Crypto World

Arthur Hayes challenges Multicoin’s Samani to $100K HYPE bet

A public feud between two high-profile crypto investors has turned into a proposed six-month price wager.

Summary

- Hayes offered a six-month bet on HYPE’s performance against large-cap altcoins.

- The challenge followed sharp criticism from Multicoin’s Kyle Samani.

- The wager highlights growing debate over Hyperliquid’s structure and value.

BitMEX co-founder Arthur Hayes has challenged Multicoin Capital co-founder Kyle Samani to a $100,000 bet over the future performance of Hyperliquid’s HYPE token.

The proposal was posted on X on Feb. 8, 2026, after Hayes reposted and responded to Samani’s sharp criticism of the project.

Under the terms outlined by Hayes, the bet would run from 00:00 UTC on Feb. 10 through 00:00 UTC on July 31, 2026. During that period, Hyperliquid (HYPE) would need to outperform any altcoin with a market capitalization above $1 billion on CoinGecko.

Samani would be allowed to select the comparison token. The loser would donate $100,000 to a charity chosen by the winner. The exchange comes as Hyperliquid and its token remain in focus among derivatives traders, even as the wider market trades under pressure.

Dispute over Hyperliquid’s structure and leadership

The bet follows weeks of criticism from Samani, who has repeatedly questioned Hyperliquid’s design and governance.

In recent posts, Samani said the platform’s code is not fully open-source, relies on a permissioned distribution model, and is led by a founder who left his home country to launch the business. He also accused the project of enabling criminal activity and described it as fundamentally flawed.

Hayes rejected those claims and framed the debate in market terms. He argued that if HYPE is truly a weak asset, it should fail to outperform other large-cap tokens over time. If it succeeds, he said, critics should reconsider their views.

The dispute gained traction after analyst Jon Charbonneau praised Hyperliquid’s trading execution, comparing it favorably with traditional venues such as CME. That commentary helped re-ignite debate over whether newer on-chain derivatives platforms can compete with established exchanges.

As of press time, Samani had not publicly confirmed whether he would accept the wager.

Hayes’ purchases and Multicoin-linked accumulation

The wager has drawn attention partly because of Hayes’ recent buying activity. According to on-chain data, Hayes spent approximately $1.91 million in early February 2026 to acquire 57,881 HYPE tokens. His entire holdings increased to about 131,807 tokens, which at the time was worth about $4.3 million.

These acquisitions, which came after the sales of PENDLE, ENA, and LDO, indicate a deliberate shift toward Hyperliquid. In September 2025, Hayes had sold about 96,600 HYPE tokens for roughly $5.1 million, locking in profits amid concerns about token unlocks and competition. His recent accumulation marks a renewed vote of confidence in the project.

Additionally, wallet data indicates that in late January 2026, addresses linked with Multicoin began accumulating HYPE. Reports indicate that more than 87,100 ETH was swapped for around 1.35 million HYPE tokens, worth over $40 million at the time, through intermediaries such as Galaxy Digital.

This accumulation took place while Samani continued to take a critical public stand, which complicated the ongoing discussion. However, in early February, Samani transitioned into an advisory position at Multicoin, resigning from daily management. Some observers believe this transition may have influenced the fund’s recent positioning.

For now, Hayes’ proposed bet stands as a rare public test of conviction in a market where opinions and capital flows often move in different directions. Whether Samani accepts the bet or not, the episode has placed renewed focus on Hyperliquid’s role in the evolving crypto derivatives landscape.

Crypto World

$44B BTC blunder puts South Korea regulators on alert

South Korea’s top financial watchdog is stepping up oversight of crypto markets days after a local exchange mistakenly distributed billions of dollars worth of bitcoin to users.

The Financial Supervisory Service said Sunday it will launch planned investigations into “high-risk” practices that undermine market order, including large-scale price manipulation by so-called whales, trading schemes tied to suspended deposits and withdrawals, and coordinated pump tactics fueled by social media misinformation.

The watchdog also said it plans to build tools that automatically extract suspicious trading patterns by the second and minute, alongside text-analysis systems using artificial intelligence to flag potential market abuse.

The announcement follows a widely reported exchange error last week in which some users of Bithumb, among the country’s biggest exchanges, were mistakenly credited with at least 2,000 bitcoin each instead of small promotional rewards, a blunder estimated at roughly $44 billion at the time.

BTC prices dropped 30% compared to the global average at the time, as some recipients tried to sell the assets. The exchange had restricted trading and withdrawals for the 695 affected customers within 35 minutes of the erroneous distribution on Friday.

Regulators said the incident exposed the “vulnerabilities and risks” of virtual assets and signaled they could conduct on-site inspections of exchanges if irregularities are found in internal control systems.

Beyond market manipulation, the FSS said it will introduce punitive fines for IT incidents across the financial sector and raise the security accountability of chief executives and chief information security officers, a shift that could have direct implications for crypto trading platforms.

The agency also confirmed it has set up a preparatory team for the Basic Digital Asset Act, which would expand Korea’s regulatory framework beyond the first phase of crypto rules.

The crackdown plan reflects a broader push by President Lee Jae-myung to stamp out what he has called “cruel financial practices,” with the FSS also outlining measures to strengthen enforcement against fraud and expand tools to combat voice phishing.

Crypto World

Bithumb Recovers Nearly All Bitcoin After Airdrop Error That Shook Prices

South Korean crypto exchange Bithumb said it has recovered nearly all of the Bitcoin mistakenly distributed during a promotional error that briefly disrupted prices on its platform earlier this month.

Summary

- Bithumb says it has recovered about 99.7% of Bitcoin mistakenly distributed during a reward event error.

- The exchange used its own funds to reconcile remaining amounts after some BTC was sold.

- Bitcoin prices briefly dropped on Bithumb but the impact did not spread to broader markets.

Bithumb says 99.7% of mistaken BTC has been recovered

In a notice published on its website, Bithumb said the incident stemmed from an internal mistake during a reward event on Feb. 6, when users were meant to receive small incentives denominated in Korean won. Due to a system configuration error, Bitcoin (BTC) was credited instead, prompting some recipients to immediately sell the assets.

The exchange said it has since recovered about 99.7% of the wrongly transferred Bitcoin, adding that the remaining amount was reconciled using Bithumb’s own funds after some users sold the assets during the brief window before the issue was identified.

As of late Feb. 7, the company said all affected balances had been fully restored, and customer assets were safely secured.

Bithumb moved quickly to block impacted accounts and initiate recovery procedures once the error was detected, stressing that the incident was the result of an operational failure rather than a security breach or hacking attempt.

The mistaken distribution briefly caused Bitcoin prices on Bithumb’s BTC/KRW market to plunge, diverging sharply from prices on other global exchanges. The episode highlighted how localized liquidity shocks on major platforms can affect price discovery, even when broader market conditions remain unchanged.

To address user impact, Bithumb said it would compensate traders who sold Bitcoin at unusually low prices during the incident and offer additional measures aimed at restoring confidence, including fee relief.

The exchange also said it has formed a dedicated internal task force to strengthen operational controls and prevent similar errors in the future.

Bithumb emphasized that the recovery of the assets demonstrates the effectiveness of its response systems and reiterated its commitment to safeguarding customer funds following the incident.

Crypto World

Buy the Dip Returns and How Far Crypto Can Recover

After falling to nearly $2.0 trillion last Friday, the total crypto market capitalization has rebounded to above $2.3 trillion. Investors appear to be spotting opportunities, and buy-the-dip sentiment is resurfacing.

The key question is whether this rebound is strong enough to form a classic V-shaped recovery. Several market signals offer insight.

Sponsored

Signs of Buy-the-Dip Behavior After the Panic Sell-Off

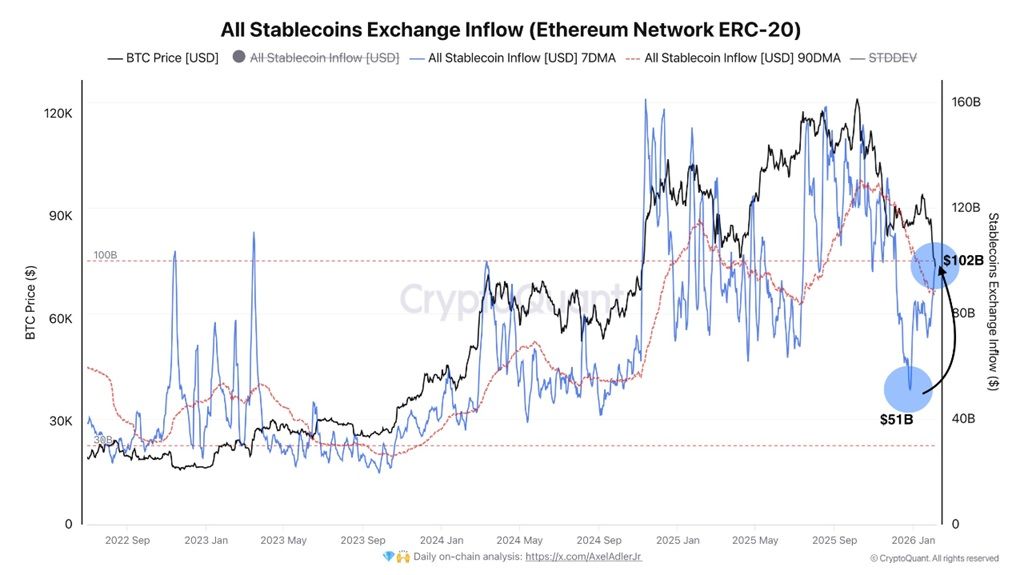

One of the earliest and most notable signals is the renewed inflow of stablecoins into centralized exchanges. This trend reversed after months of decline, even though selling pressure remains elevated.

Rising stablecoin balances on exchanges reflect investors’ readiness to deploy capital. This signal is particularly relevant to retail traders, who primarily trade on exchanges.

Data from CryptoQuant shows that the 7-day average value of ERC-20 stablecoins flowing into exchanges on Ethereum increased from $51 billion in late December 2025 to $102 billion as of now.

The $102 billion figure also exceeds the 90-day average of $89 billion. This suggests that capital deployment has accelerated over the past few weeks.

Sponsored

Although selling pressure remains significant, the growth in stablecoin inflows indicates renewed investor interest. Some market participants may already be accumulating positions at perceived market bottoms.

Additionally, the Accumulation Trend Score from Glassnode provides further confirmation. Wallets of all sizes, from small holders to large entities, are shifting toward stronger accumulation.

This indicator measures changes in balance across wallet cohorts and assigns a score between 0 and 1. Higher values indicate more aggressive accumulation behavior.

Glassnode’s chart shows the score moving from yellow and red zones (below 0.5) over the past two months to blue zones (above 0.5) across multiple wallet categories. Wallets holding 10–100 BTC stand out as the most aggressive buyers, with the indicator turning dark blue and approaching 1.

Sponsored

Observations from Lookonchain, an account that tracks notable on-chain activity, further support this data. The account has repeatedly reported whale accumulation in recent periods, not only in Bitcoin but also in Ethereum.

Overall, these signals suggest that buy-the-dip sentiment is returning among both retail investors, as reflected in rising stablecoin inflows, and whales, as reflected in on-chain accumulation. However, a sustainable recovery still depends on the market’s ability to hold key levels in total capitalization.

According to well-known analyst Daan Crypto Trades, TOTAL swept the April 2025 lows, which were associated with tariff-related news, and then closed back above them. He argues that the market must hold above $2.3 trillion in the coming days to justify expectations of a recovery toward $2.8 trillion.

Sponsored

“I think this is an important area for the market to hold if it wants to sustain a further relief bounce,” Daan Crypto Trades said.

He also noted that after several weeks of heightened volatility, market volatility could begin to decline. Price action may then stabilize within a defined range, allowing investors to reassess conditions and search for new opportunities.

A recent analysis from BeInCrypto also highlighted the importance of the $71,000 level for Bitcoin. Only if the price stabilizes above this support level can the market reasonably expect a broader, more extended recovery.

Crypto World

XRP price’s latest bounce lacks follow-through as sellers stay in control

XRP edged higher over the past 24 hours, rising roughly 2% in a modest relief move after last week’s sharp sell-off.

Summary

- XRP price rose about 2% in the past 24 hours, but the move shows little follow-through as momentum and volume indicators continue to favor sellers.

- RSI remains below neutral and on-balance volume is still trending lower, suggesting recent gains are driven by short-term relief rather than sustained buying interest.

- Fibonacci retracement levels point to heavy resistance between $2.05 and $2.30, a zone XRP price would need to reclaim to shift its short-term outlook.

But despite the uptick, the Ripple token’s (XRP) chart indicators suggest the bounce offers little cause for celebration, with sellers still firmly in control of the broader trend.

XRP price holds near $1.45, but broader downtrend remains intact

On the daily chart, XRP remains locked in a clear downtrend, marked by a series of lower highs and lower lows since late January. While price has stabilized near the $1.45 level after briefly dipping toward recent lows, the move appears more like short-term consolidation than the start of a meaningful recovery.

Momentum indicators reinforce that cautious view.

The relative strength index (RSI) is hovering in the mid-30s, well below the neutral 50 mark, indicating bearish momentum remains intact even after the latest bounce. Historically, sustained recoveries tend to coincide with RSI reclaiming neutral territory, something XRP has yet to achieve.

Volume-based indicators also point to continued selling pressure. On-balance volume (OBV) has been trending lower, suggesting that distribution is still outweighing accumulation. This implies that recent green candles may be driven by short covering or temporary relief rather than fresh buying interest.

XRP price faces heavy resistance near $2.05–$2.30 fibonacci zone

From a trend perspective, XRP is trading well below its 20-day simple moving average, currently near $1.68. The downward slope of that moving average underscores the lack of bullish follow-through and signals that rallies are likely to face selling pressure at higher levels.

Fibonacci retracement levels drawn from XRP’s recent swing high to its January low further highlight the challenge for buyers. The $2.05–$2.30 zone, which includes the 0.382, 0.5 and 0.618 retracement levels, represents a dense area of overhead resistance. A sustained move above that range would be needed to shift the short-term outlook more constructively.

Until then, analysts say the latest 2% rise should be viewed in context — as a pause within a broader downtrend rather than a decisive change in direction. With momentum and volume indicators still favoring sellers, XRP’s price action suggests caution remains warranted in the near term.

Crypto World

Market Metrics Suggest the AI Bubble Has Not Reached Peak Stage

TLDR:

- Search trends show persistent fear around the AI bubble, which historically appears during early expansion phases.

- Nasdaq returns and valuations remain far below dot-com extremes, signaling a cycle that has not reached mania.

- Rising margin debt indicates leverage growth, a pattern seen before peaks rather than during collapses.

- Market gains remain concentrated in mega-cap stocks, not broad participation typical of bubble finales.

The debate over an AI bubble has intensified as technology stocks continue to dominate market performance. New research shared by Bull Theory argues that current conditions do not match historical patterns seen at major market peaks.

Instead, indicators point to an expansion phase rather than an imminent collapse. The analysis draws on valuation metrics, liquidity trends, and long-term bubble cycles.

AI Bubble Signals Show Fear and Concentration, Not Euphoria

Bull Theory reports that search activity for the phrase “AI bubble” remains elevated on Google Trends. High search interest reflects widespread concern rather than widespread confidence.

Historical market cycles show that bubbles tend to peak when public attention fades and belief becomes absolute. Current search behavior suggests the opposite phase, where fear and skepticism remain dominant.

Nasdaq performance also differs from past mania periods. Over the last five years, the index has risen about 88 percent, far below the twelvefold surge recorded during the dot-com era.

Valuation data supports this comparison. Dot-com Nasdaq price-to-earnings ratios reached roughly 60, while today’s Nasdaq trades near 26, according to market datasets cited by Bull Theory.

Market breadth further weakens the bubble argument. The S&P 500 equal-weight index has gained only about 10 percent over the past year, showing that gains concentrate in a small group of mega-cap firms.

Nvidia, Apple, Microsoft, Google, and Amazon account for most of the rally. Previous bubble peaks required broad participation across sectors and stocks.

Volatility indicators also signal caution. VIX spikes accompany most market pullbacks, and options data shows consistent demand for downside protection.

These patterns reflect defensive positioning rather than the low-volatility environment typical of late-stage speculative peaks.

Liquidity and Leverage Data Point to Ongoing Expansion Phase

Margin debt has climbed to about $1.1 trillion, the highest level on record. Bull Theory notes that past bubbles burst only after leverage began to contract sharply.

At present, leverage continues to rise alongside market funding activity. This trend aligns with earlier phases of historical bubbles rather than final stages.

Macro liquidity conditions also remain supportive. Central bank actions in the United States, Japan, and China have injected capital into global markets, sustaining risk appetite.

U.S. fiscal projections show federal debt rising toward $50 trillion by the end of the decade. Large-scale spending typically increases liquidity across financial systems.

Sentiment indicators show division rather than certainty. Retail traders respond to every correction with increased put option activity, while institutional investors remain cautious.

Bull Theory links this environment to the period between early warnings and the eventual peak seen in prior cycles. During the dot-com era, warnings surfaced in 1997, while the market topped in 2000.

A similar pattern appeared before the housing crash, with alerts years ahead of the final breakdown. The firm places current AI-related warnings in a comparable timeline window.

Corporate earnings also support the present valuation structure. Revenue growth from firms like Nvidia and Microsoft continues to justify capital inflows tied to artificial intelligence infrastructure.

Data from Nasdaq, Google Trends, and margin accounts collectively show a market still building momentum. The research concludes that present conditions reflect acceleration rather than exhaustion.

Crypto World

Coinbase Returns to Super Bowl With Lo-Fi Karaoke Ad

Coinbase’s TV spot at the Super Bowl divided opinion online, but the crypto exchange says conversations about it were the point.

Four years after its viral QR code advertisement, crypto exchange Coinbase has returned to the Super Bowl, this time betting on a Backstreet Boys karaoke-inspired ad.

Coinbase’s one-minute TV spot during the most-watched sporting event in the US was mostly text animation that flashed the lyrics to the Backstreet Boys’ 1997 hit “Everybody (Backstreet’s Back).”

Coinbase marketing chief Catherine Ferdon said in a statement that the ad aimed to “bring people together for a shared experience that highlights how the crypto community has grown.”

It’s Coinbase’s first ad spot at the Super Bowl since 2022, when it debuted with a 60-second commercial featuring a color-changing QR code that bounced around the screen similar to a DVD screensaver.

The QR code ad directed to a link offering $15 in Bitcoin (BTC) for those who signed up to Coinbase, which was so popular that it crashed the website and reportedly saw 20 million hits in one minute.

Latest ad divides, but that means it worked, says Coinbase

Coinbase’s latest Super Bowl ad garnered divided opinions online, with some X users saying the commercial elicited jeers as crypto has lost its lustre amid a market crash and its ties to the Trump administration, while others praised it for being simple and memorable.

“If you’re talking about it, it worked,” Coinbase posted to X in response to a user who said the company’s ad was “terrible.”

Others online also piled onto the ad, with one X user posting “the room I’m in ERUPTED in boos when we found out it was a Coinbase ad,” while Axios reporter Andrew Solender said a room he was in “burst into groans and shouts of ‘fuck you’” after the ad aired.

Related: UK bans Coinbase ads that ‘trivialized’ crypto risks: Report

Ethereum Foundation engineer Chase Wright said that “half of the people at the party I was at were singing along and laughed when it was Coinbase,” while another X user said it was “lowkey genius,” as those who watched it “will 100% remember Coinbase if they ever want to buy crypto.”

Coinbase CEO Brian Armstrong defended the ad on X, arguing that “most people half-watch commercials (buzzed, in a loud room, with lots of people). It takes something unique to break through.”

Magazine: If the crypto bull run is ending… it’s time to buy a Ferrari — Crypto Kid

Crypto World

Japan’s Takaichi trade raises short-term risk for Bitcoin

Japan’s “Takaichi trade” is shifting global capital flows and tightening liquidity, adding short-term downside pressure to Bitcoin as U.S. stocks weaken.

Summary

- Japan’s election win has boosted stocks and weakened the yen.

- Portfolio rebalancing is reducing liquidity in U.S. markets.

- Equity weakness is spilling into Bitcoin trading.

Bitcoin is facing fresh near-term pressure as political shifts in Japan reshape global capital flows and reinforce a cautious tone across risk markets.

In a Feb. 9 analysis, CryptoQuant contributor XWIN Research Japan said the landslide victory of Prime Minister Sanae Takaichi in the Feb. 8 lower house election has accelerated what traders now call the “Takaichi trade,” a mix of aggressive fiscal policy, tolerance for yen weakness, and support for loose monetary conditions.

The ruling Liberal Democratic Party-led coalition secured a two-thirds supermajority, giving the new administration broad room to push stimulus and regulatory reforms.

Markets responded quickly. The Nikkei 225 climbed to fresh record highs above 57,000 on Feb. 9, while the yen weakened toward 157 per dollar before stabilizing on intervention talk. Japanese government bonds also came under pressure as investors adjusted to higher spending expectations.

At the same time, U.S. equities slipped into correction territory. Over the past seven days, the Nasdaq fell 5.59%, the S&P 500 declined 2.65%, and the Russell 2000 dropped 2.6%, reflecting tighter liquidity and a re-assessment of risk.

Portfolio rebalancing tightens conditions for risk assets

According to XWIN Research Japan, the current shift is less about capital fleeing the United States and more about global portfolio rebalancing.

“Japanese government bonds, long sidelined by ultra-low yields, are regaining appeal,” the report said, as fiscal expansion and reflation expectations lift returns.

As JGBs attract fresh capital, inflows into U.S. equity exchange-traded funds have slowed. This has reduced marginal liquidity in global stock markets and added pressure to already fragile sentiment.

Analyst GugaOnChain said the adjustment is unfolding across multiple asset classes at once. Money is rotating toward domestic Japanese assets, exporters, and selected commodities, while exposure to U.S. growth stocks is being trimmed.

Dollar strength has added another layer of stress. Yen weakness, persistent U.S.–Japan rate gaps, and defensive demand for dollars have tightened financial conditions, making leveraged trades more expensive to maintain.

In this setting, risk assets tend to move together. When U.S. equities weaken, portfolio managers often cut crypto exposure at the same time to control overall volatility.

Equity-led de-risking spills into Bitcoin markets

XWIN Research Japan said Bitcoin’s recent weakness fits this pattern.

In risk-off phases, Bitcoin (BTC) has tended to track U.S. equities, allowing stock market selling to spill into crypto. The current decline, the firm argued, is driven by cross-asset risk management rather than deterioration in on-chain activity.

CryptoQuant’s cross-asset indicators show that simultaneous equity corrections raise the probability of Bitcoin downside even when long-term holders are not selling. Recent price moves reflect futures unwinds and position reductions, not broad capitulation.

This dynamic has been visible in derivatives markets, where open interest has fallen and leverage has been cut over the past two weeks. Traders appear more focused on preserving capital than on chasing rebounds.

From a medium- to long-term perspective, the outlook diverges.

After the Feb. 8 election delivered a supermajority, the Takaichi administration has now gained the political space to advance structural reforms. Officials have positioned Web3 as a developing industry, and stablecoin laws and tax adjustments are expected later in 2026.

These actions could eventually attract institutional participation and strengthen Japan’s standing as a regulated hub for digital assets.

But for the time being, Bitcoin is still vulnerable to global risk cycles. As long as U.S. stocks are still under pressure and capital flows adjust to Japan’s fiscal pivot, short-term downside risks are likely to persist even if longer-term fundamentals hold.

Crypto World

ENS Abandons Its planned Namechain L2, Citing Drastically Lower Gas Costs

Ethereum domain name service provider ENS has canceled plans to launch a layer-2 as part of its ENSv2 upgrade, opting instead to launch a revamped protocol directly on Ethereum.

In a blog post on Friday, ENS lead developer nick.eth explained that the decision was partly due to a “99% reduction in ENS registration gas costs over the past year” amid a number of important upgrades to the Ethereum network.

“Put simply: Ethereum L1 is scaling, and it’s scaling faster than almost anyone predicted two years ago. The recent Fusaka upgrade raised the gas limit to 60 million, a 2x increase from the beginning of 2025,” nick.eth said, adding:

“Now Ethereum core developers are targeting 200 million gas limit targets in 2026, a 3x increase from today, and that’s before any ZK upgrades land.”

The Fusaka upgrade, one of the most recent Ethereum upgrades that went live in early December, has helped Ethereum drive down gas fees due to its significant scaling capabilities for both the L1 and the ecosystem of L2s.

ENS initially announced its L2 Namechain in November 2024, stating that it would make it easier and cheaper for users to register domain names through rollups.

Nick.eth emphasized that the context has changed dramatically and that it is now viable to build directly on L1 rather than opt for a full-fledged L2 to reduce costs.

“Huge L1 scalability was not part of the Ethereum roadmap, and the message was clear that L2s were the way forward. We needed to meet our users where the ecosystem was heading, and that meant building Namechain,” he said.

Related: Arbitrum, Optimism and Base weigh in after Vitalik questions L2 scaling model

With plans for Namechain now gone, the ENS lead developer noted that the project is still working on significant performance and utility improvements via ENSv2, while the protocol will remain highly interoperable with L2s.

“The vast majority of our engineering effort has gone into ENSv2 itself: the new registry architecture, the improved ownership model, better handling of name expiration, and the flexibility that comes from giving each name its own registry,” he said, adding:

“Deciding to stay on L1 doesn’t mean we’re closing the door on L2s entirely. The flexibility of the ENSv2 architecture makes L2 names more interoperable. Our new registration flow abstracts the complexity crosschain transactions.”

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?

Crypto World

Ethereum address poisoning crypto users $62M in two months: ScamSniffer

Two routine copy-and-paste actions erased $62 million in crypto over December and January, exposing how basic wallet habits are becoming one of Ethereum’s biggest security risks.

Summary

- Two victims lost $62M after copying fake wallet addresses.

- Signature phishing also jumped sharply in January.

- Low fees have made large-scale scam campaigns cheaper to run.

ScamSniffer said in a post on X on Feb. 8 that one victim lost about $50 million in December 2025 after sending funds to a fake address copied from transaction history. In January 2026, another user lost roughly $12.25 million, equal to about 4,556 ETH at the time, through the same mistake.

“Two victims. $62M gone,” the firm wrote.

Both incidents followed the same pattern. Funds were sent to look-alike addresses that had been quietly planted inside the victims’ recent activity records.

How address poisoning became easier to deploy

Address poisoning works by exploiting how most users interact with their wallets.

Attackers monitor transactions, generate vanity addresses that resemble real ones, and send tiny “dust” transfers to potential targets. These near-zero transactions place the fake addresses into transaction histories.

Later, when users copy an address from past activity instead of verifying the full string, money is sent directly to the scammer.

Security firms say this tactic has expanded rapidly since Ethereum’s (ETH) Fusaka upgrade in late 2025 lowered transaction fees. What was once expensive to run at scale has become cheap and efficient.

Millions of dust transactions are now being sent daily, according to blockchain security researchers. Many are designed only to prepare future thefts.

This activity has also distorted network data. Rising transaction counts and active wallet numbers increasingly include spam rather than genuine usage, making it harder to separate real demand from noise.

Several recent investigations have linked address poisoning campaigns to organized groups that recycle the same infrastructure across thousands of wallets.

Signature phishing adds pressure as losses climb

Alongside address poisoning, ScamSniffer recorded a sharp rise in signature-based phishing in January.

The firm reported $6.27 million in losses across 4,741 victims during the month, up 207% from December in value terms. Two wallets were responsible for about 65% of the total damage.

The largest cases included $3.02 million stolen from SLVon and XAUt tokens through malicious permit and increaseAllowance approvals, and $1.08 million taken from aEthLBTC using similar techniques.

These attacks rely on deceptive transaction prompts that appear routine. Once users sign them, scammers gain long-term access to tokens and can drain funds without further approval.

Security analysts say these schemes succeed because they target habits formed during everyday trading, not technical weaknesses in protocols.

“Most victims are not careless,” one researcher said privately. “They are doing what they’ve done hundreds of times before.”

ScamSniffer and other firms have urged users to avoid copying addresses from transaction history, verify full wallet strings manually, and use saved contacts for frequent transfers.

As transaction costs stay low and automation improves, analysts expect address poisoning and signature phishing to remain persistent threats. Until better tools and habits take hold, basic operational mistakes are likely to keep producing outsized losses.

Crypto World

Bitcoin Sharpe Ratio Hits Bear Market Lows At Negative 10

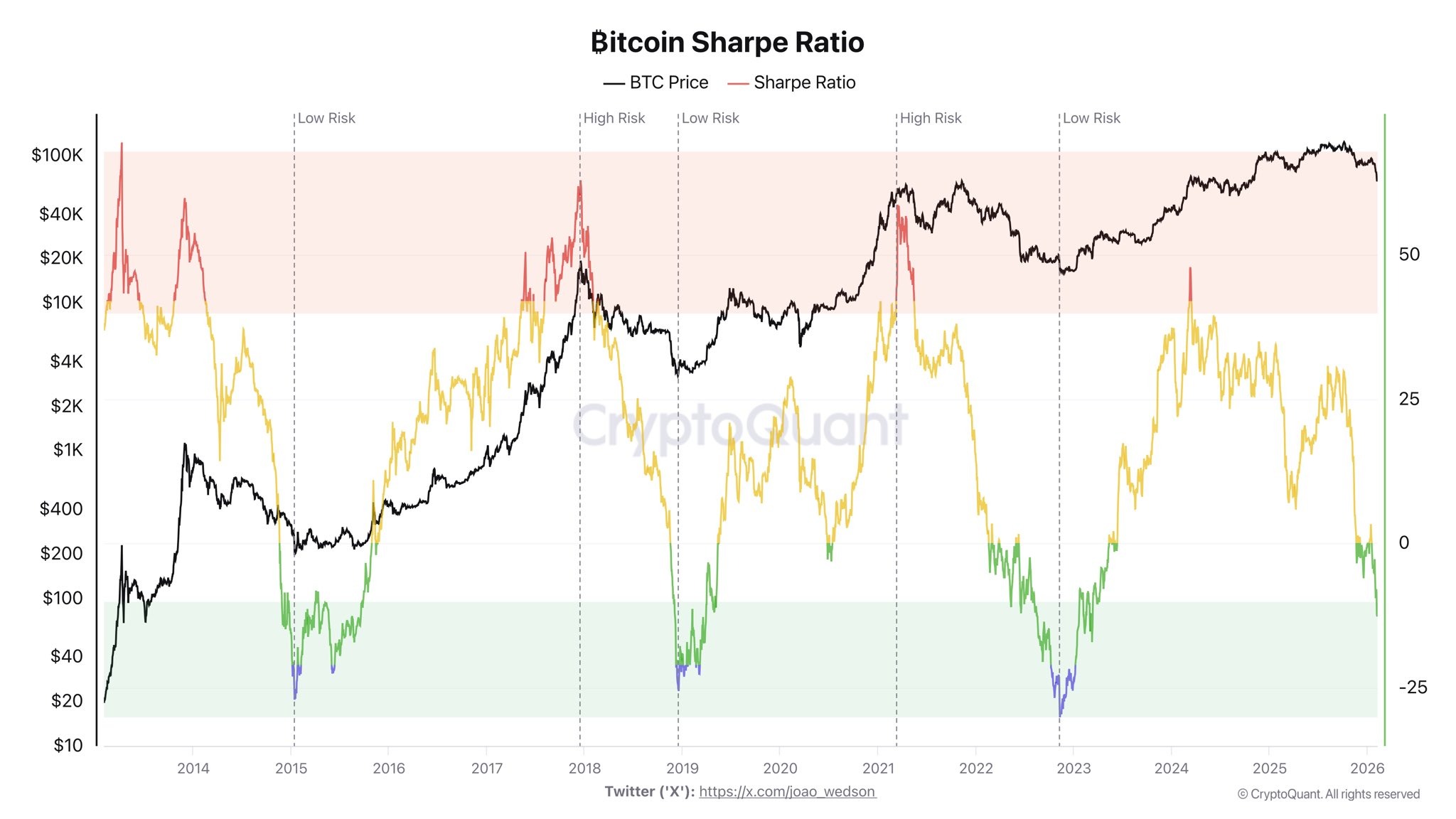

The Bitcoin Sharpe ratio, which measures risk/reward potential, is in negative territory that is often associated with the end of bear markets, according to CryptoQuant analyst Darkfost.

“The Sharpe ratio has just entered a particularly interesting zone, one that has historically aligned with the final phases of bear markets,” said the analyst on X on Saturday.

They added, however, that it is not a signal that the bear market is over, “but rather that we are approaching a point where the risk-to-reward profile is becoming extreme.”

The Sharpe ratio has fallen to -10, its lowest level since March 2023, according to CryptoQuant.

The ratio measures Bitcoin (BTC) performance relative to the risk taken, indicating how much return an investor can expect for each unit of risk.

Negative ratio signals market turning point

The ratio was lower in late 2022 to early 2023, and late 2018 to early 2019 — both periods marking the depths of the bear market cycle. The metric fell to zero in November 2025 when BTC prices hit a local low of $82,000.

The analyst said that in practical terms, “the risk associated with investing in BTC remains high relative to the returns recently observed.”

“The ratio is still deteriorating, showing that BTC’s performance is not yet attractive compared to the risk being taken,” they added.

Related: Bitcoin bear market not over? Trader sees BTC price ‘real bottom’ at $50K

However, a negative Sharpe ratio usually signals market turning points, they said.

“But this type of dynamic is precisely what tends to appear near market turning zones. We are gradually approaching an area where this trend has historically reversed.”

True reversal could be months away

The analyst cautioned that this phase “may last several more months, and BTC could continue correcting before a true reversal takes place.”

Analysts at 10x Research also expressed caution in a market update on Monday, stating:

“While sentiment and technical indicators are approaching extreme levels, the broader downtrend remains intact. In the absence of a clear catalyst, there is little urgency to step in.”

BTC tanked to $60,000 on Friday but recovered to $71,000 by Monday. However, it remains down 44% from its October peak of $126,000, and sentiment remains firmly in bear market territory, analysts say.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics13 hours ago

Politics13 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat7 hours ago

NewsBeat7 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business12 hours ago

Business12 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics15 hours ago

Politics15 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports2 hours ago

Sports2 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business20 hours ago

Business20 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition