Business

Sushovan Nayak sees short-term AI jitters, long-term opportunities for IT giants

Speaking to ET Now, Sushovan Nayak from Anand Rathi highlighted the broader context behind this market reaction. “So, basically as you would be aware, Anthropic coming up with its [product] after that there was this Altruist, which was a [platform] which basically also got released and then the China bit which you are mentioning. So these will have a sentimental negative impact on Indian IT,” he said.

Nayak added that while these developments could create short-term pain, the long-term fundamentals of Indian IT remain strong. “The question is, if you look at, let us say, an OpenAI or an Anthropic, both of them are planning to go public. So, they will come up with these plug-ins almost at regular intervals. Each time they come up with that it will be another death knell on Indian IT, but I believe that this is going to be much more resilient. But there will be some short-term pain, which obviously we are going through, so that is what my limited submission is.”

He emphasized the continuing importance of implementation and customization of software, where Indian IT firms maintain a competitive edge. “At the end of the day, you need to implement and customise those softwares. So that is where Indian IT comes through. And with those hyperscalers putting in the amount of capex—like earlier in 2025 it was almost $400 billion for the top four, now coming to $600 billion—at the end of the day you need to have cloud transformation, data governance, data cleaning, and all of that stuff, where you end up becoming implementation partners for either a Databricks or a Snowflakes, who will [require] significant amount of work,” he noted.

When asked about valuations, Nayak said he is cautiously optimistic. “I would want to see how these folks go about, like both OpenAI and Anthropic, because if they keep on releasing such disruptive models every alternate day, then we become sentimentally negative. Obviously, I would gradually increase my buying in these, but I would possibly start looking at them for sure. I mean, Infosys has obviously been top pickers and will continue to be—it is such that these are disruptive times, so yes, that is a way I will look at it.”

Regarding opportunities in the market, Nayak expressed confidence in large-cap IT stocks. “As I had also mentioned earlier, we basically are still positive on large-cap IT, and I completely understand that there is legacy IT work that is also there which will potentially get disrupted. But the ones within the large-caps which are most adaptable or are leveraging on their gen AI tools to a larger extent, someone like an Infosys, someone like an LTIM or an HCL Tech, these are the ones which we like,” he said.

He further highlighted HCL Tech’s ER&D exposure as a source of resilience. “HCL Tech, because of the ER&D exposure, because 75% of their business is services and the other 25%—that is 15% ER&D, 10% would be around HCL Software—I think that would be a little more resilient in all of this. But as I said, this is more of sentimental things rather than creating a very structural decline in all of them, that is what at least my view is, but stand corrected on this.”Despite the current nervousness, experts suggest that Indian IT’s structural strengths and ability to partner in global AI and cloud initiatives should help the sector navigate these uncertain times.

Business

‘McMansions’ become liability as buyers reject wasted scale in housing market

PMG Affordable principal Dan Coakley speaks to Fox News Digital about what it may take to making housing affordable again across the country.

The “McMansion” is officially moving from a status symbol to liability.

Twenty years after the 2006 housing boom, new data from Zillow reveals a fundamental reversal in the American Dream: Buyers are ditching “wasted scale” and mahogany-heavy footprints for high-efficiency “sanctuaries.”

As insurance premiums and property taxes soar, real estate experts warn that the oversized, unoptimized estates of the mid-aughts are becoming a financial exposure for homeowners who fail to adapt.

“The appetite for space hasn’t disappeared, but the definition of value has evolved. Buyers still want room for family, entertaining and flexibility. What they don’t want is excess without purpose,” Catena Homes principal Harrison Polsky told Fox News Digital.

HOUSING MARKET COOLS AS PRICE GROWTH HITS SLOWEST PACE SINCE GREAT RECESSION RECOVERY

“With rising insurance costs in Texas and higher property taxes, a 5,000-plus-square-foot home that isn’t energy efficient or thoughtfully designed can absolutely feel like a liability. But a well-built, high-performance home of that size with strong insulation, efficient systems and functional layout still represents the American Dream here,” he added. “The shift isn’t away from scale entirely; it’s away from wasted scale.”

Construction workers build a new home in August 2006 in a new subdivision in Sugar Grove, Illinois, a suburb outside of Chicago. (Getty Images)

“In Palm Beach County, scale still has strong appeal, particularly in waterfront and estate communities. However, soaring insurance costs in Florida have changed buyer behavior,” RWB Construction Management founder Robert Burrage also told Fox News Digital.

“A 6,000 or 7,000-square-foot home built in 2006 without impact glass, elevated construction, modern roofing and generator systems can absolutely feel like financial exposure,” Burrage noted. “Buyers are willing to pay for size, but only if it’s engineered for resilience.”

Going back to 2006, luxury was granite and mahogany. In 2026, Zillow says it’s pickleball courts and golf simulators (with listing mentions up 25%) to whole-home batteries (up 40%) and zero-energy-ready homes (up 70%).

“Resilience and lifestyle go hand in hand. Whole-home generators, battery storage, hurricane-rated systems, smart-home integration and expansive outdoor living are expected,” Burrage said.

These large 2006 California homes look identical in size, make and color. | Getty Images

“A large home without those features narrows the buyer pool significantly. Meanwhile,” he said, “a slightly smaller but technologically advanced home designed for indoor-outdoor living often performs better in terms of demand and pricing.”

“Today’s buyers are far more educated about operating costs and long-term durability,” Polsky agreed. “In this market, lifestyle infrastructure and sustainability are no longer bonuses. They’re baseline expectations.”

Resale advice used to be: “Keep it beige.” Now, Zillow finds buyers offer more for olive green and charcoal gray, with “color drenching” mentions up 149%. The experts said the “beige box” of the mid-aughts is a harder sell now.

Serhant. founder & CEO Ryan Serhant shares his perspective on the housing market on ‘The Claman Countdown.’

“The sterile beige spec home from the mid-2000s definitely feels dated. Buyers today respond to depth and personality but it has to be curated,” Polsky said. “We’re encouraging sellers to modernize with warmer neutrals, layered textures, and intentional color moments. ‘Safe’ used to mean blank. Now safe means thoughtfully designed. Homes that lack character tend to photograph poorly and sit longer.”

“Buyers want lighter, organic palettes with architectural texture and contrast,” Burrage weighed in. “We’re advising our clients who are building with us to keep interiors fresh and light strategically. A thoughtful design can materially impact buyer perception and final sales price.”

As millennials and Gen X become the primary buying force, they are rejecting the norms of what once was. The real estate experts both answered “yes” when asked if the market is seeing a permanent cultural shift in what “luxury” means.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

‘The Big Money Show’ discusses why millions of American homeowners are not selling.

“Boomers selling older estates should strongly consider modernizing systems and aesthetics,” Burrage said. “Buyers are comparing them to newly built coastal homes engineered for climate durability and lower operating risk.”

“Boomers selling 2006-era estates need to understand that today’s buyers compare everything to new construction with modern infrastructure. Updating mechanical systems, improving energy performance and refreshing interiors before listing can dramatically improve positioning,” Polsky pointed out. “The American Dream hasn’t gone away, it’s simply become more intentional. Buyers want homes that support how they live, not just how they’re seen.”

Business

Aussie shares pare early gains to fade from record

Australia’s share market has retreated after brushing up against record highs as heavyweight earnings results weighed against shocking misses for smaller companies.

Business

Grayscale Bitcoin Trust ETF: Buy It, Just Not Now

Grayscale Bitcoin Trust ETF: Buy It, Just Not Now

Business

NTPC climbs 12% in three months on thermal additions, renewable growth bets

Of the total 33 GW currently under construction, about 16.5 GW is coal-based, 1.9 GW is hydro, and roughly 15 GW comprises renewable projects. According to the company management, the company expects the 1,350 megawatt (MW) Sinnar Thermal Power Plant acquisition to close shortly following approval of the resolution plan submitted by NTPC and Maharashtra State Power Generation Company by the National Company Law Tribunal (NCLT). The acquisition will also bring nearly 1,600 acres of land for future growth.

The company’s green-energy arm NGEL has commissioned 2.6 GW so far in FY26 and is likely to complete another 2.5 GW, in line with the target of 5 GW for the year. The subsidiary has a capacity-addition target of 8 GW each in FY27 and FY28. NGEL’s Power Purchase Agreement tie-ups remain strong at 82% for FY26, 83% for FY27, and 60% for FY28, with an overall 74% PPA coverage across its around 20 GW pipeline.

Agencies

AgenciesTarget 10-15% higher Analysts have retained ‘buy’ on the stock citing expansion across thermal and renewable projects

The company is simultaneously ramping up its presence in energy storage. It is in the final stages of evaluating a 5 GWh of battery energy storage system (BESS) across 16 stations under Section 62 where BESS projects are awarded with regulated tariffs approved by regulators, rather than through competitive bidding. It has also finalised a 320 MWh BESS project in Kerala.

In hydropower storage, the third unit of the Tehri pumped-storage project has been commissioned, with the final 250 MW unit scheduled before FY26 ends. Preliminary studies are also underway for around 13 GW of pumped-storage projects allocated by various states.

Analysts have retained ‘buy’ rating with 10-15% higher target prices than the current market price of ₹367. “NTPC continues to make efforts to diversify its generation portfolio. Progress on execution of new thermal projects remains a key variable to monitor,” noted JM Financial Institutional Securities in a report. The broking firm has revised the target price to ₹420 from ₹397 earlier.

Business

VestoFX.net Review: Is This Trading Platform Any Good?

In this VestoFX.net review, we take a detailed look at what the platform offers, how it works, and what traders can expect when using it for CFD trading across multiple global markets.

The goal is to explain the platform in clear, simple language so everyday traders can understand whether it fits their trading style and experience level.

VestoFX.net Review: What Is VestoFX.net and Who Operates It?

VestoFX.net is an online CFD trading platform designed for traders who want access to multiple asset classes through one account. The platform focuses entirely on Contracts for Difference (CFDs), allowing traders to speculate on price movements without owning the underlying assets.

This website (www.vestofx.net) is operated by Fairmont Financial Services (PTY) LTD, a South African investment firm.

The company is authorized and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa and operates under Financial Service Provider (FSP) license number 51766.

VestoFX.net Review: What Markets Can Traders Access?

One of the main highlights in this VestoFX.net review is the range of CFD markets available. The platform brings together several popular asset classes that appeal to traders worldwide.

Traders can access CFDs on:

- Cryptocurrencies

- Forex currency pairs

- Commodities such as metals and energy products

- Shares of selected companies

- Global indices

All instruments are traded strictly as CFDs, allowing traders to focus on price movements rather than ownership.

VestoFX.net Review: How Does CFD Trading Work on the Platform?

CFD trading on VestoFX.net enables traders to speculate on whether an asset’s price will move up or down. Instead of purchasing the asset itself, traders open positions based on price changes.

The platform supports trading in both rising and falling markets.

Tools such as stop-loss and take-profit features are available to help traders manage positions more effectively.

VestoFX.net Review: How Does the Trading Platform Operate?

VestoFX.net provides a web-based trading platform that can be accessed from different devices. The interface is designed to be straightforward, making it easier to monitor markets and execute trades.

Key platform features include real-time charts, trade execution tools, account balance tracking, and market monitoring features. The layout avoids unnecessary complexity, which may appeal to both new and experienced traders.

VestoFX.net Review: How Can Traders Register an Account?

The registration process on VestoFX.net begins with creating an online account. Traders are required to complete a questionnaire during sign-up.

This questionnaire collects information about trading experience, financial background, and understanding of CFD products. Completing it accurately is part of the onboarding process before funding the account and accessing live trading.

VestoFX.net Review: What Account Types Are Available?

VestoFX.net offers four distinct trading account options, structured to suit a wide range of traders, from those just entering the CFD market to highly experienced participants.

The Basic Account is designed for beginners and requires a minimum deposit of $250. It features floating spreads starting from 3.0 pips on EUR/USD, 3.4 pips on GBP/USD, and 3.3 pips on USD/JPY.

This account allows new traders to begin with a relatively low initial commitment and includes one free withdrawal, making it a practical starting point.

The Gold Account is aimed at traders with more market experience and comes with a minimum deposit requirement of $25,000. Compared to the Basic Account, it offers improved trading conditions, with spreads starting from 2.7 pips for EUR/USD, 3.1 pips for GBP/USD, and 3.0 pips for USD/JPY.

Gold account holders also receive one free withdrawal per month, supporting more frequent trading activity.

For traders looking for more advanced conditions, the Platinum Account requires a minimum deposit of $100,000. This account provides tighter spreads, beginning at 2.1 pips for EUR/USD, 2.5 pips for GBP/USD, and 2.4 pips for USD/JPY.

In addition, Platinum traders benefit from three free withdrawals each month, offering greater flexibility in managing funds.

The VIP Account is structured for professional traders seeking premium trading conditions. With a minimum deposit of $250,000, this account offers the most competitive spreads, starting at 1.6 pips for EUR/USD, 2.0 pips for GBP/USD, and 1.9 pips for USD/JPY.

VIP account holders enjoy unlimited fee-free withdrawals, supporting high trading volumes and active fund movement.

Overall, these account options allow traders to choose a structure that aligns with their experience level, trading activity, and financial objectives, while progressively offering tighter spreads and more flexible withdrawal benefits at higher tiers.

VestoFX.net Review: What Can Traders Invest In Using These Accounts?

All account types provide access to the same core CFD markets, including crypto, forex, commodities, shares, and indices. Differences between accounts relate to trading conditions and platform features rather than market availability.

This setup allows traders to diversify their CFD trading activity across multiple asset classes within one platform.

VestoFX.net Review: Who Is the Platform Designed For?

VestoFX.net is built for traders from around the world, including Switzerland, UAE,Saudi Arabia, Malaysia, Kuwait, Singapore. Its multi-asset CFD structure may appeal to traders who prefer managing different markets from a single account.

With multiple account options, the platform supports traders at different experience levels and trading volumes.

VestoFX.net Review: What Are the Key Strengths and Limitations?

Strengths include:

- Access to multiple CFD markets

- Clear account type structure

- Regulated operator under the FSCA

Limitations to consider:

- Only CFD trading is available

- Trading conditions depend on the selected account type

This balanced overview helps set realistic expectations.

VestoFX.net Review: Final Thoughts on the Platform

This VestoFX.net review presents a CFD trading platform focused on providing access to crypto, forex, commodities, shares, and indices through a single interface. The platform emphasizes clarity, structured onboarding, and multiple account choices.

Rather than offering unnecessary extras, VestoFX.net focuses on core CFD trading functionality, making it a platform worth exploring for traders seeking multi-market exposure.

FAQs

Is VestoFX.net suitable for beginners?

Yes, the Basic account and simple platform layout support new traders.

What markets are available on VestoFX.net?

CFDs on crypto, forex, commodities, shares, and indices.

Do traders own assets on VestoFX.net?

No, all trading is done through CFDs only.

Can traders from Switzerland use the platform?

Yes, traders from Switzerland and many other countries can register.

Are multiple account types available?

Yes, Basic, Gold, Platinum, and VIP accounts are offered.

Business

Nancy Guthrie disappearance brings focus on cryptocurrency crime tracking

Former hostage negotiator Dan O’Shea discusses the ongoing investigation into the alleged abduction of Nancy Guthrie on day 10 of the search on ‘Mornings With Maria.’

The disappearance of Nancy Guthrie has brought a renewed focus on the traceability of cryptocurrencies and their use by criminals following reports of alleged ransom notes requesting payment in bitcoin.

Guthrie, 84, was last seen on Feb. 1, when authorities believe she was kidnapped from her home. There have been reports about multiple alleged ransom notes demanding payment in bitcoin during the course of the investigation, now in its second week.

While bitcoin gained a reputation for being associated with crime following the 2013 takedown of the Silk Road online black market, where crypto was used to buy illegal drugs and other items, the evolution of the digital assets industry and expanded regulatory oversight of it in the years since has made it more difficult for bad actors to do so.

“Every single bitcoin transaction is recorded on a public ledger called the blockchain, so when it comes to tracing transactions, following the money, you have a perfect record with bitcoin,” Perianne Boring, founder and chair of the Digital Chamber, told FOX Business. The Digital Chamber advocates for the use of digital assets and blockchain-based technologies.

EX-FBI OFFICIAL FLAGS POSSIBLE SCAM AS THIRD ALLEGED NANCY GUTHRIE LETTER EMERGES

Bitcoin transactions are recorded on the blockchain, which can be tracked by the public and law enforcement, which has more sophisticated tools. (Jakub Porzycki/NurPhoto via Getty Images)

“The blockchain is a public ledger that is free for anyone to audit, so anyone can look up a specific bitcoin wallet address and see every transaction that’s come in and out from the very beginning,” she said.

“So, there’s no way to hide those tracks. This is actually an incredibly powerful tool for law enforcement. In fact, it’s a way better tool for law enforcement than it is for criminals, which is why we really don’t see a lot of criminal activity with bitcoin anymore now that the industry has matured,” Boring added.

SEE THE PHOTOS: ARMED MAN AT NANCY GUTHRIE’S HOME

FBI Director Kash Patel shared still images recovered from a doorbell camera outside Nancy Guthrie’s residence on Tuesday, Feb. 10. (@FBIDirectorKashPatel via X)

Boring said that criminals may “self-custody” their bitcoin without using a third party – like a bank – to hold on to the money, though they would still face issues trying to convert the crypto to the fiat currency of their choice.

“If a ransom was paid to a bitcoin wallet and the criminal has control of that money, that’s totally possible. But at some point they’re going to have to transfer that money into U.S. dollars or to yen or to euros or whatever currency they want so they can use the money,” she said.

“The companies that provide that money exchange service are all regulated businesses globally… you have to use a regulated financial institution like Coinbase to do that, and at that point, you’re at a [know your customer] entity so we would know the identity of the person who’s trying to exchange the bitcoin that’s linked to the ransom payment,” Boring said.

NANCY GUTHRIE CASE: WHY CRIMINALS ARE TURNING TO CRYPTOCURRENCY FOR RANSOMS

The bitcoin and digital assets industry has developed advanced track and trace technologies, Boring said. (Photo illustration by Chesnot/Getty Images)

Another tactic used by criminals to try and subvert the traceability of bitcoin is to send it from a self-custodied crypto wallet to multiple wallets, although those various distributions are still trackable by law enforcement. Boring noted that this tactic led to the emergence of mixing services in the crypto space that will “receive crypto from multiple parties and mix it together, and then you can pull it out the other end.”

“That’s one way to conceal it. But even that, you get all the money that goes into a mixer, you can see all the crypto that comes out of it, so there’s still traceability on it, but it does confuse things a little bit for law enforcement purposes – but law enforcement is very, very sophisticated with being able to track and trace all transactions on the blockchain,” Boring said.

She noted that within the crypto economy, businesses have created track-and-trace software used by compliance officers at crypto firms as well as law enforcement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“This is a very sophisticated effort that’s been built over a decade. There is a lot of coordination that happens with the crypto exchanges and law enforcement to track and trace illicit activity in this space, and it’s very effective and very efficient,” Boring said.

She added that the Justice Department has had a number of cases in which they’ve seized large amounts of crypto from criminals, saying that “law enforcement has really done a very good job of helping police criminals that are abusing this technology for nefarious purposes and keeping this ecosystem safe.”

Business

Have Tech Stocks Hit A Reset Moment?

While tech firms may benefit from a longer-term “renaissance” in AI, TD Wealth’s Chief Wealth Strategist Brad Simpson says the recent selloff may be a “reset moment” for the sector.

Transcript

Anthony Okolie: While many of the high-flying tech stocks have come under pressure recently, our featured guest today says that investors need to be thinking about the longer-term renaissance that’s happening in the sector. Joining us now with more is Brad Simpson, Chief Wealth Strategist with TD Wealth.

And Brad, welcome to the show.

Brad Simpson: It’s great to be here.

Anthony Okolie: Alright. So, for people who haven’t seen it yet, what’s the big theme of your latest portfolio strategy quarterly? And what inspired that title?

Brad Simpson: Yeah, it’s a big title, isn’t it? “The Brand New Renaissance.” I think the reality is, we wanted to make a publication that, on first blush, it seems like a lot of hyperbole. We are of this belief that– and I think that we are in the middle of the second Renaissance right now. And the first one was 500 years ago, and we’re in the middle of a new one. And I don’t think that’s an overstatement.

And so what inspired us was, on one hand, was that we really wanted to map that out and what does that mean– take it and go back a little bit and actually look at the original Renaissance and what were some of the implications of it, and then compare it to today.

But also to hit home that this is happening at a massive rate, like a 10 times rate. The Renaissance unrolled over a series over a couple hundred years. We’re seeing this unfold rapidly, and it’s changing not just in the things that we’re seeing around us, but how we think about our cognition

Business

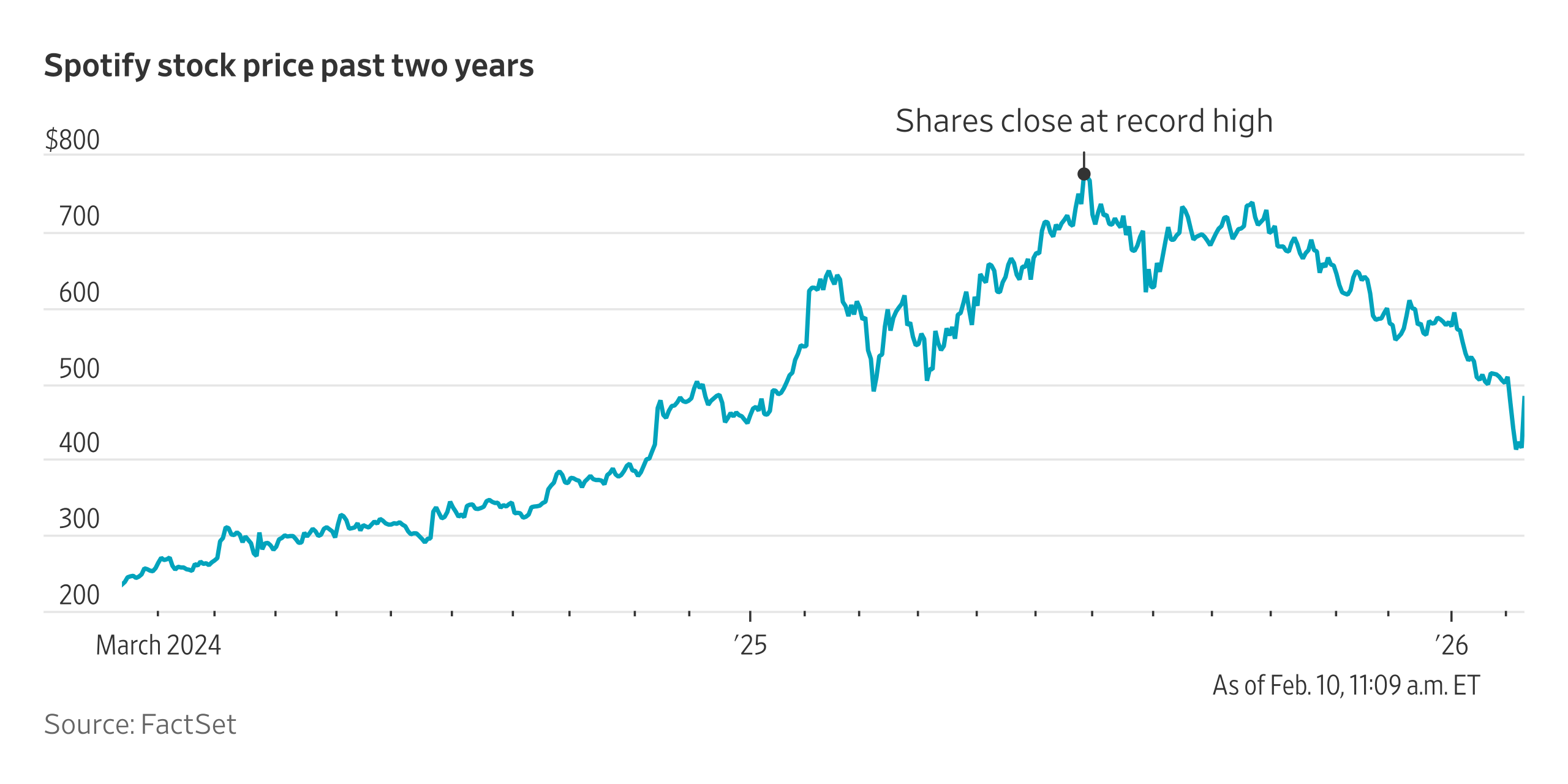

Spotify Shares Soar on Record User Gain

Spotify shares surged Tuesday, after the company added a record 38 million monthly users to its audio-streaming platform late last year.

The fourth-quarter additions took the company to 751 million monthly active users.

Spotify said more than 300 million users engaged with its year-end “Spotify Wrapped” campaign. The feature gives listeners a look back at their listening history for the year and is popular for sharing on social media.

Business

October World Oil Production Drops

October World Oil Production Drops

Business

Check Point Software earnings beat by $0.64, revenue fell short of estimates

Check Point Software earnings beat by $0.64, revenue fell short of estimates

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports11 hours ago

Sports11 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World12 hours ago

Crypto World12 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video7 hours ago

Video7 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

![[KPOP IN PUBLIC] LISA - 'MONEY' | Cover by BN DANCE TEAM FROM VIETNAM](https://wordupnews.com/wp-content/uploads/2026/02/1770893501_maxresdefault-80x80.jpg)