Business

Coles Defends Pricing Practices in Federal Court, Denies Misleading Shoppers

Coles is locked in a court battle with the Australian Competition and Consumer Commission (ACCC) and denies misleading shoppers with its pricing practices.

ACCC previously accused Coles of breaching the law with its “Down Down” promotion.

Coles Denies Misleading Customers

According to a report by The Guardian, ACCC accused Coles of offering “illusory” discounts on many common household products.

However, Coles denies doing this and claims that the promotional prices it offered are genuine discounts.

“What they would be concerned with when they’re walking down the aisle trying to work out what to buy today for their shopping is whether the claimed discount … was fair dinkum,” John Sheahan KC. Sheahan represents Coles in its federal court battle.

“So long as the was price is a genuine price, not contrived or ephemeral, then the consumer’s interest is appropriately satisfied,” he added.

ACCC’s Argument

According to ABC News, ACCC used three prices Coles charged on a tin of dog food to show that the supermarket chain has been misleading shoppers.

Between April 2022 and February 2023, the supermarket offered a 1.2 kilogram loaf of Nature’s Gift Wet Dog Food for $4, said ACCC legal counsel Garry Rich.

The price then went up by 50 per cent to $6 after. This lasted for seven days. On the eighth day, it went down to $4.50, a promotion that Coles labelled as “Down Down.”

This third price is 13 per cent more than the initial $6 shoppers were previously paying for the same product.

“It did not disclose that a reasonable consumer would not have understood that Coles had increased the price to $6 for just seven days, immediately before the promotion, and that for 296 days before that, the price was $4,” ACCC’s legal counsel argued.

However, Sheahan dismissed the argument by saying, “In the end, all prices are temporary. Nothing lasts forever.”

Business

Northrop Grumman: Underwhelming Growth Today, F/A-XX Win Could Change The Story (NYSE:NOC)

Dhierin-Perkash Bechai is an aerospace, defense and airline analyst.

Dhierin runs the investing group The Aerospace Forum, whose goal is to discover investment opportunities in the aerospace, defense and airline industry. With a background in aerospace engineering, he provides analysis of a complex industry with significant growth prospects, and offers context to developments as they occur, describing how they might affect investment theses. His investing ideas are driven by data informed analysis. The investing group also provides direct access to data analytics monitors.

Learn more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Global stocks steady as US-Iran talks, AI keep market on edge

Global stocks steady as US-Iran talks, AI keep market on edge

Business

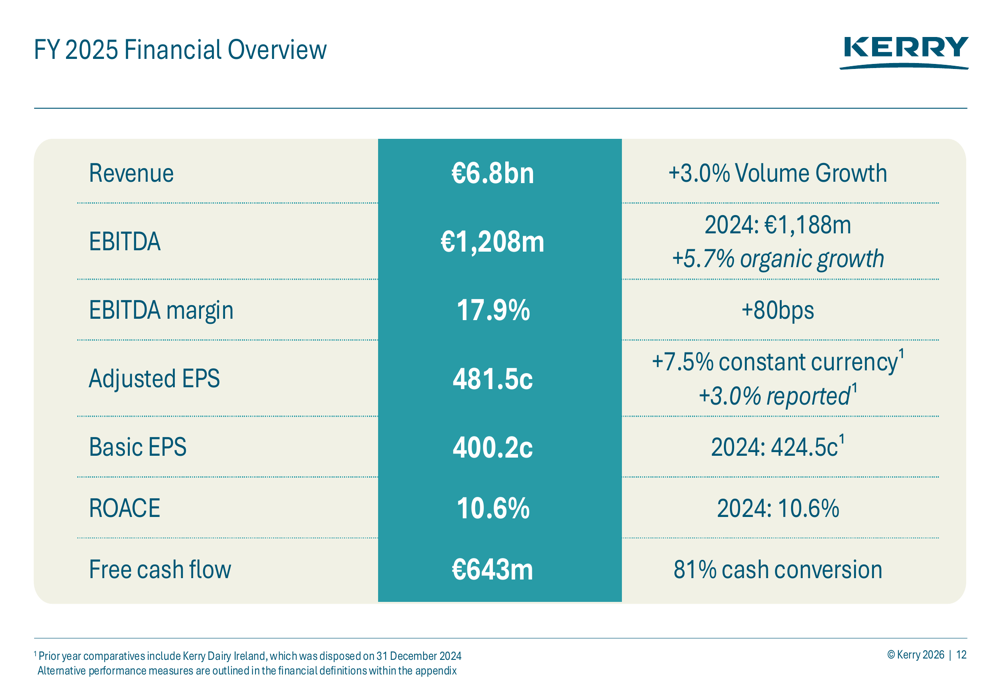

Kerry Group FY 2025 presentation: 3% volume growth drives 7.5% EPS expansion

Kerry Group FY 2025 presentation: 3% volume growth drives 7.5% EPS expansion

Business

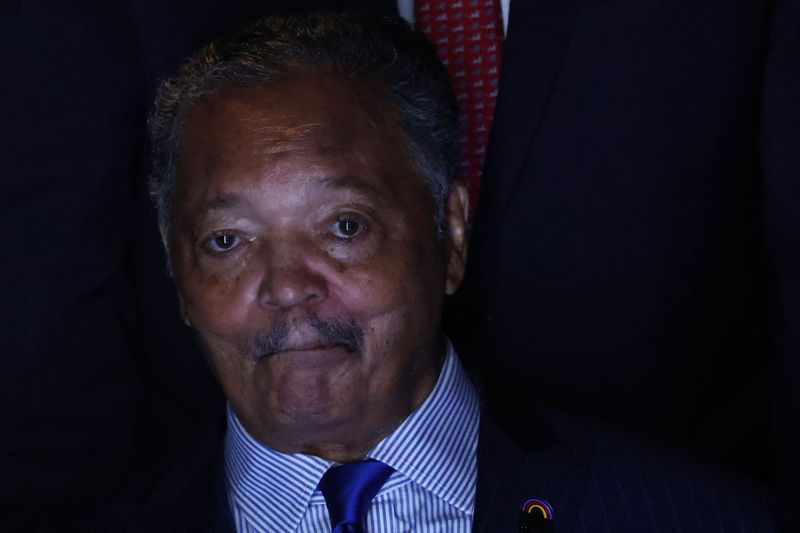

Jesse Jackson, civil rights leader and US presidential hopeful, dies at 84

Jesse Jackson, civil rights leader and US presidential hopeful, dies at 84

Business

Trek to raise $15m, as moves toward extensive drilling program at Christmas Creek

Derek Marshall-led Trek Metals has announced plans to raise $15 million, in order to propel an upcoming extensive drilling program at its Christmas Creek gold project.

Business

Royal Mail given two weeks to respond to claims it is prioritising parcels

MPs have raised “significant concerns” about reports of “failures in service” at the company.

Business

Meta, X and TikTok face Spanish investigation over AI child abuse content

Meta, X and TikTok face Spanish investigation over AI child abuse content

Business

Adding or Modifying Business Activities Post-Incorporation in the Philippines

Philippine corporations operate within their registered purpose; expansion requires amendments, affecting ownership, capital, and regulation. Foreign investment rules specify capital requirements, restrictions, and tax benefits.

Operating Limitations and Expansion Requirements

A Philippine corporation can only operate within the purposes outlined in its Articles of Incorporation, registered with the Securities and Exchange Commission under the Revised Corporation Code. Any expansion into a substantially different activity requires an amendment to the purpose clause. This process involves a thorough review of ownership eligibility, capital classification, and regulatory compliance, as it may affect the company’s legal standing and operational scope.

Capital Requirements for Retail and Domestic Enterprises

Retail trade businesses with foreign involvement generally need a paid-in capital of US$2.5 million, with specific thresholds of US$250,000 per store in certain cases. If the activity falls into a restricted sector, an equity restructuring must be undertaken before amending the purpose clause. For foreign-owned domestic market enterprises, a minimum paid-in capital of US$200,000 is typically required, which can be lowered to US$100,000 upon meeting employment or certified technology criteria. Export-oriented firms are exempt from this threshold.

Foreign Investment Regulations and Tax Incentives

Under the Foreign Investments Act, enterprises registered with the Philippine Economic Zone Authority or the Board of Investments may qualify for income tax holidays lasting four to seven years, and occasionally a 5% tax on gross income. However, income from activities outside the approved scope could be taxed at the standard corporate rate of 25%, or 20% for qualified small domestic corporations, which could impact overall tax obligations within a single legal entity.

Read the original article : How to Add or Amend Business Activities After Incorporation in the Philippines

Other People are Reading

Business

BSOL: Solana At The Crossroads

BSOL: Solana At The Crossroads

Business

At Close of Business podcast February 17 2026

Tom Zaunmayr talks to Sam Jones about why a Gnowangerup family’s investment in export infrastructure is getting attention.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video18 hours ago

Video18 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech7 hours ago

Tech7 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal