Crypto World

Analysts Call for Another Big Move After 16% Surge

Ripple’s XRP broke the weekend silence with a massive double-digit surge to over $1.65.

Unlike the weekend at the start of the month, in which the cryptocurrency market was hit hard, and multiple assets suffered massive losses, the past 24 hours have benefited almost all digital assets.

Ripple’s cross-border token has emerged as one of the top gainers, having surged by 16% daily to its highest price levels since February 1 at over $1.65.

CryptoWZRD weighed in on XRP’s performance during the weekend, indicating that both charts, against the USD and BTC, closed bullish. The analyst added that “further upside from XRPBTC is very likely.”

Cobb, one of the most vocal XRP bulls on X who made some bold price predictions yesterday with double-digit targets, noted that the cross-border asset might have started to decouple from other larger-cap cryptocurrencies.

This claim has merit at least in the past day. Aside from DOGE, which has soared by over 20% since Saturday, XRP is the only other double-digit gainer from the top 20 alts.

ERGAG CRYPTO indicated that the current two-week candle, which is set to close later today, is “shaping into either a Hammer or a Dragonfly Doji.” The analyst explained that both options are classic reversal candles that appear after a severe downtrend.

XRP has indeed been in a downtrend for the past month and a half. The asset peaked at $2.40 on January 6 but was quickly halted there and pushed south to just over $1.10 on February 6. Nevertheless, it responded well to this calamity and now trades at $1.65, representing a near 50% surge from the local lows.

You may also like:

Consequently, ERGAG CRYPTO advised their followers to ignore the noise and focus on XRP’s structure, which “remains a bullish setup, until the market proves otherwise.”

#XRP – Descending Broadening Wedge (Update):

On the 2-week timeframe, the current candle (closing in ~16 hours) is shaping into either a Hammer ⚒️ or a Dragonfly 🐉Doji.

👉Both are classic reversal candles when they appear after a downtrend.

Add to that:

▫️ The Descending… https://t.co/zGhHHznrUo pic.twitter.com/JWXVOddqiy— EGRAG CRYPTO (@egragcrypto) February 15, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

WLFI May Have Signaled Crypto Crash Hours Before Bitcoin: Study

World Liberty Financial Token (WLFI), a DeFi governance token affiliated with the Trump family, may have signaled a major market breakdown hours before Bitcoin moved, according to a new analysis by data provider Amberdata.

The report examines trading activity on Oct. 10, 2025, when roughly $6.93 billion in leveraged crypto positions were liquidated in under an hour. Bitcoin (BTC) fell about 15% and Ether (ETH) dropped roughly 20%, while smaller tokens lost as much as 70%.

Amberdata found that WLFI began a sharp decline more than five hours before the broader market downturn. At the time, Bitcoin was still trading near $121,000 and showed little immediate stress.

“A five-hour lead time is hard to dismiss as coincidence,” Mike Marshall, who authored the report, told Cointelegraph. “That duration is what separates a genuinely actionable warning from a statistical artefact,” he added.

Related: Senators ask Bessent to probe $500M UAE stake in Trump-linked WLFI

WLFI anomalies before the selloff

Researchers analyzed three unusual patterns, including a surge in trading activity, a sharp divergence from Bitcoin and extreme leverage, to determine whether WLFI signaled stress before the broader market selloff.

WLFI’s hourly volume jumped to roughly $474 million, about 21.7 times its normal level, within minutes of tariff-related political news. Meanwhile, funding rates on WLFI perpetual futures reached about 2.87% every eight hours, equivalent to an annualized borrowing cost near 131%.

The study does not claim insider trading occurred. Instead, it argues the way crypto markets are structured can make certain assets matter more than their size suggests.

WLFI’s holder base is concentrated among politically connected participants, the report says, unlike Bitcoin’s widely distributed ownership. Marshall said the trading pattern appeared “instrument-specific,” meaning activity was focused on WLFI rather than across the broader crypto complex.

“If this were superior analysis (sophisticated participants reading the tariff headlines faster and drawing better conclusions) you’d expect to see that reflected more broadly,” he said. “What we actually saw was concentrated activity in WLFI first.”

The timing is notable. Trading volume accelerated roughly three minutes after public tariff news. Marshall said such speed suggests prepared execution rather than retail traders interpreting headlines in real time.

The link between WLFI and the broader market drop comes down to leverage. Many crypto trading platforms let traders use several assets as collateral for borrowed positions. When WLFI fell sharply, the value of that collateral dropped, forcing traders to sell liquid assets like Bitcoin and Ether to cover their positions. Those sales pushed prices lower and triggered further liquidations across the market.

Related: Trump family’s WLFI plans FX and remittance platform: Report

WLFI reacted faster than Bitcoin to stress

Amberdata’s data shows WLFI’s realized volatility reached nearly eight times that of Bitcoin during the episode, making it particularly sensitive to stress. Researchers argue that structurally fragile, highly leveraged assets may move first during market shocks.

Marshall said the findings should not be interpreted as proof that WLFI can reliably predict downturns. The analysis covers a single event, and more data would be needed to establish statistical consistency. Still, he believes the behavior is significant.

“So the useful life of this signal is finite. It’s valuable now because it’s under-monitored,” he said. “The moment it becomes consensus, the alpha gets arbitraged away. That’s how all market signals work. The ones that persist are the ones nobody’s paying attention to.”

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Vitalik Buterin Gives Shocking Prediction Markets Warning

Ethereum co-founder Vitalik Buterin is calling for a fundamental restructuring of decentralized prediction markets. He argues that the sector’s current reliance on speculative gambling threatens its long-term viability.

This view comes as prediction marketplaces like Polymarket have enjoyed significant success over the past year.

Sponsored

Buterin Calls for Structural Overhaul of Prediction Markets

On February 14, Buterin contended that while platforms like Polymarket have achieved significant volume and mainstream attention, they are currently suffering from an “unhealthy market fit.”

“[Prediction markets] seem to be over-converging to an unhealthy product market fit: embracing short-term cryptocurrency price bets, sports betting, and other similar things that have dopamine value but not any kind of long-term fulfillment or societal information value,” Buterin argued.

He warned that the sector is dangerously over-reliant on “naive traders,” defined as speculators seeking short-term payouts.

This speculative behavior contrasts sharply with the markets’ intended purpose: facilitating information discovery and risk management.

Sponsored

Buterin categorized current market participants into two distinct groups: “smart traders” and “money losers.” Currently, the latter category is dominated by retail gamblers.

He argued that if prediction markets continue to prioritize revenue extraction from these users over societal utility, they risk collapsing during bear markets when speculative fervor cools.

“There is nothing fundamentally morally wrong with taking money from people with dumb opinions. But there still is something fundamentally “cursed” about relying on this too much. It gives the platform the incentive to seek out traders with dumb opinions, and create a public brand and community that encourages dumb opinions to get more people to come in,” the Ethereum co-founder contended.

To secure a sustainable future, Buterin proposed that these platforms transition to “hedging”—effectively serving as insurance mechanisms rather than betting platforms.

In this model, a user would not bet on an outcome to make a profit, but rather to offset real-world risks, such as a business owner betting on a policy change that could negatively impact their supply chain.

Sponsored

AI-Driven Hedge System to Replace Fiat

The Ethereum co-founder’s recommendations extended into radical economic territory, suggesting that prediction markets could eventually render fiat-pegged stablecoins obsolete.

Buterin proposed creating granular price indices covering major categories of global goods and services.

Under this theoretical framework, users would utilize local Large Language Models (LLMs) to analyze their personal spending habits. The AI would then construct a personalized “basket” of asset shares that mirrors the user’s specific cost of living.

Sponsored

By holding these prediction market shares rather than U.S. dollar-pegged assets such as USDC or USDT, users could theoretically maintain their purchasing power against inflation without relying on traditional banking infrastructure.

“We do not need fiat currency at all! People can hold stocks, ETH, or whatever else to grow wealth, and personalized prediction market shares when they want stability,” he wrote.

Buterin acknowledged that transitioning from the current “info buying” phase to an advanced hedging economy would require new infrastructure.

However, he maintained that replacing fiat currency with diversified asset baskets remains the technology’s ultimate evolution.

Crypto World

Bitcoin (BTC) and Ethereum (ETH) Stall, Is This the Next Big Cryptocurrency to Invest In?

Bitcoin (BTC) and Ethereum (ETH) have entered a period of consolidation, with both assets showing reduced momentum after earlier rallies. While they remain dominant in terms of market capitalization and long-term relevance, recent price action suggests near-term upside may be more limited as broader macro conditions and risk sentiment weigh on crypto markets.

BTC and ETH: Leaders Facing Short-Term Resistance

Bitcoin continues to trade below its previous all-time highs, moving within a relatively tight range as institutional inflows slow and market participants wait for clearer macro signals. As the largest cryptocurrency by market cap, BTC requires substantial capital to generate outsized percentage gains, which naturally moderates short-term upside during consolidation phases.

Ethereum, despite its strong ecosystem of DeFi, NFTs, and layer-2 networks, has also experienced sideways movement. Even with ongoing network upgrades and staking participation, ETH’s large valuation base makes exponential growth harder to achieve quickly. In such environments, capital often rotates toward smaller projects that combine early valuation with visible development progress.

Mutuum Finance: Early-Stage Growth With Active Development

Mutuum Finance (MUTM) is one such project drawing attention during this period of consolidation. Unlike large-cap tokens already trading on major exchanges, MUTM remains in its presale phase, currently priced at $0.04 with a confirmed launch price of $0.06. Since its initial Phase 1 price of $0.01, the token has already increased by 300%, and by launch it will reflect a total 500% progression from its starting level.

The presale has raised over $20.5 million and attracted more than 19,000 holders. Out of the 1.82 billion tokens allocated for presale, over 845 million have already been secured, bringing distribution close to its midpoint. Because the current price remains below the confirmed launch valuation, some investors view this phase as a discounted entry before public trading begins.

Mutuum Finance (MUTM) has emerged as one of the newer projects gaining attention while major caps pause. The protocol focuses on decentralized lending and borrowing built around overcollateralization and flexible liquidity models.

The platform introduces two complementary systems. In its Peer-to-Contract (P2C) model, users supply assets into smart-contract-managed liquidity pools where borrowing and interest rates are dynamically adjusted based on utilization. This pooled structure allows lenders to earn yield while borrowers access capital without selling their holdings.

In addition, Mutuum supports a Peer-to-Peer (P2P) framework, where lenders and borrowers can directly negotiate loan terms. This approach is particularly useful for assets that may not fit neatly into standardized liquidity pools, enabling greater flexibility across different token categories.

V1 Protocol Now Live

A distinguishing factor for Mutuum Finance is that its V1 protocol is already live on the Sepolia testnet. This means users can actively interact with the system before mainnet launch, testing its core infrastructure in a simulated environment.

Currently, participants can explore the following features:

- mtTokens: Minted when users supply assets, representing deposit positions that accrue yield over time.

- Debt Tokens: Issued upon borrowing to track principal and interest accumulation transparently on-chain.

- Automated Liquidator: Continuously monitors collateral ratios and triggers liquidations when thresholds are breached.

- Health Factor Monitoring: Provides real-time risk metrics to help users manage borrowing positions responsibly.

By offering live testnet functionality rather than only conceptual documentation, the project demonstrates operational readiness ahead of full deployment.

Why Some View It as a “Next Big” Candidate

While Bitcoin and Ethereum remain foundational assets, their growth curves tend to stabilize as market capitalization increases. In contrast, earlier-stage projects like Mutuum Finance begin from significantly smaller valuations, meaning adoption and listing exposure can have proportionally larger price impacts.

The combination of dual lending models, working testnet infrastructure, and structured presale progression positions Mutuum Finance differently from purely speculative tokens. Additionally, roadmap elements such as multichain expansion and native stablecoin development add longer-term ecosystem depth beyond initial launch.

Periods when Bitcoin and Ethereum stall often prompt investors to reassess allocation strategies. While large-cap assets remain core holdings for many portfolios, emerging DeFi infrastructure projects with live products and defined utility may offer differentiated growth potential.

Mutuum Finance, with its operational V1 protocol and flexible lending architecture, is increasingly being evaluated by investors seeking exposure to the next wave of decentralized finance innovation beyond traditional market leaders.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Bitcoin Could Reach $72K If V-Shaped Recovery Pattern Completes

Bitcoin traders welcomed a softer-than-expected US CPI print as inflation cooled, helping the cryptocurrency nudge above the $69,000 level on Friday. The move rekindled hopes for a short-term recovery after a period of consolidation near key technical zones. Market participants are watching whether bulls can clear a stubborn resistance band around $68,000 to $70,000, with several analysts outlining a potential path to higher targets if the price can establish a base above critical support near $65,000. The latest price action comes amid a broader market backdrop characterized by fluctuating risk appetite, liquidity dynamics, and ongoing discussion about the role of exchange-traded products in crypto exposure.

Key takeaways

- Traders anticipate a relief rally for BTC in the near term, contingent on clearing the $68,000–$70,000 resistance zone.

- A confirmed hold of $65,000–$66,000 could pave the way for a squeeze toward higher levels, with some strategists pointing to a potential move toward $72,000 if momentum sustains.

- Analysts describe a pattern suggesting the possibility of a short-term bounce, followed by attention to liquidity clusters that could amplify moves near major price walls around $75,000–$80,000.

- Key moving averages around the current price action—specifically the 20-period EMA near $67,500 and the long-established 200-week EMA near $68,000—feature prominently in discussions of potential breakout setups.

- Market breadth remains sensitive to macro data, ETF flows, and liquidity shifts, which could influence how BTC navigates the next price ceilings and support floors.

Tickers mentioned: $BTC

Sentiment: Neutral

Trading idea (Not Financial Advice): Hold. Near-term momentum hinges on reclaiming the $68,000 level and sustaining a push above resistance to re-energize a broader upside thesis.

Market context: The price action sits at the intersection of macro cooling inflation, ongoing liquidity considerations, and crypto-specific ETF discourse. As traders parse fresh CPI data, attention remains on how institutional flows and retail positioning will influence BTC’s short-term trajectory within the context of evolving risk sentiment and regulatory discussions.

Why it matters

Bitcoin’s recent move above the $69,000 mark underscores the market’s sensitivity to macro signals and its willingness to test established technical levels. A successful breakout beyond the $68,000–$70,000 band would be interpreted by many observers as an incremental sign of renewed buying pressure, potentially signaling the start of a broader recovery phase from the backdrop of recent volatility. The interplay between upward price action and liquidity conditions is central to whether the move can be sustained or is likely to stall at the next liquidity cluster.

Analysts have highlighted a confluence of technical indicators that could shape the near-term path. A rising potential is suggested by patterns observed on shorter timeframes, including the notion that a break above resistance could reawaken the momentum needed to test higher targets. Yet the narrative is balanced by warnings about the risks of a deeper correction if key supports fail to hold. The 20-period EMA and the 200-week EMA are cited as important reference points that could influence the speed and magnitude of any rebound, particularly if price re-tests test the lower bands near $65,000–$66,000.

From a broader market perspective, liquidity dynamics and the prospect of ETF-related flows continue to weigh on Bitcoin’s short-term direction. Traders monitor order-book depth and liquidation risk around critical price thresholds, as activity around $75,000–$80,000 has historically formed meaningful liquidity walls. In this environment, even a modest shift in risk appetite or a fresh catalyst could trigger rapid moves as participants adjust positions in anticipation of the next major swing.

What to watch next

- Watch for a decisive daily close above $68,000 to confirm a bullish breakout trajectory toward the $72,000 neckline level.

- Should BTC reclaim the $70,000 mark, monitor price action for signs of acceleration toward the $72,000–$76,000 zone and beyond to the 50-day SMA near $85,000.

- Keep an eye on liquidity clusters around $75,000–$80,000, where a crowding of bids and asks could trigger a squeeze if breached.

- Observe bids near $65,000 and the corresponding asks around $68,000; revisiting these levels could be a prerequisite for renewed upside momentum or a testing ground for stronger support.

- Follow macro and ETF-flow developments, as shifts in risk sentiment driven by regulatory developments or institutional demand can influence the pace of BTC’s advance.

Sources & verification

- BTC price action around $69,000 on the backdrop of cooler US CPI data and the referenced resistance zone near $68,000–$70,000.

- Public posts from market observers on X (formerly Twitter) noting resistance levels and potential continuation patterns.

- CoinGlass liquidity heatmap indicating walls near $75,000 and $80,000 and liquidation risk around key price zones.

- Analyses citing the significance of the 20-period EMA near $67,500 and the 200-week EMA near $68,000 in guiding near-term moves.

- Chart references from TradingView illustrating the one-hour and two-day perspectives on BTC price structure.

Market reaction and near-term setup

Bitcoin is approaching a pivotal juncture as traders weigh the impact of softer inflation prints against the persistence of macro headwinds. In the near term, a break above the $68,000 resistance line would be interpreted as a signal that bulls are regaining control after a period of consolidation. If that breakout strengthens, the narrative leans toward a move toward $72,000, a level that previous analyses have associated with a potential shift in momentum. The idea of a short squeeze—where short positions are forced to cover as prices rise—gains plausibility if the price can push beyond the immediate hurdle and clear liquidity walls just above $75,000 to $80,000. The risk remains that if the market fails to sustain above $68,000, or slips back toward $65,000–$66,000, the scenario could transition into a more pronounced corrective phase.

From a technical vantage point, BTC’s price action has been described as exhibiting a V-shaped recovery on certain four-hour timeframes, suggesting that the move could be swift if momentum holds. Traders are closely watching the interaction with the 20-period EMA and the 200-week EMA, two benchmarks that often correlate with transition points between ranges and breakouts. A sustained hold above these benchmarks would reinforce a more constructive outlook, while failure to do so could invite renewed selling pressure in the short run. The narrative remains data-driven, with macro signals continuing to shape expectations for how the market will respond to incoming data and policy cues.

In addition to price dynamics, liquidity considerations are relevant for auditing risk and potential volatility. The presence of concentrated bid and ask clusters around specific levels—such as near $65,000 and $68,000—suggests that order-flow dynamics could play a central role in determining whether BTC can press higher or retreat. If the market revisits the $65,000 area and buyers re-emerge, there is a plausible path for a return to the higher side of the spectrum; conversely, if bids fail to hold, the resulting liquidity gaps could accelerate a correction. Traders and researchers will likely focus on how real-time liquidity conditions align with price action to gauge the durability of any rallies.

What happened previously and what to monitor next

Historical context from recent weeks shows that BTC has repeatedly attempted to mount a sustained breakout, only to encounter resistance near meaningful price levels. The pattern analysis suggests that if the price can cement a foothold above the $68,000 zone, there is room for a move toward the $72,000 neckline and potentially higher toward the $76,000–$85,000 range, where the dynamic of moving averages could come into play. Market participants should remain vigilant for shifts in ETF activity and macro data, which historically have driven outsized moves relative to intra-day volatility. The crypto market continues to navigate a complex web of technical levels, liquidity constraints, and evolving regulatory considerations, all of which shape the probability of a sustained rally or a renewed pullback in the weeks ahead.

Crypto World

What It Means for XRP Investors and Prices

Ripple Labs released a major update in Feb. regarding its XRP Ledger (XRPL). But will that be enough to save XRP’s price from Bitcoin’s stiff correction?

XRP is one of the most popular cryptocurrencies worldwide. Its market cap is neck-and-neck with BNB to rank number four by this metric.

Its main use case is fast, low-fee cross-border payments, but the XRP Ledger is opening up an entirely new use case for XRP tokens—decentralized finance (DeFi).

The February update from the official team at Ripple Labs signals a significant shift in the ecosystem’s fortunes. But real quick, before diving into the update—

Here’s how XRP’s price reacted after Ripple released the update on these exciting new developments: on Friday, Feb. 13, XRP traded for a daily average price of $1.35 before it surged to over $1.65 on Sunday.

“Institutional DeFi on XRPL”

The Ripple Labs update teased “Institutional DeFi on XRPL,” in a headline that promised the network will scale real-world finance with XRP at the core. The key selling point for Ripple investors and developers in this announcement is that these updates make the XRP Ledger well-suited for institutional-grade players.

Serious financial firms with big clients in New York City and London can rely on this technology to better meet the needs of their business. Or at the very least, that’s what the XRP team states. The note opened with a quick TLDR; summary highlighting XRP’s utility in liquidity and credit markets as well as for payments.

This referred to On-Demand Liquidity (ODL) powered by Ripple. This platform feature allows large institutions or individuals moving large funds to send them via RippleNet using XRP tokens.

You may also like:

But the exciting updates included:

- MPT (fungible Multi-Purpose Tokens for RWA tokenization)

- Permissioned Domains for access management

- Lending Protocol for native on-ledger XRP credit markets

- Confidential Transfers for institutional-grade privacy

- Ripple support for foreign exchange (FX) markets

Meanwhile, sophisticated new tools such as Credentials, Token Escrow, and Batch Transactions will help enterprise-grade clients stay compliant with financial regulators and automate on-chain workflows.

“The foundation for the next generation of blockchain-based financial infrastructure is being built, with XRP as the backbone,” Ripple Labs said.

Fine-Tuning XRP Utility to Purpose

In addition to the feature set for institutions, which forms the backbone of the next-generation XRP ecosystem on the ledger, Ripple also announced that XRPL now comes equipped with new developer tools to keep open development humming along.

Livenet Explorer is a developer tool that enables institutions and blockchain developers to visualize real-time on-chain activity, balances, and token flows. Meanwhile, XRPL Devnet Tools will help blockchain developers test features such as MPTs, escrow contracts, batch transactions, and lending protocols before deploying Dapps to the mainnet.

On the payments and FX side, permissioned domains will help build walled-off environments on the open blockchain with controlled credentials. Moreover, this can support KYC and AML tools for regulatory compliance.

XRPL is also getting ready to unlock balance sheets by optimizing collateral and capital velocity. This will be possible through token escrow for conditional settlement programmed right into XRP smart contracts.

One of Ripple’s big points in the February update is MPTs, or Multi-Purpose Tokens. Ripple says MPTs are the future of tokenization on XRPL. They can support sophisticated financial instruments such as bonds and funds while also handling metadata and parameters without requiring custom contracts.

What It Means for XRP Prices

For institutional and independent blockchain developers, here are some considerable developments. They may draw more participants and large financial firms into the XRP ecosystem.

But what does it mean for cryptocurrency investors?

During the week following the update announcement, XRP’s price outperformed the rest of the top 10 cryptocurrencies by market cap, indicating the market perceived the news positively.

However, as CryptoPotato reported, the state of the industry is currently predominantly negative in terms of price action. As a matter of fact, the popular Fear and Greed Index tapped Extreme Fear territory with a score of just 5 a few days ago – the lowest in the last eight years. During times like these, good news does not move markets as much as it does in bull markets.

While the update is undoubtedly sound and important, it is unlikely to cause any significant price change, at least in the short term.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

DeepSnitch AI Surges Ahead of 1000x Launch as APT and DOGE Stall in Early 2026

Even Coinbase, the biggest U.S. crypto exchange, just posted a $667 million net loss in Q4 2025. This is its first red quarter in two years, as crypto markets buckled under a sharp Bitcoin drawdown. But in the same breath, Aptos-incubated Decibel announced a protocol-native stablecoin through Stripe-owned Bridge, a sign that builders haven’t stopped building despite the broader bleed.

Everyone knows to buy during the dip, but the next crypto to explode with genuine moonshot potential isn’t going to be among the majors. DeepSnitch AI, an AI platform driven by five agents, known as “snitches,” has now raised above $1.59M at just $0.03985 per DSNT token. Launch is so close, days away now, and emerging crypto projects with this kind of momentum tend not to stay under the radar for long.

Coinbase bleeds $667M while Decibel builds stablecoin infrastructure on Aptos ahead of mainnet

Coinbase’s Q4 earnings snapped an eight-quarter profitability streak, with net revenue falling 21.5% year-on-year to $1.78 billion and transaction revenue dropping nearly 37%. Bitcoin’s roughly 30% tumble from its October high above $126,000 to under $88,500 by year-end drove much of the damage, and with BTC continuing to slide in early 2026, the outlook for exchange-reliant revenue remains uncertain.

Meanwhile, the Decibel Foundation, incubated by Aptos Labs, is preparing a protocol-native stablecoin, USDCBL, issued via Stripe-owned Bridge. The dollar-backed token will serve as collateral for on-chain perpetual futures, letting the protocol retain reserve yield rather than handing it to third-party issuers. Its December testnet pulled in above 650,000 unique accounts and over a million daily trades.

To wrap this up simply, the takeaway here is that big platforms are hurting, but new infrastructure keeps getting laid all the while. And small-cap gems with sharp utility, particularly those priced at presale levels, could be among the biggest beneficiaries when sentiment eventually turns.

Three tokens with unique upside opportunities compared

1. DeepSnitch AI: A small-cap gem set to be the next crypto to explode

The 2026 market narrative has crystallised around two themes: utility and AI. Plenty of tokens claim one or both, but almost none can demonstrate either at the presale stage. But DeepSnitch AI can.

The tools are shipped, the smart contracts are audited, and the platform is already generating the kind of real-world value that usually only arrives post-launch. That level of credibility at this price point ($0.03985 in Stage 5 of 15) is genuinely rare, so there’s reason behind the instinct that this is the next moonshot token.

The platform will work with a dashboard that flags what’s spiking or triggering alerts across the market. You pick a token, open Token Explorer for a deep dive on risk scoring, holder concentration, and liquidity. Then, you run AuditSnitch on the contract address and get a plain-language verdict (CLEAN, CAUTION, or SKETCHY) based on ownership controls, liquidity locks, tax structures, and known exploit patterns that most retail investors never inspect.

Put simply, what used to take an hour of manual digging now takes seconds, and in the end, SnitchGPT brings it all together in a conversational layer, so you can simply ask “what’s the risk on this?” and get a clean, quick reply.

This is a utility that, among emerging crypto projects, is almost impossible to find, and the team is rightfully targeting a 1000x run once the platform launches. And until then, VIP bonus codes let you stack additional tokens proportional to your buy-in, amplifying your position before trading begins.

If you’re looking for the next crypto to explode, DeepSnitch AI is solving one of crypto’s most fundamental problems at micro-cap prices, and anyone who knows what a moonshot token looks like in its early stages will clock this token’s incredible potential.

2. Aptos: Deep in oversold territory, as the floor keeps dropping

APT sat near $0.91 on February 13, well below where most holders expected it to land by this point in the cycle. The RSI reads 25.31, so firmly oversold, and the 50-day SMA is projected to fall toward $0.99 by mid-March.

Aptos’s ecosystem has been under pressure following protocol shutdowns and declining network activity, which makes a sustained recovery harder to pin down. A hold above the $0.90 support could invite a relief rally toward $1.08, but a break below risks a longer slide toward the $0.55 zone.

The Decibel stablecoin launch adds a building narrative, yet at a current market cap that already prices in significant infrastructure, APT’s room for explosive multiples is narrower than high-growth digital assets still priced at presale entry points, something DeepSnitch AI offers at a fraction of the valuation.

3. Dogecoin: The meme king flatlines below $0.10

DOGE was hovering near $0.094 on February 13, having turned down from the $0.10 psychological level. This is a rejection that suggests bears are trying to flip that round number into resistance.

The RSI is at 34.18, neutral but leaning weak, and the 50-day SMA is forecast to dip toward $0.105 by mid-March. And a drop below $0.08 could signal a resumption of the downtrend toward $0.06.

Dogecoin has always thrived on sentiment surges rather than fundamentals, and in a fear-driven market with the CMC index at 8, that fuel is scarce. And if you’re after higher gains, the next crypto to explode this cycle is far more likely to be a project with early-stage pricing anyway.

Final thoughts

Fear indexes are at historic lows, as Coinbase is posting losses, and while this is not all doom, gloom, and nowhere to go (an up is on the horizon eventually), it is the kind of moment that separates spectators from participants.

Emerging crypto projects priced at ground level before launch tend to benefit disproportionately when capital rotates back in, and DeepSnitch AI ticks every box: live tooling, uncapped staking, and a presale price under four cents.

And for now, ahead of its launch in a matter of days, the presale is also running tiered bonus codes that hand you between 30% and 300% extra tokens depending on the size of your buy-in.

Paired with dynamic APR on staking, those bonus tokens compound your position at presale prices, meaning your upside when launch hits could be dramatically larger than the initial allocation alone.

If this is the next crypto to explode, as anticipated, now is the moment to secure your DeepSnitch AI tokens on the official website. You can also follow the team on X and Telegram for more real-time updates.

FAQs

What is the next crypto to explode in 2026?

DeepSnitch AI is a strong contender among high-growth digital assets, offering five live AI security tools at $0.03985 with above $1.59M raised and a full launch approaching within weeks.

Is Aptos a good investment right now?

APT is deeply oversold and could see a relief rally, but its ecosystem struggles and larger market cap limit potential. DeepSnitch AI’s presale pricing and live utility offer a more asymmetric risk-reward profile for those wanting the next crypto to explode.

Can Dogecoin recover from its current slump?

DOGE depends heavily on sentiment, which is at extreme lows right now. While a bounce is possible, small-cap gems like DeepSnitch AI, with working technology and near-launch timing, offer fundamentally stronger upside for 2026, which is why the latter token is more likely to be the next crypto to explode.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Wall Street remains bullish on bitcoin (BTC) price while offshore traders retreat

A divergence in global bitcoin market sentiment is widening as U.S. institutional investors hold steady while offshore traders retreat from their positions.

The gap is clearest in futures markets. CME, the go-to platform for hedge funds and institutional desks in the U.S., shows traders are still paying a premium to stay long on bitcoin, according to NYDIG’s head of research, Greg Cipolaro.

This is evident on a one-month annualized basis, essentially the markup for futures over spot prices, which remains higher than on its offshore counterpart, Deribit.

“The more pronounced drop in offshore basis suggests reduced appetite for leveraged long exposure,” Cipolaro wrote. “The widening spread between CME and Deribit basis functions as a real-time gauge of geographical risk appetite.”

Bitcoin earlier this month fell to $60,000 before rebounding. Some pinned the selloff on rising concerns that quantum computing will undermine the system’s cryptographic security. NYDIG found that the numbers don’t back up that explanation.

For one, bitcoin’s performance has closely tracked that of publicly traded quantum-computing companies like IONQ Inc. (IONQ) and D-Wave Quantum Inc. (QBTS). If quantum risk were truly weighing on crypto, those stocks would be rising while bitcoin falls.

Instead, they dropped together, pointing to a broader decline in appetite for long-term, future-driven assets. On top of that, search data on Google Trends shows interest for “quantum computing bitcoin” rises when the price of BTC rises.

Crypto World

Crisis in mortgage & real estate that tokenization can solve

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Mortgage and real estate finance underpin one of the largest asset classes in the global economy, yet the infrastructure supporting it remains fundamentally misaligned with its scale. In Canada alone, outstanding residential mortgage credit exceeds $2.6 trillion, with more than $600 billion in new mortgages originated annually. This volume demands a system capable of handling continuous verification, secure data sharing, and efficient capital movement.

Summary

- Mortgage finance runs on digitized paperwork, not real digital infrastructure: Fragmented data, manual reconciliation, and repeated verification are structural flaws — not minor inefficiencies.

- Tokenization fixes the unit of record: By turning loans into structured, verifiable, programmable data, it embeds auditability, security, and permissioned access at the infrastructure level.

- Liquidity is the unlock: Representing mortgages and real estate as transferable digital units improves capital mobility in a $2.6T+ market trapped in slow, illiquid systems.

The industry still relies on fragmented, document-based workflows designed for a pre-digital era. While front-end processes have moved online, the underlying systems governing data ownership, verification, settlement, and risk remain siloed across lenders, brokers, servicers, and regulators. Information circulates as static files rather than structured, interoperable data, requiring repeated manual validation at every stage of a loan’s lifecycle.

This is not a temporary inefficiency; it is a structural constraint. Fragmented data increases operational risk, slows settlement, limits transparency, and restricts how capital can be deployed or reallocated. As mortgage volumes grow and regulatory scrutiny intensifies, these limitations become increasingly costly.

Tokenization offers a path to address this mismatch. Not as a speculative technology, but as an infrastructure-level shift that replaces disconnected records with unified, secure, and programmable data. By rethinking how mortgage and real estate assets are represented, governed, and transferred, tokenization targets the foundational weaknesses that continue to limit efficiency, transparency, and capital mobility across housing finance.

Solving the industry’s disjointed data problem

The most persistent challenge in mortgage and real estate finance is not access to capital or demand; it is disjointed data.

Industry studies estimate that a significant share of mortgage processing costs is driven by manual data reconciliation and exception handling, with the same borrower information re-entered and re-verified multiple times across the loan lifecycle. A LoanLogics study found that roughly 11.5% of mortgage loan data is missing or erroneous, driving repeated verification and rework across fragmented systems and contributing to an estimated $7.8 billion in additional consumer costs over the past decade.

Data flows through portals, phone calls, and manual verification processes, often duplicated at each stage of a loan’s lifecycle. There is no unified system of record, only a collection of disconnected artifacts.

This fragmentation creates inefficiency by design. Verification is slow. Errors are common. Historical data is difficult to access or reuse. Even large institutions often struggle to retrieve structured information from past transactions, limiting their ability to analyze risk, improve underwriting, or develop new data-driven products.

The industry has not digitized data; it has digitized paperwork. Tokenization directly addresses this structural failure by shifting the unit of record from documents to data itself.

Embedding security, transparency, and permissioned access

Tokenization is fundamentally about how financial information is represented, secured, and governed. Regulators increasingly require not just access to data, but demonstrable lineage, accuracy, and auditability, requirements that legacy, document-based systems struggle to meet at scale.

By converting loan and asset data into structured, blockchain-based records, tokenization enables seamless integration across systems while maintaining data integrity. Individual attributes, such as income, employment, collateral details, and loan terms, can be validated once and referenced across stakeholders without repeated manual intervention.

Security is embedded directly into this model. Cryptographic hashing, immutable records, and built-in auditability protect data integrity at the system level. These characteristics reduce reconciliation risk and improve trust between counterparties.

Equally important is permissioned access. Tokenized data can be shared selectively by role, time, and purpose, reducing unnecessary duplication while supporting regulatory compliance. Instead of repeatedly uploading sensitive documents across multiple systems, participants reference the same underlying data with controlled access.

Rather than layering security and transparency on top of legacy workflows, tokenization embeds them directly into the infrastructure itself.

Liquidity and access in an illiquid asset class

Beyond data and security, tokenization addresses another long-standing constraint in real estate finance: illiquidity.

Mortgages and real estate assets are slow-moving, capital-intensive, and often locked up for extended periods. Structural illiquidity constrains capital allocation and raises barriers to entry, limiting participation and restricting how capital can engage with the asset class.

Tokenization introduces the ability to represent real estate assets, or their cash flows, as divisible and transferable units. Within appropriate regulatory and underwriting frameworks, this approach aligns with broader trends in real-world asset tokenization, where blockchain infrastructure is used to improve accessibility and capital efficiency in traditionally illiquid markets.

This does not imply disruption of housing finance fundamentals. Regulatory oversight, credit standards, and investor protections remain essential. Instead, tokenization enables incremental changes to how ownership, participation, and risk distribution are structured.

Incremental digitization to infrastructure-level change

This moment in mortgage and real estate finance is not about crypto hype. It is about rebuilding financial plumbing.

Mortgage and real estate finance are approaching the limits of what legacy, document-based infrastructure can support. As volumes grow, regulatory expectations tighten, and capital markets demand greater transparency and efficiency, the cost of fragmented data systems becomes increasingly visible.

Tokenization does not change the fundamentals of housing finance, nor does it bypass regulatory or risk frameworks. What it changes is the infrastructure beneath them, replacing disconnected records with unified, verifiable, and programmable data. In doing so, it addresses the structural constraints that digitized paperwork alone cannot solve.

The next phase of modernization in mortgage and real estate finance will not be defined by better portals or faster uploads, but by systems designed for scale, durability, and interoperability. Tokenization represents a credible step in that direction, not as a trend, but as an evolution in financial infrastructure.

Crypto World

XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation

XRP price just caught a serious bid. The token jumped more than 8% in 24 hours after news broke that Ripple CEO Brad Garlinghouse secured a seat on the CFTC Innovation Advisory Committee.

Traders are clearly betting that having Ripple closer to regulators could shift the narrative around XRP.

Key Takeaways

- XRP rallied 8.09% to trade near $1.53 on news of the Ripple CEO’s federal appointment.

- The CFTC tapped Garlinghouse and other crypto leaders to advise on digital asset frameworks.

- Institutional flows are rising, with Goldman Sachs revealing a $152 million crypto ETF position.

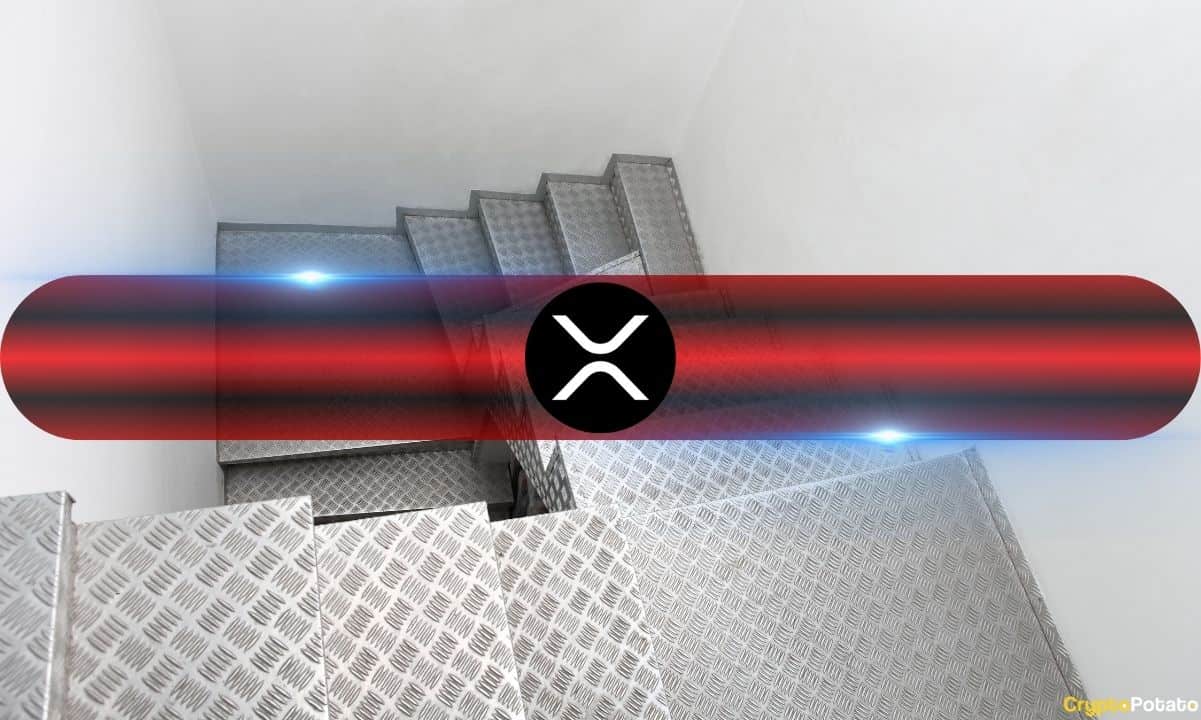

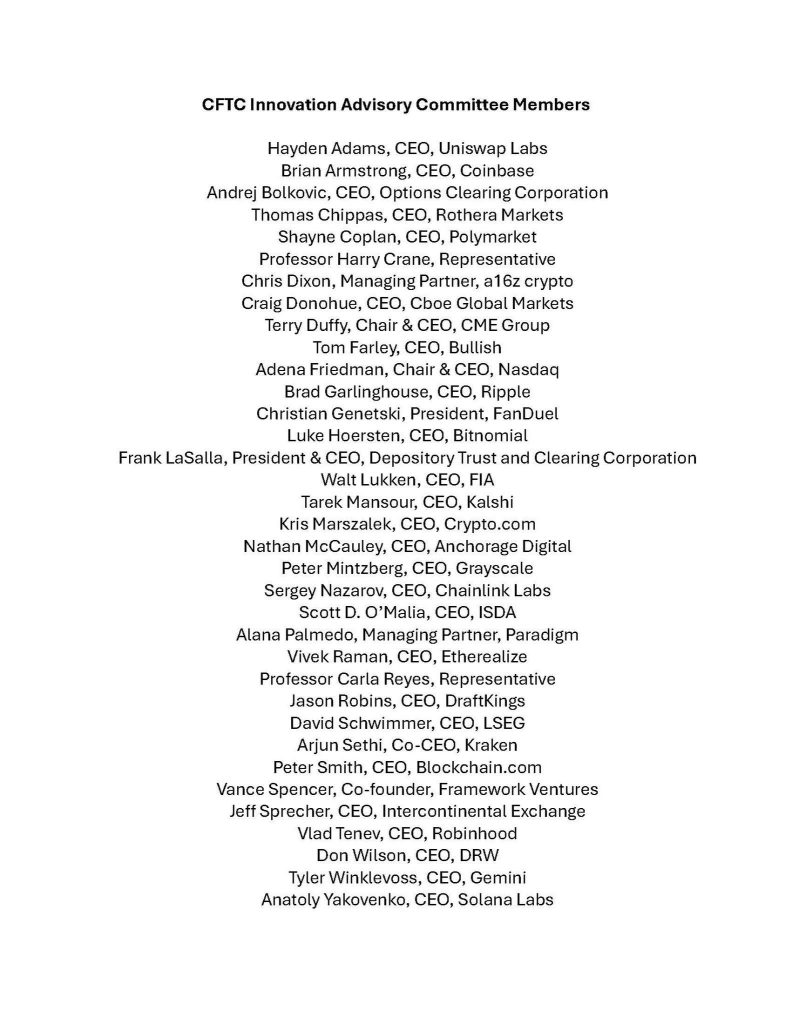

Garlinghouse Joins Expanded CFTC Committee

This is a pretty big shift from Washington. The CFTC just expanded its Innovation Advisory Committee to 35 members, and Brad Garlinghouse is now officially part of it. Chairman Michael S. Selig says the goal is to future proof U.S. markets by working closer with the industry instead of fighting it.

It is important to keep this in perspective. The CFTC mainly regulates derivatives markets, not spot crypto securities. XRP past legal fight was with the SEC, not the CFTC.

And Garlinghouse is not alone. The lineup includes Coinbase CEO Brian Armstrong, leaders from Chainlink, Solana Labs, and Uniswap, plus names from traditional finance like CME Group and Nasdaq. That is a serious mix of crypto and Wall Street in one room.

The focus areas matter too. Tokenization. Perpetual contracts. Blockchain market structure. All directly tied to how XRP fits into the bigger picture.

For XRP holders, this feels symbolic. Ripple went from battling regulators to sitting at the policy table. And with lawmakers pushing for clearer crypto rules, this could mark a new chapter in how the industry and Washington interact.

XRP Price Bulls Eye $1.54 Breakout

The market reacted fast. XRP is trading around $1.57609, up 10% on the day after bouncing from a low near $1.40731. That move pushed price cleanly out of its mid $1.40 consolidation range, backed by stronger volume and widening Bollinger Bands.

Bulls are now testing the $1.60 session high. Short term moving averages are stacking underneath price around $1.47 and $1.48, creating a stair step style support zone. That gives the rally some structure.

On the fundamental side, momentum is building too. Binance recently completed RLUSD integration on the XRP Ledger, a development many analysts see as a potential catalyst for a much larger move if momentum continues.

Institutional Interest Deepens

Beyond the CFTC news, bigger money is quietly getting into position for what could be a more crypto friendly 2026.

Recent filings show Goldman Sachs holds around $152 million in crypto ETFs, a clear sign that Wall Street is not stepping away from digital assets.

Garlinghouse has also doubled down on his vision, calling XRP the “North Star” of Ripple strategy and pointing to 2026 as a pivotal year.

While the U.S. tone appears to be softening, the global picture is still mixed. Dutch lawmakers, for example, are pushing a 36% capital gains tax on crypto, showing how fragmented regulation remains worldwide.

Broader market conditions also matter. XRP remains highly correlated with Bitcoin and overall crypto risk sentiment, meaning macro catalysts, including rate expectations and ETF flows, could amplify or cap this breakout attempt.

With price now pressing against the $1.60 resistance zone, the next move could set the tone for where momentum heads from here.

The post XRP Price Surges as Ripple CEO Takes Role Influencing Crypto Regulation appeared first on Cryptonews.

Crypto World

Solo Operators Generate Millions as Automation Drives $1 Trillion Wealth Transfer

TLDR:

- Solo developer earned $1.87M in four months using Polymarket bot without hiring single employee or team

- One trader with Clawdbot monitors 1,000+ wallets continuously matching 50-person trading desk for $20 daily

- Automated DeFi farmers create 50%+ annual yield gap over manual traders through continuous auto-compounding

- Output equation shifted from time multiplied by team size to skill times automation raised to exponential scale

A wealth transfer of unprecedented scale is currently underway as individual operators leverage automation tools to compete with traditional teams.

Crypto trader Axel Bitblaze highlighted this shift in a detailed thread, noting that solo developers and traders are now generating million-dollar revenues without employees.

The transformation represents a fundamental change in how value is created and captured in digital markets. Traditional labor-based models are losing ground to system-driven approaches.

The New Automation Economy

Individual operators are achieving results previously reserved for large organizations through automated systems. One developer built a Polymarket prediction bot that generated $1.87 million in profit over four months without any employees.

Another solo creator launched a token through Pump.fun that reached $100 million market cap within 24 hours of trading.

A single trader using Clawdbot monitors over 1,000 wallets continuously and executes trades faster than traditional trading desks.

These examples demonstrate how the leverage equation has fundamentally changed in recent years. The old model calculated output as time multiplied by skill and team size.

Modern operations follow a different formula where output equals skill times automation raised to scale. This exponential factor allows individuals to compete with teams of 100 or more people.

The shift became possible only within the past three years as AI and automation tools reached practical deployment stages.

Axel Bitblaze emphasized in his January 17 post that this is not theoretical economics but observable reality. Solo operators are running operations that would have required dozens of employees under previous paradigms.

The gap between automated and manual approaches compounds rapidly across different sectors. Polymarket bot operators earned $100,000 daily while manual traders competing in the same markets generated zero returns.

DeFi farming bots track 40 protocols simultaneously and auto-compound four times daily, creating annual percentage yield gaps exceeding 50 percent compared to manual farmers.

Silent Transfer of Economic Power

Most market participants fail to recognize this transfer because it appears gradual rather than disruptive. People attribute automated success to luck or insider advantages rather than systematic approaches.

Many believe they will catch up when time permits, but the performance gap doubles every six months according to current trends.

Historical precedents show similar leverage shifts during previous technological transitions. Factory owners captured wealth from craftsmen in the 1800s when one person with machinery could produce 100 times more output.

Digital platforms transferred value from local businesses in the 1990s as the internet’s reach expanded exponentially. The current AI and automation wave represents another magnitude shift in individual capability.

The trajectory points toward solo operators managing multi-million dollar operations within months. Traditional teams cannot match the speed and efficiency of well-designed automated systems.

Bitblaze projects that billion-dollar companies run by five people will emerge within two years as automation becomes a baseline rather than an advantage.

Positioning determines whether individuals extract value or become part of systems extracting value from their labor.

Manual checking of data that automation could track, competing on time rather than systems, and postponing automation efforts place operators on the losing side.

Building scalable systems, amplifying output through code, and seeking 10x improvements through automation indicate the correct positioning for this economic shift.

-

Politics7 days ago

Politics7 days agoWhy Israel is blocking foreign journalists from entering

-

Business7 days ago

Business7 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business7 days ago

Business7 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech10 hours ago

Tech10 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics7 days ago

Politics7 days agoThe Health Dangers Of Browning Your Food

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World1 day ago

Crypto World1 day agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

![Is The Bottom In For Bitcoin? [Here’s Your Signal]](https://wordupnews.com/wp-content/uploads/2026/02/1771160746_maxresdefault-80x80.jpg)