Business

US Market | Berkshire Hathaway invests in New York Times, trims Apple

Shares of the Times rose 4% to $76.99 in after-hours trading.

In a filing with the U.S. Securities and Exchange Commission, Berkshire said it owned about 5.07 million Times shares worth $351.7 million at the end of 2025. Berkshire’s filing contained the Omaha, Nebraska-based company’s U.S.-listed stock holdings as of December 31, which comprise most of its equity portfolio.

Berkshire said that during the fourth quarter, it also sold 4% of its stake in iPhone maker Apple, still its largest equity holding at $62 billion, and 77% of its 10 million shares in online retailer Amazon.com.

The quarter marked the end of Buffett’s 60-year run leading Berkshire. Greg Abel succeeded him as chief executive on January 1, though Buffett remains chairman.

Berkshire’s filing does not say whether investments were directed by Buffett, Abel or portfolio manager Ted Weschler. Another portfolio manager, Todd Combs, left in December for JPMorgan Chase.

Stock prices routinely rise when Berkshire reveals new stakes, reflecting what investors view as a seal of approval from Buffett. It was unclear whether that will continue under Abel. Berkshire has not named a new chief investment officer to replace Buffett, or said how it will divvy up equity investments.

BUFFETT, FORMER PAPER CARRIER, CALLED THE TIMES A SURVIVOR

Buffett delivered newspapers as a teenager, and had long defended the industry before selling Berkshire’s newspaper business, including its hometown Omaha World-Herald, to Lee Enterprises for $140 million in 2020. Berkshire also became Lee’s only lender.

Loathe to sell entire businesses, Buffett told Berkshire shareholders in 2018 that only the Times, the Wall Street Journal and perhaps the Washington Post had digital models strong enough to offset declining print circulation and advertising revenue.

The Post, owned by Amazon founder Jeff Bezos, has since encountered its own struggles, and this month laid off approximately one-third of its employees.

During the fourth quarter, Berkshire also bought and sold several other stocks, adding to its holdings in Chevron and Chubb and selling some Aon and Bank of America stock.

More details about Berkshire’s investments may appear in the company’s annual report and Abel’s first shareholder letter on February 28.

Investors and analysts have said Berkshire has been cautious about valuations, having gone more than a year with no stock buybacks and a decade without a giant acquisition.

Berkshire also owns dozens of businesses including the BNSF railroad, Geico car insurance, energy and manufacturing companies, and retail brands such as Brooks, Dairy Queen, Fruit of the Loom and See’s.

Business

Keystone Law reports revenue and profit ahead of market expectations

Keystone Law reports revenue and profit ahead of market expectations

Business

General Mills cuts profit forecast as shoppers change buying habits

‘The Big Money Show’ panel analyzes the ‘gray-shaped economy’ and the January jobs report.

Cheerios maker General Mills cut its annual sales and profit forecasts, citing weak consumer sentiment and a shift toward healthier and lower-cost food options that are pressuring demand for packaged products.

“Weak consumer sentiment, heightened uncertainty, and significant volatility have weighed on category growth and impacted consumer purchase patterns, resulting in a slower pace and higher cost of volume recovery than initially expected,” the company said in a statement ahead of its presentation at the Consumer Analyst Group of New York (CAGNY) conference on Tuesday morning.

The shifting consumer landscape, driven in part by the growing preference for healthier options and increased adoption of GLP-1 weight-loss drugs, is adding further pressure to packaged food demand.

Packages of Cheerios, a brand owned by General Mills, are seen in a store in Manhattan. (Andrew Kelly/Reuters)

WENDY’S TO CLOSE HUNDREDS OF RESTAURANTS AS COMPANY LOOKS TO FOCUS ON VALUE TO BOOST SALES

General Mills CEO Jeff Harmening said during the company’s presentation at CAGNY that the growing competition for protein options is also a factor. General Mills has its own line of protein cereals.

“We expect GLP-1 and other anti-obesity medications to have a lasting influence in the food and nutrition landscape, nudging some consumers toward smaller portions and more nutrient-dense protein and fiber-forward foods,” Harmening said.

The chief executive also said the company recognizes that its lower- and middle-income consumers have increasingly focused on value as economic pressures continue to weigh on their budgets.

“Cost of living and housing pressures are reshaping spending patterns and value is a core expectation that is here to stay,” Harmening said.

Cheerios for sale at a grocery store on Dec. 22, 2025 in Durham, North Carolina. (Al Drago/Getty Images)

Earlier this month, PepsiCo cut prices on core brands such as Lay’s and Doritos by up to 15% following a consumer backlash against earlier price hikes.

Peer Conagra, maker of Slim Jim meat snacks, has maintained its annual sales and profit targets despite reporting a muted second quarter.

General Mills, which left its annual outlook unchanged in December, has been grappling with muted demand as Americans curb discretionary spending and shift to cheaper pantry staples.

A woman shops for Cheerios at a Price Chopper supermarket in South Burlington, Vermont, Nov. 6, 2017. (Robert Nickelsberg/Getty Images)

General Mills now expects annual sales to decline 1.5% to 2%, compared with its prior range of down 1% to up 1%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GIS | GENERAL MILLS INC. | 44.96 | -3.38 | -6.99% |

The company also forecast annual adjusted operating profit and adjusted earnings per share will fall 16% to 20% in constant currency, versus its previous outlook for a 10% to 15% decline.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Reuters contributed to this report.

Business

Tesla avoids California suspension after ending ‘autopilot’ marketing

FOX Business’ Grady Trimble has the details from inside an autonomous robotaxi on ‘Varney & Co.’

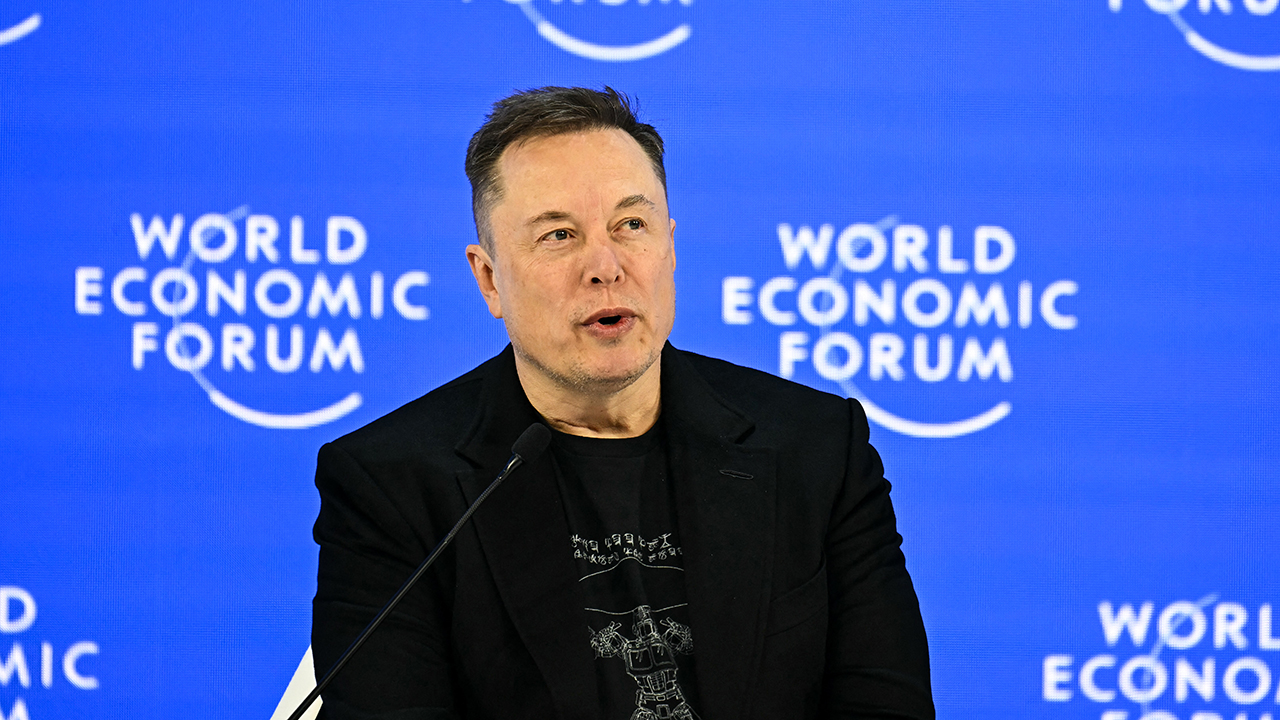

Tesla will avoid a 30-day suspension of its dealer and manufacturer licenses in California after complying with a state order to stop using the term “autopilot” when marketing its vehicles, state regulators said Tuesday.

The decision comes after the California Department of Motor Vehicles (DMV) found in December 2025 that Tesla violated state law by misleadingly marketing its electric vehicles with the terms “autopilot” and “full self-driving.”

The regulator said Tuesday that Elon Musk’s electric vehicle company took “corrective action” and had stopped using the term “autopilot,” and noted that Tesla already modified its use of the term “full self-driving” by clarifying that driver supervision is required.

CHINA MOVES TO BAN FEATURE COMMONLY SEEN ON TESLA VEHICLES OVER FEAR OF TRAPPED PASSENGERS

Tesla avoided a 30-day suspension of its California sales licenses after regulators said the company complied with an order to stop using the term “autopilot” in its marketing. (Yichuan Cao/NurPhoto / Getty Images)

“The DMV is committed to safety throughout all California’s roadways and communities,” California DMV Director Steve Gordon said in a statement. “The department is pleased that Tesla took the required action to remain in compliance with the State of California’s consumer protections.”

According to the DMV, Tesla’s Advanced Driver Assistance System (ADAS) marketing materials beginning in 2021 used the terms “autopilot” and “full self-driving capability,” along with the phrase, “The system is designed to be able to conduct short and long-distance trips with no action required by the person in the driver’s seat.”

However, the DMV said the vehicles “could not at the time of those advertisements, and cannot now, operate as autonomous vehicles.”

The DMV filed accusations against Tesla’s manufacturer and dealer licenses in November 2023, and the automaker Tesla discontinued use of the term “full self-driving capability” after noting that the system required driver supervision.

TESLA ENDS PRODUCTION OF MODEL S AND MODEL X VEHICLES, WILL FOCUS ON ROBOTS IN 2026

California regulators said Tesla took corrective action in its marketing of driver-assistance features, avoiding a temporary suspension of its sales licenses. (Eric Thayer/Bloomberg via Getty Images / Getty Images)

Last year, the California Office of Administrative Hearings held a hearing before an administrative law judge, who issued a proposed decision in November finding that the term “autopilot” violated state law.

The DMV had given Tesla 60 days to take corrective action. By complying, Tesla avoided a temporary suspension in California — its largest U.S. market.

According to its website, Tesla’s “autopilot” feature allows vehicles to match the speed of traffic and assists with steering within a marked lane.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

Tesla, led by Elon Musk, complied with a state order to stop using the term “autopilot” in California advertising, regulators said. (Fabrice COFFRINI/AFP via Getty Images / Getty Images)

The “full self-driving (supervision)” feature alerts drivers of stop signs and traffic lights, and can slow the vehicle to a stop while approaching the signal, all with driver supervision.

FOX Business reached out to Tesla for comment.

Business

Glencore profit falls 6%, announces $2 billion shareholder return

Glencore profit falls 6%, announces $2 billion shareholder return

Business

Opinion: Systems change to unlock innovation

OPINION: Overcoming systemic challenges can help businesses unlock innovation.

Business

Lower fuel prices and airfares help drive inflation down

The rate at which prices are rising is slowing down, which could lead to lower interest rates.

Business

Thailand Futures Exchange announces TFEX Best Award 2025 for outstanding derivatives brokers

TFEX announced the “TFEX Best Award 2025” to recognize broker excellence. Awards went to MTSGF, PI, KGI, KKPS, YUANTA, CAF, and INVX for outstanding performance and market contributions.

KEY POINTS

- TFEX announced the “TFEX Best Award 2025”, recognizing member companies for excellence in the areas of investor base expansion, market maker performance and active trading.

- Seven awarded brokers were MTSGF, PI, KGI, KKPS, YUANTA, CAF, and INVX

BANGKOK, February 16, 2026 – Thailand Futures Exchange pcl (TFEX) announced the recipients of the TFEX Best Award 2025, an annual recognition program honoring member companies for their excellence and outstanding performance across key areas of the derivatives market. TFEX Managing Director Triwit Wangvorawudhi emphasized that the strong cooperation and continued support from all members have been instrumental in driving the development and growth of Thailand’s derivatives market.

The “TFEX Best Award of Honor 2025” was presented to brokers that have demonstrated exceptional and consistent excellence for at least three consecutive years. The following companies received this distinction:

- MTS Capital Co., Ltd. (MTSGF) – Market Maker Best Performance

- Pi Securities pcl (PI) – Active Agent

- KGI Securities (Thailand) pcl (KGI) – Most Active House and Active Prop-Trading

For the “Best of the Year Award 2025”, the following brokers were recognized for their outstanding achievements based on trading performance and investor base expansion in each category:

- Kiatnakin Phatra Securities pcl (KKPS) – Most Active House Award

- Yuanta Securities (Thailand) Co., Ltd. (YUANTA) – Active Agent Award

- Classic Ausiris Investment Advisory Securities Co., Ltd. (CAF) – Active Prop-Trading Award

- InnovestX Securities Co., Ltd. (INVX) – Popular Agent Award

- KGI Securities (Thailand) pcl (KGI) – Market Maker Best Performance Award

Source : Thailand Futures Exchange announces TFEX Best Award 2025 for outstanding derivatives brokers

Other People are Reading

Business

City of Perth policy limits councillor’s emails

The City of Perth has started to implement suggestions from the psychosocial risk assessment, including addressing a councillor’s “inappropriate communication to staff”.

Business

Dilip Buildcon shares rally 4% as lowest bidder for Rs 702 crore Gujarat flood control project

The company has been declared the L-1 bidder for a tender issued by the Narmada Water Resources, Water Supply & Kalpasar Department, Government of Gujarat. The project entails the construction of a flood protection embankment along the Narmada River in Bharuch district.

Execution will follow an EPC (Engineering, Procurement, and Construction) model, with a total project cost of Rs 702 crore, excluding GST. The project is expected to be completed over a 24-month period.

This initiative forms part of Gujarat’s broader efforts to enhance flood protection infrastructure. Being a domestic EPC contract, it is a standard engineering and construction project with no involvement of the company’s promoters or promoter group in the awarding authority, and no related-party transactions are associated with this order.

On Tuesday, Dilip Buildcon shares closed at Rs 434.95 on the NSE, registering a modest gain of 1.02% for the day.

In terms of valuation, the stock price-to-earnings (P/E) ratio of 5.01, a price-to-sales (P/S) ratio of 0.62, and the price-to-book (P/B) ratio of 1.34. These metrics suggest that the market is valuing the company at relatively low multiples compared to its earnings, sales, and book value.

From a technical perspective, the daily Relative Strength Index (RSI) stood at 39.7. Since an RSI below 30 generally indicates that a stock is oversold and above 70 signals overbought conditions, the current level points to a neutral-to-slightly-oversold territory. Additionally, the stock is trading below all eight of its simple moving averages (SMAs), suggesting short-term bearish momentum and caution for traders relying on trend-following strategies.Looking at recent financial performance, Dilip Buildcon reported a revenue of Rs 2,308 crore in the December 2025 quarter, which represents a 12.4% decline year-on-year. However, the company’s net profit saw a substantial increase of 619.9% YoY, reaching Rs 830 crore, highlighting strong profitability improvements despite the dip in top-line revenue.

The company’s strong order wins and robust profitability in the last quarter could keep investor interest high, despite some short-term technical weakness in stock movement.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of Economic Times)

Business

Alcoa to pay "unprecedented" $55m enforceable undertaking

Alcoa Australia has made an unprecedented commitment to pay $55 million to support remediation of its mine sites as it strives for environmental approval for its South West operations.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business8 hours ago

Business8 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video23 hours ago

Video23 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World22 hours ago

Crypto World22 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

Business6 days ago

Business6 days agoAn Activist Investor Enters Wall Street Banks’ Cozy Club