Business

Analysts from Fortrade Review the Summit from a Financial Point of View

When the World Economic Forum met in Davos in January 2026, most people in financial markets were not waiting for any big announcement.

Davos has not worked like that for years. What it does is show how the people who influence money, policy, and capital are thinking at that moment.

The meeting, held from 19 to 23 January under the theme “A Spirit of Dialogue,” took place at a time when the global situation still feels uncomfortable. Inflation has eased in some places, but not enough to make central banks relaxed. Growth is holding in parts of the world and slowing in others. Debt remains high, and trade has become more political.

For financial markets, this continues to matter because tone shapes behaviour. Analysts at Fortrade, operating under FCA regulation, follow these discussions closely to see whether confidence is building or fading. Davos often quietly influences expectations, without anyone officially saying that anything has changed.

The wider background also remains important. The Global Risks Report published before the meeting remains important because it speaks directly about fragmentation and geoeconomic confrontation, and that language does not stay confined to formal documents. It appears in the way leaders talk about trade, technology, and security, shaping the broader narrative around risk. Investors notice this shift in tone and gradually factor it into how they interpret uncertainty and long-term market exposure.

Geopolitics and Market Confidence

Geopolitical risk was not treated as a distant issue at Davos in 2026. It was discussed as something that affects daily decisions. Reuters reporting showed that investors are now paying much more attention to political developments when pricing risk, partly because recent disputes and tariff threats have had very real market effects.

One example was the volatility linked to U.S. tariff threats connected to Greenland. It was a reminder that political signals can move currencies, equities, and commodities very quickly. These moves are not always logical in the short term, but they influence sentiment for much longer.

Analysts at Fortrade noted that these episodes tend to stay in traders’ minds. Even after prices stabilise, risk perception does not fully return to where it was. Over time, this changes how much investors are willing to pay for future earnings, particularly among those using short- and day-trading strategies.

Economic Resilience and Structural Debate

Discussions about growth at Davos were careful, and there was no strong sense that 2026 was being framed as a year of rapid recovery. Most forecasts pointed to moderate expansion, including a United Nations projection of global growth of around 2.7%, well below the pre-pandemic average, as reflected in the World Economic Situation and Prospects 2026 outlook. It suggests that the world economy is holding together but without enough momentum to generate sustained optimism.

In this kind of environment, markets tend to move in subtle and uneven ways rather than through strong, broad rallies. Investors become more selective about where they place capital, paying closer attention to balance sheets, policy signals, and longer-term sustainability. Many day traders become more cautious and focus on protecting capital rather than chasing fast moves. Fortrade news and market analysis page provides a broader market context and ongoing commentary, which helps traders follow major economic and policy developments without relying on unreliable sources.

Speakers at the forum also repeatedly returned to structural issues such as demographics, labour market adjustment, and inflation management. They mentioned that these slow-moving factors continue to shape interest-rate expectations and valuation models over time, explaining why markets in 2026 have remained cautious despite signs of economic resilience.

Central Banks and Policy Signals

Central bank credibility came up repeatedly in related coverage during Davos week. Policymakers spoke about independence and stability, especially as political pressure increases in some countries.

For markets, this is not theoretical. When central banks are seen as reliable, currencies tend to be more stable and bond markets calmer. When that credibility is questioned, volatility rises quickly.

Although no official policy announcements were made at Davos, the general message was clear. Monetary authorities are not in a hurry to change direction. Fortrade is a well-established broker that offers access to multiple markets through reliable trading conditions and stable platforms. The firm continues to factor this environment into how it supports traders and market participants.

Trade, Supply Chains, and Global Coordination

Trade and supply chains were discussed in practical terms throughout Davos, reflecting how costly recent disruptions have been and how companies and governments are still adjusting. It was reported that trade maps are changing as countries respond to earlier tariff measures and geopolitical pressure, with diversification and regionalisation emerging as common themes. These shifts affect markets gradually, as costs, margins, investment flows, and currency movements adjust over time rather than all at once.

Davos 2026 did not produce major agreements and functioned mainly as a platform for discussion, where leaders acknowledged that global cooperation is under strain and that new systems are still evolving. Instead of presenting clear solutions, they focused on managing complexity and adapting to long-term uncertainty.

How Davos Connected to Market Behaviour

After the summit, markets did not react sharply. There was no clear “Davos rally” or sell-off. Currencies moved slowly, and equity sectors moved unevenly.

This response itself was meaningful. Traders treated Davos as confirmation, not as a trigger.

Fortrade analysts observed that the main value of Davos 2026 was in showing how policymakers and business leaders were thinking about risk, growth, and stability when they were not trying to impress markets. That thinking influences behaviour over time. And behaviour is what shapes prices.

Davos still matters mainly because it shows how people with real influence are thinking about the months ahead, even when nothing dramatic happens at the time.

Business

Boring Company selected for Universal Orlando underground transit

Elon Musk’s Boring Company unveils underground tunnel

Elon Musk’s The Boring Company has been selected to begin negotiations for a proposed underground transit system connecting Universal Orlando’s parks, following a vote by the Shingle Creek Transit and Utility Community Development District Board.

During its Feb. 11 meeting, the board authorized staff to enter contract negotiations with The Boring Company after determining its proposal best met the district’s request for an “innovative, future-ready, point-to-point solution.”

The project is intended to support transportation infrastructure improvements, including the planned Sunshine Corridor and transit needs tied to expansion around Universal Orlando.

The decision does not finalize a contract.

PILOT PROGRAM AT MAJOR AIRPORT TRACKS MOVEMENT, APPROVES INTERNATIONAL FLYERS’ IDENTITY

An all-electric Tesla travels inside a tunnel 40 feet beneath the Las Vegas Convention Center. (Ethan Miller/Getty Images)

Any agreement would still require board approval, and officials said they will evaluate the project’s operational and financial feasibility before moving forward.

Fox 35 Orlando reported that the proposed underground transit system is intended to ease congestion along International Drive by linking Universal’s existing theme parks and CityWalk with Epic Universe, which opened last year.

The local station said the board’s vote comes after months of speculation and a competitive process that included proposals from other firms, such as Glydways.

The entrance portal welcomes guests during a preview day for Universal Epic Universe in Orlando on April 5, 2025. (Patrick Connolly/Orlando Sentinel/Tribune News Service via Getty Images)

While some competitors pitched elevated guideway systems designed to reduce construction time, the district ultimately opted to pursue an underground concept similar to The Boring Company’s “Vegas Loop” in Nevada.

TESLA ATTACK IN LAS VEGAS ‘CERTAINLY HAS SOME OF THE HALLMARKS’ OF TERRORISM, FBI OFFICIAL SAYS

A Tesla drives through the Las Vegas Convention Center Loop during a media preview on April 9, 2021. (Ethan Miller/Getty Images)

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

“I think it would be a new opportunity to lessen traffic load and good for visitors as well,” said resident Scott Heinz, according to Fox 35.

Mary Walters-Clark, another resident, said the move could help ease congestion during peak hours by giving visitors an alternative to navigating heavy traffic and allowing them to better manage their time.

Business

Lazard Enhanced Opportunities Portfolio Q4 2025 Commentary

Lazard Asset Management delivers world-class investment solutions and long-term value for their clients. When clients partner with Lazard, they gain a trusted advocate committed to championing their success and helping them achieve their unique ambitions. Note: This account is not managed or monitored by Lazard Asset Management, and any messages sent via Seeking Alpha will not receive a response. For inquiries or communication, please use Lazard Asset Management’s official channels.

Business

Diamond Hill Select Strategy Q4 2025 Portfolio Review

Diamond Hill Capital Management, Inc. is a wholly owned subsidiary of Diamond Hill Investment Group, Inc. Diamond Hill Investment Group is a publicly traded company, and its shares trade on the NASDAQ (Ticker: DHIL). Note: This account is not managed or monitored by Diamond Hill Capital Management, and any messages sent via Seeking Alpha will not receive a response. For inquiries or communication, please use Diamond Hill Capital Management’s official channels.

Business

Democrats willing to spend tens of millions to reshape Virginia voting maps, top lawmaker says

Democrats willing to spend tens of millions to reshape Virginia voting maps, top lawmaker says

Business

Nebius: AI Discount Bin

Nebius: AI Discount Bin

Business

Victory Sycamore Small Company Opportunity Fund Q4 2025 Commentary

Victory Sycamore Small Company Opportunity Fund Q4 2025 Commentary

Business

BlackRock Global Equity Market Neutral Fund Q4 2025 Commentary

BlackRock Global Equity Market Neutral Fund Q4 2025 Commentary

Business

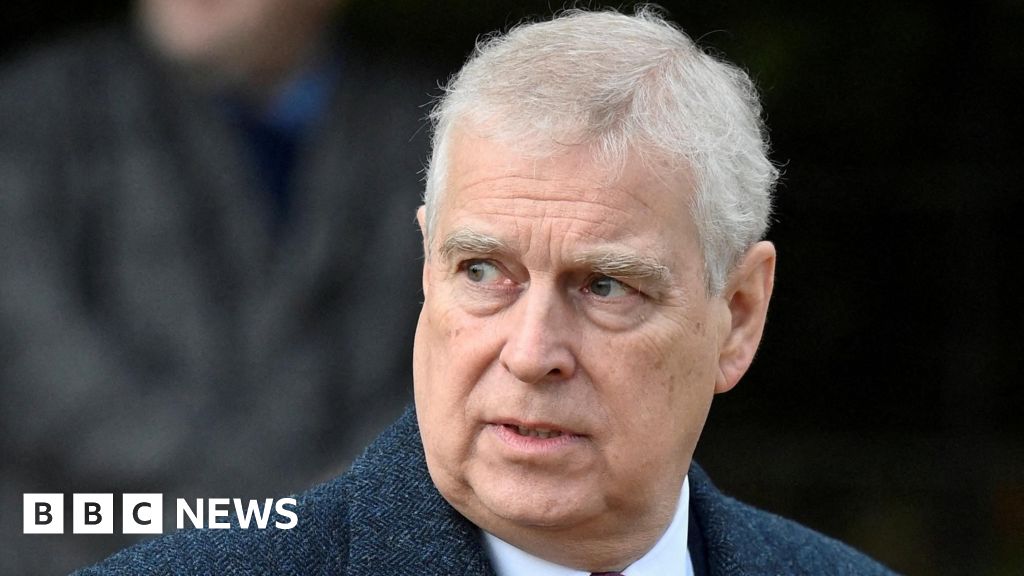

Andrew's time as trade envoy should be investigated, says Vince Cable

The former prince’s alleged actions were “totally unacceptable”, the ex-business secretary says.

Business

Trump told Netanyahu in December he would support Israeli strikes on Iran’s missile program, CBS News reports

Trump told Netanyahu in December he would support Israeli strikes on Iran’s missile program, CBS News reports

Business

Touchstone Dividend Equity Fund Q4 2025 Commentary

At Touchstone Investments, we recognize that not all mutual fund companies are created equal. Our commitment to being Distinctively Active means the employment of a fully integrated and rigorous process for identifying and partnering with asset managers who sub-advise our mutual funds and advocating a robust approach to portfolio construction that either uses standalone active strategies or serves as a complement to passive strategies. That is the power of Distinctively Active.

Touchstone Funds are offered nationally through intermediaries including broker-dealers, financial planners, registered investment advisors and institutions by Touchstone Securities, Inc. For more information please call 800.638.8194 or visit www.touchstoneinvestments.com

Specialties

Touchstone Investments helps investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific area of expertise.

Touchstone Securities Inc. is a registered broker-dealer and member FINRA and SIPC Note: This account is not managed or monitored by Touchstone Investments, and any messages sent via Seeking Alpha will not receive a response. For inquiries or communication, please use Touchstone Investments’s official channels.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech17 hours ago

Tech17 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 hours ago

NewsBeat2 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business3 days ago

Business3 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market