Crypto World

15% growth in malicious email attacks in 2025

Editor’s note: In crypto and fintech security, email remains a critical attack vector. The 2025 Kaspersky findings show a sharp rise in malicious and potentially unwanted emails, with spam accounting for nearly half of global traffic and millions of dangerous attachments hitting users. For crypto firms and investors, these trends mean more phishing, more BEC attempts, and combined-channel scams that blend email with messaging apps and even legitimate-looking services. This editorial summarizes the implications and directs attention to the press release’s key points, which detail where threats are coming from, how attackers adapt, and practical defenses for the year ahead.

Key points

- 44.99% of global email traffic was spam in 2025.

- Over 144 million malicious and potentially unwanted email attachments.

- APAC led detections at 30%, Europe 21%, with China 14% among top countries.

- Detections peaked in June, July and November.

- Trends include cross-channel scams, evasion techniques, platform abuse, and refined BEC tactics.

Why this matters

Kaspersky’s 2025 telemetry shows 44.99% of global email traffic was spam, with 144 million malicious attachments and APAC leading detections, underscoring rising phishing risks.

Attackers increasingly blend email with other channels, employ advanced disguises, and imitate legitimate services, creating risk for crypto platforms and users alike. Staying ahead requires awareness, user training, and layered security measures.

What to watch next

- Monitor cross-channel phishing and fraudulent outreach patterns.

- Watch for increased use of legitimate platforms to send spam and scams.

- Be vigilant for refined BEC tactics and fake email threads.

- Strengthen phishing awareness and security controls across organizations.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Kaspersky reports 15% growth in malicious email attacks in 2025

12 February 2026

According to Kaspersky telemetry, almost every second email – 44.99% of global traffic – was spam in 2025. Spam consists not only of unsolicited emails, but can also include various email threats such as scam, phishing and malware. In 2025, individuals and corporate users encountered over 144 million malicious and potentially unwanted email attachments, representing a 15% increase compared to the previous year figures.

In 2025, APAC had the largest share of email antivirus detections: it reached 30%, followed by Europe with 21%. Next came Latin America (16%) and the Middle East (15%), Russia and CIS (12%) and Africa (6%). As for individual countries, China had the highest rate of malicious and potentially unwanted email attachments, with the share of email antivirus detections of 14%. Russia ranked second (11%), followed by Mexico (8%), Spain (8%) and Turkey (5%).

Email antivirus detections peaked moderately in June, July and November.

Key trends in email spam and phishing

Kaspersky’s annual analysis has also identified several persistent trends in the email spam and phishing threat landscape that are expected to continue into 2026:

- Combination of various communication channels. Attackers lure email users into switching to messengers or calling fraudulent phone numbers. For instance, scam investment mailings may redirect victims to fake websites, where they are asked to provide their contact information, and then cybercriminals will follow up with a phone call.

- Usage of diverse evasion techniques in phishing and malicious emails. Threat actors frequently try to disguise phishing URLs, for example, with the help of link protection services and QR codes. These QR codes are often embedded directly in email bodies or within PDF attachments, which not only conceals phishing links but also encourages users to scan them on mobile devices, potentially exploiting weaker security measures than corporate PCs.

- Mailings exploiting diverse legitimate platforms. For example, Kaspersky experts discovered a fraudulent tactic that abuses OpenAI’s organization creation and team invitation features to send spam emails from legitimate OpenAI addresses, potentially tricking users into clicking scam links or dialing fraudulent phone numbers. Additionally, a calendar-based phishing scheme, which originated in the late 2010s, resurfaced last year with a focus on corporate users.

- Refining tactics in business email compromise (BEC) attacks. In 2025 attackers attempted to become even more persuasive by incorporating fake forwarded emails into their correspondence. These emails lacked thread-index headers or other headers, making it difficult to verify their legitimacy within an email conversation.

Email phishing shouldn’t be underestimated. Our report reveals that one in ten business attacks starts with phishing, with a significant proportion being Advanced Persistent Threats (APTs). In 2025, we saw an increase in the sophistication of targeted email attacks. Even the smallest details are meticulously crafted in these malicious campaigns, including the composition of sender addresses and the tailoring of content to real corporate events and processes. The commodification of generative AI has significantly amplified this threat, enabling attackers to craft convincing, personalized phishing messages at scale with minimal effort, automatically adapting tone, language and context to specific targets,

To learn more about spam and phishing threat landscape, visit securelist.com.

To stay safe, Kaspersky recommends:

- Treat unsolicited invitations from any platform with suspicion, even if they appear to come from trusted sources.

- Carefully inspect URLs before clicking.

- Do not call any phone numbers indicated in suspicious emails – if you need to call support of a certain service, it is best to find the phone number on the official webpage of this service.

- For corporate users, Kaspersky Security for Mail Server with its multi-layered defense mechanisms powered by machine learning algorithms provides robust protection against a wide range of evolving threats and offers peace of mind to businesses in the face of evolving cyber risks.

- Ensure all employee devices, including smartphones, are equipped with robust security software.

- Conduct regular training on modern phishing tactics.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure, and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.

Crypto World

Key Senate Democrat wants U.S. crypto bill to move, and SEC chief reveals danger of defeat

One way or another, the U.S. crypto industry is likely to receive official policy that defines which digital assets get what treatment from which federal agencies. The problem: It might not last.

Securities and Exchange Commission Chairman Paul Atkins is focused on reversing the “head in the sand” approach he accuses his predecessors of having on crypto policy, and he’s ready to issue rules that give the industry the regulatory clarity it craves. The catch, though, is that such rules won’t be locked down and can be erased by the same kind of commission vote that puts them in place. They won’t be backed by a targeted law that makes them unassailable by future administrations.

“We need a firm grounding in statute so we can’t have any backsliding in the future,” Atkins told the Senate Banking Committee in Thursday testimony. No matter how enthusiastic he is in giving the industry innovation-friendly rules, they’re not “future-proof.”

But the legislation in the U.S. Senate that would govern such things is floundering. Crypto executives and bankers haven’t been able to reach a compromise on one of the sticking points in stablecoin rewards programs. And Democratic lawmakers haven’t been offered answers to a number of their core concerns, including the full staffing of regulatory commissions and the danger of conflicts of interest when senior government officials have deep business ties to crypto (most obviously, in their view, President Donald Trump).

Senator Mark Warner, one of the leading Democratic negotiators on the Digital Asset Market Clarity Act, which still needs a hearing in the banking panel, said there’s still a big, bipartisan group working hard on the bill.

“We want to get this done,” he said, signalling that Democrats haven’t yet abandoned the talks. “It’s got to be done safely.”

His primary concern is decentralized finance (DeFi) and preventing bad actors from using it for illicit purposes. Warner’s views on this have, at times, shaken the industry and been seen as a threat to the future existence of DeFi projects. But the latest talks over the bill’s treatment of illicit finance haven’t yet settled on an approach.

“We’ve got to make sure that we don’t set up a regime that allows bad actors or carves out enforcement,” Warner said.

A Republican lawmaker, Senator Bernie Moreno, commiserated with the SEC chairman, saying, “Congress has failed miserably to give you laws.”

Atkins reiterated that his agency has “pretty broad authority” to write rules now that put crypto businesses on a clear regulatory foundation, as he’s been trying to execute with his “Project Crypto” agenda. But, he said, the rules would need to have legislation “undergird” them.

“We do need, I believe, a good law coming out of Congress,” Atkins said.

Read More: The big U.S. crypto bill is on the move. Here is what it means for everyday users

So far, a similar version of the Clarity Act already passed the House of Representatives last year. And just last month, another version cleared the Senate Agriculture Committee in a party-line vote. However, when it comes time for the full Senate to vote on a final market structure bill, the industry will need at least seven Democrats like Warner on board — and potentially more, if the Republicans aren’t unanimous.

While Senate Banking Committee Chairman Tim Scott sounded a hopeful note on Thursday about the Clarity Act, even industry leaders such as Coinbase CEO Brian Armstrong have shown a willingness to pull support if the policy doesn’t look right. And Treasury Secretary Scott Bessent called out crypto-industry “nihilists” who are ready to stand in the way, saying they should move to El Salvador if they don’t want vigorous regulation.

The girding that Atkins needs for the SEC’s pending rules remains uncertain, though the White House has directed negotiators to find common ground before the month is out. The clock is ticking, as House Financial Services Committee Chairman French Hill put it.

Read More: SEC’s Paul Atkins grilled on crypto enforcement pull-back, including with Justin Sun, Tron

Crypto World

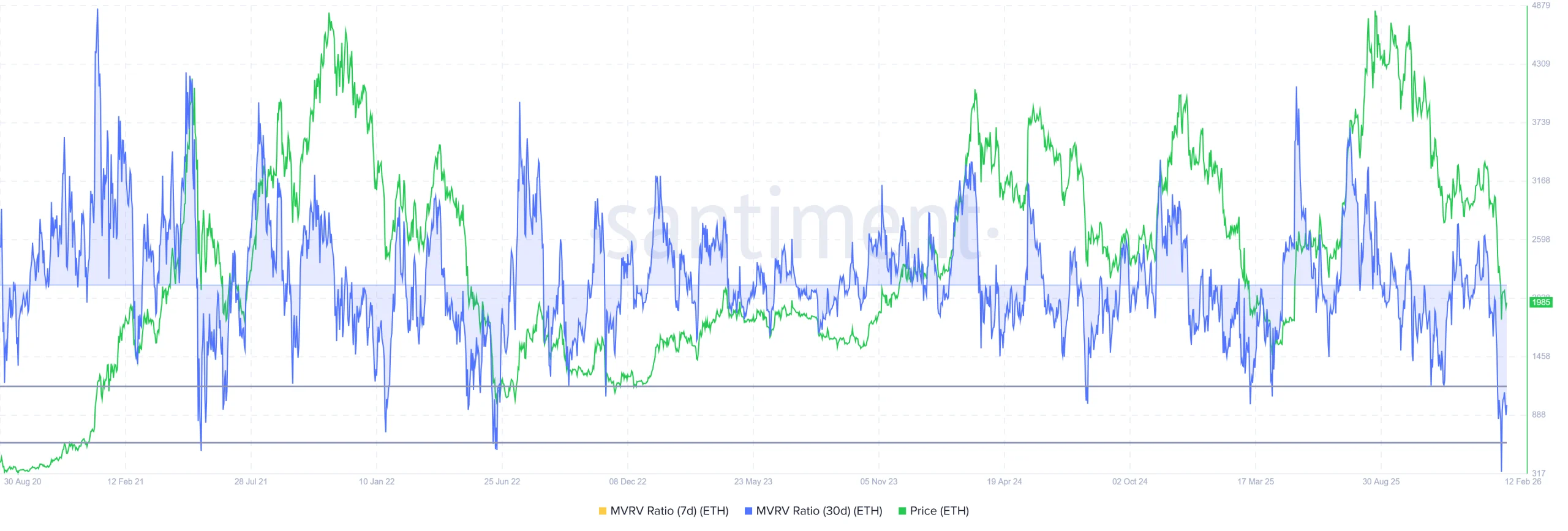

Ethereum Price Struggles Below $2,000 Despite Entering Buy Zone

Ethereum price remains under pressure after a sharp decline that unsettled investors across the crypto market.

Although Ethereum appears to be entering a historically favorable accumulation zone, on-chain indicators reveal mixed conviction among different holder cohorts.

Sponsored

Sponsored

Ethereum Is In a Prime Accumulation Range

Ethereum’s Market Value to Realized Value, or MVRV, ratio indicates that ETH has entered what analysts describe as an “opportunity zone.” This range lies between negative 18% and negative 28%. Historically, when MVRV falls into this band, selling pressure approaches exhaustion.

Previous entries into this zone often preceded price reversals. Investors typically accumulate when unrealized losses deepen. Such behavior can stabilize the Ethereum price and initiate recovery phases. However, historical probability does not guarantee immediate upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Current macro conditions complicate the outlook. Liquidity constraints and cautious sentiment may delay accumulation. While MVRV suggests undervaluation relative to realized cost basis, broader market weakness could suppress momentum and extend consolidation before any meaningful rebound begins.

Ethereum Holders Are Leaning Differently

Short-term holders are regaining influence over Ethereum price action. The MVRV Long/Short Difference measures profitability between long-term and short-term holders. Deeply negative readings signal greater profitability among short-term holders compared to long-term investors.

Sponsored

Sponsored

Toward the end of January, the metric suggested profitability was shifting away from short-term traders. That trend hinted at an improving structure. However, the recent decline reversed that dynamic, restoring short-term holder profits. These investors typically sell quickly, increasing vulnerability to renewed downside pressure.

The HODLer net position change metric reveals another shift. Long-term holders previously exhibited steady accumulation. In recent days, the buying pressure has transitioned into distribution, reflecting reduced confidence among strategic investors.

Long-term holder selling adds structural risk. These participants often provide foundational support during downturns. Without renewed accumulation from this cohort, the Ethereum price may struggle to absorb supply. Current data shows limited evidence of strong counterbalancing demand.

ETH Price May Look At Consolidation

Ethereum price trades at $1,983 and remains above the $1,811 support level. Despite this stability, the altcoin recently marked a nine-month low at $1,743. Maintaining $1,811 is critical to prevent deeper technical deterioration.

Given ongoing selling from both short-term and long-term holders, recovery may face resistance near $2,238. Continued weakness could keep ETH trading closer to support rather than challenging overhead barriers. A confirmed breakdown below $1,811 may expose Ethereum to $1,571.

Alternatively, reduced selling from short-term holders could ease pressure. If long-term holders resume accumulation, Ethereum may attempt a stronger rebound. A decisive move above $2,238, followed by a rally past $2,509, would invalidate the bearish thesis and improve the medium-term outlook.

Crypto World

What is Zero Knowledge Proof (ZKP)? A $100M Self-Funded Layer-1 Powering Private AI and Driving Massive Growth

In recent years, millions of traders and crypto users have experienced what it feels like when personal data gets exposed. Exchange leaks, identity verification breaches, wallet tracking, and analytics tools have made privacy a growing concern in digital finance. Many blockchain networks record everything publicly, making transactions transparent but not always private. For users who value security, that model no longer feels enough.

This is where Zero Knowledge Proof (ZKP) enters the conversation. ZKP is a Layer-1 blockchain built around one clear principle: prove computation is correct without revealing the underlying data. Instead of exposing sensitive information, it validates results while protecting privacy. In a market where trust is often tested, Zero Knowledge Proof (ZKP) is gaining attention as the top crypto to buy today for those seeking a more secure blockchain foundation.

What is Zero Knowledge Proof (ZKP)?

Zero Knowledge Proof (ZKP) is a Layer-1 blockchain built to validate computation without revealing the underlying data. In simple terms, the network allows a result to be proven correct while keeping sensitive inputs private. This approach is central to zero-knowledge cryptography and is the foundation of the entire ZKP ecosystem.

The project was developed with a strong commitment to readiness. Before launching its presale, the team invested $100 million of self-funded capital into building the blockchain architecture, proof systems, and supporting infrastructure. This build-first model reduces risk and signals long-term focus.

Core features include:

- A privacy-focused Layer-1 blockchain

- Zero-knowledge validation of computation

- Architecture designed for secure AI workloads

- Integration with real hardware through Proof Pods

For newcomers exploring options in today’s market, ZKP stands apart because it already operates with infrastructure in place. This foundation strengthens its case as the top crypto buy today, especially for those looking beyond early hype and into practical execution.

Live Presale Auction: Stage 2 Momentum Builds

Zero Knowledge Proof (ZKP) is currently in a structured crypto presale auction that distributes coins in progressive stages. The presale has already raised $1.85 million, showing early traction. At present, Stage 2 is closing in 6 days, marking a critical point in the auction cycle.

Market observers and analysts have noted the pace of participation. Some experts project that if momentum continues, the ZKP presale auction could reach $1.7 billion, highlighting expectations around the project’s scale.

Below is the current auction snapshot:

| Category | Details |

| Current Stage | STAGE 2 : ROUND 4 |

| Total Raised | $1.85M |

| Yesterday’s Closing Price | $0.00007 USD |

| Auction Day | 77 / 450 |

The auction model allows price discovery across stages rather than through a fixed-price sale. This structured progression creates measurable entry points and encourages sustained participation. For those searching for the top crypto buy today, the combination of raised capital, staged structure, and projected growth gives ZKP a strong position within the current presale market.

Proof Pods: A Working Product Backed by $17M

Proof Pods represent the tangible layer of the Zero Knowledge Proof (ZKP) ecosystem. These physical devices are designed to generate verifiable computation for the network. Instead of relying solely on digital staking models, ZKP connects blockchain incentives to measurable hardware performance.

The project allocated $17 million specifically for Proof Pods creation, covering development, production, and logistics. This investment demonstrates that Proof Pods are not conceptual but operational components of the network’s design.

Key benefits of Proof Pods include:

- Real hardware participation in blockchain validation

- Generation of cryptographic proofs

- Decentralized distribution of computing power

- Accessibility for non-technical users

Proof Pods strengthen decentralization while tying network rewards to real activity. For presale participants, this working product provides tangible backing to the blockchain’s function.

When evaluating the top crypto buy today, projects with operational hardware and capital commitment often stand out. ZKP’s integration of Proof Pods shows that it is building a functioning ecosystem rather than relying purely on token demand.

Final Say

Zero Knowledge Proof (ZKP) combines three critical elements rarely seen together in early-stage blockchain projects: a fully developed Layer-1 architecture, a structured live presale auction, and a working hardware product in Proof Pods. With a $100 million self-funded development, $17 million allocated to hardware, and a presale that has already raised $1.85 million, ZKP demonstrates preparation and execution before scaling further.

As Stage 2 closes in 6 days and experts project the presale could reach $1.7 billion, the project continues to build measurable momentum. The staged auction structure provides transparency, while Proof Pods anchor the network in real-world computation.

For newcomers seeking the top crypto buy today, Zero Knowledge Proof (ZKP) presents a strong combination of privacy technology, financial commitment, and live participation mechanics. Rather than promising future development, ZKP enters the market with infrastructure already built and an ecosystem actively expanding.

Explore ZKP:

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor

Retail traders are dumping Bitcoin in panic mode right now. Fear is everywhere. The Fear and Greed Index is stuck at 12. That is extreme.

However, perpetual futures volume is actually spiking. That kind of divergence does not show up for no reason.

The market has wiped out nearly $800 billion in a month. Brutal. But the real question is this. Is smart money quietly positioning before the next major move.

Because when fear is loud and volume rises at the same time, something is about to break.

Key Takeaways

- JPMorgan maintains a bullish 2026 outlook despite the total market cap falling from $3.1T to $2.3T.

- The Crypto Fear & Greed Index is pinned at 12 (“Extreme Fear”), levels historically associated with bottom formation.

- Bitcoin is trading at $67,610, significantly below its estimated production cost of $77,000.

- Whale activity in perpetual markets suggests complex institutional hedging is dominant over spot selling.

Is This Institutional Hedging or Strategic Accumulation?

So let’s pause for a second.

Who is buying when the market feels this terrified? Bitcoin price is around $67,610 and Ether near $1,950, both down heavily this month.

Spot charts look rough and retail is clearly panicking. Yet, Perpetual futures volume is climbing fast, which usually signals sophisticated players stepping in with structured positions, not emotional longs.

This isn’t what speculative euphoria looks like. When retail piles in, funding spikes positive. Instead, BTC funding is nearly flat and ETH funding is negative.

There are only two real explanations here: institutional hedging… or strategic positioning ahead of a larger move.

Will Bitcoin Price $50K Floor Hold?

The charts look terrible right now, no doubt about it. However, fundamentals wise it might leaning bullish good long term.

JPMorgan estimates Bitcoin’s production cost sits around $77,000. BTC is trading well below that.

Historically, when price drops under production cost, it does not stay there long. Miners either shut off machines or pressure builds for a rebound.

Still, the downside risk is not gone. Chief equity strategist John Blank warned Bitcoin could slide to $40,000 within 6 to 8 months.

That would be a full blown capitulation scenario. All Traders are now locked on $60,000 as the key support to watchout for.

The post The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor appeared first on Cryptonews.

Crypto World

Stacks price retests $0.28: can STX go higher?

- Stacks price surged by 5% to test resistance near $0.28.

- Gains follow Bitcoin’s uptick to $67,500.

- STX could still dip to recent lows if the Bitcoin price falls to new lows.

Stacks’ STX token edged higher on the day as Bitcoin held above the $67,500 level following a roughly 2% intraday move.

Despite the modest gain, the Bitcoin layer-2 network’s native token continues to trade in volatile conditions, reflecting uncertainty across the broader cryptocurrency market.

A sustained pickup in momentum could lift STX toward levels last seen in May 2025.

However, ongoing market turbulence and expectations of further downside risk for Bitcoin suggest Stacks may remain under pressure.

Analysts point to $0.24 as a key support level that bulls will need to defend to prevent a deeper pullback.

Stacks price today

STX posted modest daily gains on February 12, 2026, trading around $0.27 at the time of writing with a 5% uptick.

But buyers are hovering at these levels after hitting resistance around $.028, a level reached after STX recovered from Feb.5, 2026, lows of $0.22.

Despite weekly losses having moderated to 2%, Stacks remains more than 32% down in the monthly time frame.

Meanwhile, gains on the day have also come amid reduced buyer interest, with daily trading volume down 6% to $13.2 million.

Notably, prices remain within the range that offers support at $0.24, with bulls revisiting the level on three occasions year-to-date.

Stacks price prediction

Stacks is among the top Bitcoin DeFi protocols looking to leverage a layer-2 network to enable smart contracts and yield opportunities directly on Bitcoin’s security.

The project has gained traction as the digital asset investment space broadens.

One of its landmark moves is the recent integration with Fireblocks, which could potentially expose over 2,400 institutional clients to STX for native Bitcoin DeFi participation.

“Bitcoiners want to earn yield without sacrificing security. They want their yield to be denominated in Bitcoin and ideally, with as few additional trust assumptions as possible,” the firms stated in their announcement.

Clients will be able to tap into Bitcoin-denominated rewards, BTC-yielding vaults, and BTC-backed loans.

This institutional gateway could significantly boost STX adoption, especially if Bitcoin prices spike.

Bulls could eye the $0.56-$0.60 range or higher, with the altcoin having reached highs of $1.05 in May 2025.

The technical picture supports this short-term outlook and targets.

On the daily chart, the Relative Strength Index (RSI) hovers at 34, but signals bullish divergence.

Charts also show the Moving Average Convergence Divergence (MACD) indicator pointing to a bullish crossover.

If Bitcoin faces intensified selling pressure, Stacks’ upside potential could suffer.

In this case, STX may find support in the $0.23-$0.20 area.

Crypto World

Optimism Taps Succinct to Enable Instant Withdrawals

The zero-knowledge validity proofs will become canonical across the OP stack.

Ethereum Layer 2 Optimism is partnering with Succinct as its first zero-knowledge (ZK) proving provider, in order to provide instant and real-time withdrawals from the L2, according to an announcement shared exclusively with The Defiant.

The move makes Succinct Optimism’s first official ZK partner, and by leveraging Succinct’s proof system, users can off-ramp capital from Optimism to any other chain in a timely fashion, as opposed to the bridge’s traditional, multi-day wait time.

By accelerating the bridge time from Optimism, large on-chain operators such as market makers or treasuries, can move capital quickly without having to rely on a third party bridging solution.

In addition to its withdrawal time upgrade, Optimism is also working towards a larger ZK proof infrastructure launch on the chain, which will allow teams building across the OP Stack to upgrade to ZK validity proofs “seamlessly” per a release shared with The Defiant.

Karl Floersch, the co-founder of Optimism commented on the news:

“Succinct offers one of the most trusted proof systems in the industry, securing billions of dollars in TVL. We’re excited to bring validity proofs to the Superchain as we focus on fast, cost-effective scaling for Optimism and our partners in 2026 and beyond.”

“We’re honored to partner with Optimism to bring ZK to the Superchain, starting with OP Mainnet. As rollups consolidate around ZK, Succinct is building the proving infrastructure the ecosystem can rely on,” said Uma Roy, CEO and co-founder of Succinct.

The news comes shortly after Optimism unveiled OP Enterprise — a new chain deployment suite for enterprise clients who are looking to build their own native blockchains.

Crypto World

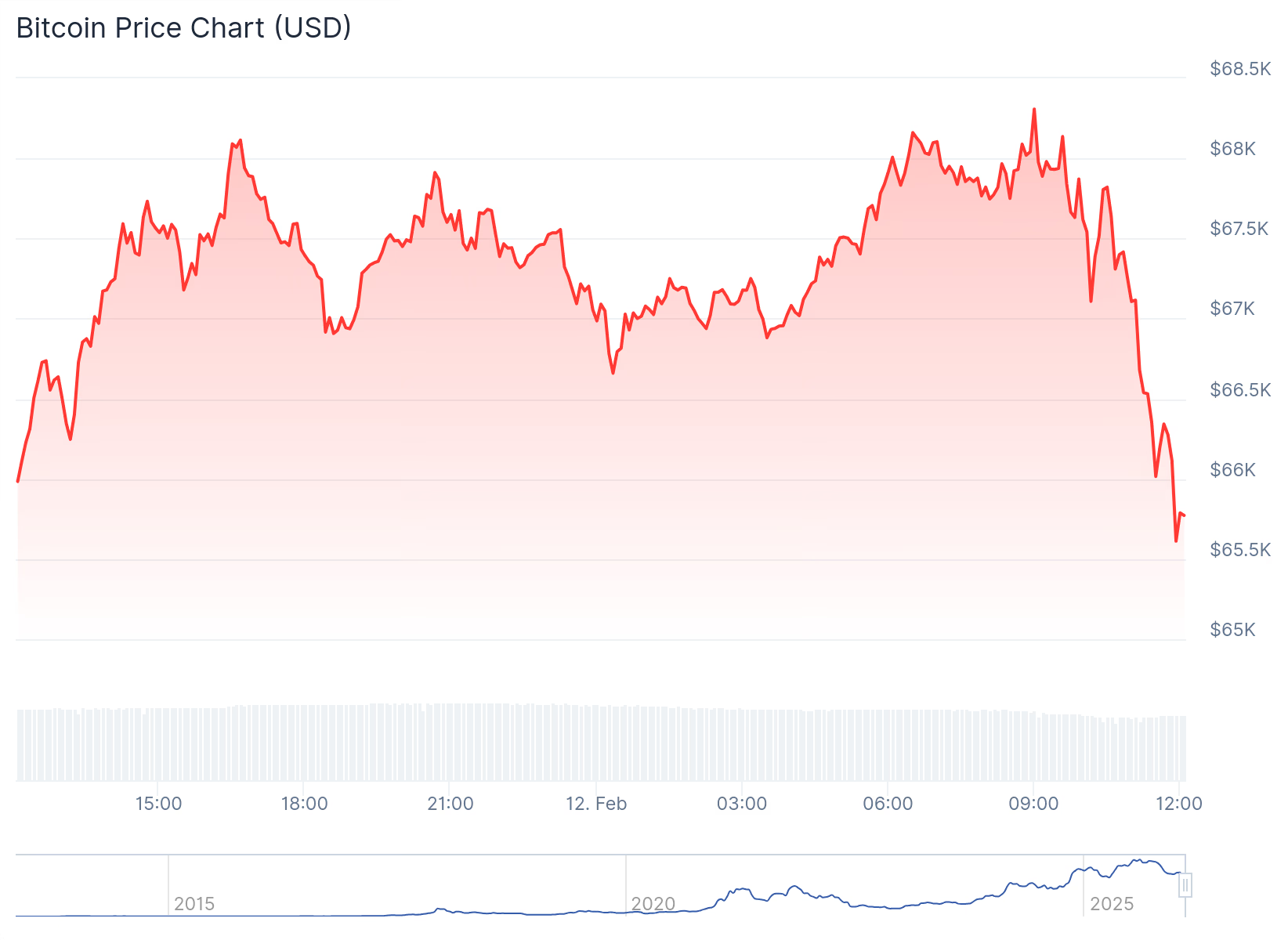

Bitcoin Plunges Under $66,000 as Crypto Sentiment Index Hits Historic Low

Total market cap is holding steady today, even as sentiment sinks to the weakest level on record.

Crypto markets took a tumble Thursday morning, Feb. 12, pushing Bitcoin below $66,000 and Ethereum below $2,000, as investor sentiment deteriorated to unprecedented lows.

Total crypto market capitalization is flat over the past 24 hours around $2.33 trillion, while large-cap assets are mixed today. At press time, Bitcoin (BTC) is trading at $65,747 at press time, down marginally on the day and bringing 7-day losses to about 5%.

Ethereum (ETH) fell to $1,910 this morning, little changed over the past 24 hours and down 4% on the week.

While BNB gained nearly 2% on the day, it’s still down almost 10% over the past week. Solana (SOL) slipped 0.6% in the past 24 hours, and is down 8% on the week.

Among the top-10 crypto assets, XRP and Figure Heloc (FIGR_HELOC) stood out on the weekly timeframe, both up about 4%.

Unprecedented Extreme Fear

Market sentiment, however, continues to lag price action. The Crypto Fear & Greed Index fell today to a reading of 5, its lowest level on record, pushing sentiment deeper into “extreme fear” territory than during any previous bear market.

Glassnode analysts said in an X post today that the disconnect between prices and sentiment reflects a market under sustained stress rather than a clear capitulation event.

The analysts pointed out that the 30-day simple moving average of net flows for both BTC and ETH spot ETFs has remained negative for most of the past 90 days, showing “no sign of renewed demand.”

They added in a separate research report that liquidity remains thin, with traders maintaining defensive positioning. Without renewed spot demand or improvement in risk appetite, glassnode warned that price action is likely to remain driven by short-term positioning.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, earlier today, Aster (ASTER) climbed more than 7% after the decentralized exchange confirmed that the mainnet launch of Aster Chain is scheduled for March. Hyperliquid’s HYPE token also rose about 7%, extending its recent rebound.

On the downside, Uniswap (UNI) led losses among large-caps, down 11.6%, erasing all of its gains from Wednesday’s rally that followed news of a strategic investment by BlackRock.

According to CoinGlass data, over 120,000 traders were liquidated over the past 24 hours, with total liquidations reaching $285 million. Bitcoin accounted for roughly $118 million of that total, followed by Ethereum at about $65 million.

ETFs and Macro Conditions

On Wednesday, Feb. 11, spot Bitcoin ETFs reversed their inflow streak, posting over $276 million in net outflows on the day. Spot Ethereum ETFs also recorded net outflows of more than $129 million, according to data from SoSoValue.

In macro markets, U.S. Treasury yields moved lower today as investors assessed fresh labor data and looked ahead to Friday’s consumer price index report. The 10-year yield slipped to 4.158%, while the 30-year fell to 4.782%, CNBC reported.

Per a report published today from the U.S. Labor Department, initial jobless claims came in at 227,000 for the week ended Feb. 7, slightly above expectations but lower than the prior week, the report notes, adding that investors continue to digest January’s nonfarm payrolls report, which showed a decline in the unemployment rate to 4.3%.

Crypto World

XRP price shows bottoming signs as RLUSD hits key milestone

XRP’s price has retreated for six consecutive weeks, in line with the broader market’s performance.

Summary

- XRP price has retreated and moved into a bear market in the past few months.

- Ripple USD’s stablecoin supply has jumped to over $1.5 billion for the first time ever.

- The coin has become oversold and formed a falling wedge chart pattern.

Ripple (XRP) token was trading at $1.3915 on Thursday, down by 62% from its all-time high of $3.6590. Technical indicators suggest the coin may be about to rebound as demand for the Ripple USD (RLUSD) stablecoin rises.

Ripple USD supply is rising

There are signs that demand for the RLUSD stablecoin is growing, a trend that may accelerate after Binance completes its integration on the XRP Ledger. The integration enabled users to deposit and withdraw the token on the largest crypto exchange in the industry.

Data compiled by Artemis shows that the supply of RLUSD in circulation jumped to over $1.5 billion for the first time ever. $1.1 billion of these tokens are in Ethereum, while the rest is in the XRP Ledger.

In a statement on Thursday, Jack McDonald, the Senior Vice President at Ripple Labs, hinted that the stablecoin will overtake “traditional dollar, Venmo, PayPal, and others.” He pointed to the rising institutional demand for the coin, especially as the developers gears to launch the Permissioned DEX platform.

Artemis data show that RLUSD’s usage continues to grow. It handled over 480,000 transactions in the last 30 days, while the adjusted transaction volume soared to close to $4.9 billion. Most of the volume was in decentralized finance, followed by blockchains and centralized exchanges.

Meanwhile, XRP price may benefit from the ongoing ETF inflows. Data compiled by SoSoValue show that spot XRP ETFs have added over $48 million this month so far, more than Bitcoin and Ethereum, which have shed substantial assets in the past few months.

XRP price prediction: Technical analysis

The weekly timeframe chart shows that the XRP price has pulled back in the past few months as the crypto market crash accelerated.

The Relative Strength Index has moved to the oversold level of 30, its lowest level since August 2022. It is common for a coin to rebound after moving to the oversold level.

XRP has also formed a large falling wedge pattern, consisting of two descending, converging trendlines that are nearing the confluence point.

Therefore, the coin will likely rebound in the coming weeks, potentially reaching the key psychological level of $2.0, which is 45% above the current level.

Crypto World

BTC remains under pressure amid slumping stock market

Bitcoin has fallen back to the low end of its recent trading range during late-morning U.S. trading hours on Thursday as the tech-heavy Nasdaq tumbles 1.6%.

Trading at $65,700, bitcoin is now lower by 1.5% over the past 24 hours, while ether , just above $1,900, is down more than 2%.

The bitcoin price action — uncorrelated with the Nasdaq when that index is headed higher, but perfectly correlated when it heads lower — has become all too familiar for the crypto sector. And the failure to hold any sort of sustained bounce from last week’s panicky plunge has bulls seemingly in full capitulation mode.

Alternative’s well-followed Crypto Fear & Greed Index today fell to just 5, a level of “extreme fear” exceeding even what was seen during the multiple collapses of the 2022 crypto winter and the 2020 Covid crash.

Also raising eyebrows is longtime bull Geoff Kendrick from Standard Chartered, slashing his 2026 price targets for bitcoin, ether, solana, BNB and AVAX, while warning bitcoin could dip to as low as $50,000.

Crypto stocks lose ground

Coinbase (COIN) and Robinhood (HOOD) are among the largest losers on Thursday, each down more than 8%. Coinbase reports fourth-quarter results after the bell, but Robinhood’s fourth-quarter report earlier this week confirmed that the crypto bear market had taken a large bite out of trading revenues in the final three months of 2025 — and that was before the price action got really bad to begin 2026.

Other large decliners today include Strategy (MSTR), down 4.2%, Circle Financial (CRCL), down 4.3%, and Hut 8 (HUT), down 6.6%.

Crypto World

Juspay Strengthens Middle East Presence with DIFC Headquarters

Editor’s note: In today’s fintech landscape, global payment infrastructures are increasingly decisive in unlocking cross-border commerce. Juspay’s Dubai DIFC HQ marks a milestone in its expansion, signaling a focus on enterprise-grade payments in the Middle East. The move aligns with GCC digitization goals and regional fintech collaboration, and demonstrates how scalable payments platforms can drive growth across international markets. This release outlines Juspay’s strategy and what it means for merchants, banks, and developers navigating multi‑currency challenges.

Key points

- Juspay opens a regional headquarters in DIFC Dubai to expand its Middle East presence.

- The expansion aims to serve enterprise merchants, banks, and networks across GCC and MEASA.

- The DIFC hub enables closer engagement with partners to scale enterprise payments.

- Juspay powers 500+ enterprise merchants and banks globally with full‑stack payment orchestration and related services.

Why this matters

This expansion signals a long‑term commitment to open, interoperable payments across the MEA region, offering an institutional‑grade platform to handle multi‑currency and regulatory challenges. It also reinforces Dubai’s role as a fintech hub and positions Juspay to partner with regional banks, networks and merchants to scale payments across markets.

What to watch next

- Regional team growth and partnerships with banks and networks in DIFC and GCC.

- Adoption of Juspay’s payments orchestration platform by MEA enterprises.

- Regulatory and compliance readiness to support multi‑currency, cross‑border payments across GCC and MEASA.

- Expansion of services to additional markets in MEASA as demand scales.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Juspay Strengthens Middle East Presence with DIFC Headquarters

Dubai, February 10th, 2026 – Juspay, a global leader in payment infrastructure solutions for enterprises and banks, today announced its expansion into the Middle East with the opening of its regional headquarters in Dubai International Financial Centre (DIFC). This move marks an important step in Juspay’s international expansion, deepening its focus on serving enterprise merchants, banks, and financial institutions in the Middle East. The DIFC headquarters will support closer engagement with existing partners as enterprise payment demand continues to scale.

With digital commerce accelerating in the GCC region, rapidly scaling enterprises in sectors such as airlines, hospitality, e‑commerce, and financial services face increasing complexity driven by multiple regional currencies, evolving regulations, and diverse local payment methods.

To address this complexity, Juspay’s payments orchestration platform provides a unified & reliable payments stack, helping organizations optimize authorisation rates and costs, simplify compliance and scale seamlessly across GCC and global markets with institutional‑grade reliability.

Establishing operations in DIFC highlights Juspay’s long‑term commitment to the Middle East, with a focus on building , regulated, and enterprise‑grade payments infrastructure in the region. As a leading global financial hub, DIFC provides a strong regulatory environment, robust infrastructure, and access to high quality talent. Juspay plans to leverage this and work closely with regional banks, acquirers, networks, and ecosystem partners to deliver scalable and reliable payment solutions tailored for enterprises operating across global markets.

Commenting on the expansion, Sheetal Lalwani, Co‑founder & COO of Juspay, said: “Juspay has been building foundational payments infrastructure for large‑scale, mission‑critical commerce globally for over a decade. We are excited to bring these learnings to the Middle East and partner with merchants, banks, networks, and the broader ecosystem to build secure, scalable payments infrastructure that supports the region’s rapidly evolving digital economy.”

Salmaan Jaffery, Chief Business Development Officer at DIFC Authority said: “We are pleased to welcome Juspay to the Middle East, Africa and South Asia’s most significant fintech and financial services ecosystem. As a global leader in payment infrastructure, Juspay’s presence strengthens our growing digital economy, reinforces DIFC’s role as a catalyst for financial innovation and cements Dubai’s position as a top four global FinTech hub.”

With more than a decade of experience in scaling payment infrastructure, Juspay powers 500+ enterprise merchants and banks globally including Agoda, Amazon, Flipkart, Google, HSBC, IndiGo, Swiggy, Urban Company, Zepto & more. It offers a comprehensive suite of payment solutions that spans full‑stack payment orchestration, authentication, tokenisation, reconciliation, fraud solutions and more. The company also provides end‑to‑end, white‑label payment gateway and real‑time payments infrastructure tailored for banks. Together these capabilities enable merchants and banks to deliver seamless, reliable and scalable payment experiences to the end‑consumers.

Speaking about Juspay’s regional focus, Nakul Kothari, head of Middle East & APAC said, “By establishing our presence in the Middle East with DIFC, we continue our mission of building innovative payment solutions rooted in deep local market understanding. The region holds tremendous potential, and we are investing in long‑term partnerships with merchants and banks to help them build future‑ready payment stacks that can scale across markets.”

This expansion reflects Juspay’s long‑term vision of enabling open, interoperable, and accessible payments worldwide. With a team of over 1,500 payment experts solving payment complexities across Asia‑Pacific, Latin America, Europe, UK, and North America, Juspay is strategically positioned to reshape the Middle Eastern payments landscape. The company plans to grow its regional team, specifically targeting growth in business development, solution engineering, and partnerships.

About Juspay

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 300 million daily transactions, exceeding an annualized total payment volume (TPV) of $1 trillion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1500+ payment experts operating across San Francisco, Dublin, São Paulo, Dubai, and Singapore.

Juspay offers a comprehensive product suite for merchants that includes open‑source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end‑to‑end reconciliation, unified payment analytics & more. The company’s offerings also include end‑to‑end white label payment gateway solutions & real‑time payments infrastructure for banks. These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

To learn more about Juspay, visit: http://www.juspay.io

About Dubai International Financial Centre

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA), which comprises 77 countries with an approximate population of 3.7bn and an estimated GDP of USD 10.5trn. With a 20‑year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast‑growing markets with the economies of Asia, Europe, and the Americas through Dubai. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of 46,000 professionals working across over 6,900 active registered companies – making up the largest and most diverse pool of industry talent in the region. Comprising a variety of world‑renowned retail and dining venues, a dynamic art and culture scene, residential apartments, hotels, and public spaces, DIFC continues to be one of Dubai’s most sought‑after business and lifestyle destinations. For further information, please visit our website: http://difc.ae, or follow us on LinkedIn and X @DIFC.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports17 hours ago

Sports17 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World19 hours ago

Crypto World19 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video14 hours ago

Video14 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’