Europe’s biggest defence contractor reports record earnings of £3.32bn for 2025, up 12%

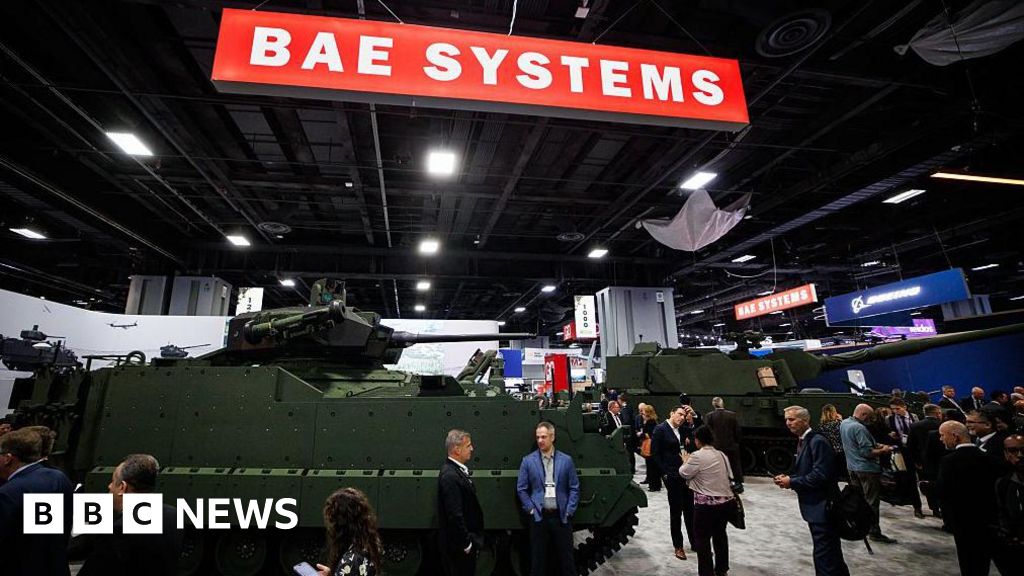

BAE Systems has broken records with its annual results, buoyed by a surge in global defence expenditure amid ongoing geopolitical instability.

Europe’s largest defence contractor posted better-than-expected underlying earnings before interest and taxes of £3.32 billion for 2025, a 12% increase on the previous year, as sales soared 10% to an all-time high of £30.66 billion.

The aerospace and arms manufacturer revealed its order backlog also reached a record £83.6 billion at the end of December, whilst its order intake was £36.8 billion.

Chief executive Charles Woodburn said: “In a new era of defence spending, driven by escalating security challenges, we’re well-positioned to provide both the advanced conventional systems and disruptive technologies needed to protect the nations we serve now and into the future.

“With a record order backlog and continuing investment in our business to enhance agility, efficiency and capacity, we’re confident in our ability to keep delivering growth over the coming years.”

The company anticipates further expansion in 2026, albeit at a more moderate rate, forecasting underlying earnings growth of between 9% to 11% and sales to increase by between 7% and 9%.

BAE – which manufactures a range of weaponry from missiles and artillery systems to tanks, aircraft and warships – has benefited from a worldwide uptick in defence spending, particularly as Europe re-arms itself.

In the UK, Prime Minister Sir Keir Starmer indicated earlier this week that Britain must “go faster” in boosting military expenditure and is reportedly considering bringing forward plans to allocate 3% of UK gross domestic product (GDP) to defence.

BAE highlighted significant contracts last year including an agreement with Turkey for 20 Typhoon aircraft, anticipated to be worth £4.6 billion to the company and sustain 20,000 UK jobs, alongside an order from Norway for Type 26 frigates.

BAE shares climbed 4% during Wednesday morning trading, having increased by nearly a fifth since the beginning of 2026 alone and more than tripling since Russia’s invasion of Ukraine in 2022, which triggered a surge in defence expenditure globally.

Richard Hunter, head of markets at Interactive Investor, suggested BAE’s stronger-than-expected results demonstrate the “unfortunate sign of the times that defence stocks are squarely back in fashion, as governments around the world look to protect their interests and lands from growing tensions”.

He continued: “The geopolitical backdrop is a reminder that brittle relationships are seemingly never far away, ranging from potential and actual conflicts in the likes of Venezuela, between China and Japan and Russia and Ukraine.

“The backdrop has led to a number of governments pledging a higher percentage of GDP to defence spending over the next decade, which in turn means that opportunities remain within the burgeoning defence sector.”

BAE employs some 12,000 people at its Warton and Samlesbury sites in Lancashire and said it had seen “significant success across its combat air business in the region” Over the year it recruited 1,225 people to work at the the two sites.

Other key UK sites include its submarine bases in Barrow-in-Furness, its munitions site at Glascoed in Wales, its advanced technology plants in Dorchester and Filton, digital intelligence bases in Bristol, Gloucester and Christchurch, and its air sector base in Brough in East Yorkshire.