Business

How to Choose Your Forex Broker? A 2026 Guide for UK Investors

In the vast and often turbulent ocean of the financial markets, your broker is your vessel. Choose a sturdy, well-equipped ship, and you can navigate through economic storms to reach your destination.

Choose a leaky raft, and you may find yourself sinking before you even leave the harbor. As we settle into 2026, the retail forex industry has become more competitive than ever. Hundreds of brokers are vying for your attention with flashy advertisements and promises of low spreads. However, for the serious investor, the decision must be based on rigorous due diligence rather than marketing hype. Whether you are a seasoned trader looking to switch providers or a novice taking your first steps, selecting the right partner is the single most critical decision you will make. This guide breaks down the essential criteria for choosing a broker that aligns with your financial goals and risk appetite.

1. Regulation and Safety of Funds

The first rule of trading is preservation of capital. Before you even look at spreads or trading platforms, you must verify the broker’s regulatory status. In 2026, the distinction between regulated and unregulated entities is stark.

The Importance of Tier-1 Licenses

A reputable broker will always be authorized by a top-tier regulatory body. In the UK, this is the Financial Conduct Authority (FCA). Other respected regulators include ASIC (Australia) and CySEC (Cyprus). These bodies enforce strict standards, such as segregating client funds from the company’s operating capital. According to Wikipedia, regulatory oversight is the primary defense against fraud in the retail forex market, ensuring that brokers adhere to fair practices and maintain sufficient capital reserves.

Negative Balance Protection

Ensure your broker offers negative balance protection. This feature guarantees that you cannot lose more than your initial deposit. In a market known for its volatility, where gaps can occur over the weekend, this safety net is indispensable for managing your long-term financial health.

2. Trading Costs and Transparency

Every pip counts. Over the course of a year, the difference between a 1-pip spread and a 2-pip spread can amount to thousands of pounds in transaction costs. However, low costs should not come at the expense of execution quality.

Spreads vs. Commissions

Brokers generally operate on two models:

- Commission-Free: You pay no separate fee, but the cost is built into a slightly wider spread.

- Raw Spread/ECN: You get spreads as low as 0.0 pips but pay a fixed commission per lot traded. For high-volume traders and scalpers, the raw spread model often proves cheaper. A leading forex broker will be transparent about these costs, displaying them clearly on their website rather than hiding them in the fine print.

Hidden Fees

Be wary of non-trading fees. Some brokers charge for withdrawals, inactivity, or even currency conversion. Always check the “banking” or “funding” section of the broker’s site to ensure you won’t be penalized for moving your own money.

3. Execution Speed and Infrastructure

In 2026, technology is the great equalizer. The speed at which your order travels from your terminal to the market can determine whether you make a profit or suffer “slippage” (getting filled at a worse price than expected).

Dealing Desk (DD) vs. No Dealing Desk (NDD)

- Market Makers (DD): These brokers take the other side of your trade. While they offer stable spreads, there is an inherent conflict of interest.

- NDD/STP Brokers: These brokers route your orders directly to liquidity providers (banks, hedge funds). This model is generally preferred by professional traders as it ensures transparency and faster execution without human intervention.

Platform Stability

Does the broker offer industry-standard platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader? Proprietary platforms can be good, but they often lack the advanced customizability of established software. Ensure the platform has a track record of stability during high-impact news events.

4. Range of Markets and Instruments

While your primary focus might be forex, a diversified portfolio is key to risk management. The best brokers in 2026 act as multi-asset gateways.

Beyond Currency Pairs

Look for a broker that offers access to:

- Commodities: Gold, Silver, Oil.

- Indices: S&P 500, FTSE 100, DAX.

- Shares: Access to global equities. Having all these assets under one roof allows you to hedge your positions. For example, if the USD weakens, you might want to long Gold. Being able to do this instantly on the same account is a massive logistical advantage.

5. Customer Support and Education

Even the best technology fails occasionally, and you will eventually have a question. When that happens, you need immediate answers.

24/7 Availability

The forex market runs 24/5, and crypto markets run 24/7. Your broker’s support should match these hours. Test their live chat before you sign up. Do they answer in seconds, or are you stuck in a queue?

Educational Resources

A broker invested in your success will provide educational tools. Look for webinars, daily market analysis, and tutorials. Furthermore, understanding risk and return is fundamental to your survival in the markets; a good broker will provide resources that help you grasp these concepts rather than just encouraging you to trade blindly.

Conclusion: Making the Final Call

Choosing a forex broker is not a decision to be rushed. It requires balancing cost, safety, and technological capability. By focusing on regulated entities that offer transparent pricing and NDD execution, you set a solid foundation for your trading career. Remember, the goal is not just to find a place to trade, but to find a partner that facilitates your growth as an investor. Take your time, test their demo accounts, and ensure they meet the high standards required for trading in 2026.

Business

Cracker Barrel revenue falls amid rebranding recovery efforts

Cracker Barrel CEO Julie Masino spoke to The Blaze’s Glenn Back about the backlash she and the company faced after its controversial redesign this year.

Cracker Barrel reported a drop in quarterly revenue and profit as the company continues to recover from last summer’s rebranding controversy, though CEO Julie Masino says early signs of a turnaround are beginning to emerge.

Speaking during the Tennessee-based restaurant and retail chain’s fiscal second-quarter 2026 earnings call on Wednesday, Masino said that the company is focused on strengthening operations, refining its menu and marketing strategy to better connect with customers, and reducing costs to improve profitability.

“We’re gaining traction and are encouraged by some important guest metrics and green shoots around traffic, and we’re energized in terms of driving improved performance,” Masino said.

Cracker Barrel posted second-quarter revenue of $874.8 million, down 7.9% from a year earlier.

CRACKER BARREL RESPONDS TO REPORTS ABOUT EMPLOYEE DINING REQUIREMENTS DURING WORK TRAVEL

A Cracker Barrel sign hangs on the outside of a restaurant on Aug. 21, 2025, in Homestead, Florida. (Joe Raedle/Getty Images)

Comparable restaurant sales fell 7.1%, largely driven by a 10.1% drop in traffic, while comparable retail sales slid 9.2%, according to chief financial officer Craig Pommells.

Net income totaled $1.3 million, a sharp decrease from $22.2 million in the same quarter last year.

Despite the declines, results topped Wall Street expectations.

Masino highlighted improving employee turnover rates and a higher Google star rating as evidence that the company’s turnaround efforts are gaining traction.

A general view of a Cracker Barrel Country Store in Fishkill, NY, on Monday, August 25, 2025. (Richard Beetham for Fox News Digital)

“We view all of these metrics as important leading indicators and are confident that these gains will translate into improved traffic over time,” she said.

As part of its strategy to win back customers, Cracker Barrel has also reintroduced popular limited-time offerings, including Country Fried Turkey, and added new menu items such as a breakfast burger and Garden and Farmhouse Scrambles.

The company’s loyalty program now has more than 11 million members and accounts for over 40% of tracked sales. Masino said loyalty member traffic has held up better than nonmembers since August.

“We’re committed to operating with excellence, and we’re implementing actions to improve profitability, all to strengthen the business and to return to positive momentum,” Masino said.

Cracker Barrel CEO Julie Felss Masino walks out of a Starbucks in Nashville, Tennessee, on Aug. 28, 2025. (Zak Bennett for Fox News Digital)

The revenue slump follows backlash last summer after Cracker Barrel announced changes to its logo and store interiors, including removing the “old timer” from its branding.

The company reversed course less than a week later after complaints from customers.

Masino has previously cautioned that the company’s recovery will take time.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Cracker Barrel did not immediately respond to FOX Business’ request for comment.

FOX Business’ Eric Revell contributed to this report.

Business

Alphabet Stock Edges Lower in Early Trading as AI Capex Concerns Weigh Amid Geopolitical Volatility

Alphabet Inc. shares dipped modestly in early U.S. trading Friday, reflecting broader market caution driven by surging oil prices and ongoing Middle East tensions, while investors continued to digest the company’s massive 2026 capital expenditure plans tied to artificial intelligence infrastructure.

AFP

Alphabet Class A shares (NASDAQ: GOOGL) were trading around $299.50 to $300.00 by mid-morning Eastern Time, down approximately 1.0% to 1.2% from Thursday’s close of $303.13. The stock opened near $302.50 to $303.00, with intraday action ranging from a low near $298.80 to a high of about $303.30. Volume approached 5 million to 10 million shares in early sessions, consistent with recent averages but below levels seen during high-volatility periods.

Alphabet Class C shares (NASDAQ: GOOG) moved similarly, trading near $300.00 to $300.50, down about 1.0% from the prior close around $303.45. The company’s combined market capitalization hovered near $3.65 trillion to $3.67 trillion, cementing its position among the world’s most valuable firms despite recent pullbacks.

The decline extended a pattern of consolidation after Alphabet reached multi-month highs earlier in 2026, with shares peaking near $349.00 in early February. Year-to-date performance remains positive but lags the broader S&P 500 amid concerns over heavy AI spending and competitive pressures in search and cloud computing. Over the past 12 months, GOOGL has gained significantly, up more than 70% from lows around $140 in early 2025, driven by strong revenue acceleration and AI advancements.

Recent momentum traces to Alphabet’s fourth-quarter earnings reported in early February, which beat expectations across key metrics. Revenue climbed 18% year-over-year to $113.8 billion, while adjusted earnings per share reached $2.82, surpassing consensus by about 7%. Google Cloud posted explosive 48% growth, underscoring its role as a major growth engine alongside core advertising.

Management’s guidance for 2026 capital expenditures—projected between $175 billion and $185 billion—sparked debate. The figure, roughly double 2025’s estimated $91 billion to $92 billion, prioritizes servers, data centers, and networking to support Gemini AI, cloud expansion, and other initiatives. Roughly 60% targets compute infrastructure, with the remainder for facilities.

Analysts view the spending as a bold bet on AI dominance but warn of near-term pressure on free cash flow and margins. Depreciation costs are expected to rise sharply, potentially compressing profitability even as revenue grows. Some forecasts suggest free cash flow could dip temporarily before rebounding, with optimistic scenarios projecting $55 billion to $72 billion annually in coming years if execution succeeds.

Bullish voices highlight Alphabet’s cash generation strength and positioning in AI. Google Cloud’s momentum, Gemini’s user growth beyond 750 million monthly actives, and advertising resilience provide tailwinds. Options activity has shown bullish tilt, with notable call volume at strikes near current levels for short-dated expirations, signaling trader bets on near-term recovery.

Yet challenges persist. Antitrust scrutiny, regulatory risks in multiple jurisdictions, and competition from OpenAI, Meta, and others in generative AI remain headwinds. Recent news highlighted partnerships like expanded Google Cloud collaborations with CVS Health and others, but also isolated incidents involving Waymo robotaxis and legal matters.

Broader market context amplified Friday’s softness. Oil’s surge amid Middle East conflict pressured growth stocks, with energy-sensitive sectors underperforming. The Dow and S&P 500 traded lower, while tech showed relative resilience but failed to buck the trend fully. The VIX stayed elevated, reflecting ongoing geopolitical unease.

Wall Street coverage leans positive, with consensus “Strong Buy” ratings and average price targets around $350 to $380, implying 15% to 25% upside from recent levels. Firms like Mizuho and Bank of America maintained bullish stances, citing AI opportunities despite capex concerns. Some analysts forecast potential re-rating if cloud and AI monetization accelerates.

Alphabet’s diversified revenue—advertising still dominant but cloud and other bets growing—offers resilience. Q1 earnings, expected late April, will provide updates on spending progress, Gemini adoption, and cloud margins.

For now, shares consolidate near $300 support, with traders eyeing macro developments and any AI-related catalysts. The stock’s valuation, at a forward P/E around 28, appears reasonable relative to growth prospects, though execution on capex remains key.

Investors monitor closely as Alphabet navigates AI investment phase amid volatile macro backdrop. Friday’s dip illustrates sensitivity to external risks, but fundamentals suggest long-term optimism for the tech giant.

Business

CoreWeave Stock Is Rising. The Neocloud Wins a New AI Deal.

CoreWeave Stock Is Rising. The Neocloud Wins a New AI Deal.

Business

Electrovaya Inc. (ELVA:CA) Discusses Battery Technology Advancements and Business Growth Strategy Transcript

Glen Akselrod

Bristol Capital Ltd.

The purpose of today’s presentation is to give our audience a better understanding of the business through a presentation and then questions with management. The presentation is going to be led by Raj Das Gupta, CEO, who is also joined on the call by John Gibson, CFO; and Jason Roy, VP of IR. If you’d like to get a copy of today’s presentation, simply e-mail me at glen@bristolir.com. We’ll break for questions at the end of the formal presentation. When we do break, we encourage those questions. And as a reminder, we’re only going to take questions through the webinar portal. If you’re listening over telephone, please access the web link sent earlier to ask a question.

You can submit a question using the text box within the portal at any time. I’ll ask the question on air for everyone to hear and Raj or John will answer. I’m not going to reference any names, but simply read the questions asked. And as we do have a very large audience today, if I can’t get to your question online and has not yet been addressed during the call and can’t be, I’ll come back to you by e-mail. I won’t read the forward-looking statements, but I do state that they apply, and I reference them on Page 2 of this presentation.

With that said, once again, thank you for joining us. Remember, this is fairly informal, and we do encourage questions to help you better understand the business and its growth path. And now I’ll turn the call over to

Business

Trump administration weighs asking China to cut Iran, Russia oil purchases

EQT President and CEO Toby Z. Rice joins ‘Mornings with Maria’ to discuss the sudden rise in oil and natural gas prices as the Middle East conflict rages.

The U.S. is reportedly considering asking China to curb its purchases of oil from America’s adversaries, like Iran and Russia, ahead of President Donald Trump’s trip to Beijing at the end of the month.

The Wall Street Journal reported that Treasury Secretary Scott Bessent is weighing whether to raise the issue of China’s energy purchases with his counterpart, Vice Premier He Lifeng, when they meet in Paris mid-March.

The Journal’s report cited people familiar with Bessent’s meetings with former U.S. officials, business executives and policy analysts about how the administration wants China to buy U.S. energy products instead.

China sources a significant portion of its oil purchases from Russia. Those purchases come at a steep discount due to international sanctions levied on Russia’s energy sector that stem from its ongoing war against Ukraine, which has been funded in part by Moscow’s oil sales.

CHINA COULD FACE ‘REAL PROBLEMS’ WITHIN TWO MONTHS IF STRAIT OF HORMUZ CRISIS DRAGS ON, EXPERT WARNS

Treasury Secretary Scott Bessent is reportedly discussing plans to ask China to curb its purchases of Iranian and Russian oil in favor of U.S. energy. (Alex Wong/Getty Images)

It’s unclear whether China would consider paying more for American oil and potentially undermining its close ties with Russia while its strategic partner is straining to fund its war effort.

Iran is also factoring into Bessent’s consideration of energy issues related to China. The Journal’s report indicated that the Treasury chief wants China to commit to cutting back its long-term reliance on Iranian oil if Iran’s energy sector is able to resume shipments after U.S. and Israeli strikes on the country.

Iran’s conflict with the U.S., Israel and other countries near the Persian Gulf has hindered the flow of oil shipments through the Strait of Hormuz. (Giuseppe Cacace/AFP via Getty Images)

China’s economy is heavily reliant on imported energy and, as of this year, imports from Russia, Iran and Venezuela made up over one-third of China’s total oil imports despite disruptions in supplies from Venezuela after the ouster of Nicolás Maduro, according to the report.

The report also noted that Bessent has said in private meetings that the Trump administration is pressing China to step up purchases of Boeing jetliners and soybeans grown in the U.S., along with a relaxation of China’s export controls on rare earth minerals.

GORDON CHANG URGES US TO TREAT CHINA AS ‘ENEMY COMBATANT,’ WARNS SUBS OPERATING ‘VERY CLOSE’ TO US

President Donald Trump and Chinese President Xi Jinping are expected to meet in Beijing within a month. (Evelyn Hockstein/Reuters)

The Chinese government put in place tough restrictions on exporting rare earths, which are elements used in a vast range of advanced technological products, in response to the White House’s tariffs.

For its part, the Chinese government is expected to press the U.S. to be more proactive in its stance against Taiwanese independence.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

China views Taiwan, a self-governing democracy, as part of its territory even though the Chinese Communist Party has never controlled Taiwan.

The U.S. adheres to a “One China” policy that acknowledges China’s position that Taiwan is part of it but doesn’t recognize that view. By contrast, China asserts that Taiwan is its sovereign territory under the CCP’s “One China Principle.”

Business

Grove Collaborative Holdings, Inc. 2025 Q4 – Results – Earnings Call Presentation (NYSE:GROV) 2026-03-05

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Iran war threatens global travel industry as passengers get stuck

Zoey Gong, a Chinese medicine food therapist, was days away from boarding an Emirates flight from Paris to Shanghai via Dubai, United Arab Emirates, when the U.S. and Israel attacked Iran on Saturday.

Gong, 30, had her flight plans derailed as a result, and she told CNBC that she had to pay $1,600 to get to Shanghai, more than double the price of her original ticket.

She’s one of millions of travelers swept up in war and other conflicts from Iran to Mexico this year, problems that are threatening the global tourism industry that’s worth an estimated $11.7 trillion to the world’s economy, according to industry group World Travel & Tourism Council. It’s showing that people who are far from falling missiles, drone attacks and other geopolitical flashpoints aren’t immune to ripple effects.

‘Aviation quagmire’

Stranded passengers wait with their luggage outside the Hazrat Shahjalal International Airport in Dhaka on March 3, 2026 after carriers cancelled flights amid the Middle East conflict.

Munir Uz Zaman | Afp | Getty Images

The U.S.-Israel attack on Iran set off massive aviation, travel and safety crises.

More than a million people around the world were stranded because of airspace closures that have grounded over 20,000 flights since Saturday, according to aviation data firm Cirium. Some were also stuck on cruise ships. Inquiries for more expensive “cancel for any reason” travel insurance policies surged 18-fold this week, said Chrissy Valdez, senior director of operations for Squaremouth, an online insurance marketplace.

Since Saturday, Iran has launched retaliatory attacks on the United Arab Emirates — home to Dubai International Airport, the world’s busiest for international passenger traffic, according to Airports Council International — as well as Qatar, Jordan, Israel and Cyprus. The back-and-forth attacks have left airlines with little recourse to repatriate travelers.

Days after the attack, the U.S. State Department told citizens in a large part of the region to leave immediately, with few options at hand. The department said it is organizing charter flights for U.S. citizens who want to return from Saudi Arabia, Israel, UAE and Qatar.

“This has spiraled into an aviation quagmire,” said Henry Harteveldt, a former airline executive and founder of travel consulting firm Atmosphere Research Group.

Other sectors of the travel industry are also dealing with the war’s impact. Debris rained down near Accor‘s Fairmont The Palm Hotel in Dubai over the weekend. The company said four people were injured, but none were guests, visitors or staff. Meanwhile the iconic Burj Al Arab hotel had a fire earlier this week after it was hit by debris from an Iranian drone.

(L to R) The Malta-flagged cruise ships Aroya Manara and MSC Euribia are anchored at the port of Dubai on March 4, 2026.

Giuseppe Cacace | AFP | Getty Images

MSC Cruises’ more than 6,300-passenger MSC Euribia ship has been stranded in Dubai and the company is trying to get flights for affected guests, it said. “We are requesting priority for our guests from our partners,” the company said in a statement.

“In order to speed up the repatriation, we are working on other options such as chartering flights” from Dubai, Abu Dhabi, UAE, or Muscat, Oman, but the situation on board “remains calm,” the cruise company said.

Earlier this week, MSC said it would cancel its remaining sailings from Dubai for the winter. “We understand that this will be disappointing, but we are sure that guests impacted will understand this decision,” it said.

Putting aside the Covid-19 health crisis that ground most international travel to a halt, Harteveldt called this week “the most chaotic event we’ve seen frankly since 9/11 when the U.S. chose to close its airspace. We haven’t seen anything that has had such a long and geographically widespread impact on travel.”

Global conflicts

Flightradar24 still of flight traffic across the Middle East on March 4th, 2026.

Source: Flightradar24.com

The Iran war is the most severe military conflict this year, but it’s one of a series of obstacles that have threatened travel demand and profits for hotels, airlines and cruise companies, as well as local economies that depend heavily on travel, especially international tourists, who tend to spend more than local visitors.

Three days into 2026, the U.S. struck Venezuela and captured its president, Nicolás Maduro, and his wife, Cilia Flores. The attack prompted the U.S. to close airspace throughout the Caribbean, stranding travelers, many at pricey resorts and home rentals they had booked for the holidays.

Then in February, flights were grounded in parts of Mexico, including in the coastal resort city of Puerto Vallarta and in Guadalajara, after violence broke out following the Mexican army’s killing of a cartel leader.

Executives have already had to make costly changes: rerouting or cancelling sailings, issuing flexible booking and refund policies, grounding planes and changing flight plans altogether, or discounting hotel rooms.

The cost of these conflicts is still being tallied, including for fuel, one of the biggest expenses for cruise companies and airlines along with labor, and are usually passed along to consumers, so that means pricier tickets and stays could be in the cards.

Australian carrier Qantas, for example, told CNBC that its flight from Perth, Australia, to London will now travel a route that requires it to stop to refuel in Singapore, though that will also allow it to pick up another roughly 60 passengers.

Best year ever?

Passengers look at departure screens showing cancelled flights to Puerto Vallarta at Benito Juarez International Airport after authorities reinforced security following roadblocks and arson attacks carried out by organized crime in several states, after a military operation in which a government source said Mexican drug lord Nemesio Oseguera, known as “El Mencho,” was killed in Jalisco state, in Mexico City, Mexico, February 22, 2026.

Luis Cortes | Reuters

Travel executives started off 2026 as they often do: upbeat. Some airline executives, including those at the most profitable U.S. carriers, Delta Air Lines and United Airlines, forecast record earnings this year.

The war and other incidents erupted as the travel industry has been leaning on premium options to woo wealthier customers, who make up a greater share of spending overall. Losing the base for more expensive trips could be extra disadvantageous to those companies and local economies.

In Mexico, for example, tourism makes up close to 9% of the economy and international tourist arrivals rose 13.6% last year to 98.2 million people, who spent close to $35 billion, according to the country’s Tourism Ministry.

Now, airlines are pulling back on traveling to Puerto Vallarta, at least from the United States in the near term. Delta cut routes from April 3 through the end of the month to the city, except for once-daily flights from Los Angeles and Atlanta, according to the Cranky Network Weekly newsletter, which covers the airline industry’s network changes. Alaska Airlines and Southwest Airlines also cut service in March.

“Perhaps people will forget about the PVR [Puerto Vallarta International Airport] concerns now that headlines will shift to the Middle East and bookings will rebound, but we will be watching capacity changes as leading indicators,” Brett Snyder and Courtney Miller, the newsletter’s authors, said in the March 1 edition.

Smoke billows amid a wave of violence, with torched vehicles and gunmen blocking highways in more than half a dozen states, following a military operation in which a government source said Mexican drug lord Nemesio Oseguera, known as “El Mencho,” was killed, in Puerto Vallarta, Jalisco, Mexico, February 22, 2026.

@morelifediares via Instagram | Reuters

The recent issues also come three months ahead of the FIFA World Cup, which is set to be hosted by cities in Canada, Mexico and the United States.

Some hotels in Mexico are starting to notice a change, too.

Victor Razo, manager at the Rivera del Rio hotel in Puerto Vallarta, told CNBC that bookings are down around 10% compared with last year.

“We’ve had some promotions given what had happened,” he said, adding it brought down rates between 10% and 20% ahead of the busy spring break and Holy Week period in the coming month.

He added that the hotel wasn’t near the problems, which included road blockades, and that bookings have since stabilized.

“It’s not like the beginning of the pandemic,” he said. “There is no comparison.”

Business

Stocks Are Rising as Oil Prices Pull Back From Highs

Stocks opened higher on Wednesday as oil prices eased.

The Dow Jones Industrial Average rose 206 points, or 0.4%. The S&P 500 was up 0.3%. The Nasdaq Composite was up 0.5%.

West Texas Intermediate crude oil futures were down 0.5% to $74.16 a barrel. Brent crude futures fell 0.5% to $81.01.

Business

Trump, Bondi sued by shareholders over alleged TikTok deal law violations

Sen. Pete Ricketts, R-Neb., joins ‘Varney & Co.’ to discuss concerns over TikTok data security, mounting pressure on Iran and the fight to keep the government open.

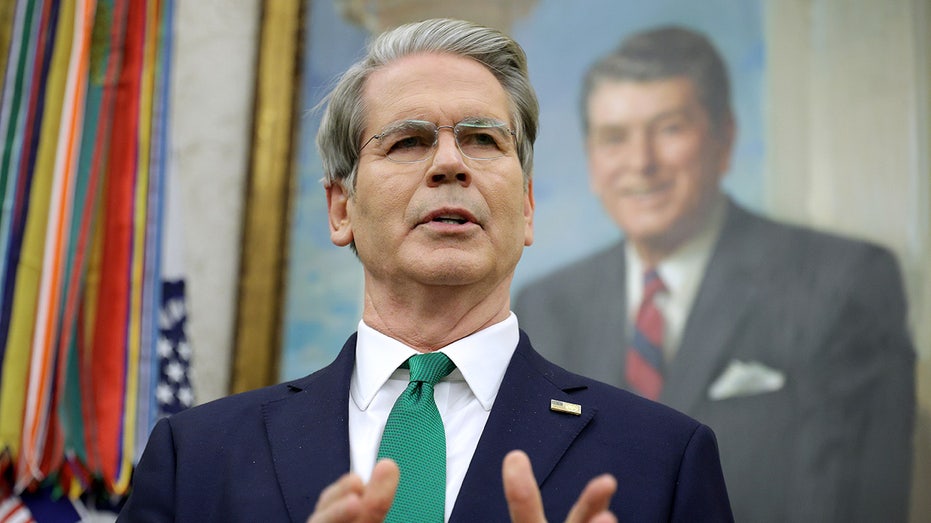

President Donald Trump and Attorney General Pam Bondi on Thursday were sued over their handling of the TikTok deal that was finalized in January, according to a petition filed by two shareholders in competing tech firms.

The plaintiffs argued that Trump approved a joint venture that failed to fully sever the app’s operational ties to China, granted several unlawful extensions and that Bondi failed to investigate the alleged breaches as required by the Protecting Americans from Foreign Adversary Controlled Applications (PAFACA) Act, which mandated TikTok to divest from its Chinese parent company, ByteDance, by early 2025.

The petition was filed by Zhaocheng Anthony Tan, a shareholder in Alphabet, and Garrett Reid, a shareholder in Meta Platforms, who said the TikTok deal also led to declines in Meta and Google stock.

“For the law to mean something, it must be followed, even—perhaps especially—by the President,” the lawsuit, filed by the Public Integrity Project, stated. “Respondents have violated the statute and subverted the will of Congress. Petitioners bring this case to ensure that such violations, and such subversion, do not continue.”

TIKTOK AVOIDS US BAN BY FINALIZING HISTORIC TRUMP-BACKED AMERICAN MAJORITY OWNERSHIP DEAL

Trump in January backed the launch of The Joint Venture LLC, a seven-member majority-American board that enabled TikTok to keep operating in the U.S. (Getty Images)

Under the current agreement, TikTok was spun off into a separate U.S.-owned entity to remain operational in the country, satisfying an executive order issued by Trump on Sept. 25 of last year. The majority American-owned joint venture gives U.S. entities an 80.1% stake, while parent company ByteDance retains 19.9%.

“In short, under the announced deal, ByteDance would still control all the essential elements of TikTok,” the lawsuit said. “Such a deal would subvert the very purpose of the TikTok Law, as ByteDance could continue to push Chinese propaganda and censor the content it does not like, exactly the harm that the law was intended to prevent.”

TIKTOK REACHES AGREEMENTS ON NEW US JOINT VENTURE WITH CLOSING SET FOR 2026

Attorney General Pam Bondi conducts a news conference at the Department of Justice on Thursday, Dec. 4, 2025. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

According to the lawsuit, the American entity of TikTok does not actually own the app’s algorithm but instead collaborates with ByteDance, violating the statutory ban on algorithmic cooperation. While ByteDance retains ownership and licensing of the algorithm, TikTok U.S. will only “retrain, test, and update” it using U.S. user data.

The U.S. entity’s budget, legal compliance and commercial activity will also be overseen by ByteDance CEO Shou Chew, who will sit on the board of directors for TikTok U.S., creating another operational relationship that the lawsuit alleges is prohibited.

The petition further alleges that Trump violated PAFACA, which allows the president to grant only a one-time extension of no more than 90 days, and only with the necessary certifications to Congress. Trump reportedly approved five separate extensions — lasting 75, 75, 90, 90, and 120 days — far exceeding the statutory limit.

The petition alleges that Trump unlawfully directed Bondi not to investigate or enforce any violations of PAFACA, in direct violation of the act.

Shou Zi Chew (C), the CEO of TikTok, arrives to attend Donald Trump’s inauguration as the next U.S. president in the rotunda of the U.S. Capitol in Washington, D.C., on Jan. 20, 2025. (Shawn Thew/POOL/AFP via Getty Images)

The lawsuit claims that Trump’s actions financially harmed investors in TikTok’s competitors. The plaintiffs noted that when the deal was made in January, Alphabet’s stock immediately dropped from $330.84 to $328.43.

Similarly, Meta stock fell from $760.66 to $748.91 during the initial framework announcement in September 2025, as it became apparent that the law might not be enforced.

Business

States sue Trump over new ‘unlawful’ global tariffs

According to the lawsuit, which is led by New York, California, Oregon and Arizona, the Trump administration’s imposition of tariffs also violates the US Constitution because Congress, not the president, has the power to impose sweeping tariffs, which are taxes on imports.

-

Politics7 days ago

Politics7 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech16 hours ago

Tech16 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports5 hours ago

Sports5 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial