Politics

Ob Gyn Warns Menopause May Trigger New Mental Illness

Medical advice provided by Dr Charis Chambers, ob-gyn and Chief Medical Officer at Clue.

Menopause, which has over 60 symptoms, seems to remain a poorly-discussed topic.

90% of postmenopausal women weren’t ever taught about it, a University College London study found. Most (over 60%) only sought information about the menopause once symptoms had already begun.

And, the Royal College of Psychiatrists (RCP) has said, over three-quarters of women (78%) don’t know menopause can lead to new mental illness.

In their position statement on menopause and mental health, an anonymous source told the RCP that during a period of depression they think could have been linked to menopause, the association “was never discussed or, to my

knowledge, considered as a factor in this episode”.

Here, we spoke to ob-gyn Dr Charis Chambers about it.

How might menopause affect mental health?

Dr Charis explained, “Menopause, and even perimenopause, can unmask or worsen mental health conditions because oestrogen is not just a reproductive hormone, it is also a brain hormone.

“Oestrogen directly influences key neurotransmitters like serotonin and dopamine, which regulate mood, sleep, and emotional processing. When oestrogen levels decline or fluctuate significantly during the menopause transition, that neurochemical stability is disrupted.

“The result can be anxiety, depression, irritability, brain fog and even new-onset psychiatric symptoms in women with no prior history.”

One paper has found a link between the hormonal fluctuations linked to menopause and a higher incidence of bipolar.

Another study said that “perimenopause was associated with an increased risk of developing [major depressive disorder] and mania” for the first time.

Additionally, the depressive episodes seen in menopause seem to be different to those that happen outside of menopause. Study authors dubbed this the “Meno-D”.

Dr Charis added, “women with a history of postpartum depression, severe PMS or PMDD face a higher risk during menopause.

“These conditions signal a heightened sensitivity to hormonal shifts. If the brain has previously struggled to adapt to rapid oestrogen changes, the hormonal volatility of perimenopause can trigger similar.”

Research suggests that the hormonal and physical changes linked to the menopause and perimenopause could exacerbate existing eating disorders, or even bring about new ones, too

Davina McCall has spoken on the topic

Following the statement, Davina McCall, an RCP Honorary Fellow, said: “Some women sail through the menopause unscathed. But some don’t, and the impact on their mental health can be devastating and have a huge impact on their lives and their relationships.”

Calling the stigma and lack of education on the topic unacceptable, she added, “Together, we must make the link between mental health and menopause known across society – among health professionals, NHS, government, members of the public and employers – to improve the policies, care and support provided for all women experiencing menopause”.

Meanwhile, RCP’s President, Dr Lade Smith CBE, said: “Menopause can have a significant yet often overlooked impact on women’s mental health and wellbeing.

“Women account for 51% of the population, and all will experience menopause at some point. This is a societal issue for everyone. Simply put, we must do better.”

The NHS said that you should see a doctor if you think you’ve noticed any signs of the menopause.

Your GP can help you to find strategies, including hormone replacement therapy (HRT) and cognitive behavioural therapy (CBT).

Politics

Why Trump’s Iran Strikes Pose A Legal And Political Nightmare For Starmer

Donald Trump’s attempts to rope the UK into his attacks on Iran have left Keir Starmer trying to plot his way through a legal and political minefield.

The US and Israel launched joint strikes on Iran at the weekend, killing the country’s Supreme Leader Ayatollah Ali Khamenei.

Tehran retaliated by targeting US military bases in countries across the region and hitting back at Israel as the conflict escalates.

After rejecting an initial the US request, Starmer announced on Sunday night that he had granted America permission to use British military bases to target weapons storage facilities and missile launch sites.

The prime minister said: “The basis of our decision is the collective self-defence of longstanding friends and allies, and protecting British lives. This is in line with international law.”

However, any hope that honouring the US’s request would strength the “special relationship” was torpedoed on Monday when Trump told the Telegraph he was “very disappointed” in Starmer’s slow response.

An Iranian drone attack on the RAF’s Akrotiri base in Cyprus has also piled pressure on Starmer to green light a UK response.

The prime minister is walking a military and political tightrope as international tensions soar.

Fresh Tensions With Trump

The prime minister has been blasted for his hesitation over helping Trump in the UK.

Broadcaster Andrew Neil told Times Radio that the PM had handled this situation “very badly”, and accused him of putting international law ahead of the UK’s national interest.

“All America wanted from us was the use of the bases in Britain and Diego Garcia,” he said, saying that would have been “no skin off our nose”.

“The United States did not want us to go to war with them. They don’t need us,” Neil said. “The stupidity of that decision… allowing international lawyers of dubious providence to determine the national interest of the United Kingdom is a disaster for transatlantic relations.”

Similarly, former head of MI6 Sir Richard Dearlove told LBC: “We should have been clear cut from day one and supported the Americans and Israelis unequivocally.”

“We should have had the confidence and the moral conviction to know where our national security and defence interest best lay,” he said.

Domestic Frustrations

But Neil and Dearlove’s responses to the prime minister’s reactions do not appear to be supported by voters.

YouGov pollsters have found 50% of Brits oppose allowing the States to use RAF bases to attack Iran.

A further 45% of Brits say the government should neither praise nor condemn the US for the Iran attacks.

Around one in five (21%) want the UK to condemn the US over its actions.

The PM told MPs on Monday that his government “does not believe in regime change from the skies”, a subtle dig at the Trump administration’s apparent strategy.

The Greens – which leapfrogged Labour into second place in a new opinion poll – is clear in its opposition to the US-Israeli military action.

The party has tabled an Armed Conflicts Requirements bill to stop the UK being dragged into war abroad.

The legislation is modelled on the prime minister’s own promises from when he was running to be Labour leader, highlighting Starmer’s own flip-flopping over the years.

The conflict could also have profound economic consequences, given the world’s reliance on Middle East oil.

If global oil and gas prices increase by 20%, British inflation could go up, stunting economic growth, which has been Labour’s main mission since getting into power.

Legal Questions Loom

There could be further danger ahead for Starmer over his attempts to avoid falling into legal trouble over the strikes, too.

Dr Aurel Sari, international law expert from the University of Exeter, suggested Starmer’s legal defence “rests on a crucial distinction between offensive and defensive military action”.

“Iran, responding to the US-Israeli assault, exercised its own right of self-defence, a right it was entitled to invoke under the UN Charter given the scale of the attack on it,” he said.

“However, Iran’s strikes have not been limited to military targets, but also hit civilian infrastructure, including international airports, hotels and residential areas across the Gulf.”

Iran has launched missiles and drone attacks against targets in Israel, Bahrain, Qatar, the United Arab Emirates, Kuwait and Iraq since Saturday.

There are around 300,000 British citizens in the Gulf region.

Sari continued: “Because those attacks on civilian targets served no genuine defensive purpose, they exceeded what international law permits in self-defence.

“The government argues that this, together with Iranian drone strikes against RAF Akrotiri, entitles the UK to use force against Iran in the exercise of the right of individual and collective self-defence.”

However, Sari said this position is “highly precarious in practice”, because US military operations “do not neatly separate offensive from defensive activities”.

The same military bases operate both personnel and intelligence systems.

He warned: “If British bases inadvertently support the broader US-Israeli campaign to destroy Iran’s military and change its government, the UK’s carefully constructed legal position collapses.

“While the government has drawn a clear legal line, it may lack the ability to hold it.”

Occupying The Middle Ground In Europe

But as RUSI’s international security director, Neil Melvin, pointed out, the US’s attacks have exposed the limits of international law and a lack of enforcement – and Europe’s difficult position.

“Many have said Iran has been allowed to hide behind international law for many decades, and engage in terrorism against the United States and its allies,” Melvin said.

“So therefore it’s a slightly strange position that the Europeans have adopted – that they often seem to be upholding more the rights of regimes which are repressing their populations and conducting terrorism.

“So now we’ve seen the Europeans having to shift.”

He said Trump’s action has revealed inconsistency within Europe’s position, as Spain continues to call the strikes an illegal act, and have even asked the US forces to leave their bases in Spain.

But Germany “has come out quite firmly supporting President Trump while not necessarily agreeing with the legality of this”.

Meanwhile, Starmer is somewhere in between.

Melvin said: “The UK has been struggling to occupy a middle ground, so the longer this conflict goes on, the more these difficulties and contradictions in the European position, I think, are going to be exposed.”

The pressure is on for Starmer to hold onto the course he has set out on – no matter how convoluted it may be.

Politics

Charlotte Salomon: The Conservatives are right to defend childhood online and draw the line at 16

Charlotte Salomon has worked in political communications, and was a Conservative candidate at the 2024 Election she is now studying for the bar.

We have built a comforting story around the idea of “digital natives”.

Teenagers, we’re told, are born into technology. They understand it instinctively. They are quicker, sharper, more adaptable than the adults trying to supervise them. And so we reassure ourselves that parents can manage it at home, that the state should keep out, that young people will figure it out.

It is an attractive argument. Some say it’s a Conservative one. I disagree.

Being a digital native does not mean being digitally protected. It does not mean understanding how data is harvested, how algorithms profile behaviour, or how consent operates in law.

Fluency is not comprehension. And confidence is not consent.

That is where this debate really starts.

Kemi Badenoch is right to argue that under-16s should not be on social media. It is no surprise that public support is growing. But beneath the surface of this debate lies something deeper that we cannot afford to ignore. This is not just about screen time, culture, or whether teenagers spend too many hours indoors. It is about data. It is about law. And it is about whether we are prepared to keep pretending that children are giving “informed consent” to systems they do not, and cannot, truly understand.

When Parliament set the digital age of consent at 13 under the Data Protection Act 2018, it chose the lowest age permitted under Article 8 of the UK GDPR. Thirteen. From that birthday onwards, a child can legally consent to the processing of their personal data by online services without parental involvement.

At the time, this was presented as pragmatic. Children were already online. The law needed to reflect reality. But the digital world of 2018 is not the digital world of 2026. And even then, we were asking the wrong question.

Under UK GDPR, consent must be “freely given, specific, informed and unambiguous.” That is not a soft standard. It requires an individual to understand what data is collected, how it is used, who it is shared with, and what rights they retain.

Now ask yourself honestly: when was the last time you read a privacy policy in full? (No judgment). Consent fatigue is real, and all of us have succumbed to it at one time or another.

Now picture a 13-year-old inside an ecosystem engineered around infinite scroll, dopamine spikes, dark patterns, loot boxes, manufactured FOMO and relentless peer validation.

If we are going to talk seriously about social media and the online world, we have to understand the wider architecture of data-driven design. These platforms are not neutral public squares. They are commercial systems engineered to maximise engagement, harvest behavioural data and refine algorithmic targeting.

Children do not just use these platforms. They are manipulated to generate value for them.

They provide data they knowingly share: names, photos, messages. They emit data traces they never see: location metadata, device fingerprints, patterns of behaviour. And most significantly, they become the subject of inferred data created through algorithmic profiling. That is where the real power lies. Platforms do not simply observe behaviour. They model it. They predict it. They shape it. They monetize it.

A 13-year-old cannot meaningfully assess what it means for an AI system to construct a long-term psychological profile about them, one that influences what content they see, which products they are shown, which insecurities are targeted and which emotional triggers are most effective.

That is not informed consent. It is behavioural modelling at scale, wrapped in a tick box.

And here is where we find a deeper inconsistency in our laws.

Under contract law, minors lack full capacity. We recognise that a child should not be bound into complex commercial arrangements because they may not understand the implications.

In medical law, we go further still. We do not rely purely on age. We assess maturity under the principle of Gillick competence. We test whether there is real understanding.

Yet online, we allow a 13-year-old to bind themselves to opaque data processing agreements longer than most mortgage documents.

Why is digital autonomy treated as less serious than medical autonomy?

The uncomfortable answer is economic. Data is profitable. Children are valuable markets. Capture attention early and you shape habits that can last a lifetime. And the most dangerous part is that it is largely invisible. Data extraction does not look like harm. Algorithms do not arrive with warning labels. There is no obvious moment of damage, no visible bruise.

But after a while, the consequences begin to surface. Rising anxiety. Broken sleep. Thinning attention spans. Children who feel constantly watched, compared and judged. The NHS has opened clinics for gaming disorders. Schools report collapsing concentration. Parents describe children who simply cannot disengage.

We are getting something wrong.

It is to the Conservatives’ credit that this is now being confronted directly. Kemi Badenoch’s position recognises something simple and profoundly conservative: childhood is a protected category in British law. We draw lines around it. We set boundaries. We accept that some freedoms require maturity. So, where is everyone else?

Yes, some will call this paternalistic. But we are paternalistic in every serious area of childhood. We regulate. We set age limits. We draw lines. We do it because we understand developmental reality. We should do it here because we understand technological reality too.

The Conservative pledge to ban social media for under-16s is not radical. It is responsible. It is not nanny state politics. It is proportionate, measured, and in step with international peers. And it restores coherence to a legal framework that currently rests on a polite fiction.

A serious country protects its children. Not just in the physical world, but in the digital one too.

If we cannot draw a boundary around childhood online, then we have quietly decided that profit matters more than protecting children.

That is not a conservative position. And it is not one we should accept.

Politics

DWP jobs fair presents warmongering to out of work youth

The Department for Work and Pensions (DWP) held its first Youth Guarantee jobs fair in Blackpool. But as always with the DWP, it’s not all it seems – as the fair was packed with military and weapons manufacturers.

DWP Youth Guarantee plows on

As the Canary has previously reported, The Youth Guarantee is the department’s scheme to force young people into work. The DWP claims this is a supportive process, but it’s clear it’s to kick people off Universal Credit into low-paid jobs.

The DWP boasted that

Thousands of young people were brought together with employers today for the first ever jobs fair for the Youth Guarantee

The fair brought 94 employers to Blackpool Winter Gardens, however the first red flag is the type of employment on offer. While there were full time jobs, the DWP highlights that many were offering “apprenticeships, traineeships, work experience placements.” Translation: low or below minimum wage pay.

We also have to look at the kind of employers that the DWP were pushing on young people. While there were the Blackpool staples of the Pleasure Beach and Leyland Trucks, some were not as wholesome.

Heavy military and weapons presence

It’s almost expected that there’ll be a heavy military presence at these things by now. So naturally, the Royal Air Force and the UK Armed Forces were there to seduce working-class kids with the promise of a stable income, a roof over their heads and “duty”.

Also present were the police force, but this is the rare occasion where the police being somewhere was a good thing. It was reported by local press that the police apprehended a local man who tried to attack Blackpool South MP Chris Webb.

Even more worryingly, there were a number of companies there that have links to defence and the arms trade at the fair.

Arms giant BAE Systems was present at the fair. Last year they celebrated record profits of blood money from the Middle East and beyond.

Also in attendance was Composites UK, a trade association for

companies working in the UK’s fibre-reinforced polymer composite supply chain

However the trade body includes many composite suppliers to Israel’s deadly Elbit Systems. Some of whom were recruiting at the fair, Teledyne and Brookehouse Aerospace. Both also supply to arms companies Leonardo, BAE, and Raytheon.

These weren’t the only dangerous recruiters. The fair also included engineering giant Babcock International, “defence manufacturer” the WEC Group and CNC Robotics. DWP chief Pat McFadden can be seen high-fiving one of their creepy little robots at the start of the DWP’s propaganda video about the fair. The company also supplies robotics to the defence industry.

Also in attendance were Safran Nacelles, a subsidiary of Safran Group. They’re a major French aerospace, defence, and security company. Make UK trade association were also there, who have a defence sector offshoot. It’s “strategic partners” are a who’s who of the arms industry, with many links to Israel’s genocide including BAE, Lockheed Martin, Thales, and Pearson Engineering.

The DWP is forcing our kids into war

After the event, McFadden headed up a round-table with 16 employers from the manufacturing industry. The DWP says he “secured support” for the Youth Guarantee from these “major players”.

However of the 16 employers, 7 of them had links to war. Babcock International, Teledyne, Brookhouse Aerospace, Safran Nacelles, Make UK, WEC Group and CNC Robotics supplies were all part of the discussion.

The DWP talks a lot about wanting to “support” young people into work. However, it’s clear that their only alternative to low-paid, low-skilled work is to become a cog in a machine for war mongers and profiteers. That or be used as cannon fodder in rich men’s wars.

It might’ve been the Tories that wanted to bring back National Service, but it’s Labour who are coercing young people into the arms and military complex.

At least the Tories were upfront about wanting to force our kids to die in wars.

Featured image via the Canary

Politics

Cillian Murphy ‘Categorically’ Denies Harry Potter Voldemort Rumours

Cillian Murphy has shut down rumours that he will play Voldemort in the upcoming Harry Potter series once and for all.

The Oscar winner has long been rumoured for the villainous role ever since the TV adaptation was first announced in 2024, with original Voldemort actor Ralph Fiennes giving him his blessing.

However, when asked about the speculation in a recent interview, Cillian was definitive with his answer.

“I’m categorically not,” Cillian told The Times (or “scoffed”, as the publication writes) when asked about the Harry Potter rumours

He then quipped: “Can you make that the headline?”

This isn’t the first time Cillian has shot down rumours about playing “He Who Shall Not Be Named”, previously claiming he “didn’t know anything about” where the internet theories had come from.

“Also, it’s just really hard to follow anything Ralph Fiennes does,” he said during an appearance on Josh Horowitz’s Happy Sad Confused podcast in September 2025. “The man is an absolute acting legend, so good luck to whoever’s gonna fill those shoes”.

Besides, he added, he is too “attached to his nose” to play the flat-faced skeletal bad guy.

In December of last year, Ralph Fiennes gave a positive response to the suggestion that the Oppenheimer actor could take on the role during an appearance on Watch What Happens Live.

“Cillian is a fantastic actor. That’s a wonderful suggestion. I would be all in favour of Cillian,” Ralph said when asked his thoughts on the Peaky Blinders star playing Voldemort in the Wizarding World’s latest adaptation.

Fuelling the rumours even further, filmmaker Chris Columbus – who directed the first two Harry Potter movies – also expressed his approval for the popular fan cast choice.

“Cillian is one of my favorite actors, so that would be amazing,” the director told Entertainment Weekly in January 2025.

At present, no other actor is attached to play Voldemort in the upcoming Harry Potter series, but it has already announced an all-star cast, including John Lithgow as Albus Dumbledore, Nick Frost as Hagrid, Janet McTeer as Minerva McGonagall, and Paapa Essiedu as Severus Snape.

Cillian will next be seen in action as Tommy Shelby, reprising his iconic Peaky Blinders role in the new film The Immortal Man, which arrives in cinemas on Friday 6 March, before landing on Netflix two weeks later.

Politics

Kelly Osbourne Doubles Down On Appearance Critics After Brit Awards

Over the weekend, Kelly joined her mum Sharon Osbourne at the Brits, where they delivered a speech in honour of Ozzy Osbourne’s posthumous Lifetime Achievement prize.

On Monday, Kelly reposted another message from fellow rock star’s daughter Mia Tyler, which admonished those who would “dissect someone’s appearance instead of honouring their courage” while they are grieving.

“Public grief is not public property,” the original post read. “Grief can change a person. That doesn’t make their body a topic for debate. Before you comment on someone’s body, consider the possibility that they’re carrying something heavier than your opinion.

“It takes real strength to stand in the public eye, accepting accolades for their late iconic father and hold themselves together in front of the world. The least we can do is show the same grace in return. Kindness costs nothing. Cruelty costs character.”

Mia’s post concluded: “It’s unsettling how quickly people will dissect someone’s appearance instead of honouring their courage. If you have the energy to comment, you have the energy to be kind. Choose accordingly.”

Politics

Ties to Israel plague Democrats in top primaries post-Gaza

Israel, after a long, devastating war in Gaza, has become so unpopular among many voters in the Democratic base that major candidates in top primaries are using even small connections to the country’s political leaders to hit their opponents.

One Illinois Democratic operative involved in this year’s primaries has dredged up a 2019 trip that Illinois U.S. Senate candidate Juliana Stratton took to Israel to meet with the then-leader of the Israeli opposition Tzipi Livni. The operative, who was granted anonymity because they feared getting blacklisted from future political campaigns, went even further back citing a decade-old plus arrest warrant a British court issued related to a weeks-long conflict with Gaza that started in December 2008. And one of Stratton’s opponents has gone on the record criticizing the trip.

Livni, of course, is one of Netanyahu’s top critics and is solidly on the left in Israel. She is a vocal advocate of a Palestinian state aside a secure Israel despite support for a two-state solution in Israel falling precipitously in recent years. And she has met with numerous Democratic politicians over the years, including Joe Biden in 2010, Barack Obama in 2013 and a congressional delegation led by Nancy Pelosi in 2018.

Despite that record, Illinois Senate primary opponent Rep. Robin Kelly (D-Ill.) said that Stratton’s 2019 meeting with Livni raises questions about her leadership.

“Illinois voters believe that judgement matters,” she said in a statement to POLITICO when asked about Stratton’s Livni meeting. “Juliana Stratton owes them an explanation.”

Kelly sees her stance on Livni as one of her progressive bona fides.

“When I first ran for office I made a promise that nothing would compromise my ability to look myself in the mirror each day, and I’ve spent my career standing up and speaking out against injustice,” she said. “I’m the only candidate to call what happened in Gaza a genocide, reject AIPAC money, and refuse ICE-contractor cash.”

Kelly’s views on Israel’s conduct in Gaza have also shifted since she entered the Senate race in May. Kelly and Stratton, who is backed by Illinois Gov. JB Pritzker, are facing Rep. Raja Krishnamoorthi (D-Ill.), the frontrunner in the March 17 primary. Less than a year ago, Kelly even accepted donations from pro-Israel lobby AIPAC, and she’s been to Israel numerous times as part of congressional trips. In January, Kelly said she wouldn’t take AIPAC money again.

Even tangential ties to the longtime U.S. ally are likely to become campaign issues across the country as the conflict with Iran intensifies into a regional conflagration. All three candidates following the strikes on Iran were quick to condemn the joint U.S.-Israeli action, citing what they believed was Trump’s overreach and swift action without congressional approval. Other Democrats have voiced concern that Trump’s decision could plunge the U.S. into another protracted war in the Middle East.

A Gallup poll released Friday found that around two-thirds of Democrats sympathize more with the Palestinians with only around 20 percent saying they are aligned with Israelis, down from half of Democrats being pro-Israel in 2016. Nearly 50 percent of Democrats even had an unfavorable view of the Israeli people, while the same amount had a favorable view, according to a Pew poll taken in September.

Stratton is not the only Democratic candidate who has been criticized by rivals for ties to Israel. In the Michigan Senate race, Abdul El-Sayed has blasted rival Rep. Haley Stevens (D-Mich.) for being a vocal advocate of Israel and protesters have shown up to her office to denounce donations she’s received from AIPAC. Rep. Jasmine Crockett (D-Texas), whose Senate primary is Tuesday, has also been forced to defend herself for voting to fund defensive weapons for Israel.

Stratton, the current lieutenant governor of Illinois, went to Israel as part of the “2019 Influential Women in Leadership Delegation” organized by the America-Israel Friendship League and the Israeli Ministry of Foreign Affairs. A video from the organization shows her meeting with Livni, the former vice prime minister and foreign affairs minister.

In 2009, a British court issued an arrest warrant for Livni over accusations of war crimes in Gaza for her role during Operation Cast Lead. She was a member of the Israeli war cabinet during the conflict, which Palestinian authorities and an Israeli human rights organization said killed hundreds of Palestinian civilians.

She was supposed to give a speech in London at the time but later cancelled her trip. The warrant was withdrawn after the court found out that she wasn’t in the U.K. and the British government formally apologized to her for the arrest warrant.

She also had told Palestinian counterparts in 2007 during negotiations that even though she was the justice minister, “I am against law – international law in particular” and that “Palestinians don’t really need international law.”

Livni’s office has said she was “proud of all her decisions regarding Operation Cast Lead” and that the conflict achieved its objectives to protect Israel and restore Israel’s deterrence from Hamas rocket attacks from Gaza.

The America-Israel Friendship League, the Israeli Foreign Affairs Ministry and Livni didn’t respond to requests for comment.

Although Israel has yet to become a leading issue in the campaign, at a recent debate Stratton said she wanted to “see the suffering end” in the region and said that Netanyahu should step down.

Asked about the trip, a Stratton campaign spokesperson said in an email that the Livni meeting was “a group meeting that took place on a delegation trip promoting women in leadership coordinated by a third party – Juliana did not arrange the meeting and was one of several participants.” The spokesperson reiterated that she supports a two-state solution and “wants to see lasting peace in the region.”

This reporting first appeared in Illinois Playbook. Sign up to receive it in your inbox every weekday.

Politics

Starmer strong man act falls flat

UK PM Keir Starmer gave his best attempt to tell Trump off in the House of Commons. This comes in response to Trump’s recent jab at the British government’s supposed delay to jump on board with the war in Iran. Trump said that Starmer “took far too long” to allow the US military to use a UK base in Cyprus.

Of course, just hours after Starmer publicly announced that permission had been granted, the base was attacked in retaliation for facilitating the US invasion of Iran. And, it must be noted, this is a war which many ex-military officials in the US have already labelled “illegal.”

So, when Starmer’s ‘rebuke’ of Trump did come, it fell rather flat.

Starmer strong man act falls flat

Stating that the US President has ‘expressed his disagreement’ with the UK, the weak PM attempted to look strong by justifying his decision as one of British national interest. Starmer said:

The lessons of history have taught us that it is important when we make decisions like this, that we establish there is a lawful basis for what the United Kingdom is doing.

That is one of the lessons from Iraq, and that there’s a viable thought-through plan with an objective that can be achieved or has a viable prospect of being achieved.

He continued:

This government does not believe in regime change from the skies.

But, it does believe in assisting US-led regime change via supplying airbases?

This belated ‘strong man’ impression offered by Starmer has been received as the damp squib it is. After all, the human rights barrister-turned-leader has had no problem supporting his allies in their numerous war crimes. He has been perfectly happy shielding war criminals responsible for a genocide against Palestinians.

Pressure from MAGA

However, this bravado exposes how impossible it is to have a diplomatic relationship with the demagogue US President. It is well known how Trump uses economic and military warfare to get his own way, highlighting the terrifying precedent being set by the rogue president for ‘diplomacy’.

Now our government is under pressure by the MAGA administration to get involved with their illegal war on Iran, it is more important than ever that we demand a divergence from the US. It cannot be understated that this aggression threatens chaos and suffering across the region, a chaos will undoubtedly and deservedly reach our shores.

Keir Starmer, “President Trump has expressed his disagreement with our decision not to get involved in the initial strikes”

“But it is my duty to judge what is in Britain’s national interest”

“That is what I’ve done and I stand by it”

— Farrukh (@implausibleblog) March 2, 2026

It’s clear Starmer is going to great pains to differentiate between offensive and defensive military actions. But, the fact the UK is involved at all makes Starmer’s so-called ‘challenge’ to Trump look pathetic.

Iran has the right to retaliate under international law to threats posed against its sovereign territory. With our diplomatic cover and spineless behaviour, the UK is supporting the existential threat Iran faces from the US and Israel. Ignoring that, the UK Prime Minister appears to apply international law selectively – invoking and interpreting it in ways that shield the United States and Israel from accountability.

“Special relationship” under strain

Like a child throwing his toys out of the pram as per usual, Trump has already retaliated. He stated today that our relationship is now strained, indicating the cost that comes through legitimising Trump’s rogue, illegal and escalating decisions:

US President Trump has lashed out at Britain’s PM Starmer for refusing to back Washington’s war against Iran, warning that the so-called “special relationship” now faces strain.

🔴 LIVE updates: https://t.co/mSvQSyvKdN pic.twitter.com/c7YsJNdxVM

— Al Jazeera English (@AJEnglish) March 3, 2026

Our own Joe Glenton wrote in February about just how occupied we are by the US, signaling the tightrope and danger we are in if Trump is allowed to keep ignoring the rule of law. He wrote:

The UK is even more of a US military colony than we thought. New documents found in the US War Department’s website show that Britain hosts double the number of American military facilities previously reported.

Glenton finished with a vital rallying cry:

The truth is that Britain is a vassal state and colony of the United States. We say the UK would better off if it was not. US bases, troops and spies need to go.

Ordinary people thankfully can recognise legality better than our barrister PM. One X account commented on Starmer’s woefully manipulative speech, pointing out the legally obvious:

I’m just gonna leave this here.

UN Charter:

“Under international law, the UK can be held responsible if it permits its territory to be used by another state to commit an “internationally wrongful act” (such as an illegal war) if it has knowledge of the circumstances.”

It’s hard to believe Starmer doesn’t know this is illegal, especially due to his maneuvering and apparent discomfort with involvement in offensive actions. Maybe the UK PM is only happy with one illegal bombing campaign at a time, having been complicit in the genocide and heavily funded by the Israel lobby. Needless to say, his pushback to Trump is really just semantics and wordplay.

Curtis Daly pointed out on X just how easy this decision should have been:

So he should have told Trump to piss off when he asked to use our military bases. Starmer is complicit. https://t.co/RWI06XUTIq

— Curtis Daly (@CurtisDaly_) March 2, 2026

Careful the company you keep, Starmer

This horrific war of aggression that has already killed hundreds of Iranians and wounded hundreds more has to be the wake-up call for allies of the US. The US is falling, it is in its final days after repeatedly decimating any respect previously afforded to it. It being allowed to maintain control of the world order will put all countries on the backfoot, whilst prioritising the interests that Trump serves: the super-rich and powerful.

This aggressive US world order will undoubtedly escalate, and it has never been more objectively clear that a thug sits in the White House. If we don’t want Trump’s angry, bloodthirsty glare to fall on the UK we must urge our spineless PM to actually object to the US and Israel’s unaccountable war on Iran.

Featured image via the Canary

Politics

‘Hold the Line on Rosebank’ – campaigners target parliament as oil field decision looms

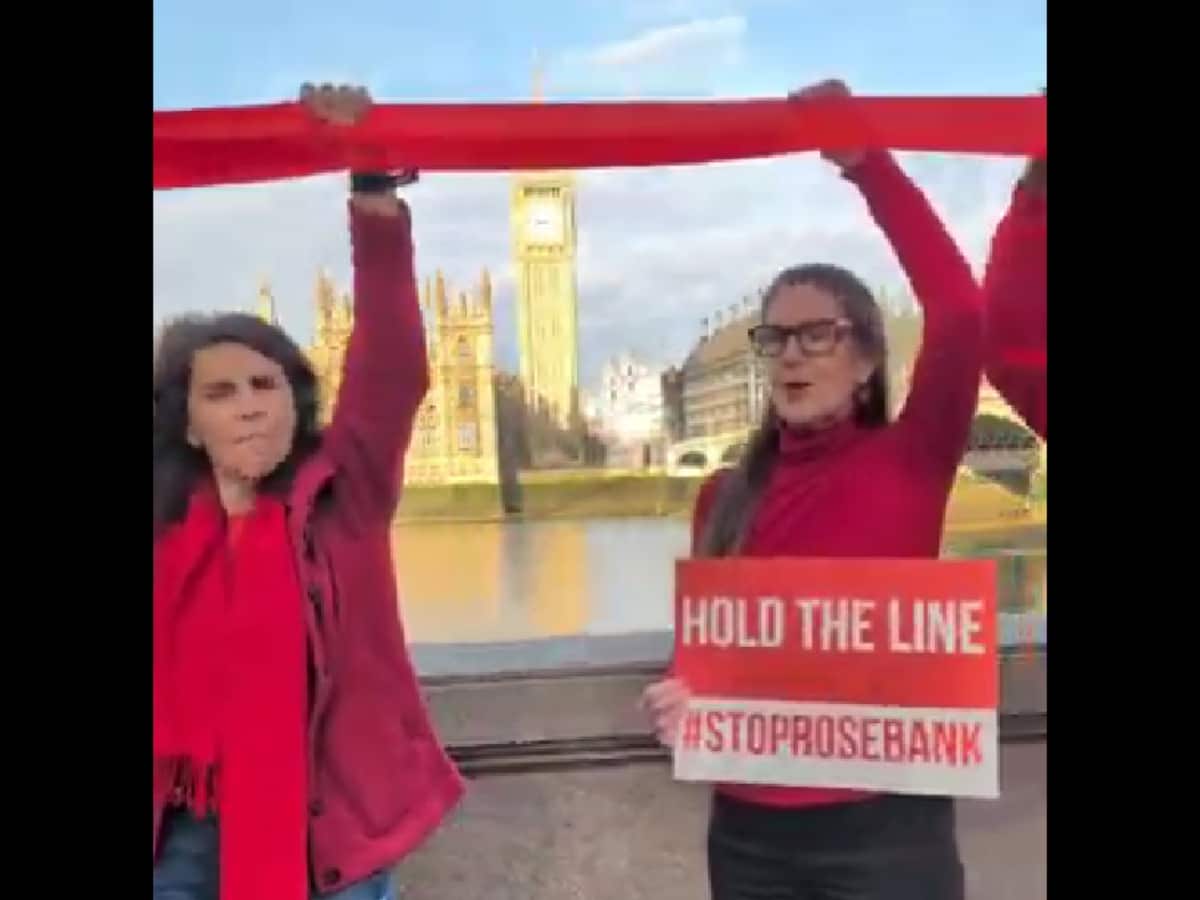

Campaigners from Fossil Free London formed a human red line along the riverbank directly across from Westminster on 3 March. All dressed in red, they held a long red ribbon and signs reading ‘Hold the Line’ and ‘Stop Rosebank’.

The demonstration comes as the government prepares to decide the fate of the Rosebank oil field. It’s the largest undeveloped oil field in the North Sea. However, the Scottish courts overturned its original approval in January 2025.

The court ruling demanded that the project’s primary owner, Norwegian state oil giant Equinor, provide a fuller assessment of the project’s climate impacts before any approval could proceed. Critics argue that burning Rosebank’s total reserves would produce more carbon dioxide than the world’s 28 lowest-income countries emit in a year combined. Also, the vast majority of the oil would go for export. So it wouldn’t be lowering UK energy bills or improving energy security.

The Rosebank development would also hand substantial tax relief from the public purse to Equinor. Equinor’s profits flow largely into Norway’s sovereign wealth fund. A share of profits would also go to the Delek Group, an Israeli fuel conglomerate. The UN has flagged this company for human rights violations in Palestine.

Joanna Warrington, spokesperson for Fossil Free London, said:

Whilst people across the country are watching their bills skyrocket and extreme weather events and climate disasters fill their phone screens: our government stands at a crossroads.

At this point in climate collapse, approving any new oil and gas project is tantamount to climate denial. It is like a doctor diagnosing a patient with lung cancer and handing them a cigarette.

A red line must be drawn. Kier Starmer, stop Rosebank.

Featured image via Fossil Free London

Politics

Frictionmaxxing: What It Means, And How To Try It

If TikTok is anything to go by, it seems the kids are “frictionmaxxing” (and by the kids, I mean gen Z – a generation of people anywhere from 14-29 years old).

The term, which was coined by author Kathryn Jezer-Morton in an article for The Cut, has gained some fans online.

And it ties into younger people’s increasingly analogue habits, like writing letters to one another and making reading cool again.

Though the term is new, a decades-old interview with author Kurt Vonnegut seemed to echo its principles. So, I gave it a try.

What is “frictionmaxxing”?

It’s about taking away the, well, frictionless ease of digital life and deliberately replacing it with less convenient, but more “human”, options.

The author wrote, “Friction-maxxing is not simply a matter of reducing your screen time, or whatever.

“It’s the process of building up tolerance for ‘inconvenience,’” which she stresses usually isn’t actually a lack of control over the problems of living among other people.

Some examples include not sharing your location with friends, so they have to ask where you are instead, not using large language models to answer your questions, and loosening the reins on your kids.

Jazer-Morton argued that friction is different to suffering. Joy is part of the point.

“An orientation toward friction is really the only defence we have against the life-annihilating suction of technologies of escape,” she wrote.

This idea might not be entirely new

“Frixtionmaxxing” reminded me of Kurt Vonnegut’s envelopes.

Speaking to PBS, the writer spoke about the time his wife asked why he went out to buy individual envelopes instead of just buying a stack to keep on hand.

“I pretend not to hear her. And go out to get an envelope because I’m going to have a hell of a good time in the process of buying one envelope,” he said.

“I meet a lot of people. And, see some great-looking babes. And a fire engine goes by. And I give them the thumbs up.”

The inconvenience, for him, was not just the point, but the joy of the trip.

For her part, Jazer-Morton said that “frictionmaxxing” should increase our tolerance of effort that isn’t strictly necessary, “reaching even toward enjoyment”.

Years before mass AI use, Vonnegut said, “the computers will do us out of that”.

I took a small step towards “frictionmaxxing” and was instantly convinced

All of which to say, I began “frictionmaxxing” by getting bits and bobs from my local store throughout the week rather than relying on an online order.

Not only did that mean I got to enjoy some of this month’s sunshine (finally!), but it also meant I felt much more connected to the world around me than I would otherwise.

I overheard some interesting arguments on the street and saw a terrible first date. I saw some very sweet goslings (picture above), noticed some heartening blossoms, and even got inspiration for an article about chocolate theft.

Since then, I’ve got my screen time down, begun reading more, and gotten back into crochet. I’ve even penned some letters and planned more IRL meetups.

Studies tell us that spending more time outdoors, having even surface-level interactions with other people, reading, and creating everything from meals to blankets, is good for us.

But I don’t think anyone who tries “frictionmaxxing” will need all that much proof. Already, I feel my self-esteem and sense of connection growing.

Politics

LIVE: Spring Statement 2026

Guido will be live-blogging throughout, so refresh the page for the latest updates. Not a pretty economic picture as Reeves stands at the despatch box…

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Tech2 days ago

Tech2 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Politics5 hours ago

Politics5 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business7 days ago

Business7 days agoTrue Citrus debuts functional drink mix collection

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports3 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoPolice latest as search for missing woman enters day nine

-

Entertainment1 day ago

Entertainment1 day agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Crypto World7 days ago

Crypto World7 days agoEntering new markets without increasing payment costs

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers