Business

Star WR Becomes Free Agent Amid Major Roster Overhaul

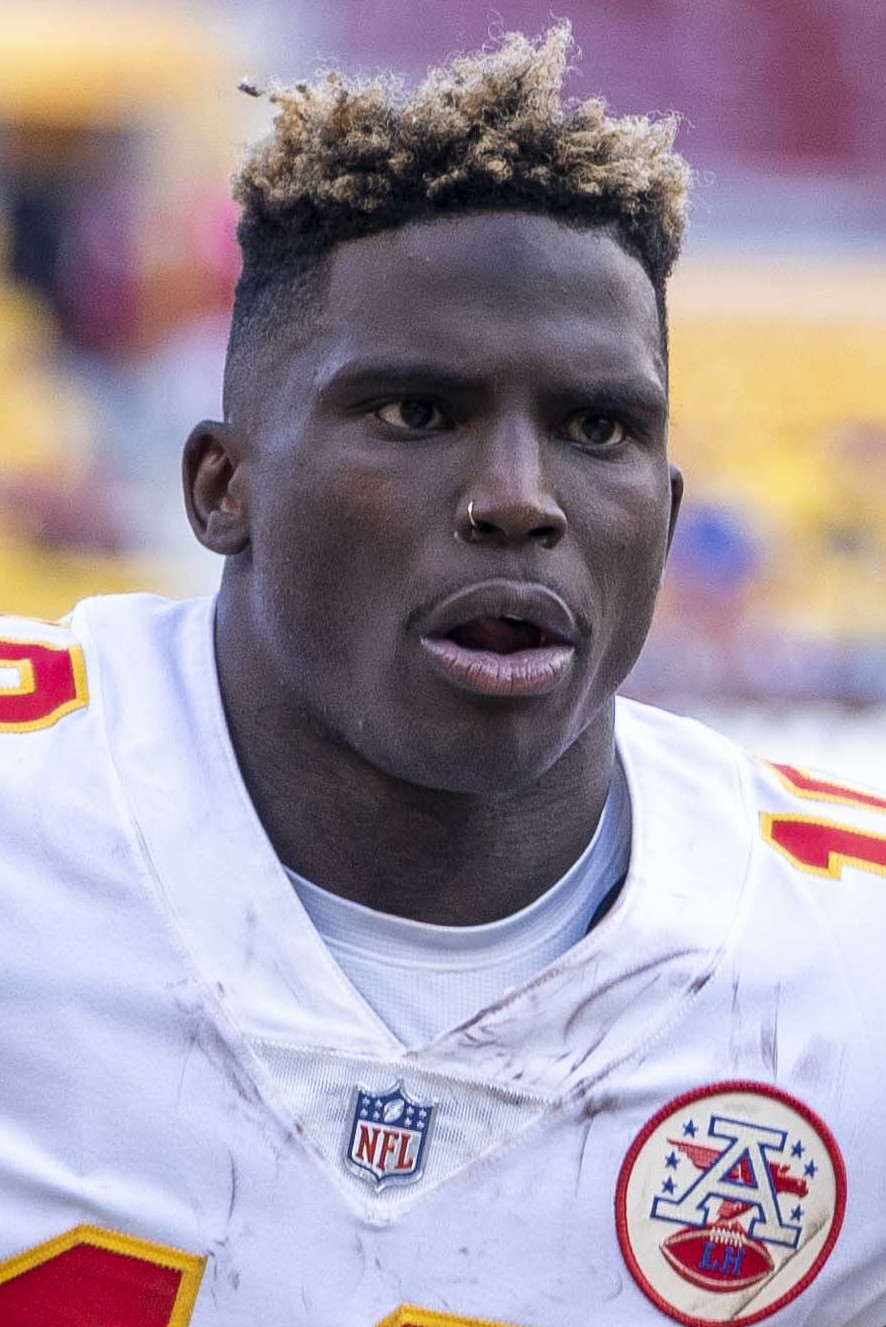

The Miami Dolphins released eight-time Pro Bowl wide receiver Tyreek Hill on Monday, Feb. 16, 2026, parting ways with one of the NFL’s most explosive playmakers and clearing significant salary cap space as the franchise begins a roster reset under new leadership.

The move, first reported by ESPN’s Adam Schefter and confirmed by multiple sources including NFL Network’s Tom Pelissero, comes amid a flurry of cost-cutting transactions on Presidents’ Day. Hill’s release follows the earlier announcement of edge rusher Bradley Chubb’s departure and includes other veterans like guard James Daniels and receiver Nick Westbrook-Ikhine. Collectively, the cuts are projected to save the Dolphins more than $56 million in 2026 cap space while incurring substantial dead money hits.

Hill, who turns 32 on March 1, becomes an unrestricted free agent for the first time in his career. He is recovering from a devastating left knee injury suffered in Week 4 of the 2025 season against the New York Jets on Sept. 29, 2025. The play resulted in a dislocated knee and multiple torn ligaments, including the ACL, requiring season-ending surgery. Hill was placed on injured reserve Oct. 1 and has been rehabbing since, with uncertainty surrounding his return timeline or full recovery for 2026.

The Dolphins acquired Hill from the Kansas City Chiefs ahead of the 2022 season in a blockbuster trade that sent draft picks and players to Kansas City. Miami then signed him to a four-year, $120 million extension that made him the highest-paid wide receiver at the time. Over four seasons in South Florida, Hill amassed impressive numbers despite the injury-shortened 2025 campaign.

In 2022, his first year with the team, Hill set an NFL single-season record with 1,799 receiving yards and added 119 catches and seven touchdowns, earning First-Team All-Pro honors. He followed with 1,799 yards again in 2023 (tied for his career high) and 1,799 in 2024, showcasing remarkable consistency as a deep threat and yards-after-catch specialist. Through three full seasons, he totaled 378 receptions for 5,397 yards and 32 touchdowns with Miami, helping fuel one of the league’s most dynamic offenses under former coach Mike McDaniel.

The 2025 season started promisingly but ended abruptly after four games. Hill’s production had shown slight declines in efficiency metrics in recent years, partly attributed to evolving defensive schemes and injuries to quarterback Tua Tagovailoa. Still, his speed and big-play ability remained elite when healthy.

Financially, Hill’s 2026 cap hit loomed large at $51.1 million, including a $29.9 million non-guaranteed base salary, a $5 million roster bonus due early in the league year, and other prorated bonuses. Sources indicated $11 million would have become fully guaranteed had he remained on the roster past a specific March date, with additional guarantees pushing the total to around $16 million if kept through mid-March.

By releasing him before June 1, the Dolphins save approximately $22.9 million in 2026 cap space while absorbing a $28.2 million dead money charge, per salary cap analyses from OverTheCap and Spotrac. Designating the release as post-June 1 could spread the dead money and increase savings, though the immediate move prioritizes flexibility for the new regime.

The decision reflects broader challenges for Miami entering the 2026 offseason. The team faces cap overages and roster questions, including the status of quarterback Tua Tagovailoa, who carries $54 million in guarantees for 2026. With a coaching change — Jeff Hafley taking over after Mike McDaniel’s departure — the front office appears committed to reshaping the roster around younger, more cost-effective talent.

For Hill, the open market offers opportunities despite his age and injury recovery. As a proven game-changer with track-record speed (once clocked at 4.29 seconds in the 40-yard dash), he could attract interest from teams needing a veteran WR1 or high-impact No. 2. Potential suitors might include squads with cap room and quarterback stability, though contract terms could trend toward shorter deals, incentives tied to health milestones, or lower base salaries to mitigate risk.

Hill’s legacy in Miami includes electrifying moments: game-breaking touchdowns, record-setting performances and leadership in the locker room. Fans and teammates lauded his work ethic during rehab, and he expressed gratitude toward the organization in past interviews.

The release marks the end of an era for one of the NFL’s most dynamic offenses of the early 2020s. Miami now turns to rebuilding its receiving corps, potentially through the draft, free agency or internal development with players like Jaylen Waddle.

As free agency approaches in March, Hill’s next chapter will be closely watched. Whether he returns to form post-ACL or transitions to a new role, his speed and explosiveness have defined an era in the league.

The Dolphins’ aggressive moves signal intent to regain competitiveness after recent struggles. With cap relief secured, attention shifts to how the front office allocates resources in a pivotal offseason.

Business

Swisscom AG (SCMWY) Q4 2025 Earnings Call Transcript

Louis Schmid

Head of Investor Relations

Good afternoon, and welcome to Swisscom’s Full Year Results Presentation 2025. My name is Louis Schmid, Head of Investor Relations. And with me are our CEO, Christoph Aeschlimann; our CFO, Eugen Stermetz; and Walter Renna, CEO of Fastweb + Vodafone.

Let us now start the meeting with the agenda for today on Page 2. As you can see, Christoph presents the first 3 chapters: achievements, where he dives into some of last year’s highlights commercially, operationally and financially; strategy update, where he presents Swisscom’s framework, lead, innovate, perform to grow free cash flow; and the review of our business in Switzerland, covering achievements 2025 and our focus 2026.

Then Walter Renna, CEO of Fastweb + Vodafone, reviews our business in Italy. He will talk about the integration of Vodafone Italia and the industrial performance of our Italian business and its plans going forward. After Walter’s part, Eugen Stermetz, our CFO, will present the financial result 2025, including the guidance 2026. And in the wrap-up chapter, some final remarks from our CEO, Christoph Aeschlimann. After the presentation, we will move directly to the Q&A session.

With that, I would like to open the meeting and hand over to Christoph for his part.

Christoph Aeschlimann

CEO & Head of Swisscom – Switzerland

Thank you, Louis. Welcome to our 2025

Business

IHI Corporation (IHICY) Q3 2026 Earnings Call Prepared Remarks Transcript

Hiromi Oshima

General Manager of Finance & Accounting Division and In Charge of Group Finance & Accounting

I am Hiromi Oshima, Executive Officer in charge of Group Finance and Accounting at IHI. We will now present an overview of our financial results for the third quarter of fiscal year 2025. The upper section shows the highlights for the third quarter fiscal year 2025.

Orders achieved JPY 1,364.8 billion, a record high for Q3, driven by expanding demand in the nuclear energy and other areas. Revenue decreased from the previous fiscal year to JPY 1,129.3 billion due to rebounding from the progress of large projects in the previous year and the impact of business divestitures, including material handling system. Operating profit was JPY 102.5 billion, remained at the same level as the previous year. Although revenue declined, we maintained the same level of profit as the previous fiscal year, which had achieved a record high. In addition, due to improvements in equity method investment income, including from Japan Marine United and others, profit attributable to owners of parent for the third quarter reached a record high.

The lower section shows forecast of fiscal year 2025. As demand continues to expand in the nuclear energy and other businesses in Energy business, we are revising our order forecast upward by JPY 90 billion. This fiscal year is the final year of our medium-term management plan. As I will explain later, while accelerating structural reforms, we expect to achieve record highs in orders, revenue, operating profit and profit attributable to owners of parent. We will firmly complete the structural reforms this year to prepare for the next fiscal year

Business

Frederick Wiseman, American documentary filmmaker, dies at 96

Frederick Wiseman, American documentary filmmaker, dies at 96

Business

BHP Group’s first-half profit jumps 22%, topping estimates

BHP Group’s first-half profit jumps 22%, topping estimates

Business

BlueScope Steel Limited (BLSFY) Q2 2026 Earnings Call Transcript

Tania Archibald

MD, CEO & Director

Good morning, everyone, and thank you for joining us. I’m Tania Archibald, BlueScope’s Managing Director and Chief Executive Officer. And with me today is David Fallu, our Chief Financial Officer. Together, we’ll take you through our results materials before we take your questions.

I’d like to begin by acknowledging the traditional custodians of the various lands on which we meet and work today and pay my respects to elders past and present. Before I go any further, I need to address the most important issue for our company. In November, a young contractor, Jack McGrath, tragically lost his life whilst working on the #6 blast furnace reline project at Port Kembla. The impact has been profound. A family lost someone they loved and the BlueScope community lost a colleague. I want to acknowledge how deeply this has affected everyone, our employees, our contractor partners and the local community.

The Safe Work New South Wales investigation into the incident is continuing, and we’re cooperating fully. I won’t comment further on the specifics. But what I will say is this, nothing matters more than the safety of

Business

Dollar Tree opens nearly half of new stores in affluent areas

Max Levchin, CEO of Affirm, provides insights into consumer spending habits based on Affirms data on ‘The Claman Countdown.’

Discount retailer Dollar Tree is opening new stores in increasingly affluent areas as it seeks to attract higher-income customers who spend more at the store per trip, a new report finds.

An analysis by Bloomberg News found that 49% of new Dollar Tree stores opened in the last six years were located in wealthier parts of metro areas around the country, up from just 41% in the preceding six years.

The share of new stores in ZIP codes with significantly higher incomes compared to the broader metro area rose to 19% in the last six years, up from 16% in the prior six years. At the other end of the spectrum, the share opened in ZIP codes with significantly lower incomes declined to 14% from 20% in the comparable periods, Bloomberg found.

Dollar stores have historically seen an uptick in business during economic downturns as more consumers look to economize, but with higher-income households driving much of consumer spending, the shift comes as a way of attracting those shoppers more frequently.

WHY SHOPPERS MAKING SIX FIGURES ARE GIVING DOLLAR TREE A BOOST

Dollar Tree is opening a rising share of new stores in more affluent areas. (Spencer Platt/Getty Images)

Dollar Tree says that in the last quarter, 60% of new Dollar Tree customers made at least six figures. About 30% were middle-income households earning between $60,000 and $100,000, while the rest were lower-income households earning under $60,000.

While these higher-income customers visit Dollar Tree less than their lower-income peers, the company said that they spend an extra $1 on average per visit and if they were to make one additional visit per year, it would boost annual sales by $1 billion.

INFLATION EASED SLIGHTLY IN JANUARY BUT REMAINED WELL ABOVE THE FED’S TARGET

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DLTR | DOLLAR TREE INC. | 126.06 | -2.37 | -1.85% |

Dollar Tree CEO Michael Creedon said late last year that the retailer serves “an increasingly broad spectrum of shoppers, from core value-focused households to middle- and higher-income shoppers who are making deliberate choices about how and where they spend.”

He added that the data “demonstrates that Dollar Tree isn’t just for tough times or for those with limited resources.”

DOLLAR GENERAL SEES INCREASE IN HIGHER-INCOME SHOPPERS LOOKING TO STRETCH THEIR DOLLARS

Dollar Tree is looking to attract more higher-income customers. (Scott Olson/Getty Images)

“While the average per household spend for our higher income customers is currently lower, even given their higher income, larger average basket size and ability to spend more, this is a simple function of trip frequency,” Creedon said.

He added that “because many of our higher income customers are still early in their relationship with Dollar Tree, their purchase frequency has significant room to grow.”

Consumers’ shopping preferences have also contributed to the pivot, as more households trade down to offset higher expenses due to inflation.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The elevated cost of essentials like groceries and household items has forced even more of them to trade down to stores known for their heavy discounting or everyday low-price models, such as Dollar Tree, Dollar General, Walmart and Aldi.

Business

Tax filing scams seek personal info for identity theft, BBB warns taxpayers

J.P. Morgan Asset Management chief global strategist David Kelly dissects what is hard to get out of the market and more on ‘Making Money.’

Tax filing season is underway and scammers are looking to take advantage of unsuspecting taxpayers through a variety of ever-evolving scams seeking money and personal information.

The International Association of Better Business Bureaus warns that tax scams typically originate with a phone call and tend to fall into two categories.

In one, the supposed IRS agent tells the would-be victim that they owe back taxes and attempts to pressure them into paying with a prepaid debit card or wire transfer, threatening an arrest and fines for noncompliance.

The other popular tax scam tactic involves the scammer claiming they’re issuing tax refunds and asking for personal information to send the would-be victim their refund. That information may later be used for identity theft, and in the case of college students, they may be targeted with a claim that their “federal student tax” hasn’t been paid.

TAX FILING SEASON IS OFFICIALLY HERE: WHAT YOU NEED TO KNOW

The Better Business Bureau warns taxpayers to be cautious with when contacted by someone claiming to be from the IRS. (iStock)

The BBB report notes that tax scammers may engage in a number of tactics to try to appear legitimate. They may give a fake badge number or name, and the caller ID may indicate that the call is coming from Washington, D.C., or use a serious “robocall” recording that sounds official.

Scammers may also send a follow-up email that uses IRS logos and colors along with language that makes the email appear legitimate.

When con artists attempt to target victims, they may try to push the would-be victim into taking action immediately before they have a chance to ask questions or otherwise process the information the scammer is throwing at them.

HERE’S WHEN TAXPAYERS WILL GET THEIR REFUNDS

The IRS doesn’t initiate contact with taxpayers by phone or email, and won’t demand immediate action as taxpayers may appeal its decisions. (Kayla Bartkowski/Getty Images)

They may also demand payment through methods like wire transfers, prepaid debit cards, or other non-traditional methods because those are harder to reverse or trace. The real IRS will never demand immediate payment, require a specific form of payment, or ask for a credit or debit card number of the phone.

The BBB notes that the IRS will allow taxpayers to ask questions or appeal any amount of back taxes they owe.

Additionally, the IRS always initiates contact by mail – not by phone calls, texts, emails or social media – so taxpayers aware of that can be better prepared to parry a scammer’s attempts via phone or email. After the IRS sends a mailed letter to a taxpayer with outstanding debts, they may reach out by phone.

DATA BREACH EXPOSES PERSONAL DATA OF 25M AMERICANS

Tax scammers may use a variety of methods to target taxpayers. (iStock)

The IRS has also warned taxpayers about a mailing scam that attempts to trick victims into thinking they have a tax refund.

Taxpayers receive a cardboard envelope with a fake letter that purports to be from the IRS regarding an unclaimed refund, which requests the taxpayer provide personal and financial information.

BBB recommends that taxpayers in doubt about whether phone calls or other outreach are legitimately from the IRS should contact the agency directly to tell them about the claims and request, which should allow them to confirm whether it was actually the IRS reaching out.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

It also suggests filing taxes as early as possible to avoid the threat of identity theft, as a scammer could attempt to use your information to file a fake return.

Business

Gen Z, Locked Out of Home Buying, Puts Its Money in the Market

A generation of young people locked out of homeownership has found another way to build wealth: putting money into the stock market.

The share of people 25 to 39 years old making annual transfers to investment accounts more than tripled between 2013 and 2023 to 14.4%, outpacing increases for those 40 and over, according to data from the JPMorgan Chase Institute. The share of 26-year-olds who transferred funds to investment accounts since turning 22 shot up from 8% in 2015 to 40% as of May 2025. The numbers don’t include people investing in 401(k)s.

“We’ve seen really strong, surprisingly strong growth in retail investing in recent years among people who may otherwise be first-time home buyers,” said George Eckerd, the research director for wealth and markets at the institute.

The age range includes young millennials and there is overlap in the numbers between investors and homeowners, but Eckerd was struck by the rise in young and lower-income investors at the same time that home buying activity has fallen. That, he said, has tilted the balance of wealth accumulation toward financial markets for young people.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

Wynnstay Group Plc (WYNSF) Q4 2025 Earnings Call Transcript

Operator

Good morning, and welcome to the Wynnstay Group plc Full Year Results Investor Presentation. [Operator Instructions] Before we begin, I would like to submit the following poll. And I would now like to hand you over to CEO, Alk Brand. Good morning to you, sir.

Alk Brand

CEO & Executive Director

Good morning, everybody. It is a pleasure to talk to all of you. My name is Alk Brand. I’m the CEO of Wynnstay Plc. And today with me is Rob Thomas, my colleague, our CFO, and we’re delighted to talk to you about the results of our previous financial year. We would like to focus on quite a few things in the presentation. So I will focus on some of the highlights of the year, Rob as well, followed by a discussion of our business model, update on some of our changes. Rob will focus on our results and the business review, and then I will come back in on our summary and outlook.

So I’m happy to say that the past financial year was a successful one and was the first year of our Project Genesis. We are now in year 2 of a 3-year project to improve the financial results of the business. And I’m pleased that after year 1, looking back, we can say that it’s been a very successful year.

So with that, I’m going to hand over to my colleague, Rob, and I’m looking forward to discussing this with our investors today. Thank you for joining us.

Rob Thomas

CFO & Executive Director

Thank you, Alk, and good morning, everyone. As Alk mentioned, we are pleased with

Business

GOP senators urge permanent divestment of Lukoil assets

Fox News senior national correspondent Rich Edson interviews U.S. Treasury Secretary Scott Bessent about potential new sanctions on Russia.

FIRST ON FOX – A group of Republican senators is urging Treasury Secretary Scott Bessent to ensure that any sale of Russian energy giant Lukoil’s foreign assets results in permanent divestment from Moscow, warning against what they describe as potential “shell game” proposals that could return control to Russia.

In a letter Monday, Sens. Tim Sheehy, R-Mont., Steve Daines, R-Mont., and John Barrasso, R-Wyo., voiced support for President Donald Trump’s sanctions strategy targeting Russia’s energy sector, but raised concerns that some proposed deals may undermine the administration’s foreign policy goals.

The senators said certain proposals under consideration could amount to temporary “caretaker or custodial arrangements” designed to revert ownership back to Lukoil if U.S. sanctions are lifted or tensions between Washington and Moscow ease.

They also warned that other potential transactions could involve a “buy-and-flip” approach that might place strategic oil and gas assets into the hands of U.S. adversaries, including China, potentially jeopardizing American national security and global energy stability.

INSIDE THE SEA WAR TO CONTAIN ‘DARK FLEET’ VESSELS — AND WHAT THE US SEIZURE SIGNALS TO RUSSIA

Steve Daines, John Barrasso, and Tim Sheehy are urging Treasury Secretary Scott Bessent to ensure that any sale of Russian energy giant Lukoil’s foreign assets results in permanent divestment from Moscow. (Pete Marovich-Pool/Getty Images; Kevin Dietsch/Getty Images; Michael Ciaglo/Getty Images / Getty Images)

The letter follows the Treasury Department’s October 2025 sanctions on Lukoil and the Office of Foreign Assets Control’s requirement that the company divest its non-Russian holdings to non-blocked entities.

It also comes amid ongoing divestment talks, including Lukoil’s Jan. 29 announcement of a conditional, non-exclusive agreement to sell its subsidiary Lukoil International GmbH, which holds its international assets, to the Carlyle Group, a U.S. investment firm.

The transaction would not include assets in Kazakhstan, according to the company.

LINDSEY GRAHAM SAYS TRUMP BACKS RUSSIA SANCTIONS BILL

Tanker trucks are seen near the PJSC Lukoil Oil Company tank storage in Neder-Over-Heembeek on Nov. 15, 2025, in Brussels, Belgium. (Thierry Monasse / Getty Images)

Lukoil International GmbH maintains operations and minority interests in oil and gas fields in Iraq, Azerbaijan, Kazakhstan, Uzbekistan, Egypt and the Republic of the Congo, among other countries.

It also has stakes in several pipelines and owns refineries and thousands of retail stations across nearly 20 European countries.

‘THEY WERE SPYING’: SULLIVAN SOUNDS ALARM ON JOINT RUSSIA-CHINA MOVES IN US ARCTIC ZONE

A worker oversees the loading of oil supplies into freight wagons at the Lukoil-Nizhegorodnefteorgsintez oil refinery in Nizhny Novgorod, Russia, on Dec. 4, 2014. (Andrey Rudakov/Bloomberg via Getty Images / Getty Images)

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

The senators described the portfolio as strategically significant to global energy markets and warned that any sale must ensure the assets remain permanently outside Russian control.

“We cannot allow U.S. adversaries to regain control over these valuable assets that have funded so much of Russia’s aggression and must prioritize bids from firms that seek to invest in and build these assets to further American national interests,” Sheehy, Daines and Barrasso wrote.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video6 hours ago

Video6 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash