Crypto World

$1K Collapse or $3K Rally? 4 AIs Speculate What is More Likely for ETH in Q1

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse,” Grok stated.

The major red wave that swept through the entire crypto market at the start of February has severely impacted Ethereum (ETH), whose price fell below $1,800 at one point. Over the past few days, the bulls have reclaimed some lost ground, but the asset currently trades just below the psychological $2,000 level.

The big question now is which scenario is more plausible during the first quarter of the year: a crash to $1,000 or a pump to $3,000. Here are the viewpoints of four of the most popular AI-powered chatbots.

What Comes Next?

ChatGPT estimated that a 50% jump to $3K sometime in Q1 is more likely, reminding that ETH has initiated such moves many times in the past. It claimed that a rebound to that level will not require an extreme catalyst but only “bullish momentum and market stability.”

The chatbot did not rule out a collapse to $1,000 but argued that such a drop could occur only in the event of a macro panic, a regulatory crackdown, or the meltdown of a leading crypto exchange.

Grok – the chatbot integrated within X – shared a similar opinion. It stated that a jump toward the upper target carries a higher probability, but added that neither extreme option is guaranteed.

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse – making a push toward $3K (or at least meaningful upside) more plausible than a plunge to $1K, especially if macro conditions improve or adoption catalysts hit,” it forecasted.

Google’s Gemini joined the theory, saying that a rally is statistically “more aligned with historical patterns and analyst consensus.” It argued that a drop to $1,000 is a low probability scenario unless a major black swan event occurs.

Perplexity is the only chatbot (from those we consulted) that leans toward the bearish option. It stated that the crypto market has not been in its best shape lately, projecting a downside move for ETH to $1,000 and even lower in the coming weeks.

You may also like:

The Crash Could be a Blessing?

Just a few days ago, the popular X user Ted asked his almost 300,000 followers whether they expect ETH to plummet to $1,000 in 2026. In his view, a plunge of that dimension would be “a great buying opportunity.”

Some commentators claimed that such a scenario is possible only in a macro crisis that could undermine the reputation of the entire cryptocurrency sector. Others welcomed the idea of a collapse to $1K, agreeing with Ted that this would provide a solid reason to increase their exposure.

Hosky.Watcher, for instance, suggested that big dips can be “chances and traps.” They advised investors to enter the ecosystem with spare cash but not to touch “emergency funds or mortgage money.”

“Keep your sense of humor and a risk plan,” the alert reads.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Fiserv Launches US Dollar Settlement Platform for Digital Asset Companies

Fiserv, a major US payments and financial technology provider, has launched a new cash settlement platform for digital asset companies, a move that could strengthen fiat infrastructure for crypto players and improve access to liquidity.

On Thursday, Fiserv announced the debut of INDX, a real-time cash settlement system that operates 24 hours a day, 365 days a year. The platform allows digital asset companies to move US dollars instantly using a single custodial account, potentially improving how exchanges, trading desks and other crypto businesses manage fiat balances.

INDX will be made available to more than 1,100 insured financial institutions participating in the Fiserv Deposit Network. The account structure provides up to $25 million in Federal Deposit Insurance Corporation (FDIC) coverage, according to the company.

The launch is notable because many digital asset companies still rely on traditional banking rails that operate only during business hours or on onchain token transfers to move dollar value. By enabling round-the-clock US dollar settlement within the banking system, INDX offers functionality similar to blockchain-based settlement while remaining offchain.

Fiserv is one of the largest payments and financial services technology providers globally, offering core banking, merchant acquiring and transaction processing services. The company generated more than $21 billion in revenue in fiscal 2025.

Fiserv has also expanded its footprint in digital assets. As Cointelegraph reported in October, the company is involved in North Dakota’s state-backed stablecoin initiative, where it is providing payments and settlement infrastructure to support the project’s rollout.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

TradFi and digital assets continue to converge

INDX is the latest example of an established financial institution building infrastructure for the digital asset sector. For institutional clients, the platform offers a more familiar banking framework while introducing faster, always-on cash management capabilities.

The system could also position Fiserv ahead of legacy banking partners that still depend on batch-based processing for US dollar transfers. For crypto infrastructure providers, including exchanges, trading desks, stablecoin issuers and custodians, reliable, real-time dollar liquidity can provide a meaningful operational advantage.

The Milwaukee, Wisconsin company in December completed the acquisition of Stone Castle Cash Management, which provides banks liquidity, in a move widely seen as bolstering its FIUSD stablecoin, launched in June 2025

Beyond settlement speed, stablecoins are increasingly being viewed by traditional financial institutions as liquidity infrastructure. Always-on digital dollars can facilitate collateral movement, treasury operations and cross-border payments with fewer intermediaries and less settlement friction.

While INDX stands out for combining traditional bank settlement with continuous-dollar availability tailored to digital-asset companies, other companies have also prioritized real-time settlement.

For example, Sygnum operates a round-the-clock multi-asset network that enables instant settlement across fiat currencies, stablecoins and other digital assets for institutional clients.

Similarly, Fireblocks supports real-time settlement infrastructure for stablecoins and digital asset transfers, helping institutions streamline liquidity management.

Related: How TradFi banks are advancing new stablecoin models

Crypto World

Russia Plans Return to US Dollar Settlement as Strategic Cooperation Talks Emerge

TLDR:

- Russia and US combined oil production could reach 22.6 million barrels daily, reshaping global markets

- Moscow controls 44% of enriched uranium and 43% of palladium, critical for US industrial supply chains

- Russia-China trade hit $245B in 2024, spurring Moscow to diversify away from yuan-heavy dependence

- Russian reserves climbed to record $833B with over $400B in gold, providing negotiation leverage

Russia is reportedly planning to shift back toward US dollar settlement systems while exploring cooperation with the United States across multiple strategic sectors.

The discussions encompass fossil fuels, natural gas, offshore oil drilling, and critical raw materials. This development marks a potential reversal of Moscow’s decade-long effort to reduce dollar exposure.

The move could reshape global commodity markets and currency dynamics while altering geopolitical alliances between major powers.

Energy Cooperation Could Reshape Global Markets

According to analyst Bull Theory, shared on social media platform X, the cooperation framework would combine significant production capacity from both nations.

The United States currently produces 13.5 million barrels per day of oil, representing the highest output in American history.

Russia maintains production at 9.1 million barrels daily despite ongoing international sanctions. Combined influence over global oil supply would immediately shift pricing power and export leverage across international markets.

Natural gas represents another critical component of the potential partnership. Russia controls some of the world’s largest gas reserves, though many liquefied natural gas and pipeline projects remained frozen after the implementation.

Reopening investment channels and joint development initiatives would reintroduce substantial supply into global markets. This shift would directly affect European energy pricing and long-term gas market dynamics.

The timing carries particular weight given the current global energy transitions. Western nations have sought alternative suppliers since 2022, creating market volatility and price fluctuations.

Russian re-entry into Western-aligned energy frameworks could stabilize certain markets while disrupting others. Energy analysts note that infrastructure investments would require years to fully materialize.

Corporate participation represents a significant financial dimension. Western companies absorbed approximately $110 billion in losses when exiting Russian operations.

Re-entry opportunities in energy fields, gas infrastructure, mining projects, and Arctic drilling zones could enable American firms to resume resource extraction activities. This corporate angle extends beyond immediate profits to long-term strategic positioning.

Critical Minerals and Currency Realignment Take Center Stage

Russia controls substantial portions of strategic resources essential to modern manufacturing. The nation holds 44 percent of enriched uranium, 43 percent of palladium, 40 percent of industrial diamonds, 25 percent of titanium, and 20 percent of vanadium globally.

These materials form core components in semiconductors, defense systems, electric vehicle production, nuclear energy, and aerospace manufacturing. Partnership in this sector addresses American supply chain vulnerabilities while reducing Chinese dependency.

Moscow spent recent years building alternatives to Western settlement systems and reducing dollar reserves. Russia-China bilateral trade reached $245 billion by 2024, creating structural dependence on yuan liquidity and Chinese imports.

However, this pivot concentrated financial risk in Beijing-oriented frameworks. Reopening dollar settlement channels would diversify Russia’s financial positioning, balancing Eastern and Western exposure while re-anchoring portions of global trade.

Russia’s financial reserves recently climbed to a record $833 billion, with gold holdings exceeding $400 billion. This reserve strength provides Moscow with negotiating leverage for structuring long-term resource agreements.

The financial stability enables Russia to approach discussions from a position beyond immediate economic necessity.

The broader framework encompasses energy cooperation affecting global supply, mineral partnerships reshaping industrial resource access, corporate re-entry unlocking infrastructure projects, and currency realignment pulling Russia partially back into dollar systems.

Geopolitical leverage simultaneously shifts between Washington, Moscow, and Beijing. If finalized, observers suggest this could represent one of the largest structural resets in global economic alignment since Cold War conclusion.

Crypto World

BlackRock Brings $2.1B Tokenized Treasury Fund to Uniswap for DeFi

BlackRock has taken a significant step into the world of decentralized finance (DeFi) by bringing its $2.1 billion tokenized Treasury fund to Uniswap. This move marks the asset management giant’s first formal engagement with DeFi and offers institutions new avenues for on-chain investment. The announcement solidifies BlackRock’s growing interest in digital assets and blockchain technology.

The launch of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) will enable institutional clients to trade tokenized securities on the Uniswap decentralized exchange. The fund’s listing represents a broader push to expand institutional access to the growing DeFi space. This venture also includes BlackRock acquiring an undisclosed amount of Uniswap’s governance token, UNI.

The listing will initially be available to a select group of institutional investors and market makers. As a part of the collaboration, Securitize, a tokenization company, facilitated the launch of BUIDL. The cooperation between Securitize and BlackRock strengthens the legitimacy of tokenized assets as viable investment products.

Tokenization Boosts DeFi and Institutional Access

Tokenized assets have seen increasing popularity as they allow real-world assets to be traded on blockchain networks. BlackRock’s foray into DeFi with BUIDL aims to provide institutions with access to tokenized money markets. These assets, backed by US Treasury securities, are designed to offer liquidity, security, and yield to investors.

Securitize CEO Carlos Domingo noted the importance of providing institutions with self-custody tools to trade tokenized real-world assets. He emphasized that this new product gives investors the flexibility to interact with decentralized finance while maintaining traditional investment characteristics. BUIDL is now the largest tokenized money market fund, with over $2.1 billion in total assets across multiple blockchains.

BUIDL is not the only fund seeking to expand access to tokenized money markets. Other major financial institutions like Goldman Sachs and BNY Mellon have entered the tokenization space, signaling wider industry acceptance. BlackRock’s partnership with Uniswap and Securitize further highlights the momentum behind blockchain technology in traditional finance.

Implications of Wall Street’s Adoption of Tokenized Assets

The rise of tokenized assets has been partly driven by the growing adoption of stablecoins and blockchain infrastructure. Financial institutions see tokenization as a way to adapt to shifting market dynamics, especially as stablecoin usage continues to rise. JPMorgan analysts have pointed out that tokenized money market funds could offer a counterbalance to the increasing use of stablecoins in the broader economy.

Tokenization could play a crucial role in mitigating potential liquidity shifts caused by the rapid expansion of stablecoins. According to JPMorgan strategist Teresa Ho, tokenized funds offer investors a way to post money market fund shares as collateral without losing yield. This feature could provide a valuable hedge against the growing dominance of stablecoins.

The regulatory landscape also plays a critical role in shaping the future of tokenized real-world assets. With the GENIUS Act expected to influence the stablecoin market, clearer regulations could encourage further adoption of blockchain technology. Solomon Tesfaye of Aptos Labs believes that stablecoin regulations may accelerate broader adoption of on-chain assets like tokenized money market funds.

Crypto World

21Shares Taps BitGo for Regulated Staking and Custody in US & Europe

BitGo Holdings and 21Shares have broadened their alliance to extend custody and staking services for 21Shares’ U.S. exchange-traded funds and global exchange-traded products. The expanded deal will see BitGo provide qualified custody, trading and execution capabilities, and a unified staking infrastructure for 21Shares’ US-listed ETFs and international ETPs. The press release notes that this arrangement gives 21Shares enhanced access to liquidity across electronic and over-the-counter markets as part of a broader strategy to scale regulated crypto yield solutions for institutional investors. The partnership is anchored in BitGo’s regulated framework in the United States and Europe, leveraging its OCC-regulated federally chartered trust bank and MiCA-licensed European operations. Announcement.

21Shares is a major crypto ETF issuer, with an established footprint across 13 exchanges and 59 listed products, supported by more than $5.4 billion in assets under management as of Feb. 11, according to its public materials. The collaboration follows BitGo’s own foray into the public markets earlier in the year, when the Palo Alto-based infrastructure provider began trading on the New York Stock Exchange under the ticker BTGO.

In recent months, custodial and staking services have become increasingly entwined as institutions seek yield-generating crypto infrastructure within regulated wrappers. The new BitGo–21Shares framework exemplifies this shift, allowing traditional and alternative asset managers to offer staking yields while maintaining compliant custody—an arrangement that can streamline onboarding for large-scale investors who require robust risk controls and auditability. The broader ecosystem has seen a spate of partnerships and integrations aimed at embedding staking deeper into regulated product lines, a trend that has accelerated as more institutions seek regulated exposure to proof-of-stake ecosystems.

Among the notable examples cited in the ecosystem: a Coinbase–Figment collaboration that broadened institutional staking for assets including Avalanche (AVAX), Aptos (APT), Sui (SUI) and Solana (SOL) through Coinbase Custody. Separately, Anchorage Digital partnered with Figment to extend staking for Hyperliquid (HYPE), integrating these services via its banking and custody infrastructure. Ripple has also expanded its institutional custody stack with integrations that add hardware security module support to enable banks and custodians to offer custody and staking without building their own validator or key-management systems.

Beyond staking, the sector is witnessing growing interest in liquid staking—an approach that lets investors earn staking rewards while retaining a tradable token that preserves liquidity. Regulators in certain jurisdictions have signaled tolerance for specific liquid-staking activities, reinforcing the push toward regulated, yield-bearing structures. In another development, Hex Trust announced a collaboration with the Jito Foundation to integrate JitoSOL, a liquid staking token on the Solana blockchain, enabling clients to earn staking and MEV rewards while keeping SOL liquid for use as collateral in borrowing and lending through its Markets platform. These moves collectively illustrate how custody providers are layering staking liquidity into regulated product lines to satisfy investor demand for yield without compromising risk controls.

In this evolving landscape, the BitGo–21Shares partnership stands out for its scope and regulatory alignment. By combining BitGo’s OCC-regulated custody framework with MiCA-licensed European operations, the alliance aims to unlock scalable staking and liquidity across major markets for a broad set of products, including US-listed ETFs and international ETPs. The collaboration signals a maturation in the ecosystem, where product issuers can offer regulated staking while maintaining robust custody and market access—an arrangement that may help attract institutions that previously shied away from crypto exposure due to compliance and operational concerns. For readers seeking a deeper dive into the breadth of the collaboration, a related press release details the global ETF-partnership expansion across staking and custody, highlighting the operational pathways BitGo will provide for 21Shares’ product lineup.

Video and media discussions surrounding the partnership can be explored through a related presentation linked to the announcement.

Market participants should watch how the integration affects liquidity profiles and trading costs for 21Shares’ ETF roster, as well as how it influences the pace at which other ETF issuers consider similar custody-and-staking models. The collaboration may also influence how global regulators view regulated staking within ETF wrappers, particularly as MiCA implementations take fuller effect across Europe and as U.S. authorities continue to refine guidelines for crypto custody and staking activities.

Key takeaways

- BitGo will deliver qualified custody, trading and execution services, plus integrated staking infrastructure for 21Shares’ US ETFs and global ETPs.

- The services will be provided through BitGo’s regulated entities in the US and Europe, leveraging an OCC-regulated trust bank and MiCA-licensed operations.

- 21Shares’ product slate includes 59 ETPs listed across 13 exchanges, with more than $5.4 billion in assets under management as of Feb. 11.

- The move aligns with a broader institutional push to embed staking within regulated custody offerings, following similar partnerships and integrations across the sector.

- The deal underscores BitGo’s ongoing expansion into ETF and regulated markets after its BTGO listing on the NYSE earlier this year.

Tickers mentioned: $BTGO, $AVAX, $APT, $SUI, $SOL

Market context: The collaboration arrives amid growing institutional interest in regulated staking and custody-enabled yield strategies, supported by clearer regulatory frameworks in the U.S. and Europe and expanding ETF liquidity across crypto assets.

Why it matters

The partnership between BitGo and 21Shares represents a meaningful step in bringing regulated staking and custody to a broader class of institutional investors. By coupling BitGo’s OCC-chartered custody capabilities with 21Shares’ diversified ETF lineup, the arrangement reduces operational friction for asset managers seeking compliant exposure to proof-of-stake ecosystems. This is particularly relevant as the crypto industry pushes toward scalable yield opportunities within regulated wrappers, a dynamic that could accelerate the adoption of staking across traditional finance channels.

For 21Shares, the deal broadens access to liquidity and trading venues for its US-listed ETFs and global ETPs. As the ETF issuer continues to grow—reporting 59 products and substantial AUM—partnerships like this can help sustain product velocity, improve execution quality, and offer investors more reliable ways to participate in staking rewards without directly managing keys or validator infrastructure.

From a regulatory perspective, the alignment with an OCC-regulated entity in the United States and MiCA-licensed operations in Europe signals a mature model for regulated crypto infrastructure. If these structures gain broader acceptance, more issuers may pursue similar multi-jurisdictional approaches, further integrating staking into mainstream investment products. In a market that remains sensitive to liquidity, risk controls, and operational risk, such collaborations could contribute to steadier capital inflows and more robust market-making activity around crypto ETPs.

What to watch next

- Rollouts of custody and staking services for 21Shares’ entire U.S. ETF lineup and broader international ETPs, with clear launch timelines.

- Regulatory updates from the OCC and updates to MiCA implementations that may affect how staking is offered within ETF wrappers.

- Potential expansion of BitGo–21Shares technology and service integrations to additional product lines or new markets.

- Continued ETF issuance activity by 21Shares and related liquidity improvements across electronic and OTC venues.

Sources & verification

- BitGo and 21Shares Accelerate Global ETF Partnership Across Staking and Custody — Business Wire press release (Feb 12, 2026).

- 21Shares product catalog and assets under management (as of Feb 11) published by 21Shares.

- BitGo IPO coverage and BTGO listing details (Cointelegraph gateway to BitGo stock information).

- FalconX acquisition of 21Shares (context for 21Shares’ corporate structure).

- Ripple expands institutional custody stack with staking and security integrations (industry context for custody-staking trends).

BitGo expands custody and staking for 21Shares across US and Europe

BitGo and 21Shares have formalized an expanded collaboration that integrates custody, trading, and staking services for 21Shares’ US ETFs and global ETPs. The arrangement will see BitGo operate through its regulated US and European entities, including a federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and MiCA-licensed European operations, providing a bridge between traditional custody controls and crypto-native staking yields. The underlying objective is to reduce friction for institutions seeking yield opportunities tied to major proof-of-stake ecosystems while maintaining stringent risk and compliance standards.

Within the scope of the agreement, 21Shares gains access to BitGo’s custody and execution frameworks, coupled with integrated staking infrastructure designed to support its ETF lineup. The collaboration underscores a broader trend in the market: custodians and wallet providers are increasingly embedding staking capabilities into regulated products to satisfy investors’ demand for yield, liquidity, and governance participation without sacrificing institutional-grade controls.

As a backdrop, the ecosystem has seen a series of institutional staking moves—ranging from Coinbase’s partnerships enabling direct staking for select assets, to Anchorage Digital’s collaborations that extend staking through regulated banking channels, and even Ripple’s expansion of its custody platform with security integrations. These developments collectively point to a maturation of the crypto infrastructure market, where regulated custody and staking go hand in hand to deliver scalable, compliant exposure to proof-of-stake networks. In this context, BitGo’s expanded alliance with 21Shares positions both firms to capture a larger slice of the ETF and ETP issuance market and to support a broader wave of institutional adoption.

Market participants will be watching how quickly the rollout unfolds and how liquidity improves across the involved products, particularly in the United States and Europe. The partnership could catalyze further collaborations between custodians and ETF issuers, as regulators continue to refine the boundaries of crypto custody and staking within regulated investment products.

Crypto World

SBET executives urge to look beyond recent price action

As institutional adoption of digital assets matures, a new corporate playbook is emerging: treat ether not just as an investment, but as productive financial infrastructure.

The shift comes amid sharp downward market volatility. SharpLink Gaming (SBET) — which saw its stock soar last May after adopting an ether treasury strategy — has since plunged (along with every other of 2025’s hastily-formed digital asset treasury companies). It’s a reminder of the turbulence that continues to define the asset class.

At a panel discussion at Consensus Hong Kong 2026 featuring Sharplink Chairman Joe Lubin and CEO Joseph Chalom, the two executives outlined how DATs are evolving into a distinct institutional strategy.

“I’ve never seen more of a moment of differentiation where the actual macro tailwinds for Ethereum have never been better in its 10-and-a-half-year history,” said Chalom, pointing to the growth of stablecoins and tokenization. “Listen to Larry Fink at Davos, when he’s telling you $14 trillion of BlackRock assets will be tokenized, and over 65% of that to date is happening on Ethereum.”

While recent ether price action and ETF flows have raised concerns, Chalom framed them as part of broader macro de-risking. “Bitcoin and ether were very easy to de-risk,” he said, adding that rotations out of liquid assets are typical during volatility. “The largest players in institutional finance are telling us out loud — they’re coming to ether.”

SharpLink’s strategy differs, he argued, because it deploys permanent capital. “An ETF is a great passive exposure vehicle, but it needs to provide daily liquidity…We own permanent capital,” he said. “The third stage — which is actually most important — is making your ETH productive.”

Lubin emphasized ether’s distinguishing feature: yield.

“Ether would be a much better asset… because it is a productive asset. It yields. It has a risk-free rate,” he said, referring to staking returns of roughly 3%. SharpLink has staked nearly all its holdings and plans to continue accumulating. “We’ll keep buying ether. We’ll keep staking ether and adding new yield to ether.”

Beyond staking, Chalom described what he called “good institutional DeFi,” using long-term locked capital to earn risk-adjusted returns rather than chasing venture-style upside. “We’re not looking for convex VC 10x outcomes — we’re looking for the best risk-adjusted yield for our investors. And we’re actually confident that by doing it, we’ll improve the DeFi ecosystem by raising its standards.”

For Lubin, the shift resembles the early internet era. “A long time ago…there were internet companies. Now every company is an internet company. Soon, every company is going to be a blockchain company,” he said, predicting firms will increasingly hold tokens on balance sheets and require sophisticated onchain treasury tools.

Read more: Ethereum treasury firm SharpLink stakes $170M ETH on Linea network

Crypto World

Zcash faces potential 66% decline, holders reduce stakes

Zcash recorded a 7% price decline over the past 24 hours, while broader cryptocurrency markets also slipped. However, large holders reduced their positions by approximately 38% over the past seven days, raising concerns about the cryptocurrency’s near-term prospects.

Summary

- Large holders reduced their stakes by 38% over the past week, and technical analysis suggests a bearish flag pattern.

- Zcash has seen a 40% drop month-over-month.

- The concentration of 70% of the supply in the top 100 addresses suggests Zcash’s current price foundation may be unstable.

The privacy-focused cryptocurrency has increased 5.8% over the past week, but decreased over 40% month-over-month, according to CoinGecko.

Bitcoin and Ethereum experienced larger declines during the same period as the broader cryptocurrency market continued its selloff.

Exchange flow data showed net outflows on Feb. 12, indicating some purchasing activity. However, on-chain data revealed that large holders decreased their Zcash holdings by roughly 38% over seven days, with additional selling occurring in the past 24 hours. Exchange inflows increased simultaneously, suggesting coins moved from private wallets to exchanges.

Technical analysts identified a bearish flag and pole pattern forming on Zcash price charts. This formation typically appears after a sharp decline, followed by a consolidation period. When prices break down from this pattern, the resulting decline often matches the distance of the initial drop, according to technical analysis methodology. For Zcash, this measured move indicates a potential 66% decline from current levels if the pattern completes.

A four-month bearish divergence signal has also formed between October and February. During this period, Zcash prices reached a higher high while the Relative Strength Index (RSI), a momentum indicator, recorded a lower high. This divergence typically indicates weakening buying pressure despite rising prices.

The RSI continues to trend downward while prices remain near recent highs, creating a widening gap between price action and momentum indicators.

On-chain data shows the top 100 addresses control approximately 70% of the total supply. Smart money indicators remained flat with no significant accumulation detected, according to blockchain analytics.

The cryptocurrency rebounded from lows reached in early February. Technical analysts stated that a breakout above resistance levels would be required to invalidate the bearish setup, while a breakdown below key support would likely accelerate declines.

Market observers noted that the relative outperformance compared to other cryptocurrencies occurred while large holders distributed their positions, creating what analysts described as a potentially unstable foundation for current price levels.

Crypto World

Crypto PAC Fairshake seeks to force resistant Texas Democrat Al Green from U.S. House

The crypto industry’s campaign-finance arm, Fairshake, has begun rolling out its campaign strategies in its well-funded effort to pack Congress with lawmakers ready to pass friendly digital assets policy, and Democratic Representative Al Green is the first lawmaker on its hit list.

An affiliate of the Fairshake political action committee, which has begun deploying its $193 million war chest on this year’s congressional midterm elections, said it will spend $1.5 million on advertisements opposing Green’s primary campaign.

The critical Texas lawmaker has often noted potential hazards posed by cryptocurrencies to the U.S. financial system and to investors, co-sponsored a bill seeking to ban President Donald Trump from his personal crypto business interests and has voted against crypto policy legislation. That opposition earned him an “F” grade from Stand With Crypto, a group that assesses crypto support from politicians.

Green, who is among the most senior Democrats on the House Financial Services Committee that has a direct hand in crypto legislation, faces rivals in the Democratic primary for the recently redrawn Texas district he represents. Texas’ primaries come quickly next month, and longtime congressman Green would have to beat a younger Democrat, Christian Menefee, who just won a special election and took the redrawn district’s seat days ago.

“Texas voters can no longer sit by and have representation in Congress that is actively hostile towards a growing Texas crypto community,” Fairshake’s super PAC affiliate, Protect Progress, said in a statement. “We are committed to electing new members who embrace innovation, growth and wealth creation for all Americans.”

Menefee is supportive of blockchain technology, according to his campaign stance, and Stand With Crypto gives him an “A” grade.

In Green’s most recent election in 2024, his campaign spent less than $450,000 to retain his seat, which went unchallenged in the primary, and he needed even less in 2022. But he’s so far brought in more than $700,000 in this more difficult contest. Still, that’s less than half of Fairshake’s spending against him.

Fairshake also this week announced that it’ll spend $5 million to boost a pro-crypto Alabama Republican, U.S. Representative Barry Moore, in that state’s Senate primary. And the group is also backing House Financial Services Committee Chairman French Hill, according to a spokesman. The super PAC generally spends money on advertisements that are general political messages, not related to crypto issues, and because they’re “independent expenditures” under election law, Fairshake isn’t allowed to coordinate with campaigns.

Crypto World

Bitcoin Institutional Adoption Accelerates as ETFs and Corporate Treasuries Reshape Market

TLDR:

- Spot bitcoin ETFs and treasuries absorbed 1.2 times new supply in 2025, reshaping demand dynamics

- Peak-to-trough bitcoin declines now limited to 50% versus historical 70-80% drawdowns in cycles

- Digital asset treasuries hold 1.1 million BTC valued at $89.9 billion as corporate adoption grows

- U.S. Strategic Bitcoin Reserve holds 325,437 BTC representing 1.6% of total bitcoin supply today

Bitcoin continues its transformation from speculative asset to institutional holding. The digital currency has attracted major financial players through regulated exchange-traded funds and corporate strategies.

Data shows spot bitcoin ETFs and digital asset treasuries absorbed 1.2 times new supply in 2025. This shift reflects broader acceptance among investors.

ETF Growth and Corporate Treasury Adoption Reshape Market Dynamics

Spot bitcoin ETFs reached a milestone during 2025, altering the asset’s supply-demand profile. Morgan Stanley and Vanguard expanded platforms to include bitcoin products in the fourth quarter.

Vanguard’s decision proved noteworthy given its historical exclusion of commodities. These vehicles attracted capital from advisors, institutions, and retail investors.

Corporate adoption has moved beyond early adopters into mainstream finance. According to ARK Investment Management and 21Shares analysts, “the unifying theme for the current cycle is bitcoin’s transition from an optional new monetary technology to a strategic allocation.”

Strategy, formerly MicroStrategy, has accumulated holdings representing 3.5% of total supply. Digital asset treasury companies hold more than 1.1 million BTC, valued at $89.9 billion. The S&P 500 and Nasdaq 100 now include bitcoin-exposed companies like Coinbase and Block.

Sovereign interest materialized through the U.S. Strategic Bitcoin Reserve. The Trump Administration launched this reserve using seized bitcoin totaling 325,437 BTC.

This represents 1.6% of total supply valued at $25.6 billion. Texas led state-level adoption by adding bitcoin to reserves.

Regulatory developments have created clearer pathways for institutional participation. The proposed CLARITY Act would establish dual-oversight between CFTC and SEC.

This legislation provides a compliance roadmap with standardized maturity tests. The clarity reduces uncertainty that drove firms offshore.

Price Performance and Market Maturation Show Evolving Investor Behavior

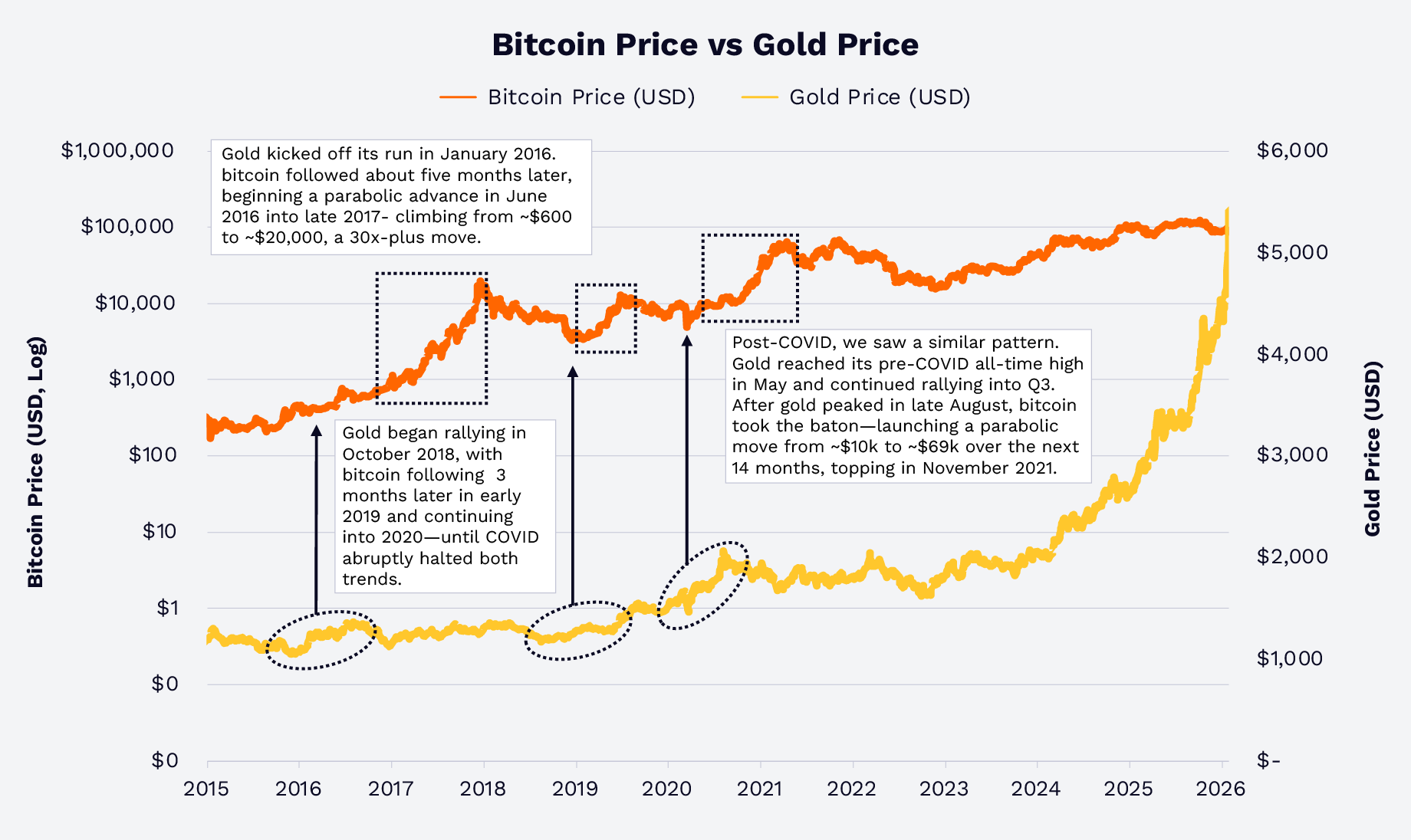

Bitcoin’s relationship with gold has demonstrated patterns throughout market cycles. Gold prices surged 64.7% during 2025 while bitcoin declined 6.2%.

Historical data from 2016, 2019, and 2020 shows gold movements preceded bitcoin rallies. Spot bitcoin ETFs achieved in under two years what gold ETFs required over 15 years.

.png)

Market volatility metrics reveal a maturing asset with improved risk characteristics. Peak-to-trough declines in the current cycle have not exceeded 50%.

This compares favorably to prior cycles where drawdowns reached 70-80%. The February 2026 correction maintained this trend.

Long-term holding strategies have outperformed market timing. A hypothetical investor purchasing $1,000 at yearly peaks from 2020 through 2025 generated positive returns.

The report notes that “in 2026, bitcoin’s story is less about whether it will survive and more about its role in diversified portfolios.”

Even accounting for February corrections, this strategy produced a 29% return. Position sizing and holding periods matter more than entry timing.

Correlation analysis shows bitcoin maintains low relationships with traditional assets. Weekly returns from 2020 through 2026 show a 0.14 correlation with gold.

This low correlation enhances portfolio diversification benefits. Combined with reduced volatility, bitcoin presents a different risk-reward proposition.

Crypto World

SEC Head Defends Enforcement Changes Amid Justin Sun Case Questions

SEC Chair Paul Atkins has defended the agency’s enforcement shift as lawmakers question why Justin Sun’s case was paused.

U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins is facing scrutiny from lawmakers as the agency moves to reshape its cryptocurrency regulatory framework.

Democrats are questioning potential links between industry actors and President Donald Trump amid a broader decline in enforcement actions.

SEC Scrutinized Over Tron Case

During a House Financial Services Committee hearing, Democratic members zeroed in on the SEC’s decision to pause its case against Tron founder Justin Sun. Representative Maxine Waters pointed to what she described as a sweeping rollback of prior crypto enforcement actions after Trump entered the White House and new SEC leadership took over last year.

Waters referenced the regulator’s 2023 lawsuit against Sun, in which he was accused of organizing the unregistered sale of crypto securities tied to the TRX and BTT tokens and manipulating trading volumes.

Later in February 2025, the SEC asked the federal court overseeing the case to issue a stay, which paused the proceedings. Since that decision, Sun has become a major financial supporter of Trump-linked crypto ventures, purchasing billions of WLFI tokens, making him the largest backer of World Liberty Financial.

Waters also highlighted a more recent claim by his alleged former girlfriend, who publicly suggested she possesses evidence of TRX manipulation.

Atkins declined to address specifics of the case, telling lawmakers he could not comment on individual enforcement matters. He added that he would be open to further discussion in a confidential setting “to the extent the rules allow me to do that.”

You may also like:

When asked whether the agency ever acts to protect investors in ways that could negatively affect Trump-affiliated businesses, he responded, “As far as what the Trump family does or not, I can’t speak to that.”

Trump’s Ties to Binance

Lawmakers also raised concerns about other high-profile litigation the SEC dropped last year, including cases against Binance, Ripple, Coinbase, Kraken, and Robinhood.

In May 2025, the financial watchdog ended its lawsuit against Binance, which it had sued in 2023 for offering unlicensed services and misrepresenting trading controls. Trump later also pardoned Zhao, while a stablecoin issued by WLF was used by an Abu Dhabi investment firm for a $2 billion investment in Binance.

“Explain to me how this happens without any enforcement action,” Representative Stephen Lynch said. “The reputational damage that the SEC is suffering right now is unbelievable. And you’re in the seat, sir. It’s your responsibility. I’m just asking for an explanation.”

The SEC Chair defended the regulator, saying it has a “robust enforcement effort” and continues to bring cases. However, data from Cornerstone Research shows that its overall legal actions fell 30% in 2025, while crypto-related cases dropped 60%.

Atkins, who became the organization’s chair in April 2025 after Gary Gensler’s departure, is known for criticizing the previous aggressive approach and framing his leadership as a move away from litigation-heavy tactics.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Israeli soldier allegedly used military secrets to gamble on Polymarket

Israel is attempting to prosecute a reserve soldier who allegedly used military secrets to place bets on security operations via Polymarket.

Polymarket offers a multitude of markets on various military operations, from bets on the outcome of the Ukraine/Russia war, to more specific targeted missile strikes against various countries.

Israel’s Shin Bet security agency announced today that the soldier — who is facing court along with an alleged civilian accomplice — used “classified reports” accessed via their military role to help make bets that could threaten Israel’s national security.

The pair is charged with numerous security offences, as well as bribery and obstruction of justice. Several people were arrested, but only two have been charged so far.

A lawyer representing the soldier told Bloomberg that the indictment is “flawed,” adding that the charge of harm to national security has been dropped.

They added, however, that he’s still believed to have used confidential information without permission.

Pair might be connected to $150K Polymarket winnings on Israel-Iran strikes

It’s unknown which prediction markets the two bet on, or if they made any profits. There are suspicions, however, that they could be linked to the Polymarket account “ricosuave666.”

This account made over $150,000 betting on Israel’s strikes against Iran in 2025, and reportedly got each prediction correct across a war that lasted 12 days.

Israeli authorities then opened up an investigation into these bets.

Previous cases involving the leaking of military secrets led to an Israeli soldier reportedly being sentenced to 27 months in jail in 2023.

The individual passed on confidential information to users on social media so that they could gain credibility and popularity online.

Read more: Logan Paul fakes $1M Super Bowl bet on Polymarket

Every month, there seems to be another debate surrounding Polymarket and the use of insider information to make bets, but it’s unclear how capable the platform is of preventing these sorts of trades.

There were concerns over one account that made $437,000 betting on the exit of Venezuela’s former president Nicolás Maduro hours before the US captured him.

There were also concerns that someone was able to use insider information to bet on the Nobel Peace Prize before it was announced.

After the home of Polymarket’s CEO, Shayne Coplan, was raided by the FBI, a company spokesperson said, “We charge no fees, take no trading positions, and allow observers from around the world to analyze all market data as a public good.”

Protos has reached out to Polymarket for comment and will update this piece should we hear anything back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports20 hours ago

Sports20 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World22 hours ago

Crypto World22 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video17 hours ago

Video17 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’