Rolls-Royce shares hit a record high as defence stocks rally and FTSE 100 climbs to 10,672p

Rolls-Royce was among a plethora of City heavyweights surging on Wednesday, aiding the FTSE 100 in securing another record.

The aerospace behemoth rose by 2.2 per cent to 1,325.50p, reaching a new all-time high and surpassing January’s previous peak of 1,305.00p.

This surge coincided with defence giant BAE Systems leaping nearly four per cent higher to 2,103.00p after initiating new plans to distribute cash to shareholders. The company’s defence counterpart Babcock also saw a two per cent increase.

The defence sector has enjoyed a robust start to the week following news that the UK is considering achieving its target to spend three per cent of GDP on defence much sooner than the previously set goal of the end of the next Parliament.

Gains across the defence sector and other major industries contributed to the FTSE 100 building on Tuesday’s record close and advancing another one per cent by midday on Wednesday, hitting 10,672.50p, as reported by City AM.

Joshua Mahony, chief market analyst at Scope Markets, said: “What was once perceived as a boring index full of old and unexciting companies has now turned into an area of relative stability amid ongoing concerns around the implications of AI.

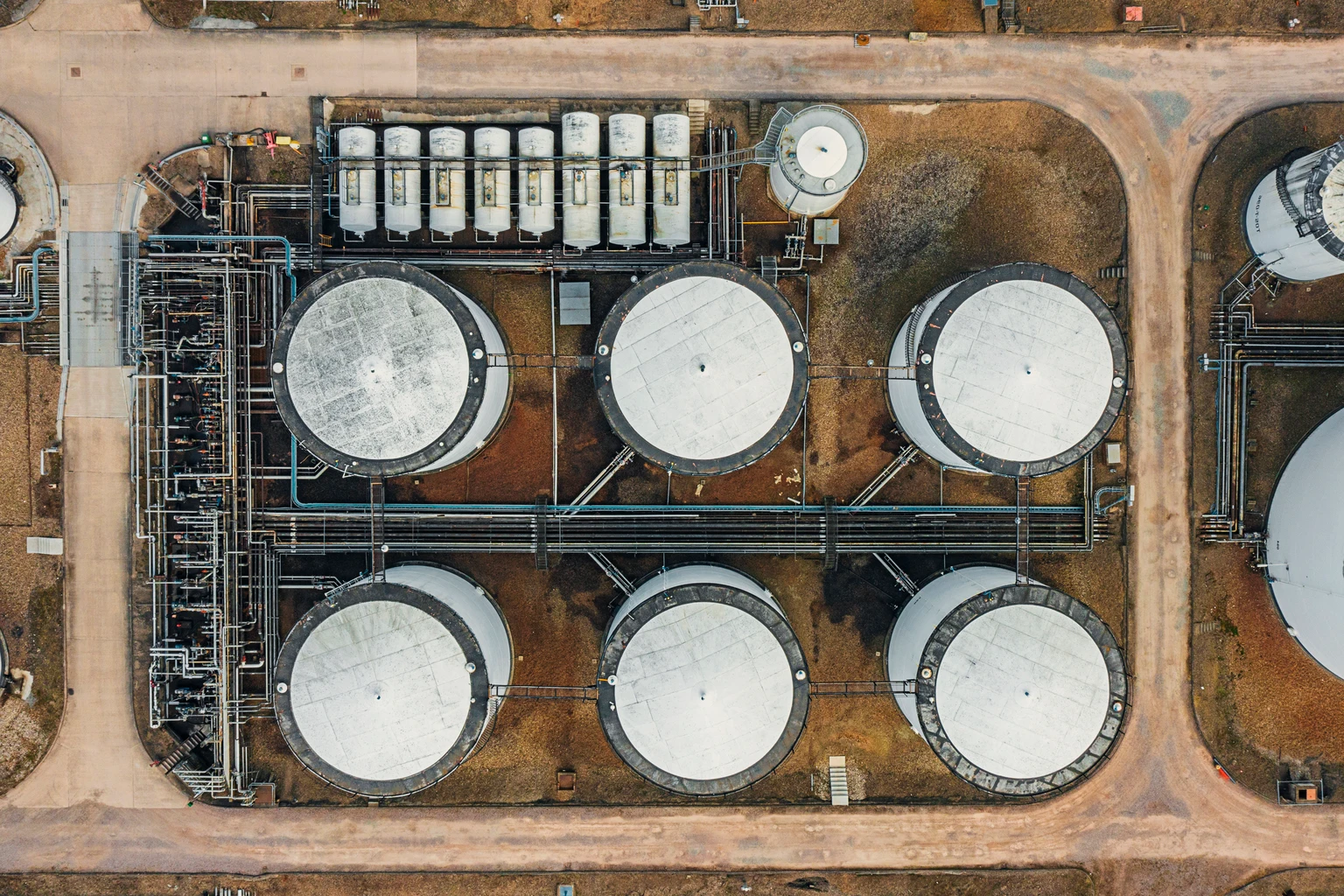

“The FTSE’s climb is broad-based, with significant momentum in energy, defence (amid Iran tensions), financials (driven by rate outlooks), and mining (as metal prices rally).”

In the banking sector, HSBC made the most significant move, leaping over two per cent to nearly 1,300p, closely followed by Barclays, which reached 484.40p after a two per cent rise.

Mining company Antofagasta surged four per cent by midday, with counterparts Anglo American and Glencore up almost three per cent. This followed Glencore’s announcement of plans to distribute $2bn to shareholders despite a dip in profits.

“Glencore’s second-half recovery may not rival Liverpool’s turnaround in Istanbul two decades ago, but the latter part of the year did represent a significant improvement – driven by strong metal prices and higher copper output,” said Russ Mould, investment director at AJ Bell.

“Like most of its peers, Glencore sees copper as the route to growth thanks to the role the metal is playing in AI data centres, renewable energy, and electric vehicle infrastructure. Building greater scale in copper production was a key driver behind the talks over a combination with Rio Tinto.”