Crypto World

Vitalik Buterin: You Don’t Need to Agree With Me to Use Ethereum

TLDR:

- Buterin confirms users need no alignment with his views on AI, DeFi, or culture to use Ethereum.

- He argues calling an app “corposlop” is free speech, not censorship, under Ethereum’s open framework.

- Buterin warns that pretend neutrality weakens values, urging crypto builders to state principles clearly.

- He compares Ethereum to Linux, saying a full-stack value-aligned ecosystem must exist alongside the protocol.

Ethereum co-founder Vitalik Buterin has issued a wide-ranging statement on personal views, free speech, and decentralized protocols.

He made clear that users do not need to share his opinions to participate in the Ethereum network. At the same time, he firmly asserted his right to openly criticize applications he disagrees with.

His remarks draw a firm line between protocol neutrality and individual expression within the broader ecosystem.

Ethereum Belongs to No Single Voice

Buterin opened his statement by listing several areas where he holds strong personal views. He wrote, “You do not have to agree with me on political topics to use Ethereum,” adding the same applies to his views on DeFi, AI, and even cultural preferences.

He noted that agreement on none of these topics is required to use Ethereum. This reflects the core promise of a permissionless system.

He was direct in stating that Ethereum is a decentralized protocol. As such, no single person — including himself — speaks for the entire ecosystem.

He noted that “the whole concept of permissionlessness and censorship resistance is that you are free to use Ethereum in whatever way you want.” Users are free to build and transact without seeking approval from any central figure.

However, Buterin acknowledged that his individual voice still carries weight in public discourse. He separated his personal commentary from any form of network-level control.

The distinction, he argued, is essential to understanding what decentralization actually means in practice.

Free Speech Carries Responsibility in Crypto

Buterin addressed the tension between criticism and censorship directly in his post. He stated clearly, “If I say that your application is corposlop, I am not censoring you.”

The network remains open regardless of what he says about any project. This, he argued, is the grand bargain of free speech.

Furthermore, he pushed back against what he described as false neutrality. He wrote that “the modern world does not call out for pretend neutrality, where a person puts on a suit and claims to be equally open to all perspectives.”

Instead, he called for the courage to state principles clearly and to point to negative examples when needed. Criticism, in his view, is a civic responsibility, not an attack.

He also noted that principles cannot remain at the protocol layer alone. He argued that “valuing something like freedom, and then acting as though it has consequences on technology choices, but is completely separate from everything else about our lives, is not pragmatic — it is hollow.” Staying silent on broader social questions, he said, weakens the values themselves.

The Linux Parallel and Full-Stack Value Systems

To illustrate his point, Buterin drew a direct comparison to Linux. He noted that “Linux is a technology of user empowerment and freedom,” yet it also serves as “the base layer of a lot of the world’s corposlop.” The same base layer can serve very different ends. Ethereum, he said, operates the same way.

Because of this, he argued that building the protocol is not enough. He wrote that “if you care about Linux because you care about user empowerment and freedom, it is not enough to just build the kernel.”

A full-stack ecosystem aligned with specific values must also exist alongside it. That ecosystem will not be the only way people use Ethereum, but it must remain available.

He closed by noting that the borders of any shared value framework are naturally fuzzy. He acknowledged that “it is possible, and indeed it is the normal case, to align with any one on some axes and not on other axes.” Ethereum, like Linux, will always serve many communities and value systems at once.

Crypto World

Ethereum price struggles around $2,000 “cold zone”

Ethereum price is hovering just below the $2,000 mark, a level that now feels more like a ceiling than support.

Summary

- ETH has continued to decline in recent sessions, now down 40% monthly.

- A key on-chain metric shows that Ethereum price may be bottoming.

- Technical structure remains bearish unless bulls reclaim the $2,150–$2,200 zone.

Ethereum was trading around $1,981, rising nearly 1% in the past 24 hours. Over the last week, the coin has moved in a tight band between $1,907 and $2,098, reflecting a pause after a period of heavy selling.

The market’s recent slide has been sharp. In the past month, Ethereum (ETH) has dropped about 40% and now sits roughly 60% below its August 2025 record high of $4,946. Activity is slowing down too. Spot trading over the last day totaled $22 billion, down 32% from the previous session, pointing to cooling spot activity.

Derivatives markets show similar caution. Data from CoinGlass shows that total futures volume fell 5.7% to $38 billion, while open interest dropped slightly to $23 billion, down 1.1%. When open interest falls while prices barely move, it usually means traders are cutting back on risk rather than betting on a major breakout.

On-chain data points to a cooling market

On Feb. 17, analytics firm Alphractal reported that Ethereum’s “Market Temperature” is nearing cold levels. This metric combines the MVRV Z-Score, RVT, and NUPL to assess if the market is oversold or overheated.

In the past, readings near or below zero have often signaled periods of lower speculative activity. Emotional trading wanes, valuations are reset, and unrealized gains decrease.

During previous cycles, markets that stayed in these cold zones for a while often set the stage for longer-term growth as more experienced investors gradually added to their positions.

Separately, a Feb. 16 analysis by CryptoQuant contributor CW8900 found that Ethereum whales are currently sitting on unrealized losses comparable to previous cycle bottoms.

Despite that, they have continued accumulating and now hold their largest balances on record, without having taken profits this cycle. That behavior suggests positioning for a future rally rather than capitulation.

Ethereum price technical analysis

Ethereum is stuck in the $1,900–$2,100 “cold zone.” Tiny daily candles show indecision as the price hovers just below $2,000, showing that traders are cautious.

The chart continues to print lower highs and lows, maintaining the downward trend. Earlier this year, ETH was pushed sharply down from above $3,000, confirming the sell-off, and no higher high has yet been formed to signal a reversal.

The 20-day moving average, which is also the Bollinger Bands’ middle, is above the tokens’ current value. The downward slope of the upper band, which is close to $2,650, strengthens the bearish pressure.

Momentum remains weak. The relative strength index recently fell into oversold territory near 20–25, then bounced to the mid-30s. Still, it has stayed below 50, keeping ETH in a bearish momentum phase.

There has been a slight recent price recovery from $1,800 to $1,900. The move appears to be more corrective than a true rally because there isn’t a significant bullish engulfing candle or volume surge.

Key resistance levels are $2,150–$2,200, $2,650, and $2,800. On the downside, $1,900 offers immediate support. Below that, the recent low is between $1,750 and $1,800, with $1,600 serving as the next significant support area.

If buyers can close daily candles above $2,150–$2,200 and push the RSI above 50, ETH could aim for $2,400. But if $1,900 fails to hold, the path may open toward $1,700–$1,600.

Crypto World

Gold Price Falls to a 10-Day Low

As today’s XAU/USD chart shows, the price of gold has dropped below the lows of 12 February, marking its weakest level in ten days. According to media reports, several factors are weighing on bullion:

→ Easing geopolitical tensions. Safe-haven demand has diminished amid US–Iran and Russia–Ukraine negotiations.

→ Slowing US inflation. This may be prompting traders to reassess expectations for Federal Reserve policy in 2026.

→ The holiday effect. With Presidents’ Day in the US and Lunar New Year celebrations in Asia, trading volumes have declined. In such thin market conditions, prices can become more vulnerable to speculation and abrupt moves.

On 9 February, when analysing gold price movements, we:

→ confirmed the validity of the long-term ascending channel;

→ noted that following a spike in extreme volatility at the turn of the month, the market could begin seeking a new equilibrium;

→ suggested a scenario involving a contraction in price swings on the XAU/USD chart, with the potential formation of temporary balance between supply and demand around the psychological $5k mark.

Indeed, from 9 to 12 February the market formed a consolidation zone slightly above $5k — more precisely, between resistance R1 and local support S1.

Technical Analysis of the XAU/USD Chart

A false bullish breakout (indicated by the arrow) highlighted the bulls’ inability to sustain momentum and effectively became a trap for buyers.

This, in turn, allowed bears to attempt to seize the initiative, resulting in a successful break below the S1 level. Subsequently, the breached level acted as resistance (R2).

Today’s decline on the XAU/USD chart suggests that:

→ bears remain in control, as evidenced by the break of local support S2;

→ a key argument in favour of the bulls may come from the major support at the lower boundary of the long-term channel.

In February, the market has already twice returned within the boundaries of the long-term upward channel. It cannot be ruled out that the price will remain inside it. Notably, if a decisive break above the resistance line (shown in red) occurs, this could reasonably be interpreted as a breakout of a bullish flag pattern.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Metaplanet stock falls as massive Bitcoin bet backfires

Metaplanet stock edged up just about 3% on the daily chart following the earnings release, but the broader trend remains under pressure. Despite the short-term bounce, the stock is still down roughly 37% over the past month, highlighting investor concerns over the company’s aggressive Bitcoin accumulation strategy and volatile earnings profile.

Summary

- Metaplanet stock rose about 3% after earnings, but remains down roughly 37% over the past month, reflecting continued investor caution.

- The company reported ¥8.9 billion in revenue (+738% YoY) and ¥6.3 billion in operating profit, but posted a ¥95 billion ($619 million) net loss due to Bitcoin-related valuation losses.

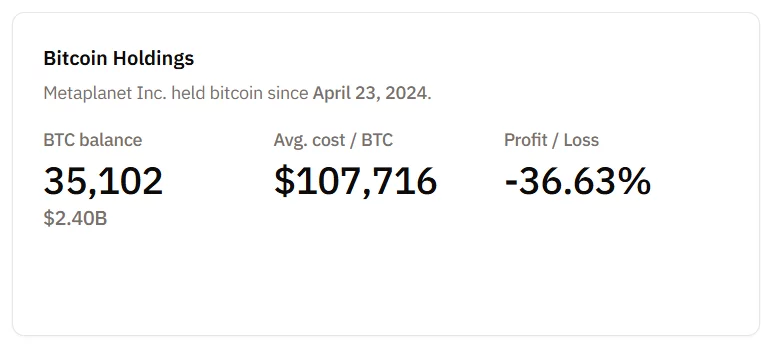

- With 35,102 BTC on its balance sheet, Metaplanet’s share price is increasingly tied to Bitcoin volatility, amplifying both gains and losses.

The Tokyo-listed Metaplanet’s stock dropped from around ¥540–¥550 levels to approximately ¥338, according to the latest monthly chart data. The sharp decline reflects market reaction to the company’s latest fiscal year results and the risks tied to its sizable Bitcoin exposure.

Metaplanet stock reacts to FY results amid Bitcoin volatility risk

In its latest full-year results, Metaplanet reported a dramatic surge in revenue, driven largely by its Bitcoin (BTC) focused operations.

For the year ending December 31, 2025, the company recorded ¥8.905 billion (about $58 million) in revenue, a 738% increase year-over-year, and reported an operating profit of ¥6.287 billion (around $41 million), up nearly 1,700% from the prior year.

Despite the strong operational performance, Metaplanet posted a net loss of roughly ¥95 billion (about $619 million), largely due to a non-cash valuation loss of approximately ¥102.2 billion (about $660 million) on its Bitcoin holdings as prices declined during the reporting period.

As accounting rules require digital asset holdings to reflect market value changes, swings in BTC prices can heavily distort bottom-line results.

Bitcoin-heavy strategy amplifies volatility

Metaplanet has rapidly scaled its crypto treasury, ending 2025 with 35,102 Bitcoin, up from just 1,762 BTC the year before, a roughly 1,892% increase, making it one of the largest corporate holders globally and the largest in Japan.

That Bitcoin stack now represents a core part of its balance sheet and revenue model, with much of its income tied to Bitcoin-related trading and yield activities.

However, the sharp correction in Bitcoin prices over recent months has turned what once were unrealized gains into deep paper losses, eroding investor confidence and weighing on the share price.

Metaplanet’s approach effectively makes the stock a leveraged play on Bitcoin itself, which has heightened market sensitivity as the crypto asset swings.

For traders and shareholders, the near-38% monthly drop underscores the risk of coupling equity valuation tightly to a volatile crypto asset, even when underlying operations are growing. Until Bitcoin stabilizes, Metaplanet’s share performance will likely continue to track broader crypto market sentiment.

Crypto World

Monero price confirms bullish reversal pattern, eyes rebound to $420

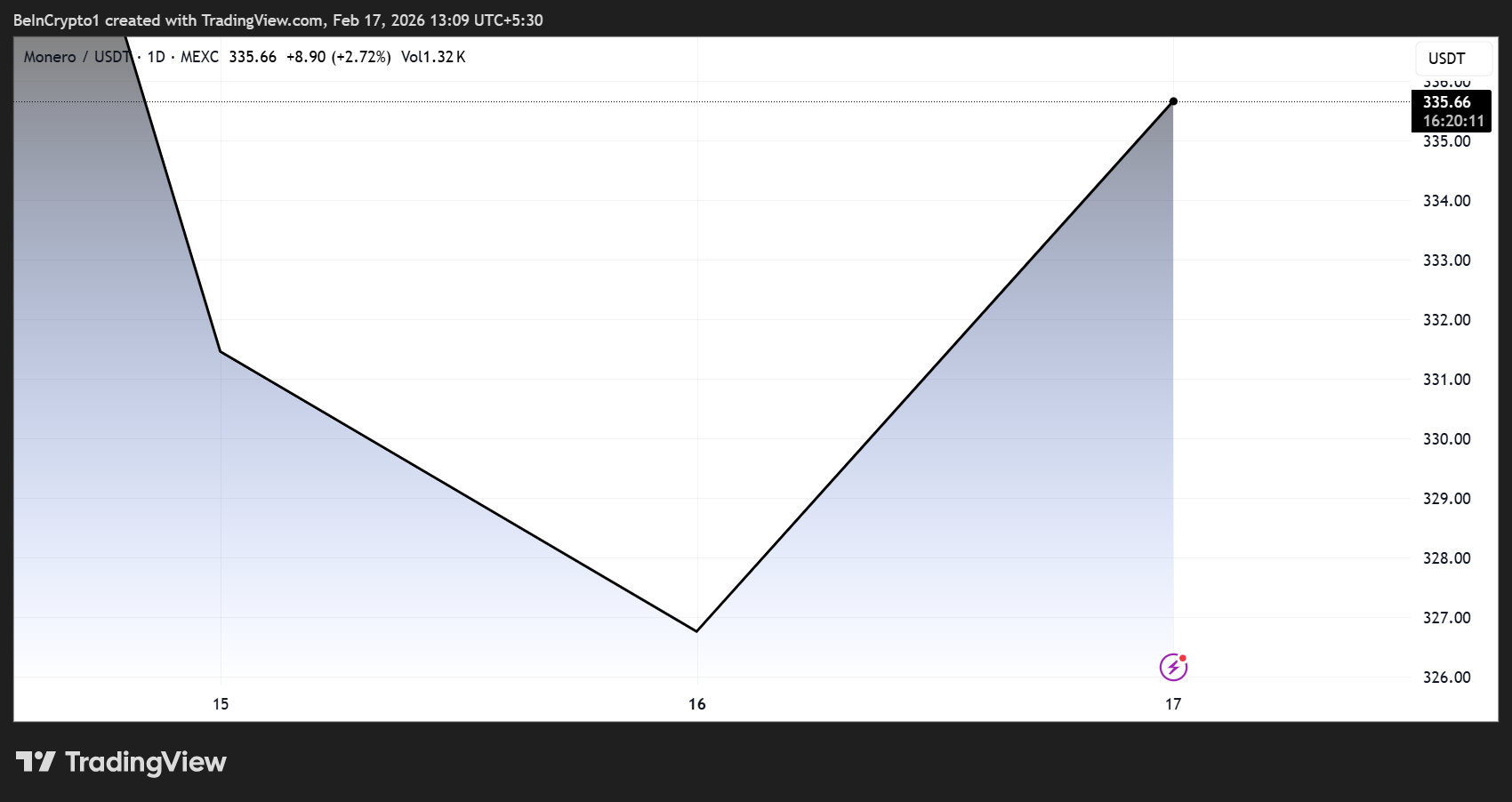

Monero price confirmed a bullish reversal pattern as dip buyers capitalized on a recent drop. XMR now eyes a potential rally to as high as $420 over the coming weeks, as demand for privacy solutions is on the rise.

Summary

- Monero price has broken out of a falling wedge pattern on the daily chart.

- Demand for privacy tokens to circumvent government surveillance, and their large-scale usage in illicit markets has been benefiting XMR.

According to data from crypto.news, Monero (XMR) price rose nearly 9% to an intraday high of $344 on Tuesday, Feb. 17, while its market cap moved back above $6.3 billion.

Dip buyers took an interest in the token after it fell to a yearly low of $284 earlier this month. While it has retraced some of the losses, XMR still lies 57% below its yearly high of $788.50.

Now, on the daily chart, Monero price has confirmed a breakout from a falling wedge pattern, one of the most popular bullish reversal patterns formed by two converging and descending lines. Historically, a breakout from such patterns has been followed by days of consistent uptrend before losing momentum.

The technical breakout gains strength from a bullish MACD crossover and an RSI that is trending close to oversold levels.

Hence, the next key resistance level for Monero lies at $381, the 200-day EMA, which would serve as the final hurdle to validate a long-term trend reversal.

Breaking above this level could offer bulls the support needed to test the psychological resistance level at $420. XMR price breakouts have stalled around this area in past market cycles.

There are multiple catalysts that are driving the Monero rebound today and could continue to act as a tailwind in the days ahead.

First, investors seem to be rotating capital from other privacy-centric tokens such as Zcash (ZEC) and Dash (DASH) as they rebalance their portfolios. Zcash, for instance, has lost much of its investor appeal after its core development team resigned last month.

Second, Monero is also benefiting from a renewed demand for privacy tokens, especially as regulators across the globe are tightening oversight. New reporting standards across many jurisdictions now require platforms to share user identities and transaction histories with authorities, which has sparked concerns over the sector’s privacy ethos.

At the same time, recent reports suggest XMR has become a popular means of payment across darknet marketplaces, where large-scale transactions are creating an additional source of demand.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Will Hyperliquid price crash as bearish crossover forms and revenue drops?

Hyperliquid price has remained in a downtrend over the past two weeks, dropping nearly 20% since its yearly high as network revenues have slumped. Will the token crash now that it has confirmed a bearish crossover?

Summary

- Hyperliquid price has fallen 25% from its yearly high.

- Bitcoin’s ongoing downtrend and a cooldown in network activity have hurt the token’s price.

- A bearish MACD crossover on the daily chart could spell more trouble for the token in the coming sessions.

According to data from crypto.news, Hyperliquid (HYPE) price fell 25% to a monthly low of $28.5 on Wednesday last week after it hit a yearly high of $37.8. It has since managed to retrace some of its losses, exchanging hands at $30.2 when writing.

Hyperliquid price has been in a downtrend due to lingering bearish sentiment in the crypto market after Bitcoin (BTC), the bellwether crypto asset, fell through multiple key psychological resistance levels one after the other, dampening investor appetite for other major cryptocurrencies.

The token’s price has fallen amid weakness in key fundamental metrics. Data from DeFiLlama shows that the weekly revenue generated by the network has dropped 55% to $11.8 million last week, while the total value locked in the platform has dropped from its yearly high of $4.7 billion to $4.24 billion.

A drop in TVL and revenue generated on the network suggests that trading activity on the exchange is cooling off. Specifically, a drop in revenue generated by the platform also lowers the total amount of capital the platform gets to buy back and burn tokens from the market. This reduction in deflationary pressure makes it harder for the price to recover while sell-side pressure remains high.

The short-term outlook for Hyperliquid price also appears to be bearish when looking at its daily chart. Notably, the MACD lines have confirmed a bearish crossover with growing red histograms signaling that selling pressure seems to overwhelm buyers.

HYPE’s daily RSI has also entered into a descending channel formation and was close to dropping below the neutral threshold. Furthermore, HYPE price was drawing closer towards the 38.2% Fibonacci retracement level at $28.4, drawn from last year’s April low to September high.

A break below this key psychological level risks a move toward $21.10. Between the bearish technical crossover and underwhelming weekly revenue, the token is trending toward the target nearly 20% lower than current prices.

On the contrary, if HYPE manages to bottom and rebound from $28.4, it could retrace back toward its yearly high of $37.8. This would likely require a broader recovery in the crypto market as well, alongside a resurgence in trading volumes on the Hyperliquid platform to drive the necessary demand.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

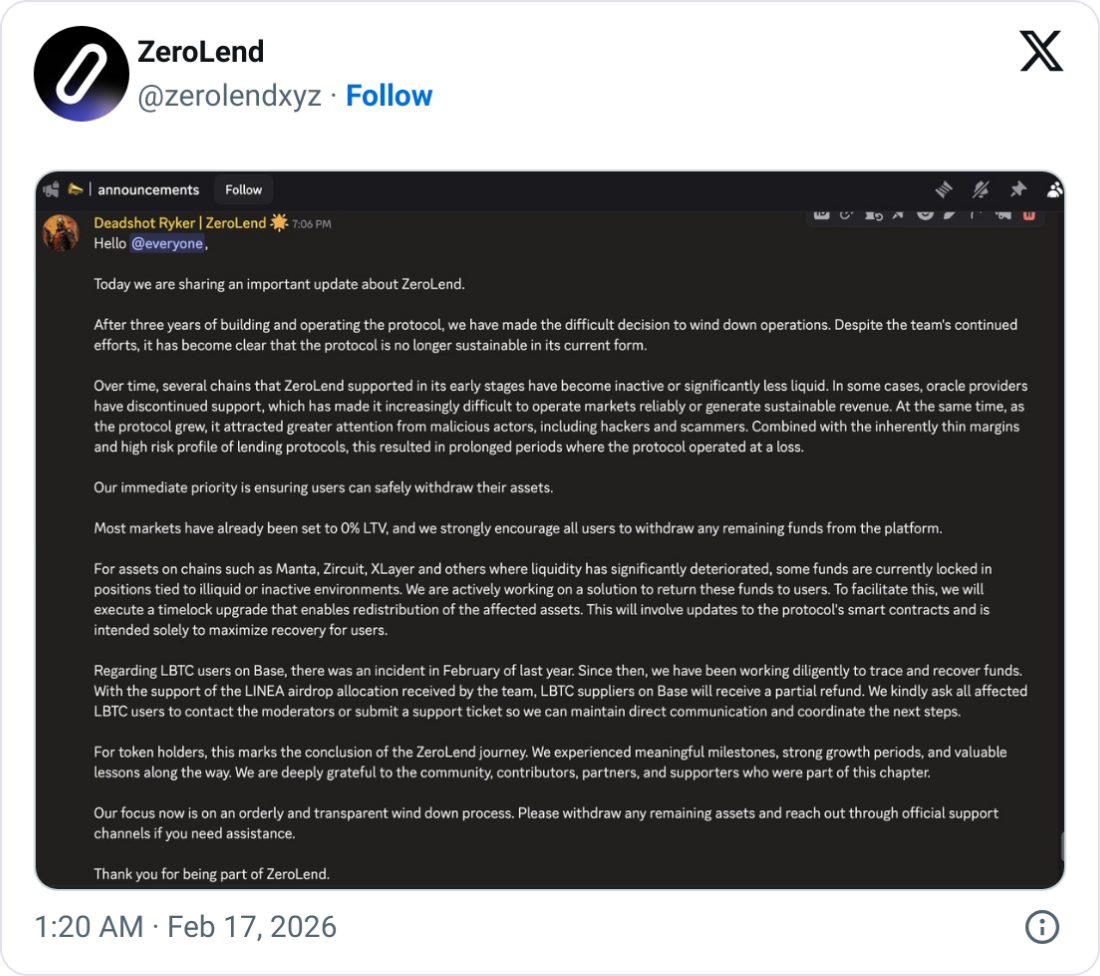

Zerolend Shutters as Founder Says It’s ‘No Longer Sustainable’

Decentralized lending protocol ZeroLend says it is shutting down completely after the blockchains it operates on have suffered from low user numbers and liquidity.

“After three years of building and operating the protocol, we have made the difficult decision to wind down operations,” ZeroLend’s founder, known only as “Ryker,” said in a post the protocol shared to X on Monday.

“Despite the team’s continued efforts, it has become clear that the protocol is no longer sustainable in its current form,” he added.

ZeroLend focused its services on Ethereum layer-2 blockchains, once touted by Ethereum co-founder Vitalik Buterin as a central part of the network’s plan to scale and remain competitive.

However, Buterin said earlier this month that his vision for scaling with layer 2s “no longer makes sense,” that many have failed to properly adopt Ethereum’s security, and that scaling should increasingly come from the mainnet and native rollups.

ZeroLend operated at loss due to illiquid chains, says Ryker

ZeroLend’s Ryker said the reason for the shutdown is that several blockchains the protocol supported “have become inactive or significantly less liquid.”

He added that in some cases, oracle providers — services that fetch data and are often crucial to running protocols — have stopped support on some networks, making it “increasingly difficult to operate markets reliably or generate sustainable revenue.”

“At the same time, as the protocol grew, it attracted greater attention from malicious actors, including hackers and scammers,” Ryker said. “Combined with the inherently thin margins and high risk profile of lending protocols, this resulted in prolonged periods where the protocol operated at a loss.”

He added that the protocol will ensure users can withdraw their assets, adding, “We strongly encourage all users to withdraw any remaining funds from the platform.”

Ryker said some user funds may be locked on blockchains that have seen “significantly deteriorated” liquidity, and ZeroLend will upgrade the protocol’s smart contracts with the aim of redistributing stuck assets.

Related: TradFi giant Apollo enters crypto lending arena via Morpho deal

He added that ZeroLend has also been working to trace and recover funds tied to an exploit in February last year, where protocol users of a Bitcoin (BTC) product on the Base blockchain were exploited after an attacker drained lending pools.

Ryker said that suppliers of the product affected by the incident will receive a partial refund funded by an airdrop allocation received by the ZeroLend team.

At its height in November 2024, ZeroLend commanded a total value locked of nearly $359 million, but that has since sunk to $6.6 million, according to DefiLlama.

The ZeroLend (ZERO) token has fallen by 34% in the last 24 hours in reaction to the protocol’s shutdown and has also lost nearly all its value since hitting a peak of one-tenth of a cent in May 2024, according to CoinGecko.

Magazine: Ethereum’s Fusaka fork explained for dummies — What the hell is PeerDAS?

Crypto World

UK crypto rules moving too slowly to secure global hub status, says FCA-registered stablecoin Issuer Agant

The U.K.’s crypto regulatory framework is moving in the right direction, but not fast enough to support the country’s ambitions of becoming a global digital asset hub, Andrew MacKenzie, CEO of sterling stablecoin developer Agant, told CoinDesk.

The government has repeatedly pledged to position London as a center for global crypto and digital asset activity. However, comprehensive legislation governing stablecoins and wider crypto activity is expected to be approved by parliament only later this year and won’t come into force until 2027.

MacKenzie said this timeline contradicts the government’s goal of remaining globally competitive within the industry.

“I think the most damaging thing today has been the time that it’s taken to get to where we are just now,” MacKenzie said in an interview at Consensus Hong Kong. “People just want clarity … If there’s anything I’d like to see from the regulators, it’s just an acceleration in the pace with which we can do things.”

The London-based company recently joined the small group of cryptoasset businesses registered with the Financial Conduct Authority (FCA) under money laundering regulations, an approval process widely regarded as one of the most stringent globally. FCA registration is a prerequisite for operating certain cryptoasset activities in the U.K., and the process has earned a reputation for being both exacting and slow.

A hard-won regulatory milestone

For Agant, which plans to issue a fully backed pound sterling stablecoin called GBPA, the registration signals institutional intent rather than a retail crypto push. The company has positioned the token as infrastructure for institutional payments, settlement and tokenized assets.

The firm maintains active dialogues with the Treasury, the FCA and the Bank of England, MacKenzie said, describing engagement as constructive, but iterative.

“There are certain aspects that we don’t like, and we’re very vocal about them,” he said, referring in part to proposed limits within the Bank of England’s stablecoin framework.

Still, he said, regulators are listening.

“The most promising aspect when we speak to regulators is the fact that they’re willing to implement changes if there’s true justification there.”

Stablecoins as a tool, not a threat

When asked if he viewed European central banks’ and U.S. private banks’ opposition to stablecoins as a problem for the future of his project, MacKenzie dismissed their concerns over financial stability and unfair competition, saying stablecoins can strengthen sovereign monetary reach.

“When you see the penny drop with central bankers, you realize that this is actually an amazing way for them to export sovereign debt,” he said. By issuing a pound-pegged stablecoin, firms like Agant could distribute digital pounds globally, increasing exposure to sterling-denominated assets and potentially lowering funding costs. “We can go and sell pounds globally,” he said. “The cost of carry for the central bank is just reduced somewhat.”

Rather than eroding sovereignty, he said, properly structured stablecoins can extend it.

For commercial banks, the concern is that if consumers hold funds in stablecoins rather than depositing them, they could lose their ability to lend.

MacKenzie rejected that premise. “I don’t think it is a valid argument. What it really brings to the table is that banks need to become more competitive.”

Credit would not disappear, he added, but could shift toward alternative providers if incumbent banks fail to adapt. In that sense, stablecoins may increase competition in financial services rather than diminish credit availability.

UK banks shift from skepticism to acceleration

Bankers in the U.K. are paying closer attention to cryptocurrency projects, MacKenzie said. Conversations have escalated up the hierarchy.

“It’s now a C-suite conversation,” he said. “There’s an exponential acceleration to banks’ adoption of blockchain technology.”

Banks increasingly recognize efficiencies in programmable reconciliation, instant settlement and cross-border interoperability, he said. Even though the transition may take decades, as it did with the shift to digital banking, momentum is building.

“The banks themselves have expressed they see this as a 30-year transition.”

If the U.K. intends to compete with faster-moving jurisdictions in Europe, the Middle East, and Asia, time may prove the most critical variable.

Whether Britain can convert ambition into leadership may depend less on regulatory design and more on how quickly policymakers move.

“Zoom out and look at the macro,” MacKenzie said. “Nothing is set in stone.”

Crypto World

New Report Sends Monero (XMR) Price Soaring 10%

The XMR price climbed nearly 10% on Tuesday following the release of a new report by TRM Labs highlighting Monero’s resilience and growing adoption in privacy-focused markets despite delistings from major exchanges.

The research sheds light on the increasing use of Monero in high-risk environments, including darknet marketplaces, while also revealing subtle network-layer behaviors that could influence real-world privacy assumptions.

Monero’s Shadow Market Growth and Network Insights Drive XMR Price Surge

As of this writing, XMR was trading for $335.66, up by nearly 10% in the last 24 hours.

Sponsored

Sponsored

According to TRM Labs, Monero’s on-chain transaction activity remained broadly stable in 2024–2025 and consistently higher than pre-2022 levels.

This trend persisted despite restrictions from leading platforms such as Binance, Coinbase, Kraken, and Huobi, which have increasingly limited access to XMR due to regulatory and traceability concerns.

“Despite exchange delistings and enforcement pressure, XMR activity on Monero remains above pre-2022 levels,” TRM Labs noted.

According to the firm’s research:

- 48% of new darknet markets in 2025 were XMR-only.

- Most ransomware payments still occur in BTC — liquidity matters.

- 14–15% of Monero peers show non-standard network behavior.

Monero’s cryptography remains strong, but network-layer dynamics can influence real-world privacy assumptions.

The report emphasizes that Monero’s resilience is not primarily driven by casual retail trading. Instead, it reflects a core user base that actively seeks privacy-preserving transactions, even when faced with higher friction, fewer on-ramps, and reduced liquidity.

Sponsored

Sponsored

Transaction volumes in 2024 and 2025 were materially higher than in early 2020–2021, indicating sustained demand rather than sporadic, speculative spikes.

This stability is particularly notable given that, according to some reports, 73 exchanges delisted Monero in 2025 alone.

As a result, liquidity for XMR is increasingly concentrated on offshore or lower-compliance venues, which partially explains why most ransomware payments still occur in Bitcoin.

While actors frequently request Monero for its privacy features, Bitcoin remains easier to acquire, move, and convert at scale.

Sponsored

Sponsored

Monero Adoption on the Rise Among Darknet Markets

Meanwhile, the report also acknowledges that Monero’s adoption in darknet markets continues to grow.

TRM Labs data shows that 48% of newly launched darknet marketplaces in 2025 now support XMR exclusively, a sharp increase compared to previous years.

This trend is especially pronounced in Western-facing markets, reflecting a direct response to enhanced tracing capabilities on Bitcoin and US dollar-backed stablecoins.

It aligns with a recent BeInCrypto report, which cited the increasing use of XMR in illegal activities.

Sponsored

Sponsored

Network-Layer Insights With Privacy in Practice

Beyond market behavior, TRM Labs conducted empirical research into Monero’s peer-to-peer (P2P) network. The analysis found that 14–15% of reachable Monero peers displayed non-standard behavior, including:

- Irregular message timing

- Handshake patterns, and

- Infrastructure concentration.

While these anomalies do not indicate protocol failures or malicious activity, they highlight how network-layer dynamics can subtly affect theoretical anonymity models, even as Monero’s on-chain cryptography remains strong.

Monero occupies a unique position in the crypto ecosystem. While transparent networks and stablecoins have become increasingly traceable and regulated, Monero continues to offer privacy-preserving functionality that appeals to users operating in high-risk or privacy-conscious environments.

TRM Labs’ findings highlight both the strengths and nuances of Monero’s privacy design. It shows that real-world usage patterns and network behavior can affect the practical efficacy of anonymity protections.

Crypto World

SBI Holdings Targets Majority Stake in Singapore Exchange Coinhako

Japanese financial conglomerate SBI Holdings is moving to deepen its presence in the crypto sector, announcing plans to take a controlling position in Singapore-based exchange Coinhako.

In a Friday announcement, the Tokyo-listed firm said its wholly owned subsidiary, SBI Ventures Asset, has signed a letter of intent with Coinhako’s parent company, Holdbuild, to inject capital into the business and purchase shares from existing investors. If completed, the transaction would give SBI Holdings a majority stake and make Coinhako a consolidated subsidiary, subject to regulatory approval.

“Bringing Coinhako into the SBI Group as a consolidated subsidiary is not merely an investment in a single platform,” chairman and CEO Yoshitaka Kitao said, describing the acquisition as part of a broader effort to build international infrastructure for digital assets, including tokenized securities and stablecoins.

Financial terms and ownership details were not disclosed, and both the structure of the investment and share purchases remain under discussion, per the announcement. The nonbinding deal would give SBI a licensed base in Singapore, one of Asia’s key regulated crypto hubs.

Related: The future of crypto in the Asia-Middle East corridor lies in permissioned scale

Coinhako operates licensed crypto trading platform in Singapore

Founded in Singapore, Coinhako operates a regional digital asset trading platform and related services through Hako Technology, a Major Payment Institution (MPI) licensed by the Monetary Authority of Singapore (MAS). The group also runs Alpha Hako, a registered virtual asset service provider overseen by the British Virgin Islands Financial Services Commission.

In 2021, SBI Holdings invested in Coinhako through the SBI-Sygnum-Azimut Digital Asset Opportunity Fund, a joint vehicle with Switzerland’s Sygnum Bank.

Coinhako co-founder and CEO Yusho Liu said the new partnership would allow the exchange to scale institutional-grade systems and meet “surging demand for tokenized assets and stablecoins, ensuring Singapore remains at the heart of the world’s next-generation financial system.”

Cointelegraph reached out to SBI Holdings for comment, but had not received a response by publication.

Related: Singapore’s ‘finance-savvy’ crypto retail prefers trust over low fees: Survey

SBI Holdings expands blockchain footprint

SBI Holdings has been active in blockchain ventures for several years, investing in tokenization projects, payment networks and crypto-related businesses.

In December 2025, SBI partnered with Web3 infrastructure company Startale Group to develop a fully regulated Japanese yen-denominated stablecoin aimed at tokenized asset markets and cross-border settlement. The token is to be issued and redeemed by Shinsei Trust & Banking, a unit of SBI Shinsei Bank, while licensed crypto exchange SBI VC Trade will handle its circulation.

In August, SBI Group partnered with blockchain oracle network Chainlink to build digital asset tools for financial institutions in Japan and across the Asia-Pacific.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi

Crypto World

Crypto exchange Kraken vows to support “Trump Accounts” in Wyoming

Crypto exchange Kraken has vowed to support President Donald Trump’s “Trump Accounts” initiative in Wyoming.

Summary

- Kraken will sponsor Trump Accounts for every child born in Wyoming in 2026.

- The program grants eligible U.S. newborns a one-time Treasury contribution, with funds invested in market index funds.

- Wyoming Senator Cynthia Lummis has welcomed the move.

According to the official announcement from Kraken, the crypto exchange will sponsor Trump Accounts for every child born in Wyoming in 2026 by making a financial contribution to each eligible account as part of the federal program.

For those unaware, Trump Accounts are a new type of tax-advantaged retirement account that allows parents or legal guardians to open and contribute funds for children under 18.

Under a federal pilot program, every U.S. citizen newborn born between Jan. 1, 2025, and Dec. 31, 2028, is entitled to a one-time $1,000 seed contribution from the U.S. Treasury. These funds are invested in eligible market index funds and grow on a tax-deferred basis until the beneficiary reaches adulthood.

“By seeding accounts for every newborn in 2026, we are backing families from day one and reinforcing Wyoming’s role as America’s home for responsible crypto leadership,” Kraken Co-CEO Arjun Sethi said in a statement.

Pro-crypto Wyoming Senator Cynthia Lummis praised Kraken’s decision to sponsor Trump Accounts in the state, adding that the investment “will ensure children in Wyoming have a financial head start.”

“I’m grateful to Kraken for their commitment to Wyoming’s next generation and to the Cowboy State’s economic future,” she added.

Kraken has not disclosed how much it will contribute to this initiative, but said the decision was driven by Wyoming’s favorable regulatory climate, where it was able to become the nation’s first Special Purpose Depository Institution under the state’s crypto-specific banking framework.

“We picked Wyoming as our global HQ because it leads with thoughtful, responsible crypto policy,” co-CEO Dave Ripley wrote in an X post.

Kraken joins Coinbase and a slew of other financial giants like JPMorgan Chase that have publicly endorsed and supported the Trump Accounts initiative.

In a similar gesture toward community support, crypto-based prediction platform Polymarket opened a temporary free grocery store in New York City, offering food assistance and pledging millions of meals for local residents.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video17 hours ago

Video17 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech5 hours ago

Tech5 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal