Business

Reeves says her plan is working as growth forecast cut for this year

Business

Five questions with Non-UPF Verified’s Megan Westgate

CEO says all CPGs in the center of the store are “under consideration.”

Business

Plantible scaling Rubi Protein development

Food technology startup receives “no questions” letter.

Business

‘Bone’ Bomber Strikes Deep in Iran Amid 2026 Conflict

The U.S. Air Force’s B-1B Lancer, nicknamed the “Bone,” has surged back into the spotlight with its high-profile strikes deep inside Iran as part of Operation Epic Fury, the ongoing U.S.-led campaign against Iranian military infrastructure in early March 2026.

On March 2, 2026, U.S. Central Command confirmed that B-1B Lancers flew nonstop from Ellsworth Air Force Base in South Dakota to target ballistic missile sites and command-and-control centers in Iran. The mission, involving multiple bombers, marked a shift from initial stealth B-2 Spirit operations to the Lancer’s high-payload, supersonic capability, signaling established air superiority and the ability to deliver massive conventional ordnance.

The deployment underscores the B-1B’s enduring role as a long-range strike platform amid escalating tensions. Here are 10 essential facts about the B-1B Lancer in 2026:

1. **Supersonic Speed and Massive Payload** — The B-1B reaches Mach 1.25 (about 900 mph at altitude) and carries up to 75,000 pounds of ordnance — the largest conventional payload in the Air Force inventory. It can haul 24 AGM-158 JASSM standoff missiles, JDAMs, cluster munitions or hypersonic weapons in ongoing upgrades.

2. **Variable-Sweep Wings for Versatility** — Its swing-wing design allows swept-back configuration for high-speed dashes and forward extension for low-altitude efficiency and loiter time, blending speed, range and maneuverability.

3. **Crew and Design Origins** — Four crew members — pilot, copilot and two weapon systems officers — operate the variable-geometry bomber, originally developed in the 1970s as a low-level nuclear penetrator before shifting to conventional missions post-Cold War.

4. **Key Specifications** — Powered by four General Electric F101-GE-102 afterburning turbofans (30,000+ pounds thrust each), it spans 137 feet with wings extended (79 feet swept), measures 146 feet long, stands 34 feet high, and has a maximum takeoff weight of 477,000 pounds with intercontinental range.

5. **Recent Upgrades for Modern Threats** — The Air Force pursues the “Super Bomber” configuration in 2026, including the Load Adaptable Modular (LAM) pylon program restoring external hardpoints for 50% more standoff weapons and integration of hypersonic missiles like the AGM-183A, bridging to the B-21 Raider.

6. **Combat Proven Across Decades** — The B-1B debuted in combat during the 1991 Gulf War and supported operations in Afghanistan, Iraq, Libya, Syria and recent 2026 actions in Venezuela and Iran, often flying ultra-long missions with aerial refueling.

7. **Ellsworth and Dyess Squadrons** — Active units operate from Ellsworth AFB, South Dakota, and Dyess AFB, Texas. The March 2 Iran strikes launched directly from Ellsworth, demonstrating transcontinental reach without forward basing initially.

8. **Non-Stealth but Survivable Design** — While lacking full-aspect stealth like the B-2, the B-1B incorporates reduced radar cross-section features and excels in post-air-defense-suppression environments, as seen in Epic Fury after initial B-2 strikes cleared threats.

9. **Long-Range Missions Highlight Endurance** — Recent Iran sorties lasted up to 37 hours round-trip with refueling, showcasing the bomber’s global strike capability. U.K. approval for Diego Garcia and RAF Fairford basing now shortens future missions.

10. **Bridge to B-21 Raider** — With about 45 airframes in service as of 2026, the B-1B serves as a high-volume “bomb truck” until the stealth B-21 fully replaces it around 2036-2038, maintaining U.S. long-range bomber capacity amid peer threats.

The B-1B’s involvement in Operation Epic Fury — following B-2 strikes — highlights its role in degrading Iran’s ballistic missile arsenal after air defenses were neutralized. Analysts note the transition to the Lancer allows sustained, high-volume precision strikes once superiority is achieved.

As the conflict widens, the “Bone” remains a cornerstone of U.S. power projection, blending Cold War origins with modern upgrades for 21st-century warfare.

Business

Chris Lansing to lead seaweed snack company

Co-founders will continue to be actively involved in the company.

Business

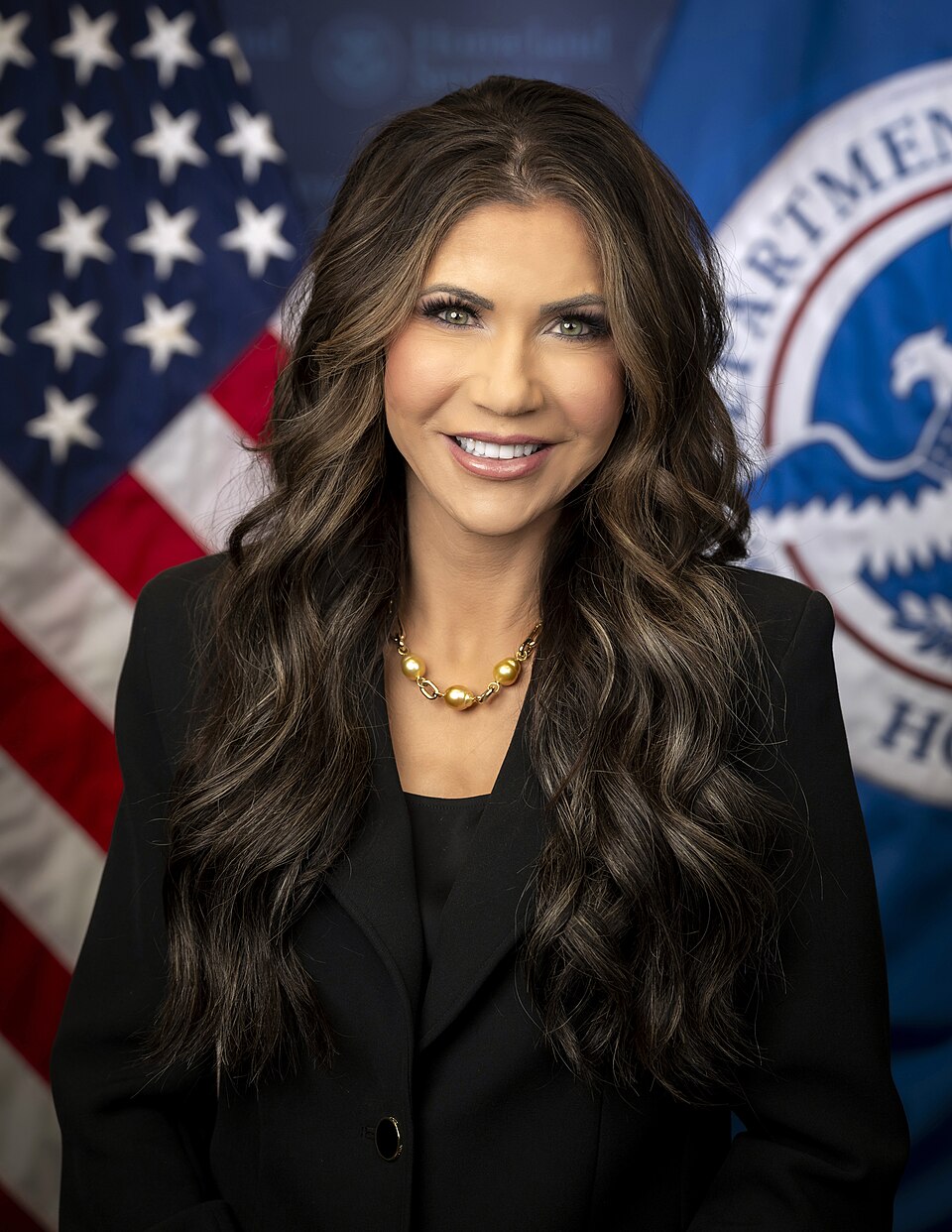

Protesters Removed from Senate Hearing Amid Grilling Over Minneapolis Deaths

WASHINGTON — Two protesters were removed from a Senate Judiciary Committee hearing on March 3, 2026, as Homeland Security Secretary Kristi Noem testified for the first time since the fatal shootings of two U.S. citizens during federal immigration operations in Minneapolis sparked widespread outrage and calls to reform or abolish ICE.

The disruptions occurred during Noem’s oversight appearance before the committee, chaired by Sen. Chuck Grassley, R-Iowa, with ranking Democrat Sen. Dick Durbin of Illinois leading questioning. The session focused on the Trump administration’s mass deportation agenda, DHS funding amid a partial shutdown threat, heightened border security measures and the deadly incidents in Minnesota that have galvanized opposition to aggressive enforcement tactics.

The first interruption came moments before Noem delivered her opening statement. As she was sworn in and prompted by Grassley, a protester stood and shouted, “Kristi Noem, you should be ashamed of yourself!” and “Abolish ICE!” Capitol Police officers quickly escorted the individual from the room. Video footage shared by Fox News, APT and other outlets captured the brief chaos, with the demonstrator yelling as they were led out.

A second protester was removed shortly after, during questioning by Durbin. As the senator pressed Noem on accountability for deaths caused by immigration agents, the individual rose and shouted about “Americans killed by ICE” and accused Noem of failing to deliver justice to grieving families. The protester was swiftly removed, allowing the hearing to resume without significant delay.

Noem, the former South Dakota governor confirmed as DHS secretary in early 2026, defended the department’s actions in her prepared remarks. She touted “historic results” under President Donald Trump’s second term, including record deportations, enhanced border security and efforts to combat threats from Iran amid ongoing military operations. She described the Minneapolis incidents as tragic but emphasized that officers faced threats and that enforcement operations target criminal activity, not peaceful protesters.

The deaths involve Renee Good, shot by an ICE officer on Jan. 7, 2026, during what DHS described as a routine enforcement action, and Alex Pretti, killed on Jan. 24 by Customs and Border Protection officers while filming operations. Both were U.S. citizens, fueling protests in Minnesota and demands from local leaders for DHS to halt operations in the state. DHS has denied wrongdoing, stating agents acted in self-defense or under threat, though investigations continue.

Grassley acknowledged “mistakes have been made” in interactions but stressed the difference between protected speech and obstruction, noting officers should not face harm while enforcing laws. Durbin pressed Noem on transparency, use of force policies and whether the administration’s rhetoric contributed to a “hateful America,” accusations Noem rejected as mischaracterizations of lawful enforcement.

The hearing unfolded against broader tensions: a partial DHS funding lapse, resistance to mass deportations and the ongoing U.S.-Israel strikes on Iran that have heightened homeland security alerts. Noem highlighted border successes and threats from foreign adversaries, but Democrats focused on civilian casualties and civil rights concerns.

Social media amplified the disruptions, with clips from Fox News, NBC News and The Independent circulating widely. Reactions split along partisan lines: supporters praised Noem’s composure and called protesters disruptive, while critics hailed the interruptions as necessary accountability for what they termed excessive force.

Capitol Police handled the removals efficiently, with no arrests reported as of late afternoon March 3. Such outbursts are common in high-profile hearings on immigration, echoing past disruptions during debates over border policy.

Noem’s testimony marked her first major congressional appearance since confirmation, following limited December questioning. The session continued into the afternoon with exchanges on funding, Iran-related threats and immigration enforcement protocols.

As the hearing progressed, attention shifted to policy questions, but the early protests underscored deep divisions over the Trump administration’s immigration agenda and its human costs. Noem maintained that DHS prioritizes safety and rule of law, while opponents demanded reforms to prevent future tragedies.

The committee plans follow-up sessions if needed, with potential votes on DHS appropriations looming amid the funding impasse.

Business

Blackstone’s Gray defends world’s largest private credit fund

Jon Gray, President and COO of Blackstone, speaks during the Axios BFD event in New York City, U.S., October 12, 2023. REUTERS/Brendan McDermid

Brendan Mcdermid | Reuters

Blackstone president Jon Gray on Tuesday defended the quality of loans within the firm’s flagship private credit fund after investors pulled nearly 8% from it in the last quarter.

The alternative asset management giant said in a late Monday filing that it allowed investors to withdraw 7.9% of BCRED, which it calls the largest private credit fund in the world, with about $82 billion invested. Blackstone did so in part by allowing the firm’s own investors to plow $150 million into the fund.

The move sparked a sell-off in Blackstone shares, which fell as much as about 8.5% in morning trading Tuesday, as well as in other private credit peers.

“When you think about credit quality, the 400-plus borrowers here, they had 10% EBITDA growth last year,” Gray told CNBC’s David Faber, using a term referring to a company’s financial performance. “So when we look at this, we feel pretty darn good.”

Instead of calming markets, recent moves by alternative asset managers to allow investors to cash out of funds have only added to jitters around private credit and loans to the software industry. Last month, the storm intensified when Blue Owl said it found buyers for $1.4 billion of its loans, in part to help cash out 30% of an embattled credit fund.

Now, with the far larger asset manager Blackstone being swept up in it, concerns around private credit seem to be broadening.

“We’ve had a ton of noise,” Gray told CNBC. “As you guys know better than anybody in the press, this has become a story.”

Concerns were first triggered last fall with the collapse of Tricolor and First Brands, firms that also received funding from banks, the Blackstone executive noted.

“There’s a constant spin cycle, and so when that’s happening, it’s not a surprise that investors can get nervous,” Gray said. “Financial advisors can say, ‘Hey, I want to redeem.’”

A Blackstone spokesman said the firm and its employees’ investment in BCRED was “about meeting 100% of requests for the quarter with certainty and timeliness. They underscore our conviction in BCRED and alignment with its investors.”

The fund delivered 9.8% annualized returns since inception for Class I shares, the spokesman said.

Business

Key Aircraft in Operation Epic Fury

WASHINGTON — The joint U.S.-Israeli military campaign against Iran, dubbed Operation Epic Fury by the United States and Operation Roaring Lion by Israel, has featured an extensive array of fighter jets since strikes began Feb. 28, 2026. U.S. Central Command (CENTCOM) and the Israel Defense Forces (IDF) have employed fifth-generation stealth fighters, fourth-generation multirole aircraft and electronic warfare platforms to achieve air superiority, suppress defenses and conduct precision strikes on Iranian ballistic missile sites, command centers, air defenses and naval assets.

As of March 4, 2026, more than 1,250 targets have been hit in Iran during the operation’s first week, with fighter jets playing a central role alongside long-range bombers like the B-2 Spirit and B-1B Lancer. The campaign has involved coordinated waves of aircraft from U.S. carriers in the Arabian Sea and Mediterranean, forward-deployed bases in the Middle East, and direct missions from the United States.

Here are the primary fighter jets confirmed in use during the strikes, based on CENTCOM releases, IDF statements and open-source reporting:

1. **F-35 Lightning II (U.S. and Israel)** — The fifth-generation stealth multirole fighter has been a cornerstone of operations. U.S. Air Force F-35As from the 48th Fighter Wing at RAF Lakenheath and Vermont Air National Guard, plus Marine Corps F-35Cs from the carrier USS Abraham Lincoln, conducted strikes and suppression of enemy air defenses (SEAD). Israel deployed its F-35I Adir variant — known as “Mighty One” — in large numbers, with reports of up to 670 sorties targeting missile systems and leadership. The F-35’s low observability enabled initial penetrations against Iranian radars.

2. **F-22 Raptor (U.S.)** — About a dozen F-22s from Joint Base Langley-Eustis, Va., deployed to Israel ahead of the operation, marking the first combat deployment there. Additional Raptors went to RAF Lakenheath. As air superiority fighters, they escorted strike packages, engaged potential air threats and maintained dominance over Iranian airspace. CENTCOM photos showed F-22s in theater by late February.

3. **F-15 Variants (U.S. and Israel)** — U.S. Air Force F-15E Strike Eagles provided multirole strike capability, though three were lost to friendly fire over Kuwait on March 2. Israel used F-15s to launch standoff missiles, including Black Sparrow air-launched ballistic missiles, against deep targets. The F-15’s range and payload supported extended missions.

4. **F-16 Fighting Falcon (U.S. and Israel)** — Dozens of U.S. F-16s, including Wild Weasel variants for SEAD, operated from regional bases. Israel’s F-16s contributed to the initial wave destroying air defenses in western Iran. The multirole fighter’s versatility aided in precision strikes and drone intercepts.

5. **F/A-18 Super Hornet (U.S. Navy/Marines)** — Carrier-based F/A-18E/Fs from the USS Abraham Lincoln and USS Gerald R. Ford launched with heavy loads, including AGM-154 Joint Standoff Weapons. Video from CENTCOM showed Super Hornets taking off for strikes. The platform’s flexibility supported naval integration in the Gulf.

6. **EA-18G Growler (U.S. Navy)** — Electronic attack variants jammed Iranian radars and communications, suppressing defenses during strike waves. Growlers, based on the F/A-18, operated from carriers and provided critical electronic warfare support.

Israeli Air Force operations involved 200-300 fighter jets in the opening hours, establishing air supremacy over Tehran and western Iran. The IDF claimed strikes on hundreds of targets, including missile launchers and command sites, with fighter jets operating with impunity after neutralizing defenses.

U.S. forces amassed about 30 F-35s in the region pre-operation, alongside F-22s, F-15Es and F-16s. Carrier strike groups provided additional F/A-18s and Growlers. Support aircraft like E-3 Sentry AWACS, P-8 Poseidon maritime patrol and KC-135 tankers enabled long-range missions, while MQ-9 Reapers and new LUCAS one-way attack drones supplemented strikes.

The campaign’s air component has drawn from lessons of prior operations, emphasizing stealth, standoff weapons and electronic warfare to minimize risk. Iranian retaliation — including ballistic missiles and drones — has been intercepted by Patriot, THAAD and fighter patrols, though incidents like the F-15 losses highlight operational hazards.

As strikes continue into the second week, fighter jets remain pivotal in maintaining pressure on Iranian capabilities while U.S. officials signal operations could extend weeks. The mix of platforms underscores the integrated, multi-domain approach defining modern air campaigns.

Business

Poland stocks lower at close of trade; WIG30 down 4.35%

Poland stocks lower at close of trade; WIG30 down 4.35%

Business

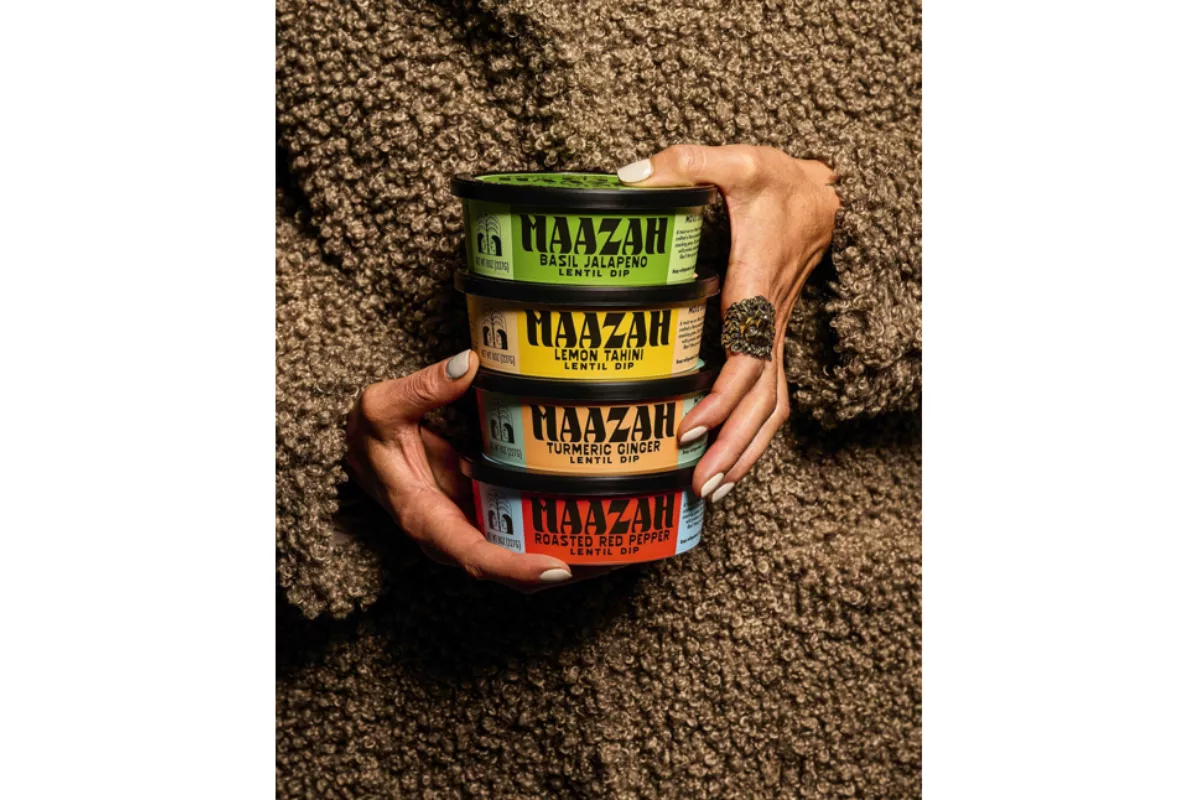

Maazah dips into funding

.webp?t=1742304584)

Middle Eastern-inspired dips, sauces startup raises $2 million.

Business

PepsiCo unveils protein-packed Doritos

The chip line features 10 grams of protein per serving.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Iris Top

-

Politics9 hours ago

Politics9 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business7 days ago

Business7 days agoTrue Citrus debuts functional drink mix collection

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat3 days ago

NewsBeat3 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech7 days ago

Tech7 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat3 days ago

NewsBeat3 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat2 days ago

NewsBeat2 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat7 days ago

NewsBeat7 days agoPolice latest as search for missing woman enters day nine

-

Entertainment1 day ago

Entertainment1 day agoBaby Gear Guide: Strollers, Car Seats

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech4 days ago

Tech4 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

Crypto World7 days ago

Crypto World7 days agoEntering new markets without increasing payment costs