Crypto World

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Aave founder Stani Kulechov announced the decentralized finance protocol is winding down its Family iOS wallet over the coming year and retiring the Avara umbrella brand as the company consolidates operations entirely under Aave Labs.

The strategic retreat from consumer wallet products comes from a bet that mainstream users will adopt crypto through focused financial applications, such as savings and lending, rather than general-purpose explorers.

Family will stop onboarding new users from April 1, with existing customers able to access the app until April 2027 before transitioning to Aave’s infrastructure.

The shift comes weeks after Aave transferred stewardship of its Lens Protocol social network to Mask Network, completing a dramatic narrowing of focus following years of ecosystem expansion and internal governance battles.

Purpose-Built Products Replace Open-Ended Wallet Strategy

Kulechov said the decision reflects lessons learned from attempting to onboard millions of users through different product approaches.

“Through this journey, we’ve learned that onboarding millions of users requires purpose-built experiences, such as savings, rather than generic, open-ended wallet experiences,” he stated in the announcement.

The Family team, acquired by Avara in 2023 for their design capabilities, contributed work across multiple Aave products, including Aave Pro, the mobile app, and the protocol’s brand identity.

According to the company’s announcement, their core technology, Family Accounts, will continue to power authentication and embedded wallet functionality across Aave’s product suite rather than operate as a standalone consumer application.

Existing Family users will maintain full control of their funds through accounts.aave.com using their credentials, though app functionality will gradually be limited to account access and withdrawals only.

Kulechov emphasized the infrastructure approach supports “a more seamless user journey, stronger safety protections, and more intuitive interfaces, while preserving user sovereignty and full control of funds.“

Consolidation Follows Governance Turmoil and Regulatory Wins

The brand consolidation follows a turbulent six-month period during which Aave faced accusations of governance manipulation and internal disputes over asset ownership.

In December, Kulechov purchased roughly $10 million worth of AAVE tokens shortly before a controversial vote, prompting critics, including DeFi strategist Robert Mullins, to allege the move was designed to boost voting power rather than demonstrate long-term commitment.

Community tensions escalated when Aave Labs unilaterally pushed a proposal to vote regarding brand asset ownership without notifying its author, Ernesto Boado of BGD Labs.

“This is not, in ethos, my proposal,” Boado declared, adding that Aave Labs “breaks all codes of trust with the community” by rushing the submission during what had been a productive forum discussion.

Contributors raised concerns that certain product decisions, including replacing Paraswap with CowSwap integration, redirected an estimated $10 million annually in fees away from the DAO treasury toward private entities.

Marc Zeller of the Aave Chan Initiative argued the DAO had paid for brand assets “four times” through the original LEND token sale, dilution, liquidity mining programs, and service provider fees.

Snapshot data showed the top three wallets controlled more than 58% of voting power, with the largest wallet holding over 27%, intensifying concerns about whale dominance and conflicts of interest within the ecosystem.

Despite internal friction, Aave secured regulatory clarity when the Securities and Exchange Commission concluded its multi-year investigation without recommending enforcement action in December, ending nearly 4 years of uncertainty, and also obtained MiCA authorization in Europe.

The Lens Protocol handover to Mask Network in January represented another piece of Aave’s consolidation strategy.

Kulechov emphasized that “all functions move to Mask,” including IP, chain infrastructure, and social media accounts, while Lens remains permissionless infrastructure.

Aave remains one of the largest DeFi platforms by total value locked, surpassing $45 billion in October.

The Estonia-born, Finland-raised founder, who recently purchased a £22 million mansion in London’s Notting Hill, is preparing to launch Aave V4.

All current and future products will now operate exclusively under the Aave Labs brand as the company focuses resources on “building Aave brand awareness and introducing DeFi to millions of new users globally.“

The post Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet appeared first on Cryptonews.

Crypto World

BTC under pressure as U.S. tech sector stumbles

Bitcoin fell back below $74,000 in the early innings of the U.S. session, with the bounce from Tuesday’s lows quickly fading away as weakness in tech stocks weighed on crypto.

The Nasdaq 100 was 1% lower following the previous day’s 1.5% decline. The software sector continued its tumble, with the thematic iShares Expanded Tech-Software ETF (IGV) declining another 4%, now down 17% in a little over a week, amid fears that AI will be severely disruptive.

Crypto miners, increasingly tied to the buildout of AI infrastructure, mirrored the slide, with Cipher Mining (CIFR), IREN, and Hut 8 (HUT) falling by more than 10%. The declines stemmed from chipmaker AMD, which fell 14% after its 2026 outlook missed analysts’ expectations.

Gold was also caught in the selling, with the yellow metal quickly reversing an overnight surge to $5,113 per ounce and sliding back below $5,000.

U.S. economic data is mixed

The ISM Services PMI for January held steady at 53.8, matching December’s revised reading and beating expectations by a hair, pointing to continued expansion in the services sector.

However, private job growth slowed sharply, with just 22,000 jobs added according to an ADP report, well below forecasts for 48,000 and December’s already weak 37,000. The government’s January job report would normally have been released this Friday, but the short government shutdown has delayed it until next week.

“Manufacturing has lost jobs every month since March 2024 (Main Street recession) but this month professional and business services and large employers joined the weakness,” said Lekker Capital CIO Quinn Thompson, who believes markets are underestimating the amount of Fed stimulus that may be coming in 2026.

Crypto World

Bitcoin Dips to $95K as Crypto Funds See Record Inflows

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped 3% in the last 24 hours to trade at $93,324, as crypto investment products continue to attract strong interest from investors with record inflows.

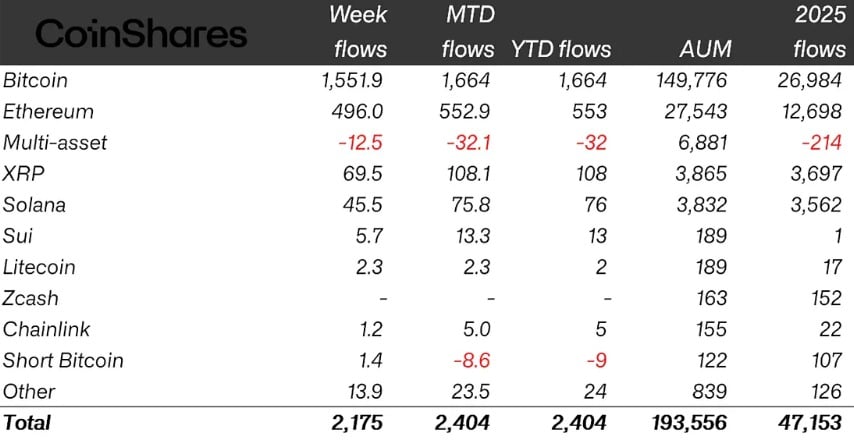

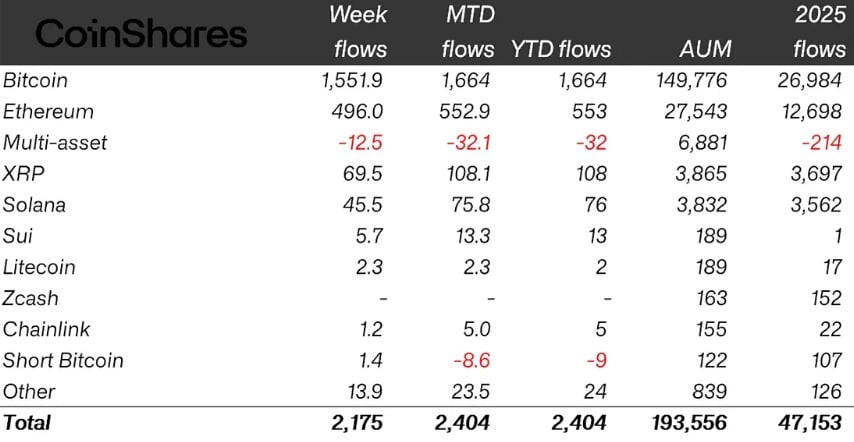

Last week, crypto funds saw inflows of $2.17 billion, the highest in 2026 so far and the largest weekly gain since October, according to European asset manager CoinShares. Most of the money entered the market earlier in the week, but Friday recorded $378 million in outflows due to geopolitical tensions in Greenland and fresh concerns over tariffs.

James Butterfill, CoinShares’ head of research, also noted that sentiment was affected by expectations that Kevin Hassett, a leading contender for US Fed Chair, would likely remain in his current position. Bitcoin dominated last week’s fund inflows, pulling in $1.55 billion, which represented over 70% of the total.

Ether followed with $496 million, while XRP and Solana attracted $70 million and $46 million, respectively. Smaller altcoins such as Sui and Hedera recorded minor inflows of $5.7 million and $2.6 million. Despite proposals under the US Senate’s CLARITY Act that could limit stablecoin yields, Ether and Solana funds held up well.

Among fund types, multi-asset and short Bitcoin products were the only categories to see outflows, totaling $32 million and $8.6 million. On the issuer side, BlackRock’s iShares ETFs led the market with $1.3 billion in inflows, followed by Grayscale Investments at $257 million and Fidelity Investments at $229 million.

Geographically, the US accounted for the majority of inflows at $2 billion, while Sweden and Brazil saw small outflows of $4.3 million and $1 million, respectively. With these gains, total assets under management in crypto funds surpassed $193 billion for the first time since early November, showing renewed investor confidence.

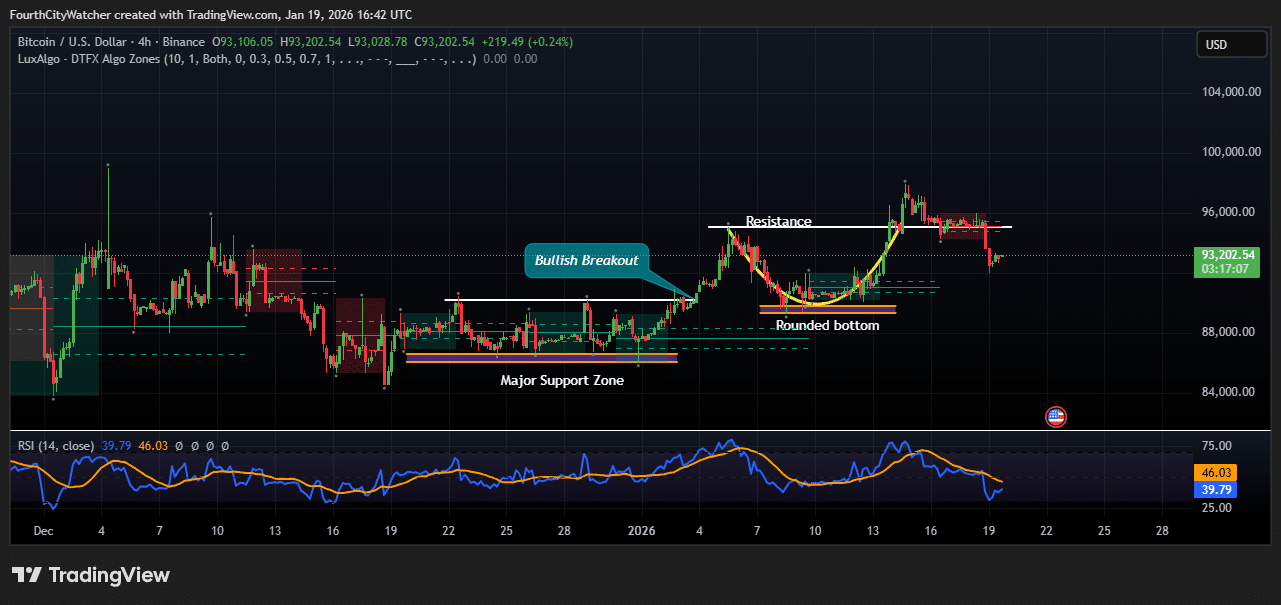

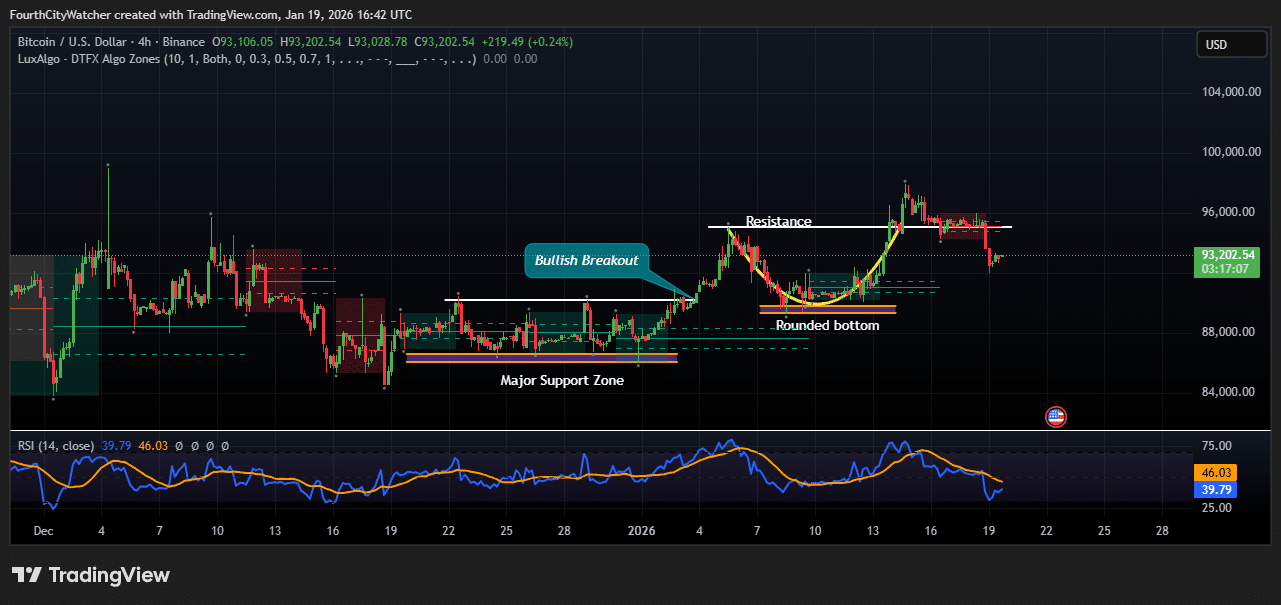

The Bitcoin price 4-hour chart shows a series of bullish developments, though recent price action indicates some short-term consolidation. Price recently rebounded from a major support zone around $87,500–$88,500, which had previously acted as a strong accumulation area. This level has successfully absorbed selling pressure multiple times in the past, providing a solid foundation for higher moves.

Following this support, Bitcoin formed a rounded bottom pattern between January 6 and January 12, signaling a shift from bearish to bullish sentiment. The rounded bottom reflects a gradual loss of selling momentum, allowing buyers to regain control.

A bullish breakout occurred after the rounded bottom, pushing the price above prior resistance levels around $91,000. This breakout was accompanied by strong upward momentum, with the price briefly testing the $96,000 region. The breakout confirms that buyers were willing to step in decisively after the consolidation, signaling potential continuation of the short-term uptrend.

Currently, the price has pulled back slightly after hitting the $96,000 resistance area. The minor retracement appears healthy, as it allows buyers to enter at lower levels without threatening the overall bullish structure. The relative strength index (RSI), currently around 39.8, shows that Bitcoin is not yet oversold, indicating room for further upside once buyers re-enter. The 46-level on the RSI also indicates previous resistance in momentum, now acting as a potential pivot point.

The chart shows a well-defined support and resistance structure, with price respecting the $88,000–$91,000 range before attempting higher levels. The rounded bottom and bullish breakout highlight a transition from accumulation to renewed upward momentum. Traders may watch for a retest of $91,000–$92,000 as a key support level, while the $96,000 area remains a near-term resistance barrier.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Bitcoin-native USDT protocol joins CTDG Dev Hub

Bitcoin has long served a simple purpose: storing and transferring value. The blockchain’s inherent limitations in scalability and programmability prevented use cases like high-frequency payments and smart contracts.

Launched in 2018, the layer-2 solution Lightning Network introduced noticeable improvements in scalability. It takes some of the burden offchain by creating side channels between the sender and receiver.

The model settles transactions faster, with lower fees. Rendering Bitcoin feasible for daily use, the solution spurred the development of many payment apps on the blockchain.

Programmability also arrived in Bitcoin through secondary protocols, such as RGB, an open-source solution designed to expand Bitcoin’s capabilities. The protocol enables the creation of smart contracts and other digital assets on Bitcoin through private, offchain transactions.

RGB powers decentralized applications (DApps) and tokenization, and allows digital assets other than Bitcoin (BTC) to exist on top of the original blockchain.

Bitcoin-native USDT transactions

CTDG Dev Hub, a collaborative platform for blockchain developers working on protocol ideas, has added Utexo as a new participant. The project examines how stablecoin transfers could be represented natively on Bitcoin by combining the Lightning Network’s payment channels with RGB’s client-side asset model. By focusing on interoperability between Bitcoin’s scaling and asset layers, Utexo aligns with DevHub’s goal of supporting experimental infrastructure research and practical developer-driven use cases.

Before the introduction of native solutions, the prevailing practice for using USDT on Bitcoin was utilizing methods like wrapping and bridging, which add intermediaries to the process and increase security risks.

Utexo moves USDT on Bitcoin-native rails instead by combining Lightning’s payment flow with RGB’s asset transfer model. Through RGB, USDT is issued and transferred under a client-side validation model, which keeps most of the transaction details off Bitcoin’s base layer.

Meanwhile, the Lightning Network enables fast and low-cost execution. Bitcoin’s layer-1 only serves as the security anchor that ultimately settles transactions and prevents double-spending.

That combination is meant to avoid the extra trust assumptions that come with wrapping and bridging while still keeping the experience fast. In other words, speed comes from Lightning, asset logic comes from RGB and the security stays tied to Bitcoin.

In Utexo’s design, separating execution from base-layer congestion can make cost behavior less sensitive to Bitcoin’s mempool conditions, since most activity occurs off-chain and Bitcoin is used only for final settlement. This structural decoupling is one reason some implementations aim for more stable cost behavior as throughput grows.

Utilizing the Lightning Network or RGB normally requires a good amount of manual labor. Users have to set up and run a Lightning node, open and manage channels, ensure liquidity, handle routing failures and monitor payment status.

On the RGB side, they also need to manage issuance and transfers, exchange the data needed for client-side validation and keep track of state so balances remain accurate.

The project brings these steps into a single integration flow available via an SDK and REST API. It exposes programmatic access to Lightning execution, routing and failure handling, as well as RGB asset issuance, transfers and state transitions, enabling interaction with both layers through one interface.

Bitcoin developers gain a hub

Cointelegraph has been taking an active role in blockchain governance and development through its initiative, Cointelegraph Decentralization Guardians.

As part of the CTDG ecosystem, CTDG Dev Hub serves as a developer-focused hub alongside CTDG’s validator operations and educational initiatives. The hub offers an open, global public space for developers and other members of the blockchain community to exchange ideas, develop solutions, and submit proposals.

Through its participation in CTDG Dev Hub, Utexo becomes part of a shared development environment where its approach can be reviewed and discussed by other contributors. The Dev Hub serves as a coordination point for developers and community members exploring infrastructure and tooling for Bitcoin-based applications.

Crypto World

Indian investors have matured, buying BTC in shift from speculative tokens

Indian crypto investors have shed the speculative itch and are buying the dip in bitcoin price like seasoned pros, Mumbai-based CoinDCX exchange told CoinDesk.

“Indian investors are maturing. They’re no longer driven purely by sentiment or headlines; instead, they’re focused on fundamentals and the long-term potential of the asset class,” CoinDCX’s CEO Sumit Gupta said in an email.

“We’re seeing it in their behavior: regular bitcoin systematic investment plans (SIPs), deliberate market orders, and thoughtfully placed limit orders,” he added, naming ether , solana and XRP as other favorites.

The latest trend contrasts with the frenzied trading in 2021 when newbies chasing 100x pumps dabbled with clones and other smaller tokens.

“It’s clear that participation is becoming more strategic and measured, rather than reactive. Increasingly, investors are looking at Bitcoin for portfolio diversification and long-term wealth creation,” Gupta said.

Bitcoin’s price has dropped to $75,000 after having hit a high of over $126,000 in October. The broader market has followed suit, with altcoins registering bigger losses. Coincidentally, the Indian national rupee (INR) has depreciated against the U.S. dollar in recent weeks, hitting a record low of 92 per USD.

Yet trading volumes have picked up on the exchange, rising from about $269 million in December to roughly $309 million in January, he said, adding that the activity has been more balanced. “We see profit-taking from short-term traders who bought near recent lows, but at the same time, steady accumulation from long-term investors who view these levels as an opportunity,” he noted.

India, the world’s fastest-growing major economy, maintains a cautious, regulatory-focused stance on digital assets, treating them as taxable Virtual Digital Assets (VDA) rather than legal tender. The annual budget announced over the weekend maintained a 30% tax on crypto gains, with no loss set-offs, and a 1% transaction tax deducted at source.

Regulations issued by the Financial Intelligence Unit also mandate strict KYC requirements, including regular and accurate reporting of user transactions by exchanges. These measures are aimed at bolstering compliance and countering money laundering and terrorist financing.

“The Union Budget 2026 proposes strengthening compliance for crypto platforms over lapses in transaction disclosures, aiming to curb tax evasion in virtual digital assets,” Gupta said.

We remain fully committed to working with policymakers to support the development of a safe, innovative, and globally competitive VDA ecosystem, as the regulatory landscape continues to evolve.

Crypto World

NYSE Develops Blockchain Platform for Tokenized Stock Trading

Join Our Telegram channel to stay up to date on breaking news coverage

The New York Stock Exchange (NYSE) is developing a new blockchain-based platform that will allow trading of tokenized stocks and exchange-traded funds (ETFs) with 24/7 access and near-instant settlement.

The initiative is part of a broader effort by NYSE and its parent company, Intercontinental Exchange (ICE), to modernize market infrastructure and meet growing global demand for US equities. According to the announcement, the new platform will combine ICE’s existing Pillar trading engine with blockchain-powered post-trade systems.

It will support multiple blockchains for custody and settlement, allowing trades to be funded and settled in real time using stablecoins instead of the current one-day (T+1) settlement cycle used in US equity markets. The platform is subject to regulatory approval and is expected to support a new NYSE trading venue specifically designed for tokenized securities.

🇺🇸 BREAKING: NYSE plans to launch 24/7 trading for tokenized stocks & ETFs on blockchain.

The platform will support instant settlement, fractional ownership, and stablecoin-based funding — bringing TradFi and crypto closer than ever.

This move could enable global,… pic.twitter.com/fbMcO89HUf

— Mayank Dudeja || SPYONGEMS (@imcryptofreak) January 19, 2026

Tokenized stocks are digital representations of traditional company shares issued on a blockchain. They give investors exposure to stock prices while offering key benefits such as 24/7 trading, faster settlement, and fractional ownership. These features are seen as especially attractive to global investors who cannot easily trade during standard US market hours.

NYSE and ICE Push Toward 24/7, Fully On-Chain Markets

The move aligns with NYSE’s broader push to extend trading hours. In October 2024, the exchange announced plans to seek approval from the US Securities and Exchange Commission (SEC) to extend weekday trading to 22 hours. Nasdaq has also revealed plans to introduce 24-hour weekday trading, highlighting a wider industry shift toward always-on markets.

ICE described the tokenized securities platform as a core part of its digital strategy. This includes building on-chain clearing infrastructure, supporting 24/7 trading, and potentially integrating tokenized collateral. ICE is also working with major banks such as BNY and Citibank to support tokenized deposits, helping market participants manage liquidity outside traditional banking hours.

NYSE Group President Lynn Martin said the exchange aims to lead the industry toward fully on-chain solutions while maintaining strong regulatory standards. ICE executives described the initiative as a pivotal step toward creating onchain infrastructure for trading, settlement, custody, and capital formation in the next era of global finance.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Euro Stablecoin Boom Will Be Driven by RWA Tokenization, Not Payments: S& P Global

EUR-pegged stablecoins are set to grow 800x-1,600x by 2030, S&P projects.

Crypto World

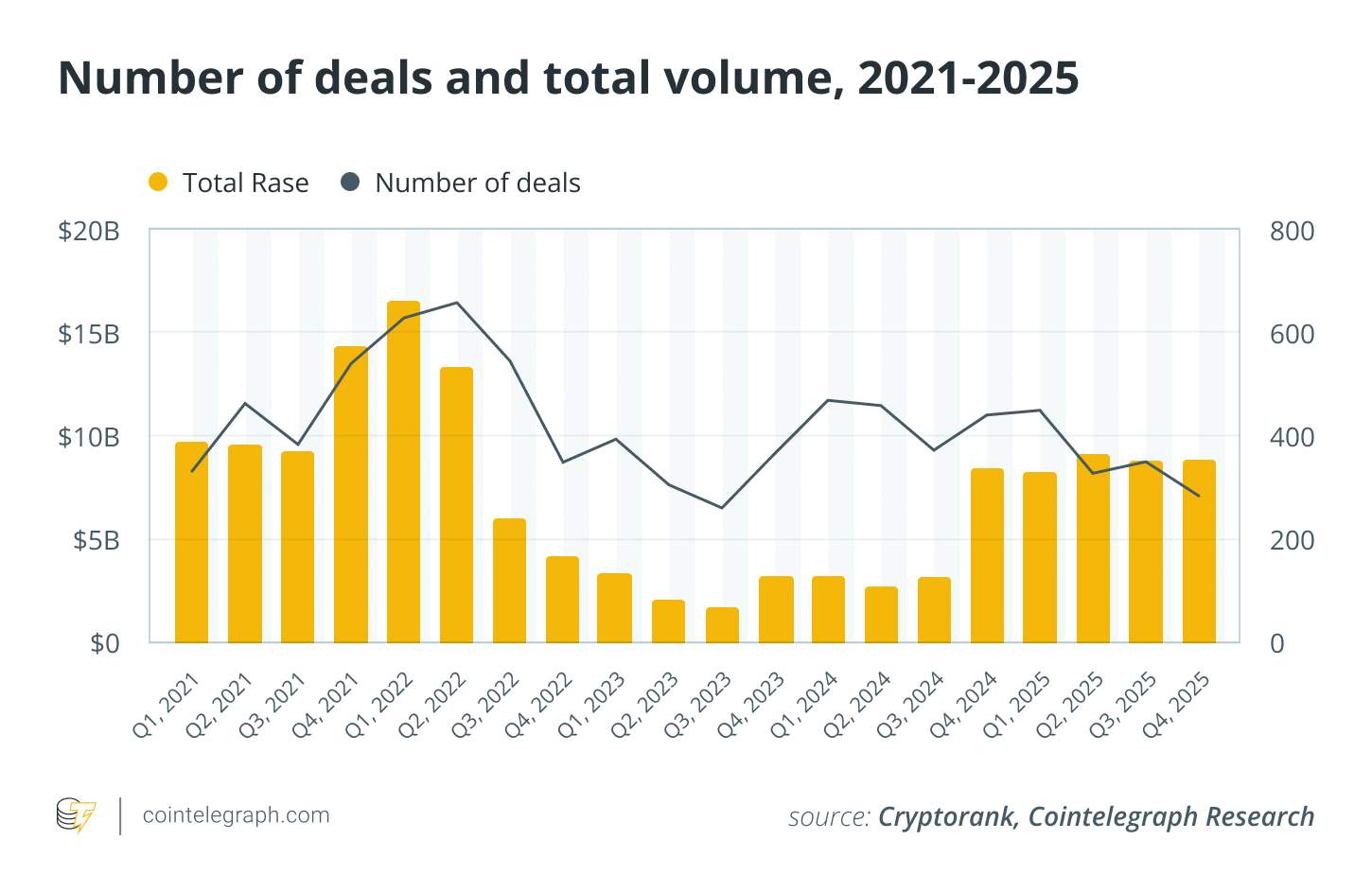

Crypto VC Funding Doubled in 2025 as RWA Tokenization Took the Lead

Cointelegraph Research provides a data-driven report on crypto VCs, highlighting capital flows, sector rotation and changes in investor behavior.

Cointelegraph Research’s latest report provides an outlook on the state of fundraising in the crypto market and the key VC trends of 2025. VC investments in Web3 startups doubled in 2025 from the year before, driven by institutional interest, particularly in the RWA sector, which raised more than $2.5 billion. There has also been a distinct increase in mergers and acquisitions (M&A) and other large-scale corporate financing arrangements.

Download the free report to discover important industry highlights

The state of crypto venture capital (VC) in 2026

In 2025, venture capital investment in crypto startups exceeded $8 billion in every quarter for the first time since 2022. Total funding in 2025 reached more than $34 billion, double the $17 billion recorded in 2024. Nevertheless, 2025 can still be considered a risk-off year, as investors favored bonds and safe-haven assets, such as precious metals, which posted exceptional performance that year, amid geopolitical uncertainty and elevated interest rates.

The reduced risk appetite of venture capital also changed perceptions of business models in crypto. In 2025, fund managers prioritized sustainable revenue models, organic user metrics and strong product market fit instead of projects with early traction and limited revenue visibility. This shift was corroborated by the move from pre-seed and seed rounds toward later financing stages. Seed-stage financing declined by 18%, while Series B funding increased by 90%. This indicates deeper investor involvement in projects and a stronger focus on ecosystem development rather than early-stage experimentation.

Download the full report to explore which startups and niches attracted most attention from VCs

The trending narrative: Real-world assets (RWA)

RWA tokenization has shifted from a narrative into a budding sector over the past three years. According to RWA.xyz data, tokenized real-world assets have surpassed a capitalization of $38 billion, up 744% from $4.5 billion in 2022. RWAs have emerged as one of the fastest-growing segments in the crypto market, second only to stablecoins. Despite this growth, the crypto RWA sector remains small relative to $156 trillion in fixed-income and $146 trillion global equities markets. This suggests substantial room for further expansion.

From the investment side, the first signs of this shift are present in the progression of annual funding figures. In 2025, VC funding for RWA tokenization projects exceeded $2.5 billion.

Download the full Cointelegraph Research report to explore deeper insights into the RWA sector

Fading narrative for Ethereum layer 2s and modular infrastructure projects

While overall VC interest in the crypto market increased throughout the year, certain narratives showed clear signs of decline. In 2022, Ethereum layer 2 projects raised more than $1.2 billion, followed by $387 million in 2023 and $587 million in 2024. In 2025, funding reached a low of $162 million, representing a 72%decline from 2024.

This was likely caused by the rapid proliferation of layer-2 blockchains, which has led to an increasingly saturated landscape and a decline in VC appetite for this technology. As the number of L2 chains quickly increased above 50, the demand for blockspace was saturated.

See which crypto sectors are losing VC interest in the latest report by Cointelegraph Research

We would like to thank Canton Foundation, CryptoRank, DWF Labs, Everest Ventures Group, Mercuryo, and RWA.xyz for contributing data, insights, and opinions to this report.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. This article is for general information purposes and is not intended to be and should not be taken as, legal, tax, investment, financial, or other advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Nvidia (NVDA) Shares Fall to a Year-to-Date Low

As the Nvidia (NVDA) share price chart shows, the stock fell below $177 during yesterday’s session, marking its lowest level since the start of 2026.

Negative market sentiment is largely driven by uncertainty surrounding supplies to China. According to the Financial Times, Nvidia’s sales of H200 chips to China are still awaiting final approval from US authorities.

Yesterday’s statement from AMD, noting that the scale of its own shipments to China remains uncertain, reinforced these concerns and added further pressure to Nvidia shares. Previously, NVDA had been supported by expectations that deliveries of H200 chips to Chinese partners would begin in early 2026.

In addition, some media reports suggest that the stock is facing extra pressure from news of delayed investment in OpenAI, which is reportedly exploring alternative suppliers.

Technical Analysis of the Nvidia (NVDA) Chart

On 23 December, when analysing NVDA price action, we:

→ reaffirmed the long-term ascending channel, which remains intact;

→ suggested that bulls might attempt to break out of the corrective pattern (shown in red) in order to reach the channel median.

As expected (indicated by the black arrow), the price reached this target. However, January’s price behaviour offers little evidence that the uptrend has resumed with renewed strength.

Moreover, the red arrows highlight several bearish signals:

→ the median acted as clear resistance;

→ the 30 January peak (the highest level since the start of the year) formed with a long upper shadow, resulting in a false break of the previous high — a classic “bull trap”.

While bearish momentum appears to be in control, it is worth noting that:

→ the break below the 20 January low could also prove to be false;

→ the lower boundary of the channel, which has acted as key support for many months, is nearby.

Taking all of this into account, it is reasonable to assume that NVDA may find a period of consolidation in the lower quarter of the channel. A potential catalyst for the next major move could be the company’s earnings release scheduled for 25 February.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

ProShares introduces first CoinDesk 20 Crypto ETF under ticker KRYP

ProShares unveiled the first U.S.-listed exchange-traded fund (ETF) designed to target the performance of the CoinDesk 20 Index, expanding options for investors seeking broad exposure to crypto markets.

The CoinDesk 20 Crypto ETF (KRYP) is the first ETF tied to the benchmark of 20 of the largest and most liquid digital assets, ProShares said in a Wednesday email.

The index is market-capitalization weighted, subject to caps, and rebalanced quarterly, aiming to provide diversified exposure while limiting concentration in any single cryptocurrency.

“As the cryptocurrency market has matured, investors have increasingly looked beyond single-asset exposure,” CEO Michael Sapir said in a statement, describing KRYP as a way to access the broader asset class through one ticker.

The CoinDesk 20 selects assets from the top 250 by market cap, applying liquidity and exchange-listing requirements, while excluding stablecoins, memecoins, privacy tokens and various wrapped or pegged assets.

ProShares already offers one of the largest suites of crypto-linked funds in the U.S., with 13 ETFs and additional mutual fund products.

Crypto World

DeepSnitch AI Holders Capitulate to Join Digitap ($TAP) Presale: Best Crypto to Buy

Market behavior during drawdowns often forces a hard reset. Tools that help traders react faster lose relevance when volatility compresses opportunity, and liquidity dries up. This is why attention is moving away from analytics-heavy platforms toward structures that preserve value and generate utility regardless of market direction.

For DeepSnitch AI holders, the current environment has created a clear inflection point. Capital is rotating out of signal-based products and into fixed-entry opportunities with real usage and cash-flow logic.

That rotation explains why Digitap ($TAP) is seen as the best crypto to buy now, positioned as a defensive crypto presale built for recessionary conditions. As risk appetite contracts, the conversation around altcoins to buy favors platforms that move money, not just data.

Why DeepSnitch AI Holders Should Move to Digitap

DeepSnitch AI was built to solve information asymmetry. Its AI-driven agents monitor wallets, contracts, liquidity shifts, and sentiment across multiple chains, delivering alerts designed to improve trading outcomes. In active markets, that value proposition resonates. In slow, risk-off conditions, actionable signals become scarce, and analytics lose leverage as capital prioritizes preservation over precision.

The platform’s reliance on constant market activity creates a dependency on volatility. When fewer trades occur and narratives stall, demand for premium alerts softens. Token utility becomes concentrated around access rather than economic throughput, leaving holders exposed to sentiment cycles rather than structural demand.

Digitap operates from a different foundation. Instead of optimizing decision-making within the market, it serves as infrastructure for price discovery outside the market. Payments, settlements, conversions, and storage continue regardless of volatility. That distinction matters when trading edges compress and capital seeks stability over timing.

For holders exiting signal-based exposure, Digitap represents a pivot from observation to utility. It facilitates day-to-day financial operations, creating demand that does not rely on speculation. This independence is why capital migration is accelerating.

How Digitap Works and What It Actually Is

Digitap is the world’s first omni-bank, designed to unify crypto and traditional finance within a single platform. It allows users to quickly exchange crypto for fiat and fiat for crypto, bridging on-chain assets with real-world banking rails through a live, downloadable app.

At the core of the ecosystem sits the $TAP token, built around fixed supply and utility-driven demand. Total supply is capped at 2 billion tokens, with no inflation, no buy or sell tax, and no hidden minting mechanisms. Circulating supply is engineered to move in one direction only: downward, as buyback and burn activity removes tokens from the market.

$TAP is woven directly into platform functionality. The token powers staking programs, unlocks fee discounts, enables governance participation, and grants access to premium account tiers. $TAP functions as the economic engine of the ecosystem.

Demand for $TAP is tied to usage of the platform itself, not to market sentiment or trading frequency. As the app scales, token utility scales alongside it.

Crypto Presale Structure, Fees, and Real Usage

Digitap’s relevance increases in recessionary conditions, where fees and friction compound financial stress. Traditional remittance channels often charge more than 6% per transfer. Digitap compresses cross-border costs to under 1%, keeping more value in circulation and reducing erosion during periods of economic pressure.

The platform also serves freelancers and remote earners who receive income in crypto. Funds can be converted to cash and routed toward rent, utilities, or daily expenses without navigating multiple applications or intermediaries. This turns crypto into spendable income rather than dormant capital.

Privacy and flexibility are embedded through a tiered KYC structure. No-KYC wallet options coexist with higher-limit accounts, allowing different levels of access without forcing a single compliance model. Offshore banking partnerships further reduce geographic concentration risk.

The current crypto presale price stands at $0.0467, with the next stage set at $0.0478 and a defined listing price of $0.14. This staged structure introduces predictability at a time when most assets lack clear valuation anchors. Nearly $5 million has been raised, with more than 213 million tokens sold.

Why $TAP Is the Best Altcoin to Buy Now

The market is no longer rewarding speed or signal density. It is rewarding resilience. Platforms that generate economic value outside price speculation are gaining ground as liquidity remains constrained and volatility fails to translate into opportunity.

Digitap fits this environment precisely. It replaces high-frequency decision-making with structural utility, positioning itself as a financial layer that functions regardless of market direction. That is why it continues to surface in discussions around the best crypto to buy now.

Compared to analytics-driven tokens, $TAP benefits from real usage cycles tied to payments, remittances, and income conversion. This creates persistent demand and separates it from assets dependent on trader sentiment.

As capital rotates out of reactive tools and into foundational infrastructure, Digitap’s presale structure amplifies its appeal. With fixed pricing, growing adoption, and clear economic logic, $TAP defines what a crypto to buy now looks like in defensive conditions.

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech8 hours ago

Tech8 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World17 hours ago

Crypto World17 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards

Aave Labs unilaterally pushed a brand ownership proposal to vote without author notification, escalating governance tensions over protocol asset control and value extraction.

Aave Labs unilaterally pushed a brand ownership proposal to vote without author notification, escalating governance tensions over protocol asset control and value extraction.