Crypto World

AVAX Eyes $147 Target as Elliott Wave Pattern Signals Multi-Year Recovery Phase

TLDR:

- AVAX completed Wave 1 between $8-$5, now entering Wave 2 recovery phase within descending channel

- CryptoPatel targets $33, $58, $97, and $147 representing potential 2,489% expansion from bottom

- Critical support at $5.50 must hold on weekly close to maintain bullish Elliott Wave structure

- Analysis suggests multi-year setup through 2026-2027 suited for spot accumulation and patience

AVAX traders are monitoring a technical analysis that suggests the token could target $147 in the coming years. Crypto analyst CryptoPatel has identified an Elliott Wave formation on the weekly chart, indicating a possible recovery phase after a 95% correction from the 2021 all-time high.

The analysis places AVAX at a critical inflection point, with the asset trading within a multi-year descending channel.

Price action currently hovers near $8.86, presenting what the analyst describes as a macro support accumulation zone.

Technical Structure Shows Wave Completion

The technical framework outlined by CryptoPatel centers on Elliott Wave theory applied to AVAX’s weekly timeframe. According to the analysis shared on X, Wave 1 completed between $8 and $5, marking a macro bottom for the current cycle.

The token now enters what the analyst labels as Wave 2, representing an early recovery phase from the previous correction.

The descending channel formation has contained price action since the 2021 peak. This pattern shows a bearish breakdown followed by a retest of the lower trendline, creating what technical analysts call a deviation setup.

Market structure at these levels suggests accumulation by institutional participants, though this remains speculative based on price behavior rather than confirmed data.

Support zones have formed between $8 and $7, coinciding with weekly demand areas. The liquidity sweep into these zones mirrors fractal patterns from previous market cycles.

Additionally, the compression phase resembles historical accumulation periods that preceded major rallies in past bull markets.

Price Targets Extend Beyond $100 Mark

CryptoPatel’s forecast includes four distinct targets as the Elliott Wave structure potentially unfolds through 2026 and 2027. The progression starts at $33, followed by $58, then $97, before reaching a final target of $147.

These levels correspond to the mid-channel resistance and eventual upper boundary of the descending formation. From the identified bottom to the highest target, the expansion measures approximately 2,489%.

The bullish scenario requires sustained weekly strength with expansion toward mid-channel resistance zones. Price must demonstrate momentum capable of breaking through overhead supply levels that accumulated during the extended correction. However, the analysis also establishes clear invalidation parameters to manage risk exposure.

The critical support level sits at $5.50, representing the Wave 1 low. A weekly close beneath this threshold would negate the Elliott Wave count and suggest further downside potential. This makes the $5.50 level essential for bulls to defend on higher timeframes.

The analyst characterizes this setup as appropriate for spot accumulation and long-term positioning rather than short-term trading.

The asymmetric risk-reward profile stems from proximity to identified support versus the distance to upside targets.

Patience remains necessary as weekly timeframe patterns develop over extended periods, typically spanning months or years rather than days or weeks.

Crypto World

Tesla (TSLA) Stock Down 16% From All-Time Highs – Should Investors Buy the Dip?

TLDR

- Tesla stock dropped 2.7% Thursday, ending a four-day winning streak, and fell another 0.7% in Friday premarket trading to $414.07

- Historical data shows Tesla stock rises 56% of the time on Friday the 13th versus 52% on regular days, with slightly lower volatility

- Shares remain down 3.3% since reporting better-than-expected Q4 earnings on January 20, despite beating analyst estimates

- Tesla plans to expand its AI-trained robo-taxi service to nine cities in the first half of 2026, currently operating in Austin and testing in San Francisco

- The company expects capital expenditures to exceed $20 billion in 2026, more than double 2025 levels, as it pivots toward AI, robotics, and autonomous vehicles

Tesla stock closed down 2.7% Thursday at $417.50, breaking a four-day winning streak. The EV maker’s shares fell another 0.7% in Friday premarket trading to $414.07.

The decline came without Tesla-specific news. Market-wide weakness hit tech stocks particularly hard. The Nasdaq Composite dropped 2% Thursday as AI disruption fears spread across sectors.

Tesla shares have now fallen 3.3% since the company reported fourth-quarter earnings on January 20. The results beat analyst expectations for both revenue and profitability. Yet investors haven’t rewarded the stock with sustained gains.

The muted reaction suggests shareholders want more than good quarterly numbers. They’re waiting for concrete progress on Tesla’s AI initiatives before pushing the stock higher.

Robo-Taxi Expansion Plans

CEO Elon Musk outlined plans to expand Tesla’s AI-trained robo-taxi service to nine cities during the first half of 2026. The service currently operates in Austin, Texas, with testing underway in San Francisco.

The company aims to begin CyberCab production in April. Musk stated he expects Tesla to eventually produce more CyberCabs than all other vehicles combined.

Tesla is also winding down production of the Model S sedan and Model X SUV in coming months. That production space will shift to manufacturing Optimus, the company’s autonomous robot. Musk’s goal is to produce 1 million Optimus units annually.

Fourth-quarter deliveries fell 16% year-over-year to 495,570 vehicles. The drop raised concerns since Tesla remains primarily an automobile company.

Capital Spending Surge

Capital expenditures are expected to top $20 billion in 2026. That’s more than double the 2025 level. The funds will support battery technology development, CyberCab production, the Robotaxi system, and AI projects.

Tesla’s Full Self-Driving Supervised platform will shift to a fully subscription-based model this quarter. The move could generate recurring revenue streams if adoption proves strong.

Despite recent weakness, Tesla stock is up 24% over the past 12 months. Shares gained 1.4% for the week heading into Friday trading.

Friday the 13th has historically been kind to Tesla stock. The company has experienced 27 Friday the 13ths since going public in 2010. Shares rose on 15 of those days, a 56% win rate. Average price movement on Friday the 13th is 2.3%, slightly below the typical 2.5% daily movement.

The stock trades at a forward P/E ratio near 205. Critics argue valuations remain stretched given unproven products like Optimus and CyberCab face uncertain demand. Competition in the EV space continues to intensify as traditional automakers expand electric offerings.

Tesla’s Full Self-Driving subscriptions face a crowded market where consumers already juggle multiple subscription services. Success depends on whether the technology delivers enough value to justify another monthly payment.

Crypto World

AVAX breaks key pattern as $9 turns into major supply zone

- The Avalanche (AVAX) token traded around $8.84 as sell-off pressure kept prices lower.

- Bulls have failed to reclaim the $10 mark and fresh declines may push AVAX to lows of $6.30.

- Sentiment across crypto is largely bearish.

Avalanche (AVAX) is facing mounting resistance just below the $9 mark, where persistent bearish pressure has stifled recent recovery attempts.

The altcoin’s bearish outlook aligns with broader cryptocurrency market vulnerability, and having recoiled off the resistance level, technicals suggest fresh losses are likely.

Avalanche price recap

AVAX has navigated a turbulent path over the past month, with prices falling since hitting highs near $15 on January 14, 2026.

The decline, currently putting the token 39% off its 30-day peak, has come amid significant macroeconomic headwinds and sector-wide profit-taking.

Bears have largely taken control despite Avalanche C-Chain’s recent network milestones, including throughput.

According to Ava Labs’ Martin Eckardt, the chain could hit over 4 million gas per second by next week.

Avalanche C-Chain is adding more throughput by the day. Goal is to hit 3.5m gas per second by the end of today and 4m by the end of next week. If everything goes smoothly we will keep pushing, since all the new supply is getting used immediately pic.twitter.com/NvKSn8nqfA

— Martin Eckardt 🔺 (@martin_eckardt) February 12, 2026

The dip to under $8.30 on February 5, 2026, intensified the sell-off pressure, and bulls find it difficult to break higher.

In the last 24 hours, the token fluctuated between a low of $8.64 and a high of $8.96, with trading volume dipping 7% to 254 million.

The past week’s performance tells a similar story of stalled momentum.

AVAX has seen two green days out of seven, with volatility under 1%, as bears defend the $9 threshold amid extreme fear readings on the Crypto Fear & Greed Index.

Avalanche price prediction: Technical picture

From a technical standpoint, AVAX has broken below a key weekly falling wedge pattern, with $9 acting as an immediate supply zone.

Further short-term bearish bias is from the weekly RSI at 30, with a move to oversold conditions hinting at a potential dip before another bounce on a volume uptick.

A notable leg down will rely on key support clusters at $8.50–$8.25, a zone reinforced by recent lows. If prices breach this defense line, bearish targets include lows of $7.50 and $.6.30.

On the other hand, upside catalysts will include a reclaim of $9.38 and a retest of the short-term max pain projection at the $13.90 resistance.

If indecisiveness resolves in favour of bulls, with the weekly MACD forming a bullish crossover, the next target will be the dynamic resistance mark coinciding with the 50-week moving average (at $19.42 as of writing).

The 200-day moving average is offering resistance at $23.69.

Avalanche’s lack of upside momentum mirrors Bitcoin’s struggle below $70,000. Crypto analysts see the overall market sentiment as still largely bearish, with forecasts for a potential dip to $50k for BTC.

Downside momentum will cascade across altcoins.

Crypto World

Nasdaq 100 May Retest This Year’s Low

As the chart of the Nasdaq 100 index (US Tech 100 mini on FXOpen) shows, bearish sentiment currently dominates the equity market. Yesterday, the technology index fell by around 2%.

Why Is the Nasdaq 100 Declining?

According to media reports, developments linked to the expansion of AI are weighing on the market:

→ Major technology firms are sharply increasing capital expenditure on infrastructure, yet there is little clarity on when these investments will begin to generate returns. For instance, Google issued bonds this week, including 100-year debt.

→ The impact of AI on traditional business models, particularly companies operating in the software sector.

Technical Analysis of the Nasdaq 100 Chart

When analysing Nasdaq 100 price action (US Tech 100 mini on FXOpen) on 2 February, we:

→ identified a resistance zone (highlighted in orange) and marked the key 25,900 resistance level;

→ noted that bears had taken the initiative and suggested they would need to maintain control around the 25,500 area — where the ascending channel had previously been broken.

Since then, bulls managed to break above this zone, but only briefly, testing the 25,900 level. As indicated by the arrow, the move was short-lived and prices soon fell back below, signalling the bulls’ inability to sustain upward momentum.

A sequence of lower highs has allowed a descending trend line (R) to be drawn. If the consolidation that began last evening reflects a temporary balance between supply and demand, a median line can be plotted, with a lower channel boundary beneath it.

Under a continued downward trend scenario, this configuration points to the potential for the Nasdaq 100 to set a fresh low for the year. Whether this outlook materialises will largely depend on US inflation data. The CPI report is due for release today at 16:30 (GMT+3). Traders should be prepared for heightened volatility.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

DeFi Education Fund calls on UK FCA to narrow definition of control in crypto regulation

The DeFi Education Fund (DEF) has urged the U.K.’s Financial Conduct Authority to adopt a narrow, functional definition of “control” as it finalizes new rules for crypto asset activities.

The Washington, D.C.-based advocacy group argued that regulatory obligations should hinge on whether an entity has unilateral authority over user funds or transactions, not merely whether it developed or contributed to a decentralized protocol, in a response to an FCA consultation paper shared exclusively with CoinDesk.

“Control should be the determinative factor” of regulatory scope, DEF said, warning that software developers could otherwise be swept into intermediary-style obligations despite lacking custody or transactional authority.

The submission focuses on an area of the consultation which considers how decentralized finance (DeFi) arrangements should be treated under the U.K.’s emerging crypto regime. DEF supports the FCA’s control-based approach in principle but says it must be tied to concrete operational powers, such as the ability to initiate or block transactions, modify protocol parameters or exclude users.

DEF is an organization focused on informing policymakers and regulators about the benefits of DeFi and has been one of the prominent lobby groups on the road to crypto regulatory frameworks being established in Washington in recent years.

The group also challenged the FCA’s framing of DeFi-specific risks, arguing that cybersecurity vulnerabilities are not unique to blockchain systems and that public blockchains offer transparency advantages in combating illicit finance.

Applying prudential, reporting and platform access requirements designed for centralized trading platforms to non-custodial, automated protocols would be “ill-suited,” DEF said.

The FCA is seeking to bring a broad range of crypto activities within its regulatory perimeter as the U.K. moves toward a comprehensive digital asset framework.

Read More: UK regulators start major consultation on crypto listings, DeFi, and staking

Crypto World

Ripple CEO Joins CFTC Panel

XRP price has struggled to recover in recent days, raising concerns about a potential repeat of the 2021-2022 bear market.

While weakness persists, a recent development involving Ripple CEO Brad Garlinghouse could shift sentiment.

Sponsored

XRP May Not Imitate The Past

Brad Garlinghouse has joined the Commodity Futures Trading Commission’s Innovation Advisory Committee. This appointment marks a significant milestone for Ripple and the broader XRP ecosystem. The same regulatory environment that challenged Ripple for nearly five years is now seeking industry input.

For XRP supporters, this signals growing regulatory normalization. Engagement with the CFTC may enhance Ripple’s credibility in US policy discussions. Constructive dialogue could ease uncertainty and reduce the long-term legal overhang that previously weighed on the XRP price.

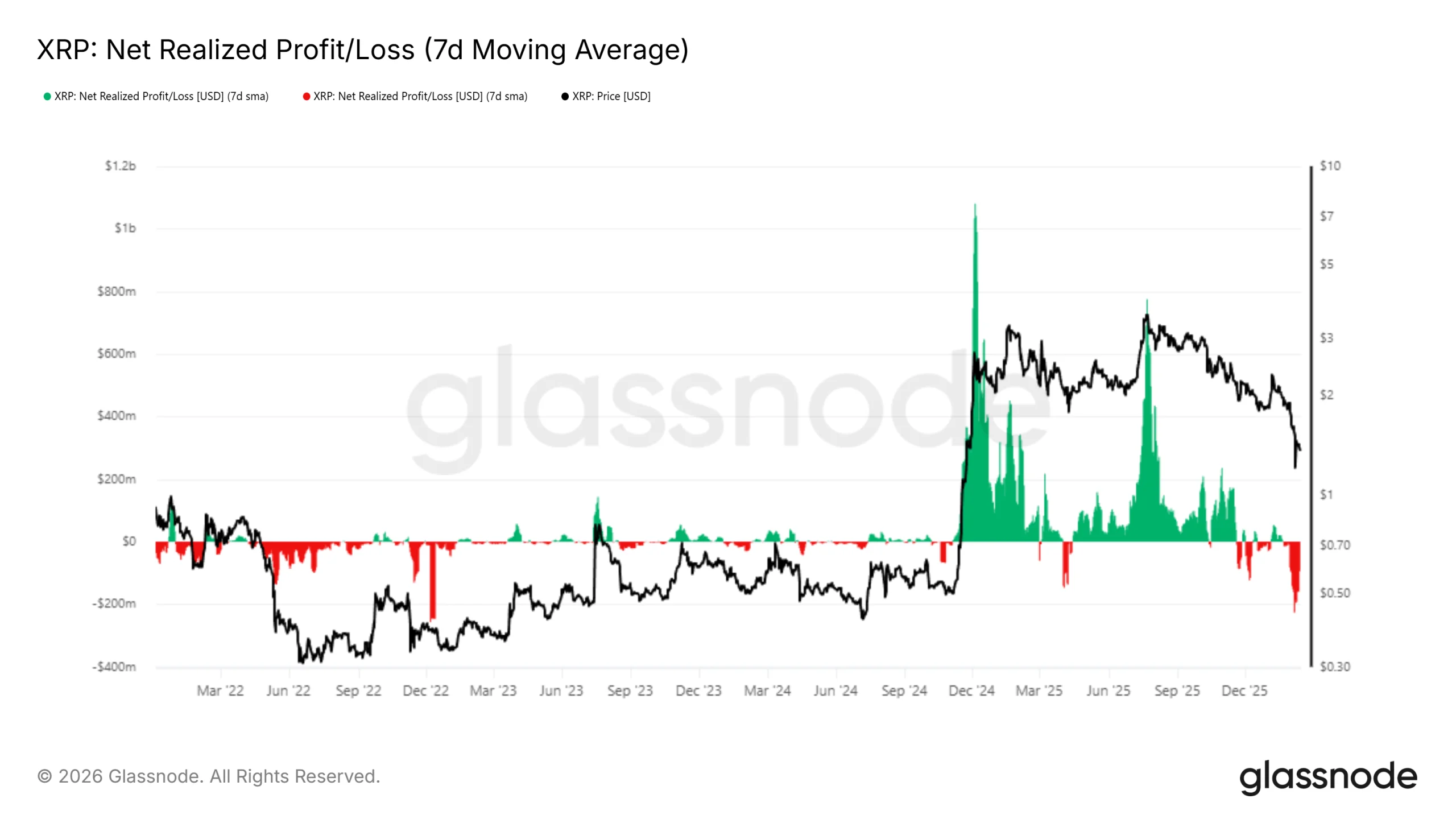

Recently realized profit-and-loss data show a spike in sales. Some observers compare this activity to early signals seen before the 2022 bear market. However, in 2022, sustained distribution lasted nearly four months. Current selling lacks that duration and intensity, reducing the probability of a prolonged downturn for XRP.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Sponsored

Selling Exists, But It’s Not a Concern

Exchange balance data suggests selling pressure remains measured. Roughly 100 million XRP moved to exchanges over the past 10 days, valued at $130 million. While notable, the scale does not indicate widespread panic.

In November 2025, 130 million XRP was sold within 72 hours. That episode reflected sharper urgency among holders. Compared to that event, current flows appear controlled and less aggressive.

Sponsored

Moderate selling combined with positive regulatory developments could stabilize sentiment. If distribution does not accelerate, XRP may absorb supply without severe downside extension. Market participants are watching closely for confirmation through on-chain metrics.

XRP Has Room To Recover

The liquidation heatmap shows limited immediate obstacles to recovery. XRP faces its next major resistance between $1.78 and $1.80. This zone represents a potential profit-taking area rather than an immediate structural ceiling.

Absence of dense liquidation clusters below current levels reduces short-term risk of cascading sell-offs. If momentum improves, XRP has room to advance before encountering significant overhead supply. That technical flexibility supports a cautiously constructive outlook.

Sponsored

XRP Price Needs To Bounce Back

XRP trades at $1.35 and is slipping below the $1.36 support level. The next key support lies near $1.27, aligning with the 23.6% Fibonacci retracement. Despite recent weakness, broader factors suggest a balanced risk profile.

Garlinghouse’s CFTC appointment may improve investor confidence. If XRP reclaims $1.51, a recovery rally could unfold. Sustained strength above that threshold may drive price toward the supply zone above $1.76.

However, a breakdown below $1.27 would shift momentum decisively. Panic selling could intensify if support fails. A drop toward $1.11 would invalidate the bullish thesis and extend the current corrective phase.

Crypto World

Powering the Future of Web3 Games

GameFi has moved beyond being a niche Web3 experiment. It is now a serious segment of the gaming industry where gameplay, finance, and digital ownership intersect. For enterprises, the opportunity is no longer theoretical.

GameFi platforms are generating real user engagement, real economies, and real revenue flows. But while many projects launch, only a few achieve scale and sustainability.

The difference?

Successful games in the GameFi sector are not just games, they are well-designed economic systems backed by strong technology and long-term strategy.

Before discussing how to build the next big one, let us look at what today’s top Web3 games are doing right.

Check Out the Top 5 Web3 Games in the GameFi Sector

Take a look at the top 5 Web3 games in the GameFi sector that have shown ecosystem impact, retention, and economic design, not hype.

1) Axie Infinity

One of the earliest GameFi successes, Axie Infinity proved that play-to-earn could drive global adoption.

Why it worked

- NFT-based ownership of characters

- Strong community culture

- Reward-driven gameplay loop

- Marketplace liquidity

Key lesson for enterprises

Ownership and community can drive growth. However, token inflation must be managed carefully for sustainability. With the help from professional service providers, enterprises can also build an NFT game like Axie Infinity to make a mark in the GameFi sector.

2) The Sandbox

The Sandbox positioned itself as a creator-driven metaverse where users build and monetize experiences.

Why it worked

- User-generated content model

- LAND-based digital real estate economy

- Major brand partnerships

- Creator monetization

Key lesson for enterprises

GameFi scales when both creators as well as just players get incentives.

3) Illuvium

Illuvium focuses on AAA-quality gameplay combined with blockchain mechanics.

Why it worked

- High production quality

- Strategic battle mechanics

- Strong token utility design

- Transparent development roadmap

Key lesson for enterprises

In web3 gaming, players still expect high-quality gameplay. Blockchain alone isn’t enough. Businesses can certainly take inspiration from Illuvium and develop an adventurous NFT game.

4) Star Atlas

A space-themed strategy game combining exploration, resource management, and NFTs.

Why it worked

- Deep in-game economy

- Long-term vision

- Asset ownership layers

- Multi-token structure

Key lesson for enterprises

Complex economies require careful modeling to remain stable.

5) Big Time

Big Time blends RPG gameplay with NFT cosmetics rather than pay-to-win mechanics.

Why it worked

- Focus on fun-first gameplay

- Cosmetic NFT monetization

- Reduced entry barriers

- Balanced economy

Key lesson for enterprises

GameFi succeeds when gameplay comes first, monetization second.

Common Success Patterns Across Top Web3 Games in the GameFi Sector

Across these examples, Several similar patterns emerge across the top web3 games in the GameFi sector

1. Gameplay First, Tokenomics Second

The most successful GameFi titles treat blockchain as an enabler, not the core product. Players stay for compelling gameplay, including progression, competition, exploration, or social interaction and not for token rewards alone.

When token incentives become the primary attraction, users behave like short-term extractors rather than long-term players. This leads to boom-and-bust cycles. Enterprises that win in the GameFi sector tend to design games where tokens enhance the experience rather than define it. The economy supports gameplay, not the other way around.

2. Sustainable Token Models

A GameFi economy behaves like a real economy. Unlimited token emissions without sinks create inflation, reducing value and user trust.

Sustainable models include:

- Controlled emission schedules

- Burning mechanisms

- Utility-driven demand

- Balanced reward pacing

Enterprises must think like central banks managing a currency, not just game studios issuing rewards. Strong tokenomics protects both player confidence and long-term platform stability.

3. Asset Utility

NFTs that exist only for speculation lose relevance within a short span of time. Assets must have in-game purpose, like access rights, upgrades, status, or gameplay advantages. Utility-driven NFTs create reasons to hold rather than flip. This stabilizes secondary markets and strengthens ecosystem value. For enterprises, this means designing assets as functional components of gameplay and community identity, not just collectibles.

4. Strong Community Loops

GameFi ecosystems grow when players feel involved, not just entertained. Guilds, DAO participation, social competitions, and collaborative events increase emotional investment.

Community-led growth reduces marketing spend and increases organic retention. When users recruit other users, acquisition becomes more efficient.

Enterprises that build social infrastructure into their games often see longer lifecycle value per player.

5. Long-Term Roadmaps

GameFi projects that succeed, rarely launch everything at once. They evolve in phases, such as alpha, beta, seasonal updates, expansions. A visible roadmap builds credibility and signals commitment. It reassures users that the platform is not a short-lived experiment.

Enterprises should consider GameFi platform development like live services, not one-time releases. Continuous development sustains engagement.

Want to Build Web3 Games in the GameFi Sector?

How Enterprises Can Build the Next Big GameFi Platform

GameFi platform development is not about copying mechanics. It’s all about designing an ecosystem.

1. Start with a Business Model, Not a Token

Many GameFi projects tend to fail because they start with token issuance instead of revenue logic. A token without a business model becomes speculation fuel.

Enterprises must define:

- How value enters the ecosystem

- How revenue is generated

- How players progress and spend

- How the platform sustains itself

Tokens should support these mechanics, not replace them. A clear model ensures predictability and investor confidence.

2. Design Sustainable Tokenomics

Tokenomics must be stress-tested against growth scenarios. What happens when users double? When rewards are farmed? When markets fluctuate?

Enterprises should simulate:

- Inflation pressure

- Liquidity demands

- User reward cycles

- Exit scenarios

This requires financial modeling expertise, not just blockchain development. Sustainable tokenomics prevents economic collapse.

3. Build for Scalability

GameFi platforms combine gaming infrastructure and financial systems. They must support:

- High user concurrency

- Secure transactions

- Marketplace activity

- Real-time gameplay

Poor scalability leads to slow transactions, high fees, and user frustration. Enterprises should architect systems for growth from day one rather than retrofitting later at higher costs.

4. Focus on Retention Mechanics

Retention is where GameFi profitability lives. Acquiring users is expensive; keeping them is valuable.

Retention tools include:

- Progression systems

- Time-limited events

- Competitive modes

- Social features

- Reward milestones

These mechanics give users reasons to return. Enterprises that master retention build predictable revenue streams.

5. Prioritize Security

GameFi platforms handle valuable assets. Exploits or breaches can erase user trust overnight.

Security must cover:

- Smart contract audits

- Anti-cheat systems

- Wallet safety

- Fraud detection

- Data integrity

Security cannot be considered as a feature, it’s foundational. Enterprises that underinvest here risk reputational and financial damage.

Why Enterprises Partner with a Professional GameFi Development Company

1. Multidisciplinary Expertise

GameFi sits at the intersection of gaming, finance, and blockchain. Few internal teams cover all three deeply. Therefore, the need for a trusted GameFi development company arises. A specialized partner brings cross-domain expertise, reducing trial-and-error risks.

2. Faster Time-to-Market

Experienced GameFi teams reuse proven frameworks, smart contract templates, and tested architectures. This accelerates development without compromising quality. Speed matters in competitive Web3 gaming markets.

3. Economic Design Support

Designing a stable in-game economy requires financial modeling skills. An experienced GameFi development company often includes tokenomics specialists who simulate economic behavior. This protects long-term viability.

4. Security & Compliance Readiness

Professional partners implement audit-ready systems and compliance-aware frameworks. This is critical as regulations tighten around digital assets.

5. LiveOps & Scaling Support

GameFi is not “launch and leave.” It requires updates, tuning, and monitoring. Development partners often support LiveOps, ensuring the ecosystem evolves safely.

Final Thoughts

The next big GameFi success won’t come from hype. It will come from solid design, strong economies, and real player value.

Antier, a vastly experienced GameFi development company, works with enterprises to design and build GameFi ecosystems that are scalable, secure, and retention-driven. Support from Antier includes:

- End-to-end GameFi platform development

- Tokenomics architecture

- NFT integration

- Smart contract development

- Marketplace and wallet systems

- LiveOps and scaling support

The goal isn’t just launching Web3 games,it is about building a sustainable digital economy. Enterprises that treat GameFi as a long-term platform opportunity and not as a short-term trend are the ones most likely to win. So, the real question is: Are you building a game, or building an economy? And your success lies within the answer itself.

Frequently Asked Questions

01. What is GameFi and how has it evolved in the gaming industry?

GameFi is a segment of the gaming industry where gameplay, finance, and digital ownership intersect, moving beyond a niche Web3 experiment to generate real user engagement, economies, and revenue flows.

02. What are the key factors that contribute to the success of GameFi projects?

Successful GameFi projects are well-designed economic systems supported by strong technology and long-term strategies, focusing on community, ownership, and sustainable token management.

03. Can you name some of the top Web3 games in the GameFi sector and their unique features?

Top Web3 games include Axie Infinity (NFT ownership and community culture), The Sandbox (user-generated content and monetization), Illuvium (AAA-quality gameplay), Star Atlas (deep in-game economy), and Big Time (fun-first gameplay with cosmetic NFTs).

Crypto World

Boerse Stuttgart Digital, Tradias Merge to Build European Crypto Hub

Boerse Stuttgart Group, operator of one of Europe’s largest stock exchanges, is pursuing a strategic consolidation of its regulated digital asset activities with Tradias, a Frankfurt-based crypto trading firm. The move aims to accelerate the group’s push into institutional crypto markets by combining Boerse Stuttgart Digital’s custody, brokerage and trading capabilities with Tradias’ execution and BaFin-licensed securities trading operations. The combined entity, still subject to regulatory approvals, would bring together roughly 300 employees under a unified management team. While formal financial terms were not disclosed in the initial announcement, Bloomberg reported that Tradias could be valued at about €200 million, with the merged group potentially exceeding €500 million in enterprise value. The deal underscores a broader shift toward regulated, institution-facing crypto infrastructure in Europe, aided by MiCA, the EU framework for crypto-assets.

The merger is framed as a natural evolution for Boerse Stuttgart’s regulated crypto unit, which has built out a comprehensive platform for trading, custody and tokenized assets in compliance with the Markets in Crypto-Assets Regulation (MiCA). The integration with Tradias is intended to extend the reach of this regulated backbone across Europe, enabling banks, brokers and other financial institutions to access a fully regulated crypto infrastructure under one umbrella. The announcement notes that the combined team will oversee services spanning brokerage, trading, custody, staking and tokenized assets, a suite designed to cover the entire value chain for institutional clients. In 2025, Boerse Stuttgart highlighted a surge in crypto trading volumes, signaling growing demand from institutions and an increasing contribution of digital assets to the group’s revenue. The leadership behind the merger expresses a bullish outlook on the sector’s trajectory and on the strategic advantages of scale in regulated markets.

The background of the deal includes Tradias’ status as a BaFin-licensed securities trading bank, a feature that aligns with Boerse Stuttgart Digital’s regulatory approach and its emphasis on a compliant crypto ecosystem. Tradias operates as the digital assets arm of Bankhaus Scheich, and its regulatory standing complements Boerse Stuttgart’s push to formalize a pan-European digital-asset platform capable of serving large-scale financial players. The two firms’ complementary strengths—Boerse Stuttgart Digital’s product suite and Tradias’ execution and licensing framework—are positioned to offer a more seamless, integrated experience for institutions seeking to deploy crypto strategies within established risk controls. As part of the strategic framing, Boerse Stuttgart Group chief executive Matthias Voelkel emphasized that the merger would drive consolidation and leadership across Europe’s crypto markets, noting that the combined entity would be better positioned to compete with other regulated platforms as institutional demand grows.

Within the discourse on regulated crypto markets, the deal sits at the intersection of technology, regulation and market structure. Boerse Stuttgart’s digital arm has been a steady contractor to the EU’s MiCA regime, providing trading, brokerage and custody services in line with the regulation’s requirements. The integration with Tradias is expected to accelerate the deployment of compliant crypto infrastructure at scale, potentially reducing the operational frictions that have long constrained institutional participation. The parties have kept financial terms private, but public signals about the valuation and scale of the combined group reinforce the sense that European players are wagering on a future where regulated, cross-border crypto services become a core element of traditional financial ecosystems.

“With the planned merger of Boerse Stuttgart Digital and Tradias, Boerse Stuttgart Group is driving the development and consolidation of the European crypto market,”

Voelkel’s remarks reflect a broader industry narrative in which established financial institutions seek to create end-to-end platforms that combine trading, custody and risk management for digital assets. The leadership of Tradias, led by founder Christopher Beck, has framed the merger as a step toward building a European champion with broader reach and deeper strategic capabilities. Beck stressed that the alliance would allow the two entities to cover the entire value chain for digital assets and to harness the strengths of both firms to accelerate market consolidation.

Beyond the immediate strategic benefits, the merger has implications for the European crypto ecosystem’s maturity. The combination of a regulated exchange operator and a BaFin-licensed securities trading bank is emblematic of a trend toward more integrated and regulated solutions, which could lower barriers to participation for banks and asset managers seeking regulated exposure to crypto markets. The regulatory backdrop—especially MiCA—will continue to shape how such entities structure their offerings, the kinds of products they can offer, and how they manage custody, staking and tokenized assets. In the context of 2025 regulatory developments, several commentators have highlighted how MiCA licensing frameworks may influence the design and distribution of crypto products, including the potential for more standardized governance and risk controls across borders. The ongoing shift toward regulated, institution-friendly models is consistent with the broader push to normalize crypto markets within mainstream financial systems.

Related: Denmark’s Danske Bank allows clients to buy Bitcoin and Ether ETPs

Tradias’ leadership has signaled that the merger would enable the two firms to expand their European footprint, leveraging their respective strengths to offer a more robust platform for institutional clients. Beck’s comments emphasize the goal of creating “a new European champion” with greater reach and operational depth that could accelerate consolidation in the sector. The strategic logic rests on combining Boerse Stuttgart Digital’s regulated product suite and custody capabilities with Tradias’ licensed market access and execution capabilities, potentially creating a more competitive, scalable and compliant ecosystem for digital-asset trading and custody across Europe.

The broader market context reinforces the strategic prudence of this move. The European crypto market has been evolving toward greater professionalization, with a growing emphasis on licensing, risk management and interoperability across borders. The MiCA framework is widely viewed as a driver of this shift, encouraging standardized practices and more predictable regulatory outcomes for participants. The proposed merger aligns with these dynamics, signaling a willingness among incumbents to invest in regulated infrastructures that can support institutional flows, wholesale trading and the custody of digital assets on a pan-European scale. The coming months will be crucial for the timeline and final terms, as regulatory approvals and integration milestones will determine how quickly the combined operation can begin delivering on its stated objectives.

Why it matters

The strategic union between Boerse Stuttgart Digital and Tradias could reshape how European institutions access crypto markets. By marrying regulated trading, custody and brokerage with a licensed execution platform, the merged entity could reduce the friction and compliance overhead that have historically limited institutional participation. This consolidation may also set a precedent for other European incumbents seeking to build comparable ecosystems, potentially accelerating the pace at which traditional financial services firms adopt and integrate digital-asset capabilities. The emphasis on tokenized assets and staking suggests a broader ambition to extend digital assets beyond simple trading to a more comprehensive asset-management framework that integrates with existing bank-grade risk controls.

From a user perspective, the deal promises continuity and scale. Banks and brokers seeking regulated access to crypto services could benefit from a more cohesive offering, including custody and settlement under a single governance framework. For digital-asset providers and fintechs, the merger highlights the value of partnerships with regulated institutions that can bridge retail and wholesale markets while maintaining high standards of compliance. The European landscape, long characterized by divergent national approaches, could gradually converge as more players align under MiCA-compliant models, reducing cross-border complexity and enabling more efficient capital deployment.

What to watch next

- Regulatory approvals and the closing date of the merger, including any conditions placed by BaFin or other European authorities.

- Integration milestones for Boerse Stuttgart Digital and Tradias, including the consolidation of tech platforms and onboarding of additional banks or brokers.

- Rollout of expanded services, such as custody, staking and tokenized-assets offerings, to new European markets.

- Any updates on the valuation, potential debt financing or equity arrangements tied to the transaction.

Sources & verification

- Boerse Stuttgart Digital-Tradias merger press release (PDF): https://www.bsdigital.com/media/fucbehz4/20260213_en_boerse-stuttgart_digital_tradias.pdf

- Bloomberg reporting on valuation: https://www.bloomberg.com/news/articles/2026-02-13/boerse-stuttgart-to-merge-crypto-arm-with-trading-firm-tradias

- Tradias BaFin-licensed status: https://cointelegraph.com/news/tradias-bafin-license-expansion-2025

- Markets in Crypto-Assets Regulation (MiCA) overview referenced in coverage: https://cointelegraph.com/learn/articles/markets-in-crypto-assets-regulation-mica

- Boerse Stuttgart growth and revenue context: https://cointelegraph.com/news/bourse-stock-exchange-25-percent-revenue-rise-crypto

European consolidation of regulated crypto services: what the merger means

Crypto World

Crypto CEO Sentenced to 20 Years in $200M Bitcoin Ponzi Scheme

A Virginia federal court handed a 20-year prison sentence to Ramil Ventura Palafox, the chief executive of Praetorian Group International (PGI), for leading a crypto investment scheme that prosecutors say defrauded tens of thousands of investors out of roughly $200 million. Court records describe a carefully orchestrated Ponzi scheme that promised daily returns of up to 3 percent from Bitcoin trading, only to funnel new money to earlier participants while fabricating apparent gains through an online portal.

Key takeaways

- The judge sentenced PGI’s founder, 61-year-old Ramil Ventura Palafox, to 20 years in prison after convictions on wire fraud and money laundering charges tied to a $200 million crypto investment scam.

- The scheme allegedly attracted more than $201 million from December 2019 to October 2021, including at least 8,198 Bitcoin (BTC) valued at about $171.5 million at the time; victims suffered losses of at least $62.7 million.

- Regulators say PGI claimed to trade Bitcoin at scale and to generate steady daily profits, but prosecutors contended the trading activity could not support the promised returns.

- Palafox allegedly used a multi-level marketing structure and paid referrals, while misrepresenting trading performance to lure new participants.

- The case combines criminal action from the Department of Justice with civil action from the Securities and Exchange Commission, underscoring cross-border enforcement and ongoing scrutiny of crypto-related fraud.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The sentencing arrives amid sustained regulatory focus on crypto investment platforms and crypto-enabled fraud. Authorities have signaled that the combination of alleged misrepresentation, aggressive fundraising, and the promise of consistent, high daily returns increases investor risk and elevates enforcement priorities. The case also reflects ongoing efforts to align crypto-related schemes with traditional securities and consumer-protection regimes, highlighting the challenges of policing cross-border online operations as crypto markets remain volatile and subject to rapid shifts in investor sentiment.

Why it matters

The PGI case illustrates how fraudsters continue to exploit the aura of professional crypto trading to attract money from retail investors. By presenting a façade of sophisticated AI-driven or large-scale Bitcoin trading, the scheme preyed on hopes of reliable, outsized returns and leveraged a multi-level referral structure to accelerate capital inflows. The financial footprint—tens of thousands of investors and hundreds of millions of dollars—shows the scale at which these operations can operate before regulators intervene.

From a regulatory perspective, the outcome reinforces the co-operation between criminal and civil agencies in tackling crypto-enabled fraud. The Department of Justice’s criminal case, paired with the SEC’s civil action filed later, demonstrates a multi-front approach to address both deception and improper fundraising in digital asset markets. The interplay between criminal penalties and potential restitution signals that victims may pursue recovery through court-administered processes, while enforcement actions may deter future misconduct by raising the stakes for misrepresentation and misappropriation of investor funds.

For investors and builders in the crypto space, the PGI case underscores a persistent risk layer: schemes can mimic legitimate trading operations, including claims of AI-powered platforms and guaranteed returns, even as real trading volumes and profits fail to materialize. Trust remains a critical asset in this industry, and cases like this one press the importance of due diligence, transparent performance reporting, and robust compliance programs for operators who manage other people’s money.

What to watch next

- Restitution processes: Regulators have indicated that victims may be eligible for restitution; follow communications from the U.S. Attorney’s Office regarding claims submissions and timelines.

- Civil case developments: The SEC’s civil complaint may yield further settlements or enforcement actions related to misrepresented trading activities and the claimed AI-driven platform.

- Cross-border enforcement updates: The case’s international elements—such as activity in the United Kingdom and other jurisdictions—could prompt additional regulatory coordination and potential asset tracing outcomes.

- Regulatory signaling: The convergence of criminal and civil actions in crypto fraud cases is likely to influence future policy discussions on crypto investment schemes, disclosure requirements, and investor protections.

Sources & verification

- Department of Justice press release on the sentencing of Ramil Ventura Palafox for a $200 million crypto Ponzi scheme.

- SEC civil complaint filed in April 2025 alleging misrepresentation of PGI’s trading activity and the use of new investor funds to pay earlier participants.

- DOJ actions detailing charges in the Eastern District of Virginia and the cross-border enforcement that accompanied the case.

- Information on the 2021 seizure of PGI’s website and related enforcement steps, indicating the global reach of the investigation.

Rewritten Article Body: Conviction underscores regulatory watch on crypto investment platforms

In a case that underscores the intensifying scrutiny of crypto-enabled investment fraud, a federal judge in Virginia handed down a 20-year prison sentence to Ramil Ventura Palafox, the founder and chief executive of Praetorian Group International (PGI). Prosecutors described the matter as a deliberate Ponzi scheme that lured tens of thousands of investors with promises of consistent daily gains from Bitcoin trading, a narrative that unfolds against a backdrop of growing regulatory focus on digital assets and investor protection.

According to the Department of Justice, the scheme operated between December 2019 and October 2021, drawing in more than $201 million from participants who believed they were backing a sophisticated trading enterprise. The government highlighted that the apparently robust performance—daily returns of up to 3 percent—was presented in a manner designed to reassure investors and sustain the inflow of new funds. Yet, prosecutors argued that the trading activity did not come close to supporting the promised returns, and that the apparent gains were often illusory, backed by funds from newer entrants rather than genuine profits.

The financial footprint of PGI’s operation was substantial. Investors poured in more than $201 million during the two-year window, and the case notes that at least 8,198 Bitcoin (CRYPTO: BTC) were involved in the scheme, with the digital asset valued at roughly $171.5 million at the time. Victims’ losses were estimated at no less than $62.7 million, a figure that illustrates the real-world harm that can accompany fraud in crypto markets. The court and prosecutors described a pattern in which new investor money was shuffled to pay earlier participants, a hallmark of Ponzi dynamics that undermines trust in similarly structured ventures.

Court filings depict a troubling panorama of misrepresentation and perceived legitimacy. Palafox allegedly oversaw an online portal that displayed steady gains, creating the illusion that accounts were compounding reliably. The operation reportedly relied on a multi-level marketing framework, with referral incentives designed to broaden the pool of participants. In parallel, the government contended that these promotional claims masked the absence of actual trading capacity to generate the claimed profits, allowing the scheme to sustain itself for a period before regulators began to unravel the web of financial red flags.

From a personal-finance perspective, the case paints a stark picture of resource misallocation. Authorities allege that Palafox diverted investor funds to support a lavish lifestyle, including millions spent on luxury vehicles and high-end real estate, as well as substantial expenditures on penthouse suites and other discretionary purchases. In a demonstration of cross-border reach, prosecutors noted transfers that included at least $800,000 and 100 Bitcoin moved to a family member, highlighting the opportunistic use of assets beyond the U.S. jurisdiction for personal enrichment.

The legal strategy behind the case extended beyond criminal charges. In a parallel civil action, the Securities and Exchange Commission filed a complaint in April 2025 accusing Palafox of misrepresenting PGI’s Bitcoin trading activity and using new investor money to compensate earlier participants. The SEC alleged that PGI promoted an AI-powered trading platform and guaranteed daily returns despite lacking a foundation in real trading operations capable of producing such profits. The dual track of enforcement—criminal and civil—emphasizes a broader regulatory intolerance for schemes that blur the lines between technology-driven finance and fraudulent conduct.

The trajectory of the case also reflects the cross-border enforcement environment facing crypto fraud. Regulators seized PGI’s website in 2021, signaling early steps toward dismantling the operation and tracing its financial flows beyond U.S. borders. Authorities later extended their scrutiny into the United Kingdom, where related operations were shuttered, illustrating the global dimension of crypto fraud investigations and the need for international cooperation in asset tracing and restitution efforts.

Victims remain at the center of the proceedings, with restitution potentially available through the U.S. Attorney’s Office process. While the criminal sentence serves as a punitive measure, the civil action and related enforcement signals are aimed at recovering assets and deterring similar misconduct in the crypto space. The case stands as a cautionary tale for investors and a reminder to operators that regulatory and judicial systems are increasingly attentive to the nuances of crypto-based investment promises and the risks of opaque performance reporting.

Crypto World

How Will Bitcoin’s Price React?

The cryptocurrency has suffered badly in the past few weeks, will it finally rebound?

The highly anticipated Consumer Price Index for the first month of 2025 just came out, showing that inflation has cooled year over year to 2.4%, which is slightly lower than the estimated 2.5%.

The Core CPI, which excludes more volatile sectors like food and energy, matched the expectations at 2.5%. Nevertheless, analysts indicated that the monthly increase in the regular CPI of just 0.2% is the lowest since last May.

Heather Long, Navy Federal Credit Union’s chief economist, noted that the prices for gas, used cars, and medical care all decreased in January, which helped bring down inflation even as utilities and transportation rose.

She determined that this is good news on the inflation front, even though there might be “one more bump from tariffs.”

Just In: US inflation cooled to 2.4% (y/y) in January —> The lowest inflation rate since May. The monthly increase was just 0.2%.

Gas prices, used cars and medical care all declined in January, helping to bring down inflation even as utilities and transportation rose.

Core CPI… pic.twitter.com/2z18M9va68

— Heather Long (@byHeatherLong) February 13, 2026

Bitcoin’s price has usually been volatile when the US CPI data comes out. The first minutes have been rather positive, as the asset rose slightly to $67,600 before it corrected to $67,200 as of press time.

A more significant impact is expected once the US Federal Reserve weighs in on this data for its next move in terms of interest rate reduction.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Binance Confirms Targeted Employee; Three Arrested in France Break-In

Three suspects were apprehended in France after a reported home-invasion targeted at a senior Binance France executive, with the parent company confirming that one employee was the victim. The incident unfolded in the Val-de-Marne area around 7:00 am CET, when armed intruders allegedly forced entry into an apartment and sought information leading to the head of Binance France. Police later recovered two mobile devices as the suspects fled. A separate attempt to break into a second residence in Hauts-de-Seine occurred roughly two hours later, culminating in arrests and the recovery of a vehicle linked to the case. Binance said it is cooperating with authorities and has intensified security measures to protect staff and families during an ongoing investigation.

Key takeaways

- In Val-de-Marne, three masked assailants forced entry into a resident’s home around 7:00 am CET, then sought directions to the Binance France head’s address and fled with two mobile phones.

- Two hours after the first incident, authorities arrested the suspects during a second home-invasion attempt in Hauts-de-Seine; investigators recovered the stolen phones and a vehicle.

- Binance confirmed the event to Cointelegraph, stating the employee and their family are safe and that the company is working closely with local law enforcement while enhancing security measures.

- The episode arrives amid broader security concerns in the crypto space, where wrench-attacks—physical assaults linked to crypto-related schemes—have surged in 2025, particularly in Europe and France.

- Binance’s co-founder Yi He publicly thanked French police for their swift response, underscoring the collaboration between crypto firms and law enforcement in addressing real-world risks.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The incident sits within a year of rising wrench-attacks against crypto investors and executives. CertiK documented a 75% increase in wrench attacks during 2025, with 72 verified cases globally. France recorded the highest number of incidents in 2025 (19), while Europe accounted for about 40% of global cases, highlighting a regional risk pattern as crypto activity expands across the continent.

Market context: The broader security environment for crypto companies is increasingly shaped by physical risk and targeted offenses, reinforcing the need for dedicated on-site security protocols and law-enforcement collaboration as firms expand in Europe.

Why it matters

The Binance France incident illustrates how crypto operations, even behind seemingly large organizations, face vulnerabilities beyond cyber threats. Physical security failures can expose executives and families to immediate danger, underscoring the importance of robust, end-to-end security planning for firms with regional leadership and critical operations. Binance’s response—expressing concern for staff welfare, cooperating with authorities, and enhancing security measures—signals a commitment to risk management that extends beyond digital assets and into real-world protection for personnel.

From a market and adoption perspective, incidents like this highlight that the crypto sector remains subject to traditional crime vectors even as the technology and markets mature. While there is no direct implication for asset prices from a single home invasion, the event reinforces the ongoing demand for secure governance, physical security protocols, and proactive collaboration with law enforcement across jurisdictions as regulatory and consumer scrutiny intensifies.

The public acknowledgment from Binance’s leadership—specifically a message from Yi He expressing gratitude for police efforts—reflects how the ecosystem increasingly relies on coordinated responses to safety incidents. That coordination can influence how crypto firms profile risk and allocate resources, potentially shaping future security investments and crisis-management protocols across regional teams.

What to watch next

- Official police updates on the investigation progress and any additional arrests or charges related to the two incidents.

- Binance’s security posture announcements or new measures implemented for employees in France and other regions.

- Any regulatory or policy developments in France or Europe addressing physical security for crypto firms and executives.

- Follow-up reporting on related wrench-attack cases in Europe to assess whether the incidents represent a broader pattern or are isolated events.

- Public statements from Binance France regarding ongoing risk assessments and collaboration with local authorities after the incident.

Sources & verification

- Binance’s formal confirmation to Cointelegraph regarding the home-invasion incident and the ongoing police investigation.

- RTL’s reporting on the initial attack in Val-de-Marne, including details about the home entry and subsequent arrest in Hauts-de-Seine.

- CertiK’s analysis noting a 75% rise in wrench-attacks in 2025 and the distribution of incidents across Europe and France.

- Cointelegraph coverage of related crypto-crime developments in France, including arrests tied to crypto-related ransom cases.

- Yi He’s X post acknowledging the incident and praising the French police unit Brigade de Répression du Banditisme.

What the announcement changes

Binance’s incident report underscores the evolving risk landscape for crypto executives operating in Europe. While the incident does not appear to affect market liquidity or exchange operations directly, it reinforces the need for rigorous physical-security protocols, crisis communication plans, and ongoing collaboration with law enforcement. For investors and users, the episode is a reminder that the sector’s growth is accompanied by real-world threats that require comprehensive risk management practices by firms and stronger protective measures for personnel in high-visibility roles.

Key figures and next steps

Authorities’ ongoing work will determine whether the two Val-de-Marne and Hauts-de-Seine cases are linked beyond the vehicle recovery and stolen devices. Binance’s leadership has stated that staff safety remains a top priority, and the company is pursuing enhanced security measures. The collaboration between Binance and French law enforcement, including high-profile units, will likely shape how the firm communicates future incidents and implements security improvements across its European footprint.

What to watch next

- Updates on the investigation from French police authorities (cases tied to the initial home-invasion and the second attempted entry).

- Details on the security enhancements Binance plans to deploy for its France team and regional offices.

- Regulatory responses in France and the broader European Union concerning physical-security standards for crypto firms.

https://cdn.ampproject.org/v0.js

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video4 hours ago

Video4 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle