Crypto World

Binance rolls out 5x futures on privacy L2 asset

Privacy-focused Aztec L2 gets a 5x Binance perpetual listing, with second-by-second mark pricing and tight funding bands in pre-market.

Summary

- Binance launches AZTECUSDT perpetuals with up to 5x leverage and USDT settlement.

- Funding starts capped at +0.005% pre-market, moving to a ±2.00% range after launch, with 4-hour settlements.

- Aztec is a privacy-first Ethereum Layer-2 with a 10.35 billion token supply and round-the-clock trading on Binance Futures.

Cryptocurrency exchange Binance announced plans to launch a perpetual futures contract for Aztec on its futures trading platform, according to an official company statement.

Binance to initiate new trading for Aztec

Binance Futures will initiate pre-market trading for the Aztec perpetual futures contract on February 11, 2026, at 07:30 UTC, the exchange stated. The contract will offer leverage of up to 5x during the pre-market period.

The underlying asset of the contract is Aztec, a privacy-focused Layer-2 solution built on the Ethereum blockchain, according to the announcement. The project aims to enable developers to build applications that protect user privacy. A dollar-pegged stablecoin will serve as the settlement unit for the contract.

The total and maximum supply of Aztec tokens stands at 10.35 billion, Binance reported. The contract’s tick size is set at 0.00001, with a minimum transaction amount of 1 Aztec token and a minimum notional value of 5 USD.

The mark price will be recalculated every second based on the average transaction prices over the preceding 10 seconds, the exchange stated. A two-tiered funding rate system will be implemented, with the funding rate capped at +0.005% during the pre-market period. Following the conclusion of pre-market trading, the funding rate limit will expand to a range of +2.00% to -2.00%. Funding fees will be settled every four hours.

The Aztec perpetual contract will be available for round-the-clock trading on Binance Futures and will support Multi-Assets Mode, according to the announcement. The exchange cautioned users about potential high volatility in the new product and advised appropriate risk management.

Crypto World

XRP price eyes a rebound as ETF inflows rise, exchange outflows rise

XRP’s price remained flat today, March, continuing the consolidation phase that began in February. However, ongoing inflows into exchange-traded funds and declining exchange supply suggest that a rebound may be on the horizon.

Summary

- XRP price has formed a double-bottom pattern pointing to a strong rebound.

- The supply of XRP tokens on exchanges has dropped to the lowest level in years.

- Data shows that spot XRP ETF inflows have continued rising this month.

Ripple (XRP), one of the top cryptocurrencies, was trading at $1.4282 on Thursday, inside a range it has been in the past few weeks. This price is 28% above the year-to-date low of $1.1137.

American investors are still buying XRP ETFs, a sign that they expect it to rebound in the coming weeks. SoSoValue data shows that spot XRP ETFs added $4.2 million in inflows on Wednesday as the crypto market rally restarted. It was the seventh consecutive day of inflows, with the cumulative total rising to $1.26 billion.

Increased buying by American institutional investors in a time when the price is stuck in a tight range is a sign of accumulation, which often leads to a strong rebound.

Another sign of accumulation is that XRP outflows from exchanges are increasing. Data compiled by CryptoQuant shows that over 7 billion XRP tokens exited exchanges in February. The total amount of XRP tokens in exchanges has dropped to the lowest level in years.

A possible reason why investors are accumulating XRP tokens is its strong fundamentals, including the ongoing Ripple USD growth. The stablecoin has accumulated over $1.5 billion in assets, with its daily volume soaring to over $1.5 billion.

RLUSD is benefiting from the rising demand from both retail and institutional investors, a trend that may continue after its integration on Ripple Prime.

XRP price forecast: Technical analysis

The eight-hour chart shows that the XRP price has remained in a narrow range in the past few weeks.

A closer look shows that it formed a double-bottom pattern at $1.3350 and a neckline at $1.6745. This pattern normally means that short-sellers are largely uncomfortable placing short trades below that level.

The coin has moved slightly above the 50-day Exponential Moving Average. Also, the Percentage Price Oscillator has crossed the zero line, while the Relative Strength Index has jumped above 50.

Therefore, the most likely XRP price forecast is bullish, with the next key target being the neckline at $1.6638. The bullish view will become invalid if it drops below the key support level at $1.3350.

Crypto World

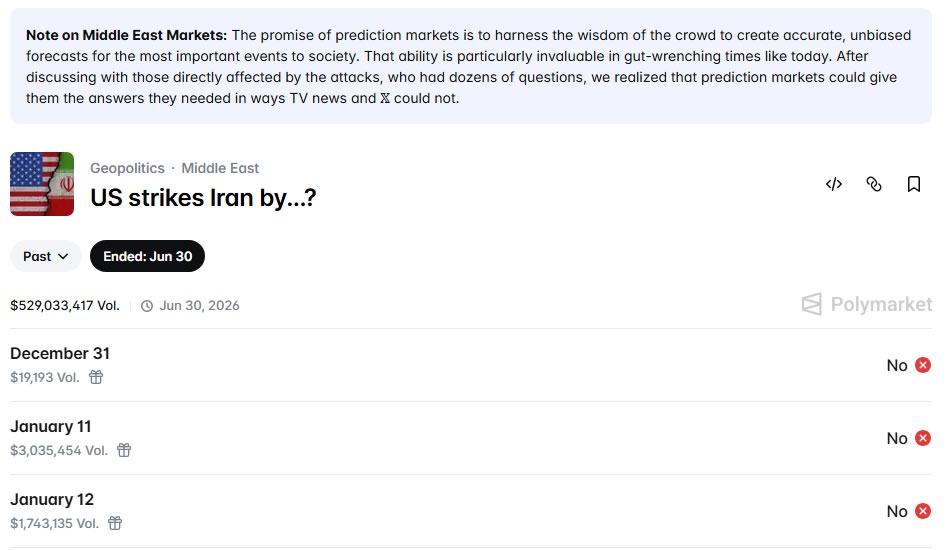

Iran Strike Bets Usher Moves to Curb Prediction Markets

Senator Chris Murphy says it’s likely people close to Donald Trump with “inside information” made bets on prediction markets on when the US would strike Iran.

US Democratic lawmakers are working on a bill to police prediction markets after raising insider trading concerns over bets made on the timing of Israeli and US strikes on Iran.

Democrat Senator Chris Murphy said in a video posted to X on Wednesday that what he claimed were White House insiders made a “very specific bet” on Friday that the US would go to war with Iran on Saturday.

“Obviously, there are people close to Donald Trump who, on Friday, knew what was happening on Saturday, and it is very likely — probable even — that the people that placed those bets were people with inside information,” he said.

Murphy added that allowing bets on war to continue could see those close to the president “pushing us into war because they can cash in.”

A number of bets on Polymarket were widely circulated on Saturday, where six newly-created accounts reportedly earned around $1 million betting on the timing of US strikes on Iran.

In several cases, bets were made just hours before explosions were first reported in Tehran.

Bets on US strikes in Iran have so far generated $529 million in volume on Polymarket. Last month, a Polymarket trader made about $400,000 from a well-timed wager on the capture of Venezuelan President Nicolás Maduro.

Bill to target prediction market insider trading

Reuters reported on Thursday that Murphy and Democratic House Representative Mike Levin are working on the bill, intensifying pressure on prediction markets such as Polymarket and Kalshi.

Related: Polymarket user gains $400K betting on ZachXBT investigation

“It’s unbelievably clear to me that if anyone is using prior knowledge of military action for financial gain, that should be absolutely illegal,” Levin said.

He added that commodity laws ban event contracts tied to war, terrorism, or other events “contrary to the public interest,” but the rules give prediction markets too much freedom.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

OKB token price jumps over 50% after ICE invests in OKX

OKB token price jumped sharply after Intercontinental Exchange, the parent company of the New York Stock Exchange, announced a strategic investment in OKB issuer OKX.

Summary

- OKB climbed from about $77 to an intraday high near $117 after ICE invested in OKX.

- The deal values OKX at $25B and includes board representation for ICE.

- Price broke out of the $75–$80 range, with $95 now key support and $115–$120 the next resistance zone.

OKB (OKB) surged from about $77.29 to an intraday high of $117.60 following the announcement. At the time of writing, the token was trading at $107.79, still up roughly 40% over the past 24 hours.

The move pushed OKB among the day’s top-performing altcoins. Over the past year, the token has gained around 149%, while monthly gains stand near 32%.

Derivatives data from CoinGlass also shows a sharp increase in market activity. Trading volume jumped more than 3,500% to about $407 billion, while open interest rose 184% to roughly $48 million as traders rushed to position around the breakout.

ICE investment strengthens ties between Wall Street and crypto

The surge followed reports that Intercontinental Exchange has taken a minority stake in OKX, valuing the exchange at approximately $25 billion.

The investment will give ICE a seat on OKX’s board of directors, although the size of the stake has not been publicly disclosed. The deal signals a deeper push by ICE into blockchain infrastructure and digital asset markets.

Under the partnership, ICE will license real-time crypto spot pricing data from OKX. At the same time, OKX plans to provide its global user base, reported to exceed 120 million, with access to ICE’s U.S. futures products and tokenized equities tied to NYSE-listed stocks.

Tokenized stock trading on the platform could go live in the second half of 2026, though the rollout still depends on regulatory approval.

The partnership also highlights how more traditional finance institutions are beginning to experiment with blockchain infrastructure. ICE has already shown interest in this space before, including investments in platforms such as prediction market operator Polymarket.

OKB price technical analysis

Market signals suggest the latest price surge could be the beginning of a new trend, though in the short term the market appears somewhat overheated. On the daily chart, OKB produced a strong breakout candle that drove the price out of the $75–$80 range and lifted it above $100.

During that move, the token also pushed beyond the upper Bollinger Band. Such movements can indicate that the price has risen too quickly and may pause, but they also often indicate strong buying momentum.

Following a few sessions of relatively tight trading, volatility has clearly increased. The Bollinger Bands spread out sharply following the breakout, which is commonly seen when a market shifts from a quiet phase into a more directional move.

Momentum indicators also lean positive. The relative strength index has risen to around 75, clearly above the 70 level that typically marks overbought conditions. This shows buyers have been in control, although it can sometimes lead to a short pause or a small dip before the next move.

OKB has now moved back above several important moving averages, including the 20-day moving average near $79. In many breakout setups, prices sometimes revisit earlier resistance levels before attempting another climb.

If the current structure remains intact, analysts see the $110–$115 area as the next barrier, with a larger resistance zone near $120. On the downside, $95 is now viewed as the main support level, while $90 could provide an additional cushion if selling pressure appears.

Should the price dip toward that region and attract fresh buying interest, it would support the possibility of another upward move, with $120 and potentially $135 as targets in the coming sessions.

Crypto World

US spot BTC, ETH and SOL ETFs log strong daily inflows

US spot crypto ETFs saw broad-based inflows across Bitcoin, Ethereum and Solana products.

Summary

- Ten US spot Bitcoin ETFs added 5,187 BTC, worth about $376m, in a single day.

- Nine Ethereum ETFs took in 43,282 ETH, totaling roughly $9.18m in new exposure.

- A Solana ETF absorbed 205,711 SOL, adding about $18.72m as majors rallied.

US-listed spot crypto ETFs recorded another strong session of net inflows, with products tied to Bitcoin (BTC), Ethereum (ETH) and Solana (SOL) all attracting fresh capital. According to ChainCatcher data, ten spot Bitcoin ETFs collectively added 5,187 BTC, equivalent to around $376m at prevailing prices, extending a run of sessions in which new money has outweighed redemptions. The flows signal that institutional allocators and wealth platforms continue to use regulated ETF wrappers to increase or rebalance exposure, even as market volatility and macro uncertainty remain elevated.

Nine Ethereum funds also saw net buying, pulling in 43,282 ETH, or roughly $9.18m, and reinforcing the notion that demand is broadening beyond the largest asset. A spot Solana vehicle added 205,711 SOL, worth about $18.72m, underlining investor appetite for higher-beta alternatives as part of diversified crypto portfolios. The multi-asset inflows came against a backdrop of rising spot volumes and a rebound in majors, with BTC reclaiming key resistance zones and dragging correlated assets higher.

ETF flows and market structure

The latest data points to an environment where ETF products are increasingly central to price discovery and liquidity, rather than acting solely as passive wrappers. Heavy buying on strong days and more modest outflows during drawdowns suggest that long-only and advisory channels are using ETFs as entry and exit points, impacting underlying spot markets via authorized participants. This dynamic has been particularly visible around BTC where large creations and redemptions have coincided with sharp moves through key technical levels.

For issuers and exchanges, sustained inflows across multiple products strengthen the business case for expanding lineups and deepening secondary-market liquidity. Platforms such as Coinbase have already positioned themselves as core infrastructure for ETF market makers and custodians, while traditional payment networks that resemble Visa are exploring stablecoin and settlement integrations that could sit alongside ETF-based strategies. As regulatory regimes like MiCA advance and more jurisdictions consider spot listings, the US experience with Bitcoin, Ethereum and Solana ETFs will remain a critical reference point for how regulated vehicles can channel institutional demand into the crypto market.

Crypto World

Crossmint, Western Union to bring USDPT stablecoin to Solana

Western Union is moving deeper into blockchain payments with a new stablecoin initiative tied to the Solana network.

Summary

- Western Union partnered with Crossmint to support the USDPT stablecoin on Solana.

- The stablecoin will connect on-chain transfers with 360,000+ Western Union cash pickup points across 200+ countries.

- Anchorage Digital Bank will issue USDPT to support compliance and institutional access.

The company has partnered with Crossmint to support the rollout of USDPT, a U.S. dollar-denominated stablecoin that will operate on the Solana (SOL) ecosystem.

The collaboration was announced on March 4 by Crossmint and will connect the stablecoin to Western Union’s newly introduced Digital Asset Network, which links on-chain dollars to real-world cash access across its global payout infrastructure.

Stablecoin connected to Western Union’s payout network

USDPT was first revealed in October 2025, with a launch expected in the first half of 2026. The stablecoin will be issued by Anchorage Digital Bank.

Western Union’s Digital Asset Network links blockchain transfers with its global cash distribution system. Through the network, users can convert digital dollars into local currency using more than 360,000 collection points worldwide, spanning over 200 countries and territories.

Malcolm Clarke, Western Union’s vice president of digital assets, said the network connects digital wallets and platforms directly to the company’s payout infrastructure. Partners such as Crossmint provide the technology layer that allows these integrations to work across blockchain systems and traditional payment rails.

This setup allows stablecoin transactions to move on-chain while still connecting to familiar cash pickup services used in many remittance corridors.

Crossmint infrastructure supports wallets and fintech apps

Crossmint will integrate USDPT into its wallet infrastructure and payment APIs, allowing fintech platforms and developers to access the stablecoin through its existing tools.

Rodrigo Fernández Touza, co-founder of Crossmint, said the collaboration links digital dollar transfers with Western Union’s global payout network.

Developers using Crossmint’s APIs can build applications that send funds on Solana while offering recipients the option to collect cash through Western Union locations where available.

The system allows fintech apps to hold value in digital dollars, transfer funds instantly on-chain, and connect to Western Union’s payout network when users need local currency.

Solana’s fast settlement speeds and low transaction costs have made it a common choice for payment-focused blockchain applications, including stablecoin transfers and cross-border transactions.

Crypto World

Crypto derivatives suffer $471m in 24-hour liquidations

A sharp volatility spike wiped out $471m in crypto derivatives positions in one day.

Summary

- Total crypto liquidations over 24 hours reached about $471m across major exchanges.

- Shorts absorbed the bulk of the damage, with $348m rekt versus $123m in long liquidations.

- Bitcoin, Ethereum and other majors saw funding reset as overleveraged bearish bets were squeezed.

Crypto derivatives traders endured another brutal reset as roughly $471m in futures positions were liquidated over a 24-hour window, according to data.

Unlike many prior stress events, this wave hit short-sellers hardest, with about $348m in short liquidations compared to $123m from longs, suggesting that bears were caught leaning too aggressively into downside bets as prices rebounded. The skew was particularly pronounced in flagship contracts tied to Bitcoin (BTC) and Ethereum (ETH), where a swift move higher forced exchanges’ risk engines to close underwater positions into rising markets.

The liquidation pattern reflects a market where sentiment flipped from cautious to overly pessimistic before the latest rally. In the lead-up to the move, open interest had rebuilt as traders added fresh short exposure on the assumption that recent gains would fade. When spot prices broke higher instead, those trades were rapidly unwound, amplifying the upside through a classic short squeeze dynamic. The episode underscores how quickly positioning can turn and how reliance on high leverage—regardless of direction—exposes traders to abrupt, forced exits when liquidity thins and volatility spikes.

Leverage squeeze and positioning reset

In the aftermath of the $471m flush, derivatives metrics suggest that some of the froth on the short side has now been cleared, with funding rates normalizing and open interest stabilizing at slightly lower levels. For BTC and other large-cap assets, that reset may provide a cleaner backdrop for spot-led moves, reducing the immediate risk of another squeeze in either direction. However, the frequency of large liquidation events in recent weeks indicates that many market participants continue to run elevated leverage, quickly rebuilding directional bets once prices show a trend.

Exchanges are likely to face renewed scrutiny over headline leverage limits, margin policies and transparency around liquidation algorithms, particularly as institutional interest in derivatives grows alongside ETF and structured-product flows. Platforms like Coinbase, which emphasize regulated derivatives offerings, and policymakers advancing frameworks similar to MiCA will watch closely how these episodes impact market integrity. Until leverage metrics show a more durable decline, professional desks may keep gross exposure in check, use options to hedge tail risks, and monitor liquidation dashboards to avoid positioning where cascading forced selling or buying can quickly overwhelm order books.

BTC is currently trading near $72,000, extending its rebound from last week’s pullback and reclaiming key resistance after testing lower support levels. The move toward $72,000 comes alongside a broader recovery in crypto majors, with renewed inflows into spot BTC products and higher derivatives activity signaling improving risk appetite. Market outlook for BTC remains cautiously bullish at these levels: trend structures have turned constructive again, but elevated volatility around $72,000 leaves room for sharp swings if macro or geopolitical sentiment deteriorates.

Crypto World

Bitcoin price analysis ahead of US non-farm payrolls data

Bitcoin price held steady on Thursday as investors focused on the upcoming US non-farm payrolls data scheduled for Friday this week.

Summary

- Bitcoin price moved to a local bull market after rising by 20% from the year-to-date low.

- The rally happened amid hopes of talks between the US and Iran on ending the war.

- The US will publish the latest non-farm payrolls data on Friday.

Bitcoin (BTC) token was trading at $72,450, up by 20% from its lowest level this year, meaning it has moved into a local bull market.

The recent rebound started on Wednesday after reports that Iran had reached out to the Americans to end the war. Still, the odds of a ceasefire happening in the near term are slim as the three sides commit to fighting. This explains why Brent and West Texas Intermediate jumped to $84.15 and $78.

Bitcoin price will next react to the upcoming US non-farm payrolls data, which will come out on Friday. Economists polls by Reuters expect the upcoming report to show that the labor market softened in February.

The average estimate is that the economy created 70k jobs, much lower than the 110k it created in January. They also expect the report to reveal that the unemployment rate remained unchanged at 4.3%.

These numbers are important as the Federal Open Market Committee will meet on March 17 and 18. Economists believe that the bank will leave rates unchanged between 3.50% and 3.75%.

A weak NFP report may push some Fed officials to support a rate cut. In a statement on Wednesday, Stephen Miran maintained that the bank should slash rates, citing the jobs market.Fed officials are concerned about inflation, which may accelerate because of the ongoing war in the Middle East.

Bitcoin and other cryptocurrencies experience more demand when the Fed is cutting interest rates.

Bitcoin price forecast: Technical analysis

BTC price has staged a comeback recently, moving from the year-to-date low of $60,000 to $72,700. It has moved above the crucial resistance level at $71,000, its highest level on February 15. This price was also the neckline of the inverted head-and-shoulders pattern.

The coin has already flipped the Supertrend indicator from red to green and moved above the 50-day Exponential Moving Average.

It is also hovering near the 23.6% Fibonacci Retracement level, which is drawn by connecting the all-time high and the lowest level this year.

The most likely Bitcoin price prediction is bullish, with the key target being the psychological level at $80,000. On the flip side, a drop below the key support level at $70,000 will cancel the bullish outlook.

Crypto World

CleanSpark ups mined BTC while selling into strength

CleanSpark increased its Bitcoin holdings despite selling most of February’s mined coins.

Summary

- CleanSpark mined 568 BTC in February, bringing its year-to-date total to 1,141 BTC.

- The miner sold 553.02 BTC at an average price of $66,279, booking cash while retaining some production.

- Total treasury holdings rose to 13,363 BTC, signaling a balance between monetization and long-term accumulation.

Bitcoin (BTC) miner CleanSpark reported a solid production update for February, underscoring how listed miners are navigating a higher price environment by both monetizing output and building balance-sheet exposure.

The company mined 568 BTC during the month, lifting its year-to-date tally to 1,141 BTC, according to figures highlighted by ChainCatcher. At the same time, CleanSpark sold 553.02 BTC at an average price of $66,279, using the rally to raise cash while still modestly increasing net holdings. By month-end, the firm’s treasury had grown to 13,363 BTC, reflecting a strategy that combines operational funding needs with a long-term bullish stance on the asset.

The approach illustrates how miners are adjusting after previous cycles where many either dumped most production to cover costs or, conversely, hoarded coins through deep drawdowns. With BTC trading near cycle highs and hash rate competition intense, CleanSpark’s blend of opportunistic selling and ongoing accumulation aims to keep leverage and dilution in check while preserving upside participation. Investors closely watch such treasury decisions, as they can influence both balance-sheet resilience and sensitivity to future price swings. Miners that sell too aggressively may underperform in bull phases, while those that over-accumulate risk liquidity stress if conditions deteriorate.

Miner treasuries and market signaling

CleanSpark’s latest update feeds into the broader discussion about how miner balance sheets impact market structure and supply dynamics. When miners sell into strength but maintain or increase core holdings, they effectively drip-feed liquidity to the market without completely removing their potential to become forced sellers during downturns. In aggregate, miner flows can influence short-term supply-demand imbalances, particularly around key events such as halvings, regulatory shifts or large ETF-driven inflows. Watching how firms manage inventories offers clues about industry confidence in current prices and future trajectories.

For institutional investors and analysts, miner treasury strategies are increasingly assessed alongside metrics like production cost per coin, energy contracts, and diversification into adjacent businesses such as high-performance computing or AI infrastructure. Some miners have partnered with platforms like Coinbase for custody or financing solutions, while others look to strike structured deals with energy providers and financial institutions akin to Visa’s partnerships in the payments world. As regulatory clarity, including regimes like MiCA, expands, miners that can demonstrate disciplined capital allocation and robust governance around their BTC holdings may enjoy better access to traditional financing and a valuation premium over less transparent peers.

Crypto World

Construction Begins on Quantum Facility Capable of Breaking Bitcoin

The quantum computing race is edging closer to a commercially viable milestone, with PsiQuantum revealing progress toward a facility that could house a million qubits. The company, which has tied its plans to a collaboration with Nvidia, says the ambitious Chicago site will rely on advanced error-tolerant architectures to deliver usable quantum power at scale. In parallel, the crypto community remains deeply engaged in the implications for Bitcoin’s security, a debate that has intensified as quantum research advances and real-world milestones creep closer to feasibility.

Key takeaways

- PsiQuantum is moving toward a 1-million-qubit facility described as capable of powering commercially useful quantum computation, backed by a $1 billion fundraising round announced in September and a collaboration with Nvidia.

- A construction update showed 500 tons of steel erected in six days for the Chicago site, underscoring the rapid pace of on-site development.

- The crypto community is split on risk: some warn quantum breakthroughs could threaten Bitcoin’s cryptography, while others expect the threat to remain distant, potentially a decade or more away.

- Analyses and statements emphasize that only a small portion of Bitcoin addresses would be susceptible today, with broader resistance possible through post-quantum upgrades and other safeguards.

- Key technical benchmarks frame the discussion: preliminary estimates suggest far more qubits than needed to break current cryptography, but practical, scalable quantum systems remain the central hurdle.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. The article frames potential quantum risk as a broad strategic consideration with limited near-term price signals.

Market context: Quantum progress is unfolding amid a broader crypto market focus on security, post-quantum readiness, and regulatory considerations shaping risk sentiment and investment flows.

Why it matters

The convergence of quantum computing and crypto security is more than a theoretical concern. If large-scale, fault-tolerant quantum devices become viable, the cryptographic foundations underpinning much of today’s digital assets could face fundamental redesigns. The Bitcoin network, which relies on elliptic-curve signatures, would be the most visible test bed for resilience in the face of quantum threats. In 2024, researchers and industry players have intensified discussions about preemptive upgrades, including hard forks and post-quantum cryptographic standards, as a means of safeguarding long-term security without interrupting existing operations.

PsiQuantum’s latest milestones illustrate the industrial-scale ambitions of quantum developers. The Chicago facility, designed to host one million qubits, is emblematic of the sector’s transition from lab-scale experiments to facilities that could underpin commercial computing for AI, simulation, and optimization workloads. A project of this magnitude hinges on both hardware breakthroughs—error correction, qubit coherence, scalable manufacturing—and software ecosystems capable of harnessing quantum advantage in practical use cases. The $1 billion fundraising and the Nvidia collaboration signal a broad, multi-industry push to de-risk the path to practical quantum advantage, even as critics note that true utility remains some years away.

From a crypto-security perspective, the debate has evolved beyond “if” to “when.” Some Bitcoin proponents argue a quantum-capable attacker could eventually compromise keys and signatures, potentially undermining the integrity of holdings and transactions. Others, including prominent voices in the ecosystem, emphasize that current cryptographic schemes can be fortified through a combination of longer-term keying practices and post-quantum cryptography, reducing the immediacy of risk. A widely cited line of reasoning holds that even if a quantum computer could break certain cryptographic keys, the actual volume of affected funds might be limited, given the distribution of private keys across the network and the ongoing movement toward more secure standards.

Academic and industry analyses also illustrate that the number of qubits needed to break modern cryptography is a moving target. A recent preprint suggested that cracking 2048-bit keys would require on the order of 100,000 qubits, while Bitcoin relies on significantly smaller 256-bit keys in its most widely used schemes. The contrast underscores both the promise and the uncertainty of leveraging quantum capabilities for cryptanalytic purposes. The scale and error-correction requirements for a practical attack remain substantial, and much of the crypto community views rapid, decisive “quantum bursts” as a longer horizon phenomenon rather than an immediate crisis.

Beyond the security implications, the quantum discourse intersects with broader tech policy and infrastructure planning. The industry’s attention to post-quantum resilience is feeding into discussions about upgrade paths, governance, and the choreography of ecosystem-wide transitions—whether through protocol-level changes, new cryptographic standards, or multi-year roadmaps to migrate away from vulnerable primitives. The ethical and operational challenges of such migrations—including compatibility with existing wallets, exchanges, and custodians—add layers of complexity to an already evolving landscape.

In public statements, PsiQuantum has stressed that it has no plans to exploit quantum capabilities to extract private keys from public ones. Co-founder Terry Rudolph reiterated at a Bitcoin-focused quantum summit that the company’s mission centers on building reliable quantum hardware and software, not on weaponizing cryptographic breaks. This distinction is important for framing the broader industry’s stance: while the threat is acknowledged, the path to actionable security solutions is a collaborative, proactive process rather than a single, dramatic inevitability.

Within the investment and research communities, assessments like those from CoinShares have suggested that even a quantum breakthrough would not instantly destabilize Bitcoin. They estimated that a relatively small subset of the total Bitcoin supply—roughly 10,230 BTC—would be at “quantum-vulnerable” addresses, which, at prevailing prices, could be managed through routine trading and standard risk controls. Such figures reinforce the view that the market’s immediate reaction to quantum news would likely be measured, with systemic safeguards and hedging strategies mitigating abrupt price shocks.

What to watch next

- Milestones for PsiQuantum’s Chicago facility: timelines for qubit generations, error correction performance, and integration with Nvidia’s hardware stack.

- Advancements in post-quantum cryptography standards and standardized migration plans for Bitcoin and other major networks.

- Regulatory and governance developments around crypto security, including any formal endorsements or requirements for post-quantum readiness.

- New research clarifying the practical qubit counts needed to threaten current cryptography, and whether optimistic estimates translate to real-world risk.

- Public disclosures from major exchanges and wallet providers about their preparedness for quantum-era threats and planned upgrade pathways.

Sources & verification

- PsiQuantum’s fundraising and Nvidia collaboration announcements

- Public posts by PsiQuantum co-founder Peter Shadbolt about the Chicago site and steel construction

- Official statements from PsiQuantum regarding non-use of quantum tools to derive private keys

- CoinShares’ February research on quantum risk to Bitcoin

- ArXiv preprint discussing qubit requirements to break various cryptographic standards

Quantum ambition tests crypto’s future guardrails

The case of PsiQuantum illustrates a defining moment for the crypto ecosystem: a single project’s trajectory toward a million-qubit capability is forging the boundary between theoretical threat and practical reality. The Chicago facility, described as capable of hosting a million qubits and powered by a plan that includes hundreds of tons of steel and a substantial funding package, embodies a new kind of industrial ambition. If realized, it would mark a leap from demonstrations in laboratory environments to a platform that can sustain complex computations at scale—an essential step for applications in AI, materials science, and optimization that quantum machines promise to accelerate.

Yet the same development timeline that excites researchers also intensifies crypto-security debates. The Bitcoin network, by design, relies on cryptographic primitives that must withstand not only current attack methods but also those that quantum machines might enable in the future. The cornerstone question—when could a sufficiently powerful quantum computer emerge to threaten private keys—drives ongoing discussions about potential fork strategies, cryptographic upgrades, and the transitional work needed to preserve user funds without disrupting network operation.

Industry observers emphasize that while the mathematical potential of quantum attacks is real, the practical path from theory to exploitation remains riddled with engineering hurdles. The demand for robust error correction, high-fidelity qubits, scalable control systems, and fault-tolerant software stacks creates a gulf between today’s research devices and a weaponized quantum infrastructure. In this sense, PsiQuantum’s progress is a reminder that the crypto security debate is less about overnight collapse and more about sustained vigilance, iterative upgrades, and cross-disciplinary collaboration among hardware developers, cryptographers, and policy makers.

As posture and preparedness become part of routine risk management, the crypto community’s emphasis on post-quantum resilience—whether through hybrid cryptographic schemes, larger key sizes, or forward-looking migration plans—will continue to shape investor sentiment and infrastructure decisions. The debate is not only about Bitcoin’s long-term security but also about how the wider financial system adapts to a quantum-enabled future. If the next few years deliver measurable progress toward scalable, reliable quantum systems, the industry could begin to operationalize safeguards well before any exploitation materializes, translating research milestones into practical risk management and clearer governance pathways.

Crypto World

OKX is building a social network directly into its trading app after a massive $25 billion valuation

Crypto exchange OKX, which was just valued at $25 billion after a strategic investment from New York Stock Exchange (NYSE) parent Intercontinental Exchange (ICE), is launching a social network built directly into its trading app, the latest example of social media and digital asset platforms converging as traders increasingly rely on online communities for market signals.

The feature, called Orbit, allows users to post market commentary, livestream discussions and create trading groups while also displaying verified performance metrics such as portfolio returns, profit and loss and win rates, OKX said Thursday. The company said the feature is designed to help users distinguish credible trading insights from hype or manipulated social media posts.

Orbit will roll out gradually beginning Feb. 26 to a limited group of users before expanding more broadly once its beta testing phase concludes.

The launch comes as social interaction plays a growing role in crypto markets. Many traders now gather ideas from online platforms where screenshots, posts and influencer commentary can quickly shape sentiment around assets such as bitcoin or ether (ETH).

“People using our app will have a native social channel where ideas are shared with posts, livestreams and group chats,” said Haider Rafique, managing partner at OKX, in a statement.

Several platforms have begun blending trading with social media features. StockTwits, for example, is a social platform focused on equities where traders share ideas using ticker symbols such as $AAPL or $TSLA to create real-time conversations about markets. In crypto, newer networks such as Farcaster had emerged as decentralized alternatives, operating as Ethereum-based social protocols designed to function as blockchain-native versions of platforms like X.

“This is quite popular in equities trading,” Rafique said. “We want to bring similar features and give traders a place where they can share their performance and interpretation of the markets.”

OKX said Orbit aims to add accountability to social trading by allowing users who choose to share metrics to verify them directly within the trading app. The platform also supports market-specific discussions using cashtags such as $BTC, $ETH and $SOL and allows traders to create both public and gated communities.

The move comes during a period of expansion for the company. OKX just received a strategic investment from Intercontinental Exchange (ICE), the global trading giant that owns the New York Stock Exchange. The deal valued the San Jose, California-based firm at about $25 billion.

As part of that partnership, OKX plans to introduce tokenized stocks and crypto futures products, signaling deeper integration between traditional financial markets and digital asset platforms.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech21 hours ago

Tech21 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports10 hours ago

Sports10 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker