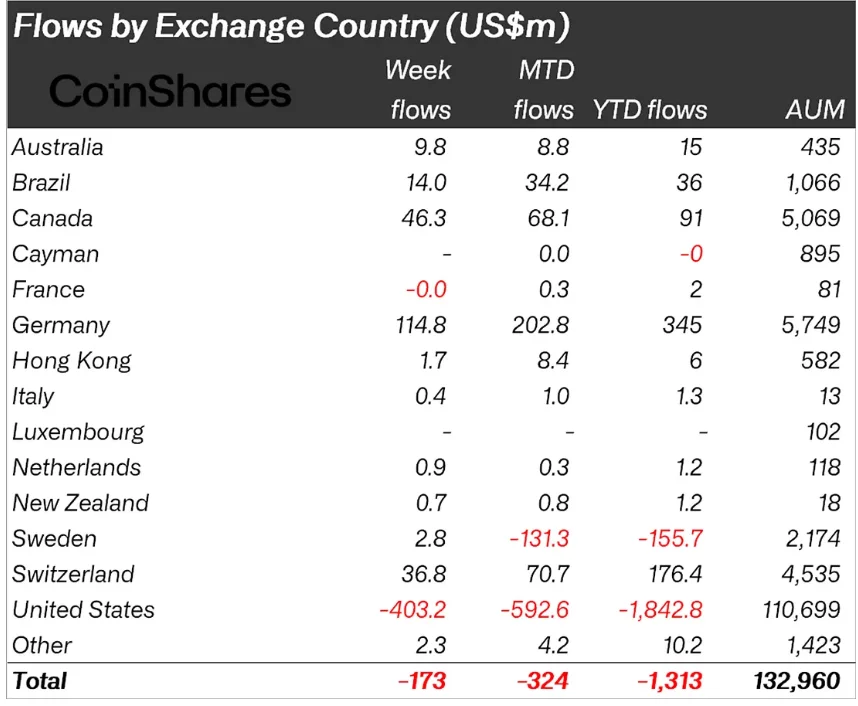

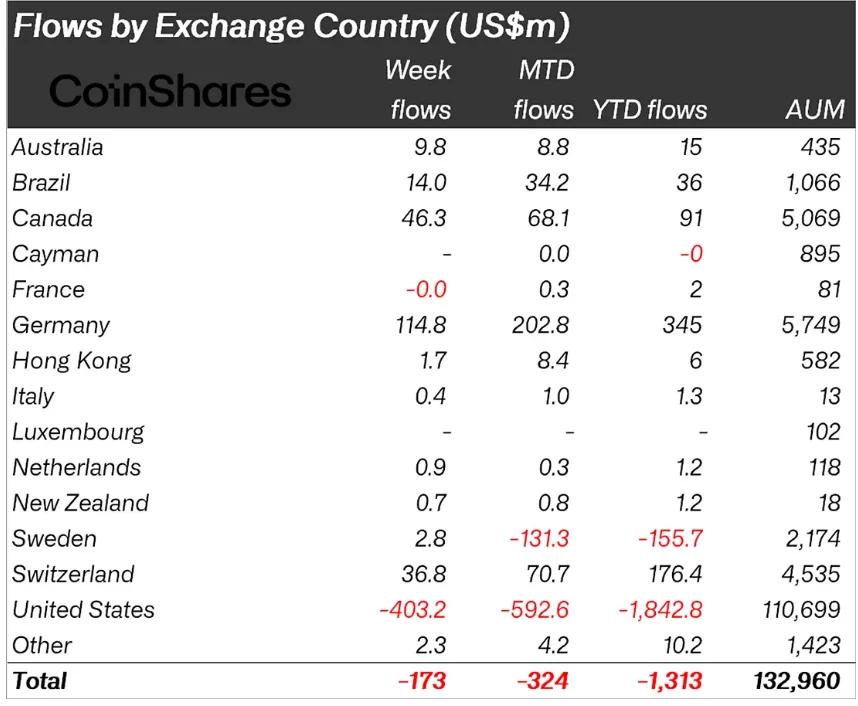

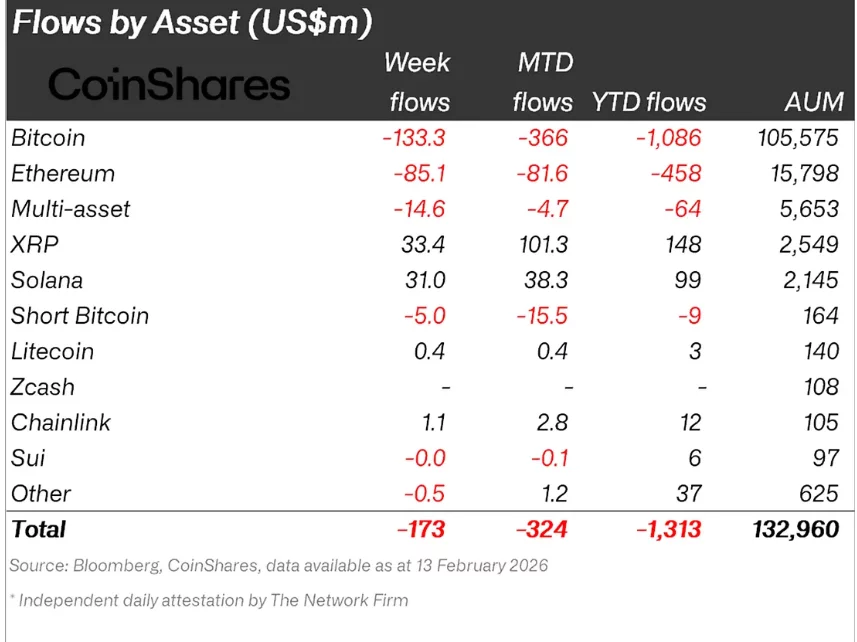

Crypto funds recorded a fourth consecutive week of outflows, with $173 million withdrawn, according to CoinShares’ latest weekly fund flows report.

Summary

- Digital asset investment products saw $173 million in outflows, marking a fourth consecutive week of withdrawals and bringing the four-week total to $3.74 billion.

- The US led the downturn with $403 million in outflows, while Europe and Canada recorded $230 million in combined inflows, highlighting sharp regional divergence.

- Bitcoin and Ethereum bore the brunt of selling, while XRP and Solana continued to attract capital.

The latest decline brings total outflows over the past four weeks to $3.74 billion, underscoring persistent investor caution amid price weakness and macro uncertainty.

The week began on a stronger footing, with $575 million in inflows, but sentiment quickly reversed. Midweek outflows reached $853 million, likely driven by further downside in crypto prices. Conditions improved slightly on Friday after weaker-than-expected US CPI data, which helped trigger $105 million in inflows.

Trading activity also cooled. Exchange-traded product (ETP) volumes fell sharply to $27 billion, down from a record $63 billion the previous week.

US leads crypto fund outflows as Europe and Canada diverge

Regional data revealed a stark divergence in sentiment. The United States accounted for $403 million in outflows, while other regions collectively posted $230 million in inflows.

Germany led with $115 million in inflows, followed by Canada ($46.3 million) and Switzerland ($36.8 million). The data suggests that while US investors remain risk-off, appetite for digital assets persists in parts of Europe and North America.

Bitcoin and Ethereum under pressure, altcoins show resilience

Bitcoin (BTC) bore the brunt of the sell-off, with $133 million in outflows last week. Ethereum (ETH) followed with $85.1 million in withdrawals.

Interestingly, short Bitcoin products also saw outflows totaling $15.4 million over the past two weeks, a pattern CoinShares notes is often observed near potential market bottoms.

In contrast, select altcoins continued to attract capital. The Ripple token (XRP) led with $33.4 million in inflows, followed closely by Solana (SOL) and Chainlink (LINK). The selective resilience suggests investors are rotating exposure rather than exiting the asset class entirely.

Despite the recent drawdown, total assets under management remain substantial, highlighting that institutional engagement in digital assets continues even amid short-term volatility.

Crypto World

Bitcoin faces quantum scrutiny as leveraged shorts eye liquidation risk zone

Bitcoin faces quantum computing scrutiny and heavy leveraged short positioning, with SOPR stabilization, ETF inflows and CME gap levels shaping whether a 10% move triggers a cascade of liquidations.

Summary

- Quantum computing risks are drawing institutional attention, raising governance and upgrade questions as ETF-driven ownership concentrates capital.

- CoinGlass maps show clustered short liquidations near 10% above spot, while CME gap zones and weekend liquidity amplify the risk of sharp squeezes.

- SOPR signals show short-term selling pressure easing and ETF flows flipping positive, hinting at a potential rebound if key trigger levels break.

Bitcoin’s potential vulnerability to quantum computing threats has drawn attention from institutional investors, while derivatives markets show concentrated short positions vulnerable to liquidation on a 10% price rally, according to market data and industry observers.

Venture capitalist Nic Carter stated that large institutional holders could pressure Bitcoin developers if potential quantum computing threats are not addressed, according to reports from Coin Bureau. The comments come as institutional exposure to Bitcoin has expanded through spot exchange-traded funds and custodial products.

Liquidation data analyzed over the weekend indicated that a significant volume of short positions would face unwinding on a 10% upside move, while substantial long positions remained exposed to liquidation on an equivalent decline, according to trader Ted Pillows, who shared the analysis on social media platform X.

Pillows’ figures showed that leveraged short positions outweighed vulnerable long positions, creating conditions where an upward price movement could trigger rapid buybacks. The analysis identified specific trigger levels that could open a path toward higher price zones, while noting a nearby area tied to a Chicago Mercantile Exchange futures gap.

CoinGlass liquidation maps reflected elevated leverage across derivatives venues, with open interest clustering around round-number strikes. The positioning followed weekend momentum periods, when reduced liquidity often amplifies price movements.

On-chain analyst miracleyoon observed that the Short-Term Holder Spent Output Profit Ratio moved below the 0.95 capitulation zone before recovering toward 1.0. The metric measures whether short-term holders sell at a profit or loss and often signals shifts in local trend behavior, according to the analyst.

The analyst stated that sustained positioning above 1.0 would imply absorbed selling pressure and could extend a technical rebound, while failure to hold that threshold would reopen range-bound conditions. The recent drawdown lacked the intensity seen on August 5, 2024, when the ratio fell toward 0.9, according to the analysis.

CryptoQuant contributor Amr Taha compared retail flows on cryptocurrency exchange Binance with institutional exchange-traded fund activity. On February 6, retail-driven sell pressure exceeded 28,000 Bitcoin, coinciding with a price drop, according to Taha’s data. A second wave on February 13 surpassed 12,000 Bitcoin, even as prices attempted stabilization.

Spot Bitcoin exchange-traded funds posted their first positive net flow day since January on February 6, according to the same analysis. BlackRock’s iShares Bitcoin Trust led with notable inflows, followed by Fidelity’s Wise Origin Bitcoin Fund, suggesting institutions accumulated holdings during periods of retail selling.

Carter framed the quantum computing issue as governance pressure rather than an immediate technical flaw, arguing that capital concentration alters power dynamics within open-source systems, according to Coin Bureau’s report. The discussions have resurfaced as more corporate treasuries and asset managers have allocated capital through regulated investment vehicles.

Analyst Teddy Bitcoins stated that the current market structure mirrored the 2022 price decline, projecting a potential substantial decline in 2026 based on chart symmetry. The thesis relied on cyclical behavior patterns rather than immediate catalysts, according to the analyst’s commentary.

The quantum risk discussion intersects with leverage imbalances and on-chain stabilization signals, reflecting different time horizons from short-term liquidations to multi-year structural considerations. Markets have absorbed these factors simultaneously, adjusting exposure across spot and derivatives venues.

Traders are monitoring whether Bitcoin prices can sustain momentum above key trigger levels to force short covering, while failure to defend nearby support levels could revive gap-fill scenarios. Developers face renewed debate over cryptographic upgrade paths as institutional ownership increases, though immediate price movements appear more likely to emerge from leveraged positioning dynamics.

Crypto World

SBI Holdings says $10B XRP talk is false, here’s what’s real

SBI Holdings has pushed back against claims circulating on social media that it holds $10 billion worth of XRP, clarifying that the figure is inaccurate and misrepresents the company’s actual exposure to Ripple.

Summary

- SBI Holdings denied holding $10 billion in XRP, correcting viral social media claims that overstated its token exposure.

- CEO Yoshitaka Kitao clarified that SBI owns around 9% of Ripple Labs, not a multibillion-dollar stash of XRP tokens.

- The company described its Ripple equity stake as a potential “hidden asset,” suggesting long-term strategic value rather than direct crypto holdings.

SBI Holdings denies $10B XRP claims

The confusion appears to have stemmed from a widely shared post stating that SBI, a long-time partner of Ripple, was a “holder of $10 billion in XRP” while expanding its footprint in Asia through the acquisition of Singapore-based crypto platform Coinhako.

However, SBI Holdings Chairman and CEO Yoshitaka Kitao publicly corrected the claim. In a reply on X, Kitao stated: “Not $10 bil. in XRP, but around 9% of Ripple Lab. So our hidden asset could be much bigger.”

The clarification makes a key distinction: SBI does not directly hold $10 billion worth of XRP tokens. Instead, the Japanese financial services giant owns approximately 9% of Ripple Labs, the U.S.-based blockchain payments company closely associated with XRP.

SBI has been one of Ripple’s most prominent strategic partners in Asia for years, backing joint ventures and promoting the use of Ripple’s cross-border payment solutions across the region. Its equity stake in Ripple Labs represents a corporate investment, not a treasury holding of XRP tokens.

Kitao’s reference to a “hidden asset” suggests that SBI views its Ripple equity stake as potentially undervalued, particularly if Ripple’s valuation strengthens following regulatory clarity and continued expansion.

The incident shows how quickly misinformation can spread in crypto markets, especially when equity investments and token holdings are conflated. The takeaway is clear: SBI’s exposure to Ripple is significant, but it is tied to ownership in the company itself, not a multibillion-dollar XRP stockpile.

Crypto World

Dogecoin and These 2 Tokens Could Trigger a Meme Coin Rally

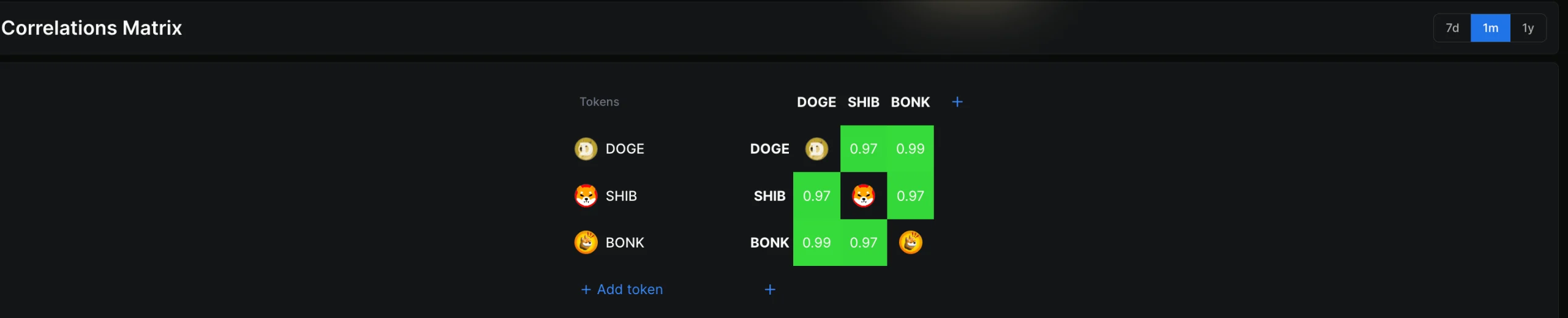

Dogecoin price may still hold the clues to whether meme coin season returns. Between February 6 and February 15, Dogecoin rallied about 47%. During the same period, the total meme coin market cap climbed by around 43%. This shows Dogecoin is still moving in step with the broader sector and continues to lead it.

Now, two of the most closely aligned meme coins, BONK and Shiba Inu, are already forming breakout patterns. Their next move may depend on whether Dogecoin confirms its own bullish structure. Together, correlation, holder behavior, and price structure suggest Dogecoin still remains the key signal for the meme coin cycle.

BONK and Shiba Inu Are Already Showing Breakout Structures

BONK and Shiba Inu currently have an extremely high correlation with Dogecoin. Correlation measures how closely assets move together.

A correlation of 1 means they move almost identically. Over the past month, BONK and Dogecoin reached a correlation as high as 0.99. Shiba Inu reached about 0.97 to 0.99 on weekly and monthly timeframes.

Sponsored

Sponsored

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This makes their price structures important early signals.

BONK is forming an inverse head and shoulders pattern on the 12-hour chart. This pattern forms when sellers lose strength and buyers gradually take control. The breakout level sits near $0.0000075. If BONK breaks above this level, the pattern projects a move toward $0.000010, which would be about a 43% rally from the neckline.

The pattern weakens with a drop under $0.0000063 and invalidates under $0.0000051.

Shiba Inu (SHIB) is forming a bullish flag pattern. A bullish flag happens when the price pauses briefly after a rally before continuing higher. The breakout level sits near $0.0000069. If Shiba Inu breaks above this level, it could rise toward $0.0000099, representing a 43% gain.

A dip under $0.0000057 can come close to invalidating the SHIB breakout theory. However, these breakouts may still depend on Dogecoin confirming its own direction.

Meme Coin Market Cap Still Follows Dogecoin’s Lead

The broader meme coin market continues to mirror Dogecoin’s movement.

Between February 6 and February 15, the meme coin market cap increased roughly 43%. Dogecoin price increased slightly more, climbing 47% during the same period.

Sponsored

Sponsored

Even after the recent pullback, the meme coin market cap has fallen only about 12.5%, holding most of its gains. This shows the overall cycle has weakened but not collapsed.

Dogecoin still dominates the meme coin sector with a market cap of nearly $17 billion, representing over 50% of the entire meme coin market, at press time. Because of this dominance, Dogecoin often determines whether meme coin rallies expand or fade.

This makes Dogecoin’s own structure the most important signal.

Holders and Whales Are Quietly Positioning Again

On-chain data shows stronger holders are increasing control while short-term traders exit.

One key metric is Spent Coins Age Band. This measures how many coins of different holding ages are being spent. When these coins move, it often means that holder cohorts are selling. When the metric falls, it shows holders are staying inactive and holding.

This metric dropped sharply from 461 million coins to 168 million coins, a decline of about 64%. Similar drops previously appeared near local bottoms.

Sponsored

Sponsored

For example:

- On February 10, the metric reached a local low. Dogecoin price then rose about 22% within four days.

- On January 26, another local low appeared. Dogecoin price rose about 6% within two days.

Another indicator called HODL Waves shows how long investors hold their coins. Short-term holders, holding coins for one to three months, reduced their share from 10.41% to 5.70%, a drop of about 45%. This shows speculative traders exited.

Meanwhile, stronger holders increased exposure. Coins held for six to twelve months increased from 10.48% to 11.22%, a 7% increase. This shows growing conviction.

Whales also accumulated. Wallets holding over one billion DOGE (the biggest whales) increased holdings from 70.56 billion to 70.84 billion coins, adding roughly 280 million coins.

This shift shows stronger hands replacing weaker ones.

Sponsored

Sponsored

Dogecoin Price Pattern Now Holds the Key Meme Coin Season Signal

Despite the recent 13% pullback, Dogecoin’s price structure remains bullish. On the 12-hour chart, Dogecoin is forming a cup and handle pattern. This pattern often appears before continuation rallies.

The cup formed between late January and early February. The current pullback forms the handle. Importantly, the handle support near $0.103 remains intact, showing buyers are still active. The key breakout level now sits near $0.117, which is also a down-sloping neckline resistance.

If Dogecoin breaks above $0.117, the pattern projects a move toward $0.180, representing roughly a 50% rally, per pattern projection. Supporting this, the Smart Money Index, which tracks experienced investor activity, remains above its signal line. This suggests larger investors have not exited.

However, risks remain. If Dogecoin falls below $0.098, the pattern would weaken. A drop below $0.091 would invalidate the bullish structure.

For now, Dogecoin price continues to hold the strongest clues for meme coin season. BONK and Shiba Inu are already preparing breakout structures.

But whether those breakouts fully develop may depend on Dogecoin confirming its own move first.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video12 hours ago

Video12 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash